Vehicle-to-Grid Technology Market Size, Share, Growth Opportunity Analysis Report by Technology Type (Bidirectional Chargers, Unidirectional Chargers, Communication Systems), Component, Battery Type, Power Rating, Charging Mode, Vehicle Type, Propulsion Type, Application and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Vehicle-to-Grid Technology Market Size, Share, and Growth

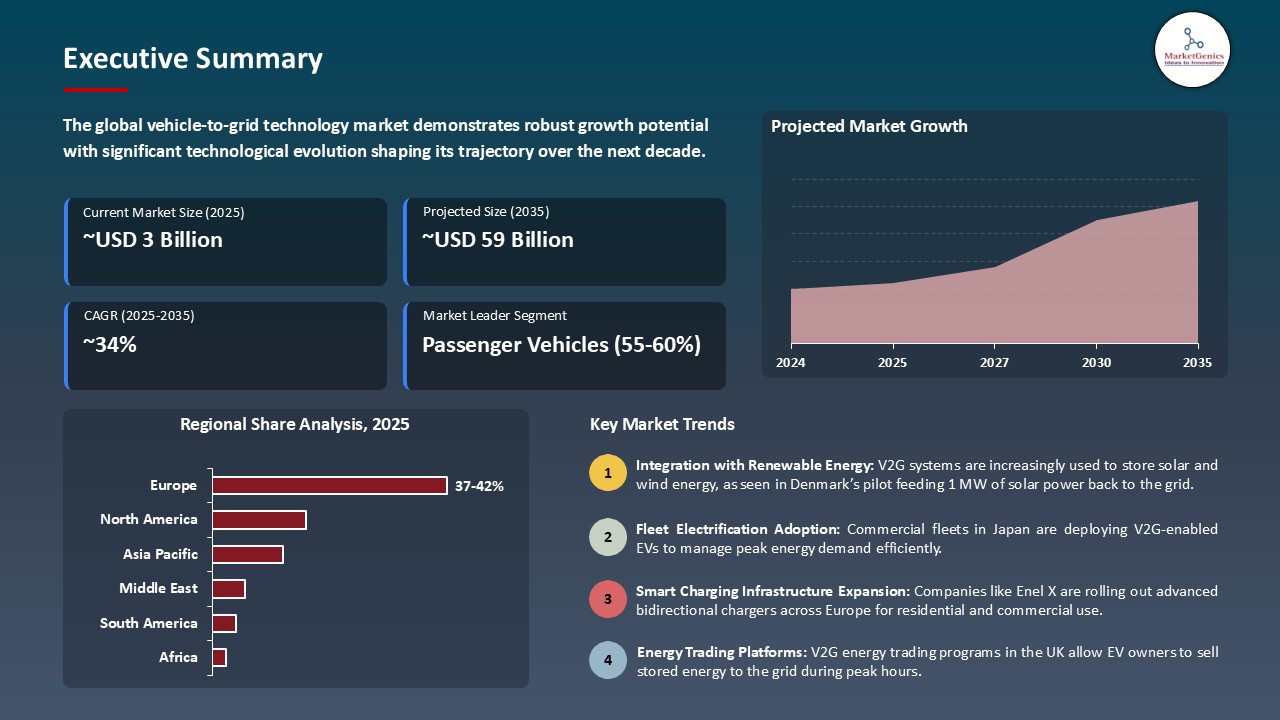

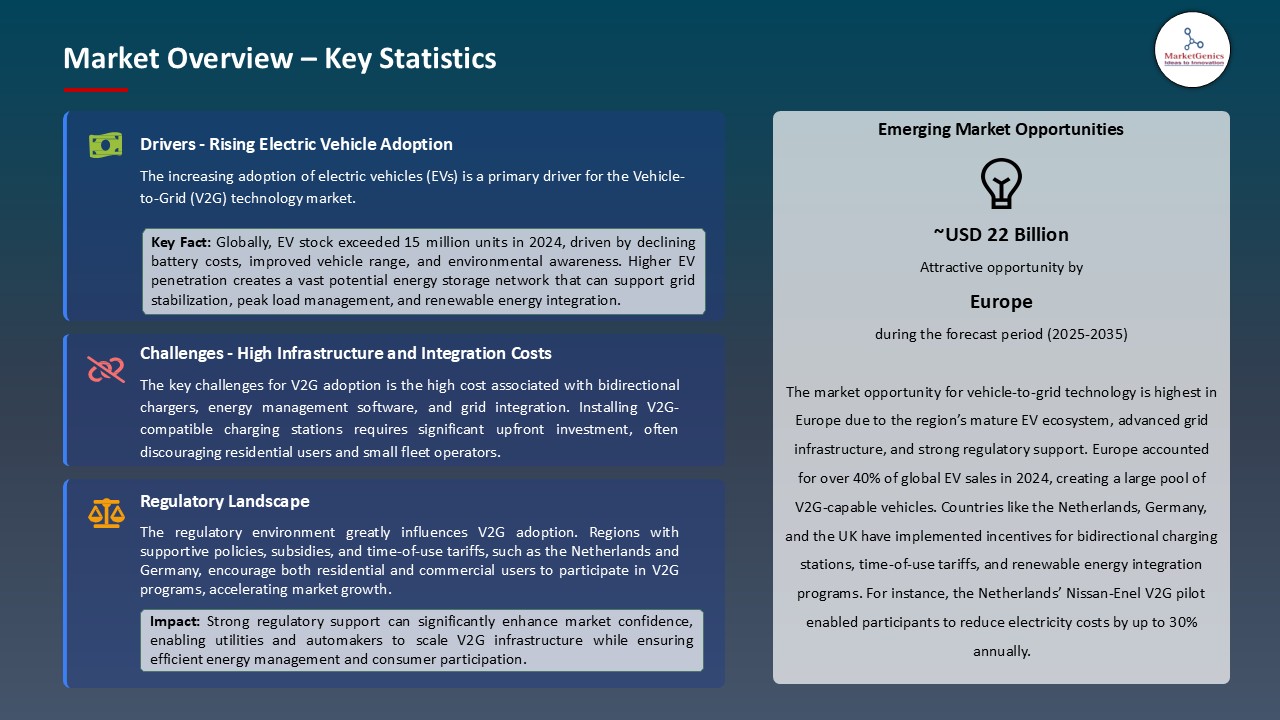

The global vehicle-to-grid technology market is projected to grow from USD 3.1 Billion in 2025 to USD 59.1 Billion in 2035, with a strong CAGR of 34.2% during the forecasted period. Europe leads the vehicle-to-grid technology market with market share of 39.2% with USD 1.2 billion revenue.

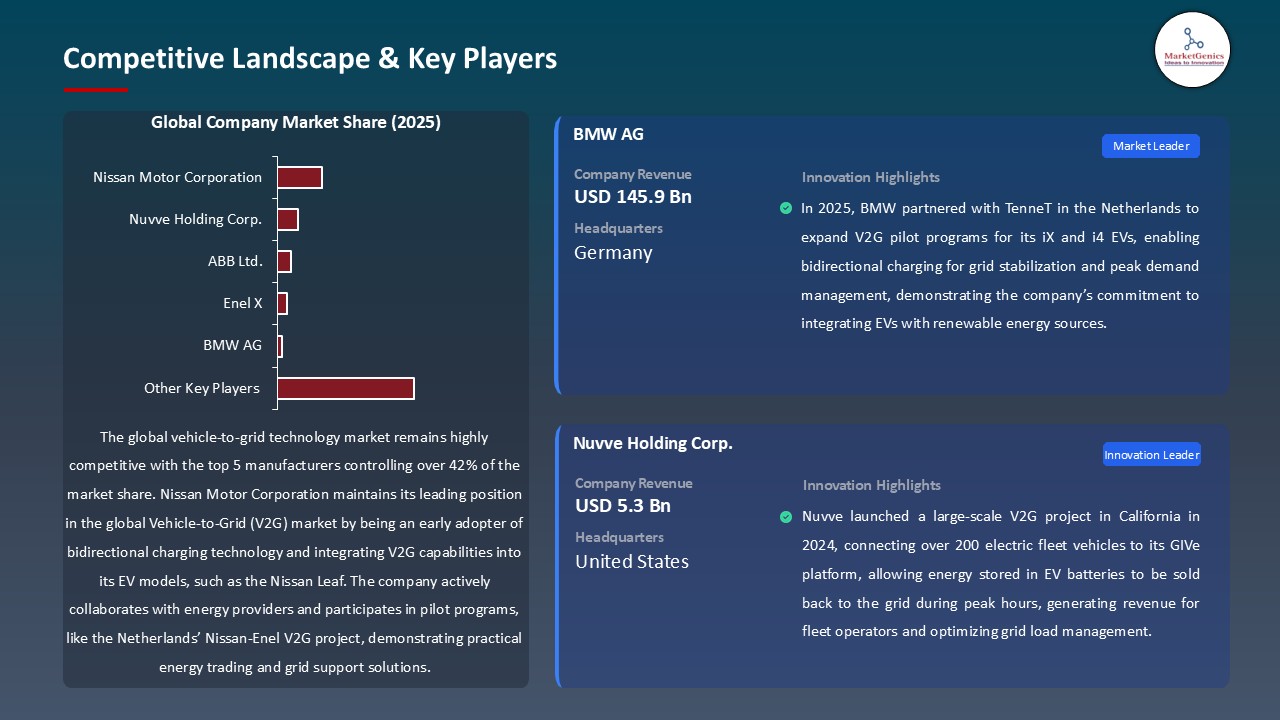

In August 2025, Nuvve Holding Corp., led by Gregory Poilasne (Chairman and CEO), launched its next-generation GIVe 3.0 vehicle-to-grid aggregation platform in collaboration with EDF Energy to enhance grid stability in Europe. This system enables bi-directional charging for EV fleets, integrating renewable energy sources and supporting large-scale smart grid operations.

The increasing popularity of electric vehicles and the rising interest in decarbonizing the grid are the key factors that drive the development of the global vehicle-to-grid technology market. An example is in June 2025, Nissan Motor Corporation increased its V2G pilot projects in Japan with Leaf e+, two-way energy flows were made to balance the grid.

Besides, in March 2025, Siemens AG unveiled its V2G-enabled VersiCharge system that can be used to integrate EV fleets into smart grids and maximize the value of renewable energy. The increasing EV penetration and renewable integration are driving the use of the V2G infrastructure on a large scale worldwide.

Major opportunities to global vehicle-to-grid technology market are smart charging infrastructure, energy storage systems, and renewable power integration platforms. These industries are complementary to V2G because they help to manage energy efficiently, flexibilize the grid, and connect the EVs to the grid. All these neighboring markets will boost the uptake of V2G and its contribution to the sustainable energy ecosystems.

Vehicle-to-Grid Technology Market Dynamics and Trends

Driver: Grid Flexibility and Renewable Energy Integration

- The worldwide energy systems are being redefined by the increased use of renewable energy like the solar and wind energy sources, but these are also posing more intermittency problems. Vehicle-to-Grid (V2G) is a newly developed technology that has become a key facilitator of grid flexibility because it enables electric vehicles (EVs) to become distributed energy storage devices. EVs can also capture the excess electricity when the renewable generation surpasses the demand and releases it to the grid when the demand peaks, thereby increasing grid stability. Therefore, it is likely to propels the growth of global vehicle-to-grid technology market.

- As an example, in June 2025, a massive installation of bidirectional charging infrastructure by one of the European EV-sharing operators demonstrated how aggregated EVs could contribute to the grid instead of relying on fossil-fuel-filled peak plants. This strategy does not only facilitate a shift to cleaner energy sources, but operational expenses of utilities are lowered as well. The governments of countries including Europe and Japan are also working on encouraging V2G pilots to ensure that there is equilibrium between the renewable integration and the grid reliability.

- This force is accelerating the adoption of V2G everywhere by replacing EVs with important parts of smart grids, allowing to balance the energy flow effectively and promote the growth of renewables.

Restraint: Battery Degradation and Warranty Limitations

- The technology has advanced, the fear of increased battery degradation because of the high frequency of charge discharge is one of the greatest barriers to the vehicle-to-grid technology market. The threat posed by reduced battery life and high replacement is the deterrent of consumers and fleet operators to join the V2G programs. Manufacturers have also been reluctant to cover V2G use whenever it is under warranty, thus causing ambiguity and low consumer uptake.

- Some current pilot initiatives in marketplaces like Australia and South Korea have started to deal with these problems with narrowly scoped warranty measures, and with charge optimization algorithms aimed at reducing battery degradation. Also, novel battery chemistries such as solid-state and lithium iron phosphate (LFP) are under development in order to overcome degradation effects. Nevertheless, mass-scale confidence yet demands more standardized warranty and a clear communication between the utilities, end-user and OEMs.

- The issue of battery life is still a major limitation to scalability of markets, and the necessity to implement standard policies and battery management innovations to enable sustainable V2G involvement.

Opportunity: Fleet Electrification and Energy Aggregation Models

- The growing use of electric vehicle fleets by the logistics, mass transit, and ride-sharing operators is a significant chance of scaling V2G applications. Models that operate on a fleet-basis enable a large-scale aggregation of many EVs to act as large virtual power plants (VPP), which can provide grid-balancing services and make money by trading power. Further, it is anticipated to create a lucrative opportunity for vehicle-to-grid technology market across the globe.

- An example is the recent massive projects undertaken by European and Japanese electricity producers, which demonstrated the possibilities of hundreds of EVs being deployed to offer grid ancillaries, frequency control, and peak demand control. Government subsidies in the development of bidirectional charging systems and grid-interactive vehicles increase the financial viability of such systems. Moreover, AI-based platforms and data analytics are enhancing predictability and efficiency of fleet energy dispatching, developing lucrative business models both to the operators and the utilities.

- The increasing trend of fleet electrification also brings about an effective commercial ecosystem of V2G making EVs not passive assets but becoming energy units with a revenue source.

Key Trend: Standardization and Policy Support for Bidirectional Infrastructure

- The trend of the global movement towards the equality of technical and regulatory standards is a certain pattern that is introducing the vehicle-to-grid technology market. Manufacturers of chargers, grid operators, and automakers are working together more to come up with interoperable communication protocols and standardized charging systems, including CHAdeMO and ISO 15118. These are standards that guarantee that EVs and grid systems are compatible and this way, two-way transmission of energy takes place smoothly.

- In 2024, a number of major car manufacturers announced future models that will have an integrated V2G capability, which complies with modernization policies in the national grid. Europe, North America and East Asian governments are also launching incentives to V2G-capable EV Charging Station infrastructure and are utilizing these technologies as part of urban energy management strategies. This harmonization of products in regulation is also creating investor confidence and minimizing market fragmentations and increasing commercial roll out.

- The current process of standardization and favorable policies is enhancing the technological and regulatory base of the vehicle-to-grid technology market, facilitating interoperability and making the technology acceptable on a global scale.

Vehicle-to-Grid Technology Market Analysis and Segmental Data

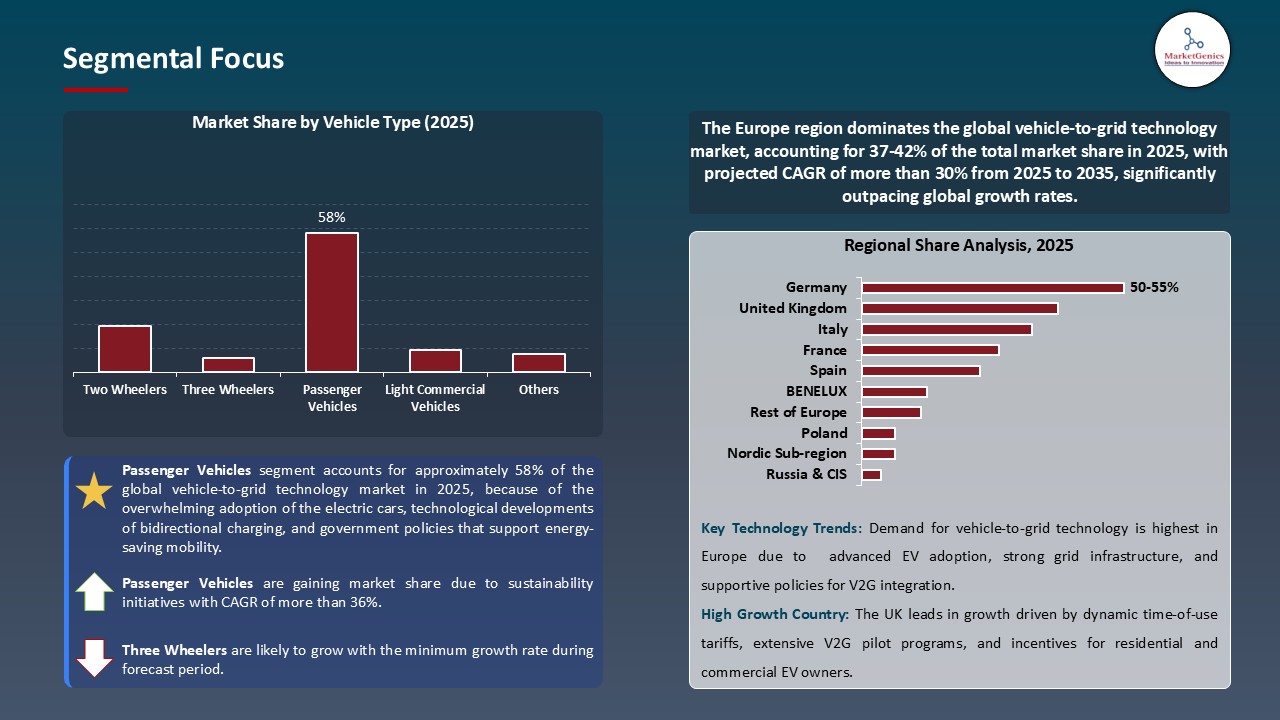

Based on Vehicle Type, the Passenger Vehicles Segment Retains the Largest Share

- The passenger vehicles segment holds major share ~58% in the global vehicle-to-grid technology market, because of the overwhelming adoption of the electric cars, technological developments of bidirectional charging, and government policies that support energy-saving mobility. The most common type of electric transport is passenger EVs, which have a very large potential in grid integration because they spend long periods of the day at rest- making the passenger EV the perfect distributed energy storage unit. Motor manufacturers are also in the process of integrating V2G to increase the energy efficiency and cost saving of users.

- For instance, Nissan increased its Leaf and Ariya V2G programs in Europe in July 2025 to serve the national grids and allow owners to sell excess power when the demand is high. On the same note, Hyundai and BYD have started to deploy bidirectional charging on new EV platforms to enhance grid engagement and increase the efficiency of vehicle utilization.

- The increased deployment of V2G in passenger EVs is turning vehicles into grid assets that can move dynamically and can be controlled in a decentralized way, mitigating the peak load pressure, and increasing the pace of the move to a resilient and carbon-neutral energy infrastructure globally.

Europe Dominates Global Vehicle-to-Grid Technology Market in 2025 and Beyond

- Europe holds the global vehicle-to-grid technology market because of good regulation around carbon neutrality, fast EV uptake, and wide-scale implementation of charging infrastructure. Large-scale implementation of bidirectional charging networks is facilitated by the goals of energy transition in the region, as well as incentives to balance the grid with renewable sources. Nations such as the U.K., Netherlands and Denmark are on the forefront of V2G pilots, with the help of utilities and automakers.

- For instance, in June 2025, Stellantis announced a massive V2G fleet pilot project in France with Fiat 500e models to offer grid stability and renewable load balancing services to cement the European focus on energy flexibility and decarbonization.

- The policy framework and well-developed EV ecosystem of Europe are driving the rapid adoption of V2G and established it as a global standard of grid-interactive mobility and energy transformation.

Vehicle-to-Grid Technology Market Ecosystem

The vehicle-to-grid technology market is moderately fragmented with a Tier-1 incumbents (global electrification and OEM companies like ABB, Siemens, Enel X, Nissan, Tesla) own strategic partnership and large contracts, Tier-2 players (ChargePoint, Wallbox, KEBA, Nuvve, Eaton) provide scalable chargers and aggregation platforms, and many Tier-3 specialists and integrators are interested in niche software, This hierarchical system promotes cooperation and maintains plurality of competitiveness.

Hardware & power electronics such as bidirectional charger, inverters and grid interconnection system that facilitates safe energy flow and Software and Services such as energy management systems, VPP/aggregations platform, market participation and O&M services that commercializes grid services.

For instance, in 2025 Wallbox launched an extension of a commercial V2G project with a large Spanish utility to test fleet and home bi-directional chargers, which shows the dynamics of co-investment and scale-up between OEMs and utilities.

Recent Development and Strategic Overview:

- In August 2025, ChargePoint collaborated with Eaton to implement a bidirectional 600 kW charging solution that has a high capacity of up to 600 kW of power. This is a large fleet infrastructure, commercial hub infrastructure, and public charging infrastructure. The modular DC platform offers V2G and V2X capabilities, allowing the energy stored in EV batteries to be returned into the grid during peak demand and offers rapid charging. This advancement points towards the continuing move towards co-location of high-capacity EV chargers and grid stabilization services where automakers, utilities, and commercial operators can make use of EV batteries as distributed energy sources.

- In September 2025, in its partnership with ChargeScape, Nissan launched a massive pilot project of V2G in Silicon Valley as part of California grid support programs. The vehicles chosen and fitted with bidirectional chargers were EVs (Nissan Leaf and Ariya models), and the energy that had been provided to the vehicles could be used to supplement the grid during the peak hours or during periods of emergencies. The pilot aims at trying to test dynamic energy trading, peak shaving, or offering ancillary grid services to prove the commercial and technical feasibility of passenger EVs as flexible grid assets.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 3.1 Bn |

|

Market Forecast Value in 2035 |

USD 59.1 Bn |

|

Growth Rate (CAGR) |

34.2% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Vehicle-to-Grid Technology Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Component |

|

|

By Technology Type |

|

|

By Battery Type |

|

|

By Power Rating |

|

|

By Charging Mode |

|

|

By Vehicle Type |

|

|

By Propulsion Type |

|

|

By Application |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Vehicle-to-Grid Technology Market Outlook

- 2.1.1. Vehicle-to-Grid Technology Market Size (Value - US$ Billion), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to-Market Strategy

- 2.5.1. Customer/ End Use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Vehicle-to-Grid Technology Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Automotive & Transportation Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Automotive & Transportation Industry

- 3.1.3. Regional Distribution for Automotive & Transportation

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.1. Global Automotive & Transportation Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising adoption of electric vehicles (EVs) globally.

- 4.1.1.2. Integration of renewable energy sources and need for grid stabilization.

- 4.1.1.3. Supportive government policies and incentives for V2G infrastructure.

- 4.1.2. Restraints

- 4.1.2.1. High cost of bidirectional chargers and V2G-compatible infrastructure.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis/ Ecosystem Analysis

- 4.4.1. Component Suppliers

- 4.4.2. Technology/ System Integrators

- 4.4.3. Vehicle-to-Grid Charging Modes

- 4.4.4. End-users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Porter’s Five Forces Analysis

- 4.7. PESTEL Analysis

- 4.8. Global Vehicle-to-Grid Technology Market Demand

- 4.8.1. Historical Market Size - in Value (Value - US$ Billion), 2021-2024

- 4.8.2. Current and Future Market Size - in Value (Value - US$ Billion), 2025–2035

- 4.8.2.1. Y-o-Y Growth Trends

- 4.8.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Vehicle-to-Grid Technology Market Analysis, by Component

- 6.1. Key Segment Analysis

- 6.2. Vehicle-to-Grid Technology Market Size (Value - US$ Billion), Analysis, and Forecasts, by Component, 2021-2035

- 6.2.1. Hardware

- 6.2.1.1. Bidirectional Chargers

- 6.2.1.2. Sensors and Controllers

- 6.2.1.3. Power Electronics

- 6.2.1.4. Others

- 6.2.2. Software

- 6.2.2.1. Energy Management Systems (EMS)

- 6.2.2.2. Communication Protocols

- 6.2.2.3. Analytics and Forecasting Tools

- 6.2.2.4. Others

- 6.2.3. Services

- 6.2.3.1. Installation & Commissioning

- 6.2.3.2. Maintenance & Support

- 6.2.3.3. Consulting & Integration Services

- 6.2.3.4. Others

- 6.2.1. Hardware

- 7. Global Vehicle-to-Grid Technology Market Analysis, by Technology Type

- 7.1. Key Segment Analysis

- 7.2. Vehicle-to-Grid Technology Market Size (Value - US$ Billion), Analysis, and Forecasts, by Technology Type, 2021-2035

- 7.2.1. Bidirectional Chargers

- 7.2.2. Unidirectional Chargers

- 7.2.3. Communication Systems

- 8. Global Vehicle-to-Grid Technology Market Analysis, by Battery Type

- 8.1. Key Segment Analysis

- 8.2. Vehicle-to-Grid Technology Market Size (Value - US$ Billion), Analysis, and Forecasts, by Battery Type, 2021-2035

- 8.2.1. Lithium-ion

- 8.2.2. Lead-acid

- 8.2.3. Solid-state

- 8.2.4. Others

- 9. Global Vehicle-to-Grid Technology Market Analysis, by Power Rating

- 9.1. Key Segment Analysis

- 9.2. Vehicle-to-Grid Technology Market Size (Value - US$ Billion), Analysis, and Forecasts, by Power Rating, 2021-2035

- 9.2.1. Below 10 kW

- 9.2.2. 10–50 kW

- 9.2.3. Above 50 kW

- 10. Global Vehicle-to-Grid Technology Market Analysis, by Charging Mode

- 10.1. Key Segment Analysis

- 10.2. Vehicle-to-Grid Technology Market Size (Value - US$ Billion), Analysis, and Forecasts, by Charging Mode, 2021-2035

- 10.2.1. AC Charging

- 10.2.2. DC Charging

- 11. Global Vehicle-to-Grid Technology Market Analysis, by Vehicle Type

- 11.1. Key Segment Analysis

- 11.2. Vehicle-to-Grid Technology Market Size (Value - US$ Billion), Analysis, and Forecasts, by Vehicle Type, 2021-2035

- 11.2.1. Two Wheelers

- 11.2.2. Three Wheelers

- 11.2.3. Passenger Vehicles

- 11.2.3.1. Hatchback

- 11.2.3.2. Sedan

- 11.2.3.3. SUVs

- 11.2.4. Light Commercial Vehicles

- 11.2.5. Heavy Duty Trucks

- 11.2.6. Buses & Coaches

- 11.2.7. Off-road Vehicles

- 12. Global Vehicle-to-Grid Technology Market Analysis and Forecasts, by Propulsion Type

- 12.1. Key Findings

- 12.2. Vehicle-to-Grid Technology Market Size (Value - US$ Billion), Analysis, and Forecasts, by Propulsion Type, 2021-2035

- 12.2.1. Battery Electric Vehicles

- 12.2.2. Hybrid/ Plug-in Hybrid Electric Vehicles

- 12.2.3. Fuel Cell Electric Vehicles

- 13. Global Vehicle-to-Grid Technology Market Analysis and Forecasts, by Application

- 13.1. Key Findings

- 13.2. Vehicle-to-Grid Technology Market Size (Value - US$ Billion), Analysis, and Forecasts, by Application, 2021-2035

- 13.2.1. Residential

- 13.2.2. Commercial

- 13.2.3. Industrial

- 13.2.4. Utility/Grid Services

- 14. Global Vehicle-to-Grid Technology Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Vehicle-to-Grid Technology Market Size (Value - US$ Billion), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Vehicle-to-Grid Technology Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Vehicle-to-Grid Technology Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 15.3.1. Component

- 15.3.2. Technology Type

- 15.3.3. Battery Type

- 15.3.4. Power Rating

- 15.3.5. Charging Mode

- 15.3.6. Vehicle Type

- 15.3.7. Propulsion Type

- 15.3.8. Application

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Vehicle-to-Grid Technology Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Component

- 15.4.3. Technology Type

- 15.4.4. Battery Type

- 15.4.5. Power Rating

- 15.4.6. Charging Mode

- 15.4.7. Vehicle Type

- 15.4.8. Propulsion Type

- 15.4.9. Application

- 15.5. Canada Vehicle-to-Grid Technology Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Component

- 15.5.3. Technology Type

- 15.5.4. Battery Type

- 15.5.5. Power Rating

- 15.5.6. Charging Mode

- 15.5.7. Vehicle Type

- 15.5.8. Propulsion Type

- 15.5.9. Application

- 15.6. Mexico Vehicle-to-Grid Technology Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Component

- 15.6.3. Technology Type

- 15.6.4. Battery Type

- 15.6.5. Power Rating

- 15.6.6. Charging Mode

- 15.6.7. Vehicle Type

- 15.6.8. Propulsion Type

- 15.6.9. Application

- 16. Europe Vehicle-to-Grid Technology Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Vehicle-to-Grid Technology Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 16.3.1. Component

- 16.3.2. Technology Type

- 16.3.3. Battery Type

- 16.3.4. Power Rating

- 16.3.5. Charging Mode

- 16.3.6. Vehicle Type

- 16.3.7. Propulsion Type

- 16.3.8. Application

- 16.3.9. Country

- 16.3.9.1. Germany

- 16.3.9.2. United Kingdom

- 16.3.9.3. France

- 16.3.9.4. Italy

- 16.3.9.5. Spain

- 16.3.9.6. Netherlands

- 16.3.9.7. Nordic Countries

- 16.3.9.8. Poland

- 16.3.9.9. Russia & CIS

- 16.3.9.10. Rest of Europe

- 16.4. Germany Vehicle-to-Grid Technology Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Component

- 16.4.3. Technology Type

- 16.4.4. Battery Type

- 16.4.5. Power Rating

- 16.4.6. Charging Mode

- 16.4.7. Vehicle Type

- 16.4.8. Propulsion Type

- 16.4.9. Application

- 16.5. United Kingdom Vehicle-to-Grid Technology Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Component

- 16.5.3. Technology Type

- 16.5.4. Battery Type

- 16.5.5. Power Rating

- 16.5.6. Charging Mode

- 16.5.7. Vehicle Type

- 16.5.8. Propulsion Type

- 16.5.9. Application

- 16.6. France Vehicle-to-Grid Technology Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Component

- 16.6.3. Technology Type

- 16.6.4. Battery Type

- 16.6.5. Power Rating

- 16.6.6. Charging Mode

- 16.6.7. Vehicle Type

- 16.6.8. Propulsion Type

- 16.6.9. Application

- 16.7. Italy Vehicle-to-Grid Technology Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Component

- 16.7.3. Technology Type

- 16.7.4. Battery Type

- 16.7.5. Power Rating

- 16.7.6. Charging Mode

- 16.7.7. Vehicle Type

- 16.7.8. Propulsion Type

- 16.7.9. Application

- 16.8. Spain Vehicle-to-Grid Technology Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Component

- 16.8.3. Technology Type

- 16.8.4. Battery Type

- 16.8.5. Power Rating

- 16.8.6. Charging Mode

- 16.8.7. Vehicle Type

- 16.8.8. Propulsion Type

- 16.8.9. Application

- 16.9. Netherlands Vehicle-to-Grid Technology Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Component

- 16.9.3. Technology Type

- 16.9.4. Battery Type

- 16.9.5. Power Rating

- 16.9.6. Charging Mode

- 16.9.7. Vehicle Type

- 16.9.8. Propulsion Type

- 16.9.9. Application

- 16.10. Nordic Countries Vehicle-to-Grid Technology Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Component

- 16.10.3. Technology Type

- 16.10.4. Battery Type

- 16.10.5. Power Rating

- 16.10.6. Charging Mode

- 16.10.7. Vehicle Type

- 16.10.8. Propulsion Type

- 16.10.9. Application

- 16.11. Poland Vehicle-to-Grid Technology Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Component

- 16.11.3. Technology Type

- 16.11.4. Battery Type

- 16.11.5. Power Rating

- 16.11.6. Charging Mode

- 16.11.7. Vehicle Type

- 16.11.8. Propulsion Type

- 16.11.9. Application

- 16.12. Russia & CIS Vehicle-to-Grid Technology Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Component

- 16.12.3. Technology Type

- 16.12.4. Battery Type

- 16.12.5. Power Rating

- 16.12.6. Charging Mode

- 16.12.7. Vehicle Type

- 16.12.8. Propulsion Type

- 16.12.9. Application

- 16.13. Rest of Europe Vehicle-to-Grid Technology Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Component

- 16.13.3. Technology Type

- 16.13.4. Battery Type

- 16.13.5. Power Rating

- 16.13.6. Charging Mode

- 16.13.7. Vehicle Type

- 16.13.8. Propulsion Type

- 16.13.9. Application

- 17. Asia Pacific Vehicle-to-Grid Technology Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. East Asia Vehicle-to-Grid Technology Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 17.3.1. Component

- 17.3.2. Technology Type

- 17.3.3. Battery Type

- 17.3.4. Power Rating

- 17.3.5. Charging Mode

- 17.3.6. Vehicle Type

- 17.3.7. Propulsion Type

- 17.3.8. Application

- 17.3.9. Country

- 17.3.9.1. China

- 17.3.9.2. India

- 17.3.9.3. Japan

- 17.3.9.4. South Korea

- 17.3.9.5. Australia and New Zealand

- 17.3.9.6. Indonesia

- 17.3.9.7. Malaysia

- 17.3.9.8. Thailand

- 17.3.9.9. Vietnam

- 17.3.9.10. Rest of Asia Pacific

- 17.4. China Vehicle-to-Grid Technology Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Component

- 17.4.3. Technology Type

- 17.4.4. Battery Type

- 17.4.5. Power Rating

- 17.4.6. Charging Mode

- 17.4.7. Vehicle Type

- 17.4.8. Propulsion Type

- 17.4.9. Application

- 17.5. India Vehicle-to-Grid Technology Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Component

- 17.5.3. Technology Type

- 17.5.4. Battery Type

- 17.5.5. Power Rating

- 17.5.6. Charging Mode

- 17.5.7. Vehicle Type

- 17.5.8. Propulsion Type

- 17.5.9. Application

- 17.6. Japan Vehicle-to-Grid Technology Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Component

- 17.6.3. Technology Type

- 17.6.4. Battery Type

- 17.6.5. Power Rating

- 17.6.6. Charging Mode

- 17.6.7. Vehicle Type

- 17.6.8. Propulsion Type

- 17.6.9. Application

- 17.7. South Korea Vehicle-to-Grid Technology Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Component

- 17.7.3. Technology Type

- 17.7.4. Battery Type

- 17.7.5. Power Rating

- 17.7.6. Charging Mode

- 17.7.7. Vehicle Type

- 17.7.8. Propulsion Type

- 17.7.9. Application

- 17.8. Australia and New Zealand Vehicle-to-Grid Technology Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Component

- 17.8.3. Technology Type

- 17.8.4. Battery Type

- 17.8.5. Power Rating

- 17.8.6. Charging Mode

- 17.8.7. Vehicle Type

- 17.8.8. Propulsion Type

- 17.8.9. Application

- 17.9. Indonesia Vehicle-to-Grid Technology Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Component

- 17.9.3. Technology Type

- 17.9.4. Battery Type

- 17.9.5. Power Rating

- 17.9.6. Charging Mode

- 17.9.7. Vehicle Type

- 17.9.8. Propulsion Type

- 17.9.9. Application

- 17.10. Malaysia Vehicle-to-Grid Technology Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Component

- 17.10.3. Technology Type

- 17.10.4. Battery Type

- 17.10.5. Power Rating

- 17.10.6. Charging Mode

- 17.10.7. Vehicle Type

- 17.10.8. Propulsion Type

- 17.10.9. Application

- 17.11. Thailand Vehicle-to-Grid Technology Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Component

- 17.11.3. Technology Type

- 17.11.4. Battery Type

- 17.11.5. Power Rating

- 17.11.6. Charging Mode

- 17.11.7. Vehicle Type

- 17.11.8. Propulsion Type

- 17.11.9. Application

- 17.12. Vietnam Vehicle-to-Grid Technology Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Component

- 17.12.3. Technology Type

- 17.12.4. Battery Type

- 17.12.5. Power Rating

- 17.12.6. Charging Mode

- 17.12.7. Vehicle Type

- 17.12.8. Propulsion Type

- 17.12.9. Application

- 17.13. Rest of Asia Pacific Vehicle-to-Grid Technology Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Component

- 17.13.3. Technology Type

- 17.13.4. Battery Type

- 17.13.5. Power Rating

- 17.13.6. Charging Mode

- 17.13.7. Vehicle Type

- 17.13.8. Propulsion Type

- 17.13.9. Application

- 18. Middle East Vehicle-to-Grid Technology Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Vehicle-to-Grid Technology Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 18.3.1. Component

- 18.3.2. Technology Type

- 18.3.3. Battery Type

- 18.3.4. Power Rating

- 18.3.5. Charging Mode

- 18.3.6. Vehicle Type

- 18.3.7. Propulsion Type

- 18.3.8. Application

- 18.3.9. Country

- 18.3.9.1. Turkey

- 18.3.9.2. UAE

- 18.3.9.3. Saudi Arabia

- 18.3.9.4. Israel

- 18.3.9.5. Rest of Middle East

- 18.4. Turkey Vehicle-to-Grid Technology Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Component

- 18.4.3. Technology Type

- 18.4.4. Battery Type

- 18.4.5. Power Rating

- 18.4.6. Charging Mode

- 18.4.7. Vehicle Type

- 18.4.8. Propulsion Type

- 18.4.9. Application

- 18.5. UAE Vehicle-to-Grid Technology Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Component

- 18.5.3. Technology Type

- 18.5.4. Battery Type

- 18.5.5. Power Rating

- 18.5.6. Charging Mode

- 18.5.7. Vehicle Type

- 18.5.8. Propulsion Type

- 18.5.9. Application

- 18.6. Saudi Arabia Vehicle-to-Grid Technology Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Component

- 18.6.3. Technology Type

- 18.6.4. Battery Type

- 18.6.5. Power Rating

- 18.6.6. Charging Mode

- 18.6.7. Vehicle Type

- 18.6.8. Propulsion Type

- 18.6.9. Application

- 18.7. Israel Vehicle-to-Grid Technology Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Component

- 18.7.3. Technology Type

- 18.7.4. Battery Type

- 18.7.5. Power Rating

- 18.7.6. Charging Mode

- 18.7.7. Vehicle Type

- 18.7.8. Propulsion Type

- 18.7.9. Application

- 18.8. Rest of Middle East Vehicle-to-Grid Technology Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Component

- 18.8.3. Technology Type

- 18.8.4. Battery Type

- 18.8.5. Power Rating

- 18.8.6. Charging Mode

- 18.8.7. Vehicle Type

- 18.8.8. Propulsion Type

- 18.8.9. Application

- 19. Africa Vehicle-to-Grid Technology Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Vehicle-to-Grid Technology Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 19.3.1. Component

- 19.3.2. Technology Type

- 19.3.3. Battery Type

- 19.3.4. Power Rating

- 19.3.5. Charging Mode

- 19.3.6. Vehicle Type

- 19.3.7. Propulsion Type

- 19.3.8. Application

- 19.3.9. Country

- 19.3.9.1. South Africa

- 19.3.9.2. Egypt

- 19.3.9.3. Nigeria

- 19.3.9.4. Algeria

- 19.3.9.5. Rest of Africa

- 19.4. South Africa Vehicle-to-Grid Technology Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Component

- 19.4.3. Technology Type

- 19.4.4. Battery Type

- 19.4.5. Power Rating

- 19.4.6. Charging Mode

- 19.4.7. Vehicle Type

- 19.4.8. Propulsion Type

- 19.4.9. Application

- 19.5. Egypt Vehicle-to-Grid Technology Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Component

- 19.5.3. Technology Type

- 19.5.4. Battery Type

- 19.5.5. Power Rating

- 19.5.6. Charging Mode

- 19.5.7. Vehicle Type

- 19.5.8. Propulsion Type

- 19.5.9. Application

- 19.6. Nigeria Vehicle-to-Grid Technology Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Component

- 19.6.3. Technology Type

- 19.6.4. Battery Type

- 19.6.5. Power Rating

- 19.6.6. Charging Mode

- 19.6.7. Vehicle Type

- 19.6.8. Propulsion Type

- 19.6.9. Application

- 19.7. Algeria Vehicle-to-Grid Technology Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Component

- 19.7.3. Technology Type

- 19.7.4. Battery Type

- 19.7.5. Power Rating

- 19.7.6. Charging Mode

- 19.7.7. Vehicle Type

- 19.7.8. Propulsion Type

- 19.7.9. Application

- 19.8. Rest of Africa Vehicle-to-Grid Technology Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Component

- 19.8.3. Technology Type

- 19.8.4. Battery Type

- 19.8.5. Power Rating

- 19.8.6. Charging Mode

- 19.8.7. Vehicle Type

- 19.8.8. Propulsion Type

- 19.8.9. Application

- 20. South America Vehicle-to-Grid Technology Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Central and South Africa Vehicle-to-Grid Technology Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 20.3.1. Component

- 20.3.2. Technology Type

- 20.3.3. Battery Type

- 20.3.4. Power Rating

- 20.3.5. Charging Mode

- 20.3.6. Vehicle Type

- 20.3.7. Propulsion Type

- 20.3.8. Application

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Vehicle-to-Grid Technology Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Component

- 20.4.3. Technology Type

- 20.4.4. Battery Type

- 20.4.5. Power Rating

- 20.4.6. Charging Mode

- 20.4.7. Vehicle Type

- 20.4.8. Propulsion Type

- 20.4.9. Application

- 20.5. Argentina Vehicle-to-Grid Technology Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Component

- 20.5.3. Technology Type

- 20.5.4. Battery Type

- 20.5.5. Power Rating

- 20.5.6. Charging Mode

- 20.5.7. Vehicle Type

- 20.5.8. Propulsion Type

- 20.5.9. Application

- 20.6. Rest of South America Vehicle-to-Grid Technology Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Component

- 20.6.3. Technology Type

- 20.6.4. Battery Type

- 20.6.5. Power Rating

- 20.6.6. Charging Mode

- 20.6.7. Vehicle Type

- 20.6.8. Propulsion Type

- 20.6.9. Application

- 21. Key Players/ Company Profile

- 21.1. ABB Ltd.

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. BMW AG

- 21.3. ChargePoint, Inc.

- 21.4. Daimler AG

- 21.5. Eaton Corporation plc

- 21.6. Enel X

- 21.7. Ford Motor Company

- 21.8. General Motors Company (GM)

- 21.9. Hitachi, Ltd.

- 21.10. Honda Motor Co., Ltd.

- 21.11. Hyundai Motor Company

- 21.12. KEBA AG

- 21.13. Kia Corporation

- 21.14. Mitsubishi Motors Corporation

- 21.15. Nissan Motor Corporation

- 21.16. Nuvve Holding Corp.

- 21.17. Schneider Electric SE

- 21.18. Siemens AG

- 21.19. Tesla, Inc.

- 21.20. Wallbox NV

- 21.21. Other Key Players

- 21.1. ABB Ltd.

Note* - This is just tentative list of players. While providing the report, we will cover a greater number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation