Gene Therapy for Ultra-Rare Diseases Market Size, Share & Trends Analysis Report by Vector Type (Viral Vectors, Non-Viral Vectors), Disease Type, Therapy Type, Route of Administration, Age Group, Product Stage, Technology Platform, Manufacturing Process, End-Users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Gene Therapy for Ultra-Rare Diseases Market Size, Share, and Growth

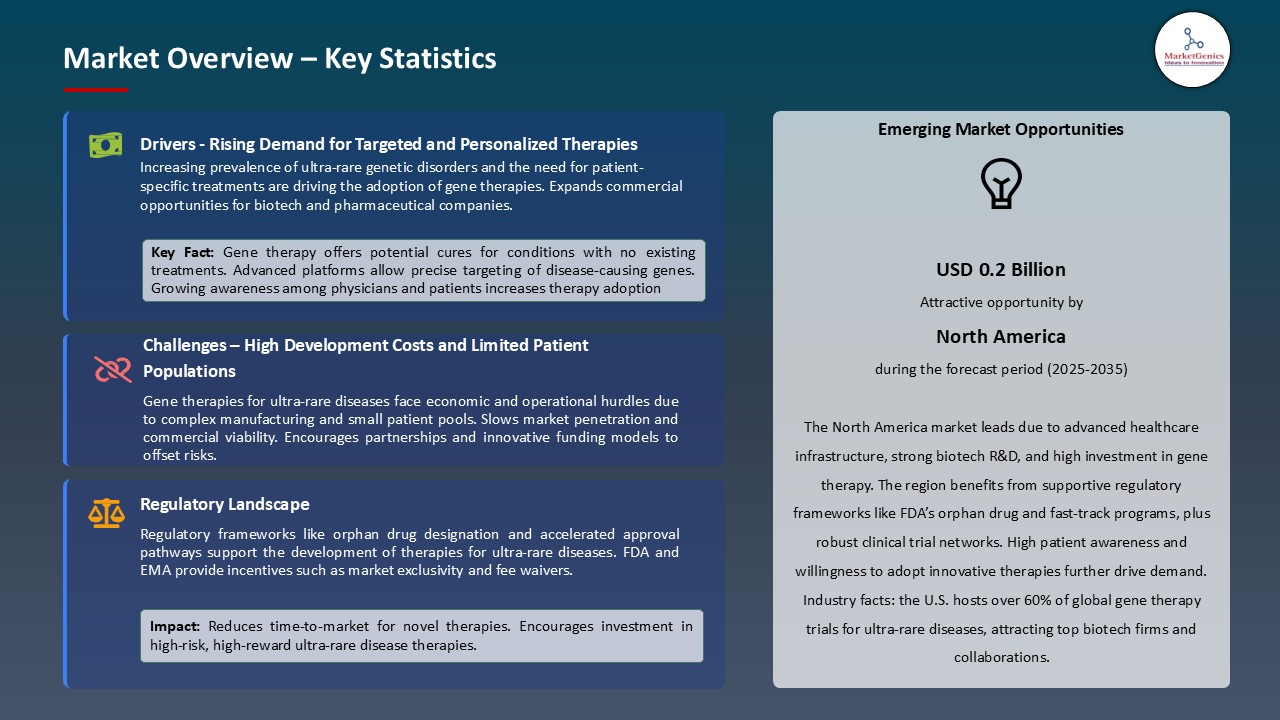

The global gene therapy for ultra-rare diseases market is witnessing strong growth, valued at USD 0.3 billion in 2025 and projected to reach USD 0.7 billion by 2035, expanding at a CAGR of 8.4% during the forecast period. North America leads the gene therapy market for ultra-rare diseases due to strong regulatory incentives, advanced R&D infrastructure, high prevalence of rare diseases, significant market share, and strategic industry collaborations.

Jennifer Doudna, founder of the (IGI) Innovative Genomics Institute said that, “The ability to develop an on-demand CRISPR therapy in such a short time opens up a new era for treating previously untreatable genetic diseases, this was a remarkable team effort”.

Strategic acquisitions of major companies are bolstering gene therapy pipeline to ultra-rare diseases, propelling development and having a direct effect of driving the growth of the global market to gene therapy to ultra-rare diseases. This can be illustrated by the example of BioCryst Pharmaceuticals acquiring Astria Therapeutics at about 700 million dollars, where a strategic decision to expand its market base can be seen through acquisitions, and transforming its growth pattern can be seen through strategic acquisition, as a very good example of how strategic acquisition can result in expansion of the market.

The development of ultra-rare disease gene therapy greatly correlates with the enabling regulatory environments that speed up development and entry into the market. As an example, in 2025, The Rare Disease Evidence Principles (RDEP) was launched to make the process of review of rare disease therapies more rapid and predictable, especially when dealing with a small patient population with high levels of medical need, such as a known genetic defect. Within the RDEP framework, sponsors can have a better understanding of the evidence that can be accepted to prove substantial effectiveness.

The fusion of AI-based personalization and Real-World Data (RWD) is a meaningful opportunity as a Gene Therapy of Ultra-Rare Diseases to deliver adaptive, evidence-based intervention in order to enhance clinical effectiveness. There is also an economic value in health promoting payer reimbursement, regulatory approval and scalable market adoption in this strategy. To illustrate this, Canvas Dx created by Cognoa employs the Artificial Intelligence (AI) and Real-World Data (RWD) as home video and caregiver questionnaires to give the most accurate diagnosis of Autism Spectrum Disorder (ASD).

Gene Therapy for Ultra-Rare Diseases Market Dynamics and Trends

Driver: Precision genome editing reduces time-to-proof and enables targeted ultra-rare therapies

- Precision genome editing, such as the CRISPR-based ex vivo and in vivo modalities has become one of the potent drivers of growth in the global Gene Therapy for Ultra-Rare Diseases Market. These technologies facilitate first generation and irreversible repair of pathogenic alleles, shortening clinical development timelines, increasing the accuracy of trials, and cutting back long-term R&D costs, resulting in a better payback period by manufacturers.

- • The method has been proven by the recent regulatory approvals of CRISPR-based cell therapies and has resulted in more investors being willing to invest in platform expansion and scale-up manufacturing. As an example, Vertex Pharmaceuticals and CRISPR Therapeutics have announced that the U.S. FDA had approved CASGEVY, the first CRISPR/Cas9-based gene-editing therapy to be used commercially in the world. The CASGEVY treatment is prescribed in the treatment of sickle cell disease (SCD) in individuals aged 12 years and above, and this was a breakthrough in accuracy in genome editing.

- Therefore, the faster the technical validation, the more rapid the growth of pipelines and a capital influx into the platforms of genome-editing.

Restraint: Manufacturing complexity and high-cost supply chains restrict commercial scalability significantly

- The intricacy of the manufacturing process both in the production of GMP-grade viral vectors, his/her cell-processing, and stringent cold-chain logistics, is also a critical bottleneck to commercial expansion of gene therapy in ultra-rare disease treatments. Small scale of high quality AAV and lentiviral vectors, extended lead times of plasmids and raw materials and strict regulatory regulations raise the costs per patient and complicate international distribution.

- • Clinical trials to full commercial supply involve huge capital requirement and validation, which increases operational as well as financial strain. The risks of supply disruption, regulatory risks, and patient waiting periods have been noted as the recent production stop and transportation problems with some high-profile gene therapies. Companies are investing in duplicate capacity production, contract-manufacturing associations and in high-quality systems, thus increasing costs to stay in the market.

- Thus, supply-chain and manufacturing issues restrict the quick market growth, raising the prices of therapy and diminishing the commercial uptake.

Opportunity: Emerging Reimbursement & Market Access Models

- The prohibitive expense of developing and commercializing gene therapy products against ultra-rare diseases has driven the development of new reimbursements and market access models aimed at making them long-term affordable and sustainable. Value-based and outcome-linked models are particularly becoming popular with payers and regulators and are based on payment that is in relation to the real-world effectiveness of the therapy and patient outcomes in the long run.

- Governments and private insurers are testing such models to promote investments and expedite patient access. The Government of India has established eight Centres of Excellence (CoEs) to diagnose, prevent, and treat rare diseases under the National Policy on Rare Diseases (NPRD) 2021 with a financial aid of up to 50 lakhs per patient. This program is indicative of the shift in India in terms of innovative reimbursement and access models to advanced therapies, comprising of gene-based therapies.

- The changing models like annuity-based payment systems, risk sharing and pay-for-performance contracts are transforming the ways expensive gene therapies are delivered to patients and the payments balance the financial risks between manufacturers and healthcare systems.

Key Trend: Integration of Artificial Intelligence and Bioinformatics in Gene Therapy Development

- Gene Therapy for Ultra-Rare Diseases Market is growing due to the introduction of AI, machine learning, and bioinformatics in the field of gene therapy research and development, which has improved the target identification process, vector design, and patient stratification.

- Bioinformatics platforms can model patient-specific genetic variations and be used to design highly personalised therapies that have a superior safety and efficacy profile. All these technologies combined minimize development time, limit the expensive trial and error methods, and improve the accuracy of therapeutic interventions. As an example, A prominent example of AI in gene therapy of ultra-rare diseases is the creation of a custom CRISPR-based cure to an infant with severe CPS1 deficiency by the Innovative Genomics Institute.

- AI and bioinformatics would enable the creation of specific gene therapies that could be used to tackle diseases with small patient groups, and it would bring opportunities to the successful treatment of the disease.

Gene Therapy for Ultra-Rare Diseases Market Analysis and Segmental Data

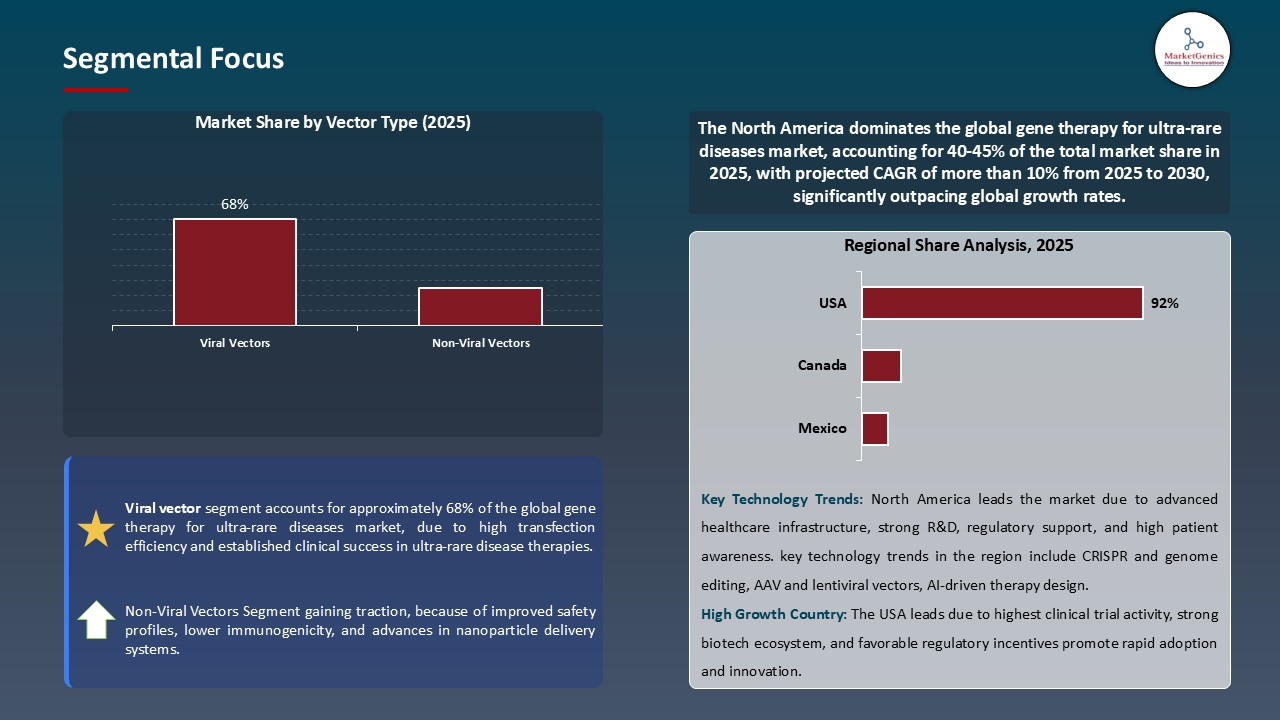

Viral Vectors Dominate Global Gene Therapy for Ultra-Rare Diseases Market

- Viral vectors dominate the global market of gene therapy on ultra-rare diseases; this is resulting in fast innovation and therapeutic development. Viral vectors have become the new hope of gene therapy development in the past few years, specifically adeno-associated viruses (AAVs); lentiviruses and retroviruses, have been demonstrated to dominate the frontline of gene therapy development in the treatment of ultra-rare diseases. Their efficiency in the delivery of therapeutic genes to target cells is high and their safety profiles are relatively well characterized, which has led to them being the drug of choice in those situations where developers are addressing conditions with very low patient populations.

- Moreover, Leading companies are using viral vectors platforms more and more to develop glycogen storage disease, hemophilia and other genetic deficiencies. As an example, Ultragenyx recently reported better longer-term results in its Phase 3 clinical trial of DTX401, an AAV-gene therapy of Glycogen Storage Disease Type Ia (GSDIa), with a demonstration of sustainable efficacy and safety, which underscores the company’s advancement in development of therapies for ultra-rare genetic disease.

- The high usage of viral vectors is rapidly advancing the creation of useful treatments, which is directly driving the development and innovation of the global gene therapy sector in ultra-rare ailments.

North America Leads Global Gene Therapy for Ultra-Rare Diseases Market Demand

- The North American market remains to control the global gene therapy market of ultra-rare diseases based on its established ecosystem of biotechnology and pharmaceutical as well as its great infrastructure of research and development and the presence of key players in the industry.

- The area also has favorable regulatory environments such as expedited approval processes by the FDA that allow faster clinical development and market access to therapies that affect small groups of patients. An example of this is the two-milestone cell-based gene therapies, Casgevy and Lyfgenia, which were approved by the U.S. FDA to treat sickle cell diseases in individuals aged 12 and above, and Casgevy is the first treatment to utilize a new technology of genome editing, which underscores a significant breakthrough in gene therapy.

- Moreover, the extensive public and private investment in genetic research, and both high patient awareness of it and the access to state-of-the-art medical care has contributed to the demand of novel gene therapies of rare diseases.

- This set of conditions has made North America a global leader in gene therapy innovation, and the number of clinical trials, product approvals, and commercial availability is driving continued growth of the market and strengthening the impact that the region has on trends in the rest of the world.

Gene Therapy for Ultra-Rare Diseases Market Ecosystem

The global gene therapy of ultra-rare diseases market is a moderately concentrated one, as the largest competitors, namely Livongo Health (Teladoc Health), Pear Therapeutics, Omada Health, Noom and Propeller Health (ResMed), possess a combined market share of about 32. These firms are leaders in the creation of evidence-based digital interventions and have considerable intellectual property, strong clinical pipelines, strategic alliance, and commercialization, and this creates technological and regulatory standards that provide barriers to entry to new entrants. An example is Pear Therapeutics, which has received FDA approval on several prescription digital therapeutics, which creates credibility and market confidence.

Service providers are important participants in the DTx ecosystem, which allows with greater speed the product development, adherence to the regulations and the implementation of such a tool at the scale. Their assistance reduces the time to development, decreases the capital needed by new entrants and increases the speed of commercialization. As an example, Teladoc Health offers complete digital health solutions and platforms enabling other DTx solutions to reach patients effectively and in large numbers.

Recent Development and Strategic Overview:

- In April 2025, Intellia Therapeutics announced that the first patient was dosed in the MAGNITUDE-2 Phase 3 study evaluating Nexiguran Ziclumeran (NEX-Z), a one-time CRISPR-based gene-editing therapy for transthyretin (ATTR) amyloidosis with polyneuropathy. This milestone underscores the potential of CRISPR-based therapies to shorten development timelines and accelerate commercial adoption, contributing to growth in the global Gene Therapy for Ultra-Rare Diseases Market.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 0.3 Bn |

|

Market Forecast Value in 2035 |

USD 0.7 Bn |

|

Growth Rate (CAGR) |

8.4% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Gene Therapy for Ultra-Rare Diseases Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Gene Therapy for Ultra-Rare Diseases Market, By Vector Type |

|

|

Gene Therapy for Ultra-Rare Diseases Market, By Disease Type |

|

|

Gene Therapy for Ultra-Rare Diseases Market, Therapy Type |

|

|

Gene Therapy for Ultra-Rare Diseases Market, By Route of Administration |

|

|

Gene Therapy for Ultra-Rare Diseases Market, By Age Group |

|

|

Gene Therapy for Ultra-Rare Diseases Market, By Product Stage |

|

|

Gene Therapy for Ultra-Rare Diseases Market, By Technology Platform |

|

|

Gene Therapy for Ultra-Rare Diseases Market, By Manufacturing Process |

|

|

Gene Therapy for Ultra-Rare Diseases Market, By End-users |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Gene Therapy for Ultra-Rare Diseases Market Outlook

- 2.1.1. Gene Therapy for Ultra-Rare Diseases Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Gene Therapy for Ultra-Rare Diseases Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Healthcare & Pharmaceutical Industry Overview, 2025

- 3.1.1. Healthcare & Pharmaceutical Industry Ecosystem Analysis

- 3.1.2. Key Trends for Healthcare & Pharmaceutical Industry

- 3.1.3. Regional Distribution for Healthcare & Pharmaceutical Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Healthcare & Pharmaceutical Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Increasing prevalence and diagnosis of ultra-rare genetic disorders

- 4.1.1.2. Advancements in viral and non-viral gene delivery technologies

- 4.1.1.3. Supportive regulatory frameworks and orphan drug incentives

- 4.1.2. Restraints

- 4.1.2.1. High cost of therapy development and treatment limiting patient access

- 4.1.2.2. Challenges in large-scale manufacturing and quality control of gene therapies

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Research & Development

- 4.4.2. Preclinical & Clinical Development

- 4.4.3. Manufacturing & Production

- 4.4.4. Distributors/ Commercializers

- 4.4.5. End-users/ Customers

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Gene Therapy for Ultra-Rare Diseases Market Demand

- 4.7.1. Historical Market Size - in Value (US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size - in Value (US$ Bn), 2025–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Gene Therapy for Ultra-Rare Diseases Market Analysis, By Vector Type

- 6.1. Key Segment Analysis

- 6.2. Gene Therapy for Ultra-Rare Diseases Market Size (Value - US$ Bn), Analysis, and Forecasts, Vector Type, 2021-2035

- 6.2.1. Viral Vectors

- 6.2.1.1. Adeno-Associated Virus (AAV) Vectors

- 6.2.1.2. Lentiviral Vectors

- 6.2.1.3. Retroviral Vectors

- 6.2.1.4. Adenoviral Vectors

- 6.2.1.5. Herpes Simplex Virus (HSV) Vectors

- 6.2.1.6. Others

- 6.2.2. Non-Viral Vectors

- 6.2.2.1. Plasmid DNA

- 6.2.2.2. Lipid Nanoparticles

- 6.2.2.3. Electroporation-based

- 6.2.2.4. Naked DNA

- 6.2.2.5. Others

- 6.2.1. Viral Vectors

- 7. Global Gene Therapy for Ultra-Rare Diseases Market Analysis, By Disease Type

- 7.1. Key Segment Analysis

- 7.2. Gene Therapy for Ultra-Rare Diseases Market Size (Value - US$ Bn), Analysis, and Forecasts, Disease Type, 2021-2035

- 7.2.1. Neurological Disorders

- 7.2.1.1. Spinal Muscular Atrophy (SMA)

- 7.2.1.2. Duchenne Muscular Dystrophy (DMD)

- 7.2.1.3. Huntington's Disease

- 7.2.1.4. Rett Syndrome

- 7.2.1.5. Batten Disease

- 7.2.1.6. Others

- 7.2.2. Hematological Disorders

- 7.2.2.1. Hemophilia A

- 7.2.2.2. Hemophilia B

- 7.2.2.3. Sickle Cell Disease

- 7.2.2.4. Beta-Thalassemia

- 7.2.2.5. Others

- 7.2.3. Metabolic Disorders

- 7.2.3.1. Lysosomal Storage Diseases

- 7.2.3.2. Gaucher Disease

- 7.2.3.3. Fabry Disease

- 7.2.3.4. Pompe Disease

- 7.2.3.5. Others

- 7.2.4. Ophthalmological Disorders

- 7.2.4.1. Leber Congenital Amaurosis

- 7.2.4.2. Retinitis Pigmentosa

- 7.2.4.3. Choroideremia

- 7.2.4.4. Others

- 7.2.5. Immunological Disorders

- 7.2.6. Cardiovascular Disorders

- 7.2.7. Others

- 7.2.1. Neurological Disorders

- 8. Global Gene Therapy for Ultra-Rare Diseases Market Analysis and Forecasts,By Therapy Type

- 8.1. Key Findings

- 8.2. Gene Therapy for Ultra-Rare Diseases Market Size (Value - US$ Mn), Analysis, and Forecasts, Therapy Type, 2021-2035

- 8.2.1. In Vivo Gene Therapy

- 8.2.1.1. Directly Administered

- 8.2.1.2. Systemically Delivered

- 8.2.1.3. Others

- 8.2.2. Ex Vivo Gene Therapy

- 8.2.2.1. Cell-based Therapies

- 8.2.2.2. Tissue-engineered Products

- 8.2.2.3. Others

- 8.2.3. Gene Editing Therapies

- 8.2.3.1. CRISPR/Cas9

- 8.2.3.2. TALENs

- 8.2.3.3. Zinc Finger Nucleases

- 8.2.4. Others

- 8.2.1. In Vivo Gene Therapy

- 9. Global Gene Therapy for Ultra-Rare Diseases Market Analysis and Forecasts, By Route of Administration

- 9.1. Key Findings

- 9.2. Gene Therapy for Ultra-Rare Diseases Market Size (Vo Value - US$ Mn), Analysis, and Forecasts, By Route of Administration, 2021-2035

- 9.2.1. Intravenous (IV)

- 9.2.2. Intramuscular (IM)

- 9.2.3. Intrathecal

- 9.2.4. Subretinal

- 9.2.5. Intravitreal

- 9.2.6. Direct Tissue Injection

- 10. Global Gene Therapy for Ultra-Rare Diseases Market Analysis and Forecasts, By Age Group

- 10.1. Key Findings

- 10.2. Gene Therapy for Ultra-Rare Diseases Market Size (Value - US$ Mn), Analysis, and Forecasts, Age Group, 2021-2035

- 10.2.1. Pediatric Patients

- 10.2.1.1. Neonates (0-1 month)

- 10.2.1.2. Infants (1 month - 2 years)

- 10.2.1.3. Children (2-12 years)

- 10.2.1.4. Adolescents (12-18 years)

- 10.2.2. Adult Patients

- 10.2.2.1. Young Adults (18-40 years)

- 10.2.2.2. Middle-aged Adults (40-65 years)

- 10.2.2.3. Elderly (65+ years)

- 10.2.1. Pediatric Patients

- 11. Global Gene Therapy for Ultra-Rare Diseases Market Analysis and Forecasts, By Product Stage

- 11.1. Key Findings

- 11.2. Gene Therapy for Ultra-Rare Diseases Market Size (Value - US$ Mn), Analysis, and Forecasts, By Product Stage, 2021-2035

- 11.2.1. Approved Therapies

- 11.2.2. Clinical Stage

- 11.2.2.1. Phase I

- 11.2.2.2. Phase II

- 11.2.2.3. Phase III

- 11.2.3. Preclinical Stage

- 11.2.4. Research & Discovery Stage

- 12. Global Gene Therapy for Ultra-Rare Diseases Market Analysis and Forecasts, By Technology Platform

- 12.1. Key Findings

- 12.2. Gene Therapy for Ultra-Rare Diseases Market Size (Value - US$ Mn), Analysis, and Forecasts, Technology Platform, 2021-2035

- 12.2.1. AAV-based Platform

- 12.2.2. Lentiviral Platform

- 12.2.3. CRISPR-based Platform

- 12.2.4. Base Editing Platform

- 12.2.5. Prime Editing Platform

- 12.2.6. RNA Interference (RNAi)

- 12.2.7. Antisense Oligonucleotides

- 13. Global Gene Therapy for Ultra-Rare Diseases Market Analysis and Forecasts, By Manufacturing Process

- 13.1. Key Findings

- 13.2. Gene Therapy for Ultra-Rare Diseases Market Size (Value - US$ Mn), Analysis, and Forecasts, By Manufacturing Process, 2021-2035

- 13.2.1. Autologous Manufacturing

- 13.2.2. Allogeneic Manufacturing

- 13.2.3. Contract Manufacturing

- 13.2.4. In-house Manufacturing

- 14. Global Gene Therapy for Ultra-Rare Diseases Market Analysis and Forecasts, By End-users

- 14.1. Key Findings

- 14.2. Gene Therapy for Ultra-Rare Diseases Market Size (Value - US$ Mn), Analysis, and Forecasts, By End-users, 2021-2035

- 14.2.1. Hospitals & Clinics

- 14.2.1.1. Diagnostic Services

- 14.2.1.2. Treatment Administration

- 14.2.1.3. Patient Monitoring

- 14.2.1.4. Acute Care Management

- 14.2.1.5. Others

- 14.2.2. Specialty Treatment Centers

- 14.2.2.1. Gene Therapy Administration

- 14.2.2.2. Post-treatment Care

- 14.2.2.3. Clinical Trial Conduct

- 14.2.2.4. Patient Follow-up Programs

- 14.2.2.5. Others

- 14.2.3. Research & Academic Institutions

- 14.2.3.1. Clinical Research

- 14.2.3.2. Drug Development

- 14.2.3.3. Biomarker Discovery

- 14.2.3.4. Preclinical Studies

- 14.2.3.5. Others

- 14.2.4. Biotechnology & Pharmaceutical Companies

- 14.2.4.1. Product Development

- 14.2.4.2. Manufacturing & Production

- 14.2.4.3. Quality Control

- 14.2.4.4. Regulatory Compliance

- 14.2.4.5. Others

- 14.2.5. Contract Research Organizations (CROs)

- 14.2.5.1. Clinical Trial Management

- 14.2.5.2. Data Analysis

- 14.2.5.3. Regulatory Support

- 14.2.5.4. Patient Recruitment

- 14.2.5.5. Others

- 14.2.6. Gene Therapy Manufacturing Facilities

- 14.2.6.1. Vector Production

- 14.2.6.2. Cell Processing

- 14.2.6.3. Quality Assurance

- 14.2.6.4. Supply Chain Management

- 14.2.6.5. Others

- 14.2.1. Hospitals & Clinics

- 15. Global Gene Therapy for Ultra-Rare Diseases Market Analysis and Forecasts, by Region

- 15.1. Key Findings

- 15.2. Gene Therapy for Ultra-Rare Diseases Market Size (Value - US$ Mn), Analysis, and Forecasts, by Region, 2021-2035

- 15.2.1. North America

- 15.2.2. Europe

- 15.2.3. Asia Pacific

- 15.2.4. Middle East

- 15.2.5. Africa

- 15.2.6. South America

- 16. North America Gene Therapy for Ultra-Rare Diseases Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. North America Gene Therapy for Ultra-Rare Diseases Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Vector Type

- 16.3.2. Disease Type

- 16.3.3. Therapy Type

- 16.3.4. Route of Administration

- 16.3.5. Age Group

- 16.3.6. Product Stage

- 16.3.7. Manufacturing Process

- 16.3.8. End-Users

- 16.3.9. Country

- 16.3.9.1. USA

- 16.3.9.2. Canada

- 16.3.9.3. Mexico

- 16.4. USA Gene Therapy for Ultra-Rare Diseases Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Vector Type

- 16.4.3. Disease Type

- 16.4.4. Therapy Type

- 16.4.5. Route of Administration

- 16.4.6. Age Group

- 16.4.7. Product Stage

- 16.4.8. Manufacturing Process

- 16.4.9. End-Users

- 16.5. Canada Gene Therapy for Ultra-Rare Diseases Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Vector Type

- 16.5.3. Disease Type

- 16.5.4. Therapy Type

- 16.5.5. Route of Administration

- 16.5.6. Age Group

- 16.5.7. Product Stage

- 16.5.8. Manufacturing Process

- 16.5.9. End-Users

- 16.6. Mexico Gene Therapy for Ultra-Rare Diseases Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Vector Type

- 16.6.3. Disease Type

- 16.6.4. Therapy Type

- 16.6.5. Route of Administration

- 16.6.6. Age Group

- 16.6.7. Product Stage

- 16.6.8. Manufacturing Process

- 16.6.9. End-Users

- 17. Europe Gene Therapy for Ultra-Rare Diseases Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Europe Gene Therapy for Ultra-Rare Diseases Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Therapeutic Application

- 17.3.2. Vector Type

- 17.3.3. Disease Type

- 17.3.4. Therapy Type

- 17.3.5. Route of Administration

- 17.3.6. Age Group

- 17.3.7. Product Stage

- 17.3.8. Manufacturing Process

- 17.3.9. End-Users

- 17.3.9.1. Germany

- 17.3.9.2. United Kingdom

- 17.3.9.3. France

- 17.3.9.4. Italy

- 17.3.9.5. Spain

- 17.3.9.6. Netherlands

- 17.3.9.7. Nordic Countries

- 17.3.9.8. Poland

- 17.3.9.9. Russia & CIS

- 17.3.9.10. Rest of Europe

- 17.4. Germany Gene Therapy for Ultra-Rare Diseases Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Vector Type

- 17.4.3. Disease Type

- 17.4.4. Therapy Type

- 17.4.5. Route of Administration

- 17.4.6. Age Group

- 17.4.7. Product Stage

- 17.4.8. Manufacturing Process

- 17.4.9. End-Users

- 17.5. United Kingdom Gene Therapy for Ultra-Rare Diseases Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Vector Type

- 17.5.3. Disease Type

- 17.5.4. Therapy Type

- 17.5.5. Route of Administration

- 17.5.6. Age Group

- 17.5.7. Product Stage

- 17.5.8. Manufacturing Process

- 17.5.9. End-Users

- 17.6. France Gene Therapy for Ultra-Rare Diseases Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Vector Type

- 17.6.3. Disease Type

- 17.6.4. Therapy Type

- 17.6.5. Route of Administration

- 17.6.6. Age Group

- 17.6.7. Product Stage

- 17.6.8. Manufacturing Process

- 17.6.9. End-Users

- 17.7. Italy Gene Therapy for Ultra-Rare Diseases Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Vector Type

- 17.7.3. Disease Type

- 17.7.4. Therapy Type

- 17.7.5. Route of Administration

- 17.7.6. Age Group

- 17.7.7. Product Stage

- 17.7.8. Manufacturing Process

- 17.7.9. End-Users

- 17.8. Spain Gene Therapy for Ultra-Rare Diseases Market

- 17.8.1. Therapeutic Application

- 17.8.2. Vector Type

- 17.8.3. Disease Type

- 17.8.4. Therapy Type

- 17.8.5. Route of Administration

- 17.8.6. Age Group

- 17.8.7. Product Stage

- 17.8.8. Manufacturing Process

- 17.8.9. End-Users

- 17.9. Netherlands Gene Therapy for Ultra-Rare Diseases Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Vector Type

- 17.9.3. Disease Type

- 17.9.4. Therapy Type

- 17.9.5. Route of Administration

- 17.9.6. Age Group

- 17.9.7. Product Stage

- 17.9.8. Manufacturing Process

- 17.9.9. End-Users

- 17.10. Nordic Countries Gene Therapy for Ultra-Rare Diseases Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Vector Type

- 17.10.3. Disease Type

- 17.10.4. Therapy Type

- 17.10.5. Route of Administration

- 17.10.6. Age Group

- 17.10.7. Product Stage

- 17.10.8. Manufacturing Process

- 17.10.9. End-Users

- 17.11. Poland Gene Therapy for Ultra-Rare Diseases Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Vector Type

- 17.11.3. Disease Type

- 17.11.4. Therapy Type

- 17.11.5. Route of Administration

- 17.11.6. Age Group

- 17.11.7. Product Stage

- 17.11.8. Manufacturing Process

- 17.11.9. End-Users

- 17.12. Russia & CIS Gene Therapy for Ultra-Rare Diseases Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Vector Type

- 17.12.3. Disease Type

- 17.12.4. Therapy Type

- 17.12.5. Route of Administration

- 17.12.6. Age Group

- 17.12.7. Product Stage

- 17.12.8. Manufacturing Process

- 17.12.9. End-Users

- 17.13. Rest of Europe Gene Therapy for Ultra-Rare Diseases Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Vector Type

- 17.13.3. Disease Type

- 17.13.4. Therapy Type

- 17.13.5. Route of Administration

- 17.13.6. Age Group

- 17.13.7. Product Stage

- 17.13.8. Manufacturing Process

- 17.13.9. End-Users

- 18. Asia Pacific Gene Therapy for Ultra-Rare Diseases Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. East Asia Gene Therapy for Ultra-Rare Diseases Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Therapeutic Application

- 18.3.2. Vector Type

- 18.3.3. Disease Type

- 18.3.4. Therapy Type

- 18.3.5. Route of Administration

- 18.3.6. Age Group

- 18.3.7. Product Stage

- 18.3.8. Manufacturing Process

- 18.3.9. End-Users

- 18.3.10. Country

- 18.3.10.1. China

- 18.3.10.2. India

- 18.3.10.3. Japan

- 18.3.10.4. South Korea

- 18.3.10.5. Australia and New Zealand

- 18.3.10.6. Indonesia

- 18.3.10.7. Malaysia

- 18.3.10.8. Thailand

- 18.3.10.9. Vietnam

- 18.3.10.10. Rest of Asia Pacific

- 18.4. China Gene Therapy for Ultra-Rare Diseases Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Vector Type

- 18.4.3. Disease Type

- 18.4.4. Therapy Type

- 18.4.5. Route of Administration

- 18.4.6. Age Group

- 18.4.7. Product Stage

- 18.4.8. Manufacturing Process

- 18.4.9. End-Users

- 18.5. India Gene Therapy for Ultra-Rare Diseases Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Vector Type

- 18.5.3. Disease Type

- 18.5.4. Therapy Type

- 18.5.5. Route of Administration

- 18.5.6. Age Group

- 18.5.7. Product Stage

- 18.5.8. Manufacturing Process

- 18.5.9. End-Users

- 18.6. Japan Gene Therapy for Ultra-Rare Diseases Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Vector Type

- 18.6.3. Disease Type

- 18.6.4. Therapy Type

- 18.6.5. Route of Administration

- 18.6.6. Age Group

- 18.6.7. Product Stage

- 18.6.8. Manufacturing Process

- 18.6.9. End-Users

- 18.7. South Korea Gene Therapy for Ultra-Rare Diseases Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Vector Type

- 18.7.3. Disease Type

- 18.7.4. Therapy Type

- 18.7.5. Route of Administration

- 18.7.6. Age Group

- 18.7.7. Product Stage

- 18.7.8. Manufacturing Process

- 18.7.9. End-Users

- 18.8. Australia and New Zealand Gene Therapy for Ultra-Rare Diseases Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Vector Type

- 18.8.3. Disease Type

- 18.8.4. Therapy Type

- 18.8.5. Route of Administration

- 18.8.6. Age Group

- 18.8.7. Product Stage

- 18.8.8. Manufacturing Process

- 18.8.9. End-Users

- 18.9. Indonesia Gene Therapy for Ultra-Rare Diseases Market

- 18.9.1. Country Segmental Analysis

- 18.9.2. Vector Type

- 18.9.3. Disease Type

- 18.9.4. Therapy Type

- 18.9.5. Route of Administration

- 18.9.6. Age Group

- 18.9.7. Product Stage

- 18.9.8. Manufacturing Process

- 18.9.9. End-Users

- 18.10. Malaysia Gene Therapy for Ultra-Rare Diseases Market

- 18.10.1. Country Segmental Analysis

- 18.10.2. Vector Type

- 18.10.3. Disease Type

- 18.10.4. Therapy Type

- 18.10.5. Route of Administration

- 18.10.6. Age Group

- 18.10.7. Product Stage

- 18.10.8. Manufacturing Process

- 18.10.9. End-Users

- 18.11. Thailand Gene Therapy for Ultra-Rare Diseases Market

- 18.11.1. Country Segmental Analysis

- 18.11.2. Vector Type

- 18.11.3. Disease Type

- 18.11.4. Therapy Type

- 18.11.5. Route of Administration

- 18.11.6. Age Group

- 18.11.7. Product Stage

- 18.11.8. Manufacturing Process

- 18.11.9. End-Users

- 18.12. Vietnam Gene Therapy for Ultra-Rare Diseases Market

- 18.12.1. Country Segmental Analysis

- 18.12.2. Vector Type

- 18.12.3. Disease Type

- 18.12.4. Therapy Type

- 18.12.5. Route of Administration

- 18.12.6. Age Group

- 18.12.7. Product Stage

- 18.12.8. Manufacturing Process

- 18.12.9. End-Users

- 18.13. Rest of Asia Pacific Gene Therapy for Ultra-Rare Diseases Market

- 18.13.1. Country Segmental Analysis

- 18.13.2. Vector Type

- 18.13.3. Disease Type

- 18.13.4. Therapy Type

- 18.13.5. Route of Administration

- 18.13.6. Age Group

- 18.13.7. Product Stage

- 18.13.8. Manufacturing Process

- 18.13.9. End-Users

- 19. Middle East Gene Therapy for Ultra-Rare Diseases Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Middle East Gene Therapy for Ultra-Rare Diseases Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Therapeutic Application

- 19.3.2. Vector Type

- 19.3.3. Disease Type

- 19.3.4. Therapy Type

- 19.3.5. Route of Administration

- 19.3.6. Age Group

- 19.3.7. Product Stage

- 19.3.8. Manufacturing Process

- 19.3.9. End-Users

- 19.3.10. Country

- 19.3.10.1. Turkey

- 19.3.10.2. UAE

- 19.3.10.3. Saudi Arabia

- 19.3.10.4. Israel

- 19.3.10.5. Rest of Middle East

- 19.4. Turkey Gene Therapy for Ultra-Rare Diseases Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Vector Type

- 19.4.3. Disease Type

- 19.4.4. Therapy Type

- 19.4.5. Route of Administration

- 19.4.6. Age Group

- 19.4.7. Product Stage

- 19.4.8. Manufacturing Process

- 19.4.9. End-Users

- 19.5. UAE Gene Therapy for Ultra-Rare Diseases Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Vector Type

- 19.5.3. Disease Type

- 19.5.4. Therapy Type

- 19.5.5. Route of Administration

- 19.5.6. Age Group

- 19.5.7. Product Stage

- 19.5.8. Manufacturing Process

- 19.5.9. End-Users

- 19.6. Saudi Arabia Gene Therapy for Ultra-Rare Diseases Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Vector Type

- 19.6.3. Disease Type

- 19.6.4. Therapy Type

- 19.6.5. Route of Administration

- 19.6.6. Age Group

- 19.6.7. Product Stage

- 19.6.8. Manufacturing Process

- 19.6.9. End-Users

- 19.7. Israel Gene Therapy for Ultra-Rare Diseases Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Vector Type

- 19.7.3. Disease Type

- 19.7.4. Therapy Type

- 19.7.5. Route of Administration

- 19.7.6. Age Group

- 19.7.7. Product Stage

- 19.7.8. Manufacturing Process

- 19.7.9. End-Users

- 19.8. Rest of Middle East Gene Therapy for Ultra-Rare Diseases Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Vector Type

- 19.8.3. Disease Type

- 19.8.4. Therapy Type

- 19.8.5. Route of Administration

- 19.8.6. Age Group

- 19.8.7. Product Stage

- 19.8.8. Manufacturing Process

- 19.8.9. End-Users

- 20. Africa Gene Therapy for Ultra-Rare Diseases Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Africa Gene Therapy for Ultra-Rare Diseases Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Therapeutic Application

- 20.3.2. Vector Type

- 20.3.3. Disease Type

- 20.3.4. Therapy Type

- 20.3.5. Route of Administration

- 20.3.6. Age Group

- 20.3.7. Product Stage

- 20.3.8. Manufacturing Process

- 20.3.9. End-Users

- 20.3.10. Country

- 20.3.10.1. South Africa

- 20.3.10.2. Egypt

- 20.3.10.3. Nigeria

- 20.3.10.4. Algeria

- 20.3.10.5. Rest of Africa

- 20.4. South Africa Gene Therapy for Ultra-Rare Diseases Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Vector Type

- 20.4.3. Disease Type

- 20.4.4. Therapy Type

- 20.4.5. Route of Administration

- 20.4.6. Age Group

- 20.4.7. Product Stage

- 20.4.8. Manufacturing Process

- 20.4.9. End-Users

- 20.5. Egypt Gene Therapy for Ultra-Rare Diseases Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Vector Type

- 20.5.3. Disease Type

- 20.5.4. Therapy Type

- 20.5.5. Route of Administration

- 20.5.6. Age Group

- 20.5.7. Product Stage

- 20.5.8. Manufacturing Process

- 20.5.9. End-Users

- 20.6. Nigeria Gene Therapy for Ultra-Rare Diseases Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Vector Type

- 20.6.3. Disease Type

- 20.6.4. Therapy Type

- 20.6.5. Route of Administration

- 20.6.6. Age Group

- 20.6.7. Product Stage

- 20.6.8. Manufacturing Process

- 20.6.9. End-Users

- 20.7. Algeria Gene Therapy for Ultra-Rare Diseases Market

- 20.7.1. Country Segmental Analysis

- 20.7.2. Vector Type

- 20.7.3. Disease Type

- 20.7.4. Therapy Type

- 20.7.5. Route of Administration

- 20.7.6. Age Group

- 20.7.7. Product Stage

- 20.7.8. Manufacturing Process

- 20.7.9. End-Users

- 20.8. Rest of Africa Gene Therapy for Ultra-Rare Diseases Market

- 20.8.1. Country Segmental Analysis

- 20.8.2. Vector Type

- 20.8.3. Disease Type

- 20.8.4. Therapy Type

- 20.8.5. Route of Administration

- 20.8.6. Age Group

- 20.8.7. Product Stage

- 20.8.8. Manufacturing Process

- 20.8.9. End-Users

- 21. South America Gene Therapy for Ultra-Rare Diseases Market Analysis

- 21.1. Key Segment Analysis

- 21.2. Regional Snapshot

- 21.3. Central and South Africa Gene Therapy for Ultra-Rare Diseases Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 21.3.1. Vector Type

- 21.3.2. Disease Type

- 21.3.3. Therapy Type

- 21.3.4. Route of Administration

- 21.3.5. Age Group

- 21.3.6. Product Stage

- 21.3.7. Manufacturing Process

- 21.3.8. End-Users

- 21.3.9. Country

- 21.3.9.1. Brazil

- 21.3.9.2. Argentina

- 21.3.9.3. Rest of South America

- 21.4. Brazil Gene Therapy for Ultra-Rare Diseases Market

- 21.4.1. Country Segmental Analysis

- 21.4.2. Vector Type

- 21.4.3. Disease Type

- 21.4.4. Therapy Type

- 21.4.5. Route of Administration

- 21.4.6. Age Group

- 21.4.7. Product Stage

- 21.4.8. Manufacturing Process

- 21.4.9. End-Users

- 21.5. Argentina Gene Therapy for Ultra-Rare Diseases Market

- 21.5.1. Country Segmental Analysis

- 21.5.2. Vector Type

- 21.5.3. Disease Type

- 21.5.4. Therapy Type

- 21.5.5. Route of Administration

- 21.5.6. Age Group

- 21.5.7. Product Stage

- 21.5.8. Manufacturing Process

- 21.5.9. End-Users

- 21.6. Rest of South America Gene Therapy for Ultra-Rare Diseases Market

- 21.6.1. Country Segmental Analysis

- 21.6.2. Vector Type

- 21.6.3. Disease Type

- 21.6.4. Therapy Type

- 21.6.5. Route of Administration

- 21.6.6. Age Group

- 21.6.7. Product Stage

- 21.6.8. Manufacturing Process

- 21.6.9. End-Users

- 22. Key Players/ Company Profile

- 22.1. BioMarin Pharmaceutical Inc.

- 22.1.1. Company Details/ Overview

- 22.1.2. Company Financials

- 22.1.3. Key Customers and Competitors

- 22.1.4. Business/ Industry Portfolio

- 22.1.5. Product Portfolio/ Specification Details

- 22.1.6. Pricing Data

- 22.1.7. Strategic Overview

- 22.1.8. Recent Developments

- 22.2. Bluebird bio, Inc.

- 22.3. Bristol Myers Squibb Company

- 22.4. CRISPR Therapeutics AG

- 22.5. CSL Behring

- 22.6. Editas Medicine, Inc.

- 22.7. Intellia Therapeutics, Inc.

- 22.8. Novartis AG

- 22.9. Orchard Therapeutics plc

- 22.10. Passage Bio, Inc.

- 22.11. Pfizer Inc.

- 22.12. Roche Holding AG

- 22.13. Sangamo Therapeutics, Inc.

- 22.14. Sarepta Therapeutics, Inc.

- 22.15. Spark Therapeutics (Roche)

- 22.16. Takeda Pharmaceutical Company Limited

- 22.17. Ultragenyx Pharmaceutical Inc.

- 22.18. uniQure N.V.

- 22.19. Vertex Pharmaceuticals Incorporated

- 22.20. Other Key Players

- 22.1. BioMarin Pharmaceutical Inc.

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation