Off-highway Electric Vehicle Market Size, Share, Growth Opportunity Analysis Report by Vehicle Type (Electric Construction Equipment, Electric Agricultural Vehicles and Electric Mining Vehicles), Battery Type, Power Output, Component, Charging Type, Propulsion Type, Application and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035.

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Off-highway Electric Vehicle Market Size, Share, and Growth

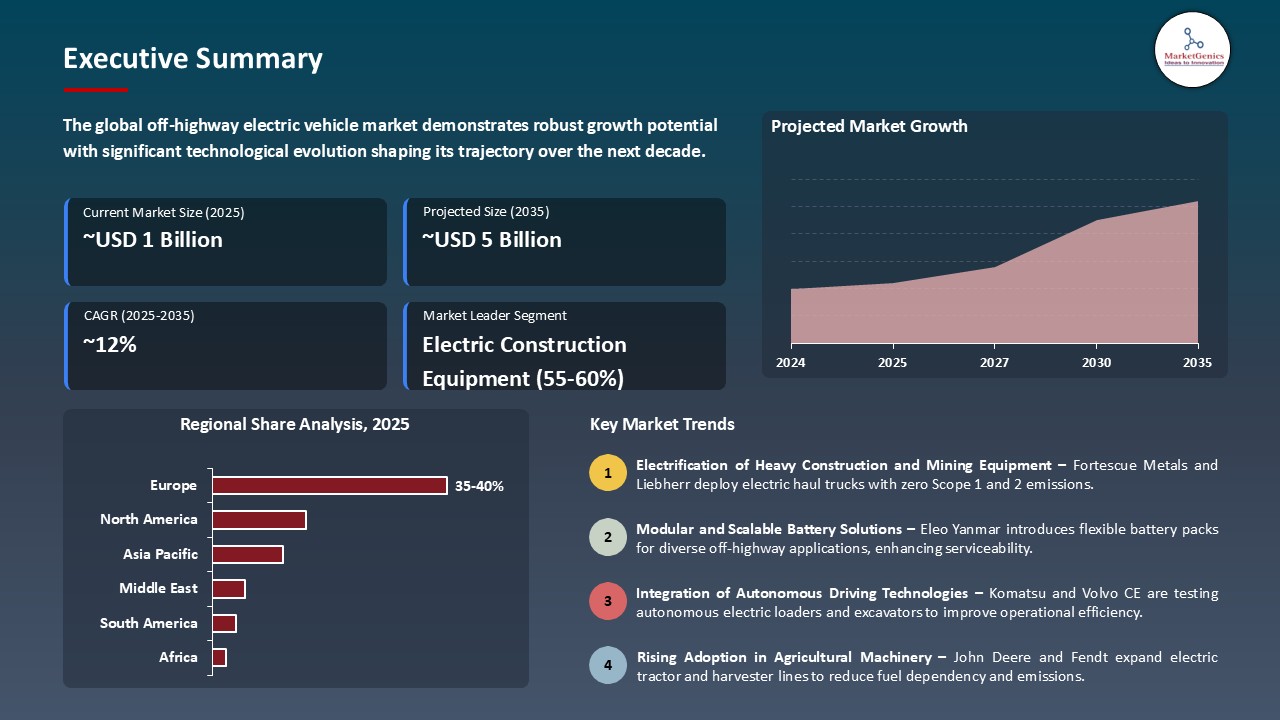

With a significant compounded annual growth rate of 12.2% from 2025-2035, global off-highway electric vehicle market is poised to be valued at USD 4.7 Billion in 2035. The global off-highway electric vehicle market's major drivers include stringent emissions regulations and propulsion through the advances in battery technology. In April 2025, JCB launched the 19-tonne all-electric excavator, the JCB CD150E, which produces zero tailpipe emissions in accordance with stringent EU Stage V norms for construction machinery.

In March 2025, Caterpillar Inc. announced the successful demonstration of its first large-scale battery-electric 988K XE wheel loader in a live quarry environment, marking a strategic milestone toward full-scale electrification of its heavy-duty fleet. The project is part of Caterpillar’s broader commitment to achieving net-zero greenhouse gas emissions by 2050. Under the leadership of Jim Umpleby, Chairman and CEO, Caterpillar has accelerated its investment in electric drivetrains, battery technologies, and energy-as-a-service (EaaS) models to support sustainable mining and construction operations globally. This development reinforces Caterpillar’s competitive positioning in the global OHEV market through product innovation and long-term electrification strategy.

Bobcat, meanwhile, brought out its fourth-generation electric skid steer in June 2025 with a fast-charging 50-kWh battery pack that matches diesel ones in performance. There is growing regulatory pressure, and with improved battery performance, adoption of electric off-highway equipment gets further impetus across industries.

Major market opportunities within the electric vehicle for off-highway market include charge infrastructure for construction and mining sites, thermal management systems for high-voltage batteries, and automated off-road navigation technologies, creating adjacent demand linkages with the EV Charging Stations. These fields complement electrified heavy equipment in ensuring dependable operation, efficiency, and safety. Supporting technologies also widen the ecosystem, which provides further impetus to the adoption and operational scalability of electric off-highway vehicles.

Off-highway Electric Vehicle Market Dynamics and Trends

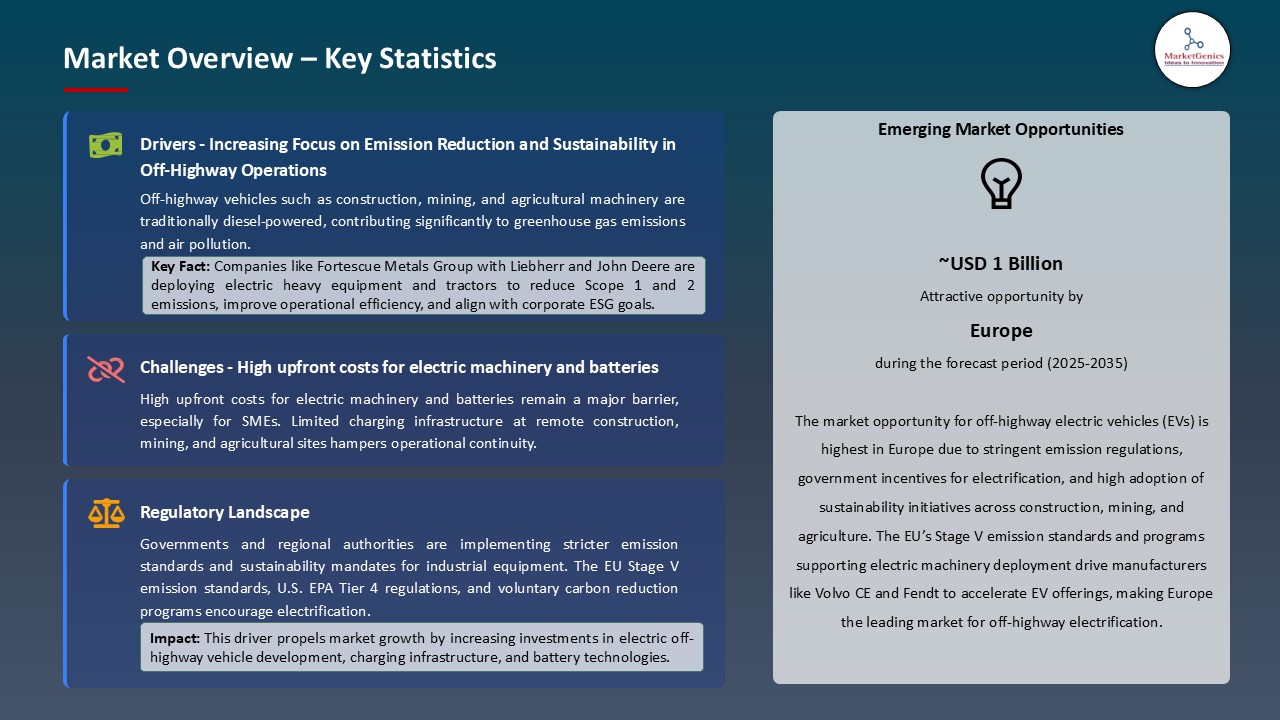

Driver: Stricter Emission Regulations

- With emission norms being raised across industrial and construction equipment segments worldwide, manufacturers are being compelled to switch toward electric drivetrains. Regulations such as U.S. EPA Tier 4, EU Stage V, and China's NRMM standards have mandated drastic cuts in NOx, particulate matter, and CO₂ emissions. Such regulations are causing further encroachment into the realm of off-road vehicles, where traditionally, allegedly diesel-powered equipment has been mastering of the craft. This regulatory push has made the switch to emissions-free not merely an ecological discretion but rather a legal compulsion, especially in cities and emission-filtered construction zones.

- The electric PC4000-11E mining excavator, along with the Eco-mode, came on the market in 2024 by Komatsu and claimed up to 95% emissions reductions as compared to diesel engines, thereby meeting the EU criterion of being able to be declared zero-emission on certain job sites. The case clearly demonstrates that manufacturers want to stay ahead of increasingly strict legislation so that projects may remain eligible and in doing so also seek to improve the environmental credits of the brand. At this point, therefore, electrification seems to be the industry's stamp for passing the regulatory test, improving brand image, and being one for the future.

- The stricter emissions mandates are quickening the transition to electric vehicles off-highway, thus bringing forth OEM interest in green technologies and bringing an even quicker global push for them.

Restraint: High Initial Cost & Battery Limitations

- Increasing sales notwithstanding, a stiff constraint remains the upfront investment in electric off-highway vehicles. These electric off-highway vehicles require costly components such as advanced lithium-ion batteries, power converters, and thermal management systems, which all greatly add to the initial costs of electric vehicles against their diesel counterparts. For a fleet owner or private construction contractor working within tight budgetary constraints, the payback period may seem too far ahead to even consider, especially in projects with low margins. Furthermore, there are fewer financial assistance schemes in emerging markets, thus putting the smaller players at a disadvantage in terms of affordability.

- Getting the price tag up there is the limitation on the performance of the existing battery technology. Electric drivetrains often get strained under prolonged heavy-duty operations in remote areas where charging infrastructure is so darn sparse or even sometimes absent. Between this middle of the year, several OEMs, including an Indian commercial vehicle major, had to put off deployment of electric loaders in mining operations due to thermal instability and low energy density under hard extremes of work. These technical drawbacks, together with financial pressures, represent a considerable bottleneck to mass deployment.

- High initial costs and current battery limitations hinder widespread adoption of off-highway electric vehicles, particularly in cost-sensitive and infrastructure-deficient regions.

Opportunity: Mobile Charging & Renewable Integration

- With off-highway electric vehicles extending their reach through the wilderness of mining sites, forests, and rural construction zones, the lack of grid presence has opened a window of opportunity for mobile charging and associated renewable energy integration. Off-grid sun-for-charging trailers and mobile-charging plazas now facilitate mobile deployment of EVs sans any permanent infrastructure. Given that these off-grid facilities are minimizing downtime and enhancing fleet scalability, project developers can avail value offerings insofar as mobility and sustainability are concerned.

- The first-ever North-American project launched in June 2024 by Polaris Inc., which installed solar-powered mobile chargers on trails for off-road recreation and construction sites nearby. This allowed the continuous use of electric ATVs, UTVs, and compact construction equipment in locations devoid of grid access. This emphasis can also be laid on the increasing magnitude to incorporate clean energy sources directly with OHEV operations to promote sustainability and availability of vehicles on difficult terrains.

- The rise of mobile and renewable charging infrastructure presents a strong opportunity to extend off-highway EV usage into remote, previously unreachable zones.

Key Trend: Autonomous Off-Highway Electric Vehicles

- Integration of autonomous operations into electric off-highway vehicles is reshaping the industry, mirroring technology convergence patterns seen in the Autonomous Trucks. The thought behind automation is to assist with the varied issues of labor shortages, human error, and operating efficiency. Inconsistencies with electrification form one solid link in the cycle of intelligent, clean, and continuous operation. Autonomous electric tractors, loaders, and haul trucks are already benefiting controlled environments like mining pits and large farms by routing optimally, minimizing idle time, and running around the clock with minimal human intervention.

- In July 2024, Komatsu, to expand its AHS, deployed more than 750 autonomous electric trucks across the globe. These vehicles are operated with such precision that each one has accumulated 100,000 operational hours without a single incident. The solution, moving to electric automation, also helps reduce carbon emissions while improving safety and consistency in operations. Presently, manufacturers are now mulling over AI and IoT platform integration for predictive maintenance and real-time diagnostics, only further pushing this trend forward.

- The convergence of automation with electrification is transforming off-highway operations into intelligent, emission-free, and labor-efficient systems.

Off-highway Electric Vehicle Market Analysis and Segmental Data

Based on Vehicle Type, the Electric Construction Equipment Segment Retains the Largest Share

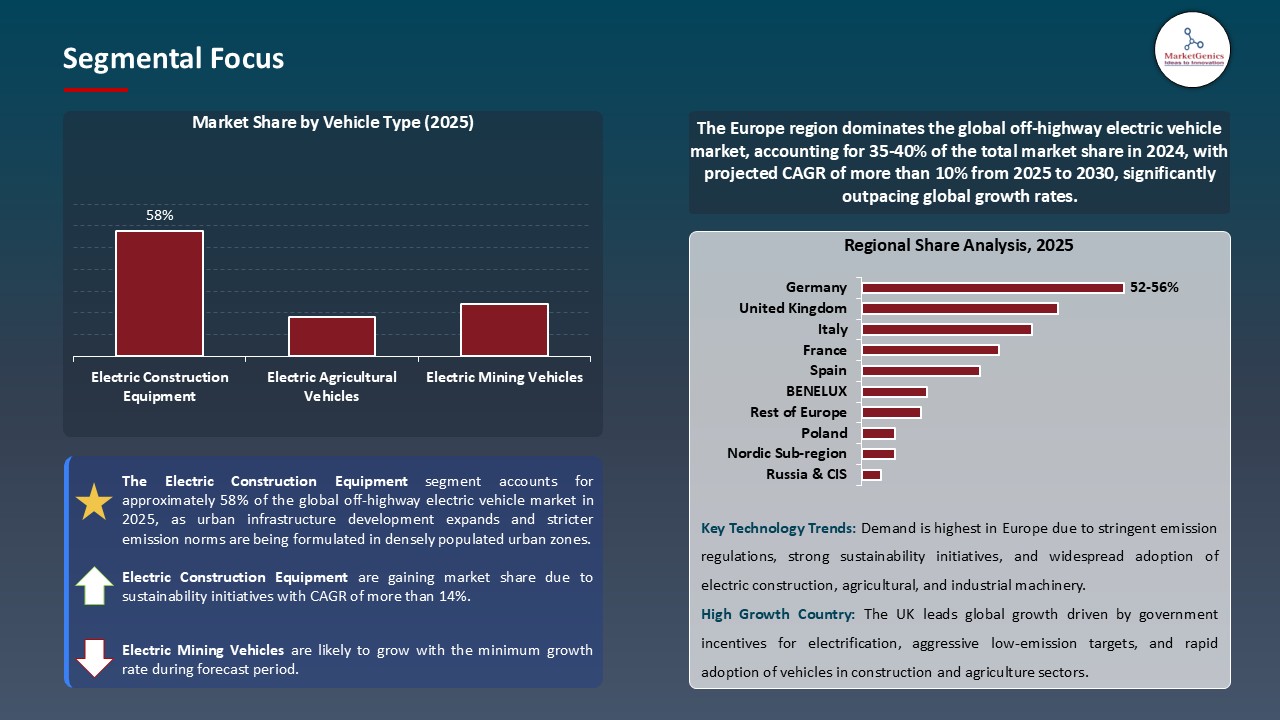

- As urban infrastructure development expands and stricter emission norms are being formulated in densely populated urban zones, the electric construction equipment segment is being considered to hold a major share at ~58% of the global off-highway electric vehicle market. Urban construction projects, such as roadworks, sites, and utilities costs, are mostly carried out in emission-regulated areas, hiking the price for contractors of investing in machines that are quiet or emission-free. Meeting carbon-neutrality goals, reducing air pollution, and limiting noise pollution from city centers have been mandated under governments and municipalities for the use of electric excavators, loaders, and mini dumpers. OEMs, facing these mandates, are now applying them to expedite their production of electric-machinery lines.

- Volvo Construction Equipment in May 2025 announced its full fleet deployment of the electric compact excavators and wheel loaders across many European cities under a public contract for infrastructure modernization. These machines cut operational costs by 45% and are meeting urban decarbonization criteria. The advances driven by these instances of implementation work for their rapid acceptance and further phase at good performance and sustainability standards.

- Electrified construction mechanization is leading the market since they will abide by emission norms, being suitable to urban projects, while showing proven discharge advantages.

Europe Dominates Global Off-highway Electric Vehicle Market in 2024 and Beyond

- In Europe, the off-highway electric vehicle (OHEV) demand is greater due to more assertive climate policy, stricter emission limitations, and the provision of an array of incentives for electrification in construction, agriculture, and mining. The EU’s Green Deal and “Fit for 55” package require machinery to reduce their emissions to a great extent and, in turn, boost the fast adoption of electric fleet. Furthermore, countries like Norway, Germany, and the Netherlands also provide subsidies and tax rebates for electric off-road machinery, speeding up the process of purchasing these vehicles by contractors and municipalities.

- In April 2025, electric backhoe loaders and telescopic handlers of JCB were deployed across major construction projects in the Netherlands under the €14 million public contract for sustainable infrastructure. The vehicles replaced diesels, thus fulfilling local carbon offset requirements and reducing the noise in residential areas. The favorable regulatory framework, plus pilot successes like this, makes Europe the world leader in OHEV adoption.

- Small in number is the demand for OHEVs across Europe as a result of regulatory enforcement, subsidy provision, and full-scale adoption of clean machinery by the public and private sectors.

Off-highway Electric Vehicle Market Ecosystem

Key players in the global off-highway electric vehicle market include prominent companies such as Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, John Deere, Hitachi Construction Machinery and Other Key Players.

The off-highway electric vehicle market is moderately fragmented, with Tier 1 players comprising Caterpillar, John Deere, and Volvo Construction Equipment, which enjoy strong product lines and global market penetration. Lion Electric and Doosan Infracore occupy niche or regional markets and fall under Tier 2 and 3. Buyer concentration is moderate, with large fleet owners in the construction, agriculture, and mining industries. Supplier concentration would be moderate to high, considering requirements for advanced EV components, batteries, and technology integration in the off-highway applications.

Recent Development and Strategic Overview:

- In August 2024, the development of a fully integrated autonomous electric haulage pilot at Christmas Creek mine is a result of the collaboration between Fortescue Metals Group and Liebherr Mining. The initiative sees the T 264 electric haul trucks from Liebherr, combined with Fortescue's fleet management and ultra-high-precision guidance systems, designed so as to have zero Scope 1 and 2 emissions by the year 2030. It is the first time coordinated autonomous electric heavy equipment is used on a large scale in actual mining operations, thereby establishing a precedent for the electrification of heavy industry and automation synergy.

- In July 2024, Eleo Yanmar's EV business unit stepped forth with a new set of modular battery packs (50 V to 720 V, up to 90 kW) designed for small-to-medium volumes and varying off-highway applications. The modularity of these packs permits manufacturers and fleets to modify battery capacity by swapping modules depending on the operation at hand, thereby cutting downtime and optimizing serviceability. This flexible architecture serves to curb the headache of customizing an electric powertrain across vehicle types, thus fast-tracking electrification in sectors such as construction and agriculture.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 1.3 Bn |

|

Market Forecast Value in 2035 |

USD 4.7 Bn |

|

Growth Rate (CAGR) |

12.2% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Thousand Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Off-highway Electric Vehicle Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Vehicle Type |

|

|

By Battery Type |

|

|

By Power Output |

|

|

By Component |

|

|

By Charging Type |

|

|

By Propulsion Type |

|

|

By Application |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Off-highway Electric Vehicle Market Outlook

- 2.1.1. Off-highway Electric Vehicle Market Size (Volume - Thousand Units & Value - US$ Billion), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End Use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Off-highway Electric Vehicle Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Automotive and Transportation Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Automotive and Transportation Industry

- 3.1.3. Regional Distribution for Automotive and Transportation

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.1. Global Automotive and Transportation Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Stringent global emission regulations promoting zero-emission machinery

- 4.1.1.2. Rising fuel costs encouraging the shift to electric alternatives

- 4.1.1.3. Growing adoption of electric construction and mining equipment in urban and regulated zones

- 4.1.2. Restraints

- 4.1.2.1. High upfront cost of electric off-highway vehicles and batteries

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis/ Ecosystem Analysis

- 4.4.1. Component Suppliers

- 4.4.2. Off-highway Electric Vehicle Manufacturers

- 4.4.3. Dealers and Distributors

- 4.4.4. End Users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Porter’s Five Forces Analysis

- 4.7. PESTEL Analysis

- 4.8. Global Off-highway Electric Vehicle Market Demand

- 4.8.1. Historical Market Size - in Value (Volume - Thousand Units & Value - US$ Billion), 2021-2024

- 4.8.2. Current and Future Market Size - in Value (Volume - Thousand Units & Value - US$ Billion), 2025–2035

- 4.8.2.1. Y-o-Y Growth Trends

- 4.8.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Off-highway Electric Vehicle Market Analysis, by Vehicle Type

- 6.1. Key Segment Analysis

- 6.2. Off-highway Electric Vehicle Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, by Vehicle Type, 2021-2035

- 6.2.1. Electric Construction Equipment

- 6.2.1.1. Electric Excavators

- 6.2.1.2. Electric Loaders

- 6.2.1.3. Electric Bulldozers

- 6.2.1.4. Electric Cranes

- 6.2.1.5. Others

- 6.2.2. Electric Agricultural Vehicles

- 6.2.2.1. Electric Tractors

- 6.2.2.2. Electric Harvesters

- 6.2.2.3. Others

- 6.2.3. Electric Mining Vehicles

- 6.2.3.1. Electric Mining Trucks

- 6.2.3.2. Electric Load-Haul-Dump (LHD) Vehicles

- 6.2.3.3. Others

- 6.2.1. Electric Construction Equipment

- 7. Global Off-highway Electric Vehicle Market Analysis, by Battery Type

- 7.1. Key Segment Analysis

- 7.2. Off-highway Electric Vehicle Market Size (Value - US$ Billion), Analysis, and Forecasts, by Battery Type, 2021-2035

- 7.2.1. Lithium-Ion Batteries

- 7.2.2. Lead-Acid Batteries

- 7.2.3. Nickel-Metal Hydride Batteries

- 7.2.4. Solid-State Batteries (Emerging)

- 7.2.5. Others

- 8. Global Off-highway Electric Vehicle Market Analysis, by Power Output

- 8.1. Key Segment Analysis

- 8.2. Off-highway Electric Vehicle Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, by Power Output, 2021-2035

- 8.2.1. <50 kW

- 8.2.2. 50–150 kW

- 8.2.3. 150–300 kW

- 8.2.4. >300 kW

- 9. Global Off-highway Electric Vehicle Market Analysis, by Component

- 9.1. Key Segment Analysis

- 9.2. Off-highway Electric Vehicle Market Size (Value - US$ Billion), Analysis, and Forecasts, by Component, 2021-2035

- 9.2.1. Electric Motors

- 9.2.2. Battery Packs

- 9.2.3. Power Electronics (Inverters, Converters, Controllers)

- 9.2.4. Thermal Management Systems

- 9.2.5. Charging Systems

- 9.2.6. Others

- 10. Global Off-highway Electric Vehicle Market Analysis, by Charging Type

- 10.1. Key Segment Analysis

- 10.2. Off-highway Electric Vehicle Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, by Charging Type, 2021-2035

- 10.2.1. Onboard Charging Systems

- 10.2.2. Offboard/Fast Charging Stations

- 10.2.3. Wireless/Inductive Charging (Emerging)

- 11. Global Off-highway Electric Vehicle Market Analysis, by Propulsion Type

- 11.1. Key Segment Analysis

- 11.2. Off-highway Electric Vehicle Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, by Propulsion Type, 2021-2035

- 11.2.1. Battery Electric Vehicles (BEV)

- 11.2.2. Hybrid Electric Vehicles (HEV)

- 11.2.3. Plug-in Hybrid Electric Vehicles (PHEV)

- 11.2.4. Fuel Cell Electric Vehicles (FCEV)

- 12. Global Off-highway Electric Vehicle Market Analysis, by Application

- 12.1. Key Segment Analysis

- 12.2. Off-highway Electric Vehicle Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, by Application, 2021-2035

- 12.2.1. Construction

- 12.2.2. Agriculture

- 12.2.3. Mining

- 12.2.4. Forestry

- 12.2.5. Material Handling

- 12.2.6. Others

- 13. Global Off-highway Electric Vehicle Market Analysis and Forecasts, by Region

- 13.1. Key Findings

- 13.2. Off-highway Electric Vehicle Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America Off-highway Electric Vehicle Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America Off-highway Electric Vehicle Market Size Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 14.3.1. Vehicle Type

- 14.3.2. Battery Type

- 14.3.3. Power Output

- 14.3.4. Component

- 14.3.5. Charging Type

- 14.3.6. Propulsion Type

- 14.3.7. Application

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA Off-highway Electric Vehicle Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Vehicle Type

- 14.4.3. Battery Type

- 14.4.4. Power Output

- 14.4.5. Component

- 14.4.6. Charging Type

- 14.4.7. Propulsion Type

- 14.4.8. Application

- 14.5. Canada Off-highway Electric Vehicle Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Vehicle Type

- 14.5.3. Battery Type

- 14.5.4. Power Output

- 14.5.5. Component

- 14.5.6. Charging Type

- 14.5.7. Propulsion Type

- 14.5.8. Application

- 14.6. Mexico Off-highway Electric Vehicle Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Vehicle Type

- 14.6.3. Battery Type

- 14.6.4. Power Output

- 14.6.5. Component

- 14.6.6. Charging Type

- 14.6.7. Propulsion Type

- 14.6.8. Application

- 15. Europe Off-highway Electric Vehicle Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe Off-highway Electric Vehicle Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 15.3.1. Vehicle Type

- 15.3.2. Battery Type

- 15.3.3. Power Output

- 15.3.4. Component

- 15.3.5. Charging Type

- 15.3.6. Propulsion Type

- 15.3.7. Application

- 15.3.8. Country

- 15.3.8.1. Germany

- 15.3.8.2. United Kingdom

- 15.3.8.3. France

- 15.3.8.4. Italy

- 15.3.8.5. Spain

- 15.3.8.6. Netherlands

- 15.3.8.7. Nordic Countries

- 15.3.8.8. Poland

- 15.3.8.9. Russia & CIS

- 15.3.8.10. Rest of Europe

- 15.4. Germany Off-highway Electric Vehicle Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Vehicle Type

- 15.4.3. Battery Type

- 15.4.4. Power Output

- 15.4.5. Component

- 15.4.6. Charging Type

- 15.4.7. Propulsion Type

- 15.4.8. Application

- 15.5. United Kingdom Off-highway Electric Vehicle Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Vehicle Type

- 15.5.3. Battery Type

- 15.5.4. Power Output

- 15.5.5. Component

- 15.5.6. Charging Type

- 15.5.7. Propulsion Type

- 15.5.8. Application

- 15.6. France Off-highway Electric Vehicle Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Vehicle Type

- 15.6.3. Battery Type

- 15.6.4. Power Output

- 15.6.5. Component

- 15.6.6. Charging Type

- 15.6.7. Propulsion Type

- 15.6.8. Application

- 15.7. Italy Off-highway Electric Vehicle Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Vehicle Type

- 15.7.3. Battery Type

- 15.7.4. Power Output

- 15.7.5. Component

- 15.7.6. Charging Type

- 15.7.7. Propulsion Type

- 15.7.8. Application

- 15.8. Spain Off-highway Electric Vehicle Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Vehicle Type

- 15.8.3. Battery Type

- 15.8.4. Power Output

- 15.8.5. Component

- 15.8.6. Charging Type

- 15.8.7. Propulsion Type

- 15.8.8. Application

- 15.9. Netherlands Off-highway Electric Vehicle Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Vehicle Type

- 15.9.3. Battery Type

- 15.9.4. Power Output

- 15.9.5. Component

- 15.9.6. Charging Type

- 15.9.7. Propulsion Type

- 15.9.8. Application

- 15.10. Nordic Countries Off-highway Electric Vehicle Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Vehicle Type

- 15.10.3. Battery Type

- 15.10.4. Power Output

- 15.10.5. Component

- 15.10.6. Charging Type

- 15.10.7. Propulsion Type

- 15.10.8. Application

- 15.11. Poland Off-highway Electric Vehicle Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Vehicle Type

- 15.11.3. Battery Type

- 15.11.4. Power Output

- 15.11.5. Component

- 15.11.6. Charging Type

- 15.11.7. Propulsion Type

- 15.11.8. Application

- 15.12. Russia & CIS Off-highway Electric Vehicle Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Vehicle Type

- 15.12.3. Battery Type

- 15.12.4. Power Output

- 15.12.5. Component

- 15.12.6. Charging Type

- 15.12.7. Propulsion Type

- 15.12.8. Application

- 15.13. Rest of Europe Off-highway Electric Vehicle Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Vehicle Type

- 15.13.3. Battery Type

- 15.13.4. Power Output

- 15.13.5. Component

- 15.13.6. Charging Type

- 15.13.7. Propulsion Type

- 15.13.8. Application

- 16. Asia Pacific Off-highway Electric Vehicle Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. East Asia Off-highway Electric Vehicle Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 16.3.1. Vehicle Type

- 16.3.2. Battery Type

- 16.3.3. Power Output

- 16.3.4. Component

- 16.3.5. Charging Type

- 16.3.6. Propulsion Type

- 16.3.7. Application

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia Pacific

- 16.4. China Off-highway Electric Vehicle Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Vehicle Type

- 16.4.3. Battery Type

- 16.4.4. Power Output

- 16.4.5. Component

- 16.4.6. Charging Type

- 16.4.7. Propulsion Type

- 16.4.8. Application

- 16.5. India Off-highway Electric Vehicle Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Vehicle Type

- 16.5.3. Battery Type

- 16.5.4. Power Output

- 16.5.5. Component

- 16.5.6. Charging Type

- 16.5.7. Propulsion Type

- 16.5.8. Application

- 16.6. Japan Off-highway Electric Vehicle Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Vehicle Type

- 16.6.3. Battery Type

- 16.6.4. Power Output

- 16.6.5. Component

- 16.6.6. Charging Type

- 16.6.7. Propulsion Type

- 16.6.8. Application

- 16.7. South Korea Off-highway Electric Vehicle Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Vehicle Type

- 16.7.3. Battery Type

- 16.7.4. Power Output

- 16.7.5. Component

- 16.7.6. Charging Type

- 16.7.7. Propulsion Type

- 16.7.8. Application

- 16.8. Australia and New Zealand Off-highway Electric Vehicle Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Vehicle Type

- 16.8.3. Battery Type

- 16.8.4. Power Output

- 16.8.5. Component

- 16.8.6. Charging Type

- 16.8.7. Propulsion Type

- 16.8.8. Application

- 16.9. Indonesia Off-highway Electric Vehicle Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Vehicle Type

- 16.9.3. Battery Type

- 16.9.4. Power Output

- 16.9.5. Component

- 16.9.6. Charging Type

- 16.9.7. Propulsion Type

- 16.9.8. Application

- 16.10. Malaysia Off-highway Electric Vehicle Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Vehicle Type

- 16.10.3. Battery Type

- 16.10.4. Power Output

- 16.10.5. Component

- 16.10.6. Charging Type

- 16.10.7. Propulsion Type

- 16.10.8. Application

- 16.11. Thailand Off-highway Electric Vehicle Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Vehicle Type

- 16.11.3. Battery Type

- 16.11.4. Power Output

- 16.11.5. Component

- 16.11.6. Charging Type

- 16.11.7. Propulsion Type

- 16.11.8. Application

- 16.12. Vietnam Off-highway Electric Vehicle Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Vehicle Type

- 16.12.3. Battery Type

- 16.12.4. Power Output

- 16.12.5. Component

- 16.12.6. Charging Type

- 16.12.7. Propulsion Type

- 16.12.8. Application

- 16.13. Rest of Asia Pacific Off-highway Electric Vehicle Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Vehicle Type

- 16.13.3. Battery Type

- 16.13.4. Power Output

- 16.13.5. Component

- 16.13.6. Charging Type

- 16.13.7. Propulsion Type

- 16.13.8. Application

- 17. Middle East Off-highway Electric Vehicle Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East Off-highway Electric Vehicle Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 17.3.1. Vehicle Type

- 17.3.2. Battery Type

- 17.3.3. Power Output

- 17.3.4. Component

- 17.3.5. Charging Type

- 17.3.6. Propulsion Type

- 17.3.7. Application

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey Off-highway Electric Vehicle Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Vehicle Type

- 17.4.3. Battery Type

- 17.4.4. Power Output

- 17.4.5. Component

- 17.4.6. Charging Type

- 17.4.7. Propulsion Type

- 17.4.8. Application

- 17.5. UAE Off-highway Electric Vehicle Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Vehicle Type

- 17.5.3. Battery Type

- 17.5.4. Power Output

- 17.5.5. Component

- 17.5.6. Charging Type

- 17.5.7. Propulsion Type

- 17.5.8. Application

- 17.6. Saudi Arabia Off-highway Electric Vehicle Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Vehicle Type

- 17.6.3. Battery Type

- 17.6.4. Power Output

- 17.6.5. Component

- 17.6.6. Charging Type

- 17.6.7. Propulsion Type

- 17.6.8. Application

- 17.7. Israel Off-highway Electric Vehicle Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Vehicle Type

- 17.7.3. Battery Type

- 17.7.4. Power Output

- 17.7.5. Component

- 17.7.6. Charging Type

- 17.7.7. Propulsion Type

- 17.7.8. Application

- 17.8. Rest of Middle East Off-highway Electric Vehicle Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Vehicle Type

- 17.8.3. Battery Type

- 17.8.4. Power Output

- 17.8.5. Component

- 17.8.6. Charging Type

- 17.8.7. Propulsion Type

- 17.8.8. Application

- 18. Africa Off-highway Electric Vehicle Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa Off-highway Electric Vehicle Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 18.3.1. Vehicle Type

- 18.3.2. Battery Type

- 18.3.3. Power Output

- 18.3.4. Component

- 18.3.5. Charging Type

- 18.3.6. Propulsion Type

- 18.3.7. Application

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa Off-highway Electric Vehicle Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Vehicle Type

- 18.4.3. Battery Type

- 18.4.4. Power Output

- 18.4.5. Component

- 18.4.6. Charging Type

- 18.4.7. Propulsion Type

- 18.4.8. Application

- 18.5. Egypt Off-highway Electric Vehicle Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Vehicle Type

- 18.5.3. Battery Type

- 18.5.4. Power Output

- 18.5.5. Component

- 18.5.6. Charging Type

- 18.5.7. Propulsion Type

- 18.5.8. Application

- 18.6. Nigeria Off-highway Electric Vehicle Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Vehicle Type

- 18.6.3. Battery Type

- 18.6.4. Power Output

- 18.6.5. Component

- 18.6.6. Charging Type

- 18.6.7. Propulsion Type

- 18.6.8. Application

- 18.7. Algeria Off-highway Electric Vehicle Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Vehicle Type

- 18.7.3. Battery Type

- 18.7.4. Power Output

- 18.7.5. Component

- 18.7.6. Charging Type

- 18.7.7. Propulsion Type

- 18.7.8. Application

- 18.8. Rest of Africa Off-highway Electric Vehicle Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Vehicle Type

- 18.8.3. Battery Type

- 18.8.4. Power Output

- 18.8.5. Component

- 18.8.6. Charging Type

- 18.8.7. Propulsion Type

- 18.8.8. Application

- 19. South America Off-highway Electric Vehicle Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Central and South Africa Off-highway Electric Vehicle Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 19.3.1. Vehicle Type

- 19.3.2. Battery Type

- 19.3.3. Power Output

- 19.3.4. Component

- 19.3.5. Charging Type

- 19.3.6. Propulsion Type

- 19.3.7. Application

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil Off-highway Electric Vehicle Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Vehicle Type

- 19.4.3. Battery Type

- 19.4.4. Power Output

- 19.4.5. Component

- 19.4.6. Charging Type

- 19.4.7. Propulsion Type

- 19.4.8. Application

- 19.5. Argentina Off-highway Electric Vehicle Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Vehicle Type

- 19.5.3. Battery Type

- 19.5.4. Power Output

- 19.5.5. Component

- 19.5.6. Charging Type

- 19.5.7. Propulsion Type

- 19.5.8. Application

- 19.6. Rest of South America Off-highway Electric Vehicle Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Vehicle Type

- 19.6.3. Battery Type

- 19.6.4. Power Output

- 19.6.5. Component

- 19.6.6. Charging Type

- 19.6.7. Propulsion Type

- 19.6.8. Application

- 20. Key Players/ Company Profile

- 20.1. AGCO Corporation

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. Caterpillar Inc.

- 20.3. CNH Industrial (Case IH, New Holland)

- 20.4. Doosan Infracore

- 20.5. Epiroc AB

- 20.6. FPT Industrial (CNH)

- 20.7. Hitachi Construction Machinery

- 20.8. JCB

- 20.9. John Deere

- 20.10. Komatsu Ltd.

- 20.11. Kubota Corporation

- 20.12. Liebherr Group

- 20.13. Lion Electric Co.

- 20.14. Sandvik Mining and Rock Technology

- 20.15. SANY Group

- 20.16. Terex Corporation

- 20.17. Tesla, Inc.

- 20.18. Volvo Construction Equipment

- 20.19. Wirtgen Group

- 20.20. Other Key Players

- 20.1. AGCO Corporation

Note* - This is just tentative list of players. While providing the report, we will cover a greater number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation