Cultured Meat Market Size, Share & Trends Analysis Report by Source Type (Poultry, Beef, Pork, Seafood, Exotic meats), Production Technology, Cell Type, Culture Medium, Product Form, Distribution Channel, End-Use Industry, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Cultured Meat Market Size, Share, and Growth

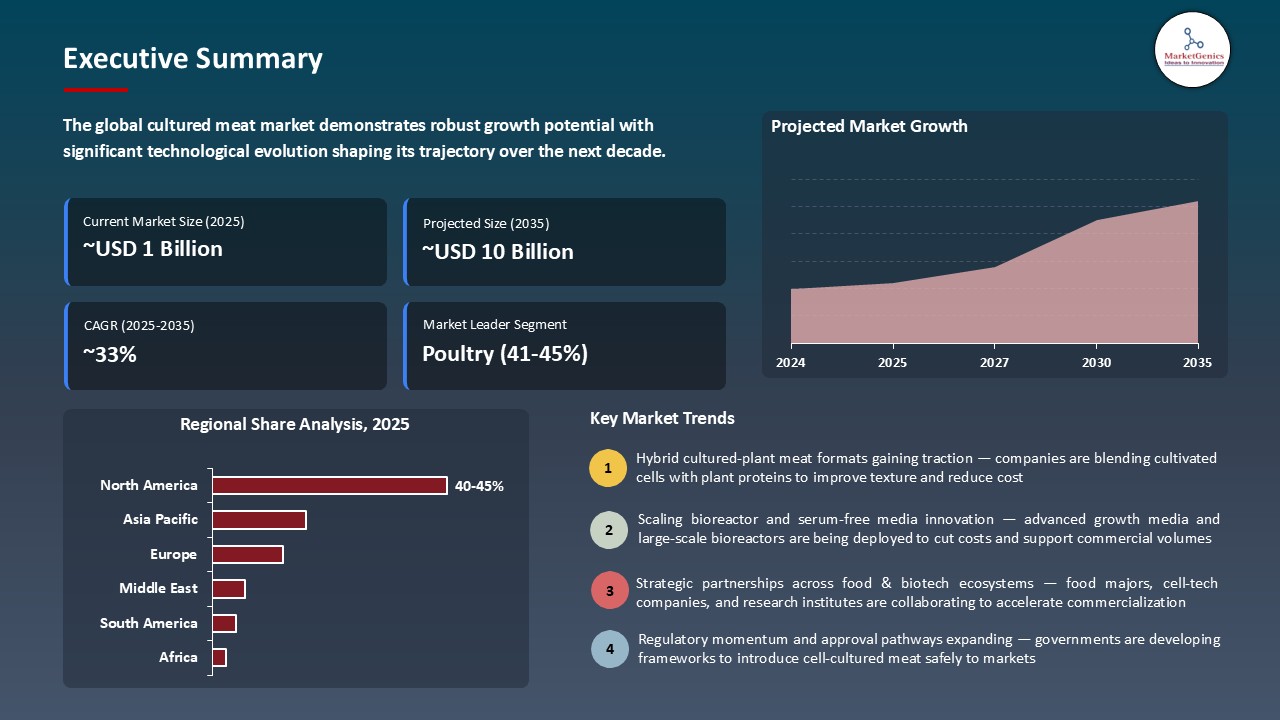

The global cultured meat market is experiencing robust growth, with its estimated value of USD 0.6 billion in the year 2025 and ~USD 10 billion by the period 2035, registering a CAGR of 32.5%, during the forecast period. The development of cellular agriculture, precision fermentation, and scalable bioprocessing systems is driving the expansion of the global cultured meat market. Companies are focusing on sustainable protein manufacturing, environmentally improving and increasing the quality of products.

Carly Arnold, Chief RDQ Officer at Nomad Foods, said, “We are thrilled to continue our partnership with BlueNalu, building on our long history of introducing innovative and great-tasting seafood products. This collaboration advances cell-cultivated seafood technology, offering consumers nutritious, safe, and sustainable alternatives. I want to thank both Nomad Foods’ and BlueNalu’s teams for their dedication to bringing this transformative technology to market. We look forward to delivering high-quality seafood products that are good for people and the planet.

Increased demand of sustainable protein, urban food security, progress in cell-culture technology, and strategic investment in bioprocessing infrastructure are the main drivers of the global cultured meat market. For instance, in April 2025, when Meatable (Netherlands) and TruMeat (Singapore) declared a strategic partnership to further the cost-effective cultivated meat development. The partnership is aimed at streamlining production, creating cheaper growth media and building a plant in Singapore based on the technology of Meatable. The joint venture is aimed at achieving volumes of production and cutting down expenses, thereby fast tracking the commercialization of cultivated meat products.

New technologies such as optimized growth media, automated bioreactors, and 3D tissue scaffolds are increasing the efficiency, scalability, and sensory qualities of the cultured meat. For instance, In June 2025, Cultivate at Scale (Netherlands) and Sartorius (Germany) installed a 1,000-litre single-use bioreactor in their plant to assist in pilot-scale manufacturing of cultivated meat, fish, and dairy. The project fills the gap between laboratory-scale research and commercial bioproduct production and can offer versatile bioprocessing, and technical assistance to a variety of businesses. These technological developments make the products more consistent, and the environmental impact is lower than the conventional livestock, and maintenance of regulatory approvals in major markets.

Hybrid protein products, plant-based scaffolds and modular bioreactors are also under consideration by startups and existing players, which would allow a broader range of protein textures and flavors, at a lower cost. Favorable regulatory environments in Singapore, Israel, and the Netherlands are being used to commercialize more rapidly and enter markets much more rapidly and venture financing and strategic alliances are affording investment in R&D and scale-up production. In combination, these factors are broadening market access, raising consumer adoption, and driving growth in the global cultured meat market.

Cultured Meat Market Dynamics and Trends

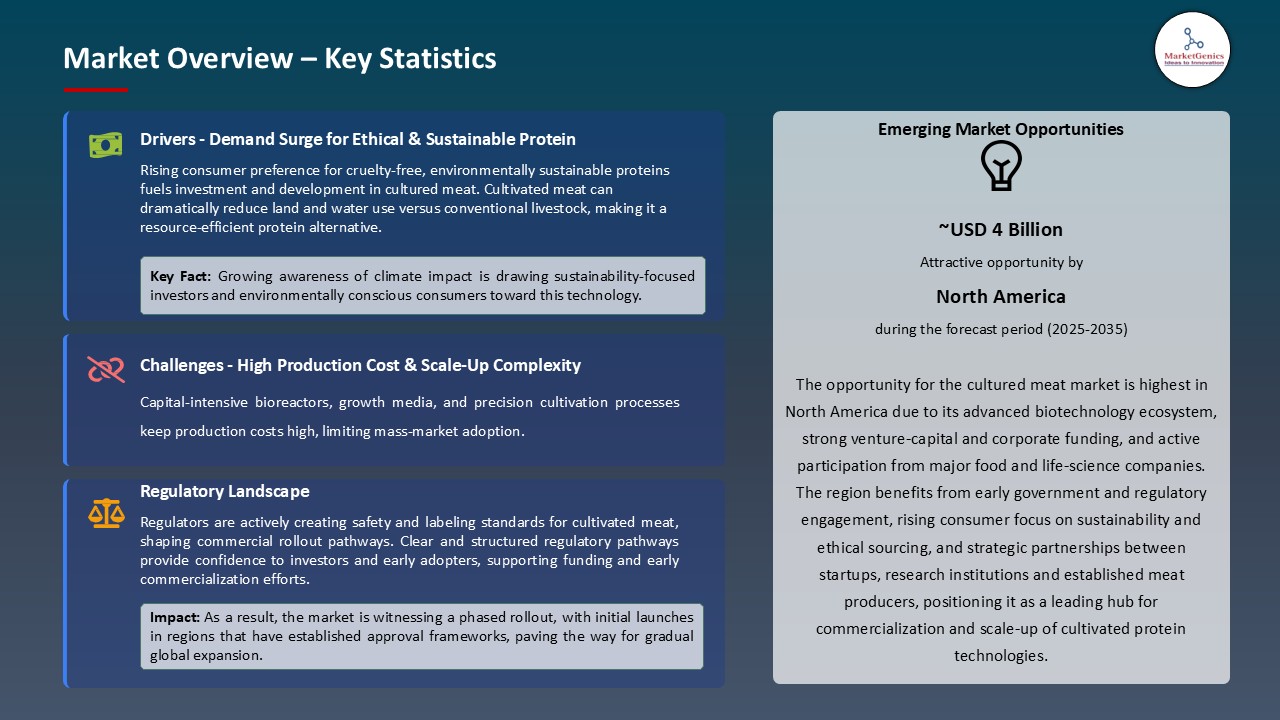

Driver: Food Security Concerns in Land-Constrained Regions Support Investment

- The increasing demand of sustainable protein products is driving businesses to increase their cultured meat pipelines by partnering and investing in them, with the goal of gaining faster access to products and satisfying the rising protein demands in urban and land-pressured areas. Emphasis is made on minimizing environmental effects, enhancing production efficiency and producing high-quality alternative proteins.

- Cultured meat companies are also establishing collaborations with bioprocessing technology vendors and cell culture ingredient suppliers to expand production and streamline the cell culture processes. For instance, in 2025, Stämm (a biopharmaceutical manufacturing company) and SuperMeat (a cultivated-chicken company) declared a strategic partnership to bring the advanced continuous bioprocessing technology of Stamme into the production system of SuperMeat. The joint venture, which is led by a common investor Varana Capital, aims to increase the volumetric productivity and minimize expenses in cultivated-meat production, thereby promoting the attainment of commercial viability faster.

- Such initiatives increase technological capacity, scalability of production and competitiveness in the market. All in all, these partnerships and investments keep innovating and accelerating commercialization and bolster leadership in the global cultured meat market.

Restraint: Production Cost Economics Prevent Mass Market Commercialization

- Cultured meat production is characterized by complex cell cultures, dedicated bioreactors, and growth media, and strict quality control, which increases the cost of production relative to regular meat. Large capital and cost of operations inhibit scale commercialization.

- Emerging firms usually have difficulties in the transition between lab to industrial manufacturing and consistency, safety, and taste, slowing down market acquisition. For instance, before regulatory approval, new cultivated meat startups will need to demonstrate the efficiency of cell growth and nutrient composition.

- The absence of international standards of cultured meat, such as labeling variations, safety testing, and approval processes in various regions, such as the US, EU and Asia-Pacific, also makes entering markets more challenging. These obstacles prolong development duration and expenses, restricting consumer reach and curbing the general growth of global cultured meat market.

Opportunity: Rapid Molecular Testing Enables Real-Time Quality Decisions

- The cultured meat market is opening up new opportunities due to the integration of AI, genetic sequencing and biomarker detection. Cell behavior, metabolic patterns, and protein expression can be analyzed to help companies to streamline cultured meat production to quality, yield, and consistency.

- The cultured meat market is rapidly advancing in innovation with the help of start-ups and research institutes together with bioprocess technology vendors. These alliances are expected to standardize quality testing, achieve scalability, and minimize the risk of production.

- The active development of strategic alliances is taking place as companies combine testing technologies to simplify process monitoring. For instance, in April 2025, Meatable and TruMeat declared a partnership to roll out superior analytics and real-time quality verification frameworks, streamline process observation, media creation, and commercial cultivated meat creation.

- The increase of such molecular-testing and monitoring platforms benefits consistency in batches, minimizes the production failures, and raises consumer confidence, which provides great growth opportunities within the global cultured meat market.

Key Trend: Precision Fermentation Produces Growth Factors Reducing Media Costs

- The cultured meat market is moving towards the use of precision fermentation to generate crucial growth factors and other media components, which will greatly lower the cost of cell culture media and enable scale-up and commercialization to occur at a faster rate. This also enhances uniformity and production of cultivated meat products.

- Firms are also actively implementing precision fermentation in order to optimise media formulation and reduce the cost of production. For instance, BioBetter (Israel) revealed the creation of plant-based bioreactors to scale production of growth factors, including insulin, transferrin, and FGF2, in 2022 at a scale that costs less than thousands of USD per gram, making cultivated meat more affordable.

- Precision fermentation enables the growth factors to be supplied in a consistent manner, less dependence on animal serum and scalable and cost-effective manufacturing. This tendency reinforces the cultured meat market around the world as it allows commercial viability and expansion of the use of cell-based meat products.

Cultured-Meat-Market Analysis and Segmental Data

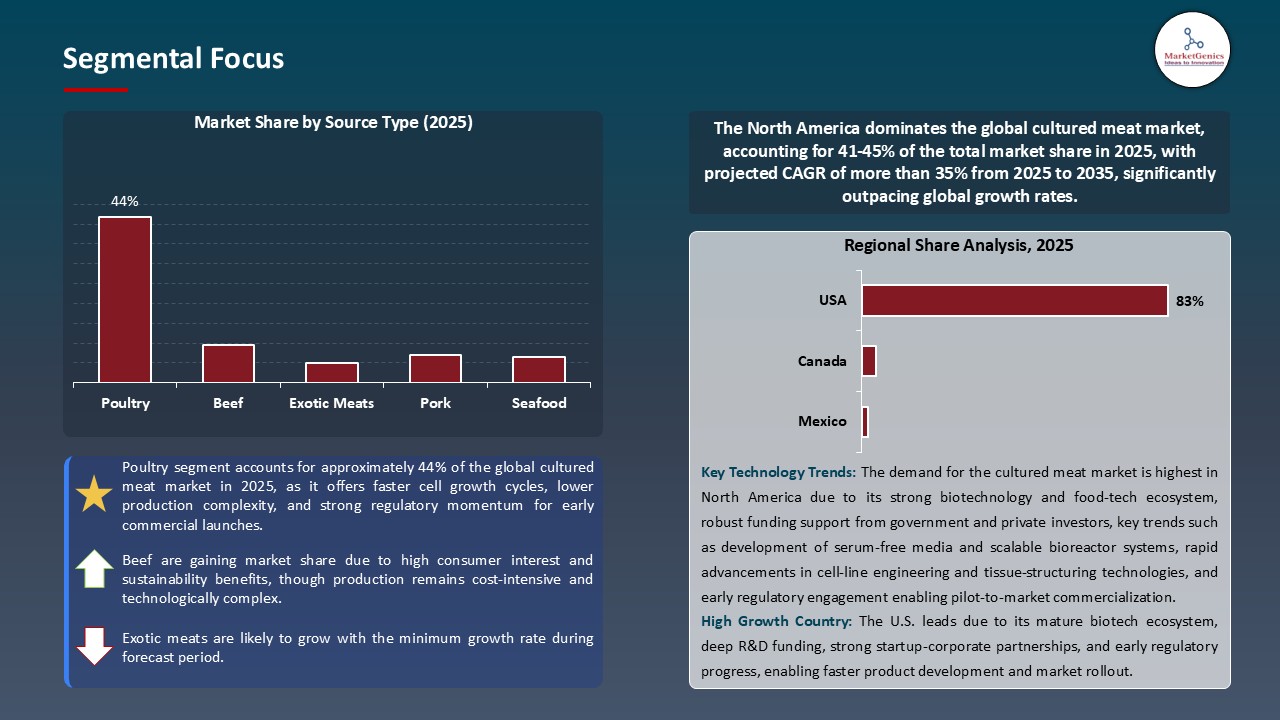

Poultry Dominate Global Cultured Meat Market

- The poultry segment dominates the cultured meat market across the world because the chicken cell lines are simpler and less expensive to grow as compared to the mammalian cells. The ease of culture, higher growth rates, and high consumer demand of poultry products worldwide make it an excellent first mover of cultured meat products. The commercialization is further enhanced by technological advancements including serum free media optimization, scalable bioreactors and regulatory precedent towards commercial production of chicken products.

- The poultry companies are aggressively diversifying their products to suit the rising demand and regulatory clearances. For instance, in October 2025, UPSIDE Foods announced that it would roll out its second poultry product, cultivated chicken shreds, in the U.S., a move that follows the previous acceptance of its whole-textured chicken product. This growth pinpoints the technological innovation, scalability and market preparedness of the poultry segment.

- The dominance of the poultry segment is supported by consumer familiarity with chicken, high demand in the global market and reduced biological barriers relative to beef or pork. All these combine to make poultry the most scalable/commercially attractive category of product in the cultured meat market.

North America Leads Global Cultured Meat Market Demand

- North America leads global cultured meat market, due to a developed system of start-ups and established firms, well-developed bioreactor and cell-culture technology, and favorable regulatory regulations by the FDA and USDA that allow the quicker commercialization of the products. Demand is also contributed by consumer awareness of the sustainable and ethical meat products.

- The North American market has a high density of cell-agriculture companies, research centers, and incubators, which allows to scale-up, produce, and commercially adopt new cultured meat products more rapidly. For instance, in September2024, Believer Meats contracted with GEA Group to expand production technologies and processes at its North Carolina plant to reach large-scale commercial production and enhance the technological innovation and commercialization leadership of the area.

- Commercialization is also expedited by venture capital investment, government funding programs and state of the art production facilities. North America contributes the biggest market share alongside the collaborative R&D ecosystems and digital food innovation platforms, and a leading hub of innovation in the global cultured meat market.

Cultured-Meat-Market Ecosystem

The worldwide cultured meat and seafood industry comprises both the large and small producers in the beef and poultry and seafood sector. Large-scale capabilities to produce foods, regulatory licenances, and diversification of products (beef and chicken) dominate the markets of Tier 1 companies like Upside Foods, Mosa Meat, and Eat Just (GOOD Meat). Aleph Farms is specialized in high-quality beef cuts and in international development, whereas BlueNalu dominates the cultivated seafood market with innovative fish items.

Fragmentation in the market is moderate as smaller start-ups and regional niche players cater to niche markets of specialty meats. Large foodservice and retail chains are the drivers of the industry, leading to moderate concentration of buyers, and supplier power is significant due to specialty cell culture media, scaffolds, as well as bioreactors, which makes it hard to enter and underlies the significance of technological skill.

Recent Development and Strategic Overview:

- In September 2025, Mission Barns introduced its cultivated-pork product at the world-first dinner in San Francisco. In the menu, there were meatballs and applewood-smoked bacon that was produced using its pork fat that had been cultivated. This method of fat-first improves taste and allows scaling at a low cost. The launch indicates evidence-of-concept of market preparation and aids the overall commercialization plan of the company.

- In September 2025, Aleph Farms declared a sales collaboration with The Cultured Hub a joint venture of Migros Industrie, Givaudan, and Buhler Group to create its first European manufacturing facility in Kemptthal, Canton of Zurich, Switzerland. This plant will be the first step into the European market by Aleph Farms, which will allow it to produce its cultivated beef products on the local level. This relocation is also in line with the strategy by the company to decentralize manufacturing, enhance supply chain proximity, and commercialization of its operations in Europe.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 0.6 Bn |

|

Market Forecast Value in 2035 |

~USD 10 Bn |

|

Growth Rate (CAGR) |

32.5% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Cultured-Meat-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Cultured Meat Market, By Source Type |

|

|

Cultured Meat Market, By Production Technology |

|

|

Cultured Meat Market, By Cell Type |

|

|

Cultured Meat Market, By Culture Medium |

|

|

Cultured Meat Market, By Product Form |

|

|

Cultured Meat Market, By Distribution Channel |

|

|

Cultured Meat Market, By End-Use Industry |

|

Frequently Asked Questions

The global cultured meat market was valued at USD 0.6 Bn in 2025.

The global cultured meat market industry is expected to grow at a CAGR of 32.5% from 2025 to 2035.

The demand for the cultured meat market is driven by increasing consumer focus on sustainable and ethical protein sources, rising awareness of environmental impacts of conventional meat, and growing health consciousness. Innovations in bioreactor design, cell culture techniques, and food-grade scaffolding, along with strategic partnerships and expanding investments in start-ups, are further accelerating global market growth.

In terms of source type, the poultry segment accounted for the major share in 2025.

Key players in the global cultured meat market include prominent companies such as Aleph Farms, Avant Meats, Balletic Foods, Believer Meats, BlueNalu, CellMEAT, Eat Just (GOOD Meat), Finless Foods, Future Meat Technologies, Higher Steaks, Integriculture, Meatable, Mission Barns, Mosa Meat, New Age Meats, Orbillion Bio, Shiok Meats, SuperMeat, Upside Foods, Vow Food, Wildtype, and Other Key Players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Cultured Meat Market Outlook

- 2.1.1. Cultured Meat Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Cultured Meat Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Food & Beverages Industry Overview, 2025

- 3.1.1. Food & Beverages Industry Ecosystem Analysis

- 3.1.2. Key Trends for Food & Beverages Industry

- 3.1.3. Regional Distribution for Food & Beverages Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Food & Beverages Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Advances in cell culture, bioprocessing and scaffold technologies enabling scale-up

- 4.1.1.2. Demand for sustainable, low-emission and animal-welfare-friendly protein alternatives

- 4.1.1.3. Strong investor funding, industry partnerships and increased R&D/commercialization efforts

- 4.1.2. Restraints

- 4.1.2.1. High production costs and technical scalability challenges

- 4.1.2.2. Regulatory uncertainty and limited consumer acceptance

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Cultured Meat Market Demand

- 4.9.1. Historical Market Size – Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size - Value (US$ Bn), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Cultured Meat Market Analysis, by Source Type

- 6.1. Key Segment Analysis

- 6.2. Cultured Meat Market Size (Value - US$ Bn), Analysis, and Forecasts, by Source Type, 2021-2035

- 6.2.1. Poultry

- 6.2.1.1. Chicken

- 6.2.1.2. Duck

- 6.2.1.3. Turkey

- 6.2.2. Beef

- 6.2.2.1. Premium cuts

- 6.2.2.2. Ground beef

- 6.2.3. Pork

- 6.2.4. Seafood

- 6.2.4.1. Fish

- 6.2.4.2. Crustaceans

- 6.2.4.3. Mollusks

- 6.2.5. Exotic meats

- 6.2.5.1. Game meat

- 6.2.5.2. Specialty proteins

- 6.2.1. Poultry

- 7. Global Cultured Meat Market Analysis, by Production Technology

- 7.1. Key Segment Analysis

- 7.2. Cultured Meat Market Size (Value - US$ Bn), Analysis, and Forecasts, by Production Technology, 2021-2035

- 7.2.1. Scaffold-based

- 7.2.1.1. Hydrogel scaffolds

- 7.2.1.2. Microcarrier-based

- 7.2.1.3. Textile scaffolds

- 7.2.2. Self-organizing

- 7.2.2.1. Organoid technology

- 7.2.2.2. 3D bioprinting

- 7.2.3. Hybrid systems

- 7.2.3.1. Plant-based scaffolding

- 7.2.3.2. Blended products

- 7.2.1. Scaffold-based

- 8. Global Cultured Meat Market Analysis, by Cell Type

- 8.1. Key Segment Analysis

- 8.2. Cultured Meat Market Size (Value - US$ Bn), Analysis, and Forecasts, by Cell Type, 2021-2035

- 8.2.1. Stem cells

- 8.2.1.1. Embryonic stem cells

- 8.2.1.2. Induced pluripotent stem cells

- 8.2.2. Satellite cells

- 8.2.3. Myoblasts

- 8.2.4. Fibroblasts

- 8.2.5. Adipocytes

- 8.2.6. Others

- 8.2.1. Stem cells

- 9. Global Cultured Meat Market Analysis, by Culture Medium

- 9.1. Key Segment Analysis

- 9.2. Cultured Meat Market Size (Value - US$ Bn), Analysis, and Forecasts, by Culture Medium, 2021-2035

- 9.2.1. Serum-free medium

- 9.2.2. Animal-free medium

- 9.2.3. Recombinant protein-based

- 9.2.4. Plant-derived medium

- 9.2.5. Hybrid medium formulations

- 10. Global Cultured Meat Market Analysis, by Product Form

- 10.1. Key Segment Analysis

- 10.2. Cultured Meat Market Size (Value - US$ Bn), Analysis, and Forecasts, by Product Form, 2021-2035

- 10.2.1. Whole-cut meat

- 10.2.2. Ground/minced meat

- 10.2.3. Processed meat products

- 10.2.3.1. Sausages

- 10.2.3.2. Nuggets

- 10.2.3.3. Patties

- 10.2.3.4. Others

- 10.2.4. Meat blends

- 10.2.4.1. Cultured-conventional hybrid

- 10.2.4.2. Cultured-plant hybrid

- 11. Global Cultured Meat Market Analysis, by Distribution Channel

- 11.1. Key Segment Analysis

- 11.2. Cultured Meat Market Size (Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 11.2.1. Direct-to-consumer

- 11.2.1.1. Online platforms

- 11.2.1.2. Subscription services

- 11.2.2. Retail

- 11.2.2.1. Supermarkets/Hypermarkets

- 11.2.2.2. Specialty stores

- 11.2.2.3. Organic food stores

- 11.2.3. Foodservice

- 11.2.1. Direct-to-consumer

- 12. Global Cultured Meat Market Analysis, by End-Use Industry

- 12.1. Key Segment Analysis

- 12.2. Cultured Meat Market Size (Value - US$ Bn), Analysis, and Forecasts, by End-Use Industry, 2021-2035

- 12.2.1. Food Processing Industry

- 12.2.1.1. Meat product manufacturing

- 12.2.1.1.1. Fresh meat processing

- 12.2.1.1.2. Frozen food production

- 12.2.1.1.3. Ready-to-eat meals

- 12.2.1.1.4. Others

- 12.2.1.2. Ingredient supply

- 12.2.1.2.1. Food ingredient formulation

- 12.2.1.2.2. Protein supplementation

- 12.2.1.2.3. Meat extract production

- 12.2.1.2.4. Others

- 12.2.1.1. Meat product manufacturing

- 12.2.2. Foodservice Industry

- 12.2.2.1. Fine dining restaurants

- 12.2.2.2. Fast-casual dining

- 12.2.2.3. Quick-service restaurants (QSR)

- 12.2.2.4. Catering services

- 12.2.2.5. Others

- 12.2.3. Retail Industry

- 12.2.4. Hospitality Industry

- 12.2.5. Institutional Sector

- 12.2.6. Pet Food Industry

- 12.2.7. Other End-user Industries

- 12.2.1. Food Processing Industry

- 13. Global Cultured Meat Market Analysis and Forecasts, by Region

- 13.1. Key Findings

- 13.2. Cultured Meat Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America Cultured Meat Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America Cultured Meat Market Size Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Source Type

- 14.3.2. Production Technology

- 14.3.3. Cell Type

- 14.3.4. Culture Medium

- 14.3.5. Product Form

- 14.3.6. Distribution Channel

- 14.3.7. End-Use Industry

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA Cultured Meat Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Source Type

- 14.4.3. Production Technology

- 14.4.4. Cell Type

- 14.4.5. Culture Medium

- 14.4.6. Product Form

- 14.4.7. Distribution Channel

- 14.4.8. End-Use Industry

- 14.5. Canada Cultured Meat Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Source Type

- 14.5.3. Production Technology

- 14.5.4. Cell Type

- 14.5.5. Culture Medium

- 14.5.6. Product Form

- 14.5.7. Distribution Channel

- 14.5.8. End-Use Industry

- 14.6. Mexico Cultured Meat Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Source Type

- 14.6.3. Production Technology

- 14.6.4. Cell Type

- 14.6.5. Culture Medium

- 14.6.6. Product Form

- 14.6.7. Distribution Channel

- 14.6.8. End-Use Industry

- 15. Europe Cultured Meat Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe Cultured Meat Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Source Type

- 15.3.2. Production Technology

- 15.3.3. Cell Type

- 15.3.4. Culture Medium

- 15.3.5. Product Form

- 15.3.6. Distribution Channel

- 15.3.7. End-Use Industry

- 15.3.8. Country

- 15.3.8.1. Germany

- 15.3.8.2. United Kingdom

- 15.3.8.3. France

- 15.3.8.4. Italy

- 15.3.8.5. Spain

- 15.3.8.6. Netherlands

- 15.3.8.7. Nordic Countries

- 15.3.8.8. Poland

- 15.3.8.9. Russia & CIS

- 15.3.8.10. Rest of Europe

- 15.4. Germany Cultured Meat Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Source Type

- 15.4.3. Production Technology

- 15.4.4. Cell Type

- 15.4.5. Culture Medium

- 15.4.6. Product Form

- 15.4.7. Distribution Channel

- 15.4.8. End-Use Industry

- 15.5. United Kingdom Cultured Meat Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Source Type

- 15.5.3. Production Technology

- 15.5.4. Cell Type

- 15.5.5. Culture Medium

- 15.5.6. Product Form

- 15.5.7. Distribution Channel

- 15.5.8. End-Use Industry

- 15.6. France Cultured Meat Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Source Type

- 15.6.3. Production Technology

- 15.6.4. Cell Type

- 15.6.5. Culture Medium

- 15.6.6. Product Form

- 15.6.7. Distribution Channel

- 15.6.8. End-Use Industry

- 15.7. Italy Cultured Meat Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Source Type

- 15.7.3. Production Technology

- 15.7.4. Cell Type

- 15.7.5. Culture Medium

- 15.7.6. Product Form

- 15.7.7. Distribution Channel

- 15.7.8. End-Use Industry

- 15.8. Spain Cultured Meat Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Source Type

- 15.8.3. Production Technology

- 15.8.4. Cell Type

- 15.8.5. Culture Medium

- 15.8.6. Product Form

- 15.8.7. Distribution Channel

- 15.8.8. End-Use Industry

- 15.9. Netherlands Cultured Meat Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Source Type

- 15.9.3. Production Technology

- 15.9.4. Cell Type

- 15.9.5. Culture Medium

- 15.9.6. Product Form

- 15.9.7. Distribution Channel

- 15.9.8. End-Use Industry

- 15.10. Nordic Countries Cultured Meat Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Source Type

- 15.10.3. Production Technology

- 15.10.4. Cell Type

- 15.10.5. Culture Medium

- 15.10.6. Product Form

- 15.10.7. Distribution Channel

- 15.10.8. End-Use Industry

- 15.11. Poland Cultured Meat Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Source Type

- 15.11.3. Production Technology

- 15.11.4. Cell Type

- 15.11.5. Culture Medium

- 15.11.6. Product Form

- 15.11.7. Distribution Channel

- 15.11.8. End-Use Industry

- 15.12. Russia & CIS Cultured Meat Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Source Type

- 15.12.3. Production Technology

- 15.12.4. Cell Type

- 15.12.5. Culture Medium

- 15.12.6. Product Form

- 15.12.7. Distribution Channel

- 15.12.8. End-Use Industry

- 15.13. Rest of Europe Cultured Meat Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Source Type

- 15.13.3. Production Technology

- 15.13.4. Cell Type

- 15.13.5. Culture Medium

- 15.13.6. Product Form

- 15.13.7. Distribution Channel

- 15.13.8. End-Use Industry

- 16. Asia Pacific Cultured Meat Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. East Asia Cultured Meat Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Source Type

- 16.3.2. Production Technology

- 16.3.3. Cell Type

- 16.3.4. Culture Medium

- 16.3.5. Product Form

- 16.3.6. Distribution Channel

- 16.3.7. End-Use Industry

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia Pacific

- 16.4. China Cultured Meat Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Source Type

- 16.4.3. Production Technology

- 16.4.4. Cell Type

- 16.4.5. Culture Medium

- 16.4.6. Product Form

- 16.4.7. Distribution Channel

- 16.4.8. End-Use Industry

- 16.5. India Cultured Meat Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Source Type

- 16.5.3. Production Technology

- 16.5.4. Cell Type

- 16.5.5. Culture Medium

- 16.5.6. Product Form

- 16.5.7. Distribution Channel

- 16.5.8. End-Use Industry

- 16.6. Japan Cultured Meat Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Source Type

- 16.6.3. Production Technology

- 16.6.4. Cell Type

- 16.6.5. Culture Medium

- 16.6.6. Product Form

- 16.6.7. Distribution Channel

- 16.6.8. End-Use Industry

- 16.7. South Korea Cultured Meat Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Source Type

- 16.7.3. Production Technology

- 16.7.4. Cell Type

- 16.7.5. Culture Medium

- 16.7.6. Product Form

- 16.7.7. Distribution Channel

- 16.7.8. End-Use Industry

- 16.8. Australia and New Zealand Cultured Meat Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Source Type

- 16.8.3. Production Technology

- 16.8.4. Cell Type

- 16.8.5. Culture Medium

- 16.8.6. Product Form

- 16.8.7. Distribution Channel

- 16.8.8. End-Use Industry

- 16.9. Indonesia Cultured Meat Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Source Type

- 16.9.3. Production Technology

- 16.9.4. Cell Type

- 16.9.5. Culture Medium

- 16.9.6. Product Form

- 16.9.7. Distribution Channel

- 16.9.8. End-Use Industry

- 16.10. Malaysia Cultured Meat Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Source Type

- 16.10.3. Production Technology

- 16.10.4. Cell Type

- 16.10.5. Culture Medium

- 16.10.6. Product Form

- 16.10.7. Distribution Channel

- 16.10.8. End-Use Industry

- 16.11. Thailand Cultured Meat Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Source Type

- 16.11.3. Production Technology

- 16.11.4. Cell Type

- 16.11.5. Culture Medium

- 16.11.6. Product Form

- 16.11.7. Distribution Channel

- 16.11.8. End-Use Industry

- 16.12. Vietnam Cultured Meat Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Source Type

- 16.12.3. Production Technology

- 16.12.4. Cell Type

- 16.12.5. Culture Medium

- 16.12.6. Product Form

- 16.12.7. Distribution Channel

- 16.12.8. End-Use Industry

- 16.13. Rest of Asia Pacific Cultured Meat Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Source Type

- 16.13.3. Production Technology

- 16.13.4. Cell Type

- 16.13.5. Culture Medium

- 16.13.6. Product Form

- 16.13.7. Distribution Channel

- 16.13.8. End-Use Industry

- 17. Middle East Cultured Meat Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East Cultured Meat Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Source Type

- 17.3.2. Production Technology

- 17.3.3. Cell Type

- 17.3.4. Culture Medium

- 17.3.5. Product Form

- 17.3.6. Distribution Channel

- 17.3.7. End-Use Industry

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey Cultured Meat Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Source Type

- 17.4.3. Production Technology

- 17.4.4. Cell Type

- 17.4.5. Culture Medium

- 17.4.6. Product Form

- 17.4.7. Distribution Channel

- 17.4.8. End-Use Industry

- 17.5. UAE Cultured Meat Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Source Type

- 17.5.3. Production Technology

- 17.5.4. Cell Type

- 17.5.5. Culture Medium

- 17.5.6. Product Form

- 17.5.7. Distribution Channel

- 17.5.8. End-Use Industry

- 17.6. Saudi Arabia Cultured Meat Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Source Type

- 17.6.3. Production Technology

- 17.6.4. Cell Type

- 17.6.5. Culture Medium

- 17.6.6. Product Form

- 17.6.7. Distribution Channel

- 17.6.8. End-Use Industry

- 17.7. Israel Cultured Meat Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Source Type

- 17.7.3. Production Technology

- 17.7.4. Cell Type

- 17.7.5. Culture Medium

- 17.7.6. Product Form

- 17.7.7. Distribution Channel

- 17.7.8. End-Use Industry

- 17.8. Rest of Middle East Cultured Meat Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Source Type

- 17.8.3. Production Technology

- 17.8.4. Cell Type

- 17.8.5. Culture Medium

- 17.8.6. Product Form

- 17.8.7. Distribution Channel

- 17.8.8. End-Use Industry

- 18. Africa Cultured Meat Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa Cultured Meat Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Source Type

- 18.3.2. Production Technology

- 18.3.3. Cell Type

- 18.3.4. Culture Medium

- 18.3.5. Product Form

- 18.3.6. Distribution Channel

- 18.3.7. End-Use Industry

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa Cultured Meat Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Source Type

- 18.4.3. Production Technology

- 18.4.4. Cell Type

- 18.4.5. Culture Medium

- 18.4.6. Product Form

- 18.4.7. Distribution Channel

- 18.4.8. End-Use Industry

- 18.5. Egypt Cultured Meat Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Source Type

- 18.5.3. Production Technology

- 18.5.4. Cell Type

- 18.5.5. Culture Medium

- 18.5.6. Product Form

- 18.5.7. Distribution Channel

- 18.5.8. End-Use Industry

- 18.6. Nigeria Cultured Meat Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Source Type

- 18.6.3. Production Technology

- 18.6.4. Cell Type

- 18.6.5. Culture Medium

- 18.6.6. Product Form

- 18.6.7. Distribution Channel

- 18.6.8. End-Use Industry

- 18.7. Algeria Cultured Meat Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Source Type

- 18.7.3. Production Technology

- 18.7.4. Cell Type

- 18.7.5. Culture Medium

- 18.7.6. Product Form

- 18.7.7. Distribution Channel

- 18.7.8. End-Use Industry

- 18.8. Rest of Africa Cultured Meat Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Source Type

- 18.8.3. Production Technology

- 18.8.4. Cell Type

- 18.8.5. Culture Medium

- 18.8.6. Product Form

- 18.8.7. Distribution Channel

- 18.8.8. End-Use Industry

- 19. South America Cultured Meat Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Central and South Africa Cultured Meat Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Source Type

- 19.3.2. Production Technology

- 19.3.3. Cell Type

- 19.3.4. Culture Medium

- 19.3.5. Product Form

- 19.3.6. Distribution Channel

- 19.3.7. End-Use Industry

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil Cultured Meat Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Source Type

- 19.4.3. Production Technology

- 19.4.4. Cell Type

- 19.4.5. Culture Medium

- 19.4.6. Product Form

- 19.4.7. Distribution Channel

- 19.4.8. End-Use Industry

- 19.5. Argentina Cultured Meat Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Source Type

- 19.5.3. Production Technology

- 19.5.4. Cell Type

- 19.5.5. Culture Medium

- 19.5.6. Product Form

- 19.5.7. Distribution Channel

- 19.5.8. End-Use Industry

- 19.6. Rest of South America Cultured Meat Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Source Type

- 19.6.3. Production Technology

- 19.6.4. Cell Type

- 19.6.5. Culture Medium

- 19.6.6. Product Form

- 19.6.7. Distribution Channel

- 19.6.8. End-Use Industry

- 20. Key Players/ Company Profile

- 20.1. Aleph Farms

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. Avant Meats

- 20.3. Balletic Foods

- 20.4. Believer Meats

- 20.5. BlueNalu

- 20.6. CellMEAT

- 20.7. Eat Just (GOOD Meat)

- 20.8. Finless Foods

- 20.9. Future Meat Technologies

- 20.10. Higher Steaks

- 20.11. Integriculture

- 20.12. Meatable

- 20.13. Mission Barns

- 20.14. Mosa Meat

- 20.15. New Age Meats

- 20.16. Orbillion Bio

- 20.17. Shiok Meats

- 20.18. SuperMeat

- 20.19. Upside Foods

- 20.20. Vow Food

- 20.21. Wildtype

- 20.22. Other Key Players

- 20.1. Aleph Farms

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data