Military Drone Market Size, Share, Growth Opportunity Analysis Report by Type (Fixed-Wing UAVs, Rotary-Wing UAVs (Rotors/Helicopter), Hybrid VTOL UAVs, Multi-Rotor UAVs, Tethered UAVs, Loitering Munitions (Kamikaze UAVs) and Others), Size/ Class, Range/ Endurance, Propulsion/ Power Source, Autonomy/ Control Mode, Operating Altitude, Application, End User and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Military Drone Market Size, Share, and Growth

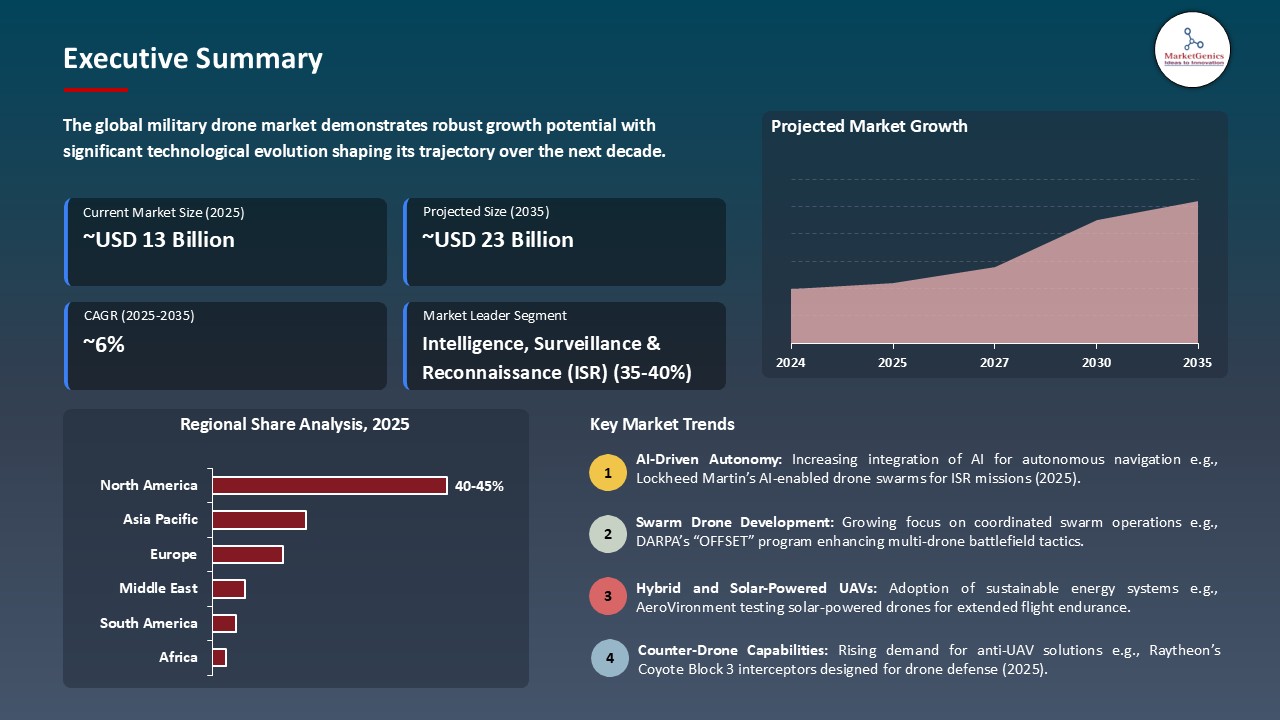

The global military drone market is projected to grow from USD 12.7 Billion in 2025 to USD 23.0 Billion in 2035, with a strong CAGR of 6.1% during the forecasted period. North America leads the military drone market with market share of 44.3% with USD 5.6 billion revenue.

In June 2025, General Atomics Aeronautical Systems, Inc. (GA-ASI) unveiled its MQ-9B SkyGuardian Global Sustainment Program aimed at enhancing drone operational efficiency and lifecycle management through predictive maintenance and AI-driven analytics. This strategy strengthens GA-ASI’s global defense partnerships and positions it as a leader in advanced unmanned aerial systems support solutions under the leadership of Linden P. Blue, CEO.

The trends that have fueled the global military drone market include the growing need to have autonomous surveillance and strike and integration of AI and sensor fusion-based technologies to provide real-time intelligence. In August 2025, Lockheed Martin Corporation made a step toward the development of its AI-powered Stalker VXE drone program in order to make its missions more focused on ISR (Intelligence, Surveillance and Reconnaissance).

In June 2025, Elbit Systems Ltd. unveiled the Hermes 650 Spark, which has more endurance and payload management of tactical operations. Such developments are driving the market to greater use of next-generation autonomous combat drones in the entire world.

The global military drone market has the opportunities of unmanned ground vehicle (UGV) market to defend the borders, autonomous decision-making with the help of AI-based battlefield analytics, and counter-drone defense systems to counter aerial threats. The segments enjoy the similarity of AI, sensor, and communication networks technologies. These neighboring innovations enhance the defense ecology and speed up the growth of the military drone market.

Military Drone Market Dynamics and Trends

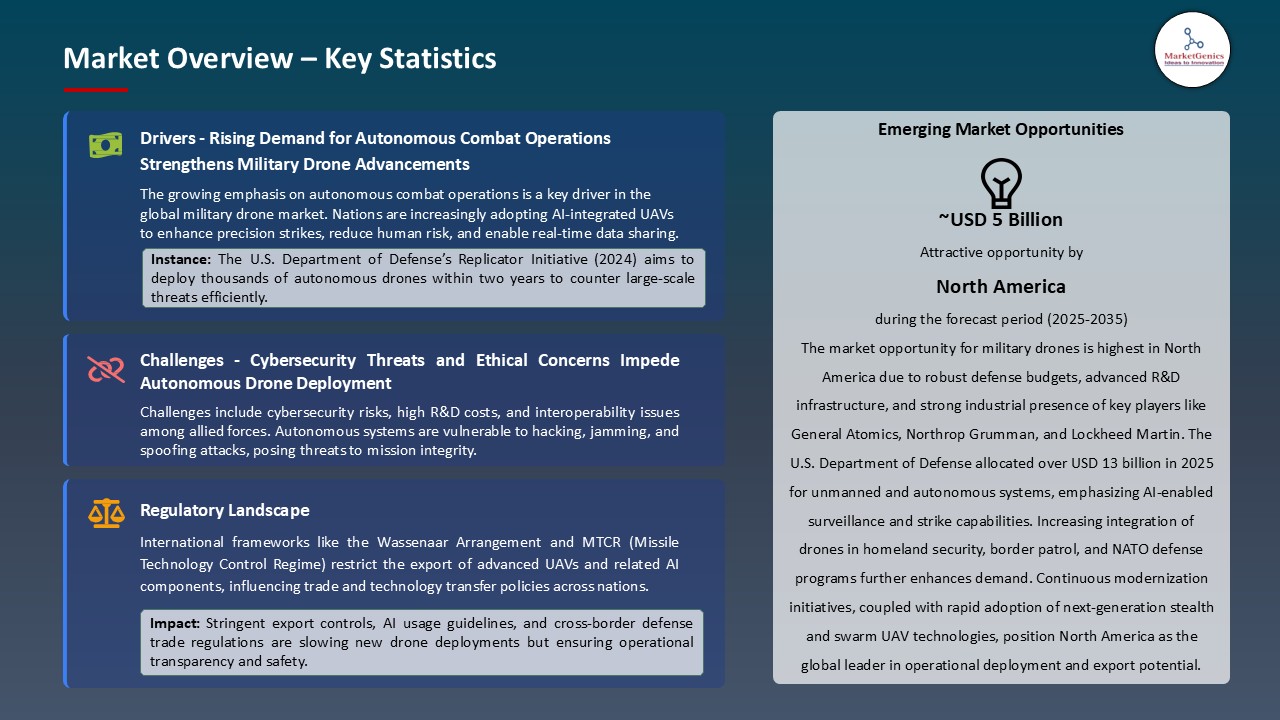

Driver: Rising Demand for Autonomous Combat Systems

- The global military drone market is being fueled by the increasing demand towards autonomous combat and surveillance systems as countries strive to make their operations more effective and reduce the level of risk to humans. The combination of AI and edge computing allows the drones to make real-time target recognition and route optimization, as well as autonomous strike missions.

- For instnace, Lockheed Martin Corporation declared the successful field testing of its Valkyrie autonomous swarm drones in May 2025, which could be coordinated with manned aircraft and would help to enhance accuracy in strike and reconnaissance missions. The development of AI-powered technologies of navigation and sensor fusion is creating the demand in autonomous drones on land and sea markets. This adoption is further enhanced by the growing defense budgets particularly in the U.S., China and India.

- The development of AI-based autonomy is driving a technological breakthrough in military drone, and this has increased the growth curve of the military drone market considerably.

Restraint: Stringent Export Regulations and Airspace Restrictions

- Harsh export policies and restricted airspace measures are still a significant limitation in the international military drone sales. The governments place stringent export licensing restrictions through regimes such as the Missile Technology Control Regime (MTCR) and International Traffic in Arms Regulations (ITAR) to ensure that such weapons are used effectively or not.

- For instance, Israel Aerospace Industries (IAI) is unable to export its Heron TP UAVs to some Asian nations in March 2025, postponing shipments and blocking market entry. In addition, the sophisticated airspace integration legislation and national security issues do not permit huge-scale cross-border operations and business partnerships. Such limitations lower the international interoperability and lengthen the process of procurement equally to both manufacturers and the defence agencies.

- The regulatory restrictions on business and operational expansion limit the otherwise fast growth of the military drone market.

Opportunity: Integration of Swarm Intelligence and Edge AI

- Swarm intelligence combined with edge AI opens up vast opportunities to the military drone market and allows coordinated missions between various drones with minimal human input. UAVs controlled by swarms can be used to conduct coordinated reconnaissance missions, electronic warfare, and precision strikes, which will transform the modern warfare tactics.

- In April 2025, the BAE Systems plc also released its SAGE-X Swarm System, which aims to enable the fleets of drones to interact and adjust dynamically to the missions. These types of systems make missions resilient because they allocate decision-making functions and minimize the chances of the failure of individual points. Governments are also putting a lot of money on the study of swarm to achieve strategic deterrence and control of the battlefield.

- The introduction of swarm AI will transform the combat intelligence and take the military drone market to the next level of group autonomy.

Key Trend: Hybrid-Energy and Long-Endurance Drone Platforms

- A trend in the military drone market across the globe is the movement to hybrid-energy propulsion systems, with the ability to combine electric and hydrogen fuel systems to increase the range of operations and stealth. The modern militaries have been focusing on drones that are able to conduct prolonged surveillance with little noise and infrared characteristics.

- In June 2025, Hybrid fuel cells by Northrop Grumman Corporation would present a Hydra H-UAV prototype, capable of flying longer by more than 40 percent than conventional platforms. This goes in line with the world defense sustainability objectives as well as the lack of reliance on fossil fuels. The focus on the durability, effectiveness, and versatility of UAVs is changing the concept of designing military UAVs to accomplish both strategic and tactical missions.

- The shift to hybrid-powered drones is an improvement in mission time, sustainability, and stealth and the future direction of the military drone market across the globe.

Military Drone Market Analysis and Segmental Data

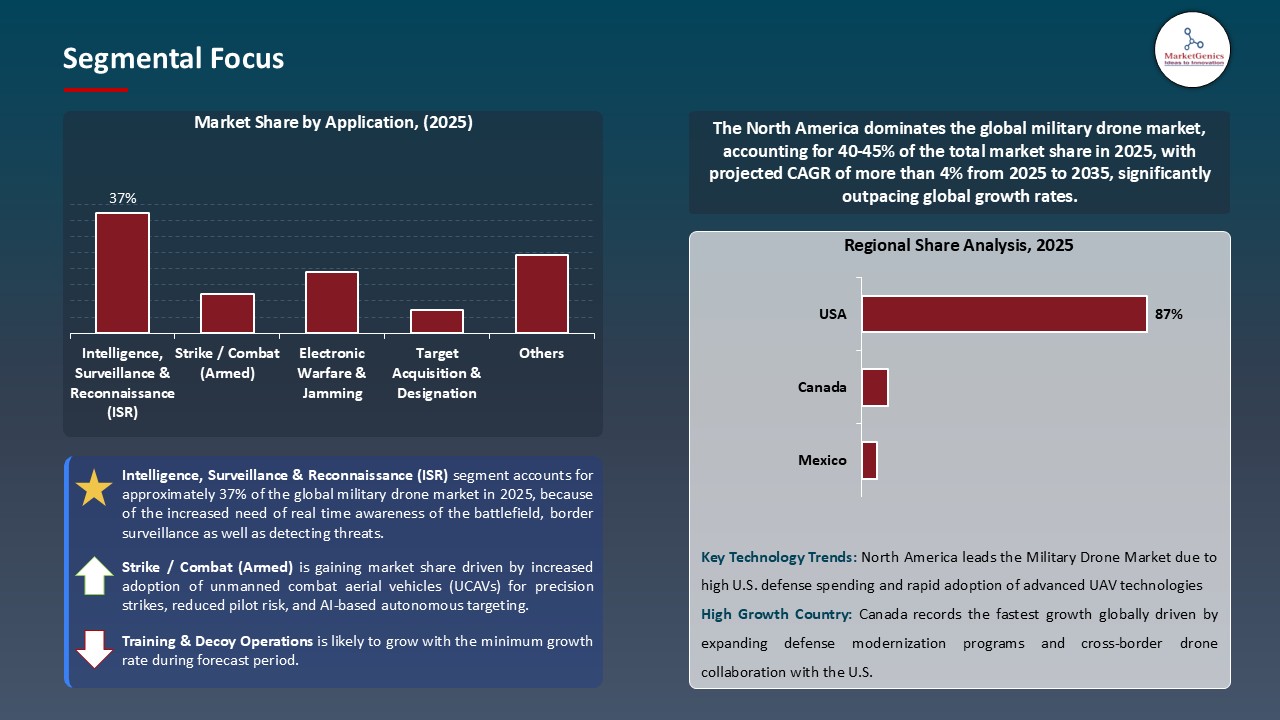

Based on Application, the Intelligence, Surveillance & Reconnaissance (ISR) Segment Retains the Largest Share

- The intelligence, surveillance & reconnaissance (ISR) segment holds major share ~37% in the global military drone market, because of the increased need of real time awareness of the battlefield, border surveillance as well as detecting threats. Aerial surveillance is taking a center stage in the modern defense forces to guarantee prompt decision making and precision in missions. The drones of ISR fitted in synthetic aperture radar (SAR), EO/IR cameras, and AI-based analytics allow the ongoing data collection to be undertaken regarding the hostile or inaccessible environment.

- For instance, in April 2025, General Atomic Aeronautical Systems, Inc. (GA-ASI) introduced an enhanced MQ-9B SkyGuardian unmanned aerial vehicle with advanced capabilities in AI-based ISR to ensure seamless data fusion and autonomous tracking of targets in multi-domain operations.

- Moreover, there has been an increase in defense spending on high-end ISR platforms along the border and the sea as a result of geopolitical tensions in the Eastern Region, the Middle East, and in the Indo-Pacific. Countries are implementing ISR systems based on UAV in order to have a better way of strategic deterrence as well as minimizing the human risk in high threat regions.

- The preeminence of ISR applications enhances the modernization of the defense and entrenches the UAVs as the fundamental resources of the new generation military intelligence missions.

North America Dominates Global Military Drone Market in 2025 and Beyond

- North America has the largest military drone demand because of the developed defense infrastructure, significant defense budgets, and an early adoption of the autonomous combat technology. The U.S. Department of Defense (DoD) still focuses on drone integration to support surveillance, strike, and logistics operations as part of the modernization processes like Joint All-Domain Command and Control (JADC2). The area is also well endowed with a good base of manufacturers like General Atomics, Northrop Grumman and Lockheed Martin who keeps on innovating to meet the changing mission needs.

- In June 2025, Northrop Grumman Corporation unveiled improvements to its RQ-4 Global Hawk Block 40 to add AI-based image recognition and increased endurance to improve ISR capabilities.

- Moreover, the interest of North America in the counterterrorism missions, the homeland security, and the supervision of the Arctic influences the persistent acquisition of drones. The work of the U.S. Air Force and defense technological startups can help to promote the next-generation unmanned systems with a focus on autonomy and network-centered warfare.

- The North American military drone market is the most profitable and the most innovative market in the global military drone market due to strong defense funding and technology leadership.

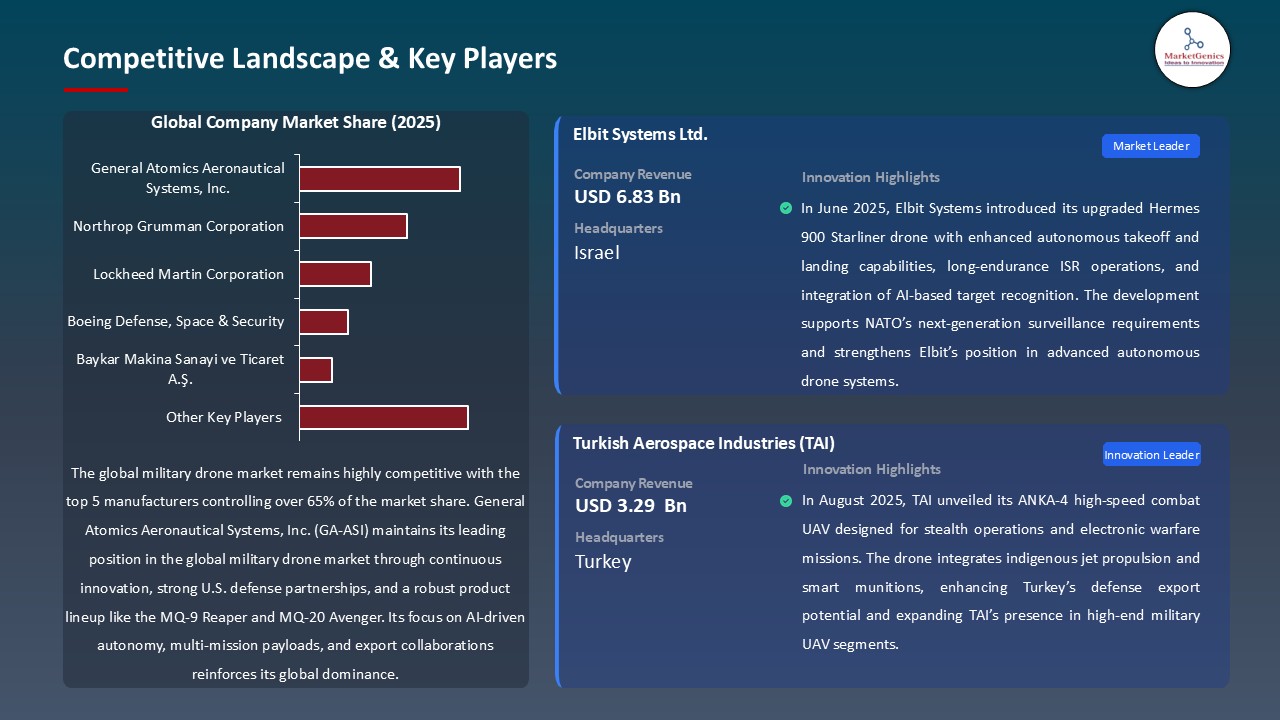

Military-Drone-Market Ecosystem

Global military drone market is moderately consolidated with the Tier 1 players including General Atomics Aeronautical Systems, Northrop Grumman, and Israel Aerospace Industries are taking over the market through the technological innovation and huge defense contracts. Tier 2 suppliers, such as Baykar Makina, Elbit Systems, and Textron Systems, serve in specialized and regional defense applications, Tier 3 suppliers, such as EHang Holdings and Kratos Defense, are prototypers and tactical UAV suppliers.

The key participants in the value chain of the military drone market are; component manufacturing, which would incorporate propulsion systems, sensors and payloads, and integration and testing, in which advanced AI, autonomous flight software and defense-grade communications are integrated and tested before use. In September 2025 Baykar Makina increased its production capacity by establishing a new combat drone plant in Ankara, which was planned to satisfy the increasing demand in the world market.

On the whole, high Tier 1 concentration and working innovation pipelines denote the high level of technological experience in this market.

Recent Development and Strategic Overview:

- In July 2025, BAE systems plc declared the successful test combination of their Malloy T-150 heavy-lift drone and Advanced Precision Kill Weapon System (APKWS) laser-guided rockets and turned their logistic drone into a counter-UAV combat platform. The development will enable the drone to address aerial threats in a cost-effective manner and retain the payload to be flexible in the multi-mission operation. The program evidences that BAE has increasingly been concerned with the capabilities of combat logistics and counter-drone warfare, as part of the modernization of NATO.

- In October 2025, Kratos also signed a strategic alliance agreement with Korea aerospace industries (KAI) to collaborate in the development of manned-unmanned teaming (MUM-T) drones to improve interoperability and export capabilities of allied military forces. The partnership involves the experience of Kratos in the field of tactical unmanned combat aerial vehicles (UCAVs) as well as the expertise of KAI in developing fighter jets, and is aimed at developing AI controllable swarm-enabled drone fleets. This project enhances the international position of Kratos and preconditions the tendency to collaborative defense innovation.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 12.7 Bn |

|

Market Forecast Value in 2035 |

USD 23.0 Bn |

|

Growth Rate (CAGR) |

6.1% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Thousand Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Military-Drone-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Military Drone Market, By Type |

|

|

Military Drone Market, By Size/ Class |

|

|

Military Drone Market, By Range/ Endurance |

|

|

Military Drone Market, By Propulsion/ Power Source |

|

|

Military Drone Market, By Autonomy/ Control Mode |

|

|

Military Drone Market, By Operating Altitude |

|

|

Military Drone Market, By Application |

|

|

Military Drone Market, By End User |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Military Drone Market Outlook

- 2.1.1. Military Drone Market Size (Volume - Thousand Units & Value - US$ Billion), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to-Market Strategy

- 2.5.1. Customer/ End Use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Military Drone Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Aerospace & Defense Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Aerospace & Defense Industry

- 3.1.3. Regional Distribution for Aerospace & Defense

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.1. Global Aerospace & Defense Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising adoption of AI and autonomous technologies for advanced surveillance and combat operations.

- 4.1.1.2. Increasing defense budgets and modernization programs across major economies.

- 4.1.1.3. Growing demand for real-time intelligence, surveillance, and reconnaissance (ISR) capabilities.

- 4.1.2. Restraints

- 4.1.2.1. Stringent regulatory frameworks and export restrictions on UAV technologies.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis/ Ecosystem Analysis

- 4.4.1. Component Suppliers

- 4.4.2. Technology Providers/ System Integrators

- 4.4.3. Military Drone Manufacturers

- 4.4.4. End-users

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Porter’s Five Forces Analysis

- 4.7. PESTEL Analysis

- 4.8. Global Military Drone Market Demand

- 4.8.1. Historical Market Size - in Value (Volume - Thousand Units & Value - US$ Billion), 2021-2024

- 4.8.2. Current and Future Market Size - in Value (Volume - Thousand Units & Value - US$ Billion), 2025–2035

- 4.8.2.1. Y-o-Y Growth Trends

- 4.8.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Military Drone Market Analysis, by Type

- 6.1. Key Segment Analysis

- 6.2. Military Drone Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, by Type, 2021-2035

- 6.2.1. Fixed-Wing UAVs

- 6.2.2. Rotary-Wing UAVs (Rotors/Helicopter)

- 6.2.3. Hybrid VTOL UAVs

- 6.2.4. Multi-Rotor UAVs

- 6.2.5. Tethered UAVs

- 6.2.6. Loitering Munitions (Kamikaze UAVs)

- 6.2.7. Others

- 7. Global Military Drone Market Analysis, by Size/ Class

- 7.1. Key Segment Analysis

- 7.2. Military Drone Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, by Size/ Class, 2021-2035

- 7.2.1. Micro / Nano UAVs

- 7.2.2. Small UAVs (SUAV)

- 7.2.3. Tactical UAVs

- 7.2.4. MALE (Medium Altitude Long Endurance) UAVs

- 7.2.5. HALE (High Altitude Long Endurance) UAVs

- 7.2.6. Others

- 8. Global Military Drone Market Analysis, by Range/ Endurance

- 8.1. Key Segment Analysis

- 8.2. Military Drone Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, by Range/ Endurance, 2021-2035

- 8.2.1. Short Range (Line-of-Sight)

- 8.2.2. Medium Range

- 8.2.3. Long Range

- 8.2.4. Endurance-based (Hours: <2, 2–12, 12–24, >24)

- 9. Global Military Drone Market Analysis, by Propulsion/ Power Source

- 9.1. Key Segment Analysis

- 9.2. Military Drone Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, by Propulsion/ Power Source, 2021-2035

- 9.2.1. Piston / Internal Combustion Engine

- 9.2.2. Turbine / Jet Engine

- 9.2.3. Electric Battery Powered

- 9.2.4. Hybrid (Fuel + Electric)

- 9.2.5. Fuel Cell Powered

- 10. Global Military Drone Market Analysis, by Autonomy/ Control Mode

- 10.1. Key Segment Analysis

- 10.2. Military Drone Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, by Autonomy/ Control Mode, 2021-2035

- 10.2.1. Remotely Piloted (Human-in-the-Loop)

- 10.2.2. Semi-Autonomous (Assisted)

- 10.2.3. Fully Autonomous (Pre-programmed / AI-driven)

- 10.2.4. Swarming / Cooperative Autonomous Systems

- 11. Global Military Drone Market Analysis, by Operating Altitude

- 11.1. Key Segment Analysis

- 11.2. Military Drone Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, by Operating Altitude, 2021-2035

- 11.2.1. Low Altitude (Below 3,000 ft)

- 11.2.2. Medium Altitude (3,000–18,000 ft)

- 11.2.3. High Altitude (Above 18,000 ft)

- 12. Global Military Drone Market Analysis and Forecasts, by Application

- 12.1. Key Findings

- 12.2. Military Drone Market Size (Value - US$ Billion), Analysis, and Forecasts, by Application, 2021-2035

- 12.2.1. Intelligence, Surveillance & Reconnaissance (ISR)

- 12.2.2. Strike / Combat (Armed)

- 12.2.3. Electronic Warfare & Jamming

- 12.2.4. Target Acquisition & Designation

- 12.2.5. Route Reconnaissance & Patrol

- 12.2.6. Logistics & Resupply

- 12.2.7. Search & Rescue / MEDEVAC

- 12.2.8. Training & Decoy Operations

- 12.2.9. Others

- 13. Global Military Drone Market Analysis and Forecasts, by End User

- 13.1. Key Findings

- 13.2. Military Drone Market Size (Value - US$ Billion), Analysis, and Forecasts, by End User, 2021-2035

- 13.2.1. National Defense Forces (Army, Air Force, Navy)

- 13.2.2. Special Operations Forces

- 13.2.3. Homeland Security / Border Patrol

- 13.2.4. Intelligence Agencies

- 13.2.5. Defense Contractors / OEM Integrators

- 13.2.6. Others

- 14. Global Military Drone Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Military Drone Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Military Drone Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Military Drone Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 15.3.1. Type

- 15.3.2. Size/ Class

- 15.3.3. Range/ Endurance

- 15.3.4. Propulsion/ Power Source

- 15.3.5. Autonomy/ Control Mode

- 15.3.6. Operating Altitude

- 15.3.7. Application

- 15.3.8. End User

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Military Drone Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Type

- 15.4.3. Size/ Class

- 15.4.4. Range/ Endurance

- 15.4.5. Propulsion/ Power Source

- 15.4.6. Autonomy/ Control Mode

- 15.4.7. Operating Altitude

- 15.4.8. Application

- 15.4.9. End User

- 15.5. Canada Military Drone Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Type

- 15.5.3. Size/ Class

- 15.5.4. Range/ Endurance

- 15.5.5. Propulsion/ Power Source

- 15.5.6. Autonomy/ Control Mode

- 15.5.7. Operating Altitude

- 15.5.8. Application

- 15.5.9. End User

- 15.6. Mexico Military Drone Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Type

- 15.6.3. Size/ Class

- 15.6.4. Range/ Endurance

- 15.6.5. Propulsion/ Power Source

- 15.6.6. Autonomy/ Control Mode

- 15.6.7. Operating Altitude

- 15.6.8. Application

- 15.6.9. End User

- 16. Europe Military Drone Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Military Drone Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 16.3.1. Type

- 16.3.2. Size/ Class

- 16.3.3. Range/ Endurance

- 16.3.4. Propulsion/ Power Source

- 16.3.5. Autonomy/ Control Mode

- 16.3.6. Operating Altitude

- 16.3.7. Application

- 16.3.8. End User

- 16.3.9. Country

- 16.3.9.1. Germany

- 16.3.9.2. United Kingdom

- 16.3.9.3. France

- 16.3.9.4. Italy

- 16.3.9.5. Spain

- 16.3.9.6. Netherlands

- 16.3.9.7. Nordic Countries

- 16.3.9.8. Poland

- 16.3.9.9. Russia & CIS

- 16.3.9.10. Rest of Europe

- 16.4. Germany Military Drone Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Type

- 16.4.3. Size/ Class

- 16.4.4. Range/ Endurance

- 16.4.5. Propulsion/ Power Source

- 16.4.6. Autonomy/ Control Mode

- 16.4.7. Operating Altitude

- 16.4.8. Application

- 16.4.9. End User

- 16.5. United Kingdom Military Drone Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Type

- 16.5.3. Size/ Class

- 16.5.4. Range/ Endurance

- 16.5.5. Propulsion/ Power Source

- 16.5.6. Autonomy/ Control Mode

- 16.5.7. Operating Altitude

- 16.5.8. Application

- 16.5.9. End User

- 16.6. France Military Drone Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Type

- 16.6.3. Size/ Class

- 16.6.4. Range/ Endurance

- 16.6.5. Propulsion/ Power Source

- 16.6.6. Autonomy/ Control Mode

- 16.6.7. Operating Altitude

- 16.6.8. Application

- 16.6.9. End User

- 16.7. Italy Military Drone Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Type

- 16.7.3. Size/ Class

- 16.7.4. Range/ Endurance

- 16.7.5. Propulsion/ Power Source

- 16.7.6. Autonomy/ Control Mode

- 16.7.7. Operating Altitude

- 16.7.8. Application

- 16.7.9. End User

- 16.8. Spain Military Drone Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Type

- 16.8.3. Size/ Class

- 16.8.4. Range/ Endurance

- 16.8.5. Propulsion/ Power Source

- 16.8.6. Autonomy/ Control Mode

- 16.8.7. Operating Altitude

- 16.8.8. Application

- 16.8.9. End User

- 16.9. Netherlands Military Drone Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Type

- 16.9.3. Size/ Class

- 16.9.4. Range/ Endurance

- 16.9.5. Propulsion/ Power Source

- 16.9.6. Autonomy/ Control Mode

- 16.9.7. Operating Altitude

- 16.9.8. Application

- 16.9.9. End User

- 16.10. Nordic Countries Military Drone Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Type

- 16.10.3. Size/ Class

- 16.10.4. Range/ Endurance

- 16.10.5. Propulsion/ Power Source

- 16.10.6. Autonomy/ Control Mode

- 16.10.7. Operating Altitude

- 16.10.8. Application

- 16.10.9. End User

- 16.11. Poland Military Drone Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Type

- 16.11.3. Size/ Class

- 16.11.4. Range/ Endurance

- 16.11.5. Propulsion/ Power Source

- 16.11.6. Autonomy/ Control Mode

- 16.11.7. Operating Altitude

- 16.11.8. Application

- 16.11.9. End User

- 16.12. Russia & CIS Military Drone Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Type

- 16.12.3. Size/ Class

- 16.12.4. Range/ Endurance

- 16.12.5. Propulsion/ Power Source

- 16.12.6. Autonomy/ Control Mode

- 16.12.7. Operating Altitude

- 16.12.8. Application

- 16.12.9. End User

- 16.13. Rest of Europe Military Drone Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Type

- 16.13.3. Size/ Class

- 16.13.4. Range/ Endurance

- 16.13.5. Propulsion/ Power Source

- 16.13.6. Autonomy/ Control Mode

- 16.13.7. Operating Altitude

- 16.13.8. Application

- 16.13.9. End User

- 17. Asia Pacific Military Drone Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. East Asia Military Drone Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 17.3.1. Type

- 17.3.2. Size/ Class

- 17.3.3. Range/ Endurance

- 17.3.4. Propulsion/ Power Source

- 17.3.5. Autonomy/ Control Mode

- 17.3.6. Operating Altitude

- 17.3.7. Application

- 17.3.8. End User

- 17.3.9. Country

- 17.3.9.1. China

- 17.3.9.2. India

- 17.3.9.3. Japan

- 17.3.9.4. South Korea

- 17.3.9.5. Australia and New Zealand

- 17.3.9.6. Indonesia

- 17.3.9.7. Malaysia

- 17.3.9.8. Thailand

- 17.3.9.9. Vietnam

- 17.3.9.10. Rest of Asia Pacific

- 17.4. China Military Drone Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Type

- 17.4.3. Size/ Class

- 17.4.4. Range/ Endurance

- 17.4.5. Propulsion/ Power Source

- 17.4.6. Autonomy/ Control Mode

- 17.4.7. Operating Altitude

- 17.4.8. Application

- 17.4.9. End User

- 17.5. India Military Drone Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Type

- 17.5.3. Size/ Class

- 17.5.4. Range/ Endurance

- 17.5.5. Propulsion/ Power Source

- 17.5.6. Autonomy/ Control Mode

- 17.5.7. Operating Altitude

- 17.5.8. Application

- 17.5.9. End User

- 17.6. Japan Military Drone Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Type

- 17.6.3. Size/ Class

- 17.6.4. Range/ Endurance

- 17.6.5. Propulsion/ Power Source

- 17.6.6. Autonomy/ Control Mode

- 17.6.7. Operating Altitude

- 17.6.8. Application

- 17.6.9. End User

- 17.7. South Korea Military Drone Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Type

- 17.7.3. Size/ Class

- 17.7.4. Range/ Endurance

- 17.7.5. Propulsion/ Power Source

- 17.7.6. Autonomy/ Control Mode

- 17.7.7. Operating Altitude

- 17.7.8. Application

- 17.7.9. End User

- 17.8. Australia and New Zealand Military Drone Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Type

- 17.8.3. Size/ Class

- 17.8.4. Range/ Endurance

- 17.8.5. Propulsion/ Power Source

- 17.8.6. Autonomy/ Control Mode

- 17.8.7. Operating Altitude

- 17.8.8. Application

- 17.8.9. End User

- 17.9. Indonesia Military Drone Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Type

- 17.9.3. Size/ Class

- 17.9.4. Range/ Endurance

- 17.9.5. Propulsion/ Power Source

- 17.9.6. Autonomy/ Control Mode

- 17.9.7. Operating Altitude

- 17.9.8. Application

- 17.9.9. End User

- 17.10. Malaysia Military Drone Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Type

- 17.10.3. Size/ Class

- 17.10.4. Range/ Endurance

- 17.10.5. Propulsion/ Power Source

- 17.10.6. Autonomy/ Control Mode

- 17.10.7. Operating Altitude

- 17.10.8. Application

- 17.10.9. End User

- 17.11. Thailand Military Drone Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Type

- 17.11.3. Size/ Class

- 17.11.4. Range/ Endurance

- 17.11.5. Propulsion/ Power Source

- 17.11.6. Autonomy/ Control Mode

- 17.11.7. Operating Altitude

- 17.11.8. Application

- 17.11.9. End User

- 17.12. Vietnam Military Drone Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Type

- 17.12.3. Size/ Class

- 17.12.4. Range/ Endurance

- 17.12.5. Propulsion/ Power Source

- 17.12.6. Autonomy/ Control Mode

- 17.12.7. Operating Altitude

- 17.12.8. Application

- 17.12.9. End User

- 17.13. Rest of Asia Pacific Military Drone Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Type

- 17.13.3. Size/ Class

- 17.13.4. Range/ Endurance

- 17.13.5. Propulsion/ Power Source

- 17.13.6. Autonomy/ Control Mode

- 17.13.7. Operating Altitude

- 17.13.8. Application

- 17.13.9. End User

- 18. Middle East Military Drone Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Military Drone Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 18.3.1. Type

- 18.3.2. Size/ Class

- 18.3.3. Range/ Endurance

- 18.3.4. Propulsion/ Power Source

- 18.3.5. Autonomy/ Control Mode

- 18.3.6. Operating Altitude

- 18.3.7. Application

- 18.3.8. End User

- 18.3.9. Country

- 18.3.9.1. Turkey

- 18.3.9.2. UAE

- 18.3.9.3. Saudi Arabia

- 18.3.9.4. Israel

- 18.3.9.5. Rest of Middle East

- 18.4. Turkey Military Drone Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Type

- 18.4.3. Size/ Class

- 18.4.4. Range/ Endurance

- 18.4.5. Propulsion/ Power Source

- 18.4.6. Autonomy/ Control Mode

- 18.4.7. Operating Altitude

- 18.4.8. Application

- 18.4.9. End User

- 18.5. UAE Military Drone Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Type

- 18.5.3. Size/ Class

- 18.5.4. Range/ Endurance

- 18.5.5. Propulsion/ Power Source

- 18.5.6. Autonomy/ Control Mode

- 18.5.7. Operating Altitude

- 18.5.8. Application

- 18.5.9. End User

- 18.6. Saudi Arabia Military Drone Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Type

- 18.6.3. Size/ Class

- 18.6.4. Range/ Endurance

- 18.6.5. Propulsion/ Power Source

- 18.6.6. Autonomy/ Control Mode

- 18.6.7. Operating Altitude

- 18.6.8. Application

- 18.6.9. End User

- 18.7. Israel Military Drone Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Type

- 18.7.3. Size/ Class

- 18.7.4. Range/ Endurance

- 18.7.5. Propulsion/ Power Source

- 18.7.6. Autonomy/ Control Mode

- 18.7.7. Operating Altitude

- 18.7.8. Application

- 18.7.9. End User

- 18.8. Rest of Middle East Military Drone Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Type

- 18.8.3. Size/ Class

- 18.8.4. Range/ Endurance

- 18.8.5. Propulsion/ Power Source

- 18.8.6. Autonomy/ Control Mode

- 18.8.7. Operating Altitude

- 18.8.8. Application

- 18.8.9. End User

- 19. Africa Military Drone Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Military Drone Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 19.3.1. Type

- 19.3.2. Size/ Class

- 19.3.3. Range/ Endurance

- 19.3.4. Propulsion/ Power Source

- 19.3.5. Autonomy/ Control Mode

- 19.3.6. Operating Altitude

- 19.3.7. Application

- 19.3.8. End User

- 19.3.9. Country

- 19.3.9.1. South Africa

- 19.3.9.2. Egypt

- 19.3.9.3. Nigeria

- 19.3.9.4. Algeria

- 19.3.9.5. Rest of Africa

- 19.4. South Africa Military Drone Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Type

- 19.4.3. Size/ Class

- 19.4.4. Range/ Endurance

- 19.4.5. Propulsion/ Power Source

- 19.4.6. Autonomy/ Control Mode

- 19.4.7. Operating Altitude

- 19.4.8. Application

- 19.4.9. End User

- 19.5. Egypt Military Drone Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Type

- 19.5.3. Size/ Class

- 19.5.4. Range/ Endurance

- 19.5.5. Propulsion/ Power Source

- 19.5.6. Autonomy/ Control Mode

- 19.5.7. Operating Altitude

- 19.5.8. Application

- 19.5.9. End User

- 19.6. Nigeria Military Drone Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Type

- 19.6.3. Size/ Class

- 19.6.4. Range/ Endurance

- 19.6.5. Propulsion/ Power Source

- 19.6.6. Autonomy/ Control Mode

- 19.6.7. Operating Altitude

- 19.6.8. Application

- 19.6.9. End User

- 19.7. Algeria Military Drone Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Type

- 19.7.3. Size/ Class

- 19.7.4. Range/ Endurance

- 19.7.5. Propulsion/ Power Source

- 19.7.6. Autonomy/ Control Mode

- 19.7.7. Operating Altitude

- 19.7.8. Application

- 19.7.9. End User

- 19.8. Rest of Africa Military Drone Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Type

- 19.8.3. Size/ Class

- 19.8.4. Range/ Endurance

- 19.8.5. Propulsion/ Power Source

- 19.8.6. Autonomy/ Control Mode

- 19.8.7. Operating Altitude

- 19.8.8. Application

- 19.8.9. End User

- 20. South America Military Drone Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Central and South Africa Military Drone Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 20.3.1. Type

- 20.3.2. Size/ Class

- 20.3.3. Range/ Endurance

- 20.3.4. Propulsion/ Power Source

- 20.3.5. Autonomy/ Control Mode

- 20.3.6. Operating Altitude

- 20.3.7. Application

- 20.3.8. End User

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Military Drone Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Type

- 20.4.3. Size/ Class

- 20.4.4. Range/ Endurance

- 20.4.5. Propulsion/ Power Source

- 20.4.6. Autonomy/ Control Mode

- 20.4.7. Operating Altitude

- 20.4.8. Application

- 20.4.9. End User

- 20.5. Argentina Military Drone Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Type

- 20.5.3. Size/ Class

- 20.5.4. Range/ Endurance

- 20.5.5. Propulsion/ Power Source

- 20.5.6. Autonomy/ Control Mode

- 20.5.7. Operating Altitude

- 20.5.8. Application

- 20.5.9. End User

- 20.6. Rest of South America Military Drone Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Type

- 20.6.3. Size/ Class

- 20.6.4. Range/ Endurance

- 20.6.5. Propulsion/ Power Source

- 20.6.6. Autonomy/ Control Mode

- 20.6.7. Operating Altitude

- 20.6.8. Application

- 20.6.9. End User

- 21. Key Players/ Company Profile

- 21.1. AeroVironment, Inc.

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. BAE Systems plc

- 21.3. Baykar Makina Sanayi ve Ticaret A.Ş.

- 21.4. Boeing Defense, Space & Security

- 21.5. EHang Holdings Limited

- 21.6. Elbit Systems Ltd.

- 21.7. General Atomics Aeronautical Systems, Inc. (GA-ASI)

- 21.8. Hindustan Aeronautics Limited (HAL)

- 21.9. Israel Aerospace Industries Ltd. (IAI)

- 21.10. Kratos Defense & Security Solutions, Inc.

- 21.11. Leonardo S.p.A.

- 21.12. Lockheed Martin Corporation

- 21.13. Northrop Grumman Corporation

- 21.14. Rheinmetall AG

- 21.15. Saab AB

- 21.16. Textron Systems Corporation

- 21.17. Thales Group

- 21.18. Turkish Aerospace Industries (TAI)

- 21.19. Other Key Players

- 21.1. AeroVironment, Inc.

Note* - This is just tentative list of players. While providing the report, we will cover a greater number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation