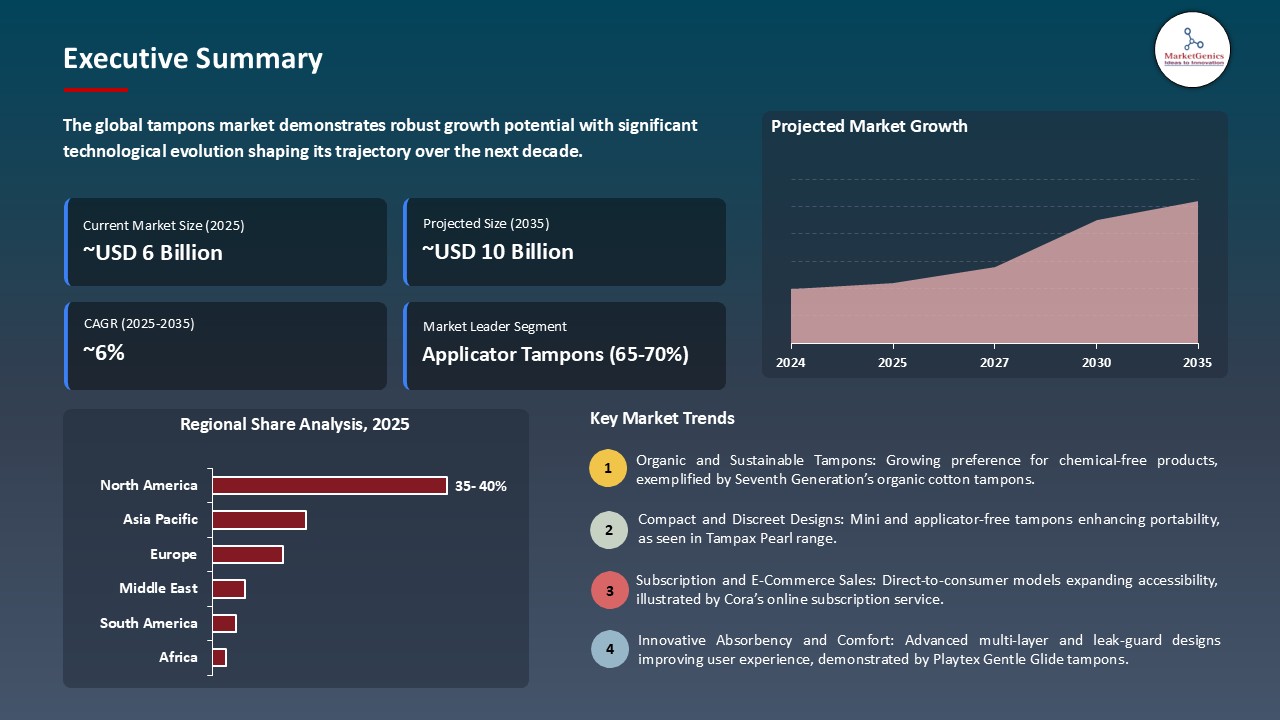

- The global tampons market is valued at USD 5.5 billion in 2025.

- The market is projected to grow at a CAGR of 6.1% during the forecast period of 2026 to 2035.

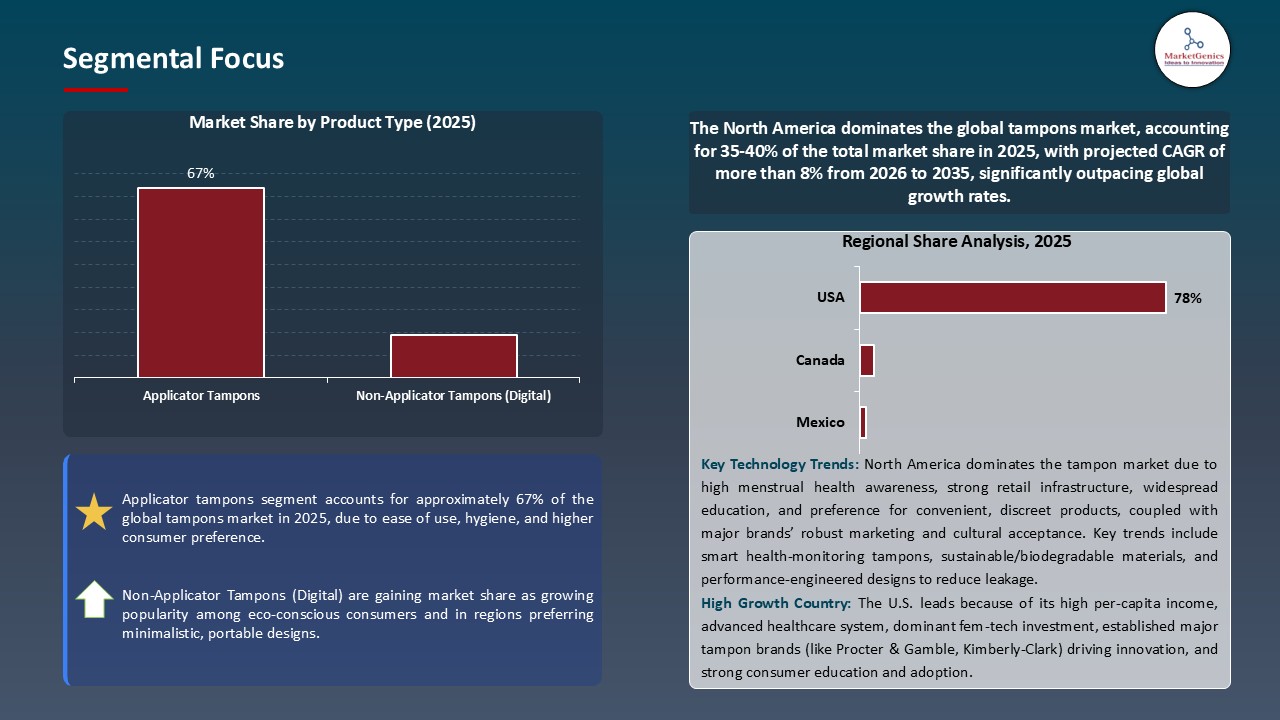

- The applicator tampons segment holds major share ~67% in the global tampons market, driven by consumer preference for convenience, hygiene, and ease of use.

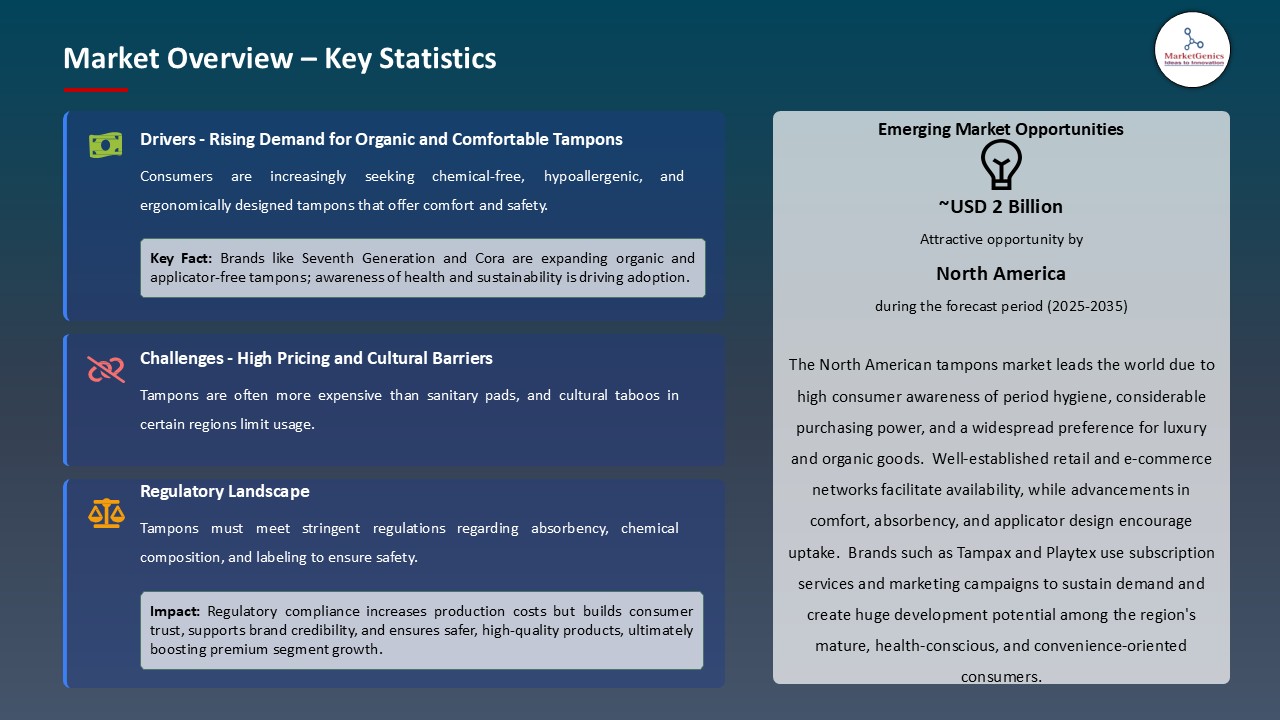

- Rising demand for personalized menstrual care: Growing consumer preference for tailored absorbency levels, applicator vs. non-applicator options, and subscription-based delivery is accelerating global adoption of tampons.

- Product innovation and feature enhancement: Advancements in organic and biodegradable materials, improved absorbency designs, leak-prevention technologies, and smart/diagnostic tampons are enhancing comfort, safety, and overall user experience in the tampons market.

- The top five player’s accounts for over 55% of the global tampons-market in 2025.

- In July 2025: VYLD launched Kelpon, the first biodegradable seaweed-based tampon that supports marine ecosystem restoration.

- In September 2025: Harper Hygienics introduced Cleanic Pure Cotton Tampons, a 100% organic, plastic- and chlorine-free sustainable menstrual care option.

- Global Tampons Market is likely to create the total forecasting opportunity of ~USD 4 Bn till 2035.

- North America leads the tampon market, driven by high consumer awareness, strong demand for organic and biodegradable products, and well-established retail and D2C channels. Premium product positioning and sustainability initiatives further support steady regional growth.

- The growing government and non-governmental effort that is dramatically raising access to menstrual hygiene products in developing economies. This can be achieved through subsidized distribution of tampons and sanitary pads, educational programs in schools, and sensitizing communities on the importance of using the new modern menstrual protection, especially in rural and low-income regions, to reduce cultural stigma and improves product knowledge and helps first time users transitioning to modern menstrual protection, instead of using traditional cloth or unhygienic methods.

- These initiatives are supported by massive national interventions in ensuring mass accessibility. For instance, the project of Menstrual hygiene education under Ladli Foundation is called Project Menstrushala which aims to reach 100 to 150 pad vending machines and incinerators in rural and peri-urban communities by 2030, thus even increasing accessibility and awareness. Corporate social responsibility projects by major manufacturers and other NGOs supplement these projects with donation programs, school awareness campaigns and vending machines and disposal systems.

- The combined effort of these multidimensional approaches will help boost awareness, build long-term demand, and expand in markets that previously had limited access to menstruation products.

- The global tampons market is experiencing a problem with the deep cultural taboos and social stigma towards menstruation. These norms limit free discussion, education, and product visibility in most areas especially first-time users and rural dwellers. The embarrassment that is linked to buying or using tampons tends to push potential customers to shun the domestic stores or use conventional substitutes, which narrows down the market reach.

- There is also the lack of awareness and social acceptance, which even more decelerates the adoption of products as new convenient-based products emerge. The stigma poses obstacles to the manufacturers who would desire to educate and get consumers involved, limiting the growth of demand among the important demographics. Brands can overcome problems by investing in targeted awareness campaigns, covert distribution routes, and community engagement activities.

- Market development will remain constrained in emerging and conservative areas until cultural perceptions shift and the stigma is gone.

- The increasing need of specialized product and product that is specific to particular consumer groups creates a growth potential of the tampons market. The increasing number of women in sports, professional lives and other specialized lifestyles is leading to the creation of menstrual products with special needs which include increased comfort, greater capacity to keep the wearer dry and fit in specific activities.

- Major brands are turning to alliances and product differentiation as an approach in serving these niche markets. For instance, in May 2024, Sequel has introduced its Spiral Tampon that is made with biodegradable viscose and BPA-free applicators in helical format, offering athletes the best leak control and absorption customized to the needs of active women. Also, the opportunity to obtain niche demographics and enhance brand engagement was demonstrated, when Sequel was announced as an official tampon partner of the Indiana Fever.

- These initiatives aid producers differentiate their merchandise, build consumer loyalty, reach untapped markets, and meet changing lifestyle and functionality needs.

- The digital-enabled health sector in the global tampons market is growing rapidly because customers now require products that are not only convenient but include their own menstrual and reproductive health knowledge and perspectives. Smart tampons, sensors, and applications, or built-in diagnostic functionality, are also making it possible to monitor menstruation, pH levels, and reproductive health indicators in real-time. This is a trend that indicates increased consumer concern with active data-driven health management.

- As a sign of this development, the market is adopting tampons that have a digital health system. For instance, in November 2023, the UK-based Fem tech Company Daye reused tampons into home-based STI testing kits, which used PCR to test sexually transmitted infections, including chlamydia and gonorrhoea with the results presented digitally. The innovation shows how menstrual hygiene products and health-tech solutions intersect to make them more convenient to users, encourage proactive reproductive health management, and provide a standard of what smart tampons should be in the future.

- Manufacturers advance app-integrated tampon R&D and engage with healthcare and telemedicine to ensure regulatory compliance. This confluence is raising the perception of smart tampons as a premium feminine care product.

- The applicator tampons segment leads the global tampons market, due to the convenience, healthiness, and wide consumer preference towards convenience in both urban and semi-urban communities. The segment is favored by increased interests in the health of menstruation, increasing use of high-end and organic products, and continued interest in comfortable and discreet solutions. Its reliability and easy to use feature support a leadership role in a variety of demographics.

- Additional technological innovations in the applicator ergonomics, biodegradable components, and absorbent core designs make the segment even more competitive. For instance, in 2023, biodegradable plastic tampon applicator designed by Corman and Tosama using the agricultural wastes (wheat, corn, and sugarcane) and integrating sustainability with easy and hygienic use. Expansion, which is facilitated by e-commerce platforms, subscription and strategic collaboration with healthcare programs and NGOs also contribute to growth.

- The presence of more safe and sustainable and comfortable menstrual solutions is still increasing consumer demand, which further strengthens the popularity of applicator tampons in the global market.

- North America leads the tampon market, fuelled by high levels of consumer awareness of menstrual health, a love of high-quality and organic products, and widespread use of convenience-based feminine hygiene products. Increasing urbanization, a growing number of females in the workforce, and the increasing growth in disposable income increases demand in the U.S. and Canada even more.

- Product innovation and brand expansions are used to support market momentum. For instance, in June 2024, Aunt Flow released 36-count direct-to-consumer boxes of tampons and pads, following on the school and university distribution efforts. The brand also launched a line of sanitary disposal system that is a vegetarian product due to the rising consumer demand towards sustainable, accessible, and health-conscious menstrual options.

- North American consumers are showing a growing preference towards tampons with more comfortable and hypoallergenic materials and smart packaging. Companies are adapting by expanding their online stores, subscriptions, and omnichannel retail businesses, as well as merging online interaction and instructional marketing methods.

- All of these factors enable North America one of the world's leading innovation and growth centers in the tampons market.

- In July 2025, VYLD launched Kelpon, the first tampon in the world, a seaweed-based one, with the support of the EU BlueInvest initiative. The biopolymer made out of seaweed is completely biodegradable and does not undergo any chemical bleaching, and its regenerative sourcing functions to absorb CO 2 and nitrogen, which is beneficial in restoring marine life.

- In September 2025, Harper Hygienics introduced Cleanic Pure Cotton Tampons, its first tampon collection in September 2025. The tampons are chlorine and plastic free with mini, normal and super sizes, so they provide an alternative to menstrual care that is sustainable and skin friendly.

- United States

- Canada

- Mexico

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic Countries

- Poland

- Russia & CIS

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Turkey

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Nigeria

- Algeria

- Brazil

- Argentina

- Corman SpA

- Edgewell Personal Care (Playtex, o.b.)

- Flex Company

- Johnson & Johnson

- Kao Corporation

- Kimberly-Clark Corporation

- Maxim Hygiene Products

- Daye

- Rael

- Seventh Generation

- TOTM

- Lola

- Unicharm Corporation

- Veeda

- Other Key Players

- Organic Tampons

- 100% Certified Organic Cotton

- Partially Organic

- Conventional Tampons

- Rayon

- Cotton-Rayon Blend

- Pure Cotton

- Biodegradable Tampons

- Reusable Tampons

- Light Flow

- Regular Flow

- Super Flow

- Ultra Flow

- Applicator Tampons

- Plastic Applicator

- Cardboard Applicator

- Biodegradable Applicator

- Non-Applicator Tampons (Digital)

- Online Channels

- E-commerce Platforms

- Company Websites

- Online Pharmacies

- Others

- Offline Channels

- Supermarkets/Hypermarkets

- Pharmacies/Drugstores

- Convenience Stores

- Specialty Stores

- Others

- Individual Wrapped

- Multi-pack Boxes

- 8-count

- 16-count

- 32-count

- 48-count and above

- Eco-friendly Packaging

- Travel-size Packaging

- Teenagers (13-19 years)

- Young Adults (20-30 years)

- Adults (31-45 years)

- Mature Adults (46+ years)

- Menstruating Women (General Population)

- Athletes and Sports Professionals

- Working Professionals

- Students

- Travelers

- Postpartum Women

- Women with Medical Conditions

- Other

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Tampons Market Outlook

- 2.1.1. Tampons Market Size Value (US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Tampons Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 3.1.1. Consumer Goods & Services Industry Ecosystem Analysis

- 3.1.2. Key Trends for Consumer Goods & Services Industry

- 3.1.3. Regional Distribution for Consumer Goods & Services Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Growing female workforce participation increasing demand for convenient menstrual hygiene products.

- 4.1.1.2. Rising awareness of menstrual health and expanded access through retail and e-commerce channels.

- 4.1.1.3. Product innovations such as organic, biodegradable, and chemical-free tampons.

- 4.1.2. Restraints

- 4.1.2.1. Cultural hesitancy and low acceptance in several emerging markets.

- 4.1.2.2. Risk concerns related to Toxic Shock Syndrome (TSS) and sensitivities toward synthetic materials.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Tampons Manufacturers

- 4.4.3. Dealers/ Distributors

- 4.4.4. End-Use

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Tampons Market Demand

- 4.7.1. Historical Market Size – Value (US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size – Value (US$ Bn), 2026–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Tampons Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Tampons Market Size Value (US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Organic Tampons

- 6.2.1.1. 100% Certified Organic Cotton

- 6.2.1.2. Partially Organic

- 6.2.2. Conventional Tampons

- 6.2.2.1. Rayon

- 6.2.2.2. Cotton-Rayon Blend

- 6.2.2.3. Pure Cotton

- 6.2.3. Biodegradable Tampons

- 6.2.4. Reusable Tampons

- 6.2.1. Organic Tampons

- 7. Global Tampons Market Analysis, by Absorbency Level

- 7.1. Key Segment Analysis

- 7.2. Tampons Market Size Value (US$ Bn), Analysis, and Forecasts, by Absorbency Level, 2021-2035

- 7.2.1. Light Flow

- 7.2.2. Regular Flow

- 7.2.3. Super Flow

- 7.2.4. Ultra Flow

- 8. Global Tampons Market Analysis, by Applicator Type

- 8.1. Key Segment Analysis

- 8.2. Tampons Market Size Value (US$ Bn), Analysis, and Forecasts, by Applicator Type, 2021-2035

- 8.2.1. Applicator Tampons

- 8.2.1.1. Plastic Applicator

- 8.2.1.2. Cardboard Applicator

- 8.2.1.3. Biodegradable Applicator

- 8.2.2. Non-Applicator Tampons (Digital)

- 8.2.1. Applicator Tampons

- 9. Global Tampons Market Analysis, by Distribution Channel

- 9.1. Key Segment Analysis

- 9.2. Tampons Market Size Value (US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 9.2.1. Online Channels

- 9.2.1.1. E-commerce Platforms

- 9.2.1.2. Company Websites

- 9.2.1.3. Online Pharmacies

- 9.2.1.4. Others

- 9.2.2. Offline Channels

- 9.2.2.1. Supermarkets/Hypermarkets

- 9.2.2.2. Pharmacies/Drugstores

- 9.2.2.3. Convenience Stores

- 9.2.2.4. Specialty Stores

- 9.2.2.5. Others

- 9.2.1. Online Channels

- 10. Global Tampons Market Analysis, by Packaging Type

- 10.1. Key Segment Analysis

- 10.2. Tampons Market Size Value (US$ Bn), Analysis, and Forecasts, by Packaging Type, 2021-2035

- 10.2.1. Individual Wrapped

- 10.2.2. Multi-pack Boxes

- 10.2.2.1. 8-count

- 10.2.2.2. 16-count

- 10.2.2.3. 32-count

- 10.2.2.4. 48-count and above

- 10.2.3. Eco-friendly Packaging

- 10.2.4. Travel-size Packaging

- 11. Global Tampons Market Analysis, by Target Age Group

- 11.1. Key Segment Analysis

- 11.2. Tampons Market Size Value (US$ Bn), Analysis, and Forecasts, by Target Age Group, 2021-2035

- 11.2.1. Teenagers (13-19 years)

- 11.2.2. Young Adults (20-30 years)

- 11.2.3. Adults (31-45 years)

- 11.2.4. Mature Adults (46+ years)

- 12. Global Tampons Market Analysis, by End-users

- 12.1. Key Segment Analysis

- 12.2. Tampons Market Size Value (US$ Bn), Analysis, and Forecasts, by End-users, 2021-2035

- 12.2.1. Menstruating Women (General Population)

- 12.2.2. Athletes and Sports Professionals

- 12.2.3. Working Professionals

- 12.2.4. Students

- 12.2.5. Travelers

- 12.2.6. Postpartum Women

- 12.2.7. Women with Medical Conditions

- 12.2.8. Other

- 13. Global Tampons Market Analysis and Forecasts, by Region

- 13.1. Key Findings

- 13.2. Tampons Market Size Value (US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America Tampons Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America Tampons Market Size-Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Product Type

- 14.3.2. Absorbency Level

- 14.3.3. Applicator Type

- 14.3.4. Distribution Channel

- 14.3.5. Packaging Type

- 14.3.6. Target Age Group

- 14.3.7. End-users

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA Tampons Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Product Type

- 14.4.3. Absorbency Level

- 14.4.4. Applicator Type

- 14.4.5. Distribution Channel

- 14.4.6. Packaging Type

- 14.4.7. Target Age Group

- 14.4.8. End-users

- 14.5. Canada Tampons Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Product Type

- 14.5.3. Absorbency Level

- 14.5.4. Applicator Type

- 14.5.5. Distribution Channel

- 14.5.6. Packaging Type

- 14.5.7. Target Age Group

- 14.5.8. End-users

- 14.6. Mexico Tampons Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Product Type

- 14.6.3. Absorbency Level

- 14.6.4. Applicator Type

- 14.6.5. Distribution Channel

- 14.6.6. Packaging Type

- 14.6.7. Target Age Group

- 14.6.8. End-users

- 15. Europe Tampons Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe Tampons Market Size Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Absorbency Level

- 15.3.3. Applicator Type

- 15.3.4. Distribution Channel

- 15.3.5. Packaging Type

- 15.3.6. Target Age Group

- 15.3.7. End-users

- 15.3.8. Country

- 15.3.8.1. Germany

- 15.3.8.2. United Kingdom

- 15.3.8.3. France

- 15.3.8.4. Italy

- 15.3.8.5. Spain

- 15.3.8.6. Netherlands

- 15.3.8.7. Nordic Countries

- 15.3.8.8. Poland

- 15.3.8.9. Russia & CIS

- 15.3.8.10. Rest of Europe

- 15.4. Germany Tampons Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Absorbency Level

- 15.4.4. Applicator Type

- 15.4.5. Distribution Channel

- 15.4.6. Packaging Type

- 15.4.7. Target Age Group

- 15.4.8. End-users

- 15.5. United Kingdom Tampons Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Absorbency Level

- 15.5.4. Applicator Type

- 15.5.5. Distribution Channel

- 15.5.6. Packaging Type

- 15.5.7. Target Age Group

- 15.5.8. End-users

- 15.6. France Tampons Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Absorbency Level

- 15.6.4. Applicator Type

- 15.6.5. Distribution Channel

- 15.6.6. Packaging Type

- 15.6.7. Target Age Group

- 15.6.8. End-users

- 15.7. Italy Tampons Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Product Type

- 15.7.3. Absorbency Level

- 15.7.4. Applicator Type

- 15.7.5. Distribution Channel

- 15.7.6. Packaging Type

- 15.7.7. Target Age Group

- 15.7.8. End-users

- 15.8. Spain Tampons Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Product Type

- 15.8.3. Absorbency Level

- 15.8.4. Applicator Type

- 15.8.5. Distribution Channel

- 15.8.6. Packaging Type

- 15.8.7. Target Age Group

- 15.8.8. End-users

- 15.9. Netherlands Tampons Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Product Type

- 15.9.3. Absorbency Level

- 15.9.4. Applicator Type

- 15.9.5. Distribution Channel

- 15.9.6. Packaging Type

- 15.9.7. Target Age Group

- 15.9.8. End-users

- 15.10. Nordic Countries Tampons Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Product Type

- 15.10.3. Absorbency Level

- 15.10.4. Applicator Type

- 15.10.5. Distribution Channel

- 15.10.6. Packaging Type

- 15.10.7. Target Age Group

- 15.10.8. End-users

- 15.11. Poland Tampons Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Product Type

- 15.11.3. Absorbency Level

- 15.11.4. Applicator Type

- 15.11.5. Distribution Channel

- 15.11.6. Packaging Type

- 15.11.7. Target Age Group

- 15.11.8. End-users

- 15.12. Russia & CIS Tampons Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Product Type

- 15.12.3. Absorbency Level

- 15.12.4. Applicator Type

- 15.12.5. Distribution Channel

- 15.12.6. Packaging Type

- 15.12.7. Target Age Group

- 15.12.8. End-users

- 15.13. Rest of Europe Tampons Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Product Type

- 15.13.3. Absorbency Level

- 15.13.4. Applicator Type

- 15.13.5. Distribution Channel

- 15.13.6. Packaging Type

- 15.13.7. Target Age Group

- 15.13.8. End-users

- 16. Asia Pacific Tampons Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Asia Pacific Tampons Market Size Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Absorbency Level

- 16.3.3. Applicator Type

- 16.3.4. Distribution Channel

- 16.3.5. Packaging Type

- 16.3.6. Target Age Group

- 16.3.7. End-users

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia Pacific

- 16.4. China Tampons Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Absorbency Level

- 16.4.4. Applicator Type

- 16.4.5. Distribution Channel

- 16.4.6. Packaging Type

- 16.4.7. Target Age Group

- 16.4.8. End-users

- 16.5. India Tampons Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Absorbency Level

- 16.5.4. Applicator Type

- 16.5.5. Distribution Channel

- 16.5.6. Packaging Type

- 16.5.7. Target Age Group

- 16.5.8. End-users

- 16.6. Japan Tampons Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Absorbency Level

- 16.6.4. Applicator Type

- 16.6.5. Distribution Channel

- 16.6.6. Packaging Type

- 16.6.7. Target Age Group

- 16.6.8. End-users

- 16.7. South Korea Tampons Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Absorbency Level

- 16.7.4. Applicator Type

- 16.7.5. Distribution Channel

- 16.7.6. Packaging Type

- 16.7.7. Target Age Group

- 16.7.8. End-users

- 16.8. Australia and New Zealand Tampons Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Absorbency Level

- 16.8.4. Applicator Type

- 16.8.5. Distribution Channel

- 16.8.6. Packaging Type

- 16.8.7. Target Age Group

- 16.8.8. End-users

- 16.9. Indonesia Tampons Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Product Type

- 16.9.3. Absorbency Level

- 16.9.4. Applicator Type

- 16.9.5. Distribution Channel

- 16.9.6. Packaging Type

- 16.9.7. Target Age Group

- 16.9.8. End-users

- 16.10. Malaysia Tampons Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Product Type

- 16.10.3. Absorbency Level

- 16.10.4. Applicator Type

- 16.10.5. Distribution Channel

- 16.10.6. Packaging Type

- 16.10.7. Target Age Group

- 16.10.8. End-users

- 16.11. Thailand Tampons Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Product Type

- 16.11.3. Absorbency Level

- 16.11.4. Applicator Type

- 16.11.5. Distribution Channel

- 16.11.6. Packaging Type

- 16.11.7. Target Age Group

- 16.11.8. End-users

- 16.12. Vietnam Tampons Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Product Type

- 16.12.3. Absorbency Level

- 16.12.4. Applicator Type

- 16.12.5. Distribution Channel

- 16.12.6. Packaging Type

- 16.12.7. Target Age Group

- 16.12.8. End-users

- 16.13. Rest of Asia Pacific Tampons Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Product Type

- 16.13.3. Absorbency Level

- 16.13.4. Applicator Type

- 16.13.5. Distribution Channel

- 16.13.6. Packaging Type

- 16.13.7. Target Age Group

- 16.13.8. End-users

- 17. Middle East Tampons Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East Tampons Market Size Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Absorbency Level

- 17.3.3. Applicator Type

- 17.3.4. Distribution Channel

- 17.3.5. Packaging Type

- 17.3.6. Target Age Group

- 17.3.7. End-users

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey Tampons Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Absorbency Level

- 17.4.4. Applicator Type

- 17.4.5. Distribution Channel

- 17.4.6. Packaging Type

- 17.4.7. Target Age Group

- 17.4.8. End-users

- 17.5. UAE Tampons Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Absorbency Level

- 17.5.4. Applicator Type

- 17.5.5. Distribution Channel

- 17.5.6. Packaging Type

- 17.5.7. Target Age Group

- 17.5.8. End-users

- 17.6. Saudi Arabia Tampons Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Absorbency Level

- 17.6.4. Applicator Type

- 17.6.5. Distribution Channel

- 17.6.6. Packaging Type

- 17.6.7. Target Age Group

- 17.6.8. End-users

- 17.7. Israel Tampons Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Absorbency Level

- 17.7.4. Applicator Type

- 17.7.5. Distribution Channel

- 17.7.6. Packaging Type

- 17.7.7. Target Age Group

- 17.7.8. End-users

- 17.8. Rest of Middle East Tampons Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Absorbency Level

- 17.8.4. Applicator Type

- 17.8.5. Distribution Channel

- 17.8.6. Packaging Type

- 17.8.7. Target Age Group

- 17.8.8. End-users

- 18. Africa Tampons Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa Tampons Market Size Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Absorbency Level

- 18.3.3. Applicator Type

- 18.3.4. Distribution Channel

- 18.3.5. Packaging Type

- 18.3.6. Target Age Group

- 18.3.7. End-users

- 18.3.7.1. South Africa

- 18.3.7.2. Egypt

- 18.3.7.3. Nigeria

- 18.3.7.4. Algeria

- 18.3.7.5. Rest of Africa

- 18.4. South Africa Tampons Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Absorbency Level

- 18.4.4. Applicator Type

- 18.4.5. Distribution Channel

- 18.4.6. Packaging Type

- 18.4.7. Target Age Group

- 18.4.8. End-users

- 18.5. Egypt Tampons Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Absorbency Level

- 18.5.4. Applicator Type

- 18.5.5. Distribution Channel

- 18.5.6. Packaging Type

- 18.5.7. Target Age Group

- 18.5.8. End-users

- 18.6. Nigeria Tampons Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Absorbency Level

- 18.6.4. Applicator Type

- 18.6.5. Distribution Channel

- 18.6.6. Packaging Type

- 18.6.7. Target Age Group

- 18.6.8. End-users

- 18.7. Algeria Tampons Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Absorbency Level

- 18.7.4. Applicator Type

- 18.7.5. Distribution Channel

- 18.7.6. Packaging Type

- 18.7.7. Target Age Group

- 18.7.8. End-users

- 18.8. Rest of Africa Tampons Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Absorbency Level

- 18.8.4. Applicator Type

- 18.8.5. Distribution Channel

- 18.8.6. Packaging Type

- 18.8.7. Target Age Group

- 18.8.8. End-users

- 19. South America Tampons Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. South America Tampons Market Size Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Absorbency Level

- 19.3.3. Applicator Type

- 19.3.4. Distribution Channel

- 19.3.5. Packaging Type

- 19.3.6. Target Age Group

- 19.3.7. End-users

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil Tampons Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Absorbency Level

- 19.4.4. Applicator Type

- 19.4.5. Distribution Channel

- 19.4.6. Packaging Type

- 19.4.7. Target Age Group

- 19.4.8. End-users

- 19.5. Argentina Tampons Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Absorbency Level

- 19.5.4. Applicator Type

- 19.5.5. Distribution Channel

- 19.5.6. Packaging Type

- 19.5.7. Target Age Group

- 19.5.8. End-users

- 19.6. Rest of South America Tampons Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Absorbency Level

- 19.6.4. Applicator Type

- 19.6.5. Distribution Channel

- 19.6.6. Packaging Type

- 19.6.7. Target Age Group

- 19.6.8. End-users

- 20. Key Players/ Company Profile

- 20.1. Cora

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. Corman SpA

- 20.3. Daye

- 20.4. Edgewell Personal Care (Playtex, o.b.)

- 20.5. Essity AB

- 20.6. Flex Company

- 20.7. Johnson & Johnson

- 20.8. Kao Corporation

- 20.9. Kimberly-Clark Corporation

- 20.10. Lola

- 20.11. Maxim Hygiene Products

- 20.12. Natracare

- 20.13. Organyc

- 20.14. Procter & Gamble (Tampax)

- 20.15. Rael

- 20.16. Seventh Generation

- 20.17. TOTM

- 20.18. Unicharm Corporation

- 20.19. Veeda

- 20.20. Other Key Players

- 20.1. Cora

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Insightified

Mid-to-large firms spend $20K–$40K quarterly on systematic research and typically recover multiples through improved growth and profitability

Research is no longer optional. Leading firms use it to uncover $10M+ in hidden revenue opportunities annually

Our research-consulting programs yields measurable ROI: 20–30% revenue increases from new markets, 11% profit upticks from pricing, and 20–30% cost savings from operations

Tampons Market Size, Share & Trends Analysis Report by Product Type (Organic Tampons, Conventional Tampons, Biodegradable Tampons, Reusable Tampons), Absorbency Level, Applicator Type, Distribution Channel, Packaging Type, Target Age Group, End-users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Tampons Market Size, Share, and Growth

The global tampons market is experiencing robust growth, with its estimated value of USD 5.5 billion in the year 2025 and USD 9.9 billion by 2035, registering a CAGR of 6.1%, during the forecast period. Wellness-based consumer behavior is also becoming the force behind the tampons market, as consumers are interested in products with a stronger emphasis on comfort, safety, and eco-design. The increasing demand of organic, biodegradable, and hypoallergenic products is compelling brands to create health-conscious, user-friendly tampon products that are both effective and sustainable and well-being oriented.

Claire Coder, founder and CEO of Aunt Flow, shares, Menstruators in 750 schools and 150 universities across the U.S. have come to trust Aunt Flow and rely on our period products during their school day. After receiving requests from parents that their daughters were curious if these products were available for ‘normal people sales’, we decided to give the girls what they’ve been asking for!

The demand of tampons is growing across the world due to the increased awareness on issues of health, the entry of more women into the workforce and the increased acceptance of menstrual hygiene products. The consumers also demand convenient, comfortable, and discreet solutions, and this preference has formed favor towards innovative and premium products that meet the various flow requirements and lifestyle preferences.

Market is moving towards the traditional retail to subscription, direct-to-consumer, and digitally integrated delivery solutions, which creates the convenience and repeat usage. Online platforms also provide individualized instruction, easy shopping and educational services, and the e-commerce and the contactless delivery increase accessibility in underserved areas. Brand engagement and retention are also enhanced with the help of loyalty programs and bundles of products that the company chooses.

Innovations in the absorbent materials, green designs and culture sensitive marketing tactics are other growth enabling factors that broaden the market in the emerging markets. As awareness grows, sustainability-oriented innovations, and digitally-refined distribution, the global tampons market is set to grow steadily in a diversified manner.

Tampons Market Dynamics and Trends

Driver: Rising Awareness of Menstrual Hygiene

Restraint: Cultural Taboos and Social Stigma Limiting Tampon Adoption

Opportunity: Customized Menstrual Solutions for Niche Demographics

Key Trend: Digital-Enabled Health Monitoring Tampons

Tampons Market Analysis and Segmental Data

Applicator Tampons Dominate Global Tampons Market

North America Leads Global Tampons Market Demand

Tampons-Market Ecosystem

The global tampons market is highly consolidated with the main players, including Procter & Gamble (Tampax), Kimberly-Clark, Johnson and Johnson, Edgewell Personal Care (Playtex, o.b.), and Unicharm, with their competitive advantages being innovation, brand recognition, large distribution systems, and size of marketing. The competition in Tier 2 and regional specialists targets localized orientation, value positioning and niche products, whereas smaller domestic and emerging sustainable brands cater to eco-conscious and specialty markets.

The value chain involves the procurement of absorbent fibers, production of applicators, tampon cores, automated assembly, distribution of the products in multi layers through wholesalers, retailers and expanding direct to consumer channels. Major manufacturers are vertically integrated throughout key manufacturing processes and are efficient due to automation, process innovation and proprietary materials. Differentiated products, such as ergonomic applicators, biodegradable cores, and skin-sensitive materials, can be offered with strategic product innovations that span consumer segments, with simple protection solutions, through to high-end and health-oriented solutions.

Recent Development and Strategic Overview:

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 5.5 Bn |

|

Market Forecast Value in 2035 |

USD 9.9 Bn |

|

Growth Rate (CAGR) |

6.1% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

|

Tampons-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Tampons Market, By Product Type |

|

|

Tampons Market, By Absorbency Level |

|

|

Tampons Market, By Applicator Type |

|

|

Tampons Market, By Distribution Channel |

|

|

Tampons Market, By Packaging Type |

|

|

Tampons Market, By Target Age Group |

|

|

Tampons Market, By End-users |

|

Frequently Asked Questions

Table of Contents

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

Forecasting Models / Techniques

Multiple Regression Analysis

Time Series Analysis – Seasonal Patterns

Time Series Analysis – Trend Analysis

Expert Opinion – Expert Interviews

Multi-Scenario Development

Time Series Analysis – Moving Averages

Econometric Models

Expert Opinion – Delphi Method

Monte Carlo Simulation

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation