Reproductive Health Innovations Market Size, Share & Trends Analysis Report by Product Type (Fertility Monitoring Devices, Contraceptive Innovations, Assisted Reproductive Technology (ART) Products, Prenatal & Pregnancy Care Devices, Menstrual Health Products, Other Product Types), Technology, Application Area, Distribution Channel, Age Group, Gender, Service Model, End-users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Reproductive Health Innovations Market Size, Share, and Growth

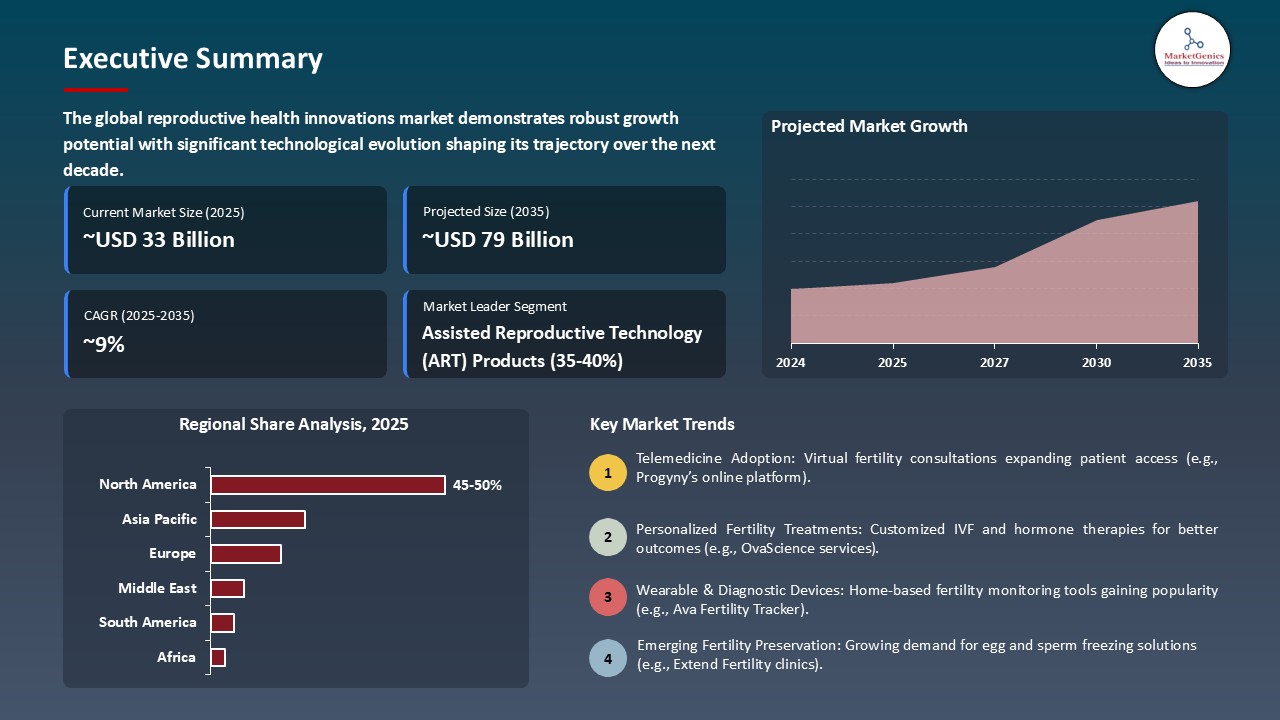

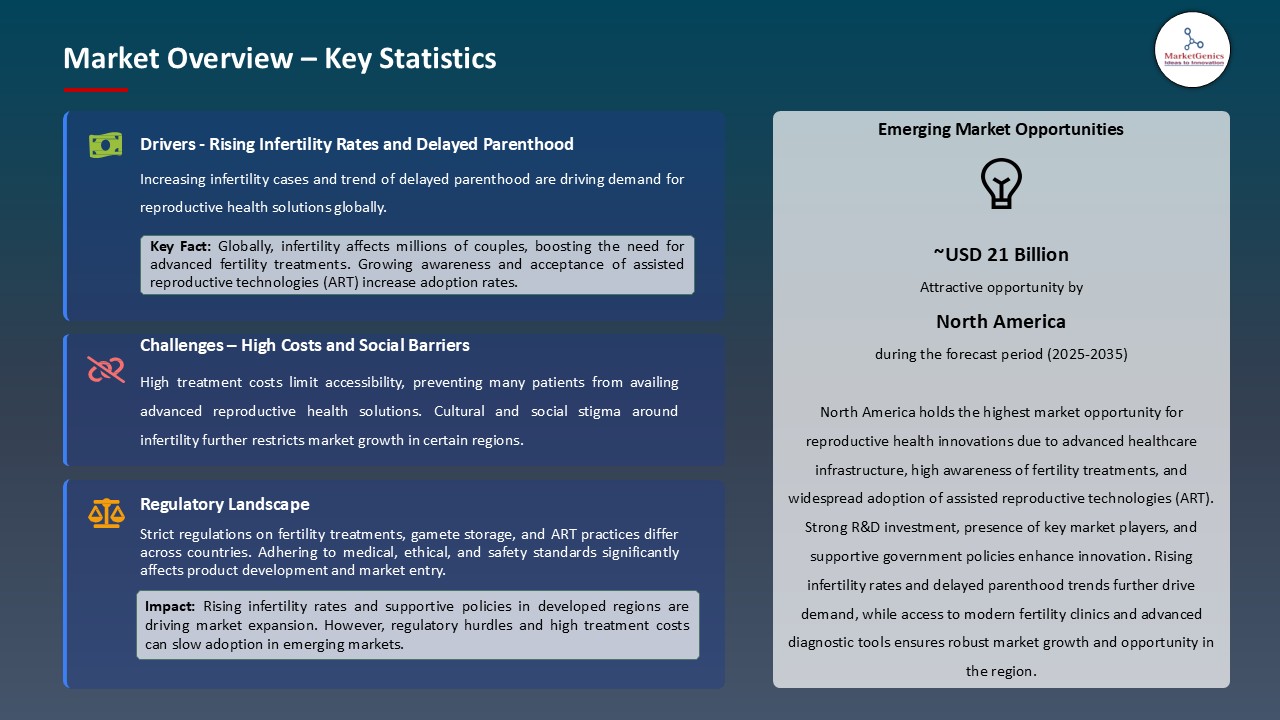

The global reproductive health innovations market is experiencing robust growth, with its estimated value of USD 32.7 billion in the year 2025 and USD 78.8 billion by the period 2035, registering a CAGR of 9.2%, during the forecast period. The global reproductive health innovations market is growing rapidly, driven by rising awareness of fertility preservation, increasing adoption of ART, and demand for personalized reproductive care. Growth is supported by investments from healthcare organizations, strategic partnerships between FemTech startups and pharmaceutical companies, and advancements in AI-powered fertility platforms, genetic testing, and hormone monitoring. Integration of digital health solutions and telemedicine further enhances accessibility and treatment outcomes, reinforcing market expansion worldwide.

Jannine Versi, CEO and co-founder of Elektra Health, told Fierce Healthcare that women who are navigating menopause often feel overlooked, and seeing an offering like this built especially for them can be heartening.

Increasing use of modern fertility technologies, AI-based digital apps, and hormone monitoring are the major drivers of the global reproductive health innovations market. For instance, in April 2025, Maven Clinic introduced its countrywide fertility and reproductive health telehealth service which provides virtual healthcare to its patients, creating individualized care plans and remote monitoring of hormone therapy and fertility medications. The program enlarges the access to reproductive care and allows clinicians to provide individual intervention in the most effective way.

New technological development in ART, such as AI-assisted embryo selection, microfluidic sperm sorting, and advanced genetic screening are making treatment outcomes and success rates even better. For instance, in October 2024, scientists at Cornell University created a fully automated artificial intelligence-based system called BELA to measure the quality of IVF embryos. This system examines the quality score of the embryo and ploidy status, which gives a complete overview of the embryo, which is important in order to optimize success during implantation and general IVF outcomes.

Other novel fertility diagnostics, hormone biosensors, and telehealth systems are being introduced by startups and biotech firms, and are enhancing patient access, monitoring, and personalization. These platforms minimize the frequency of visits to the clinic and enable clinicians to streamline treatment regimens on a remote scale. Laws and health services in North America, Europe and Asia-Pacific are facilitating a more rapid uptake of novel fertility therapies, allowing more patients to access reproductive healthcare and making commercialization of novel reproductive health solutions easier.

Reproductive Health Innovations Market Dynamics and Trends

Driver: Growing Awareness and Adoption of Digital Reproductive Health Solutions

- The rising attention to the health of women, fertility control, and sexual health globally has emerged as a key force behind the Reproductive Health Innovations Market. Increasing awareness regarding menstrual health, fertility planning, and maternal care along with the prevalence of smartphones has increased the pace of adoption of mobile health apps and connected monitoring devices on reproductive health.

- Digital reproductive apps allow women to monitor ovulation, pregnancy, and hormonal fluctuations with personalized information based on the artificial intelligence and wearable technologies. For instance, in September 2025, when Clue collaborated with Ultrahuman to add menstrual cycle monitoring to the Ultrahuman Ring AIR platform to combine a biometric reading with menstrual history to provide more detailed health information. These alliances demonstrate the swift growth and integration of solutions in Reproductive Health Innovations Market.

- These innovations facilitate proactive reproductive health, enable users with informed health decisions, and aid clinicians with remotely-insightful patients.

Restraint: Data Privacy Concerns and Regulatory Challenges

- The growing adoption of mobile applications, telemedicine solutions, and connected fertility products in reproductive health concerns raise essential data privacy and ethical issues. Sensitive health and behavioral information posted on those sources will need powerful encryption and adherence to such regulations as HIPAA and GDPR that directly influence the development of the Reproductive Health Innovations Market.

- A variety of digital health startups encounter challenges in getting clinical validation, data security certifications and end user trust. For instance, In 2025, FemTech Analytics survey found that almost 40 percent of users were concerned with how fertility and sexual health data is stored and used by third parties, as a barrier to using it in some areas of the reproductive health innovations Market.

- In addition, lack of consistent regulations across states makes it slow to penetrate the international markets by international firms. The necessity of transparent data management, standard privacy and safe digital ecosystems is another major limitation that hinders full commercialization and user trust in reproductive health innovation.

Opportunity: Expansion of Personalized Fertility and Hormonal Care Platforms

- New opportunities in personalized reproductive health management are opening up due to developments in artificial intelligence, biosensors, and hormone-based diagnostics. Innovators may now develop specific fertility and hormonal care plans to achieve improved health results by examining hormone patterns, ovulation patterns, and metabolism data.

- The rise of cross-sector relationships between healthcare institutions, FemTech startups and government agencies is contributing to expedited innovation of the female health. Such partnerships are geared towards closing the gap between research, finance, and technology to ensure that individualized reproductive health is more affordable and accessible.

- With this rising trend, companies are establishing strategic alliances to combine technologies and size personalized health solutions. For instance, in 2024, Dexcom invested in ŌURA as a Series D partner, and collaborated to combine Dexcom with ŌURA to integrate the Dexcom continuous glucose monitoring and the ŌURA smart ring. This integration is a mix of metabolic, sleep, and hormonal information, which users can use to get data-driven insights on a personal basis. The partnership also facilitates co-marketing, cross-selling, and the introduction of a companion app in 2025, with the assistance of fertility, metabolic, and overall wellness promotion.

- Expanding these personalized care systems will be able to tackle infertility, polycystic ovary syndrome (PCOS), and menopause by detecting them early and preventing them.

Key Trend: Growth of Virtual Fertility Clinics and Telehealth-Based Reproductive Care

- Reproductive Health Innovations market demonstrates a transition toward making fertility care services available in new geographic locations and becoming more virtual. This allows the greater access to patients, decreases the travel needs, and facilitates the timely interventions in reproductive health.

- Healthcare professionals are decentralizing the services by establishing programs and IVF institutions in strategically located areas outside of the conventional metropolitan areas. For instance, in August 2024, Kindbody announced opening a new clinic and IVF laboratory in San Diego, California, where fertility and family-building services are offered to an underserved population, with virtual consultations included to provide after- and pre-treatment support.

- Moreover, the use of telehealth solutions, digital diagnostics, and remote patient monitoring contributes to the increased personalization of the treatment process, efficiency of operations, and patient interaction.

Reproductive Health Innovations Market Analysis and Segmental Data

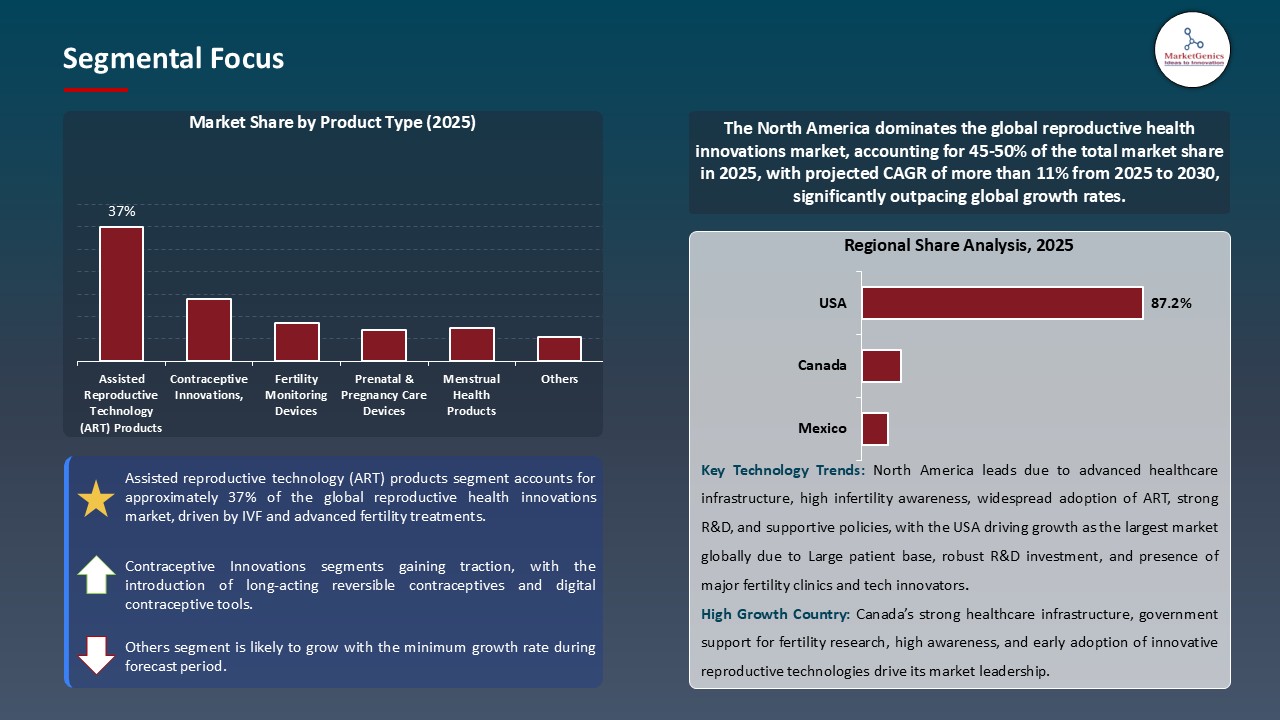

Assisted Reproductive Technology (ART) Products Dominate Global Reproductive Health Innovations Market

- The ART segment is poised to dominate the world reproductive health innovations market with the growing infertility rate, the increasing awareness of fertility preservation, and the widespread use of IVF, IUI and egg/sperm freezing procedures. Products of ART such as ovulation induction kits, embryo culture media, and cryopreservation systems are important in enhancing success rates and personalized fertility management.

- ART efficacy and precision is being propelled by technological advances. New technologies, like AI-based embryo selection, time-lapse microscopy, and automated sperm counting make clinicians able to maximize treatment outcomes. Digital fertility integration will enable continuous hormonal level monitoring, ovulation cycle, and patient-specific treatment changes, add to personalization and clinical efficacy.

- Facility expansions and new services also enhance access to the market and clinical adoption. For instance, in May 2025, Kindbody launched a high-tech fertility clinic/IVF laboratory in Charlotte, North Carolina, extending high-touch fertility and family-building services to the larger metropolitan region. This growth is a sign of increased territorial coverage and uptake of ART solutions worldwide.

- These developments lead to greater success in treatment, increased accessibility to patients and the strengthening of ART products as the foundation of reproductive health innovations at the global level.

North America Leads Global Reproductive Health Innovations Market Demand

- North America is the most prominent market in the Reproductive Health Innovations market because of the initial introduction of sophisticated ART technologies, AI-based fertility services, and unified telehealth. The market dominance of the region is attributed to high fertility preservation awareness, broad availability of insurance to fertility treatment, and the desire of patients to have individualized reproductive care.

- The area has an established system of fertility clinics, research facilities, and FemTech startups, which allows conducting clinical tests and adopting innovative ART-based solutions much faster. For instance, in July 2025, Progyny collaborated with ŌURA, the developer of the most popular smart ring, to incorporate wearable health information into individualized fertility and women health services. This partnership enables teams providing care to utilize real-time biometric information to enhance preconception to menopause outcomes, showing that North America is the first region to combine technology and clinical care.

- Strong government support, insurance reimbursement policy, and commercialization and adoption of reproductive health innovations are also aided by good policies. Combined with modern manufacturing and digital solutions, and strong R&D ecosystems, North American countries hold the biggest market share and remain appealing to investors around the world in terms of reproductive health technologies.

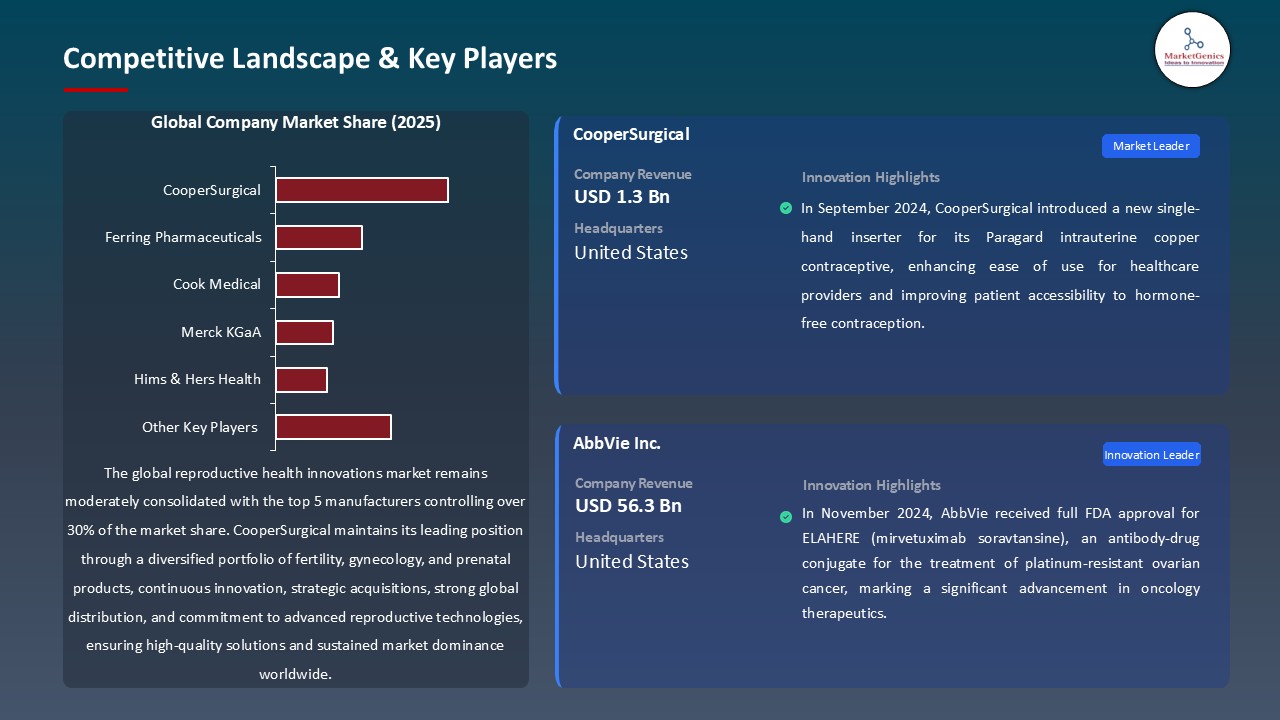

Reproductive Health Innovations Market Ecosystem

The global reproductive health innovations market is characterized by a dynamic ecosystem led by prominent healthcare and fertility technology companies such as CooperSurgical, Ferring Pharmaceuticals, Cook Medical, Merck KGaA, and Hims & Hers Health, which are advancing fertility care, digital reproductive platforms, and hormonal therapy solutions. These companies focus on assisted reproductive technologies (ART), AI-based fertility tracking and custom-made treatment programs to raise the success rates, as well as, to increase the access to reproductive healthcare.

Government programs, research institutions, and private investors are important in financing clinical trials, women health innovations and R&D process that hastens the novel solutions on reproductive matters. As an example, in July 2025, Carrot Fertility launched a program called Sprints, which focused on metabolic causes of infertility including obesity and insulin resistance to improve the IVF efficacy and shorten the treatment cycles to show that the market is oriented towards evidence-based innovation and patient-centered care.

Simultaneously, startups and university laboratories are launching complementary technologies like AI-based embryo diagnosis, genetic screening, and telehealth-based fertility tracking, which can improve the accuracy of diagnosis and personalize treatment. Together, a strong ecosystem composed of strategic partnerships, technology, and sustained investment is still driving sustainable growth, clinical development, and universal adaptation of high-quality reproductive health solutions.

Recent Development and Strategic Overview:

- In February 2025, Carrot Fertility announced the launch of its Virtual Menopause and Midlife Clinic which would increase the availability of female health services in all 50 U.S. states. The clinic is providing telehealth services and certified menopause specialists, hormone and non-hormonal medications, and holistic care such as mental health and nutrition assistance. This introduction will enhance the presence of Carrot in the reproductive and midlife care solutions that are highly technological.

- In November 2024, Alife Health collaborated with US Fertility to test its AI program, which is called Embryo Assist, in embryology labs. The instrument is connected to microscopes and cloud computing to record the data of embryo images, generate audit trails, and deliver real-time analytics to control the quality of laboratories and provide knowledge.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 32.7 Bn |

|

Market Forecast Value in 2035 |

USD 78.8 Bn |

|

Growth Rate (CAGR) |

9.2% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value

|

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Reproductive Health Innovations Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Reproductive Health Innovations Market, By Product Type |

|

|

Reproductive Health Innovations Market, By Technology |

|

|

Reproductive Health Innovations Market, By Application Area |

|

|

Reproductive Health Innovations Market, By Distribution Channel |

|

|

Reproductive Health Innovations Market, By Age Group |

|

|

Reproductive Health Innovations Market, By Gender |

|

|

Reproductive Health Innovations Market, By Service Model |

|

|

Reproductive Health Innovations Market, By End-users |

|

Frequently Asked Questions

The global reproductive health innovations market was valued at USD 32.7 Bn in 2025.

The global reproductive health innovations market industry is expected to grow at a CAGR of 9.2% from 2025 to 2035.

The demand for reproductive health innovations market is driven by the rising prevalence of infertility and reproductive disorders, increasing awareness about fertility preservation and assisted reproductive technologies (ART), and advancements in genetic screening and embryo selection.

In terms of product type, the assisted reproductive technology (ART) products segment accounted for the major share in 2025.

Key players in the global reproductive health innovations market include prominent companies such as Abbott Laboratories, Ava Science, Bayer AG, Carrot Fertility, Celmatix, Church & Dwight, Cook Medical, CooperSurgical, Ferring Pharmaceuticals, Hims & Hers Health, Kindbody, Maven Clinic, Merck KGaA, Modern Fertility, Natural Cycles, Organon, Prelude Fertility, Prestige Consumer Healthcare, Progyny, Ro (Roman Health), TMRW Life Sciences, Univfy, Vitrolife, and Other Key Players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Reproductive Health Innovations Market Outlook

- 2.1.1. Reproductive Health Innovations Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Reproductive Health Innovations Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Healthcare Industry Overview, 2025

- 3.1.1. Healthcare Industry Ecosystem Analysis

- 3.1.2. Key Trends for Healthcare Industry

- 3.1.3. Regional Distribution for Healthcare Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Healthcare Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising infertility rates and delayed parenthood

- 4.1.1.2. Technological advancements in fertility treatments

- 4.1.1.3. Increasing awareness and adoption of reproductive health solutions

- 4.1.2. Restraints

- 4.1.2.1. High treatment costs

- 4.1.2.2. Regulatory and ethical challenges

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Research & Development

- 4.4.2. Raw Materials & Components

- 4.4.3. Manufacturing & Production

- 4.4.4. Distribution & Supply Chain

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Reproductive Health Innovations Market Demand

- 4.9.1. Historical Market Size – Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size - Value (US$ Bn), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Reproductive Health Innovations Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Reproductive Health Innovations Market Size (Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Fertility Monitoring Devices

- 6.2.1.1. Ovulation Trackers

- 6.2.1.2. Basal Body Temperature Monitors

- 6.2.1.3. Fertility Wearables

- 6.2.1.4. Smart Fertility Apps

- 6.2.1.5. Others

- 6.2.2. Contraceptive Innovations

- 6.2.2.1. Long-Acting Reversible Contraceptives (LARCs)

- 6.2.2.2. Hormonal Implants

- 6.2.2.3. Smart Birth Control Pills

- 6.2.2.4. Non-Hormonal Contraceptives

- 6.2.2.5. Others

- 6.2.3. Assisted Reproductive Technology (ART) Products

- 6.2.3.1. IVF Equipment & Consumables

- 6.2.3.2. Embryo Culture Media

- 6.2.3.3. Cryopreservation Systems

- 6.2.3.4. Microfluidic Devices

- 6.2.3.5. Others

- 6.2.4. Prenatal & Pregnancy Care Devices

- 6.2.4.1. Home Pregnancy Tests

- 6.2.4.2. Fetal Monitoring Systems

- 6.2.4.3. Prenatal Genetic Testing Kits

- 6.2.4.4. Smart Pregnancy Wearables

- 6.2.4.5. Others

- 6.2.5. Menstrual Health Products

- 6.2.5.1. Period Tracking Apps

- 6.2.5.2. Smart Menstrual Cups

- 6.2.5.3. Innovative Sanitary Products

- 6.2.5.4. Pain Management Devices

- 6.2.5.5. Others

- 6.2.6. Other Product Types

- 6.2.1. Fertility Monitoring Devices

- 7. Global Reproductive Health Innovations Market Analysis, by Technology

- 7.1. Key Segment Analysis

- 7.2. Reproductive Health Innovations Market Size (Value - US$ Bn), Analysis, and Forecasts, by Technology, 2021-2035

- 7.2.1. Digital Health Solutions

- 7.2.1.1. Mobile Applications

- 7.2.1.2. Telemedicine Platforms

- 7.2.1.3. AI-Powered Diagnostics

- 7.2.1.4. Cloud-Based Data Management

- 7.2.1.5. Others

- 7.2.2. Biotechnology

- 7.2.2.1. Genomics & Genetic Testing

- 7.2.2.2. Stem Cell Technology

- 7.2.2.3. CRISPR & Gene Editing

- 7.2.2.4. Biomarker Discovery

- 7.2.2.5. Others

- 7.2.3. Medical Devices

- 7.2.3.1. Implantable Devices

- 7.2.3.2. Wearable Technology

- 7.2.3.3. Diagnostic Equipment

- 7.2.3.4. Surgical Instruments

- 7.2.3.5. Others

- 7.2.4. Drug Delivery Systems

- 7.2.4.1. Transdermal Patches

- 7.2.4.2. Injectable Systems

- 7.2.4.3. Oral Formulations

- 7.2.4.4. Vaginal Rings

- 7.2.4.5. Others

- 7.2.5. Other Technologies

- 7.2.1. Digital Health Solutions

- 8. Global Reproductive Health Innovations Market Analysis, by Application Area

- 8.1. Key Segment Analysis

- 8.2. Reproductive Health Innovations Market Size (Value - US$ Bn), Analysis, and Forecasts, by Application Area, 2021-2035

- 8.2.1. Infertility Treatment

- 8.2.1.1. Male Infertility

- 8.2.1.2. Female Infertility

- 8.2.1.3. Unexplained Infertility

- 8.2.1.4. Others

- 8.2.2. Family Planning

- 8.2.2.1. Contraception

- 8.2.2.2. Birth Spacing

- 8.2.2.3. Preconception Care

- 8.2.2.4. Others

- 8.2.3. Pregnancy Management

- 8.2.3.1. Prenatal Care

- 8.2.3.2. High-Risk Pregnancy Monitoring

- 8.2.3.3. Labor & Delivery Support

- 8.2.3.4. Others

- 8.2.4. Reproductive Disease Management

- 8.2.4.1. Polycystic Ovary Syndrome (PCOS)

- 8.2.4.2. Endometriosis

- 8.2.4.3. Sexually Transmitted Infections (STIs)

- 8.2.4.4. Reproductive Cancers

- 8.2.4.5. Others

- 8.2.5. Menstrual Health Management

- 8.2.5.1. Menstrual Cycle Tracking

- 8.2.5.2. Dysmenorrhea Management

- 8.2.5.3. Menstrual Disorder Treatment

- 8.2.5.4. Others

- 8.2.6. Other Application Areas

- 8.2.1. Infertility Treatment

- 9. Global Reproductive Health Innovations Market Analysis, by Distribution Channel

- 9.1. Key Segment Analysis

- 9.2. Reproductive Health Innovations Market Size (Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 9.2.1. Hospital Pharmacies

- 9.2.2. Retail Pharmacies

- 9.2.3. Online Pharmacies & E-commerce

- 9.2.4. Fertility Clinics

- 9.2.5. Specialized Reproductive Health Centers

- 9.2.6. Direct-to-Consumer (DTC) Platforms

- 10. Global Reproductive Health Innovations Market Analysis, by Age Group

- 10.1. Key Segment Analysis

- 10.2. Reproductive Health Innovations Market Size (Value - US$ Bn), Analysis, and Forecasts, by Age Group, 2021-2035

- 10.2.1. Adolescents (13-19 years)

- 10.2.2. Young Adults (20-29 years)

- 10.2.3. Adults (30-39 years)

- 10.2.4. Middle-Aged (40-49 years)

- 10.2.5. Perimenopausal & Menopausal (50+ years)

- 11. Global Reproductive Health Innovations Market Analysis, by Gender

- 11.1. Key Segment Analysis

- 11.2. Reproductive Health Innovations Market Size (Value - US$ Bn), Analysis, and Forecasts, by Gender, 2021-2035

- 11.2.1. Female-Focused Solutions

- 11.2.2. Male-Focused Solutions

- 11.2.3. Gender-Neutral Solutions

- 11.2.4. LGBTQ+ Inclusive Solutions

- 12. Global Reproductive Health Innovations Market Analysis, by Service Model

- 12.1. Key Segment Analysis

- 12.2. Reproductive Health Innovations Market Size (Value - US$ Bn), Analysis, and Forecasts, by Service Model, 2021-2035

- 12.2.1. Clinic-Based Services

- 12.2.2. Home-Based/Self-Care Solutions

- 12.2.3. Hybrid (Clinic + Home) Models

- 12.2.4. Mobile Health Services

- 12.2.5. Telehealth Services

- 13. Global Reproductive Health Innovations Market Analysis, by End-users

- 13.1. Key Segment Analysis

- 13.2. Reproductive Health Innovations Market Size (Value - US$ Bn), Analysis, and Forecasts, by End-users, 2021-2035

- 13.2.1. Healthcare Facilities

- 13.2.2. Fertility & IVF Clinics

- 13.2.3. Diagnostic Laboratories

- 13.2.4. Retail & E-commerce

- 13.2.5. Telemedicine & Digital Health Platforms

- 13.2.6. Research & Academic Institutions

- 13.2.7. Pharmaceutical Companies

- 13.2.8. Home Healthcare

- 13.2.9. Other End-users

- 14. Global Reproductive Health Innovations Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Reproductive Health Innovations Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Reproductive Health Innovations Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Reproductive Health Innovations Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Technology

- 15.3.3. Application Area

- 15.3.4. Distribution Channel

- 15.3.5. Age Group

- 15.3.6. Gender

- 15.3.7. Service Model

- 15.3.8. End-users

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Reproductive Health Innovations Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Technology

- 15.4.4. Application Area

- 15.4.5. Distribution Channel

- 15.4.6. Age Group

- 15.4.7. Gender

- 15.4.8. Service Model

- 15.4.9. End-users

- 15.5. Canada Reproductive Health Innovations Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Technology

- 15.5.4. Application Area

- 15.5.5. Distribution Channel

- 15.5.6. Age Group

- 15.5.7. Gender

- 15.5.8. Service Model

- 15.5.9. End-users

- 15.6. Mexico Reproductive Health Innovations Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Technology

- 15.6.4. Application Area

- 15.6.5. Distribution Channel

- 15.6.6. Age Group

- 15.6.7. Gender

- 15.6.8. Service Model

- 15.6.9. End-users

- 16. Europe Reproductive Health Innovations Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Reproductive Health Innovations Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Technology

- 16.3.3. Application Area

- 16.3.4. Distribution Channel

- 16.3.5. Age Group

- 16.3.6. Gender

- 16.3.7. Service Model

- 16.3.8. End-users

- 16.3.9. Country

- 16.3.9.1. Germany

- 16.3.9.2. United Kingdom

- 16.3.9.3. France

- 16.3.9.4. Italy

- 16.3.9.5. Spain

- 16.3.9.6. Netherlands

- 16.3.9.7. Nordic Countries

- 16.3.9.8. Poland

- 16.3.9.9. Russia & CIS

- 16.3.9.10. Rest of Europe

- 16.4. Germany Reproductive Health Innovations Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Technology

- 16.4.4. Application Area

- 16.4.5. Distribution Channel

- 16.4.6. Age Group

- 16.4.7. Gender

- 16.4.8. Service Model

- 16.4.9. End-users

- 16.5. United Kingdom Reproductive Health Innovations Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Technology

- 16.5.4. Application Area

- 16.5.5. Distribution Channel

- 16.5.6. Age Group

- 16.5.7. Gender

- 16.5.8. Service Model

- 16.5.9. End-users

- 16.6. France Reproductive Health Innovations Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Technology

- 16.6.4. Application Area

- 16.6.5. Distribution Channel

- 16.6.6. Age Group

- 16.6.7. Gender

- 16.6.8. Service Model

- 16.6.9. End-users

- 16.7. Italy Reproductive Health Innovations Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Technology

- 16.7.4. Application Area

- 16.7.5. Distribution Channel

- 16.7.6. Age Group

- 16.7.7. Gender

- 16.7.8. Service Model

- 16.7.9. End-users

- 16.8. Spain Reproductive Health Innovations Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Technology

- 16.8.4. Application Area

- 16.8.5. Distribution Channel

- 16.8.6. Age Group

- 16.8.7. Gender

- 16.8.8. Service Model

- 16.8.9. End-users

- 16.9. Netherlands Reproductive Health Innovations Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Product Type

- 16.9.3. Technology

- 16.9.4. Application Area

- 16.9.5. Distribution Channel

- 16.9.6. Age Group

- 16.9.7. Gender

- 16.9.8. Service Model

- 16.9.9. End-users

- 16.10. Nordic Countries Reproductive Health Innovations Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Product Type

- 16.10.3. Technology

- 16.10.4. Application Area

- 16.10.5. Distribution Channel

- 16.10.6. Age Group

- 16.10.7. Gender

- 16.10.8. Service Model

- 16.10.9. End-users

- 16.11. Poland Reproductive Health Innovations Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Product Type

- 16.11.3. Technology

- 16.11.4. Application Area

- 16.11.5. Distribution Channel

- 16.11.6. Age Group

- 16.11.7. Gender

- 16.11.8. Service Model

- 16.11.9. End-users

- 16.12. Russia & CIS Reproductive Health Innovations Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Product Type

- 16.12.3. Technology

- 16.12.4. Application Area

- 16.12.5. Distribution Channel

- 16.12.6. Age Group

- 16.12.7. Gender

- 16.12.8. Service Model

- 16.12.9. End-users

- 16.13. Rest of Europe Reproductive Health Innovations Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Product Type

- 16.13.3. Technology

- 16.13.4. Application Area

- 16.13.5. Distribution Channel

- 16.13.6. Age Group

- 16.13.7. Gender

- 16.13.8. Service Model

- 16.13.9. End-users

- 17. Asia Pacific Reproductive Health Innovations Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. East Asia Reproductive Health Innovations Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Technology

- 17.3.3. Application Area

- 17.3.4. Distribution Channel

- 17.3.5. Age Group

- 17.3.6. Gender

- 17.3.7. Service Model

- 17.3.8. End-users

- 17.3.9. Country

- 17.3.9.1. China

- 17.3.9.2. India

- 17.3.9.3. Japan

- 17.3.9.4. South Korea

- 17.3.9.5. Australia and New Zealand

- 17.3.9.6. Indonesia

- 17.3.9.7. Malaysia

- 17.3.9.8. Thailand

- 17.3.9.9. Vietnam

- 17.3.9.10. Rest of Asia Pacific

- 17.4. China Reproductive Health Innovations Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Technology

- 17.4.4. Application Area

- 17.4.5. Distribution Channel

- 17.4.6. Age Group

- 17.4.7. Gender

- 17.4.8. Service Model

- 17.4.9. End-users

- 17.5. India Reproductive Health Innovations Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Technology

- 17.5.4. Application Area

- 17.5.5. Distribution Channel

- 17.5.6. Age Group

- 17.5.7. Gender

- 17.5.8. Service Model

- 17.5.9. End-users

- 17.6. Japan Reproductive Health Innovations Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Technology

- 17.6.4. Application Area

- 17.6.5. Distribution Channel

- 17.6.6. Age Group

- 17.6.7. Gender

- 17.6.8. Service Model

- 17.6.9. End-users

- 17.7. South Korea Reproductive Health Innovations Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Technology

- 17.7.4. Application Area

- 17.7.5. Distribution Channel

- 17.7.6. Age Group

- 17.7.7. Gender

- 17.7.8. Service Model

- 17.7.9. End-users

- 17.8. Australia and New Zealand Reproductive Health Innovations Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Technology

- 17.8.4. Application Area

- 17.8.5. Distribution Channel

- 17.8.6. Age Group

- 17.8.7. Gender

- 17.8.8. Service Model

- 17.8.9. End-users

- 17.9. Indonesia Reproductive Health Innovations Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Product Type

- 17.9.3. Technology

- 17.9.4. Application Area

- 17.9.5. Distribution Channel

- 17.9.6. Age Group

- 17.9.7. Gender

- 17.9.8. Service Model

- 17.9.9. End-users

- 17.10. Malaysia Reproductive Health Innovations Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Product Type

- 17.10.3. Technology

- 17.10.4. Application Area

- 17.10.5. Distribution Channel

- 17.10.6. Age Group

- 17.10.7. Gender

- 17.10.8. Service Model

- 17.10.9. End-users

- 17.11. Thailand Reproductive Health Innovations Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Product Type

- 17.11.3. Technology

- 17.11.4. Application Area

- 17.11.5. Distribution Channel

- 17.11.6. Age Group

- 17.11.7. Gender

- 17.11.8. Service Model

- 17.11.9. End-users

- 17.12. Vietnam Reproductive Health Innovations Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Product Type

- 17.12.3. Technology

- 17.12.4. Application Area

- 17.12.5. Distribution Channel

- 17.12.6. Age Group

- 17.12.7. Gender

- 17.12.8. Service Model

- 17.12.9. End-users

- 17.13. Rest of Asia Pacific Reproductive Health Innovations Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Product Type

- 17.13.3. Technology

- 17.13.4. Application Area

- 17.13.5. Distribution Channel

- 17.13.6. Age Group

- 17.13.7. Gender

- 17.13.8. Service Model

- 17.13.9. End-users

- 18. Middle East Reproductive Health Innovations Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Reproductive Health Innovations Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Technology

- 18.3.3. Application Area

- 18.3.4. Distribution Channel

- 18.3.5. Age Group

- 18.3.6. Gender

- 18.3.7. Service Model

- 18.3.8. End-users

- 18.3.9. Country

- 18.3.9.1. Turkey

- 18.3.9.2. UAE

- 18.3.9.3. Saudi Arabia

- 18.3.9.4. Israel

- 18.3.9.5. Rest of Middle East

- 18.4. Turkey Reproductive Health Innovations Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Technology

- 18.4.4. Application Area

- 18.4.5. Distribution Channel

- 18.4.6. Age Group

- 18.4.7. Gender

- 18.4.8. Service Model

- 18.4.9. End-users

- 18.5. UAE Reproductive Health Innovations Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Technology

- 18.5.4. Application Area

- 18.5.5. Distribution Channel

- 18.5.6. Age Group

- 18.5.7. Gender

- 18.5.8. Service Model

- 18.5.9. End-users

- 18.6. Saudi Arabia Reproductive Health Innovations Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Technology

- 18.6.4. Application Area

- 18.6.5. Distribution Channel

- 18.6.6. Age Group

- 18.6.7. Gender

- 18.6.8. Service Model

- 18.6.9. End-users

- 18.7. Israel Reproductive Health Innovations Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Technology

- 18.7.4. Application Area

- 18.7.5. Distribution Channel

- 18.7.6. Age Group

- 18.7.7. Gender

- 18.7.8. Service Model

- 18.7.9. End-users

- 18.8. Rest of Middle East Reproductive Health Innovations Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Technology

- 18.8.4. Application Area

- 18.8.5. Distribution Channel

- 18.8.6. Age Group

- 18.8.7. Gender

- 18.8.8. Service Model

- 18.8.9. End-users

- 19. Africa Reproductive Health Innovations Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Reproductive Health Innovations Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Technology

- 19.3.3. Application Area

- 19.3.4. Distribution Channel

- 19.3.5. Age Group

- 19.3.6. Gender

- 19.3.7. Service Model

- 19.3.8. End-users

- 19.3.9. Country

- 19.3.9.1. South Africa

- 19.3.9.2. Egypt

- 19.3.9.3. Nigeria

- 19.3.9.4. Algeria

- 19.3.9.5. Rest of Africa

- 19.4. South Africa Reproductive Health Innovations Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Technology

- 19.4.4. Application Area

- 19.4.5. Distribution Channel

- 19.4.6. Age Group

- 19.4.7. Gender

- 19.4.8. Service Model

- 19.4.9. End-users

- 19.5. Egypt Reproductive Health Innovations Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Technology

- 19.5.4. Application Area

- 19.5.5. Distribution Channel

- 19.5.6. Age Group

- 19.5.7. Gender

- 19.5.8. Service Model

- 19.5.9. End-users

- 19.6. Nigeria Reproductive Health Innovations Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Technology

- 19.6.4. Application Area

- 19.6.5. Distribution Channel

- 19.6.6. Age Group

- 19.6.7. Gender

- 19.6.8. Service Model

- 19.6.9. End-users

- 19.7. Algeria Reproductive Health Innovations Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Product Type

- 19.7.3. Technology

- 19.7.4. Application Area

- 19.7.5. Distribution Channel

- 19.7.6. Age Group

- 19.7.7. Gender

- 19.7.8. Service Model

- 19.7.9. End-users

- 19.8. Rest of Africa Reproductive Health Innovations Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Product Type

- 19.8.3. Technology

- 19.8.4. Application Area

- 19.8.5. Distribution Channel

- 19.8.6. Age Group

- 19.8.7. Gender

- 19.8.8. Service Model

- 19.8.9. End-users

- 20. South America Reproductive Health Innovations Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Central and South Africa Reproductive Health Innovations Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Product Type

- 20.3.2. Technology

- 20.3.3. Application Area

- 20.3.4. Distribution Channel

- 20.3.5. Age Group

- 20.3.6. Gender

- 20.3.7. Service Model

- 20.3.8. End-users

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Reproductive Health Innovations Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Product Type

- 20.4.3. Technology

- 20.4.4. Application Area

- 20.4.5. Distribution Channel

- 20.4.6. Age Group

- 20.4.7. Gender

- 20.4.8. Service Model

- 20.4.9. End-users

- 20.5. Argentina Reproductive Health Innovations Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Product Type

- 20.5.3. Technology

- 20.5.4. Application Area

- 20.5.5. Distribution Channel

- 20.5.6. Age Group

- 20.5.7. Gender

- 20.5.8. Service Model

- 20.5.9. End-users

- 20.6. Rest of South America Reproductive Health Innovations Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Product Type

- 20.6.3. Technology

- 20.6.4. Application Area

- 20.6.5. Distribution Channel

- 20.6.6. Age Group

- 20.6.7. Gender

- 20.6.8. Service Model

- 20.6.9. End-users

- 21. Key Players/ Company Profile

- 21.1. Abbott Laboratories

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. Ava Science

- 21.3. Bayer AG

- 21.4. Carrot Fertility

- 21.5. Celmatix

- 21.6. Church & Dwight

- 21.7. Cook Medical

- 21.8. CooperSurgical

- 21.9. Ferring Pharmaceuticals

- 21.10. Hims & Hers Health

- 21.11. Kindbody

- 21.12. Maven Clinic

- 21.13. Merck KGaA

- 21.14. Modern Fertility

- 21.15. Natural Cycles

- 21.16. Organon

- 21.17. Prelude Fertility

- 21.18. Prestige Consumer Healthcare

- 21.19. Progyny

- 21.20. Ro (Roman Health)

- 21.21. TMRW Life Sciences

- 21.22. Univfy

- 21.23. Vitrolife

- 21.24. Other Key Players

- 21.1. Abbott Laboratories

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data