- The global smart ring market is valued at USD 0.5 billion in 2025.

- The market is projected to grow at a CAGR of 29.1% during the forecast period of 2026 to 2035.

- The advanced smart rings segment holds major share ~62% in the global smart ring market, due to multifunctional features, health tracking, sleek design, and seamless smartphone integration.

- The smart ring market growing due to increasing use of sensors for heart rate, sleep, SpO₂, and activity tracking.

- The smart ring market is driven by rising demand for advanced biometric sensors and AI-driven insights.

- The top five players accounting for over 45% of the global smart-ring-market share in 2025.

- In August 2025, Ultrahuman launched the Ring AIR – Cycle & Ovulation Pro, featuring temperature‑based women’s health tracking and enhanced wellness algorithms.

- In May 2024, Zepp Health launched the titanium Amazfit Helio Ring in the U.S., featuring recovery tracking and smartwatch integration.

- Global Smart Ring market is likely to create the total forecasting opportunity of ~USD 6 Bn till 2035.

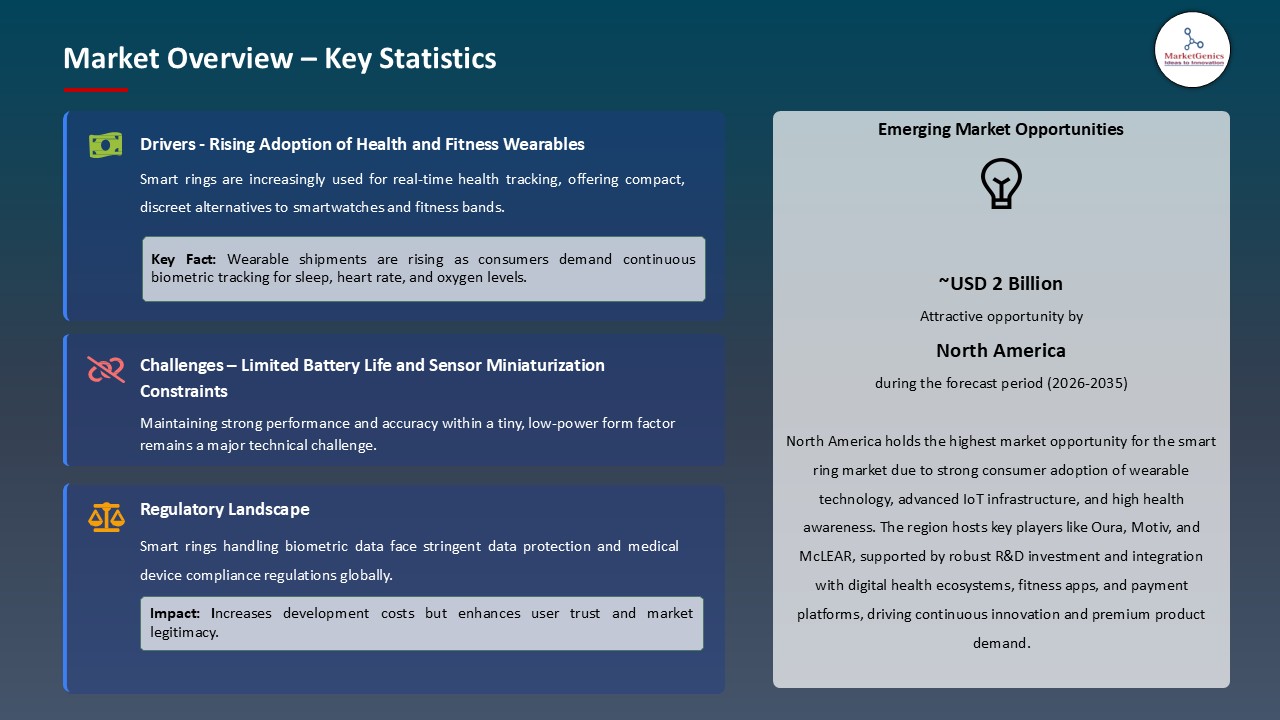

- North America is most attractive region due to high wearable adoption, strong tech infrastructure, rising health awareness, and significant disposable income.

- The smart rings market is driven by the transition to preventive care as it will be possible to monitor physiological parameters constantly. This aids in early intervention, lifestyle change, and longitudinal data could better help clinicians in making their diagnoses and preventing chronic disease. For instance, in March 2024, Amazfit Helio Ring was introduced as a sub-4g titanium smart ring, which offers heart rate, SpO 2, stress, and sleep health features to support proactive athlete recovery.

- Moreover, corporate wellness programs are starting to offer smart rings to their staff to help manage the population health, intervene risk in time, and promote healthy behaviors. Major corporations, such as Amazon and Google, have been experimenting with such programs, creating opportunities of bulk purchase and facilitating the wider uptake of smart rings.

- Smart rings integration with clinical validation, provider endorsement, employer programs, and insurance recognition creates a demand for preventive health measures that surpasses that of traditional consumer electronics, making them a long-term part of the health infrastructure rather than an optional technology.

- The smart rings market is limited by the absence of displays, small size of user interface elements, and slight battery capacity, which restrict sensors performance and connectivity. As a result, smart rings cannot be as functional as smartwatches, and manufacturers need to consider a specific usage scenario and focus rings as accessories instead of independent gadgets.

- For instance, smart rings do not support notifications, navigation, interpersonal communication with apps, and data, and are purely dependent on companion smartphone applications, making them inconvenient in comparison to self-sufficient wrist-worn devices.

- Moreover, the problem of ring sizing introduces inventory control issues and heightens the risk of returns because customers have to choose the right sizes, and variations in the size of the fingers can influence the fit and the accuracy of the sensor. Although the latter can offer sizing kits or flexible return policies, this is still a significant drawback as opposed to adjustable wrist-worn devices.

- Smart rings are limited in functionality and size, making them only suitable for niche users seeking discrete wearability and sleep tracking. Widespread adoption is unlikely until technological advancements improve ring capabilities.

- The smart ring market has a high growth opportunity because medical devices regulations allow its usage clinically, reimbursement through insurance, and combination with healthcare monitoring systems to manage chronic diseases, post-operative recovery, and clinical trials. The regulatory classification maximizes the credibility, pricing power as well as access to healthcare budgets much above consumer electronics markets.

- For instance, in 2024, Happy Health Happy Ring received the FDA clearance as a clinical-grade smart ring and integrated digital health platform. FDA approval makes smart rings viable medical equipment, growing market acceptance, allowing reimbursement, and prompting assimilation into clinical and healthcare networks.

- Moreover, smart rings have benefits in nocturnal monitoring, which classifies sleep stages accurately and measures the amount of oxygen saturation at night. This facilitates the detection of sleep disorders and combination with clinical or home sleep testing which may lead to the minimization of the use of expensive polysomnography.

- Positioning smart rings as medical equipment allows for healthcare payments, provider networks, and recurring revenue, while avoiding hardware sales and consumer electronics pricing pressure.

- The smart ring market is developing strategically with fashion partnerships, metals, and custom designs based on wearable technology, aligning with the tastes of the consumers. The design must be as fine jewelry in order to provide sustained wearability to ensure the devices are desirable in all contexts throughout the day to monitor their health.

- For instance, in 2025, Jewelex, a luxury jewelry manufacturer, collaborated with Ultrahuman to develop the Rare collection, integrating high-end artisanal craftsmanship with advanced wearable health technology. The luxury partnerships will add value to smart rings and promote their usability among fashionable customers and their wearability sustainability in efficient health-monitoring.

- Moreover, manufacturers have introduced smart rings in titanium, gold-plated and rose gold with customizable widths, engravings and interchangeable sleeves making it possible to turn health monitors into personal style statements and encourage constant wear to enable continuous health monitoring.

- Smart rings are becoming more of a lifestyle accessory, with a focus on design, premium materials, and brand value. This allows for sustainable distinction and high-end pricing by adding aesthetic value to technical functionality.

- The advanced smart rings segment leads the global smart ring market with its combination of clinical-grade sensors and multifunctional health monitoring: heart rate, SpO2, sleep, and activity measurements, fitting the upsurge in consumer preference of proactive wellness solutions. For instance, in 2025, a smart ring with a health-focus was introduced with an improved level of biometric tracking training recovery (heart rate, SpO 2, sleep tracking).

- Additionally, the usage of high-quality materials, reduced size, and extended battery duration improves comfort, wearability, and constant tracking promoting preference toward high-end smart ring models to the low-end one. For instance, in 2025, Oura released a line of smart rings in ceramic finish with wireless charging support of up to five full charges.

- Longer battery life and advanced sensor integration improve user experience and health tracking, leading to increased adoption of smart rings and market leadership in multipurpose wellness products.

- North America holds a dominant position in the global smart ring market owing to high health awareness among consumers, strong wearable technology adoption, high-income populations who can afford to spend on high quality health-monitoring rings, high level of health awareness in the advanced healthcare system, and existence of major innovators in the smart ring like Oura Health, Movano Health, and RingConn.

- For instance, Oura Health, based in North America, has continued to introduce high-tech smart rings with high-grade sensors and sleek design, which has propelled mass adoption by health-conscious consumers and enable the region to emerge as a leading global market of wearable health technology.

- The region benefits from supportive regulatory frameworks, such as FDA regulations of digital health devices, strong intellectual property environments to invest in innovation, and healthcare payment models that are slowly being modified to treat smart rings as medically reimbursable devices in certain clinical use cases.

- North America is the world's largest market for smart rings due to its high-income, health-conscious customers, innovative leadership, favorable regulations, and preventive, data-oriented healthcare system.

- In August 2025, Ultrahuman and viO Health Tech collaborate to introduced the Ring -AIR -Cycle & -Ovulation Pro. The update will include the high-tech tracking women health based on temperature biomarkers and sophisticated algorithms, enhancing the overall ability of the gadget in wellness.

- In May 2024, Zepp Health Corporation released the Amazfit Helio Ring in the US that is made of titanium alloy, offering a sport-centric smart ring, which can be easily paired with other Amazfit smartwatches via the Zepp app, improving the capabilities of the latter in tracking fitness and health overall.

- United States

- Canada

- Mexico

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic Countries

- Poland

- Russia & CIS

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Turkey

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Nigeria

- Algeria

- Brazil

- Argentina

- Amazfit

- Blinq

- Boat Lifestyle

- Circular Ring

- Jakcom Technology

- Kerv Wearables

- McLear Ltd

- Moodmetric

- Motiv Inc.

- Neyya

- NFC Ring

- Nimb

- Noise

- Oura Health

- Ringly

- Samsung Electronics

- Smarty Ring

- Talon

- Token Ring

- Ultrahuman Ring

- Xenxo

- Other Key Players

- Basic Smart Rings

- Advanced Smart Rings

- Luxury Smart Rings

- Medical-Grade Smart Rings

- NFC (Near Field Communication)

- RFID (Radio Frequency Identification)

- Bluetooth

- Multi-technology Integration

- iOS Compatible

- Android Compatible

- Windows Compatible

- Cross-Platform Compatible

- Rechargeable Battery

- Non-Rechargeable Battery

- Solar Powered

- Kinetic Energy Powered

- Others

- Healthcare & Medical

- Patient Health Monitoring

- Chronic Disease Management

- Medication Adherence Tracking

- Hospital Access Control

- Medical Data Collection

- Others

- Fitness & Wellness

- Personal Fitness Tracking

- Sleep Quality Analysis

- Workout Performance Monitoring

- Stress & Recovery Monitoring

- Athlete Performance Optimization

- Others

- Retail & E-commerce

- Contactless Payment

- Customer Loyalty Programs

- In-Store Navigation

- Personalized Shopping Experience

- Quick Checkout

- Others

- Banking & Finance

- Mobile Banking Authentication

- Contactless Transactions

- Digital Wallet Integration

- Secure Payment Processing

- Account Access Control

- Others

- Corporate & Enterprise

- Smart Home & IoT

- Home Access Control

- Smart Home Device Control

- Home Security Integration

- Automation Triggers

- Others

- Transportation & Logistics

- Hospitality & Tourism

- Sports & Entertainment

- Event Access Control

- Venue Payment Systems

- Fan Engagement

- Performance Tracking (Athletes)

- Others

- Personal & Lifestyle

- Government & Defense

- Other End-users

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Smart Ring Market Outlook

- 2.1.1. Smart Ring Market Size (Volume - Million Units and Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Smart Ring Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 3.1.1. Consumer Goods & Services Industry Ecosystem Analysis

- 3.1.2. Key Trends for Consumer Goods & Services Industry

- 3.1.3. Regional Distribution for Consumer Goods & Services Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for continuous health and biometric monitoring (sleep, HR, SpO₂, activity)

- 4.1.1.2. Advances in miniaturized sensors, low-power chips and materials enabling comfortable ring form-factors

- 4.1.1.3. Growing consumer preference for discreet, fashion-friendly wearables and strong smartphone/IoT integration

- 4.1.2. Restraints

- 4.1.2.1. Limited battery capacity and charging constraints due to extremely small form factor

- 4.1.2.2. Data privacy/security concerns and regulatory scrutiny over sensitive biometric data

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Component Suppliers

- 4.4.2. Smart Ring Manufacturers

- 4.4.3. Dealers/ Distributors

- 4.4.4. End-Users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Smart Ring Market Demand

- 4.9.1. Historical Market Size – Volume (Million Units) and Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size – Volume (Million Units) and Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Smart Ring Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Smart Ring Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Basic Smart Rings

- 6.2.2. Advanced Smart Rings

- 6.2.3. Luxury Smart Rings

- 6.2.4. Medical-Grade Smart Rings

- 7. Global Smart Ring Market Analysis, by Technology

- 7.1. Key Segment Analysis

- 7.2. Smart Ring Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Technology, 2021-2035

- 7.2.1. NFC (Near Field Communication)

- 7.2.2. RFID (Radio Frequency Identification)

- 7.2.3. Bluetooth

- 7.2.4. Multi-technology Integration

- 8. Global Smart Ring Market Analysis, by Operating System Compatibility

- 8.1. Key Segment Analysis

- 8.2. Smart Ring Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Operating System Compatibility, 2021-2035

- 8.2.1. iOS Compatible

- 8.2.2. Android Compatible

- 8.2.3. Windows Compatible

- 8.2.4. Cross-Platform Compatible

- 9. Global Smart Ring Market Analysis, by Battery Type

- 9.1. Key Segment Analysis

- 9.2. Smart Ring Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Battery Type, 2021-2035

- 9.2.1. Rechargeable Battery

- 9.2.2. Non-Rechargeable Battery

- 9.2.3. Solar Powered

- 9.2.4. Kinetic Energy Powered

- 9.2.5. Others

- 10. Global Smart Ring Market Analysis, by End-Users

- 10.1. Key Segment Analysis

- 10.2. Smart Ring Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by End-Users, 2021-2035

- 10.2.1. Healthcare & Medical

- 10.2.1.1. Patient Health Monitoring

- 10.2.1.2. Chronic Disease Management

- 10.2.1.3. Medication Adherence Tracking

- 10.2.1.4. Hospital Access Control

- 10.2.1.5. Medical Data Collection

- 10.2.1.6. Others

- 10.2.2. Fitness & Wellness

- 10.2.2.1. Personal Fitness Tracking

- 10.2.2.2. Sleep Quality Analysis

- 10.2.2.3. Workout Performance Monitoring

- 10.2.2.4. Stress & Recovery Monitoring

- 10.2.2.5. Athlete Performance Optimization

- 10.2.2.6. Others

- 10.2.3. Retail & E-commerce

- 10.2.3.1. Contactless Payment

- 10.2.3.2. Customer Loyalty Programs

- 10.2.3.3. In-Store Navigation

- 10.2.3.4. Personalized Shopping Experience

- 10.2.3.5. Quick Checkout

- 10.2.3.6. Others

- 10.2.4. Banking & Finance

- 10.2.4.1. Mobile Banking Authentication

- 10.2.4.2. Contactless Transactions

- 10.2.4.3. Digital Wallet Integration

- 10.2.4.4. Secure Payment Processing

- 10.2.4.5. Account Access Control

- 10.2.4.6. Others

- 10.2.5. Corporate & Enterprise

- 10.2.6. Smart Home & IoT

- 10.2.6.1. Home Access Control

- 10.2.6.2. Smart Home Device Control

- 10.2.6.3. Home Security Integration

- 10.2.6.4. Automation Triggers

- 10.2.6.5. Others

- 10.2.7. Transportation & Logistics

- 10.2.8. Hospitality & Tourism

- 10.2.9. Sports & Entertainment

- 10.2.9.1. Event Access Control

- 10.2.9.2. Venue Payment Systems

- 10.2.9.3. Fan Engagement

- 10.2.9.4. Performance Tracking (Athletes)

- 10.2.9.5. Others

- 10.2.10. Personal & Lifestyle

- 10.2.11. Government & Defense

- 10.2.12. Other End-users

- 10.2.1. Healthcare & Medical

- 11. Global Smart Ring Market Analysis and Forecasts, by Region

- 11.1. Key Findings

- 11.2. Smart Ring Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 11.2.1. North America

- 11.2.2. Europe

- 11.2.3. Asia Pacific

- 11.2.4. Middle East

- 11.2.5. Africa

- 11.2.6. South America

- 12. North America Smart Ring Market Analysis

- 12.1. Key Segment Analysis

- 12.2. Regional Snapshot

- 12.3. North America Smart Ring Market Size Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 12.3.1. Product Type

- 12.3.2. Technology

- 12.3.3. Operating System Compatibility

- 12.3.4. Battery Type

- 12.3.5. End-Users

- 12.3.6. Country

- 12.3.6.1. USA

- 12.3.6.2. Canada

- 12.3.6.3. Mexico

- 12.4. USA Smart Ring Market

- 12.4.1. Country Segmental Analysis

- 12.4.2. Product Type

- 12.4.3. Technology

- 12.4.4. Operating System Compatibility

- 12.4.5. Battery Type

- 12.4.6. End-Users

- 12.5. Canada Smart Ring Market

- 12.5.1. Country Segmental Analysis

- 12.5.2. Product Type

- 12.5.3. Technology

- 12.5.4. Operating System Compatibility

- 12.5.5. Battery Type

- 12.5.6. End-Users

- 12.6. Mexico Smart Ring Market

- 12.6.1. Country Segmental Analysis

- 12.6.2. Product Type

- 12.6.3. Technology

- 12.6.4. Operating System Compatibility

- 12.6.5. Battery Type

- 12.6.6. End-Users

- 13. Europe Smart Ring Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. Europe Smart Ring Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 13.3.1. Product Type

- 13.3.2. Technology

- 13.3.3. Operating System Compatibility

- 13.3.4. Battery Type

- 13.3.5. End-Users

- 13.3.6. Country

- 13.3.6.1. Germany

- 13.3.6.2. United Kingdom

- 13.3.6.3. France

- 13.3.6.4. Italy

- 13.3.6.5. Spain

- 13.3.6.6. Netherlands

- 13.3.6.7. Nordic Countries

- 13.3.6.8. Poland

- 13.3.6.9. Russia & CIS

- 13.3.6.10. Rest of Europe

- 13.4. Germany Smart Ring Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Product Type

- 13.4.3. Technology

- 13.4.4. Operating System Compatibility

- 13.4.5. Battery Type

- 13.4.6. End-Users

- 13.5. United Kingdom Smart Ring Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Product Type

- 13.5.3. Technology

- 13.5.4. Operating System Compatibility

- 13.5.5. Battery Type

- 13.5.6. End-Users

- 13.6. France Smart Ring Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Product Type

- 13.6.3. Technology

- 13.6.4. Operating System Compatibility

- 13.6.5. Battery Type

- 13.6.6. End-Users

- 13.7. Italy Smart Ring Market

- 13.7.1. Country Segmental Analysis

- 13.7.2. Product Type

- 13.7.3. Technology

- 13.7.4. Operating System Compatibility

- 13.7.5. Battery Type

- 13.7.6. End-Users

- 13.8. Spain Smart Ring Market

- 13.8.1. Country Segmental Analysis

- 13.8.2. Product Type

- 13.8.3. Technology

- 13.8.4. Operating System Compatibility

- 13.8.5. Battery Type

- 13.8.6. End-Users

- 13.9. Netherlands Smart Ring Market

- 13.9.1. Country Segmental Analysis

- 13.9.2. Product Type

- 13.9.3. Technology

- 13.9.4. Operating System Compatibility

- 13.9.5. Battery Type

- 13.9.6. End-Users

- 13.10. Nordic Countries Smart Ring Market

- 13.10.1. Country Segmental Analysis

- 13.10.2. Product Type

- 13.10.3. Technology

- 13.10.4. Operating System Compatibility

- 13.10.5. Battery Type

- 13.10.6. End-Users

- 13.11. Poland Smart Ring Market

- 13.11.1. Country Segmental Analysis

- 13.11.2. Product Type

- 13.11.3. Technology

- 13.11.4. Operating System Compatibility

- 13.11.5. Battery Type

- 13.11.6. End-Users

- 13.12. Russia & CIS Smart Ring Market

- 13.12.1. Country Segmental Analysis

- 13.12.2. Product Type

- 13.12.3. Technology

- 13.12.4. Operating System Compatibility

- 13.12.5. Battery Type

- 13.12.6. End-Users

- 13.13. Rest of Europe Smart Ring Market

- 13.13.1. Country Segmental Analysis

- 13.13.2. Product Type

- 13.13.3. Technology

- 13.13.4. Operating System Compatibility

- 13.13.5. Battery Type

- 13.13.6. End-Users

- 14. Asia Pacific Smart Ring Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. Asia Pacific Smart Ring Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Product Type

- 14.3.2. Technology

- 14.3.3. Operating System Compatibility

- 14.3.4. Battery Type

- 14.3.5. End-Users

- 14.3.6. Country

- 14.3.6.1. China

- 14.3.6.2. India

- 14.3.6.3. Japan

- 14.3.6.4. South Korea

- 14.3.6.5. Australia and New Zealand

- 14.3.6.6. Indonesia

- 14.3.6.7. Malaysia

- 14.3.6.8. Thailand

- 14.3.6.9. Vietnam

- 14.3.6.10. Rest of Asia Pacific

- 14.4. China Smart Ring Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Product Type

- 14.4.3. Technology

- 14.4.4. Operating System Compatibility

- 14.4.5. Battery Type

- 14.4.6. End-Users

- 14.5. India Smart Ring Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Product Type

- 14.5.3. Technology

- 14.5.4. Operating System Compatibility

- 14.5.5. Battery Type

- 14.5.6. End-Users

- 14.6. Japan Smart Ring Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Product Type

- 14.6.3. Technology

- 14.6.4. Operating System Compatibility

- 14.6.5. Battery Type

- 14.6.6. End-Users

- 14.7. South Korea Smart Ring Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Product Type

- 14.7.3. Technology

- 14.7.4. Operating System Compatibility

- 14.7.5. Battery Type

- 14.7.6. End-Users

- 14.8. Australia and New Zealand Smart Ring Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Product Type

- 14.8.3. Technology

- 14.8.4. Operating System Compatibility

- 14.8.5. Battery Type

- 14.8.6. End-Users

- 14.9. Indonesia Smart Ring Market

- 14.9.1. Country Segmental Analysis

- 14.9.2. Product Type

- 14.9.3. Technology

- 14.9.4. Operating System Compatibility

- 14.9.5. Battery Type

- 14.9.6. End-Users

- 14.10. Malaysia Smart Ring Market

- 14.10.1. Country Segmental Analysis

- 14.10.2. Product Type

- 14.10.3. Technology

- 14.10.4. Operating System Compatibility

- 14.10.5. Battery Type

- 14.10.6. End-Users

- 14.11. Thailand Smart Ring Market

- 14.11.1. Country Segmental Analysis

- 14.11.2. Product Type

- 14.11.3. Technology

- 14.11.4. Operating System Compatibility

- 14.11.5. Battery Type

- 14.11.6. End-Users

- 14.12. Vietnam Smart Ring Market

- 14.12.1. Country Segmental Analysis

- 14.12.2. Product Type

- 14.12.3. Technology

- 14.12.4. Operating System Compatibility

- 14.12.5. Battery Type

- 14.12.6. End-Users

- 14.13. Rest of Asia Pacific Smart Ring Market

- 14.13.1. Country Segmental Analysis

- 14.13.2. Product Type

- 14.13.3. Technology

- 14.13.4. Operating System Compatibility

- 14.13.5. Battery Type

- 14.13.6. End-Users

- 15. Middle East Smart Ring Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Middle East Smart Ring Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Technology

- 15.3.3. Operating System Compatibility

- 15.3.4. Battery Type

- 15.3.5. End-Users

- 15.3.6. Country

- 15.3.6.1. Turkey

- 15.3.6.2. UAE

- 15.3.6.3. Saudi Arabia

- 15.3.6.4. Israel

- 15.3.6.5. Rest of Middle East

- 15.4. Turkey Smart Ring Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Technology

- 15.4.4. Operating System Compatibility

- 15.4.5. Battery Type

- 15.4.6. End-Users

- 15.5. UAE Smart Ring Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Technology

- 15.5.4. Operating System Compatibility

- 15.5.5. Battery Type

- 15.5.6. End-Users

- 15.6. Saudi Arabia Smart Ring Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Technology

- 15.6.4. Operating System Compatibility

- 15.6.5. Battery Type

- 15.6.6. End-Users

- 15.7. Israel Smart Ring Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Product Type

- 15.7.3. Technology

- 15.7.4. Operating System Compatibility

- 15.7.5. Battery Type

- 15.7.6. End-Users

- 15.8. Rest of Middle East Smart Ring Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Product Type

- 15.8.3. Technology

- 15.8.4. Operating System Compatibility

- 15.8.5. Battery Type

- 15.8.6. End-Users

- 16. Africa Smart Ring Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Africa Smart Ring Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Technology

- 16.3.3. Operating System Compatibility

- 16.3.4. Battery Type

- 16.3.5. End-Users

- 16.3.6. Country

- 16.3.6.1. South Africa

- 16.3.6.2. Egypt

- 16.3.6.3. Nigeria

- 16.3.6.4. Algeria

- 16.3.6.5. Rest of Africa

- 16.4. South Africa Smart Ring Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Technology

- 16.4.4. Operating System Compatibility

- 16.4.5. Battery Type

- 16.4.6. End-Users

- 16.5. Egypt Smart Ring Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Technology

- 16.5.4. Operating System Compatibility

- 16.5.5. Battery Type

- 16.5.6. End-Users

- 16.6. Nigeria Smart Ring Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Technology

- 16.6.4. Operating System Compatibility

- 16.6.5. Battery Type

- 16.6.6. End-Users

- 16.7. Algeria Smart Ring Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Technology

- 16.7.4. Operating System Compatibility

- 16.7.5. Battery Type

- 16.7.6. End-Users

- 16.8. Rest of Africa Smart Ring Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Technology

- 16.8.4. Operating System Compatibility

- 16.8.5. Battery Type

- 16.8.6. End-Users

- 17. South America Smart Ring Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. South America Smart Ring Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Technology

- 17.3.3. Operating System Compatibility

- 17.3.4. Battery Type

- 17.3.5. End-Users

- 17.3.6. Country

- 17.3.6.1. Brazil

- 17.3.6.2. Argentina

- 17.3.6.3. Rest of South America

- 17.4. Brazil Smart Ring Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Technology

- 17.4.4. Operating System Compatibility

- 17.4.5. Battery Type

- 17.4.6. End-Users

- 17.5. Argentina Smart Ring Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Technology

- 17.5.4. Operating System Compatibility

- 17.5.5. Battery Type

- 17.5.6. End-Users

- 17.6. Rest of South America Smart Ring Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Technology

- 17.6.4. Operating System Compatibility

- 17.6.5. Battery Type

- 17.6.6. End-Users

- 18. Key Players/ Company Profile

- 18.1. Amazfit

- 18.1.1. Company Details/ Overview

- 18.1.2. Company Financials

- 18.1.3. Key Customers and Competitors

- 18.1.4. Business/ Industry Portfolio

- 18.1.5. Product Portfolio/ Specification Details

- 18.1.6. Pricing Data

- 18.1.7. Strategic Overview

- 18.1.8. Recent Developments

- 18.2. Blinq

- 18.3. Boat Lifestyle

- 18.4. Circular Ring

- 18.5. Jakcom Technology

- 18.6. Kerv Wearables

- 18.7. McLear Ltd

- 18.8. Moodmetric

- 18.9. Motiv Inc.

- 18.10. Neyya

- 18.11. NFC Ring

- 18.12. Nimb

- 18.13. Noise

- 18.14. Oura Health

- 18.15. Ringly

- 18.16. Samsung Electronics

- 18.17. Smarty Ring

- 18.18. Talon

- 18.19. Token Ring

- 18.20. Ultrahuman Ring

- 18.21. Xenxo

- 18.22. Other Key Players

- 18.1. Amazfit

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Insightified

Mid-to-large firms spend $20K–$40K quarterly on systematic research and typically recover multiples through improved growth and profitability

Research is no longer optional. Leading firms use it to uncover $10M+ in hidden revenue opportunities annually

Our research-consulting programs yields measurable ROI: 20–30% revenue increases from new markets, 11% profit upticks from pricing, and 20–30% cost savings from operations

Smart Ring Market Size, Share & Trends Analysis Report by Product Type (Basic Smart Rings, Advanced Smart Rings, Luxury Smart Rings, Medical-Grade Smart Rings), Technology, Operating System Compatibility, Battery Type, End-Users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Smart Ring Market Size, Share, and Growth

The global smart ring market is experiencing robust growth, with its estimated value of USD 0.5 billion in the year 2025 and USD 6.3 billion by the period 2035, registering a CAGR of 29.1%, during the forecast period. The demand for smart rings is driven by rising health and fitness awareness, growing adoption of wearable technology, increasing use of contactless payments, seamless smartphone and IoT integration, and consumer preference for compact, stylish, and multifunctional devices.

Wayne Huang, CEO of Zepp Health said, "At Zepp Health, we're empowering athletes with elite-level performance and recovery analysis right at their fingertips. With our Zepp App now seamlessly integrating data from both the athlete's smartwatch and their Amazfit Helio Ring, they will have complete access to all their insights in one place. It's not just about monitoring; it's about leveraging every bit of insight to push boundaries, unlock potential, and redefine athletic excellence."

The global smart rings market is motivated by the increasing consumer interest in proactive health management and the need in small, unobtrusive technology of a wearable object, which provides seamless and unobtrusive health monitoring systems in everyday life. For instance, in September 2024, RingConn introduced its Gen 2 smart ring, which has an inbuilt sleep apnea functionality, with the emphasis being placed on the improved health-monitoring features. The trend will increase adoption in the market, increase consumer reach and innovation in compact, multifunctional smart rings.

Moreover, the technological improvements in the miniaturization, battery efficiency, and sensor accuracy drive the smart ring market as the device can perform clinical-quality measurements by using finger-based photoplethysmography and skin temperature reading. An example, in July 2024, Samsung Galaxy Ring, introduced, has PPG sensors, skin temperature detection, 10ATM water resistant, and up to seven days of battery life in a small ring size. These advancements make smart rings valid health trackers and not basic activity trackers.

The global smart ring market presents adjacent opportunities in wearable health devices, contactless payment solutions, fitness and activity trackers, IoT-enabled smart home controls such as smart lighting, and luxury fashion-tech accessories. These segments are additive to smart ring adoption, cross-industry innovation, increased consumer touchpoints, and market penetration.

Smart Ring Market Dynamics and Trends

Driver: Health Consciousness and Preventive Healthcare Paradigm Shift

Restraint: Limited Screen Real Estate and Functionality Constraints

Opportunity: Clinical Integration and Medical Device Classification

Key Trend: Fashion Collaboration and Premium Design Aesthetics

Smart Ring Market Analysis and Segmental Data

Advanced Smart Rings Dominate Global Smart Ring Market

North America Leads Global Smart Ring Market Demand

Smart-Ring-Market Ecosystem

The global smart ring market is moderately consolidated, with high concentration among key players such as Oura Health, Samsung Electronics, Ultrahuman Ring, Circular Ring, and NFC Ring, who dominate through technological innovation, premium products, strategic partnership, and well-established brands.

The presence of market consolidation allows major participants in the market to foster innovation, premium pricing, tastes and preferences of consumers and hold on to competitive advantages which will continue to assert their dominance in the global smart ring market.

Recent Development and Strategic Overview:

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 0.5 Bn |

|

Market Forecast Value in 2035 |

USD 6.3 Bn |

|

Growth Rate (CAGR) |

29.1% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Million Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

|

Smart-Ring-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Smart Ring Market, By Product Type |

|

|

Smart Ring Market, By Technology |

|

|

Smart Ring Market, By Operating System Compatibility |

|

|

Smart Ring Market, By Battery Type |

|

|

Smart Ring Market, By End-Users

|

|

Frequently Asked Questions

Table of Contents

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

Forecasting Models / Techniques

Multiple Regression Analysis

Time Series Analysis – Seasonal Patterns

Time Series Analysis – Trend Analysis

Expert Opinion – Expert Interviews

Multi-Scenario Development

Time Series Analysis – Moving Averages

Econometric Models

Expert Opinion – Delphi Method

Monte Carlo Simulation

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation