Activewear Market Size, Share & Trends Analysis Report by Product Type (Tops, Bottoms, Full Body, Accessories), Fabric Type, Gender, Distribution Channel, Design/Style, End-Users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Activewear Market Size, Share, and Growth

The global activewear market is experiencing robust growth, with its estimated value of USD 416.2 billion in the year 2025 and USD 826.4 billion by 2035, registering a CAGR of 7.1%, during the forecast period. The activewear market is boosted by increased participation in sports and fitness activities across various age groups, influence from social media and celebrity endorsements, and the convenience of online sales.

Nikhil Aggarwal, CEO of Campus Activewear said,

“We are delighted to partner with Umran Malik for the launch of our Nitrofly range. Umrans exceptional skills as Indias fastest bowler perfectly align with our brands essence of pushing the boundaries and achieving extraordinary performance. With Umrans endorsement, we are confident that Nitrofly will revolutionize the world of athletic footwear. This collaboration is a testament to our dedication to providing our customers with the best possible products that empower them to soar beyond their expectations.”

The global activewear market is one of the most vibrant parts of the apparel industry that is characterized by the steady growth due to the rise of the trend of health awareness, the popularization of the athleisure fashion, and the ongoing development of the technologies of performance fabrics. Activewear encompasses a variety of clothing tailored to sporting and athletic purposes like tops, pants, and jackets as well as athleisure wear that blends athletic utility with modern casual design, allowing them to be worn in an active or everyday context. For instance, in October 2024, Campus Activewear (India) released its Autumn-Winter 2024 range of products aimed at young people, merging fashion and comfort in sports/fitness wear and clothing, as the transition to everyday lifestyle use of sports/fitness wear continues.

The increased focus on health and wellness among consumers is a major motivation behind the activewear market worldwide. The changes in lifestyles associated with the post-pandemic period resulted in the long-term growth of gym membership, home workouts, and engagement in other activities like running and yoga. This long-term behavioral shift has led to a high level of organic demand of activewear, which frequently attracts consumers who desire to wear clothing that can help in healthy and active living. As an example, in June 2024, Campus Activewear has declared its partnership with Umran Malik to roll out the Nitrofly range. These high-performance shoes, powered by Nitro Technology, are priced at 130 dollars and have the tagline Why Run When You Can Fly that allows users to challenge limits and deliver their high performance ever.

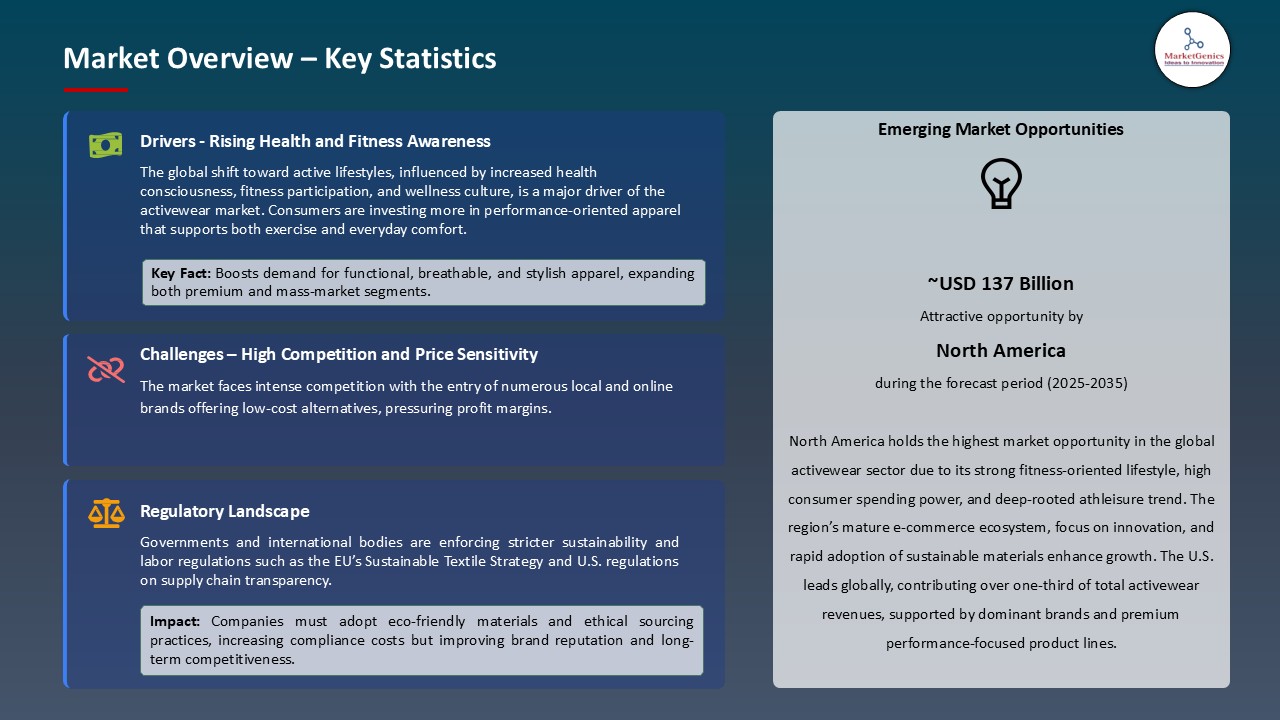

The regulatory framework of the key economies is driving the expansion of the activewear global market by enforcing more stringent sustainability policies, circular economies, and eco-labeling policies. As an example, the European Commission proposed the EPR programs of textile and footwear products. The schemes will require producers of footwear and textiles to pay a fee on every item they sell. This fee will facilitate the collection process and also the management of the textiles collected, their recycling, disposal and re-utilization.

The key market opportunities of the global activewear market are sustainable performance textiles, athleisure footwear, smart wearable technology, digital fitness platforms, and eco-friendly sports accessories. These industries are complementary to activewear development in technological integration, material innovations, and lifestyle convergence.

Activewear Market Dynamics and Trends

Driver: Health and Wellness Consciousness Driving Increased Fitness Participation and Athletic Apparel Demand

- The growing fitness enthusiasts worldwide is creating a high demand in activewear due to the true athletic application. The increase in gym attendance and boutique fitness trends like yoga, pilates, cycling, and high-intensity training is presenting different apparel requirements including the moisture-wicking, compression, flexibility and weather-protective performance apparel. As an example, in February of 2025, Target Corporation declared a strategic alliance with the company that has been known as the original American sportswear brand, Champion. The Champion collection of Targets will be a new interpretation of the classic appearance of Champion with a new line of high-quality and trend-following active attire and sporting items to adults and children.

- Additionally, the global activewear market is boosted by the continuous growth of the home fitness ecosystem. The popularity of connected devices, including Peloton, Mirror, and Tonal, has deeply ingrained home exercise and ensured a high demand on performance products because consumers have more expectations on comfortable, functional, and self-directed workouts. As an example, in 2025, STRCH has collaborated with international entertainment giant Warner Bros. to introduce a first-time performance-based wear line of character-related adult wear. This partnership is an indicator of a strategic partnership of 3 years that is expected to integrate the high-performance athletic design with the recognizable flair of the popular superheroes of the Warner Bros.

Restraint: Intense Competition and Market Saturation Compressing Margins Across Price Segments

- The activewear market is evolving rapidly in the global arena and has increased competition across all price points, including high-performance brands, low-end fast-fashion brands, and new direct-to-consumer brands. This intensified competitive environment puts a lot of margin pressure on the firms as they seek differentiation by investing more in marketing, promotional policies, and product improvements that push costs upward and fail to achieve a commensurate increase in pricing power.

- Additionally, the global activewear market faces restraint from the growing presence of fast-fashion retailers such as Zara, H&M, and Uniqlo. These companies offer performance-driven apparel at significantly lower price points, leveraging advanced fabrics and appealing designs. This trend erodes premium brand equity and forces mid-market players to compete primarily on pricing, thereby compressing profit margins and limiting innovation-led differentiation.

- The emergence of activewear brands that deal directly with consumers has increased market fragmentation. These digital-first companies provide high-quality products at affordable rates by skipping the conventional retail channels. The issue with this model is that even though it increases consumer choice and access, it also increases competition, which makes it tough to establish a sustainable market presence and scale efficiency within individual brands. As an example, in May 2025, the Indian D2C activewear brand BlissClub (1.5 billion dollars) which had raised about 33 crores (led by Elevation Capital) 2025 as it grows online and develops products to meet the niche needs of active women.

Opportunity: Sustainable and Eco-Friendly Activewear Materials Addressing Environmental Consumer Concerns

- The activewear market is presenting great opportunities in the global market due to the increasing environmental awareness. Most consumers are increasingly examining the aspect of sustainability in their clothing consumption and a large number of consumers are prepared to pay high prices to purchase environmentally friendly products. This is consistent with the health-conscience activewear segment, which is offering sustainably manufactured performance fabrics, recycling, and low-impact production processes. Indicatively, in May 2025, PANGAIA introduced its 365 Seamless Activewear collection based on 100 percent bio-based EVO Nylon (from Fulgar) and Hyosung regen BIO Max elastane (98 percent renewable resources) as a next-generation approach to plant-based activewear.

- Additionally, post-consumer polyester bottle recycling is the most commercially feasible sustainable activewear fabric. The big brands are actively using high recycled content, such as Nike, Adidas, and Patagonia, to compete at the same performance of virgin polyester, reducing petroleum consumption, and minimizing plastic waste. The increase in rPET capacity presents a high growth opportunity. For instance, in January 2025, SHEIN has developed its evoluSHEIN strategy by establishing an innovative polyester recycling process in partnership with Donghua University, one of the most successful universities in textile research. It can be done with a wider variety of materials, both pre-consumer and post-consumer polyester such as textile waste and PET bottles.

Key Trend: Athleisure Blur Between Athletic Performance Wear and Fashion Casualwear Expanding Wearing Occasions

- Athleisure is a respondent to major trends in the market that focus on versatility, performance, and lifestyle integration. The development of the category into something more than sportswear is an indication of consumer demand of multifunctional apparel that provides comfort, style, and technical functionality. As an example, in January 2025, LA-based fashion brand Staud runs a permanent sportswear brand titled Staud Sport, including a 65-piece collection valued between $75 and $395. As Vogue readers get early access to shop it. The shift to wellness-focused consumption, experience-driven retailing, and high-end daily wear remains a booster of market growth and high-pricing strategies in international markets.

- Athletic elements are being incorporated into collections by fashion designers and luxury houses, establishing athleisure as a category in the larger fashion industry and not casual sportswear. Strategic partnerships with high fashion designers and performance brands. An example is in September 2024, adidas partnered with Stella McCartney collection, releasing the so-called Rasant unisex trainer at Paris Fashion Week, which is a high-top shoe made of vegan materials with hints of racing design. Such collaborations have increased the popularity of athleisure with style-conscious consumers to improve its market positioning and cement its premium, trend-driven apparel category.

Activewear-Market Analysis and Segmental Data

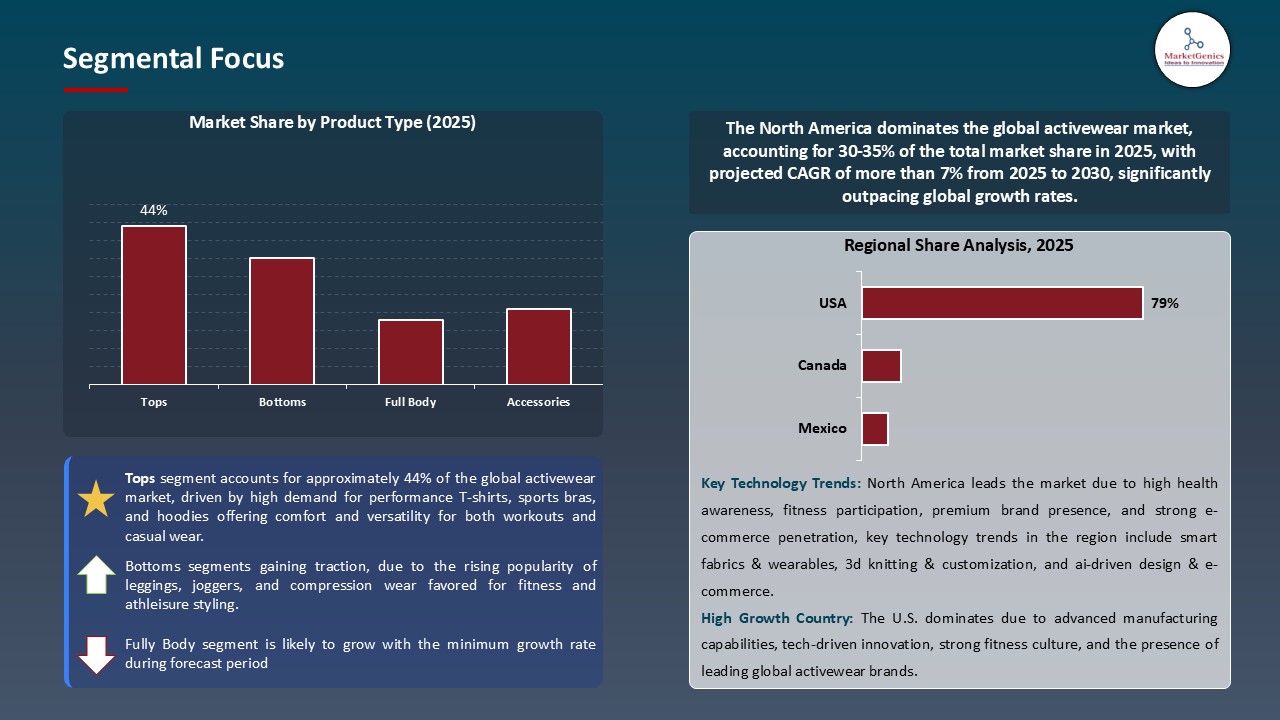

Tops Dominate Global Activewear Market

- Tops dominate the global Activewear market the development of high-performance textiles especially the moisture-wicking, breathable, and stretchable fabrics based on recycled polyester, and bio-based fibers are making major improvements on the comfort, durability and functionality of garments. These innovations are adding to the strength of tops in the activewear industry as they serve the needs of both sporting performance and everyday life usage. For instance, in 2024, Roica by Asahi which launched Roica V550 biodegradable stretch fibre and Roica EF recycled stretch fibre at ISPO 2024 and that has good elastane-like performance but high environmental performance to facilitate sustainable activewear manufacturing.

- Additionally, the trend of increasing consumer demand to the multifunctional products of clothing combining performance, comfort and fashion is increasing the market segment of active tops within the global active wear category. This trend is also supplemented by strategic brand partnerships and innovations in fabric technology, which allow active tops to easily shift the fitness to every-day wear and cement their status as lifestyle necessities. As an example, in February 2025, Nike revealed a partnership with SKIMS, the brand of Kim Kardashian, to release a female line of activewear using the performance innovation of Nike and the fashion-focused design of SKIMS. The collaboration will also target the rising demand of versatile, fashionable, and practical athleisure fashion.

North America Leads Global Activewear Market Demand

- North America leads the global activewear market, due to as consumption is high per-capita and the trends of athleisure have been early. The market leadership is premised on the casual lifestyle preferences and the high concentration of the premium athletic brands in the region. Vancouver-based Lululemon was among the first to dominate the high-end athleisure market, and the company still earns its major share of revenue in North America, with the larger corporations such as Nike and Under Armour also recording a high rate of concentrate sales focused in the region.

- Furthermore, the culture of fitness and gym is exceptionally well-developed in North America, developing long-term interest in performance-based active wear items that go beyond the aesthetic appeal. As an example, in January 2024, Under Armour introduced the NEOLAST fiber, a major innovation where the company declared the material a high-performing alternative to elastane (spandex) with durability, stretch and recyclability. These textile technologies support the evolution of performance-focused active-tops that are not restricted to the gym application.

Activewear-Market Ecosystem

The global activewear market is moderately fragmented, with high concentration among key players such as Nike, Inc., Adidas AG, Lululemon Athletica, Puma, and Under Armour, who dominate through innovative product development, strategic collaborations, and strong brand positioning. These corporations use innovative material technologies, sustainability-focused programs, and omnichannel retailing to provide consumers with a better experience and reach a wider market. The ongoing investment in performance fabrics, digital marketing and direct-to-consumer platforms also helps cement their leadership in the global activewear environment.

Recent Development and Strategic Overview:

- In May 2025, ASICS launched new METASPEED SKY TOKYO / EDGE TOKYO / RAY models, advancing lightweight, race-oriented running technology to capture performance runners and premium running-apparel cross-sell opportunities.

- In February 2025, Nike, Inc. and SKIMS are teamed up to disrupt the global fitness and activewear industry with the launch of NikeSKIMS, a new brand that will deliver industry leading innovation. The long-term partnership will introduce an extensive product line that invites more athletes and women into the world of sport and movement.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 416.2 Bn |

|

Market Forecast Value in 2035 |

USD 826.4 Bn |

|

Growth Rate (CAGR) |

7.1% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Activewear-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Activewear Market By Product Type |

|

|

Activewear Market By Fabric Type |

|

|

Activewear Market By Gender

|

|

|

Activewear Market By Distribution Channel |

|

|

Activewear Market By Design/Style

|

|

|

Activewear Market By End-Users

|

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Activewear Market Outlook

- 2.1.1. Activewear Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Activewear Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Activewear Industry Overview, 2025

- 3.1.1. Consumer Goods & Services Industry Ecosystem Analysis

- 3.1.2. Key Trends for Consumer Goods & Services Industry

- 3.1.3. Regional Distribution for Consumer Goods & Services Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Activewear Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Growing health, fitness and athleisure lifestyle driving everyday activewear demand

- 4.1.1.2. Innovation in performance, sustainable and smart textiles improving product appeal

- 4.1.1.3. Expansion of e-commerce, D2C channels and personalization/omnichannel retailing

- 4.1.2. Restraints

- 4.1.2.1. Intense competition, brand saturation and high price sensitivity among consumers

- 4.1.2.2. Supply-chain disruptions, rising raw-material costs and production/shipping constraints

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Activewear Manufacturers

- 4.4.3. Distributors/ Suppliers

- 4.4.4. End-users/ Customers

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Activewear Market Demand

- 4.7.1. Historical Market Size - (Value - US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size - (Value - US$ Bn), 2025–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Activewear Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Activewear Market Size (Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Tops

- 6.2.1.1. T-shirts

- 6.2.1.2. Tank tops

- 6.2.1.3. Sports bras

- 6.2.1.4. Hoodies & Sweatshirts

- 6.2.1.5. Jackets

- 6.2.1.6. Long-sleeve shirts

- 6.2.1.7. Others

- 6.2.2. Bottoms

- 6.2.2.1. Leggings

- 6.2.2.2. Shorts

- 6.2.2.3. Track pants

- 6.2.2.4. Joggers

- 6.2.2.5. Capris

- 6.2.2.6. Skirts & Skorts

- 6.2.2.7. Others

- 6.2.3. Full Body

- 6.2.3.1. Unitards

- 6.2.3.2. Jumpsuits

- 6.2.3.3. Bodysuits

- 6.2.3.4. Others

- 6.2.4. Accessories

- 6.2.4.1. Headbands

- 6.2.4.2. Gloves

- 6.2.4.3. Compression sleeves

- 6.2.4.4. Athletic socks

- 6.2.4.5. Others

- 6.2.1. Tops

- 7. Global Activewear Market Analysis, by Fabric Type

- 7.1. Key Segment Analysis

- 7.2. Activewear Market Size (Value - US$ Bn), Analysis, and Forecasts, by Fabric Type, 2021-2035

- 7.2.1. Synthetic Fabrics

- 7.2.1.1. Polyester

- 7.2.1.2. Nylon

- 7.2.1.3. Spandex/Elastane

- 7.2.1.4. Polypropylene

- 7.2.1.5. Others

- 7.2.2. Natural Fabrics

- 7.2.2.1. Cotton

- 7.2.2.2. Merino wool

- 7.2.2.3. Bamboo

- 7.2.2.4. Hemp

- 7.2.2.5. Others

- 7.2.3. Blended Fabrics

- 7.2.3.1. Cotton-polyester blends

- 7.2.3.2. Nylon-spandex blends

- 7.2.3.3. Other hybrid materials

- 7.2.4. Smart Fabrics

- 7.2.4.1. Moisture-wicking fabrics

- 7.2.4.2. Temperature-regulating fabrics

- 7.2.4.3. Antimicrobial fabrics

- 7.2.4.4. Others

- 7.2.1. Synthetic Fabrics

- 8. Global Activewear Market Analysis and Forecasts, by Gender

- 8.1. Key Findings

- 8.2. Activewear Market Size (Value - US$ Bn), Analysis, and Forecasts, by Gender, 2021-2035

- 8.2.1. Men's Activewear

- 8.2.2. Women's Activewear

- 8.2.3. Unisex Activewear

- 8.2.4. Kids' Activewear

- 9. Global Activewear Market Analysis and Forecasts, by Distribution Channel

- 9.1. Key Findings

- 9.2. Activewear Market Size (Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 9.2.1. Online Channels

- 9.2.1.1. Brand websites/E-commerce

- 9.2.1.2. Multi-brand e-retailers

- 9.2.1.3. Online marketplaces

- 9.2.2. Offline Channels

- 9.2.2.1. Specialty sports stores

- 9.2.2.2. Hypermarkets & Supermarkets

- 9.2.2.3. Brand exclusive stores

- 9.2.2.4. Department stores

- 9.2.2.5. Discount stores

- 9.2.1. Online Channels

- 10. Global Activewear Market Analysis and Forecasts, by Design/Style

- 10.1. Key Findings

- 10.2. Activewear Market Size (Value - US$ Bn), Analysis, and Forecasts, by Design/Style, 2021-2035

- 10.2.1. Performance-oriented

- 10.2.2. Athleisure/Fashion-forward

- 10.2.3. Minimalist

- 10.2.4. Bold/Vibrant patterns

- 10.2.5. Sustainable/Eco-friendly designs

- 11. Global Activewear Market Analysis and Forecasts, by End-Users

- 11.1. Key Findings

- 11.2. Activewear Market Size (Value - US$ Bn), Analysis, and Forecasts, by End-Users, 2021-2035

- 11.2.1. Individual Consumers

- 11.2.1.1. Fitness & Training Applications

- 11.2.1.1.1. Gym workouts

- 11.2.1.1.2. Home fitness

- 11.2.1.1.3. Personal training

- 11.2.1.1.4. Rehabilitation exercises

- 11.2.1.2. Sports Performance Applications

- 11.2.1.2.1. Competitive sports

- 11.2.1.2.2. Recreational sports

- 11.2.1.2.3. Adventure sports

- 11.2.1.3. Lifestyle Applications

- 11.2.1.3.1. Athleisure wear

- 11.2.1.3.2. Casual daily wear

- 11.2.1.3.3. Travel wear

- 11.2.1.3.4. Loungewear

- 11.2.1.1. Fitness & Training Applications

- 11.2.2. Commercial/Institutional

- 11.2.2.1. Sports Clubs & Teams

- 11.2.2.1.1. Team uniforms

- 11.2.2.1.2. Training gear

- 11.2.2.1.3. Competition wear

- 11.2.2.2. Fitness Centers & Gyms

- 11.2.2.2.1. Staff uniforms

- 11.2.2.2.2. Member merchandise

- 11.2.2.2.3. Group class apparel

- 11.2.2.3. Corporate Wellness Programs

- 11.2.2.3.1. Employee fitness initiatives

- 11.2.2.3.2. Corporate team building

- 11.2.2.3.3. Branded wellness apparel

- 11.2.2.4. Educational Institutions

- 11.2.2.4.1. School sports programs

- 11.2.2.4.2. University athletics

- 11.2.2.4.3. Physical education uniforms

- 11.2.2.5. Military & Defense

- 11.2.2.5.1. Physical training uniforms

- 11.2.2.5.2. Combat fitness gear

- 11.2.2.1. Sports Clubs & Teams

- 11.2.3. Healthcare & Rehabilitation

- 11.2.3.1. Physical Therapy Applications

- 11.2.3.2. Medical Fitness Programs

- 11.2.3.3. Post-surgery Recovery Wear

- 11.2.4. Hospitality & Recreation

- 11.2.4.1. Hotel/Resort Fitness Facilities

- 11.2.4.2. Spa & Wellness Centers

- 11.2.4.3. Adventure Tourism Operations

- 11.2.5. Other End-users

- 11.2.1. Individual Consumers

- 12. Global Activewear Market Analysis and Forecasts, by Region

- 12.1. Key Findings

- 12.2. Activewear Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 12.2.1. North America

- 12.2.2. Europe

- 12.2.3. Asia Pacific

- 12.2.4. Middle East

- 12.2.5. Africa

- 12.2.6. South America

- 13. North America Activewear Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. North America Activewear Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 13.3.1. Product Type

- 13.3.2. Fabric Type

- 13.3.3. Gender

- 13.3.4. Distribution Channel

- 13.3.5. Design/Style

- 13.3.6. End-Users

- 13.3.7. Country

- 13.3.7.1. USA

- 13.3.7.2. Canada

- 13.3.7.3. Mexico

- 13.4. USA Activewear Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Product Type

- 13.4.3. Fabric Type

- 13.4.4. Gender

- 13.4.5. Distribution Channel

- 13.4.6. Design/Style

- 13.4.7. End-Users

- 13.5. Canada Activewear Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Product Type

- 13.5.3. Fabric Type

- 13.5.4. Gender

- 13.5.5. Distribution Channel

- 13.5.6. Design/Style

- 13.5.7. End-Users

- 13.6. Mexico Activewear Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Product Type

- 13.6.3. Fabric Type

- 13.6.4. Gender

- 13.6.5. Distribution Channel

- 13.6.6. Design/Style

- 13.6.7. End-Users

- 14. Europe Activewear Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. Europe Activewear Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Product Type

- 14.3.2. Fabric Type

- 14.3.3. Gender

- 14.3.4. Distribution Channel

- 14.3.5. Design/Style

- 14.3.6. End-Users

- 14.3.7. Country

- 14.3.7.1. Germany

- 14.3.7.2. United Kingdom

- 14.3.7.3. France

- 14.3.7.4. Italy

- 14.3.7.5. Spain

- 14.3.7.6. Netherlands

- 14.3.7.7. Nordic Countries

- 14.3.7.8. Poland

- 14.3.7.9. Russia & CIS

- 14.3.7.10. Rest of Europe

- 14.4. Germany Activewear Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Product Type

- 14.4.3. Fabric Type

- 14.4.4. Gender

- 14.4.5. Distribution Channel

- 14.4.6. Design/Style

- 14.4.7. End-Users

- 14.5. United Kingdom Activewear Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Product Type

- 14.5.3. Fabric Type

- 14.5.4. Gender

- 14.5.5. Distribution Channel

- 14.5.6. Design/Style

- 14.5.7. End-Users

- 14.6. France Activewear Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Product Type

- 14.6.3. Fabric Type

- 14.6.4. Gender

- 14.6.5. Distribution Channel

- 14.6.6. Design/Style

- 14.6.7. End-Users

- 14.7. Italy Activewear Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Product Type

- 14.7.3. Fabric Type

- 14.7.4. Gender

- 14.7.5. Distribution Channel

- 14.7.6. Design/Style

- 14.7.7. End-Users

- 14.8. Spain Activewear Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Product Type

- 14.8.3. Fabric Type

- 14.8.4. Gender

- 14.8.5. Distribution Channel

- 14.8.6. Design/Style

- 14.8.7. End-Users

- 14.9. Netherlands Activewear Market

- 14.9.1. Country Segmental Analysis

- 14.9.2. Product Type

- 14.9.3. Fabric Type

- 14.9.4. Gender

- 14.9.5. Distribution Channel

- 14.9.6. Design/Style

- 14.9.7. End-Users

- 14.10. Nordic Countries Activewear Market

- 14.10.1. Country Segmental Analysis

- 14.10.2. Product Type

- 14.10.3. Fabric Type

- 14.10.4. Gender

- 14.10.5. Distribution Channel

- 14.10.6. Design/Style

- 14.10.7. End-Users

- 14.11. Poland Activewear Market

- 14.11.1. Country Segmental Analysis

- 14.11.2. Product Type

- 14.11.3. Fabric Type

- 14.11.4. Gender

- 14.11.5. Distribution Channel

- 14.11.6. Design/Style

- 14.11.7. End-Users

- 14.12. Russia & CIS Activewear Market

- 14.12.1. Country Segmental Analysis

- 14.12.2. Product Type

- 14.12.3. Fabric Type

- 14.12.4. Gender

- 14.12.5. Distribution Channel

- 14.12.6. Design/Style

- 14.12.7. End-Users

- 14.13. Rest of Europe Activewear Market

- 14.13.1. Country Segmental Analysis

- 14.13.2. Product Type

- 14.13.3. Fabric Type

- 14.13.4. Gender

- 14.13.5. Distribution Channel

- 14.13.6. Design/Style

- 14.13.7. End-Users

- 15. Asia Pacific Activewear Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. East Asia Activewear Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Fabric Type

- 15.3.3. Gender

- 15.3.4. Distribution Channel

- 15.3.5. Design/Style

- 15.3.6. End-Users

- 15.3.7. Country

- 15.3.7.1. China

- 15.3.7.2. India

- 15.3.7.3. Japan

- 15.3.7.4. South Korea

- 15.3.7.5. Australia and New Zealand

- 15.3.7.6. Indonesia

- 15.3.7.7. Malaysia

- 15.3.7.8. Thailand

- 15.3.7.9. Vietnam

- 15.3.7.10. Rest of Asia Pacific

- 15.4. China Activewear Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Fabric Type

- 15.4.4. Gender

- 15.4.5. Distribution Channel

- 15.4.6. Design/Style

- 15.4.7. End-Users

- 15.5. India Activewear Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Fabric Type

- 15.5.4. Gender

- 15.5.5. Distribution Channel

- 15.5.6. Design/Style

- 15.5.7. End-Users

- 15.6. Japan Activewear Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Fabric Type

- 15.6.4. Gender

- 15.6.5. Distribution Channel

- 15.6.6. Design/Style

- 15.6.7. End-Users

- 15.7. South Korea Activewear Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Product Type

- 15.7.3. Fabric Type

- 15.7.4. Gender

- 15.7.5. Distribution Channel

- 15.7.6. Design/Style

- 15.7.7. End-Users

- 15.8. Australia and New Zealand Activewear Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Product Type

- 15.8.3. Fabric Type

- 15.8.4. Gender

- 15.8.5. Distribution Channel

- 15.8.6. Design/Style

- 15.8.7. End-Users

- 15.9. Indonesia Activewear Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Product Type

- 15.9.3. Fabric Type

- 15.9.4. Gender

- 15.9.5. Distribution Channel

- 15.9.6. Design/Style

- 15.9.7. End-Users

- 15.10. Malaysia Activewear Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Product Type

- 15.10.3. Fabric Type

- 15.10.4. Gender

- 15.10.5. Distribution Channel

- 15.10.6. Design/Style

- 15.10.7. End-Users

- 15.11. Thailand Activewear Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Product Type

- 15.11.3. Fabric Type

- 15.11.4. Gender

- 15.11.5. Distribution Channel

- 15.11.6. Design/Style

- 15.11.7. End-Users

- 15.12. Vietnam Activewear Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Product Type

- 15.12.3. Fabric Type

- 15.12.4. Gender

- 15.12.5. Distribution Channel

- 15.12.6. Design/Style

- 15.12.7. End-Users

- 15.13. Rest of Asia Pacific Activewear Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Product Type

- 15.13.3. Fabric Type

- 15.13.4. Gender

- 15.13.5. Distribution Channel

- 15.13.6. Design/Style

- 15.13.7. End-Users

- 16. Middle East Activewear Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Middle East Activewear Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Fabric Type

- 16.3.3. Gender

- 16.3.4. Distribution Channel

- 16.3.5. Design/Style

- 16.3.6. End-Users

- 16.3.7. Country

- 16.3.7.1. Turkey

- 16.3.7.2. UAE

- 16.3.7.3. Saudi Arabia

- 16.3.7.4. Israel

- 16.3.7.5. Rest of Middle East

- 16.4. Turkey Activewear Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Fabric Type

- 16.4.4. Gender

- 16.4.5. Distribution Channel

- 16.4.6. Design/Style

- 16.4.7. End-Users

- 16.5. UAE Activewear Market

- 16.5.1. Product Type

- 16.5.2. Fabric Type

- 16.5.3. Gender

- 16.5.4. Distribution Channel

- 16.5.5. Design/Style

- 16.5.6. End-Users

- 16.6. Saudi Arabia Activewear Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Fabric Type

- 16.6.4. Gender

- 16.6.5. Distribution Channel

- 16.6.6. Design/Style

- 16.6.7. End-Users

- 16.7. Israel Activewear Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Fabric Type

- 16.7.4. Gender

- 16.7.5. Distribution Channel

- 16.7.6. Design/Style

- 16.7.7. End-Users

- 16.8. Rest of Middle East Activewear Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Fabric Type

- 16.8.4. Gender

- 16.8.5. Distribution Channel

- 16.8.6. Design/Style

- 16.8.7. End-Users

- 17. Africa Activewear Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Africa Activewear Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Fabric Type

- 17.3.3. Gender

- 17.3.4. Distribution Channel

- 17.3.5. Design/Style

- 17.3.6. End-Users

- 17.3.7. Country

- 17.3.7.1. South Africa

- 17.3.7.2. Egypt

- 17.3.7.3. Nigeria

- 17.3.7.4. Algeria

- 17.3.7.5. Rest of Africa

- 17.4. South Africa Activewear Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Fabric Type

- 17.4.4. Gender

- 17.4.5. Distribution Channel

- 17.4.6. Design/Style

- 17.4.7. End-Users

- 17.5. Egypt Activewear Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Fabric Type

- 17.5.4. Gender

- 17.5.5. Distribution Channel

- 17.5.6. Design/Style

- 17.5.7. End-Users

- 17.6. Nigeria Activewear Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Fabric Type

- 17.6.4. Gender

- 17.6.5. Distribution Channel

- 17.6.6. Design/Style

- 17.6.7. End-Users

- 17.7. Algeria Activewear Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Fabric Type

- 17.7.4. Gender

- 17.7.5. Distribution Channel

- 17.7.6. Design/Style

- 17.7.7. End-Users

- 17.8. Rest of Africa Activewear Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Fabric Type

- 17.8.4. Gender

- 17.8.5. Distribution Channel

- 17.8.6. Design/Style

- 17.8.7. End-Users

- 18. South America Activewear Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Central and South Africa Activewear Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Fabric Type

- 18.3.3. Gender

- 18.3.4. Distribution Channel

- 18.3.5. Design/Style

- 18.3.6. End-Users

- 18.3.7. Country

- 18.3.7.1. Brazil

- 18.3.7.2. Argentina

- 18.3.7.3. Rest of South America

- 18.4. Brazil Activewear Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Fabric Type

- 18.4.4. Gender

- 18.4.5. Distribution Channel

- 18.4.6. Design/Style

- 18.4.7. End-Users

- 18.5. Argentina Activewear Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Fabric Type

- 18.5.4. Gender

- 18.5.5. Distribution Channel

- 18.5.6. Design/Style

- 18.5.7. End-Users

- 18.6. Rest of South America Activewear Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Fabric Type

- 18.6.4. Gender

- 18.6.5. Distribution Channel

- 18.6.6. Design/Style

- 18.6.7. End-Users

- 19. Key Players/ Company Profile

- 19.1. Adidas

- 19.1.1. Company Details/ Overview

- 19.1.2. Company Financials

- 19.1.3. Key Customers and Competitors

- 19.1.4. Business/ Industry Portfolio

- 19.1.5. Product Portfolio/ Specification Details

- 19.1.6. Pricing Data

- 19.1.7. Strategic Overview

- 19.1.8. Recent Developments

- 19.2. Alo Yoga

- 19.3. ASICS

- 19.4. Athleta (Gap Inc.)

- 19.5. Brooks Sports

- 19.6. Columbia Sportswear

- 19.7. Decathlon

- 19.8. Fabletics

- 19.9. Gymshark

- 19.10. Lorna Jane

- 19.11. Lululemon Athletica

- 19.12. New Balance

- 19.13. Nike

- 19.14. Outdoor Voices

- 19.15. Patagonia

- 19.16. Puma

- 19.17. Reebok

- 19.18. Skechers

- 19.19. Sweaty Betty

- 19.20. The North Face (VF Corporation)

- 19.21. Under Armour

- 19.22. Other Key Players

- 19.1. Adidas

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation