Brain-Computer Interfaces & Neuromodulators Market Size, Share & Trends Analysis Report by Product Type (Brain-Computer Interfaces (BCIs), Neuromodulators), Technology, Signal Acquisition Method, Application, End-User Type, Device Portability, Signal Processing, Therapeutic Modality, Control Mechanism and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Brain-Computer Interfaces and Neuromodulators Market Size, Share, and Growth

The global brain-computer interfaces and neuromodulators market is experiencing robust growth, with its estimated value of USD 5.2 billion in the year 2025 and USD 16.6 billion by the period 2035, registering a CAGR of 12.4%, during the forecast period. North America leads the market with market share of 47% with USD 2.4 billion revenue.

In 2025, CorTec Announces Neurotech Milestone, First Human Implantatation of a Brain-Computer Interface made in Germany. This closed-loop brain-computer interface, has been implanted in a human for the first time at Harborview Medical Center, Seattle, under an FDA-approved NIH-funded trial. The project aims to test whether direct cortical stimulation can improve upper-limb motor recovery in stroke patients. Prof. Jeffrey Ojemann confirmed the surgery was successful and the patient is recovering well, adding that “the technology and therapeutic strategy are novel, with promising potential for patients.”

Rapid innovations in advanced sensors, neural implants, wearable devices and signal processing are enhancing the accuracy, efficiency and effectiveness of the bran computer interfaces and neuromodulation therapies fueling the expansion of the market. For instance, in 2025, Paradromics completed its first in human recording with Connexus brain computer interface.

The collaboration of Paradromics with University of Michigan marked the transition of the company into the clinical stage. This project successfully demonstrated that the Connexus BCI can safely record brain activity and can be removed intact in less than 20 minutes using standard surgical techniques. Such advancements illustrate significant improvements in functionality, safety, and precision, driving the greater adoption and fueling the growth of brain computer interface and neuromodulators market.

The global brain-computer interfaces & neuromodulators market has adjacent opportunities in areas such as neurorehabilitation, mental health management, cognitive enhancement and personalized neurology. Application are expanding in advance neuroprosthetics, closed loop neuromodulation, long term therapeutic benefits and integration with digital health platforms for broader impact across healthcare sectors.

Brain-Computer Interfaces and Neuromodulators Market Dynamics and Trends

Driver: Burden of neurological disease fuels brain computer interface and neuromodulators market

- Increasing cases of alzheimer’s, epilepsy, spinal injuries, parkinson’s and depression are driving demand for brain computer interface and neuromodulators because the existing treatment often have limited effectiveness, cause side effects or only manage symptoms. Brain computer interface and neuromodulation technologies provides alternatives that can directly target the brain and nerve activity. In 2025, Brainsense which is the world’s first adaptive deep brain stimulation (aDABS), developed by Medtronic has received an FDA approval for parkinson’s disease.

- It is a novel system of closed-loop deep brain stimulation (DBS) treatment of Parkinson disease. In contrast to the conventional DBS where a constant stimulation is provided to the brain, BrainSense measures brain activity in real-time and automatically manipulates electrical impulses to target affected regions with greater focus. This personalization ensures that motor symptoms are minimized, reduces side effects, and facilitates personalization to the daily life activities of the patients, providing them with constant, optimized therapy.

- This progress would be the primary factor contributing to the improvement of the efficiency of treatment and the overall patient outcomes, thus propelling the expansion of the Brain-Computer Interfaces and Neuromodulators Market.

Restraint: High R&D investment and stringent regulatory requirements

- The brain-computer interfaces (BCIs) and neuromodulation devices will be extremely resource-intensive and need massive investment at each point in the innovation pipeline. Firms are forced to invest huge capital in basic research, prototype development and multiple phase clinical trials that can be conducted over the span of a few years. Clinical validation, is demanding, because these devices communicate directly with the nervous system and demonstrate functionality, long-term safety as well as biocompatibility.

- Also, the regulatory environment is another source of complexity. Regulators like the U.S. Food and Drug Administration (FDA) and the European CE marking body have stringent requirements in terms of approvals, which demand evident data in the form of feasibility studies, pivotal trials, and post-market surveillance information. These processes time consuming, expensive and usually prolong the product development and commercialization.

- Hence, the pool of large R&D investment, lengthy clinical trials, and strict regulation pose a great hinderance to the market of brain computer interfaces and neuromodulation.

Opportunity: Rehabilitation advances fuel neurotech market growth

- The potential of the brain-computer interfaces (BCIs) and neuromodulation devices in rehabilitation and assistive technology will give stroke survivors, spinal injury patients, and physically disabled people an opportunity to stand, walk, and live normally. This develops an expanding market of solutions that integrate neural technology with care to patients.

- In July 2025, neurosurgeons at the University of Washington Harborview Medical Center implanted a new closed-loop BCI system into a stroke patient. This device is designed to make the brain rewire and repair lost motor functions (including arm and leg movements) by stressing the potential transformative benefits of brain-computer interfaces (BCIs) and neuromodulation devices in rehabilitation.

- Overall, all of these developments reveal that BCIs and neuromodulation devices are leaving the experimental phase to enter the practical phase of therapeutic applications, and that new age of neurorehabilitation and patient recovery is imminent.

Key Trend: AI integration boosts precision and functionality in brain computer interfaces and neuromodulation technologies

- Technologies in neuromodulation in conjunction with the application of the artificial intelligence (AI) and brain-computer interfaces (BCIs) are helping to substantially improve the accuracy and functionality of neurotechnology solutions. Such a combination provides a chance to the interpretation of neural signals in real-time and capable of controlling the assistive equipment with less difficulty and produce more outputs in the support of people with neurological conditions.

- In 2025 the University of California, Los Angeles (UCLA) researchers proposed a non-invasive brain-computer interface (BCI) system that adds artificial intelligence (AI) as a co-pilot to the wearable version. The AI element interprets the user intentions using neural signals in real time to accurately predict the user. In this way, the system will be able to help users accomplish tasks, including using a computer cursor or assistive devices, with more precision and responsiveness.

- Such a strategy improves experience as a whole by making the contact with neurotechnology easier and more efficient, especially with people with neurological disabilities.

Brain-Computer Interfaces & Neuromodulators Market Analysis and Segmental Data

Hospitals and Clinics Dominate Global Brain-Computer Interfaces & Neuromodulators Market

- The hospitals and clinical sub-segment is the leading segment in the global brain-computer interfaces & neuromodulators market as such, hospitals are the main centers of performing patient trials, surgical implantations and rehabilitation therapies which are critical in adoption and validation of the technology. University Hospitals began the ReHAB (Reconnecting the Hand and Arm to the Brain) clinical trial in 2025, testing a new BCI that would restore meaningful control of the arms and hands in patients with paralysis of the spinal cord or stroke.

- Moreover, in 2025, Stanford Medicine created a BCI, which can read inner speech in individuals with serious speech disorders, including those induced by stroke or ALS. The system captures brain signals in speech active regions and converts them to text or synthesized speech, enabling patients to communicate without speech or movement, providing a more intuitive and quicker alternative to traditional assistive technologies.

- Collectively, these capabilities of the hospital and clinical division contribute to the brain-computer interfaces & neuromodulators market growth, and enhances its uptake, the number of patients that can be served, and confidence of healthcare professionals and investors in the clinical value of these technologies.

North America Leads Global Brain-Computer Interfaces & Neuromodulators Market Demand

- North America is leading the brain-computer interfaces and neuromodulators market since most hospitals, research and biotechnology firms have invested massively in the development of advanced neurotechnology systems. In 2025, scientists at the University of California, Davis, have created an experimental brain-computer interface, which can instantly decode the brain activity as a person attempts to speak into voice. The technology is meant to rehabilitate the process of engaging in real-time conversations to people who have been deprived of the capacity to talk as a result of neurological disorders.

- Also, the region is adopting the newest BCI and neuromodulation devices because of the high funding climate and focus on innovation in the neurorehabilitation and assistive technology, as well as precision medicine. For instance, Johns Hopkins University launched a clinical trial of the CortiCom brain-computer interface (BCI) system that is intended to help patients with the most severe speech impairment by conditions such as ALS or a stroke to their brain stem. In CortiCom system, the brain is implanted with a maximum of 128 electrodes on the surface after which the neural signals are captured and analyzed into a text or speech.

- Collectively, these aspects make North America a central brain computer exchange and neuromodulators capital, propelling the growth of the global brain computer interfaces and neuromodulators market by being an early adopter and clinical validator, through ongoing technological innovation.

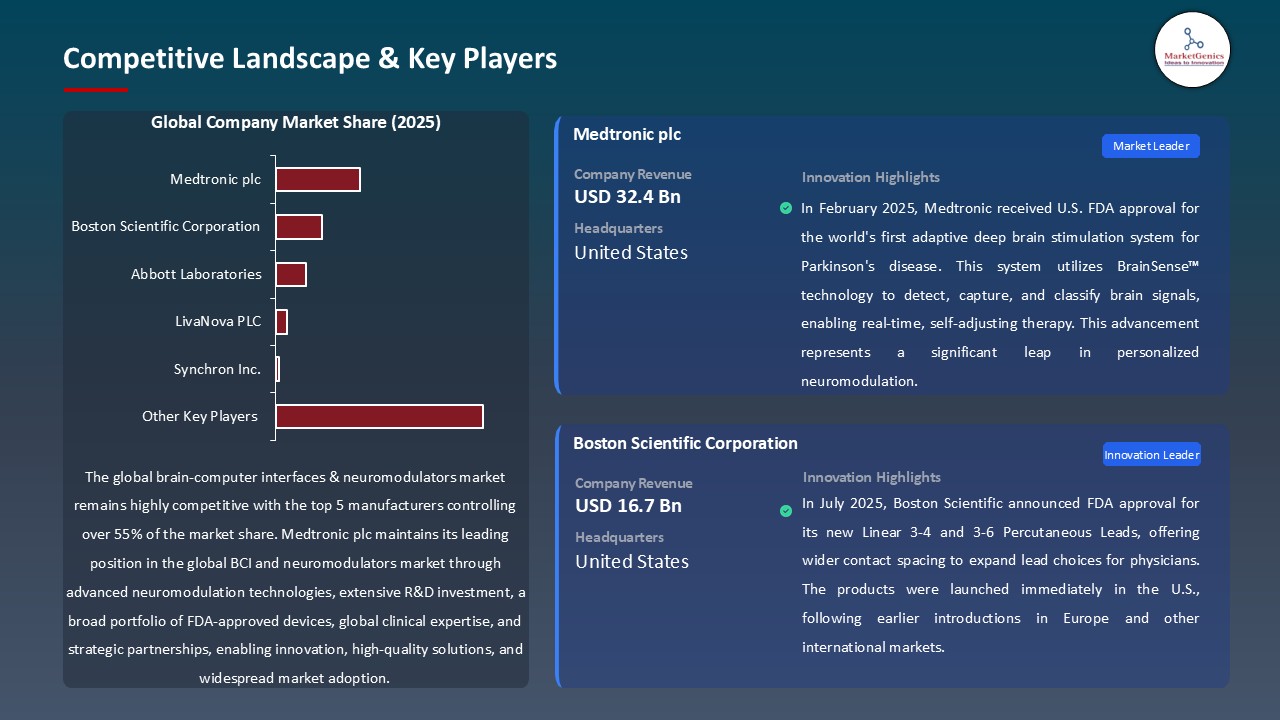

Brain-Computer Interfaces & Neuromodulators Market Ecosystem

The brain-computer interfaces and neuromodulators market are moderately consolidated with the Tier 1 companies, such as Abbott Laboratories, Boston Scientific, Medtronic, and LivaNova, controlling the primary market segment and the Tier 2 and Tier 3 companies, such as Emotiv, BrainCo, Kernel, and OpenBCI, innovation and niche applications. The concentration of buyers is moderate because there are few substitutes to the high-end and specialized devices by healthcare providers and research institutes. The concentration of suppliers is moderate; therefore, it depends on the high-end microelectronics, neural-sensors, and proprietary software parts, which affect pricing and bargaining power.

Recent Development and Strategic Overview:

- In May 2025, Synchron became the first BCI company to integrate natively with Apple devices, including iPhone, iPad, and Vision Pro, enabling users with severe motor impairments to control their devices directly with thought via Apple’s BCI HID protocol.

- In January 2024, Noland became the first person to receive Neuralink’s implant, a wireless brain-computer interface enabling thought-based control of devices. Joined by Alex (SCI) and Brad (ALS), the three participants in the PRIME Study have now used the technology for over 4,900 hours across 670+ days, averaging 6.5 hours of independent daily use. The implant is helping them regain autonomy, with Noland noting it has reconnected him to family and restored independence in daily life.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 5.2 Bn |

|

Market Forecast Value in 2035 |

USD 16.6 Bn |

|

Growth Rate (CAGR) |

12.4% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Brain-Computer Interfaces & Neuromodulators Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Brain-Computer Interfaces & Neuromodulators Market, By Product Type |

|

|

Brain-Computer Interfaces & Neuromodulators Market, By Technology |

|

|

Brain-Computer Interfaces & Neuromodulators Market, By Signal Acquisition Method |

|

|

Brain-Computer Interfaces & Neuromodulators Market, By Application |

|

|

Brain-Computer Interfaces & Neuromodulators Market, By End-User Type |

|

|

Brain-Computer Interfaces & Neuromodulators Market, By Device Portability |

|

|

Brain-Computer Interfaces & Neuromodulators Market, By Signal Processing |

|

|

Brain-Computer Interfaces & Neuromodulators Market, By Therapeutic Modality |

|

|

Brain-Computer Interfaces & Neuromodulators Market, By Control Mechanism |

|

Frequently Asked Questions

The global brain-computer interfaces & neuromodulators market was valued at USD 5.2 Bn in 2025.

The global brain-computer interfaces & neuromodulators market industry is expected to grow at a CAGR of 12.4% from 2025 to 2035.

The demand for brain-computer interfaces & neuromodulators market is driven by the growing use of rapid innovations in advanced sensors, neural implants, wearable devices and signal processing are enhancing the accuracy, efficiency and effectiveness fueling the expansion of the market.

In terms of end-user type, hospital and clinics segment accounted for the major share in 2025.

North America is a more attractive region.

Key players in the global brain-computer interfaces & neuromodulators market include prominent companies such as Abbott Laboratories, Blackrock Neurotech, Boston Scientific Corporation, BrainCo Inc., Cogito Corporation, CTRL-labs (Meta), Emotiv Inc., g.tec Medical Engineering, Kernel Inc., LivaNova PLC, Medtronic plc, MindMaze SA, Neurable Inc., Neural Dust (UC Berkeley), Neuralink Corporation, NeuroSky Inc., NextMind (Snap Inc.), OpenBCI, Paradromics Inc., Synchron Inc. and other key players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Brain-Computer Interfaces & Neuromodulators Market Outlook

- 2.1.1. Brain-Computer Interfaces & Neuromodulators Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Brain-Computer Interfaces & Neuromodulators Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Healthcare & Pharmaceutical Industry Overview, 2025

- 3.1.1. Healthcare & Pharmaceutical Industry Ecosystem Analysis

- 3.1.2. Key Trends for Healthcare & Pharmaceutical Industry

- 3.1.3. Regional Distribution for Healthcare & Pharmaceutical Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Healthcare & Pharmaceutical Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising prevalence of neurological disorders

- 4.1.1.2. Advancements in neurotechnology and AI integration

- 4.1.1.3. Increasing investments in brain-computer interface R&D

- 4.1.2. Restraints

- 4.1.2.1. High cost of devices and procedures

- 4.1.2.2. Regulatory and ethical challenges

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Brain-Computer Interfaces & Neuromodulators Manufacturers

- 4.4.3. Distributors/ Suppliers

- 4.4.4. End-users/ Customers

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Brain-Computer Interfaces & Neuromodulators Market Demand

- 4.7.1. Historical Market Size - in Value (US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size - in Value (US$ Bn), 2025–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Brain-Computer Interfaces & Neuromodulators Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Brain-Computer Interfaces & Neuromodulators Market Size (Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Brain-Computer Interfaces (BCIs)

- 6.2.1.1. Invasive BCIs

- 6.2.1.2. Non-invasive BCIs

- 6.2.1.3. Semi-invasive BCIs

- 6.2.1.4. Hybrid BCIs

- 6.2.1.5. Others

- 6.2.2. Neuromodulators

- 6.2.2.1. Deep Brain Stimulation (DBS) systems

- 6.2.2.2. Spinal Cord Stimulators (SCS)

- 6.2.2.3. Transcranial Magnetic Stimulation (TMS)

- 6.2.2.4. Transcranial Direct Current Stimulation (tDCS)

- 6.2.2.5. Vagus Nerve Stimulation (VNS)

- 6.2.2.6. Sacral Nerve Stimulation (SNS)

- 6.2.2.7. Others

- 6.2.1. Brain-Computer Interfaces (BCIs)

- 7. Global Brain-Computer Interfaces & Neuromodulators Market Analysis, By Technology

- 7.1. Key Segment Analysis

- 7.2. Brain-Computer Interfaces & Neuromodulators Market Size (Value - US$ Bn), Analysis, and Forecasts, By Technology, 2021-2035

- 7.2.1. Electroencephalography (EEG)

- 7.2.2. Electrocorticography (ECoG)

- 7.2.3. Local Field Potentials (LFP)

- 7.2.4. Single Unit Activity (SUA)

- 7.2.5. Functional Near-Infrared Spectroscopy (fNIRS)

- 7.2.6. Functional Magnetic Resonance Imaging (fMRI)

- 7.2.7. Magnetoencephalography (MEG)

- 7.2.8. Optogenetics

- 7.2.9. Others

- 8. Global Brain-Computer Interfaces & Neuromodulators Market Analysis and Forecasts, By Signal Acquisition Method

- 8.1. Key Findings

- 8.2. Brain-Computer Interfaces & Neuromodulators Market Size (Value - US$ Bn), Analysis, and Forecasts, By Signal Acquisition Method, 2021-2035

- 8.2.1. Invasive Methods

- 8.2.1.1. Microelectrode arrays

- 8.2.1.2. Depth electrodes

- 8.2.1.3. Penetrating electrodes

- 8.2.1.4. Others

- 8.2.2. Non-invasive Methods

- 8.2.2.1. Surface electrodes

- 8.2.2.2. External sensors

- 8.2.2.3. Wearable devices

- 8.2.2.4. Others

- 8.2.3. Semi-invasive Methods

- 8.2.3.1. Subdural electrodes

- 8.2.3.2. Epidural electrodes

- 8.2.1. Invasive Methods

- 9. Global Brain-Computer Interfaces & Neuromodulators Market Analysis and Forecasts, By Application

- 9.1. Key Findings

- 9.2. Brain-Computer Interfaces & Neuromodulators Market Size (Value - US$ Bn), Analysis, and Forecasts, By Application, 2021-2035

- 9.2.1. Motor Control & Restoration

- 9.2.1.1. Prosthetic control

- 9.2.1.2. Robotic limb control

- 9.2.1.3. Wheelchair navigation

- 9.2.1.4. Computer cursor control

- 9.2.1.5. Others

- 9.2.2. Communication & Interaction

- 9.2.2.1. Speech synthesis

- 9.2.2.2. Text input systems

- 9.2.2.3. Virtual keyboard control

- 9.2.2.4. Others

- 9.2.3. Sensory Restoration

- 9.2.3.1. Visual prostheses

- 9.2.3.2. Auditory implants

- 9.2.3.3. Tactile feedback systems

- 9.2.3.4. Others

- 9.2.4. Cognitive Enhancement

- 9.2.4.1. Memory augmentation

- 9.2.4.2. Attention training

- 9.2.4.3. Learning acceleration

- 9.2.4.4. Others

- 9.2.5. Therapeutic Applications

- 9.2.5.1. Pain management

- 9.2.5.2. Depression treatment

- 9.2.5.3. Epilepsy control

- 9.2.5.4. Movement disorder treatment

- 9.2.5.5. Others

- 9.2.1. Motor Control & Restoration

- 10. Global Brain-Computer Interfaces & Neuromodulators Market Analysis and Forecasts, By End-User Type

- 10.1. Key Findings

- 10.2. Brain-Computer Interfaces & Neuromodulators Market Size (Value - US$ Bn), Analysis, and Forecasts, By End-User Type, 2021-2035

- 10.2.1. Hospitals & Clinics

- 10.2.2. Research Institutes

- 10.2.3. Rehabilitation Centers

- 10.2.4. Home Care Settings

- 10.2.5. Academic Institutions

- 10.2.6. Military & Defense

- 10.2.7. Gaming & Entertainment

- 10.2.8. Consumer Electronics

- 10.2.9. Others

- 11. Global Brain-Computer Interfaces & Neuromodulators Market Analysis and Forecasts, By Device Portability

- 11.1. Key Findings

- 11.2. Brain-Computer Interfaces & Neuromodulators Market Size (Volume - Thousand Units and Value - US$ Mn), Analysis, and Forecasts, By Device Portability, 2021-2035

- 11.2.1. Implantable Devices

- 11.2.1.1. Fully implantable systems

- 11.2.1.2. Partially implantable systems

- 11.2.2. Wearable Devices

- 11.2.2.1. Head-mounted devices

- 11.2.2.2. Portable units

- 11.2.3. Stationary Systems

- 11.2.3.1. Clinical-grade equipment

- 11.2.3.2. Laboratory systems

- 11.2.1. Implantable Devices

- 12. Global Brain-Computer Interfaces & Neuromodulators Market Analysis and Forecasts, By Signal Processing

- 12.1. Key Findings

- 12.2. Brain-Computer Interfaces & Neuromodulators Market Size (Volume - Thousand Units and Value - US$ Mn), Analysis, and Forecasts, By Signal Processing, 2021-2035

- 12.2.1. Real-time Processing

- 12.2.2. Offline Processing

- 12.2.3. Cloud-based Processing

- 12.2.4. Edge Computing

- 12.2.5. Hybrid Processing

- 13. Global Brain-Computer Interfaces & Neuromodulators Market Analysis and Forecasts, By Therapeutic Modality

- 13.1. Key Findings

- 13.2. Brain-Computer Interfaces & Neuromodulators Market Size (Volume - Thousand Units and Value - US$ Mn), Analysis, and Forecasts, By Therapeutic Modality, 2021-2035

- 13.2.1. Stimulation-based

- 13.2.1.1. Electrical stimulation

- 13.2.1.2. Magnetic stimulation

- 13.2.1.3. Optical stimulation

- 13.2.1.4. Ultrasound stimulation

- 13.2.1.5. Others

- 13.2.2. Recording-based

- 13.2.2.1. Neural signal recording

- 13.2.2.2. Biomarker detection

- 13.2.2.3. Feedback systems

- 13.2.2.4. Others

- 13.2.3. Bidirectional Systems

- 13.2.3.1. Closed-loop systems

- 13.2.3.2. Adaptive stimulation

- 13.2.1. Stimulation-based

- 14. Global Brain-Computer Interfaces & Neuromodulators Market Analysis and Forecasts, By Control Mechanism

- 14.1. Key Findings

- 14.2. Brain-Computer Interfaces & Neuromodulators Market Size (Volume - Thousand Units and Value - US$ Mn), Analysis, and Forecasts, By Control Mechanism, 2021-2035

- 14.2.1. Voluntary Control

- 14.2.2. Involuntary Control

- 14.2.3. Hybrid Control

- 15. Global Brain-Computer Interfaces & Neuromodulators Market Analysis and Forecasts, by Region

- 15.1. Key Findings

- 15.2. Brain-Computer Interfaces & Neuromodulators Market Size (Volume - Thousand Units and Value - US$ Mn), Analysis, and Forecasts, by Region, 2021-2035

- 15.2.1. North America

- 15.2.2. Europe

- 15.2.3. Asia Pacific

- 15.2.4. Middle East

- 15.2.5. Africa

- 15.2.6. South America

- 16. North America Brain-Computer Interfaces & Neuromodulators Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. North America Brain-Computer Interfaces & Neuromodulators Market Size Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Technology

- 16.3.3. Signal Acquisition Method

- 16.3.4. Application

- 16.3.5. By End-User Type

- 16.3.6. Device Portability

- 16.3.7. Signal Processing

- 16.3.8. Therapeutic Modality

- 16.3.9. Control Mechanism

- 16.3.10. Country

- 16.3.10.1. USA

- 16.3.10.2. Canada

- 16.3.10.3. Mexico

- 16.4. USA Brain-Computer Interfaces & Neuromodulators Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Technology

- 16.4.4. Signal Acquisition Method

- 16.4.5. Application

- 16.4.6. By End-User Type

- 16.4.7. Device Portability

- 16.4.8. Signal Processing

- 16.4.9. Therapeutic Modality

- 16.4.10. Control Mechanism

- 16.5. Canada Brain-Computer Interfaces & Neuromodulators Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Technology

- 16.5.4. Signal Acquisition Method

- 16.5.5. Application

- 16.5.6. By End-User Type

- 16.5.7. Device Portability

- 16.5.8. Signal Processing

- 16.5.9. Therapeutic Modality

- 16.5.10. Control Mechanism

- 16.6. Mexico Brain-Computer Interfaces & Neuromodulators Market

- 16.6.1. Product Type

- 16.6.2. Technology

- 16.6.3. Signal Acquisition Method

- 16.6.4. Application

- 16.6.5. By End-User Type

- 16.6.6. Device Portability

- 16.6.7. Signal Processing

- 16.6.8. Therapeutic Modality

- 16.6.9. Control Mechanism

- 17. Europe Brain-Computer Interfaces & Neuromodulators Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Europe Brain-Computer Interfaces & Neuromodulators Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Technology

- 17.3.3. Signal Acquisition Method

- 17.3.4. Application

- 17.3.5. By End-User Type

- 17.3.6. Device Portability

- 17.3.7. Signal Processing

- 17.3.8. Therapeutic Modality

- 17.3.9. Control Mechanism

- 17.3.10. Country

- 17.3.10.1. Germany

- 17.3.10.2. United Kingdom

- 17.3.10.3. France

- 17.3.10.4. Italy

- 17.3.10.5. Spain

- 17.3.10.6. Netherlands

- 17.3.10.7. Nordic Countries

- 17.3.10.8. Poland

- 17.3.10.9. Russia & CIS

- 17.3.10.10. Rest of Europe

- 17.4. Germany Brain-Computer Interfaces & Neuromodulators Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Technology

- 17.4.4. Signal Acquisition Method

- 17.4.5. Application

- 17.4.6. By End-User Type

- 17.4.7. Device Portability

- 17.4.8. Signal Processing

- 17.4.9. Therapeutic Modality

- 17.4.10. Control Mechanism

- 17.5. United Kingdom Brain-Computer Interfaces & Neuromodulators Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Technology

- 17.5.4. Signal Acquisition Method

- 17.5.5. Application

- 17.5.6. By End-User Type

- 17.5.7. Device Portability

- 17.5.8. Signal Processing

- 17.5.9. Therapeutic Modality

- 17.5.10. Control Mechanism

- 17.6. France Brain-Computer Interfaces & Neuromodulators Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Technology

- 17.6.4. Signal Acquisition Method

- 17.6.5. Application

- 17.6.6. By End-User Type

- 17.6.7. Device Portability

- 17.6.8. Signal Processing

- 17.6.9. Therapeutic Modality

- 17.6.10. Control Mechanism

- 17.7. Italy Brain-Computer Interfaces & Neuromodulators Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Technology

- 17.7.4. Signal Acquisition Method

- 17.7.5. Application

- 17.7.6. By End-User Type

- 17.7.7. Device Portability

- 17.7.8. Signal Processing

- 17.7.9. Therapeutic Modality

- 17.7.10. Control Mechanism

- 17.8. Spain Brain-Computer Interfaces & Neuromodulators Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Technology

- 17.8.4. Signal Acquisition Method

- 17.8.5. Application

- 17.8.6. By End-User Type

- 17.8.7. Device Portability

- 17.8.8. Signal Processing

- 17.8.9. Therapeutic Modality

- 17.8.10. Control Mechanism

- 17.9. Netherlands Brain-Computer Interfaces & Neuromodulators Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Product Type

- 17.9.3. Technology

- 17.9.4. Signal Acquisition Method

- 17.9.5. Application

- 17.9.6. By End-User Type

- 17.9.7. Device Portability

- 17.9.8. Signal Processing

- 17.9.9. Therapeutic Modality

- 17.9.10. Control Mechanism

- 17.10. Nordic Countries Brain-Computer Interfaces & Neuromodulators Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Product Type

- 17.10.3. Technology

- 17.10.4. Signal Acquisition Method

- 17.10.5. Application

- 17.10.6. By End-User Type

- 17.10.7. Device Portability

- 17.10.8. Signal Processing

- 17.10.9. Therapeutic Modality

- 17.10.10. Control Mechanism

- 17.11. Poland Brain-Computer Interfaces & Neuromodulators Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Product Type

- 17.11.3. Technology

- 17.11.4. Signal Acquisition Method

- 17.11.5. Application

- 17.11.6. By End-User Type

- 17.11.7. Device Portability

- 17.11.8. Signal Processing

- 17.11.9. Therapeutic Modality

- 17.11.10. Control Mechanism

- 17.12. Russia & CIS Brain-Computer Interfaces & Neuromodulators Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Product Type

- 17.12.3. Technology

- 17.12.4. Signal Acquisition Method

- 17.12.5. Application

- 17.12.6. By End-User Type

- 17.12.7. Device Portability

- 17.12.8. Signal Processing

- 17.12.9. Therapeutic Modality

- 17.12.10. Control Mechanism

- 17.13. Rest of Europe Brain-Computer Interfaces & Neuromodulators Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Product Type

- 17.13.3. Technology

- 17.13.4. Signal Acquisition Method

- 17.13.5. Application

- 17.13.6. By End-User Type

- 17.13.7. Device Portability

- 17.13.8. Signal Processing

- 17.13.9. Therapeutic Modality

- 17.13.10. Control Mechanism

- 18. Asia Pacific Brain-Computer Interfaces & Neuromodulators Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. East Asia Brain-Computer Interfaces & Neuromodulators Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Technology

- 18.3.3. Signal Acquisition Method

- 18.3.4. Application

- 18.3.5. By End-User Type

- 18.3.6. Device Portability

- 18.3.7. Signal Processing

- 18.3.8. Therapeutic Modality

- 18.3.9. Control Mechanism

- 18.3.10. Country

- 18.3.10.1. China

- 18.3.10.2. India

- 18.3.10.3. Japan

- 18.3.10.4. South Korea

- 18.3.10.5. Australia and New Zealand

- 18.3.10.6. Indonesia

- 18.3.10.7. Malaysia

- 18.3.10.8. Thailand

- 18.3.10.9. Vietnam

- 18.3.10.10. Rest of Asia Pacific

- 18.4. China Brain-Computer Interfaces & Neuromodulators Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Technology

- 18.4.4. Signal Acquisition Method

- 18.4.5. Application

- 18.4.6. By End-User Type

- 18.4.7. Device Portability

- 18.4.8. Signal Processing

- 18.4.9. Therapeutic Modality

- 18.4.10. Control Mechanism

- 18.5. India Brain-Computer Interfaces & Neuromodulators Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Technology

- 18.5.4. Signal Acquisition Method

- 18.5.5. Application

- 18.5.6. By End-User Type

- 18.5.7. Device Portability

- 18.5.8. Signal Processing

- 18.5.9. Therapeutic Modality

- 18.5.10. Control Mechanism

- 18.6. Japan Brain-Computer Interfaces & Neuromodulators Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Technology

- 18.6.4. Signal Acquisition Method

- 18.6.5. Application

- 18.6.6. By End-User Type

- 18.6.7. Device Portability

- 18.6.8. Signal Processing

- 18.6.9. Therapeutic Modality

- 18.6.10. Control Mechanism

- 18.7. South Korea Brain-Computer Interfaces & Neuromodulators Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Technology

- 18.7.4. Signal Acquisition Method

- 18.7.5. Application

- 18.7.6. By End-User Type

- 18.7.7. Device Portability

- 18.7.8. Signal Processing

- 18.7.9. Therapeutic Modality

- 18.7.10. Control Mechanism

- 18.8. Australia and New Zealand Brain-Computer Interfaces & Neuromodulators Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Technology

- 18.8.4. Signal Acquisition Method

- 18.8.5. Application

- 18.8.6. By End-User Type

- 18.8.7. Device Portability

- 18.8.8. Signal Processing

- 18.8.9. Therapeutic Modality

- 18.8.10. Control Mechanism

- 18.9. Indonesia Brain-Computer Interfaces & Neuromodulators Market

- 18.9.1. Country Segmental Analysis

- 18.9.2. Product Type

- 18.9.3. Technology

- 18.9.4. Signal Acquisition Method

- 18.9.5. Application

- 18.9.6. By End-User Type

- 18.9.7. Device Portability

- 18.9.8. Signal Processing

- 18.9.9. Therapeutic Modality

- 18.9.10. Control Mechanism

- 18.10. Malaysia Brain-Computer Interfaces & Neuromodulators Market

- 18.10.1. Country Segmental Analysis

- 18.10.2. Product Type

- 18.10.3. Technology

- 18.10.4. Signal Acquisition Method

- 18.10.5. Application

- 18.10.6. By End-User Type

- 18.10.7. Device Portability

- 18.10.8. Signal Processing

- 18.10.9. Therapeutic Modality

- 18.10.10. Control Mechanism

- 18.11. Thailand Brain-Computer Interfaces & Neuromodulators Market

- 18.11.1. Country Segmental Analysis

- 18.11.2. Product Type

- 18.11.3. Technology

- 18.11.4. Signal Acquisition Method

- 18.11.5. Application

- 18.11.6. By End-User Type

- 18.11.7. Device Portability

- 18.11.8. Signal Processing

- 18.11.9. Therapeutic Modality

- 18.11.10. Control Mechanism

- 18.12. Vietnam Brain-Computer Interfaces & Neuromodulators Market

- 18.12.1. Country Segmental Analysis

- 18.12.2. Product Type

- 18.12.3. Technology

- 18.12.4. Signal Acquisition Method

- 18.12.5. Application

- 18.12.6. By End-User Type

- 18.12.7. Device Portability

- 18.12.8. Signal Processing

- 18.12.9. Therapeutic Modality

- 18.12.10. Control Mechanism

- 18.13. Rest of Asia Pacific Brain-Computer Interfaces & Neuromodulators Market

- 18.13.1. Country Segmental Analysis

- 18.13.2. Product Type

- 18.13.3. Technology

- 18.13.4. Signal Acquisition Method

- 18.13.5. Application

- 18.13.6. By End-User Type

- 18.13.7. Device Portability

- 18.13.8. Signal Processing

- 18.13.9. Therapeutic Modality

- 18.13.10. Control Mechanism

- 19. Middle East Brain-Computer Interfaces & Neuromodulators Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Middle East Brain-Computer Interfaces & Neuromodulators Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Technology

- 19.3.3. Signal Acquisition Method

- 19.3.4. Application

- 19.3.5. By End-User Type

- 19.3.6. Device Portability

- 19.3.7. Signal Processing

- 19.3.8. Therapeutic Modality

- 19.3.9. Control Mechanism

- 19.3.10. Country

- 19.3.10.1. Turkey

- 19.3.10.2. UAE

- 19.3.10.3. Saudi Arabia

- 19.3.10.4. Israel

- 19.3.10.5. Rest of Middle East

- 19.4. Turkey Brain-Computer Interfaces & Neuromodulators Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Technology

- 19.4.4. Signal Acquisition Method

- 19.4.5. Application

- 19.4.6. By End-User Type

- 19.4.7. Device Portability

- 19.4.8. Signal Processing

- 19.4.9. Therapeutic Modality

- 19.4.10. Control Mechanism

- 19.5. UAE Brain-Computer Interfaces & Neuromodulators Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Technology

- 19.5.4. Signal Acquisition Method

- 19.5.5. Application

- 19.5.6. By End-User Type

- 19.5.7. Device Portability

- 19.5.8. Signal Processing

- 19.5.9. Therapeutic Modality

- 19.5.10. Control Mechanism

- 19.6. Saudi Arabia Brain-Computer Interfaces & Neuromodulators Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Technology

- 19.6.4. Signal Acquisition Method

- 19.6.5. Application

- 19.6.6. By End-User Type

- 19.6.7. Device Portability

- 19.6.8. Signal Processing

- 19.6.9. Therapeutic Modality

- 19.6.10. Control Mechanism

- 19.7. Israel Brain-Computer Interfaces & Neuromodulators Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Product Type

- 19.7.3. Technology

- 19.7.4. Signal Acquisition Method

- 19.7.5. Application

- 19.7.6. By End-User Type

- 19.7.7. Device Portability

- 19.7.8. Signal Processing

- 19.7.9. Therapeutic Modality

- 19.7.10. Control Mechanism

- 19.8. Rest of Middle East Brain-Computer Interfaces & Neuromodulators Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Product Type

- 19.8.3. Technology

- 19.8.4. Signal Acquisition Method

- 19.8.5. Application

- 19.8.6. By End-User Type

- 19.8.7. Device Portability

- 19.8.8. Signal Processing

- 19.8.9. Therapeutic Modality

- 19.8.10. Control Mechanism

- 20. Africa Brain-Computer Interfaces & Neuromodulators Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Africa Brain-Computer Interfaces & Neuromodulators Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Product Type

- 20.3.2. Technology

- 20.3.3. Signal Acquisition Method

- 20.3.4. Application

- 20.3.5. By End-User Type

- 20.3.6. Device Portability

- 20.3.7. Signal Processing

- 20.3.8. Therapeutic Modality

- 20.3.9. Control Mechanism

- 20.3.10. Country

- 20.3.10.1. South Africa

- 20.3.10.2. Egypt

- 20.3.10.3. Nigeria

- 20.3.10.4. Algeria

- 20.3.10.5. Rest of Africa

- 20.4. South Africa Brain-Computer Interfaces & Neuromodulators Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Product Type

- 20.4.3. Technology

- 20.4.4. Signal Acquisition Method

- 20.4.5. Application

- 20.4.6. By End-User Type

- 20.4.7. Device Portability

- 20.4.8. Signal Processing

- 20.4.9. Therapeutic Modality

- 20.4.10. Control Mechanism

- 20.5. Egypt Brain-Computer Interfaces & Neuromodulators Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Product Type

- 20.5.3. Technology

- 20.5.4. Signal Acquisition Method

- 20.5.5. Application

- 20.5.6. By End-User Type

- 20.5.7. Device Portability

- 20.5.8. Signal Processing

- 20.5.9. Therapeutic Modality

- 20.5.10. Control Mechanism

- 20.6. Nigeria Brain-Computer Interfaces & Neuromodulators Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Product Type

- 20.6.3. Technology

- 20.6.4. Signal Acquisition Method

- 20.6.5. Application

- 20.6.6. By End-User Type

- 20.6.7. Device Portability

- 20.6.8. Signal Processing

- 20.6.9. Therapeutic Modality

- 20.6.10. Control Mechanism

- 20.7. Algeria Brain-Computer Interfaces & Neuromodulators Market

- 20.7.1. Country Segmental Analysis

- 20.7.2. Product Type

- 20.7.3. Technology

- 20.7.4. Signal Acquisition Method

- 20.7.5. Application

- 20.7.6. By End-User Type

- 20.7.7. Device Portability

- 20.7.8. Signal Processing

- 20.7.9. Therapeutic Modality

- 20.7.10. Control Mechanism

- 20.8. Rest of Africa Brain-Computer Interfaces & Neuromodulators Market

- 20.8.1. Country Segmental Analysis

- 20.8.2. Product Type

- 20.8.3. Technology

- 20.8.4. Signal Acquisition Method

- 20.8.5. Application

- 20.8.6. By End-User Type

- 20.8.7. Device Portability

- 20.8.8. Signal Processing

- 20.8.9. Therapeutic Modality

- 20.8.10. Control Mechanism

- 21. South America Brain-Computer Interfaces & Neuromodulators Market Analysis

- 21.1. Key Segment Analysis

- 21.2. Regional Snapshot

- 21.3. Central and South Africa Brain-Computer Interfaces & Neuromodulators Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 21.3.1. Product Type

- 21.3.2. Technology

- 21.3.3. Signal Acquisition Method

- 21.3.4. Application

- 21.3.5. By End-User Type

- 21.3.6. Device Portability

- 21.3.7. Signal Processing

- 21.3.8. Therapeutic Modality

- 21.3.9. Control Mechanism

- 21.3.10. Country

- 21.3.10.1. Brazil

- 21.3.10.2. Argentina

- 21.3.10.3. Rest of South America

- 21.4. Brazil Brain-Computer Interfaces & Neuromodulators Market

- 21.4.1. Country Segmental Analysis

- 21.4.2. Product Type

- 21.4.3. Technology

- 21.4.4. Signal Acquisition Method

- 21.4.5. Application

- 21.4.6. By End-User Type

- 21.4.7. Device Portability

- 21.4.8. Signal Processing

- 21.4.9. Therapeutic Modality

- 21.4.10. Control Mechanism

- 21.5. Argentina Brain-Computer Interfaces & Neuromodulators Market

- 21.5.1. Country Segmental Analysis

- 21.5.2. Product Type

- 21.5.3. Technology

- 21.5.4. Signal Acquisition Method

- 21.5.5. Application

- 21.5.6. By End-User Type

- 21.5.7. Device Portability

- 21.5.8. Signal Processing

- 21.5.9. Therapeutic Modality

- 21.5.10. Control Mechanism

- 21.6. Rest of South America Brain-Computer Interfaces & Neuromodulators Market

- 21.6.1. Country Segmental Analysis

- 21.6.2. Product Type

- 21.6.3. Technology

- 21.6.4. Signal Acquisition Method

- 21.6.5. Application

- 21.6.6. By End-User Type

- 21.6.7. Device Portability

- 21.6.8. Signal Processing

- 21.6.9. Therapeutic Modality

- 21.6.10. Control Mechanism

- 22. Key Players/ Company Profile

- 22.1. Abbott Laboratories

- 22.1.1. Company Details/ Overview

- 22.1.2. Company Financials

- 22.1.3. Key Customers and Competitors

- 22.1.4. Business/ Industry Portfolio

- 22.1.5. Product Portfolio/ Specification Details

- 22.1.6. Pricing Data

- 22.1.7. Strategic Overview

- 22.1.8. Recent Developments

- 22.2. Blackrock Neurotech

- 22.3. Boston Scientific Corporation

- 22.4. BrainCo Inc.

- 22.5. Cogito Corporation

- 22.6. CTRL-labs (Meta)

- 22.7. Emotiv Inc.

- 22.8. g.tec Medical Engineering

- 22.9. Kernel Inc.

- 22.10. LivaNova PLC

- 22.11. Medtronic plc

- 22.12. MindMaze SA

- 22.13. Neurable Inc.

- 22.14. Neural Dust (UC Berkeley)

- 22.15. Neuralink Corporation

- 22.16. NeuroSky Inc.

- 22.17. NextMind (Snap Inc.)

- 22.18. OpenBCI

- 22.19. Paradromics Inc.

- 22.20. Synchron Inc.

- 22.21. Other Key Players

- 22.1. Abbott Laboratories

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data