Outpatient Surgery Market Size, Share & Trends Analysis Report by Procedure Type (Ophthalmology Procedures, Orthopedic Procedures, Gastrointestinal Procedures, Cardiovascular Procedures, Plastic and Reconstructive Surgery, ENT Procedures, Gynecological Procedures, Pain Management Procedures, Urological Procedures, Other Procedures), Technology/Equipment, Anesthesia Type, Facility Type, Procedure Complexity, End-users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Outpatient Surgery Market Size, Share, and Growth

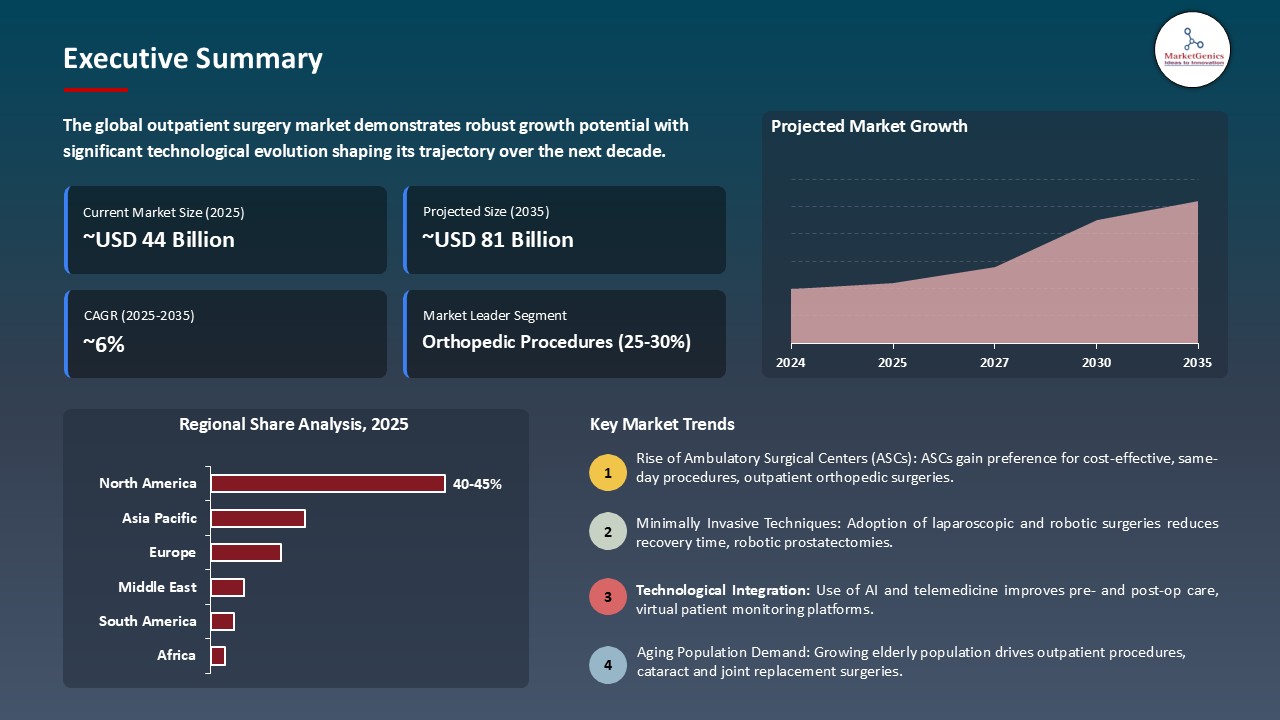

The global outpatient surgery market is witnessing strong growth, valued at USD 43.8 billion in 2025 and projected to reach USD 80.7 billion by 2035, expanding at a CAGR of 6.3% during the forecast period. The Asia Pacific region is the fastest-growing for the outpatient surgery market because of rapid healthcare infrastructure development and rising adoption of cost-efficient surgical procedures.

AMSURG Vice President of Operations Brandon Hollis said that, “In 2026, AMSURG will be focused on strategic investments that support facility and service line expansion, driven by increased demand for outpatient surgical care. Regulatory updates, such as the addition of CPT codes to the ASC Covered Procedures List and the removal of inpatient-only (IPO) codes, are enabling a broader range of procedures to be performed in the ASC setting. These changes allow us to scale responsibly while maintaining our commitment to clinical excellence and delivering a superb patient experience”.

An increase in the prevalence of chronic conditions and aging population can be regarded as one of the key stimuli of the outpatient surgery market. As the population of the world ages and chronic musculoskeletal, cardiovascular, and gastrointestinal disorders become more prevalent, elective and same-day surgery is in demand, which is effective and does not require much hospitalization. To illustrate, in 2025, U.S. Ambulatory Surgery Centers (ASCs) will carry out more than 80% of surgeries as outpatient due to increasing population of 49 million American people over 65 years old, which underscores the surge in outpatient surgery demand.

Partnerships among providers, device manufacturers, and facility managers improve technology uptake, increase patient access, and efficiency, leading to the growth of the outpatient surgery market. As an example, in 2025, Cleveland Clinic and Regent Surgical collaborated to create and run joint ambulatory surgery centers (ASCs) leveraging the clinical expertise of Cleveland Clinic with the expertise of Regent to manage its outpatient facilities. Its collaboration is to increase patient access, improve operational efficiency and promote expansion of outpatient surgical services to improve trends toward multispecialty, same-day care in the U.S.

The use of technology in imaging and AI-assisted surgery is a huge opportunity to the outpatient surgery market. Developed imaging technologies, including 3D visualization, intraoperative navigation, and augmented reality systems, help to increase surgical accuracy, which allows surgeons to execute complicated interventions with fewer incisions, less tissue damage, and a shorter healing process. In the meantime, AI-based surgical robots can assist in decision-making, working process optimization, and the ability to predict possible complications, enhancing patient safety and efficiency during the operation in an ambulatory.

Outpatient Surgery Market Dynamics and Trends

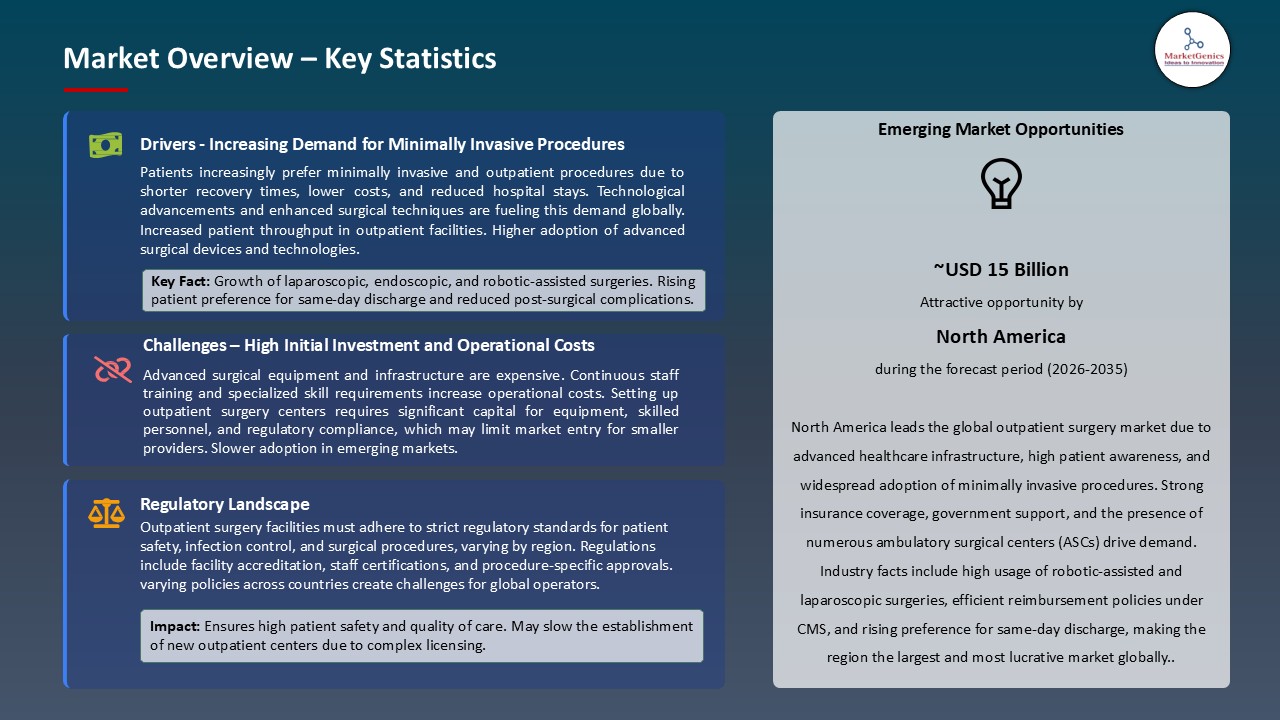

Driver: Cost Advantages Over Hospital Settings Drive Payer Promotion

- Outpatient surgery market is growing at a rapid pace largely due to cost advantages compared to hospital settings. The outpatient surgical centers greatly lower the total healthcare expenditures by eradicating prolonged hospitalization, cutting down overhead expenditures, and maximizing the utilization of resources. Such cost-efficiencies render outpatient procedures to be very appealing to the patients and payers.

- Outpatient settings are becoming a more popular choice among elective and minimally invasive surgeries in terms of their economic advantages without sacrificing clinical results, supported by insurance providers and government healthcare programs. Also, the beneficial effects of the growth in the anesthesia field, the development of surgical apparatus and the post-surgery treatment have made patients safer and provided earlier recovery, which also contributes to the cost-efficiency of ambulatory surgeries.

- HCA Healthcare has enhanced its vision of enhancing medical practice by developing 190 hospitals and approximately 2,400 ambulatory care sites in 20 states in the U.S. and the United Kingdom, reflecting its focus on delivering cost-efficient, high-quality outpatient surgery and reinforced payer-centric approaches to value-based care.

- The global healthcare systems are focused on value-based care and affordability, the economic advantages of outpatient surgery centers are contributing to their popularity and broadening their scope of application in the modern healthcare system of providing surgical care.

Restraint: Scope of Practice Limitations Restrict Complex Procedure Migration

- Limitations of scope of practice emerge as a major obstacle to outpatient surgery market expansion. However, even with significant advances in minimal invasive procedures and surgical technologies, a significant number of complicated surgeries have remained hospital-based due to the presence of stringent regulatory and credentialing limitations. Such restrictions help determine the scope of services that surgeries and anesthesia can have in ambulatory centers, excluding the transfer of high-level services.

- Also, differences in state and national policies introduce discrepancies in the actions that can be done by surgeons and anesthesiologists beyond hospitals, further delaying the transition to outpatient models. Patient safety, post-operative follow-up, and emergency response ability are some of the issues of concern that strengthen these limitations.

- Consequently, despite the significant cost and efficiency advantages of outpatient facilities, the scope of practice remains a limiting factor in expanding the market across to more complicated surgical areas.

Opportunity: Minimally Invasive Surgical Advancement Expands Procedure Portfolio

- Minimally invasive surgical development is a significant opportunity in the growth of outpatient surgery market. Ongoing advances in laparoscopic, endoscopic and robotic-assisted versions have enabled operations that were previously limited to inpatient care to be performed in outpatient environments owing to the significant decrease in surgical trauma, recovery periods as well as possible complications. The technologies enable surgeons to conduct complex procedures through small incisions, higher precision, and faster healing, which improves patient outcomes and satisfaction.

- The safe and effective outpatient care is further supported by the incorporation of the advanced imaging, real-time navigation, and AI-assisted tools. The movement toward minimally invasive versions fit the outpatient model perfectly, as the healthcare systems and payers focus more on value-based care and cost reduction.

- A global leader in the field of minimally invasive care, Intuitive Surgical, in 2025, published reports that covered 408 hospitals in the United States and demonstrated that facilities using robotic-assisted surgery (RAS) experienced a 5.3% increase in minimally invasive surgery rates (60.5% to 65.8) and increased access by individuals aged 35 and those with Medicare or commercial health insurance. To date, Intuitive has helped more than 16 million patients in urology, gynecology, colorectal, general, thoracic, and cardiac surgeries to recover faster and with fewer complications.

- Collectively, all these developments drive the outpatient surgery market to safer, faster, and more affordable surgical services.

Key Trend: Multispecialty Centers Replace Single-Specialty Model

- The rapid migration to multiple specialty centers is one of the main trends that influence the outpatient surgery market. They traditionally had been outpatient facilities with an emphasis on a particular specialty like orthopedics or ophthalmology, however, the increasing need to provide more complete and cost-effective care is prompting the introduction of a number of specialties under a single roof.

- Multispecialty centers provide more variety of processes as well as general and orthopedic surgeries up to gastroenterology, gynecology and cardiovascular surgeries that facilitate patient convenience and usage of resources. The model will enable the healthcare provider to maximize surgical capacity, streamline processes and enhance specialist coordination, which will result in improved patient outcomes and financial performance.

- The growth of the Cleveland Clinic in Palm Beach County shows a clear tendency of switching to integrated multispecialty outpatient care. The new hospital, medical office building, and ambulatory surgery center are planned, as well as the extension of chemotherapy, imaging, endoscopy, and outpatient surgery services, and they will all fall under a single system.

- The trend highlights the shift in the healthcare sector towards combined, patient-focused outpatient care models that facilitate efficiency, access, and quality of care delivery.

Outpatient-Surgery-Market Analysis and Segmental Data

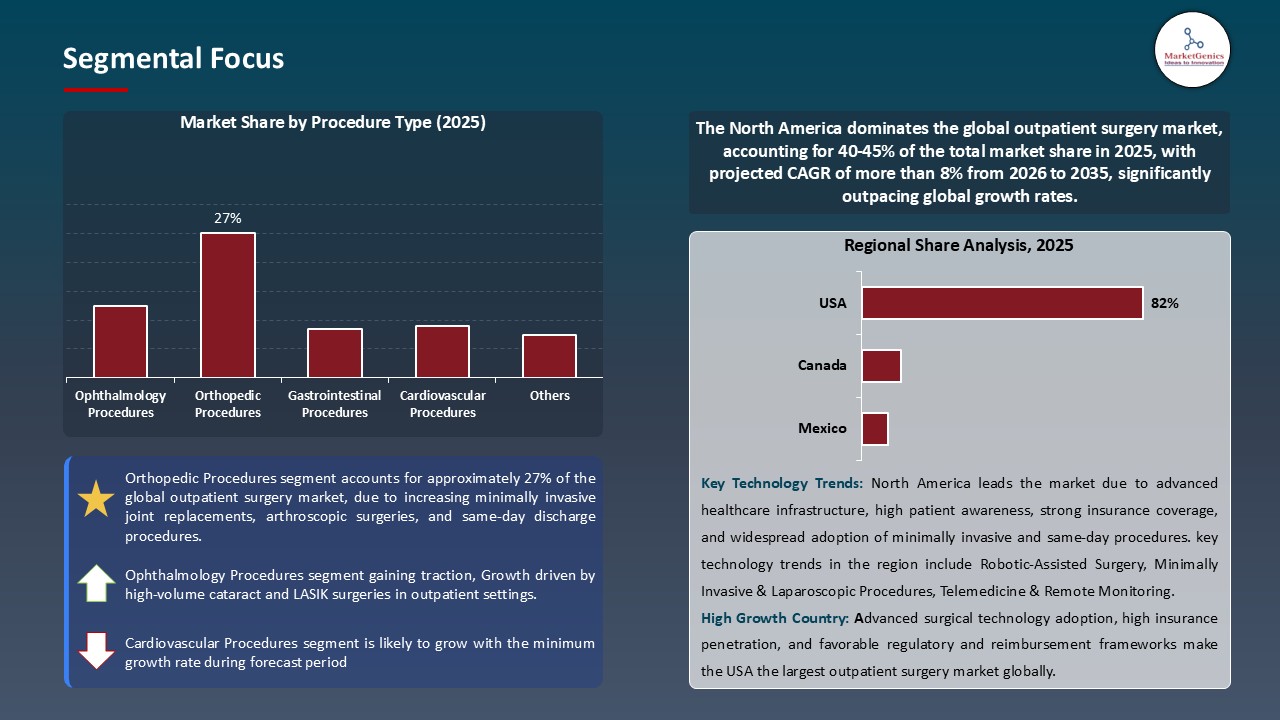

Orthopedic Procedures Dominate Global Outpatient Surgery Market

- The orthopedic procedures segment dominates the market of the global outpatient surgery market, facilitated by the development of the minimally invasive and robotic-assisted technologies offering the chance of shorter recovery time, minimized risks of infection, and reduced hospitalization.

- Surgeries in the form of arthroscopy, joint replacement and even spinal decompression are all taking the trend of shifting to ASCs as a result of better surgical accuracy and anesthesia results. Increased cases of osteoarthritis, sports-related injuries, and bone diseases of old age also increase the outpatient orthopedic care.

- Stryker released the next-generation Mako SmartRobotics at the AAOS Annual Meeting in 2025, with new AI analytics, improved haptic feed, and abilities with more joint replacement. The innovation increases the precision of surgeries and recovery, shifting complex orthopedic surgeries such as knee and hip replacement surgeries to ambulatory centers, making orthopedics the dominant segment of the global outpatient surgery market.

- The innovation and procedural migration that remains continuous makes orthopedics as a cornerstone of growth in the outpatient surgery market, which contributes to the increased access of patients, better results, and more cost-effective care delivery.

North America Leads Global Outpatient Surgery Market Demand

- Outpatient surgery market in the North America region has been dominated, with developed healthcare facilities, high usage of low-invasive and robotic-assisted surgical devices, and high payer coverage of cost-effective surgery.

- The area has a strong network of ambulatory surgery centers (ASCs) and hospitals that are moving elective and complex surgeries, including orthopedic, gastrointestinal, and cardiovascular surgeries, to outpatient care. Positive reimbursement strategies and value-based care programs also increase the motivation of the providers to increase the outpatient services, which maximize efficiency and decrease the total healthcare expenditure.

- Moreover, high demand is motivated by the increasing prevalence of chronic musculoskeletal conditions, the aging populations, and a growing preference of patients to same-day procedures. Innovations in imaging and AI-enabled surgical devices, as well as telemedicine services, are also early adopted by the North American providers, improving the quality of the procedures and patient outcomes.

- In 2025, California, in San Marcos, Scripps Health declared the creation of a new medical center campus, its initial phase is a full-fledged ambulatory care center. The center will consist of outpatient suites of surgery, physician offices, cancer care, imaging, and other specialty services, which are meant to enhance the patient access, as well as the high-volume and same-day procedures.

- Together, these conditions solidify the dominance of the region in outpatient surgery market, due the usage of the technological advances and the growth of the multispecialty ambulatory care facilities.

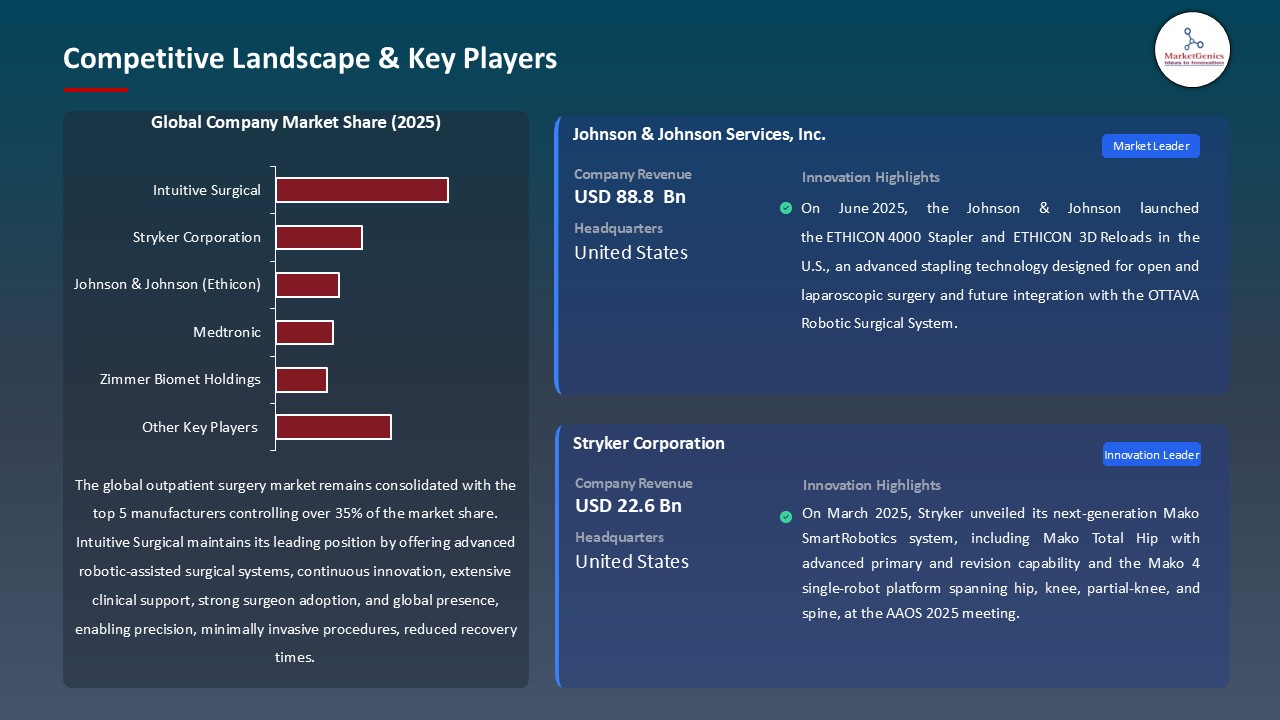

Outpatient-Surgery-Market Ecosystem

The outpatient surgery market is moderately concentrated in the world market with Intuitive Surgical, Stryker Corporation, Johnson and Johnson (Ethicon), Medtronic, and Zimmer Biomet Holdings sharing nearly 37% of the global market share. These major players have made a strong impact in the industry by designing and introducing more sophisticated surgical technologies, such as robotic-assisted technology, minimally invasive technology, and digital surgery technology. Their high R&D abilities, broad intellectual property bases, and long-standing manufacturing and distribution chains have established high standards of surgical accuracy, speed, and patient outcomes that provide significant entry barriers.

Moreover, ambulatory surgery centers (ASCs), hospitals, and service providers also help the ecosystem to develop by allowing the implementation of new high-tech technologies, staff training, and compliance with regulations. The strategic alliances between the devices manufacturers and the healthcare providers lead to faster integration of technology, efficient operation and increased access to complex outpatient operations and thus the growth of the market and the market dominance of the two players.

The level of buyer concentration depends on commercial payers and the presence of Medicare associated with large revenues and individual patients deciding where to go based on physician recommendation and being included in an insurance network. The concentration of suppliers of medical devices, pharmaceutical and equipment is moderate with established suppliers catering to both the ambulatory and hospital market. The physician partnerships and long-term leasing do provide switching costs and market stability towards the established operators.

Recent Development and Strategic Overview:

- In June 2025, Constitution Surgery Alliance (CSA), the developer and operator of 16 ambulatory surgery centers (ASCs) in five states that perform more than 100,000 procedures each year based in the U.S., received a strategic growth investment by Welsh, Carson, Anderson and Stowe (WCAS), a private equity firm. The collaboration intends to increase the national presence of CSA, accelerate the implementation of the newest outpatient surgical advancements, and secure its status in the already booming outpatient surgery sector, allowing more high-quality, same-day surgery and increasing operational efficiency and patient access.

- In July 2025, Zimmer Biomet acquired Monogram Technologies, valued at around US 177 million, and added FDA-cleared, semi-autonomous AI-guided knee arthroplasty systems to its ROSA Robotics platform. Such a strategic action will increase the accuracy of surgery performed by Zimmer, the volume of outpatient and same-day orthopedic operations, and its spread in the market of minimally invasive robotic-assisted surgeries that develop.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 43.8 Bn |

|

Market Forecast Value in 2035 |

USD 80.7 Bn |

|

Growth Rate (CAGR) |

6.3% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Outpatient-Surgery-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Outpatient Surgery Market, By Procedure Type |

|

|

Outpatient Surgery Market, By Technology/Equipment |

|

|

Outpatient Surgery Market, By Anesthesia Type |

|

|

Outpatient Surgery Market, By Facility Type |

|

|

Outpatient Surgery Market, By Procedure Complexity |

|

|

Outpatient Surgery Market, By End-users |

|

Frequently Asked Questions

The global outpatient surgery market was valued at USD 43.8 Bn in 2025.

The global outpatient surgery market industry is expected to grow at a CAGR of 6.3% from 2026 to 2035.

The demand for the outpatient surgery market is driven by the increasing shift toward minimally invasive techniques, reduced hospital stays, and greater cost efficiency.

In terms of procedure type, the orthopedic procedures segment accounted for the major share in 2025.

North America is the most attractive region for outpatient surgery market.

Prominent players operating in the global outpatient surgery market are Abbott Laboratories, Alcon (Novartis), Arthrex, Inc., B. Braun Melsungen AG, Bausch + Lomb, Becton, Dickinson and Company (BD), Boston Scientific Corporation, ConMed Corporation, Cooper Surgical, Hologic, Inc., Intuitive Surgical, Johnson & Johnson (Ethicon), Karl Storz SE & Co. KG, Medtronic, NuVasive, Inc., Olympus Corporation, Smith & Nephew, Stryker Corporation, Teleflex Incorporated, Zimmer Biomet Holdings, and Other Key Players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Outpatient Surgery Market Outlook

- 2.1.1. Outpatient Surgery Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Outpatient Surgery Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Healthcare & Pharmaceutical Industry Overview, 2025

- 3.1.1. Healthcare & Pharmaceutical Industry Ecosystem Analysis

- 3.1.2. Key Trends for Healthcare & Pharmaceutical Industry

- 3.1.3. Regional Distribution for Healthcare & Pharmaceutical Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Healthcare & Pharmaceutical Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Growth in minimally invasive & same-day procedures increasing case suitability

- 4.1.1.2. Technology advances (robotics, scopes, energy devices) enabling outpatient care

- 4.1.1.3. Payer cost-containment and reimbursement incentives favoring ambulatory settings

- 4.1.2. Restraints

- 4.1.2.1. Regulatory, accreditation and licensing variability across countries

- 4.1.2.2. Patient comorbidities and limited post-op support raising readmission risk

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Medical Device & Equipment Suppliers

- 4.4.2. Pharmaceutical & Consumables Providers

- 4.4.3. Outpatient Surgery Facilities / ASCs / Clinics

- 4.4.4. Postoperative Care & Rehabilitation Services

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Outpatient Surgery Market Demand

- 4.9.1. Historical Market Size –Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size –Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Outpatient Surgery Market Analysis, By Procedure Type

- 6.1. Key Segment Analysis

- 6.2. Outpatient Surgery Market Size (Value - US$ Bn), Analysis, and Forecasts, By Procedure Type, 2021-2035

- 6.2.1. Ophthalmology Procedures

- 6.2.1.1. Cataract Surgery

- 6.2.1.2. LASIK and Refractive Surgery

- 6.2.1.3. Glaucoma Surgery

- 6.2.1.4. Retinal Surgery

- 6.2.1.5. Others

- 6.2.2. Orthopedic Procedures

- 6.2.2.1. Arthroscopy

- 6.2.2.2. Joint Replacement (Knee, Hip)

- 6.2.2.3. Sports Medicine Procedures

- 6.2.2.4. Spine Surgery

- 6.2.2.5. Others

- 6.2.3. Gastrointestinal Procedures

- 6.2.3.1. Endoscopy

- 6.2.3.2. Colonoscopy

- 6.2.3.3. Hernia Repair

- 6.2.3.4. Bariatric Surgery

- 6.2.3.5. Others

- 6.2.4. Cardiovascular Procedures

- 6.2.4.1. Cardiac Catheterization

- 6.2.4.2. Pacemaker Implantation

- 6.2.4.3. Vascular Surgery

- 6.2.4.4. Angioplasty

- 6.2.4.5. Others

- 6.2.5. Plastic and Reconstructive Surgery

- 6.2.5.1. Cosmetic Procedures

- 6.2.5.2. Skin Lesion Removal

- 6.2.5.3. Reconstructive Surgery

- 6.2.5.4. Others

- 6.2.6. ENT Procedures

- 6.2.7. Gynecological Procedures

- 6.2.8. Pain Management Procedures

- 6.2.9. Urological Procedures

- 6.2.10. Other Procedures

- 6.2.1. Ophthalmology Procedures

- 7. Global Outpatient Surgery Market Analysis, By Technology/Equipment

- 7.1. Key Segment Analysis

- 7.2. Outpatient Surgery Market Size (Value - US$ Bn), Analysis, and Forecasts, By Technology/Equipment, 2021-2035

- 7.2.1. Surgical Instruments

- 7.2.1.1. Handheld Instruments

- 7.2.1.2. Powered Instruments

- 7.2.1.3. Robotic Surgical Systems

- 7.2.1.4. Others

- 7.2.2. Imaging Systems

- 7.2.2.1. Fluoroscopy Systems

- 7.2.2.2. Ultrasound Systems

- 7.2.2.3. Endoscopic Imaging

- 7.2.2.4. Others

- 7.2.3. Anesthesia Equipment

- 7.2.3.1. Anesthesia Delivery Systems

- 7.2.3.2. Monitoring Devices

- 7.2.3.3. Others

- 7.2.4. Sterilization Equipment

- 7.2.5. Patient Monitoring Systems

- 7.2.6. Electrosurgical Devices

- 7.2.7. Laser Systems

- 7.2.1. Surgical Instruments

- 8. Global Outpatient Surgery Market Analysis,By Anesthesia Type

- 8.1. Key Segment Analysis

- 8.2. Outpatient Surgery Market Size (Value - US$ Bn), Analysis, and Forecasts, By Anesthesia Type, 2021-2035

- 8.2.1. Local Anesthesia

- 8.2.2. Regional Anesthesia

- 8.2.3. General Anesthesia

- 8.2.4. Conscious Sedation

- 9. Global Outpatient Surgery Market Analysis, By Facility Type

- 9.1. Key Segment Analysis

- 9.2. Outpatient Surgery Market Size (Value - US$ Bn), Analysis, and Forecasts, By Facility Type, 2021-2035

- 9.2.1. Hospital-Based Outpatient Surgery Centers

- 9.2.1.1. Hospital Outpatient Departments (HOPD)

- 9.2.1.2. Hospital-Owned ASCs

- 9.2.2. Independent Ambulatory Surgery Centers (ASCs)

- 9.2.3. Physician Office-Based Labs

- 9.2.4. Specialty Surgical Centers

- 9.2.1. Hospital-Based Outpatient Surgery Centers

- 10. Global Outpatient Surgery Market Analysis, By Procedure Complexity

- 10.1. Key Segment Analysis

- 10.2. Outpatient Surgery Market Size (Value - US$ Bn), Analysis, and Forecasts, By Procedure Complexity, 2021-2035

- 10.2.1. Minor Procedures

- 10.2.2. Intermediate Procedures

- 10.2.3. Major Complex Procedures

- 11. Global Outpatient Surgery Market Analysis, By End-users

- 11.1. Key Segment Analysis

- 11.2. Outpatient Surgery Market Size (Value - US$ Bn), Analysis, and Forecasts, By End-users, 2021-2035

- 11.2.1. Hospitals

- 11.2.1.1. Emergency Surgical Procedures

- 11.2.1.2. Elective Surgery

- 11.2.1.3. Follow-up Procedures

- 11.2.1.4. Diagnostic Procedures

- 11.2.1.5. Preventive Care Procedures

- 11.2.1.6. Others

- 11.2.2. Ambulatory Surgery Centers

- 11.2.2.1. Same-Day Surgical Procedures

- 11.2.2.2. Minimally Invasive Surgery

- 11.2.2.3. Diagnostic Imaging Procedures

- 11.2.2.4. Pain Management Applications

- 11.2.2.5. Cosmetic Procedures

- 11.2.2.6. Others

- 11.2.3. Physician Offices

- 11.2.3.1. In-Office Surgical Procedures

- 11.2.3.2. Minor Dermatological Procedures

- 11.2.3.3. Diagnostic Procedures

- 11.2.3.4. Screening Procedures

- 11.2.3.5. Others

- 11.2.4. Specialty Clinics

- 11.2.5. Diagnostic Centers

- 11.2.6. Other End-users

- 11.2.1. Hospitals

- 12. Global Outpatient Surgery Market Analysis and Forecasts, by Region

- 12.1. Key Findings

- 12.2. Outpatient Surgery Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 12.2.1. North America

- 12.2.2. Europe

- 12.2.3. Asia Pacific

- 12.2.4. Middle East

- 12.2.5. Africa

- 12.2.6. South America

- 13. North America Outpatient Surgery Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. North America Outpatient Surgery Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 13.3.1. Procedure Type

- 13.3.2. Technology/Equipment

- 13.3.3. Anesthesia Type

- 13.3.4. Facility Type

- 13.3.5. Procedure Complexity

- 13.3.6. End-users

- 13.3.7. Country

- 13.3.7.1. USA

- 13.3.7.2. Canada

- 13.3.7.3. Mexico

- 13.4. USA Outpatient Surgery Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Procedure Type

- 13.4.3. Technology/Equipment

- 13.4.4. Anesthesia Type

- 13.4.5. Facility Type

- 13.4.6. Procedure Complexity

- 13.4.7. End-users

- 13.5. Canada Outpatient Surgery Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Procedure Type

- 13.5.3. Technology/Equipment

- 13.5.4. Anesthesia Type

- 13.5.5. Facility Type

- 13.5.6. Procedure Complexity

- 13.5.7. End-users

- 13.6. Mexico Outpatient Surgery Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Procedure Type

- 13.6.3. Technology/Equipment

- 13.6.4. Anesthesia Type

- 13.6.5. Facility Type

- 13.6.6. Procedure Complexity

- 13.6.7. End-users

- 14. Europe Outpatient Surgery Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. Europe Outpatient Surgery Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Procedure Type

- 14.3.2. Technology/Equipment

- 14.3.3. Anesthesia Type

- 14.3.4. Facility Type

- 14.3.5. Procedure Complexity

- 14.3.6. End-users

- 14.3.7. Country

- 14.3.7.1. Germany

- 14.3.7.2. United Kingdom

- 14.3.7.3. France

- 14.3.7.4. Italy

- 14.3.7.5. Spain

- 14.3.7.6. Netherlands

- 14.3.7.7. Nordic Countries

- 14.3.7.8. Poland

- 14.3.7.9. Russia & CIS

- 14.3.7.10. Rest of Europe

- 14.4. Germany Outpatient Surgery Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Procedure Type

- 14.4.3. Technology/Equipment

- 14.4.4. Anesthesia Type

- 14.4.5. Facility Type

- 14.4.6. Procedure Complexity

- 14.4.7. End-users

- 14.5. United Kingdom Outpatient Surgery Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Procedure Type

- 14.5.3. Technology/Equipment

- 14.5.4. Anesthesia Type

- 14.5.5. Facility Type

- 14.5.6. Procedure Complexity

- 14.5.7. End-users

- 14.6. France Outpatient Surgery Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Procedure Type

- 14.6.3. Technology/Equipment

- 14.6.4. Anesthesia Type

- 14.6.5. Facility Type

- 14.6.6. Procedure Complexity

- 14.6.7. End-users

- 14.7. Italy Outpatient Surgery Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Procedure Type

- 14.7.3. Technology/Equipment

- 14.7.4. Anesthesia Type

- 14.7.5. Facility Type

- 14.7.6. Procedure Complexity

- 14.7.7. End-users

- 14.8. Spain Outpatient Surgery Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Procedure Type

- 14.8.3. Technology/Equipment

- 14.8.4. Anesthesia Type

- 14.8.5. Facility Type

- 14.8.6. Procedure Complexity

- 14.8.7. End-users

- 14.9. Netherlands Outpatient Surgery Market

- 14.9.1. Country Segmental Analysis

- 14.9.2. Procedure Type

- 14.9.3. Technology/Equipment

- 14.9.4. Anesthesia Type

- 14.9.5. Facility Type

- 14.9.6. Procedure Complexity

- 14.9.7. End-users

- 14.10. Nordic Countries Outpatient Surgery Market

- 14.10.1. Country Segmental Analysis

- 14.10.2. Procedure Type

- 14.10.3. Technology/Equipment

- 14.10.4. Anesthesia Type

- 14.10.5. Facility Type

- 14.10.6. Procedure Complexity

- 14.10.7. End-users

- 14.11. Poland Outpatient Surgery Market

- 14.11.1. Country Segmental Analysis

- 14.11.2. Procedure Type

- 14.11.3. Technology/Equipment

- 14.11.4. Anesthesia Type

- 14.11.5. Facility Type

- 14.11.6. Procedure Complexity

- 14.11.7. End-users

- 14.12. Russia & CIS Outpatient Surgery Market

- 14.12.1. Country Segmental Analysis

- 14.12.2. Procedure Type

- 14.12.3. Technology/Equipment

- 14.12.4. Anesthesia Type

- 14.12.5. Facility Type

- 14.12.6. Procedure Complexity

- 14.12.7. End-users

- 14.13. Rest of Europe Outpatient Surgery Market

- 14.13.1. Country Segmental Analysis

- 14.13.2. Procedure Type

- 14.13.3. Technology/Equipment

- 14.13.4. Anesthesia Type

- 14.13.5. Facility Type

- 14.13.6. Procedure Complexity

- 14.13.7. End-users

- 15. Asia Pacific Outpatient Surgery Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Asia Pacific Outpatient Surgery Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Procedure Type

- 15.3.2. Technology/Equipment

- 15.3.3. Anesthesia Type

- 15.3.4. Facility Type

- 15.3.5. Procedure Complexity

- 15.3.6. End-users

- 15.3.7. Country

- 15.3.7.1. China

- 15.3.7.2. India

- 15.3.7.3. Japan

- 15.3.7.4. South Korea

- 15.3.7.5. Australia and New Zealand

- 15.3.7.6. Indonesia

- 15.3.7.7. Malaysia

- 15.3.7.8. Thailand

- 15.3.7.9. Vietnam

- 15.3.7.10. Rest of Asia Pacific

- 15.4. China Outpatient Surgery Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Procedure Type

- 15.4.3. Technology/Equipment

- 15.4.4. Anesthesia Type

- 15.4.5. Facility Type

- 15.4.6. Procedure Complexity

- 15.4.7. End-users

- 15.5. India Outpatient Surgery Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Procedure Type

- 15.5.3. Technology/Equipment

- 15.5.4. Anesthesia Type

- 15.5.5. Facility Type

- 15.5.6. Procedure Complexity

- 15.5.7. End-users

- 15.6. Japan Outpatient Surgery Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Procedure Type

- 15.6.3. Technology/Equipment

- 15.6.4. Anesthesia Type

- 15.6.5. Facility Type

- 15.6.6. Procedure Complexity

- 15.6.7. End-users

- 15.7. South Korea Outpatient Surgery Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Procedure Type

- 15.7.3. Technology/Equipment

- 15.7.4. Anesthesia Type

- 15.7.5. Facility Type

- 15.7.6. Procedure Complexity

- 15.7.7. End-users

- 15.8. Australia and New Zealand Outpatient Surgery Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Procedure Type

- 15.8.3. Technology/Equipment

- 15.8.4. Anesthesia Type

- 15.8.5. Facility Type

- 15.8.6. Procedure Complexity

- 15.8.7. End-users

- 15.9. Indonesia Outpatient Surgery Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Procedure Type

- 15.9.3. Technology/Equipment

- 15.9.4. Anesthesia Type

- 15.9.5. Facility Type

- 15.9.6. Procedure Complexity

- 15.9.7. End-users

- 15.10. Malaysia Outpatient Surgery Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Procedure Type

- 15.10.3. Technology/Equipment

- 15.10.4. Anesthesia Type

- 15.10.5. Facility Type

- 15.10.6. Procedure Complexity

- 15.10.7. End-users

- 15.11. Thailand Outpatient Surgery Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Procedure Type

- 15.11.3. Technology/Equipment

- 15.11.4. Anesthesia Type

- 15.11.5. Facility Type

- 15.11.6. Procedure Complexity

- 15.11.7. End-users

- 15.12. Vietnam Outpatient Surgery Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Procedure Type

- 15.12.3. Technology/Equipment

- 15.12.4. Anesthesia Type

- 15.12.5. Facility Type

- 15.12.6. Procedure Complexity

- 15.12.7. End-users

- 15.13. Rest of Asia Pacific Outpatient Surgery Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Procedure Type

- 15.13.3. Technology/Equipment

- 15.13.4. Anesthesia Type

- 15.13.5. Facility Type

- 15.13.6. Procedure Complexity

- 15.13.7. End-users

- 16. Middle East Outpatient Surgery Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Middle East Outpatient Surgery Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Procedure Type

- 16.3.2. Technology/Equipment

- 16.3.3. Anesthesia Type

- 16.3.4. Facility Type

- 16.3.5. Procedure Complexity

- 16.3.6. End-users

- 16.3.7. Country

- 16.3.7.1. Turkey

- 16.3.7.2. UAE

- 16.3.7.3. Saudi Arabia

- 16.3.7.4. Israel

- 16.3.7.5. Rest of Middle East

- 16.4. Turkey Outpatient Surgery Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Procedure Type

- 16.4.3. Technology/Equipment

- 16.4.4. Anesthesia Type

- 16.4.5. Facility Type

- 16.4.6. Procedure Complexity

- 16.4.7. End-users

- 16.5. UAE Outpatient Surgery Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Procedure Type

- 16.5.3. Technology/Equipment

- 16.5.4. Anesthesia Type

- 16.5.5. Facility Type

- 16.5.6. Procedure Complexity

- 16.5.7. End-users

- 16.6. Saudi Arabia Outpatient Surgery Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Procedure Type

- 16.6.3. Technology/Equipment

- 16.6.4. Anesthesia Type

- 16.6.5. Facility Type

- 16.6.6. Procedure Complexity

- 16.6.7. End-users

- 16.7. Israel Outpatient Surgery Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Procedure Type

- 16.7.3. Technology/Equipment

- 16.7.4. Anesthesia Type

- 16.7.5. Facility Type

- 16.7.6. Procedure Complexity

- 16.7.7. End-users

- 16.8. Rest of Middle East Outpatient Surgery Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Procedure Type

- 16.8.3. Technology/Equipment

- 16.8.4. Anesthesia Type

- 16.8.5. Facility Type

- 16.8.6. Procedure Complexity

- 16.8.7. End-users

- 17. Africa Outpatient Surgery Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Africa Outpatient Surgery Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Procedure Type

- 17.3.2. Technology/Equipment

- 17.3.3. Anesthesia Type

- 17.3.4. Facility Type

- 17.3.5. Procedure Complexity

- 17.3.6. End-users

- 17.3.7. Country

- 17.3.7.1. South Africa

- 17.3.7.2. Egypt

- 17.3.7.3. Nigeria

- 17.3.7.4. Algeria

- 17.3.7.5. Rest of Africa

- 17.4. South Africa Outpatient Surgery Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Procedure Type

- 17.4.3. Technology/Equipment

- 17.4.4. Anesthesia Type

- 17.4.5. Facility Type

- 17.4.6. Procedure Complexity

- 17.4.7. End-users

- 17.5. Egypt Outpatient Surgery Market

- 17.5.1. Procedure Type

- 17.5.2. Technology/Equipment

- 17.5.3. Anesthesia Type

- 17.5.4. Facility Type

- 17.5.5. Procedure Complexity

- 17.5.6. End-users

- 17.6. Nigeria Outpatient Surgery Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Procedure Type

- 17.6.3. Technology/Equipment

- 17.6.4. Anesthesia Type

- 17.6.5. Facility Type

- 17.6.6. Procedure Complexity

- 17.6.7. End-users

- 17.7. Algeria Outpatient Surgery Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Procedure Type

- 17.7.3. Technology/Equipment

- 17.7.4. Anesthesia Type

- 17.7.5. Facility Type

- 17.7.6. Procedure Complexity

- 17.7.7. End-users

- 17.8. Rest of Africa Outpatient Surgery Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Procedure Type

- 17.8.3. Technology/Equipment

- 17.8.4. Anesthesia Type

- 17.8.5. Facility Type

- 17.8.6. Procedure Complexity

- 17.8.7. End-users

- 18. South America Outpatient Surgery Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. South America Outpatient Surgery Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Organoid Type

- 18.3.2. Procedure Type

- 18.3.3. Technology/Equipment

- 18.3.4. Anesthesia Type

- 18.3.5. Facility Type

- 18.3.6. Procedure Complexity

- 18.3.7. End-users

- 18.3.8. Country

- 18.3.8.1. Brazil

- 18.3.8.2. Argentina

- 18.3.8.3. Rest of South America

- 18.4. Brazil Outpatient Surgery Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Procedure Type

- 18.4.3. Technology/Equipment

- 18.4.4. Anesthesia Type

- 18.4.5. Facility Type

- 18.4.6. Procedure Complexity

- 18.4.7. End-users

- 18.5. Argentina Outpatient Surgery Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Procedure Type

- 18.5.3. Technology/Equipment

- 18.5.4. Anesthesia Type

- 18.5.5. Facility Type

- 18.5.6. Procedure Complexity

- 18.5.7. End-users

- 18.6. Rest of South America Outpatient Surgery Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Procedure Type

- 18.6.3. Technology/Equipment

- 18.6.4. Anesthesia Type

- 18.6.5. Facility Type

- 18.6.6. Procedure Complexity

- 18.6.7. End-users

- 19. Key Players/ Company Profile

- 19.1. Abbott Laboratories

- 19.1.1. Company Details/ Overview

- 19.1.2. Company Financials

- 19.1.3. Key Customers and Competitors

- 19.1.4. Business/ Industry Portfolio

- 19.1.5. Product Portfolio/ Specification Details

- 19.1.6. Pricing Data

- 19.1.7. Strategic Overview

- 19.1.8. Recent Developments

- 19.2. Alcon (Novartis)

- 19.3. Arthrex, Inc.

- 19.4. B. Braun Melsungen AG

- 19.5. Bausch + Lomb

- 19.6. Becton, Dickinson and Company (BD)

- 19.7. Boston Scientific Corporation

- 19.8. ConMed Corporation

- 19.9. Cooper Surgical

- 19.10. Hologic, Inc.

- 19.11. Intuitive Surgical

- 19.12. Johnson & Johnson (Ethicon)

- 19.13. Karl Storz SE & Co. KG

- 19.14. Medtronic

- 19.15. NuVasive, Inc.

- 19.16. Olympus Corporation

- 19.17. Smith & Nephew

- 19.18. Stryker Corporation

- 19.19. Teleflex Incorporated

- 19.20. Zimmer Biomet Holdings

- 19.21. Other Key Players

- 19.1. Abbott Laboratories

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data