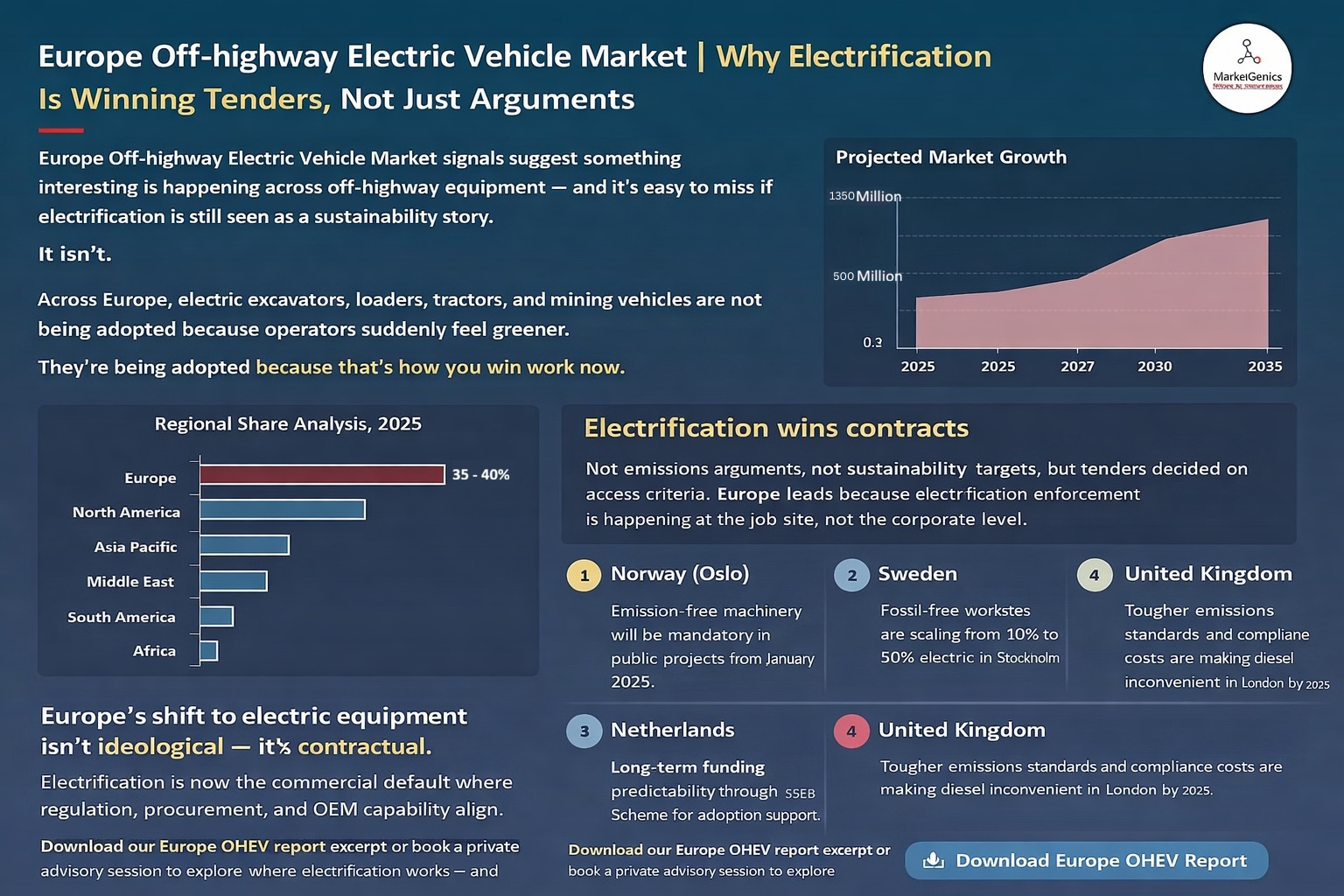

Europe Off-highway Electric Vehicle Market | Why Electrification Is Winning Tenders, Not Just Arguments

Europe Off-highway Electric Vehicle Market signals suggest something interesting is happening across off-highway equipment — and it’s easy to miss if electrification is still seen as a sustainability story.

It isn’t.

Across Europe, electric excavators, loaders, tractors, and mining vehicles are not being adopted because operators suddenly feel greener. They’re being adopted because that’s how you win work now.

The Europe Off-highway Electric Vehicle Market is moving faster than any other region not because Europe is more idealistic, but because regulation, procurement, and OEM capability have finally lined up in a way that makes electrification commercially unavoidable.

That shift is already showing up in the numbers, though not in the way headline forecasts usually frame it.

The Europe Off-highway Electric Vehicle Market, valued at roughly USD 500 million in 2025, is expanding at about a 10% annual rate (2025-2035) —less because enthusiasm for electrification has surged, and more because procurement rules, subsidy structures, and OEM delivery models are quietly removing the option to stay diesel.

And the clearest way to see that isn’t by looking at Europe as a bloc — it’s by looking country by country.

Europe’s electrification shift isn’t ideological. It’s contractual.

For years, off-highway electrification sat in the same bucket as many green initiatives: pilots, press releases, and future roadmaps.

What’s changed is where the decision is being enforced.

In Europe, electrification is increasingly decided at the job-site and tender level, not in corporate ESG decks. If your equipment can’t meet emissions, noise, or compliance rules, you don’t just pay a penalty — you lose access to projects.

That single shift explains why Europe now leads the global off-highway electric vehicle market.

Norway (Oslo) | when electrification becomes a prerequisite, not a preference

Oslo may be the most instructive case study in the Europe off-highway electric vehicle market.

By 2023, roughly 77% of machinery used on Oslo’s municipal construction sites was already zero-emission.

From January 1, 2025, “emission-free” machinery is no longer encouraged — it is mandatory for public projects.

That’s not a target. It’s a rule.

And rules change markets faster than incentives ever do.

Contractors operating in Oslo don’t debate the ROI of electric equipment in abstract terms. They ask a simpler question: Do we qualify for tenders without it?

When electrification becomes a condition for revenue access, adoption accelerates quietly and decisively. Oslo shows that the fastest way to scale off-highway EVs isn’t persuasion — it’s procurement.

Sweden | where electrification meets engineering reality

Sweden is doing something subtler — and arguably more important for long-term market confidence.

In Stockholm, electric construction machinery is moving beyond demonstration.

Volvo Construction Equipment has publicly pointed to fossil-free construction sites where electric machine usage has scaled from around 10% to nearly 50%.

That’s not symbolic adoption; that’s machine-hour substitution.

At the same time, Sweden is anchoring Europe’s push into electrified mining and automation.

Hitachi Construction Machinery Europe has run cold-climate testing of its ZE135 zero-emission excavator in Swedish conditions — deliberately stress-testing battery performance, thermal management, and uptime under the very conditions critics often cite as barriers.

And crucially, capital is following.

The European Investment Bank’s €500 million backing for Sandvik explicitly supports battery-electric mining equipment and digitalised excavation technologies. This reframes electrification from a compliance cost into a productivity and automation strategy.

Sweden’s role in the Europe off-highway electric vehicle market is clear: it’s where electrification is being proven under real industrial constraints — with real money behind it.

Netherlands | subsidies that actually move fleets

If Norway shows what mandates can do, the Netherlands shows what well-designed subsidies can achieve.

Through the SSEB scheme, the Dutch government supports not just the purchase of zero-emission construction equipment, but also retrofits and innovation. Importantly, the program has application windows extending through 2025, with longer-term funding visibility.

That matters more than headline amounts.

Off-highway electrification is capital-heavy. Contractors don’t need one-off grants — they need predictability. The Netherlands provides that, which is why it has emerged as one of Europe’s earliest markets for large-scale deployment of emission-free construction machinery.

This is what policy looks like when it’s designed to pull equipment into fleets, not just signal intent.

United Kingdom | not banning diesel — just making it uneconomic

The UK’s approach is less dramatic, but no less effective.

From January 1, 2025, non-road mobile machinery across Greater London must meet Stage IV emission standards, with enforcement tightening and future standards clearly signposted.

There’s no outright ban on diesel. Instead, diesel is becoming commercially inconvenient.

Older machines now carry higher compliance risk, retrofit costs, inspection exposure, and administrative friction. Electric and hybrid equipment increasingly looks like a way to reduce uncertainty, not increase it.

London shows another pathway for the Europe off-highway electric vehicle market: you don’t have to force electrification — you can simply make the alternatives progressively harder to justify.

Germany | scale happens when service does

Germany is where Europe’s electrification story stops being experimental and starts becoming structural.

It combines three things that matter enormously in off-highway markets: scale, service infrastructure, and capital.

In December 2025, Hitachi Construction Machinery announced a new European development company in Germany under its LANDCROS transition strategy — a clear signal that product engineering and localisation are being anchored long-term.

At the same time, Volvo Construction Equipment’s SEK 7 billion acquisition of Swecon strengthened direct control over dealer networks across Germany and neighbouring markets. That matters because electrification fails without service, uptime guarantees, and financing support.

Germany also sits within broader industrial decarbonisation funding flows, where electrified equipment benefits indirectly as industries clean up entire value chains.

In short: Germany is where electrification scales not because the machines are ready — but because the ecosystem is.

The quiet reshaping of Europe’s OHEV market

Zooming out, several Europe-wide signals reinforce this shift:

OEMs are consolidating dealer and service control.

Compact equipment electrification is attracting acquisition interest.

Mining electrification is being tied directly to automation, safety, and productivity funding.

These aren’t marketing moves. They change how risk is priced, how fleets are financed, and how adoption friction is removed.

So, what does this say about the Europe off-highway electric vehicle market?

It says Europe is not leading because it’s greener.

It’s leading because electrification now wins contracts, reduces compliance risk, and fits public procurement economics.

Europe is the first region where off-highway electrification clears on regulation, capital, and operations at the same time. That makes it the earliest real monetisation zone for electric construction, agricultural, and mining vehicles.

Other regions will follow. But they’ll follow the models Europe is already stress-testing — country by country, site by site.

About the MarketGenics Report

This article is informed by MarketGenics’ Off-highway Electric Vehicle Market research, which provides detailed Europe-level and country-level forecasts, OEM benchmarking, and adoption economics across construction, agriculture, and mining.

Download the Europe segment excerpt or book a private advisory briefing to explore where electrification works — and where it still doesn’t.