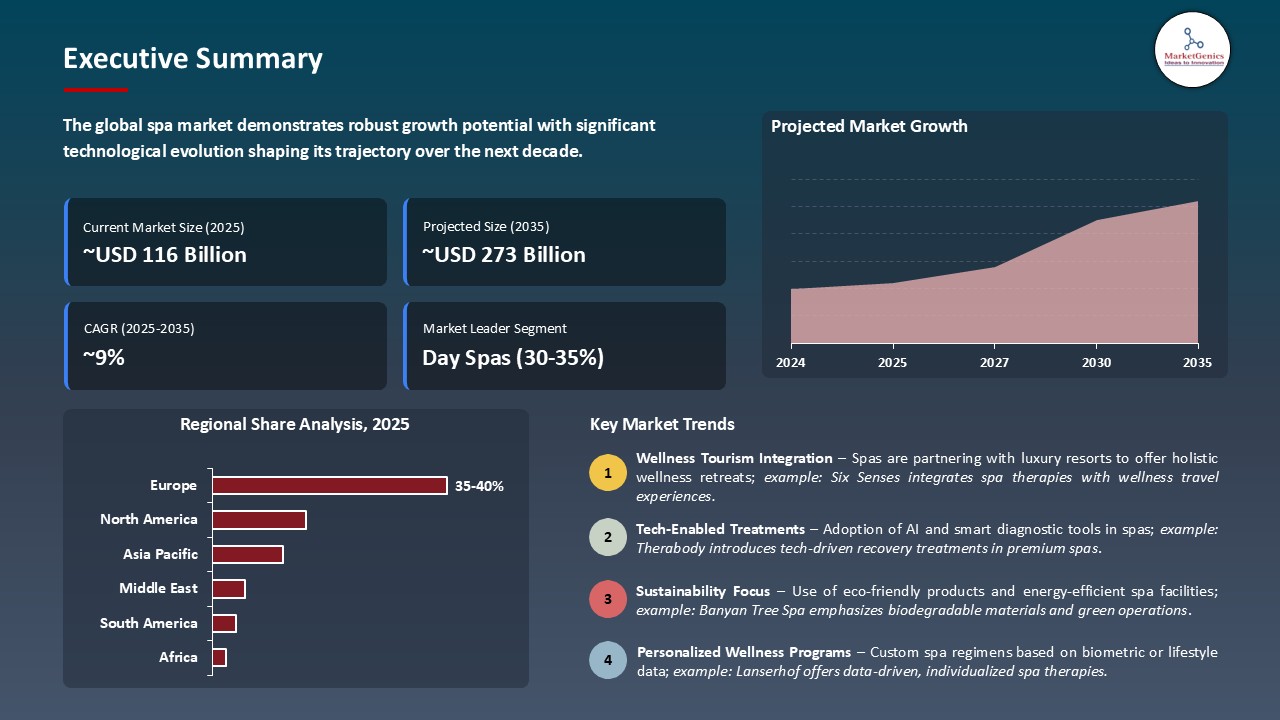

- The global spa market is valued at USD 116.3 billion in 2025.

- The market is projected to grow at a CAGR of 8.9% during the forecast period of 2026 to 2035.

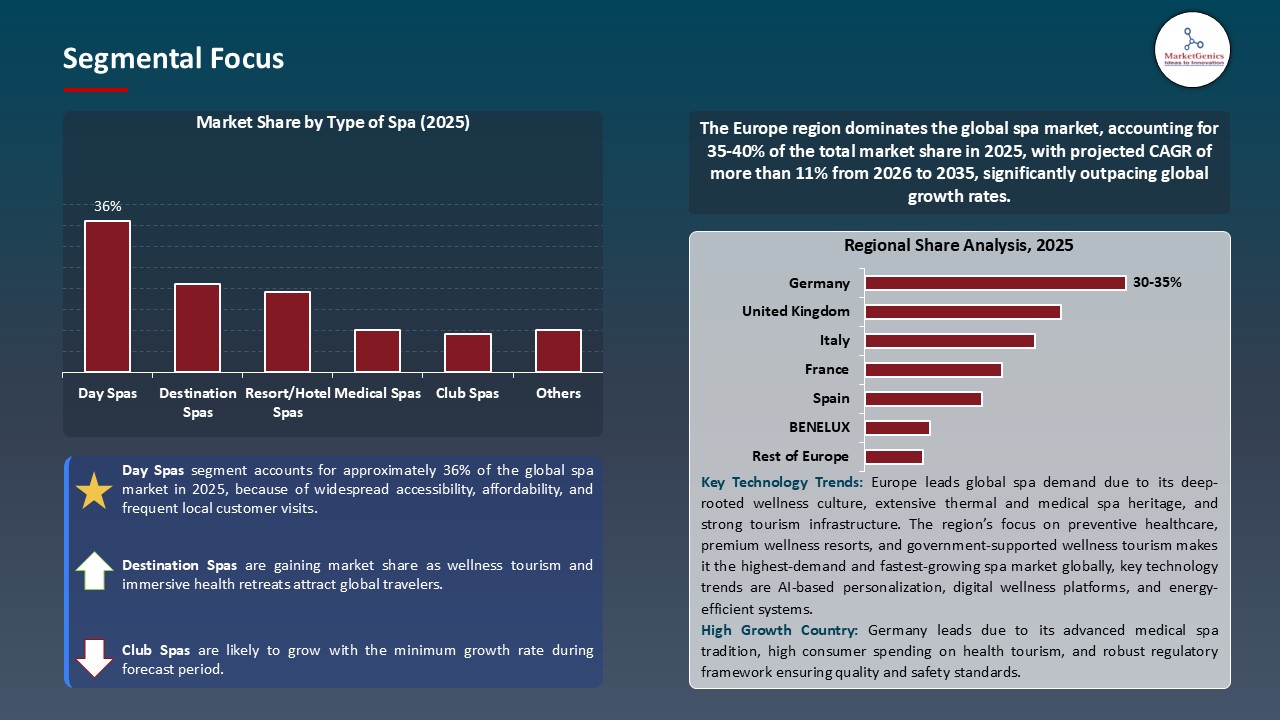

- The day spas segment holds major share ~36% in the global spa market, due to their affordability, accessibility, and growing consumer preference for convenient, short-duration wellness and beauty treatments.

- The spa market growing due to rising demand for customized treatments integrating nutrition, mindfulness, and wellness diagnostics.

- The spa market is driven by growth in AI-based skin analysis, mobile booking apps, and digital wellness tracking.

- The top five players accounting for nearly 20% of the global spa-market share in 2025.

- In June 2025, Anantara Spa partnered with UK-based Kloris CBD to introduce botanical CBD therapies, blending traditional healing with modern wellness innovation.

- In April 2025, Valmont partnered with The Ritz-Carlton Spa, Bali, to launch exclusive Swiss cellular anti-aging treatments, enhancing the resort’s premium wellness and skincare offerings.

- Global Spa Market is likely to create the total forecasting opportunity of ~USD 157 Bn till 2035.

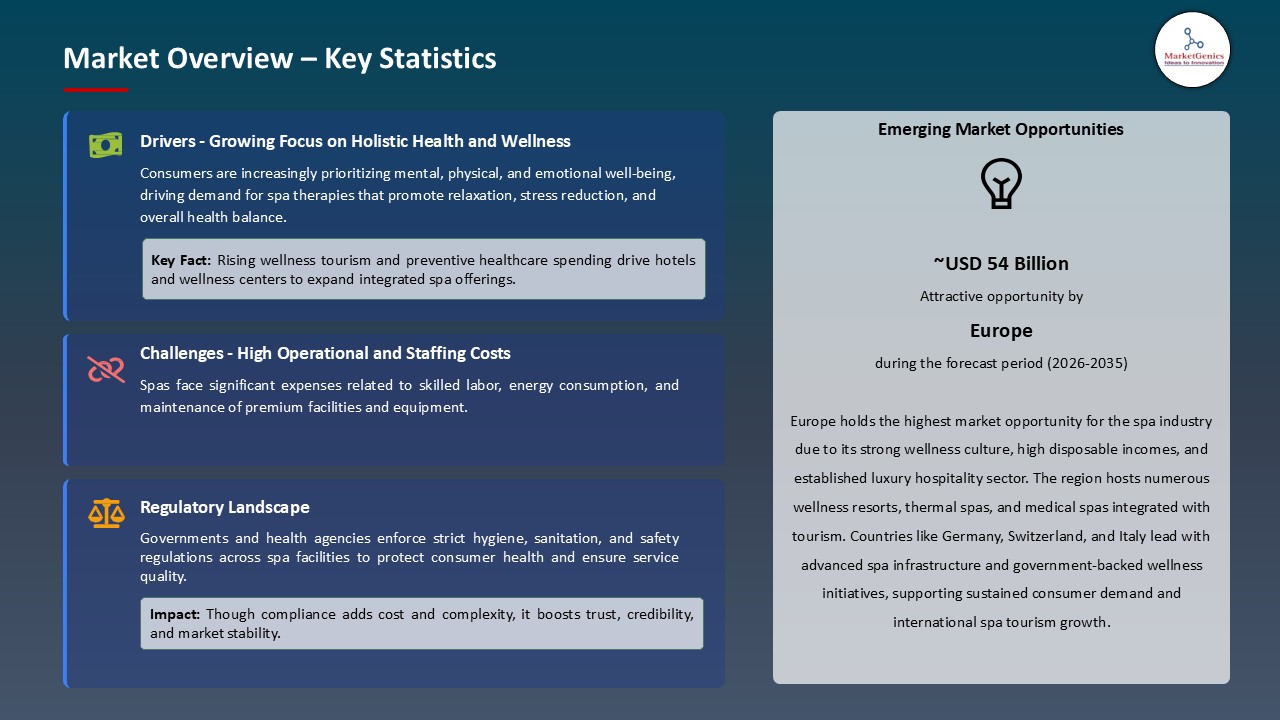

- Europe is most attractive region due to its strong wellness tourism industry, established luxury spa infrastructure, and high consumer spending on health and relaxation services.

- The spa market is also experiencing high growth due to the increasing stress levels impacting the modern population, and such things as the massage, meditation, and restorative treatments have been proven to be effective in reducing anxiety and the quality of sleep. Spa services are becoming more and more accepted as part of preventive care instead of a luxury experience as mental health awareness grows and clinical studies confirm their clinical value.

- For instance, in November 2024, a newly established spa in Plaza Midwood, Charlotte, introduced a Himalayan salt-cave halotherapy experience designed to promote stress relief, reduce anxiety, and enhance respiratory function and sleep quality. This invention adds to the increasing inclusion of therapeutic wellness services as part of standard spa amenities.

- Additionally, corporate wellness programs are moving toward the incorporation of spa services as a stress management tool because employers are managing burnout and loss of productivity as the spa provides treatments on-site, wellness events, and subsidized spa memberships.

- Increasing stress awareness, medicalization of mental health, and integration of spa services into corporate wellness programs, as well as wider insurance and HSA coverage, are redefining the spa as a non-luxury wellness offering. This is expanding the spa market and making demand more stable and recession-resistant.

- The spa market is particularly challenged by acute labor shortages of massage therapists, estheticians, and wellness specialists, and the labor costs are 40-60 percent of the total revenue, and labor costs pressure the margins. These workforce challenges impose capacity on services, long wait times during appointments, and shortened working hours, whereas practitioner burnout is becoming more of a concern regarding service quality and customer experience.

- Additionally, increasing operating costs such as commercial real estate, inventory, equipment maintenance and regulatory compliance add to the labor cost pressures, making unit economics difficult in the independent spa business that does not have the scale economies of the large chains. Consequently, several operators are constrained by profitability in spite of the existing consumer demand and high-service prices.

- The spa market's growth is hindered by a constant labor supply and rising operating expenses, resulting in reduced capacity and higher prices. To sustain long-term scalability, the industry must automate, innovate, and invest in talent.

- The spa market is experiencing strong growth due to the growth of medical spa (med-spa) services that incorporate the traditional relaxation services with the high-tech aesthetic services like Botox, dermal fillers, laser treatments, chemical peels, and body shaping. These high-end services appeal to the luxury customer base, repeat business, and reinforcement of market differentiation through increasing demands of beauty and anti-aging products.

- For instance, in November 2024, MedSmart Wellness Centers, a subsidiary of the Medholdings Group Inc., collaborated with Aesthetics Partners to launch new high-tech anti-aging services, such as platelet-rich plasma and hair restoration, to its medical spa system. This partnership improves innovation of services and market positioning in the fast-growing medical aesthetics industry.

- Additionally, regenerative medicine products, such as platelet-rich plasma (PRP) hair restoration and skin rejuvenation treatments, IV vitamin and hormone optimization treatment, can attract health-conscious consumers who desire evidence-based, high-price wellness treatments. These high-tech services make spas preventive healthcare facilities that supplement conventional medical care. The med-spa segment can help traditional spas diversify revenue streams, increase profitability through high-end services, and attract high-income clients.

- However, it requires medical control, practitioner training, and compliance with government regulations to manage the increased operational costs.

- The spa market is shifting to sustainability by sourcing organically, using renewable energy, and designing in an eco-friendly way, and it is incorporating the wellness tourism into providing high-end experience-based retreats and destination resorts. For instance, in June 2025, Sabah introduced SWWICE2025 to establish itself as a premier global wellness tourism destination based on nature, culture and sustainability.

- Additionally, wellness tourism integration will allow more immersive programs that can combine spa treatments, fitness, nutrition, mindfulness, and nature-based tourism as a way of providing transformative well-being results that can appeal to wealthy consumers who desire well-rounded health promotion and lifestyle rejuvenation.

- For instance, in July 2025, Marriott International unveiled its Luxury Wellbeing Series in three locations in Bali, Maldives and Goa, which comprised of wellness programs which included nutrition, sleep therapies, yoga and spa sessions to the high-end travelers.

- Sustainability and wellness tourism trends are transforming spas into destination-based brands that prioritize premium positioning, immersive experiences, and align with consumer preferences for environmentally responsible wellness products and services.

- The day spa segment leads the global spa market due to their convenient access, flexible timing, a wide range of services, and low prices which attract a wide range of consumers with day spas being not a luxury but a necessary wellness provider. As an example, In April 2024, Italian skincare brand Comfort Zone collaborated with Tattva Wellness Spa to launch a series of high-end facial treatments in its salons, to complement the existing premium service products in the mid-market day spa industry.

- Additionally, day spa has the advantage of flexibility in operation enabling them to tailor their services to the local preferences of the market, optimize the use of the facilities and, scale the staffing to fit the demand, which would not be the case in the resort infrastructure. This flexibility facilitates effective performance in diverse markets whether in metropolitan or suburban areas.

- The day spa segment is the market leader due to its accessibility, convenience, flexibility, and affordability, making wellness and spa services more accessible to a wider population and view them as a necessity rather than a luxury.

- Europe leads the global spa market due to its advanced wellness tourism infrastructure with destinations spas in Italy, France and Switzerland providing services that incorporate medical wellness, natural remedies as well as luxury hospitality services. As an example, in April 2025, Italy opened the 172,000 sq ft urban thermal spa De Montel - Terme Milano, which has pools, saunas, hammam, and sustainable design, further establishing Milan as a major location in the wellness industry.

- Furthermore, the domination of Europe spa market is further advanced by the increasing consumer trend towards preventive health and holistic well-being which is supported by the wellness programs sponsored by governments supporting medical tourism and sustainable health. Spas in medical, thermal and rehabilitation resorts increase ease of access to evidence-based treatments, integrating clinical knowledge with traditional treatments.

- Furthermore, Germany, Hungary and Austria are examples of countries that have harnessed centuries of thermal traditions to the benefit of international wellness tourists through regulated health care systems, to pursue restorative science-based wellness experiences.

- Europe has established itself as a global leader in wellness tourism integration, resulting in long-term market growth, improved destination competitiveness, and strengthened leadership in premium science-based spa and holistic health experiences.

- In June 2025, Anantara Mina Ras Al Khaimah Resort Anantara SpA collaborated with UK-based wellness brand Kloris CBD to launch a new range of botanical CBD treatments merging traditional healing methods with modern wellness science and expanding the existing range of holistic spa services in the Middle East.

- In April 2025, Valmont collaborated with The Ritz-Carlton Spa, Bali, to introduce its exclusive Swiss cellular anti-aging skincare treatments, enhancing the resort’s premium wellness portfolio and reinforcing both brands’ positioning in the luxury spa and skincare segment.

- United States

- Canada

- Mexico

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic Countries

- Poland

- Russia & CIS

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Turkey

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Nigeria

- Algeria

- Brazil

- Argentina

- Banyan Tree Spa

- Bliss Spa

- Burke Williams

- Canyon Ranch

- Clinique La Prairie

- European Wax Center

- Four Seasons Hotels and Resorts

- Hand & Stone Massage and Facial Spa

- Lanserhof

- Mandarin Oriental Spa

- Massage Envy

- Miraval Group

- Rancho La Puerta

- Red Door Spa

- SHA Wellness Clinic

- Six Senses Hotels Resorts Spas

- Steiner Leisure

- The Ritz-Carlton Spa

- Woodhouse Spa

- Other Key Players

- Day Spas

- Destination Spas

- Resort/Hotel Spas

- Medical Spas

- Mineral/Thermal Springs Spas

- Club Spas

- Others

- Massage Therapy

- Facial Treatments

- Body Treatments

- Beauty & Grooming Services

- Wellness Services

- Medical/Aesthetic Services

- Others

- Age Group

- Below 25 Years

- 25-35 Years

- 36-50 Years

- 51-65 Years

- Above 65 Years

- Gender

- Women

- Men

- Unisex

- Independent/Standalone Spas

- Franchise Spas

- Chain/Corporate-Owned Spas

- Individual Consumers

- Corporate Clients (Wellness Programs)

- Healthcare Institutions

- Hospitality Industry

- Tourism Industry

- Other End-users

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Spa Market Outlook

- 2.1.1. Spa Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Spa Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 3.1.1. Consumer Goods & Services Industry Ecosystem Analysis

- 3.1.2. Key Trends for Consumer Goods & Services Industry

- 3.1.3. Regional Distribution for Consumer Goods & Services Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising consumer awareness of wellness, self‑care, and preventive health

- 4.1.1.2. Growth in disposable incomes and the affluent/middle‑class population

- 4.1.1.3. Expansion of wellness tourism and demand for spa/resort-based experiences

- 4.1.2. Restraints

- 4.1.2.1. High operational and setup costs, along with a shortage of skilled staff

- 4.1.2.2. Intense competition and market saturation in certain segments

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Ecosystem Analysis

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Spa Market Demand

- 4.7.1. Historical Market Size – Value (US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size – Value (US$ Bn), 2026–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Spa Market Analysis, by Type of Spa

- 6.1. Key Segment Analysis

- 6.2. Spa Market Size (Value - US$ Bn), Analysis, and Forecasts, by Type of Spa, 2021-2035

- 6.2.1. Day Spas

- 6.2.2. Destination Spas

- 6.2.3. Resort/Hotel Spas

- 6.2.4. Medical Spas

- 6.2.5. Mineral/Thermal Springs Spas

- 6.2.6. Club Spas

- 6.2.7. Others

- 7. Global Spa Market Analysis, by Service Type

- 7.1. Key Segment Analysis

- 7.2. Spa Market Size (Value - US$ Bn), Analysis, and Forecasts, by Service Type, 2021-2035

- 7.2.1. Massage Therapy

- 7.2.2. Facial Treatments

- 7.2.3. Body Treatments

- 7.2.4. Beauty & Grooming Services

- 7.2.5. Wellness Services

- 7.2.6. Medical/Aesthetic Services

- 7.2.7. Others

- 8. Global Spa Market Analysis, by Consumer Demographic

- 8.1. Key Segment Analysis

- 8.2. Spa Market Size (Value - US$ Bn), Analysis, and Forecasts, by Consumer Demographic, 2021-2035

- 8.2.1. Age Group

- 8.2.1.1. Below 25 Years

- 8.2.1.2. 25-35 Years

- 8.2.1.3. 36-50 Years

- 8.2.1.4. 51-65 Years

- 8.2.1.5. Above 65 Years

- 8.2.2. Gender

- 8.2.2.1. Women

- 8.2.2.2. Men

- 8.2.2.3. Unisex

- 8.2.1. Age Group

- 9. Global Spa Market Analysis, by Ownership Type

- 9.1. Key Segment Analysis

- 9.2. Spa Market Size (Value - US$ Bn), Analysis, and Forecasts, by Ownership Type, 2021-2035

- 9.2.1. Independent/Standalone Spas

- 9.2.2. Franchise Spas

- 9.2.3. Chain/Corporate-Owned Spas

- 10. Global Spa Market Analysis, by End-Users

- 10.1. Key Segment Analysis

- 10.2. Spa Market Size (Value - US$ Bn), Analysis, and Forecasts, by End-Users, 2021-2035

- 10.2.1. Individual Consumers

- 10.2.2. Corporate Clients (Wellness Programs)

- 10.2.3. Healthcare Institutions

- 10.2.4. Hospitality Industry

- 10.2.5. Tourism Industry

- 10.2.6. Other End-users

- 11. Global Spa Market Analysis and Forecasts, by Region

- 11.1. Key Findings

- 11.2. Spa Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 11.2.1. North America

- 11.2.2. Europe

- 11.2.3. Asia Pacific

- 11.2.4. Middle East

- 11.2.5. Africa

- 11.2.6. South America

- 12. North America Spa Market Analysis

- 12.1. Key Segment Analysis

- 12.2. Regional Snapshot

- 12.3. North America Spa Market Size Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 12.3.1. Type of Spa

- 12.3.2. Service Type

- 12.3.3. Consumer Demographic

- 12.3.4. Ownership Type

- 12.3.5. End-Users

- 12.3.6. Country

- 12.3.6.1. USA

- 12.3.6.2. Canada

- 12.3.6.3. Mexico

- 12.4. USA Spa Market

- 12.4.1. Country Segmental Analysis

- 12.4.2. Type of Spa

- 12.4.3. Service Type

- 12.4.4. Consumer Demographic

- 12.4.5. Ownership Type

- 12.4.6. End-Users

- 12.5. Canada Spa Market

- 12.5.1. Country Segmental Analysis

- 12.5.2. Type of Spa

- 12.5.3. Service Type

- 12.5.4. Consumer Demographic

- 12.5.5. Ownership Type

- 12.5.6. End-Users

- 12.6. Mexico Spa Market

- 12.6.1. Country Segmental Analysis

- 12.6.2. Type of Spa

- 12.6.3. Service Type

- 12.6.4. Consumer Demographic

- 12.6.5. Ownership Type

- 12.6.6. End-Users

- 13. Europe Spa Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. Europe Spa Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 13.3.1. Type of Spa

- 13.3.2. Service Type

- 13.3.3. Consumer Demographic

- 13.3.4. Ownership Type

- 13.3.5. End-Users

- 13.3.6. Country

- 13.3.6.1. Germany

- 13.3.6.2. United Kingdom

- 13.3.6.3. France

- 13.3.6.4. Italy

- 13.3.6.5. Spain

- 13.3.6.6. Netherlands

- 13.3.6.7. Nordic Countries

- 13.3.6.8. Poland

- 13.3.6.9. Russia & CIS

- 13.3.6.10. Rest of Europe

- 13.4. Germany Spa Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Type of Spa

- 13.4.3. Service Type

- 13.4.4. Consumer Demographic

- 13.4.5. Ownership Type

- 13.4.6. End-Users

- 13.5. United Kingdom Spa Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Type of Spa

- 13.5.3. Service Type

- 13.5.4. Consumer Demographic

- 13.5.5. Ownership Type

- 13.5.6. End-Users

- 13.6. France Spa Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Type of Spa

- 13.6.3. Service Type

- 13.6.4. Consumer Demographic

- 13.6.5. Ownership Type

- 13.6.6. End-Users

- 13.7. Italy Spa Market

- 13.7.1. Country Segmental Analysis

- 13.7.2. Type of Spa

- 13.7.3. Service Type

- 13.7.4. Consumer Demographic

- 13.7.5. Ownership Type

- 13.7.6. End-Users

- 13.8. Spain Spa Market

- 13.8.1. Country Segmental Analysis

- 13.8.2. Type of Spa

- 13.8.3. Service Type

- 13.8.4. Consumer Demographic

- 13.8.5. Ownership Type

- 13.8.6. End-Users

- 13.9. Netherlands Spa Market

- 13.9.1. Country Segmental Analysis

- 13.9.2. Type of Spa

- 13.9.3. Service Type

- 13.9.4. Consumer Demographic

- 13.9.5. Ownership Type

- 13.9.6. End-Users

- 13.10. Nordic Countries Spa Market

- 13.10.1. Country Segmental Analysis

- 13.10.2. Type of Spa

- 13.10.3. Service Type

- 13.10.4. Consumer Demographic

- 13.10.5. Ownership Type

- 13.10.6. End-Users

- 13.11. Poland Spa Market

- 13.11.1. Country Segmental Analysis

- 13.11.2. Type of Spa

- 13.11.3. Service Type

- 13.11.4. Consumer Demographic

- 13.11.5. Ownership Type

- 13.11.6. End-Users

- 13.12. Russia & CIS Spa Market

- 13.12.1. Country Segmental Analysis

- 13.12.2. Type of Spa

- 13.12.3. Service Type

- 13.12.4. Consumer Demographic

- 13.12.5. Ownership Type

- 13.12.6. End-Users

- 13.13. Rest of Europe Spa Market

- 13.13.1. Country Segmental Analysis

- 13.13.2. Type of Spa

- 13.13.3. Service Type

- 13.13.4. Consumer Demographic

- 13.13.5. Ownership Type

- 13.13.6. End-Users

- 14. Asia Pacific Spa Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. Asia Pacific Spa Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Type of Spa

- 14.3.2. Service Type

- 14.3.3. Consumer Demographic

- 14.3.4. Ownership Type

- 14.3.5. End-Users

- 14.3.6. Country

- 14.3.6.1. China

- 14.3.6.2. India

- 14.3.6.3. Japan

- 14.3.6.4. South Korea

- 14.3.6.5. Australia and New Zealand

- 14.3.6.6. Indonesia

- 14.3.6.7. Malaysia

- 14.3.6.8. Thailand

- 14.3.6.9. Vietnam

- 14.3.6.10. Rest of Asia Pacific

- 14.4. China Spa Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Type of Spa

- 14.4.3. Service Type

- 14.4.4. Consumer Demographic

- 14.4.5. Ownership Type

- 14.4.6. End-Users

- 14.5. India Spa Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Type of Spa

- 14.5.3. Service Type

- 14.5.4. Consumer Demographic

- 14.5.5. Ownership Type

- 14.5.6. End-Users

- 14.6. Japan Spa Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Type of Spa

- 14.6.3. Service Type

- 14.6.4. Consumer Demographic

- 14.6.5. Ownership Type

- 14.6.6. End-Users

- 14.7. South Korea Spa Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Type of Spa

- 14.7.3. Service Type

- 14.7.4. Consumer Demographic

- 14.7.5. Ownership Type

- 14.7.6. End-Users

- 14.8. Australia and New Zealand Spa Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Type of Spa

- 14.8.3. Service Type

- 14.8.4. Consumer Demographic

- 14.8.5. Ownership Type

- 14.8.6. End-Users

- 14.9. Indonesia Spa Market

- 14.9.1. Country Segmental Analysis

- 14.9.2. Type of Spa

- 14.9.3. Service Type

- 14.9.4. Consumer Demographic

- 14.9.5. Ownership Type

- 14.9.6. End-Users

- 14.10. Malaysia Spa Market

- 14.10.1. Country Segmental Analysis

- 14.10.2. Type of Spa

- 14.10.3. Service Type

- 14.10.4. Consumer Demographic

- 14.10.5. Ownership Type

- 14.10.6. End-Users

- 14.11. Thailand Spa Market

- 14.11.1. Country Segmental Analysis

- 14.11.2. Type of Spa

- 14.11.3. Service Type

- 14.11.4. Consumer Demographic

- 14.11.5. Ownership Type

- 14.11.6. End-Users

- 14.12. Vietnam Spa Market

- 14.12.1. Country Segmental Analysis

- 14.12.2. Type of Spa

- 14.12.3. Service Type

- 14.12.4. Consumer Demographic

- 14.12.5. Ownership Type

- 14.12.6. End-Users

- 14.13. Rest of Asia Pacific Spa Market

- 14.13.1. Country Segmental Analysis

- 14.13.2. Type of Spa

- 14.13.3. Service Type

- 14.13.4. Consumer Demographic

- 14.13.5. Ownership Type

- 14.13.6. End-Users

- 15. Middle East Spa Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Middle East Spa Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Type of Spa

- 15.3.2. Service Type

- 15.3.3. Consumer Demographic

- 15.3.4. Ownership Type

- 15.3.5. End-Users

- 15.3.6. Country

- 15.3.6.1. Turkey

- 15.3.6.2. UAE

- 15.3.6.3. Saudi Arabia

- 15.3.6.4. Israel

- 15.3.6.5. Rest of Middle East

- 15.4. Turkey Spa Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Type of Spa

- 15.4.3. Service Type

- 15.4.4. Consumer Demographic

- 15.4.5. Ownership Type

- 15.4.6. End-Users

- 15.5. UAE Spa Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Type of Spa

- 15.5.3. Service Type

- 15.5.4. Consumer Demographic

- 15.5.5. Ownership Type

- 15.5.6. End-Users

- 15.6. Saudi Arabia Spa Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Type of Spa

- 15.6.3. Service Type

- 15.6.4. Consumer Demographic

- 15.6.5. Ownership Type

- 15.6.6. End-Users

- 15.7. Israel Spa Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Type of Spa

- 15.7.3. Service Type

- 15.7.4. Consumer Demographic

- 15.7.5. Ownership Type

- 15.7.6. End-Users

- 15.8. Rest of Middle East Spa Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Type of Spa

- 15.8.3. Service Type

- 15.8.4. Consumer Demographic

- 15.8.5. Ownership Type

- 15.8.6. End-Users

- 16. Africa Spa Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Africa Spa Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Type of Spa

- 16.3.2. Service Type

- 16.3.3. Consumer Demographic

- 16.3.4. Ownership Type

- 16.3.5. End-Users

- 16.3.6. Country

- 16.3.6.1. South Africa

- 16.3.6.2. Egypt

- 16.3.6.3. Nigeria

- 16.3.6.4. Algeria

- 16.3.6.5. Rest of Africa

- 16.4. South Africa Spa Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Type of Spa

- 16.4.3. Service Type

- 16.4.4. Consumer Demographic

- 16.4.5. Ownership Type

- 16.4.6. End-Users

- 16.5. Egypt Spa Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Type of Spa

- 16.5.3. Service Type

- 16.5.4. Consumer Demographic

- 16.5.5. Ownership Type

- 16.5.6. End-Users

- 16.6. Nigeria Spa Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Type of Spa

- 16.6.3. Service Type

- 16.6.4. Consumer Demographic

- 16.6.5. Ownership Type

- 16.6.6. End-Users

- 16.7. Algeria Spa Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Type of Spa

- 16.7.3. Service Type

- 16.7.4. Consumer Demographic

- 16.7.5. Ownership Type

- 16.7.6. End-Users

- 16.8. Rest of Africa Spa Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Type of Spa

- 16.8.3. Service Type

- 16.8.4. Consumer Demographic

- 16.8.5. Ownership Type

- 16.8.6. End-Users

- 17. South America Spa Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. South America Spa Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Type of Spa

- 17.3.2. Service Type

- 17.3.3. Consumer Demographic

- 17.3.4. Ownership Type

- 17.3.5. End-Users

- 17.3.6. Country

- 17.3.6.1. Brazil

- 17.3.6.2. Argentina

- 17.3.6.3. Rest of South America

- 17.4. Brazil Spa Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Type of Spa

- 17.4.3. Service Type

- 17.4.4. Consumer Demographic

- 17.4.5. Ownership Type

- 17.4.6. End-Users

- 17.5. Argentina Spa Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Type of Spa

- 17.5.3. Service Type

- 17.5.4. Consumer Demographic

- 17.5.5. Ownership Type

- 17.5.6. End-Users

- 17.6. Rest of South America Spa Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Type of Spa

- 17.6.3. Service Type

- 17.6.4. Consumer Demographic

- 17.6.5. Ownership Type

- 17.6.6. End-Users

- 18. Key Players/ Company Profile

- 18.1. Banyan Tree Spa

- 18.1.1. Company Details/ Overview

- 18.1.2. Company Financials

- 18.1.3. Key Customers and Competitors

- 18.1.4. Business/ Industry Portfolio

- 18.1.5. Product Portfolio/ Specification Details

- 18.1.6. Pricing Data

- 18.1.7. Strategic Overview

- 18.1.8. Recent Developments

- 18.2. Bliss Spa

- 18.3. Burke Williams

- 18.4. Canyon Ranch

- 18.5. Clinique La Prairie

- 18.6. European Wax Center

- 18.7. Four Seasons Hotels and Resorts

- 18.8. Hand & Stone Massage and Facial Spa

- 18.9. Lanserhof

- 18.10. Mandarin Oriental Spa

- 18.11. Massage Envy

- 18.12. Miraval Group

- 18.13. Rancho La Puerta

- 18.14. Red Door Spa

- 18.15. SHA Wellness Clinic

- 18.16. Six Senses Hotels Resorts Spas

- 18.17. Steiner Leisure

- 18.18. The Ritz-Carlton Spa

- 18.19. Woodhouse Spa

- 18.20. Other Key Players

- 18.1. Banyan Tree Spa

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Insightified

Mid-to-large firms spend $20K–$40K quarterly on systematic research and typically recover multiples through improved growth and profitability

Research is no longer optional. Leading firms use it to uncover $10M+ in hidden revenue opportunities annually

Our research-consulting programs yields measurable ROI: 20–30% revenue increases from new markets, 11% profit upticks from pricing, and 20–30% cost savings from operations

Spa Market Size, Share & Trends Analysis Report by Type of Spa (Day Spas, Destination Spas, Resort/Hotel Spas, Medical Spas, Mineral/Thermal Springs Spas, Club Spas, Others), Service Type, Consumer Demographic, Ownership Type, End-Users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Spa Market Size, Share, and Growth

The global spa market is experiencing robust growth, with its estimated value of USD 116.3 billion in the year 2025 and USD 272.8 billion by 2035, registering a CAGR of 8.9%, during the forecast period. The growing demand for the spa market is driven by rising wellness awareness, increasing disposable incomes, and expanding wellness tourism. Consumers seek holistic health, stress relief, and beauty treatments, while technological integration and personalized services enhance convenience and experience.

Go Kondo, General Manager of The Ritz-Carlton, Bali said,

"At the Ritz-Carlton, Bali, we are committed to providing our guests with the highest level of comfort and genuine service. We are proud to introduce and add Valmont products to our spa treatments—a brand renowned for its Swiss heritage, scientific innovation, and exceptional results. We invite you to experience the transformative power of Valmont in our serene spa environment.”

The global market in the spa has been fueled by the increased adoption of wellness lifestyle and growing emphasis on preventive health, as consumers abandon the occasional pampering in favor of the regular practice of wellness to reduce stress and maintain overall well-being. For instance, in 2024, Augustinus Bader collaborated with Corinthia London to launch a new menu of spa treatments that combine high tech skincare science with holistic wellness rituals to the personalized treatment offerings of the luxury spa. This is increasing the spa sector to science based, experiences-based models of wellness which boost customer retention and high-end service.

Moreover, the spa industry is evolving to include more than the traditional massage and facial services to incorporate medical aesthetics, psychological wellness initiatives, nutritional counseling, fitness, and technology-based treatment including cryotherapy, infrared sauna, and IV vitamin treatment, alongside an expanded portfolio of professional beauty services. As an example, in July 2025, Dior recently launched a high-end spa in New York City with sophisticated procedures such as cryotherapy and cold laser therapy as a representation of how aesthetics and technology intersect and support one another, as well as a place where wellness and technology can be experienced. This diversification is making spas more of a wellness center, widening the appeal and increasing the value of services.

The global spa market offers significant adjacent opportunities across retail product sales, wellness retreats, corporate wellness programs, medical tourism, and subscription-based memberships. These differentiated sources of revenue maximize customer lifetime value, facility usage, and create consistent and recurring revenues, leading to business sustainability and resiliency in the long-term.

Spa Market Dynamics and Trends

Driver: Stress Epidemic and Mental Wellness Prioritization

Restraint: Labor Shortages and High Operational Costs

Opportunity: Medical Spa Integration and Aesthetic Services

Key Trend: Sustainability and Wellness Tourism Integration

Spa-Market Analysis and Segmental Data

Day Spa Dominate Global Spa Market

Europe Leads Global Spa Market Demand

Spa-Market Ecosystem

The global spa market is highly fragmented, with high concentration among key players such as Four Seasons Hotels and Resorts, Mandarin Oriental Spa, Six Senses Hotels Resorts Spas, Massage Envy, and Hand & Stone Massage and Facial Spa, who dominate through with worldwide networks, quality brand equity, sophisticated service individualization, and incorporation of wellness innovations that augment customer loyalty and superior positioning.

For instance, in 2025, Six Senses declared the opening of its new wellness club and spa at The Whiteley, London, equipped with a 20-meter indoor swimming pool, an Alchemy Bar, and the new brand-written concept of the integrated well-being club named Six Senses Place. These innovations strengthen the competitive edge of leading brands by providing differentiated and experience-based wellness products and enhancing their globalization and hastens premiumization throughout the spa sector.

Recent Development and Strategic Overview:

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 116.3 Bn |

|

Market Forecast Value in 2035 |

USD 272.8 Bn |

|

Growth Rate (CAGR) |

8.9% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

|

Spa-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Spa Market, By Type of Spa |

|

|

Spa Market, By Service Type |

|

|

Spa Market, By Consumer Demographic |

|

|

Spa Market, By Ownership Type |

|

|

Spa Market, By End-Users

|

|

Frequently Asked Questions

Table of Contents

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

Forecasting Models / Techniques

Multiple Regression Analysis

Time Series Analysis – Seasonal Patterns

Time Series Analysis – Trend Analysis

Expert Opinion – Expert Interviews

Multi-Scenario Development

Time Series Analysis – Moving Averages

Econometric Models

Expert Opinion – Delphi Method

Monte Carlo Simulation

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation