Organoids & Next-Gen Human In-Vitro Models Market Size, Share & Trends Analysis Report by Product Type (Brain Organoids, Liver Organoids, Kidney Organoids, Intestinal Organoids, Lung Organoids, Cardiac Organoid, Pancreatic Organoids, Tumor Organoids, Other Organoid Types), Technology/Platform, Cell Source, Application, Disease Type, Complexity Level, Scale of Operation, End-users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Organoids & Next-Gen Human In-Vitro Models Market Size, Share, and Growth

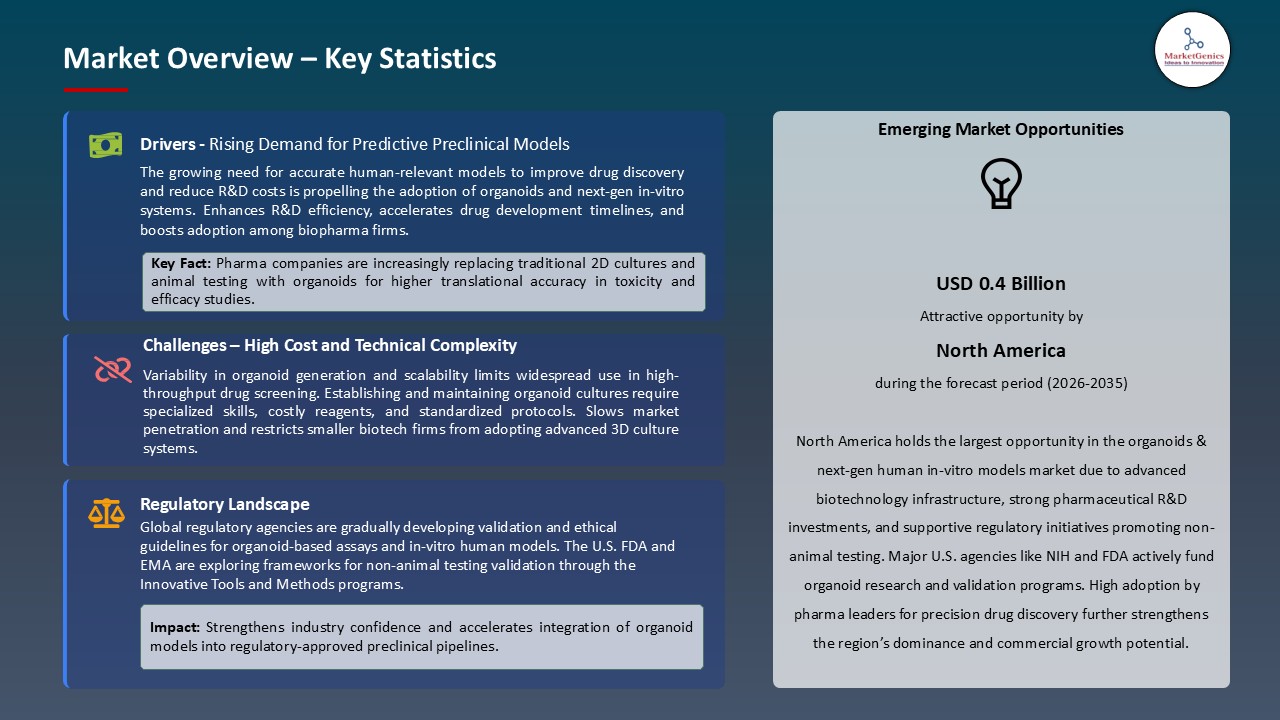

The global organoids & next-gen human in-vitro models market is witnessing strong growth, valued at USD 0.4 billion in 2025 and projected to reach USD 1.3 billion by 2035, expanding at a CAGR of 12.6% during the forecast period. The Asia Pacific region is the fastest-growing for the organoids & next-gen human in-vitro models market because of expanding biotech research infrastructure, rising government funding, and increasing adoption of advanced in-vitro systems for drug discovery and precision medicine.

Jim Corbett, Chief Executive Officer at Emulate said that, “AVA gives scientists unprecedented experimental capacity with the biological depth of live human tissue—something no other platform can match, by combining Emulate’s proven Organ-on-a-Chip technology with high-throughput consumables, automated imaging, and streamlined workflows in one benchtop unit, AVA lets teams ask bigger questions earlier and move the right drug candidates forward faster.”

The growing incidences of chronic and complicated diseases including cancer, diabetes, neurodegenerative, and cardiovascular diseases are major contributors to the organoids and next-gen human in-vitro models market. Such conditions necessitate rigorous models, which are physiologically applicable to achieve a more insightful understanding of the disease processes and to test the possible treatments. In June 2025, Predictive Oncology developed Labcorp exclusive human and rat 3D liver organoids, which could be used to test drug metabolism and drug toxicity rates accurately and to speed up preclinical testing of cancer drugs.

The research institutes, biotechnology companies, and healthcare organizations are collaborating and forming strategic alliances to accelerate the organoids and next-gen human in-vitro models market through technology exchange, increasing their capability for novel breakthrough in clinical implementation. An example is the formation of a strategic collaboration between MD Anderson Cancer Center and TOPPAN Holdings in 2025, which co-developed organoid-based technology to assess the effectiveness of cancer therapies to enhance predictive behavior in therapy choices and enhance individual study of cancer.

AI & automation to analyze images, automate culture systems to increase throughput, reproducibility, as well as research efficiency are significant adjacent opportunities in the organoids and next-gen human in-vitro models market. For instance, in August 2025, Molecular Devices, LLC released CellXpress.ai Automated Cell Culture System, upgrading development and long-term maintenance of brain organoids, enabling faster progress in neurodegenerative disease research.

Organoids & Next-Gen Human In-Vitro Models-Market Dynamics and Trends

Driver: Animal Model Limitations Drive Alternative Platform Development

- The organoids and next-generation human in-vitro models market is primarily driven by growing awareness of the limitations of traditional animal models, which often fail to replicate human physiological responses, leading to high drug failure rates in clinical trials. The shift toward organoids is further accelerated by ethical considerations, regulatory pressure to minimize animal testing, and the demand for more predictive, human-relevant systems.

- Human stem cell–derived organoids provide accurate biological models for disease study, toxicity screening, and personalized drug testing. Initiatives such as FDA-sponsored oncology programs are promoting the integration of organoid systems in preclinical research. In 2025, Stanford University researchers created vascularized organoids that mimic human tissue functions, enhancing physiological relevance in regenerative medicine and drug development.

- These advancements signify a transformative shift in biomedical research, positioning market as the cornerstone of future drug discovery, safety evaluation, and personalized medicine.

Restraint: Regulatory Complexity and Safety Uncertainties Delay Novel Modality Approvals

- The absence of standardized procedures in the creation and growing of organoid, culture and analysis conditions are an important limitation to the organoids and next-generation human in-vitro models market.

- The differences in stem cell sources and differentiation protocols and growth media can also be a cause of differences in organoid morphology and behavior and thus hard to replicate results across laboratories. This inability to be reproducible impedes large scale validation and integration of organoid models to regulatory approved workflows.

- Moreover, there are no common quality control standards in use that could reduce cross-study comparability, impeding its adoption in pharmaceutical research and clinical practice. Placing industry and academic efforts on standardized guidelines and reference models are underway but reaching consensus is complicated since there is a variety of the types of organoid and applications.

- The challenges of standardization that need to be addressed to provide scientific reliability, faster commercialization, and develop regulatory traction in next-generation in-vitro technologies.

Opportunity Patient-Derived Organoids Enable Precision Medicine Applications

- The advent of patient-derived organoids (PDOs) is an excellent prospect to the organoids and next-gen human in-vitro models market, as it fills a gap between laboratory research and individual clinical care.

- PDOs, created on the basis of the stem cells of single patient or biopsy samples, still preserve the genetic and phenotypic attributes of the native tissue, and can be used to precisely model disease progression and drug efficacy. This renders them indispensable in determining the customized format of treatment, clinical decision forecasting, and minimizing trial and error in generating clinical decisions.

- Pharmaceutical companies are moving towards PDOs with the adoption of drug screening programs to streamline the targeted therapies in oncology, rare diseases, and regenerative medicine. Moreover, increasing interventional partnerships between hospitals, biobanks, and biotech companies are increasing the development of extensive PDO repositories, which is improving the possibilities of translational research.

- Samsung Biologicals also established a new service called Samsung Organoids in 2025 an innovative drug screening company that uses patient-derived organoids to test anti-cancer drugs with greater precision. This project is the first step towards strategic growth of the company out of biomanufacturing into precision medicine and early-stage in-vitro drug discovery.

- The shift of healthcare is moving towards customization, patient-engineered organoids will become a foundation of the development of precision medicine and targeted drug discovery.

Key Trend: Organ-on-Chip Integration Creates Multi-Organ System Models

- The combination of organoids and organ-on-chip is one of the trends that are changing the organoids & next-gen human in-vitro models market. Expected to offer interconnected multi-organ systems, which are more realistic models of the human physiology than the traditional single-organ or animal models.

- Combining organoids and microfluidic platforms, researchers have the ability to recapitulate complex biological functions like nutrient exchange, metabolic interactions and systemic drug effects among tissues. These multi-organ systems improve the precision of toxicity, pharmacokinetic and efficacy assays and aid in the creation of less toxic and effective therapeutics.

- Emulate Inc. launched the AVA Emulation System in 2025, a high-throughput Organ-Chip platform based on the technology capable of culturing, monitoring, and analyzing several human-relevant tissues simultaneously. This technology allows better forecasting of drug effectiveness and toxicity, increases the use of animals in tests, and the speed at which preclinical research is performed throughout drug development.

- Together, these developments upscale the convergence of organoid and organ-on-chip technology, as a new standard of predictive, ethical, and human-relevant preclinical research.

Organoids-and-Next-Gen-Human-In-Vitro-Models-Market Analysis and Segmental Data

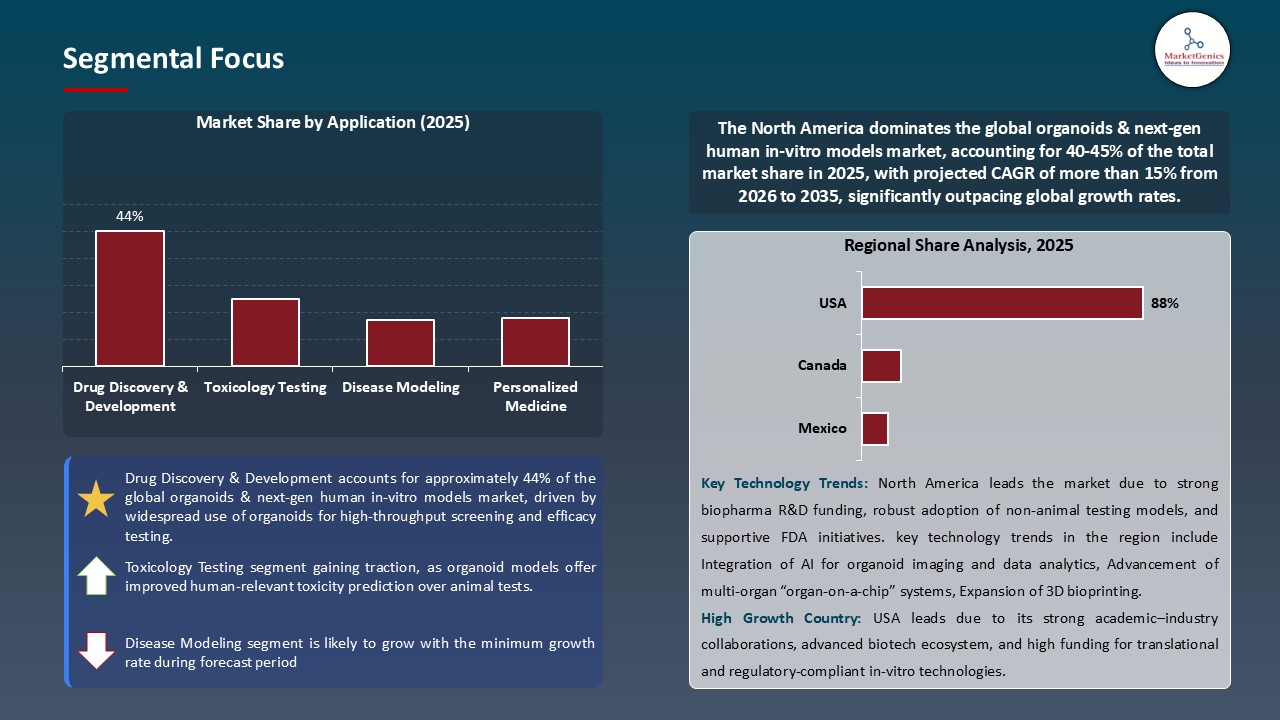

Drug Discovery & Development Dominate Global Organoids & Next-Gen Human In-Vitro Models Market

- Drug Discovery and Development segment is the biggest segment in the global organoids and next-gen human in-vitro models market, due to the demand of more predictive and human-relevant preclinical models. Conventional 2D cell culture and animal models in most cases lack human physiology, resulting in high attrition rate when working with drug development.

- The next-generation in-vitro models as well as patient-derived and disease-specific organoids offer physiologically relevant models that replicate tissue architecture and function to high fidelity, allowing close analysis of drug effects, drug toxicity and drug mechanism of action. These models are becoming more useful in pharmaceutical and biotechnology companies to expedite high-throughput screening, optimize candidate selection, and make preclinical studies fast and less expensive.

- Corning Incorporated also presented its organoid and spheroid platforms at the 3D Exhibitor Spotlight in 2025, with its application to high-throughput cancer drug screening. They can also provide more precise assessment of drug efficacy and toxicity with 3D models that will expedite preclinical drug development and eliminate the use of conventional 2D cultures and animal models.

- Moerover, AI-driven analysis and automated culture systems increase the reproducibility and accuracy of data, securing the dominance of the segment in the organoids and next-gen human in-vitro models market.

North America Leads Global Organoids & Next-Gen Human In-Vitro Models Market Demand

- North America is the leader in the world organoids and next-gen human in-vitro models market, driven by major investment in biotechnology and pharmaceutical research, superior laboratory facilities, and high uptake of the next-generation cell-based models. The region’s growth is reinforced by the rising preference for physiologically relevant human models in drug discovery, disease modeling, and toxicity testing, reducing dependence on traditional 2D cultures and animal research.

- Supportive regulatory environments that promote the use of alternatives to animal testing and efforts in the precision and personalized medicine also contribute to enhanced adoption by the market. Moreover, the availability of leading research centers, established R&D, and a high rate of technological change, including AI-based imaging, automated organoid culture, and high-throughput screening increases the efficiency and reproducibility of the experiments.

- Additionally, the NIH’s policy shift toward human-based research funding has spurred broader adoption of organoid models and improved drug discovery outcomes. Collectively, these factors solidify North America’s dominance and sustain its leadership in global innovation.

Organoids-and-Next-Gen-Human-In-Vitro-Models-Market Ecosystem

The global organoids and next-generation human in-vitro models market is moderately concentrated, with the dominating companies of Thermo Fisher Scientific Inc., Corning Incorporated, Emulate, InSphero AG and Hubrecht Organoid Technology (HUB) owning about 34% of the market share. These industry leaders are innovating through the creation of more advanced organoid platforms, new generation 3D cell models and automated culture platforms, backed by strong intellectual property (IP) portfolios, mature R&D efforts and firmly established manufacturing and distribution channels.

Moreover, the service providers and the contract research organizations (CROs/CDMOs) are important components of the ecosystem because they make it possible to obtain organoids at scale, comply with the regulations, and speed up translational research. As an example, collaborations between key organoid platform developers and CDMOs can help to scale complex organoid models fast, simplify the R&D process, shorten time-to-market, and increase the global presence. These partnerships do not only provide a boost of operational efficiency but also the expansion of the wider use of organoid-based models in drug development, toxicology testing, and personalized medicine, ultimately leading to the expansion of the organoids and next-gen human in-vitro models market.

Buyer concentration is average with pharmaceutical and biotechnology companies that are a large source of revenue but with the academic and government research laboratories that develop diversified demand. The concentration of suppliers of key reagents such as growth factors and special media ingredients is not very high and the suppliers of cell cultures with some established relationships with their customers have been using the existing ties. Moderate switching costs to favour incumbent suppliers are formed by long validation cycle and investments in development of methods.

Recent Development and Strategic Overview:

- In November 2025, InSphero AG to acquire DOPPL SA, to strengthen its position in advanced 3D in vitro models, by combining scalable spheroid and organoid technologies with integrated assay and data solutions for drug discovery and safety testing.

- In September 2025, MIMETAS introduced the OrganoReady Colon Organoid, a commercial 3D colon model preassembled as an OrganoPlate, on the high-throughput drug discovery platform. It is based on adult stem cells, and mimics human intestinal physiology, allowing the reliable evaluation of drug absorption, barrier properties, and toxicity, and simplifies preclinical testing with minimum set up time.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 0.4 Bn |

|

Market Forecast Value in 2035 |

USD 1.3 Bn |

|

Growth Rate (CAGR) |

12.6% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Organoids-and-Next-Gen-Human-In-Vitro-Models-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Organoids & Next-Gen Human In-Vitro Models Market, By Product Type |

|

|

Organoids & Next-Gen Human In-Vitro Models Market, By Technology/Platform |

|

|

Organoids & Next-Gen Human In-Vitro Models Market, By Cell Source |

|

|

Organoids & Next-Gen Human In-Vitro Models Market, By Application |

|

|

Organoids & Next-Gen Human In-Vitro Models Market, By Disease Type |

|

|

Organoids & Next-Gen Human In-Vitro Models Market, By Complexity Level |

|

|

Organoids & Next-Gen Human In-Vitro Models Market, By Scale of Operation |

|

|

Organoids & Next-Gen Human In-Vitro Models Market, By End-users |

|

Frequently Asked Questions

The global organoids & next-gen human in-vitro models market was valued at USD 0.4 Bn in 2025.

The global organoids & next-gen human in-vitro models market is expected to grow at a CAGR of 12.6% from 2026 to 2035.

The demand for organoids & next-gen human in-vitro models is driven by the need for more accurate drug discovery, personalized medicine, ethical alternatives to animal testing, and advanced disease modelling.

In terms of application, the drug discovery & development segment accounted for the major share in 2025.

North America is the most attractive region for organoids & next-gen human in-vitro models market.

Prominent players operating in the global organoids & next-gen human in-vitro models market are Agilent Technologies Inc., CELLINK (BICO Group), CN Bio Innovations, Corning Incorporated, DefiniGEN Ltd., Emulate Inc., Hubrecht Organoid Technology (HUB), InSphero AG, Kirkstall Ltd., Lonza Group AG, Merck KGaA, Mimetas B.V., Molecular Devices LLC, Nortis Inc., Organovo Holdings Inc., PerkinElmer Inc., Sigma-Aldrich, STEMCELL Technologies Inc., Thermo Fisher Scientific Inc., TissUse GmbH, and Other Key Players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Organoids & Next-Gen Human In-Vitro Models Market Outlook

- 2.1.1. Organoids & Next-Gen Human In-Vitro Models Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Organoids & Next-Gen Human In-Vitro Models Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Healthcare & Pharmaceutical Industry Overview, 2025

- 3.1.1. Healthcare & Pharmaceutical Ecosystem Analysis

- 3.1.2. Key Trends for Healthcare & Pharmaceutical Industry

- 3.1.3. Regional Distribution for Healthcare & Pharmaceutical Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

-

- 3.5.1.1. Manufacturer

- 3.5.1.2. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

-

- 3.6. Raw Material Analysis

- 3.1. Healthcare & Pharmaceutical Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for more predictive preclinical models

- 4.1.1.2. Technological advancements in organoid and in-vitro platforms

- 4.1.1.3. Increased pharmaceutical outsourcing for drug discovery

- 4.1.2. Restraints

- 4.1.2.1. High cost of organoid and next-gen model development.

- 4.1.2.2. Limited regulatory acceptance for clinical submissions

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Organoids & Next-Gen Human In-Vitro Models Manufacturers

- 4.4.3. Dealers/ Distributors

- 4.4.4. End-Users/ Customers

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Organoids & Next-Gen Human In-Vitro Models Market Demand

- 4.7.1. Historical Market Size –Value (US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size –Value (US$ Bn), 2026–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Organoids & Next-Gen Human In-Vitro Models Market Analysis, By Product Type

- 6.1. Key Segment Analysis

- 6.2. Organoids & Next-Gen Human In-Vitro Models Market Size (Value - US$ Bn), Analysis, and Forecasts, By Product Type, 2021-2035

- 6.2.1. Brain Organoids

- 6.2.2. Liver Organoids

- 6.2.3. Kidney Organoids

- 6.2.4. Intestinal Organoids

- 6.2.5. Lung Organoids

- 6.2.6. Cardiac Organoid

- 6.2.7. Pancreatic Organoids

- 6.2.8. Tumor Organoids

- 6.2.9. Other Organoid Types

- 7. Global Organoids & Next-Gen Human In-Vitro Models Market Analysis, By Technology/Platform

- 7.1. Key Segment Analysis

- 7.2. Organoids & Next-Gen Human In-Vitro Models Market Size (Value - US$ Bn), Analysis, and Forecasts, By Technology/Platform, 2021-2035

- 7.2.1. 3D Cell Culture

- 7.2.2. Microfluidic Systems (Organ-on-a-Chip)

- 7.2.3. Bioprinting Technology

- 7.2.4. Spheroid-based Systems

- 7.2.5. Hydrogel-based Systems

- 7.2.6. Organoid-on-a-Chip

- 7.2.7. Patient-Derived Organoids (PDOs)

- 8. Global Organoids & Next-Gen Human In-Vitro Models Market Analysis, By Cell Source

- 8.1. Key Segment Analysis

- 8.2. Organoids & Next-Gen Human In-Vitro Models Market Size (Value - US$ Bn), Analysis, and Forecasts, By Cell Source, 2021-2035

- 8.2.1. Pluripotent Stem Cells

- 8.2.2. Induced Pluripotent Stem Cells (iPSCs)

- 8.2.3. Embryonic Stem Cells (ESCs)

- 8.2.4. Adult Stem Cells

- 8.2.5. Primary Cells

- 8.2.6. Cell Lines

- 9. Global Organoids & Next-Gen Human In-Vitro Models Market Analysis, By Application

- 9.1. Key Segment Analysis

- 9.2. Organoids & Next-Gen Human In-Vitro Models Market Size (Value - US$ Bn), Analysis, and Forecasts, By Application, 2021-2035

- 9.2.1. Drug Discovery & Development

- 9.2.1.1. Target Identification

- 9.2.1.2. Lead Optimization

- 9.2.1.3. Efficacy Testing

- 9.2.1.4. Others

- 9.2.2. Toxicology Testing

- 9.2.2.1. Hepatotoxicity

- 9.2.2.2. Cardiotoxicity

- 9.2.2.3. Nephrotoxicity

- 9.2.2.4. Neurotoxicity

- 9.2.2.5. Others

- 9.2.3. Disease Modeling

- 9.2.3.1. Cancer Research

- 9.2.3.2. Infectious Diseases

- 9.2.3.3. Genetic Disorders

- 9.2.3.4. Neurodegenerative Diseases

- 9.2.3.5. Others

- 9.2.4. Personalized Medicine

- 9.2.5. Regenerative Medicine

- 9.2.6. Basic Research

- 9.2.1. Drug Discovery & Development

- 10. Global Organoids & Next-Gen Human In-Vitro Models Market Analysis, By Disease Type

- 10.1. Key Segment Analysis

- 10.2. Organoids & Next-Gen Human In-Vitro Models Market Size (Value - US$ Bn), Analysis, and Forecasts, By Disease Type, 2021-2035

- 10.2.1. Oncology

- 10.2.1.1. Solid Tumors

- 10.2.1.2. Hematological Malignancies

- 10.2.2. Neurological Disorders

- 10.2.2.1. Alzheimer's Disease

- 10.2.2.2. Parkinson's Disease

- 10.2.2.3. Epilepsy

- 10.2.2.4. Others

- 10.2.3. Metabolic Disorders

- 10.2.4. Cardiovascular Diseases

- 10.2.5. Gastrointestinal Disorders

- 10.2.6. Respiratory Diseases

- 10.2.7. Infectious Diseases

- 10.2.1. Oncology

- 11. Global Organoids & Next-Gen Human In-Vitro Models Market Analysis, By Complexity Level

- 11.1. Key Segment Analysis

- 11.2. Organoids & Next-Gen Human In-Vitro Models Market Size (Value - US$ Bn), Analysis, and Forecasts, By Complexity Level, 2021-2035

- 11.2.1. Simple Organoids (Single Cell Type)

- 11.2.2. Complex Organoids (Multiple Cell Types)

- 11.2.3. Assembloids (Fused Organoids)

- 11.2.4. Vascularized Organoids

- 12. Global Organoids & Next-Gen Human In-Vitro Models Market Analysis, By Scale of Operation

- 12.1. Key Segment Analysis

- 12.2. Organoids & Next-Gen Human In-Vitro Models Market Size (Value - US$ Bn), Analysis, and Forecasts, By Scale of Operation, 2021-2035

- 12.2.1. Research Scale

- 12.2.2. Preclinical Scale

- 12.2.3. Clinical Scale

- 12.2.4. Commercial Production Scale

- 13. Global Organoids & Next-Gen Human In-Vitro Models Market Analysis, By End-users

- 13.1. Key Segment Analysis

- 13.2. Organoids & Next-Gen Human In-Vitro Models Market Size (Value - US$ Bn), Analysis, and Forecasts, By End-users, 2021-2035

- 13.2.1. Pharmaceutical & Biotechnology Companies

- 13.2.1.1. Drug Discovery

- 13.2.1.2. Preclinical Testing

- 13.2.1.3. Toxicity Screening

- 13.2.1.4. Target Validation

- 13.2.1.5. Drug Repurposing

- 13.2.1.6. Others

- 13.2.2. Academic & Research Institutions

- 13.2.2.1. Basic Research

- 13.2.2.2. Disease Mechanism Studies

- 13.2.2.3. Genetic Research

- 13.2.2.4. Developmental Biology Studies

- 13.2.2.5. Publications & Studies

- 13.2.2.6. Others

- 13.2.3. Contract Research Organizations (CROs)

- 13.2.3.1. Preclinical Services

- 13.2.3.2. Toxicology Testing Services

- 13.2.3.3. Efficacy Studies

- 13.2.3.4. Custom Research Projects

- 13.2.3.5. Others

- 13.2.4. Hospitals & Diagnostic Centers

- 13.2.4.1. Personalized Treatment Planning

- 13.2.4.2. Disease Diagnosis

- 13.2.4.3. Patient-Specific Drug Testing

- 13.2.4.4. Precision Medicine

- 13.2.4.5. Others

- 13.2.5. Cosmetic & Chemical Industries

- 13.2.5.1. Safety Testing

- 13.2.5.2. Product Development

- 13.2.5.3. Alternative to Animal Testing

- 13.2.5.4. Regulatory Compliance Testing

- 13.2.5.5. Others

- 13.2.6. Agricultural Biotechnology

- 13.2.6.1. Pesticide Testing

- 13.2.6.2. Crop Protection Research

- 13.2.6.3. Toxicity Assessment

- 13.2.6.4. Others

- 13.2.7. Other End-users

- 13.2.1. Pharmaceutical & Biotechnology Companies

- 14. Global Organoids & Next-Gen Human In-Vitro Models Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Organoids & Next-Gen Human In-Vitro Models Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Organoids & Next-Gen Human In-Vitro Models Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Organoids & Next-Gen Human In-Vitro Models Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Technology/Platform

- 15.3.3. Cell Source

- 15.3.4. Application

- 15.3.5. Disease Type

- 15.3.6. Complexity Level

- 15.3.7. Scale of Operation

- 15.3.8. End-users

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Organoids & Next-Gen Human In-Vitro Models Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Technology/Platform

- 15.4.4. Cell Source

- 15.4.5. Application

- 15.4.6. Disease Type

- 15.4.7. Complexity Level

- 15.4.8. Scale of Operation

- 15.4.9. End-users

- 15.5. Canada Organoids & Next-Gen Human In-Vitro Models Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Technology/Platform

- 15.5.4. Cell Source

- 15.5.5. Application

- 15.5.6. Disease Type

- 15.5.7. Complexity Level

- 15.5.8. Scale of Operation

- 15.5.9. End-users

- 15.6. Mexico Organoids & Next-Gen Human In-Vitro Models Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Technology/Platform

- 15.6.4. Cell Source

- 15.6.5. Application

- 15.6.6. Disease Type

- 15.6.7. Complexity Level

- 15.6.8. Scale of Operation

- 15.6.9. End-users

- 16. Europe Organoids & Next-Gen Human In-Vitro Models Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Organoids & Next-Gen Human In-Vitro Models Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Technology/Platform

- 16.3.3. Cell Source

- 16.3.4. Application

- 16.3.5. Disease Type

- 16.3.6. Complexity Level

- 16.3.7. Scale of Operation

- 16.3.8. End-users

- 16.3.9. Country

- 16.3.9.1. Germany

- 16.3.9.2. United Kingdom

- 16.3.9.3. France

- 16.3.9.4. Italy

- 16.3.9.5. Spain

- 16.3.9.6. Netherlands

- 16.3.9.7. Nordic Countries

- 16.3.9.8. Poland

- 16.3.9.9. Russia & CIS

- 16.3.9.10. Rest of Europe

- 16.4. Germany Organoids & Next-Gen Human In-Vitro Models Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Technology/Platform

- 16.4.4. Cell Source

- 16.4.5. Application

- 16.4.6. Disease Type

- 16.4.7. Complexity Level

- 16.4.8. Scale of Operation

- 16.4.9. End-users

- 16.5. United Kingdom Organoids & Next-Gen Human In-Vitro Models Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Technology/Platform

- 16.5.4. Cell Source

- 16.5.5. Application

- 16.5.6. Disease Type

- 16.5.7. Complexity Level

- 16.5.8. Scale of Operation

- 16.5.9. End-users

- 16.6. France Organoids & Next-Gen Human In-Vitro Models Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Technology/Platform

- 16.6.4. Cell Source

- 16.6.5. Application

- 16.6.6. Disease Type

- 16.6.7. Complexity Level

- 16.6.8. Scale of Operation

- 16.6.9. End-users

- 16.7. Italy Organoids & Next-Gen Human In-Vitro Models Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Technology/Platform

- 16.7.4. Cell Source

- 16.7.5. Application

- 16.7.6. Disease Type

- 16.7.7. Complexity Level

- 16.7.8. Scale of Operation

- 16.7.9. End-users

- 16.8. Spain Organoids & Next-Gen Human In-Vitro Models Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Technology/Platform

- 16.8.4. Cell Source

- 16.8.5. Application

- 16.8.6. Disease Type

- 16.8.7. Complexity Level

- 16.8.8. Scale of Operation

- 16.8.9. End-users

- 16.9. Netherlands Organoids & Next-Gen Human In-Vitro Models Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Product Type

- 16.9.3. Technology/Platform

- 16.9.4. Cell Source

- 16.9.5. Application

- 16.9.6. Disease Type

- 16.9.7. Complexity Level

- 16.9.8. Scale of Operation

- 16.9.9. End-users

- 16.10. Nordic Countries Organoids & Next-Gen Human In-Vitro Models Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Product Type

- 16.10.3. Technology/Platform

- 16.10.4. Cell Source

- 16.10.5. Application

- 16.10.6. Disease Type

- 16.10.7. Complexity Level

- 16.10.8. Scale of Operation

- 16.10.9. End-users

- 16.11. Poland Organoids & Next-Gen Human In-Vitro Models Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Product Type

- 16.11.3. Technology/Platform

- 16.11.4. Cell Source

- 16.11.5. Application

- 16.11.6. Disease Type

- 16.11.7. Complexity Level

- 16.11.8. Scale of Operation

- 16.11.9. End-users

- 16.12. Russia & CIS Organoids & Next-Gen Human In-Vitro Models Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Product Type

- 16.12.3. Technology/Platform

- 16.12.4. Cell Source

- 16.12.5. Application

- 16.12.6. Disease Type

- 16.12.7. Complexity Level

- 16.12.8. Scale of Operation

- 16.12.9. End-users

- 16.13. Rest of Europe Organoids & Next-Gen Human In-Vitro Models Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Product Type

- 16.13.3. Technology/Platform

- 16.13.4. Cell Source

- 16.13.5. Application

- 16.13.6. Disease Type

- 16.13.7. Complexity Level

- 16.13.8. Scale of Operation

- 16.13.9. End-users

- 17. Asia Pacific Organoids & Next-Gen Human In-Vitro Models Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Asia Pacific Organoids & Next-Gen Human In-Vitro Models Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Technology/Platform

- 17.3.3. Cell Source

- 17.3.4. Application

- 17.3.5. Disease Type

- 17.3.6. Complexity Level

- 17.3.7. Scale of Operation

- 17.3.8. End-users

- 17.3.9. Country

- 17.3.9.1. China

- 17.3.9.2. India

- 17.3.9.3. Japan

- 17.3.9.4. South Korea

- 17.3.9.5. Australia and New Zealand

- 17.3.9.6. Indonesia

- 17.3.9.7. Malaysia

- 17.3.9.8. Thailand

- 17.3.9.9. Vietnam

- 17.3.9.10. Rest of Asia Pacific

- 17.4. China Organoids & Next-Gen Human In-Vitro Models Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Technology/Platform

- 17.4.4. Cell Source

- 17.4.5. Application

- 17.4.6. Disease Type

- 17.4.7. Complexity Level

- 17.4.8. Scale of Operation

- 17.4.9. End-users

- 17.5. India Organoids & Next-Gen Human In-Vitro Models Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Technology/Platform

- 17.5.4. Cell Source

- 17.5.5. Application

- 17.5.6. Disease Type

- 17.5.7. Complexity Level

- 17.5.8. Scale of Operation

- 17.5.9. End-users

- 17.6. Japan Organoids & Next-Gen Human In-Vitro Models Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Technology/Platform

- 17.6.4. Cell Source

- 17.6.5. Application

- 17.6.6. Disease Type

- 17.6.7. Complexity Level

- 17.6.8. Scale of Operation

- 17.6.9. End-users

- 17.7. South Korea Organoids & Next-Gen Human In-Vitro Models Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Technology/Platform

- 17.7.4. Cell Source

- 17.7.5. Application

- 17.7.6. Disease Type

- 17.7.7. Complexity Level

- 17.7.8. Scale of Operation

- 17.7.9. End-users

- 17.8. Australia and New Zealand Organoids & Next-Gen Human In-Vitro Models Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Technology/Platform

- 17.8.4. Cell Source

- 17.8.5. Application

- 17.8.6. Disease Type

- 17.8.7. Complexity Level

- 17.8.8. Scale of Operation

- 17.8.9. End-users

- 17.9. Indonesia Organoids & Next-Gen Human In-Vitro Models Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Product Type

- 17.9.3. Technology/Platform

- 17.9.4. Cell Source

- 17.9.5. Application

- 17.9.6. Disease Type

- 17.9.7. Complexity Level

- 17.9.8. Scale of Operation

- 17.9.9. End-users

- 17.10. Malaysia Organoids & Next-Gen Human In-Vitro Models Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Product Type

- 17.10.3. Technology/Platform

- 17.10.4. Cell Source

- 17.10.5. Application

- 17.10.6. Disease Type

- 17.10.7. Complexity Level

- 17.10.8. Scale of Operation

- 17.10.9. End-users

- 17.11. Thailand Organoids & Next-Gen Human In-Vitro Models Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Product Type

- 17.11.3. Technology/Platform

- 17.11.4. Cell Source

- 17.11.5. Application

- 17.11.6. Disease Type

- 17.11.7. Complexity Level

- 17.11.8. Scale of Operation

- 17.11.9. End-users

- 17.12. Vietnam Organoids & Next-Gen Human In-Vitro Models Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Product Type

- 17.12.3. Technology/Platform

- 17.12.4. Cell Source

- 17.12.5. Application

- 17.12.6. Disease Type

- 17.12.7. Complexity Level

- 17.12.8. Scale of Operation

- 17.12.9. End-users

- 17.13. Rest of Asia Pacific Organoids & Next-Gen Human In-Vitro Models Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Product Type

- 17.13.3. Technology/Platform

- 17.13.4. Cell Source

- 17.13.5. Application

- 17.13.6. Disease Type

- 17.13.7. Complexity Level

- 17.13.8. Scale of Operation

- 17.13.9. End-users

- 18. Middle East Organoids & Next-Gen Human In-Vitro Models Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Organoids & Next-Gen Human In-Vitro Models Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Technology/Platform

- 18.3.3. Cell Source

- 18.3.4. Application

- 18.3.5. Disease Type

- 18.3.6. Complexity Level

- 18.3.7. Scale of Operation

- 18.3.8. End-users

- 18.3.9. Country

- 18.3.9.1. Turkey

- 18.3.9.2. UAE

- 18.3.9.3. Saudi Arabia

- 18.3.9.4. Israel

- 18.3.9.5. Rest of Middle East

- 18.4. Turkey Organoids & Next-Gen Human In-Vitro Models Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Technology/Platform

- 18.4.4. Cell Source

- 18.4.5. Application

- 18.4.6. Disease Type

- 18.4.7. Complexity Level

- 18.4.8. Scale of Operation

- 18.4.9. End-users

- 18.5. UAE Organoids & Next-Gen Human In-Vitro Models Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Technology/Platform

- 18.5.4. Cell Source

- 18.5.5. Application

- 18.5.6. Disease Type

- 18.5.7. Complexity Level

- 18.5.8. Scale of Operation

- 18.5.9. End-users

- 18.6. Saudi Arabia Organoids & Next-Gen Human In-Vitro Models Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Technology/Platform

- 18.6.4. Cell Source

- 18.6.5. Application

- 18.6.6. Disease Type

- 18.6.7. Complexity Level

- 18.6.8. Scale of Operation

- 18.6.9. End-users

- 18.7. Israel Organoids & Next-Gen Human In-Vitro Models Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Technology/Platform

- 18.7.4. Cell Source

- 18.7.5. Application

- 18.7.6. Disease Type

- 18.7.7. Complexity Level

- 18.7.8. Scale of Operation

- 18.7.9. End-users l

- 18.8. Rest of Middle East Organoids & Next-Gen Human In-Vitro Models Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Technology/Platform

- 18.8.4. Cell Source

- 18.8.5. Application

- 18.8.6. Disease Type

- 18.8.7. Complexity Level

- 18.8.8. Scale of Operation

- 18.8.9. End-users

- 19. Africa Organoids & Next-Gen Human In-Vitro Models Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Organoids & Next-Gen Human In-Vitro Models Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Technology/Platform

- 19.3.3. Cell Source

- 19.3.4. Application

- 19.3.5. Disease Type

- 19.3.6. Complexity Level

- 19.3.7. Scale of Operation

- 19.3.8. End-users

- 19.3.9. Country

- 19.3.9.1. South Africa

- 19.3.9.2. Egypt

- 19.3.9.3. Nigeria

- 19.3.9.4. Algeria

- 19.3.9.5. Rest of Africa

- 19.4. South Africa Organoids & Next-Gen Human In-Vitro Models Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Technology/Platform

- 19.4.4. Cell Source

- 19.4.5. Application

- 19.4.6. Disease Type

- 19.4.7. Complexity Level

- 19.4.8. Scale of Operation

- 19.4.9. End-users

- 19.5. Egypt Organoids & Next-Gen Human In-Vitro Models Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Technology/Platform

- 19.5.4. Cell Source

- 19.5.5. Application

- 19.5.6. Disease Type

- 19.5.7. Complexity Level

- 19.5.8. Scale of Operation

- 19.5.9. End-users

- 19.6. Nigeria Organoids & Next-Gen Human In-Vitro Models Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Technology/Platform

- 19.6.4. Cell Source

- 19.6.5. Application

- 19.6.6. Disease Type

- 19.6.7. Complexity Level

- 19.6.8. Scale of Operation

- 19.6.9. End-users

- 19.7. Algeria Organoids & Next-Gen Human In-Vitro Models Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Product Type

- 19.7.3. Technology/Platform

- 19.7.4. Cell Source

- 19.7.5. Application

- 19.7.6. Disease Type

- 19.7.7. Complexity Level

- 19.7.8. Scale of Operation

- 19.7.9. End-users

- 19.8. Rest of Africa Organoids & Next-Gen Human In-Vitro Models Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Product Type

- 19.8.3. Technology/Platform

- 19.8.4. Cell Source

- 19.8.5. Application

- 19.8.6. Disease Type

- 19.8.7. Complexity Level

- 19.8.8. Scale of Operation

- 19.8.9. End-users

- 20. South America Organoids & Next-Gen Human In-Vitro Models Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. South America Organoids & Next-Gen Human In-Vitro Models Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Product Type

- 20.3.2. Technology/Platform

- 20.3.3. Cell Source

- 20.3.4. Application

- 20.3.5. Disease Type

- 20.3.6. Complexity Level

- 20.3.7. Scale of Operation

- 20.3.8. End-users

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Organoids & Next-Gen Human In-Vitro Models Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Product Type

- 20.4.3. Technology/Platform

- 20.4.4. Cell Source

- 20.4.5. Application

- 20.4.6. Disease Type

- 20.4.7. Complexity Level

- 20.4.8. Scale of Operation

- 20.4.9. End-users

- 20.5. Argentina Organoids & Next-Gen Human In-Vitro Models Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Product Type

- 20.5.3. Technology/Platform

- 20.5.4. Cell Source

- 20.5.5. Application

- 20.5.6. Disease Type

- 20.5.7. Complexity Level

- 20.5.8. Scale of Operation

- 20.5.9. End-users

- 20.6. Rest of South America Organoids & Next-Gen Human In-Vitro Models Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Product Type

- 20.6.3. Technology/Platform

- 20.6.4. Cell Source

- 20.6.5. Application

- 20.6.6. Disease Type

- 20.6.7. Complexity Level

- 20.6.8. Scale of Operation

- 20.6.9. End-users

- 21. Key Players/ Company Profile

- 21.1. Agilent Technologies Inc.

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. CELLINK (BICO Group)

- 21.3. CN Bio Innovations

- 21.4. Corning Incorporated

- 21.5. DefiniGEN Ltd.

- 21.6. Emulate Inc.

- 21.7. Hubrecht Organoid Technology (HUB)

- 21.8. InSphero AG

- 21.9. Kirkstall Ltd.

- 21.10. Lonza Group AG

- 21.11. Merck KGaA

- 21.12. Mimetas B.V.

- 21.13. Molecular Devices LLC

- 21.14. Nortis Inc.

- 21.15. Organovo Holdings Inc.

- 21.16. PerkinElmer Inc.

- 21.17. Sigma-Aldrich

- 21.18. STEMCELL Technologies Inc.

- 21.19. Thermo Fisher Scientific Inc.

- 21.20. TissUse GmbH

- 21.21. Other Key Players

- 21.1. Agilent Technologies Inc.

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

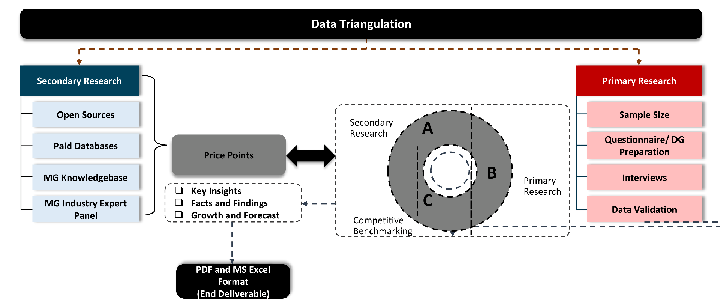

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data