Onsite Occupational Health Services Market Size, Share & Trends Analysis Report by Service Type (Primary Care Services, Acute illness treatment, Preventive Health Services, Occupational Health Assessments, Health Surveillance Programs, Emergency Medical Services, Rehabilitation Services, Health Promotion & Wellness Programs), Staffing Model, Facility Type, Technology Integration, Contract Type, Pricing Model, End-users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Onsite Occupational Health Services Market Size, Share, and Growth

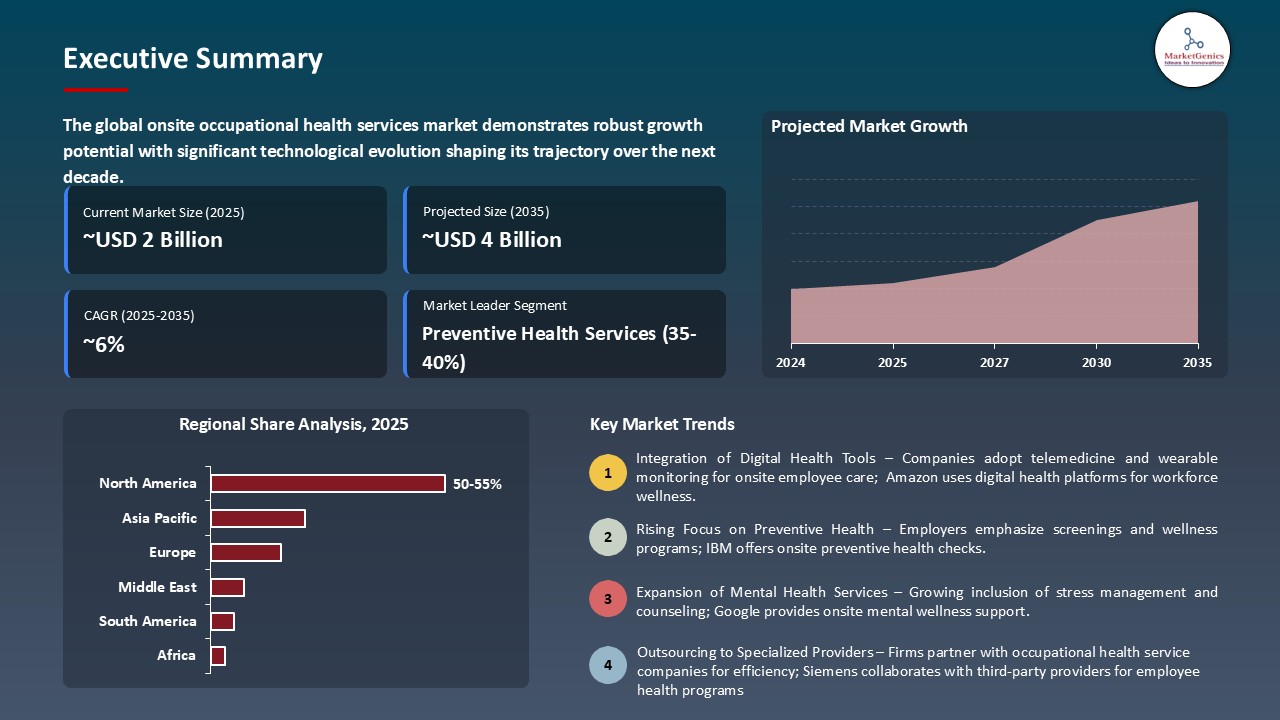

The global onsite occupational health services Market is witnessing strong growth, valued at USD 1.9 billion in 2025 and projected to reach USD 3.5 billion by 2035, expanding at a CAGR of 6.3% during the forecast period. The Asia Pacific region is the fastest-growing for onsite occupational health services market, driven by rapid industrialization, rising workforce population, and increasing employer emphasis on health and safety compliance.

Daniel Strobel, Cigna Healthcare's Medicare market president said that, “Infirmary Health has a long-standing history of providing quality care – and this agreement will allow for greater access to care for thousands of our customers across the region, We look forward to collaborating with Infirmary Health to bring best-in-class service in our local communities”.

The onsite occupational health services are undergoing a rapid technological change that has greatly increased efficiency, accessibility and value of the services to the employers. Telemedicine makes it possible to integrate and conduct remote consultations and provide employees at various locations with immediate medical assistance. An example of such is Included Health (formerly Grand Rounds/Doctor On Demand), which offers a hybrid model of virtual and in-person care, including primary, urgent, and behavioral health to employees and their dependents.

Partnerships in onsite occupational health services market promote growth through service expansions, adoption of innovative care services, and improvement of workplace health outcomes, which makes the onsite healthcare more efficient and effective to employers. An example is that in 2025, Wolters Kluwer collaborated with Enterprise Health to increase the capacity of occupational health, including the incorporation of advanced clinical data, wellness programs, and regulatory compliance solutions.

The growing tendency to incorporate the environmental, social, and governance (ESG) goals in the corporate strategies is another opportunity that the Onsite Occupational Health Services (OHS) market gets. Onsite health programs provide organizations a chance to meet their ESG commitments, be socially responsible, improve the well-being of their workforce, and increase organizational resiliency. Indicatively, the example of UnitedHealth Group and its holistic well-being program incorporates onsite care, mental health, and wellness programs that are aligned to employee health, and thus its effectiveness in meeting its ESG objectives- demonstrating a close prospect of OHS providers serving corporate sustainability and employee wellness.

Onsite Occupational Health Services Market Dynamics and Trends

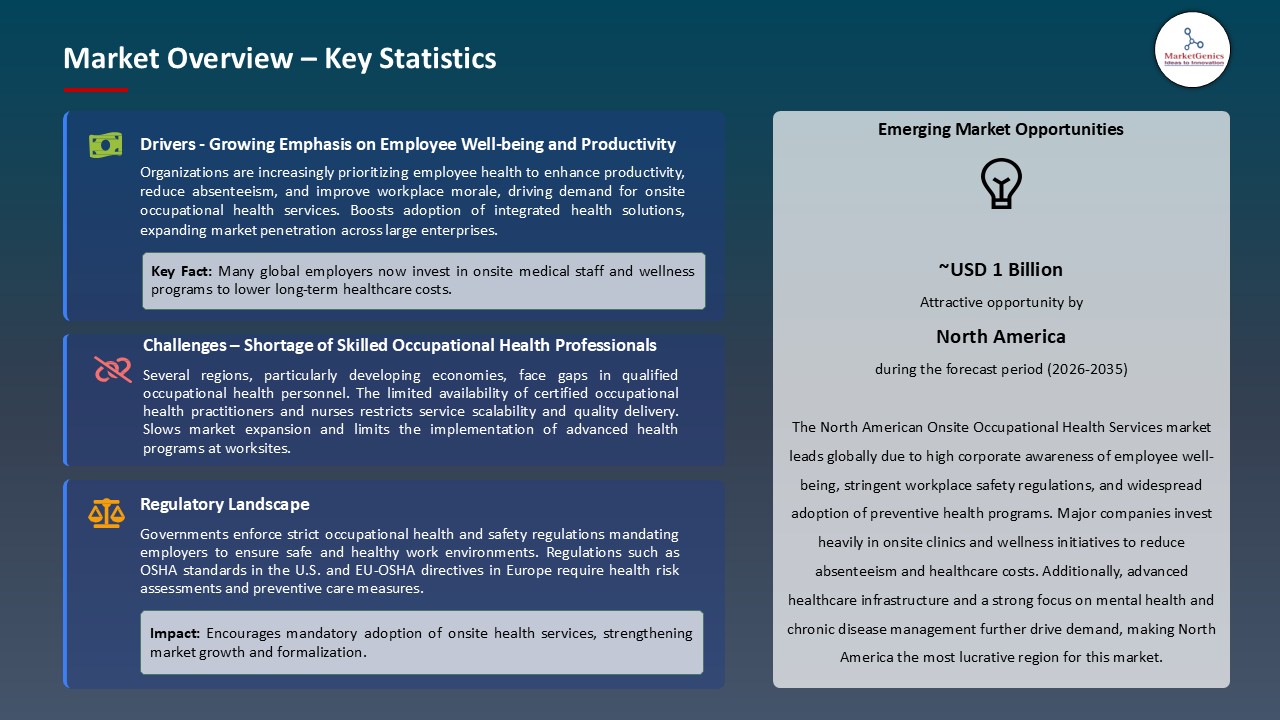

Driver: Labor Market Competitiveness Drives Comprehensive Benefit Offerings

- The presence of a highly competitive labor market has put pressure on organizations to acquire and maintain top employees through offering strong employee benefits. Access to health and wellness services, such as convenient medical services, have become one of the most essential factors of employer differentiation.

- Onsite occupational health services (OHS) enable the employers to combine preventive services, regular health checks, long-term disease management, and well-being initiatives at the workplace. This enhances employee satisfaction and productivity as well as minimizing absenteeism and healthcare expenses. Consequently, employers are also spending more on onsite clinics and health programs as a way of staying competitive in the talent market.

- The demand will lead to the growth of the onsite occupational health services market, with the providers to increase the services range, implement innovative healthcare technologies, and create scalable solutions to the increased corporate demands of the integrated, workplace-based healthcare.

- ConocoPhillips, in 2025, has introduced the Houston Onsite Medical Clinic Plan at its headquarters in Houston, where it offers employees and in certain instances their dependents access to a full-service primary care clinic on site.

- Essentially, the motivation of acquiring the best talent through provision of excellent health benefits is one of the main catalysts to the introduction and growth of onsite occupational health services market across the world.

Restraint: Implementation Costs and Space Requirements Challenge Small Employer Adoption

- High set up and operational fees have also been identified as one of the major obstacles to the penetration of onsite occupational health services market especially among small and mid-sized enterprises. The cost of developing onsite clinics is that it is necessary to invest considerable funds in the medical infrastructure, equipment, staffing, and adherence to the standards of control.

- Moreover, there might be difficulties in assigning physical space to the office area or industrial complex in case of a medical facility, particularly in big cities where the prices of real estate are high. Continued maintenance and integration of technology along with the constant delivery of services increases the financial strain even more. Therefore, small entities are now choosing an outsourced or shared health service model over an onsite facility.

- The price and space restrictions prevent the scale of onsite occupational health programs and therefore curtail the market growth in general, but more so in the cost sensitive industries and developing countries where budget constraints are even stronger.

Opportunity: Chronic Disease Management Programs Demonstrate Strong ROI

- The rising numbers of chronic diseases among working populations including diabetes, hypertension, and cardiovascular disorders are a major opportunity to the onsite occupational health services market.

- Instituting intensive chronic disease regulation initiatives in the work place clinics, the employers are able to offer constant check-ups, early therapy and special care to the affected workforce. These programs are not only effective in enhancing health outcomes of the workforce but also cause quantifiable decreases in absenteeism, hospitalizations and insurance claims.

- The case of BMW and Premise Health long-term relationship demonstrates the strength of ROI of chronic disease management in the workplace. Its onsite diabetes program, which is a combination of personalized counseling, pharmacist supervision, and continuous follow-ups by onsite pharmacists and providers, has improved the health outcomes of employees, decreased complications, and saved considerably since 2008.

- The inclusion of chronic disease management in onsite health programs leads to significant cost reduction, enhanced employee output, and enhanced employer ROI making this a critical growth driver in the onsite occupational health services sector.

Key Trend: Mental Health Integration Addresses Growing Workforce Needs

- Mental health integrated with onsite occupational health programs have become one of the most significant trends to influence the onsite occupational health services market. With the increase in stress, burnout, and anxiety at the workplace, employers are now focusing on both mental and physical health.

- Onsite clinics will provide counseling, mindfulness, and resilience training, which digital tools enable in order to have access to from anywhere and to engage at any time. Such a holistic approach not only boosts employee morale and retention, but also productivity and decreases absenteeism.

- The Cigna Group Foundation partnered with the community organization to provide better mental health care to the youth in 2025, benefiting more than 34,000 lives. This program is indicative of the wider efforts by Cigna to incorporate mental health in workplace and community health programs and is consistent with the trend in increased holistic onsite occupational health services.

- The inclusion of mental health into OHS models is a manifestation of employers redefining the concept of workplace wellness and the shift of reactive illness-care to proactive, supportive, and preventive health systems.

Onsite-Occupational-Health-Services-Market Analysis and Segmental Data

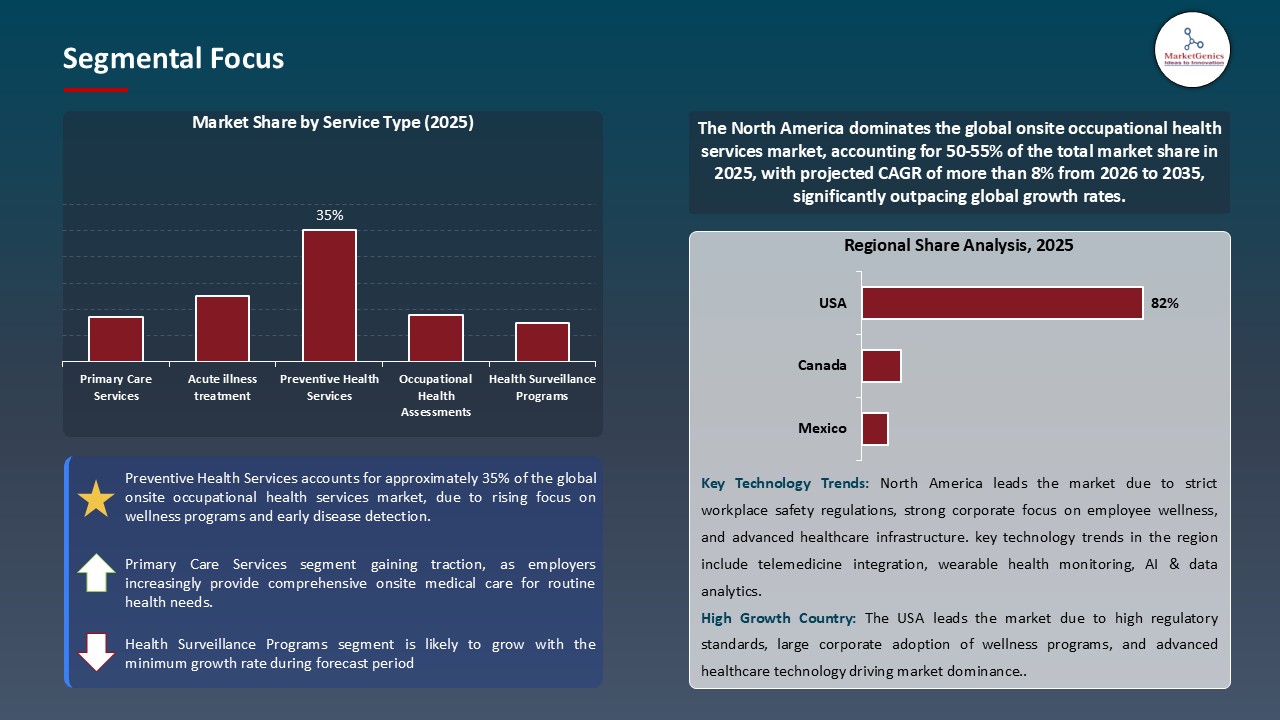

Preventive Health Services Dominate Global Onsite Occupational Health Services Market

- Preventative health services continue to be the largest portion of the worldwide onsite occupational health services (OHS) market with the greatest percentage share as employers are moving towards greater emphasis on early disease detection, regular check-ups, vaccinations, and wellness opportunities. Focusing on preventive care, employers can save both the long-term healthcare expenses and the absenteeism and increase productivity of the workforce.

- Onsite clinics and built-in health plans to provide physicals, biometric screening, chronic disease risk assessments and lifestyle counseling are also being adopted in most industries. Premise health and Centivo introduced a new employed and union centered primary care health plan in 2025 that is based on onsite and near-site clinics with integrated clinically coordinated network.

- This campaign underscores the increasing focus on preventive and individualistic care in workplace health programs which upholds the importance of OHS services in enhancing the health outcomes of employees as well as minimizing long-term healthcare expenditures.

- The high focus on preventive health care which is aided by the built-in onsite care models and innovative employer alliances creates a strong emphasis on the importance of OHS in optimizing the well-being of the workforce, lowering healthcare spending, and generating sustainable productivity advantage throughout industries.

North America Leads Global Onsite Occupational Health Services Market Demand

- North America has most established and expansive ecosystem in onsite occupational health services market, due to the presence of high levels of corporate implementation of wellness programs, strict occupational health standards, and an increased employer emphasis on preventive care. In the U.S. especially, there has been much adoption of onsite clinics, telehealth initiatives, as well as chronic diseases management initiatives in manufacturing, technology, and logistics.

- Infrastructure Advanced healthcare infrastructure, effective reimbursement schemes and competitive labor market also encourage firms to invest in extensive onsite healthcare programs to attract and retain talent. The major suppliers have created large cluster networks and care models in the area, strengthening the hegemony of North America.

- Overall, the high demand of OHS in the region is fueled by regulatory support, adoption of corporate wellness, and technological advancements.

Onsite-Occupational-Health-Services-Market Ecosystem

The international onsite occupational health services market is slightly fragmented with major industry players including Concentra, UnitedHealth Group, Cigna Onsite Health, Premise Health, and International SOS controlling about 27% of the market share. These market pioneers’ control with a strong network of clinics, integrated models of care delivery and advanced health management technology. This is because of their experience in providing preventive care, chronic disease management, and occupational health compliance that allow them to serve a wide range of industries, such as manufacturing, through the corporate campuses, in the global markets.

The high standards of operations and services of these companies, developed by means of strategic partnerships, digital health integration, and evidence-based care models, have made entry barriers significant to smaller providers. In addition, partnerships with employers and health technology companies provide the ability to deliver services on a scale, better health outcomes among the workforce, and healthcare cost reduction. All these strengths collectively consolidate their market leadership and predetermine the continued development of the onsite occupational health services market.

Recent Development and Strategic Overview:

- In November 2024, Cigna Healthcare collaborated with Infirmary Health to increase access to the Medicare Advantage network and cover the Gulf Coast of Alabama and incorporate value-based care to improve their population health and cut costs. This partnership enhances Cignas emphasis on coordinated and preventive and workplace-based care delivery to facilitate the development of onsite and near-site health care arrangements.

- In October 2025, Accenture purchased UK-based Decho to increase its Palantir and Gen AI applications in health and public service markets. This reinforces the data-driven healthcare provision, head-on AI-supported analytics, predictive health tracking and combined digital platforms, which bolster efficiency and customization of onsite occupational health services- which support innovation and expansion in the market.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 1.9 Bn |

|

Market Forecast Value in 2035 |

USD 3.5 Bn |

|

Growth Rate (CAGR) |

6.3% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Onsite-Occupational-Health-Services-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Onsite Occupational Health Services Market, By Service Type |

|

|

Onsite Occupational Health Services Market, By Staffing Model |

|

|

Onsite Occupational Health Services Market, By Facility Type |

|

|

Onsite Occupational Health Services Market, By Technology Integration |

|

|

Onsite Occupational Health Services Market, By Contract Type |

|

|

Onsite Occupational Health Services Market, By Pricing Model |

|

|

Onsite Occupational Health Services Market, By End-users |

|

Frequently Asked Questions

The global onsite occupational health services market was valued at USD 1.9 Bn in 2025.

The global onsite occupational health services market industry is expected to grow at a CAGR of 6.3% from 2026 to 2035.

The demand for onsite occupational health services market is driven by rising corporate wellness initiatives, stringent workplace safety regulations, and growing focus on reducing healthcare costs through preventive and comprehensive employee health programs.

In terms of service type, the preventive health services segment accounted for the major share in 2025.

North America is the most attractive region for onsite occupational health services market.

Prominent players operating in the global onsite occupational health services market are Accenture Health, Axiom Medical, Cigna Onsite Health, Concentra, Dignity Health, Everside Health, HCA Healthcare, Healthstat, Holzer Health System, International SOS, Marathon Health, Medcor, Premise Health, Proactive MD, Sonic Healthcare, UnitedHealth Group, Vera Whole Health, Wellness Corporate Solutions, WorkCare, and Other Key Players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Onsite Occupational Health Services Market Outlook

- 2.1.1. Onsite Occupational Health Services Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Onsite Occupational Health Services Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Packaging Industry Overview, 2025

- 3.1.1. Healthcare & Pharmaceutical Industry Ecosystem Analysis

- 3.1.2. Key Trends for Healthcare & Pharmaceutical Industry

- 3.1.3. Regional Distribution for Healthcare & Pharmaceutical Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Packaging Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Stronger workplace safety regulations and compliance

- 4.1.1.2. Growing corporate focus on employee wellness and productivity

- 4.1.1.3. Expansion of large-scale industrial, construction, and remote-site projects

- 4.1.2. Restraints

- 4.1.2.1. High setup and operational costs for on-site facilities

- 4.1.2.2. Shortage of qualified occupational health professionals

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

-

- 4.2.1.1. Regulatory Framework

- 4.2.2. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.2.3. Tariffs and Standards

- 4.2.4. Impact Analysis of Regulations on the Market

-

- 4.3. Ecosystem Analysis

- 4.4. Porter’s Five Forces Analysis

- 4.5. PESTEL Analysis

- 4.6. Global Onsite Occupational Health Services Market Demand

- 4.6.1. Historical Market Size - in Value (US$ Bn), 2020-2024

- 4.6.2. Current and Future Market Size - in Value (US$ Bn), 2026–2035

- 4.6.2.1. Y-o-Y Growth Trends

- 4.6.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Onsite Occupational Health Services Market Analysis, By Service Type

- 6.1. Key Segment Analysis

- 6.2. Onsite Occupational Health Services Market Size (Value - US$ Bn), Analysis, and Forecasts, By Service Type, 2021-2035

- 6.2.1. Primary Care Services

- 6.2.2. Acute illness treatment

- 6.2.2.1. Minor injury management

- 6.2.2.2. Routine health assessments

- 6.2.2.3. Others

- 6.2.3. Preventive Health Services

- 6.2.3.1. Health screenings

- 6.2.3.2. Vaccination programs

- 6.2.3.3. Wellness examinations

- 6.2.3.4. Others

- 6.2.4. Occupational Health Assessments

- 6.2.5. Health Surveillance Programs

- 6.2.6. Emergency Medical Services

- 6.2.6.1. First aid response

- 6.2.6.2. Emergency stabilization

- 6.2.6.3. Critical incident management

- 6.2.6.4. Others

- 6.2.7. Rehabilitation Services

- 6.2.8. Health Promotion & Wellness Programs

- 7. Global Onsite Occupational Health Services Market Analysis, By Staffing Model

- 7.1. Key Segment Analysis

- 7.2. Onsite Occupational Health Services Market Size (Value - US$ Bn), Analysis, and Forecasts, By Staffing Model, 2021-2035

- 7.2.1. Full-Time Onsite Medical Staff

- 7.2.2. Part-Time Medical Personnel

- 7.2.3. Hybrid Staffing Solutions

- 7.2.4. Telemedicine-Supported Services

- 8. Global Onsite Occupational Health Services Market Analysis and Forecasts,By Facility Type

- 8.1. Key Findings

- 8.2. Onsite Occupational Health Services Market Size (Value - US$ Mn), Analysis, and Forecasts, By Facility Type, 2021-2035

- 8.2.1. Basic First Aid Stations

- 8.2.2. Medical Clinics

- 8.2.3. Comprehensive Health Centers

- 8.2.4. Mobile Medical Units

- 8.2.5. Modular Healthcare Facilities

- 8.2.6. Others

- 9. Global Onsite Occupational Health Services Market Analysis and Forecasts, By Technology Integration

- 9.1. Key Findings

- 9.2. Onsite Occupational Health Services Market Size (Vo Value - US$ Mn), Analysis, and Forecasts, By Technology Integration, 2021-2035

- 9.2.1. Traditional Manual Services

- 9.2.1.1. Digitally-Enabled Services

- 9.2.1.2. Electronic health records (EHR)

- 9.2.1.3. Digital case management

- 9.2.2. Advanced Technology-Integrated Services

- 9.2.2.1. Wearable health monitoring

- 9.2.2.2. IoT-enabled health tracking

- 9.2.2.3. Predictive analytics platforms

- 9.2.2.4. Others

- 9.2.3. Telemedicine-Enhanced Services

- 9.2.1. Traditional Manual Services

- 10. Global Onsite Occupational Health Services Market Analysis and Forecasts, By Contract Type

- 10.1. Key Findings

- 10.2. Onsite Occupational Health Services Market Size (Value - US$ Mn), Analysis, and Forecasts, By Contract Type, 2021-2035

- 10.2.1. Managed Services Contracts

- 10.2.2. Staffing-Only Contracts

- 10.2.3. Co-Sourced Arrangements

- 10.2.4. Build-Operate-Transfer (BOT) Models

- 11. Global Onsite Occupational Health Services Market Analysis and Forecasts, By Pricing Model

- 11.1. Key Findings

- 11.2. Onsite Occupational Health Services Market Size (Value - US$ Mn), Analysis, and Forecasts, By Pricing Model, 2021-2035

- 11.2.1. Per-Employee-Per-Month (PEPM)

- 11.2.2. Fixed Monthly Retainer

- 11.2.3. Fee-For-Service

- 11.2.4. Value-Based Arrangements

- 11.2.5. Capitated Models

- 12. Global Onsite Occupational Health Services Market Analysis and Forecasts, By End-users

- 12.1. Key Findings

- 12.2. Onsite Occupational Health Services Market Size (Value - US$ Mn), Analysis, and Forecasts, By End-users, 2021-2035

- 12.2.1. Manufacturing

- 12.2.1.1. Workplace injury prevention and treatment

- 12.2.1.2. Repetitive strain injury management

- 12.2.1.3. Chemical exposure monitoring

- 12.2.1.4. Others

- 12.2.2. Oil & Gas

- 12.2.2.1. Remote site medical services

- 12.2.2.2. Emergency response and trauma care

- 12.2.2.3. Hazardous material exposure management

- 12.2.2.4. Offshore medical facilities

- 12.2.2.5. Others

- 12.2.3. Mining

- 12.2.3.1. Respiratory health surveillance

- 12.2.3.2. Dust exposure monitoring

- 12.2.3.3. Vibration-related health monitoring

- 12.2.3.4. Remote location healthcare

- 12.2.3.5. Others

- 12.2.4. Construction

- 12.2.4.1. On-site injury treatment

- 12.2.4.2. Fall prevention and management

- 12.2.4.3. Heat stress management

- 12.2.4.4. Substance abuse screening

- 12.2.4.5. Others

- 12.2.5. Transportation & Logistics

- 12.2.5.1. Fatigue management programs

- 12.2.5.2. Driver fitness assessments

- 12.2.5.3. Back injury prevention

- 12.2.5.4. Drug and alcohol testing

- 12.2.5.5. Others

- 12.2.6. Healthcare Facilities

- 12.2.6.1. Needle stick injury management

- 12.2.6.2. Infectious disease prevention

- 12.2.6.3. Staff wellness programs

- 12.2.6.4. Immunization programs

- 12.2.6.5. Others

- 12.2.7. Retail & Hospitality

- 12.2.8. Energy & Utilities

- 12.2.9. Agriculture & Food Processing

- 12.2.10. Pharmaceutical & Chemical

- 12.2.11. Aviation & Aerospace

- 12.2.12. Other End-users

- 12.2.1. Manufacturing

- 13. Global Onsite Occupational Health Services Market Analysis and Forecasts, by Region

- 13.1. Key Findings

- 13.2. Onsite Occupational Health Services Market Size (Value - US$ Mn), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America Onsite Occupational Health Services Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America Onsite Occupational Health Services Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Service Type

- 14.3.2. Staffing Model

- 14.3.3. Facility Type

- 14.3.4. Technology Integration

- 14.3.5. Contract Type

- 14.3.6. Pricing Model

- 14.3.7. End-Users

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA Onsite Occupational Health Services Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Service Type

- 14.4.3. Staffing Model

- 14.4.4. Facility Type

- 14.4.5. Technology Integration

- 14.4.6. Contract Type

- 14.4.7. Pricing Model

- 14.4.8. End-Users

- 14.5. Canada Onsite Occupational Health Services Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Service Type

- 14.5.3. Staffing Model

- 14.5.4. Facility Type

- 14.5.5. Technology Integration

- 14.5.6. Contract Type

- 14.5.7. Pricing Model

- 14.5.8. End-Users

- 14.6. Mexico Onsite Occupational Health Services Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Service Type

- 14.6.3. Staffing Model

- 14.6.4. Facility Type

- 14.6.5. Technology Integration

- 14.6.6. Contract Type

- 14.6.7. Pricing Model

- 14.6.8. End-Users

- 15. Europe Onsite Occupational Health Services Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe Onsite Occupational Health Services Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Service Type

- 15.3.2. Staffing Model

- 15.3.3. Facility Type

- 15.3.4. Technology Integration

- 15.3.5. Contract Type

- 15.3.6. Pricing Model

- 15.3.7. End-Users

- 15.3.8. Country

- 15.3.8.1. Germany

- 15.3.8.2. United Kingdom

- 15.3.8.3. France

- 15.3.8.4. Italy

- 15.3.8.5. Spain

- 15.3.8.6. Netherlands

- 15.3.8.7. Nordic Countries

- 15.3.8.8. Poland

- 15.3.8.9. Russia & CIS

- 15.3.8.10. Rest of Europe

- 15.4. Germany Onsite Occupational Health Services Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Service Type

- 15.4.3. Staffing Model

- 15.4.4. Facility Type

- 15.4.5. Technology Integration

- 15.4.6. Contract Type

- 15.4.7. Pricing Model

- 15.4.8. End-Users

- 15.5. United Kingdom Onsite Occupational Health Services Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Service Type

- 15.5.3. Staffing Model

- 15.5.4. Facility Type

- 15.5.5. Technology Integration

- 15.5.6. Contract Type

- 15.5.7. Pricing Model

- 15.5.8. End-Users

- 15.6. France Onsite Occupational Health Services Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Service Type

- 15.6.3. Staffing Model

- 15.6.4. Facility Type

- 15.6.5. Technology Integration

- 15.6.6. Contract Type

- 15.6.7. Pricing Model

- 15.6.8. End-Users

- 15.7. Italy Onsite Occupational Health Services Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Service Type

- 15.7.3. Staffing Model

- 15.7.4. Facility Type

- 15.7.5. Technology Integration

- 15.7.6. Contract Type

- 15.7.7. Pricing Model

- 15.7.8. End-Users

- 15.8. Spain Onsite Occupational Health Services Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Service Type

- 15.8.3. Staffing Model

- 15.8.4. Facility Type

- 15.8.5. Technology Integration

- 15.8.6. Contract Type

- 15.8.7. Pricing Model

- 15.8.8. End-Users

- 15.9. Netherlands Onsite Occupational Health Services Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Service Type

- 15.9.3. Staffing Model

- 15.9.4. Facility Type

- 15.9.5. Technology Integration

- 15.9.6. Contract Type

- 15.9.7. Pricing Model

- 15.9.8. End-Users

- 15.10. Nordic Countries Onsite Occupational Health Services Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Service Type

- 15.10.3. Staffing Model

- 15.10.4. Facility Type

- 15.10.5. Technology Integration

- 15.10.6. Contract Type

- 15.10.7. Pricing Model

- 15.10.8. End-Users

- 15.11. Poland Onsite Occupational Health Services Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Service Type

- 15.11.3. Staffing Model

- 15.11.4. Facility Type

- 15.11.5. Technology Integration

- 15.11.6. Contract Type

- 15.11.7. Pricing Model

- 15.11.8. End-Users

- 15.12. Russia & CIS Onsite Occupational Health Services Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Service Type

- 15.12.3. Staffing Model

- 15.12.4. Facility Type

- 15.12.5. Technology Integration

- 15.12.6. Contract Type

- 15.12.7. Pricing Model

- 15.12.8. End-Users

- 15.13. Rest of Europe Onsite Occupational Health Services Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Service Type

- 15.13.3. Staffing Model

- 15.13.4. Facility Type

- 15.13.5. Technology Integration

- 15.13.6. Contract Type

- 15.13.7. Pricing Model

- 15.13.8. End-Users

- 16. Asia Pacific Onsite Occupational Health Services Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. East Asia Onsite Occupational Health Services Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Service Type

- 16.3.2. Staffing Model

- 16.3.3. Facility Type

- 16.3.4. Technology Integration

- 16.3.5. Contract Type

- 16.3.6. Pricing Model

- 16.3.7. End-Users

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia Pacific

- 16.4. China Onsite Occupational Health Services Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Service Type

- 16.4.3. Staffing Model

- 16.4.4. Facility Type

- 16.4.5. Technology Integration

- 16.4.6. Contract Type

- 16.4.7. Pricing Model

- 16.4.8. End-Users

- 16.5. India Onsite Occupational Health Services Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Service Type

- 16.5.3. Staffing Model

- 16.5.4. Facility Type

- 16.5.5. Technology Integration

- 16.5.6. Contract Type

- 16.5.7. Pricing Model

- 16.5.8. End-Users

- 16.6. Japan Onsite Occupational Health Services Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Service Type

- 16.6.3. Staffing Model

- 16.6.4. Facility Type

- 16.6.5. Technology Integration

- 16.6.6. Contract Type

- 16.6.7. Pricing Model

- 16.6.8. End-Users

- 16.7. South Korea Onsite Occupational Health Services Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Service Type

- 16.7.3. Staffing Model

- 16.7.4. Facility Type

- 16.7.5. Technology Integration

- 16.7.6. Contract Type

- 16.7.7. Pricing Model

- 16.7.8. End-Users

- 16.8. Australia and New Zealand Onsite Occupational Health Services Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Service Type

- 16.8.3. Staffing Model

- 16.8.4. Facility Type

- 16.8.5. Technology Integration

- 16.8.6. Contract Type

- 16.8.7. Pricing Model

- 16.8.8. End-Users

- 16.9. Indonesia Onsite Occupational Health Services Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Service Type

- 16.9.3. Staffing Model

- 16.9.4. Facility Type

- 16.9.5. Technology Integration

- 16.9.6. Contract Type

- 16.9.7. Pricing Model

- 16.9.8. End-Users

- 16.10. Malaysia Onsite Occupational Health Services Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Service Type

- 16.10.3. Staffing Model

- 16.10.4. Facility Type

- 16.10.5. Technology Integration

- 16.10.6. Contract Type

- 16.10.7. Pricing Model

- 16.10.8. End-Users

- 16.11. Thailand Onsite Occupational Health Services Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Service Type

- 16.11.3. Staffing Model

- 16.11.4. Facility Type

- 16.11.5. Technology Integration

- 16.11.6. Contract Type

- 16.11.7. Pricing Model

- 16.11.8. End-Users

- 16.12. Vietnam Onsite Occupational Health Services Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Service Type

- 16.12.3. Staffing Model

- 16.12.4. Facility Type

- 16.12.5. Technology Integration

- 16.12.6. Contract Type

- 16.12.7. Pricing Model

- 16.12.8. End-Users

- 16.13. Rest of Asia Pacific Onsite Occupational Health Services Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Service Type

- 16.13.3. Staffing Model

- 16.13.4. Facility Type

- 16.13.5. Technology Integration

- 16.13.6. Contract Type

- 16.13.7. Pricing Model

- 16.13.8. End-Users

- 17. Middle East Onsite Occupational Health Services Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East Onsite Occupational Health Services Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Service Type

- 17.3.2. Staffing Model

- 17.3.3. Facility Type

- 17.3.4. Technology Integration

- 17.3.5. Contract Type

- 17.3.6. Pricing Model

- 17.3.7. End-Users

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey Onsite Occupational Health Services Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Service Type

- 17.4.3. Staffing Model

- 17.4.4. Facility Type

- 17.4.5. Technology Integration

- 17.4.6. Contract Type

- 17.4.7. Pricing Model

- 17.4.8. End-Users

- 17.5. UAE Onsite Occupational Health Services Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Service Type

- 17.5.3. Staffing Model

- 17.5.4. Facility Type

- 17.5.5. Technology Integration

- 17.5.6. Contract Type

- 17.5.7. Pricing Model

- 17.5.8. End-Users

- 17.6. Saudi Arabia Onsite Occupational Health Services Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Service Type

- 17.6.3. Staffing Model

- 17.6.4. Facility Type

- 17.6.5. Technology Integration

- 17.6.6. Contract Type

- 17.6.7. Pricing Model

- 17.6.8. End-Users

- 17.7. Israel Onsite Occupational Health Services Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Service Type

- 17.7.3. Staffing Model

- 17.7.4. Facility Type

- 17.7.5. Technology Integration

- 17.7.6. Contract Type

- 17.7.7. Pricing Model

- 17.7.8. End-Users

- 17.8. Rest of Middle East Onsite Occupational Health Services Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Service Type

- 17.8.3. Staffing Model

- 17.8.4. Facility Type

- 17.8.5. Technology Integration

- 17.8.6. Contract Type

- 17.8.7. Pricing Model

- 17.8.8. End-Users

- 18. Africa Onsite Occupational Health Services Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa Onsite Occupational Health Services Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Service Type

- 18.3.2. Staffing Model

- 18.3.3. Facility Type

- 18.3.4. Technology Integration

- 18.3.5. Contract Type

- 18.3.6. Pricing Model

- 18.3.7. End-Users

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa Onsite Occupational Health Services Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Service Type

- 18.4.3. Staffing Model

- 18.4.4. Facility Type

- 18.4.5. Technology Integration

- 18.4.6. Contract Type

- 18.4.7. Pricing Model

- 18.4.8. End-Users

- 18.5. Egypt Onsite Occupational Health Services Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Service Type

- 18.5.3. Staffing Model

- 18.5.4. Facility Type

- 18.5.5. Technology Integration

- 18.5.6. Contract Type

- 18.5.7. Pricing Model

- 18.5.8. End-Users

- 18.6. Nigeria Onsite Occupational Health Services Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Service Type

- 18.6.3. Staffing Model

- 18.6.4. Facility Type

- 18.6.5. Technology Integration

- 18.6.6. Contract Type

- 18.6.7. Pricing Model

- 18.6.8. End-Users

- 18.7. Algeria Onsite Occupational Health Services Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Service Type

- 18.7.3. Staffing Model

- 18.7.4. Facility Type

- 18.7.5. Technology Integration

- 18.7.6. Contract Type

- 18.7.7. Pricing Model

- 18.7.8. End-Users

- 18.8. Rest of Africa Onsite Occupational Health Services Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Service Type

- 18.8.3. Staffing Model

- 18.8.4. Facility Type

- 18.8.5. Technology Integration

- 18.8.6. Contract Type

- 18.8.7. Pricing Model

- 18.8.8. End-Users

- 19. South America Onsite Occupational Health Services Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Central and South Africa Onsite Occupational Health Services Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Service Type

- 19.3.2. Staffing Model

- 19.3.3. Facility Type

- 19.3.4. Technology Integration

- 19.3.5. Contract Type

- 19.3.6. Pricing Model

- 19.3.7. End-Users

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil Onsite Occupational Health Services Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Service Type

- 19.4.3. Staffing Model

- 19.4.4. Facility Type

- 19.4.5. Technology Integration

- 19.4.6. Contract Type

- 19.4.7. Pricing Model

- 19.4.8. End-Users

- 19.5. Argentina Onsite Occupational Health Services Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Service Type

- 19.5.3. Staffing Model

- 19.5.4. Facility Type

- 19.5.5. Technology Integration

- 19.5.6. Contract Type

- 19.5.7. Pricing Model

- 19.5.8. End-Users

- 19.6. Rest of South America Onsite Occupational Health Services Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Service Type

- 19.6.3. Staffing Model

- 19.6.4. Facility Type

- 19.6.5. Technology Integration

- 19.6.6. Contract Type

- 19.6.7. Pricing Model

- 19.6.8. End-Users

- 20. Key Players/ Company Profile

- 20.1. Accenture Health

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. Axiom Medical

- 20.3. Cigna Onsite Health

- 20.4. Concentra

- 20.5. Dignity Health

- 20.6. Everside Health

- 20.7. HCA Healthcare

- 20.8. Healthstat

- 20.9. Holzer Health System

- 20.10. International SOS

- 20.11. Marathon Health

- 20.12. Medcor

- 20.13. Premise Health

- 20.14. Proactive MD

- 20.15. Sonic Healthcare

- 20.16. UnitedHealth Group

- 20.17. Vera Whole Health

- 20.18. Wellness Corporate Solutions

- 20.19. WorkCare

- 20.20. Other Key Players

- 20.1. Accenture Health

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data