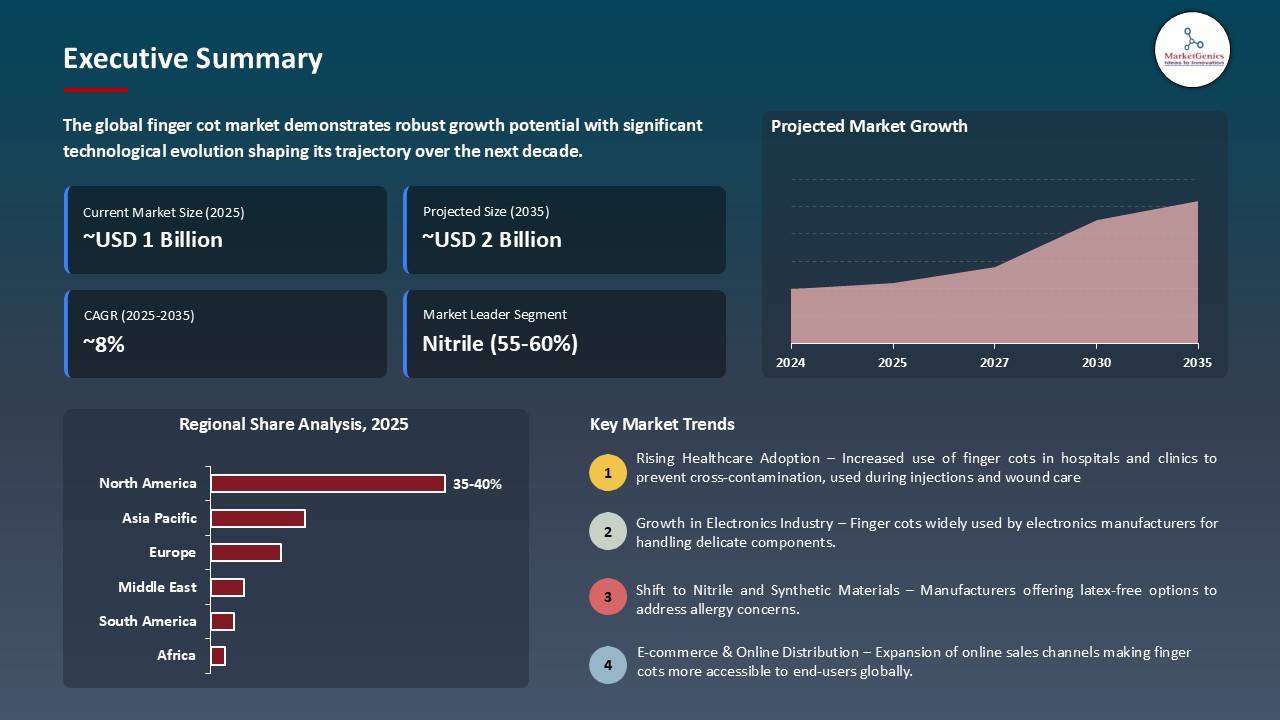

- The global finger cot market is valued at USD 0.9 billion in 2025.

- The market is projected to grow at a CAGR of 7.8% during the forecast period of 2026 to 2035.

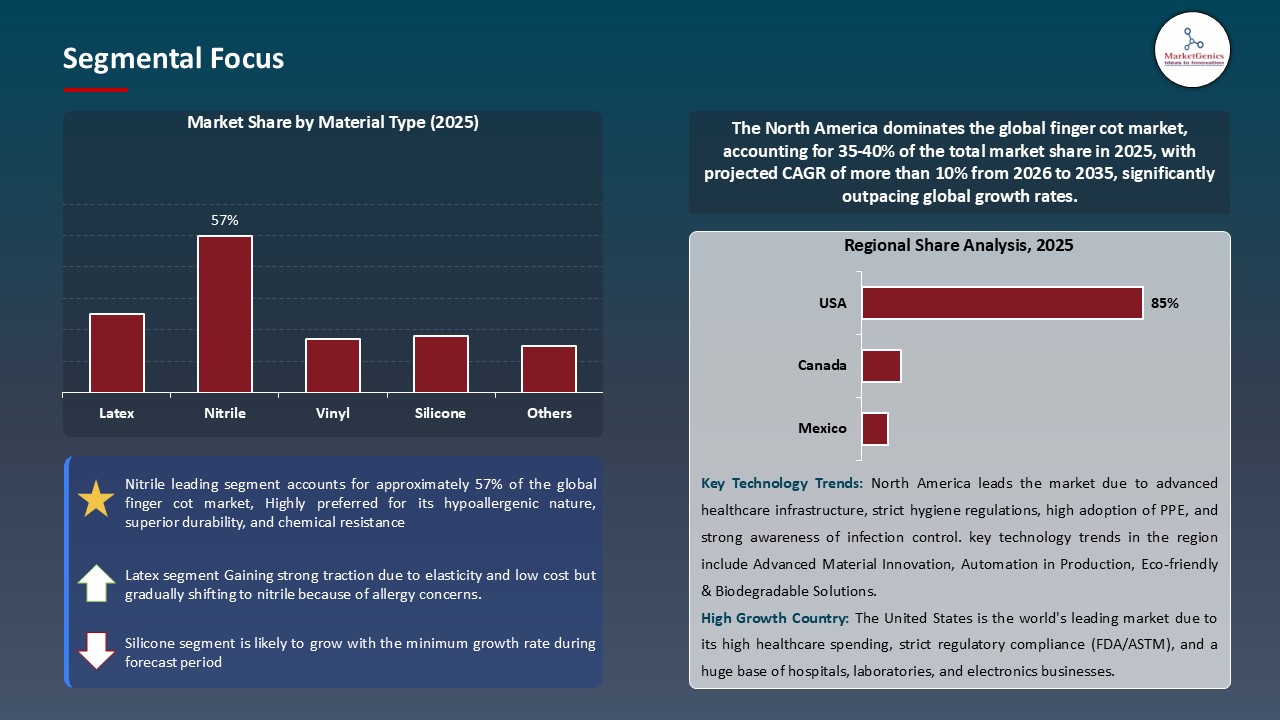

- The nitrile segment dominates the global finger cot market, accounting for around 57% share, due to its hypoallergenic properties, superior durability, and chemical resistance, making it the preferred choice across healthcare, laboratory, and industrial applications

- Growing focus on infection control and hygiene in hospitals and laboratories is driving rising demand for finger cots to prevent cross-contamination during medical procedures and laboratory handling

- Increasing use of finger cots in electronics and precision manufacturing to protect sensitive components from dust, oils, and static is boosting market demand globally

- The top five players account for over 35% of the global finger-cot-market in 2025

- In May 2025, Ansell introduced its BioClean finger cots — made of 100% nitrile, powder‑free and incorporating a proprietary antistatic agent to minimize electrostatic discharge

- In November 2025, Histologics LLC highlighted its Soft K-Cot finger cot as part of its advanced wound care portfolio. Designed for gentle and precise tissue management, the Soft K-Cot provides clinicians with a protective barrier

- Global Finger Cot market is likely to create the total forecasting opportunity of ~USD 1 Bn till 2035.

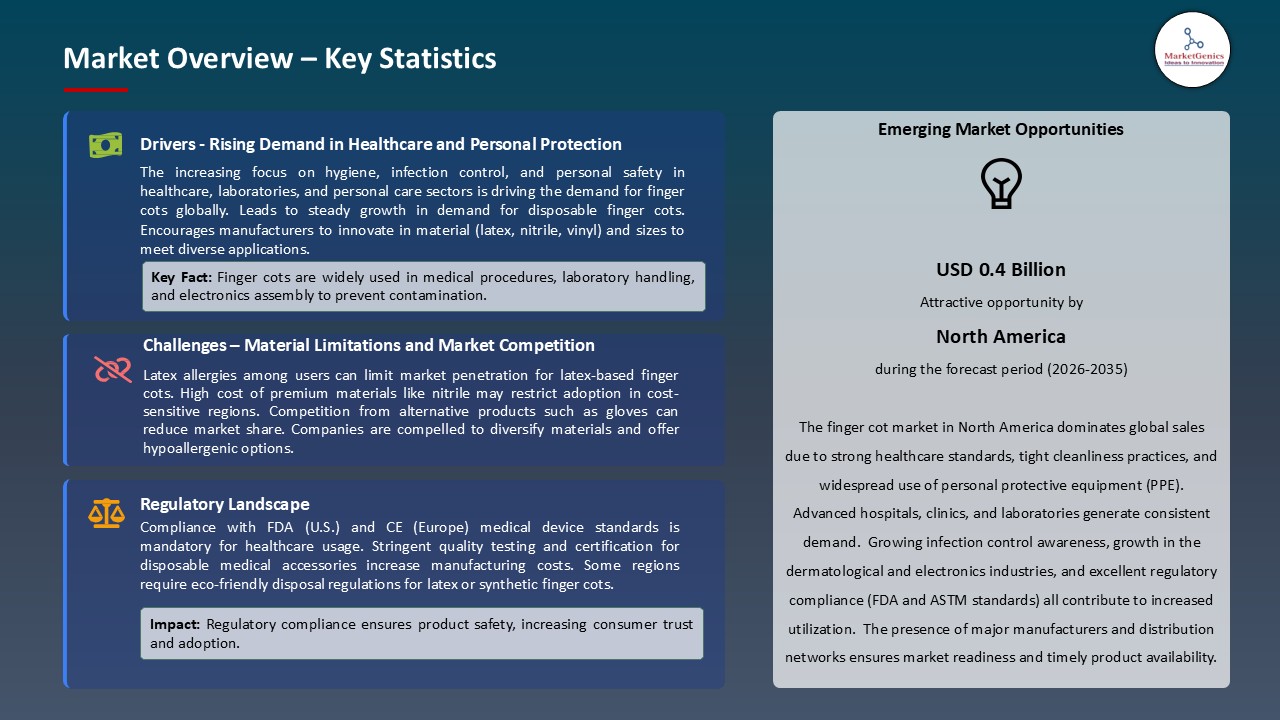

- North America’s finger cot market offers strong opportunities due to advanced healthcare infrastructure, stringent hygiene regulations, high PPE adoption, and growing demand in medical, laboratory, and electronics sectors.

- The increasing focus on infection control and patient safety in health care facilities is increasing the demand of finger cot market. Hospitals, clinics, laboratories, and surgical centers are gaining more emphasis on prevention measures to avoid cross-contamination throughout the medical procedure, sterile technical instrument handling, and the treatment of minor wounds. Finger cots offer an easy shield of efficient protection of transmitting pathogens between patients, medical staff, and equipment.

- Increased cases of minimally invasive surgery, outpatient surgery and special lab work only add to the importance of extreme care of hygiene at the fingertip level. Moreover, the strict regulatory policies and compliance requirements to sterilization, single use medical devices, and hygiene practices are forcing medical professionals to find protective measures like finger cots.

- On Medline, finger cots that are lightly powdered are available to cover the finger wounds and stop cross-contamination and infection. These cots can be used in a number of healthcare functions such as applying medication in open wounds and in procedures such as rectal tests to help provide a barrier to infection to caregivers.

- The growing attention to infection prevention and high hygiene standards are evolving into the use of finger cots as a key barrier to effective and safe patient care.

- The first limitation that is very limiting to the finger cot market is the occurrence of allergic reactions to some materials and therefore to natural latex. Type I hypersensitivity reactions can be aroused by latex finger cots that need to be used because of their elasticity, comfort, and cost-effectiveness. These reactions may be mild skin irritation and rashes, and more serious symptoms may include respiratory distress or anaphylaxis in the extreme cases.

- The end user of the latex allergy risk, not only to the end-users such as patients and healthcare workers but also to the liability and compliance aspect of the manufacturers and healthcare providers. Consequently, alternative materials like nitrile or vinyl are also desired, but in reality, they are costlier and do not necessarily offer an equivalent tactile feel or finish compared to latex. This problem makes the extensive use in some of the areas or environments where the financial limits are strict.

- Therefore, issues of allergy are a major constraint, which shapes the design of the product and the market penetration plans.

- The growing worldwide attention to sustainability and practices that are environmentally friendly is presenting huge opportunities to the finger cot market. Manufacturers can also produce eco and biodegradable finger cots out of plant or recyclable materials and lower the environmental impact of the finger cots in comparison with traditional latex or nitrile products. These innovation types can attract the eco-friendly healthcare systems, laboratories, and accuracy industries, which focus on the hygiene and sustainability.

- The implementation of biodegradable finger cots can also assist companies to meet the new regulations on medical and industrial waste disposal, as well as distinguish their products in a competitive market. This tendency is in line with the larger scope of introducing green operations in the healthcare and manufacturing fields.

- Spores finger cots is created to be used in the precision industries of Medlabio, and it provides protection, comfort, and increased grip to the delicate job. They are offered in cut tip, straight beaded and rolled beaded styles and have high elasticity, sensitivity of touch and anti-static surfaces. It is important to note that these finger cots are biodegradable and friendly to the environment, which can enhance a sustainable approach to the environment by using it in manufacturing microelectronics, optical disk, and semiconductor.

- The trend of going green and biodegradable finger cots creates a strategic position of manufacturers to address sustainability objectives and cater to the healthcare systems and precision industries.

- The global finger cot market is currently experiencing a substantial switch in single use and disposable products due to the necessity of limiting cross-contamination in healthcare, laboratory, and precision industry applications. Finger cots are disposable to close the pathway of transfer of the pathogens or contaminants between patients, samples or delicate equipment and add more safety and hygiene standards.

- Powder-free versions are gaining more popularity, which lowers chances of skin irritation and latex-induced allergic reactions, therefore are acceptable to people with sensitive skin. This has given rise to a marked trend especially in hospitals, clinics, research laboratories and electronics production where high standards of cleanliness are of paramount importance. Disposability and skin-safe materials will likely remain influential factors in product development and adoption in the world.

- A good example of this trend is the AEROSHIELD Large Nitrile Finger Cots (Box of 100) which represents the shift towards single-use, powder-free finger cots in medical and laboratory environments. They are made of tough nitrile which gives them better flexibility, puncture resistance, and comfort to use on a long-term basis. The powder-free construction makes it allergy-free, the ambidextrous, anti-static and pre-rolled properties guarantee hygiene, accuracy and ease of use, which is in line with recent trends in preference of disposable, safe and efficient finger protection.

- The increased interest in single-use, powder-free finger cots, such as AEROSHIELD, are indicative of the fact that the market puts an emphasis on safety, hygiene, and convenient, easy-to-use solutions in the healthcare and lab setting.

- Nitrile finger cots are now dominating the finger cotton market across the globe since it is more durable, resistant to chemicals, and hypoallergenic than the natural latex and vinyl finger cots. They are also resistant to punctures, oils and chemicals and as such find use in healthcare, laboratories and precision industrial settings such as electronics and semiconductor assembly.

- Moreover, nitrile is latex free which takes care of allergy issues and more sensitive users are adopting it. Flexibility, durability and adherence to different industrial and medical requirements have made nitrile even more superior as the material of choice. This means that nitrile finger cots will continue to dominate the market as awareness about latex allergies and need of high-performance protective solutions are still on the increase.

- QRP Gloves, Inc. launched its 9C Nifty Nitrile Latex-Free Fingercots, which are designed to be used in the industrial and cleanroom environments. These finger cots are 100 percent nitrile, ESD-safe, and meet ANSI/ESD S20.20 -2014, ASTM and IEST-RP-CC 005.3 standards and are compatible with Class 100 (ISO5/M3.5) setting. They are made to work with the static sensors in the industries like aerospace, defense, and marine electronics as well as in the IC manufacturing which offers a high level of protection and performance by being latex free.

- Nitrile finger cots still dominate the market through durable, chemical resistant and allergy free products available in health care and precision industry applications.

- North America has the dominant finger cots market, due to its developed healthcare system, strict hygiene requirements, and adoption of contemporary medical and industrial solutions. The U.S. and Canada are the countries that place the emphasis on the infection control, preciseness in handling, and prevention of cross-contamination, which greatly increase the demand on the protective solutions, including finger cots.

- Further market development is reinforced by the availability of major medical device producers and manufacturers, and fast adoption of technology in both healthcare and electronic manufacturing. Also, more people have been made aware of latex allergies and the need to use latex-free products, including nitrile and vinyl finger cots, which has increased the adoption of the products. The dominance of North America also comes up with favorable regulatory frameworks, strong purchasing power, and increased attention to occupational safety both in clean room and industrial settings.

- Medline Industries, LP., amajor manufacturers and distributors of healthcare supplies in the U.S., specializing in finger cots, or those that can be used by individuals not allergic to nitrates or latex. With its vast healthcare system, Medline can guarantee quick access to quality protective solutions. The company is also innovation oriented and offers finger cots that have increased tactile sensitivity, anti-static ability and ergonomic design and yet still meets the regulatory and environmental standards.

- The reason behind sustained demand and leadership in the finger cot market is through North America and the well-established healthcare infrastructures, regulatory backing, and innovative manufacturers such as Medline.

- In May 2025, Ansell unveiled its BioClean finger cots, a 100 percent nitrile powder-free product with a proprietary antistatic additive designed to reduce electrostatic release. They are washed using deionized (DI) water and are therefore suitable in small-part manipulation in Biotechnology, semiconductor and electronics assembly where no full gloves are needed.

- In November 2025, Histologics LLC announced its Soft K-Cot finger cot as the addition to its wound care advanced portfolio. The Soft K-Cot is designed to offer clinicians a clean and gentle handling of the tissues while providing them with a protective covering, allowing them to complete the debidement and biopsy and wound assessment process without trauma to the patients and to perform the operations more efficiently.

- United States

- Canada

- Mexico

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic Countries

- Poland

- Russia & CIS

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Turkey

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Nigeria

- Algeria

- Brazil

- Argentina

- ACL Staticide Inc.

- Ansell Limited

- Honeywell International Inc.

- Shandong Yuyuan Latex

- KIRGEN Co., Ltd.

- Dou Yee Enterprises (S) Pte Ltd.

- Hartalega Holdings Berhad

- Jiangsu Cureguard Glove Co., Ltd.

- Kanam Latex Industries

- Kossan Rubber Industries Bhd

- Oriental Rubber Industries (ORI)

- Botron Company Inc.

- QRP Gloves (QRP, Inc.)

- Rubberex Corporation (M) Berhad

- Semperit AG Holding

- Gloves Co., Ltd.

- Shenzhen Maxsharer Technology Co., Ltd.

- Superior Glove Works Ltd.

- Supermax Corporation Berhad

- Shijiazhuang Hongray Group

- Top Glove Corporation Bhd

- Zhanjiang Jiali Glove Products Co., Ltd.

- Other Key Players

- Latex

- Natural Rubber Latex

- Synthetic Latex

- Nitrile

- Powder-Free Nitrile

- Powdered Nitrile

- Vinyl

- Silicone

- Polyethylene

- Rubber (Non-Latex)

- Disposable Finger Cots

- Reusable Finger Cots

- Anti-Static Finger Cots

- Dissipative

- Conductive

- Textured Finger Cots

- Smooth Finger Cots

- Sterile Finger Cots

- Non-Sterile Finger Cots

- Thin (Below 0.08mm)

- Medium (0.08mm - 0.15mm)

- Thick (Above 0.15mm)

- Powdered

- Cornstarch Powdered

- Modified Cornstarch Powdered

- Powder-Free

- Chlorinated

- Polymer Coated

- Smooth Surface

- Textured Surface

- Micro-Textured

- Macro-Textured

- Patterned Surface

- Bulk Packaging

- Bags (100 pieces)

- Bags (500 pieces)

- Bags (1000+ pieces)

- Dispenser Boxes

- Individual Packaging (Sterile)

- Roll Packaging

- Direct Sales

- B2B Direct

- Manufacturer to End-User

- Others

- Indirect Sales

- Distributors

- Wholesalers

- Retailers

- Others

- Online Sales

- E-commerce Platforms

- Company Websites

- Others

- Healthcare & Medical

- Surgical Procedures

- Wound Dressing & Care

- Medical Examinations

- Laboratory Testing

- Pharmaceutical Handling

- Others

- Electronics & Semiconductor

- Circuit Board Assembly

- Component Handling

- Semiconductor Manufacturing

- Electronic Device Assembly

- Quality Inspection

- Precision Assembly Work

- Others

- Food & Beverage

- Food Processing

- Food Packaging

- Food Handling & Preparation

- Quality Control & Inspection

- Catering Services

- Others

- Pharmaceutical

- Drug Manufacturing

- Tablet Handling

- Quality Control Testing

- Research & Development

- Compounding

- Others

- Cosmetics & Beauty

- Printing & Arts

- Laboratory & Research

- Industrial Manufacturing

- Janitorial & Cleaning Services

- Other End-users

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Finger Cot Market Outlook

- 2.1.1. Finger Cot Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Finger Cot Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Healthcare & Pharmaceutical Industry Overview, 2025

- 3.1.1. Healthcare & Pharmaceutical Industry Ecosystem Analysis

- 3.1.2. Key Trends for Healthcare & Pharmaceutical Industry

- 3.1.3. Regional Distribution for Healthcare & Pharmaceutical Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Healthcare & Pharmaceutical Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand in healthcare and medical procedures.

- 4.1.1.2. Increasing awareness of hygiene and infection control.

- 4.1.1.3. Growth in electronics and precision manufacturing industries.

- 4.1.2. Restraints

- 4.1.2.1. High cost of premium finger cots.

- 4.1.2.2. Availability of alternative protective gloves.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Manufacturers

- 4.4.3. Distributors/ Dealers

- 4.4.4. End-users

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Finger Cot Market Demand

- 4.7.1. Historical Market Size –Value (US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size –Value (US$ Bn), 2026–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Finger Cot Market Analysis, By Material Type

- 6.1. Key Segment Analysis

- 6.2. Finger Cot Market Size (Value - US$ Bn), Analysis, and Forecasts, By Material Type, 2021-2035

- 6.2.1. Latex

- 6.2.1.1. Natural Rubber Latex

- 6.2.1.2. Synthetic Latex

- 6.2.2. Nitrile

- 6.2.2.1. Powder-Free Nitrile

- 6.2.2.2. Powdered Nitrile

- 6.2.3. Vinyl

- 6.2.4. Silicone

- 6.2.5. Polyethylene

- 6.2.6. Rubber (Non-Latex)

- 6.2.1. Latex

- 7. Global Finger Cot Market Analysis, By Product Type

- 7.1. Key Segment Analysis

- 7.2. Finger Cot Market Size (Value - US$ Bn), Analysis, and Forecasts, By Product Type, 2021-2035

- 7.2.1. Disposable Finger Cots

- 7.2.2. Reusable Finger Cots

- 7.2.3. Anti-Static Finger Cots

- 7.2.3.1. Dissipative

- 7.2.3.2. Conductive

- 7.2.4. Textured Finger Cots

- 7.2.5. Smooth Finger Cots

- 7.2.6. Sterile Finger Cots

- 7.2.7. Non-Sterile Finger Cots

- 8. Global Finger Cot Market Analysis,By Thickness

- 8.1. Key Segment Analysis

- 8.2. Finger Cot Market Size (Value - US$ Bn), Analysis, and Forecasts, By Thickness, 2021-2035

- 8.2.1. Thin (Below 0.08mm)

- 8.2.2. Medium (0.08mm - 0.15mm)

- 8.2.3. Thick (Above 0.15mm)

- 9. Global Finger Cot Market Analysis, By Powder Content

- 9.1. Key Segment Analysis

- 9.2. Finger Cot Market Size (Value - US$ Bn), Analysis, and Forecasts, By Powder Content, 2021-2035

- 9.2.1. Powdered

- 9.2.1.1. Cornstarch Powdered

- 9.2.1.2. Modified Cornstarch Powdered

- 9.2.2. Powder-Free

- 9.2.2.1. Chlorinated

- 9.2.2.2. Polymer Coated

- 9.2.1. Powdered

- 10. Global Finger Cot Market Analysis, By Surface Texture

- 10.1. Key Segment Analysis

- 10.2. Finger Cot Market Size (Value - US$ Bn), Analysis, and Forecasts, By Surface Texture, 2021-2035

- 10.2.1. Smooth Surface

- 10.2.2. Textured Surface

- 10.2.2.1. Micro-Textured

- 10.2.2.2. Macro-Textured

- 10.2.3. Patterned Surface

- 11. Global Finger Cot Market Analysis, By Packaging Type

- 11.1. Key Segment Analysis

- 11.2. Finger Cot Market Size (Value - US$ Bn), Analysis, and Forecasts, By Packaging Type, 2021-2035

- 11.2.1. Bulk Packaging

- 11.2.1.1. Bags (100 pieces)

- 11.2.1.2. Bags (500 pieces)

- 11.2.1.3. Bags (1000+ pieces)

- 11.2.2. Dispenser Boxes

- 11.2.3. Individual Packaging (Sterile)

- 11.2.4. Roll Packaging

- 11.2.1. Bulk Packaging

- 12. Global Finger Cot Market Analysis, By Distribution Channel

- 12.1. Key Segment Analysis

- 12.2. Finger Cot Market Size (Value - US$ Bn), Analysis, and Forecasts, By Distribution Channel, 2021-2035

- 12.2.1. Direct Sales

- 12.2.1.1. B2B Direct

- 12.2.1.2. Manufacturer to End-User

- 12.2.1.3. Others

- 12.2.2. Indirect Sales

- 12.2.2.1. Distributors

- 12.2.2.2. Wholesalers

- 12.2.2.3. Retailers

- 12.2.2.4. Others

- 12.2.3. Online Sales

- 12.2.3.1. E-commerce Platforms

- 12.2.3.2. Company Websites

- 12.2.3.3. Others

- 12.2.1. Direct Sales

- 13. Global Finger Cot Market Analysis, By End-users

- 13.1. Key Segment Analysis

- 13.2. Finger Cot Market Size (Value - US$ Bn), Analysis, and Forecasts, By End-users, 2021-2035

- 13.2.1. Healthcare & Medical

- 13.2.1.1. Surgical Procedures

- 13.2.1.2. Wound Dressing & Care

- 13.2.1.3. Medical Examinations

- 13.2.1.4. Laboratory Testing

- 13.2.1.5. Pharmaceutical Handling

- 13.2.1.6. Others

- 13.2.2. Electronics & Semiconductor

- 13.2.2.1. Circuit Board Assembly

- 13.2.2.2. Component Handling

- 13.2.2.3. Semiconductor Manufacturing

- 13.2.2.4. Electronic Device Assembly

- 13.2.2.5. Quality Inspection

- 13.2.2.6. Precision Assembly Work

- 13.2.2.7. Others

- 13.2.3. Food & Beverage

- 13.2.3.1. Food Processing

- 13.2.3.2. Food Packaging

- 13.2.3.3. Food Handling & Preparation

- 13.2.3.4. Quality Control & Inspection

- 13.2.3.5. Catering Services

- 13.2.3.6. Others

- 13.2.4. Pharmaceutical

- 13.2.4.1. Drug Manufacturing

- 13.2.4.2. Tablet Handling

- 13.2.4.3. Quality Control Testing

- 13.2.4.4. Research & Development

- 13.2.4.5. Compounding

- 13.2.4.6. Others

- 13.2.5. Cosmetics & Beauty

- 13.2.5.1. Printing & Arts

- 13.2.5.2. Laboratory & Research

- 13.2.5.3. Industrial Manufacturing

- 13.2.5.4. Janitorial & Cleaning Services

- 13.2.5.5. Other End-users

- 13.2.1. Healthcare & Medical

- 14. Global Finger Cot Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Finger Cot Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Finger Cot Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Finger Cot Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Material Type

- 15.3.2. Product Type

- 15.3.3. Thickness

- 15.3.4. Powder Content

- 15.3.5. Surface Texture

- 15.3.6. Packaging Type

- 15.3.7. Distribution Channel

- 15.3.8. End-Users

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Finger Cot Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Material Type

- 15.4.3. Product Type

- 15.4.4. Thickness

- 15.4.5. Powder Content

- 15.4.6. Surface Texture

- 15.4.7. Packaging Type

- 15.4.8. Distribution Channel

- 15.4.9. End-Users

- 15.5. Canada Finger Cot Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Material Type

- 15.5.3. Product Type

- 15.5.4. Thickness

- 15.5.5. Powder Content

- 15.5.6. Surface Texture

- 15.5.7. Packaging Type

- 15.5.8. Distribution Channel

- 15.5.9. End-Users

- 15.6. Mexico Finger Cot Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Material Type

- 15.6.3. Product Type

- 15.6.4. Thickness

- 15.6.5. Powder Content

- 15.6.6. Surface Texture

- 15.6.7. Packaging Type

- 15.6.8. Distribution Channel

- 15.6.9. End-Users

- 16. Europe Finger Cot Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Finger Cot Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Material Type

- 16.3.2. Product Type

- 16.3.3. Thickness

- 16.3.4. Powder Content

- 16.3.5. Surface Texture

- 16.3.6. Packaging Type

- 16.3.7. Distribution Channel

- 16.3.8. End-Users

- 16.3.9. Country

- 16.3.9.1. Germany

- 16.3.9.2. United Kingdom

- 16.3.9.3. France

- 16.3.9.4. Italy

- 16.3.9.5. Spain

- 16.3.9.6. Netherlands

- 16.3.9.7. Nordic Countries

- 16.3.9.8. Poland

- 16.3.9.9. Russia & CIS

- 16.3.9.10. Rest of Europe

- 16.4. Germany Finger Cot Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Material Type

- 16.4.3. Product Type

- 16.4.4. Thickness

- 16.4.5. Powder Content

- 16.4.6. Surface Texture

- 16.4.7. Packaging Type

- 16.4.8. Distribution Channel

- 16.4.9. End-Users

- 16.5. United Kingdom Finger Cot Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Material Type

- 16.5.3. Product Type

- 16.5.4. Thickness

- 16.5.5. Powder Content

- 16.5.6. Surface Texture

- 16.5.7. Packaging Type

- 16.5.8. Distribution Channel

- 16.5.9. End-Users

- 16.6. France Finger Cot Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Material Type

- 16.6.3. Product Type

- 16.6.4. Thickness

- 16.6.5. Powder Content

- 16.6.6. Surface Texture

- 16.6.7. Packaging Type

- 16.6.8. Distribution Channel

- 16.6.9. End-Users

- 16.7. Italy Finger Cot Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Material Type

- 16.7.3. Product Type

- 16.7.4. Thickness

- 16.7.5. Powder Content

- 16.7.6. Surface Texture

- 16.7.7. Packaging Type

- 16.7.8. Distribution Channel

- 16.7.9. End-Users

- 16.8. Spain Finger Cot Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Material Type

- 16.8.3. Product Type

- 16.8.4. Thickness

- 16.8.5. Powder Content

- 16.8.6. Surface Texture

- 16.8.7. Packaging Type

- 16.8.8. Distribution Channel

- 16.8.9. End-Users

- 16.9. Netherlands Finger Cot Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Material Type

- 16.9.3. Product Type

- 16.9.4. Thickness

- 16.9.5. Powder Content

- 16.9.6. Surface Texture

- 16.9.7. Packaging Type

- 16.9.8. Distribution Channel

- 16.9.9. End-Users

- 16.10. Nordic Countries Finger Cot Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Material Type

- 16.10.3. Product Type

- 16.10.4. Thickness

- 16.10.5. Powder Content

- 16.10.6. Surface Texture

- 16.10.7. Packaging Type

- 16.10.8. Distribution Channel

- 16.10.9. End-Users

- 16.11. Poland Finger Cot Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Material Type

- 16.11.3. Product Type

- 16.11.4. Thickness

- 16.11.5. Powder Content

- 16.11.6. Surface Texture

- 16.11.7. Packaging Type

- 16.11.8. Distribution Channel

- 16.11.9. End-Users

- 16.12. Russia & CIS Finger Cot Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Material Type

- 16.12.3. Product Type

- 16.12.4. Thickness

- 16.12.5. Powder Content

- 16.12.6. Surface Texture

- 16.12.7. Packaging Type

- 16.12.8. Distribution Channel

- 16.12.9. End-Users

- 16.13. Rest of Europe Finger Cot Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Material Type

- 16.13.3. Product Type

- 16.13.4. Thickness

- 16.13.5. Powder Content

- 16.13.6. Surface Texture

- 16.13.7. Packaging Type

- 16.13.8. Distribution Channel

- 16.13.9. End-Users

- 17. Asia Pacific Finger Cot Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Asia Pacific Finger Cot Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Material Type

- 17.3.2. Product Type

- 17.3.3. Thickness

- 17.3.4. Powder Content

- 17.3.5. Surface Texture

- 17.3.6. Packaging Type

- 17.3.7. Distribution Channel

- 17.3.8. End-Users

- 17.3.9. Country

- 17.3.9.1. China

- 17.3.9.2. India

- 17.3.9.3. Japan

- 17.3.9.4. South Korea

- 17.3.9.5. Australia and New Zealand

- 17.3.9.6. Indonesia

- 17.3.9.7. Malaysia

- 17.3.9.8. Thailand

- 17.3.9.9. Vietnam

- 17.3.9.10. Rest of Asia Pacific

- 17.4. China Finger Cot Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Material Type

- 17.4.3. Product Type

- 17.4.4. Thickness

- 17.4.5. Powder Content

- 17.4.6. Surface Texture

- 17.4.7. Packaging Type

- 17.4.8. Distribution Channel

- 17.4.9. End-Users

- 17.5. India Finger Cot Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Material Type

- 17.5.3. Product Type

- 17.5.4. Thickness

- 17.5.5. Powder Content

- 17.5.6. Surface Texture

- 17.5.7. Packaging Type

- 17.5.8. Distribution Channel

- 17.5.9. End-Users

- 17.6. Japan Finger Cot Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Material Type

- 17.6.3. Product Type

- 17.6.4. Thickness

- 17.6.5. Powder Content

- 17.6.6. Surface Texture

- 17.6.7. Packaging Type

- 17.6.8. Distribution Channel

- 17.6.9. End-Users

- 17.7. South Korea Finger Cot Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Material Type

- 17.7.3. Product Type

- 17.7.4. Thickness

- 17.7.5. Powder Content

- 17.7.6. Surface Texture

- 17.7.7. Packaging Type

- 17.7.8. Distribution Channel

- 17.7.9. End-Users

- 17.8. Australia and New Zealand Finger Cot Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Material Type

- 17.8.3. Product Type

- 17.8.4. Thickness

- 17.8.5. Powder Content

- 17.8.6. Surface Texture

- 17.8.7. Packaging Type

- 17.8.8. Distribution Channel

- 17.8.9. End-Users

- 17.9. Indonesia Finger Cot Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Material Type

- 17.9.3. Product Type

- 17.9.4. Thickness

- 17.9.5. Powder Content

- 17.9.6. Surface Texture

- 17.9.7. Packaging Type

- 17.9.8. Distribution Channel

- 17.9.9. End-Users

- 17.10. Malaysia Finger Cot Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Material Type

- 17.10.3. Product Type

- 17.10.4. Thickness

- 17.10.5. Powder Content

- 17.10.6. Surface Texture

- 17.10.7. Packaging Type

- 17.10.8. Distribution Channel

- 17.10.9. End-Users

- 17.11. Thailand Finger Cot Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Material Type

- 17.11.3. Product Type

- 17.11.4. Thickness

- 17.11.5. Powder Content

- 17.11.6. Surface Texture

- 17.11.7. Packaging Type

- 17.11.8. Distribution Channel

- 17.11.9. End-Users

- 17.12. Vietnam Finger Cot Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Material Type

- 17.12.3. Product Type

- 17.12.4. Thickness

- 17.12.5. Powder Content

- 17.12.6. Surface Texture

- 17.12.7. Packaging Type

- 17.12.8. Distribution Channel

- 17.12.9. End-Users

- 17.13. Rest of Asia Pacific Finger Cot Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Material Type

- 17.13.3. Product Type

- 17.13.4. Thickness

- 17.13.5. Powder Content

- 17.13.6. Surface Texture

- 17.13.7. Packaging Type

- 17.13.8. Distribution Channel

- 17.13.9. End-Users

- 18. Middle East Finger Cot Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Finger Cot Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Material Type

- 18.3.2. Product Type

- 18.3.3. Thickness

- 18.3.4. Powder Content

- 18.3.5. Surface Texture

- 18.3.6. Packaging Type

- 18.3.7. Distribution Channel

- 18.3.8. End-Users

- 18.3.9. Country

- 18.3.9.1. Turkey

- 18.3.9.2. UAE

- 18.3.9.3. Saudi Arabia

- 18.3.9.4. Israel

- 18.3.9.5. Rest of Middle East

- 18.4. Turkey Finger Cot Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Material Type

- 18.4.3. Product Type

- 18.4.4. Thickness

- 18.4.5. Powder Content

- 18.4.6. Surface Texture

- 18.4.7. Packaging Type

- 18.4.8. Distribution Channel

- 18.4.9. End-Users

- 18.5. UAE Finger Cot Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Material Type

- 18.5.3. Product Type

- 18.5.4. Thickness

- 18.5.5. Powder Content

- 18.5.6. Surface Texture

- 18.5.7. Packaging Type

- 18.5.8. Distribution Channel

- 18.5.9. End-Users

- 18.6. Saudi Arabia Finger Cot Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Material Type

- 18.6.3. Product Type

- 18.6.4. Thickness

- 18.6.5. Powder Content

- 18.6.6. Surface Texture

- 18.6.7. Packaging Type

- 18.6.8. Distribution Channel

- 18.6.9. End-Users

- 18.7. Israel Finger Cot Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Material Type

- 18.7.3. Product Type

- 18.7.4. Thickness

- 18.7.5. Powder Content

- 18.7.6. Surface Texture

- 18.7.7. Packaging Type

- 18.7.8. Distribution Channel

- 18.7.9. End-Users

- 18.8. Rest of Middle East Finger Cot Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Material Type

- 18.8.3. Product Type

- 18.8.4. Thickness

- 18.8.5. Powder Content

- 18.8.6. Surface Texture

- 18.8.7. Packaging Type

- 18.8.8. Distribution Channel

- 18.8.9. End-Users

- 19. Africa Finger Cot Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Finger Cot Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Material Type

- 19.3.2. Product Type

- 19.3.3. Thickness

- 19.3.4. Powder Content

- 19.3.5. Surface Texture

- 19.3.6. Packaging Type

- 19.3.7. Distribution Channel

- 19.3.8. End-Users

- 19.3.9. Country

- 19.3.9.1. South Africa

- 19.3.9.2. Egypt

- 19.3.9.3. Nigeria

- 19.3.9.4. Algeria

- 19.3.9.5. Rest of Africa

- 19.4. South Africa Finger Cot Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Material Type

- 19.4.3. Product Type

- 19.4.4. Thickness

- 19.4.5. Powder Content

- 19.4.6. Surface Texture

- 19.4.7. Packaging Type

- 19.4.8. Distribution Channel

- 19.4.9. End-Users

- 19.5. Egypt Finger Cot Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Material Type

- 19.5.3. Product Type

- 19.5.4. Thickness

- 19.5.5. Powder Content

- 19.5.6. Surface Texture

- 19.5.7. Packaging Type

- 19.5.8. Distribution Channel

- 19.5.9. End-Users

- 19.6. Nigeria Finger Cot Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Material Type

- 19.6.3. Product Type

- 19.6.4. Thickness

- 19.6.5. Powder Content

- 19.6.6. Surface Texture

- 19.6.7. Packaging Type

- 19.6.8. Distribution Channel

- 19.6.9. End-Users

- 19.7. Algeria Finger Cot Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Material Type

- 19.7.3. Product Type

- 19.7.4. Thickness

- 19.7.5. Powder Content

- 19.7.6. Surface Texture

- 19.7.7. Packaging Type

- 19.7.8. Distribution Channel

- 19.7.9. End-Users

- 19.8. Rest of Africa Finger Cot Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Material Type

- 19.8.3. Product Type

- 19.8.4. Thickness

- 19.8.5. Powder Content

- 19.8.6. Surface Texture

- 19.8.7. Packaging Type

- 19.8.8. Distribution Channel

- 19.8.9. End-Users

- 20. South America Finger Cot Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. South America Finger Cot Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Material Type

- 20.3.2. Product Type

- 20.3.3. Thickness

- 20.3.4. Powder Content

- 20.3.5. Surface Texture

- 20.3.6. Packaging Type

- 20.3.7. Distribution Channel

- 20.3.8. End-Users

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Finger Cot Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Material Type

- 20.4.3. Product Type

- 20.4.4. Thickness

- 20.4.5. Powder Content

- 20.4.6. Surface Texture

- 20.4.7. Packaging Type

- 20.4.8. Distribution Channel

- 20.4.9. End-Users

- 20.5. Argentina Finger Cot Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Material Type

- 20.5.3. Product Type

- 20.5.4. Thickness

- 20.5.5. Powder Content

- 20.5.6. Surface Texture

- 20.5.7. Packaging Type

- 20.5.8. Distribution Channel

- 20.5.9. End-Users

- 20.6. Rest of South America Finger Cot Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Material Type

- 20.6.3. Product Type

- 20.6.4. Thickness

- 20.6.5. Powder Content

- 20.6.6. Surface Texture

- 20.6.7. Packaging Type

- 20.6.8. Distribution Channel

- 20.6.9. End-Users

- 21. Key Players/ Company Profile

- 21.1. ACL Staticide Inc.

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. Ansell Limited

- 21.3. Botron Company Inc.

- 21.4. Dou Yee Enterprises (S) Pte Ltd.

- 21.5. Hartalega Holdings Berhad

- 21.6. Honeywell International Inc.

- 21.7. Jiangsu Cureguard Glove Co., Ltd.

- 21.8. Kanam Latex Industries Pvt. Ltd.

- 21.9. KIRGEN Co., Ltd.

- 21.10. Kossan Rubber Industries Bhd

- 21.11. Oriental Rubber Industries (ORI)

- 21.12. Protexgloves

- 21.13. QRP Gloves (QRP, Inc.)

- 21.14. Rubberex Corporation (M) Berhad

- 21.15. Semperit AG Holding

- 21.16. Shandong Yuyuan Latex Gloves Co., Ltd.

- 21.17. Shenzhen Maxsharer Technology Co., Ltd.

- 21.18. Shijiazhuang Hongray Group

- 21.19. Superior Glove Works Ltd.

- 21.20. Supermax Corporation Berhad

- 21.21. Top Glove Corporation Bhd

- 21.22. Zhanjiang Jiali Glove Products Co., Ltd.

- 21.23. Other Key Players

- 21.1. ACL Staticide Inc.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Insightified

Mid-to-large firms spend $20K–$40K quarterly on systematic research and typically recover multiples through improved growth and profitability

Research is no longer optional. Leading firms use it to uncover $10M+ in hidden revenue opportunities annually

Our research-consulting programs yields measurable ROI: 20–30% revenue increases from new markets, 11% profit upticks from pricing, and 20–30% cost savings from operations

Finger Cot Market Size, Share & Trends Analysis Report by Material Type (Latex, Nitrile, Vinyl, Silicone, Polyethylene, Rubber (Non-Latex)), Product Type, Thickness, Powder Content, Surface Texture, Packaging Type, Distribution Channel, End-Users and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Finger Cot Market Size, Share, and Growth

The global finger cot market is witnessing strong growth, valued at USD 0.9 billion in 2025 and projected to reach USD 1.8 billion by 2035, expanding at a CAGR of 7.8% during the forecast period. The Asia Pacific region is the fastest-growing for the finger cot market due to rising healthcare investments, expanding hospitals and clinics, increasing awareness of hygiene, and growing demand in electronics and industrial sectors.

Dr. Neal Lonky, CEO and Founder of Histologics, LLC, said that,

“The Soft K-Bride represents a significant step forward in achieving that goal, building on our trusted portfolio that includes the Soft K-Cot finger cot, the Soft K-Rette crevice tapered debridement device, and our dual debridement and tangential biopsy device, the SoftBiopsy®+D. Kylon® brush tangential biopsies of the debrided base entrap tissue in the array for transport to a lab for culture or molecular testing, leading to guidance for therapy and antibiotic stewardship.”

The trend of growing popularity of outpatient and minimally invasive surgeries is influencing the widespread use of finger cots to handle surgical and wound-care procedures more accurately, with greater hygienic results. As an example, the Medline Industries, LP sells its Fold-Over Finger Cot Splints that are made of malleable aluminum with soft polyester to stabilise and provide cover to the injured or post-operative fingers. These splints offer support externally without involves surgeries so that immobilization and healing can proceed with least tissue traumas, pains and chances of infection.

The global finger cot market is backed by recognized regulatory systems, such as FDA classification in the United States, ASTM quality standards, and other national medical device regulations, which are critical in determining product safety, quality, and compliance. Such regulations contribute to creating trust between healthcare providers and industrial users, which leads to adoption and enables market development. The FDA assigns finger cots Product Code LZB as Class I medical devices. The majority of them are 510(k)-exempt in that the producer can manufacture and sell them without prior notification, making the U.S. market much easier to regulate.

Introduction of finger cots into modern wound-care devices is a major growth prospect. Specially created finger cots that can be used with a debridement tool, biopsy instrument, or diagnostic equipment can be used to increase the efficiency of the procedure, precision, and hygiene. Manufacturers can respond to the changing needs of healthcare practitioners, especially in the wound care, minimally invasive surgery and outpatient care setting by providing value added solutions that will facilitate clinical workflows.

Finger Cot Market Dynamics and Trends

Driver: Rising Demand for Finger Cots to Prevent Cross-Contamination and Protect Against Infection in Healthcare Settings

Restraint: Resistance Development Limits Treatment Durability

Opportunity: Development of Eco‑Friendly and Biodegradable Finger Cots

Key Trend: Rising Preference for Single-Use, Powder-Free Finger Cots

Finger Cot Market Analysis and Segmental Data

Nitrile Dominate Global Finger Cot Market

North America Leads Global Finger Cot Market Demand

Finger-Cot-Market Ecosystem

The global finger cot market is consolidated, with the leading players such as Top Glove Corporation Bhd, Ansell Limited, Hartalega Holdings Berhad, Kossan Rubber Industries Bhd, and Supermax Corporation Berhad, holding approximately 37% of the market share. These leading manufacturers influence the market through advanced manufacturing capabilities, high-quality material innovations, and extensive distribution networks. Their strong R&D investments, focus on product safety and compliance with international standards, and broad intellectual property portfolios create high barriers for new entrants.

Strategic collaborations with healthcare providers, cleanroom technology companies, and industrial clients further strengthen their market position by integrating specialized solutions, improving product performance, and expanding reach across medical, laboratory, and precision industrial applications. The moderate concentration of buyers, including hospitals, laboratories, and electronics manufacturers, emphasizes the importance of quality, reliability, and compliance. Overall, these top players drive market growth, innovation, and leadership momentum in the global finger cot industry.

Recent Development and Strategic Overview:

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 0.9 Bn |

|

Market Forecast Value in 2035 |

USD 1.8 Bn |

|

Growth Rate (CAGR) |

7.8% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

Protexgloves |

|

|

|

|

Finger-Cot-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Finger Cot Market, By Material Type |

|

|

Finger Cot Market, By Product Type |

|

|

Finger Cot Market, By Thickness |

|

|

Finger Cot Market, By Powder Content |

|

|

Finger Cot Market, By Surface Texture |

|

|

Finger Cot Market, By Packaging Type |

|

|

Finger Cot Market, By Distribution Channel |

|

|

Finger Cot Market, By End-users |

|

Frequently Asked Questions

Table of Contents

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

Forecasting Models / Techniques

Multiple Regression Analysis

Time Series Analysis – Seasonal Patterns

Time Series Analysis – Trend Analysis

Expert Opinion – Expert Interviews

Multi-Scenario Development

Time Series Analysis – Moving Averages

Econometric Models

Expert Opinion – Delphi Method

Monte Carlo Simulation

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation