Car Leasing Market Size, Share, Growth Opportunity Analysis Report by Lease Type (Closed-End Lease, Open-End Lease, Single-Payment Lease, Subvented Lease and High-Mileage Lease), Leasing Model, Service Providers, Car Type, Propulsion Type, End Users and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035.

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Car Leasing Market Size, Share, and Growth

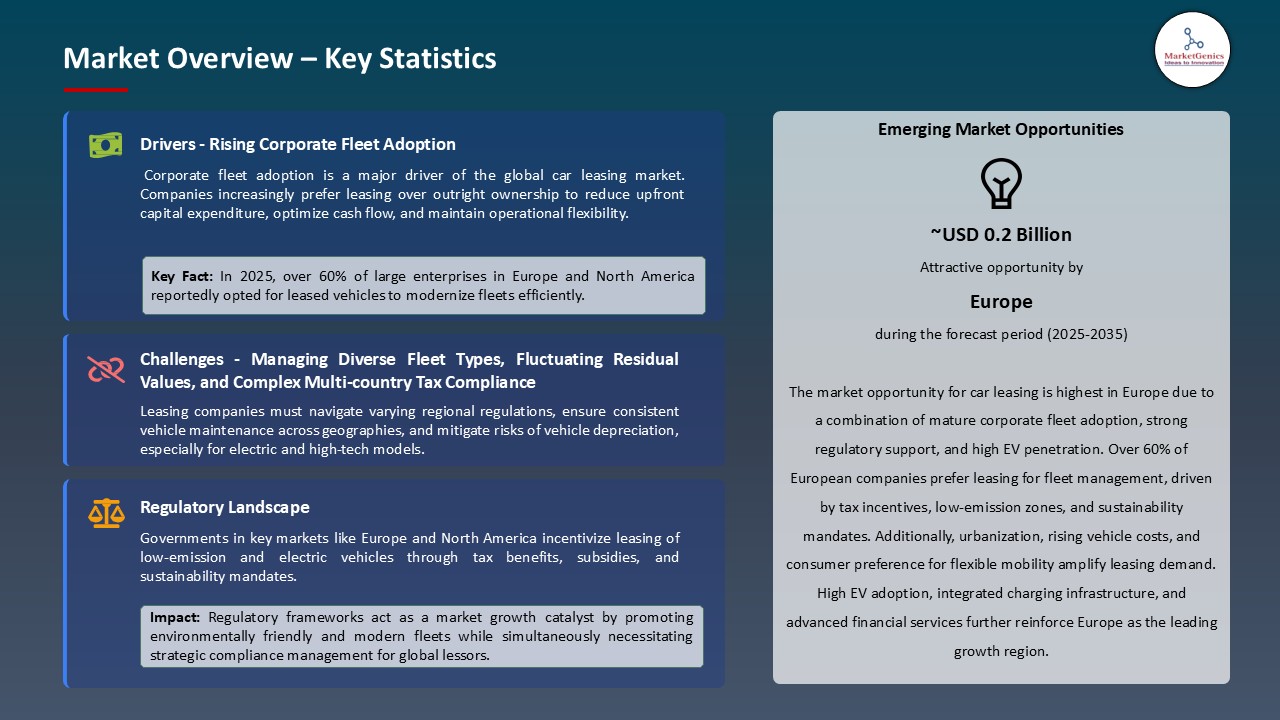

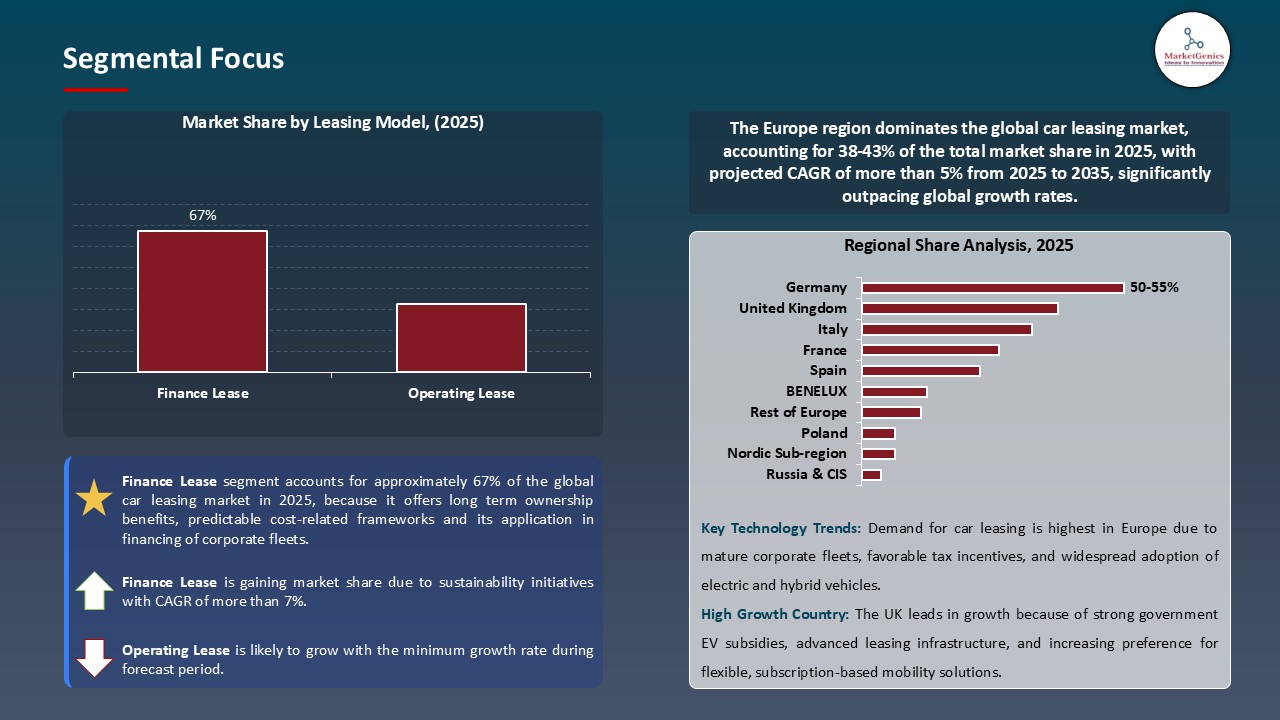

The global car leasing market is projected to grow from USD 0.7 Billion in 2025 to USD 1.3 Billion in 2035, with a strong CAGR of 6.6% during the forecasted period. Europe leads the car leasing market with market share of 41.2% with USD 0.3 billion revenue.

In June 2025, Ayvens Group, under the leadership of CEO Tim Albertsen, launched its “Sustainable Fleet Transition Initiative” aimed at accelerating the shift of corporate clients toward electric and hybrid vehicle leasing. The strategy includes offering carbon tracking dashboards, flexible leasing terms for EV adoption, and strategic partnerships with charging infrastructure providers. This initiative strengthens Ayvens’ position in the global car leasing market by aligning with corporate sustainability goals and expanding its electric mobility portfolio.

The key drivers of the global car leasing market are the growing popularity of the flexible mobility solution and the growing corporate transition to electric and hybrid fleets. Enterprise Holdings, Inc. increased its subscription-based Enterprise Flex-E-Rent in Europe in May 2025, which is a short-to-long-term leasing business solution to respond to the changing urban mobility and business fleet requirements.

For instance, in August 2025, Arval BNP Paribas Group launched its "Arval Charging Services" to offer corporate clients new to electric vehicles a way to go electric, by adding EV charging infrastructure to the lease contract. Such developments are driving market growth through digital transformation, sustainability and convenience in the models of fleet leasing globally.

The vehicle subscription services, mobility-as-a-service (MaaS) solutions, and EV fleet management solutions are some of the major opportunities to the global car leasing market. These new models are based on the trend of digital connectivity and sustainability to diversify their revenue and customer base. These nearby markets increase profitability potential and spur global mobility ecosystem innovation.

Car Leasing Market Dynamics and Trends

Driver: Technological Obsolescence Driving Demand for Leasing

- The key driver in the global car leasing market is the swift and steady technological change in the automotive sector and especially in such fields as electrification, digital connectivity, and autonomous systems. Leasing has become more popular among consumers and business people as a way of avoiding the possibility of having outdated technology by owning a vehicle. The ever-evolving EV battery performance, telematics integration, and the sophisticated driver-assistance systems (ADAS) have reduced the supposed vehicle lifecycle, and leasing has become a more affordable and not so hard commitment.

- Another leasing solution is being embraced by fleet operators in order to have the opportunity to have the updated fleets which meet the requirements of the emission and corporate sustainability without incurring the entire cost of depreciation. Additionally, with the automakers constantly releasing regular software updates and digital upgrades, leasing gives users the opportunity to migrate to newer models more easily.

- In 2025, Mercedes-Benz Financial Services has increased its Flexible Mobility Program that provides superior leasing packages with new EV and connected car technologies. This program allows both business and individual customers to get the latest models with an improved digital dashboard, increased safety, and better battery life on a shorter leasing term. Such a position can be associated with the increasing demand of the technologically modernized cars with no chance to be deprived of them long-term.

- The ever-changing nature of the automotive technology is driving the growth of the car leasing market as it transforms the obsolescence of vehicles into an ongoing leasing business and hence increasing the time of renewal and retention of customers.

Restraint: Declining Residual Value of Electric Vehicles

- The key restraint to the car leasing market is the falling residual value of electric vehicles (EVs) due to the intense price wars, high depreciation rate, and technological risks. The residual value- the approximate value of a car at the expiry of a lease- is very crucial in the calculation of leasing profitability. The accelerating development of EV technology, limited battery life, and uncertain residuals in the secondary market are complicating the ability of leasing companies to predict the correct residuals. The resale of the leased cars becomes very low when the manufacturers lower the prices of the new vehicles so the leasing providers are forced to make the leasing companies lose money. There is also the impact of unequal government subsidies and incentives which further alters market prices and values of future which pose financial risk to lessor.

- In the first half of 2025, Element Fleet Management Corp. had difficulties as the value of its electric vehicles was resold because of significant price cuts in the market on newer electric vehicles. To address this, the company updated its residual value assessment models and launched superior predictive analytics to deal with the depreciation risks more efficiently. But these led to the strain on operations and cost pressures.

- Lessors are constrained by the shrinking EV residual values as this reduces their profit margins and they have to adjust their pricing model and create a fine balance of affordability and profitability in the lease contract.

Opportunity: Growth in Flexible Ownership and Mobility-as-a-Service (MaaS) Models

- Flexible ownership and Mobility-as-a-Service (MaaS) models, which are a combination of conventional leasing and subscription-based and shared mobility are an emerging opportunity to the global car leasing market. The current day consumer, especially urban consumers like access over ownership, flexibility and convenience, which take into account the long-term commitments. Corporate customers are further moving to on-demand leasing and short-term leasing as a way of accommodating changing mobility demands, particularly in the hybrid work models. The leasing firms are taking the advantage of this by building tailor-made packages that combine maintenance, insurance, tele-matics and charging systems. The models are also in line with the sustainability objectives as they enable the common use of vehicles and minimized carbon emission.

- SIXT SE widened its "SIXT+" flexible subscription plan in Europe and North America in the middle of 2025. The initiative enables the customers to change their choice of vehicles every month and acquire electric or hybrid vehicles with combined insurance and service. It is also the company that incorporated its service into mobility platforms so that users can easily switch between car rentals, leases, and subscriptions.

- New sources of revenue are being unleashed through the emergence of the flexible leasing and subscriptions-based paradigms and the leasing providers can now access more customers and thus the car leasing market can scale to a greater extent in the long term.

Key Trend: Digitalization and AI-Driven Fleet Management Solutions

- The major trends for car leasing market across the globe is the digitalization of the fleet management system and data analysis using AI. More leasing companies are adopting new telematics, IoT sensors, and artificial intelligence to track the health of vehicles, driver activity, mileage data, and predictive maintenance requirements. Such technologies will provide more precise pricing, enhanced capabilities in forecasting the residual value, and enhanced customer satisfaction. The digital platforms are also simplifying the lifecycle of leasing including application, approval, payment, and return through reducing the administrative cost and improving transparency. Additionally, AI-informed information is assisting lessors to customize lease offers and products according to user preference to maximize the utilization rate and enhance operational effectiveness.

- In 2025, Arval BNP Paribas Group released its "Arval Smart Mobility Suite" that combines AI-based predictive analytics with telematics to optimize corporate fleet performance and sustainability. The system monitors CO2 emissions, driving habits and energy use and thus clients can enhance cost and environmental compliance. This new digital advancement has made Arval a pioneer in data-focused mobility leasing solutions.

- The increasing digitalization of the leasing processes will contribute to higher efficiency, closer communication with customers, and profitability, which makes AI-based platforms one of the foundations of the future car leasing ecosystem.

Car Leasing Market Analysis and Segmental Data

Based on Leasing Model, the Finance Lease Segment Retains the Largest Share

- The finance lease segment holds major share ~67% in the global car leasing market, because it offers long term ownership benefits, predictable cost-related frameworks and its application in financing of corporate fleets. Finance leases enable businesses to report vehicles as an asset availing the business tax benefits, as well as fixed monthly payments, and ownership alternatives in the future and this makes it tax wise appealing to those businesses that have a large fleet limit. In addition, they give stability in management of residual value particularly in premium and electric automobiles.

- Frank Hagele (Managing Director of Mobility Solutions) of Deutsche Leasing AG increased its finance lease offering in Europe in 2025 targeting corporate customers moving to EV-based fleets to achieve operational and tax efficiency.

- The increasing popularity of finance leases provides greater predictability of revenue to lessors over the long-term and promotes the modernization of corporate fleets globally.

Europe Dominates Global Car Leasing Market in 2025 and Beyond

- Europe holds the global car leasing market because of high rates of corporate fleet uptake, favourable taxation and well-established mobility ecosystem, owing to the financial institutions and automakers. In Europe, governments encourage leasing by providing deductions on taxes, incentives on reducing emissions and sustainability policies which convince businesses to lease cars instead of owning them. Moreover, increased EV usage and strict carbon emission regulations are driving leasing as an affordable compliance option to fleets.

- In 2025, under Tex Gunning (CEO), LeasePlan (Ayvens Group subsidiary) extended the electric fleet leasing services to France, Germany and UK in an effort to comply with corporate sustainability requirements.

- The regulatory and corporate structures of Europe remain to be dominant enough to ensure that the region remains a market leader in terms of sustainable and fleet-based car leasing market development.

Car Leasing Market Ecosystem

The global car leasing market is moderately consolidated with a medium-high concentration due to the representation of a strong part of the international market by the Tier-1 players, including Ayaven ven group, Arval BNP Paribas and Enterprise Holdings, Inc., who hold a significant share in the sector. The Tier-2 companies, including Avis Budget Group, SIXT SE, and The Hertz Corporation, have a robust regional presence and are concentrated on the flexible leasing and short-term rental model, whereas Tier-3 players, such as Ewald Automotive Group and Wilmar Inc., are located locally and are focused on the individual and SME-oriented leasing model. This structure establishes a competitive equilibrium on a scale, regional specialization, and innovation.

The key nodes in the electric vehicle (EV) market value chain that determine the growth of leasing included the integration of charging infrastructure, which, in turn, makes it possible to electrify the entire fleet, and battery lifecycle management, which, in turn, provides sustainable residual value optimization.

In 2025, Avis Budget Group, Inc. grew its leasing business by concentrating on EVs by incorporating charging and managing battery services in major urban centers. This dynamic ecosystem consolidates the market as well as reinforcing technology-based unions that make leasing more profitable and sustainable.

Recent Development and Strategic Overview:

- In September 2025, Franz Reiner, head of Mercedes-Benz Financial Services, launched a leasing package of electric vehicles (EVs) in Germany. This program comprises of built-in charging, maintenance, and customized lease agreements to corporate customers who move to eco-friendly fleets. The action will assist companies in going EVs and addressing operational expenses and infrastructural requirements.

- In August 2025, Caroline Parot, the head of Europcar Mobility Group, introduced a leasing-on-demand model, which works through subscriptions in the UK. This model enables the customers to have a variety of vehicles including EVs and offers a flexible contract and complementary services like insurance and maintenance. The project is aimed at urban workers who need flexible mobility options without having to make long-term contracts.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 0.7 Bn |

|

Market Forecast Value in 2035 |

USD 1.3 Bn |

|

Growth Rate (CAGR) |

6.6% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Number of Cars Leased for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Car Leasing Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Lease Type |

|

|

By Leasing Model |

|

|

By Service Providers |

|

|

By Car Type |

|

|

By Propulsion Type |

|

|

By End Users |

|

Frequently Asked Questions

The global car leasing market was valued at USD 0.7 Bn in 2025.

The global car leasing market industry is expected to grow at a CAGR of 6.6% from 2025 to 2035.

The demand for the global car leasing market is primarily driven by rising corporate fleet adoption, increasing preference for flexible mobility solutions, growing electric vehicle (EV) integration, and favorable taxation policies in key regions. Businesses and individuals prefer leasing to avoid large upfront costs, access newer vehicles with advanced technology, and manage operational and maintenance expenses efficiently, while sustainability initiatives and urbanization further accelerate market growth.

Finance lease contributed to the largest share of the car leasing market business in 2025, because it offers long term ownership benefits, predictable cost-related frameworks and its application in financing of corporate fleets.

The United Kingdom is among the fastest-growing countries globally.

American Electric Power Company, Inc., Arval BNP Paribas Group, Avis Budget Group, Inc., Ayvens Group, Deutsche Leasing AG, Element Fleet Management Corp., Emkay Global Financial Services Ltd., Enterprise Holdings, Inc., Europcar Mobility Group, Ewald Automotive Group, Lex Autolease Limited, Mercedes-Benz Financial Services, ORIX Corporation, SIXT SE, The Caldwell Company, The Hertz Corporation, United Leasing, Inc., Wheels Inc., Wilmar Inc., and Other Key Players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Car Leasing Market Outlook

- 2.1.1. Car Leasing Market Size (Volume - Number of Cars Leased & Value - US$ Billion), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to-Market Strategy

- 2.5.1. Customer/ End Use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Car Leasing Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Automotive & Transportation Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Automotive & Transportation Industry

- 3.1.3. Regional Distribution for Automotive & Transportation

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.1. Global Automotive & Transportation Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising corporate fleet adoption and preference for operational cost optimization.

- 4.1.1.2. Growing demand for electric and hybrid vehicle leasing due to sustainability initiatives.

- 4.1.1.3. Increasing urbanization and preference for flexible, subscription-based mobility solutions.

- 4.1.2. Restraints

- 4.1.2.1. Fluctuating interest rates and high financing costs affecting lease affordability.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis/ Ecosystem Analysis

- 4.4.1. Vehicle Procurement and Sourcing

- 4.4.2. Car Leasing Service Providers

- 4.4.3. Dealers and Integrators

- 4.4.4. End-users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Porter’s Five Forces Analysis

- 4.7. PESTEL Analysis

- 4.8. Global Car Leasing Market Demand

- 4.8.1. Historical Market Size - in Value (Volume - Number of Cars Leased & Value - US$ Billion), 2021-2024

- 4.8.2. Current and Future Market Size - in Value (Volume - Number of Cars Leased & Value - US$ Billion), 2025–2035

- 4.8.2.1. Y-o-Y Growth Trends

- 4.8.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Car Leasing Market Analysis, by Lease Type

- 6.1. Key Segment Analysis

- 6.2. Car Leasing Market Size (Volume - Number of Cars Leased & Value - US$ Billion), Analysis, and Forecasts, by Lease Type, 2021-2035

- 6.2.1. Closed-End Lease

- 6.2.2. Open-End Lease

- 6.2.3. Single-Payment Lease

- 6.2.4. Subvented Lease

- 6.2.5. High-Mileage Lease

- 7. Global Car Leasing Market Analysis, by Leasing Model

- 7.1. Key Segment Analysis

- 7.2. Car Leasing Market Size (Volume - Number of Cars Leased & Value - US$ Billion), Analysis, and Forecasts, by Leasing Model, 2021-2035

- 7.2.1. Finance Lease

- 7.2.1.1. Subscription-Based Leasing

- 7.2.1.2. Traditional Leasing

- 7.2.2. Operating Lease

- 7.2.2.1. Subscription-Based Leasing

- 7.2.2.2. Traditional Leasing

- 7.2.1. Finance Lease

- 8. Global Car Leasing Market Analysis, by Service Providers

- 8.1. Key Segment Analysis

- 8.2. Car Leasing Market Size (Volume - Number of Cars Leased & Value - US$ Billion), Analysis, and Forecasts, by Service Providers, 2021-2035

- 8.2.1. Automotive Manufacturers and Dealerships

- 8.2.2. NBFC’s

- 8.2.3. Independent Leasing Companies

- 8.2.4. Online Leasing Platforms

- 8.2.5. Credit Unions and Cooperative Leasing Programs

- 8.2.6. Automotive Rental Companies

- 8.2.7. Others

- 9. Global Car Leasing Market Analysis, by Car Type

- 9.1. Key Segment Analysis

- 9.2. Car Leasing Market Size (Volume - Number of Cars Leased & Value - US$ Billion), Analysis, and Forecasts, by Car Type, 2021-2035

- 9.2.1. Minicompact (A segment)

- 9.2.2. Supermini (B segment)

- 9.2.3. Compact (C segment)

- 9.2.4. Mid-size (D segment)

- 9.2.5. Executive (E segment)

- 9.2.6. Luxury (F segment)

- 9.2.7. Utility Vehicle (Sport Utility Vehicles & Multi-purpose Vehicle)

- 10. Global Car Leasing Market Analysis, by Propulsion Type

- 10.1. Key Segment Analysis

- 10.2. Car Leasing Market Size (Volume - Number of Cars Leased & Value - US$ Billion), Analysis, and Forecasts, by Propulsion Type, 2021-2035

- 10.2.1. ICE Vehicles

- 10.2.1.1. Gasoline

- 10.2.1.2. Diesel

- 10.2.2. Electric Vehicles

- 10.2.2.1. Battery Electric Vehicle (BEV)

- 10.2.2.2. Hybrid Electric Vehicle (HEV)

- 10.2.1. ICE Vehicles

- 11. Global Car Leasing Market Analysis, by End Users

- 11.1. Key Segment Analysis

- 11.2. Car Leasing Market Size (Volume - Number of Cars Leased & Value - US$ Billion), Analysis, and Forecasts, by End Users, 2021-2035

- 11.2.1. Private

- 11.2.2. Commercial

- 11.2.2.1. Corporate Businesses

- 11.2.2.2. Small and Medium-sized Enterprises (SMEs)

- 11.2.2.3. Government Agencies

- 11.2.2.4. Construction and Infrastructure Companies

- 11.2.2.5. Logistics and Delivery Services

- 11.2.2.6. Manufacturing Companies

- 11.2.2.7. Healthcare Institutions

- 11.2.2.8. Educational Institutions

- 11.2.2.9. IT Companies

- 11.2.2.10. Others

- 12. Global Car Leasing Market Analysis and Forecasts, by Region

- 12.1. Key Findings

- 12.2. Car Leasing Market Size (Volume - Number of Cars Leased & Value - US$ Billion), Analysis, and Forecasts, by Region, 2021-2035

- 12.2.1. North America

- 12.2.2. Europe

- 12.2.3. Asia Pacific

- 12.2.4. Middle East

- 12.2.5. Africa

- 12.2.6. South America

- 13. North America Car Leasing Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. North America Car Leasing Market Size (Volume - Number of Cars Leased & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 13.3.1. Lease Type

- 13.3.2. Leasing Model

- 13.3.3. Service Providers

- 13.3.4. Car Type

- 13.3.5. Propulsion Type

- 13.3.6. End Users

- 13.3.7. Country

- 13.3.7.1. USA

- 13.3.7.2. Canada

- 13.3.7.3. Mexico

- 13.4. USA Car Leasing Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Lease Type

- 13.4.3. Leasing Model

- 13.4.4. Service Providers

- 13.4.5. Car Type

- 13.4.6. Propulsion Type

- 13.4.7. End Users

- 13.5. Canada Car Leasing Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Lease Type

- 13.5.3. Leasing Model

- 13.5.4. Service Providers

- 13.5.5. Car Type

- 13.5.6. Propulsion Type

- 13.5.7. End Users

- 13.6. Mexico Car Leasing Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Lease Type

- 13.6.3. Leasing Model

- 13.6.4. Service Providers

- 13.6.5. Car Type

- 13.6.6. Propulsion Type

- 13.6.7. End Users

- 14. Europe Car Leasing Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. Europe Car Leasing Market Size (Volume - Number of Cars Leased & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 14.3.1. Lease Type

- 14.3.2. Leasing Model

- 14.3.3. Service Providers

- 14.3.4. Car Type

- 14.3.5. Propulsion Type

- 14.3.6. End Users

- 14.3.7. Country

- 14.3.7.1. Germany

- 14.3.7.2. United Kingdom

- 14.3.7.3. France

- 14.3.7.4. Italy

- 14.3.7.5. Spain

- 14.3.7.6. Netherlands

- 14.3.7.7. Nordic Countries

- 14.3.7.8. Poland

- 14.3.7.9. Russia & CIS

- 14.3.7.10. Rest of Europe

- 14.4. Germany Car Leasing Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Lease Type

- 14.4.3. Leasing Model

- 14.4.4. Service Providers

- 14.4.5. Car Type

- 14.4.6. Propulsion Type

- 14.4.7. End Users

- 14.5. United Kingdom Car Leasing Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Lease Type

- 14.5.3. Leasing Model

- 14.5.4. Service Providers

- 14.5.5. Car Type

- 14.5.6. Propulsion Type

- 14.5.7. End Users

- 14.6. France Car Leasing Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Lease Type

- 14.6.3. Leasing Model

- 14.6.4. Service Providers

- 14.6.5. Car Type

- 14.6.6. Propulsion Type

- 14.6.7. End Users

- 14.7. Italy Car Leasing Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Lease Type

- 14.7.3. Leasing Model

- 14.7.4. Service Providers

- 14.7.5. Car Type

- 14.7.6. Propulsion Type

- 14.7.7. End Users

- 14.8. Spain Car Leasing Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Lease Type

- 14.8.3. Leasing Model

- 14.8.4. Service Providers

- 14.8.5. Car Type

- 14.8.6. Propulsion Type

- 14.8.7. End Users

- 14.9. Netherlands Car Leasing Market

- 14.9.1. Country Segmental Analysis

- 14.9.2. Lease Type

- 14.9.3. Leasing Model

- 14.9.4. Service Providers

- 14.9.5. Car Type

- 14.9.6. Propulsion Type

- 14.9.7. End Users

- 14.10. Nordic Countries Car Leasing Market

- 14.10.1. Country Segmental Analysis

- 14.10.2. Lease Type

- 14.10.3. Leasing Model

- 14.10.4. Service Providers

- 14.10.5. Car Type

- 14.10.6. Propulsion Type

- 14.10.7. End Users

- 14.11. Poland Car Leasing Market

- 14.11.1. Country Segmental Analysis

- 14.11.2. Lease Type

- 14.11.3. Leasing Model

- 14.11.4. Service Providers

- 14.11.5. Car Type

- 14.11.6. Propulsion Type

- 14.11.7. End Users

- 14.12. Russia & CIS Car Leasing Market

- 14.12.1. Country Segmental Analysis

- 14.12.2. Lease Type

- 14.12.3. Leasing Model

- 14.12.4. Service Providers

- 14.12.5. Car Type

- 14.12.6. Propulsion Type

- 14.12.7. End Users

- 14.13. Rest of Europe Car Leasing Market

- 14.13.1. Country Segmental Analysis

- 14.13.2. Lease Type

- 14.13.3. Leasing Model

- 14.13.4. Service Providers

- 14.13.5. Car Type

- 14.13.6. Propulsion Type

- 14.13.7. End Users

- 15. Asia Pacific Car Leasing Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. East Asia Car Leasing Market Size (Volume - Number of Cars Leased & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 15.3.1. Lease Type

- 15.3.2. Leasing Model

- 15.3.3. Service Providers

- 15.3.4. Car Type

- 15.3.5. Propulsion Type

- 15.3.6. End Users

- 15.3.7. Country

- 15.3.7.1. China

- 15.3.7.2. India

- 15.3.7.3. Japan

- 15.3.7.4. South Korea

- 15.3.7.5. Australia and New Zealand

- 15.3.7.6. Indonesia

- 15.3.7.7. Malaysia

- 15.3.7.8. Thailand

- 15.3.7.9. Vietnam

- 15.3.7.10. Rest of Asia Pacific

- 15.4. China Car Leasing Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Lease Type

- 15.4.3. Leasing Model

- 15.4.4. Service Providers

- 15.4.5. Car Type

- 15.4.6. Propulsion Type

- 15.4.7. End Users

- 15.5. India Car Leasing Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Lease Type

- 15.5.3. Leasing Model

- 15.5.4. Service Providers

- 15.5.5. Car Type

- 15.5.6. Propulsion Type

- 15.5.7. End Users

- 15.6. Japan Car Leasing Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Lease Type

- 15.6.3. Leasing Model

- 15.6.4. Service Providers

- 15.6.5. Car Type

- 15.6.6. Propulsion Type

- 15.6.7. End Users

- 15.7. South Korea Car Leasing Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Lease Type

- 15.7.3. Leasing Model

- 15.7.4. Service Providers

- 15.7.5. Car Type

- 15.7.6. Propulsion Type

- 15.7.7. End Users

- 15.8. Australia and New Zealand Car Leasing Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Lease Type

- 15.8.3. Leasing Model

- 15.8.4. Service Providers

- 15.8.5. Car Type

- 15.8.6. Propulsion Type

- 15.8.7. End Users

- 15.9. Indonesia Car Leasing Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Lease Type

- 15.9.3. Leasing Model

- 15.9.4. Service Providers

- 15.9.5. Car Type

- 15.9.6. Propulsion Type

- 15.9.7. End Users

- 15.10. Malaysia Car Leasing Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Lease Type

- 15.10.3. Leasing Model

- 15.10.4. Service Providers

- 15.10.5. Car Type

- 15.10.6. Propulsion Type

- 15.10.7. End Users

- 15.11. Thailand Car Leasing Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Lease Type

- 15.11.3. Leasing Model

- 15.11.4. Service Providers

- 15.11.5. Car Type

- 15.11.6. Propulsion Type

- 15.11.7. End Users

- 15.12. Vietnam Car Leasing Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Lease Type

- 15.12.3. Leasing Model

- 15.12.4. Service Providers

- 15.12.5. Car Type

- 15.12.6. Propulsion Type

- 15.12.7. End Users

- 15.13. Rest of Asia Pacific Car Leasing Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Lease Type

- 15.13.3. Leasing Model

- 15.13.4. Service Providers

- 15.13.5. Car Type

- 15.13.6. Propulsion Type

- 15.13.7. End Users

- 16. Middle East Car Leasing Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Middle East Car Leasing Market Size (Volume - Number of Cars Leased & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 16.3.1. Lease Type

- 16.3.2. Leasing Model

- 16.3.3. Service Providers

- 16.3.4. Car Type

- 16.3.5. Propulsion Type

- 16.3.6. End Users

- 16.3.7. Country

- 16.3.7.1. Turkey

- 16.3.7.2. UAE

- 16.3.7.3. Saudi Arabia

- 16.3.7.4. Israel

- 16.3.7.5. Rest of Middle East

- 16.4. Turkey Car Leasing Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Lease Type

- 16.4.3. Leasing Model

- 16.4.4. Service Providers

- 16.4.5. Car Type

- 16.4.6. Propulsion Type

- 16.4.7. End Users

- 16.5. UAE Car Leasing Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Lease Type

- 16.5.3. Leasing Model

- 16.5.4. Service Providers

- 16.5.5. Car Type

- 16.5.6. Propulsion Type

- 16.5.7. End Users

- 16.6. Saudi Arabia Car Leasing Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Lease Type

- 16.6.3. Leasing Model

- 16.6.4. Service Providers

- 16.6.5. Car Type

- 16.6.6. Propulsion Type

- 16.6.7. End Users

- 16.7. Israel Car Leasing Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Lease Type

- 16.7.3. Leasing Model

- 16.7.4. Service Providers

- 16.7.5. Car Type

- 16.7.6. Propulsion Type

- 16.7.7. End Users

- 16.8. Rest of Middle East Car Leasing Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Lease Type

- 16.8.3. Leasing Model

- 16.8.4. Service Providers

- 16.8.5. Car Type

- 16.8.6. Propulsion Type

- 16.8.7. End Users

- 17. Africa Car Leasing Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Africa Car Leasing Market Size (Volume - Number of Cars Leased & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 17.3.1. Lease Type

- 17.3.2. Leasing Model

- 17.3.3. Service Providers

- 17.3.4. Car Type

- 17.3.5. Propulsion Type

- 17.3.6. End Users

- 17.3.7. Country

- 17.3.7.1. South Africa

- 17.3.7.2. Egypt

- 17.3.7.3. Nigeria

- 17.3.7.4. Algeria

- 17.3.7.5. Rest of Africa

- 17.4. South Africa Car Leasing Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Lease Type

- 17.4.3. Leasing Model

- 17.4.4. Service Providers

- 17.4.5. Car Type

- 17.4.6. Propulsion Type

- 17.4.7. End Users

- 17.5. Egypt Car Leasing Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Lease Type

- 17.5.3. Leasing Model

- 17.5.4. Service Providers

- 17.5.5. Car Type

- 17.5.6. Propulsion Type

- 17.5.7. End Users

- 17.6. Nigeria Car Leasing Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Lease Type

- 17.6.3. Leasing Model

- 17.6.4. Service Providers

- 17.6.5. Car Type

- 17.6.6. Propulsion Type

- 17.6.7. End Users

- 17.7. Algeria Car Leasing Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Lease Type

- 17.7.3. Leasing Model

- 17.7.4. Service Providers

- 17.7.5. Car Type

- 17.7.6. Propulsion Type

- 17.7.7. End Users

- 17.8. Rest of Africa Car Leasing Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Lease Type

- 17.8.3. Leasing Model

- 17.8.4. Service Providers

- 17.8.5. Car Type

- 17.8.6. Propulsion Type

- 17.8.7. End Users

- 18. South America Car Leasing Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Central and South Africa Car Leasing Market Size (Volume - Number of Cars Leased & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 18.3.1. Lease Type

- 18.3.2. Leasing Model

- 18.3.3. Service Providers

- 18.3.4. Car Type

- 18.3.5. Propulsion Type

- 18.3.6. End Users

- 18.3.7. Country

- 18.3.7.1. Brazil

- 18.3.7.2. Argentina

- 18.3.7.3. Rest of South America

- 18.4. Brazil Car Leasing Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Lease Type

- 18.4.3. Leasing Model

- 18.4.4. Service Providers

- 18.4.5. Car Type

- 18.4.6. Propulsion Type

- 18.4.7. End Users

- 18.5. Argentina Car Leasing Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Lease Type

- 18.5.3. Leasing Model

- 18.5.4. Service Providers

- 18.5.5. Car Type

- 18.5.6. Propulsion Type

- 18.5.7. End Users

- 18.6. Rest of South America Car Leasing Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Lease Type

- 18.6.3. Leasing Model

- 18.6.4. Service Providers

- 18.6.5. Car Type

- 18.6.6. Propulsion Type

- 18.6.7. End Users

- 19. Key Players/ Company Profile

- 19.1. American Electric Power Company, Inc.

- 19.1.1. Company Details/ Overview

- 19.1.2. Company Financials

- 19.1.3. Key Customers and Competitors

- 19.1.4. Business/ Industry Portfolio

- 19.1.5. Product Portfolio/ Specification Details

- 19.1.6. Pricing Data

- 19.1.7. Strategic Overview

- 19.1.8. Recent Developments

- 19.2. Arval BNP Paribas Group

- 19.3. Avis Budget Group, Inc.

- 19.4. Ayvens Group

- 19.5. Deutsche Leasing AG

- 19.6. Element Fleet Management Corp.

- 19.7. Emkay Global Financial Services Ltd.

- 19.8. Enterprise Holdings, Inc.

- 19.9. Europcar Mobility Group

- 19.10. Ewald Automotive Group

- 19.11. Lex Autolease Limited

- 19.12. Mercedes-Benz Financial Services

- 19.13. ORIX Corporation

- 19.14. SIXT SE

- 19.15. The Caldwell Company

- 19.16. The Hertz Corporation

- 19.17. United Leasing, Inc.

- 19.18. Wheels Inc.

- 19.19. Wilmar Inc.

- 19.20. Other Key Players

- 19.1. American Electric Power Company, Inc.

Note* - This is just tentative list of players. While providing the report, we will cover a greater number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data