SiC Substrate Market Size, Share & Trends Analysis Report by Diameter (2-inch, 4-inch, 6-inch and 8-inch), Conductivity Type, Wafer Type, Polytype, Industry Vertical X Application, Distribution Channel and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025 – 2035

|

Market Structure & Evolution |

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

SiC substrate Market Size, Share, And Growth

The global SiC substrate market is experiencing robust growth, with its estimated value of USD 0.4 billion in the year 2025 and USD 1.0 billion by the period 2035, registering a CAGR of 9.1% during the forecast period.

Michael Chen, CTO of ON Semiconductor, said: “Our new AI-enabled SiC substrate platform will help manufacturers optimize their wafer yield and device performance. By utilizing ON Semiconductor’s manufacturing and process expertise with advanced machine learning analytics, we will increase efficiency and further accelerate innovation in power electronics.”

The global SiC substrate market is growing substantially due to multiple factors, including the advancement of high-performance substrates that improve the efficiency and reliability of power electronics. For instance, in February 2025, samples of a cutting-edge 4H-SiC wafer were introduced by Rohm Semiconductor, boasting enhanced thermal conductivity and defect densities that improve power electronics operating efficiency in electric vehicle (EV) inverters and industrial power modules.

The growing prevalence of electric vehicles, renewable energy systems, and high-voltage industrial equipment has increased interest in SiC substrates. Global Semiconductors, for example, announced in March 2025 that they would be expanding production of SiC, met the growing need from automotive and renewable energy sectors. Furthermore, efficiency and reliability expectations from infrastructure industries, such as automotive, aerospace, and energy, are stimulating manufacturers to roll out state-of-the art SiC technologies, positively impacting SiC substrate market growth.

Key opportunities in the SiC substrate market include the production of SiC epitaxial layers, development of high-power devices, thermal management solutions, and wafer-level testing equipment. With these adjacent verticals, manufacturers are able to leverage performance optimization, increase operational performance, and develop additional revenue streams, both in power electronics and the semiconductor market.

SiC Substrate Market Dynamics and Trends

Driver: Technology-Driven Growth and Adoption in SiC Substrates

- Steady growth is occurring in the global SiC substrate market due to increasing use of the high-performance 4H- and 6H-SiC substrates in power electronics, electric vehicles (EVs), and renewable energy. Major players including Rohm Semiconductor, ON Semiconductor, Cree (Wolfspeed), STMicroelectronics, and Infineon Technologies, are fueling innovation with enhanced epitaxial growth methods, defect optimization, and AI-led process control to increase yield and efficiency.

- In February 2025, Rohm Semiconductor launched the next generation of 4H-SiC wafer for high thermal conductivity and low defect density operating high-voltage EV inverters and industrial power modules. AI-based process monitoring with live wafer characterization were included to enhance yield and efficiency in production as these factors also enhance device reliability.

- The demand for energy-efficient solutions with the rapidly expanding EV market as well as electrification of the industrial space is driving growth with additional opportunities in emerging markets as production costs depreciate and infrastructure becomes developed.

Restraint: High Production Costs and Manufacturing Challenges Limiting SiC Substrates Widespread Adoption

- Creating SiC (silicon carbide) substrates is typically a large capital investment (tens of millions of dollars) and financially unattainable to others in many other areas of the world due to the cost issues.

- The cost of SiC substrates is comprised of a host of challenging characteristics associated with SiC substrates. Creating SiC substrates requires complicated epitaxial growth sequences, including quality assurance procedures (both in fabrication and final test). All of these complications lead to long production runs that contribute cost to the substrate itself.

- Additionally, additional difficulties related to wafer size, defect density, and consistent material properties and performance (perhaps the most pivotal of the issues facing wafer production is the ability of a material property or performance characteristic to be repeatable from substates, batch to batch) also limits the adoption of SiC substrates worldwide.

Opportunity: Expanding Applications in EVs and Renewable Energy

- The progress of SiC (Silicon Carbide) technology offers higher efficiency and dependability in power inverters, converters, and industrial electronics. The practices of AI-enabled process control and predictive maintenance allow manufacturers to boost throughput and minimize defect rates. The growing electric vehicle market, solar and wind power installations, and a range of high-voltage industrial equipment create compelling new opportunities for substrate manufacturers to grow an expanded catalogue of energy-efficient solutions in new geographies.

- Rising government incentives to adopt clean energy sources, increasing regulations to reduce emissions, and demand for environmentally sustainable technologies are driving demand for power devices using SiC. Moreover, partnerships between SiC substrate and companies focused on automotive, industrial and renewable energy are helping to enhance technology adoption and accelerate commercialization of next-generation power solutions.

Key Trend: Integration of AI and Advanced Manufacturing Technologies

- AI, IoT, and machine learning have been increasingly applied to wafer defect inspection, predictive maintenance, and process/output management in the marketplace. A perfect example of this is when ON Semiconductor used AI-enabled real-time wafer data to evaluate productivity in March 2025 and observed a productivity yield that was 15%, better, as well as, less waiting/downtime.

- The growth of large wafer sizes, advancements in epitaxial layers, and partnerships between substrate manufacturers and power device manufacturers driven by improved power electronics that are higher performance, reliable, and cheap are all working together to push the market forward.

- The other key trend noted is the use of digital twins and more advanced process simulations of automated inspection lines to reduce & develop R&D cycles, reduce redundant waste, and allow production to scale more easily.

SiC Substrate Market Analysis and Segmental Data

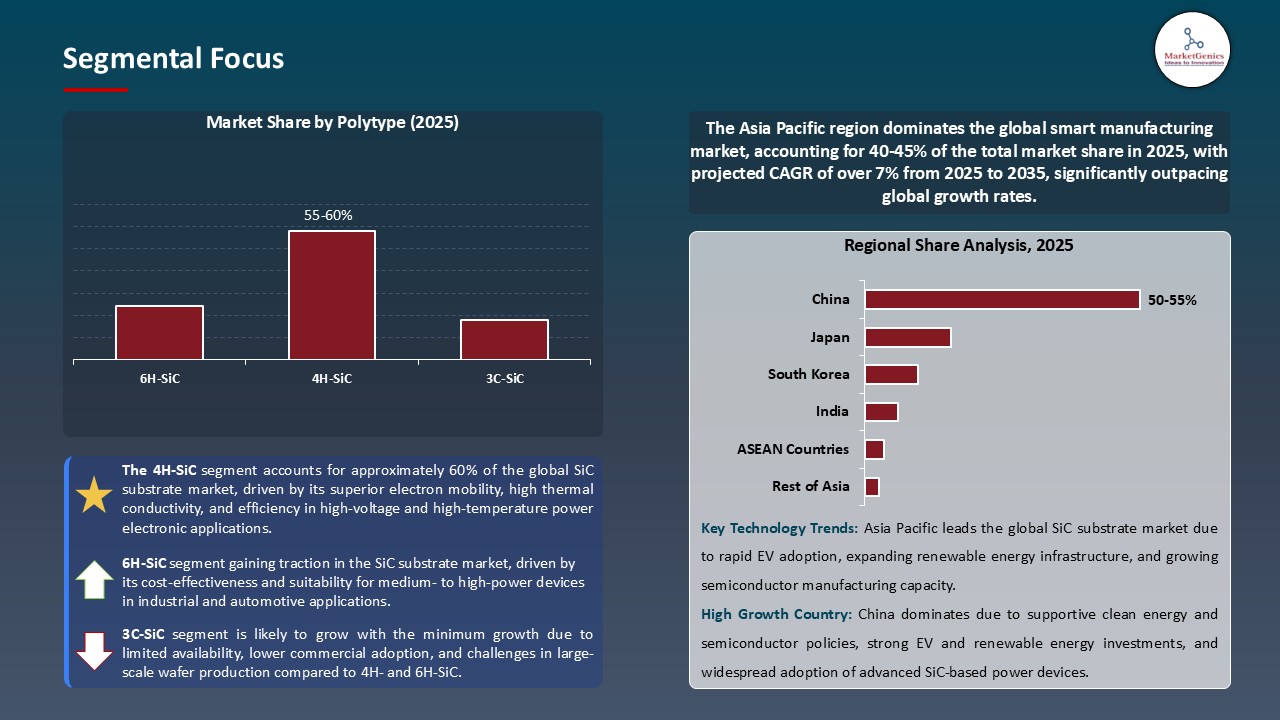

4H-SiC Polytype Industry’s Supremacy in SiC Substrate Industry

- With its unparalleled electrical and thermal performance, the 4H-SiC polytype remains the leading type of SiC substrate worldwide. Leading companies, including Cree (Wolfspeed), Rohm Semiconductor, ON Semiconductor, STMicroelectronics, and Infineon Technologies are utilizing 4H-SiC wafers in highly efficient power devices for Electric Vehicles (EVs), industrial applications, and renewable energy. In January 2025, Wolfspeed launched a next-generation 4H-SiC wafers with lower defect density and increased thermal conductivity to enable operation at higher voltages while also increasing device reliability.

- Committing to 4H-SiC is preferred over other polytypes because it can utilize more advanced epitaxial growth processes and larger wafer sizes which also leads to better average yield. Advanced processes and greater die yield lead to increased market adoption and faster proliferation of 4H-SiC power devices in electric vehicle inverters, power modules, and industrial electronics, where reliability and efficiency is the highest priority.

- Semiconductor companies are investing heavily into AI assisted monitoring, defect detection, and process optimization for 4H-SiC material production, consistent output quality, reduced material loss and decreased time to market. The continued dedication to 4H-SiC further solidifies its position as the premier SiC substrate, creating a compounding road of technology improvements and wider global utilization of 4H-SiC devices.

Asia Pacific’s Dominance in SiC Substrate Implementation

- Owing to major semiconductor companies like Rohm Semiconductor, STMicroelectronics, Infineon Technologies, and Walvax Biotechnology, as well as the region's strong initiatives for electric vehicles, renewable energy, and industrial power electronics. The already-developed manufacturing system, favorable government policies, and encouragements for advanced semiconductor fabrication have only solidified the region's leadership. In March 2025, China's Ministry of Industry and Information Technology triggered a new program aimed at promoting widespread adoption of SiC-based power devices, leading to greater production capabilities and innovation.

- For example, STMicroelectronics initiated AI-enabled 4H-SiC wafer monitoring processes at its facilities in the Asia Pacific through defect detection and optimized process control, to greater yields (20%) and decreased powered material waste (30%) across multiple lines of production.

- Further, with previous commitments to R&D and production capacity, the Asia Pacific region is now a world leader in the deployment of SiC substrates. The region's commitment to technology transfer and high-volume manufacturing and energy-efficient production will allow for acceleration in adoption, enhanced performance of devices, and competitive advantages in the semiconductor space.

SiC-Substrate-Market Ecosystem

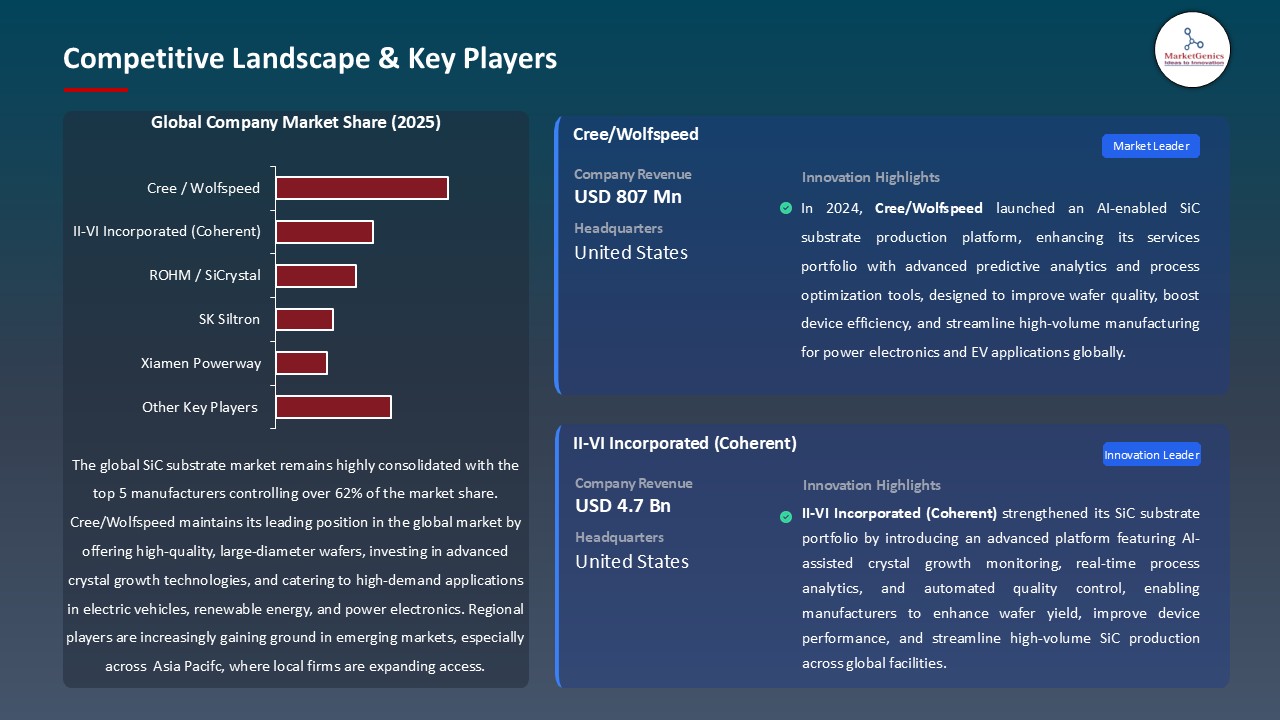

The global silicon carbide (SiC) substrate market is moderately consolidated, with leading companies, such as Cree, Inc., ROHM Co., Ltd., STMicroelectronics N.V., Infineon Technologies AG, Mitsubishi Electric Corporation, and II-VI Incorporated, remaining dominant players due to advances in wafer engineering and epitaxy growth technologies. Lead firms supply products for high-demand markets, such as electrical vehicles, renewable energy, and industrial power electronics.

Lead firms focus on niche solutions to drive innovation. For example, ROHM manufactures high-purity 4H-SiC wafers that are used in automotive inverter applications, while STMicroelectronics commercializes epitaxial SiC wafers that improve thermal performance and reliability in industrial applications.

Further, government organizations and R&D groups are also investing to advance technology. In March 2025, China’s Ministry of Industry and Information Technology launched AI-assisted production programs for SiC wafers that aim to improve yield, reduce defect levels, and enable faster adoption in energy-efficient electronics. Likewise, market opportunities are also being driven by new product offerings related to integrated solutions. For instance, Mitsubishi Electric developed multi-wafer production lines to meet customer demand for increased productivity and less energy consumption.

Getting back to the advancements in technology, one of the key objectives continues to be improving efficiencies. In June 2025, Infineon applied an AI-based real time wafer defect detection and data collection system in order to improve yield by another 15% and cut down on downtime by about 20%. All of these advancements demonstrate yet another example of the SiC market’s focus on combining material innovation with a digital intelligence approach to provide a process with reliable and efficient improvements.

Recent Development and Strategic Overview:

- In February 2025, Cree, Inc. launched its artificial intelligence-based SiC wafer monitoring platform to provide real-time visibility into defect rates and production efficiency. The platform utilizes machine learning algorithms to study wafer growth patterns, suggesting adjustments to processes, all enabling producers to increase yield and reduce material waste by improving overall operational efficiency.

- In May 2025, II-VI Incorporated unveiled, an AI-based predictive maintenance solution for SiC epitaxial reactors. The solution gathers and assesses sensor data from multiple production lines and predicts when equipment will fail, proactively scheduling appropriate maintenance activities. This contributes to an improved uptime (18%) by lessening unplanned downtimes, thereby ensuring wafer quality remains steady in high-volume manufacturing situations.

Report Scope

|

Attribute |

Detail |

|

Market Size in 2025 |

USD 0.4 Bn |

|

Market Forecast Value in 2035 |

USD 1.0 Bn |

|

Growth Rate (CAGR) |

9.1% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

USD Bn for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

Regions and Countries Covered |

|||||

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

SiC-Substrate-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

SiC Substrate Market, By Diameter |

|

|

SiC Substrate Market, By Conductivity Type |

|

|

SiC Substrate Market, By Wafer Type |

|

|

SiC Substrate Market, By Polytype |

|

|

SiC Substrate Market, By Industry Vertical X Application |

|

|

SiC Substrate Market, By Distribution Channel |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global SiC Substrate Market Outlook

- 2.1.1. SiC Substrate Market Size (Value - USD Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global SiC Substrate Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Semiconductors & Electronics Industry Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Semiconductors & Electronics Industry

- 3.1.3. Regional Distribution for Semiconductors & Electronics Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Semiconductors & Electronics Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising Demand for Electric Vehicles (EVs)

- 4.1.1.2. Expansion of Power Electronics Applications

- 4.1.1.3. Government Support for Energy Efficiency

- 4.1.2. Restraints

- 4.1.2.1. High Manufacturing Cost

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis/Ecosystem Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Wafer Manufacturing & Processing

- 4.4.3. Packaging & Distribution

- 4.4.4. End Users

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global SiC Substrate Market Demand

- 4.9.1. Historical Market Size – (Value - USD Bn), 2020-2024

- 4.9.2. Current and Future Market Size – (Value - USD Bn), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global SiC Substrate Market Analysis, by Diameter

- 6.1. Key Segment Analysis

- 6.2. SiC Substrate Market Size (Value - USD Bn), Analysis, and Forecasts, by Diameter, 2021-2035

- 6.2.1. 2-inch

- 6.2.2. 4-inch

- 6.2.3. 6-inch

- 6.2.4. 8-inch

- 7. Global SiC Substrate Market Analysis, by Conductivity Type

- 7.1. Key Segment Analysis

- 7.2. SiC Substrate Market Size (Value - USD Bn), Analysis, and Forecasts, by Conductivity Type, 2021-2035

- 7.2.1. Semi-insulating SiC Substrate

- 7.2.2. Conductive SiC Substrate

- 8. Global SiC Substrate Market Analysis, by Wafer Type

- 8.1. Key Segment Analysis

- 8.2. SiC Substrate Market Size (Value - USD Bn), Analysis, and Forecasts, by Wafer Type, 2021-2035

- 8.2.1. Single-Crystal Wafer

- 8.2.2. Epitaxial Wafer

- 9. Global SiC Substrate Market Analysis, by Polytype

- 9.1. Key Segment Analysis

- 9.2. SiC Substrate Market Size (Value - USD Bn), Analysis, and Forecasts, by Polytype, 2021-2035

- 9.2.1. 4H-SiC

- 9.2.2. 6H-SiC

- 9.2.3. 3C-SiC

- 10. Global SiC Substrate Market Analysis, by Industry Vertical X Application

- 10.1. Key Segment Analysis

- 10.2. SiC Substrate Market Size (Value - USD Bn), Analysis, and Forecasts, by Industry Vertical X Application, 2021-2035

- 10.2.1. Automotive

- 10.2.1.1. Power Devices for Electric Vehicles (EVs)

- 10.2.1.2. Onboard Chargers (OBCs)

- 10.2.1.3. DC-DC Converters

- 10.2.1.4. Traction Inverters

- 10.2.1.5. Others

- 10.2.2. Consumer Electronics

- 10.2.2.1. Power Management ICs

- 10.2.2.2. Fast Charging Adapters

- 10.2.2.3. LED Lighting Components

- 10.2.2.4. Radio Frequency (RF) Modules

- 10.2.2.5. Others

- 10.2.3. Telecommunications

- 10.2.3.1. 5G Base Station Power Amplifiers

- 10.2.3.2. RF Devices for High-Frequency Communication

- 10.2.3.3. Optical Transceivers

- 10.2.3.4. Satellite Communication Modules

- 10.2.3.5. Others

- 10.2.4. Energy & Power

- 10.2.4.1. Power Conversion Systems

- 10.2.4.2. Renewable Energy Inverters (Solar/Wind)

- 10.2.4.3. Smart Grid Power Electronics

- 10.2.4.4. Industrial Motor Drives

- 10.2.4.5. Others

- 10.2.5. Aerospace & Defense

- 10.2.5.1. High-Power Radar Systems

- 10.2.5.2. RF and Microwave Amplifiers

- 10.2.5.3. Avionics Power Control Modules

- 10.2.5.4. Space Communication Equipment

- 10.2.5.5. Others

- 10.2.6. Industrial & Manufacturing

- 10.2.6.1. Robotics Power Modules

- 10.2.6.2. Motor Control Systems

- 10.2.6.3. Industrial Automation Drives

- 10.2.6.4. High-Temperature Sensors

- 10.2.6.5. Others

- 10.2.7. Healthcare

- 10.2.7.1. Medical Imaging Devices

- 10.2.7.2. Diagnostic Laser Equipment

- 10.2.7.3. High-Frequency Monitoring Systems

- 10.2.7.4. Power Supply Units for Medical Tools

- 10.2.7.5. Others

- 10.2.8. Other Industry Verticals

- 10.2.1. Automotive

- 11. Global SiC Substrate Market Analysis, by Distribution Channel

- 11.1. Key Segment Analysis

- 11.2. SiC Substrate Market Size (Value - USD Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 11.2.1. Direct Sales

- 11.2.2. Distributors

- 12. Global SiC Substrate Market Analysis and Forecasts, by Region

- 12.1. Key Findings

- 12.2. SiC Substrate Market Size (Volume - Million Units and Value - US$ Mn), Analysis, and Forecasts, by Region, 2021-2035

- 12.2.1. North America

- 12.2.2. Europe

- 12.2.3. Asia Pacific

- 12.2.4. Middle East

- 12.2.5. Africa

- 12.2.6. South America

- 13. North America SiC Substrate Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. North America SiC Substrate Market Size Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 13.3.1. Diameter

- 13.3.2. Conductivity Type

- 13.3.3. Wafer Type

- 13.3.4. Polytype

- 13.3.5. Industry Vertical X Application

- 13.3.6. Distribution Channel

- 13.3.7. Country

- 13.3.7.1. USA

- 13.3.7.2. Canada

- 13.3.7.3. Mexico

- 13.4. USA SiC Substrate Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Diameter

- 13.4.3. Conductivity Type

- 13.4.4. Wafer Type

- 13.4.5. Polytype

- 13.4.6. Industry Vertical X Application

- 13.4.7. Distribution Channel

- 13.5. Canada SiC Substrate Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Diameter

- 13.5.3. Conductivity Type

- 13.5.4. Wafer Type

- 13.5.5. Polytype

- 13.5.6. Industry Vertical X Application

- 13.5.7. Distribution Channel

- 13.6. Mexico SiC Substrate Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Diameter

- 13.6.3. Conductivity Type

- 13.6.4. Wafer Type

- 13.6.5. Polytype

- 13.6.6. Industry Vertical X Application

- 13.6.7. Distribution Channel

- 14. Europe SiC Substrate Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. Europe SiC Substrate Market Size (Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Diameter

- 14.3.2. Conductivity Type

- 14.3.3. Wafer Type

- 14.3.4. Polytype

- 14.3.5. Industry Vertical X Application

- 14.3.6. Distribution Channel

- 14.3.7. Country

- 14.3.7.1. Germany

- 14.3.7.2. United Kingdom

- 14.3.7.3. France

- 14.3.7.4. Italy

- 14.3.7.5. Spain

- 14.3.7.6. Netherlands

- 14.3.7.7. Nordic Countries

- 14.3.7.8. Poland

- 14.3.7.9. Russia & CIS

- 14.3.7.10. Rest of Europe

- 14.4. Germany SiC Substrate Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Diameter

- 14.4.3. Conductivity Type

- 14.4.4. Wafer Type

- 14.4.5. Polytype

- 14.4.6. Industry Vertical X Application

- 14.4.7. Distribution Channel

- 14.5. United Kingdom SiC Substrate Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Diameter

- 14.5.3. Conductivity Type

- 14.5.4. Wafer Type

- 14.5.5. Polytype

- 14.5.6. Industry Vertical X Application

- 14.5.7. Distribution Channel

- 14.6. France SiC Substrate Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Diameter

- 14.6.3. Conductivity Type

- 14.6.4. Wafer Type

- 14.6.5. Polytype

- 14.6.6. Industry Vertical X Application

- 14.6.7. Distribution Channel

- 14.7. Italy SiC Substrate Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Diameter

- 14.7.3. Conductivity Type

- 14.7.4. Wafer Type

- 14.7.5. Polytype

- 14.7.6. Industry Vertical X Application

- 14.7.7. Distribution Channel

- 14.8. Spain SiC Substrate Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Diameter

- 14.8.3. Conductivity Type

- 14.8.4. Wafer Type

- 14.8.5. Polytype

- 14.8.6. Industry Vertical X Application

- 14.8.7. Distribution Channel

- 14.9. Netherlands SiC Substrate Market

- 14.9.1. Country Segmental Analysis

- 14.9.2. Diameter

- 14.9.3. Conductivity Type

- 14.9.4. Wafer Type

- 14.9.5. Polytype

- 14.9.6. Industry Vertical X Application

- 14.9.7. Distribution Channel

- 14.10. Nordic Countries SiC Substrate Market

- 14.10.1. Country Segmental Analysis

- 14.10.2. Diameter

- 14.10.3. Conductivity Type

- 14.10.4. Wafer Type

- 14.10.5. Polytype

- 14.10.6. Industry Vertical X Application

- 14.10.7. Distribution Channel

- 14.11. Poland SiC Substrate Market

- 14.11.1. Country Segmental Analysis

- 14.11.2. Diameter

- 14.11.3. Conductivity Type

- 14.11.4. Wafer Type

- 14.11.5. Polytype

- 14.11.6. Industry Vertical X Application

- 14.11.7. Distribution Channel

- 14.12. Russia & CIS SiC Substrate Market

- 14.12.1. Country Segmental Analysis

- 14.12.2. Diameter

- 14.12.3. Conductivity Type

- 14.12.4. Wafer Type

- 14.12.5. Polytype

- 14.12.6. Industry Vertical X Application

- 14.12.7. Distribution Channel

- 14.13. Rest of Europe SiC Substrate Market

- 14.13.1. Country Segmental Analysis

- 14.13.2. Diameter

- 14.13.3. Conductivity Type

- 14.13.4. Wafer Type

- 14.13.5. Polytype

- 14.13.6. Industry Vertical X Application

- 14.13.7. Distribution Channel

- 15. Asia Pacific SiC Substrate Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. East Asia SiC Substrate Market Size (Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Diameter

- 15.3.2. Conductivity Type

- 15.3.3. Wafer Type

- 15.3.4. Polytype

- 15.3.5. Industry Vertical X Application

- 15.3.6. Distribution Channel

- 15.3.7. Country

- 15.3.7.1. China

- 15.3.7.2. India

- 15.3.7.3. Japan

- 15.3.7.4. South Korea

- 15.3.7.5. Australia and New Zealand

- 15.3.7.6. Indonesia

- 15.3.7.7. Malaysia

- 15.3.7.8. Thailand

- 15.3.7.9. Vietnam

- 15.3.7.10. Rest of Asia Pacific

- 15.4. China SiC Substrate Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Diameter

- 15.4.3. Conductivity Type

- 15.4.4. Wafer Type

- 15.4.5. Polytype

- 15.4.6. Industry Vertical X Application

- 15.4.7. Distribution Channel

- 15.5. India SiC Substrate Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Diameter

- 15.5.3. Conductivity Type

- 15.5.4. Wafer Type

- 15.5.5. Polytype

- 15.5.6. Industry Vertical X Application

- 15.5.7. Distribution Channel

- 15.6. Japan SiC Substrate Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Diameter

- 15.6.3. Conductivity Type

- 15.6.4. Wafer Type

- 15.6.5. Polytype

- 15.6.6. Industry Vertical X Application

- 15.6.7. Distribution Channel

- 15.7. South Korea SiC Substrate Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Diameter

- 15.7.3. Conductivity Type

- 15.7.4. Wafer Type

- 15.7.5. Polytype

- 15.7.6. Industry Vertical X Application

- 15.7.7. Distribution Channel

- 15.8. Australia and New Zealand SiC Substrate Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Diameter

- 15.8.3. Conductivity Type

- 15.8.4. Wafer Type

- 15.8.5. Polytype

- 15.8.6. Industry Vertical X Application

- 15.8.7. Distribution Channel

- 15.9. Indonesia SiC Substrate Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Diameter

- 15.9.3. Conductivity Type

- 15.9.4. Wafer Type

- 15.9.5. Polytype

- 15.9.6. Industry Vertical X Application

- 15.9.7. Distribution Channel

- 15.10. Malaysia SiC Substrate Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Diameter

- 15.10.3. Conductivity Type

- 15.10.4. Wafer Type

- 15.10.5. Polytype

- 15.10.6. Industry Vertical X Application

- 15.10.7. Distribution Channel

- 15.11. Thailand SiC Substrate Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Diameter

- 15.11.3. Conductivity Type

- 15.11.4. Wafer Type

- 15.11.5. Polytype

- 15.11.6. Industry Vertical X Application

- 15.11.7. Distribution Channel

- 15.12. Vietnam SiC Substrate Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Diameter

- 15.12.3. Conductivity Type

- 15.12.4. Wafer Type

- 15.12.5. Polytype

- 15.12.6. Industry Vertical X Application

- 15.12.7. Distribution Channel

- 15.13. Rest of Asia Pacific SiC Substrate Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Diameter

- 15.13.3. Conductivity Type

- 15.13.4. Wafer Type

- 15.13.5. Polytype

- 15.13.6. Industry Vertical X Application

- 15.13.7. Distribution Channel

- 16. Middle East SiC Substrate Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Middle East SiC Substrate Market Size (Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Diameter

- 16.3.2. Conductivity Type

- 16.3.3. Wafer Type

- 16.3.4. Polytype

- 16.3.5. Industry Vertical X Application

- 16.3.6. Distribution Channel

- 16.3.7. Country

- 16.3.7.1. Turkey

- 16.3.7.2. UAE

- 16.3.7.3. Saudi Arabia

- 16.3.7.4. Israel

- 16.3.7.5. Rest of Middle East

- 16.4. Turkey SiC Substrate Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Diameter

- 16.4.3. Conductivity Type

- 16.4.4. Wafer Type

- 16.4.5. Polytype

- 16.4.6. Industry Vertical X Application

- 16.4.7. Distribution Channel

- 16.5. UAE SiC Substrate Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Diameter

- 16.5.3. Conductivity Type

- 16.5.4. Wafer Type

- 16.5.5. Polytype

- 16.5.6. Industry Vertical X Application

- 16.5.7. Distribution Channel

- 16.6. Saudi Arabia SiC Substrate Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Diameter

- 16.6.3. Conductivity Type

- 16.6.4. Wafer Type

- 16.6.5. Polytype

- 16.6.6. Industry Vertical X Application

- 16.6.7. Distribution Channel

- 16.7. Israel SiC Substrate Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Diameter

- 16.7.3. Conductivity Type

- 16.7.4. Wafer Type

- 16.7.5. Polytype

- 16.7.6. Industry Vertical X Application

- 16.7.7. Distribution Channel

- 16.8. Rest of Middle East SiC Substrate Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Diameter

- 16.8.3. Conductivity Type

- 16.8.4. Wafer Type

- 16.8.5. Polytype

- 16.8.6. Industry Vertical X Application

- 16.8.7. Distribution Channel

- 17. Africa SiC Substrate Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Africa SiC Substrate Market Size (Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Diameter

- 17.3.2. Conductivity Type

- 17.3.3. Wafer Type

- 17.3.4. Polytype

- 17.3.5. Industry Vertical X Application

- 17.3.6. Distribution Channel

- 17.3.7. Country

- 17.3.7.1. South Africa

- 17.3.7.2. Egypt

- 17.3.7.3. Nigeria

- 17.3.7.4. Algeria

- 17.3.7.5. Rest of Africa

- 17.4. South Africa SiC Substrate Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Diameter

- 17.4.3. Conductivity Type

- 17.4.4. Wafer Type

- 17.4.5. Polytype

- 17.4.6. Industry Vertical X Application

- 17.4.7. Distribution Channel

- 17.5. Egypt SiC Substrate Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Diameter

- 17.5.3. Conductivity Type

- 17.5.4. Wafer Type

- 17.5.5. Polytype

- 17.5.6. Industry Vertical X Application

- 17.5.7. Distribution Channel

- 17.6. Nigeria SiC Substrate Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Diameter

- 17.6.3. Conductivity Type

- 17.6.4. Wafer Type

- 17.6.5. Polytype

- 17.6.6. Industry Vertical X Application

- 17.6.7. Distribution Channel

- 17.7. Algeria SiC Substrate Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Diameter

- 17.7.3. Conductivity Type

- 17.7.4. Wafer Type

- 17.7.5. Polytype

- 17.7.6. Industry Vertical X Application

- 17.7.7. Distribution Channel

- 17.8. Rest of Africa SiC Substrate Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Diameter

- 17.8.3. Conductivity Type

- 17.8.4. Wafer Type

- 17.8.5. Polytype

- 17.8.6. Industry Vertical X Application

- 17.8.7. Distribution Channel

- 18. South America SiC Substrate Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Central and South Africa SiC Substrate Market Size (Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Diameter

- 18.3.2. Conductivity Type

- 18.3.3. Wafer Type

- 18.3.4. Polytype

- 18.3.5. Industry Vertical X Application

- 18.3.6. Distribution Channel

- 18.3.7. Country

- 18.3.7.1. Brazil

- 18.3.7.2. Argentina

- 18.3.7.3. Rest of South America

- 18.4. Brazil SiC Substrate Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Diameter

- 18.4.3. Conductivity Type

- 18.4.4. Wafer Type

- 18.4.5. Polytype

- 18.4.6. Industry Vertical X Application

- 18.4.7. Distribution Channel

- 18.5. Argentina SiC Substrate Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Diameter

- 18.5.3. Conductivity Type

- 18.5.4. Wafer Type

- 18.5.5. Polytype

- 18.5.6. Industry Vertical X Application

- 18.5.7. Distribution Channel

- 18.6. Rest of South America SiC Substrate Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Diameter

- 18.6.3. Conductivity Type

- 18.6.4. Wafer Type

- 18.6.5. Polytype

- 18.6.6. Industry Vertical X Application

- 18.6.7. Distribution Channel

- 19. Key Players/ Company Profile

- 19.1. Cree, Inc.

- 19.1.1. Company Details/ Overview

- 19.1.2. Company Financials

- 19.1.3. Key Customers and Competitors

- 19.1.4. Business/ Industry Portfolio

- 19.1.5. Product Portfolio/ Specification Details

- 19.1.6. Pricing Data

- 19.1.7. Strategic Overview

- 19.1.8. Recent Developments

- 19.2. Dow Corning Corporation

- 19.3. GT Advanced Technologies Inc.

- 19.4. Hebei Synlight Crystal Co., Ltd.

- 19.5. II-VI Incorporated

- 19.6. Infineon Technologies AG

- 19.7. Mitsubishi Electric Corporation

- 19.8. Nippon Steel & Sumitomo Metal Corporation

- 19.9. ROHM Co., Ltd.

- 19.10. Showa Denko K.K. (Resonac Holdings)

- 19.11. SICC Co., Ltd.

- 19.12. SK Siltron Co., Ltd.

- 19.13. STMicroelectronics N.V.

- 19.14. Sumitomo Electric Industries, Ltd.

- 19.15. TankeBlue Semiconductor Co., Ltd.

- 19.16. Xiamen Powerway Advanced Material Co., Ltd.

- 19.17. Others Key Players

- 19.1. Cree, Inc.

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation