Obesity Drug Market Size, Share & Trends Analysis Report by Drug Type/Class (GLP-1 Receptor Agonists, GIP/GLP-1 Receptor Agonists (Dual Agonists), Lipase Inhibitors, Combination Therapies, Sympathomimetic Amines, Novel Mechanisms (Emerging)), Route of Administration, Prescription Type, Treatment Duration, Indication, Age Group, Mechanism of Action, End-Users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Obesity Drug Market Size, Share, and Growth

The global obesity drug market is witnessing strong growth, valued at USD 7.3 billion in 2025 and projected to reach USD 50.3 billion by 2035, expanding at a CAGR of 21.3% during the forecast period. The Asia-Pacific region is the fastest-growing market for obesity drugs due to rising urbanization, changing dietary habits, increasing prevalence of obesity and related comorbidities, greater healthcare access, and growing awareness of pharmacological weight-management options.

Professor Subodh Verma, Cardiac Surgeon, University of Toronto said that, “The CagriSema data presented at ObesityWeek are very encouraging regarding the effects on well-known CV risk factors like high blood pressure – a strong signal that warrants further investigation. High blood pressure has a significant impact on the heart, increasing the risk of heart attacks and strokes and, alongside inflammation, is a key driver of cardiovascular disease, If we can lower inflammation, bring blood pressure to more normal levels, and help people lose weight at the same time, there’s potential for holistic improvement in overall health”.

The increasing awareness of people about the harsh health and economic effects of obesity is greatly contributing to the demand of obesity medicines. With governments, healthcare organizations and advocacy groups emphasizing the dangers of being overweight, patients are becoming more willing to take medical action instead of using lifestyle alone as the solution. Healthcare providers also take a more proactive position into prescribing pharmacological treatment with diet and exercise. An example of this is the fact that on 1 April 2025, the World Health Organization (WHO) called on obesity prevention and management to become a core pillar of population health, with a greater emphasis on awareness and clinical interventions targeting obesity and other health consequences.

The obesity drug market collaborations also enhance the faster innovation, increased patient access, digital and behavioral support, and minimized risks of development, which altogether contribute to the market growth. As an example, in 2025, OPKO Health and Entera bio signed a deal to further its oral GLP 1/glucagon pill candidate into clinical trials to treat obesity and metabolic conditions.

Combining the insulin pharmacotherapy of obesity with digital health technologies is a huge market potential. With the integration of obesity medications with mobile applications, wearable gadgets, telehealth applications, and remote access instruments, pharmaceutical manufacturing firms can become more engaged with the patients, monitor their compliance, and offer real-time communications regarding diet, physical activity, and weight oversight. It does not only enhance treatment results but also helps in maintaining weight in the long term, promoting individualized care. An example is On May, 2025, CheqUp and WW International (WeightWatchers) declared a strategic alliance in the UK that incorporated CheqUp GLP-1 medication service with WW GLP-1 Companion Programme to provide a comprehensive weight-loss service.

Obesity Drug Market Dynamics and Trends

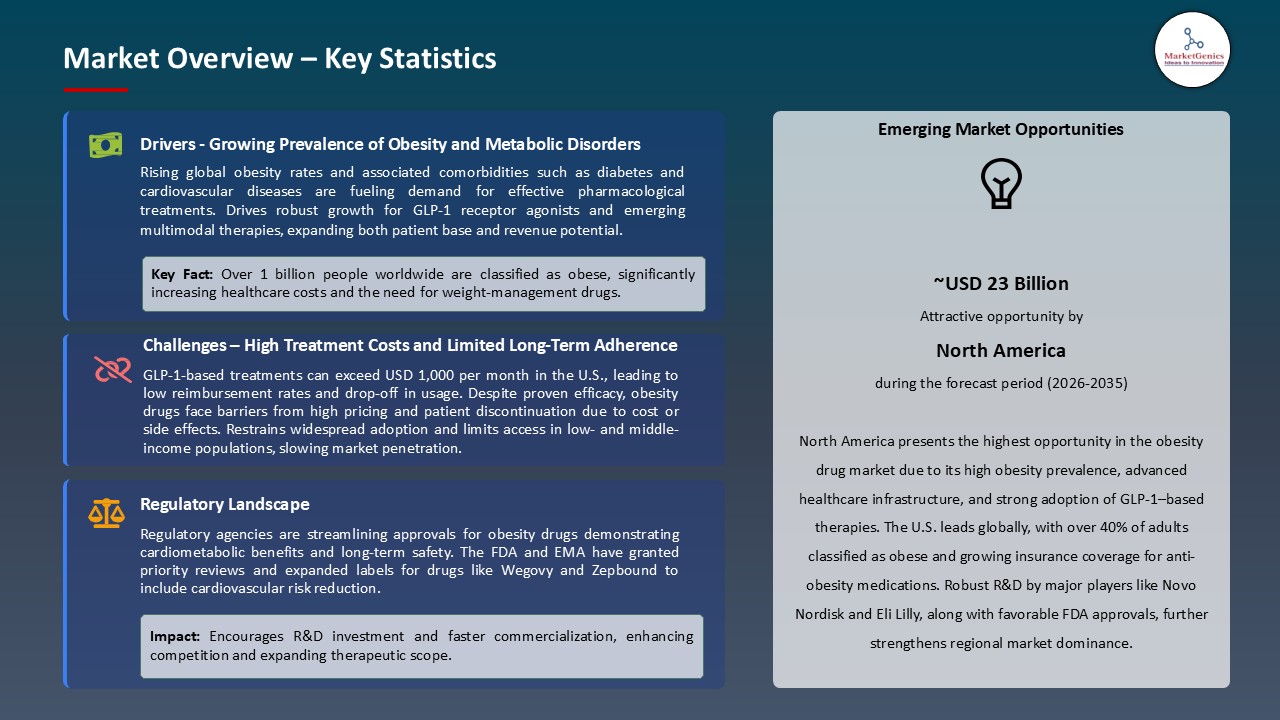

Driver: Obesity Epidemic Expansion Creates Urgent Public Health Imperative

- The current obesity epidemic has been a major health problem of concern to the population, and the prevalence of obesity-related illnesses has been on the increase in terms of type 2 diabetes, heart diseases and some types of cancers. Due to this obesity epidemic, there is a high demand to find effective weight management methods, which is directly associated with the expansion of the obesity drug market.

- The fact that patients are increasingly resorting to pharmacological interventions to supplement dietary and lifestyle changes is a fact that is being supported by healthcare providers and governments to access novel therapies. Innovations in medical research have resulted in safer and more effective obesity medications, which is an added incentive. The social and economic consequences of the epidemic is prompting investment and innovation in therapeutics leading to a cycle where increased obesity in the population is driving market growth.

- Novo Nordisk (2025) has reported that the users of Wegovy had significant waist circumference and BMI reduction that enhanced health and reduced the incidence of obesity-related complications. This underscore increasing dependence on effective obesity medications that facilitate market growth due to the pressing societal health concern to combat obesity epidemic.

- Therefore, the obesity epidemic is not only a health issue, but also a major source of growth, increasing sales, research efforts, and general market expansion within the obesity drug market.

Restraint: Regulatory Complexity and Safety Uncertainties Delay Novel Modality Approvals

- Restraints in supply chains are restricting the growth of the obesity drug market despite high demand even in the market. These therapeutics are complex to manufacture and require highly controlled quality, as well as depend on specialized raw materials, and so scale-up is difficult.

- Any disruption to international logistics, such as transportation delays, unavailability of active pharmaceutical ingredients (APIs), and cross-border distribution regulatory barriers can decrease the supply of products and drive up costs. These are bottlenecks that negatively impact the effectiveness of manufacturers to supply on the increased patient demand particularly at areas where the prevalence of obesity is on the upswing.

- Even high clinical adoption and increasing insurance coverage, the lack of supply may slow the accessibility of patients, hamper entry into the market, and reduce the growth in revenue. As such, supply chain inefficiencies are an important limitation, which makes manufacturers invest in increasing production capacity, sourcing diversification and channel optimization so as to maintain market growth and address the increasing therapeutic demand.

Opportunity: Precision Oncology and Advanced Diagnostics Drive Growth in Novel Cancer Therapeutics

- The emergence of combination therapy in the treatment of obesity offers a great growth potential in the market because combination therapy has the potential to induce better weight loss levels than a monotherapy. Combination drugs have better efficacy and clinical outcomes by acting on many of the pathways that are engaged in appetite regulation, metabolism, and energy expenditure, offering increased benefits and improved clinical results to patients with a problem of obesity and associated comorbidities.

- The method is especially useful with patients who fail to respond adequately to the single-agent treatment. Combination therapies are also successful, which promotes innovation in pharmaceutical companies, thus having more drug candidates in the pipeline. Moreover, through better patient outcomes, healthcare providers and payers can become more accepting, which will further promote adoption.

- CagriSema (cagrilintide + semaglutide), a combination therapy body of Novo Nordisk, achieved significant reductions in systolic blood pressure (–10.9 mmHg), hsCRP (–69%), and 10-year ASCVD risk, and almost 40% of participants could reduce or discontinue blood pressure drugs at ObesityWeek 2025. Consistent with GLP-1 RAs, the majority of GI events were mild and moderate, which also points to its potential to enhance cardiovascular conditions besides weight control.

- Consequently, combination therapies can not only fulfill unmet medical needs, but they also can increase the market potential, making obesity drugs a more effective and desirable treatment to a broader patient population.

Key Trend: Increasing Focus on Personalized Medicine Accelerates Engineered Exosome Development

- The increasing trend in the obesity drug market has been the increasing development and uptake of oral formulations which are more convenient than the traditional injectable therapies. The market has been dominated by injectable agents, especially GLP 1 and dual / triple agonists which are highly effective but pose challenges like needle fatigue, injection site pain, storage, and medical supervision.

- Oral therapies provide solutions to such challenges because they allow patients to self-administer their medication, enhance adherence, and decrease the logistical burden of the injection, including cold-chain storage and other specialized equipment. The ease of administration through oral form also increases access to patients especially in primary care and new markets where injectables may be restricted by the healthcare infrastructure.

- Viking Therapeutics, 2025 positive Phase 2 top-line results of VK2735, an oral GLP-1/GIP dual-agonist, showed up to a top of ~12.2 percent weight loss in obese patients, indicating the potential of oral therapies in offering convenience and ease to patients that is comparable to injectable therapies.

- Oral formulations enhance efficacy and safety and will increase market share, enhance adherence, and increase access among patients, so administration route will be a major competitive differentiator in the treatment of obesity.

Obesity-Drug-Market Analysis and Segmental Data

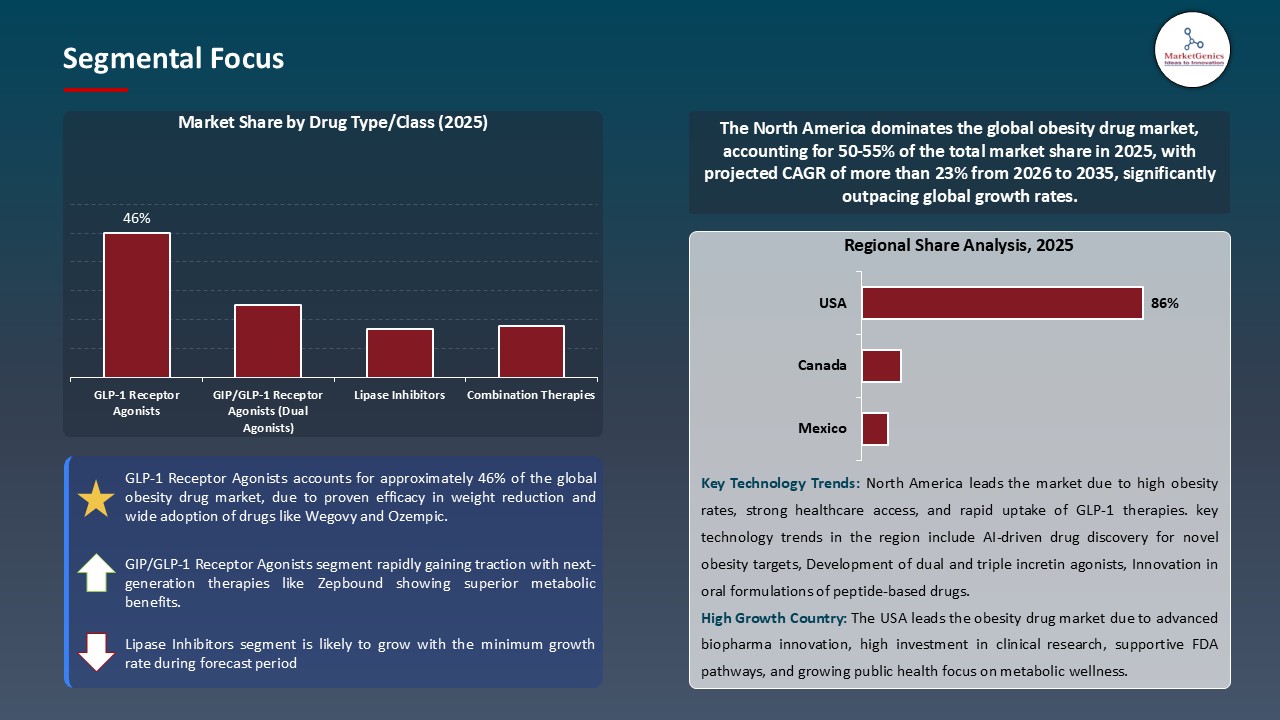

GLP-1 Receptor Agonists Dominate Global Obesity Drug Market

- GLP-1 receptor agonist (GLP-1 RAs) stand as the most promising segment in the worldwide obesity medication market, which is stimulated by their capacity to provide significant and long-term weight reduction. Their mechanisms, which control appetite, retard gastric emptying and increase satiety, translate into good clinical outcomes and high real-life efficacy that they are the preferred pharmacologic option in managing chronic obesity.

- Besides reducing weight, GLP-1 RAs positively impact major cardiometabolic risk factors, which enhances their health care system and payer value. Positive safety profiles, the possibility of long-term therapy, continuous innovations in the form of oral preparations and combination therapy, boost patient adhesiveness and increase access to the market.

- The efficacy, safety, and potential of oral glucagon-like peptide-1 (GLP-1) 2025, orforglipron, in oral obesity treatment were demonstrated because, in the ATTAIN-1 Phase 3 study, in 72 weeks, the average weight loss was 12.4 percent and cardiometabolic risk factors were improved (Eli Lilly, 2018).

- The outcomes support the effectiveness, safety and potential of oral GLP-1 therapy, which has become more and more significant in the pharmacologic therapy industry as a convenient, effective, and long-term treatment in obesity.

North America Leads Global Obesity Drug Market Demand

- North America remains the world leader in demand of obesity drugs due to a mixture of high prevalence of obesity, increased awareness of its health risks and high acceptability of pharmacologic intervention. The area is favorable due to properly developed healthcare facilities, excellent access of patients to new treatment methods and the high insurance coverage on treating obesity that facilitates quick dissemination of new medications.

- Moreover, raising awareness about obesity among physicians and prescribing of the condition as a chronic disease has prompted a more aggressive treatment strategy, including the use of GLP-1 receptor agonists and new oral therapies.

- Canary Cure Therapeutics is a North American-based company developing its new obesity treatment CCT-217, which showed 26-34% body-weight loss in preclinical trials without its effect on lean muscle. It broadens the current therapeutic range of obesity, catalyses innovation in the region, as well as provides the North American obesity-drug industry with improved pipeline depth, greater patient adoption, and increased activity by investors.

- Combined with active clinical research, regulatory approvals and early adoption of new treatments, these are the factors which make North America the major contributor to revenue and market growth in the global obesity drug market.

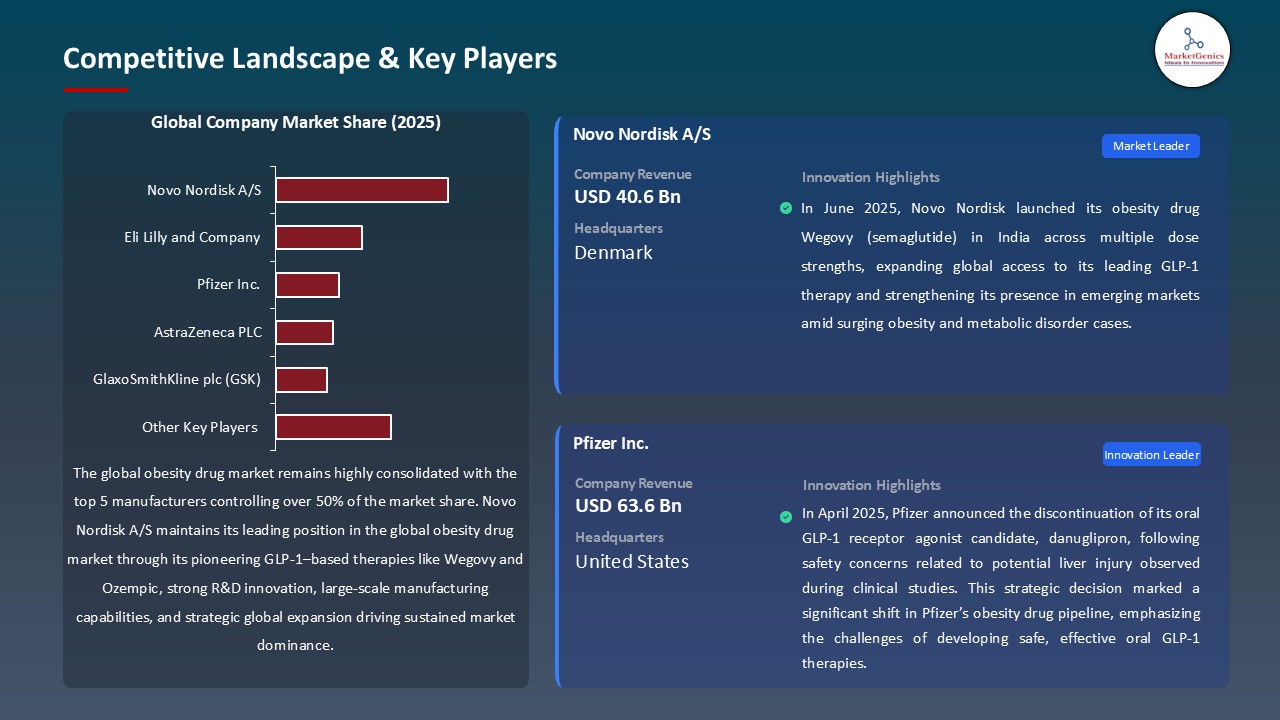

Obesity-Drug-Market Ecosystem

The obesity drug market is also moderately consolidated with the major pharmaceutical corporations including Novo Nordisk A/S, Eli Lilly and Company, Pfizer Inc., AstraZeneca PLC and GlaxoSmithKline plc (GSK) holding a large market share of about 53%. These key players are accelerating the trend of innovation in obesity therapeutics with the creation of GLP-1 receptor agonists, dual and triple agonists, oral medications and new biologics with massive intellectual property holdings, strong clinical pipeline, and high-quality manufacturing and distribution. Their technological competences, strategic partnership, and regulatory successes set high standards of the industry and make entry barriers very significant to new companies.

Service providers and contract development and manufacturing organizations (CDMOs) are also very crucial actors in the ecosystem of obesity drugs. They enable scale-to-production, guarantee regulatory adherence, and expedite translation of clinical products. As an example, major pharmaceutical firms like Novo Nordisk and Eli Lilly partner with CDMOs that can facilitate the production of GLP-1-based therapy and new oral drugs so that they can develop and market them within a short period of time. These alliances facilitate a smooth-sailing R&D, less time-to-market and a broader scope of global coverage, add to bolster expansion and rivalry within the obesity drug sector.

Recent Development and Strategic Overview:

- In June 2025, Amgen reported Phase 2 results on its monthly obesity drug MariTide at the ADA 85th Scientific Sessions, demonstrating up to ~20 percent weight loss in obese adults and substantial HbA1c improvements in patients with type 2 diabetes, and improvements in cardiometabolic parameters, and a safety profile that was similar to GLP-1 therapy.

- In September 2025, Pfizer declared an agreement to purchase Metsera at an initial price of around 4.9 billion dollars and can trigger milestone payments that will make the sum total around 7.3 billion dollars. The acquisition will combine four Metsera obesity programs at clinical stage such as injectable GLP -1 and amylin analogs and oral candidates to the Pfizer pipeline as the obesity market expands. The deal is anticipated to close in Q4 2025 and the deal is subject to regulatory and shareholder approvals.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 7.3 Bn |

|

Market Forecast Value in 2035 |

USD 50.3 Bn |

|

Growth Rate (CAGR) |

21.3% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Obesity-Drug-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Obesity Drug Market, By Drug Type/Class |

|

|

Obesity Drug Market, By Route of Administration |

|

|

Obesity Drug Market, By Prescription Type |

|

|

Obesity Drug Market, By Treatment Duration |

|

|

Obesity Drug Market, By Indication |

|

|

Obesity Drug Market, By Age Group |

|

|

Obesity Drug Market, By Mechanism of Action |

|

|

Obesity Drug Market, By End-Users |

|

Frequently Asked Questions

The global obesity drug market was valued at USD 7.3 Bn in 2025.

The global obesity drug market industry is expected to grow at a CAGR of 21.3% from 2026 to 2035.

Rising obesity prevalence, increasing health awareness, and advancements in effective weight-management therapies are key factors driving the demand for the obesity drug market.

In terms of drug type, the GLP-1 receptor agonists segment accounted for the major share in 2025.

North America is the most attractive region for obesity drug market.

Prominent players operating in the global obesity drug market are Altimmune Inc., Amgen Inc., AstraZeneca PLC, Boehringer Ingelheim, Currax Pharmaceuticals LLC, Eli Lilly and Company, GlaxoSmithKline plc (GSK), Nalpropion Pharmaceuticals, Novo Nordisk A/S, Novo Nordisk A/S, Orexigen Therapeutics, Pfizer Inc., Rhythm Pharmaceuticals, Roche Holding AG, Sanofi S.A., Sciwind Biosciences, Structure Therapeutics, Takeda Pharmaceutical Company, Viking Therapeutics, Vivus Inc., Zealand Pharma A/S, and Other Key Players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Obesity Drug Market Outlook

- 2.1.1. Obesity Drug Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Obesity Drug Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Obesity Drug Industry Overview, 2025

- 3.1.1. Healthcare & Pharmaceutical Industry Ecosystem Analysis

- 3.1.2. Key Trends for Healthcare & Pharmaceutical Industry

- 3.1.3. Regional Distribution for Healthcare & Pharmaceutical Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Obesity Drug Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising global obesity prevalence and greater health awareness

- 4.1.1.2. Breakthrough pharmacotherapies (GLP-1s, oral small molecules) with strong efficacy

- 4.1.1.3. Increased payer support, government incentives and demand for non-surgical options

- 4.1.2. Restraints

- 4.1.2.1. High drug costs and limited access/reimbursement

- 4.1.2.2. Safety concerns and lack of long-term real-world data

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

-

- 4.2.1.1. Regulatory Framework

- 4.2.2. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.2.3. Tariffs and Standards

- 4.2.4. Impact Analysis of Regulations on the Market

-

- 4.3. Value Chain Analysis

- 4.3.1. Raw Material Suppliers

- 4.3.2. Obesity Drug Manufacturers

- 4.3.3. Distributors/ Commercializers

- 4.3.4. End-users/ Customers

- 4.4. Porter’s Five Forces Analysis

- 4.5. PESTEL Analysis

- 4.6. Global Obesity Drug Market Demand

- 4.6.1. Historical Market Size - in Value (US$ Bn), 2020-2024

- 4.6.2. Current and Future Market Size - in Value (US$ Bn), 2026–2035

- 4.6.2.1. Y-o-Y Growth Trends

- 4.6.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Obesity Drug Market Analysis, By Drug Type/Class

- 6.1. Key Segment Analysis

- 6.2. Obesity Drug Market Size (Value - US$ Bn), Analysis, and Forecasts, By Drug Type/Class, 2021-2035

- 6.2.1. GLP-1 Receptor Agonists

- 6.2.1.1. Semaglutide

- 6.2.1.2. Liraglutide

- 6.2.1.3. Dulaglutide

- 6.2.1.4. Exenatide

- 6.2.1.5. Others

- 6.2.2. GIP/GLP-1 Receptor Agonists (Dual Agonists)

- 6.2.3. Lipase Inhibitors

- 6.2.4. Combination Therapies

- 6.2.5. Sympathomimetic Amines

- 6.2.6. Novel Mechanisms (Emerging)

- 6.2.1. GLP-1 Receptor Agonists

- 7. Global Obesity Drug Market Analysis, By Route of Administration

- 7.1. Key Segment Analysis

- 7.2. Obesity Drug Market Size (Value - US$ Bn), Analysis, and Forecasts, By Route of Administration, 2021-2035

- 7.2.1. Injectable

- 7.2.2. Subcutaneous injection

- 7.2.3. Pre-filled pens

- 7.2.4. Auto-injectors

- 7.2.5. Oral

- 7.2.6. Tablets

- 7.2.7. Capsules

- 7.2.8. Extended-release formulations

- 8. Global Obesity Drug Market Analysis and Forecasts,By Prescription Type

- 8.1. Key Findings

- 8.2. Obesity Drug Market Size (Value - US$ Mn), Analysis, and Forecasts, By Prescription Type, 2021-2035

- 8.2.1. Prescription-based

- 8.2.2. Over-the-Counter (OTC)

- 8.2.3. Specialty Prescription

- 9. Global Obesity Drug Market Analysis and Forecasts, By Treatment Duration

- 9.1. Key Findings

- 9.2. Obesity Drug Market Size (Vo Value - US$ Mn), Analysis, and Forecasts, By Treatment Duration Method, 2021-2035

- 9.2.1. Short-term (< 3 months)

- 9.2.2. Medium-term (3-6 months)

- 9.2.3. Long-term (> 6 months)

- 9.2.4. Chronic/Maintenance therapy

- 10. Global Obesity Drug Market Analysis and Forecasts, By Indication

- 10.1. Key Findings

- 10.2. Obesity Drug Market Size (Value - US$ Mn), Analysis, and Forecasts, By Indication, 2021-2035

- 10.2.1. Obesity with Type 2 Diabetes

- 10.2.2. Obesity with Cardiovascular Disease

- 10.2.3. Obesity with Hypertension

- 10.2.4. Obesity with Sleep Apnea

- 10.2.5. Obesity with Dyslipidemia

- 10.2.6. Others

- 11. Global Obesity Drug Market Analysis and Forecasts, By Age Group

- 11.1. Key Findings

- 11.2. Obesity Drug Market Size (Value - US$ Mn), Analysis, and Forecasts, By Age Group, 2021-2035

- 11.2.1. Pediatric

- 11.2.2. Adolescent

- 11.2.3. Adult

- 11.2.4. Geriatric

- 12. Global Obesity Drug Market Analysis and Forecasts, By Mechanism of Action

- 12.1. Key Findings

- 12.2. Obesity Drug Market Size (Value - US$ Mn), Analysis, and Forecasts, By Mechanism of Action, 2021-2035

- 12.2.1. Appetite Suppressants

- 12.2.2. Metabolic Modulators

- 12.2.3. Fat Absorption Inhibitors

- 12.2.4. Incretin Mimetics

- 12.2.5. Combination Mechanisms

- 13. Global Obesity Drug Market Analysis and Forecasts, By End-users

- 13.1. Key Findings

- 13.2. Obesity Drug Market Size (Value - US$ Mn), Analysis, and Forecasts, By End-users, 2021-2035

- 13.2.1. Hospitals & Clinics

- 13.2.2. Specialty Weight Management Centers

- 13.2.3. Primary Care Practices

- 13.2.4. Endocrinology Clinics

- 13.2.5. Cardiology Centers

- 13.2.6. Home Healthcare

- 13.2.7. Research Institutions

- 13.2.8. Corporate Wellness Programs

- 13.2.9. Other End-users

- 14. Global Obesity Drug Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Obesity Drug Market Size (Value - US$ Mn), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Obesity Drug Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Obesity Drug Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Drug Type/Class

- 15.3.2. Route of Administration

- 15.3.3. Prescription Type

- 15.3.4. Treatment Duration

- 15.3.5. Indication

- 15.3.6. Age Group

- 15.3.7. Mechanism of Action

- 15.3.8. End-Users

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Obesity Drug Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Drug Type/Class

- 15.4.3. Route of Administration

- 15.4.4. Prescription Type

- 15.4.5. Treatment Duration

- 15.4.6. Indication

- 15.4.7. Age Group

- 15.4.8. Mechanism of Action

- 15.4.9. End-Users

- 15.5. Canada Obesity Drug Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Drug Type/Class

- 15.5.3. Route of Administration

- 15.5.4. Prescription Type

- 15.5.5. Treatment Duration

- 15.5.6. Indication

- 15.5.7. Age Group

- 15.5.8. Mechanism of Action

- 15.5.9. End-Users

- 15.6. Mexico Obesity Drug Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Drug Type/Class

- 15.6.3. Route of Administration

- 15.6.4. Prescription Type

- 15.6.5. Treatment Duration

- 15.6.6. Indication

- 15.6.7. Age Group

- 15.6.8. Mechanism of Action

- 15.6.9. End-Users

- 16. Europe Obesity Drug Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Obesity Drug Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Drug Type/Class

- 16.3.2. Route of Administration

- 16.3.3. Prescription Type

- 16.3.4. Treatment Duration

- 16.3.5. Indication

- 16.3.6. Age Group

- 16.3.7. Mechanism of Action

- 16.3.8. End-Users

- 16.3.9. Country

- 16.3.9.1. Germany

- 16.3.9.2. United Kingdom

- 16.3.9.3. France

- 16.3.9.4. Italy

- 16.3.9.5. Spain

- 16.3.9.6. Netherlands

- 16.3.9.7. Nordic Countries

- 16.3.9.8. Poland

- 16.3.9.9. Russia & CIS

- 16.3.9.10. Rest of Europe

- 16.4. Germany Obesity Drug Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Drug Type/Class

- 16.4.3. Route of Administration

- 16.4.4. Prescription Type

- 16.4.5. Treatment Duration

- 16.4.6. Indication

- 16.4.7. Age Group

- 16.4.8. Mechanism of Action

- 16.4.9. End-Users

- 16.5. United Kingdom Obesity Drug Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Drug Type/Class

- 16.5.3. Route of Administration

- 16.5.4. Prescription Type

- 16.5.5. Treatment Duration

- 16.5.6. Indication

- 16.5.7. Age Group

- 16.5.8. Mechanism of Action

- 16.5.9. End-Users

- 16.6. France Obesity Drug Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Drug Type/Class

- 16.6.3. Route of Administration

- 16.6.4. Prescription Type

- 16.6.5. Treatment Duration

- 16.6.6. Indication

- 16.6.7. Age Group

- 16.6.8. Mechanism of Action

- 16.6.9. End-Users

- 16.7. Italy Obesity Drug Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Drug Type/Class

- 16.7.3. Route of Administration

- 16.7.4. Prescription Type

- 16.7.5. Treatment Duration

- 16.7.6. Indication

- 16.7.7. Age Group

- 16.7.8. Mechanism of Action

- 16.7.9. End-Users

- 16.8. Spain Obesity Drug Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Drug Type/Class

- 16.8.3. Route of Administration

- 16.8.4. Prescription Type

- 16.8.5. Treatment Duration

- 16.8.6. Indication

- 16.8.7. Age Group

- 16.8.8. Mechanism of Action

- 16.8.9. End-Users

- 16.9. Netherlands Obesity Drug Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Drug Type/Class

- 16.9.3. Route of Administration

- 16.9.4. Prescription Type

- 16.9.5. Treatment Duration

- 16.9.6. Indication

- 16.9.7. Age Group

- 16.9.8. Mechanism of Action

- 16.9.9. End-Users

- 16.10. Nordic Countries Obesity Drug Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Drug Type/Class

- 16.10.3. Route of Administration

- 16.10.4. Prescription Type

- 16.10.5. Treatment Duration

- 16.10.6. Indication

- 16.10.7. Age Group

- 16.10.8. Mechanism of Action

- 16.10.9. End-Users

- 16.11. Poland Obesity Drug Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Drug Type/Class

- 16.11.3. Route of Administration

- 16.11.4. Prescription Type

- 16.11.5. Treatment Duration

- 16.11.6. Indication

- 16.11.7. Age Group

- 16.11.8. Mechanism of Action

- 16.11.9. End-Users

- 16.12. Russia & CIS Obesity Drug Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Drug Type/Class

- 16.12.3. Route of Administration

- 16.12.4. Prescription Type

- 16.12.5. Treatment Duration

- 16.12.6. Indication

- 16.12.7. Age Group

- 16.12.8. Mechanism of Action

- 16.12.9. End-Users

- 16.13. Rest of Europe Obesity Drug Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Drug Type/Class

- 16.13.3. Route of Administration

- 16.13.4. Prescription Type

- 16.13.5. Treatment Duration

- 16.13.6. Indication

- 16.13.7. Age Group

- 16.13.8. Mechanism of Action

- 16.13.9. End-Users

- 17. Asia Pacific Obesity Drug Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Asia Pacific Obesity Drug Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Drug Type/Class

- 17.3.2. Route of Administration

- 17.3.3. Prescription Type

- 17.3.4. Treatment Duration

- 17.3.5. Indication

- 17.3.6. Age Group

- 17.3.7. Mechanism of Action

- 17.3.8. End-Users

- 17.3.9. Country

- 17.3.9.1. China

- 17.3.9.2. India

- 17.3.9.3. Japan

- 17.3.9.4. South Korea

- 17.3.9.5. Australia and New Zealand

- 17.3.9.6. Indonesia

- 17.3.9.7. Malaysia

- 17.3.9.8. Thailand

- 17.3.9.9. Vietnam

- 17.3.9.10. Rest of Asia Pacific

- 17.4. China Obesity Drug Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Drug Type/Class

- 17.4.3. Route of Administration

- 17.4.4. Prescription Type

- 17.4.5. Treatment Duration

- 17.4.6. Indication

- 17.4.7. Age Group

- 17.4.8. Mechanism of Action

- 17.4.9. End-Users

- 17.5. India Obesity Drug Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Drug Type/Class

- 17.5.3. Route of Administration

- 17.5.4. Prescription Type

- 17.5.5. Treatment Duration

- 17.5.6. Indication

- 17.5.7. Age Group

- 17.5.8. Mechanism of Action

- 17.5.9. End-Users

- 17.6. Japan Obesity Drug Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Drug Type/Class

- 17.6.3. Route of Administration

- 17.6.4. Prescription Type

- 17.6.5. Treatment Duration

- 17.6.6. Indication

- 17.6.7. Age Group

- 17.6.8. Mechanism of Action

- 17.6.9. End-Users

- 17.7. South Korea Obesity Drug Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Drug Type/Class

- 17.7.3. Route of Administration

- 17.7.4. Prescription Type

- 17.7.5. Treatment Duration

- 17.7.6. Indication

- 17.7.7. Age Group

- 17.7.8. Mechanism of Action

- 17.7.9. End-Users

- 17.8. Australia and New Zealand Obesity Drug Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Drug Type/Class

- 17.8.3. Route of Administration

- 17.8.4. Prescription Type

- 17.8.5. Treatment Duration

- 17.8.6. Indication

- 17.8.7. Age Group

- 17.8.8. Mechanism of Action

- 17.8.9. End-Users

- 17.9. Indonesia Obesity Drug Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Drug Type/Class

- 17.9.3. Route of Administration

- 17.9.4. Prescription Type

- 17.9.5. Treatment Duration

- 17.9.6. Indication

- 17.9.7. Age Group

- 17.9.8. Mechanism of Action

- 17.9.9. End-Users

- 17.10. Malaysia Obesity Drug Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Drug Type/Class

- 17.10.3. Route of Administration

- 17.10.4. Prescription Type

- 17.10.5. Treatment Duration

- 17.10.6. Indication

- 17.10.7. Age Group

- 17.10.8. Mechanism of Action

- 17.10.9. End-Users

- 17.11. Thailand Obesity Drug Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Drug Type/Class

- 17.11.3. Route of Administration

- 17.11.4. Prescription Type

- 17.11.5. Treatment Duration

- 17.11.6. Indication

- 17.11.7. Age Group

- 17.11.8. Mechanism of Action

- 17.11.9. End-Users

- 17.12. Vietnam Obesity Drug Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Drug Type/Class

- 17.12.3. Route of Administration

- 17.12.4. Prescription Type

- 17.12.5. Treatment Duration

- 17.12.6. Indication

- 17.12.7. Age Group

- 17.12.8. Mechanism of Action

- 17.12.9. End-Users

- 17.13. Rest of Asia Pacific Obesity Drug Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Drug Type/Class

- 17.13.3. Route of Administration

- 17.13.4. Prescription Type

- 17.13.5. Treatment Duration

- 17.13.6. Indication

- 17.13.7. Age Group

- 17.13.8. Mechanism of Action

- 17.13.9. End-Users

- 18. Middle East Obesity Drug Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Obesity Drug Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Drug Type/Class

- 18.3.2. Route of Administration

- 18.3.3. Prescription Type

- 18.3.4. Treatment Duration

- 18.3.5. Indication

- 18.3.6. Age Group

- 18.3.7. Mechanism of Action

- 18.3.8. End-Users

- 18.3.9. Country

- 18.3.9.1. Turkey

- 18.3.9.2. UAE

- 18.3.9.3. Saudi Arabia

- 18.3.9.4. Israel

- 18.3.9.5. Rest of Middle East

- 18.4. Turkey Obesity Drug Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Drug Type/Class

- 18.4.3. Route of Administration

- 18.4.4. Prescription Type

- 18.4.5. Treatment Duration

- 18.4.6. Indication

- 18.4.7. Age Group

- 18.4.8. Mechanism of Action

- 18.4.9. End-Users

- 18.5. UAE Obesity Drug Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Drug Type/Class

- 18.5.3. Route of Administration

- 18.5.4. Prescription Type

- 18.5.5. Treatment Duration

- 18.5.6. Indication

- 18.5.7. Age Group

- 18.5.8. Mechanism of Action

- 18.5.9. End-Users

- 18.6. Saudi Arabia Obesity Drug Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Drug Type/Class

- 18.6.3. Route of Administration

- 18.6.4. Prescription Type

- 18.6.5. Treatment Duration

- 18.6.6. Indication

- 18.6.7. Age Group

- 18.6.8. Mechanism of Action

- 18.6.9. End-Users

- 18.7. Israel Obesity Drug Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Drug Type/Class

- 18.7.3. Route of Administration

- 18.7.4. Prescription Type

- 18.7.5. Treatment Duration

- 18.7.6. Indication

- 18.7.7. Age Group

- 18.7.8. Mechanism of Action

- 18.7.9. End-Users

- 18.8. Rest of Middle East Obesity Drug Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Drug Type/Class

- 18.8.3. Route of Administration

- 18.8.4. Prescription Type

- 18.8.5. Treatment Duration

- 18.8.6. Indication

- 18.8.7. Age Group

- 18.8.8. Mechanism of Action

- 18.8.9. End-Users

- 19. Africa Obesity Drug Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Obesity Drug Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Drug Type/Class

- 19.3.2. Route of Administration

- 19.3.3. Prescription Type

- 19.3.4. Treatment Duration

- 19.3.5. Indication

- 19.3.6. Age Group

- 19.3.7. Mechanism of Action

- 19.3.8. End-Users

- 19.3.9. Country

- 19.3.9.1. South Africa

- 19.3.9.2. Egypt

- 19.3.9.3. Nigeria

- 19.3.9.4. Algeria

- 19.3.9.5. Rest of Africa

- 19.4. South Africa Obesity Drug Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Drug Type/Class

- 19.4.3. Route of Administration

- 19.4.4. Prescription Type

- 19.4.5. Treatment Duration

- 19.4.6. Indication

- 19.4.7. Age Group

- 19.4.8. Mechanism of Action

- 19.4.9. End-Users

- 19.5. Egypt Obesity Drug Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Drug Type/Class

- 19.5.3. Route of Administration

- 19.5.4. Prescription Type

- 19.5.5. Treatment Duration

- 19.5.6. Indication

- 19.5.7. Age Group

- 19.5.8. Mechanism of Action

- 19.5.9. End-Users

- 19.6. Nigeria Obesity Drug Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Drug Type/Class

- 19.6.3. Route of Administration

- 19.6.4. Prescription Type

- 19.6.5. Treatment Duration

- 19.6.6. Indication

- 19.6.7. Age Group

- 19.6.8. Mechanism of Action

- 19.6.9. End-Users

- 19.7. Algeria Obesity Drug Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Drug Type/Class

- 19.7.3. Route of Administration

- 19.7.4. Prescription Type

- 19.7.5. Treatment Duration

- 19.7.6. Indication

- 19.7.7. Age Group

- 19.7.8. Mechanism of Action

- 19.7.9. End-Users

- 19.8. Rest of Africa Obesity Drug Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Drug Type/Class

- 19.8.3. Route of Administration

- 19.8.4. Prescription Type

- 19.8.5. Treatment Duration

- 19.8.6. Indication

- 19.8.7. Age Group

- 19.8.8. Mechanism of Action

- 19.8.9. End-Users

- 20. South America Obesity Drug Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. South America Obesity Drug Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Drug Type/Class

- 20.3.2. Route of Administration

- 20.3.3. Prescription Type

- 20.3.4. Treatment Duration

- 20.3.5. Indication

- 20.3.6. Age Group

- 20.3.7. Mechanism of Action

- 20.3.8. End-Users

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Obesity Drug Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Drug Type/Class

- 20.4.3. Route of Administration

- 20.4.4. Prescription Type

- 20.4.5. Treatment Duration

- 20.4.6. Indication

- 20.4.7. Age Group

- 20.4.8. Mechanism of Action

- 20.4.9. End-Users

- 20.5. Argentina Obesity Drug Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Drug Type/Class

- 20.5.3. Route of Administration

- 20.5.4. Prescription Type

- 20.5.5. Treatment Duration

- 20.5.6. Indication

- 20.5.7. Age Group

- 20.5.8. Mechanism of Action

- 20.5.9. End-Users

- 20.6. Rest of South America Obesity Drug Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Drug Type/Class

- 20.6.3. Route of Administration

- 20.6.4. Prescription Type

- 20.6.5. Treatment Duration

- 20.6.6. Indication

- 20.6.7. Age Group

- 20.6.8. Mechanism of Action

- 20.6.9. End-Users

- 21. Key Players/ Company Profile

- 21.1. Altimmune Inc.

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. Amgen Inc.

- 21.3. AstraZeneca PLC

- 21.4. Boehringer Ingelheim

- 21.5. Currax Pharmaceuticals LLC

- 21.6. Eli Lilly and Company

- 21.7. GlaxoSmithKline plc (GSK)

- 21.8. Nalpropion Pharmaceuticals

- 21.9. Novo Nordisk A/S

- 21.10. Novo Nordisk A/S

- 21.11. Orexigen Therapeutics

- 21.12. Pfizer Inc.

- 21.13. Rhythm Pharmaceuticals

- 21.14. Roche Holding AG

- 21.15. Sanofi S.A.

- 21.16. Sciwind Biosciences

- 21.17. Structure Therapeutics

- 21.18. Takeda Pharmaceutical Company

- 21.19. Viking Therapeutics

- 21.20. Vivus Inc.

- 21.21. Zealand Pharma A/S

- 21.22. Other Key Players

- 21.1. Altimmune Inc.

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data