Europe Spa Market | Growth Is No Longer the Question. Structure Is.

Why the Europe Spa Market Has Moved Beyond the Growth Question

Has the Europe spa market reached the point where growth itself is no longer in doubt?

Yes. Quite clearly.

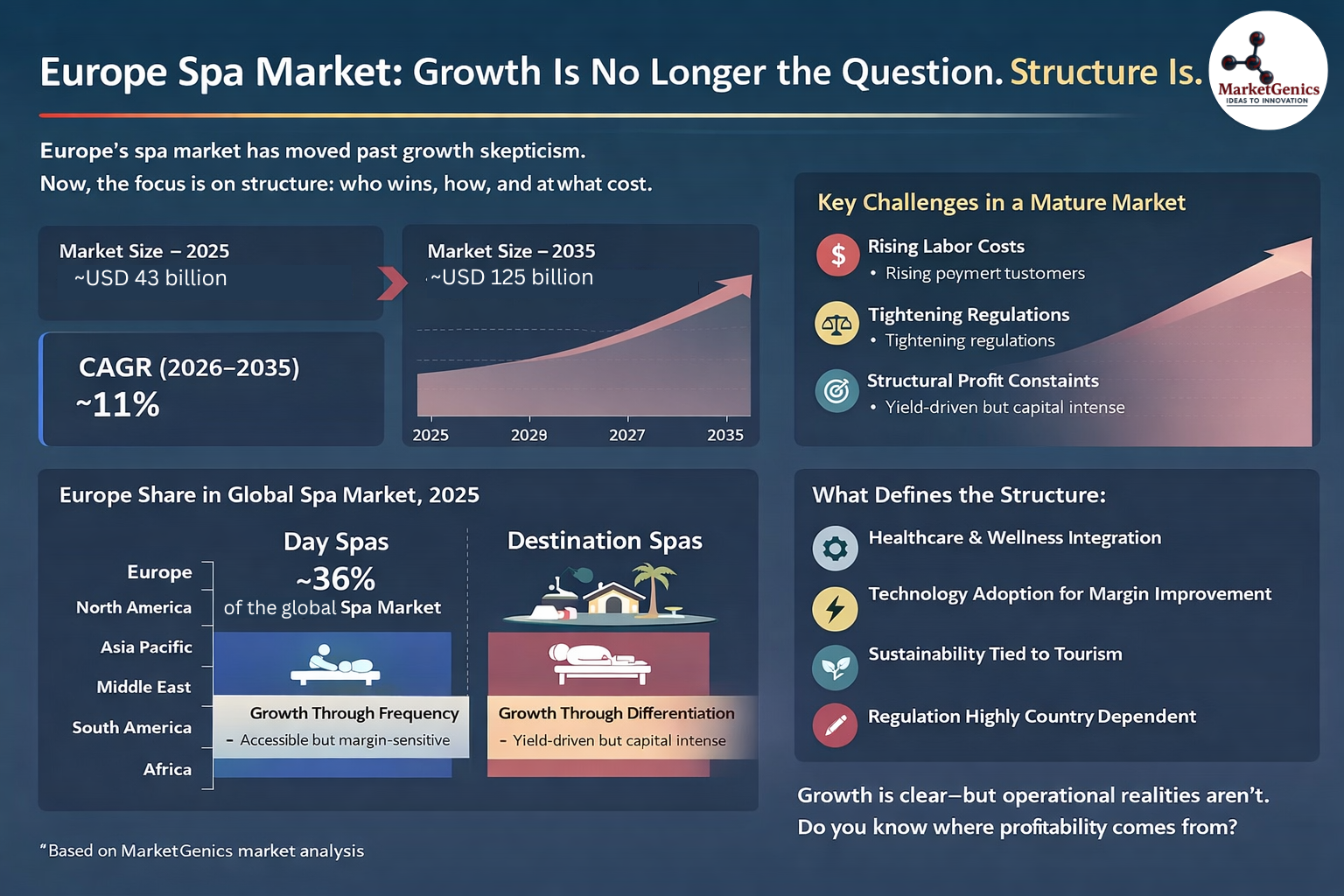

With the global spa market valued at USD 116.3 billion in 2025 and projected to reach USD 272.8 billion by 2035, Europe already accounts for 35–40% of global demand. That translates to a European spa market size of ~USD 43 billion today, moving toward ~USD 125 billion by 2035, at a CAGR exceeding 11%.

Growth is happening.

The harder question now is what kind of growth it is, and who it actually works for.

Because once a market crosses this scale, the challenge is no longer whether demand exists. It is whether operating models, cost structures, and regulatory realities can keep up.

Why the Europe Spa Market Behaves Differently

The Europe spa market does not behave like most wellness markets.

In many regions, spas are still framed as discretionary experiences—something consumers “treat themselves to.” In Europe, that framing quietly broke years ago. Thermal baths, medical spas, rehabilitation centers, and wellness retreats were never positioned purely as indulgence. They evolved alongside healthcare systems, preventive medicine, and public well-being.

This matters because it changes demand behavior.

When spa services are linked to stress management, rehabilitation, preventive health, and longevity, consumption becomes habitual. It becomes repeat-driven. It becomes harder to displace.

That is a large part of why Europe continues to outperform global growth rates in the spa market. Demand is not just expanding. It is embedded.

Europe Spa Market Size | The Headline Numbers Hide the Real Shift

On paper, the numbers look straightforward.

-

Market size (2025): ~USD 43 billion

-

Market forecast (2035): ~USD 125 billion

-

Market CAGR (2026–2035): ~11%

But numbers alone miss the shift happening underneath.

Europe will generate ~USD 82 billion in new spa market value over the next decade. That is not incremental growth. That is a structural expansion comparable to building an entirely new regional market inside an existing one.

The question is not whether Europe will grow.

The question is where margins survive and where they don’t.

Germany Shows What a Mature Spa Market Actually Looks Like

If there is a country that explains the Europe spa market, it is Germany.

Germany accounts for 30–35% of the European spa market, making it the single most influential geography in the region. Its strength comes from something many markets underestimate: integration.

German spas are often:

- Medically supervised

- Linked to rehabilitation or preventive care

- Embedded within regulated health frameworks

For consumers, this creates trust. For operators, it creates consistency. For investors, it creates predictability.

Germany demonstrates what happens when the spa market moves beyond episodic luxury and becomes part of everyday health behavior. It also exposes a quiet tension: this model works exceptionally well—but it is not easy to replicate elsewhere.

Day Spas vs Destination Spas in Europe | The Trade-Off Few Talk About

From the outside, growth in the Europe spa market looks uniform. It isn’t.

Day Spas | Scale With Pressure

Day spas account for around 36% of the global spa market share, and Europe closely reflects this share. Their appeal is obvious: accessibility, affordability, and frequent visits.

In many European cities, day spas function as stress-management infrastructure. They are part of weekly or monthly routines, not special occasions.

But scale brings pressure. Labor costs, staffing shortages, and scheduling constraints become gating factors. Volume does not automatically mean margin.

Destination Spas | Yield With Complexity

At the same time, destination spas in Europe are gaining momentum through wellness tourism. Italy, France, Switzerland, Spain, and BENELUX are attracting travelers seeking immersive, multi-day wellness experiences.

These spas combine medical wellness, nutrition, mindfulness, thermal therapies, and luxury hospitality. Yield is higher. Brand equity is stronger. Capital intensity is unavoidable.

This is where decisions become complicated.

Operators cannot treat day spas and destination spas as variations of the same model. They solve different problems—and fail in different ways.

Technology Is Quietly Redefining the Europe Spa Market

One of the least visible but most consequential shifts in the Europe spa market is technology adoption.

Labor represents 40–60% of spa operating costs. At the same time, Europe faces structural shortages of therapists, estheticians, and wellness specialists. Demand alone cannot solve that.

This is why adoption is accelerating in:

- AI-based skin and treatment personalization

- Digital wellness platforms for booking and customer tracking

- Energy-efficient systems aligned with sustainability requirements

These are not “nice to have” upgrades. They are responses to real operational constraints. Without them, capacity stalls—even when demand is strong.

The irony is that technology is often discussed as innovation, while in practice it is becoming risk management.

Sustainability and Wellness Tourism | Alignment, Not Messaging

Sustainability in the European market is rarely symbolic.

Consumers increasingly scrutinize:

- Energy use

- Water management

- Organic sourcing

- Environmental design

At the same time, governments across Europe actively promote wellness tourism as an economic and public-health lever.

Projects like De Montel – Terme Milano, a 172,000 sq ft urban thermal spa launched in 2025, illustrate how sustainability, urban renewal, and wellness economics are merging.

This alignment reduces friction. Sustainability supports tourism. Tourism supports pricing. Pricing supports long-term investment.

It sounds simple. It is not. But Europe has made more progress on this alignment than any other region.

The Europe Spa Market Is Large—But Not Easy

Despite its size, the European spa market remains highly fragmented.

Global brands such as Four Seasons, Mandarin Oriental, and Six Senses dominate the premium end. Thousands of independent operators compete locally, often under cost pressure and regulatory complexity.

This creates opportunity—but only for players who understand local realities. Scale alone does not guarantee success in Europe. Neither does brand strength. Structure matters more.

The Real Question the Europe Spa Market Is Asking

At this stage, the Europe spa market is no longer asking whether wellness will grow.

It is asking harder questions:

- Can your model absorb rising labor costs?

- Are you built for repeat behavior or one-time experiences?

- Do regulations support your expansion—or quietly limit it?

- Where does margin actually come from once the market matures?

These are not philosophical questions. They are operational ones.

And they are where most strategies quietly struggle.

Why Europe Requires Deeper Market Intelligence

On the surface, the Europe spa market looks attractive—and it is.

But beneath the surface, growth is uneven, margins are conditional, and success depends on choices that are easy to underestimate from the outside.

Understanding where Europe’s ~USD 82 billion spa market opportunity will actually concentrate value requires more than growth forecasts. It requires clarity on structure, trade-offs, and execution pressure.

That is where most conversations stop.

And where the real work begins.

Choose a time to speak one-on-one with our team.

Or reach us for more details at sales@marketgenics.co