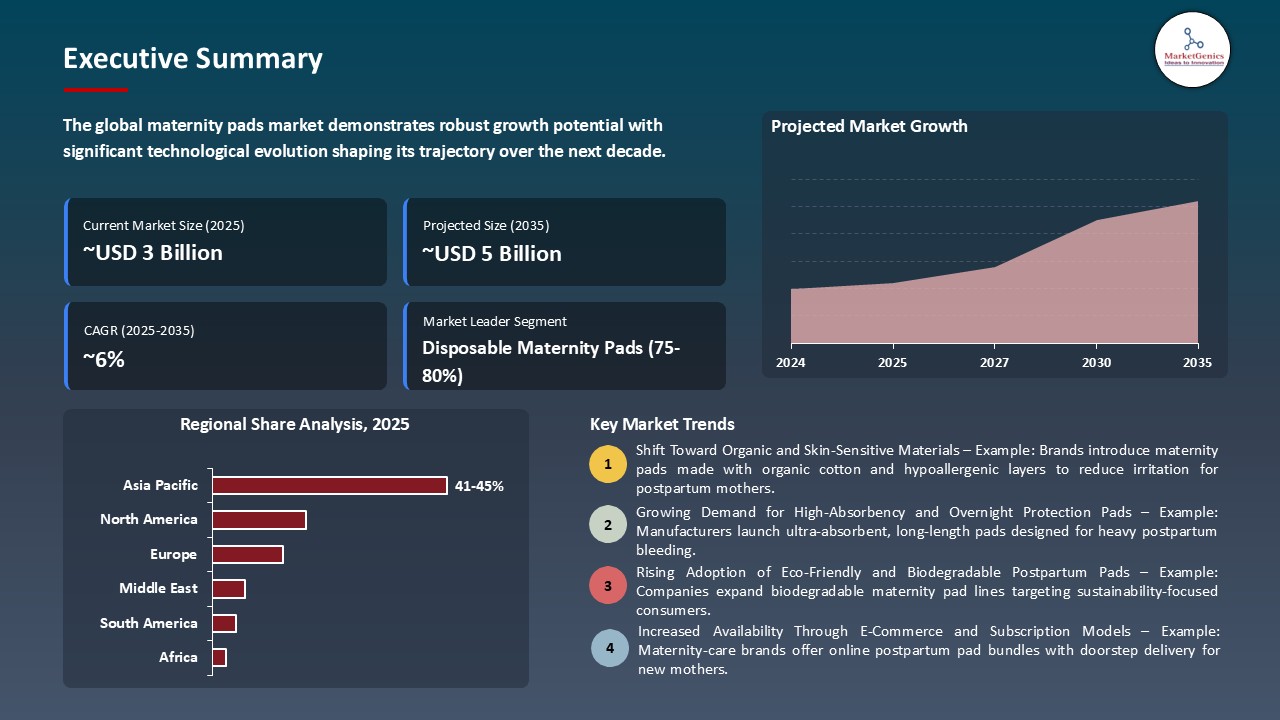

- The global maternity pads market is valued at USD 2.8 billion in 2025.

- The market is projected to grow at a CAGR of 6.4% during the forecast period of 2026 to 2035.

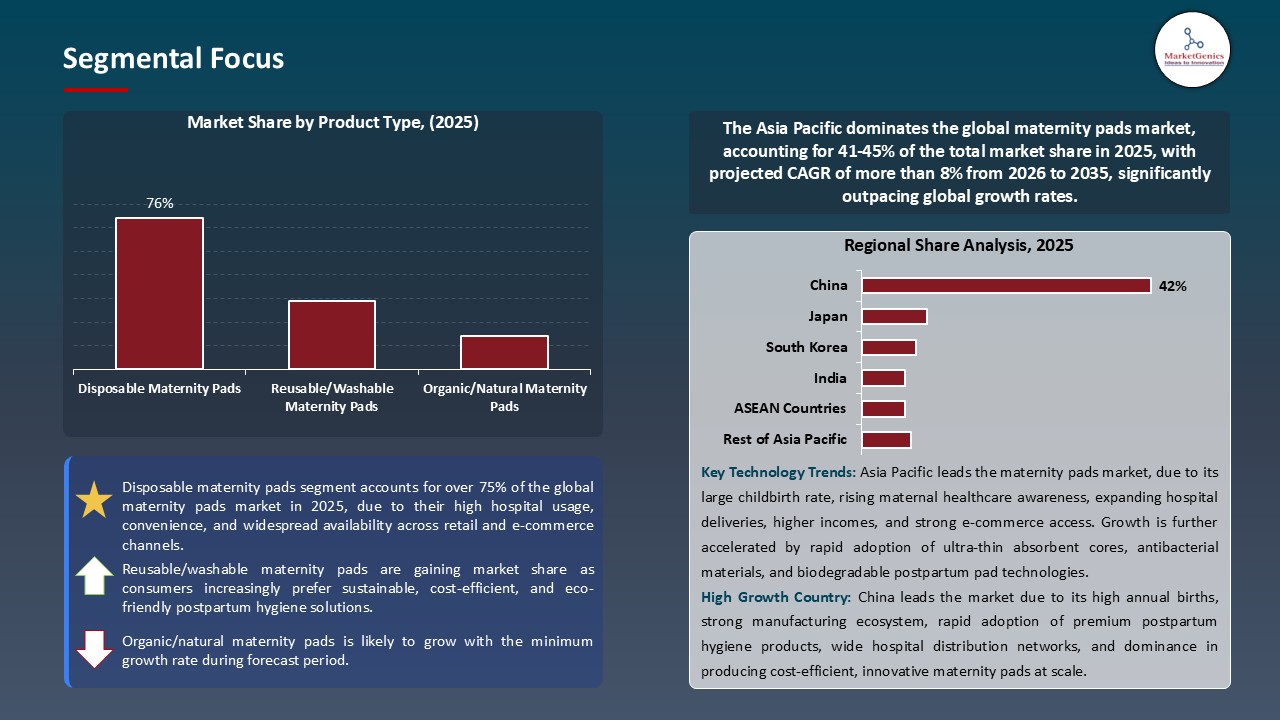

- The disposable maternity pads segment holds major share ~76% in the global maternity pads market, due to high demand for convenience, hygiene, and postpartum protection, driven by rising birth rates and awareness of menstrual hygiene. Product innovations like ultra-thin, high-absorbency, and skin-friendly designs further boost adoption.

- Rising consumer demand for sustainable and personalized maternity care is pushing brands to develop biodegradable maternity pads and subscription-based models tailored to postpartum flow, comfort, and lifestyle needs.

- Innovation is accelerating: companies are launching ultra-absorbent, skin-friendly pads, breathable organic cotton variants, and eco-engineered designs with biodegradable back‑sheets, combining high performance with environmental responsibility.

- The top five player’s accounts for nearly 35% of the global maternity pads market in 2025.

- In May 2024, Edgewell’s Carefree launched a new pad line with multi‑fluid protection, odor control, and enhanced top‑layer comfort for mothers.

- In December 2024, Toyota Tsusho and Unicharm began local production of “SOFY Long Lasting” pads in Kenya to improve affordability and support women’s empowerment.

- Global Maternity Pads Market is likely to create the total forecasting opportunity of ~USD 2 Bn till 2035.

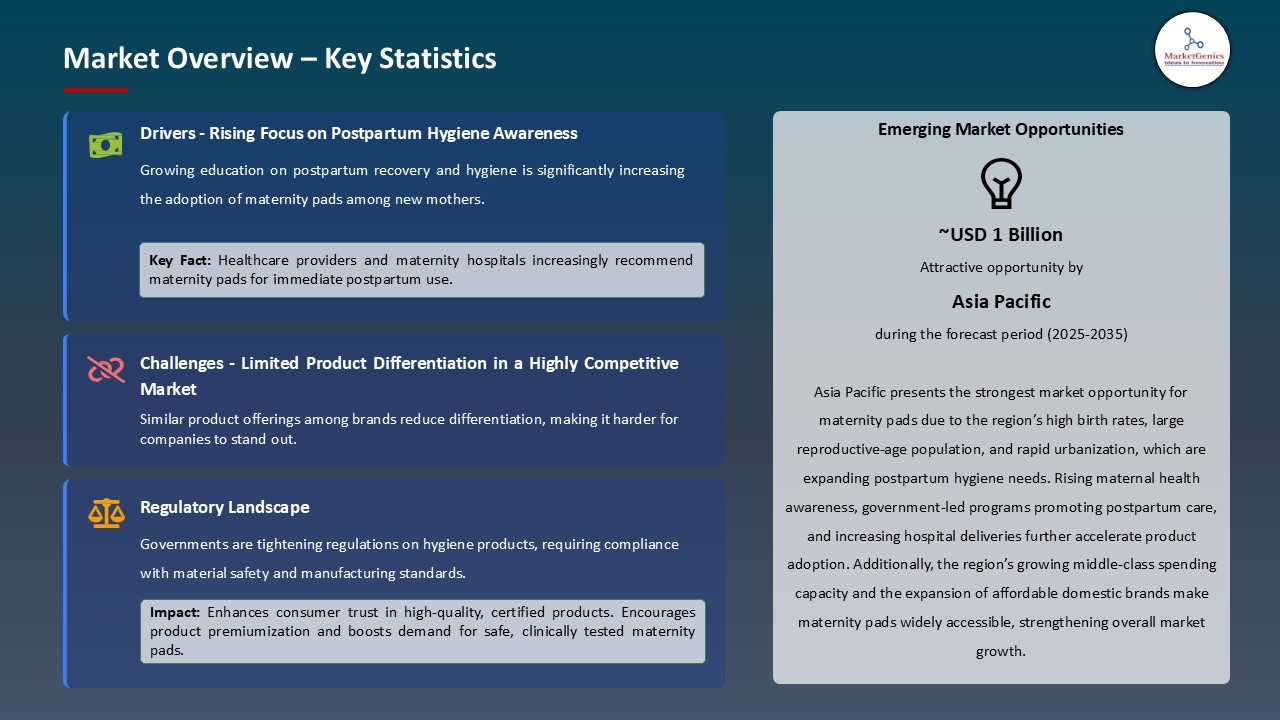

- Asia‑Pacific leads maternity pads market, driven by high birth rates, rising disposable incomes, urbanization, and increasing awareness of postpartum hygiene. Rapid population growth in key markets like China and India supports strong demand for maternity pads.

- Emerging economies are increasing their birth rates and this is boosting the maternity pads market as it influences consumer preferences in terms of demand, brand preference and product development. The importance of health awareness, environmental awareness, and social responsibility is gradually making changes to the buying choices of consumers, especially those of millennial and Gen Z generations who value authenticity and continuity with personal values.

- The growth of products offered by the companies is growing to fulfill the demand on organic, sustainable, and health-related solutions. For instance, in October 2025, EveryLife introduced its organic feminine care category, which as the company has already extended its product range to include GOTS-certified organic cotton pads and afterpartum recovery items, the region is heavily concerned with sustainable and health-centered solutions. Competitive advancements are being countered by the market leaders through repackaging, removing controversial ingredients, securing third party certification, and using sustainable packaging.

- All of this contributes to the market's continuous growth as innovation winners are rewarded and traditional firms are driven to adapt their business models in order to match shifting consumer expectations.

- Cost sensitivity in cost-sensitive markets has been a major hindrance to expansion, market share, and trading success in the maternity pads industry. The economic and product consciousness aspects and differences in cultural perception of disposable hygiene products decrease the adoption rates, particularly in low- and middle-income locations.

- Such responses in companies include value-based product lines, local pricing plans, and target education plans. Nevertheless, to overcome this restraint, the long-term investment, cultural knowledge, and market-specific changes in the products positioning and distribution are necessary.

- Premium services have stronger value propositions and brand loyalty, while mass-market categories are more susceptible to competition. This has resulted in constant cost-cutting tactics, improved supply chain efficiency, and marketing innovation to assure affordability and market share protection in very price sensitive regions.

- An organic and chemical-free maternity pad is experiencing growing demand, and this has become a fruitful growth area to any company that can offer differentiated, health conscious products to the market. For instance, in January 2025, LOLA released postpartum care line that uses 100 percent of organic cotton pads without chlorine, dyes, and PFAS. The most competitive organizations are tactically investing in product development, channel differentiation, and capability-building in order to address the changing consumer trend and new market trends.

- This is a multi-dimensional opportunity, as it relates to expansion into higher growth areas, penetration of the related female hygiene markets, creation of high-end and green product lines, and the evolution of direct-to-consumer patterns that maximize the customer experience and profitability. To seize this opportunity, an excellent consumer insight capacity, a digital maturity, and a swift operational implementation with a determination to remain innovative based on market trends are needed.

- Companies that successfully understand and exploit these opportunities can achieve market-leading growth, competitive positioning, and long-term value generation in a continually evolving maternity hygiene environment.

- The invention of biodegradable and sustainable maternity pads is transforming the design and user expectations of a product as well as the competition in the market. With material science and the process of sustainability innovation, the companies are developing pads that are both high-absorbency, skin-respectful, and environmentally friendly. Those who are early adopters are developing a powerful competitive moat through focusing on performance and eco-credentials.

- Environmentally friendly maternity pads are becoming more and more popular with the help of sustainable innovations and corporate partnerships. For example, in 2023, Birla Cellulose teamed with Sparkle to develop plastic-free pregnancy pads manufactured from biodegradable viscose nonwovens, demonstrating how partnerships may be used to produce more sustainable materials without compromising product functionality.

- Such a partnership represents the increased focus on innovations that are pro-ecological in terms of postpartum care. As this trend matures, price-sensitive consumer sectors are likely to adopt it.

- The evolution has the potential to power new business models such as subscription services, formulas, and other sustainability-focused loyalty programs that enhance consumer relationships and lifetime value.

- Disposable maternity pads leads the maternity pads market because of convenience, hygiene, and the fact that the pads are accepted by most of the women who had been postpartum both in urban and semi-urban areas. The segment enjoys the increased awareness of postpartum care, inclination to high-absorbency products, and possibility of offering comfort and protection in the course of recovery. Disposable maternity pads have become the best alternative among the modern mothers because of their convenience and reliability.

- The segment is even more competitive with technological innovations including super-absorbent cores, breathable and skin-friendly top layers, and leak-proof designs, etc. For instance, in 2023, KNH released sustainable disposable maternity and sanitary pads created of environmentally sustainable materials, with the emphasis on comfort, absorbency, and environmental concern. This shows how the industry is comfortable, sustainable and accessible.

- The expansion of retail, e-commerce, and subscription channels drives market growth. Partnerships with healthcare providers, non-governmental organizations (NGOs), and postpartum education programs help to raise product awareness, reduce barriers to adoption, and reinforce the leadership of disposable maternity pads globally.

- The Asia Pacific is a leading provider of maternity pads in the world because of the high birth rates, rising disposable incomes and the rising awareness on the importance of postpartum hygiene. A large number of women in rural and semi-urban regions continue to use cloth, which means that an opportunity to integrate modern, disposable maternity pads can be provided with the help of education campaigns and the increased access to retail.

- Government programs and NGO efforts are other activities that contribute towards the development of the market through overcoming cultural barriers and increasing awareness of products. For instance, in June 2025, DKSH Consumer Goods Singapore collaborated with Enya Technologies on increasing the access to organic maternity and sanitary pads in Singapore, taking advantage of the distribution, marketing, and e-commerce opportunities of DKSH. Such initiatives enhance awareness and lessen adoption resistance as well as promote behavior change in the long term.

- Demographics, such as rising female literacy, urbanization, and a growing workforce, have fueled market expansion. Along with other initiatives such as Safe Motherhood in China and Maternal Health Drives in Southeast Asia, Asia Pacific is currently a major growth opportunity for maternity pads, with continuous rises in the market predicted throughout the region.

- In May 2024, the brand Carefree of Edgewell Personal Care Company introduced a new line of pads (as well as liners) under the campaign name Protection of the Protectors and was to offer multi-fluid, odor-control protection with a new top-layer comfort technology to mothers.

- In December 2024, Toyota Tsusho Corporation and Unicharm Corporation announced that they had begun local production and sales of “SOFY Long Lasting” sanitary napkins in Kenya, aiming to boost access to affordable feminine hygiene products and support women’s social advancement.

- United States

- Canada

- Mexico

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic Countries

- Poland

- Russia & CIS

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Turkey

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Nigeria

- Algeria

- Brazil

- Argentina

- Bambo Nature

- Daio Paper Corporation

- Earth Mama

- Naty AB

- Essity AB

- Frida Mom

- Fujian Hengan Group

- Hengan International Group

- Honey Pot Company

- Kao Corporation

- Kimberly-Clark Corporation

- Maxim Hygiene Products

- Natracare

- Edgewell Personal Care

- Organyc

- Procter & Gamble

- Seventh Generation

- Johnson & Johnson

- The Honest Company

- Unicharm Corporation

- Other Key Players

- Disposable Maternity Pads

- Reusable/Washable Maternity Pads

- Organic/Natural Maternity Pads

- Bamboo Maternity Pads

- Cotton Maternity Pads

- Others

- Light Absorbency

- Moderate Absorbency

- Heavy Absorbency

- Super/Maximum Absorbency

- Overnight Absorbency

- Regular (Up to 25 cm)

- Long (25-35 cm)

- Extra-Long (35-45 cm)

- Maxi (Above 45 cm)

- Online Channels

- E-commerce Platforms

- Company Websites

- Online Pharmacies

- Others

- Offline Channels

- Supermarkets/Hypermarkets

- Pharmacies/Drugstores

- Convenience Stores

- Specialty Stores

- Others

- Economy/Budget

- Mid-Range

- Premium

- Super Premium/Luxury

- Dry Surface

- Mesh Surface

- Cotton Surface

- Non-Woven Fabric

- Perforated Film

- Healthcare Facilities

- Hospitals & Maternity Clinics

- Post-Delivery Care

- C-Section Recovery

- Emergency Maternity Care

- Others

- Birthing Centers

- Natural Birth Support

- Water Birth Aftercare

- Others

- Nursing Homes

- Others

- Hospitals & Maternity Clinics

- Residential/Home Use

- Individual Consumers

- Postpartum Recovery at Home

- Post-Cesarean Care

- Post-Miscarriage Care

- Others

- Home Birth Settings

- Planned Home Deliveries

- Post-Birth Management

- Others

- Individual Consumers

- Others

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Maternity Pads Market Outlook

- 2.1.1. Maternity Pads Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Maternity Pads Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 3.1.1. Consumer Goods & Services Industry Ecosystem Analysis

- 3.1.2. Key Trends for Consumer Goods & Services Industry

- 3.1.3. Regional Distribution for Consumer Goods & Services Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising global birth rates and increased hospital-based deliveries boosting postpartum hygiene product demand.

- 4.1.1.2. Growing awareness of postpartum recovery and need for high-absorbency, comfortable maternity pads.

- 4.1.1.3. Expansion of e-commerce and retail distribution improving access to specialized maternity hygiene products.

- 4.1.2. Restraints

- 4.1.2.1. Increasing shift toward reusable postpartum underwear reducing reliance on disposable maternity pads.

- 4.1.2.2. Limited awareness and affordability challenges in low-income regions slowing adoption.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Maternity Pads Manufacturers

- 4.4.3. Dealers/ Distributors

- 4.4.4. End-Users/ Customers

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Maternity Pads Market Demand

- 4.7.1. Historical Market Size – Value (US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size – Value (US$ Bn), 2026–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Maternity Pads Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Maternity Pads Market Size (Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Disposable Maternity Pads

- 6.2.2. Reusable/Washable Maternity Pads

- 6.2.3. Organic/Natural Maternity Pads

- 6.2.4. Bamboo Maternity Pads

- 6.2.5. Cotton Maternity Pads

- 6.2.6. Others

- 7. Global Maternity Pads Market Analysis, by Absorbency Level

- 7.1. Key Segment Analysis

- 7.2. Maternity Pads Market Size (Value - US$ Bn), Analysis, and Forecasts, by Absorbency Level, 2021-2035

- 7.2.1. Light Absorbency

- 7.2.2. Moderate Absorbency

- 7.2.3. Heavy Absorbency

- 7.2.4. Super/Maximum Absorbency

- 7.2.5. Overnight Absorbency

- 8. Global Maternity Pads Market Analysis, by Size/Length

- 8.1. Key Segment Analysis

- 8.2. Maternity Pads Market Size (Value - US$ Bn), Analysis, and Forecasts, by Form, 2021-2035

- 8.2.1. Regular (Up to 25 cm)

- 8.2.2. Long (25-35 cm)

- 8.2.3. Extra-Long (35-45 cm)

- 8.2.4. Maxi (Above 45 cm)

- 9. Global Maternity Pads Market Analysis, by Distribution Channel

- 9.1. Key Segment Analysis

- 9.2. Maternity Pads Market Size (Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 9.2.1. Online Channels

- 9.2.1.1. E-commerce Platforms

- 9.2.1.2. Company Websites

- 9.2.1.3. Online Pharmacies

- 9.2.1.4. Others

- 9.2.2. Offline Channels

- 9.2.2.1. Supermarkets/Hypermarkets

- 9.2.2.2. Pharmacies/Drugstores

- 9.2.2.3. Convenience Stores

- 9.2.2.4. Specialty Stores

- 9.2.2.5. Others

- 9.2.1. Online Channels

- 10. Global Maternity Pads Market Analysis, by Price Range

- 10.1. Key Segment Analysis

- 10.2. Maternity Pads Market Size (Value - US$ Bn), Analysis, and Forecasts, by Price Range, 2021-2035

- 10.2.1. Economy/Budget

- 10.2.2. Mid-Range

- 10.2.3. Premium

- 10.2.4. Super Premium/Luxury

- 11. Global Maternity Pads Market Analysis, by Surface Type

- 11.1. Key Segment Analysis

- 11.2. Maternity Pads Market Size (Value - US$ Bn), Analysis, and Forecasts, by Surface Type, 2021-2035

- 11.2.1. Dry Surface

- 11.2.2. Mesh Surface

- 11.2.3. Cotton Surface

- 11.2.4. Non-Woven Fabric

- 11.2.5. Perforated Film

- 12. Global Maternity Pads Market Analysis, by End-users

- 12.1. Key Segment Analysis

- 12.2. Maternity Pads Market Size (Value - US$ Bn), Analysis, and Forecasts, by End-users, 2021-2035

- 12.2.1. Healthcare Facilities

- 12.2.1.1. Hospitals & Maternity Clinics

- 12.2.1.1.1. Post-Delivery Care

- 12.2.1.1.2. C-Section Recovery

- 12.2.1.1.3. Emergency Maternity Care

- 12.2.1.1.4. Others

- 12.2.1.2. Birthing Centers

- 12.2.1.2.1. Natural Birth Support

- 12.2.1.2.2. Water Birth Aftercare

- 12.2.1.2.3. Others

- 12.2.1.3. Nursing Homes

- 12.2.1.4. Others

- 12.2.1.1. Hospitals & Maternity Clinics

- 12.2.2. Residential/Home Use

- 12.2.2.1. Individual Consumers

- 12.2.2.1.1. Postpartum Recovery at Home

- 12.2.2.1.2. Post-Cesarean Care

- 12.2.2.1.3. Post-Miscarriage Care

- 12.2.2.1.4. Others

- 12.2.2.2. Home Birth Settings

- 12.2.2.2.1. Planned Home Deliveries

- 12.2.2.2.2. Post-Birth Management

- 12.2.2.2.3. Others

- 12.2.2.1. Individual Consumers

- 12.2.3. Others

- 12.2.1. Healthcare Facilities

- 13. Global Maternity Pads Market Analysis and Forecasts, by Region

- 13.1. Key Findings

- 13.2. Maternity Pads Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America Maternity Pads Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America Maternity Pads Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Product Type

- 14.3.2. Absorbency Level

- 14.3.3. Size/Length

- 14.3.4. Distribution Channel

- 14.3.5. Price Range

- 14.3.6. Surface Type

- 14.3.7. End-users

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA Maternity Pads Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Product Type

- 14.4.3. Absorbency Level

- 14.4.4. Size/Length

- 14.4.5. Distribution Channel

- 14.4.6. Price Range

- 14.4.7. Surface Type

- 14.4.8. End-users

- 14.5. Canada Maternity Pads Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Product Type

- 14.5.3. Absorbency Level

- 14.5.4. Size/Length

- 14.5.5. Distribution Channel

- 14.5.6. Price Range

- 14.5.7. Surface Type

- 14.5.8. End-users

- 14.6. Mexico Maternity Pads Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Product Type

- 14.6.3. Absorbency Level

- 14.6.4. Size/Length

- 14.6.5. Distribution Channel

- 14.6.6. Price Range

- 14.6.7. Surface Type

- 14.6.8. End-users

- 15. Europe Maternity Pads Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe Maternity Pads Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Absorbency Level

- 15.3.3. Size/Length

- 15.3.4. Distribution Channel

- 15.3.5. Price Range

- 15.3.6. Surface Type

- 15.3.7. End-users

- 15.3.8. Country

- 15.3.8.1. Germany

- 15.3.8.2. United Kingdom

- 15.3.8.3. France

- 15.3.8.4. Italy

- 15.3.8.5. Spain

- 15.3.8.6. Netherlands

- 15.3.8.7. Nordic Countries

- 15.3.8.8. Poland

- 15.3.8.9. Russia & CIS

- 15.3.8.10. Rest of Europe

- 15.4. Germany Maternity Pads Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Absorbency Level

- 15.4.4. Size/Length

- 15.4.5. Distribution Channel

- 15.4.6. Price Range

- 15.4.7. Surface Type

- 15.4.8. End-users

- 15.5. United Kingdom Maternity Pads Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Absorbency Level

- 15.5.4. Size/Length

- 15.5.5. Distribution Channel

- 15.5.6. Price Range

- 15.5.7. Surface Type

- 15.5.8. End-users

- 15.6. France Maternity Pads Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Absorbency Level

- 15.6.4. Size/Length

- 15.6.5. Distribution Channel

- 15.6.6. Price Range

- 15.6.7. Surface Type

- 15.6.8. End-users

- 15.7. Italy Maternity Pads Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Product Type

- 15.7.3. Absorbency Level

- 15.7.4. Size/Length

- 15.7.5. Distribution Channel

- 15.7.6. Price Range

- 15.7.7. Surface Type

- 15.7.8. End-users

- 15.8. Spain Maternity Pads Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Product Type

- 15.8.3. Absorbency Level

- 15.8.4. Size/Length

- 15.8.5. Distribution Channel

- 15.8.6. Price Range

- 15.8.7. Surface Type

- 15.8.8. End-users

- 15.9. Netherlands Maternity Pads Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Product Type

- 15.9.3. Absorbency Level

- 15.9.4. Size/Length

- 15.9.5. Distribution Channel

- 15.9.6. Price Range

- 15.9.7. Surface Type

- 15.9.8. End-users

- 15.10. Nordic Countries Maternity Pads Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Product Type

- 15.10.3. Absorbency Level

- 15.10.4. Size/Length

- 15.10.5. Distribution Channel

- 15.10.6. Price Range

- 15.10.7. Surface Type

- 15.10.8. End-users

- 15.11. Poland Maternity Pads Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Product Type

- 15.11.3. Absorbency Level

- 15.11.4. Size/Length

- 15.11.5. Distribution Channel

- 15.11.6. Price Range

- 15.11.7. Surface Type

- 15.11.8. End-users

- 15.12. Russia & CIS Maternity Pads Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Product Type

- 15.12.3. Absorbency Level

- 15.12.4. Size/Length

- 15.12.5. Distribution Channel

- 15.12.6. Price Range

- 15.12.7. Surface Type

- 15.12.8. End-users

- 15.13. Rest of Europe Maternity Pads Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Product Type

- 15.13.3. Absorbency Level

- 15.13.4. Size/Length

- 15.13.5. Distribution Channel

- 15.13.6. Price Range

- 15.13.7. Surface Type

- 15.13.8. End-users

- 16. Asia Pacific Maternity Pads Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Asia Pacific Maternity Pads Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Absorbency Level

- 16.3.3. Size/Length

- 16.3.4. Distribution Channel

- 16.3.5. Price Range

- 16.3.6. Surface Type

- 16.3.7. End-users

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia Pacific

- 16.4. China Maternity Pads Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Absorbency Level

- 16.4.4. Size/Length

- 16.4.5. Distribution Channel

- 16.4.6. Price Range

- 16.4.7. Surface Type

- 16.4.8. End-users

- 16.5. India Maternity Pads Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Absorbency Level

- 16.5.4. Size/Length

- 16.5.5. Distribution Channel

- 16.5.6. Price Range

- 16.5.7. Surface Type

- 16.5.8. End-users

- 16.6. Japan Maternity Pads Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Absorbency Level

- 16.6.4. Size/Length

- 16.6.5. Distribution Channel

- 16.6.6. Price Range

- 16.6.7. Surface Type

- 16.6.8. End-users

- 16.7. South Korea Maternity Pads Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Absorbency Level

- 16.7.4. Size/Length

- 16.7.5. Distribution Channel

- 16.7.6. Price Range

- 16.7.7. Surface Type

- 16.7.8. End-users

- 16.8. Australia and New Zealand Maternity Pads Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Absorbency Level

- 16.8.4. Size/Length

- 16.8.5. Distribution Channel

- 16.8.6. Price Range

- 16.8.7. Surface Type

- 16.8.8. End-users

- 16.9. Indonesia Maternity Pads Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Product Type

- 16.9.3. Absorbency Level

- 16.9.4. Size/Length

- 16.9.5. Distribution Channel

- 16.9.6. Price Range

- 16.9.7. Surface Type

- 16.9.8. End-users

- 16.10. Malaysia Maternity Pads Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Product Type

- 16.10.3. Absorbency Level

- 16.10.4. Size/Length

- 16.10.5. Distribution Channel

- 16.10.6. Price Range

- 16.10.7. Surface Type

- 16.10.8. End-users

- 16.11. Thailand Maternity Pads Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Product Type

- 16.11.3. Absorbency Level

- 16.11.4. Size/Length

- 16.11.5. Distribution Channel

- 16.11.6. Price Range

- 16.11.7. Surface Type

- 16.11.8. End-users

- 16.12. Vietnam Maternity Pads Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Product Type

- 16.12.3. Absorbency Level

- 16.12.4. Size/Length

- 16.12.5. Distribution Channel

- 16.12.6. Price Range

- 16.12.7. Surface Type

- 16.12.8. End-users

- 16.13. Rest of Asia Pacific Maternity Pads Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Product Type

- 16.13.3. Absorbency Level

- 16.13.4. Size/Length

- 16.13.5. Distribution Channel

- 16.13.6. Price Range

- 16.13.7. Surface Type

- 16.13.8. End-users

- 17. Middle East Maternity Pads Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East Maternity Pads Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Absorbency Level

- 17.3.3. Size/Length

- 17.3.4. Distribution Channel

- 17.3.5. Price Range

- 17.3.6. Surface Type

- 17.3.7. End-users

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey Maternity Pads Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Absorbency Level

- 17.4.4. Size/Length

- 17.4.5. Distribution Channel

- 17.4.6. Price Range

- 17.4.7. Surface Type

- 17.4.8. End-users

- 17.5. UAE Maternity Pads Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Absorbency Level

- 17.5.4. Size/Length

- 17.5.5. Distribution Channel

- 17.5.6. Price Range

- 17.5.7. Surface Type

- 17.5.8. End-users

- 17.6. Saudi Arabia Maternity Pads Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Absorbency Level

- 17.6.4. Size/Length

- 17.6.5. Distribution Channel

- 17.6.6. Price Range

- 17.6.7. Surface Type

- 17.6.8. End-users

- 17.7. Israel Maternity Pads Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Absorbency Level

- 17.7.4. Size/Length

- 17.7.5. Distribution Channel

- 17.7.6. Price Range

- 17.7.7. Surface Type

- 17.7.8. End-users

- 17.8. Rest of Middle East Maternity Pads Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Absorbency Level

- 17.8.4. Size/Length

- 17.8.5. Distribution Channel

- 17.8.6. Price Range

- 17.8.7. Surface Type

- 17.8.8. End-users

- 18. Africa Maternity Pads Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa Maternity Pads Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Absorbency Level

- 18.3.3. Size/Length

- 18.3.4. Distribution Channel

- 18.3.5. Price Range

- 18.3.6. Surface Type

- 18.3.7. End-users

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa Maternity Pads Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Absorbency Level

- 18.4.4. Size/Length

- 18.4.5. Distribution Channel

- 18.4.6. Price Range

- 18.4.7. Surface Type

- 18.4.8. End-users

- 18.5. Egypt Maternity Pads Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Absorbency Level

- 18.5.4. Size/Length

- 18.5.5. Distribution Channel

- 18.5.6. Price Range

- 18.5.7. Surface Type

- 18.5.8. End-users

- 18.6. Nigeria Maternity Pads Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Absorbency Level

- 18.6.4. Size/Length

- 18.6.5. Distribution Channel

- 18.6.6. Price Range

- 18.6.7. Surface Type

- 18.6.8. End-users

- 18.7. Algeria Maternity Pads Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Absorbency Level

- 18.7.4. Size/Length

- 18.7.5. Distribution Channel

- 18.7.6. Price Range

- 18.7.7. Surface Type

- 18.7.8. End-users

- 18.8. Rest of Africa Maternity Pads Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Absorbency Level

- 18.8.4. Size/Length

- 18.8.5. Distribution Channel

- 18.8.6. Price Range

- 18.8.7. Surface Type

- 18.8.8. End-users

- 19. South America Maternity Pads Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. South America Maternity Pads Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Absorbency Level

- 19.3.3. Size/Length

- 19.3.4. Distribution Channel

- 19.3.5. Price Range

- 19.3.6. Surface Type

- 19.3.7. End-users

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil Maternity Pads Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Absorbency Level

- 19.4.4. Size/Length

- 19.4.5. Distribution Channel

- 19.4.6. Price Range

- 19.4.7. Surface Type

- 19.4.8. End-users

- 19.5. Argentina Maternity Pads Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Absorbency Level

- 19.5.4. Size/Length

- 19.5.5. Distribution Channel

- 19.5.6. Price Range

- 19.5.7. Surface Type

- 19.5.8. End-users

- 19.6. Rest of South America Maternity Pads Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Absorbency Level

- 19.6.4. Size/Length

- 19.6.5. Distribution Channel

- 19.6.6. Price Range

- 19.6.7. Surface Type

- 19.6.8. End-users

- 20. Key Players/ Company Profile

- 20.1. Bambo Nature

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. Daio Paper Corporation

- 20.3. Earth Mama

- 20.4. Edgewell Personal Care

- 20.5. Essity AB

- 20.6. Frida Mom

- 20.7. Fujian Hengan Group

- 20.8. Hengan International Group

- 20.9. Honey Pot Company

- 20.10. Johnson & Johnson

- 20.11. Kao Corporation

- 20.12. Kimberly-Clark Corporation

- 20.13. Maxim Hygiene Products

- 20.14. Natracare

- 20.15. Naty AB

- 20.16. Organyc

- 20.17. Procter & Gamble

- 20.18. Seventh Generation

- 20.19. The Honest Company

- 20.20. Unicharm Corporation

- 20.21. Other Key Players

- 20.1. Bambo Nature

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Insightified

Mid-to-large firms spend $20K–$40K quarterly on systematic research and typically recover multiples through improved growth and profitability

Research is no longer optional. Leading firms use it to uncover $10M+ in hidden revenue opportunities annually

Our research-consulting programs yields measurable ROI: 20–30% revenue increases from new markets, 11% profit upticks from pricing, and 20–30% cost savings from operations

Maternity Pads Market Size, Share & Trends Analysis Report by Product Type (Disposable Maternity Pads, Reusable/Washable Maternity Pads, Organic/Natural Maternity Pads, Bamboo Maternity Pads, Cotton Maternity Pads, Others), Absorbency Level, Size/Length, Distribution Channel, Price Range, Surface Type, End-users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Maternity Pads Market Size, Share, and Growth

The global maternity pads market is experiencing robust growth, with its estimated value of USD 2.8 billion in the year 2025 and USD 5.2 billion by 2035, registering a CAGR of 6.4%, during the forecast period. The global maternity pads market is more influenced by the increasing consumer attention to health, wellness, and sustainability. Products that provide comfort, skin safety and reliable protection are on the list of priorities of women and lead to the demand of high-quality and clinically safe products. The increased consciousness of menstrual hygiene, the love of natural and organic products, and environmental issues stimulate the brands to develop biodegradable, eco-friendly, and ethically sourced products.

Rahul Bansal, Global Head of Business Development and AVP Sales at Birla, stated,

"We at Birla Cellulose initiated research to find sustainable alternatives. As a result, we successfully created a top sheet made with our viscose that meets consumers’ expectations for absorbency, softness and overall comfort during use. During our search for potential partners, we discovered that Sparkle, an innovative start-up, shares our commitment to sustainability and developing eco-friendly products. Therefore, we decided that collaborating with Sparkle was a natural choice for both companies."

There is active development of the maternity pads market as consumers change their preferences in favour of a healthier, eco-friendly and customized approach. Women are also paying more attention to the products that reflect their values, which means they expect to discover transparency in products, ethical sourcing and evidence-based efficacy. Brands such as GingerOrganic are cashing in on this inheriting trend by providing ECOCERT certified maternity pads free of perfumes and synthetic superabsorbents and biodegradable materials, which is part of the larger trend in society where women are empowered to make their own decisions about their health, beauty, and environmental consequences.

The market leaders are responding by redefining products to exclude contentious ingredients, designing sustainable packaging changes, and using digital platforms to develop genuine consumer interactions. Companies are adopting the ethos of clean beauty, certifying themselves, and providing educational information that appeals to consumers with high values and a high level of information. For instance, Cambio sells maternity pads with 100% organic cotton, that are breathable and comfortable in heavy postpartum bleeding, which is an exemplar of sustainable, safe, and consumer-friendly solutions in the market.

The adjacent opportunities are customized beauty technologies, subscriptions, telehealth integration, and diversifying into other related wellness. These approaches allow the providers of maternity pads to increase their revenue streams, customer lifetime value, and create the ecosystem covering various aspects of women health, beauty, and lifestyle requirements.

Maternity Pads Market Dynamics and Trends

Driver: Rising Global Birth Rates in Emerging Economies

Restraint: Price Sensitivity in Cost-Conscious Markets

Opportunity: Growing Demand for Organic and Chemical-Free Products

Key Trend: Development of Biodegradable and Sustainable Maternity Pads

Maternity-Pads-Market Analysis and Segmental Data

Disposable Maternity Pads Dominate Global Maternity Pads Market

Asia Pacific Leads Global Maternity Pads Market Demand

Maternity-Pads-Market Ecosystem

The global maternity pads market is moderately consolidated with the multinational companies, specialty brands, and direct-to-consumer startups operating in different segments and price levels. The major competitors, such as Procter and Gamble, Kimberly-Clark Corporation, Unicharm Corporation, Kao Corporation, and Johnson & Johnson, use scale, research and research, distribution networks to stay competitive in mass-market segments, whereas the niche brands focus on premium products and direct consumer appeal.

The value chain includes suppliers, contract manufacturers, packaging suppliers, distributors, retailers and marketing partners. The major business organizations are moving towards vertical integration, direct-to-consumer, and digital marketing as main initiatives to increase margins, competitive positioning, and achieve personalized and data-driven innovation.

Recent Development and Strategic Overview:

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 2.8 Bn |

|

Market Forecast Value in 2035 |

USD 5.2 Bn |

|

Growth Rate (CAGR) |

6.4% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

|

Maternity-Pads-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Maternity Pads Market, By Product Type |

|

|

Maternity Pads Market, By Absorbency Level |

|

|

Maternity Pads Market, By Size/Length |

|

|

Maternity Pads Market, By Distribution Channel |

|

|

Maternity Pads Market, By Price Range |

|

|

Maternity Pads Market, By Surface Type |

|

|

Maternity Pads Market, By End-users |

|

Frequently Asked Questions

Table of Contents

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

Forecasting Models / Techniques

Multiple Regression Analysis

Time Series Analysis – Seasonal Patterns

Time Series Analysis – Trend Analysis

Expert Opinion – Expert Interviews

Multi-Scenario Development

Time Series Analysis – Moving Averages

Econometric Models

Expert Opinion – Delphi Method

Monte Carlo Simulation

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation