Aerospace Foam Market Size, Share, Growth Opportunity Analysis Report by Foam Type (Polyurethane Foam, Polyethylene Foam, Melamine Foam, Metal Foam, Polyimide Foam and Others (e.g., PVC, phenolic, silicone-based foams)), Material Type, Aircraft Type, Functionality, Application, End Use Industry, Distribution Channel and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Aerospace Foam Market Size, Share, and Growth

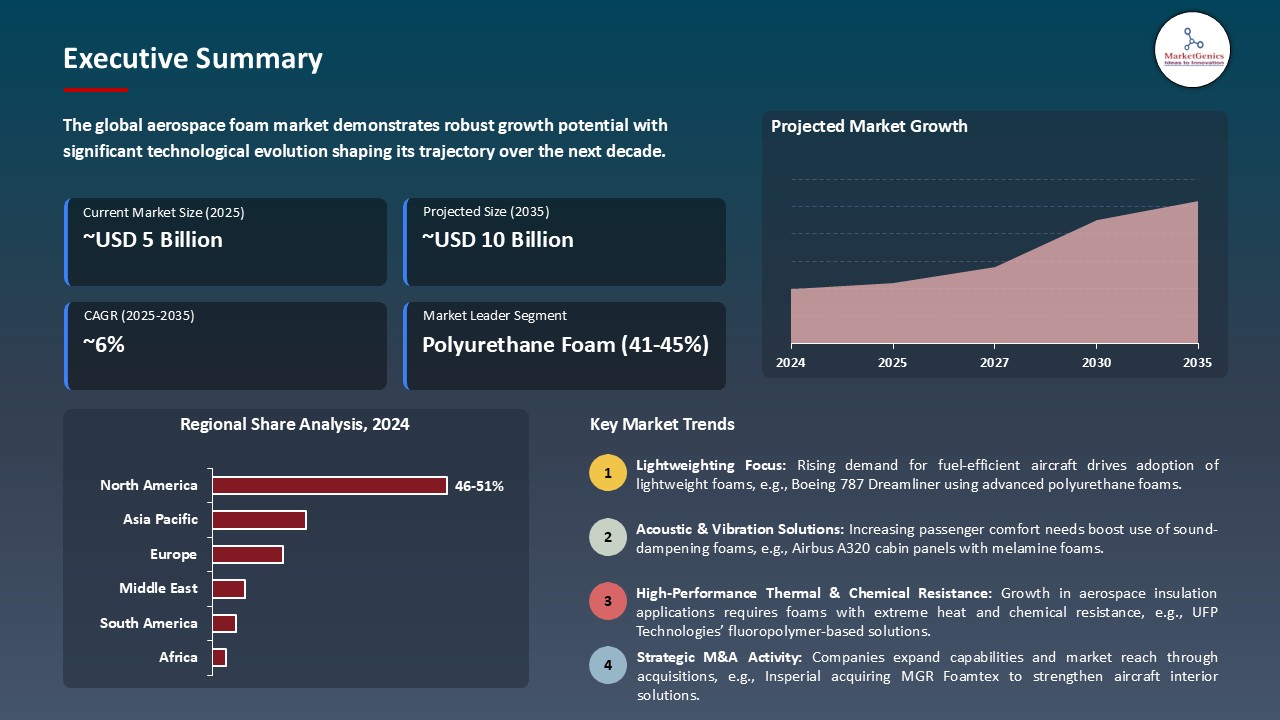

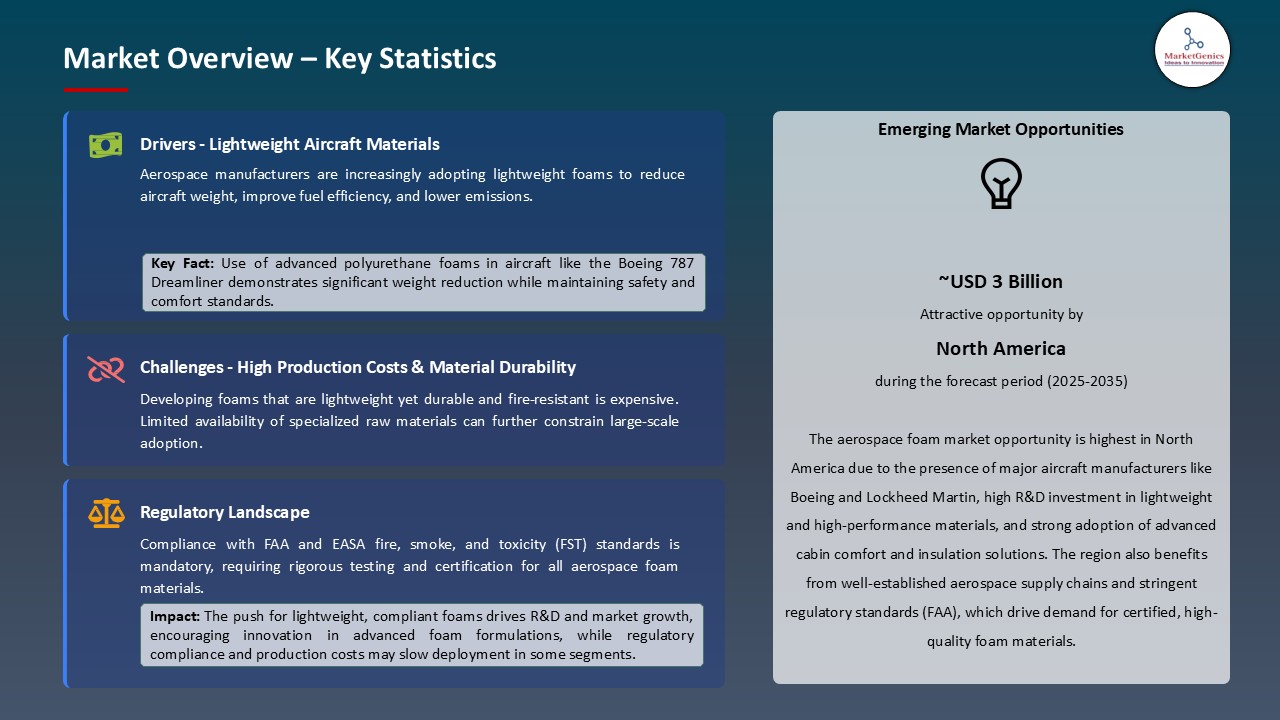

The growth of global aerospace foam market is likely to create a significant opportunity of USD 5.4 Billion during the forecasting period, 2025-2035. Some key factors driving the aerospace foam market are growing demand for lightweight and fuel-efficient aircraft and growing production of aircrafts amid the growing air-travel industry. Polyurethane and polyethylene aerospace foam Lys electrify the proposed reduction in aircraft weight for fuel-efficiency and performance operational.

"In March 2025, Rogers Corporation launched a new lightweight polyurethane foam tailored for electric aircraft thermal management systems, targeting improved insulation and fire resistance. This strategic product development aligns with the growing demand for sustainable aviation solutions. Colin Gouveia, President and CEO of Rogers Corporation, emphasized this move as part of their broader commitment to next-generation aerospace innovations. The launch enhances Rogers’ position in emerging electric aviation markets by addressing both safety and energy efficiency needs."

For example, Zotefoams plc arose in 2024 by expanding polyolefin foam capacity to support Airbus and Boeing in aircraft deliveries rallying from skyrocketing orders, showing OEMs' increased reliance on advanced lightweight foams. Increased production of aircraft and sustainability objectives are fast-tracking increased utilization of aerospace foams for commercial and defense aviation channels.

Raising electric aircraft, the growing demand for lightweight UAVs, and the happy growth of space tourism will act as key opportunities taking the entry of the aerospace foam market. Those industries need advanced insulation, vibration damping, and lightweight materials, hence providing new aerospace foam application opportunities beyond traditional commercial and military aircraft. With such diversification into adjacent sectors, the growth potential and application scope of the aerospace foam markets are certainly being spread out.

Aerospace Foam Market Dynamics and Trends

Driver: Growth in MRO (Maintenance, Repair, and Overhaul) Activities

-

Increasing demand for MRO services in the aviation industry is largely fueling the growth of the aerospace foams market. As fleets grow older and air traffic recovers after the pandemic, airlines give refurbishment programs for their cabins, refurbishing of furnishings, and replacement of insulations a higher priority in order to improve on the passenger experience and fuel efficiency. Aerospace foams find applications in seat cushions, headrests, sidewalls, and noise insulation panels, being favored for their light weight and high performance.

- In February 2025, for instance, Recticel announced a strategic collaboration with an MRO provider in Europe for the supply of advanced polyurethane foams for use in the interior retrofitting of aircraft to meet new safety and environmental standards. Such collaborations are evidence pointing toward the increased importance placing aftermarket services as a revenue steam by foam manufacturers.

Restraint: Volatility in Raw Material Prices

-

The nature of varied costs in raw-materials has troubled aerospace foams: prime materials are polyurethane, polyethylene, or other petro-chemical derivatives. These raw materials, the prices of which used to depend on crude oil prices, have been affected by the disruptions in the supply chain, and in some cases, environmental legislations-this affects aerospace foam prices and supply. At times, manufacturers either bear these costs sufficiently or pass these costs along, thereby putting pressure on pricing competitiveness.

- For instance, in November 2024, BASF SE declared a squeezing of the margin in its Performance Materials segment as a result of gross price escalation in the prices of isocyanates and polyols, essential to producing polyurethane foams. Such price volatility impedes long-term planning of projects and further discourages procurement by OEMs and MRO service providers, especially in cost-sensitive segments like low-cost carriers.

Opportunity: Sustainable and Recyclable Foam Development

-

The concept of sustainability being ingrained into the very fabric of human activity gives the aerospace foam manufacturers the openings to pursue innovations with recyclable formulations and green compounds. Airlines and aircraft OEMs are increasingly accepting materials that adhere to a strict set of environmental norms and simultaneously meet the performance standards mandated. This inclination toward sustainable aviation practices finds its place in the broader agenda toward decarbonization.

- In March 2025, the company Rogers Corporation revealed a bio-based, high-performance foam that was designed specifically for aircraft interiors, diminishing the carbon footprint by more than 30% in contrast to regular foams. Such innovations attract OEMs such as Boeing and Airbus that are pressured to reduce emissions across lifecycle. These are the times to build on the large opportunities that government and industry initiatives are expected to create for circular and green aviation in the years ahead.

Key Trend: Integration of Advanced Composite Foams in Urban Air Mobility (UAM)

-

Since Urban Air Mobility (UAM), comprising eVTOLs (electric vertical takeoff and landing) aircraft, is at its peak advent, aerospace foam makers are looking towards ultra-light-weighted composite foams to provide for these aircraft in terms of performance. UAM platforms require materials that thermally insulate, reduce noise, be structurally sound, yet also contribute very little in terms of weight.

- In January 2025, Evonik together with an advanced mobility startup launched a new generation of thermoplastic foam aimed at eVTOL interior panels and cabin acoustics. This trend clearly shows an adaptation by aerospace foam to future mobility means, thereby making yet another venue open to it as an end user. The foam further courts utility in new-age aviation platforms by being compatible with electric propulsion systems and modular designs.

Aerospace Foam Market Analysis and Segmental Data

Based on Foam Type, the Polyurethane Foam Segment Retains the Largest Share

-

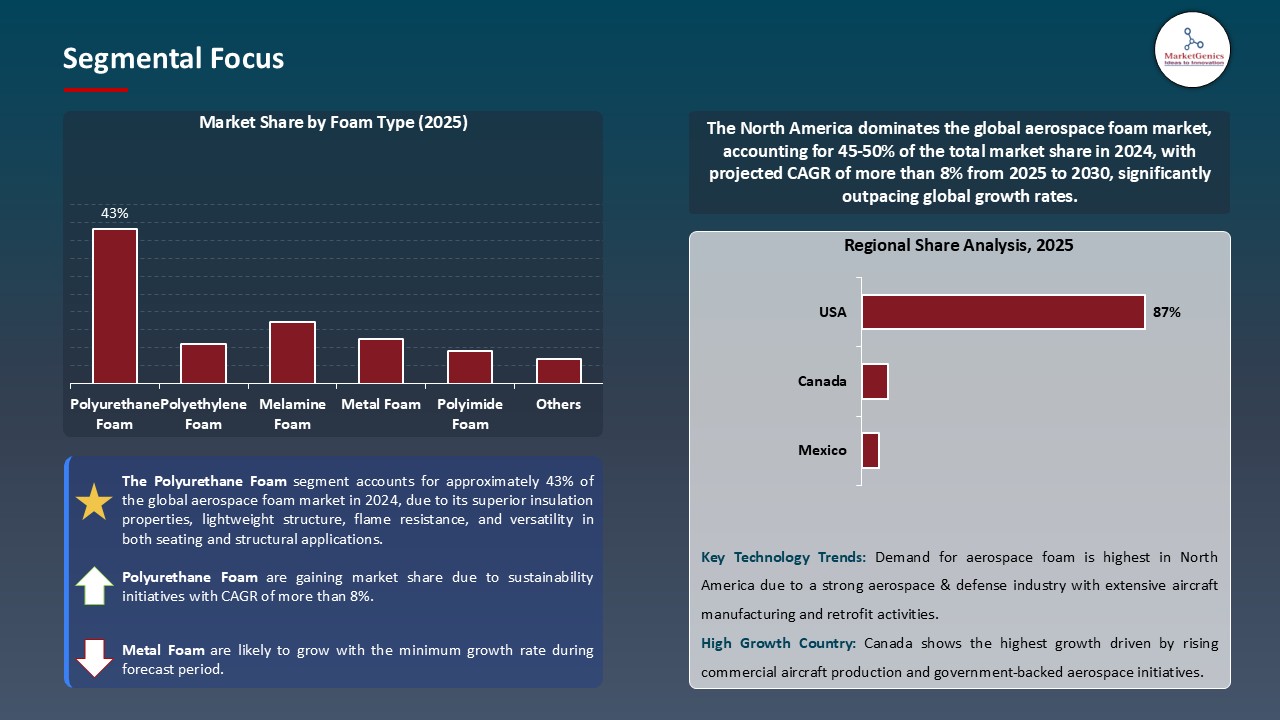

The polyurethane foam segment holds major share ~43% in the global aerospace foam market, due to its superior insulation properties, lightweight structure, flame resistance, and versatility in both seating and structural applications. Polyurethane foams serve efficient functions in aircraft seating and multiple walls, ceilings, and soundproofing installations for their compliance with FAA flammability standards and for maximizing passenger comfort and cabin efficiency. In response to the increased OEM and MRO demand for highly customizable, high-performance foam solutions, UFP Technologies, in April 2025, extended its line of aerospace polyurethane foams to meet the increased Boeing 737 and 787 productions.

- Moreover, polyurethane foams confer exceptional durability and fatigue resistance while offering shape adaptability, which aids in modern designs of aircraft cabins and retrofits. Since, polyurethane foams can be recycled and handled in environmentally friendly formulations, this presents their desirability from a sustainability perspective. Hence, this coupled technical and regulatory benefit describes polyurethane foam as the first choice in commercial, defense, and next-generation aerospace platforms.

- In need of multifunctional nature and regulatory compliance, polyurethane foam comes out in the lead in the aerospace foam market.

North America Dominates Global Aerospace Foam Market in 2024 and Beyond

-

Aerospace foam in North America is held at the highest level of demand in the region caused by its supremacy in aircraft manufacturing coupled with a strong defense sector and advanced MRO infrastructure. The existence of giant OEMs such as Boeing and Lockheed Martin and also strong R&D-dimensional capabilities hasten the commerce of high-performance foams in both commercial and military applications.

- In May 2025, General Plastics Manufacturing Company announced the commencement of a new supply agreement with Lockheed Martin for special rigid polyurethane foam blocks for use in lightweight military aircraft components, again underscoring the defense-driven demand spurt in the U.S.

- Innovation in sustainable and lightweight materials supports the ongoing development of cabin interiors and structural insulation in North America. There is also a growing network of MROs in the region for foams used for retrofits of aging fleets and to meet changing regulatory requirements. In this region, aerospace foam consumption is also fueled by the heavy government expenditure in aviation and defense.

- North America's aerospace leadership and defense modernization initiatives are key contributors to the region's dominant aerospace foam consumption.

Aerospace Foam Market Ecosystem

Key players in the global aerospace foam market include prominent companies such as BASF SE, Evonik Industries AG, Rogers Corporation, Solvay S.A., Boyd Corporation and Other Key Players.

The aerospace foam market is moderately consolidated, with Tier 1 players such as BASF, Rogers Corporation, and SABIC leading due to their advanced material technologies and strong OEM partnerships. Tier 2 and 3 players like Zotefoams and General Plastics serve niche and regional aerospace needs. Buyer concentration is moderate, driven by a limited number of major aircraft manufacturers, while supplier concentration is high due to stringent material certifications, specialty polymers, and regulatory compliance in aerospace applications.

Recent Development and Strategic Overview:

-

In April 2025, Insperial, a portfolio company of Adagia Partners, completed the acquisition of MGR Foamtex, one of the major suppliers in the UK of soft furnishing and foam-based comfort products for aircraft interiors. This strategic move seeks to leverage Insperial's industrial material arm along with MGR Foamtex's aerospace expertise in seating and noise insulation and trim applications.

- In June 2025, UFP Technologies, an American leader in aerospace-grade foam and component solutions, acquired Welch Fluorocarbon, a company that provides thin-film welding and thermoforming of high-performance plastics such as fluoropolymers. This acquisition enhances UFP's capacity regarding aerospace insulation and protective packaging, in particular applications where extremely high levels of heat and chemical resistance are demanded.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 31.6 Bn |

|

Market Forecast Value in 2035 |

USD 116.5 Bn |

|

Growth Rate (CAGR) |

12.6% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Aerospace Foam Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Foam Type |

|

|

By Material Type |

|

|

By Aircraft Type |

|

|

By Functionality |

|

|

By Application |

|

|

By End Use Industry |

|

|

By Distribution Channel |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Aerospace Foam Market Outlook

- 2.1.1. Aerospace Foam Market Size (Value - US$ Billion), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End Use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Aerospace Foam Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Aerospace & Defense Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Aerospace & Defense Industry

- 3.1.3. Regional Distribution for Aerospace & Defense

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.1. Global Aerospace & Defense Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for lightweight materials to improve fuel efficiency in aircraft

- 4.1.1.2. Increasing aircraft production and fleet expansion globally

- 4.1.1.3. Growing use of foam for thermal and acoustic insulation in aircraft cabins

- 4.1.2. Restraints

- 4.1.2.1. Volatility in raw material prices, especially petrochemical derivatives.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis/ Ecosystem Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Aerospace Foam Manufacturers

- 4.4.3. Distributors & Retailers

- 4.4.4. OEM & Aircraft Manufacturers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Porter’s Five Forces Analysis

- 4.7. PESTEL Analysis

- 4.8. Global Aerospace Foam Market Demand

- 4.8.1. Historical Market Size - in Value (Value - US$ Billion), 2021-2024

- 4.8.2. Current and Future Market Size - in Value (Value - US$ Billion), 2025–2035

- 4.8.2.1. Y-o-Y Growth Trends

- 4.8.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Aerospace Foam Market Analysis, by Foam Type

- 6.1. Key Segment Analysis

- 6.2. Aerospace Foam Market Size (Value - US$ Billion), Analysis, and Forecasts, by Foam Type, 2021-2035

- 6.2.1. Polyurethane Foam

- 6.2.2. Polyethylene Foam

- 6.2.3. Melamine Foam

- 6.2.4. Metal Foam

- 6.2.5. Polyimide Foam

- 6.2.6. Others (e.g., PVC, phenolic, silicone-based foams)

- 7. Global Aerospace Foam Market Analysis, by Material Type

- 7.1. Key Segment Analysis

- 7.2. Aerospace Foam Market Size (Value - US$ Billion), Analysis, and Forecasts, by Material Type, 2021-2035

- 7.2.1. Synthetic Foam

- 7.2.2. Bio-based Foam

- 8. Global Aerospace Foam Market Analysis, by Aircraft Type

- 8.1. Key Segment Analysis

- 8.2. Aerospace Foam Market Size (Value - US$ Billion), Analysis, and Forecasts, by Aircraft Type, 2021-2035

- 8.2.1. Commercial Aircraft

- 8.2.2. Military Aircraft

- 8.2.3. General Aviation Aircraft

- 8.2.4. Helicopters

- 8.2.5. Spacecraft

- 8.2.6. Others

- 9. Global Aerospace Foam Market Analysis, by Functionality

- 9.1. Key Segment Analysis

- 9.2. Aerospace Foam Market Size (Value - US$ Billion), Analysis, and Forecasts, by Functionality, 2021-2035

- 9.2.1. Thermal Insulation

- 9.2.2. Acoustic Insulation

- 9.2.3. Vibration Damping

- 9.2.4. Flame Resistance

- 9.2.5. Others

- 10. Global Aerospace Foam Market Analysis, by Application

- 10.1. Key Segment Analysis

- 10.2. Aerospace Foam Market Size (Value - US$ Billion), Analysis, and Forecasts, by Application, 2021-2035

- 10.2.1. Seating

- 10.2.2. Cabin Interiors (e.g., wall panels, overhead bins)

- 10.2.3. Insulation

- 10.2.4. Flooring

- 10.2.5. Flight Deck Padding

- 10.2.6. Cargo Liners

- 10.2.7. Others

- 11. Global Aerospace Foam Market Analysis, by End Use Industry

- 11.1. Key Segment Analysis

- 11.2. Aerospace Foam Market Size (Value - US$ Billion), Analysis, and Forecasts, by End Use Industry, 2021-2035

- 11.2.1. OEM (Original Equipment Manufacturer)

- 11.2.2. MRO (Maintenance, Repair, and Overhaul)

- 12. Global Aerospace Foam Market Analysis, by Distribution Channel

- 12.1. Key Segment Analysis

- 12.2. Aerospace Foam Market Size (Value - US$ Billion), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 12.2.1. Direct Sales

- 12.2.2. Distributors/ Third-party Vendors

- 12.2.3. Others

- 13. Global Aerospace Foam Market Analysis and Forecasts, by Region

- 13.1. Key Findings

- 13.2. Aerospace Foam Market Size (Value - US$ Billion), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America Aerospace Foam Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America Aerospace Foam Market Size Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 14.3.1. Foam Type

- 14.3.2. Material Type

- 14.3.3. Aircraft Type

- 14.3.4. Functionality

- 14.3.5. Application

- 14.3.6. End Use Industry

- 14.3.7. Distribution Channel

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA Aerospace Foam Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Foam Type

- 14.4.3. Material Type

- 14.4.4. Aircraft Type

- 14.4.5. Functionality

- 14.4.6. Application

- 14.4.7. End Use Industry

- 14.4.8. Distribution Channel

- 14.5. Canada Aerospace Foam Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Foam Type

- 14.5.3. Material Type

- 14.5.4. Aircraft Type

- 14.5.5. Functionality

- 14.5.6. Application

- 14.5.7. End Use Industry

- 14.5.8. Distribution Channel

- 14.6. Mexico Aerospace Foam Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Foam Type

- 14.6.3. Material Type

- 14.6.4. Aircraft Type

- 14.6.5. Functionality

- 14.6.6. Application

- 14.6.7. End Use Industry

- 14.6.8. Distribution Channel

- 15. Europe Aerospace Foam Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe Aerospace Foam Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 15.3.1. Foam Type

- 15.3.2. Material Type

- 15.3.3. Aircraft Type

- 15.3.4. Functionality

- 15.3.5. Application

- 15.3.6. End Use Industry

- 15.3.7. Distribution Channel

- 15.3.8. Country

- 15.3.8.1. Germany

- 15.3.8.2. United Kingdom

- 15.3.8.3. France

- 15.3.8.4. Italy

- 15.3.8.5. Spain

- 15.3.8.6. Netherlands

- 15.3.8.7. Nordic Countries

- 15.3.8.8. Poland

- 15.3.8.9. Russia & CIS

- 15.3.8.10. Rest of Europe

- 15.4. Germany Aerospace Foam Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Foam Type

- 15.4.3. Material Type

- 15.4.4. Aircraft Type

- 15.4.5. Functionality

- 15.4.6. Application

- 15.4.7. End Use Industry

- 15.4.8. Distribution Channel

- 15.5. United Kingdom Aerospace Foam Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Foam Type

- 15.5.3. Material Type

- 15.5.4. Aircraft Type

- 15.5.5. Functionality

- 15.5.6. Application

- 15.5.7. End Use Industry

- 15.5.8. Distribution Channel

- 15.6. France Aerospace Foam Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Foam Type

- 15.6.3. Material Type

- 15.6.4. Aircraft Type

- 15.6.5. Functionality

- 15.6.6. Application

- 15.6.7. End Use Industry

- 15.6.8. Distribution Channel

- 15.7. Italy Aerospace Foam Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Foam Type

- 15.7.3. Material Type

- 15.7.4. Aircraft Type

- 15.7.5. Functionality

- 15.7.6. Application

- 15.7.7. End Use Industry

- 15.7.8. Distribution Channel

- 15.8. Spain Aerospace Foam Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Foam Type

- 15.8.3. Material Type

- 15.8.4. Aircraft Type

- 15.8.5. Functionality

- 15.8.6. Application

- 15.8.7. End Use Industry

- 15.8.8. Distribution Channel

- 15.9. Netherlands Aerospace Foam Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Foam Type

- 15.9.3. Material Type

- 15.9.4. Aircraft Type

- 15.9.5. Functionality

- 15.9.6. Application

- 15.9.7. End Use Industry

- 15.9.8. Distribution Channel

- 15.10. Nordic Countries Aerospace Foam Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Foam Type

- 15.10.3. Material Type

- 15.10.4. Aircraft Type

- 15.10.5. Functionality

- 15.10.6. Application

- 15.10.7. End Use Industry

- 15.10.8. Distribution Channel

- 15.11. Poland Aerospace Foam Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Foam Type

- 15.11.3. Material Type

- 15.11.4. Aircraft Type

- 15.11.5. Functionality

- 15.11.6. Application

- 15.11.7. End Use Industry

- 15.11.8. Distribution Channel

- 15.12. Russia & CIS Aerospace Foam Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Foam Type

- 15.12.3. Material Type

- 15.12.4. Aircraft Type

- 15.12.5. Functionality

- 15.12.6. Application

- 15.12.7. End Use Industry

- 15.12.8. Distribution Channel

- 15.13. Rest of Europe Aerospace Foam Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Foam Type

- 15.13.3. Material Type

- 15.13.4. Aircraft Type

- 15.13.5. Functionality

- 15.13.6. Application

- 15.13.7. End Use Industry

- 15.13.8. Distribution Channel

- 16. Asia Pacific Aerospace Foam Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. East Asia Aerospace Foam Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 16.3.1. Foam Type

- 16.3.2. Material Type

- 16.3.3. Aircraft Type

- 16.3.4. Functionality

- 16.3.5. Application

- 16.3.6. End Use Industry

- 16.3.7. Distribution Channel

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia Pacific

- 16.4. China Aerospace Foam Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Foam Type

- 16.4.3. Material Type

- 16.4.4. Aircraft Type

- 16.4.5. Functionality

- 16.4.6. Application

- 16.4.7. End Use Industry

- 16.4.8. Distribution Channel

- 16.5. India Aerospace Foam Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Foam Type

- 16.5.3. Material Type

- 16.5.4. Aircraft Type

- 16.5.5. Functionality

- 16.5.6. Application

- 16.5.7. End Use Industry

- 16.5.8. Distribution Channel

- 16.6. Japan Aerospace Foam Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Foam Type

- 16.6.3. Material Type

- 16.6.4. Aircraft Type

- 16.6.5. Functionality

- 16.6.6. Application

- 16.6.7. End Use Industry

- 16.6.8. Distribution Channel

- 16.7. South Korea Aerospace Foam Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Foam Type

- 16.7.3. Material Type

- 16.7.4. Aircraft Type

- 16.7.5. Functionality

- 16.7.6. Application

- 16.7.7. End Use Industry

- 16.7.8. Distribution Channel

- 16.8. Australia and New Zealand Aerospace Foam Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Foam Type

- 16.8.3. Material Type

- 16.8.4. Aircraft Type

- 16.8.5. Functionality

- 16.8.6. Application

- 16.8.7. End Use Industry

- 16.8.8. Distribution Channel

- 16.9. Indonesia Aerospace Foam Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Foam Type

- 16.9.3. Material Type

- 16.9.4. Aircraft Type

- 16.9.5. Functionality

- 16.9.6. Application

- 16.9.7. End Use Industry

- 16.9.8. Distribution Channel

- 16.10. Malaysia Aerospace Foam Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Foam Type

- 16.10.3. Material Type

- 16.10.4. Aircraft Type

- 16.10.5. Functionality

- 16.10.6. Application

- 16.10.7. End Use Industry

- 16.10.8. Distribution Channel

- 16.11. Thailand Aerospace Foam Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Foam Type

- 16.11.3. Material Type

- 16.11.4. Aircraft Type

- 16.11.5. Functionality

- 16.11.6. Application

- 16.11.7. End Use Industry

- 16.11.8. Distribution Channel

- 16.12. Vietnam Aerospace Foam Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Foam Type

- 16.12.3. Material Type

- 16.12.4. Aircraft Type

- 16.12.5. Functionality

- 16.12.6. Application

- 16.12.7. End Use Industry

- 16.12.8. Distribution Channel

- 16.13. Rest of Asia Pacific Aerospace Foam Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Foam Type

- 16.13.3. Material Type

- 16.13.4. Aircraft Type

- 16.13.5. Functionality

- 16.13.6. Application

- 16.13.7. End Use Industry

- 16.13.8. Distribution Channel

- 17. Middle East Aerospace Foam Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East Aerospace Foam Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 17.3.1. Foam Type

- 17.3.2. Material Type

- 17.3.3. Aircraft Type

- 17.3.4. Functionality

- 17.3.5. Application

- 17.3.6. End Use Industry

- 17.3.7. Distribution Channel

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey Aerospace Foam Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Foam Type

- 17.4.3. Material Type

- 17.4.4. Aircraft Type

- 17.4.5. Functionality

- 17.4.6. Application

- 17.4.7. End Use Industry

- 17.4.8. Distribution Channel

- 17.5. UAE Aerospace Foam Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Foam Type

- 17.5.3. Material Type

- 17.5.4. Aircraft Type

- 17.5.5. Functionality

- 17.5.6. Application

- 17.5.7. End Use Industry

- 17.5.8. Distribution Channel

- 17.6. Saudi Arabia Aerospace Foam Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Foam Type

- 17.6.3. Material Type

- 17.6.4. Aircraft Type

- 17.6.5. Functionality

- 17.6.6. Application

- 17.6.7. End Use Industry

- 17.6.8. Distribution Channel

- 17.7. Israel Aerospace Foam Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Foam Type

- 17.7.3. Material Type

- 17.7.4. Aircraft Type

- 17.7.5. Functionality

- 17.7.6. Application

- 17.7.7. End Use Industry

- 17.7.8. Distribution Channel

- 17.8. Rest of Middle East Aerospace Foam Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Foam Type

- 17.8.3. Material Type

- 17.8.4. Aircraft Type

- 17.8.5. Functionality

- 17.8.6. Application

- 17.8.7. End Use Industry

- 17.8.8. Distribution Channel

- 18. Africa Aerospace Foam Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa Aerospace Foam Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 18.3.1. Foam Type

- 18.3.2. Material Type

- 18.3.3. Aircraft Type

- 18.3.4. Functionality

- 18.3.5. Application

- 18.3.6. End Use Industry

- 18.3.7. Distribution Channel

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa Aerospace Foam Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Foam Type

- 18.4.3. Material Type

- 18.4.4. Aircraft Type

- 18.4.5. Functionality

- 18.4.6. Application

- 18.4.7. End Use Industry

- 18.4.8. Distribution Channel

- 18.5. Egypt Aerospace Foam Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Foam Type

- 18.5.3. Material Type

- 18.5.4. Aircraft Type

- 18.5.5. Functionality

- 18.5.6. Application

- 18.5.7. End Use Industry

- 18.5.8. Distribution Channel

- 18.6. Nigeria Aerospace Foam Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Foam Type

- 18.6.3. Material Type

- 18.6.4. Aircraft Type

- 18.6.5. Functionality

- 18.6.6. Application

- 18.6.7. End Use Industry

- 18.6.8. Distribution Channel

- 18.7. Algeria Aerospace Foam Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Foam Type

- 18.7.3. Material Type

- 18.7.4. Aircraft Type

- 18.7.5. Functionality

- 18.7.6. Application

- 18.7.7. End Use Industry

- 18.7.8. Distribution Channel

- 18.8. Rest of Africa Aerospace Foam Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Foam Type

- 18.8.3. Material Type

- 18.8.4. Aircraft Type

- 18.8.5. Functionality

- 18.8.6. Application

- 18.8.7. End Use Industry

- 18.8.8. Distribution Channel

- 19. South America Aerospace Foam Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Central and South Africa Aerospace Foam Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 19.3.1. Foam Type

- 19.3.2. Material Type

- 19.3.3. Aircraft Type

- 19.3.4. Functionality

- 19.3.5. Application

- 19.3.6. End Use Industry

- 19.3.7. Distribution Channel

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil Aerospace Foam Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Foam Type

- 19.4.3. Material Type

- 19.4.4. Aircraft Type

- 19.4.5. Functionality

- 19.4.6. Application

- 19.4.7. End Use Industry

- 19.4.8. Distribution Channel

- 19.5. Argentina Aerospace Foam Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Foam Type

- 19.5.3. Material Type

- 19.5.4. Aircraft Type

- 19.5.5. Functionality

- 19.5.6. Application

- 19.5.7. End Use Industry

- 19.5.8. Distribution Channel

- 19.6. Rest of South America Aerospace Foam Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Foam Type

- 19.6.3. Material Type

- 19.6.4. Aircraft Type

- 19.6.5. Functionality

- 19.6.6. Application

- 19.6.7. End Use Industry

- 19.6.8. Distribution Channel

- 20. Key Players/ Company Profile

- 20.1. Aerontec Pty Ltd

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. Armacell International S.A.

- 20.3. BASF SE

- 20.4. Boyd Corporation

- 20.5. DuPont de Nemours, Inc.

- 20.6. ERG Materials and Aerospace Corp.

- 20.7. Evonik Industries AG

- 20.8. FoamPartner Group

- 20.9. General Plastics Manufacturing Company

- 20.10. Hutchinson SA

- 20.11. Rogers Corporation

- 20.12. SABIC

- 20.13. Saint-Gobain Performance Plastics

- 20.14. Solvay S.A.

- 20.15. Technifab Inc.

- 20.16. The Dow Chemical Company

- 20.17. The Gill Corporation

- 20.18. TransDigm Group Incorporated (Esterline)

- 20.19. UFP Technologies, Inc.

- 20.20. Universal Foam Products, LLC

- 20.21. Zotefoams plc

- 20.22. Other Key Players

- 20.1. Aerontec Pty Ltd

Note* - This is just tentative list of players. While providing the report, we will cover a greater number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation