Agriculture Robots Market Size, Share & Trends Analysis Report by Robot Type (Milking Robots, Harvesting and Picking Robots, Weeding Robots, Seeding and Planting Robots, Crop Monitoring and Analysis Robots, Driverless Tractors / Autonomous Tractors, UAVs/Drones, Fertilizing Robots, Irrigation Robots, Pruning Robots, Sorting and Packing Robots, Other Specialized Agricultural Robots), Component, Farming Environment, Application, Farm Type, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Agriculture Robots Market Size, Share, and Growth

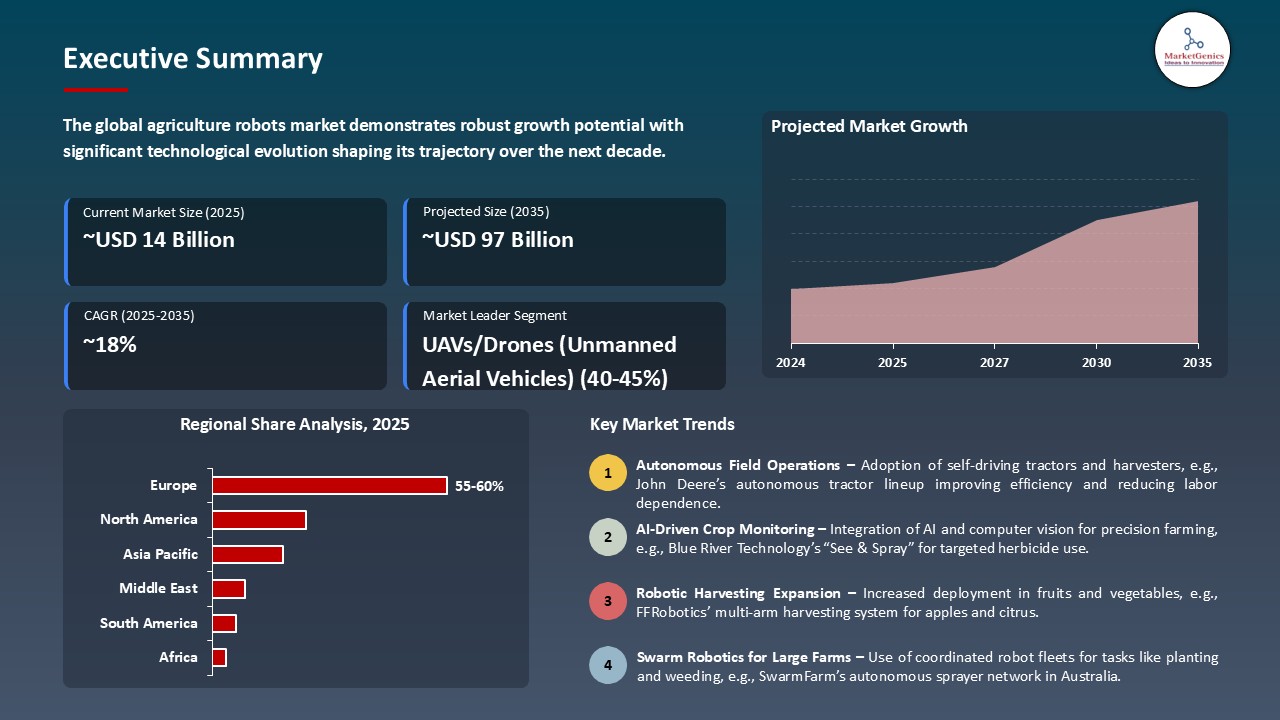

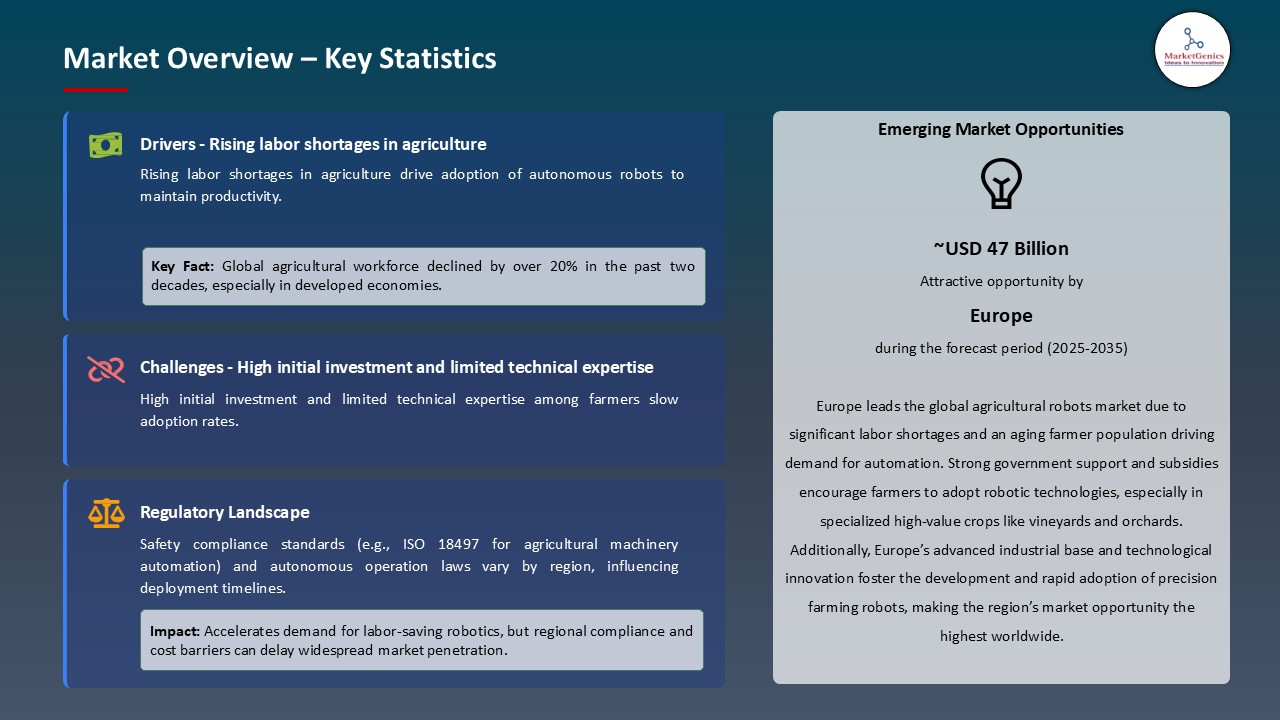

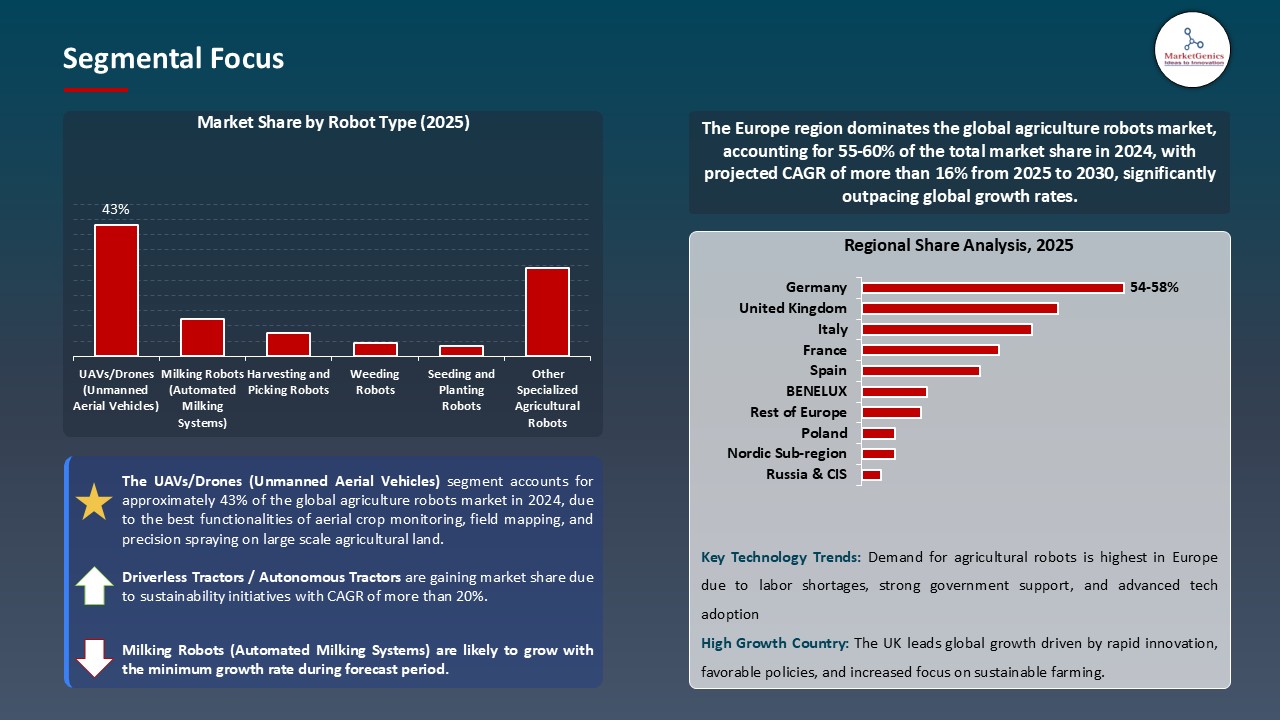

The global agriculture robots market is experiencing robust growth, with its estimated value of USD 14.8 billion in the year 2025 and USD 97.5 billion by the period 2035, registering a CAGR of 18.7%. Europe leads the market with a share of 57.2% with USD 8.5 billion revenue. The agriculture robots market is experiencing a major push on the global level as automated tools to mitigate the labor scarcity situation and the overall boost in efficiency are urgently needed in farming.

AGCO Corporation, led by CEO Eric Hansotia and SVP Seth Crawford, unveiled in early May 2025 an ambitious retrofit-first strategy rolling out the OutRun autonomous tractor kits for mixed fleets (including Fendt and John Deere models aimed at full autonomous field operations by 2030 and $2 billion of precision ag net sales by 2029

The increased demand of precision farming in the global market has led to a faster speed of using AI-driven field robots that can monitor crops, weed, and mechanically harvest all on their own. As an illustration, in March 2025, Naio Technologies introduced a new model of its Oz robot, incorporating enhanced AI, and vision capabilities, to independently control vegetable fields, phasing out manual labor substantially.

Moreover, increased focus on sustainable farming is also encouraging farmers to use robots reducing the use of chemicals and maximizing resource use. In April 2025, John Deere added smart sprayers of an autonomous tractor as its product lineup to make their customers be sure of apposite spraying at any time and create less ecological collision or even harm. All these are developments which lead to the rising number of robotics being integrated in current day farming.

The adjacent market that offers pivotal opportunities to the global agriculture robots market is precision farming technologies, drone-based crop analytics and autonomous irrigation systems. These modules contribute to the integration of robots as they contribute to improved data-driven decisions, crop health monitoring, and the management of water, respectively, creating an integrated ecosystem of smart farming.

Agriculture Robots Market Dynamics and Trends

Driver: Surging Demand for Crop Monitoring and Real-Time Decision-Making Is Driving the Adoption of Multi-Functional Agricultural Robots

- The agriculture robots market is showing significant expansion with the increasing requirement of real time crop tracking solutions coupled with data analytics. Robotic systems, which integrate machine vision and AI, along with sensor-based analysis, are emerging as an alternative way that farmers can quickly understand the health of the soil, identify diseases, and oversee their crops.

- Such capabilities are necessary in maximizing yields with minimal input costs. In May 2025, AgXeed, a Dutch agri-tech company, launched its new AgXeed Robot X that boasted the use of autonomous scouting and autonomous precision navigation. This robot gathers exhaustive field information to facilitate decision-making about sowing, fertilizing, and investing in pest control.

- In a landscape where the changes in climate and weather patterns are unpredictable, such smart robot platforms are facilitating data-led agriculture with a steady increase in productivity.

Restraint: High Initial Investment Costs and ROI Uncertainty Are Restricting Widespread Adoption in Resource-Constrained Farms

- The large capital cost associated with acquiring and maintaining agricultural robots has been and continues to be a major obstacle, especially in developing and cost-conscious areas despite technological advancements. Small and medium-sized farms are frequently not in a position to justify the cost of investment on their automation budgets as they experience uncertainties in their productivity.

- The price is not only the cost of the robot but also the integration of the supplementary infrastructure such as GPS mapping, remote connectivity, and the software platforms. Indicatively, in April 2025, FarmWise Labs, a company known to have developed the robot weeding platform, Titan, revised its pricing to accommodate large-scale agricultural companies better, leaving small farms at a disadvantage when trying to afford the same quantum of automation.

- Such gap in affordability is increasing the digital divide between industrialized and traditional social systems of farmers, thus constraining market penetration in the emerging economies.

Opportunity: Growing Government Subsidies and Agri-Tech Incentives Create Expansion Opportunities for Agricultural Robotics Market

- Governments across the globe are increasingly encouraging the use of more sophisticated farming equipment in order to guarantee food security, optimum utilization of raw materials and taking care of the environment. The government is providing subsidies, tax-based inducements and grants to agri-tech venture startups and to purchase robotic equipment which is fertilizing the market to grow. In particular, the policy measures are focused on climate-resilient technologies and automation tools that could reduce the risk of labor shortage and unstable weather.

- In June 2025 the Japanese government started running a subsidy scheme as part of its Smart Agriculture Strategy where it would cover up to 50 percent of costs to install robotic harvesters and AI-operated machines in the field and companies that take advantage of the scheme include Kubota Corporation as it expanded its line of self-driving tractors in this way to additional prefectures.

- These policy-based incentives are the ones that are fueling both the demand and supply, augmenting the availability of agricultural robotics to a wide range of agricultural scales.

Key Trend: Integration of Robotic Platforms with IoT and Cloud Infrastructure Is Emerging as a Transformational Market Trend

- The emergence of the intersection between agricultural robots and the Internet of Things (IoT) networks and cloud computing platforms is turning farm management into fully automated, and remotely controllable process. Robots are being developed not merely to help with physical labour (planting, harvesting, etc.) but also as moving data nodes that accumulate, transmit, and process field data.

- The resultant fusion enables predictive analytics, long-range diagnostics and real time farm monitoring. In March 2025, Blue River Technology, a branch of John Deere, upgraded its See & Spray Ultimate to possess real-time cloud connectivity with diagnostic and environmental monitoring capabilities to enhance the accuracy of precise weed management.

- These advancements are transforming the current position of agricultural robotics as isolated tech to central elements of an intelligent digital landscapes that integrate and work in collaboration with other smart devices.

Agriculture Robots Market Analysis and Segmental Data

High Precision Aerial Surveillance and Cost Efficiency Elevate UAV Demand in Agricultural Robotics

- The agricultural robots market is dominated by the UAVs/drones segment as they have the best functionalities of aerial crop monitoring, field mapping, and precision spraying on large scale agricultural land. They are agile, have a reduced operating cost, and are able to provide real-time imagery, which makes them essential in the modern precision farming.

- In May 2025, DJI Agriculture released the Agras T60 drone, equipped with a dual atomization spray and an AI system that plans the flight route of large-scale farms, thereby letting them solve pest control more efficiently, using less chemicals. This trend shows that unmanned aerial vehicles are taking a more all-, or multi-purpose form that is highly beneficial in the agricultural sector.

- Their flexibility of deployment and capability to operate in different terrains makes UAVs the ideal robotic platform used by farmers and agri-tech companies.

Europe’s Strategic Push Toward Sustainable and Automated Farming Fuels Agricultural Robot Demand

- The European region is the most active in the demand of robotics in agriculture due to regulatory pressure in the sustainable agricultural forecasts, lack of labor in rural areas and high penetration rates of agriculture technology in large-scale farms. The strict environmental goals of the EU Green Deal and Farm to Fork Strategy in the region are prompting mechanization that lowers the amount of chemicals in use and minimizes the emission of carbon. In April 2025, Norwegian startup Saga Robotics launched Thorvald, its autonomous robot platform, into Germany and Denmark, deploying in strawberry and grape vineyards using UV-C light to combat disease in what was a proactive shift to automated cleaning crops in the industry across Europe.

- This widespread use of the region is also stimulated by government incentives and an established agri-tech environment that has enabled innovation in both crop and livestock operations.

Agriculture Robots Market Ecosystem

Key players in the global agriculture robots market include prominent companies such John Deere, AGCO Corporation, Blue River Technology, DJI (SZ DJI Technology Co., Ltd.), Lely Industries N.V. and Other Key Players.

The global agriculture robots market exhibits a moderately fragmented structure, with a mid-to-high level of market concentration. Tier 1 players such as Deere & Company, DJI, CNH Industrial, and Trimble Inc. possess strong technological integration and global reach. Tier 2 companies like Naïo Technologies, Robotics Plus Ltd., and AgEagle offer specialized automation solutions, while Tier 3 startups such as Octinion and Iron Ox focus on niche applications. The buyer concentration is medium, with diversified demand across regions, while supplier concentration is high due to limited producers of core robotic components and software ecosystems.

Recent Development and Strategic Overview:

- In January 2025, John Deere unveiled its second‑generation autonomy kit and a new fleet of autonomous machines including tractors, orchard units, and self‑driving mowers featuring on‑board Nvidia GPUs and lidar cameras at CES 2025, aiming to address acute labor shortages and boost operational efficiency.

- In March 2025, Kubota debuted its Type V and Type S versatile autonomous platform robots at Expo 2025 in Osaka; these multipurpose machines adjust to crop and terrain variations, supporting tasks from tillage to harvesting while operating autonomously in coordinated fleets.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 14.8 Bn |

|

Market Forecast Value in 2035 |

USD 97.5 Bn |

|

Growth Rate (CAGR) |

18.7% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Thousand Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Agriculture Robots Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Robot Type |

|

|

By Component |

|

|

By Farming Environment |

|

|

By Application |

|

|

By Farm Type |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Agriculture Robots Market Outlook

- 2.1.1. Agriculture Robots Market Size (Volume – Thousand Units and Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Agriculture Robots Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Automotive Industry Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Automotive Industry

- 3.1.3. Regional Distribution for Automotive Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Automotive Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising labor shortages in agriculture-intensive regions

- 4.1.1.2. Growing adoption of precision farming and data-driven crop management

- 4.1.1.3. Government incentives and subsidies promoting agri-tech automation

- 4.1.2. Restraints

- 4.1.2.1. High initial investment and operational costs

- 4.1.2.2. Lack of technical expertise among farmers for robot operation and maintenance

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material and Component Suppliers

- 4.4.2. Agriculture Robots Manufacturers

- 4.4.3. Distributors/ Suppliers

- 4.4.4. End-users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Agriculture Robots Market Demand

- 4.9.1. Historical Market Size - in Volume (Thousand Units) and Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size - in Volume (Thousand Units) and Value (US$ Bn), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Agriculture Robots Market Analysis, by Robot Type

- 6.1. Key Segment Analysis

- 6.2. Agriculture Robots Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by Robot Type, 2021-2035

- 6.2.1. Milking Robots (Automated Milking Systems)

- 6.2.2. Harvesting and Picking Robots

- 6.2.3. Weeding Robots

- 6.2.4. Seeding and Planting Robots

- 6.2.5. Crop Monitoring and Analysis Robots

- 6.2.6. Driverless Tractors / Autonomous Tractors

- 6.2.7. UAVs/Drones (Unmanned Aerial Vehicles)

- 6.2.8. Fertilizing Robots

- 6.2.9. Irrigation Robots

- 6.2.10. Pruning Robots

- 6.2.11. Sorting and Packing Robots

- 6.2.12. Other Specialized Agricultural Robots

- 7. Global Agriculture Robots Market Analysis, by Component

- 7.1. Key Segment Analysis

- 7.2. Agriculture Robots Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by Component, 2021-2035

- 7.2.1. Hardware

- 7.2.1.1. Sensors (GPS, LiDAR, Camera, etc.)

- 7.2.1.2. Controllers

- 7.2.1.3. Drives and Actuators

- 7.2.1.4. End Effectors

- 7.2.1.5. Power Systems

- 7.2.1.6. Chassis/Frames

- 7.2.1.7. Others

- 7.2.2. Software

- 7.2.2.1. Robot Operating System (ROS)

- 7.2.2.2. Artificial Intelligence & Machine Learning Tools

- 7.2.2.3. Navigation & Mapping Software

- 7.2.2.4. Others

- 7.2.3. Services

- 7.2.3.1. Integration & Installation Services

- 7.2.3.2. Maintenance & Support

- 7.2.3.3. Consulting & Training Services

- 7.2.1. Hardware

- 8. Global Agriculture Robots Market Analysis, Farming Environment

- 8.1. Key Segment Analysis

- 8.2. Agriculture Robots Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by Farming Environment, 2021-2035

- 8.2.1. Outdoor

- 8.2.2. Indoor

- 9. Global Agriculture Robots Market Analysis, Application

- 9.1. Key Segment Analysis

- 9.2. Agriculture Robots Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by Application, 2021-2035

- 9.2.1. Dairy Management

- 9.2.1.1. Automated Milking

- 9.2.1.2. Cow Monitoring

- 9.2.2. Field Farming

- 9.2.2.1. Tilling

- 9.2.2.2. Sowing

- 9.2.2.3. Harvesting

- 9.2.2.4. Weed Control

- 9.2.3. Precision Agriculture

- 9.2.3.1. Crop Scouting

- 9.2.3.2. Variable Rate Application (Fertilizer, Pesticide)

- 9.2.4. Horticulture

- 9.2.4.1. Fruit Picking

- 9.2.4.2. Pruning

- 9.2.4.3. Flower Care

- 9.2.5. Livestock Monitoring

- 9.2.5.1. Health Monitoring

- 9.2.5.2. Feeding Automation

- 9.2.6. Soil Management

- 9.2.6.1. Soil Sampling

- 9.2.6.2. Moisture Sensing

- 9.2.7. Irrigation Management

- 9.2.8. Greenhouse Management

- 9.2.9. Crop Sorting and Packaging

- 9.2.10. Others

- 9.2.1. Dairy Management

- 10. Global Agriculture Robots Market Analysis, Farm Type

- 10.1. Key Segment Analysis

- 10.2. Agriculture Robots Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by Farm Type, 2021-2035

- 10.2.1. Field Crops

- 10.2.2. Fruits and Vegetables

- 10.2.3. Dairy Farms

- 10.2.4. Orchards and Vineyards

- 10.2.5. Horticulture

- 10.2.6. Greenhouses

- 10.2.7. Others

- 11. Global Agriculture Robots Market Analysis and Forecasts, by Region

- 11.1. Key Findings

- 11.2. Agriculture Robots Market Size (Volume - Thousand Units and Value - US$ Mn), Analysis, and Forecasts, by Region, 2021-2035

- 11.2.1. North America

- 11.2.2. Europe

- 11.2.3. Asia Pacific

- 11.2.4. Middle East

- 11.2.5. Africa

- 11.2.6. South America

- 12. North America Agriculture Robots Market Analysis

- 12.1. Key Segment Analysis

- 12.2. Regional Snapshot

- 12.3. North America Agriculture Robots Market Size Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 12.3.1. Robot Type

- 12.3.2. Component

- 12.3.3. Farming Environment

- 12.3.4. Farming Environment

- 12.3.5. Application

- 12.3.6. Farm Type

- 12.3.7. Country

- 12.3.7.1. USA

- 12.3.7.2. Canada

- 12.3.7.3. Mexico

- 12.4. USA Agriculture Robots Market

- 12.4.1. Country Segmental Analysis

- 12.4.2. Robot Type

- 12.4.3. Component

- 12.4.4. Farming Environment

- 12.4.5. Farming Environment

- 12.4.6. Application

- 12.4.7. Farm Type

- 12.5. Canada Agriculture Robots Market

- 12.5.1. Country Segmental Analysis

- 12.5.2. Robot Type

- 12.5.3. Component

- 12.5.4. Farming Environment

- 12.5.5. Farming Environment

- 12.5.6. Application

- 12.5.7. Farm Type

- 12.6. Mexico Agriculture Robots Market

- 12.6.1. Country Segmental Analysis

- 12.6.2. Robot Type

- 12.6.3. Component

- 12.6.4. Farming Environment

- 12.6.5. Farming Environment

- 12.6.6. Application

- 12.6.7. Farm Type

- 13. Europe Agriculture Robots Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. Europe Agriculture Robots Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 13.3.1. Robot Type

- 13.3.2. Component

- 13.3.3. Farming Environment

- 13.3.4. Farming Environment

- 13.3.5. Application

- 13.3.6. Farm Type

- 13.3.7. Country

- 13.3.7.1. Germany

- 13.3.7.2. United Kingdom

- 13.3.7.3. France

- 13.3.7.4. Italy

- 13.3.7.5. Spain

- 13.3.7.6. Netherlands

- 13.3.7.7. Nordic Countries

- 13.3.7.8. Poland

- 13.3.7.9. Russia & CIS

- 13.3.7.10. Rest of Europe

- 13.4. Germany Agriculture Robots Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Robot Type

- 13.4.3. Component

- 13.4.4. Farming Environment

- 13.4.5. Farming Environment

- 13.4.6. Application

- 13.4.7. Farm Type

- 13.5. United Kingdom Agriculture Robots Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Robot Type

- 13.5.3. Component

- 13.5.4. Farming Environment

- 13.5.5. Farming Environment

- 13.5.6. Application

- 13.5.7. Farm Type

- 13.6. France Agriculture Robots Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Robot Type

- 13.6.3. Component

- 13.6.4. Farming Environment

- 13.6.5. Farming Environment

- 13.6.6. Application

- 13.6.7. Farm Type

- 13.7. Italy Agriculture Robots Market

- 13.7.1. Country Segmental Analysis

- 13.7.2. Robot Type

- 13.7.3. Component

- 13.7.4. Farming Environment

- 13.7.5. Farming Environment

- 13.7.6. Application

- 13.7.7. Farm Type

- 13.8. Spain Agriculture Robots Market

- 13.8.1. Country Segmental Analysis

- 13.8.2. Robot Type

- 13.8.3. Component

- 13.8.4. Farming Environment

- 13.8.5. Farming Environment

- 13.8.6. Application

- 13.8.7. Farm Type

- 13.9. Netherlands Agriculture Robots Market

- 13.9.1. Country Segmental Analysis

- 13.9.2. Robot Type

- 13.9.3. Component

- 13.9.4. Farming Environment

- 13.9.5. Farming Environment

- 13.9.6. Application

- 13.9.7. Farm Type

- 13.10. Nordic Countries Agriculture Robots Market

- 13.10.1. Country Segmental Analysis

- 13.10.2. Robot Type

- 13.10.3. Component

- 13.10.4. Farming Environment

- 13.10.5. Farming Environment

- 13.10.6. Application

- 13.10.7. Farm Type

- 13.11. Poland Agriculture Robots Market

- 13.11.1. Country Segmental Analysis

- 13.11.2. Robot Type

- 13.11.3. Component

- 13.11.4. Farming Environment

- 13.11.5. Farming Environment

- 13.11.6. Application

- 13.11.7. Farm Type

- 13.12. Russia & CIS Agriculture Robots Market

- 13.12.1. Country Segmental Analysis

- 13.12.2. Robot Type

- 13.12.3. Component

- 13.12.4. Farming Environment

- 13.12.5. Farming Environment

- 13.12.6. Application

- 13.12.7. Farm Type

- 13.13. Rest of Europe Agriculture Robots Market

- 13.13.1. Country Segmental Analysis

- 13.13.2. Robot Type

- 13.13.3. Component

- 13.13.4. Farming Environment

- 13.13.5. Farming Environment

- 13.13.6. Application

- 13.13.7. Farm Type

- 14. Asia Pacific Agriculture Robots Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. East Asia Agriculture Robots Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Robot Type

- 14.3.2. Component

- 14.3.3. Farming Environment

- 14.3.4. Farming Environment

- 14.3.5. Application

- 14.3.6. Farm Type

- 14.3.7. Country

- 14.3.7.1. China

- 14.3.7.2. India

- 14.3.7.3. Japan

- 14.3.7.4. South Korea

- 14.3.7.5. Australia and New Zealand

- 14.3.7.6. Indonesia

- 14.3.7.7. Malaysia

- 14.3.7.8. Thailand

- 14.3.7.9. Vietnam

- 14.3.7.10. Rest of Asia Pacific

- 14.4. China Agriculture Robots Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Robot Type

- 14.4.3. Component

- 14.4.4. Farming Environment

- 14.4.5. Farming Environment

- 14.4.6. Application

- 14.4.7. Farm Type

- 14.5. India Agriculture Robots Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Robot Type

- 14.5.3. Component

- 14.5.4. Farming Environment

- 14.5.5. Farming Environment

- 14.5.6. Application

- 14.5.7. Farm Type

- 14.6. Japan Agriculture Robots Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Robot Type

- 14.6.3. Component

- 14.6.4. Farming Environment

- 14.6.5. Farming Environment

- 14.6.6. Application

- 14.6.7. Farm Type

- 14.7. South Korea Agriculture Robots Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Robot Type

- 14.7.3. Component

- 14.7.4. Farming Environment

- 14.7.5. Farming Environment

- 14.7.6. Application

- 14.7.7. Farm Type

- 14.8. Australia and New Zealand Agriculture Robots Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Robot Type

- 14.8.3. Component

- 14.8.4. Farming Environment

- 14.8.5. Farming Environment

- 14.8.6. Application

- 14.8.7. Farm Type

- 14.9. Indonesia Agriculture Robots Market

- 14.9.1. Country Segmental Analysis

- 14.9.2. Robot Type

- 14.9.3. Component

- 14.9.4. Farming Environment

- 14.9.5. Farming Environment

- 14.9.6. Application

- 14.9.7. Farm Type

- 14.10. Malaysia Agriculture Robots Market

- 14.10.1. Country Segmental Analysis

- 14.10.2. Robot Type

- 14.10.3. Component

- 14.10.4. Farming Environment

- 14.10.5. Farming Environment

- 14.10.6. Application

- 14.10.7. Farm Type

- 14.11. Thailand Agriculture Robots Market

- 14.11.1. Country Segmental Analysis

- 14.11.2. Robot Type

- 14.11.3. Component

- 14.11.4. Farming Environment

- 14.11.5. Farming Environment

- 14.11.6. Application

- 14.11.7. Farm Type

- 14.12. Vietnam Agriculture Robots Market

- 14.12.1. Country Segmental Analysis

- 14.12.2. Robot Type

- 14.12.3. Component

- 14.12.4. Farming Environment

- 14.12.5. Farming Environment

- 14.12.6. Application

- 14.12.7. Farm Type

- 14.13. Rest of Asia Pacific Agriculture Robots Market

- 14.13.1. Country Segmental Analysis

- 14.13.2. Robot Type

- 14.13.3. Component

- 14.13.4. Farming Environment

- 14.13.5. Farming Environment

- 14.13.6. Application

- 14.13.7. Farm Type

- 15. Middle East Agriculture Robots Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Middle East Agriculture Robots Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Robot Type

- 15.3.2. Component

- 15.3.3. Farming Environment

- 15.3.4. Farming Environment

- 15.3.5. Application

- 15.3.6. Farm Type

- 15.3.7. Country

- 15.3.7.1. Turkey

- 15.3.7.2. UAE

- 15.3.7.3. Saudi Arabia

- 15.3.7.4. Israel

- 15.3.7.5. Rest of Middle East

- 15.4. Turkey Agriculture Robots Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Robot Type

- 15.4.3. Component

- 15.4.4. Farming Environment

- 15.4.5. Farming Environment

- 15.4.6. Application

- 15.4.7. Farm Type

- 15.5. UAE Agriculture Robots Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Robot Type

- 15.5.3. Component

- 15.5.4. Farming Environment

- 15.5.5. Farming Environment

- 15.5.6. Application

- 15.5.7. Farm Type

- 15.6. Saudi Arabia Agriculture Robots Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Robot Type

- 15.6.3. Component

- 15.6.4. Farming Environment

- 15.6.5. Farming Environment

- 15.6.6. Application

- 15.6.7. Farm Type

- 15.7. Israel Agriculture Robots Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Robot Type

- 15.7.3. Component

- 15.7.4. Farming Environment

- 15.7.5. Farming Environment

- 15.7.6. Application

- 15.7.7. Farm Type

- 15.8. Rest of Middle East Agriculture Robots Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Robot Type

- 15.8.3. Component

- 15.8.4. Farming Environment

- 15.8.5. Farming Environment

- 15.8.6. Application

- 15.8.7. Farm Type

- 16. Africa Agriculture Robots Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Africa Agriculture Robots Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Robot Type

- 16.3.2. Component

- 16.3.3. Farming Environment

- 16.3.4. Farming Environment

- 16.3.5. Application

- 16.3.6. Farm Type

- 16.3.7. Country

- 16.3.7.1. South Africa

- 16.3.7.2. Egypt

- 16.3.7.3. Nigeria

- 16.3.7.4. Algeria

- 16.3.7.5. Rest of Africa

- 16.4. South Africa Agriculture Robots Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Robot Type

- 16.4.3. Component

- 16.4.4. Farming Environment

- 16.4.5. Farming Environment

- 16.4.6. Application

- 16.4.7. Farm Type

- 16.5. Egypt Agriculture Robots Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Robot Type

- 16.5.3. Component

- 16.5.4. Farming Environment

- 16.5.5. Farming Environment

- 16.5.6. Application

- 16.5.7. Farm Type

- 16.6. Nigeria Agriculture Robots Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Robot Type

- 16.6.3. Component

- 16.6.4. Farming Environment

- 16.6.5. Farming Environment

- 16.6.6. Application

- 16.6.7. Farm Type

- 16.7. Algeria Agriculture Robots Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Robot Type

- 16.7.3. Component

- 16.7.4. Farming Environment

- 16.7.5. Farming Environment

- 16.7.6. Application

- 16.7.7. Farm Type

- 16.8. Rest of Africa Agriculture Robots Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Robot Type

- 16.8.3. Component

- 16.8.4. Farming Environment

- 16.8.5. Farming Environment

- 16.8.6. Application

- 16.8.7. Farm Type

- 17. South America Agriculture Robots Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Central and South Africa Agriculture Robots Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Robot Type

- 17.3.2. Component

- 17.3.3. Farming Environment

- 17.3.4. Farming Environment

- 17.3.5. Application

- 17.3.6. Farm Type

- 17.3.7. Country

- 17.3.7.1. Brazil

- 17.3.7.2. Argentina

- 17.3.7.3. Rest of South America

- 17.4. Brazil Agriculture Robots Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Robot Type

- 17.4.3. Component

- 17.4.4. Farming Environment

- 17.4.5. Farming Environment

- 17.4.6. Application

- 17.4.7. Farm Type

- 17.5. Argentina Agriculture Robots Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Robot Type

- 17.5.3. Component

- 17.5.4. Farming Environment

- 17.5.5. Farming Environment

- 17.5.6. Application

- 17.5.7. Farm Type

- 17.6. Rest of South America Agriculture Robots Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Robot Type

- 17.6.3. Component

- 17.6.4. Farming Environment

- 17.6.5. Farming Environment

- 17.6.6. Application

- 17.6.7. Farm Type

- 18. Key Players/ Company Profile

- 18.1. Abundant Robotics

- 18.1.1. Company Details/ Overview

- 18.1.2. Company Financials

- 18.1.3. Key Customers and Competitors

- 18.1.4. Business/ Industry Portfolio

- 18.1.5. Product Portfolio/ Specification Details

- 18.1.6. Pricing Data

- 18.1.7. Strategic Overview

- 18.1.8. Recent Developments

- 18.2. AGCO Corporation

- 18.3. AgEagle Aerial Systems Inc.

- 18.4. Agrobot

- 18.5. Autonomous Tractor Corporation

- 18.6. Blue River Technology (acquired by John Deere)

- 18.7. BouMatic Robotics B.V.

- 18.8. CNH Industrial N.V.

- 18.9. Deere & Company (John Deere)

- 18.10. DJI (SZ DJI Technology Co., Ltd.)

- 18.11. ecoRobotix

- 18.12. Ecorobotix SA

- 18.13. Harvest CROO Robotics

- 18.14. Iron Ox, Inc.

- 18.15. Lely Holding S.à r.l.

- 18.16. Naïo Technologies

- 18.17. Octinion

- 18.18. Robotics Plus Ltd.

- 18.19. Trimble Inc.

- 18.20. Yamaha Motor Co., Ltd.

- 18.21. Other Key Players

- 18.1. Abundant Robotics

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation