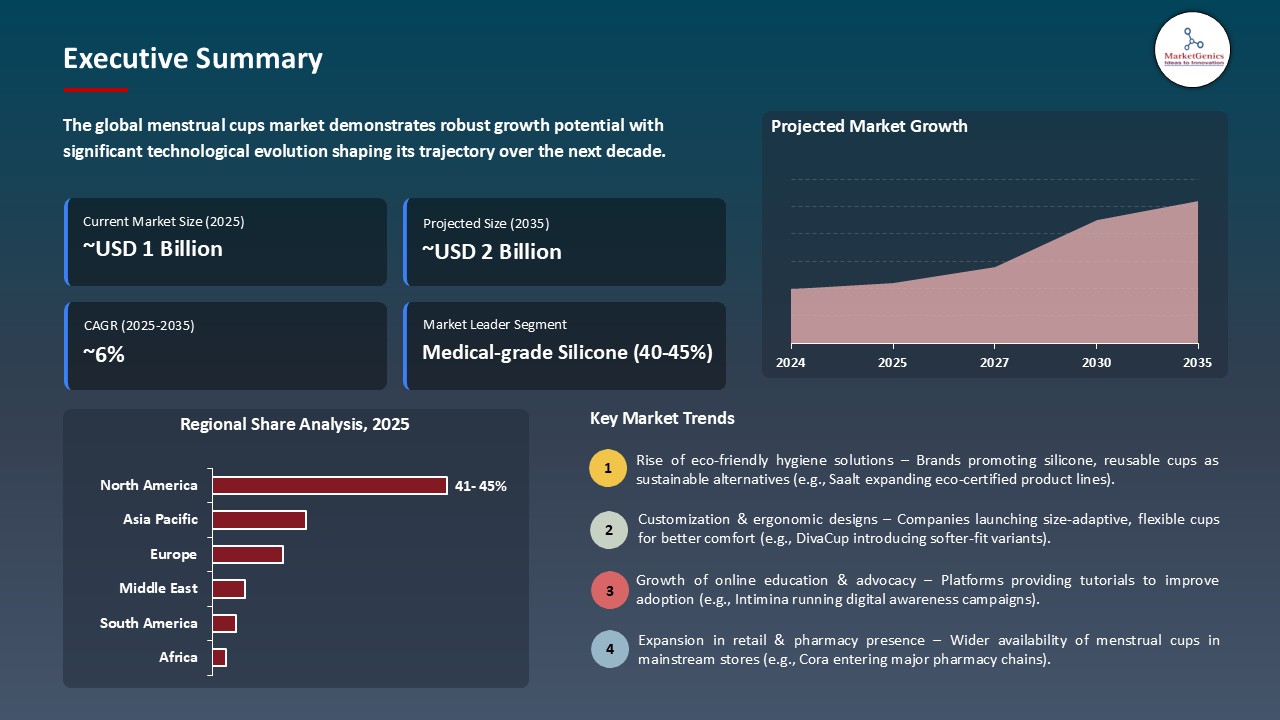

- The global menstrual cups market is valued at USD 1.1 billion in 2025.

- The market is projected to grow at a CAGR of 6.3% during the forecast period of 2026 to 2035.

- The medical-grade silicone segment holds major share ~41% in the global menstrual cups market, due to its superior hygiene, comfort, durability, and growing consumer preference for safe, long-lasting, and convenient menstrual solutions.

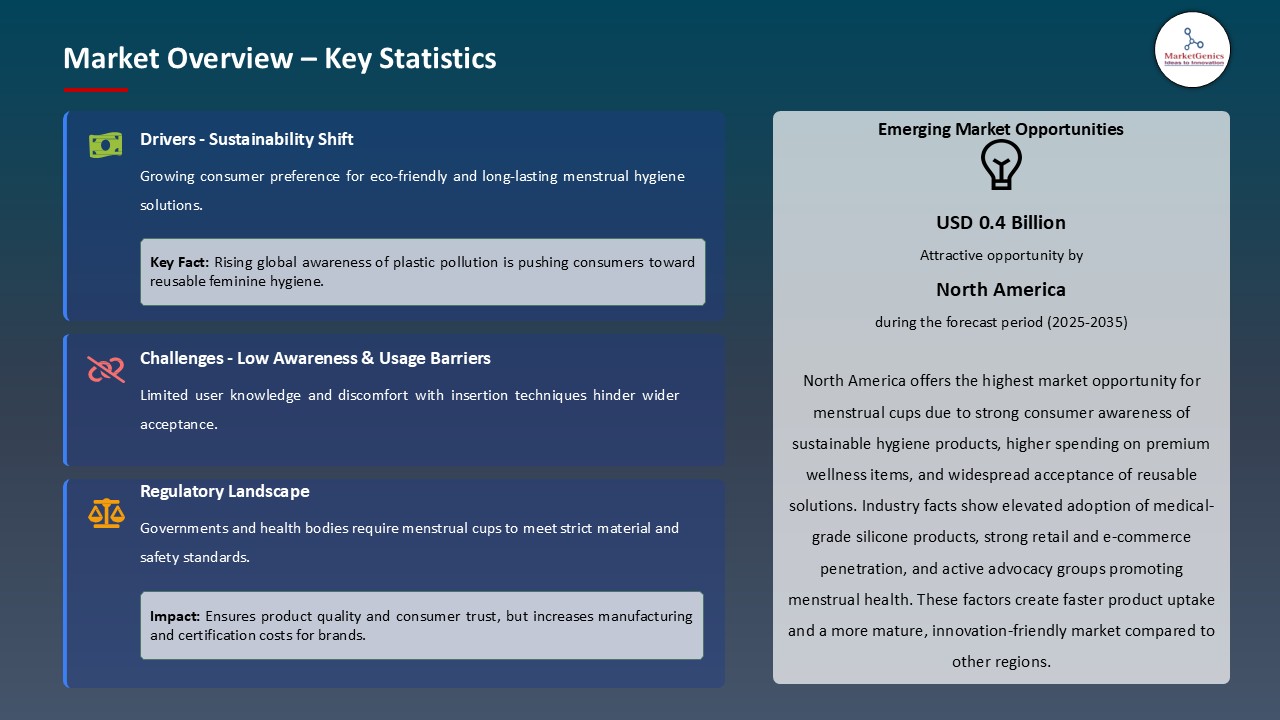

- Rising consumer demand for sustainable and personalized menstrual solutions is driving brands to develop reusable menstrual cups in multiple sizes, flexible designs, and subscription-based models that suit individual flow and lifestyle preferences.

- Innovation is accelerating: companies are launching medical-grade silicone cups with ergonomic shapes, foldable designs for comfort and portability, and skin-friendly, hypoallergenic materials, while emphasizing eco-friendly, long-lasting, and biodegradable production.

- The top five player’s accounts for nearly 25% of the global menstrual cups market in 2025.

- In May 2025, Perfectfit launched its first menstrual cup in Bali, made from 100% medical-grade silicone in two sizes, offering a sustainable, and low-waste alternative to disposables.

- In January 2025, Cambridge City Council partnered with Mooncup to offer reusable menstrual cups at £5 (down from £23.50), promoting sustainable adoption and reducing disposable waste.

- Global Menstrual Cups Market is likely to create the total forecasting opportunity of ~USD 1 Bn till 2035.

- North America leads the menstrual cups market, driven by high consumer purchasing power, increasing awareness of sustainable menstrual solutions, and a strong preference for wellness-focused products.

- The level of environmental awareness and sustainability increases, the menstrual cups market is changing the way consumers make purchases, brand commitment and product innovation. In the selection of personal care products, millennials and Gen Z, in particular, attach importance to authenticity, transparency, and compliance with personal values.

- Some of the ways in which market leaders react include re-formulating products, third-party certifications, sustainable packaging, marketing corporate values and targeted marketing. For instance, in 2023, the European Commission launched new EU Ecolabel rules to absorbent hygiene products and reusable menstrual cups, establishing high demands on the environment and safety, which brands can use to build stronger consumer confidence and distinguish their products. These programs also increase the brand differentiation, consumer trust and competitive advantages, particularly in a market in which sustainability contributes to premium pricing.

- These developments contribute to market expansion, creating opportunities for innovation leaders. Established players have to adapt to shifting customer needs and achieve stronger transformation.

- Cultural taboos and low consumer awareness constitute great challenges to the growth in menstrual cups market, its market penetration, business performance and expansion in different areas. Such obstacles are based on the lack of awareness, cultural values, economic barriers, and regulatory flexibility, which together limits the growth of the market.

- The companies are overcoming these obstacles by employing educational programs, partnerships with influencers, clinical validation, and pricing. An efficient mitigation must be a long term investment, culturally sensitive, strategic patient and must adapt to the local market conditions, consumer behavior and its competitive environment.

- The economic effect of these restraints is different segments. High-end products are more resilient because they provide exceptional value and have loyal customers, whereas mass-market products face greater pressure and require efficiency improvements, marketing innovation, and value-driven product development to remain competitive.

- The increase in e-commerce and direct-to-consumer (D2C) is presenting an enormous growth potential to menstrual cup providers. One of the outcomes of the growing preference of consumers to convenient, discreet, and value-filled shopping experiences is the brand response in terms of focused product development and channel strategies. The first to move is claiming this opportunity through differentiated design, online storefront, and digital engagement - and they are set to gain competitive advantage in the long term.

- Brands are building their digital-native, consumer-centric offerings by using social media, influencer content, and educating about menstrual cups, which is a reinforcer to their positioning. In April 2024, FemiSafe collaborated with Flipkart to increase its audiences, in the Indian Tier II and III cities, to earn a substantial share of its earnings online. This integration into electronic commerce systems enables the brands to achieve a quick gain, inventory optimization, and a connection to the customers. Businesses are forming strategic alliances with complementary brands, technology suppliers, and innovators to capitalize on the e-commerce boom.

- These collaborations not only help reach the channel, but they are also inventive enough to allow subscription products, entry-level kits, and direct-to-consumer solutions that add value, reduce friction, and encourage repeat purchases.

- The introduction of smart menstrual cups is changing the product functionality, consumer expectations, and competitors in the market. The trend represents the merging of technological innovation, scientific research, sustainability, and consumer demand, which need to be measurable, safe, and eco-friendly. First movers are setting the pace technologically and creating competitive advantages that can hardly be imitated by the followers. The advantages of using this trend in companies include; improvement in the performance of the products, brand differentiation, consumer satisfaction and increased power of prices.

- For instance, in 2023, Gals Bio released the Tulipon, a smart menstrual-cup-like device that provides AI-based health tracking of biomarkers such as vaginal pH and volume of monthly bleeding, with the aim of diagnosing conditions such as iron deficiency or infection. Adoption is most pronounced in highly consumer sophisticated markets where innovation is appreciated, which is facilitated by investment in research and development, clinical trials and consumer education. Smart menstrual cups can expand into new market sectors, including mass-market and price-sensitive purchasers, as awareness grows.

- This transformation will drive market revolution, individualized product offers, subscriptions, and results-based guarantees, thereby boosting customer connections and lifetime value.

- The medical-grade silicone material type leads the global menstrual cups market, due to the high level of consumer acceptance, on the basis of effective performance, good experiences, and brand reputation in the various market streams. The leadership has been notably pronounced in markets where familiarity, accessibility, and perceived value sustain preference despite competition arising in the market by alternative emerging products. For instance, in September 2024, Sunny received FDA 510(k) clearance of its Sunny Cup + Applicator, the first menstrual cup with a tampon-like applicator, the capacity and longevity of a cup and the familiarity with inserting a tampon.

- Market leaders are also still making investment on product innovation, brand development and expansion of distribution. Increases in design, performance, and sustainability improve competitive advantages, whereas strategic marketing based on clinical validation, influencer relationships, and user testimonials enhance consumer confidence and stimulate repeat buying behavior.

- The segment has solid supply chains, manufacturing knowledge, regulatory experience, and consumer understanding to inform product creation. These contributing variables facilitate lucrative development through line extensions, geographic expansion, and high-end products to consumers seeking enhanced performance and premium experiences.

- The North American leads the menstrual cups market, due to the strong consumer purchasing power, developed retail ecosystems and high-quality, sustainable personal care products, leading to the dominance of the menstrual cups market. Customers are extremely active in categories relating to wellness and they are very willing to move towards top quality innovations. For instnace, in May 2025, Bfree Cup, a Canadian social enterprise, introduced the first boil-, antibacterial-, and therefore safe-, convenient-to-use menstrual cup in the world in Winnipeg, which underscores the strength of the region in terms of innovative and safe and convenient solutions.

- Urban centers are innovation hubs where brands are tested, positioning perfected, and networks of influencers utilized. Favorable regulating environment, along with the developed e-commerce and social media platforms, will allow commercializing fast and reaching out to consumers individually, driving faster adoption among various groups.

- The region capitalizes on a strong concentration of well-developed personal care enterprises, advanced marketing abilities, and an audience open to new sustainable technology and solutions. These attributes will lead to long-term supremacy in the North American market, as global preferences shift toward quality, performance, and ecologic sustainability.

- In May 2025, Perfectfit launched its first menstrual cup in Bali, Indonesia, which was made of 100% medical-grade silicone and came in two sizes to fit and feel more comfortable. The mission is the launch of a sustainable and low waste period product alternative to disposable products. The product is designed to expedite the adoption of reusable menstrual products in Southeast Asia because it lays significant importance on body-safe materials and long-term affordability.

- In January 2025, Cambridge City Council launched a subsidy program in collaboration with Mooncup that enabled Cambridgeshire residents to buy the reusable period cup at a discounted price of only 5 pounds instead of the usual 23.50 to ensure that waste disposal on disposable menstrual items could be reduced and that people would adopt the reusable cup in high numbers.

- United States

- Canada

- Mexico

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic Countries

- Poland

- Russia & CIS

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Turkey

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Nigeria

- Algeria

- Brazil

- Argentina

- Blossom Cup

- Merula Cup

- Dutchess Cup

- Pixie Cup

- Flex Company

- Intimina (LELO)

- Juju Cup

- Lena Cup

- Lunette

- MeLuna USA

- Mooncup Ltd

- Saalt LLC

- Organicup

- Ruby Cup.

- Diva International Inc. (DivaCup)

- FemmyCycle

- Sckoon Organics

- Super Jennie

- The Keeper Inc.

- Yuuki Company

- Other Key Players

- Medical-grade Silicone

- Thermoplastic Elastomer (TPE)

- Latex/Rubber

- Natural Rubber

- Small (15-20 ml)

- Medium (20-25 ml)

- Large (25-30 ml)

- Extra Large (30+ ml)

- Soft Firmness

- Medium Firmness

- Firm

- Extra Firm

- Bell-shaped

- V-shaped

- Round-based

- Flat-based

- Rounded Rim

- Flat Rim

- Angled Rim

- Double Rim

- Ball Stem

- Ring Stem

- Flat Tab Stem

- Hollow Stem

- No Stem

- Online Channels

- E-commerce Platforms

- Company Websites

- Online Pharmacies

- Others

- Offline Channels

- Supermarkets/Hypermarkets

- Pharmacies/Drugstores

- Convenience Stores

- Specialty Stores

- Others

- Teenagers (13-19 years)

- Young Adults (20-29 years)

- Adults (30-39 years)

- Mature Adults (40-50 years)

- First-time Users/Beginners

- Experienced Users

- Postpartum Women

- Athletes/Sports Enthusiasts

- Travelers

- Environmentally Conscious Consumers

- Others

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Menstrual Cups Market Outlook

- 2.1.1. Menstrual Cups Market Size Volume (Million Units) and Value (US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Menstrual Cups Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Consumer Goods & Services Industry

- 3.1.3. Regional Distribution for Consumer Goods & Services Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Growing preference for reusable and eco-friendly feminine hygiene products.

- 4.1.1.2. Rising awareness of long-term cost efficiency compared to disposable alternatives.

- 4.1.1.3. Increasing campaigns by NGOs and health organizations promoting menstrual sustainability and safety.

- 4.1.2. Restraints

- 4.1.2.1. Limited awareness and cultural resistance in developing regions.

- 4.1.2.2. Initial discomfort, improper fit concerns, and lack of trained guidance for first-time users.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Manufacturing

- 4.4.3. Distribution

- 4.4.4. End-Use

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Menstrual Cups Market Demand

- 4.9.1. Historical Market Size – Volume (Million units) and Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size – Volume (Million units) and Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Menstrual Cups Market Analysis, by Material Type

- 6.1. Key Segment Analysis

- 6.2. Menstrual Cups Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Material Type, 2021-2035

- 6.2.1. Medical-grade Silicone

- 6.2.2. Thermoplastic Elastomer (TPE)

- 6.2.3. Latex/Rubber

- 6.2.4. Natural Rubber

- 7. Global Menstrual Cups Market Analysis, by Size/Capacity

- 7.1. Key Segment Analysis

- 7.2. Menstrual Cups Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Size/Capacity, 2021-2035

- 7.2.1. Small (15-20 ml)

- 7.2.2. Medium (20-25 ml)

- 7.2.3. Large (25-30 ml)

- 7.2.4. Extra Large (30+ ml)

- 8. Global Menstrual Cups Market Analysis, by Firmness Level

- 8.1. Key Segment Analysis

- 8.2. Menstrual Cups Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Firmness Level, 2021-2035

- 8.2.1. Soft Firmness

- 8.2.2. Medium Firmness

- 8.2.3. Firm

- 8.2.4. Extra Firm

- 9. Global Menstrual Cups Market Analysis, by Shape/Design

- 9.1. Key Segment Analysis

- 9.2. Menstrual Cups Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Shape/Design, 2021-2035

- 9.2.1. Bell-shaped

- 9.2.2. V-shaped

- 9.2.3. Round-based

- 9.2.4. Flat-based

- 10. Global Menstrual Cups Market Analysis, by Rim Type

- 10.1. Key Segment Analysis

- 10.2. Menstrual Cups Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Rim Type, 2021-2035

- 10.2.1. Rounded Rim

- 10.2.2. Flat Rim

- 10.2.3. Angled Rim

- 10.2.4. Double Rim

- 11. Global Menstrual Cups Market Analysis, by Stem Type

- 11.1. Key Segment Analysis

- 11.2. Menstrual Cups Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Stem Type, 2021-2035

- 11.2.1. Ball Stem

- 11.2.2. Ring Stem

- 11.2.3. Flat Tab Stem

- 11.2.4. Hollow Stem

- 11.2.5. No Stem

- 12. Global Menstrual Cups Market Analysis, by Distribution Channel

- 12.1. Key Segment Analysis

- 12.2. Menstrual Cups Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 12.2.1. Online Channels

- 12.2.1.1. E-commerce Platforms

- 12.2.1.2. Company Websites

- 12.2.1.3. Online Pharmacies

- 12.2.1.4. Others

- 12.2.2. Offline Channels

- 12.2.3. Supermarkets/Hypermarkets

- 12.2.3.1. Pharmacies/Drugstores

- 12.2.3.2. Convenience Stores

- 12.2.3.3. Specialty Stores

- 12.2.3.4. Others

- 12.2.1. Online Channels

- 13. Global Menstrual Cups Market Analysis, by Age Group

- 13.1. Key Segment Analysis

- 13.2. Menstrual Cups Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Age Group, 2021-2035

- 13.2.1. Teenagers (13-19 years)

- 13.2.2. Young Adults (20-29 years)

- 13.2.3. Adults (30-39 years)

- 13.2.4. Mature Adults (40-50 years)

- 14. Global Menstrual Cups Market Analysis, by End-Users

- 14.1. Key Segment Analysis

- 14.2. Menstrual Cups Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by End-Users, 2021-2035

- 14.2.1. First-time Users/Beginners

- 14.2.2. Experienced Users

- 14.2.3. Postpartum Women

- 14.2.4. Athletes/Sports Enthusiasts

- 14.2.5. Travelers

- 14.2.6. Environmentally Conscious Consumers

- 14.2.7. Others

- 15. Global Menstrual Cups Market Analysis and Forecasts, by Region

- 15.1. Key Findings

- 15.2. Menstrual Cups Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 15.2.1. North America

- 15.2.2. Europe

- 15.2.3. Asia Pacific

- 15.2.4. Middle East

- 15.2.5. Africa

- 15.2.6. South America

- 16. North America Menstrual Cups Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. North America Menstrual Cups Market Size Volume (Million units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Material Type

- 16.3.2. Size/Capacity

- 16.3.3. Firmness Level

- 16.3.4. Shape/Design

- 16.3.5. Rim Type

- 16.3.6. Stem Type

- 16.3.7. Distribution Channel

- 16.3.8. Age Group

- 16.3.9. End-Users

- 16.3.10. Country

- 16.3.10.1. USA

- 16.3.10.2. Canada

- 16.3.10.3. Mexico

- 16.4. USA Menstrual Cups Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Material Type

- 16.4.3. Size/Capacity

- 16.4.4. Firmness Level

- 16.4.5. Shape/Design

- 16.4.6. Rim Type

- 16.4.7. Stem Type

- 16.4.8. Distribution Channel

- 16.4.9. Age Group

- 16.4.10. End-Users

- 16.5. Canada Menstrual Cups Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Material Type

- 16.5.3. Size/Capacity

- 16.5.4. Firmness Level

- 16.5.5. Shape/Design

- 16.5.6. Rim Type

- 16.5.7. Stem Type

- 16.5.8. Distribution Channel

- 16.5.9. Age Group

- 16.5.10. End-Users

- 16.6. Mexico Menstrual Cups Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Material Type

- 16.6.3. Size/Capacity

- 16.6.4. Firmness Level

- 16.6.5. Shape/Design

- 16.6.6. Rim Type

- 16.6.7. Stem Type

- 16.6.8. Distribution Channel

- 16.6.9. Age Group

- 16.6.10. End-Users

- 17. Europe Menstrual Cups Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Europe Menstrual Cups Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Material Type

- 17.3.2. Size/Capacity

- 17.3.3. Firmness Level

- 17.3.4. Shape/Design

- 17.3.5. Rim Type

- 17.3.6. Stem Type

- 17.3.7. Distribution Channel

- 17.3.8. Age Group

- 17.3.9. End-Users

- 17.3.9.1. Germany

- 17.3.9.2. United Kingdom

- 17.3.9.3. France

- 17.3.9.4. Italy

- 17.3.9.5. Spain

- 17.3.9.6. Netherlands

- 17.3.9.7. Nordic Countries

- 17.3.9.8. Poland

- 17.3.9.9. Russia & CIS

- 17.3.9.10. Rest of Europe

- 17.4. Germany Menstrual Cups Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Material Type

- 17.4.3. Size/Capacity

- 17.4.4. Firmness Level

- 17.4.5. Shape/Design

- 17.4.6. Rim Type

- 17.4.7. Stem Type

- 17.4.8. Distribution Channel

- 17.4.9. Age Group

- 17.4.10. End-Users

- 17.5. United Kingdom Menstrual Cups Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Material Type

- 17.5.3. Size/Capacity

- 17.5.4. Firmness Level

- 17.5.5. Shape/Design

- 17.5.6. Rim Type

- 17.5.7. Stem Type

- 17.5.8. Distribution Channel

- 17.5.9. Age Group

- 17.5.10. End-Users

- 17.6. France Menstrual Cups Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Material Type

- 17.6.3. Size/Capacity

- 17.6.4. Firmness Level

- 17.6.5. Shape/Design

- 17.6.6. Rim Type

- 17.6.7. Stem Type

- 17.6.8. Distribution Channel

- 17.6.9. Age Group

- 17.6.10. End-Users

- 17.7. Italy Menstrual Cups Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Material Type

- 17.7.3. Size/Capacity

- 17.7.4. Firmness Level

- 17.7.5. Shape/Design

- 17.7.6. Rim Type

- 17.7.7. Stem Type

- 17.7.8. Distribution Channel

- 17.7.9. Age Group

- 17.7.10. End-Users

- 17.8. Spain Menstrual Cups Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Material Type

- 17.8.3. Size/Capacity

- 17.8.4. Firmness Level

- 17.8.5. Shape/Design

- 17.8.6. Rim Type

- 17.8.7. Stem Type

- 17.8.8. Distribution Channel

- 17.8.9. Age Group

- 17.8.10. End-Users

- 17.9. Netherlands Menstrual Cups Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Material Type

- 17.9.3. Size/Capacity

- 17.9.4. Firmness Level

- 17.9.5. Shape/Design

- 17.9.6. Rim Type

- 17.9.7. Stem Type

- 17.9.8. Distribution Channel

- 17.9.9. Age Group

- 17.9.10. End-Users

- 17.10. Nordic Countries Menstrual Cups Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Material Type

- 17.10.3. Size/Capacity

- 17.10.4. Firmness Level

- 17.10.5. Shape/Design

- 17.10.6. Rim Type

- 17.10.7. Stem Type

- 17.10.8. Distribution Channel

- 17.10.9. Age Group

- 17.10.10. End-Users

- 17.11. Poland Menstrual Cups Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Material Type

- 17.11.3. Size/Capacity

- 17.11.4. Firmness Level

- 17.11.5. Shape/Design

- 17.11.6. Rim Type

- 17.11.7. Stem Type

- 17.11.8. Distribution Channel

- 17.11.9. Age Group

- 17.11.10. End-Users

- 17.12. Russia & CIS Menstrual Cups Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Material Type

- 17.12.3. Size/Capacity

- 17.12.4. Firmness Level

- 17.12.5. Shape/Design

- 17.12.6. Rim Type

- 17.12.7. Stem Type

- 17.12.8. Distribution Channel

- 17.12.9. Age Group

- 17.12.10. End-Users

- 17.13. Rest of Europe Menstrual Cups Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Material Type

- 17.13.3. Size/Capacity

- 17.13.4. Firmness Level

- 17.13.5. Shape/Design

- 17.13.6. Rim Type

- 17.13.7. Stem Type

- 17.13.8. Distribution Channel

- 17.13.9. Age Group

- 17.13.10. End-Users

- 18. Asia Pacific Menstrual Cups Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Asia Pacific Menstrual Cups Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Material Type

- 18.3.2. Size/Capacity

- 18.3.3. Firmness Level

- 18.3.4. Shape/Design

- 18.3.5. Rim Type

- 18.3.6. Stem Type

- 18.3.7. Distribution Channel

- 18.3.8. Age Group

- 18.3.9. End-Users

- 18.3.10. Country

- 18.3.10.1. China

- 18.3.10.2. India

- 18.3.10.3. Japan

- 18.3.10.4. South Korea

- 18.3.10.5. Australia and New Zealand

- 18.3.10.6. Indonesia

- 18.3.10.7. Malaysia

- 18.3.10.8. Thailand

- 18.3.10.9. Vietnam

- 18.3.10.10. Rest of Asia Pacific

- 18.4. China Menstrual Cups Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Material Type

- 18.4.3. Size/Capacity

- 18.4.4. Firmness Level

- 18.4.5. Shape/Design

- 18.4.6. Rim Type

- 18.4.7. Stem Type

- 18.4.8. Distribution Channel

- 18.4.9. Age Group

- 18.4.10. End-Users

- 18.5. India Menstrual Cups Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Material Type

- 18.5.3. Size/Capacity

- 18.5.4. Firmness Level

- 18.5.5. Shape/Design

- 18.5.6. Rim Type

- 18.5.7. Stem Type

- 18.5.8. Distribution Channel

- 18.5.9. Age Group

- 18.5.10. End-Users

- 18.6. Japan Menstrual Cups Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Material Type

- 18.6.3. Size/Capacity

- 18.6.4. Firmness Level

- 18.6.5. Shape/Design

- 18.6.6. Rim Type

- 18.6.7. Stem Type

- 18.6.8. Distribution Channel

- 18.6.9. Age Group

- 18.6.10. End-Users

- 18.7. South Korea Menstrual Cups Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Material Type

- 18.7.3. Size/Capacity

- 18.7.4. Firmness Level

- 18.7.5. Shape/Design

- 18.7.6. Rim Type

- 18.7.7. Stem Type

- 18.7.8. Distribution Channel

- 18.7.9. Age Group

- 18.7.10. End-Users

- 18.8. Australia and New Zealand Menstrual Cups Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Material Type

- 18.8.3. Size/Capacity

- 18.8.4. Firmness Level

- 18.8.5. Shape/Design

- 18.8.6. Rim Type

- 18.8.7. Stem Type

- 18.8.8. Distribution Channel

- 18.8.9. Age Group

- 18.8.10. End-Users

- 18.9. Indonesia Menstrual Cups Market

- 18.9.1. Country Segmental Analysis

- 18.9.2. Material Type

- 18.9.3. Size/Capacity

- 18.9.4. Firmness Level

- 18.9.5. Shape/Design

- 18.9.6. Rim Type

- 18.9.7. Stem Type

- 18.9.8. Distribution Channel

- 18.9.9. Age Group

- 18.9.10. End-Users

- 18.10. Malaysia Menstrual Cups Market

- 18.10.1. Country Segmental Analysis

- 18.10.2. Material Type

- 18.10.3. Size/Capacity

- 18.10.4. Firmness Level

- 18.10.5. Shape/Design

- 18.10.6. Rim Type

- 18.10.7. Stem Type

- 18.10.8. Distribution Channel

- 18.10.9. Age Group

- 18.10.10. End-Users

- 18.11. Thailand Menstrual Cups Market

- 18.11.1. Country Segmental Analysis

- 18.11.2. Material Type

- 18.11.3. Size/Capacity

- 18.11.4. Firmness Level

- 18.11.5. Shape/Design

- 18.11.6. Rim Type

- 18.11.7. Stem Type

- 18.11.8. Distribution Channel

- 18.11.9. Age Group

- 18.11.10. End-Users

- 18.12. Vietnam Menstrual Cups Market

- 18.12.1. Country Segmental Analysis

- 18.12.2. Material Type

- 18.12.3. Size/Capacity

- 18.12.4. Firmness Level

- 18.12.5. Shape/Design

- 18.12.6. Rim Type

- 18.12.7. Stem Type

- 18.12.8. Distribution Channel

- 18.12.9. Age Group

- 18.12.10. End-Users

- 18.13. Rest of Asia Pacific Menstrual Cups Market

- 18.13.1. Country Segmental Analysis

- 18.13.2. Material Type

- 18.13.3. Size/Capacity

- 18.13.4. Firmness Level

- 18.13.5. Shape/Design

- 18.13.6. Rim Type

- 18.13.7. Stem Type

- 18.13.8. Distribution Channel

- 18.13.9. Age Group

- 18.13.10. End-Users

- 19. Middle East Menstrual Cups Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Middle East Menstrual Cups Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Material Type

- 19.3.2. Size/Capacity

- 19.3.3. Firmness Level

- 19.3.4. Shape/Design

- 19.3.5. Rim Type

- 19.3.6. Stem Type

- 19.3.7. Distribution Channel

- 19.3.8. Age Group

- 19.3.9. End-Users

- 19.3.10. Country

- 19.3.10.1. Turkey

- 19.3.10.2. UAE

- 19.3.10.3. Saudi Arabia

- 19.3.10.4. Israel

- 19.3.10.5. Rest of Middle East

- 19.4. Turkey Menstrual Cups Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Material Type

- 19.4.3. Size/Capacity

- 19.4.4. Firmness Level

- 19.4.5. Shape/Design

- 19.4.6. Rim Type

- 19.4.7. Stem Type

- 19.4.8. Distribution Channel

- 19.4.9. Age Group

- 19.4.10. End-Users

- 19.5. UAE Menstrual Cups Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Material Type

- 19.5.3. Size/Capacity

- 19.5.4. Firmness Level

- 19.5.5. Shape/Design

- 19.5.6. Rim Type

- 19.5.7. Stem Type

- 19.5.8. Distribution Channel

- 19.5.9. Age Group

- 19.5.10. End-Users

- 19.6. Saudi Arabia Menstrual Cups Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Material Type

- 19.6.3. Size/Capacity

- 19.6.4. Firmness Level

- 19.6.5. Shape/Design

- 19.6.6. Rim Type

- 19.6.7. Stem Type

- 19.6.8. Distribution Channel

- 19.6.9. Age Group

- 19.6.10. End-Users

- 19.7. Israel Menstrual Cups Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Material Type

- 19.7.3. Size/Capacity

- 19.7.4. Firmness Level

- 19.7.5. Shape/Design

- 19.7.6. Rim Type

- 19.7.7. Stem Type

- 19.7.8. Distribution Channel

- 19.7.9. Age Group

- 19.7.10. End-Users

- 19.8. Rest of Middle East Menstrual Cups Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Material Type

- 19.8.3. Size/Capacity

- 19.8.4. Firmness Level

- 19.8.5. Shape/Design

- 19.8.6. Rim Type

- 19.8.7. Stem Type

- 19.8.8. Distribution Channel

- 19.8.9. Age Group

- 19.8.10. End-Users

- 20. Africa Menstrual Cups Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Africa Menstrual Cups Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Material Type

- 20.3.2. Size/Capacity

- 20.3.3. Firmness Level

- 20.3.4. Shape/Design

- 20.3.5. Rim Type

- 20.3.6. Stem Type

- 20.3.7. Distribution Channel

- 20.3.8. Age Group

- 20.3.9. End-Users

- 20.3.10. Country

- 20.3.10.1. South Africa

- 20.3.10.2. Egypt

- 20.3.10.3. Nigeria

- 20.3.10.4. Algeria

- 20.3.10.5. Rest of Africa

- 20.4. South Africa Menstrual Cups Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Material Type

- 20.4.3. Size/Capacity

- 20.4.4. Firmness Level

- 20.4.5. Shape/Design

- 20.4.6. Rim Type

- 20.4.7. Stem Type

- 20.4.8. Distribution Channel

- 20.4.9. Age Group

- 20.4.10. End-Users

- 20.5. Egypt Menstrual Cups Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Material Type

- 20.5.3. Size/Capacity

- 20.5.4. Firmness Level

- 20.5.5. Shape/Design

- 20.5.6. Rim Type

- 20.5.7. Stem Type

- 20.5.8. Distribution Channel

- 20.5.9. Age Group

- 20.5.10. End-Users

- 20.6. Nigeria Menstrual Cups Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Material Type

- 20.6.3. Size/Capacity

- 20.6.4. Firmness Level

- 20.6.5. Shape/Design

- 20.6.6. Rim Type

- 20.6.7. Stem Type

- 20.6.8. Distribution Channel

- 20.6.9. Age Group

- 20.6.10. End-Users

- 20.7. Algeria Menstrual Cups Market

- 20.7.1. Country Segmental Analysis

- 20.7.2. Material Type

- 20.7.3. Size/Capacity

- 20.7.4. Firmness Level

- 20.7.5. Shape/Design

- 20.7.6. Rim Type

- 20.7.7. Stem Type

- 20.7.8. Distribution Channel

- 20.7.9. Age Group

- 20.7.10. End-Users

- 20.8. Rest of Africa Menstrual Cups Market

- 20.8.1. Country Segmental Analysis

- 20.8.2. Material Type

- 20.8.3. Size/Capacity

- 20.8.4. Firmness Level

- 20.8.5. Shape/Design

- 20.8.6. Rim Type

- 20.8.7. Stem Type

- 20.8.8. Distribution Channel

- 20.8.9. Age Group

- 20.8.10. End-Users

- 21. South America Menstrual Cups Market Analysis

- 21.1. Key Segment Analysis

- 21.2. Regional Snapshot

- 21.3. South America Menstrual Cups Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 21.3.1. Material Type

- 21.3.2. Size/Capacity

- 21.3.3. Firmness Level

- 21.3.4. Shape/Design

- 21.3.5. Rim Type

- 21.3.6. Stem Type

- 21.3.7. Distribution Channel

- 21.3.8. Age Group

- 21.3.9. End-Users

- 21.3.10. Country

- 21.3.10.1. Brazil

- 21.3.10.2. Argentina

- 21.3.10.3. Rest of South America

- 21.4. Brazil Menstrual Cups Market

- 21.4.1. Country Segmental Analysis

- 21.4.2. Material Type

- 21.4.3. Size/Capacity

- 21.4.4. Firmness Level

- 21.4.5. Shape/Design

- 21.4.6. Rim Type

- 21.4.7. Stem Type

- 21.4.8. Distribution Channel

- 21.4.9. Age Group

- 21.4.10. End-Users

- 21.5. Argentina Menstrual Cups Market

- 21.5.1. Country Segmental Analysis

- 21.5.2. Material Type

- 21.5.3. Size/Capacity

- 21.5.4. Firmness Level

- 21.5.5. Shape/Design

- 21.5.6. Rim Type

- 21.5.7. Stem Type

- 21.5.8. Distribution Channel

- 21.5.9. Age Group

- 21.5.10. End-Users

- 21.6. Rest of South America Menstrual Cups Market

- 21.6.1. Country Segmental Analysis

- 21.6.2. Material Type

- 21.6.3. Size/Capacity

- 21.6.4. Firmness Level

- 21.6.5. Shape/Design

- 21.6.6. Rim Type

- 21.6.7. Stem Type

- 21.6.8. Distribution Channel

- 21.6.9. Age Group

- 21.6.10. End-Users

- 22. Key Players/ Company Profile

- 22.1. Blossom Cup.

- 22.1.1. Company Details/ Overview

- 22.1.2. Company Financials

- 22.1.3. Key Customers and Competitors

- 22.1.4. Business/ Industry Portfolio

- 22.1.5. Product Portfolio/ Specification Details

- 22.1.6. Pricing Data

- 22.1.7. Strategic Overview

- 22.1.8. Recent Developments

- 22.2. Diva International Inc. (DivaCup)

- 22.3. Dutchess Cup

- 22.4. FemmyCycle

- 22.5. Flex Company

- 22.6. Intimina (LELO)

- 22.7. Juju Cup

- 22.8. Lena Cup

- 22.9. Lunette

- 22.10. MeLuna USA

- 22.11. Merula Cup

- 22.12. Mooncup Ltd

- 22.13. Organicup

- 22.14. Pixie Cup

- 22.15. Ruby Cup

- 22.16. Saalt LLC

- 22.17. Sckoon Organics

- 22.18. Super Jennie

- 22.19. The Keeper Inc.

- 22.20. Yuuki Company

- 22.21. Other Key Players

- 22.1. Blossom Cup.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Insightified

Mid-to-large firms spend $20K–$40K quarterly on systematic research and typically recover multiples through improved growth and profitability

Research is no longer optional. Leading firms use it to uncover $10M+ in hidden revenue opportunities annually

Our research-consulting programs yields measurable ROI: 20–30% revenue increases from new markets, 11% profit upticks from pricing, and 20–30% cost savings from operations

Menstrual Cups Market Size, Share & Trends Analysis Report by Material Type (Medical-grade Silicone, Thermoplastic Elastomer (TPE), Latex/Rubber, Natural Rubber), Size/Capacity, Firmness Level, Shape/Design, Rim Type, Stem Type, Distribution Channel, Age Group, End-Users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Menstrual Cups Market Size, Share, and Growth

The global menstrual cups market is experiencing robust growth, with its estimated value of USD 1.1 billion in the year 2025 and ~USD 2 billion by 2035, registering a CAGR of 6.3%, during the forecast period. The menstrual cups market is developing globally due to increasing consumer interest in wellness, sustainability, and comfort with a need to use a skin-safe, safe, and reliable menstrual cups. The increasing awareness of menstrual hygiene and support of eco-friendly and biodegradable products is pushing the brands to innovate with high-quality and convenient products.

Zeinab Hosseinidoust, an associate professor of biomedical and chemical engineering and co-lead researcher on the team, says,

"This project opened my eyes to how urgently innovation is needed in menstrual care. There’s been little movement in the conversation around menstrual care. Some of that is due to stigma and some is lack of interest, but cups have the potential to make a serious difference in the lives of women around the world."

The menstrual cups market is experiencing a positive growth due to the demand to buy well-centered, environmentally friendly, and personalized items among consumers. Women are more demanding products that would capture their values, focusing on transparency, ethical sourcing, and clinical-supported effectiveness. This movement is reflective of the wider societal changes that enable women to make sound decision-making behaviors on health and beauty and their effects on the environment.

Market-leaders are reformulating products in order to eliminate problematic ingredients, adopt sustainable packaging and use digital channels to create genuine consumer relationships. For instance, in 2025, the Kerala government increased its project of distributing menstrual cups under the program Thinkal, where 300,000 menstrual cups were provided to the needy women free of charge with resources to educate them on their application, with institutional and consumer attention to sustainable menstrual health growing. Brands are also implementing clean beauty, getting certifications and utilizing educational content to deliver benefits to value-conscious knowledgeable consumers.

There are adjacent opportunities in subscriptions-based delivery, online menstrual wellness health services and additional eco-friendly feminine care products. These sectors enable the menstrual cup firms to expand their revenue, improve customer lifetime value, and create complete ecosystems that cover various sides of female health and beauty.

Menstrual Cups Market Dynamics and Trends

Driver: Growing Environmental Consciousness and Sustainability Awareness

Restraint: Cultural Taboos and Limited Awareness in Emerging Markets

Opportunity: Expanding E-Commerce Penetration and Direct-to-Consumer Channels

Key Trend: Development of Smart Menstrual Cups with Health Monitoring Capabilities

Menstrual-Cups-Market Analysis and Segmental Data

Medical-grade Silicone Dominate Global Menstrual Cups Market

North America Leads Global Menstrual Cups Market Demand

Menstrual-Cups-Market Ecosystem

The global menstrual cups markets are moderately fragmented, with well-established companies like Diva International Inc. (DivaCup), Lunette, Mooncup Ltd., Saalt LLC, and MeLuna USA competing with new D2C companies. Major players use powerful research and development, quality production, and extensive retailing network to establish themselves in the market, and smaller brands distinguish themselves by using higher quality material, ergonomic design, and community-driven form of engagement that is aimed at younger and more sustainability oriented consumers.

The value chain extends to suppliers of materials, product developers, contract manufacturers, packaging partners, distributors and omnichannel retail platforms. Firms are moving towards vertical integration, reinforcing D2C relationships, and investing in digital marketing to enhance a better margin and establish long-lasting consumer relationships. These plans are conducive to more individualization, quicker innovation times, and evidence-based product innovation that will increase the competitiveness in the market at large.

Recent Development and Strategic Overview:

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 1.1 Bn |

|

Market Forecast Value in 2035 |

~USD 2 Bn |

|

Growth Rate (CAGR) |

6.3% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Million Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

|

Menstrual-Cups-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Menstrual Cups Market, By Material Type |

|

|

Menstrual Cups Market, By Size/Capacity |

|

|

Menstrual Cups Market, By Firmness Level |

|

|

Menstrual Cups Market, By Shape/Design |

|

|

Menstrual Cups Market, By Rim Type |

|

|

Menstrual Cups Market, By Stem Type |

|

|

Menstrual Cups Market, By Distribution Channel |

|

|

Menstrual Cups Market, By Age Group |

|

|

Menstrual Cups Market, By End-Users |

|

Frequently Asked Questions

Table of Contents

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

Forecasting Models / Techniques

Multiple Regression Analysis

Time Series Analysis – Seasonal Patterns

Time Series Analysis – Trend Analysis

Expert Opinion – Expert Interviews

Multi-Scenario Development

Time Series Analysis – Moving Averages

Econometric Models

Expert Opinion – Delphi Method

Monte Carlo Simulation

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation