Aerospace Fasteners Market Size, Share & Trends Analysis Report by Product Type (Rivets, Nuts & Bolts, Screws, Washers, Pins, Bolts, Collars, Specialty Fasteners), Material Type, Aircraft Type, Coating/Finishing, Application, End User, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

Market Structure & Evolution |

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Aerospace Fasteners Market Size, Share, and Growth

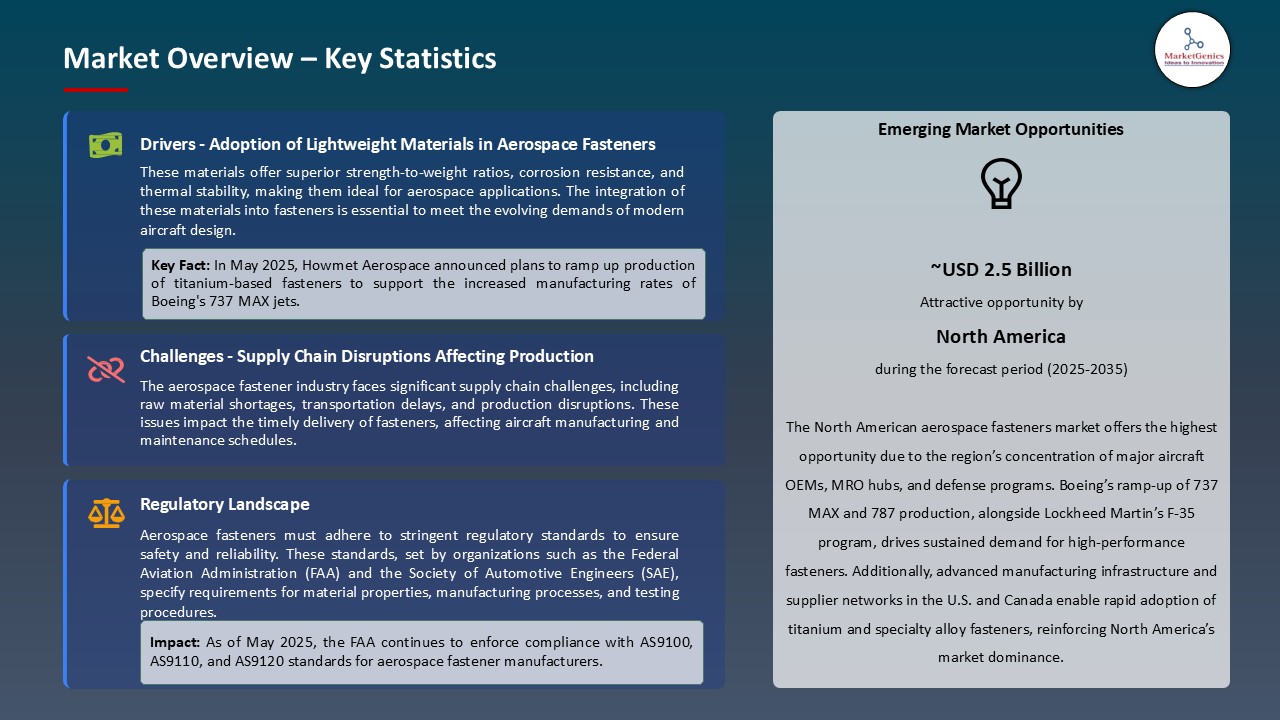

The global aerospace fasteners market is experiencing robust growth, with its estimated value of USD 7.4 billion in the year 2025 and USD 14.1 billion by the period 2035, registering a CAGR of 6.6%. North America leads the market with market share of 37.1% with USD 2.8 billion revenue.

On May 5, 2025, Ed Hilborne, Global Marketing and Product Manager of Aerospace Fasteners, highlighted that aerospace order backlogs—around 15,800 aircraft at the end of 2024—have driven strong demand for advanced coatings that enhance durability and fuel efficiency, such as lightweight basecoat/clearcoat systems reducing maintenance frequency and operational weight

Growth in the number of commercial and defense aircraft, the trend towards modernization in fleet, and highly demanding fastening solutions that are lightweight and high strength occupy the leading position in the market globally in the field of aerospace fasteners. Fasteners are an essential part of OEM and MRO operations in guaranteeing the safety of the aircraft and structural integrity as well as fuel efficiency. In May 2025, Howmet Aerospace signed a multiannual extension of the contract with Airbus to deliver titanium fasteners that offer a lower overall weight of the aircraft but capable of withstanding harsh operating environments.

Equally, Boeing is experiencing accelerated deliveries of 737 MAX in the first quarter of 2025 which creates increased demand of precision-engineered fasteners to aid increased production plans. Moreover, the development of materials like superalloys and corrosion-resistant coatings are increasing product reliability in line with sustainability efforts. The market is poised for robust expansion, tightly linked to global aircraft production and modernization programs.

Adjacent opportunities to the aerospace fasteners market are the growth in thin and lightweight composite materials, additive manufacturing of high-precision components, advancing surface treatment and coating technologies, and aircraft cabin modernization as well as the electric/hybrid aircraft segments, which require specialized fastening solutions. This exploitation of neighboring markets will broaden sources of revenue and make aerospace fasteners more competitive.

Aerospace Fasteners Market Dynamics and Trends

Driver: Rising Aircraft Production Backlogs and OEM Contracts Fueling Fastener Demand

- The substantial aircraft backlog and the resulting OEM production boom are driving the aerospace fasteners market particularly hard. With delivery rates of aircrafts witnessing a quickened pace to accommodate an increased demand in air travel, the need of fasteners with high performance speeds heightens. Boeing has confirmed that it is adding significant volumes to the production of the 737 MAX and 787 Dreamliner models in July 2025, which has directly improved the orders that the fastener suppliers signed in long-term contracts.

- Companies including Lisi Aerospace have diversified on their sophisticated fastening solutions to cater to the OEM requirements of lightweight alloy and titanium tough fasteners that maintain structural integrity without hampering with the fuel economy. These supply chain expansions, however, have not only brought out the vitality of fasteners in the airframe assembly, but reinforce their significance in maintaining safety and reliability standards.

- The increasing backlog and growing OEM commitments is expected to boost long-term growth momentum for aerospace fasteners manufacturers.

Restraint: Raw Material Volatility and Supply Chain Disruptions Affecting Fastener Production

- Raw material price fluctuations and uncertainties in the supply chain are some of the major barriers to growth of the aerospace fasteners market. The key materials used in manufacturing aerospace fasteners, titanium, superalloys and high-grade aluminum are susceptible to price dynamics and geopolitical shocks. In early 2025, Howmet Aerospace complained about the unstable situation in titanium supplies worldwide, necessary to change the sources of supply and reorganize the prices of production.

- These interruptions can have severe effects on the delivery schedule, forcing OEMs to incur delays in assembly schedules and cause more strain to the fastener manufacturers. Substitution is also limited because the industry strongly depends on specialized alloys; therefore, the industry is very vulnerable to costs fluctuations. Although key players have embraced strategic stockpiling and supplier-diversification elements, the continued volatility of raw materials has continued to prohibit smooth scalability in the market.

- The volatility of raw material costs and the imposed constraints of availability can limit the manufacturing output and dilute profitability of manufacturers.

Opportunity: Expansion of Electric and Hybrid Aircraft Programs Driving Specialized Fastener Needs

- Electrification and hybridization of aviation provide a notable scope to promote the portfolios of the aerospace fastener producers. Such new generation aircrafts need special fastening items that allow lighter composite materials, high vibration resistance and thermal quality. In March 2025, using its ZEROe hydrogen initiative, Airbus collaborated with suppliers to validate next-generation lightweight fasteners that are suitable to work with cryogenic hydrogen fuel tanks and battery packs.

- This change has brought about more innovative fastening solutions, which can meet the new structural demands but raise the safety regulations. Companies specialising in R&D in this sector will be in a strong position to be able to enter into long-term contracts with the OEMs at the forefront of the green aviation trend. The consistency with sustainability objectives and aircraft electrification create new revenue streams besides traditional commercial and defence activities.

Key Trend: Rising Adoption of Additive Manufacturing for Customized Aerospace Fastener Production

- The use of additive manufacturing (AM) to promote flexibility and customization of production is a definitive trend that has been witnessed in the aerospace fasteners market. The technology has enabled on-demand, 3D manufactured complex, lightweight fasteners customized to individual aircraft components, shortening lead times and material waste. In May 2025, Spirit AeroSystems have announced development of the implementation of AM in production of specific aerospace hardware, including fastening components involved in structural assembly of new generation aircraft.

- This forced integration of 3D printing in the production of fasteners both solves supply chain snags besides allowing manufacturers to exceed high performance requirements at the same time make the entire process more cost effective. As OEMs require more rapid turnaround and flexibility, AM-based, fastener manufacturing is gaining traction as an industry disrupter. This trend is representative of the larger transition towards digital manufacturing and state of the art engineering solutions within aerospace supply chains.

Aerospace Fasteners Market Analysis and Segmental Data

Rivets: The Backbone of Aerospace Fastening Solutions

- The rivet segment holds the highest demand in aerospace fasteners due to its unmatched strength, reliability, and cost-effectiveness in securing aircraft structural components. Boeing increased the manufacturing of its 737 MAX in June 2025, and given the demand and quick deliveries, millions of precision rivets were needed to sustain fuselage integrity.

- The advantages of rivets over the alternatives are that they guarantee vibration resistance, durability, and ease of assembly particularly in high production airframe assembly. In April 2025, Airbus also verified the prevalent application of new advanced lightweight titanium rivets in its A321XLR program to drive fuel efficiency without compromising structural integrity.

- The rivet segment will continue to dominate especially when it comes to safety-critical fasteners where aircraft OEMs want to have proven fasteners.

North America: The Core Hub of Aerospace Fasteners Demand

- North America accounts for the highest demand in the aerospace fasteners market due to its concentration of major OEMs, robust defense programs, and advanced MRO facilities. In May 2025, Lockheed Martin expanded its F-35 production line in Texas, significantly increasing fastener procurement to meet U.S. defense contract requirements.

- There is also a high aftermarket demand with airlines such as American Airlines opening up massive fleet maintenance programs early in 2025 that necessitated millions of new fasteners. This combined with high MRO activities and excellent OEM output makes North America the epicenter of aerospace fastener consumption.

- North America will continue to dominate with constant investments on defence and commercial fleet maintenance missions.

Aerospace Fasteners Market Ecosystem

The global aerospace fasteners market exhibits a moderately consolidated structure, with Tier 1 players such as Howmet Aerospace, Precision Castparts Corp., and LISI Group dominating through technological innovation and large-scale supply contracts with OEMs like Boeing and Airbus. Tier 2 companies, including Cherry Aerospace and TriMas Corporation, focus on specialized fastening solutions, while Tier 3 players such as 3V Fasteners and TPS Aviation Inc. cater to niche or regional demands. Buyer concentration is high, as major aircraft manufacturers exert strong bargaining power, while supplier concentration is moderate, with a few large producers controlling key aerospace-grade raw materials.

Recent Development and Strategic Overview:

- In August, 2025, Swedish bearings maker SKF announced the sale of its non-core aerospace operation in Elgin, U.S., to Carco PRP Group for an estimated $70 million. This strategic divestment allows SKF to concentrate on its core aerospace sectors, aligning with its long-term business objectives.

- In January 2025, Bossard Group acquired the German Ferdinand Gross Group, a leading distributor of fastening technology. This acquisition enhances Bossard's presence in the important German market and expands its operations to Hungary and Poland, strengthening its position in the European aerospace fasteners market.

Report Scope

|

Attribute |

Detail |

|

Market Size in 2025 |

USD 7.4 Bn |

|

Market Forecast Value in 2035 |

USD 14.1 Bn |

|

Growth Rate (CAGR) |

6.6% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Million Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

Regions and Countries Covered |

|||||

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Aerospace Fasteners Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Product Type |

|

|

By Material Type |

|

|

By Aircraft Type |

|

|

By Coating/Finishing |

|

|

By Application |

|

|

By End User |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Aerospace Fasteners Market Outlook

- 2.1.1. Aerospace Fasteners Market Size (Volume – Million Units and Value – US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Aerospace Fasteners Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Aerospace & Defense Industry Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Aerospace & Defense Industry

- 3.1.3. Regional Distribution for Aerospace & Defense Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Aerospace & Defense Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Increasing commercial and defense aircraft production driving fastener demand

- 4.1.1.2. Rising adoption of lightweight and composite-compatible fasteners for fuel efficiency

- 4.1.1.3. Expansion of global MRO (Maintenance, Repair, and Overhaul) networks creating replacement fastener requirements

- 4.1.2. Restraints

- 4.1.2.1. High precision manufacturing and raw material costs limiting smaller suppliers.

- 4.1.2.2. Stringent regulatory compliance (FAA, EASA) increasing certification and production complexity

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Aerospace Fasteners Manufacturers

- 4.4.3. Distributors

- 4.4.4. End-users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Aerospace Fasteners Market Demand

- 4.9.1. Historical Market Size - in Volume (Million Units) and Value (US$ Bn), 2021-2024

- 4.9.2. Current and Future Market Size - in Volume (Million Units) and Value (US$ Bn), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Aerospace Fasteners Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Aerospace Fasteners Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Rivets

- 6.2.1.1. Solid Rivets

- 6.2.1.2. Blind Rivets

- 6.2.1.3. Semi-tubular Rivets

- 6.2.1.4. Drive Rivets

- 6.2.1.5. Others

- 6.2.2. Nuts & Bolts

- 6.2.2.1. Hex Bolts

- 6.2.2.2. Carriage Bolts

- 6.2.2.3. Socket Head Cap Screws

- 6.2.2.4. Wing Nuts

- 6.2.2.5. Hex Nuts

- 6.2.2.6. Lock Nuts

- 6.2.2.7. Others

- 6.2.3. Screws

- 6.2.3.1. Machine Screws

- 6.2.3.2. Self-tapping Screws

- 6.2.3.3. Wood Screws

- 6.2.3.4. Sheet Metal Screws

- 6.2.3.5. Others

- 6.2.4. Washers

- 6.2.4.1. Flat Washers

- 6.2.4.2. Lock Washers

- 6.2.4.3. Spring Washers

- 6.2.4.4. Fender Washers

- 6.2.4.5. Others

- 6.2.5. Pins

- 6.2.6. Bolts

- 6.2.7. Collars

- 6.2.8. Specialty Fasteners (Quick-release, Blind Fasteners, etc.)

- 6.2.1. Rivets

- 7. Global Aerospace Fasteners Market Analysis, by Material Type

- 7.1. Key Segment Analysis

- 7.2. Aerospace Fasteners Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Material Type, 2021-2035

- 7.2.1. Metal Materials

- 7.2.1.1. Aluminum

- 7.2.1.2. Titanium

- 7.2.1.3. Steel

- 7.2.1.4. Specialty Alloys

- 7.2.1.5. Others

- 7.2.2. Non-Metal Materials

- 7.2.2.1. Composites

- 7.2.2.2. Ceramics

- 7.2.2.3. Plastics/Polymers

- 7.2.2.4. Others

- 7.2.1. Metal Materials

- 8. Global Aerospace Fasteners Market Analysis, by Aircraft Type

- 8.1. Key Segment Analysis

- 8.2. Aerospace Fasteners Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Aircraft Type, 2021-2035

- 8.2.1. Commercial Aircraft

- 8.2.2. Military Aircraft

- 8.2.3. Business Jets

- 8.2.4. Helicopters

- 8.2.5. Spacecraft & Satellites

- 8.2.6. UAVs (Unmanned Aerial Vehicles)

- 8.2.7. Others

- 9. Global Aerospace Fasteners Market Analysis, by Coating/Finishing

- 9.1. Key Segment Analysis

- 9.2. Aerospace Fasteners Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Coating/Finishing, 2021-2035

- 9.2.1. Surface Treatments

- 9.2.1.1. Anodizing

- 9.2.1.2. Type II Anodizing

- 9.2.1.3. Type III Hard Anodizing

- 9.2.1.4. Others

- 9.2.2. Plating

- 9.2.2.1. Chromate Conversion Coating

- 9.2.2.2. Zinc Plating

- 9.2.2.3. Cadmium Plating

- 9.2.2.4. Silver Plating

- 9.2.2.5. Others

- 9.2.3. Passivation

- 9.2.4. Black Oxide

- 9.2.5. Phosphate Coating

- 9.2.6. Organic Coatings

- 9.2.7. Others

- 9.2.1. Surface Treatments

- 10. Global Aerospace Fasteners Market Analysis, by Application

- 10.1. Key Segment Analysis

- 10.2. Aerospace Fasteners Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Application, 2021-2035

- 10.2.1. Fuselage Assembly

- 10.2.2. Wing Assembly

- 10.2.3. Control Surfaces

- 10.2.4. Engine Attachments

- 10.2.5. Landing Gear Assembly

- 10.2.6. Interior Cabin Fixtures

- 10.2.7. Others

- 11. Global Aerospace Fasteners Market Analysis, by End User

- 11.1. Key Segment Analysis

- 11.2. Aerospace Fasteners Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by End User, 2021-2035

- 11.2.1. Commercial Aviation

- 11.2.2. Defense & Military Aviation

- 11.2.3. Space Exploration & Satellites

- 11.2.4. Private/Business Aviation

- 11.2.5. UAV/Drone Manufacturing

- 11.2.6. Others

- 12. Global Aerospace Fasteners Market Analysis and Forecasts, by Region

- 12.1. Key Findings

- 12.2. Aerospace Fasteners Market Size (Volume - Mn Units and Value - US$ Mn), Analysis, and Forecasts, by Region, 2021-2035

- 12.2.1. North America

- 12.2.2. Europe

- 12.2.3. Asia Pacific

- 12.2.4. Middle East

- 12.2.5. Africa

- 12.2.6. South America

- 13. North America Aerospace Fasteners Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. North America Aerospace Fasteners Market Size Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 13.3.1. Product Type

- 13.3.2. Material Type

- 13.3.3. Aircraft Type

- 13.3.4. Coating/Finishing

- 13.3.5. Application

- 13.3.6. End User

- 13.3.7. Country

- 13.3.7.1. USA

- 13.3.7.2. Canada

- 13.3.7.3. Mexico

- 13.4. USA Aerospace Fasteners Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Product Type

- 13.4.3. Material Type

- 13.4.4. Aircraft Type

- 13.4.5. Coating/Finishing

- 13.4.6. Application

- 13.4.7. End User

- 13.5. Canada Aerospace Fasteners Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Product Type

- 13.5.3. Material Type

- 13.5.4. Aircraft Type

- 13.5.5. Coating/Finishing

- 13.5.6. Application

- 13.5.7. End User

- 13.6. Mexico Aerospace Fasteners Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Product Type

- 13.6.3. Material Type

- 13.6.4. Aircraft Type

- 13.6.5. Coating/Finishing

- 13.6.6. Application

- 13.6.7. End User

- 14. Europe Aerospace Fasteners Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. Europe Aerospace Fasteners Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Product Type

- 14.3.2. Material Type

- 14.3.3. Aircraft Type

- 14.3.4. Coating/Finishing

- 14.3.5. Application

- 14.3.6. End User

- 14.3.7. Country

- 14.3.7.1. Germany

- 14.3.7.2. United Kingdom

- 14.3.7.3. France

- 14.3.7.4. Italy

- 14.3.7.5. Spain

- 14.3.7.6. Netherlands

- 14.3.7.7. Nordic Countries

- 14.3.7.8. Poland

- 14.3.7.9. Russia & CIS

- 14.3.7.10. Rest of Europe

- 14.4. Germany Aerospace Fasteners Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Product Type

- 14.4.3. Material Type

- 14.4.4. Aircraft Type

- 14.4.5. Coating/Finishing

- 14.4.6. Application

- 14.4.7. End User

- 14.5. United Kingdom Aerospace Fasteners Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Product Type

- 14.5.3. Material Type

- 14.5.4. Aircraft Type

- 14.5.5. Coating/Finishing

- 14.5.6. Application

- 14.5.7. End User

- 14.6. France Aerospace Fasteners Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Product Type

- 14.6.3. Material Type

- 14.6.4. Aircraft Type

- 14.6.5. Coating/Finishing

- 14.6.6. Application

- 14.6.7. End User

- 14.7. Italy Aerospace Fasteners Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Product Type

- 14.7.3. Material Type

- 14.7.4. Aircraft Type

- 14.7.5. Coating/Finishing

- 14.7.6. Application

- 14.7.7. End User

- 14.8. Spain Aerospace Fasteners Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Product Type

- 14.8.3. Material Type

- 14.8.4. Aircraft Type

- 14.8.5. Coating/Finishing

- 14.8.6. Application

- 14.8.7. End User

- 14.9. Netherlands Aerospace Fasteners Market

- 14.9.1. Country Segmental Analysis

- 14.9.2. Product Type

- 14.9.3. Material Type

- 14.9.4. Aircraft Type

- 14.9.5. Coating/Finishing

- 14.9.6. Application

- 14.9.7. End User

- 14.10. Nordic Countries Aerospace Fasteners Market

- 14.10.1. Country Segmental Analysis

- 14.10.2. Product Type

- 14.10.3. Material Type

- 14.10.4. Aircraft Type

- 14.10.5. Coating/Finishing

- 14.10.6. Application

- 14.10.7. End User

- 14.11. Poland Aerospace Fasteners Market

- 14.11.1. Country Segmental Analysis

- 14.11.2. Product Type

- 14.11.3. Material Type

- 14.11.4. Aircraft Type

- 14.11.5. Coating/Finishing

- 14.11.6. Application

- 14.11.7. End User

- 14.12. Russia & CIS Aerospace Fasteners Market

- 14.12.1. Country Segmental Analysis

- 14.12.2. Product Type

- 14.12.3. Material Type

- 14.12.4. Aircraft Type

- 14.12.5. Coating/Finishing

- 14.12.6. Application

- 14.12.7. End User

- 14.13. Rest of Europe Aerospace Fasteners Market

- 14.13.1. Country Segmental Analysis

- 14.13.2. Product Type

- 14.13.3. Material Type

- 14.13.4. Aircraft Type

- 14.13.5. Coating/Finishing

- 14.13.6. Application

- 14.13.7. End User

- 15. Asia Pacific Aerospace Fasteners Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. East Asia Aerospace Fasteners Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Material Type

- 15.3.3. Aircraft Type

- 15.3.4. Coating/Finishing

- 15.3.5. Application

- 15.3.6. End User

- 15.3.7. Country

- 15.3.7.1. China

- 15.3.7.2. India

- 15.3.7.3. Japan

- 15.3.7.4. South Korea

- 15.3.7.5. Australia and New Zealand

- 15.3.7.6. Indonesia

- 15.3.7.7. Malaysia

- 15.3.7.8. Thailand

- 15.3.7.9. Vietnam

- 15.3.7.10. Rest of Asia Pacific

- 15.4. China Aerospace Fasteners Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Material Type

- 15.4.4. Aircraft Type

- 15.4.5. Coating/Finishing

- 15.4.6. Application

- 15.4.7. End User

- 15.5. India Aerospace Fasteners Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Material Type

- 15.5.4. Aircraft Type

- 15.5.5. Coating/Finishing

- 15.5.6. Application

- 15.5.7. End User

- 15.6. Japan Aerospace Fasteners Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Material Type

- 15.6.4. Aircraft Type

- 15.6.5. Coating/Finishing

- 15.6.6. Application

- 15.6.7. End User

- 15.7. South Korea Aerospace Fasteners Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Product Type

- 15.7.3. Material Type

- 15.7.4. Aircraft Type

- 15.7.5. Coating/Finishing

- 15.7.6. Application

- 15.7.7. End User

- 15.8. Australia and New Zealand Aerospace Fasteners Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Product Type

- 15.8.3. Material Type

- 15.8.4. Aircraft Type

- 15.8.5. Coating/Finishing

- 15.8.6. Application

- 15.8.7. End User

- 15.9. Indonesia Aerospace Fasteners Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Product Type

- 15.9.3. Material Type

- 15.9.4. Aircraft Type

- 15.9.5. Coating/Finishing

- 15.9.6. Application

- 15.9.7. End User

- 15.10. Malaysia Aerospace Fasteners Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Product Type

- 15.10.3. Material Type

- 15.10.4. Aircraft Type

- 15.10.5. Coating/Finishing

- 15.10.6. Application

- 15.10.7. End User

- 15.11. Thailand Aerospace Fasteners Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Product Type

- 15.11.3. Material Type

- 15.11.4. Aircraft Type

- 15.11.5. Coating/Finishing

- 15.11.6. Application

- 15.11.7. End User

- 15.12. Vietnam Aerospace Fasteners Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Product Type

- 15.12.3. Material Type

- 15.12.4. Aircraft Type

- 15.12.5. Coating/Finishing

- 15.12.6. Application

- 15.12.7. End User

- 15.13. Rest of Asia Pacific Aerospace Fasteners Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Product Type

- 15.13.3. Material Type

- 15.13.4. Aircraft Type

- 15.13.5. Coating/Finishing

- 15.13.6. Application

- 15.13.7. End User

- 16. Middle East Aerospace Fasteners Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Middle East Aerospace Fasteners Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Material Type

- 16.3.3. Aircraft Type

- 16.3.4. Coating/Finishing

- 16.3.5. Application

- 16.3.6. End User

- 16.3.7. Country

- 16.3.7.1. Turkey

- 16.3.7.2. UAE

- 16.3.7.3. Saudi Arabia

- 16.3.7.4. Israel

- 16.3.7.5. Rest of Middle East

- 16.4. Turkey Aerospace Fasteners Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Material Type

- 16.4.4. Aircraft Type

- 16.4.5. Coating/Finishing

- 16.4.6. Application

- 16.4.7. End User

- 16.5. UAE Aerospace Fasteners Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Material Type

- 16.5.4. Aircraft Type

- 16.5.5. Coating/Finishing

- 16.5.6. Application

- 16.5.7. End User

- 16.6. Saudi Arabia Aerospace Fasteners Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Material Type

- 16.6.4. Aircraft Type

- 16.6.5. Coating/Finishing

- 16.6.6. Application

- 16.6.7. End User

- 16.7. Israel Aerospace Fasteners Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Material Type

- 16.7.4. Aircraft Type

- 16.7.5. Coating/Finishing

- 16.7.6. Application

- 16.7.7. End User

- 16.8. Rest of Middle East Aerospace Fasteners Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Material Type

- 16.8.4. Aircraft Type

- 16.8.5. Coating/Finishing

- 16.8.6. Application

- 16.8.7. End User

- 17. Africa Aerospace Fasteners Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Africa Aerospace Fasteners Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Material Type

- 17.3.3. Aircraft Type

- 17.3.4. Coating/Finishing

- 17.3.5. Application

- 17.3.6. End User

- 17.3.7. Country

- 17.3.7.1. South Africa

- 17.3.7.2. Egypt

- 17.3.7.3. Nigeria

- 17.3.7.4. Algeria

- 17.3.7.5. Rest of Africa

- 17.4. South Africa Aerospace Fasteners Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Material Type

- 17.4.4. Aircraft Type

- 17.4.5. Coating/Finishing

- 17.4.6. Application

- 17.4.7. End User

- 17.5. Egypt Aerospace Fasteners Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Material Type

- 17.5.4. Aircraft Type

- 17.5.5. Coating/Finishing

- 17.5.6. Application

- 17.5.7. End User

- 17.6. Nigeria Aerospace Fasteners Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Material Type

- 17.6.4. Aircraft Type

- 17.6.5. Coating/Finishing

- 17.6.6. Application

- 17.6.7. End User

- 17.7. Algeria Aerospace Fasteners Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Material Type

- 17.7.4. Aircraft Type

- 17.7.5. Coating/Finishing

- 17.7.6. Application

- 17.7.7. End User

- 17.8. Rest of Africa Aerospace Fasteners Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Material Type

- 17.8.4. Aircraft Type

- 17.8.5. Coating/Finishing

- 17.8.6. Application

- 17.8.7. End User

- 18. South America Aerospace Fasteners Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Central and South Africa Aerospace Fasteners Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Material Type

- 18.3.3. Aircraft Type

- 18.3.4. Coating/Finishing

- 18.3.5. Application

- 18.3.6. End User

- 18.3.7. Country

- 18.3.7.1. Brazil

- 18.3.7.2. Argentina

- 18.3.7.3. Rest of South America

- 18.4. Brazil Aerospace Fasteners Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Material Type

- 18.4.4. Aircraft Type

- 18.4.5. Coating/Finishing

- 18.4.6. Application

- 18.4.7. End User

- 18.5. Argentina Aerospace Fasteners Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Material Type

- 18.5.4. Aircraft Type

- 18.5.5. Coating/Finishing

- 18.5.6. Application

- 18.5.7. End User

- 18.6. Rest of South America Aerospace Fasteners Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Material Type

- 18.6.4. Aircraft Type

- 18.6.5. Coating/Finishing

- 18.6.6. Application

- 18.6.7. End User

- 19. Key Players/ Company Profile

- 19.1. 3V Fasteners Company Inc.

- 19.1.1. Company Details/ Overview

- 19.1.2. Company Financials

- 19.1.3. Key Customers and Competitors

- 19.1.4. Business/ Industry Portfolio

- 19.1.5. Product Portfolio/ Specification Details

- 19.1.6. Pricing Data

- 19.1.7. Strategic Overview

- 19.1.8. Recent Developments

- 19.2. Arconic Inc.

- 19.3. B&B Specialties Inc.

- 19.4. Bossard Group

- 19.5. Bufab Group

- 19.6. Cherry Aerospace (Howmet Aerospace)

- 19.7. Fastener Technology Corporation

- 19.8. FATIGUE TECHNOLOGY INC.

- 19.9. Ho-Ho-Kus Inc.

- 19.10. Howmet Aerospace Inc.

- 19.11. Huck International

- 19.12. LISI Group

- 19.13. McMaster-Carr

- 19.14. Monogram Aerospace Fasteners

- 19.15. MW Industries Inc.

- 19.16. National Aerospace Fasteners Corporation (NAFCO)

- 19.17. Precision Castparts Corp

- 19.18. SFS Group

- 19.19. Stanley Black & Decker Inc.

- 19.20. The Boeing Company

- 19.21. TPS Aviation Inc.

- 19.22. TriMas Corporation

- 19.23. Unbrako (SPS Technologies)

- 19.24. The Würth Group

- 19.25. Other Key Players

- 19.1. 3V Fasteners Company Inc.

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation