Pallet Stretch Wrapping Machine Market Size, Share & Trends Analysis Report by Machine Type (Semi-Automatic Stretch Wrapping Machines, Automatic Stretch Wrapping Machines, and Manual/Portable Stretch Wrapping Machines), Wrapping Capacity, Film Type, Load Weight Capacity, Wrapping Configuration, Control System, Power Source, End-Use Industry, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Pallet Stretch Wrapping Machine Market Size, Share, and Growth

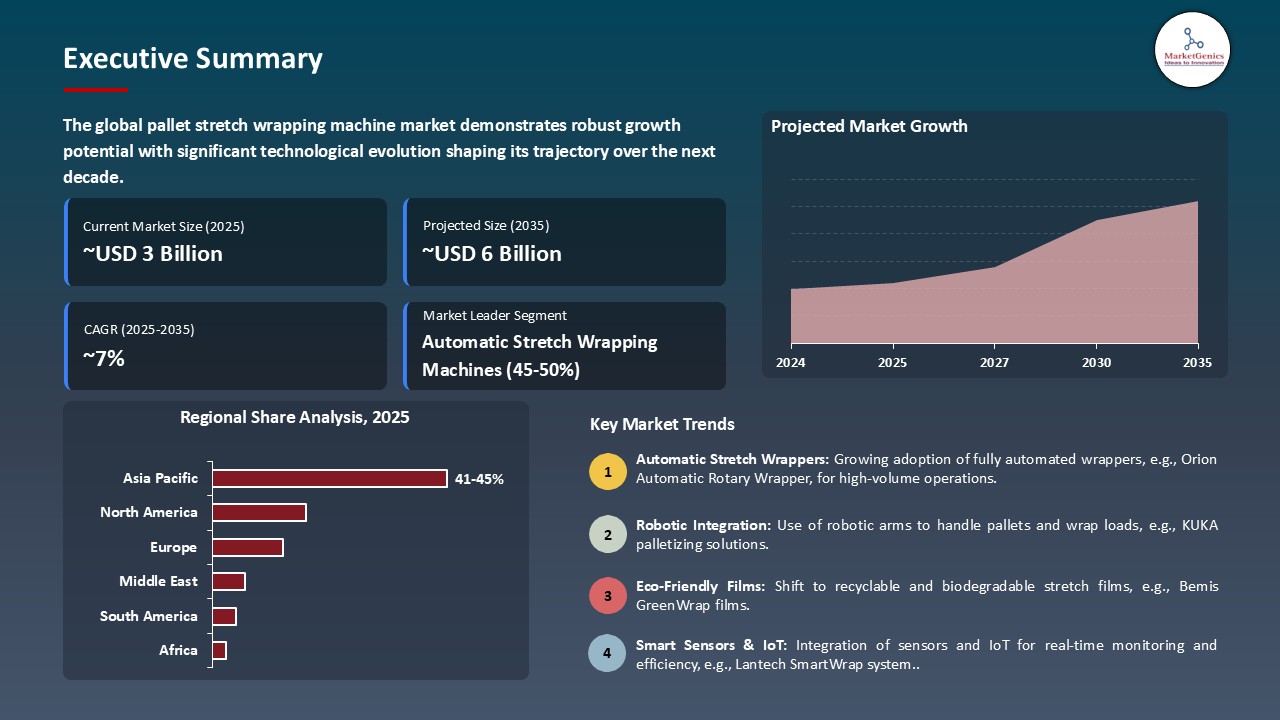

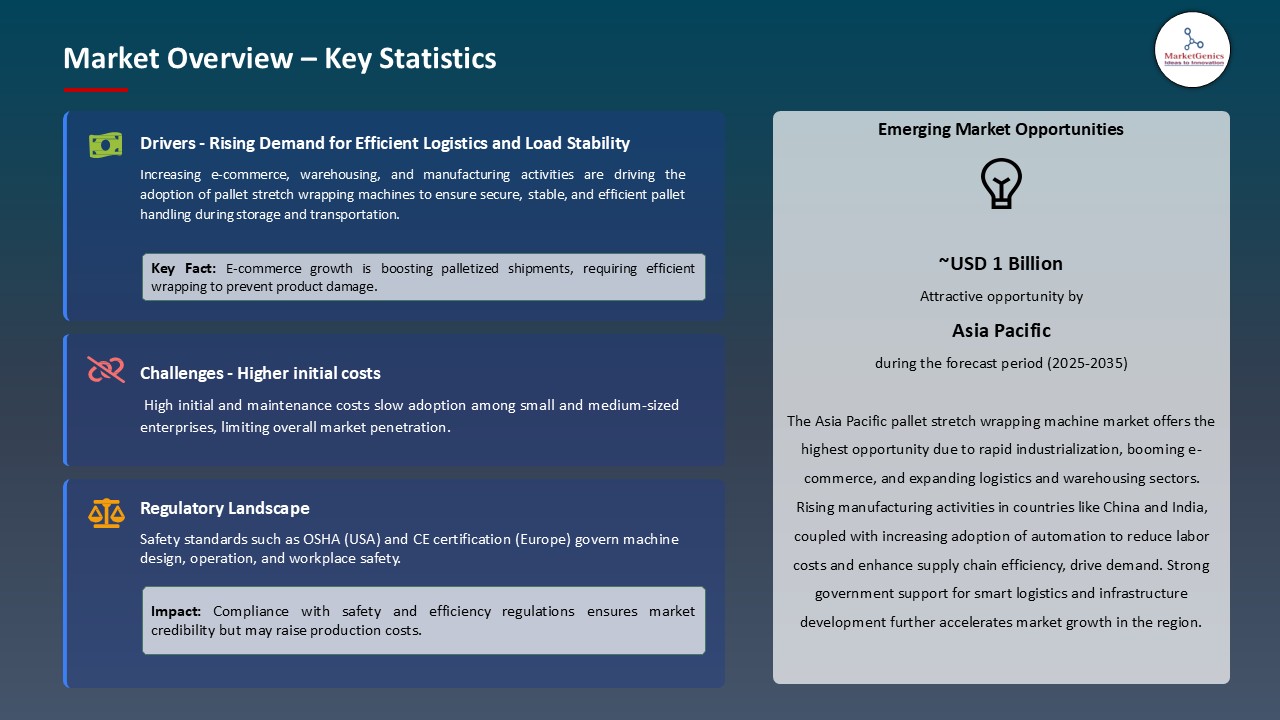

The global pallet stretch wrapping machine market is experiencing robust growth, with its estimated value of USD 2.8 billion in the year 2025 and USD 5.7 billion by the period 2035, registering a CAGR of 7.3%, during the forecast period. The pallet stretch wrapping machine market is growing due to the growth of e-commerce and global trade, the need for load stability and product protection, and the ongoing push for automation and efficiency in the logistics and manufacturing industries.

Darryl Gee, Vice President of Sales at Lantech said, “Our team is thrilled to be able to participate in both Drinktec and PackExpo and demonstrate how our machines are wonderful solutions for many packaging challenges. We look forward to meeting industry professionals in München and Las Vegas to discuss how we can help them meet their packaging goals.”

The global pallet stretch wrapping machine market is because of rapid e-commerce and beverage-driven pallet volumes, rising labor costs and chronic operator shortages, and corporate sustainability targets demanding reduced film use and lower total cost of ownership are driving investment in faster, more automated stretch-wrapping equipment. For instance, in May 2025, Robopac’s HELIX 4 EVO top-tier rotary arm automatic stretch wrapper built for high-demand, high-volume environments that can’t afford bottlenecks. With a top speed of 36 RPM and throughput up to 90 pallet loads per hour, the Helix 4 EVO delivers the speed and durability that peak operations require.

Moreover, manufacturers are increasingly adopting fully automatic and digitally connected stretch wrappers to support higher throughput and lower labor costs. For instance, Robopac Machinery showcased its Vario Stretch carriage at the LIGNA 2025 trade fair, enabling automatic film pre-stretch regulation and roping for irregular loads with no sliding contacts, increasing uptime and system reliability.

The regulatory framework across various countries is fostering the growth of the pallet stretch wrapping machine market by encouraging automation, sustainability, and packaging efficiency in logistics and manufacturing operations. For instance, in February 2025, the European Commission updated its Packaging and Packaging Waste Regulation (PPWR), setting stricter limits on plastic film usage and mandating recyclability standards for industrial packaging. This prompted manufacturers like Robopac and Signode to invest in advanced pre-stretch and downgauging technologies that minimize film waste while maintaining load stability.

The key market opportunities of the global pallet stretch wrapping machine market are in automated conveyor systems, robotic palletizers, warehouse management software, sustainable packaging materials, and IoT-enabled logistics monitoring. Companies can integrate these solutions to enhance end-to-end material handling, reduce labor, and improve operational efficiency. In addition, integration with adjacent technologies will boost overall system value, driving higher adoption of smart, sustainable, and fully automated wrapping solutions.

Pallet Stretch Wrapping Machine Market Dynamics and Trends

Driver: Increasing Demand for Automation in Packaging Operations

- The global pallet stretch wrapping machine market is experiencing significant growth due to the increasing demand for automation in packaging operations. Manufacturers are investing in automated solutions to enhance efficiency, reduce labor costs, and improve consistency in packaging processes. For instance, in September 2024, At PACK EXPO 2024, Orion Packaging Systems showcased its Flex HPD stretch wrapper, demonstrating its capability to handle diverse load types, including fresh produce. The machine utilizes SeaStretch protective paper wrap and stretch roping technology to secure organic products, addressing sustainability and freshness concerns.

- Additionally, innovations reflect the industry's shift towards automation to meet the growing demands of modern logistics and manufacturing sectors. For instance, in September 2025, Lantech introduced the SL400 and SL400LT semi-automatic stretch wrappers, designed to meet growing automation goals and address labor challenges. These models offer enhanced features for improved efficiency and adaptability in packaging operations. Lantech's new models provide scalable solutions for businesses seeking to enhance automation and efficiency in their packaging processes.

Restraint: Limited Skilled Workforce for Operating Advanced Automated Systems

- The pallet stretch wrapping machine market is restricted because of the adoption of advanced pallet stretch wrapping machines is constrained by the scarcity of trained personnel capable of operating and maintaining high-tech automated systems. For instance, in 2025, Lantech highlighted challenges in training operators for its next-generation SL400 and SL400LT semi-automatic stretch wrappers, which feature complex touchscreen controls, IoT integration, and automated film management.

- Additionally, many small and mid-sized manufacturing units struggle to recruit or train staff with the required technical expertise, leading to underutilization of equipment and occasional operational errors. This skill gap can increase downtime, reduce machine efficiency, and slow the return on investment for high-end automated solutions.

- Thus, the shortage of skilled operators may slow market penetration of advanced stretch wrapping machines, prompting manufacturers to invest in operator training programs or develop more user-friendly, intuitive systems.

Opportunity: Integration with Sustainable Packaging Solutions

- The growing emphasis on sustainability presents a significant opportunity for the pallet stretch wrapping machine market. Manufacturers are increasingly focusing on developing machines that can handle biodegradable and recyclable films, aligning with global environmental goals. For instance, in 2024, Robopac introduced a paper-based stretch wrap solution in collaboration with Mondi Group, which achieved a 62% reduction in greenhouse gas emissions compared to traditional plastic films. This innovation caters to the rising demand for eco-friendly packaging solutions in industries such as food and beverage, retail, and logistics.

- Furthermore, the adoption of sustainable packaging solutions is expected to drive market growth by attracting environmentally conscious consumers and businesses, leading to increased demand for eco-friendly pallet stretch wrapping machines. For instance, in February 2024, Innova Group introduced the AWS Pro automatic arm stretch wrapper, which features a pre-stretch system capable of stretching film up to 400%, thereby reducing film consumption by nearly 50% compared to conventional wrappers.

- This innovation not only lowers material costs but also aligns with environmental goals by minimizing plastic waste.

Key Trend: Adoption of IoT and Industry 4.0 Technologies

- The adoption of Internet of Things (IoT) and Industry 4.0 technologies is transforming the pallet stretch wrapping machine market. Manufacturers are incorporating smart sensors, predictive maintenance capabilities, and real-time monitoring systems into their machines. For instance, in November, 2024 Lantech to showcase innovative packaging solutions and new technologies at packexpo in Chicago. The QL400XT is the most intuitive semi-automatic stretch wrapper on the market with our patented Load Guardian control system that is based on 50+ years of customer observations. This innovative solution allows for simultaneous wrapping and weighing, significantly reducing operator time and increasing throughput.

- Furthermore, the integration of IoT and Industry 4.0 technologies in pallet stretch wrapping machines is expected to drive market growth by enhancing operational efficiency, reducing maintenance costs, and meeting the increasing demand for automated and sustainable packaging solutions. For instance, in upgraded 2024, Robopac USA has introduced IoT-enabled stretch wrapping machines designed to enhance operational efficiency and reduce downtime. These machines feature real-time monitoring capabilities, allowing for predictive maintenance and remote diagnostics.

- This integration ensures consistent performance and minimizes unexpected breakdowns, contributing to improved productivity in packaging operations.

Pallet Stretch Wrapping Machine Market Analysis and Segmental Data

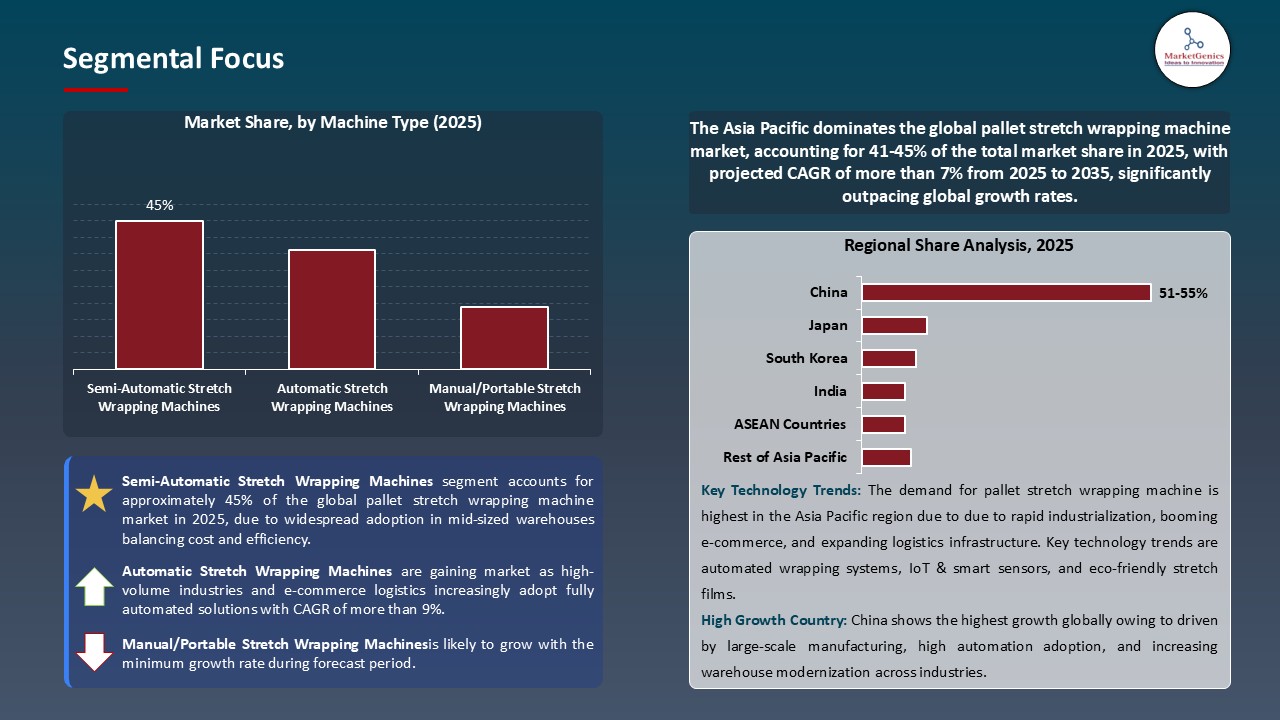

Automatic Stretch Wrapping Machines Dominate Global Pallet Stretch Wrapping Machine Market

- Automatic stretch wrapping machines the global pallet stretch wrapping machine market owing to the increasing demand for automation in packaging processes is driving the adoption of automatic stretch wrapping machines. These machines offer high throughput, reduced labor costs, and consistent wrap quality, making them ideal for industries aiming to streamline operations. For instance, in September 2024, Pacteon Group added Descon Conveyor Systems to its portfolio, joining Schneider Packaging Equipment, ESS Technologies, and Phoenix Stretch Wrappers. This acquisition enhances their ability to deliver integrated solutions for a broad range of packaging needs, including pallet stretch wrapping machines.

- Furthermore, the adoption of automatic stretch wrapping machines is boosting market growth by enhancing operational efficiency, minimizing labor costs, and ensuring consistent packaging quality. Expansion of integrated solutions and advanced automation capabilities is driving wider implementation across logistics, manufacturing, and e-commerce sectors, reinforcing the market’s momentum and supporting scalable packaging operations.

Asia Pacific Leads Global Pallet Stretch Wrapping Machine Market Demand

- The Asia Pacific's dominance in the global pallet stretch wrapping machine market is propelled by the region's rapid industrialization, expanding logistics networks, and the surge in e-commerce activities. For instance, in 2024, a prominent packaging machinery manufacturer in China introduced an advanced automatic stretch wrapping machine tailored for high-speed production lines, addressing the increasing demand for efficient packaging solutions in the food and beverage sector.

- Furthermore, Asia Pacific's leadership in the global pallet stretch wrapping machine market is significantly influenced by proactive government initiatives aimed at enhancing manufacturing capabilities and promoting automation. In India, the government's "Make in India" program has been instrumental in fostering domestic manufacturing, thereby increasing the demand for advanced packaging solutions.

- These initiatives have created a conducive environment for the growth of the pallet stretch wrapping machine market in the region.

Pallet Stretch Wrapping Machine Market Ecosystem

The global pallet stretch wrapping machine market is moderately consolated, with high concentration among key players such as Robopac (Aetna Group), Lantech, Signode Industrial Group, M.J. Maillis Group, and Orion Packaging Systems, who dominate through strategic product innovations, extensive distribution networks, and strong customer relationships. These companies maintain market leadership by introducing advanced automated and semi-automatic stretch wrappers, enhancing energy efficiency, and offering customized solutions tailored to diverse industry requirements, including food & beverage, logistics, and manufacturing.

For instance, in September 2024, At PACK EXPO 2024, Orion showcased its redesigned MA Fully Automatic Rotary Stretch Wrapping System, featuring fast lead times and advanced pre-stretch film delivery systems. This innovation aims to enhance efficiency and reduce operational costs for users. These strategic initiatives underscore the competitive landscape of the pallet stretch wrapping machine market, with key players focusing on technological advancements, acquisitions, and sustainability to maintain and enhance their market positions.

Recent Development and Strategic Overview:

- In September 2025, Signode announced the Octopus Prestige: a next-gen high-speed stretch wrapper that doubles throughput and cuts film use via a double-S carriage and performance optimizations — aimed at high-volume e-commerce and beverage lines.

- In May 2025, Lantech announced its participation in Drinktec (München, Germany) and PackExpo (Las Vegas, NV, USA). As a pioneer with decades of leadership, Lantech continues to drive innovation, debuting revolutionary stretch wrapping and case, tray and lid handling solutions at these premier global trade shows.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 2.8 Bn |

|

Market Forecast Value in 20255 |

USD 5.7 Bn |

|

Growth Rate (CAGR) |

7.3% |

|

Forecast Period |

2025 – 20255 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value MMT for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Pallet Stretch Wrapping Machine Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Pallet Stretch Wrapping Machine Market By Machine Type |

|

|

Pallet Stretch Wrapping Machine Market By Wrapping Capacity

|

|

|

Pallet Stretch Wrapping Machine Market By Film Type

|

|

|

Pallet Stretch Wrapping Machine Market By Load Weight Capacity |

|

|

Pallet Stretch Wrapping Machine Market By Wrapping Configuration

|

|

|

Pallet Stretch Wrapping Machine Market By Control System

|

|

|

Pallet Stretch Wrapping Machine Market By Power Source |

|

|

Pallet Stretch Wrapping Machine Market By End-Use Industry |

|

Frequently Asked Questions

The global pallet stretch wrapping machine market was valued at USD 2.8 Bn in 2025.

The global pallet stretch wrapping machine market industry is expected to grow at a CAGR of 7.3% from 2025 to 2035.

The pallet stretch wrapping machine market is driving due to the growth of e-commerce and global trade, the need for load stability and product protection, and the ongoing push for automation and efficiency in the logistics and manufacturing industries.

In terms of machine type, automatic stretch wrapping machines is the segment accounted for the major share in 2025

Asia Pacific is a more attractive region for vendors.

Key players in the global pallet stretch wrapping machine market include prominent companies such as Aetna Group, ARPAC LLC, Atlanta Stretch, Cousins Packaging, Fhope Packaging Machinery, FROMM Packaging Systems, Hangzhou Youngsun Intelligent Equipment, Highlight Industries, Italdibipack, Kuka AG (Swisslog), Lantech,M.J. Maillis Group, Muller LCS, Orion Packaging Systems, Phoenix Wrappers, Premier Tech Chronos, Robopac (Aetna Group),Shandong Dyehome Intelligent Equipment, Signode Industrial Group, TAB Industries, Technowrapp, Webster Griffin, Wulftec International, and Other Key Players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Pallet Stretch Wrapping Machine Market Outlook

- 2.1.1. Pallet Stretch Wrapping Machine Market Size (Volume-MMT and Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Pallet Stretch Wrapping Machine Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Pallet Stretch Wrapping Machine Industry Overview, 2025

- 3.1.1. PackagingIndustry Ecosystem Analysis

- 3.1.2. Key Trends for Packaging Industry

- 3.1.3. Regional Distribution for Packaging Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Pallet Stretch Wrapping Machine Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Growing e-commerce and logistics industry increasing demand for efficient pallet handling

- 4.1.1.2. Rising need for load stability and protection during transportation

- 4.1.1.3. Increasing automation and labor cost reduction in warehouses and manufacturing facilities

- 4.1.2. Restraints

- 4.1.2.1. High initial investment and maintenance costs of advanced wrapping machines

- 4.1.2.2. Limited adoption among small and medium-sized enterprises due to cost constraints

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Pallet Stretch Wrapping Machine Manufacturers

- 4.4.3. Distributors/ Suppliers

- 4.4.4. End-users/ Customers

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Pallet Stretch Wrapping Machine Market Demand

- 4.7.1. Historical Market Size - in (Volume-MMT and Value - US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size - in (Volume-MMT and Value - US$ Bn), 2025–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Pallet Stretch Wrapping Machine Market Analysis, by Machine Type

- 6.1. Key Segment Analysis

- 6.2. Pallet Stretch Wrapping Machine Market Size (Volume-MMT and Value - US$ Bn), Analysis, and Forecasts, by Machine Type, 2021-2035

- 6.2.1. Semi-Automatic Stretch Wrapping Machines

- 6.2.1.1. Turntable Semi-Automatic

- 6.2.1.2. Rotary Arm Semi-Automatic

- 6.2.1.3. Rotary Ring Semi-Automatic

- 6.2.1.4. Others

- 6.2.2. Automatic Stretch Wrapping Machines

- 6.2.2.1. Turntable Automatic

- 6.2.2.2. Rotary Arm Automatic

- 6.2.2.3. Rotary Ring Automatic

- 6.2.2.4. Orbital Automatic

- 6.2.2.5. Others

- 6.2.3. Manual/Portable Stretch Wrapping Machines

- 6.2.1. Semi-Automatic Stretch Wrapping Machines

- 7. Global Pallet Stretch Wrapping Machine Market Analysis, by Wrapping Capacity

- 7.1. Key Segment Analysis

- 7.2. Pallet Stretch Wrapping Machine Market Size (Volume-MMT and Value - US$ Bn), Analysis, and Forecasts, by Wrapping Capacity, 2021-2035

- 7.2.1. Up to 30 pallets/hour

- 7.2.2. 30-60 pallets/hour

- 7.2.3. 60-120 pallets/hour

- 7.2.4. Above 120 pallets/hour

- 8. Global Pallet Stretch Wrapping Machine Market Analysis and Forecasts, by Film Type

- 8.1. Key Findings

- 8.2. Pallet Stretch Wrapping Machine Market Size (Volume-MMT and Value - US$ Bn), Analysis, and Forecasts, by Film Type, 2021-2035

- 8.2.1. Stretch Film

- 8.2.1.1. Blown Stretch Film

- 8.2.1.2. Cast Stretch Film

- 8.2.1.3. Others

- 8.2.2. Pre-Stretch Film

- 8.2.3. Nano Stretch Film

- 8.2.4. Biodegradable/Eco-Friendly Film

- 8.2.1. Stretch Film

- 9. Global Pallet Stretch Wrapping Machine Market Analysis and Forecasts, by Load Weight Capacity

- 9.1. Key Findings

- 9.2. Pallet Stretch Wrapping Machine Market Size (Volume-MMT and Value - US$ Bn), Analysis, and Forecasts, by Load Weight Capacity, 2021-2035

- 9.2.1. Up to 1,000 kg

- 9.2.2. 1,000-2,000 kg

- 9.2.3. 2,000-3,000 kg

- 9.2.4. Above 3,000 kg

- 10. Global Pallet Stretch Wrapping Machine Market Analysis and Forecasts, by Wrapping Configuration

- 10.1. Key Findings

- 10.2. Pallet Stretch Wrapping Machine Market Size (Volume-MMT and Value - US$ Bn), Analysis, and Forecasts, by Wrapping Configuration, 2021-2035

- 10.2.1. Standard Wrapping

- 10.2.2. Top Sheet Application

- 10.2.3. Roping Application

- 10.2.4. Top & Bottom Wrapping

- 10.2.5. Side Wrapping

- 11. Global Pallet Stretch Wrapping Machine Market Analysis and Forecasts, by Control System

- 11.1. Key Findings

- 11.2. Pallet Stretch Wrapping Machine Market Size (Volume-MMT and Value - US$ Bn), Analysis, and Forecasts, by Control System, 2021-2035

- 11.2.1. PLC Controlled

- 11.2.2. Microprocessor Controlled

- 11.2.3. Manual Control

- 11.2.4. IoT-Enabled/Smart Control Systems

- 12. Global Pallet Stretch Wrapping Machine Market Analysis and Forecasts, by Power Source

- 12.1. Key Findings

- 12.2. Pallet Stretch Wrapping Machine Market Size (Volume-MMT and Value - US$ Bn), Analysis, and Forecasts, by Power Source, 2021-2035

- 12.2.1. Electric Powered

- 12.2.1.1. Single Phase

- 12.2.1.2. Three Phase

- 12.2.2. Pneumatic Powered

- 12.2.3. Hybrid

- 12.2.1. Electric Powered

- 13. Global Pallet Stretch Wrapping Machine Market Analysis and Forecasts, by End-Use Industry

- 13.1. Key Findings

- 13.2. Pallet Stretch Wrapping Machine Market Size (Volume-MMT and Value - US$ Bn), Analysis, and Forecasts, by Thickness, 2021-2035

- 13.2.1. Food & Beverage

- 13.2.1.1. Packaged Food Products Palletizing

- 13.2.1.2. Beverage Bottles & Cans Palletizing

- 13.2.1.3. Dairy Products Wrapping

- 13.2.1.4. Frozen Food Storage & Transport

- 13.2.1.5. Bulk Food Ingredient Handling

- 13.2.1.6. Others

- 13.2.2. Pharmaceutical & Healthcare

- 13.2.2.1. Medicine & Drug Packaging

- 13.2.2.2. Medical Equipment & Devices

- 13.2.2.3. Healthcare Supplies Distribution

- 13.2.2.4. API (Active Pharmaceutical Ingredients) Handling

- 13.2.2.5. Laboratory Equipment Packaging

- 13.2.2.6. Others

- 13.2.3. Chemical

- 13.2.3.1. Chemical Drums & Containers

- 13.2.3.2. Hazardous Material Packaging

- 13.2.3.3. Fertilizer & Agrochemical Packaging

- 13.2.3.4. Industrial Chemical Distribution

- 13.2.3.5. Paint & Coating Products

- 13.2.3.6. Others

- 13.2.4. E-commerce & Retail

- 13.2.4.1. Consumer Goods Packaging

- 13.2.4.2. Multi-Product Pallet Wrapping

- 13.2.4.3. Return Logistics Handling

- 13.2.4.4. Warehouse Distribution Centers

- 13.2.4.5. Seasonal Product Storage

- 13.2.4.6. Others

- 13.2.5. Automotive

- 13.2.5.1. Auto Parts & Components

- 13.2.5.2. Spare Parts Distribution

- 13.2.5.3. Tire & Rubber Products

- 13.2.5.4. Automotive Accessories

- 13.2.5.5. Export Packaging for Vehicles

- 13.2.5.6. Others

- 13.2.6. Building & Construction

- 13.2.6.1. Construction Materials (Bricks, Tiles)

- 13.2.6.2. Cement Bags Palletizing

- 13.2.6.3. Hardware & Tools Packaging

- 13.2.6.4. Roofing Materials

- 13.2.6.5. Plumbing & Electrical Supplies

- 13.2.6.6. Others

- 13.2.7. Electronics & Electrical

- 13.2.7.1. Consumer Electronics Packaging

- 13.2.7.2. White Goods & Appliances

- 13.2.7.3. Electronic Components

- 13.2.7.4. Cables & Wiring Products

- 13.2.7.5. Battery & Power Supply Units

- 13.2.7.6. Others

- 13.2.8. Paper & Printing

- 13.2.9. Textile & Apparel

- 13.2.10. Logistics & Warehousing

- 13.2.11. Metal & Mining

- 13.2.12. Agriculture & Horticulture

- 13.2.13. Other End-use Industries

- 13.2.1. Food & Beverage

- 14. Global Pallet Stretch Wrapping Machine Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Pallet Stretch Wrapping Machine Market Size (Volume-MMT and Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Pallet Stretch Wrapping Machine Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Pallet Stretch Wrapping Machine Market Size (Volume-MMT and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Machine Type

- 15.3.2. Wrapping Capacity

- 15.3.3. Film Type

- 15.3.4. Load Weight Capacity

- 15.3.5. Wrapping Configuration

- 15.3.6. Control System

- 15.3.7. Power Source

- 15.3.8. End-Use Industry

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Pallet Stretch Wrapping Machine Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Machine Type

- 15.4.3. Wrapping Capacity

- 15.4.4. Film Type

- 15.4.5. Load Weight Capacity

- 15.4.6. Wrapping Configuration

- 15.4.7. Control System

- 15.4.8. Power Source

- 15.4.9. End-Use Industry

- 15.5. Canada Pallet Stretch Wrapping Machine Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Machine Type

- 15.5.3. Wrapping Capacity

- 15.5.4. Film Type

- 15.5.5. Load Weight Capacity

- 15.5.6. Wrapping Configuration

- 15.5.7. Control System

- 15.5.8. Power Source

- 15.5.9. End-Use Industry

- 15.6. Mexico Pallet Stretch Wrapping Machine Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Machine Type

- 15.6.3. Wrapping Capacity

- 15.6.4. Film Type

- 15.6.5. Load Weight Capacity

- 15.6.6. Wrapping Configuration

- 15.6.7. Control System

- 15.6.8. Power Source

- 15.6.9. End-Use Industry

- 16. Europe Pallet Stretch Wrapping Machine Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Pallet Stretch Wrapping Machine Market Size (Volume-MMT and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Machine Type

- 16.3.2. Wrapping Capacity

- 16.3.3. Film Type

- 16.3.4. Load Weight Capacity

- 16.3.5. Wrapping Configuration

- 16.3.6. Control System

- 16.3.7. Power Source

- 16.3.8. End-Use Industry

- 16.3.9. Country

- 16.3.9.1. Germany

- 16.3.9.2. United Kingdom

- 16.3.9.3. France

- 16.3.9.4. Italy

- 16.3.9.5. Spain

- 16.3.9.6. Netherlands

- 16.3.9.7. Nordic Countries

- 16.3.9.8. Poland

- 16.3.9.9. Russia & CIS

- 16.3.9.10. Rest of Europe

- 16.4. Germany Pallet Stretch Wrapping Machine Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Machine Type

- 16.4.3. Wrapping Capacity

- 16.4.4. Film Type

- 16.4.5. Load Weight Capacity

- 16.4.6. Wrapping Configuration

- 16.4.7. Control System

- 16.4.8. Power Source

- 16.4.9. End-Use Industry

- 16.5. United Kingdom Pallet Stretch Wrapping Machine Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Machine Type

- 16.5.3. Wrapping Capacity

- 16.5.4. Film Type

- 16.5.5. Load Weight Capacity

- 16.5.6. Wrapping Configuration

- 16.5.7. Control System

- 16.5.8. Power Source

- 16.5.9. End-Use Industry

- 16.6. France Pallet Stretch Wrapping Machine Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Machine Type

- 16.6.3. Wrapping Capacity

- 16.6.4. Film Type

- 16.6.5. Load Weight Capacity

- 16.6.6. Wrapping Configuration

- 16.6.7. Control System

- 16.6.8. Power Source

- 16.6.9. End-Use Industry

- 16.7. Italy Pallet Stretch Wrapping Machine Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Machine Type

- 16.7.3. Wrapping Capacity

- 16.7.4. Film Type

- 16.7.5. Load Weight Capacity

- 16.7.6. Wrapping Configuration

- 16.7.7. Control System

- 16.7.8. Power Source

- 16.7.9. End-Use Industry

- 16.8. Spain Pallet Stretch Wrapping Machine Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Machine Type

- 16.8.3. Wrapping Capacity

- 16.8.4. Film Type

- 16.8.5. Load Weight Capacity

- 16.8.6. Wrapping Configuration

- 16.8.7. Control System

- 16.8.8. Power Source

- 16.8.9. End-Use Industry

- 16.9. Netherlands Pallet Stretch Wrapping Machine Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Machine Type

- 16.9.3. Wrapping Capacity

- 16.9.4. Film Type

- 16.9.5. Load Weight Capacity

- 16.9.6. Wrapping Configuration

- 16.9.7. Control System

- 16.9.8. Power Source

- 16.9.9. End-Use Industry

- 16.10. Nordic Countries Pallet Stretch Wrapping Machine Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Machine Type

- 16.10.3. Wrapping Capacity

- 16.10.4. Film Type

- 16.10.5. Load Weight Capacity

- 16.10.6. Wrapping Configuration

- 16.10.7. Control System

- 16.10.8. Power Source

- 16.10.9. End-Use Industry

- 16.11. Poland Pallet Stretch Wrapping Machine Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Machine Type

- 16.11.3. Wrapping Capacity

- 16.11.4. Film Type

- 16.11.5. Load Weight Capacity

- 16.11.6. Wrapping Configuration

- 16.11.7. Control System

- 16.11.8. Power Source

- 16.11.9. End-Use Industry

- 16.12. Russia & CIS Pallet Stretch Wrapping Machine Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Machine Type

- 16.12.3. Wrapping Capacity

- 16.12.4. Film Type

- 16.12.5. Load Weight Capacity

- 16.12.6. Wrapping Configuration

- 16.12.7. Control System

- 16.12.8. Power Source

- 16.12.9. End-Use Industry

- 16.13. Rest of Europe Pallet Stretch Wrapping Machine Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Machine Type

- 16.13.3. Wrapping Capacity

- 16.13.4. Film Type

- 16.13.5. Load Weight Capacity

- 16.13.6. Wrapping Configuration

- 16.13.7. Control System

- 16.13.8. Power Source

- 16.13.9. End-Use Industry

- 17. Asia Pacific Pallet Stretch Wrapping Machine Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. East Asia Pallet Stretch Wrapping Machine Market Size (Volume-MMT and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Machine Type

- 17.3.2. Wrapping Capacity

- 17.3.3. Film Type

- 17.3.4. Load Weight Capacity

- 17.3.5. Wrapping Configuration

- 17.3.6. Control System

- 17.3.7. Power Source

- 17.3.8. End-Use Industry

- 17.3.9. Country

- 17.3.9.1. China

- 17.3.9.2. India

- 17.3.9.3. Japan

- 17.3.9.4. South Korea

- 17.3.9.5. Australia and New Zealand

- 17.3.9.6. Indonesia

- 17.3.9.7. Malaysia

- 17.3.9.8. Thailand

- 17.3.9.9. Vietnam

- 17.3.9.10. Rest of Asia Pacific

- 17.4. China Pallet Stretch Wrapping Machine Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Machine Type

- 17.4.3. Wrapping Capacity

- 17.4.4. Film Type

- 17.4.5. Load Weight Capacity

- 17.4.6. Wrapping Configuration

- 17.4.7. Control System

- 17.4.8. Power Source

- 17.4.9. End-Use Industry

- 17.5. India Pallet Stretch Wrapping Machine Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Machine Type

- 17.5.3. Wrapping Capacity

- 17.5.4. Film Type

- 17.5.5. Load Weight Capacity

- 17.5.6. Wrapping Configuration

- 17.5.7. Control System

- 17.5.8. Power Source

- 17.5.9. End-Use Industry

- 17.6. Japan Pallet Stretch Wrapping Machine Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Machine Type

- 17.6.3. Wrapping Capacity

- 17.6.4. Film Type

- 17.6.5. Load Weight Capacity

- 17.6.6. Wrapping Configuration

- 17.6.7. Control System

- 17.6.8. Power Source

- 17.6.9. End-Use Industry

- 17.7. South Korea Pallet Stretch Wrapping Machine Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Machine Type

- 17.7.3. Wrapping Capacity

- 17.7.4. Film Type

- 17.7.5. Load Weight Capacity

- 17.7.6. Wrapping Configuration

- 17.7.7. Control System

- 17.7.8. Power Source

- 17.7.9. End-Use Industry

- 17.8. Australia and New Zealand Pallet Stretch Wrapping Machine Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Machine Type

- 17.8.3. Wrapping Capacity

- 17.8.4. Film Type

- 17.8.5. Load Weight Capacity

- 17.8.6. Wrapping Configuration

- 17.8.7. Control System

- 17.8.8. Power Source

- 17.8.9. End-Use Industry

- 17.9. Indonesia Pallet Stretch Wrapping Machine Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Machine Type

- 17.9.3. Wrapping Capacity

- 17.9.4. Film Type

- 17.9.5. Load Weight Capacity

- 17.9.6. Wrapping Configuration

- 17.9.7. Control System

- 17.9.8. Power Source

- 17.9.9. End-Use Industry

- 17.10. Malaysia Pallet Stretch Wrapping Machine Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Machine Type

- 17.10.3. Wrapping Capacity

- 17.10.4. Film Type

- 17.10.5. Load Weight Capacity

- 17.10.6. Wrapping Configuration

- 17.10.7. Control System

- 17.10.8. Power Source

- 17.10.9. End-Use Industry

- 17.11. Thailand Pallet Stretch Wrapping Machine Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Machine Type

- 17.11.3. Wrapping Capacity

- 17.11.4. Film Type

- 17.11.5. Load Weight Capacity

- 17.11.6. Wrapping Configuration

- 17.11.7. Control System

- 17.11.8. Power Source

- 17.11.9. End-Use Industry

- 17.12. Vietnam Pallet Stretch Wrapping Machine Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Machine Type

- 17.12.3. Wrapping Capacity

- 17.12.4. Film Type

- 17.12.5. Load Weight Capacity

- 17.12.6. Wrapping Configuration

- 17.12.7. Control System

- 17.12.8. Power Source

- 17.12.9. End-Use Industry

- 17.13. Rest of Asia Pacific Pallet Stretch Wrapping Machine Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Machine Type

- 17.13.3. Wrapping Capacity

- 17.13.4. Film Type

- 17.13.5. Load Weight Capacity

- 17.13.6. Wrapping Configuration

- 17.13.7. Control System

- 17.13.8. Power Source

- 17.13.9. End-Use Industry

- 18. Middle East Pallet Stretch Wrapping Machine Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Pallet Stretch Wrapping Machine Market Size (Volume-MMT and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Machine Type

- 18.3.2. Wrapping Capacity

- 18.3.3. Film Type

- 18.3.4. Load Weight Capacity

- 18.3.5. Wrapping Configuration

- 18.3.6. Control System

- 18.3.7. Power Source

- 18.3.8. End-Use Industry

- 18.3.9. Country

- 18.3.9.1. Turkey

- 18.3.9.2. UAE

- 18.3.9.3. Saudi Arabia

- 18.3.9.4. Israel

- 18.3.9.5. Rest of Middle East

- 18.4. Turkey Pallet Stretch Wrapping Machine Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Machine Type

- 18.4.3. Wrapping Capacity

- 18.4.4. Film Type

- 18.4.5. Load Weight Capacity

- 18.4.6. Wrapping Configuration

- 18.4.7. Control System

- 18.4.8. Power Source

- 18.4.9. End-Use Industry

- 18.5. UAE Pallet Stretch Wrapping Machine Market

- 18.5.1. Product Type

- 18.5.2. Machine Type

- 18.5.3. Wrapping Capacity

- 18.5.4. Film Type

- 18.5.5. Load Weight Capacity

- 18.5.6. Wrapping Configuration

- 18.5.7. Control System

- 18.5.8. Power Source

- 18.5.9. End-Use Industry

- 18.6. Saudi Arabia Pallet Stretch Wrapping Machine Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Machine Type

- 18.6.3. Wrapping Capacity

- 18.6.4. Film Type

- 18.6.5. Load Weight Capacity

- 18.6.6. Wrapping Configuration

- 18.6.7. Control System

- 18.6.8. Power Source

- 18.6.9. End-Use Industry

- 18.7. Israel Pallet Stretch Wrapping Machine Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Machine Type

- 18.7.3. Wrapping Capacity

- 18.7.4. Film Type

- 18.7.5. Load Weight Capacity

- 18.7.6. Wrapping Configuration

- 18.7.7. Control System

- 18.7.8. Power Source

- 18.7.9. End-Use Industry

- 18.8. Rest of Middle East Pallet Stretch Wrapping Machine Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Machine Type

- 18.8.3. Wrapping Capacity

- 18.8.4. Film Type

- 18.8.5. Load Weight Capacity

- 18.8.6. Wrapping Configuration

- 18.8.7. Control System

- 18.8.8. Power Source

- 18.8.9. End-Use Industry

- 19. Africa Pallet Stretch Wrapping Machine Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Pallet Stretch Wrapping Machine Market Size (Volume-MMT and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Machine Type

- 19.3.2. Wrapping Capacity

- 19.3.3. Film Type

- 19.3.4. Load Weight Capacity

- 19.3.5. Wrapping Configuration

- 19.3.6. Control System

- 19.3.7. Power Source

- 19.3.8. End-Use Industry

- 19.3.9. Country

- 19.3.9.1. South Africa

- 19.3.9.2. Egypt

- 19.3.9.3. Nigeria

- 19.3.9.4. Algeria

- 19.3.9.5. Rest of Africa

- 19.4. South Africa Pallet Stretch Wrapping Machine Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Machine Type

- 19.4.3. Wrapping Capacity

- 19.4.4. Film Type

- 19.4.5. Load Weight Capacity

- 19.4.6. Wrapping Configuration

- 19.4.7. Control System

- 19.4.8. Power Source

- 19.4.9. End-Use Industry

- 19.5. Egypt Pallet Stretch Wrapping Machine Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Machine Type

- 19.5.3. Wrapping Capacity

- 19.5.4. Film Type

- 19.5.5. Load Weight Capacity

- 19.5.6. Wrapping Configuration

- 19.5.7. Control System

- 19.5.8. Power Source

- 19.5.9. End-Use Industry

- 19.6. Nigeria Pallet Stretch Wrapping Machine Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Machine Type

- 19.6.3. Wrapping Capacity

- 19.6.4. Film Type

- 19.6.5. Load Weight Capacity

- 19.6.6. Wrapping Configuration

- 19.6.7. Control System

- 19.6.8. Power Source

- 19.6.9. End-Use Industry

- 19.7. Algeria Pallet Stretch Wrapping Machine Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Machine Type

- 19.7.3. Wrapping Capacity

- 19.7.4. Film Type

- 19.7.5. Load Weight Capacity

- 19.7.6. Wrapping Configuration

- 19.7.7. Control System

- 19.7.8. Power Source

- 19.7.9. End-Use Industry

- 19.8. Rest of Africa Pallet Stretch Wrapping Machine Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Machine Type

- 19.8.3. Wrapping Capacity

- 19.8.4. Film Type

- 19.8.5. Load Weight Capacity

- 19.8.6. Wrapping Configuration

- 19.8.7. Control System

- 19.8.8. Power Source

- 19.8.9. End-Use Industry

- 20. South America Pallet Stretch Wrapping Machine Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Central and South Africa Pallet Stretch Wrapping Machine Market Size (Volume-MMT and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Machine Type

- 20.3.2. Wrapping Capacity

- 20.3.3. Film Type

- 20.3.4. Load Weight Capacity

- 20.3.5. Wrapping Configuration

- 20.3.6. Control System

- 20.3.7. Power Source

- 20.3.8. End-Use Industry

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Pallet Stretch Wrapping Machine Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Machine Type

- 20.4.3. Wrapping Capacity

- 20.4.4. Film Type

- 20.4.5. Load Weight Capacity

- 20.4.6. Wrapping Configuration

- 20.4.7. Control System

- 20.4.8. Power Source

- 20.4.9. End-Use Industry

- 20.5. Argentina Pallet Stretch Wrapping Machine Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Machine Type

- 20.5.3. Wrapping Capacity

- 20.5.4. Film Type

- 20.5.5. Load Weight Capacity

- 20.5.6. Wrapping Configuration

- 20.5.7. Control System

- 20.5.8. Power Source

- 20.5.9. End-Use Industry

- 20.6. Rest of South America Pallet Stretch Wrapping Machine Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Machine Type

- 20.6.3. Wrapping Capacity

- 20.6.4. Film Type

- 20.6.5. Load Weight Capacity

- 20.6.6. Wrapping Configuration

- 20.6.7. Control System

- 20.6.8. Power Source

- 20.6.9. End-Use Industry

- 21. Key Players/ Company Profile

- 21.1. Aetna Group

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. ARPAC LLC

- 21.3. Atlanta Stretch

- 21.4. Cousins Packaging

- 21.5. Fhope Packaging Machinery

- 21.6. FROMM Packaging Systems

- 21.7. Hangzhou Youngsun Intelligent Equipment

- 21.8. Highlight Industries

- 21.9. Italdibipack

- 21.10. Kuka AG (Swisslog)

- 21.11. Lantech

- 21.12. M.J. Maillis Group

- 21.13. Muller LCS

- 21.14. Orion Packaging Systems

- 21.15. Phoenix Wrappers

- 21.16. Premier Tech Chronos

- 21.17. Robopac (Aetna Group)

- 21.18. Shandong Dyehome Intelligent Equipment

- 21.19. Signode Industrial Group

- 21.20. TAB Industries

- 21.21. Technowrapp

- 21.22. Webster Griffin

- 21.23. Wulftec International

- 21.24. Other Key Players

- 21.1. Aetna Group

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data