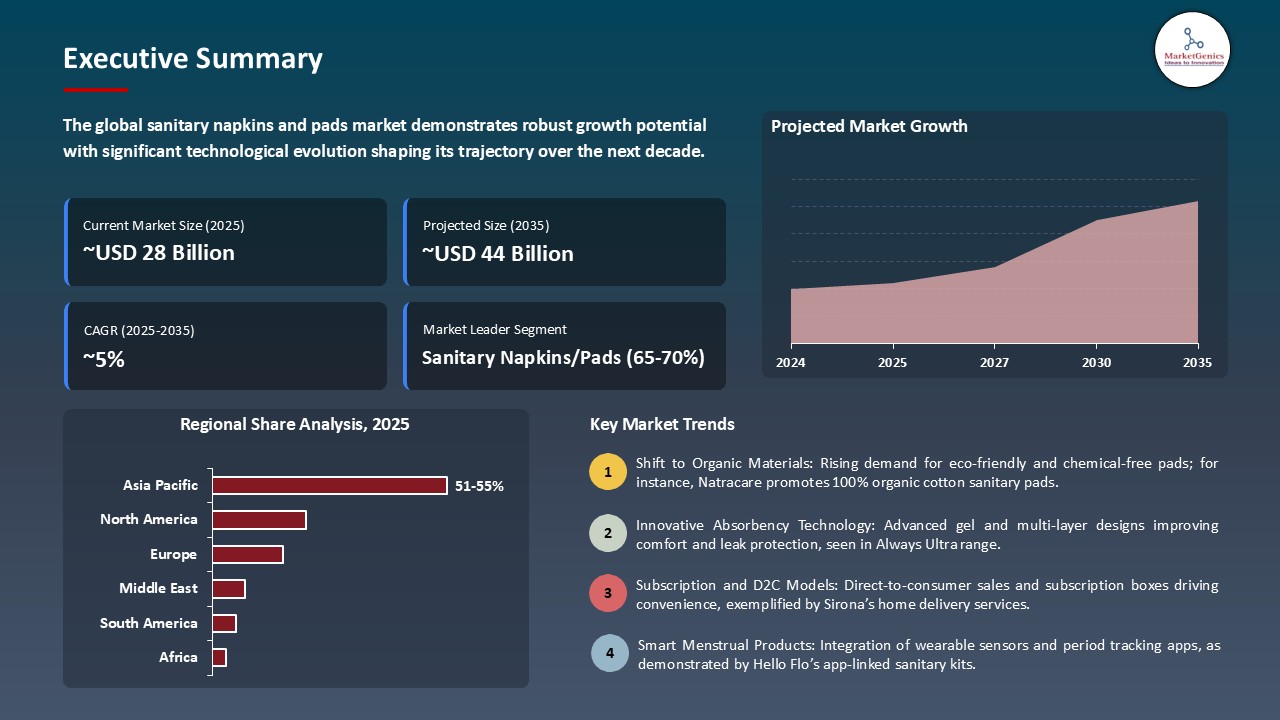

- The global sanitary napkins and pads market is valued at USD 27.8 billion in 2025.

- The market is projected to grow at a CAGR of 4.8% during the forecast period of 2026 to 2035.

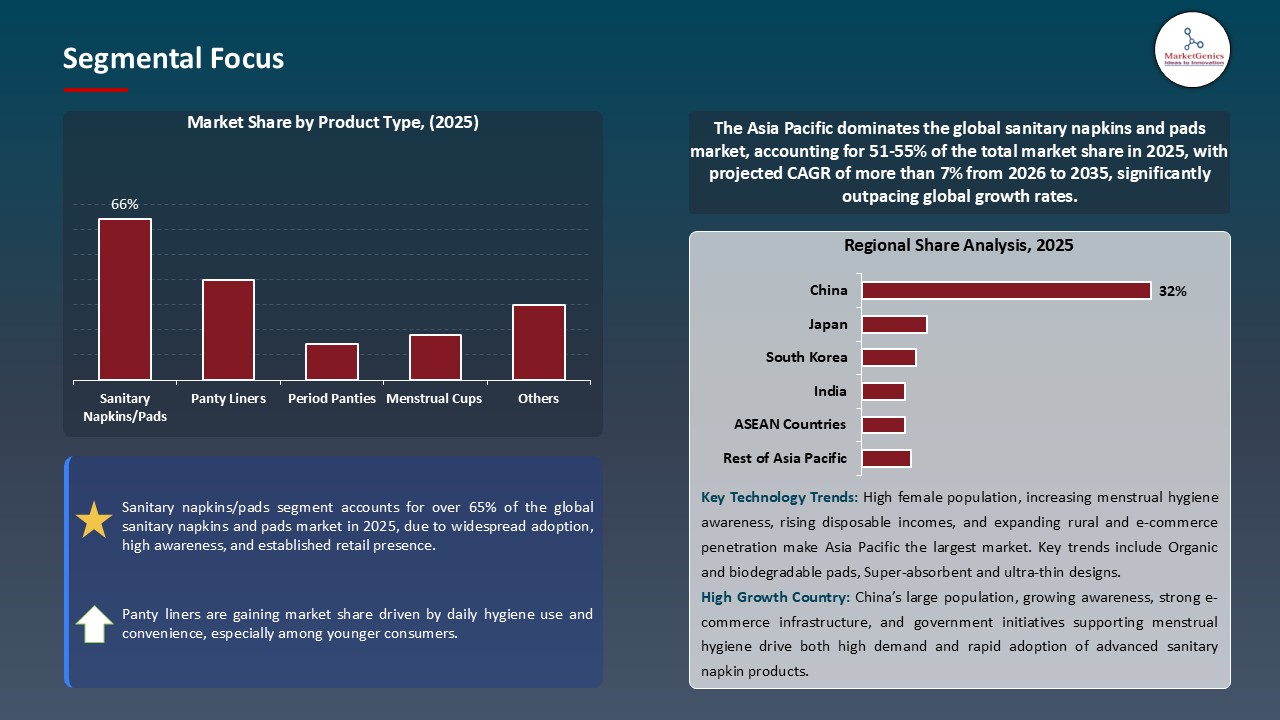

- The sanitary napkins/pads segment holds major share ~66% in the global sanitary napkins and pads market, ue to rising demand for convenient, hygienic, and comfortable menstrual products. Superior absorbency, variety of options, and growing menstrual hygiene awareness drive its widespread adoption.

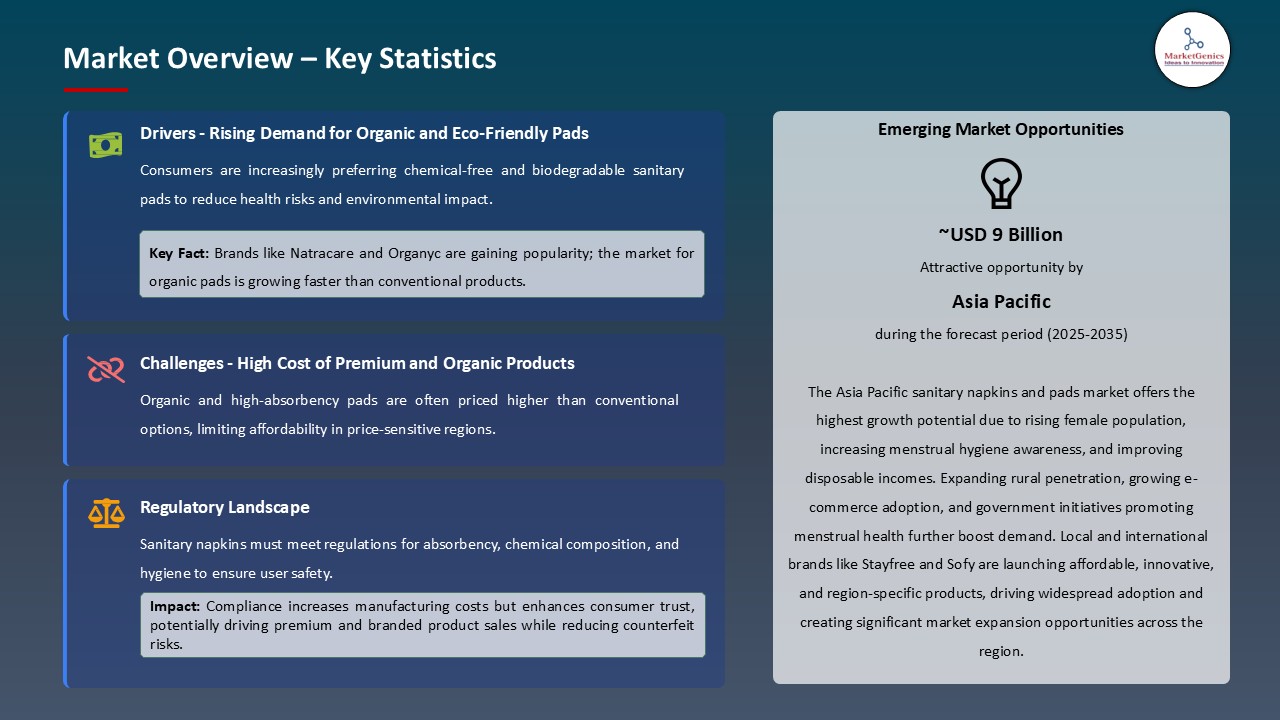

- Rising consumer demand for sustainable and personalized menstrual care is pushing brands to develop biodegradable pads and subscription-based models tailored to individual flow and lifestyle needs.

- Innovation is accelerating: companies are launching ultra-thin, super‑absorbent pads, flow-sensing or “smart” designs, and skin-friendly variants, while incorporating eco-engineered materials and biodegradable back‑sheets.

- The top five player’s accounts for over 35% of the global sanitary-napkins-and-pads-market in 2025.

- In December 2024, The Indian Army launched a biodegradable sanitary‑pad unit in Ladakh, empowering local women and promoting eco-friendly menstrual hygiene.

- In March 2024, ADRA India and ASRLM opened a sanitary‑pad unit in Assam, producing various pads and introducing vending machines to improve access and manage menstrual waste.

- Global Sanitary Napkins and Pads Market is likely to create the total forecasting opportunity of ~USD 17 Bn till 2035.

- Asia Pacific leads the sanitary napkins market, driven by rising incomes, urbanization, and growing menstrual hygiene awareness, is fueling rapid adoption across the region.

- Progressive government policies that encourage menstrual hygiene and period poverty is contributing to a big market reach in the emerging economies. Education programmes in schools, subsidised distribution of products and awareness campaigns by the community members lower the cultural stigmas, promote product knowledge and first-time users shifting away traditional cloth practices to the use of modern sanitary protection, especially in rural and low-income communities.

- These efforts are supported by massive government initiatives that are aimed at making them as accessible and available to all. For instance, in 2025, the Ministry of Women & Child Development in India rolled out the sanitary nap pad scheme that is a part of the Scheme for Promotion of Menstrual Hygiene that provides pads under the sanitary-napkin scheme in rural and semi-urban regions, through Jan Aushadhi Kendras and ASHA workers. Corporate social responsibility activities of large manufacturers are supplementary to these efforts with donation campaigns, school curricula, and vending and disposal systems.

- These multidimensional methods work together to create long-term awareness, demand, and market growth for initially marginalized populations.

- The pads and sanitary napkins business experiences some of the most serious problems when it comes to the culture of stigmatizing menstruation, especially in conservative cultures. Social taboos tend to curtail the conversation, diminish education and lower the availability of the products and hamper the market penetration even when considerable products are available in the market. The rural and semi-urban areas are particularly susceptible to younger and first time users.

- A poor disposal system also impedes the market. Some areas do not have proper waste management systems and traditional sanitary items that contain plastics also add to the long term environmental issues. The challenge of proper disposal poses further pressure on the consumers who are becoming more aware of sustainability and environmental responsibility.

- High prices of eco-friendly or biodegradable substitutes further make these issues difficult, as price-sensitive people can hardly afford them. Cultural, infrastructural, and environmental barriers combined are decelerating the overall market growth and force manufacturers to find the balance between sustainability, affordability, and accessibility in the creation of a product.

- The increased propensity of consumers to pay high prices due to augmented comfort, natural materials and feature attributes opens huge opportunities in addition to the basic products. There is the growing preference towards tampons of better absorbency and odor control, soothing skin compositions and organic fabric, owing to rising disposable income and product awareness. This trend of premiumization enables the manufacturers to achieve better margins, outdo cost-effective rivals, and create brand equity.

- Sports-related and fitness-based segments are becoming one of the potential markets in the premium tampon market. For instance, in October 2025, Sequel released its Spiral Tampon to Athletes, which is composed of biodegradable Viscose with BPA-free applicators. Its helical design will provide better absorption and leak protection that is targeted at active women. The product targets niche demands in the sports and fitness category, where traditional tampons had long served as the poorly addressed niche.

- Sports-specific aspects such as moisture-wicking fabrics, ergonomics, and tackling straps increase the high-end products. Efforts to form collaborations with sports organizations and endorse athletes can increase credibility, normalize period conversations in an athletic setting, and develop the chance to capture additional margin via high-value, niche products.

- Environmental sustainability is making innovation in the sanitary napkins and pads industry focus on the materials used, manufacturing, and product design. The population is gradually shifting more towards biodegradable, plastic-free products and transparent supply chains, with younger age groups being more ready to pay premiums to the environmentally responsible products. Product manufacturers have the pressure to minimize the effect on the environment without having to compromise on the anticipated performance levels.

- The companies are on the move to launch plant-based and biodegradable solutions to increasing eco-conscious demand. In 2023, the first biodegradable sanitary pads made in India made of PLA, certified by CIPET, were introduced by Niine Sanitary Napkins. These pads break down quickly, are vegan and chemical-free, and provide the same level of absorption and comfort as standard products as the market shifts its attention on eco-friendly alternatives.

- Reusable period underwear and cloth pads are also becoming more popular and should draw in and keep more environmentally-conscious consumers and prompt more traditional manufacturers to focus on sustainable innovation. The trend is transforming the source materials, packaging and the business environmental commitments and developing differentiation and loyalty to brands that portray genuine sustainability leadership.

- The sanitary napkins/pads segment dominates the global sanitary napkins and pads market, because of its convenient, reliable and widely accepted nature by consumers in both urban and semi-urban settings. The segment is presently booming, given the awareness on health, hygiene education, and the high level of preference on convenient high-absorbency products. Its extensive availability and stable functionality supports the luxury status of the product among the contemporary consumers.

- Also upheld are technological advances in absorbent cores, skin sensitive top layers and leak resistant designs which increase the competitiveness of the segment further. For instnace, in March 2025, Procter and Gamble released Always Pocket Flexfoam, a small pad that provides leak-free comfort and zero feel, and this represents how the industry is emphasizing the comfort, sustainability, and portability.

- Expansion of retail, e-commerce, and subscription channels enables market growth. Collaborations with medical practitioners, non-governmental organizations (NGOs), and education campaigns raise demand awareness, minimize adoption obstacles, and position sanitary napkins/pads as a global market leader.

- Asia Pacific leads the global sanitary napkins and pads market, due to the high number of women, the growth of disposable incomes and the increasing awareness on menstrual hygiene. There is also a big potential, with lots of consumers still dependent on the old ways of doing things using cloths, which opens the prospects of implementing modern products through organized education campaigns and an increase in retail outlets.

- Other programs by the government and the NGOs contribute to the development of market by overcoming the cultural constraints and enhance the product awareness. For instance, in April 2025, Pinkishe Foundation, which runs Menstrual Health & Hygiene Education Camps as part of PadBank and provides free sanitary pads and educates the women and girls in underserved areas. These programs lead to increased awareness, less resistance to adoption, and behavioral change in the long term.

- Demographic patterns, such as increasing women literacy, movement to cities, and working population offer more tailwinds to the market. The combination of these demographic forces with such initiatives as Pad Women in India and menstrual health campaigns in China makes Asia Pacific a growth engine, and firm growth is anticipated in many countries of the region.

- In December 2024, The Indian Army opened a biodegradable sanitary napkin manufacturing plant in Martselang, Ladakh. The local women-managed unit manufactures UV-treated, environmentally friendly pads, which encourage menstrual cleanliness, and generate economic growth in the area.

- In March 2024, ADRA India with the Assam State Rural Livelihood Mission (ASRLM) opened a second sanitary-pad production facility in Tinsukia, Assam to empower rural women and better access to low-cost menstrual hygiene items. The unit manufactures all types of pads such as ultra-thin, regular, and emergency ones and has launched Sanskriti vending machines to sell pads and collect menstrual wastes in local institutions.

- United States

- Canada

- Mexico

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic Countries

- Poland

- Russia & CIS

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Turkey

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Nigeria

- Algeria

- Brazil

- Argentina

- Bella

- Ontex Group

- Corman SpA

- Daio Paper Corporation

- Lil-Lets UK Limited

- Edgewell Personal Care

- Hengan International Group

- Johnson & Johnson

- Kao Corporation

- Kimberly-Clark Corporation

- Natracare

- Bodywise

- Maxim Hygiene Products

- Premier FMCG Manufacturing

- Procter & Gamble (P&G)

- Reckitt Benckiser Group

- Seventh Generation Inc

- Essity AB

- The Honest Company

- Unicharm Corporation

- Other Key Players

- Sanitary Napkins/Pads

- Ultra-thin pads

- Regular pads

- Maxi/Super pads

- Overnight/Extra-long pads

- Maternity pads

- Others

- Panty Liners

- Regular panty liners

- Long panty liners

- Scented panty liners

- Others

- Period Panties

- Menstrual Cups

- Others

- Cotton-based

- 100% organic cotton

- Cotton blend

- Synthetic Materials

- Non-woven fabric

- Cellulose

- Super absorbent polymer (SAP)

- Biodegradable Materials

- Bamboo fiber

- Banana fiber

- Other plant-based materials

- Hybrid Materials

- Light Flow

- Regular/Medium Flow

- Heavy Flow

- Super/Extra Heavy Flow

- Variable Absorbency

- Mini (Less than 180mm)

- Regular (180-240mm)

- Long (240-290mm)

- Extra-Long/Overnight (290-350mm)

- Winged/With Wings

- Wingless/Without Wings

- Extra-Wide Wings

- Online Channels

- E-commerce platforms

- Brand websites

- Online pharmacies

- Subscription services

- Others

- Offline Channels

- Supermarkets/Hypermarkets

- Convenience stores

- Pharmacies/Drug stores

- Specialty stores

- General retail stores

- Others

- Disposable

- Reusable/Washable

- Individual wrapped

- Multi-pack

- Bulk packaging

- Eco-friendly packaging

- Teenagers (12-19 years)

- Young Adults (20-35 years)

- Adults (36-45 years)

- Pre-menopausal (46-55 years)

- Individual Consumers

- Healthcare Facilities

- Educational Institutions

- Corporate/Workplace

- Hospitality Industry

- Government & NGO Programs

- Sports & Fitness Centers

- Other End-users

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Sanitary Napkins and Pads Market Outlook

- 2.1.1. Sanitary Napkins and Pads Market Size Value (US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Sanitary Napkins and Pads Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 3.1.1. Consumer Goods & Services Industry Ecosystem Analysis

- 3.1.2. Key Trends for Consumer Goods & Services Industry

- 3.1.3. Regional Distribution for Consumer Goods & Services Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising menstrual hygiene awareness driven by government programs, NGO initiatives, and school-level education campaigns.

- 4.1.1.2. Growing female workforce participation and urbanization, increasing demand for convenient, high-absorbency sanitary protection products.

- 4.1.1.3. Product innovation, including ultra-thin pads, biodegradable alternatives, and organic cotton variants supporting comfort and sustainability preferences.

- 4.1.2. Restraints

- 4.1.2.1. Environmental concerns related to plastic waste generation from disposable sanitary pads, limiting adoption among eco-conscious consumers.

- 4.1.2.2. Affordability challenges in low-income regions, where high product costs and limited retail access restrict market penetration.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Manufacturing

- 4.4.3. Distribution

- 4.4.4. End-Use

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Sanitary Napkins and Pads Market Demand

- 4.7.1. Historical Market Size – Value (US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size – Value (US$ Bn), 2026–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Sanitary Napkins and Pads Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Sanitary Napkins and Pads Market Size Value (US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Sanitary Napkins/Pads

- 6.2.1.1. Ultra-thin pads

- 6.2.1.2. Regular pads

- 6.2.1.3. Maxi/Super pads

- 6.2.1.4. Overnight/Extra-long pads

- 6.2.1.5. Maternity pads

- 6.2.1.6. Others

- 6.2.2. Panty Liners

- 6.2.2.1. Regular panty liners

- 6.2.2.2. Long panty liners

- 6.2.2.3. Scented panty liners

- 6.2.2.4. Others

- 6.2.3. Period Panties

- 6.2.4. Menstrual Cups

- 6.2.5. Others

- 6.2.1. Sanitary Napkins/Pads

- 7. Global Sanitary Napkins and Pads Market Analysis, by Material Type

- 7.1. Key Segment Analysis

- 7.2. Sanitary Napkins and Pads Market Size Value (US$ Bn), Analysis, and Forecasts, by Material Type, 2021-2035

- 7.2.1. Cotton-based

- 7.2.1.1. 100% organic cotton

- 7.2.1.2. Cotton blend

- 7.2.2. Synthetic Materials

- 7.2.2.1. Non-woven fabric

- 7.2.2.2. Cellulose

- 7.2.2.3. Super absorbent polymer (SAP)

- 7.2.3. Biodegradable Materials

- 7.2.3.1. Bamboo fiber

- 7.2.3.2. Banana fiber

- 7.2.3.3. Other plant-based materials

- 7.2.4. Hybrid Materials

- 7.2.1. Cotton-based

- 8. Global Sanitary Napkins and Pads Market Analysis, by Absorbency Level

- 8.1. Key Segment Analysis

- 8.2. Sanitary Napkins and Pads Market Size Value (US$ Bn), Analysis, and Forecasts, by Absorbency Level, 2021-2035

- 8.2.1. Light Flow

- 8.2.2. Regular/Medium Flow

- 8.2.3. Heavy Flow

- 8.2.4. Super/Extra Heavy Flow

- 8.2.5. Variable Absorbency

- 9. Global Sanitary Napkins and Pads Market Analysis, by Size/Length

- 9.1. Key Segment Analysis

- 9.2. Sanitary Napkins and Pads Market Size Value (US$ Bn), Analysis, and Forecasts, by Size/Length, 2021-2035

- 9.2.1. Mini (Less than 180mm)

- 9.2.2. Regular (180-240mm)

- 9.2.3. Long (240-290mm)

- 9.2.4. Extra-Long/Overnight (290-350mm)

- 10. Global Sanitary Napkins and Pads Market Analysis, by Wing Type

- 10.1. Key Segment Analysis

- 10.2. Sanitary Napkins and Pads Market Size Value (US$ Bn), Analysis, and Forecasts, by Wing Type, 2021-2035

- 10.2.1. Winged/With Wings

- 10.2.2. Wingless/Without Wings

- 10.2.3. Extra-Wide Wings

- 11. Global Sanitary Napkins and Pads Market Analysis, by Distribution Channel

- 11.1. Key Segment Analysis

- 11.2. Sanitary Napkins and Pads Market Size Value (US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 11.2.1. Online Channels

- 11.2.1.1. E-commerce platforms

- 11.2.1.2. Brand websites

- 11.2.1.3. Online pharmacies

- 11.2.1.4. Subscription services

- 11.2.1.5. Others

- 11.2.2. Offline Channels

- 11.2.2.1. Supermarkets/Hypermarkets

- 11.2.2.2. Convenience stores

- 11.2.2.3. Pharmacies/Drug stores

- 11.2.2.4. Specialty stores

- 11.2.2.5. General retail stores

- 11.2.2.6. Others

- 11.2.1. Online Channels

- 12. Global Sanitary Napkins and Pads Market Analysis, by Usage Type

- 12.1. Key Segment Analysis

- 12.2. Sanitary Napkins and Pads Market Size Value (US$ Bn), Analysis, and Forecasts, by Usage Type, 2021-2035

- 12.2.1. Disposable

- 12.2.2. Reusable/Washable

- 13. Global Sanitary Napkins and Pads Market Analysis, by Packaging Type

- 13.1. Key Segment Analysis

- 13.2. Sanitary Napkins and Pads Market Size Value (US$ Bn), Analysis, and Forecasts, by Packaging Type, 2021-2035

- 13.2.1. Individual wrapped

- 13.2.2. Multi-pack

- 13.2.3. Bulk packaging

- 13.2.4. Eco-friendly packaging

- 14. Global Sanitary Napkins and Pads Market Analysis, by Age Group

- 14.1. Key Segment Analysis

- 14.2. Sanitary Napkins and Pads Market Size Value (US$ Bn), Analysis, and Forecasts, by Age Group, 2021-2035

- 14.2.1. Teenagers (12-19 years)

- 14.2.2. Young Adults (20-35 years)

- 14.2.3. Adults (36-45 years)

- 14.2.4. Pre-menopausal (46-55 years)

- 15. Global Sanitary Napkins and Pads Market Analysis, by End-users

- 15.1. Key Segment Analysis

- 15.2. Sanitary Napkins and Pads Market Size Value (US$ Bn), Analysis, and Forecasts, by End-users, 2021-2035

- 15.2.1. Individual Consumers

- 15.2.2. Healthcare Facilities

- 15.2.3. Educational Institutions

- 15.2.4. Corporate/Workplace

- 15.2.5. Hospitality Industry

- 15.2.6. Government & NGO Programs

- 15.2.7. Sports & Fitness Centers

- 15.2.8. Other End-users

- 16. Global Sanitary Napkins and Pads Market Analysis and Forecasts, by Region

- 16.1. Key Findings

- 16.2. Sanitary Napkins and Pads Market Size Value (US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 16.2.1. North America

- 16.2.2. Europe

- 16.2.3. Asia Pacific

- 16.2.4. Middle East

- 16.2.5. Africa

- 16.2.6. South America

- 17. North America Sanitary Napkins and Pads Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. North America Sanitary Napkins and Pads Market Size- Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Material Type

- 17.3.3. Absorbency Level

- 17.3.4. Size/Length

- 17.3.5. Wing Type

- 17.3.6. Distribution Channel

- 17.3.7. Usage Type

- 17.3.8. Packaging Type

- 17.3.9. Age Group

- 17.3.10. End-users

- 17.3.11. Country

- 17.3.11.1. USA

- 17.3.11.2. Canada

- 17.3.11.3. Mexico

- 17.4. USA Sanitary Napkins and Pads Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Material Type

- 17.4.4. Absorbency Level

- 17.4.5. Size/Length

- 17.4.6. Wing Type

- 17.4.7. Distribution Channel

- 17.4.8. Usage Type

- 17.4.9. Packaging Type

- 17.4.10. Age Group

- 17.4.11. End-users

- 17.5. Canada Sanitary Napkins and Pads Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Material Type

- 17.5.4. Absorbency Level

- 17.5.5. Size/Length

- 17.5.6. Wing Type

- 17.5.7. Distribution Channel

- 17.5.8. Usage Type

- 17.5.9. Packaging Type

- 17.5.10. Age Group

- 17.5.11. End-users

- 17.6. Mexico Sanitary Napkins and Pads Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Material Type

- 17.6.4. Absorbency Level

- 17.6.5. Size/Length

- 17.6.6. Wing Type

- 17.6.7. Distribution Channel

- 17.6.8. Usage Type

- 17.6.9. Packaging Type

- 17.6.10. Age Group

- 17.6.11. End-users

- 18. Europe Sanitary Napkins and Pads Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Europe Sanitary Napkins and Pads Market Size Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Material Type

- 18.3.3. Absorbency Level

- 18.3.4. Size/Length

- 18.3.5. Wing Type

- 18.3.6. Distribution Channel

- 18.3.7. Usage Type

- 18.3.8. Packaging Type

- 18.3.9. Age Group

- 18.3.10. End-users

- 18.3.11. Country

- 18.3.11.1. Germany

- 18.3.11.2. United Kingdom

- 18.3.11.3. France

- 18.3.11.4. Italy

- 18.3.11.5. Spain

- 18.3.11.6. Netherlands

- 18.3.11.7. Nordic Countries

- 18.3.11.8. Poland

- 18.3.11.9. Russia & CIS

- 18.3.11.10. Rest of Europe

- 18.4. Germany Sanitary Napkins and Pads Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Material Type

- 18.4.4. Absorbency Level

- 18.4.5. Size/Length

- 18.4.6. Wing Type

- 18.4.7. Distribution Channel

- 18.4.8. Usage Type

- 18.4.9. Packaging Type

- 18.4.10. Age Group

- 18.4.11. End-users

- 18.5. United Kingdom Sanitary Napkins and Pads Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Material Type

- 18.5.4. Absorbency Level

- 18.5.5. Size/Length

- 18.5.6. Wing Type

- 18.5.7. Distribution Channel

- 18.5.8. Usage Type

- 18.5.9. Packaging Type

- 18.5.10. Age Group

- 18.5.11. End-users

- 18.6. France Sanitary Napkins and Pads Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Material Type

- 18.6.4. Absorbency Level

- 18.6.5. Size/Length

- 18.6.6. Wing Type

- 18.6.7. Distribution Channel

- 18.6.8. Usage Type

- 18.6.9. Packaging Type

- 18.6.10. Age Group

- 18.6.11. End-users

- 18.7. Italy Sanitary Napkins and Pads Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Material Type

- 18.7.4. Absorbency Level

- 18.7.5. Size/Length

- 18.7.6. Wing Type

- 18.7.7. Distribution Channel

- 18.7.8. Usage Type

- 18.7.9. Packaging Type

- 18.7.10. Age Group

- 18.7.11. End-users

- 18.8. Spain Sanitary Napkins and Pads Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Material Type

- 18.8.4. Absorbency Level

- 18.8.5. Size/Length

- 18.8.6. Wing Type

- 18.8.7. Distribution Channel

- 18.8.8. Usage Type

- 18.8.9. Packaging Type

- 18.8.10. Age Group

- 18.8.11. End-users

- 18.9. Netherlands Sanitary Napkins and Pads Market

- 18.9.1. Country Segmental Analysis

- 18.9.2. Product Type

- 18.9.3. Material Type

- 18.9.4. Absorbency Level

- 18.9.5. Size/Length

- 18.9.6. Wing Type

- 18.9.7. Distribution Channel

- 18.9.8. Usage Type

- 18.9.9. Packaging Type

- 18.9.10. Age Group

- 18.9.11. End-users

- 18.10. Nordic Countries Sanitary Napkins and Pads Market

- 18.10.1. Country Segmental Analysis

- 18.10.2. Product Type

- 18.10.3. Material Type

- 18.10.4. Absorbency Level

- 18.10.5. Size/Length

- 18.10.6. Wing Type

- 18.10.7. Distribution Channel

- 18.10.8. Usage Type

- 18.10.9. Packaging Type

- 18.10.10. Age Group

- 18.10.11. End-users

- 18.11. Poland Sanitary Napkins and Pads Market

- 18.11.1. Country Segmental Analysis

- 18.11.2. Product Type

- 18.11.3. Material Type

- 18.11.4. Absorbency Level

- 18.11.5. Size/Length

- 18.11.6. Wing Type

- 18.11.7. Distribution Channel

- 18.11.8. Usage Type

- 18.11.9. Packaging Type

- 18.11.10. Age Group

- 18.11.11. End-users

- 18.12. Russia & CIS Sanitary Napkins and Pads Market

- 18.12.1. Country Segmental Analysis

- 18.12.2. Product Type

- 18.12.3. Material Type

- 18.12.4. Absorbency Level

- 18.12.5. Size/Length

- 18.12.6. Wing Type

- 18.12.7. Distribution Channel

- 18.12.8. Usage Type

- 18.12.9. Packaging Type

- 18.12.10. Age Group

- 18.12.11. End-users

- 18.13. Rest of Europe Sanitary Napkins and Pads Market

- 18.13.1. Country Segmental Analysis

- 18.13.2. Product Type

- 18.13.3. Material Type

- 18.13.4. Absorbency Level

- 18.13.5. Size/Length

- 18.13.6. Wing Type

- 18.13.7. Distribution Channel

- 18.13.8. Usage Type

- 18.13.9. Packaging Type

- 18.13.10. Age Group

- 18.13.11. End-users

- 19. Asia Pacific Sanitary Napkins and Pads Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Asia Pacific Sanitary Napkins and Pads Market Size Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Material Type

- 19.3.3. Absorbency Level

- 19.3.4. Size/Length

- 19.3.5. Wing Type

- 19.3.6. Distribution Channel

- 19.3.7. Usage Type

- 19.3.8. Packaging Type

- 19.3.9. Age Group

- 19.3.10. End-users

- 19.3.11. Country

- 19.3.11.1. China

- 19.3.11.2. India

- 19.3.11.3. Japan

- 19.3.11.4. South Korea

- 19.3.11.5. Australia and New Zealand

- 19.3.11.6. Indonesia

- 19.3.11.7. Malaysia

- 19.3.11.8. Thailand

- 19.3.11.9. Vietnam

- 19.3.11.10. Rest of Asia Pacific

- 19.4. China Sanitary Napkins and Pads Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Material Type

- 19.4.4. Absorbency Level

- 19.4.5. Size/Length

- 19.4.6. Wing Type

- 19.4.7. Distribution Channel

- 19.4.8. Usage Type

- 19.4.9. Packaging Type

- 19.4.10. Age Group

- 19.4.11. End-users

- 19.5. India Sanitary Napkins and Pads Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Material Type

- 19.5.4. Absorbency Level

- 19.5.5. Size/Length

- 19.5.6. Wing Type

- 19.5.7. Distribution Channel

- 19.5.8. Usage Type

- 19.5.9. Packaging Type

- 19.5.10. Age Group

- 19.5.11. End-users

- 19.6. Japan Sanitary Napkins and Pads Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Material Type

- 19.6.4. Absorbency Level

- 19.6.5. Size/Length

- 19.6.6. Wing Type

- 19.6.7. Distribution Channel

- 19.6.8. Usage Type

- 19.6.9. Packaging Type

- 19.6.10. Age Group

- 19.6.11. End-users

- 19.7. South Korea Sanitary Napkins and Pads Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Product Type

- 19.7.3. Material Type

- 19.7.4. Absorbency Level

- 19.7.5. Size/Length

- 19.7.6. Wing Type

- 19.7.7. Distribution Channel

- 19.7.8. Usage Type

- 19.7.9. Packaging Type

- 19.7.10. Age Group

- 19.7.11. End-users

- 19.8. Australia and New Zealand Sanitary Napkins and Pads Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Product Type

- 19.8.3. Material Type

- 19.8.4. Absorbency Level

- 19.8.5. Size/Length

- 19.8.6. Wing Type

- 19.8.7. Distribution Channel

- 19.8.8. Usage Type

- 19.8.9. Packaging Type

- 19.8.10. Age Group

- 19.8.11. End-users

- 19.9. Indonesia Sanitary Napkins and Pads Market

- 19.9.1. Country Segmental Analysis

- 19.9.2. Product Type

- 19.9.3. Material Type

- 19.9.4. Absorbency Level

- 19.9.5. Size/Length

- 19.9.6. Wing Type

- 19.9.7. Distribution Channel

- 19.9.8. Usage Type

- 19.9.9. Packaging Type

- 19.9.10. Age Group

- 19.9.11. End-users

- 19.10. Malaysia Sanitary Napkins and Pads Market

- 19.10.1. Country Segmental Analysis

- 19.10.2. Product Type

- 19.10.3. Material Type

- 19.10.4. Absorbency Level

- 19.10.5. Size/Length

- 19.10.6. Wing Type

- 19.10.7. Distribution Channel

- 19.10.8. Usage Type

- 19.10.9. Packaging Type

- 19.10.10. Age Group

- 19.10.11. End-users

- 19.11. Thailand Sanitary Napkins and Pads Market

- 19.11.1. Country Segmental Analysis

- 19.11.2. Product Type

- 19.11.3. Material Type

- 19.11.4. Absorbency Level

- 19.11.5. Size/Length

- 19.11.6. Wing Type

- 19.11.7. Distribution Channel

- 19.11.8. Usage Type

- 19.11.9. Packaging Type

- 19.11.10. Age Group

- 19.11.11. End-users

- 19.12. Vietnam Sanitary Napkins and Pads Market

- 19.12.1. Country Segmental Analysis

- 19.12.2. Product Type

- 19.12.3. Material Type

- 19.12.4. Absorbency Level

- 19.12.5. Size/Length

- 19.12.6. Wing Type

- 19.12.7. Distribution Channel

- 19.12.8. Usage Type

- 19.12.9. Packaging Type

- 19.12.10. Age Group

- 19.12.11. End-users

- 19.13. Rest of Asia Pacific Sanitary Napkins and Pads Market

- 19.13.1. Country Segmental Analysis

- 19.13.2. Product Type

- 19.13.3. Material Type

- 19.13.4. Absorbency Level

- 19.13.5. Size/Length

- 19.13.6. Wing Type

- 19.13.7. Distribution Channel

- 19.13.8. Usage Type

- 19.13.9. Packaging Type

- 19.13.10. Age Group

- 19.13.11. End-users

- 20. Middle East Sanitary Napkins and Pads Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Middle East Sanitary Napkins and Pads Market Size Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Product Type

- 20.3.2. Material Type

- 20.3.3. Absorbency Level

- 20.3.4. Size/Length

- 20.3.5. Wing Type

- 20.3.6. Distribution Channel

- 20.3.7. Usage Type

- 20.3.8. Packaging Type

- 20.3.9. Age Group

- 20.3.10. End-users

- 20.3.11. Country

- 20.3.11.1. Turkey

- 20.3.11.2. UAE

- 20.3.11.3. Saudi Arabia

- 20.3.11.4. Israel

- 20.3.11.5. Rest of Middle East

- 20.4. Turkey Sanitary Napkins and Pads Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Product Type

- 20.4.3. Material Type

- 20.4.4. Absorbency Level

- 20.4.5. Size/Length

- 20.4.6. Wing Type

- 20.4.7. Distribution Channel

- 20.4.8. Usage Type

- 20.4.9. Packaging Type

- 20.4.10. Age Group

- 20.4.11. End-users

- 20.5. UAE Sanitary Napkins and Pads Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Product Type

- 20.5.3. Material Type

- 20.5.4. Absorbency Level

- 20.5.5. Size/Length

- 20.5.6. Wing Type

- 20.5.7. Distribution Channel

- 20.5.8. Usage Type

- 20.5.9. Packaging Type

- 20.5.10. Age Group

- 20.5.11. End-users

- 20.6. Saudi Arabia Sanitary Napkins and Pads Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Product Type

- 20.6.3. Material Type

- 20.6.4. Absorbency Level

- 20.6.5. Size/Length

- 20.6.6. Wing Type

- 20.6.7. Distribution Channel

- 20.6.8. Usage Type

- 20.6.9. Packaging Type

- 20.6.10. Age Group

- 20.6.11. End-users

- 20.7. Israel Sanitary Napkins and Pads Market

- 20.7.1. Country Segmental Analysis

- 20.7.2. Product Type

- 20.7.3. Material Type

- 20.7.4. Absorbency Level

- 20.7.5. Size/Length

- 20.7.6. Wing Type

- 20.7.7. Distribution Channel

- 20.7.8. Usage Type

- 20.7.9. Packaging Type

- 20.7.10. Age Group

- 20.7.11. End-users

- 20.8. Rest of Middle East Sanitary Napkins and Pads Market

- 20.8.1. Country Segmental Analysis

- 20.8.2. Product Type

- 20.8.3. Material Type

- 20.8.4. Absorbency Level

- 20.8.5. Size/Length

- 20.8.6. Wing Type

- 20.8.7. Distribution Channel

- 20.8.8. Usage Type

- 20.8.9. Packaging Type

- 20.8.10. Age Group

- 20.8.11. End-users

- 21. Africa Sanitary Napkins and Pads Market Analysis

- 21.1. Key Segment Analysis

- 21.2. Regional Snapshot

- 21.3. Africa Sanitary Napkins and Pads Market Size Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 21.3.1. Product Type

- 21.3.2. Material Type

- 21.3.3. Absorbency Level

- 21.3.4. Size/Length

- 21.3.5. Wing Type

- 21.3.6. Distribution Channel

- 21.3.7. Usage Type

- 21.3.8. Packaging Type

- 21.3.9. Age Group

- 21.3.10. End-users

- 21.3.11. Country

- 21.3.11.1. South Africa

- 21.3.11.2. Egypt

- 21.3.11.3. Nigeria

- 21.3.11.4. Algeria

- 21.3.11.5. Rest of Africa

- 21.4. South Africa Sanitary Napkins and Pads Market

- 21.4.1. Country Segmental Analysis

- 21.4.2. Product Type

- 21.4.3. Material Type

- 21.4.4. Absorbency Level

- 21.4.5. Size/Length

- 21.4.6. Wing Type

- 21.4.7. Distribution Channel

- 21.4.8. Usage Type

- 21.4.9. Packaging Type

- 21.4.10. Age Group

- 21.4.11. End-users

- 21.5. Egypt Sanitary Napkins and Pads Market

- 21.5.1. Country Segmental Analysis

- 21.5.2. Product Type

- 21.5.3. Material Type

- 21.5.4. Absorbency Level

- 21.5.5. Size/Length

- 21.5.6. Wing Type

- 21.5.7. Distribution Channel

- 21.5.8. Usage Type

- 21.5.9. Packaging Type

- 21.5.10. Age Group

- 21.5.11. End-users

- 21.6. Nigeria Sanitary Napkins and Pads Market

- 21.6.1. Country Segmental Analysis

- 21.6.2. Product Type

- 21.6.3. Material Type

- 21.6.4. Absorbency Level

- 21.6.5. Size/Length

- 21.6.6. Wing Type

- 21.6.7. Distribution Channel

- 21.6.8. Usage Type

- 21.6.9. Packaging Type

- 21.6.10. Age Group

- 21.6.11. End-users

- 21.7. Algeria Sanitary Napkins and Pads Market

- 21.7.1. Country Segmental Analysis

- 21.7.2. Product Type

- 21.7.3. Material Type

- 21.7.4. Absorbency Level

- 21.7.5. Size/Length

- 21.7.6. Wing Type

- 21.7.7. Distribution Channel

- 21.7.8. Usage Type

- 21.7.9. Packaging Type

- 21.7.10. Age Group

- 21.7.11. End-users

- 21.8. Rest of Africa Sanitary Napkins and Pads Market

- 21.8.1. Country Segmental Analysis

- 21.8.2. Product Type

- 21.8.3. Material Type

- 21.8.4. Absorbency Level

- 21.8.5. Size/Length

- 21.8.6. Wing Type

- 21.8.7. Distribution Channel

- 21.8.8. Usage Type

- 21.8.9. Packaging Type

- 21.8.10. Age Group

- 21.8.11. End-users

- 22. South America Sanitary Napkins and Pads Market Analysis

- 22.1. Key Segment Analysis

- 22.2. Regional Snapshot

- 22.3. South America Sanitary Napkins and Pads Market Size Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 22.3.1. Product Type

- 22.3.2. Material Type

- 22.3.3. Absorbency Level

- 22.3.4. Size/Length

- 22.3.5. Wing Type

- 22.3.6. Distribution Channel

- 22.3.7. Usage Type

- 22.3.8. Packaging Type

- 22.3.9. Age Group

- 22.3.10. End-users

- 22.3.11. Country

- 22.3.11.1. Brazil

- 22.3.11.2. Argentina

- 22.3.11.3. Rest of South America

- 22.4. Brazil Sanitary Napkins and Pads Market

- 22.4.1. Country Segmental Analysis

- 22.4.2. Product Type

- 22.4.3. Material Type

- 22.4.4. Absorbency Level

- 22.4.5. Size/Length

- 22.4.6. Wing Type

- 22.4.7. Distribution Channel

- 22.4.8. Usage Type

- 22.4.9. Packaging Type

- 22.4.10. Age Group

- 22.4.11. End-users

- 22.5. Argentina Sanitary Napkins and Pads Market

- 22.5.1. Country Segmental Analysis

- 22.5.2. Product Type

- 22.5.3. Material Type

- 22.5.4. Absorbency Level

- 22.5.5. Size/Length

- 22.5.6. Wing Type

- 22.5.7. Distribution Channel

- 22.5.8. Usage Type

- 22.5.9. Packaging Type

- 22.5.10. Age Group

- 22.5.11. End-users

- 22.6. Rest of South America Sanitary Napkins and Pads Market

- 22.6.1. Country Segmental Analysis

- 22.6.2. Product Type

- 22.6.3. Material Type

- 22.6.4. Absorbency Level

- 22.6.5. Size/Length

- 22.6.6. Wing Type

- 22.6.7. Distribution Channel

- 22.6.8. Usage Type

- 22.6.9. Packaging Type

- 22.6.10. Age Group

- 22.6.11. End-users

- 23. Key Players/ Company Profile

- 23.1. Bella

- 23.1.1. Company Details/ Overview

- 23.1.2. Company Financials

- 23.1.3. Key Customers and Competitors

- 23.1.4. Business/ Industry Portfolio

- 23.1.5. Product Portfolio/ Specification Details

- 23.1.6. Pricing Data

- 23.1.7. Strategic Overview

- 23.1.8. Recent Developments

- 23.2. Bodywise

- 23.3. Corman SpA

- 23.4. Daio Paper Corporation

- 23.5. Edgewell Personal Care

- 23.6. Essity AB

- 23.7. Hengan International Group

- 23.8. Johnson & Johnson

- 23.9. Kao Corporation

- 23.10. Kimberly-Clark Corporation

- 23.11. Lil-Lets UK Limited

- 23.12. Maxim Hygiene Products

- 23.13. Natracare

- 23.14. Ontex Group

- 23.15. Premier FMCG Manufacturing

- 23.16. Procter & Gamble (P&G)

- 23.17. Reckitt Benckiser Group

- 23.18. Seventh Generation Inc.

- 23.19. The Honest Company

- 23.20. Unicharm Corporation

- 23.21. Other Key Players

- 23.1. Bella

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Sanitary Napkins and Pads Market by Product Type, Material Type, Absorbency Level, Size/Length, Wing Type, Distribution Channel, Usage Type, Packaging Type, Age Group, End-users, and Geography

Insightified

Mid-to-large firms spend $20K–$40K quarterly on systematic research and typically recover multiples through improved growth and profitability

Research is no longer optional. Leading firms use it to uncover $10M+ in hidden revenue opportunities annually

Our research-consulting programs yields measurable ROI: 20–30% revenue increases from new markets, 11% profit upticks from pricing, and 20–30% cost savings from operations

Sanitary Napkins and Pads Market Size, Share & Trends Analysis Report by Product Type (Sanitary Napkins/Pads, Panty Liners, Period Panties, Menstrual Cups, Others), Material Type, Absorbency Level, Size/Length, Wing Type, Distribution Channel, Usage Type, Packaging Type, Age Group, End-users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Sanitary Napkins and Pads Market Size, Share, and Growth

The global sanitary napkins and pads market is experiencing robust growth, with its estimated value of USD 27.8 billion in the year 2025 and USD 44.4 billion by the period 2035, registering a CAGR of 4.8%, during the forecast period. The global sanitary napkins and pads market is becoming more and more influenced by the health and wellness tendency in consumers, as the customers are interested in things which provide comfort, skin friendliness, and dependable protection. The increasing awareness of menstrual hygiene, a shift in favor of natural or organic products, and the need to find environmentally friendly, biodegradable options, are encouraging brands to develop high-quality, safe, and convenient products.

Amar Tulsiyan, Founder, Niine Sanitary Napkins, said, "Five years ago, we were challenged with a crucial question: 'Can you develop a sustainable solution?' Today, we proudly present our resounding answer. After extensive research, development, and certifications, we launch our biodegradable sanitary napkins—a leap towards the future, embodying an evolution for a better tomorrow. Importantly, this milestone aligns with the UN's sustainable development goals, emphasising a cleaner environment for all. As pioneers, we take pride in leading the way, championing sustainability and empowering individuals with a responsible choice.

The multifunctional and lifestyle-integrated product types are becoming one of the major forces behind the sanitary napkins and pads market. Manufacturers are creating pads that have odor-neutralizing technology, skin-soothing botanicals and adaptive absorbency that adjusts to the activity and hormone levels. Partnerships with digital health platforms also contribute to the development of the market, as they give an individual approach to ovulation tracking, product choices, and wellness advice.

The growing use of hybrid period care products that use a combination of disposables with reusable features such as pads containing detachable liners or biodegradable features built into the product are expanding choice but also helped to counter the environmental issue. For instance, patent on a reusable sanitary pad (WO2022034113A1) in which the top layer is made of fabric and an insert that is removable but wicks fluid into a reusable absorbent core. DTC and lifestyle-based subscription services are increasing involvement, convenience and repeat buying attitudes, especially in urban and technologically-advanced populations.

These innovations position the market to attract health-conscious, convenience-seeking, and sustainability-minded customers, with businesses distinguishing themselves through functionality, personalization, and ecosystem integration. The trend of consumers shifting towards hybrid and reusable solutions stimulates product design, materials and subscription models. In conjuction, co-operations with digital platforms and health-centered programs improve brand participation and create long-term loyalty by various demographic groups.

Sanitary Napkins and Pads Market Dynamics and Trends

Driver: Government Initiatives and Menstrual Health Awareness Campaigns

Restraint: Cultural Stigmas and Limited Disposal Infrastructure

Opportunity: Premium and Specialized Product Segment Development

Key Trend: Sustainable and Eco-Friendly Product Innovation

Sanitary Napkins and Pads Market Analysis and Segmental Data

Sanitary Napkins/Pads Dominate Global Sanitary Napkins and Pads Market

Asia Pacific Leads Global Sanitary Napkins and Pads Market Demand

Sanitary-Napkins-and-Pads-Market Ecosystem

The global sanitary napkins and pads market is moderately fragmented, with the major players like Procter and Gamble, Kimberly-Clark, Unicharm, Kao, and Essity competing in the market, using their resources of innovation, extensive marketing, extensive distribution channels, and a wide brand portfolio. Primary competitors and regional experts are concerned with local strategies and value positioning, whereas smaller domestic and new sustainable brands serve a niche segment.

The value chain involves the sourcing of super-absorbent polymer and cellulose pulp, non-woven fabrics manufacturing, process of automated assembly, and multi-channel distribution, which includes direct-to-consumer subscriptions. The best firms focus on vertical integration and optimization of processes to facilitate manufacturing efficiency and cost benefits. The use of proprietary material technologies and new product forms facilitates on varying offerings to the consumer segments between the normal protection offerings and the premium and organic offerings.

Recent Development and Strategic Overview:

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 27.8 Bn |

|

Market Forecast Value in 2035 |

USD 44.4 Bn |

|

Growth Rate (CAGR) |

4.8% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

|

Sanitary-Napkins-and-Pads-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Sanitary Napkins and Pads Market, By Product Type |

|

|

Sanitary Napkins and Pads Market, By Material Type |

|

|

Sanitary Napkins and Pads Market, By Absorbency Level |

|

|

Sanitary Napkins and Pads Market, By Size/Length |

|

|

Sanitary Napkins and Pads Market, By Wing Type |

|

|

Sanitary Napkins and Pads Market, By Distribution Channel |

|

|

Sanitary Napkins and Pads Market, By Usage Type |

|

|

Sanitary Napkins and Pads Market, By Packaging Type |

|

|

Sanitary Napkins and Pads Market, By Age Group |

|

|

Sanitary Napkins and Pads Market, By End-users |

|

Frequently Asked Questions

Table of Contents

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

Forecasting Models / Techniques

Multiple Regression Analysis

Time Series Analysis – Seasonal Patterns

Time Series Analysis – Trend Analysis

Expert Opinion – Expert Interviews

Multi-Scenario Development

Time Series Analysis – Moving Averages

Econometric Models

Expert Opinion – Delphi Method

Monte Carlo Simulation

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation