Proton Exchange Membrane Fuel Cell Market Size, Share, Growth Opportunity Analysis Report by Fuel Type (Hydrogen, Methanol (Reformed Hydrogen) and Other Hydrogen-Rich Fuels), Component, Electrolyte Type, Power Output, Installation Type, Application, End Use Industry and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

Market Structure & Evolution |

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Proton Exchange Membrane Fuel Cell Market Size, Share, and Growth

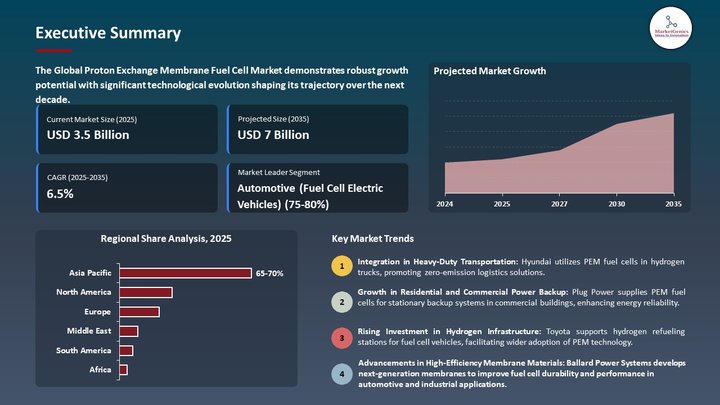

The global proton exchange membrane fuel cell market is projected to grow from USD 3.5 Billion in 2025 to USD 7.0 Billion in 2035, with a strong CAGR of 6.5% during the forecasted period. According to government mandates for required zero-emission vehicles, PEM fuel cells are demanded especially in commercial mobility. Ballard Power Systems partnered with Quantron AG in March 2024 in supplying PEM fuel cell engines for hydrogen trucks and buses in Europe to further the deployment of clean fleet.

In May 2024, Intelligent Energy Limited announced a strategic partnership with Suzuki Motor Corporation to co-develop next-generation PEM fuel cell systems for lightweight mobility and drone applications. The collaboration aims to enhance energy density and reduce system weight for broader commercial use. David Woolhouse, CEO of Intelligent Energy, emphasized this initiative as pivotal in scaling clean hydrogen power for new-age transportation markets. This strategy accelerates PEM fuel cell innovation in emerging sectors, expanding the technology’s market footprint beyond traditional automotive use.

With mounting dependency on clean energy backup solutions across telecom and data center sectors, PEM fuel cells are on the rise. As mentioned in February 2024, Plug Power Inc. deployed its PEM-based GenSure system for off-grid power to remote telecom sites in India and Southeast Asia, having conveyed the issues with grid non-reliability. These developments in PEM fuel cell technology are raising PEs viability and scalability while fostering global accelerated growth.

Green hydrogen production, hydrogen storage solutions, and fuel cell vehicle infrastructure are some of the promising areas that the global proton exchange membrane (PEM) Fuel Cell market can explore. Alongside PEM fuel cell adoption, investments in electrolysis, high-pressure tanks, and refueling stations as hydrogen supply chains unfold have collective synergistic growth opportunities. These adjacent markets together assist in scaling the integration of PEM fuel cells into mobility and stationary applications.

Proton Exchange Membrane Fuel Cell Market Dynamics and Trends

Driver: Rising Adoption in Material Handling Equipment

- One of the major factors driving the growth is the proliferation of PEM fuel cells in material handling equipment such as forklifts. Warehouses and distribution centers are hence keen on exploring renewable and efficient options instead of conventional lead acid batteries to minimize emissions and downtime. The PEM fuel cells can be refueled quickly, provide constant power, and work for a longer period which makes them an excellent option for high-intensity logistics operations.

- An announcement from Nuvera Fuel Cells, a division of the Hyster-Yale Group, was made in January 2024, that they jointly launched the Nuvera E-Series Fuel Cell Engine for electric forklifts Class I and Class II in North America. The solution has a plug- and use-design and is currently being used at Walmart's multiple distribution centers across the U.S. to further sustainability goals. These cases stand as a reference to the cost-saving and operational effectiveness PEM fuel cells bring to logistics companies.

- An incidental boost in demand for PEM fuel cell forklift handling systems comes from the expanding logistics and e-commerce sectors.

Restraint: High Costs of Platinum-Based Catalysts

- High costs associated with platinum-based catalysts can be considered one key constraint that the PEM fuel cell market faces. This cost constrains large-scale adoption and more so in cost-sensitive markets. R&D efforts, while trying to reduce platinum loading or discover alternatives, have still found slow commercial adoption.

- In December 2023, investor update, Johnson Matthey, a strategic supplier of fuel cell catalysts, said that there had been an increase in platinum demand for PEM fuel cells but high price volatility was still a barrier. Even if they were the frontrunners in low-platinum catalyst technologies, platinum price continues to weigh upon the OEMs for fuel cell vehicles, such as Toyota and Hyundai. This cost hamper includes the competitiveness of the alternatives being battery-electric, especially for light-duty applications, where price is paramount.

- Continued dependence on high priced catalysts also limits cost-efficient scaling of PEM fuel cells for mass-market applications.

Opportunity: Government-Backed Hydrogen Mobility Corridors

- Global investments in hydrogen mobility corridors offer a great chance for PEM fuel cell deployment. Governments are funding the hydrogen infrastructure along freight and transit routes to green long-haul transport, wherein PEM fuel cells outperform battery systems considering faster refueling and longer ranges.

- The initiative for a $3 billion hydrogen highway was announced in February 2024 by Hyundai Motor Group and the South Korean government that will see 500 PEM fuel cell trucks and 100 hydrogen refueling stations are to be deployed by 2030. The programme links well with South Korea's Hydrogen Economy Roadmap and stimulates OEMs, logistics providers, and energy companies to invest in hydrogen-powered transportation. Similar efforts are emerging in the EU and U.S., thus embedding PEM fuel cell technology into public-private partnerships for decarbonization.

- Government-supported infrastructure is opening up opportunities for large-scale, regional deployment of PEM fuel cells, particularly for heavy-duty transport.

Key Trend: Integration of PEM Fuel Cells in Maritime Applications

- With the increased acceptance of PEM fuel cells in maritime uses, shipping companies are now focusing on the IMO 2050 emission standards. PEM fuel cells are considered to be power sources for auxiliary power units (APU) and propulsion systems for ferries, cargo ships, and offshore support vessels.

- The sea trials on the 200 kW PEM fuel cell module aboard a passenger vessel in Norway were completed in March 2024, showing preparedness for the rigors of a marine environment. The initiative is under the Department of the Green Shipping Program of Norway, which supports zero-emission maritime innovation. This trial shall be a landmark in the process of walking coastal and short-sea shipping fleets away from major diesel towards hydrogen-based propulsion.

- PEM fuel cell systems would be applied in maritime fields, which would further diversify and promote innovation toward market acceptance.

Proton Exchange Membrane Fuel Cell Market Analysis and Segmental Data

Based on End Use Industry, the Automotive (Fuel Cell Electric Vehicles) Segment Retains the Largest Share

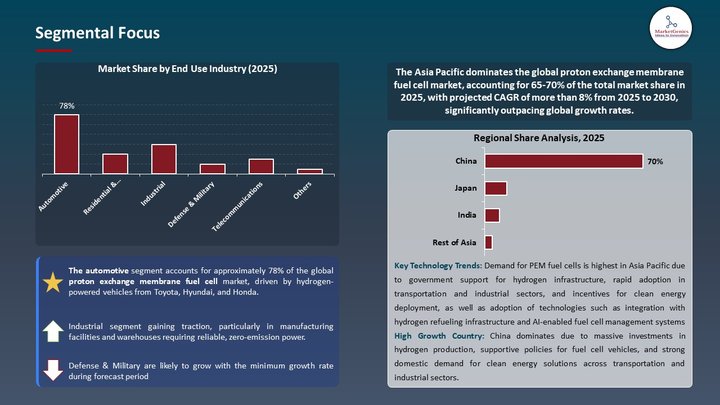

- The automotive sector is owing to a share of 78% in the global proton exchange membrane fuel cell market due to increased consideration of zero-emission mobility while talking about long-range and heavy-duty vehicles. PEM fuel cells are perhaps the most appropriate for FCEV applications, having very high-power density and therefore very short refuel times, while performing very well under instances of dynamic loading.

- In April 2024, Toyota released the latest Mirai FCEV with a newly improved PEM fuel cell stack, having a 30% range improvement capacity and better cold start-up conditions, thereby reinforcing PEM technology's automotive electrification name.

- However, policy incentives and subsidies, along with building a hydrogen refueling infrastructure across the globe, are further promoting the growth of the segment. As another example, Hyundai and First Element Fuel, in March 2024, collaborated to promote the expansion of hydrogen stations throughout California to service NEXO FCEVs. All these changes support sales and adoption for consumer and fleet vehicles around the globe.

- In automotive FCEVs, demand anchors the massive scale commercialization of PEM fuel cell systems across various global regions.

Asia Pacific Dominates Global Proton Exchange Membrane Fuel Cell Market in 2025 and Beyond

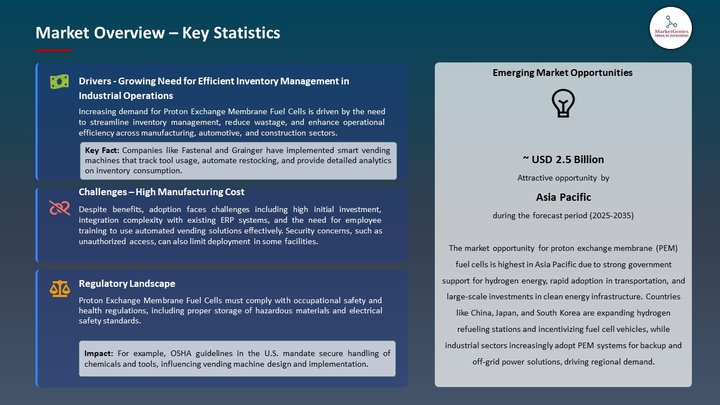

- The Asia Pacific region is the key driver for the global emergence of proton exchange membrane fuel cells, with aggressive government-level initiatives to promote the hydrogen economy and zero-emission technologies. Further huge investments are undertaken in the countries such as China, Japan, and South Korea for building hydrogen infrastructure, to ramp up R&D in fuel cells, and deployment in PEM-based mobility and stationary systems.

- According to the announcement of the Ministry of Industry and Information Technology of China, in April 2024, under the Fuel Cell Vehicle Demonstration Program, there will be deployment of over 10,000 PEM fuel cell vehicles in major cities like Shanghai and Beijing, which will turn out to be one of the largest government-led deployments of fuel cell vehicles worldwide.

- The region further offers a home to many elite producers and integrators of PEM fuel cells such as SinoHytec, Panasonic, and Toyota, who are preparing their manufacturing facilities to become the production hubs for both the domestic and export markets. The deployment of PEM-based systems installed in buses, trucks, and power backup applications spread throughout urban centers further drives the market. Such initiatives are supported by long-term policy frameworks and public-private partnerships.

- With Asia Pacific's policy-driven ecosystem and industrial base cement the forefront position of PEM fuel cell adoption globally.

Key Players Operating in the Proton Exchange Membrane Fuel Cell Market

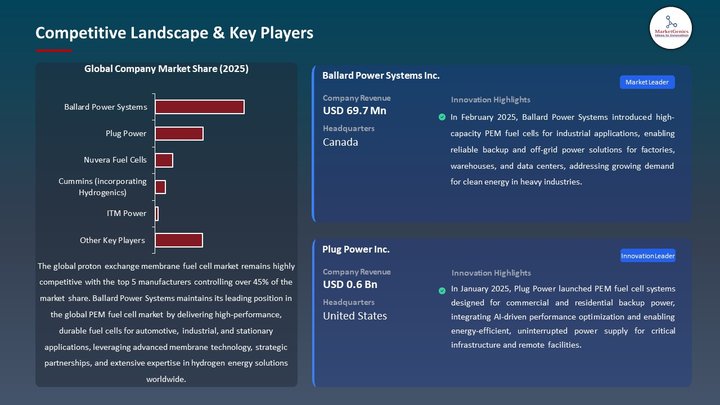

Key players in the global proton exchange membrane fuel cell market include prominent companies such Ballard Power Systems, Plug Power, Nuvera Fuel Cells, Cummins (incorporating Hydrogenics), ITM Power, and Other Key Players.

The proton exchange membrane (PEM) fuel cell market is moderately fragmented, characterized by a balanced presence of both global conglomerates and new-age innovators. Tier-1 companies such as Ballard Power Systems, Toyota Motor Corporation, and Plug Power Inc. command a significant market share, with Tier-2 and Tier-3 entities bringing in niche innovations. The market exhibits moderate buyer concentration due to automotive and industrial OEMs, while supplier concentration is high because of few sources for specialized membrane materials and catalysts, thus affecting pricing power and supply dynamics.

Recent Development and Strategic Overview:

- In March 2025, Bosch announced at the Hannover Messe that it would start manufacturing two Hybrion PEM electrolyser stacks (2.5 MW each) in Bamberg with FEST. 100 MW worth of orders have been secured, while the launch of sales in April signals Bosch's bold entry into production of large-scale green hydrogen.

- In January 2025, EKPO then launched a new-generation 400 kW NM20 PEM stack module for heavy-duty transport and stationary power with the strategic focus on high-output applications through increased efficiency and durability.

Report Scope

|

Attribute |

Detail |

|

Market Size in 2025 |

USD 3.5 Billion |

|

Market Forecast Value in 2035 |

USD 7.0 Billion |

|

Growth Rate (CAGR) |

6.5% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value

|

|

Report Format |

Electronic (PDF) + Excel |

|

Regions and Countries Covered |

|||||

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Proton Exchange Membrane Fuel Cell Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Component |

|

|

By Electrolyte Type |

|

|

By Power Output |

|

|

By Fuel Type |

|

|

By Installation Type |

|

|

By Application |

|

|

By End Use Industry |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Proton Exchange Membrane Fuel Cell Market Outlook

- 2.1.1. Proton Exchange Membrane Fuel Cell Market Size (Value - US$ Billion), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to-Market Strategy

- 2.5.1. Customer/ End Use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Proton Exchange Membrane Fuel Cell Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Energy & Power Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Energy & Power Industry

- 3.1.3. Regional Distribution for Energy & Power

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.1. Global Energy & Power Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for zero-emission vehicles across public and commercial transport.

- 4.1.1.2. Government incentives and hydrogen infrastructure development worldwide.

- 4.1.1.3. Increasing use of PEM fuel cells in backup power and material handling applications.

- 4.1.2. Restraints

- 4.1.2.1. High cost of platinum-based catalysts and system components.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis/ Ecosystem Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Component and Stack Manufacturers

- 4.4.3. System Integrators & OEM

- 4.4.4. End Users

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Porter’s Five Forces Analysis

- 4.7. PESTEL Analysis

- 4.8. Global Proton Exchange Membrane Fuel Cell Market Demand

- 4.8.1. Historical Market Size - in Value (Value - US$ Billion), 2021-2024

- 4.8.2. Current and Future Market Size - in Value (Value - US$ Billion), 2025–2035

- 4.8.2.1. Y-o-Y Growth Trends

- 4.8.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Proton Exchange Membrane Fuel Cell Market Analysis, by Component

- 6.1. Key Segment Analysis

- 6.2. Proton Exchange Membrane Fuel Cell Market Size (Value - US$ Billion), Analysis, and Forecasts, by Component, 2021-2035

- 6.2.1. Membrane Electrode Assembly (MEA)

- 6.2.2. Catalyst

- 6.2.3. Gas Diffusion Layer (GDL)

- 6.2.4. Bipolar Plates

- 6.2.5. Gaskets

- 6.2.6. End Plates

- 6.2.7. Current Collectors

- 6.2.8. Others

- 7. Global Proton Exchange Membrane Fuel Cell Market Analysis, by Electrolyte Type

- 7.1. Key Segment Analysis

- 7.2. Proton Exchange Membrane Fuel Cell Market Size (Value - US$ Billion), Analysis, and Forecasts, by Electrolyte Type, 2021-2035

- 7.2.1. Perfluorinated Membranes

- 7.2.2. Partially Fluorinated Membranes

- 7.2.3. Hydrocarbon Membranes

- 8. Global Proton Exchange Membrane Fuel Cell Market Analysis, by Power Output

- 8.1. Key Segment Analysis

- 8.2. Proton Exchange Membrane Fuel Cell Market Size (Value - US$ Billion), Analysis, and Forecasts, by Power Output, 2021-2035

- 8.2.1. <1 kW

- 8.2.2. 1–10 kW

- 8.2.3. 10–100 kW

- 8.2.4. >100 kW

- 9. Global Proton Exchange Membrane Fuel Cell Market Analysis, by Fuel Type

- 9.1. Key Segment Analysis

- 9.2. Proton Exchange Membrane Fuel Cell Market Size (Value - US$ Billion), Analysis, and Forecasts, by Fuel Type, 2021-2035

- 9.2.1. Hydrogen

- 9.2.2. Methanol (Reformed Hydrogen)

- 9.2.3. Other Hydrogen-Rich Fuels

- 10. Global Proton Exchange Membrane Fuel Cell Market Analysis, by Installation Type

- 10.1. Key Segment Analysis

- 10.2. Proton Exchange Membrane Fuel Cell Market Size (Value - US$ Billion), Analysis, and Forecasts, by Installation Type, 2021-2035

- 10.2.1. Fixed/ Stationary

- 10.2.2. Portable/ Mobile

- 11. Global Proton Exchange Membrane Fuel Cell Market Analysis, by Application

- 11.1. Key Segment Analysis

- 11.2. Proton Exchange Membrane Fuel Cell Market Size (Value - US$ Billion), Analysis, and Forecasts, by Application, 2021-2035

- 11.2.1. Portable Power Systems

- 11.2.2. Stationary Power Generation

- 11.2.3. Backup Power Systems

- 11.2.4. Combined Heat and Power (CHP) Systems

- 11.2.5. Others

- 12. Global Proton Exchange Membrane Fuel Cell Market Analysis, by End Use Industry

- 12.1. Key Segment Analysis

- 12.2. Proton Exchange Membrane Fuel Cell Market Size (Value - US$ Billion), Analysis, and Forecasts, by End Use Industry, 2021-2035

- 12.2.1. Automotive (Fuel Cell Electric Vehicles)

- 12.2.2. Residential & Commercial

- 12.2.3. Industrial

- 12.2.4. Defense & Military

- 12.2.5. Telecommunications

- 12.2.6. Others

- 13. Global Proton Exchange Membrane Fuel Cell Market Analysis and Forecasts, by Region

- 13.1. Key Findings

- 13.2. Proton Exchange Membrane Fuel Cell Market Size (Value - US$ Billion), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America Proton Exchange Membrane Fuel Cell Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America Proton Exchange Membrane Fuel Cell Market Size Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 14.3.1. Component

- 14.3.2. Electrolyte Type

- 14.3.3. Power Output

- 14.3.4. Fuel Type

- 14.3.5. Installation Type

- 14.3.6. Application

- 14.3.7. End Use Industry

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA Proton Exchange Membrane Fuel Cell Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Component

- 14.4.3. Electrolyte Type

- 14.4.4. Power Output

- 14.4.5. Fuel Type

- 14.4.6. Installation Type

- 14.4.7. Application

- 14.4.8. End Use Industry

- 14.5. Canada Proton Exchange Membrane Fuel Cell Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Component

- 14.5.3. Electrolyte Type

- 14.5.4. Power Output

- 14.5.5. Fuel Type

- 14.5.6. Installation Type

- 14.5.7. Application

- 14.5.8. End Use Industry

- 14.6. Mexico Proton Exchange Membrane Fuel Cell Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Component

- 14.6.3. Electrolyte Type

- 14.6.4. Power Output

- 14.6.5. Fuel Type

- 14.6.6. Installation Type

- 14.6.7. Application

- 14.6.8. End Use Industry

- 15. Europe Proton Exchange Membrane Fuel Cell Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe Proton Exchange Membrane Fuel Cell Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 15.3.1. Component

- 15.3.2. Electrolyte Type

- 15.3.3. Power Output

- 15.3.4. Fuel Type

- 15.3.5. Installation Type

- 15.3.6. Application

- 15.3.7. End Use Industry

- 15.3.8. Country

- 15.3.8.1. Germany

- 15.3.8.2. United Kingdom

- 15.3.8.3. France

- 15.3.8.4. Italy

- 15.3.8.5. Spain

- 15.3.8.6. Netherlands

- 15.3.8.7. Nordic Countries

- 15.3.8.8. Poland

- 15.3.8.9. Russia & CIS

- 15.3.8.10. Rest of Europe

- 15.4. Germany Proton Exchange Membrane Fuel Cell Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Component

- 15.4.3. Electrolyte Type

- 15.4.4. Power Output

- 15.4.5. Fuel Type

- 15.4.6. Installation Type

- 15.4.7. Application

- 15.4.8. End Use Industry

- 15.5. United Kingdom Proton Exchange Membrane Fuel Cell Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Component

- 15.5.3. Electrolyte Type

- 15.5.4. Power Output

- 15.5.5. Fuel Type

- 15.5.6. Installation Type

- 15.5.7. Application

- 15.5.8. End Use Industry

- 15.6. France Proton Exchange Membrane Fuel Cell Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Component

- 15.6.3. Electrolyte Type

- 15.6.4. Power Output

- 15.6.5. Fuel Type

- 15.6.6. Installation Type

- 15.6.7. Application

- 15.6.8. End Use Industry

- 15.7. Italy Proton Exchange Membrane Fuel Cell Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Component

- 15.7.3. Electrolyte Type

- 15.7.4. Power Output

- 15.7.5. Fuel Type

- 15.7.6. Installation Type

- 15.7.7. Application

- 15.7.8. End Use Industry

- 15.8. Spain Proton Exchange Membrane Fuel Cell Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Component

- 15.8.3. Electrolyte Type

- 15.8.4. Power Output

- 15.8.5. Fuel Type

- 15.8.6. Installation Type

- 15.8.7. Application

- 15.8.8. End Use Industry

- 15.9. Netherlands Proton Exchange Membrane Fuel Cell Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Component

- 15.9.3. Electrolyte Type

- 15.9.4. Power Output

- 15.9.5. Fuel Type

- 15.9.6. Installation Type

- 15.9.7. Application

- 15.9.8. End Use Industry

- 15.10. Nordic Countries Proton Exchange Membrane Fuel Cell Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Component

- 15.10.3. Electrolyte Type

- 15.10.4. Power Output

- 15.10.5. Fuel Type

- 15.10.6. Installation Type

- 15.10.7. Application

- 15.10.8. End Use Industry

- 15.11. Poland Proton Exchange Membrane Fuel Cell Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Component

- 15.11.3. Electrolyte Type

- 15.11.4. Power Output

- 15.11.5. Fuel Type

- 15.11.6. Installation Type

- 15.11.7. Application

- 15.11.8. End Use Industry

- 15.12. Russia & CIS Proton Exchange Membrane Fuel Cell Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Component

- 15.12.3. Electrolyte Type

- 15.12.4. Power Output

- 15.12.5. Fuel Type

- 15.12.6. Installation Type

- 15.12.7. Application

- 15.12.8. End Use Industry

- 15.13. Rest of Europe Proton Exchange Membrane Fuel Cell Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Component

- 15.13.3. Electrolyte Type

- 15.13.4. Power Output

- 15.13.5. Fuel Type

- 15.13.6. Installation Type

- 15.13.7. Application

- 15.13.8. End Use Industry

- 16. Asia Pacific Proton Exchange Membrane Fuel Cell Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. East Asia Proton Exchange Membrane Fuel Cell Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 16.3.1. Component

- 16.3.2. Electrolyte Type

- 16.3.3. Power Output

- 16.3.4. Fuel Type

- 16.3.5. Installation Type

- 16.3.6. Application

- 16.3.7. End Use Industry

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia Pacific

- 16.4. China Proton Exchange Membrane Fuel Cell Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Component

- 16.4.3. Electrolyte Type

- 16.4.4. Power Output

- 16.4.5. Fuel Type

- 16.4.6. Installation Type

- 16.4.7. Application

- 16.4.8. End Use Industry

- 16.5. India Proton Exchange Membrane Fuel Cell Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Component

- 16.5.3. Electrolyte Type

- 16.5.4. Power Output

- 16.5.5. Fuel Type

- 16.5.6. Installation Type

- 16.5.7. Application

- 16.5.8. End Use Industry

- 16.6. Japan Proton Exchange Membrane Fuel Cell Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Component

- 16.6.3. Electrolyte Type

- 16.6.4. Power Output

- 16.6.5. Fuel Type

- 16.6.6. Installation Type

- 16.6.7. Application

- 16.6.8. End Use Industry

- 16.7. South Korea Proton Exchange Membrane Fuel Cell Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Component

- 16.7.3. Electrolyte Type

- 16.7.4. Power Output

- 16.7.5. Fuel Type

- 16.7.6. Installation Type

- 16.7.7. Application

- 16.7.8. End Use Industry

- 16.8. Australia and New Zealand Proton Exchange Membrane Fuel Cell Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Component

- 16.8.3. Electrolyte Type

- 16.8.4. Power Output

- 16.8.5. Fuel Type

- 16.8.6. Installation Type

- 16.8.7. Application

- 16.8.8. End Use Industry

- 16.9. Indonesia Proton Exchange Membrane Fuel Cell Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Component

- 16.9.3. Electrolyte Type

- 16.9.4. Power Output

- 16.9.5. Fuel Type

- 16.9.6. Installation Type

- 16.9.7. Application

- 16.9.8. End Use Industry

- 16.10. Malaysia Proton Exchange Membrane Fuel Cell Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Component

- 16.10.3. Electrolyte Type

- 16.10.4. Power Output

- 16.10.5. Fuel Type

- 16.10.6. Installation Type

- 16.10.7. Application

- 16.10.8. End Use Industry

- 16.11. Thailand Proton Exchange Membrane Fuel Cell Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Component

- 16.11.3. Electrolyte Type

- 16.11.4. Power Output

- 16.11.5. Fuel Type

- 16.11.6. Installation Type

- 16.11.7. Application

- 16.11.8. End Use Industry

- 16.12. Vietnam Proton Exchange Membrane Fuel Cell Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Component

- 16.12.3. Electrolyte Type

- 16.12.4. Power Output

- 16.12.5. Fuel Type

- 16.12.6. Installation Type

- 16.12.7. Application

- 16.12.8. End Use Industry

- 16.13. Rest of Asia Pacific Proton Exchange Membrane Fuel Cell Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Component

- 16.13.3. Electrolyte Type

- 16.13.4. Power Output

- 16.13.5. Fuel Type

- 16.13.6. Installation Type

- 16.13.7. Application

- 16.13.8. End Use Industry

- 17. Middle East Proton Exchange Membrane Fuel Cell Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East Proton Exchange Membrane Fuel Cell Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 17.3.1. Component

- 17.3.2. Electrolyte Type

- 17.3.3. Power Output

- 17.3.4. Fuel Type

- 17.3.5. Installation Type

- 17.3.6. Application

- 17.3.7. End Use Industry

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey Proton Exchange Membrane Fuel Cell Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Component

- 17.4.3. Electrolyte Type

- 17.4.4. Power Output

- 17.4.5. Fuel Type

- 17.4.6. Installation Type

- 17.4.7. Application

- 17.4.8. End Use Industry

- 17.5. UAE Proton Exchange Membrane Fuel Cell Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Component

- 17.5.3. Electrolyte Type

- 17.5.4. Power Output

- 17.5.5. Fuel Type

- 17.5.6. Installation Type

- 17.5.7. Application

- 17.5.8. End Use Industry

- 17.6. Saudi Arabia Proton Exchange Membrane Fuel Cell Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Component

- 17.6.3. Electrolyte Type

- 17.6.4. Power Output

- 17.6.5. Fuel Type

- 17.6.6. Installation Type

- 17.6.7. Application

- 17.6.8. End Use Industry

- 17.7. Israel Proton Exchange Membrane Fuel Cell Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Component

- 17.7.3. Electrolyte Type

- 17.7.4. Power Output

- 17.7.5. Fuel Type

- 17.7.6. Installation Type

- 17.7.7. Application

- 17.7.8. End Use Industry

- 17.8. Rest of Middle East Proton Exchange Membrane Fuel Cell Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Component

- 17.8.3. Electrolyte Type

- 17.8.4. Power Output

- 17.8.5. Fuel Type

- 17.8.6. Installation Type

- 17.8.7. Application

- 17.8.8. End Use Industry

- 18. Africa Proton Exchange Membrane Fuel Cell Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa Proton Exchange Membrane Fuel Cell Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 18.3.1. Component

- 18.3.2. Electrolyte Type

- 18.3.3. Power Output

- 18.3.4. Fuel Type

- 18.3.5. Installation Type

- 18.3.6. Application

- 18.3.7. End Use Industry

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa Proton Exchange Membrane Fuel Cell Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Component

- 18.4.3. Electrolyte Type

- 18.4.4. Power Output

- 18.4.5. Fuel Type

- 18.4.6. Installation Type

- 18.4.7. Application

- 18.4.8. End Use Industry

- 18.5. Egypt Proton Exchange Membrane Fuel Cell Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Component

- 18.5.3. Electrolyte Type

- 18.5.4. Power Output

- 18.5.5. Fuel Type

- 18.5.6. Installation Type

- 18.5.7. Application

- 18.5.8. End Use Industry

- 18.6. Nigeria Proton Exchange Membrane Fuel Cell Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Component

- 18.6.3. Electrolyte Type

- 18.6.4. Power Output

- 18.6.5. Fuel Type

- 18.6.6. Installation Type

- 18.6.7. Application

- 18.6.8. End Use Industry

- 18.7. Algeria Proton Exchange Membrane Fuel Cell Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Component

- 18.7.3. Electrolyte Type

- 18.7.4. Power Output

- 18.7.5. Fuel Type

- 18.7.6. Installation Type

- 18.7.7. Application

- 18.7.8. End Use Industry

- 18.8. Rest of Africa Proton Exchange Membrane Fuel Cell Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Component

- 18.8.3. Electrolyte Type

- 18.8.4. Power Output

- 18.8.5. Fuel Type

- 18.8.6. Installation Type

- 18.8.7. Application

- 18.8.8. End Use Industry

- 19. South America Proton Exchange Membrane Fuel Cell Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Central and South Africa Proton Exchange Membrane Fuel Cell Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 19.3.1. Component

- 19.3.2. Electrolyte Type

- 19.3.3. Power Output

- 19.3.4. Fuel Type

- 19.3.5. Installation Type

- 19.3.6. Application

- 19.3.7. End Use Industry

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil Proton Exchange Membrane Fuel Cell Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Component

- 19.4.3. Electrolyte Type

- 19.4.4. Power Output

- 19.4.5. Fuel Type

- 19.4.6. Installation Type

- 19.4.7. Application

- 19.4.8. End Use Industry

- 19.5. Argentina Proton Exchange Membrane Fuel Cell Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Component

- 19.5.3. Electrolyte Type

- 19.5.4. Power Output

- 19.5.5. Fuel Type

- 19.5.6. Installation Type

- 19.5.7. Application

- 19.5.8. End Use Industry

- 19.6. Rest of South America Proton Exchange Membrane Fuel Cell Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Component

- 19.6.3. Electrolyte Type

- 19.6.4. Power Output

- 19.6.5. Fuel Type

- 19.6.6. Installation Type

- 19.6.7. Application

- 19.6.8. End Use Industry

- 20. Key Players/ Company Profile

- 20.1. AVL List GmbH

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. Ballard Power Systems

- 20.3. Bloom Energy Corporation

- 20.4. Ceres Power Holdings plc

- 20.5. Cummins Inc.

- 20.6. Doosan Fuel Cell Co., Ltd.

- 20.7. ElringKlinger AG

- 20.8. Honda Motor Co., Ltd.

- 20.9. Horizon Fuel Cell Technologies

- 20.10. Hydrogenics Corporation

- 20.11. Hyundai Motor Company

- 20.12. Intelligent Energy Limited

- 20.13. Nedstack Fuel Cell Technology BV

- 20.14. Nuvera Fuel Cells, LLC

- 20.15. Panasonic Corporation

- 20.16. Plug Power Inc.

- 20.17. Proton Motor Power Systems PLC

- 20.18. SFC Energy AG

- 20.19. Toshiba Energy Systems & Solutions Corporation

- 20.20. Toyota Motor Corporation

- 20.21. Other Key Players

- 20.1. AVL List GmbH

Note* - This is just tentative list of players. While providing the report, we will cover a greater number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation