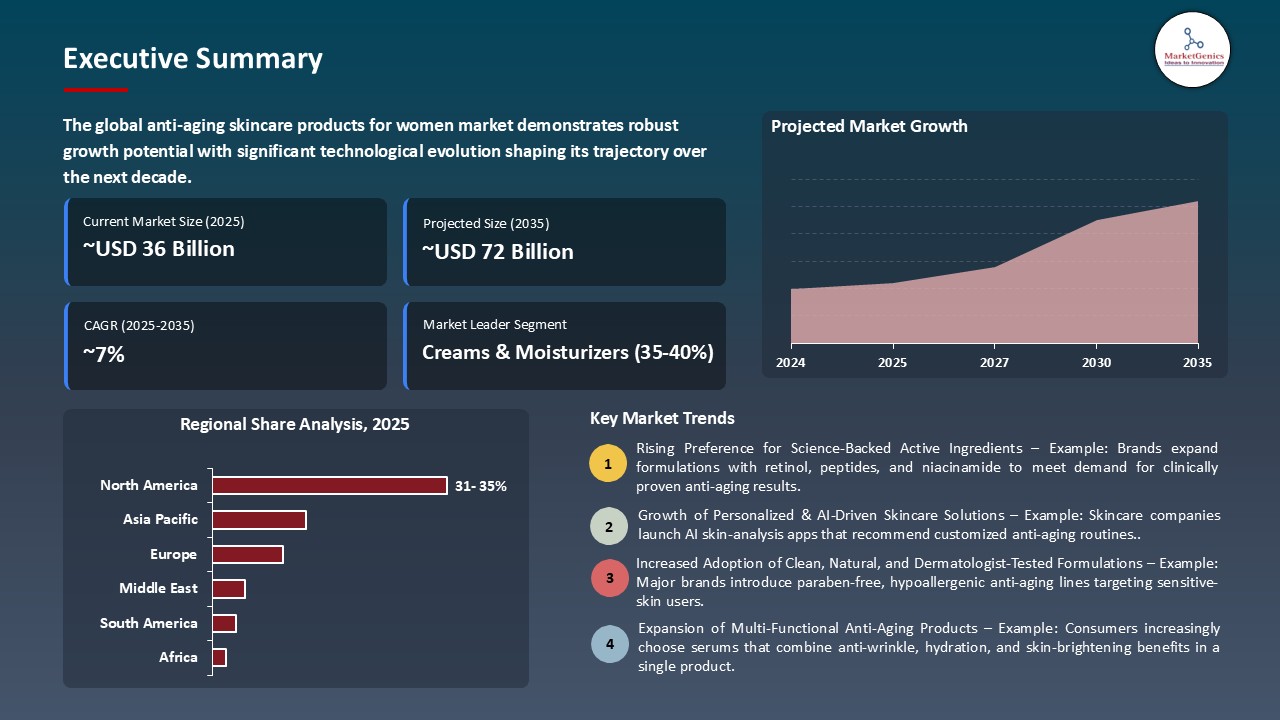

- The global anti-aging skincare products for women market is valued at USD 36.2 billion in 2025.

- The market is projected to grow at a CAGR of 7.1% during the forecast period of 2026 to 2035.

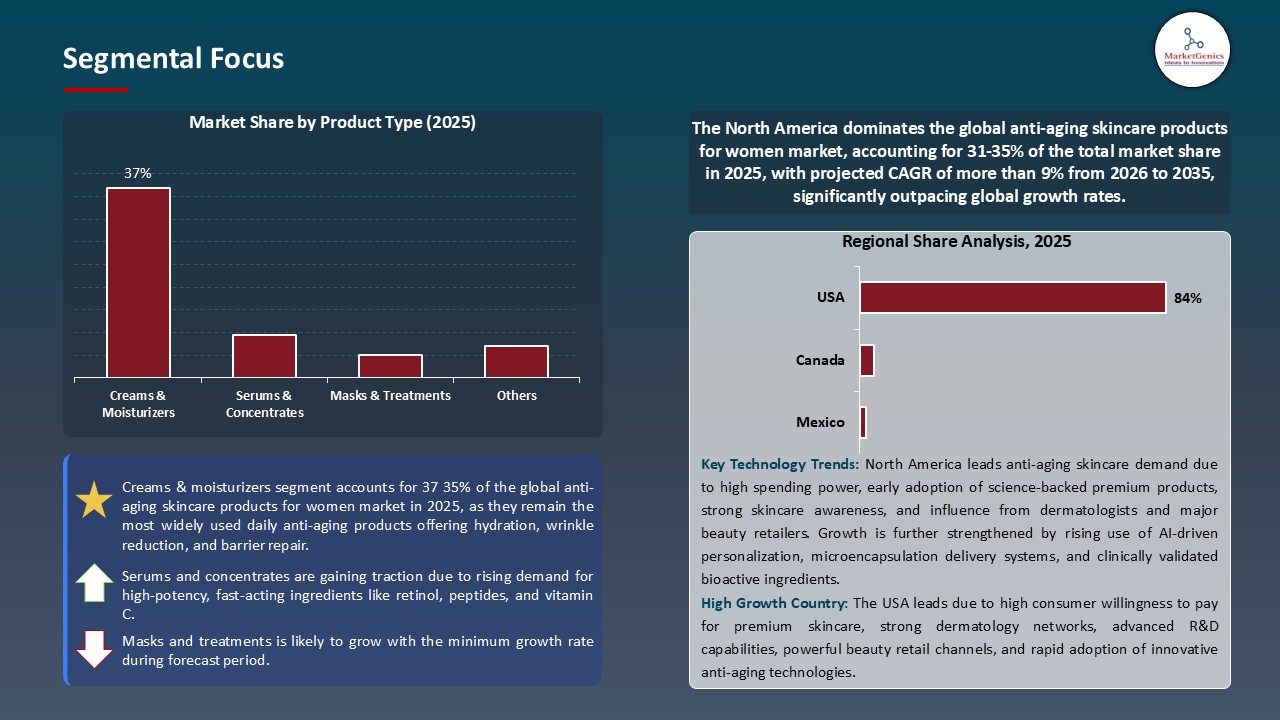

- The creams & moisturizers segment holds major share ~37% in the global anti-aging skincare products for women market, driven by high consumer preference for convenient, multi-functional formulations that hydrate, reduce wrinkles, and improve skin elasticity. Proven efficacy, wide availability, and trusted brand presence support strong adoption across diverse demographics.

- Rising consumer demand for sustainable and personalized anti-aging skincare is driving brands to develop clean, eco-friendly formulations and subscription-based models tailored to individual skin concerns and routines.

- Innovation is accelerating: companies are launching multi-peptide creams, plant-based retinol alternatives, hyaluronic acid serums, and customized formulations, while incorporating natural, ethically sourced, and clinically validated ingredients.

- The top five player’s accounts for over 25% of the global anti-aging skincare products for women market in 2025.

- In December 2024, Kao launched SENSAI TOTAL FORM EXPERT CREAM, combining Koishimaru Silk EX and “Total Form CPX” to enhance hydration, firmness, and elasticity with a gentle sculpting effect.

- In March 2025, InnBeauty Project introduced Extreme Cream Eye Firming & Contouring Eye Cream, using peptides and botanical extracts to lift, smooth wrinkles, and deeply hydrate.

- Global Anti-Aging Skincare Products for Women Market is likely to create the total forecasting opportunity of ~USD 36 Bn till 2035.

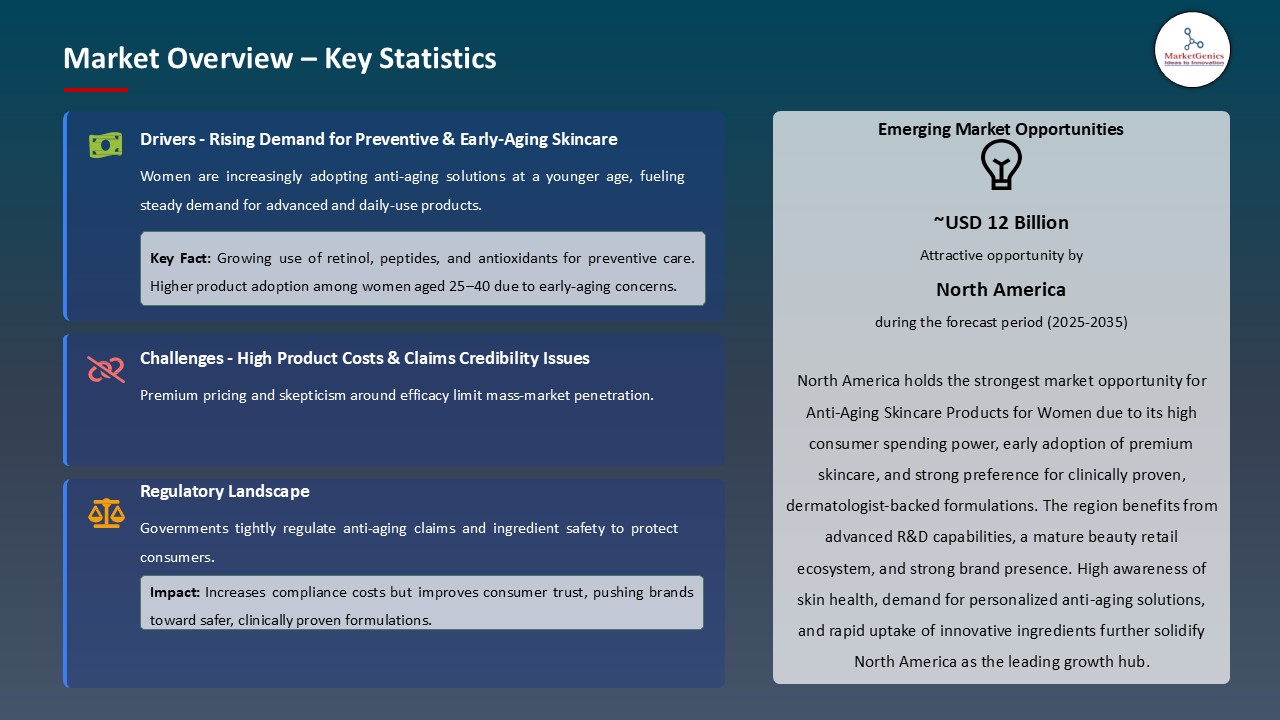

- North America leads the anti-aging skincare products for women market, driven by high consumer purchasing power, strong awareness of skincare science, and preference for premium, clinically validated solutions, supported by advanced e-commerce and retail channels, and is fuelling rapid adoption across the region.

- The anti-aging skincare products for women market is growing due to the ageing population and the rising middle income population as this age group and these middle income groups are influencing buying behaviour, brand loyalty and their focus on product development. The concept of health consciousness, sustainability, and social responsibility is tipping the consumer decision making especially on millennials and Gen z who are demanding transparency and authenticity on beauty products. For instance, in August 2025, Elm skincare (Dr. Dhaval Bhanusali and Martha Stewart) was founded, a science-driven brand that addresses age-related issues, which helps draw attention to the focus that the market has on the products that serve the ageing population.

- The market leaders, in their turn, react by redesigning their portfolios, removing controversial ingredients, gaining third-party certifications, switching to sustainable packaging and promoting corporate values through specific campaigns. Such activities will increase brand differentiation, consumer trust and competitive advantage in which sustainability and ethical standards underpin high prices.

- All these trends are collectively leading to the creation of long-term growth of the market in the developed parts where consumers are ready to spend money on high-performance, safe, and socially responsible products.

- The high regulatory complexity and strict clinical efficacy standards pose a serious inhibition of development and penetration of the anti-aging skincare products industry. The varying regulatory systems, levels of substantiation, and approval procedures pose excessive compliance costs especially to science based formulations with claimed measurable effects.

- The response measures being taken by companies are based on clinical research, safety tests, regulatory knowledge, and open communication. But such limitations require organizations to have resources, lengthy development cycles, and be capable of changing product claims and formulations in response to the expectations of regional regulations.

- The constantly changing environment expands competition, emphasizing the importance of operational efficiency, market accuracy, and a well-established compliance infrastructure in order to remain competitive in highly restricted environments.

- The growth of the anti-aging category among men is a great development prospect of the brands that have relied on the female segment of the skincare industry. Firms are becoming more involved in product development, targeted positioning, omnichannel distribution, and capability building of products to meet the increased demand among men toward more advanced and efficacy-oriented products. For instance, in September 2025, Suntory Wellness entered the U.S. men skincare sector with category leader KIZEN, with patented Water Bond Technology, which is indicative of an increasing industry interest in anti-aging innovation for men.

- The opportunity is across high-growth emerging markets, venture into other nearby grooming and wellness businesses, creation of high-quality and clinically validated formulations, and the expansion of direct-to-consumer strategies to reinforce interaction and unit economics. It takes an excellent consumer insight sense, digital savvy, agile execution, and relentless innovation to succeed in line with changing behavioral and demographic trends.

- Companies that excel in these verticals outperform the market, establish stronger competitive positions, and create long-term value in the rapidly expanding men's skin care ecosystem.

- The convergence of biotechnology and peptide-based formulations is transforming product performance, consumer expectations and competitive forces in the anti-aging skincare for women market. This is an indication of the meeting of technological technology, scientific validation, and consumer demand of safe products and results that are driven. The early adopters are creating a great technology leadership and competitive advantages.

- Companies which exploit this strategy are attaining better effectiveness, greater customer satisfaction, greater brand distinction, and greater purchasing power. For instnace, in April 2025, Ashland rolled out Collapeptyl, a biochemical peptide-hyaluronic acid polymer that stimulated collagen synthesis, skin elasticity, and minimization of observable aging effects, which showed how biotechnology can be used commercially in anti-aging products. The trend is more pronounced on segments that have high consumer sophistication as innovation and differentiation are rewarded. This can only be fulfilled through investing in R and D, clinical research and education to the consumer.

- The trend is expected to expand to include mass-market and price-sensitive segments, leading to market transformation, new competitive hierarchies, and business model innovations such as personalized formulations, subscription services, and outcome-based programs that increase customer loyalty and lifetime value.

- The creams and moisturizers market segment holds the largest share in the global anti-aging skincare products for women market since it is convenient, effective and generally acceptable by the consumers in both urban and semi-urban locations. The segment benefits from increased skin care knowledge, anti-aging prevention, and a high demand for moisturizing and high-efficiency formulations. Its widespread availability and proven effectiveness underlines its status as part and parcel of women's skincare routines.

- Technological inventions in this sector like peptides enriched creams, hyaluronic acid formula, antioxidant blend, and SPF incorporated moisturizers make it even more competitive, as anti-aging regimens increasingly integrate protective solutions traditionally associated with sun care products to prevent photoaging and long-term skin damage. For example, in June 2025, L'Oréal Groupe launched its "Beauty at the Heart of Longevity" campaign, which introduced anti-aging products and formulations based on Longevity Integrative Science to improve skin hydration, reduce wrinkles, and boost overall skin strength, demonstrating the industry's desire to focus on multifunctional and science-based innovations.

- Retail locations, e-commerce, and subscription services help expand the market. Collaborations with dermatologists, beauty influencers, and skincare educational programs can help to improve awareness, lower adoption hurdles, and strengthen cream and moisturizer crews in the worldwide anti-aging skincare products for women market.

- The anti-aging skincare products for women market in North America is dominated by a large consumer expenditure, extensive knowledge of tested and proven scientifically supported skincare products, and the existence of high-end and luxurious brands. The growth potential is also high because younger consumers are starting to embrace preventative anti-aging measures, and this opens up the opportunity to create personalized products and engage with these consumers via e-commerce and tele-dermatology services.

- Programs developed by dermatology associations, wellness organizations and NGOs also contribute to the development of the market by informing the consumers about the health of the skin and proper use of anti-aging methods. For instance, in May 2025, RoC Skincare introduced its Empowered Aging program, collaborating with SeekHer Foundation and creating a research fund at Brown University to facilitate women to benefit from skin care and aging studies. These attempts increase product awareness, adoption, and long-term behavioral change.

- In conjunction with beauty trends pushed via social media and online skincare marketing, North America is poised to be one of the most powerful development engines, with the area expected to rise consistently.

- In December 2024, Kao declared the release of SENSAI TOTAL FORM EXPERT CREAM, an international anti-aging skincare product. The cream contains the Koishimaru Silk EX with the new Total Form CPX botanical complex to improve hydration, firmness and elasticity, and has a Plumping Veil Formula to sculpt the skin softly.

- In March 2025, InnBeauty launched the first eye-cream extension to its Extreme Cream product line, Project with Extreme Cream Eye Firming & Contouring Eye Cream. It is a reverse-emulsions formula with core ingredients such as Acetyl Hexapeptide -8 and paracress extract to visually raised and plumped wrinkles, snow mushroom and glycerle glucoside to deeply hydrated the skin.

- United States

- Canada

- Mexico

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic Countries

- Poland

- Russia & CIS

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Turkey

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Nigeria

- Algeria

- Brazil

- Argentina

- Amorepacific Corporation

- Avon Products Inc.

- Chanel S.A.

- Christian Dior SE

- Clarins Group

- Colgate-Palmolive Company

- Coty Inc.

- Beiersdorf AG

- Estée Lauder Companies Inc.

- Kao Corporation

- LVMH Moët Hennessy Louis Vuitton

- Mary Kay Inc.

- Natura &Co

- Johnson & Johnson

- Procter & Gamble Company

- Revlon Inc.

- Shiseido Company Limited

- L'Oréal S.A.

- The Honest Company

- Unilever PLC

- Other Key Players

- Creams & Moisturizers

- Day Creams

- Night Creams

- Eye Creams

- Neck Creams

- Others

- Serums & Concentrates

- Vitamin C Serums

- Retinol Serums

- Hyaluronic Acid Serums

- Peptide Serums

- Others

- Masks & Treatments

- Sheet Masks

- Clay Masks

- Peel-off Masks

- Overnight Masks

- Others

- Cleansers & Toners

- Sunscreens & UV Protection

- Eye Treatment Products

- Lip Care Products

- Retinoids (Retinol, Retinoic Acid)

- Peptides

- Antioxidants

- Vitamin C

- Vitamin E

- Coenzyme Q10

- Resveratrol

- Others

- Alpha Hydroxy Acids (AHAs)

- Glycolic Acid

- Lactic Acid

- Others

- Beta Hydroxy Acids (BHAs)

- Hyaluronic Acid

- Niacinamide

- Others

- Normal Skin

- Dry Skin

- Oily Skin

- Combination Skin

- Jars

- Tubes

- Pumps & Dispensers

- Droppers

- Airless Containers

- Others

- Cream-based

- Gel-based

- Lotion-based

- Oil-based

- Water-based

- Others

- SPF 15-25

- SPF 30-40

- SPF 50+

- No SPF

- Online Channels

- E-commerce Platforms

- Company Websites

- Online Pharmacies

- Others

- Offline Channels

- Supermarkets/Hypermarkets

- Pharmacies/Drugstores

- Convenience Stores

- Specialty Stores

- Others

- Organic

- Natural

- Vegan

- Cruelty-Free

- Personal Use/Home Care

- Daily Skincare Routine

- Preventive Anti-Aging

- Corrective Treatment

- Special Occasion Preparation

- Others

- Dermatology Clinics

- Medical-Grade Treatments

- Post-Procedure Care

- Professional Consultation Products

- Others

- Beauty Salons & Spas

- Facial Treatments

- Professional Anti-Aging Services

- Retail Products for Clients

- Others

- Aesthetic Medicine Centers

- Complementary Skincare

- Pre/Post Cosmetic Procedure Care

- Others

- Hospitals & Medical Centers

- Dermatology Departments

- Post-Surgical Care

- Others

- Pharmacies

- Over-the-Counter Products

- Prescription-Grade Formulations

- Others

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Anti-Aging Skincare Products for Women Market Outlook

- 2.1.1. Anti-Aging Skincare Products for Women Market Size (Volume - Million Units and Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Anti-Aging Skincare Products for Women Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 3.1.1. Consumer Goods & Services Industry Ecosystem Analysis

- 3.1.2. Key Trends for Consumer Goods & Services Industry

- 3.1.3. Regional Distribution for Consumer Goods & Services Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Increasing aging population and rising demand for age-defying skincare solutions.

- 4.1.1.2. Advancements in active ingredients such as retinoids, peptides, and hyaluronic acid.

- 4.1.1.3. Growing consumer preference for premium, science-backed and clinical-grade skincare brands.

- 4.1.2. Restraints

- 4.1.2.1. High product costs and limited affordability in price-sensitive markets.

- 4.1.2.2. Regulatory scrutiny over ingredient safety and claims slowing product launches.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Anti-Aging Skincare Products Manufacturers

- 4.4.3. Dealers/ Distributors

- 4.4.4. End-Users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Anti-Aging Skincare Products for Women Market Demand

- 4.9.1. Historical Market Size – Volume (Million Units) and Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size – Volume (Million Units) and Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Anti-Aging Skincare Products for Women Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Anti-Aging Skincare Products for Women Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Creams & Moisturizers

- 6.2.1.1. Day Creams

- 6.2.1.2. Night Creams

- 6.2.1.3. Eye Creams

- 6.2.1.4. Neck Creams

- 6.2.1.5. Others

- 6.2.2. Serums & Concentrates

- 6.2.2.1. Vitamin C Serums

- 6.2.2.2. Retinol Serums

- 6.2.2.3. Hyaluronic Acid Serums

- 6.2.2.4. Peptide Serums

- 6.2.2.5. Others

- 6.2.3. Masks & Treatments

- 6.2.3.1. Sheet Masks

- 6.2.3.2. Clay Masks

- 6.2.3.3. Peel-off Masks

- 6.2.3.4. Overnight Masks

- 6.2.3.5. Others

- 6.2.4. Cleansers & Toners

- 6.2.5. Sunscreens & UV Protection

- 6.2.6. Eye Treatment Products

- 6.2.7. Lip Care Products

- 6.2.1. Creams & Moisturizers

- 7. Global Anti-Aging Skincare Products for Women Market Analysis, by Active Ingredient

- 7.1. Key Segment Analysis

- 7.2. Anti-Aging Skincare Products for Women Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Active Ingredient, 2021-2035

- 7.2.1. Retinoids (Retinol, Retinoic Acid)

- 7.2.1.1. Peptides

- 7.2.1.2. Antioxidants

- 7.2.1.3. Vitamin C

- 7.2.1.4. Vitamin E

- 7.2.1.5. Coenzyme Q10

- 7.2.1.6. Resveratrol

- 7.2.1.7. Others

- 7.2.2. Alpha Hydroxy Acids (AHAs)

- 7.2.2.1. Glycolic Acid

- 7.2.2.2. Lactic Acid

- 7.2.2.3. Others

- 7.2.3. Beta Hydroxy Acids (BHAs)

- 7.2.4. Hyaluronic Acid

- 7.2.5. Niacinamide

- 7.2.6. Others

- 7.2.1. Retinoids (Retinol, Retinoic Acid)

- 8. Global Anti-Aging Skincare Products for Women Market Analysis, by Skin Type

- 8.1. Key Segment Analysis

- 8.2. Anti-Aging Skincare Products for Women Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Skin Type, 2021-2035

- 8.2.1. Normal Skin

- 8.2.2. Dry Skin

- 8.2.3. Oily Skin

- 8.2.4. Combination Skin

- 9. Global Anti-Aging Skincare Products for Women Market Analysis, by Packaging Type

- 9.1. Key Segment Analysis

- 9.2. Anti-Aging Skincare Products for Women Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Packaging Type, 2021-2035

- 9.2.1. Jars

- 9.2.2. Tubes

- 9.2.3. Pumps & Dispensers

- 9.2.4. Droppers

- 9.2.5. Airless Containers

- 9.2.6. Others

- 10. Global Anti-Aging Skincare Products for Women Market Analysis, by Formulation

- 10.1. Key Segment Analysis

- 10.2. Anti-Aging Skincare Products for Women Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Formulation, 2021-2035

- 10.2.1. Cream-based

- 10.2.2. Gel-based

- 10.2.3. Lotion-based

- 10.2.4. Oil-based

- 10.2.5. Water-based

- 10.2.6. Others

- 11. Global Anti-Aging Skincare Products for Women Market Analysis, by SPF Rating

- 11.1. Key Segment Analysis

- 11.2. Anti-Aging Skincare Products for Women Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by SPF Rating, 2021-2035

- 11.2.1. SPF 15-25

- 11.2.2. SPF 30-40

- 11.2.3. SPF 50+

- 11.2.4. No SPF

- 12. Global Anti-Aging Skincare Products for Women Market Analysis, by Distribution Channel

- 12.1. Key Segment Analysis

- 12.2. Anti-Aging Skincare Products for Women Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 12.2.1. Online Channels

- 12.2.1.1. E-commerce Platforms

- 12.2.1.2. Company Websites

- 12.2.1.3. Online Pharmacies

- 12.2.1.4. Others

- 12.2.2. Offline Channels

- 12.2.2.1. Supermarkets/Hypermarkets

- 12.2.2.2. Pharmacies/Drugstores

- 12.2.2.3. Convenience Stores

- 12.2.2.4. Specialty Stores

- 12.2.2.5. Others

- 12.2.1. Online Channels

- 13. Global Anti-Aging Skincare Products for Women Market Analysis, by Nature

- 13.1. Key Segment Analysis

- 13.2. Anti-Aging Skincare Products for Women Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Nature, 2021-2035

- 13.2.1. Organic

- 13.2.2. Natural

- 13.2.3. Vegan

- 13.2.4. Cruelty-Free

- 14. Global Anti-Aging Skincare Products for Women Market Analysis, by End-users

- 14.1. Key Segment Analysis

- 14.2. Anti-Aging Skincare Products for Women Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by End-users, 2021-2035

- 14.2.1. Personal Use/Home Care

- 14.2.1.1. Daily Skincare Routine

- 14.2.1.2. Preventive Anti-Aging

- 14.2.1.3. Corrective Treatment

- 14.2.1.4. Special Occasion Preparation

- 14.2.1.5. Others

- 14.2.2. Dermatology Clinics

- 14.2.2.1. Medical-Grade Treatments

- 14.2.2.2. Post-Procedure Care

- 14.2.2.3. Professional Consultation Products

- 14.2.2.4. Others

- 14.2.3. Beauty Salons & Spas

- 14.2.3.1. Facial Treatments

- 14.2.3.2. Professional Anti-Aging Services

- 14.2.3.3. Retail Products for Clients

- 14.2.3.4. Others

- 14.2.4. Aesthetic Medicine Centers

- 14.2.4.1. Complementary Skincare

- 14.2.4.2. Pre/Post Cosmetic Procedure Care

- 14.2.4.3. Others

- 14.2.5. Hospitals & Medical Centers

- 14.2.5.1. Dermatology Departments

- 14.2.5.2. Post-Surgical Care

- 14.2.5.3. Others

- 14.2.6. Pharmacies

- 14.2.6.1. Over-the-Counter Products

- 14.2.6.2. Prescription-Grade Formulations

- 14.2.6.3. Others

- 14.2.1. Personal Use/Home Care

- 15. Global Anti-Aging Skincare Products for Women Market Analysis and Forecasts, by Region

- 15.1. Key Findings

- 15.2. Anti-Aging Skincare Products for Women Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 15.2.1. North America

- 15.2.2. Europe

- 15.2.3. Asia Pacific

- 15.2.4. Middle East

- 15.2.5. Africa

- 15.2.6. South America

- 16. North America Anti-Aging Skincare Products for Women Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. North America Anti-Aging Skincare Products for Women Market Size Volume (Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Active Ingredient

- 16.3.3. Skin Type

- 16.3.4. Packaging Type

- 16.3.5. Formulation

- 16.3.6. SPF Rating

- 16.3.7. Distribution Channel

- 16.3.8. Nature

- 16.3.9. End-users

- 16.3.10. Country

- 16.3.10.1. USA

- 16.3.10.2. Canada

- 16.3.10.3. Mexico

- 16.4. USA Anti-Aging Skincare Products for Women Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Active Ingredient

- 16.4.4. Skin Type

- 16.4.5. Packaging Type

- 16.4.6. Formulation

- 16.4.7. SPF Rating

- 16.4.8. Distribution Channel

- 16.4.9. Nature

- 16.4.10. End-users

- 16.5. Canada Anti-Aging Skincare Products for Women Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Active Ingredient

- 16.5.4. Skin Type

- 16.5.5. Packaging Type

- 16.5.6. Formulation

- 16.5.7. SPF Rating

- 16.5.8. Distribution Channel

- 16.5.9. Nature

- 16.5.10. End-users

- 16.6. Mexico Anti-Aging Skincare Products for Women Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Active Ingredient

- 16.6.4. Skin Type

- 16.6.5. Packaging Type

- 16.6.6. Formulation

- 16.6.7. SPF Rating

- 16.6.8. Distribution Channel

- 16.6.9. Nature

- 16.6.10. End-users

- 17. Europe Anti-Aging Skincare Products for Women Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Europe Anti-Aging Skincare Products for Women Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Active Ingredient

- 17.3.3. Skin Type

- 17.3.4. Packaging Type

- 17.3.5. Formulation

- 17.3.6. SPF Rating

- 17.3.7. Distribution Channel

- 17.3.8. Nature

- 17.3.9. End-users

- 17.3.10. Country

- 17.3.10.1. Germany

- 17.3.10.2. United Kingdom

- 17.3.10.3. France

- 17.3.10.4. Italy

- 17.3.10.5. Spain

- 17.3.10.6. Netherlands

- 17.3.10.7. Nordic Countries

- 17.3.10.8. Poland

- 17.3.10.9. Russia & CIS

- 17.3.10.10. Rest of Europe

- 17.4. Germany Anti-Aging Skincare Products for Women Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Active Ingredient

- 17.4.4. Skin Type

- 17.4.5. Packaging Type

- 17.4.6. Formulation

- 17.4.7. SPF Rating

- 17.4.8. Distribution Channel

- 17.4.9. Nature

- 17.4.10. End-users

- 17.5. United Kingdom Anti-Aging Skincare Products for Women Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Active Ingredient

- 17.5.4. Skin Type

- 17.5.5. Packaging Type

- 17.5.6. Formulation

- 17.5.7. SPF Rating

- 17.5.8. Distribution Channel

- 17.5.9. Nature

- 17.5.10. End-users

- 17.6. France Anti-Aging Skincare Products for Women Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Active Ingredient

- 17.6.4. Skin Type

- 17.6.5. Packaging Type

- 17.6.6. Formulation

- 17.6.7. SPF Rating

- 17.6.8. Distribution Channel

- 17.6.9. Nature

- 17.6.10. End-users

- 17.7. Italy Anti-Aging Skincare Products for Women Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Active Ingredient

- 17.7.4. Skin Type

- 17.7.5. Packaging Type

- 17.7.6. Formulation

- 17.7.7. SPF Rating

- 17.7.8. Distribution Channel

- 17.7.9. Nature

- 17.7.10. End-users

- 17.8. Spain Anti-Aging Skincare Products for Women Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Active Ingredient

- 17.8.4. Skin Type

- 17.8.5. Packaging Type

- 17.8.6. Formulation

- 17.8.7. SPF Rating

- 17.8.8. Distribution Channel

- 17.8.9. Nature

- 17.8.10. End-users

- 17.9. Netherlands Anti-Aging Skincare Products for Women Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Product Type

- 17.9.3. Active Ingredient

- 17.9.4. Skin Type

- 17.9.5. Packaging Type

- 17.9.6. Formulation

- 17.9.7. SPF Rating

- 17.9.8. Distribution Channel

- 17.9.9. Nature

- 17.9.10. End-users

- 17.10. Nordic Countries Anti-Aging Skincare Products for Women Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Product Type

- 17.10.3. Active Ingredient

- 17.10.4. Skin Type

- 17.10.5. Packaging Type

- 17.10.6. Formulation

- 17.10.7. SPF Rating

- 17.10.8. Distribution Channel

- 17.10.9. Nature

- 17.10.10. End-users

- 17.11. Poland Anti-Aging Skincare Products for Women Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Product Type

- 17.11.3. Active Ingredient

- 17.11.4. Skin Type

- 17.11.5. Packaging Type

- 17.11.6. Formulation

- 17.11.7. SPF Rating

- 17.11.8. Distribution Channel

- 17.11.9. Nature

- 17.11.10. End-users

- 17.12. Russia & CIS Anti-Aging Skincare Products for Women Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Product Type

- 17.12.3. Active Ingredient

- 17.12.4. Skin Type

- 17.12.5. Packaging Type

- 17.12.6. Formulation

- 17.12.7. SPF Rating

- 17.12.8. Distribution Channel

- 17.12.9. Nature

- 17.12.10. End-users

- 17.13. Rest of Europe Anti-Aging Skincare Products for Women Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Product Type

- 17.13.3. Active Ingredient

- 17.13.4. Skin Type

- 17.13.5. Packaging Type

- 17.13.6. Formulation

- 17.13.7. SPF Rating

- 17.13.8. Distribution Channel

- 17.13.9. Nature

- 17.13.10. End-users

- 18. Asia Pacific Anti-Aging Skincare Products for Women Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Asia Pacific Anti-Aging Skincare Products for Women Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Active Ingredient

- 18.3.3. Skin Type

- 18.3.4. Packaging Type

- 18.3.5. Formulation

- 18.3.6. SPF Rating

- 18.3.7. Distribution Channel

- 18.3.8. Nature

- 18.3.9. End-users

- 18.3.10. Country

- 18.3.10.1. China

- 18.3.10.2. India

- 18.3.10.3. Japan

- 18.3.10.4. South Korea

- 18.3.10.5. Australia and New Zealand

- 18.3.10.6. Indonesia

- 18.3.10.7. Malaysia

- 18.3.10.8. Thailand

- 18.3.10.9. Vietnam

- 18.3.10.10. Rest of Asia Pacific

- 18.4. China Anti-Aging Skincare Products for Women Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Active Ingredient

- 18.4.4. Skin Type

- 18.4.5. Packaging Type

- 18.4.6. Formulation

- 18.4.7. SPF Rating

- 18.4.8. Distribution Channel

- 18.4.9. Nature

- 18.4.10. End-users

- 18.5. India Anti-Aging Skincare Products for Women Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Active Ingredient

- 18.5.4. Skin Type

- 18.5.5. Packaging Type

- 18.5.6. Formulation

- 18.5.7. SPF Rating

- 18.5.8. Distribution Channel

- 18.5.9. Nature

- 18.5.10. End-users

- 18.6. Japan Anti-Aging Skincare Products for Women Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Active Ingredient

- 18.6.4. Skin Type

- 18.6.5. Packaging Type

- 18.6.6. Formulation

- 18.6.7. SPF Rating

- 18.6.8. Distribution Channel

- 18.6.9. Nature

- 18.6.10. End-users

- 18.7. South Korea Anti-Aging Skincare Products for Women Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Active Ingredient

- 18.7.4. Skin Type

- 18.7.5. Packaging Type

- 18.7.6. Formulation

- 18.7.7. SPF Rating

- 18.7.8. Distribution Channel

- 18.7.9. Nature

- 18.7.10. End-users

- 18.8. Australia and New Zealand Anti-Aging Skincare Products for Women Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Active Ingredient

- 18.8.4. Skin Type

- 18.8.5. Packaging Type

- 18.8.6. Formulation

- 18.8.7. SPF Rating

- 18.8.8. Distribution Channel

- 18.8.9. Nature

- 18.8.10. End-users

- 18.9. Indonesia Anti-Aging Skincare Products for Women Market

- 18.9.1. Country Segmental Analysis

- 18.9.2. Product Type

- 18.9.3. Active Ingredient

- 18.9.4. Skin Type

- 18.9.5. Packaging Type

- 18.9.6. Formulation

- 18.9.7. SPF Rating

- 18.9.8. Distribution Channel

- 18.9.9. Nature

- 18.9.10. End-users

- 18.10. Malaysia Anti-Aging Skincare Products for Women Market

- 18.10.1. Country Segmental Analysis

- 18.10.2. Product Type

- 18.10.3. Active Ingredient

- 18.10.4. Skin Type

- 18.10.5. Packaging Type

- 18.10.6. Formulation

- 18.10.7. SPF Rating

- 18.10.8. Distribution Channel

- 18.10.9. Nature

- 18.10.10. End-users

- 18.11. Thailand Anti-Aging Skincare Products for Women Market

- 18.11.1. Country Segmental Analysis

- 18.11.2. Product Type

- 18.11.3. Active Ingredient

- 18.11.4. Skin Type

- 18.11.5. Packaging Type

- 18.11.6. Formulation

- 18.11.7. SPF Rating

- 18.11.8. Distribution Channel

- 18.11.9. Nature

- 18.11.10. End-users

- 18.12. Vietnam Anti-Aging Skincare Products for Women Market

- 18.12.1. Country Segmental Analysis

- 18.12.2. Product Type

- 18.12.3. Active Ingredient

- 18.12.4. Skin Type

- 18.12.5. Packaging Type

- 18.12.6. Formulation

- 18.12.7. SPF Rating

- 18.12.8. Distribution Channel

- 18.12.9. Nature

- 18.12.10. End-users

- 18.13. Rest of Asia Pacific Anti-Aging Skincare Products for Women Market

- 18.13.1. Country Segmental Analysis

- 18.13.2. Product Type

- 18.13.3. Active Ingredient

- 18.13.4. Skin Type

- 18.13.5. Packaging Type

- 18.13.6. Formulation

- 18.13.7. SPF Rating

- 18.13.8. Distribution Channel

- 18.13.9. Nature

- 18.13.10. End-users

- 19. Middle East Anti-Aging Skincare Products for Women Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Middle East Anti-Aging Skincare Products for Women Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Active Ingredient

- 19.3.3. Skin Type

- 19.3.4. Packaging Type

- 19.3.5. Formulation

- 19.3.6. SPF Rating

- 19.3.7. Distribution Channel

- 19.3.8. Nature

- 19.3.9. End-users

- 19.3.10. Country

- 19.3.10.1. Turkey

- 19.3.10.2. UAE

- 19.3.10.3. Saudi Arabia

- 19.3.10.4. Israel

- 19.3.10.5. Rest of Middle East

- 19.4. Turkey Anti-Aging Skincare Products for Women Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Active Ingredient

- 19.4.4. Skin Type

- 19.4.5. Packaging Type

- 19.4.6. Formulation

- 19.4.7. SPF Rating

- 19.4.8. Distribution Channel

- 19.4.9. Nature

- 19.4.10. End-users

- 19.5. UAE Anti-Aging Skincare Products for Women Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Active Ingredient

- 19.5.4. Skin Type

- 19.5.5. Packaging Type

- 19.5.6. Formulation

- 19.5.7. SPF Rating

- 19.5.8. Distribution Channel

- 19.5.9. Nature

- 19.5.10. End-users

- 19.6. Saudi Arabia Anti-Aging Skincare Products for Women Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Active Ingredient

- 19.6.4. Skin Type

- 19.6.5. Packaging Type

- 19.6.6. Formulation

- 19.6.7. SPF Rating

- 19.6.8. Distribution Channel

- 19.6.9. Nature

- 19.6.10. End-users

- 19.7. Israel Anti-Aging Skincare Products for Women Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Product Type

- 19.7.3. Active Ingredient

- 19.7.4. Skin Type

- 19.7.5. Packaging Type

- 19.7.6. Formulation

- 19.7.7. SPF Rating

- 19.7.8. Distribution Channel

- 19.7.9. Nature

- 19.7.10. End-users

- 19.8. Rest of Middle East Anti-Aging Skincare Products for Women Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Product Type

- 19.8.3. Active Ingredient

- 19.8.4. Skin Type

- 19.8.5. Packaging Type

- 19.8.6. Formulation

- 19.8.7. SPF Rating

- 19.8.8. Distribution Channel

- 19.8.9. Nature

- 19.8.10. End-users

- 20. Africa Anti-Aging Skincare Products for Women Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Africa Anti-Aging Skincare Products for Women Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Product Type

- 20.3.2. Active Ingredient

- 20.3.3. Skin Type

- 20.3.4. Packaging Type

- 20.3.5. Formulation

- 20.3.6. SPF Rating

- 20.3.7. Distribution Channel

- 20.3.8. Nature

- 20.3.9. End-users

- 20.3.10. Country

- 20.3.10.1. South Africa

- 20.3.10.2. Egypt

- 20.3.10.3. Nigeria

- 20.3.10.4. Algeria

- 20.3.10.5. Rest of Africa

- 20.4. South Africa Anti-Aging Skincare Products for Women Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Product Type

- 20.4.3. Active Ingredient

- 20.4.4. Skin Type

- 20.4.5. Packaging Type

- 20.4.6. Formulation

- 20.4.7. SPF Rating

- 20.4.8. Distribution Channel

- 20.4.9. Nature

- 20.4.10. End-users

- 20.5. Egypt Anti-Aging Skincare Products for Women Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Product Type

- 20.5.3. Active Ingredient

- 20.5.4. Skin Type

- 20.5.5. Packaging Type

- 20.5.6. Formulation

- 20.5.7. SPF Rating

- 20.5.8. Distribution Channel

- 20.5.9. Nature

- 20.5.10. End-users

- 20.6. Nigeria Anti-Aging Skincare Products for Women Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Product Type

- 20.6.3. Active Ingredient

- 20.6.4. Skin Type

- 20.6.5. Packaging Type

- 20.6.6. Formulation

- 20.6.7. SPF Rating

- 20.6.8. Distribution Channel

- 20.6.9. Nature

- 20.6.10. End-users

- 20.7. Algeria Anti-Aging Skincare Products for Women Market

- 20.7.1. Country Segmental Analysis

- 20.7.2. Product Type

- 20.7.3. Active Ingredient

- 20.7.4. Skin Type

- 20.7.5. Packaging Type

- 20.7.6. Formulation

- 20.7.7. SPF Rating

- 20.7.8. Distribution Channel

- 20.7.9. Nature

- 20.7.10. End-users

- 20.8. Rest of Africa Anti-Aging Skincare Products for Women Market

- 20.8.1. Country Segmental Analysis

- 20.8.2. Product Type

- 20.8.3. Active Ingredient

- 20.8.4. Skin Type

- 20.8.5. Packaging Type

- 20.8.6. Formulation

- 20.8.7. SPF Rating

- 20.8.8. Distribution Channel

- 20.8.9. Nature

- 20.8.10. End-users

- 21. South America Anti-Aging Skincare Products for Women Market Analysis

- 21.1. Key Segment Analysis

- 21.2. Regional Snapshot

- 21.3. South America Anti-Aging Skincare Products for Women Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 21.3.1. Product Type

- 21.3.2. Active Ingredient

- 21.3.3. Skin Type

- 21.3.4. Packaging Type

- 21.3.5. Formulation

- 21.3.6. SPF Rating

- 21.3.7. Distribution Channel

- 21.3.8. Nature

- 21.3.9. End-users

- 21.3.10. Country

- 21.3.10.1. Brazil

- 21.3.10.2. Argentina

- 21.3.10.3. Rest of South America

- 21.4. Brazil Anti-Aging Skincare Products for Women Market

- 21.4.1. Country Segmental Analysis

- 21.4.2. Product Type

- 21.4.3. Active Ingredient

- 21.4.4. Skin Type

- 21.4.5. Packaging Type

- 21.4.6. Formulation

- 21.4.7. SPF Rating

- 21.4.8. Distribution Channel

- 21.4.9. Nature

- 21.4.10. End-users

- 21.5. Argentina Anti-Aging Skincare Products for Women Market

- 21.5.1. Country Segmental Analysis

- 21.5.2. Product Type

- 21.5.3. Active Ingredient

- 21.5.4. Skin Type

- 21.5.5. Packaging Type

- 21.5.6. Formulation

- 21.5.7. SPF Rating

- 21.5.8. Distribution Channel

- 21.5.9. Nature

- 21.5.10. End-users

- 21.6. Rest of South America Anti-Aging Skincare Products for Women Market

- 21.6.1. Country Segmental Analysis

- 21.6.2. Product Type

- 21.6.3. Active Ingredient

- 21.6.4. Skin Type

- 21.6.5. Packaging Type

- 21.6.6. Formulation

- 21.6.7. SPF Rating

- 21.6.8. Distribution Channel

- 21.6.9. Nature

- 21.6.10. End-users

- 22. Key Players/ Company Profile

- 22.1. Amorepacific Corporation

- 22.1.1. Company Details/ Overview

- 22.1.2. Company Financials

- 22.1.3. Key Customers and Competitors

- 22.1.4. Business/ Industry Portfolio

- 22.1.5. Product Portfolio/ Specification Details

- 22.1.6. Pricing Data

- 22.1.7. Strategic Overview

- 22.1.8. Recent Developments

- 22.2. Avon Products Inc.

- 22.3. Beiersdorf AG

- 22.4. Chanel S.A.

- 22.5. Christian Dior SE

- 22.6. Clarins Group

- 22.7. Colgate-Palmolive Company

- 22.8. Coty Inc.

- 22.9. Estée Lauder Companies Inc.

- 22.10. Johnson & Johnson

- 22.11. Kao Corporation

- 22.12. L'Oréal S.A.

- 22.13. LVMH Moët Hennessy Louis Vuitton

- 22.14. Mary Kay Inc.

- 22.15. Natura &Co

- 22.16. Procter & Gamble Company

- 22.17. Revlon Inc.

- 22.18. Shiseido Company Limited

- 22.19. The Honest Company

- 22.20. Unilever PLC

- 22.21. Other Key Players

- 22.1. Amorepacific Corporation

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Anti-Aging Skincare Products for Women Market by Product Type, Active Ingredient, Skin Type, Packaging Type, Formulation, SPF Rating, Distribution Channel, Nature, End-users, and Geography

Insightified

Mid-to-large firms spend $20K–$40K quarterly on systematic research and typically recover multiples through improved growth and profitability

Research is no longer optional. Leading firms use it to uncover $10M+ in hidden revenue opportunities annually

Our research-consulting programs yields measurable ROI: 20–30% revenue increases from new markets, 11% profit upticks from pricing, and 20–30% cost savings from operations

Anti-Aging Skincare Products for Women Market Size, Share & Trends Analysis Report by Product Type (Creams & Moisturizers, Serums & Concentrates, Masks & Treatments, Cleansers & Toners, Sunscreens & UV Protection, Eye Treatment Products, Lip Care Products), Active Ingredient, Skin Type, Packaging Type, Formulation, SPF Rating, Distribution Channel, Nature, End-users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Anti-Aging Skincare Products for Women Market Size, Share, and Growth

The global anti-aging skincare products for women market is experiencing robust growth, with its estimated value of USD 36.2 billion in the year 2025 and USD 71.9 billion by the period 2035, registering a CAGR of 7.1%, during the forecast period. The global anti-aging skincare products for women market continues to be influenced by the increasing consumer interests in the health, wellness and customized beauty products. Women are becoming more and more concerned about the products which have visible anti-aging effects, skin safety and overall skin health. Brands are developing high-quality, effective and safe anti-aging solutions due to growing awareness of ingredient transparency and preference towards natural or clean formulations and environmental responsibility and sustainability.

Vincent Warnery, CEO of Beiersdorf, said,

"It is truly life-changing what we have already achieved with our pioneering epigenetic research: Eucerin Hyaluron-Filler Epigenetic Serum – a single product that fights a whole ten signs of skin aging at once and makes people look up to five years younger. We are turning back time!” He added: “With our Eucerin Hyaluron-Filler Epigenetic Serum we are revolutionizing skin care – not for the first and certainly not for the last time in our Beiersdorf history."

There is strong demand in the anti-aging skincare for women market which is growing at a healthy pace due to the demand of wellness based, sustainable and personalized solutions by the consumer. Females are more likely to pursue products that are in line with their values, whereby ingredient transparency, ethically sourced, and clinically proven to be effective are more desired as there is a move in general to make informed health-conscious decisions, extending from core treatments to daily routines such as facial cleansers for women. For instance, a clean, plant-based, anti-aging serum that uses stem-cell extract instead of classic retinol is KORA Organic Plant Stem-Cell Retinol Alternative Serum that satisfies consumer needs by offering skincare that is safer, more affordable, and effective.

The major brands are reacting and redefining their portfolios to eliminate disputable ingredients, switch to sustainable packaging, and use digital platforms to support original consumer interactions. A lot are incorporating clean beauty values, acquiring the appropriate qualifications, and providing content that appeals to value-conscious customers.

The next opportunities are customized beauty technology, subscriptions, telehealth setup, and diversification into other wellness categories. These opportunities enable firms to diversify income streams, increase lifetime customer value and create holistic ecosystems that touch on various dimensions of health, beauty and lifestyle choices of women as firms continue to face the challenge of competitive positioning in a highly dynamic market.

Anti-Aging Skincare Products for Women Market Dynamics and Trends

Driver: Aging Population and Growing Middle-Class Demographics

Restraint: Regulatory Complexity and Clinical Efficacy Requirements

Opportunity: Expansion of Men's Anti-Aging Segment

Key Trend: Integration of Biotechnology and Peptide-Based Formulations

Anti-Aging-Skincare-Products-for-Women-Market Analysis and Segmental Data

Creams & Moisturizers Dominate Global Anti-Aging Skincare Products for Women Market

North America Leads Global Anti-Aging Skincare Products for Women Market Demand

Anti-Aging-Skincare-Products-for-Women-Market Ecosystem

The global anti-aging skincare products for women market is moderately consolidated, with the multinationals and conglomerate, niche, and direct-to-consumer companies interacting in different sectors and at different degrees of pricing. The major competitors like L Oréal S A, Estee Lauder Companies Inc, Procter and Gamble Company, Unilever PLC and Shiseido Company Limited use scale, R and D, and large distribution networks to capture mass market segments whereas specialty brands are differentiated by premium positioning, authenticity and consumer targeting.

Ingredient suppliers, formulation developers, contract manufacturers, packaging providers, distribution partners, retail channels and marketing agencies are all availed as part of the market value chain and provide the comprehensive answers to satisfy the various consumer demands. Major firms are progressively investing in vertical integration, direct-to-consumer, and digital marketing to become more competitive, maximize profit margins, and promote personalization by developing innovation based on data.

Recent Development and Strategic Overview:

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 36.2 Bn |

|

Market Forecast Value in 2035 |

USD 71.1 Bn |

|

Growth Rate (CAGR) |

7.1% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Million Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

|

Anti-Aging-Skincare-Products-for-Women-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Anti-Aging Skincare Products for Women Market, By Product Type |

|

|

Anti-Aging Skincare Products for Women Market, By Active Ingredient |

|

|

Anti-Aging Skincare Products for Women Market, By Skin Type |

|

|

Anti-Aging Skincare Products for Women Market, By Packaging Type |

|

|

Anti-Aging Skincare Products for Women Market, By Formulation |

|

|

Anti-Aging Skincare Products for Women Market, By SPF Rating |

|

|

Anti-Aging Skincare Products for Women Market, By Distribution Channel |

|

|

Anti-Aging Skincare Products for Women Market, By Nature |

|

|

Anti-Aging Skincare Products for Women Market, By End-users |

|

Frequently Asked Questions

Table of Contents

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

Forecasting Models / Techniques

Multiple Regression Analysis

Time Series Analysis – Seasonal Patterns

Time Series Analysis – Trend Analysis

Expert Opinion – Expert Interviews

Multi-Scenario Development

Time Series Analysis – Moving Averages

Econometric Models

Expert Opinion – Delphi Method

Monte Carlo Simulation

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation