Digital Therapeutics (DTX) Market Size, Share & Trends Analysis Report by Therapeutic Application (Diabetes Management, Obesity Management, Cardiovascular Diseases, Central Nervous System (CNS) Disorders, Respiratory Diseases, Substance Abuse Disorders, Gastrointestinal Disorders, Musculoskeletal Disorders, Sleep Disorders, Chronic Pain Management), Product Type, Sales Channel, Prescription Type, Patient Age Group, Reimbursement Model, Delivery Mode, Technology, End-users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Digital Therapeutics (DTX) Market Size, Share, and Growth

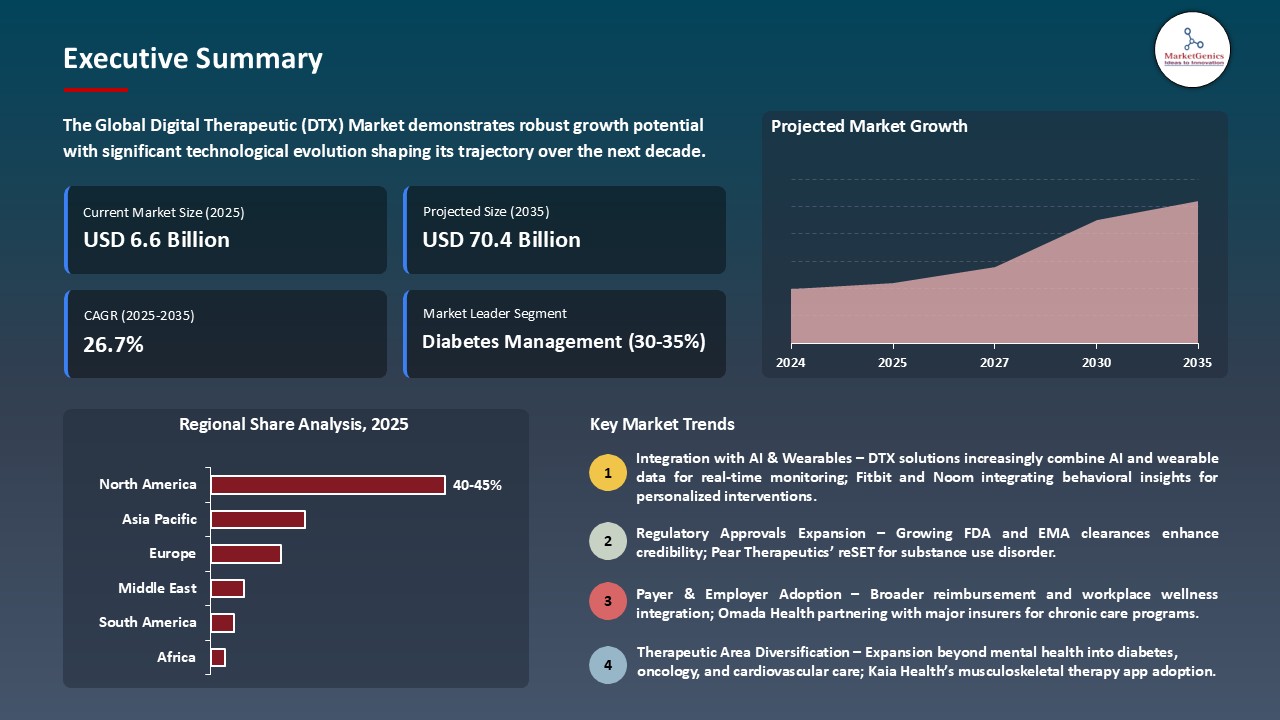

The global digital therapeutics (DTX) market is witnessing strong growth, valued at USD 6.6 billion in 2025 and projected to reach USD 70.4 billion by 2035, expanding at a CAGR of 26.7% during the forecast period. North America leads the digital therapeutics (DTX) market due to strong healthcare infrastructure, high adoption of digital health technologies, and supportive regulatory frameworks such as FDA approvals for DTx products.

Medidata, CEO, Anthony Costello said that, “Digital therapeutics are beginning to transform the way customers think about their future clinical development programs and are providing demonstrable therapeutic benefits over drugs alone in many cases”.

The digital therapeutics (DTx) market is experiencing a significant growth as the worldwide demand increases to seek scalable and evidence-based as well as patient-centered healthcare solutions. The proliferation of telehealth and the digitization of the healthcare industry also contributes to this growth because hospitals, clinics, and payers are steadily depending on electronic health records (EHRs), telemedicine platforms, and mobile health-related apps. An example is the Building Better Caregivers program by Canary Health, which extended the services to caregivers of severely ill and injured veterans, and caregivers of non-veterans, still under the U.S. Department of Veterans Affairs Caregiver Support Program.

Combining AI-based personalization with Real-World Data (RWD) is a significant Digital Therapeutics (DTx) opportunity to provide adaptive, evidence-based intervention that can improve clinical effectiveness. This strategy also reflects economic value in health promoting payer reimbursement, regulatory approval and scalable market adoption. As an example, Canvas Dx developed by Cognoa uses Artificial Intelligence (AI) and Real-World Data (RWD) in the form of home video and caregiver questionnaires to provide highly accurate Autism Spectrum Disorder (ASD) diagnosis.

Digital Therapeutics (DTX) Market Dynamics and Trends

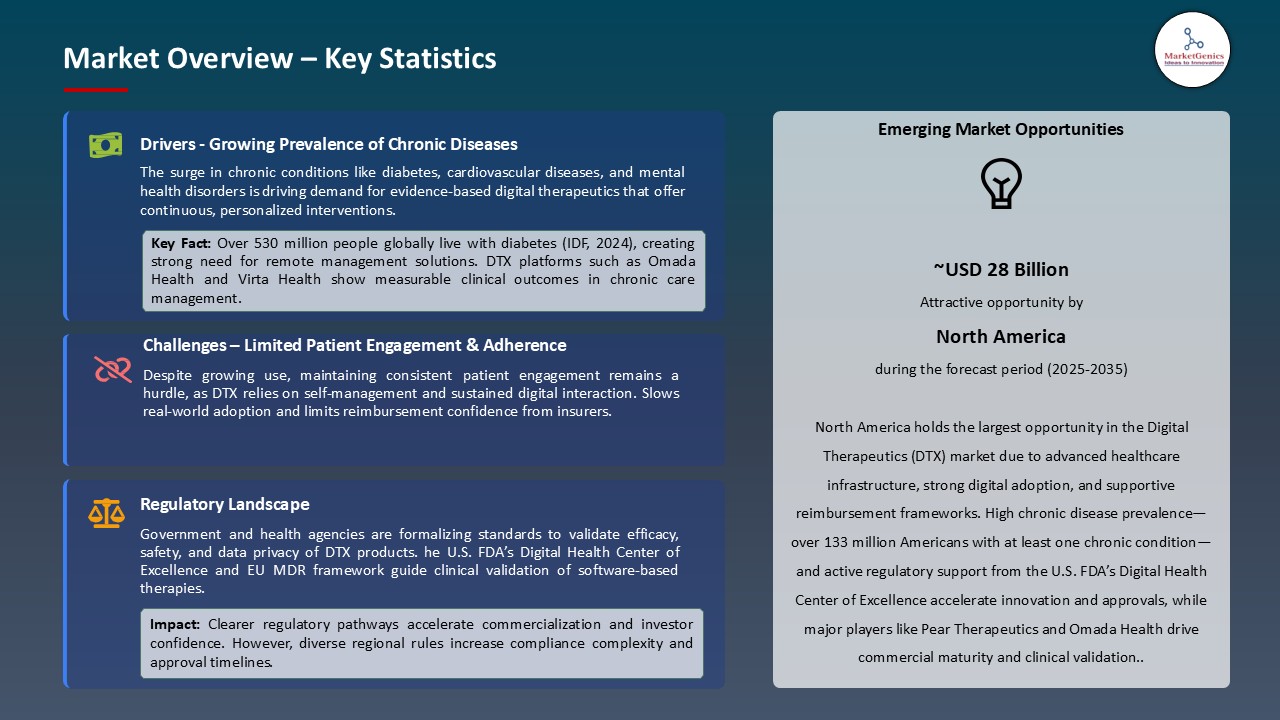

Driver: Rising prevalence of chronic diseases driving the growth of market

- The increasing number of ailments like diabetes, obesity, heart diseases, and mental health disorders is growing rapidly worldwide, making the digital therapeutic (DTX) market grow. The causes of this surge are varied and some of them include sedentary lifestyle, unhealthy eating habits, aging, urbanization and rising stress.

- Digital therapeutics (DTx) represent another solution to the mental health issue since they provide the options of real-time intervention, remote monitoring, and evidence-based behavior change. As an example, Happify Health provides gamified digital response to stress, anxiety, and depression, based on positive psychology and cognitive behavioral therapy, to enhance the emotional well-being.

- Thus, Digital therapeutics are revitalizing the market through scalable, personalized, and evidence-based interventions in chronic physical and mental health.

Restraint: Clinical Validation Gaps and Reimbursement Challenges in the Digital Therapeutics (DTx) Market Limit Accessibility

- The short supply of long-term clinical trials and real-world data of most digital therapeutics lowers provider confidence and payer readiness to recompense. This inhibits adoption, reduces market penetration and reduces the general growth of the digital therapeutics DTx market.

- The inconsistent or uneven coverage of payers is a barrier to growth in the digital therapeutics (DTx) market by imposing financial barriers on patients and restricting physician prescribing, preventing adoption and slowing the overall market growth.

- Generally, the Digital Therapeutics (DTx) market experiences high impediments due to the lack of clinical validation and unequal reimbursement, all of which diminish adoption, limit market penetration, and stifle the growth potential of the sector.

Opportunity: Opportunity in Prescription DTx and Co-Packaged Drug with Software Solutions

- Prescription digital therapeutics (PDTs) and co-packaged drug-software solutions are the new segments that are emerging in the digital therapeutics market with high growth rates. Being regulated, prescribable products, having better clinical credibility and better chances of reimbursement, promote adoption by healthcare providers and payers. As an example, the purchase of the assets of Better Therapeutics, including AspyreRx, the first FDA-approved prescription digital therapeutic type 2 diabetes, reinforces the pipeline of Click Therapeutics in the fields of obesity, diabetes, hypertension, hyperlipidemia, and MASH.

- Co-packaged solutions allow offers of integrated therapy solutions to improve patient outcomes, adherence, and value-based care models, making these products a core source of revenue in the dynamic DTx environment. To give just one example, The FDA Prescription Drug-Use Related Software (PDURS) initiative is an evident regulatory avenue of co-packed drug and digital therapeutic solutions. It provides clinical evidence and endorsement to guarantee safety, effectiveness as well as expediting its adoption in clinical practice.

- Thus, digital therapeutics prescriptions and co-packaged drug and software solution is a promising market segment, as it allows the adoption of a wider range of potential patients, improved patient outcomes, and a high revenue capacity in the rapidly changing digital therapeutics.

Key Trend: Shift Toward Clinically Validated, Prescribable Digital Therapeutics

- A current trend in the digital therapeutics market is a transition to clinically validated, prescribable therapies, whereby there is a significant emphasis on rigorous randomized controlled trials (RCTs), which prove the economic value of health. This is an indication of the shift in the industry towards evidence-based, medically validated interventions that can be incorporated into mainstream clinical practice. As an example, for instance, metaMe Health is revolutionizing the chronic condition management by providing prescription digital therapeutics (PDTs), which involves using smartphone- and tablet-based applications to condition the brain to mitigate symptoms and enhance patient outcomes without the use of additional medication.

- Prescribable therapies are getting formal regulatory approvals and healthcare providers use them to prescribe and incorporate them into standard clinical care, making DTx not a supplemental wellness intervention, but a medically accepted intervention. As an example, Big Health has created DaylightRx, an FDA-cleared prescription digital therapeutic that is intended to treat generalized anxiety disorder (GAD) in adults (22 years and above).

- The future of digital therapeutics lies in clinically-validated, prescribable systems that are part of standard care, which offer effective, evidence-based, management of chronic and mental illness.

Digital Therapeutics (DTX) Market Analysis and Segmental Data

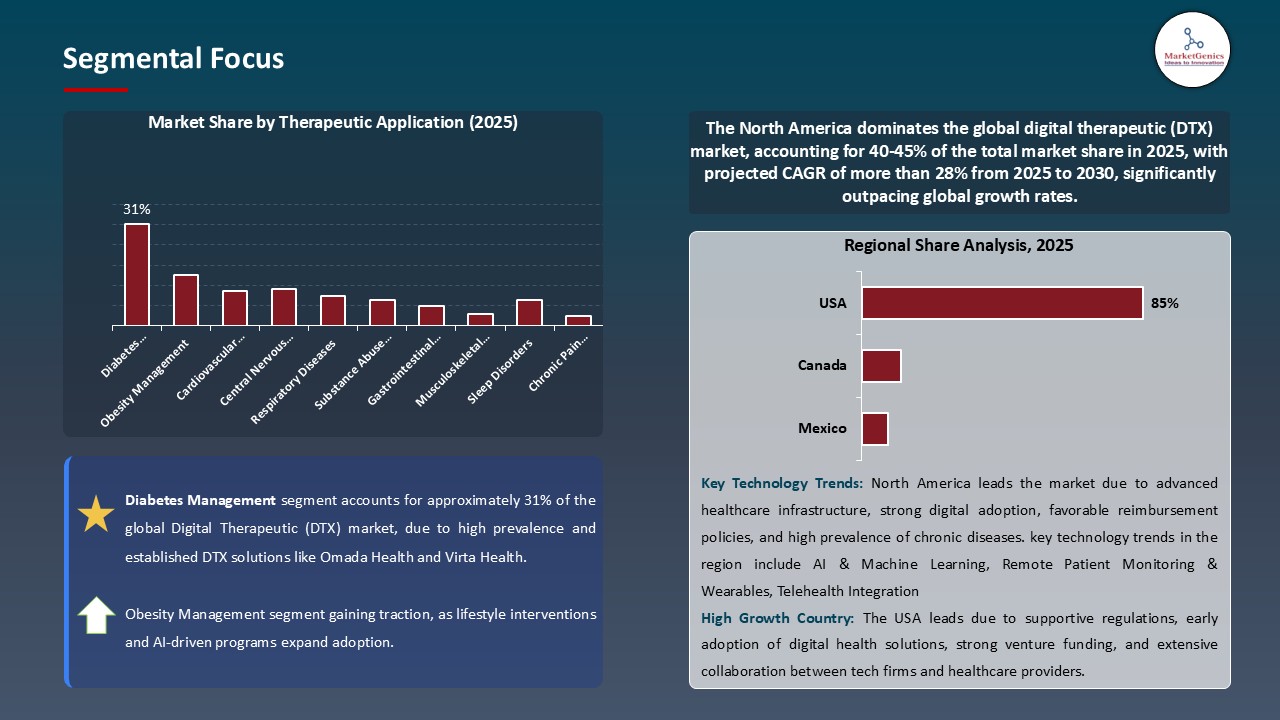

Diabetes Management Dominate Global Digital Therapeutics (DTX) Market

- The diabetes management segment is the largest in the world of digital therapeutics (DTx) because of the increasing prevalence and the requirements of personalized and ongoing management. An example is the Enhanced GLP-1 Care Track of Omada Health, which narrated real-life results, wherein 60% of participants sustained their weight loss and better medication adherence, which was the effective management of diabetes in a sustainable manner.

- Additionally, Digital therapeutics in diabetes offer real time glucose monitoring, behavior coaching, lifestyle change programs as well as connecting with wearable devices and this means that patients can better manage their condition and avoid complications. As an example, BlueStar by Welldoc is an FDA-cleared digital therapeutic diabetes management platform.

- As such, the diabetes management segment is an example of digital therapeutics that are revolutionizing chronic disease care, which is an integration of clinical validation, patient-specific interventions, and integrates technology to enhance patient outcomes and support long-term health benefits.

North America Leads Global Digital Therapeutics (DTX) Market Demand

- North America controls the global market of digital therapeutics (DTx) with a share of 31 percent, the demand is caused by a set of factors, such as high healthcare spending, developed technological infrastructure, and the popularity of digital health solutions. The area has a robust availability of prime DTx organizations, developed regulations in favor of software as a medical instrument, and increasing policies on reimbursement of digital health interventions.

- Regulation efforts promote innovation and easy embracing of digital therapies. An example of such an initiative is Digital Health Software Precertification (Pre-Cert) Program by the FDA in North America. The program is made to simplify the approval of digital health products, such as digital therapeutics, by assessing the quality systems of the software developer instead of assessing the individual products.

- Therefore, all these make North America a center of digital therapeutics innovation, which will create more rapid development, broader adoption, and increased access of effective digital health solutions to patients.

Digital Therapeutics (DTX) Market Ecosystem

The global digital therapeutics (DTx) market is moderately fragmented, with key players such as Livongo Health (Teladoc Health), Pear Therapeutics, Omada Health, Noom, and Propeller Health (ResMed) holding a combined market share of approximately 32%. These companies are pioneers in developing evidence-based digital interventions, owning significant intellectual property, robust clinical pipelines, strategic partnerships, and commercialization capabilities, which set technological and regulatory benchmarks that present entry barriers for new participants. For instance, Pear Therapeutics has achieved FDA clearance for multiple prescription digital therapeutics, establishing credibility and market trust.

Service providers play a crucial role in the DTx ecosystem, enabling faster product development, regulatory compliance, and scalable deployment. Their support shortens development timelines, lowers capital requirements for new entrants, and accelerates commercialization. For example, Teladoc Health provides integrated digital health services and platforms that allow other DTx solutions to reach patients efficiently and at scale.

Recent Development and Strategic Overview:

- In August 2025, Click Therapeutics and Boehringer Ingelheim reported that CT-155, a digital therapeutic for schizophrenia, significantly reduced negative symptoms. The therapy delivers digital cognitive-behavioral interventions, improving accessibility and patient engagement, and supports regulatory approval, highlighting DTx’s role in mental health care.

- In January 2025, ActiGraph, a global leader in wearable digital health technology for clinical research and development, announced the acquisition of Biofourmis Connect, a division of Biofourmis specializing in AI-powered digital trial platforms for the life science industry. This strategic acquisition aims to modernize clinical research by creating a unified software and data ecosystem that spans the entire drug-product lifecycle and therapeutic areas.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 6.6 Bn |

|

Market Forecast Value in 2035 |

USD 70.4 Bn |

|

Growth Rate (CAGR) |

26.7% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Digital Therapeutics (DTX) Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Digital Therapeutics (DTX) Market, By Therapeutic Application |

|

|

Digital Therapeutics (DTX) Market, By Product Type |

|

|

Digital Therapeutics (DTX) Market, By Sales Channel |

|

|

Digital Therapeutics (DTX) Market, By Prescription Type |

|

|

Digital Therapeutics (DTX) Market, By Patient Age Group |

|

|

Digital Therapeutics (DTX) Market, By Reimbursement Model |

|

|

Digital Therapeutics (DTX) Market, By Delivery Mode |

|

|

Digital Therapeutics (DTX) Market, By Technology |

|

|

Digital Therapeutics (DTX) Market, By End-users |

|

Frequently Asked Questions

The global digital therapeutics (DTX) market was valued at USD 6.6 Bn in 2025.

The global digital therapeutics (DTX) market industry is expected to grow at a CAGR of 26.7% from 2025 to 2035.

The demand for digital therapeutics (DTx) is driven by increasing chronic diseases, rising patient engagement, cost-effective care solutions, widespread smartphone and internet use, technological innovations, supportive regulations, preventive healthcare focus, aging populations, and integration with traditional healthcare systems.

In terms of therapeutic application, the diabetes management segment accounted for the major share in 2025.

North America is the most attractive market for digital therapeutics due to advanced healthcare infrastructure and strong adoption, while Asia-Pacific is the fastest-growing region driven by rising chronic diseases and increasing digital health access.

Prominent players operating in the global digital therapeutics (DTX) market are 2Morrow, Akili Interactive, Ayogo Health, Better Therapeutics, Big Health, Biofourmis, Canary Health, Click Therapeutics, Cognoa, Happify Health, Kaia Health, Livongo Health (Teladoc Health), Mango Health, Mindstrong Health, Noom, Omada Health, Pear Therapeutics, Propeller Health (ResMed), Proteus Digital Health, Voluntis (now part of AstraZeneca), Welldoc, and Other Key Players

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Digital Therapeutics (DTX) Market Outlook

- 2.1.1. Digital Therapeutics (DTX) Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Digital Therapeutics (DTX) Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Digital Therapeutics (DTX) Industry Overview, 2025

- 3.1.1. Healthcare & Pharmaceutical Industry Ecosystem Analysis

- 3.1.2. Key Trends for Healthcare & Pharmaceutical Industry

- 3.1.3. Regional Distribution for Healthcare & Pharmaceutical Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Digital Therapeutics (DTX) Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising chronic disease burden and demand for remote, scalable care

- 4.1.1.2. Strengthening clinical evidence and regulatory acceptance / integration into care pathways

- 4.1.1.3. Greater smartphone/internet penetration plus rising payer reimbursement and investment

- 4.1.2. Restraints

- 4.1.2.1. Data privacy/security concerns and fragmented regulatory frameworks

- 4.1.2.2. Low patient engagement/digital literacy and limited clinician reimbursement

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Digital Therapeutics (DTX) Market Demand

- 4.7.1. Historical Market Size - in Value (US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size - in Value (US$ Bn), 2025–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Digital Therapeutics (DTX) Market Analysis, By Therapeutic Application

- 6.1. Key Segment Analysis

- 6.2. Digital Therapeutics (DTX) Market Size (Value - US$ Bn), Analysis, and Forecasts, By Therapeutic Application, 2021-2035

- 6.2.1. Diabetes Management

- 6.2.2. Obesity Management

- 6.2.3. Cardiovascular Diseases

- 6.2.4. Central Nervous System (CNS) Disorders

- 6.2.4.1. Depression

- 6.2.4.2. Anxiety

- 6.2.4.3. Schizophrenia

- 6.2.4.4. ADHD

- 6.2.4.5. Others

- 6.2.5. Respiratory Diseases

- 6.2.5.1. Asthma

- 6.2.5.2. COPD

- 6.2.5.3. Others

- 6.2.6. Substance Abuse Disorders

- 6.2.6.1. Smoking Cessation

- 6.2.6.2. Alcohol Dependence

- 6.2.6.3. Opioid Addiction

- 6.2.6.4. Others

- 6.2.7. Gastrointestinal Disorders

- 6.2.8. Musculoskeletal Disorders

- 6.2.9. Sleep Disorders

- 6.2.10. Chronic Pain Management

- 7. Global Digital Therapeutics (DTX) Market Analysis, By Product Type

- 7.1. Key Segment Analysis

- 7.2. Digital Therapeutics (DTX) Market Size (Value - US$ Bn), Analysis, and Forecasts, By Product Type, 2021-2035

- 7.2.1. Software Applications

- 7.2.2. Wearable Devices

- 7.2.3. Mobile Applications

- 7.2.4. Web-based Platforms

- 7.2.5. Virtual Reality (VR) Solutions

- 7.2.6. Augmented Reality (AR) Solutions

- 7.2.7. Game-based Therapeutics

- 7.2.8. Chatbot/AI-powered Solutions

- 8. Global Digital Therapeutics (DTX) Market Analysis and Forecasts,By Sales Channel

- 8.1. Key Findings

- 8.2. Digital Therapeutics (DTX) Market Size (Value - US$ Mn), Analysis, and Forecasts, By Sales Channel, 2021-2035

- 8.2.1. Business-to-Business (B2B)

- 8.2.1.1. Healthcare Providers

- 8.2.1.2. Employers

- 8.2.1.3. Payers/Insurance Companies

- 8.2.1.4. Others

- 8.2.2. Business-to-Consumer (B2C)

- 8.2.2.1. Direct-to-Patient

- 8.2.2.2. App Stores

- 8.2.2.3. Online Platforms

- 8.2.2.4. Others

- 8.2.1. Business-to-Business (B2B)

- 9. Global Digital Therapeutics (DTX) Market Analysis and Forecasts, By Prescription Type

- 9.1. Key Findings

- 9.2. Digital Therapeutics (DTX) Market Size (Vo Value - US$ Mn), Analysis, and Forecasts, By Prescription Type, 2021-2035

- 9.2.1. Prescription DTx

- 9.2.2. Non-prescription DTx (OTC)

- 10. Global Digital Therapeutics (DTX) Market Analysis and Forecasts, By Patient Age Group

- 10.1. Key Findings

- 10.2. Digital Therapeutics (DTX) Market Size (Value - US$ Mn), Analysis, and Forecasts, By Patient Age Group, 2021-2035

- 10.2.1. Pediatric (0-17 years)

- 10.2.2. Adults (18-64 years)

- 10.2.3. Geriatric (65+ years)

- 11. Global Digital Therapeutics (DTX) Market Analysis and Forecasts, By Reimbursement Model

- 11.1. Key Findings

- 11.2. Digital Therapeutics (DTX) Market Size (Value - US$ Mn), Analysis, and Forecasts, By Reimbursement Model, 2021-2035

- 11.2.1. Insurance Reimbursed

- 11.2.2. Out-of-Pocket

- 11.2.3. Employer-sponsored

- 11.2.4. Government-funded Programs

- 11.2.5. Others

- 12. Global Digital Therapeutics (DTX) Market Analysis and Forecasts, By Delivery Mode

- 12.1. Key Findings

- 12.2. Digital Therapeutics (DTX) Market Size (Value - US$ Mn), Analysis, and Forecasts, By Delivery Mode, 2021-2035

- 12.2.1. Standalone DTx Solutions

- 12.2.2. Integrated with Medical Devices

- 12.2.3. Hybrid

- 13. Global Digital Therapeutics (DTX) Market Analysis and Forecasts, By Technology

- 13.1. Key Findings

- 13.2. Digital Therapeutics (DTX) Market Size (Value - US$ Mn), Analysis, and Forecasts, By Technology, 2021-2035

- 13.2.1. Cognitive Behavioral Therapy (CBT) Digital Programs

- 13.2.2. Biofeedback Technology

- 13.2.3. Gamification Technology

- 13.2.4. Telehealth Integration

- 13.2.5. Remote Patient Monitoring

- 13.2.6. Data Analytics & Predictive Modeling

- 13.2.7. AI & ML Integration

- 13.2.8. Blockchain Technology

- 13.2.9. Others

- 14. Global Digital Therapeutics (DTX) Market Analysis and Forecasts, By End-users

- 14.1. Key Findings

- 14.2. Digital Therapeutics (DTX) Market Size (Value - US$ Mn), Analysis, and Forecasts, By End-users, 2021-2035

- 14.2.1. Healthcare Providers

- 14.2.1.1. Hospitals

- 14.2.1.2. Clinics

- 14.2.1.3. Rehabilitation Centers

- 14.2.1.4. Primary Care Physicians

- 14.2.1.5. Others

- 14.2.2. Insurance Companies

- 14.2.2.1. Health Insurance Providers

- 14.2.2.2. Medicare/Medicaid

- 14.2.2.3. Private Insurers

- 14.2.2.4. Others

- 14.2.3. Patients/Individual Consumers

- 14.2.3.1. Chronic Disease Patients

- 14.2.3.2. Mental Health Patients

- 14.2.3.3. Wellness Seekers

- 14.2.3.4. Others

- 14.2.4. Pharmaceutical Companies

- 14.2.4.1. Drug Manufacturers

- 14.2.4.2. Biotech Firms

- 14.2.4.3. Others

- 14.2.5. Research Institutions

- 14.2.6. Other End-users

- 14.2.1. Healthcare Providers

- 15. Global Digital Therapeutics (DTX) Market Analysis and Forecasts, by Region

- 15.1. Key Findings

- 15.2. Digital Therapeutics (DTX) Market Size (Value - US$ Mn), Analysis, and Forecasts, by Region, 2021-2035

- 15.2.1. North America

- 15.2.2. Europe

- 15.2.3. Asia Pacific

- 15.2.4. Middle East

- 15.2.5. Africa

- 15.2.6. South America

- 16. North America Digital Therapeutics (DTX) Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. North America Digital Therapeutics (DTX) Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Therapeutic Application

- 16.3.2. Product Type

- 16.3.3. Sales Channel

- 16.3.4. Prescription Type

- 16.3.5. Patient Age Group

- 16.3.6. Reimbursement Model

- 16.3.7. Delivery Mode

- 16.3.8. Technology

- 16.3.9. End-Users

- 16.3.10. Country

- 16.3.10.1. USA

- 16.3.10.2. Canada

- 16.3.10.3. Mexico

- 16.4. USA Digital Therapeutics (DTX) Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Therapeutic Application

- 16.4.3. Product Type

- 16.4.4. Sales Channel

- 16.4.5. Prescription Type

- 16.4.6. Patient Age Group

- 16.4.7. Reimbursement Model

- 16.4.8. Delivery Mode

- 16.4.9. Technology

- 16.4.10. End-Users

- 16.5. Canada Digital Therapeutics (DTX) Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Therapeutic Application

- 16.5.3. Product Type

- 16.5.4. Sales Channel

- 16.5.5. Prescription Type

- 16.5.6. Patient Age Group

- 16.5.7. Reimbursement Model

- 16.5.8. Delivery Mode

- 16.5.9. Technology

- 16.5.10. End-Users

- 16.6. Mexico Digital Therapeutics (DTX) Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Material Type

- 16.6.3. Packaging Type

- 16.6.4. Technology Used

- 16.6.5. Distribution Channel

- 16.6.6. Product Format

- 16.6.7. Production Process

- 16.6.8. End-Users

- 17. Europe Digital Therapeutics (DTX) Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Europe Digital Therapeutics (DTX) Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Therapeutic Application

- 17.3.2. Product Type

- 17.3.3. Sales Channel

- 17.3.4. Prescription Type

- 17.3.5. Patient Age Group

- 17.3.6. Reimbursement Model

- 17.3.7. Delivery Mode

- 17.3.8. Technology

- 17.3.9. End-Users

- 17.3.10. Country

- 17.3.10.1. Germany

- 17.3.10.2. United Kingdom

- 17.3.10.3. France

- 17.3.10.4. Italy

- 17.3.10.5. Spain

- 17.3.10.6. Netherlands

- 17.3.10.7. Nordic Countries

- 17.3.10.8. Poland

- 17.3.10.9. Russia & CIS

- 17.3.10.10. Rest of Europe

- 17.4. Germany Digital Therapeutics (DTX) Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Therapeutic Application

- 17.4.3. Product Type

- 17.4.4. Sales Channel

- 17.4.5. Prescription Type

- 17.4.6. Patient Age Group

- 17.4.7. Reimbursement Model

- 17.4.8. Delivery Mode

- 17.4.9. Technology

- 17.4.10. End-Users

- 17.5. United Kingdom Digital Therapeutics (DTX) Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Therapeutic Application

- 17.5.3. Product Type

- 17.5.4. Sales Channel

- 17.5.5. Prescription Type

- 17.5.6. Patient Age Group

- 17.5.7. Reimbursement Model

- 17.5.8. Delivery Mode

- 17.5.9. Technology

- 17.5.10. End-Users

- 17.6. France Digital Therapeutics (DTX) Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Therapeutic Application

- 17.6.3. Product Type

- 17.6.4. Sales Channel

- 17.6.5. Prescription Type

- 17.6.6. Patient Age Group

- 17.6.7. Reimbursement Model

- 17.6.8. Delivery Mode

- 17.6.9. Technology

- 17.6.10. End-Users

- 17.7. Italy Digital Therapeutics (DTX) Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Therapeutic Application

- 17.7.3. Product Type

- 17.7.4. Sales Channel

- 17.7.5. Prescription Type

- 17.7.6. Patient Age Group

- 17.7.7. Reimbursement Model

- 17.7.8. Delivery Mode

- 17.7.9. Technology

- 17.7.10. End-Users

- 17.8. Spain Digital Therapeutics (DTX) Market

- 17.8.1. Therapeutic Application

- 17.8.2. Product Type

- 17.8.3. Sales Channel

- 17.8.4. Prescription Type

- 17.8.5. Patient Age Group

- 17.8.6. Reimbursement Model

- 17.8.7. Delivery Mode

- 17.8.8. Technology

- 17.8.9. End-Users

- 17.9. Netherlands Digital Therapeutics (DTX) Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Therapeutic Application

- 17.9.3. Product Type

- 17.9.4. Sales Channel

- 17.9.5. Prescription Type

- 17.9.6. Patient Age Group

- 17.9.7. Reimbursement Model

- 17.9.8. Delivery Mode

- 17.9.9. Technology

- 17.9.10. End-Users

- 17.10. Nordic Countries Digital Therapeutics (DTX) Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Therapeutic Application

- 17.10.3. Product Type

- 17.10.4. Sales Channel

- 17.10.5. Prescription Type

- 17.10.6. Patient Age Group

- 17.10.7. Reimbursement Model

- 17.10.8. Delivery Mode

- 17.10.9. Technology

- 17.10.10. End-Users

- 17.11. Poland Digital Therapeutics (DTX) Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Therapeutic Application

- 17.11.3. Product Type

- 17.11.4. Sales Channel

- 17.11.5. Prescription Type

- 17.11.6. Patient Age Group

- 17.11.7. Reimbursement Model

- 17.11.8. Delivery Mode

- 17.11.9. Technology

- 17.11.10. End-Users

- 17.12. Russia & CIS Digital Therapeutics (DTX) Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Therapeutic Application

- 17.12.3. Product Type

- 17.12.4. Sales Channel

- 17.12.5. Prescription Type

- 17.12.6. Patient Age Group

- 17.12.7. Reimbursement Model

- 17.12.8. Delivery Mode

- 17.12.9. Technology

- 17.12.10. End-Users

- 17.13. Rest of Europe Digital Therapeutics (DTX) Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Therapeutic Application

- 17.13.3. Product Type

- 17.13.4. Sales Channel

- 17.13.5. Prescription Type

- 17.13.6. Patient Age Group

- 17.13.7. Reimbursement Model

- 17.13.8. Delivery Mode

- 17.13.9. Technology

- 17.13.10. End-Users

- 18. Asia Pacific Digital Therapeutics (DTX) Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. East Asia Digital Therapeutics (DTX) Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Therapeutic Application

- 18.3.2. Product Type

- 18.3.3. Sales Channel

- 18.3.4. Prescription Type

- 18.3.5. Patient Age Group

- 18.3.6. Reimbursement Model

- 18.3.7. Delivery Mode

- 18.3.8. Technology

- 18.3.9. End-Users

- 18.3.10. Country

- 18.3.10.1. China

- 18.3.10.2. India

- 18.3.10.3. Japan

- 18.3.10.4. South Korea

- 18.3.10.5. Australia and New Zealand

- 18.3.10.6. Indonesia

- 18.3.10.7. Malaysia

- 18.3.10.8. Thailand

- 18.3.10.9. Vietnam

- 18.3.10.10. Rest of Asia Pacific

- 18.4. China Digital Therapeutics (DTX) Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Therapeutic Application

- 18.4.3. Product Type

- 18.4.4. Sales Channel

- 18.4.5. Prescription Type

- 18.4.6. Patient Age Group

- 18.4.7. Reimbursement Model

- 18.4.8. Delivery Mode

- 18.4.9. Technology

- 18.4.10. End-Users

- 18.5. India Digital Therapeutics (DTX) Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Therapeutic Application

- 18.5.3. Product Type

- 18.5.4. Sales Channel

- 18.5.5. Prescription Type

- 18.5.6. Patient Age Group

- 18.5.7. Reimbursement Model

- 18.5.8. Delivery Mode

- 18.5.9. Technology

- 18.5.10. End-Users

- 18.6. Japan Digital Therapeutics (DTX) Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Therapeutic Application

- 18.6.3. Product Type

- 18.6.4. Sales Channel

- 18.6.5. Prescription Type

- 18.6.6. Patient Age Group

- 18.6.7. Reimbursement Model

- 18.6.8. Delivery Mode

- 18.6.9. Technology

- 18.6.10. End-Users

- 18.7. South Korea Digital Therapeutics (DTX) Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Therapeutic Application

- 18.7.3. Product Type

- 18.7.4. Sales Channel

- 18.7.5. Prescription Type

- 18.7.6. Patient Age Group

- 18.7.7. Reimbursement Model

- 18.7.8. Delivery Mode

- 18.7.9. Technology

- 18.7.10. End-Users

- 18.8. Australia and New Zealand Digital Therapeutics (DTX) Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Therapeutic Application

- 18.8.3. Product Type

- 18.8.4. Sales Channel

- 18.8.5. Prescription Type

- 18.8.6. Patient Age Group

- 18.8.7. Reimbursement Model

- 18.8.8. Delivery Mode

- 18.8.9. Technology

- 18.8.10. End-Users

- 18.9. Indonesia Digital Therapeutics (DTX) Market

- 18.9.1. Country Segmental Analysis

- 18.9.2. Therapeutic Application

- 18.9.3. Product Type

- 18.9.4. Sales Channel

- 18.9.5. Prescription Type

- 18.9.6. Patient Age Group

- 18.9.7. Reimbursement Model

- 18.9.8. Delivery Mode

- 18.9.9. Technology

- 18.9.10. End-Users

- 18.10. Malaysia Digital Therapeutics (DTX) Market

- 18.10.1. Country Segmental Analysis

- 18.10.2. Therapeutic Application

- 18.10.3. Product Type

- 18.10.4. Sales Channel

- 18.10.5. Prescription Type

- 18.10.6. Patient Age Group

- 18.10.7. Reimbursement Model

- 18.10.8. Delivery Mode

- 18.10.9. Technology

- 18.10.10. End-Users

- 18.11. Thailand Digital Therapeutics (DTX) Market

- 18.11.1. Country Segmental Analysis

- 18.11.2. Therapeutic Application

- 18.11.3. Product Type

- 18.11.4. Sales Channel

- 18.11.5. Prescription Type

- 18.11.6. Patient Age Group

- 18.11.7. Reimbursement Model

- 18.11.8. Delivery Mode

- 18.11.9. Technology

- 18.11.10. End-Users

- 18.12. Vietnam Digital Therapeutics (DTX) Market

- 18.12.1. Country Segmental Analysis

- 18.12.2. Therapeutic Application

- 18.12.3. Product Type

- 18.12.4. Sales Channel

- 18.12.5. Prescription Type

- 18.12.6. Patient Age Group

- 18.12.7. Reimbursement Model

- 18.12.8. Delivery Mode

- 18.12.9. Technology

- 18.12.10. End-Users

- 18.13. Rest of Asia Pacific Digital Therapeutics (DTX) Market

- 18.13.1. Country Segmental Analysis

- 18.13.2. Therapeutic Application

- 18.13.3. Product Type

- 18.13.4. Sales Channel

- 18.13.5. Prescription Type

- 18.13.6. Patient Age Group

- 18.13.7. Reimbursement Model

- 18.13.8. Delivery Mode

- 18.13.9. Technology

- 18.13.10. End-Users

- 19. Middle East Digital Therapeutics (DTX) Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Middle East Digital Therapeutics (DTX) Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Therapeutic Application

- 19.3.2. Product Type

- 19.3.3. Sales Channel

- 19.3.4. Prescription Type

- 19.3.5. Patient Age Group

- 19.3.6. Reimbursement Model

- 19.3.7. Delivery Mode

- 19.3.8. Technology

- 19.3.9. End-Users

- 19.3.10. Country

- 19.3.10.1. Turkey

- 19.3.10.2. UAE

- 19.3.10.3. Saudi Arabia

- 19.3.10.4. Israel

- 19.3.10.5. Rest of Middle East

- 19.4. Turkey Digital Therapeutics (DTX) Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Therapeutic Application

- 19.4.3. Product Type

- 19.4.4. Sales Channel

- 19.4.5. Prescription Type

- 19.4.6. Patient Age Group

- 19.4.7. Reimbursement Model

- 19.4.8. Delivery Mode

- 19.4.9. Technology

- 19.4.10. End-Users

- 19.5. UAE Digital Therapeutics (DTX) Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Therapeutic Application

- 19.5.3. Product Type

- 19.5.4. Sales Channel

- 19.5.5. Prescription Type

- 19.5.6. Patient Age Group

- 19.5.7. Reimbursement Model

- 19.5.8. Delivery Mode

- 19.5.9. Technology

- 19.5.10. End-Users

- 19.6. Saudi Arabia Digital Therapeutics (DTX) Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Therapeutic Application

- 19.6.3. Product Type

- 19.6.4. Sales Channel

- 19.6.5. Prescription Type

- 19.6.6. Patient Age Group

- 19.6.7. Reimbursement Model

- 19.6.8. Delivery Mode

- 19.6.9. Technology

- 19.6.10. End-Users

- 19.7. Israel Digital Therapeutics (DTX) Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Therapeutic Application

- 19.7.3. Product Type

- 19.7.4. Sales Channel

- 19.7.5. Prescription Type

- 19.7.6. Patient Age Group

- 19.7.7. Reimbursement Model

- 19.7.8. Delivery Mode

- 19.7.9. Technology

- 19.7.10. End-Users

- 19.8. Rest of Middle East Digital Therapeutics (DTX) Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Therapeutic Application

- 19.8.3. Product Type

- 19.8.4. Sales Channel

- 19.8.5. Prescription Type

- 19.8.6. Patient Age Group

- 19.8.7. Reimbursement Model

- 19.8.8. Delivery Mode

- 19.8.9. Technology

- 19.8.10. End-Users

- 20. Africa Digital Therapeutics (DTX) Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Africa Digital Therapeutics (DTX) Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Therapeutic Application

- 20.3.2. Product Type

- 20.3.3. Sales Channel

- 20.3.4. Prescription Type

- 20.3.5. Patient Age Group

- 20.3.6. Reimbursement Model

- 20.3.7. Delivery Mode

- 20.3.8. Technology

- 20.3.9. End-Users

- 20.3.10. Country

- 20.3.10.1. South Africa

- 20.3.10.2. Egypt

- 20.3.10.3. Nigeria

- 20.3.10.4. Algeria

- 20.3.10.5. Rest of Africa

- 20.4. South Africa Digital Therapeutics (DTX) Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Therapeutic Application

- 20.4.3. Product Type

- 20.4.4. Sales Channel

- 20.4.5. Prescription Type

- 20.4.6. Patient Age Group

- 20.4.7. Reimbursement Model

- 20.4.8. Delivery Mode

- 20.4.9. Technology

- 20.4.10. End-Users

- 20.5. Egypt Digital Therapeutics (DTX) Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Therapeutic Application

- 20.5.3. Product Type

- 20.5.4. Sales Channel

- 20.5.5. Prescription Type

- 20.5.6. Patient Age Group

- 20.5.7. Reimbursement Model

- 20.5.8. Delivery Mode

- 20.5.9. Technology

- 20.5.10. End-Users

- 20.6. Nigeria Digital Therapeutics (DTX) Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Therapeutic Application

- 20.6.3. Product Type

- 20.6.4. Sales Channel

- 20.6.5. Prescription Type

- 20.6.6. Patient Age Group

- 20.6.7. Reimbursement Model

- 20.6.8. Delivery Mode

- 20.6.9. Technology

- 20.6.10. End-Users

- 20.7. Algeria Digital Therapeutics (DTX) Market

- 20.7.1. Country Segmental Analysis

- 20.7.2. Therapeutic Application

- 20.7.3. Product Type

- 20.7.4. Sales Channel

- 20.7.5. Prescription Type

- 20.7.6. Patient Age Group

- 20.7.7. Reimbursement Model

- 20.7.8. Delivery Mode

- 20.7.9. Technology

- 20.7.10. End-Users

- 20.8. Rest of Africa Digital Therapeutics (DTX) Market

- 20.8.1. Country Segmental Analysis

- 20.8.2. Therapeutic Application

- 20.8.3. Product Type

- 20.8.4. Sales Channel

- 20.8.5. Prescription Type

- 20.8.6. Patient Age Group

- 20.8.7. Reimbursement Model

- 20.8.8. Delivery Mode

- 20.8.9. Technology

- 20.8.10. End-Users

- 21. South America Digital Therapeutics (DTX) Market Analysis

- 21.1. Key Segment Analysis

- 21.2. Regional Snapshot

- 21.3. Central and South Africa Digital Therapeutics (DTX) Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 21.3.1. Therapeutic Application

- 21.3.2. Product Type

- 21.3.3. Sales Channel

- 21.3.4. Prescription Type

- 21.3.5. Patient Age Group

- 21.3.6. Reimbursement Model

- 21.3.7. Delivery Mode

- 21.3.8. Technology

- 21.3.9. End-Users

- 21.3.10. Country

- 21.3.10.1. Brazil

- 21.3.10.2. Argentina

- 21.3.10.3. Rest of South America

- 21.4. Brazil Digital Therapeutics (DTX) Market

- 21.4.1. Country Segmental Analysis

- 21.4.2. Therapeutic Application

- 21.4.3. Product Type

- 21.4.4. Sales Channel

- 21.4.5. Prescription Type

- 21.4.6. Patient Age Group

- 21.4.7. Reimbursement Model

- 21.4.8. Delivery Mode

- 21.4.9. Technology

- 21.4.10. End-Users

- 21.5. Argentina Digital Therapeutics (DTX) Market

- 21.5.1. Country Segmental Analysis

- 21.5.2. Therapeutic Application

- 21.5.3. Product Type

- 21.5.4. Sales Channel

- 21.5.5. Prescription Type

- 21.5.6. Patient Age Group

- 21.5.7. Reimbursement Model

- 21.5.8. Delivery Mode

- 21.5.9. Technology

- 21.5.10. End-Users

- 21.6. Rest of South America Digital Therapeutics (DTX) Market

- 21.6.1. Country Segmental Analysis

- 21.6.2. Therapeutic Application

- 21.6.3. Product Type

- 21.6.4. Sales Channel

- 21.6.5. Prescription Type

- 21.6.6. Patient Age Group

- 21.6.7. Reimbursement Model

- 21.6.8. Delivery Mode

- 21.6.9. Technology

- 21.6.10. End-Users

- 22. Key Players/ Company Profile

- 22.1. 2Morrow

- 22.1.1. Company Details/ Overview

- 22.1.2. Company Financials

- 22.1.3. Key Customers and Competitors

- 22.1.4. Business/ Industry Portfolio

- 22.1.5. Product Portfolio/ Specification Details

- 22.1.6. Pricing Data

- 22.1.7. Strategic Overview

- 22.1.8. Recent Developments

- 22.2. Akili Interactive

- 22.3. Ayogo Health

- 22.4. Better Therapeutics

- 22.5. Big Health

- 22.6. Biofourmis

- 22.7. Canary Health

- 22.8. Click Therapeutics

- 22.9. Cognoa

- 22.10. Happify Health

- 22.11. Kaia Health

- 22.12. Livongo Health (Teladoc Health)

- 22.13. Mango Health

- 22.14. Mindstrong Health

- 22.15. Noom

- 22.16. Omada Health

- 22.17. Pear Therapeutics

- 22.18. Propeller Health (ResMed)

- 22.19. Proteus Digital Health

- 22.20. Voluntis (now part of AstraZeneca)

- 22.21. Welldoc

- 22.22. Other Key Players

- 22.1. 2Morrow

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data