Flow Meters and Controllers Market Size, Share & Trends Analysis Report by Product Type (Differential Pressure Flow Meters, Positive Displacement Flow Meters, Velocity Flow Meters, Mass Flow Meters, Open Channel Flow Meters), Technology, Measurement Type, Fluid Type, Pipe Size (Diameter), Operating Pressure, Installation Type, End-Use Industry, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Flow Meters and Controllers Market Size, Share, and Growth

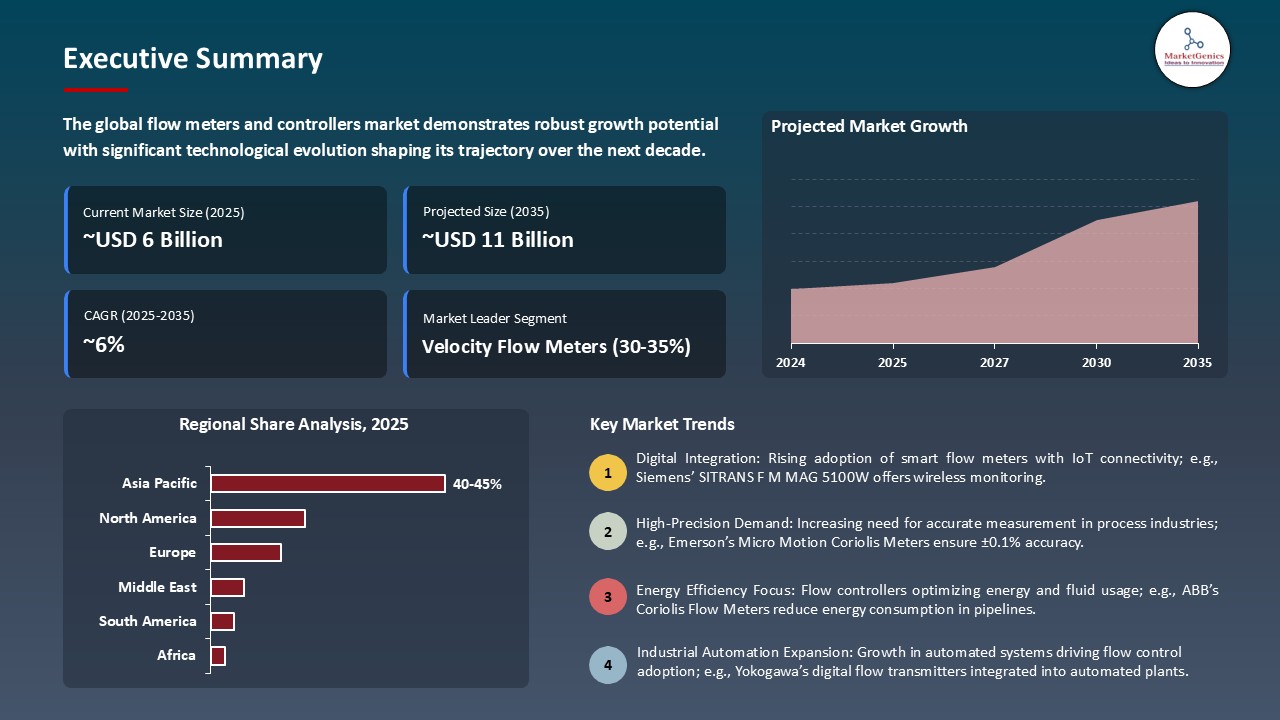

The global flow meters and controllers market is witnessing strong growth, valued at USD 6.3 billion in 2025 and projected to reach USD 10.8 billion by 2035, expanding at a CAGR of 5.5% during the forecast period. North America is the fastest-growing region in the flow meters and controllers market due to increasing demand for precise measurement and monitoring, rising industrial automation, adoption of smart and connected flow solutions, and stringent regulatory standards promoting efficiency and process safety.

Alyssa Jenkins, Alicat VP of Customer Experience, said, “When we researched whether a display was important, customers told us, ‘A display would be awesome.’ The CODA flow product line with display brings one of Alicat’s most identifiable features to a product line of precise liquid and gas flow control instrumentation.”

The rising industrial automation and digitalization also propel the demand of smart, connected flow instruments with advanced diagnostics in the flow meters and controllers market. With the switching of industries to IIoT, integrated control systems, real-time monitoring, flow meters with self-diagnostics, predictive maintenance, and smooth communication interfaces are on the agenda to make the process more reliable, reduce downtime, and data-driven optimization of modern automated plants.

The fast development of the hydrogen economy and massive carbon-capture projects in the flow meters and controllers market is generating immense opportunities in the specialized high-pressure, cryogenic and low-molecular-weight gas flow measurement solutions. An example is the ultrasonic flowmeters developed by in 2025, Endress+Hauser that could process hydrogen-blended and pure-hydrogen gas streams. As the amount of hydrogen injected into gas grids increases and the nature of the gas properties alters rapidly, the company noted that high-accuracy ultrasonic metering was required to establish safe, stable, and accurate flow measurement throughout the next-generation hydrogen infrastructure.

Major market adjacent opportunities comprise industrial IoT solutions to data analytics, cloud-based solutions to data monitoring, edge computing solutions and artificial intelligence solutions. These complementary technologies provide a synergistic integration opportunities that can reach a broader and larger addressable market and allow manufacturers to present end to end solutions that can cover many areas of customer pain at once.

Flow Meters and Controllers Market Dynamics and Trends

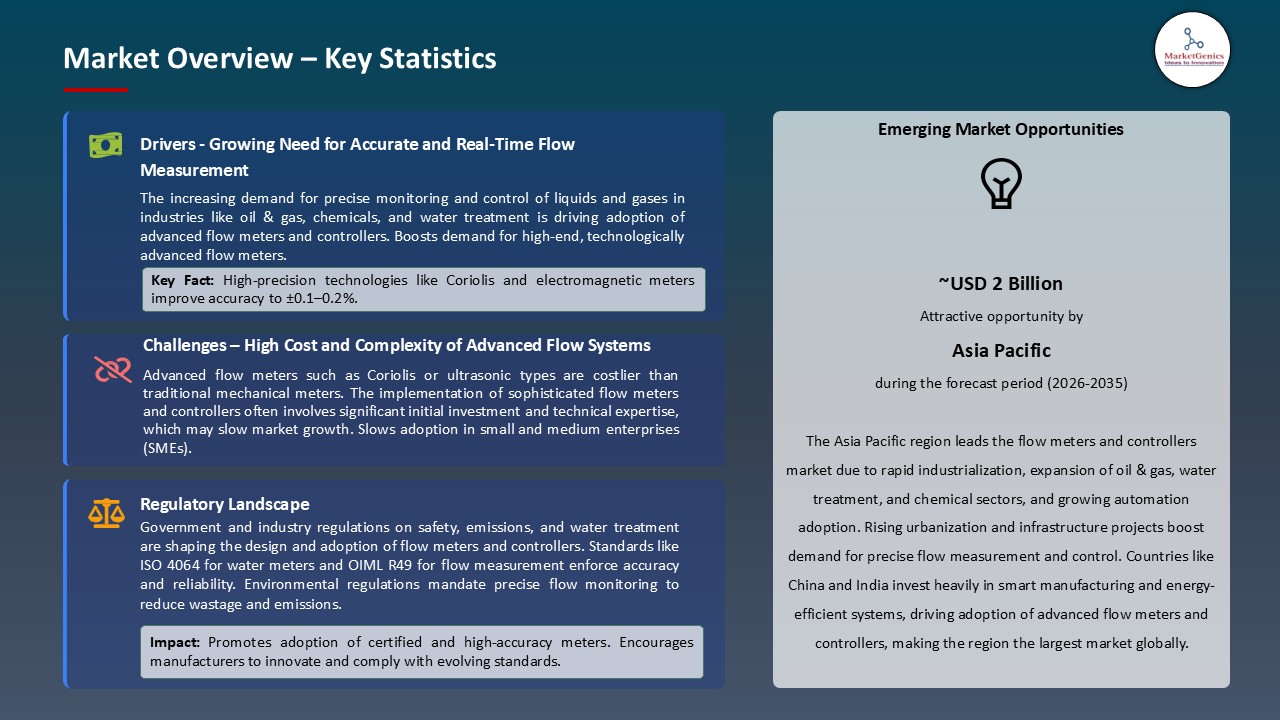

Driver: Growing Water and Wastewater Management Infrastructure

- The development of a new water and wastewater management infrastructure is the biggest contributor to the flow meters and controllers market with a growing focus on efficient resources, leakage management, and regulation control by utilities and industries. The increasing urbanization, industrialization and stricter environmental regulations are compelling the municipalities to upgrade their old pipelines, treatment facilities, and distribution systems with smart and precise flow-measuring systems.

- Investments in desalination, reuse systems and decentralized treatment facilities also increase the demand on the high level of flow meters that can treat various types of media, variable flow and real-time monitoring requirements. With rising attention paid to sustainable water security and digital water infrastructure by countries, the utilization of high-precision flow meters and smart controllers is gaining and gaining momentum.

- Schneider Electric was awarded the contract of automating the largest 2,000 MLD Bhandup Water Treatment Plant in Mumbai, India in February 2025. The company is using its EcoStruxure Power and Process automation platform, drives, relays, and digital control solutions in conjunction with Welspun Enterprises and Veolia to improve efficiency, reliability, and water recyclability. The project will be supporting the Maharashtra mission of supplying drinkable water to 22 million individuals and modernizing the water and wastewater systems.

- Upgrading large-scale water infrastructure projects promotes the use of modern flow meters and controllers internationally.

Restraint: Application-Specific Technology Limitations

- Application specific technology restrictions are a major setback to the flow meters and controllers market as various industries, fluids and operating conditions demand highly specialized measurement capabilities that are unavailable in all devices.

- Changes in the viscosity, temperature, pressure, chemical content, presence of particulates or corrosiveness may limit the applicability of some flow-meter technologies, lowering their accuracy or life. Sometimes devices cannot deal with extremely low or extremely high flow rates, multiphase flows, or rapidly varying conditions, complicating calibration requirements and establishing more complicated operations.

- The environment is also harsh or dangerous and requires higher-grade materials, certifications and tailored engineering, which once again restricts interoperability across industries. These limitations usually result in increased procurement and maintenance expenses, increased specification cycles and reserved implementation of newer technologies.

- The necessity of custom solutions, compatibility tests, and high-performance validation rates decrease the speed of deployment and discourage standardization, which in turn affects the development of the market as a whole.

Opportunity: Expansion in Oil and Gas Midstream Infrastructure

- The constant development of oil and gas midstream infrastructure is also providing the market with substantial opportunities to the Flow Meters and Controllers since operators are investing in new pipelines, storage facilities, pumping stations, and LNG assets to support the growing world energy needs. Expanding international pipeline operations, capacity expansion, and upgrading of transmission systems can all be achieved through very precise, reliable, and real-time monitoring systems to guarantee the safety and efficiency of the flow management.

- Midstream operators are also focusing on accuracy measuring technologies to maximize throughput, minimize risks of leaks and meet the tough regulatory requirements. With the increased pace of digitalization in pipeline operations, the demand in smart flow meters and automated controllers is ever-increasing, which contributes to their further acceptance in the pipeline transport of liquid hydrocarbons and natural gas.

- In 2025, Tejon Treating & Carbon Solutions had been pursuing additional sour-gas collection, treatment, and carbon-sequestration at its Mongoose Gas Plant in the Midland Basin to accommodate capacity shortages in the region and provide a way to develop oil and gas resources on a low-carbon basis. As all the wellhead and the VRU gas is captured and processed, the expanding midstream infrastructure of the facility raises the demand of the precise flow measure and control technologies to coordinate sour-gas processing, effectiveness of the treatment, and the regulatory provisions.

- Overall, the ongoing investment in midstream facilities is supporting long-term demand of flow-measurements and flow-control solutions in the oil and gas industry.

Key Trend: Integration of Diagnostics and Predictive Maintenance Capabilities

- The inclusion of modern diagnostics and predictive maintenance systems is a new direction in the industry of Flow Meters and Controllers due to the pressure of increased operation uptime, lower maintenance expenses, and higher reliability of equipment.

- Modern flow-measurement instruments have now incorporated self-monitoring sensors, real-time analytics, and health-status reporting capabilities to identify anomalies like drift, clogging, wear or calibration problems, before they become failures. Combining AI-based predictive algorithms and cloud connectivity, these systems will enable operators to plan maintenance and use assets to optimize their life cycles and avoid unexpected downtimes.

- Endress+Hauser (2025) won the AMA Innovation Award with its Proline Prosonic Flow P 500, a clamp-on ultrasonic flowmeter that can measure liquids up to 550 o C. The device has built in sophisticated diagnostics in the form of onboard web server and Heartbeat Technology that will allow it to offer continuous self-verification, disturbance compensation (FlowDC) and predictive maintenance. This novelty helps to improve the accuracy, minimizing the number of manual checks, and promoting trusted and condition-based functioning under difficult industrial conditions.

- The trend is driving the move towards smarter, self-diagnosing flow systems that optimize reliability, minimize downtime and help fully connected, predictive industrial operations.

Flow-Meters-and-Controllers-Market Analysis and Segmental Data

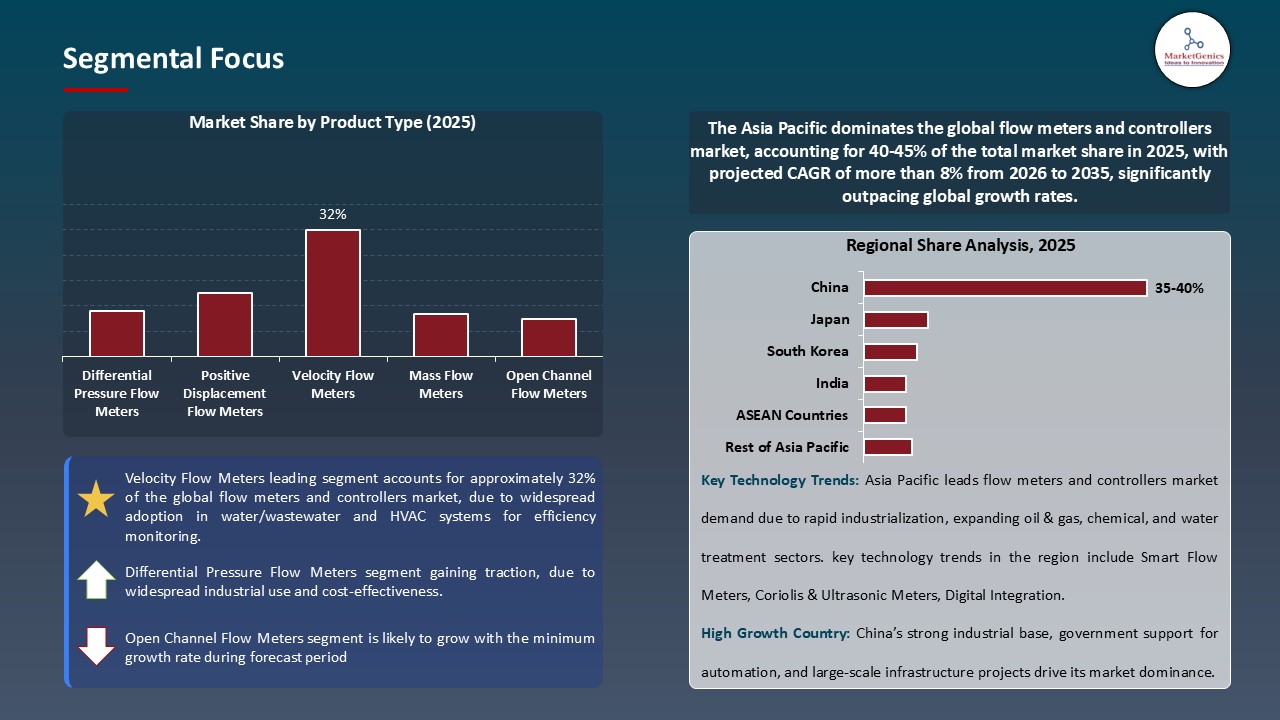

Velocity Flow Meters Dominate Global Flow Meters and Controllers Market

- Velocity flow meters are the most popular in the international Flow Meters and Controllers market because of their broad applicability, excellent accuracy, and economical performance in different industries. Electromagnetic, ultrasonic and vortex flow meters are some of the technologies that provide dependable measurement of liquids, gases and steam in spite of changing flow conditions.

- Technologies like electromagnetic, ultrasonic and vortex flow meters have proven to be very useful in the measurement of liquids, gases and steam regardless of the prevailing flow conditions. They are used in water and wastewater treatment, oil and gas extraction, chemical processing and HVAC leaks as their non-intrusive designs, low pressure loss and low maintenance needs make them the choice.

- Improvements in ultrasonic and electromagnetic detecting, in addition to digital signal processing and built-in diagnostics, make them even more accurate and efficient. Velocity flow meters still occupy the largest market world over since industries are seeking efficiency, durability and smart monitoring capabilities.

- In 2025, Malema (PSG/Dover) introduced the M-3100 Series Clamp-On Ultrasonic Flow Meter, which provides non-invasive, high-precision velocity measurements of semiconductor processes. It features a ±2% accuracy, compact DIN-rail design, and non-contact sensors, which have advanced features, and an RS-485 Modbus connection, which reflects current innovation and high demand of velocity-based flow metering solutions.

- Overall, the sustained innovation, versatility and reliability of the velocity flow meter technologies continue to solidify their position as the market leader in the world flow meter and controllers market.

Asia Pacific Leads Global Flow Meters and Controllers Market Demand

- Asia Pacific Asians remain at the forefront of flow meter and controller demand worldwide due to high rates of industrialization, increasing manufacturing capacity and high amounts of investments in energy, water and process infrastructure. Since chemical, pharmaceutical, food and beverage and semiconductor industries are increasing in the region, flow measurement is important to facilitate the maximization of operational effectiveness and the strictness of regulatory requirements.

- Greater proliferation of water and wastewater treatment plants in China, India, and southeast Asia only enhances the use of advanced flow technologies. There are also influential government campaigns in favor of smart industrial automation, digital monitoring, and pipeline modernization, which increases the demand of smart and high-accuracy flow devices. As the capital spending increases and diversified growth in industries progresses, Asia Pacific has become the leading and the fastest growing market in the world.

- Japan Azbil Kimmon (Japan) collaborated with Kamstrup in July 2025, to design next-generation ultrasonic smart water meters to match the aging water infrastructure in Japan. The meters are high-accuracy and low-flow, have a small non-moving-part design, and last long, and they also feature a machine-learning-powered cloud leak-detection service via the Azbil SMaaS platform, which helps facilitate more efficient monitoring and maintenance of water networks in the area.

- Asia Pacific's leading position in the global flow meters and controllers market is attributed to strong industrial expansion, improved infrastructure, and rapid adoption of smart metering technologies.

Flow-Meters-and-Controllers-Market Ecosystem

The global flow meters and controllers market is relatively concentrated, with significant players such as Endress+Hauser Group, Emerson Electric Co., Yokogawa Electric Corporation, Siemens AG, and ABB Ltd. To maintain their position as leaders, these companies rely on their well-established global distribution network, high measurement accuracy, improved diagnostics, and simplicity of integration with industrial automation systems.

The market value chain involves sensor and transducer production, flow meter and controller, signal processing technologies, communication protocol development, system integration, calibration, certification, and after-sales services including predictive maintenance, lifecycle monitoring and performance analytics.

The barriers to entry are also high because of the requirement of high-accuracy, certified, and application-specific flow measurement technologies and built-in customer trust. The market is further driven in technological progress with specialized vendors still innovating in such niches as ultrasonic, Coriolis, and smart IoT-enabled flow systems.

Recent Development and Strategic Overview:

- In May 2025, Alicat scientific launched its CODA miniaturized Coriolis mass flow meters, controllers, and pump systems with a new multivariate LCD display interface. The upgrade allows real-time flow rate, density, and temperature monitoring, allows menu-driven construction without a PLC or a PC, is compatible with the major industrial protocols, and improves usability, accuracy, and real-time control of the flow rate, density, and temperature of the liquid and gas flow.

- In September 2025, OMRON will launch the Sysmac-Edge DX1 Data Flow Controller on September 30, enabling no-code collection, analysis, and visualization of factory-floor data. Working with the Sysmac Automation Platform, DX1 standardizes data retrieval, removes dependence on AI/IoT specialists, and improves connectivity across diverse devices. With built-in templates and a simple flow editor, it enhances usability, accelerates on-site data utilization, and supports digital transformation in manufacturing.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 6.3 Bn |

|

Market Forecast Value in 2035 |

USD 10.8 Bn |

|

Growth Rate (CAGR) |

5.5% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Million Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Flow-Meters-and-Controllers-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Flow Meters and Controllers Market, By Product Type |

|

|

Flow Meters and Controllers Market, By Technology |

|

|

Flow Meters and Controllers Market, By Measurement Type |

|

|

Flow Meters and Controllers Market, By Fluid Type |

|

|

Flow Meters and Controllers Market, By Pipe Size (Diameter) |

|

|

Flow Meters and Controllers Market, By Operating Pressure |

|

|

Flow Meters and Controllers Market, By Installation Type |

|

|

Flow Meters and Controllers Market, By End-Use Industry |

|

Frequently Asked Questions

The global flow meters and controllers market was valued at USD 6.3 Bn in 2025.

The global flow meters and controllers market industry is expected to grow at a CAGR of 5.5% from 2026 to 2035.

Key factors driving demand include growing water and wastewater management infrastructure, increasing industrial automation adoption, technological innovation, and growing requirements for operational efficiency and safety compliance across multiple industry verticals.

In terms of product type, the velocity flow meters segment accounted for the major share in 2025.

Asia Pacific is the most attractive region for flow meters and controllers market.

Prominent players operating in the global flow meters and controllers market are ABB Ltd., Alicat Scientific Inc., Azbil Corporation, Badger Meter Inc., Bronkhorst High-Tech B.V., Brooks Instrument, Emerson Electric Co., Endress+Hauser Group, Honeywell International Inc., KROHNE Messtechnik GmbH, Magnetrol International, McCrometer Inc., OMEGA Engineering (Spectris plc), Oval Corporation, Schneider Electric SE, SICK AG, Siemens AG, Sierra Instruments Inc., Tokyo Keiso Co., Ltd., Yokogawa Electric Corporation, and Other Key Players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Flow Meters and Controllers Market Outlook

- 2.1.1. Flow Meters and Controllers Market Volume (Million Units) and Value (US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Flow Meters and Controllers Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Automation & Process Control Industry Overview, 2025

- 3.1.1. Automation & Process Control Industry Ecosystem Analysis

- 3.1.2. Key Trends for Automation & Process Control Industry

- 3.1.3. Regional Distribution for Automation & Process Control Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Automation & Process Control Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for accurate and real-time flow measurement in industrial processes.

- 4.1.1.2. Increasing adoption of smart and IoT-enabled flow meters for automation and efficiency.

- 4.1.1.3. Expansion of water treatment, oil & gas, and chemical industries globally.

- 4.1.2. Restraints

- 4.1.2.1. High cost and complexity of advanced flow meter technologies.

- 4.1.2.2. Maintenance and calibration challenges in harsh industrial environments.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Component Suppliers

- 4.4.2. Manufacturing & Assembly

- 4.4.3. Distributors & Supply Chain

- 4.4.4. End-User Industries

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Flow Meters and Controllers Market Demand

- 4.9.1. Historical Market Size – Volume (Million Units) and Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size – Volume (Million Units) and Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Flow Meters and Controllers Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Flow Meters and Controllers Market Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Differential Pressure Flow Meters

- 6.2.1.1. Orifice Plates

- 6.2.1.2. Venturi Tubes

- 6.2.1.3. Flow Nozzles

- 6.2.1.4. Pitot Tubes

- 6.2.1.5. Others

- 6.2.2. Positive Displacement Flow Meters

- 6.2.2.1. Oval Gear Meters

- 6.2.2.2. Nutating Disc Meters

- 6.2.2.3. Reciprocating Piston Meters

- 6.2.2.4. Rotary Vane Meters

- 6.2.2.5. Others

- 6.2.3. Velocity Flow Meters

- 6.2.3.1. Turbine Flow Meters

- 6.2.3.2. Paddlewheel Flow Meters

- 6.2.3.3. Vortex Flow Meters

- 6.2.3.4. Electromagnetic Flow Meters

- 6.2.3.5. Ultrasonic Flow Meters (Doppler & Transit-Time)

- 6.2.3.6. Others

- 6.2.4. Mass Flow Meters

- 6.2.4.1. Coriolis Flow Meters

- 6.2.4.2. Thermal Mass Flow Meters

- 6.2.4.3. Others

- 6.2.5. Open Channel Flow Meters

- 6.2.5.1. Weir Flow Meters

- 6.2.5.2. Flume Flow Meters

- 6.2.5.3. Others

- 6.2.1. Differential Pressure Flow Meters

- 7. Global Flow Meters and Controllers Market Analysis, by Technology

- 7.1. Key Segment Analysis

- 7.2. Flow Meters and Controllers Market Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Technology, 2021-2035

- 7.2.1. Mechanical Flow Meters

- 7.2.2. Electronic Flow Meters

- 7.2.3. Digital Flow Meters

- 7.2.4. Smart/Intelligent Flow Meters

- 7.2.5. Analog Flow Meters

- 7.2.6. Others

- 8. Global Flow Meters and Controllers Market Analysis, by Measurement Type

- 8.1. Key Segment Analysis

- 8.2. Flow Meters and Controllers Market Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Measurement Type, 2021-2035

- 8.2.1. Volumetric Flow Measurement

- 8.2.2. Mass Flow Measurement

- 8.2.3. Velocity Flow Measurement

- 9. Global Flow Meters and Controllers Market Analysis, by Fluid Type

- 9.1. Key Segment Analysis

- 9.2. Flow Meters and Controllers Market Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Fluid Type, 2021-2035

- 9.2.1. Liquid Flow Meters

- 9.2.1.1. Water

- 9.2.1.2. Chemicals

- 9.2.1.3. Petroleum Products

- 9.2.1.4. Cryogenic Liquids

- 9.2.1.5. Others

- 9.2.2. Gas Flow Meters

- 9.2.2.1. Natural Gas

- 9.2.2.2. Compressed Air

- 9.2.2.3. Steam

- 9.2.2.4. Industrial Gases

- 9.2.2.5. Others

- 9.2.3. Multiphase Flow Meters

- 9.2.1. Liquid Flow Meters

- 10. Global Flow Meters and Controllers Market Analysis, by Pipe Size (Diameter)

- 10.1. Key Segment Analysis

- 10.2. Flow Meters and Controllers Market Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Pipe Size (Diameter), 2021-2035

- 10.2.1. Less than 2 inches

- 10.2.2. 2-6 inches

- 10.2.3. 6-12 inches

- 10.2.4. Above 12 inches

- 11. Global Flow Meters and Controllers Market Analysis, by Operating Pressure

- 11.1. Key Segment Analysis

- 11.2. Flow Meters and Controllers Market Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Operating Pressure, 2021-2035

- 11.2.1. Low Pressure

- 11.2.2. Medium Pressure

- 11.2.3. High Pressure

- 11.2.4. Ultra-High Pressure

- 12. Global Flow Meters and Controllers Market Analysis, by Installation Type

- 12.1. Key Segment Analysis

- 12.2. Flow Meters and Controllers Market Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Installation Type, 2021-2035

- 12.2.1. Inline Flow Meters

- 12.2.2. Insertion Flow Meters

- 12.2.3. Clamp-On Flow Meters

- 12.2.4. In-Line Insertion Flow Meters

- 13. Global Flow Meters and Controllers Market Analysis, by End-Use Industry

- 13.1. Key Segment Analysis

- 13.2. Flow Meters and Controllers Market Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by End-Use Industry, 2021-2035

- 13.2.1. Oil & Gas

- 13.2.2. Chemical & Petrochemical

- 13.2.3. Power Generation

- 13.2.4. Pharmaceutical & Biotechnology

- 13.2.5. Aerospace & Defense

- 13.2.6. Semiconductor Manufacturing

- 13.2.7. Automotive Manufacturing

- 13.2.8. Metal & Mining

- 13.2.9. HVAC & Building Automation

- 13.2.10. Water & Wastewater Treatment

- 13.2.11. Environmental Monitoring

- 13.2.12. Marine & Shipping

- 13.2.13. Energy & Utilities

- 13.2.14. Others

- 14. Global Flow Meters and Controllers Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Flow Meters and Controllers Market Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Flow Meters and Controllers Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Flow Meters and Controllers Market Size Volume (Million units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Technology

- 15.3.3. Measurement Type

- 15.3.4. Fluid Type

- 15.3.5. Pipe Size (Diameter)

- 15.3.6. Operating Pressure

- 15.3.7. Installation Type

- 15.3.8. End-Use Industry

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Flow Meters and Controllers Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Technology

- 15.4.4. Measurement Type

- 15.4.5. Fluid Type

- 15.4.6. Pipe Size (Diameter)

- 15.4.7. Operating Pressure

- 15.4.8. Installation Type

- 15.4.9. End-Use Industry

- 15.5. Canada Flow Meters and Controllers Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Technology

- 15.5.4. Measurement Type

- 15.5.5. Fluid Type

- 15.5.6. Pipe Size (Diameter)

- 15.5.7. Operating Pressure

- 15.5.8. Installation Type

- 15.5.9. End-Use Industry

- 15.6. Mexico Flow Meters and Controllers Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Technology

- 15.6.4. Measurement Type

- 15.6.5. Fluid Type

- 15.6.6. Pipe Size (Diameter)

- 15.6.7. Operating Pressure

- 15.6.8. Installation Type

- 15.6.9. End-Use Industry

- 16. Europe Flow Meters and Controllers Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Flow Meters and Controllers Market Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Technology

- 16.3.3. Measurement Type

- 16.3.4. Fluid Type

- 16.3.5. Pipe Size (Diameter)

- 16.3.6. Operating Pressure

- 16.3.7. Installation Type

- 16.3.8. End-Use Industry

- 16.3.9. Country

- 16.3.9.1. Germany

- 16.3.9.2. United Kingdom

- 16.3.9.3. France

- 16.3.9.4. Italy

- 16.3.9.5. Spain

- 16.3.9.6. Netherlands

- 16.3.9.7. Nordic Countries

- 16.3.9.8. Poland

- 16.3.9.9. Russia & CIS

- 16.3.9.10. Rest of Europe

- 16.4. Germany Flow Meters and Controllers Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Technology

- 16.4.4. Measurement Type

- 16.4.5. Fluid Type

- 16.4.6. Pipe Size (Diameter)

- 16.4.7. Operating Pressure

- 16.4.8. Installation Type

- 16.4.9. End-Use Industry

- 16.5. United Kingdom Flow Meters and Controllers Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Technology

- 16.5.4. Measurement Type

- 16.5.5. Fluid Type

- 16.5.6. Pipe Size (Diameter)

- 16.5.7. Operating Pressure

- 16.5.8. Installation Type

- 16.5.9. End-Use Industry

- 16.6. France Flow Meters and Controllers Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Technology

- 16.6.4. Measurement Type

- 16.6.5. Fluid Type

- 16.6.6. Pipe Size (Diameter)

- 16.6.7. Operating Pressure

- 16.6.8. Installation Type

- 16.6.9. End-Use Industry

- 16.7. Italy Flow Meters and Controllers Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Technology

- 16.7.4. Measurement Type

- 16.7.5. Fluid Type

- 16.7.6. Pipe Size (Diameter)

- 16.7.7. Operating Pressure

- 16.7.8. Installation Type

- 16.7.9. End-Use Industry

- 16.8. Spain Flow Meters and Controllers Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Technology

- 16.8.4. Measurement Type

- 16.8.5. Fluid Type

- 16.8.6. Pipe Size (Diameter)

- 16.8.7. Operating Pressure

- 16.8.8. Installation Type

- 16.8.9. End-Use Industry

- 16.9. Netherlands Flow Meters and Controllers Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Product Type

- 16.9.3. Technology

- 16.9.4. Measurement Type

- 16.9.5. Fluid Type

- 16.9.6. Pipe Size (Diameter)

- 16.9.7. Operating Pressure

- 16.9.8. Installation Type

- 16.9.9. End-Use Industry

- 16.10. Nordic Countries Flow Meters and Controllers Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Product Type

- 16.10.3. Technology

- 16.10.4. Measurement Type

- 16.10.5. Fluid Type

- 16.10.6. Pipe Size (Diameter)

- 16.10.7. Operating Pressure

- 16.10.8. Installation Type

- 16.10.9. End-Use Industry

- 16.11. Poland Flow Meters and Controllers Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Product Type

- 16.11.3. Technology

- 16.11.4. Measurement Type

- 16.11.5. Fluid Type

- 16.11.6. Pipe Size (Diameter)

- 16.11.7. Operating Pressure

- 16.11.8. Installation Type

- 16.11.9. End-Use Industry

- 16.12. Russia & CIS Flow Meters and Controllers Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Product Type

- 16.12.3. Technology

- 16.12.4. Measurement Type

- 16.12.5. Fluid Type

- 16.12.6. Pipe Size (Diameter)

- 16.12.7. Operating Pressure

- 16.12.8. Installation Type

- 16.12.9. End-Use Industry

- 16.13. Rest of Europe Flow Meters and Controllers Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Product Type

- 16.13.3. Technology

- 16.13.4. Measurement Type

- 16.13.5. Fluid Type

- 16.13.6. Pipe Size (Diameter)

- 16.13.7. Operating Pressure

- 16.13.8. Installation Type

- 16.13.9. End-Use Industry

- 17. Asia Pacific Flow Meters and Controllers Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Asia Pacific Flow Meters and Controllers Market Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Technology

- 17.3.3. Measurement Type

- 17.3.4. Fluid Type

- 17.3.5. Pipe Size (Diameter)

- 17.3.6. Operating Pressure

- 17.3.7. Installation Type

- 17.3.8. End-Use Industry

- 17.3.9. Country

- 17.3.9.1. China

- 17.3.9.2. India

- 17.3.9.3. Japan

- 17.3.9.4. South Korea

- 17.3.9.5. Australia and New Zealand

- 17.3.9.6. Indonesia

- 17.3.9.7. Malaysia

- 17.3.9.8. Thailand

- 17.3.9.9. Vietnam

- 17.3.9.10. Rest of Asia Pacific

- 17.4. China Flow Meters and Controllers Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Technology

- 17.4.4. Measurement Type

- 17.4.5. Fluid Type

- 17.4.6. Pipe Size (Diameter)

- 17.4.7. Operating Pressure

- 17.4.8. Installation Type

- 17.4.9. End-Use Industry

- 17.5. India Flow Meters and Controllers Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Technology

- 17.5.4. Measurement Type

- 17.5.5. Fluid Type

- 17.5.6. Pipe Size (Diameter)

- 17.5.7. Operating Pressure

- 17.5.8. Installation Type

- 17.5.9. End-Use Industry

- 17.6. Japan Flow Meters and Controllers Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Technology

- 17.6.4. Measurement Type

- 17.6.5. Fluid Type

- 17.6.6. Pipe Size (Diameter)

- 17.6.7. Operating Pressure

- 17.6.8. Installation Type

- 17.6.9. End-Use Industry

- 17.7. South Korea Flow Meters and Controllers Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Technology

- 17.7.4. Measurement Type

- 17.7.5. Fluid Type

- 17.7.6. Pipe Size (Diameter)

- 17.7.7. Operating Pressure

- 17.7.8. Installation Type

- 17.7.9. End-Use Industry

- 17.8. Australia and New Zealand Flow Meters and Controllers Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Technology

- 17.8.4. Measurement Type

- 17.8.5. Fluid Type

- 17.8.6. Pipe Size (Diameter)

- 17.8.7. Operating Pressure

- 17.8.8. Installation Type

- 17.8.9. End-Use Industry

- 17.9. Indonesia Flow Meters and Controllers Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Product Type

- 17.9.3. Technology

- 17.9.4. Measurement Type

- 17.9.5. Fluid Type

- 17.9.6. Pipe Size (Diameter)

- 17.9.7. Operating Pressure

- 17.9.8. Installation Type

- 17.9.9. End-Use Industry

- 17.10. Malaysia Flow Meters and Controllers Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Product Type

- 17.10.3. Technology

- 17.10.4. Measurement Type

- 17.10.5. Fluid Type

- 17.10.6. Pipe Size (Diameter)

- 17.10.7. Operating Pressure

- 17.10.8. Installation Type

- 17.10.9. End-Use Industry

- 17.11. Thailand Flow Meters and Controllers Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Product Type

- 17.11.3. Technology

- 17.11.4. Measurement Type

- 17.11.5. Fluid Type

- 17.11.6. Pipe Size (Diameter)

- 17.11.7. Operating Pressure

- 17.11.8. Installation Type

- 17.11.9. End-Use Industry

- 17.12. Vietnam Flow Meters and Controllers Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Product Type

- 17.12.3. Technology

- 17.12.4. Measurement Type

- 17.12.5. Fluid Type

- 17.12.6. Pipe Size (Diameter)

- 17.12.7. Operating Pressure

- 17.12.8. Installation Type

- 17.12.9. End-Use Industry

- 17.13. Rest of Asia Pacific Flow Meters and Controllers Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Product Type

- 17.13.3. Technology

- 17.13.4. Measurement Type

- 17.13.5. Fluid Type

- 17.13.6. Pipe Size (Diameter)

- 17.13.7. Operating Pressure

- 17.13.8. Installation Type

- 17.13.9. End-Use Industry

- 18. Middle East Flow Meters and Controllers Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Flow Meters and Controllers Market Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Technology

- 18.3.3. Measurement Type

- 18.3.4. Fluid Type

- 18.3.5. Pipe Size (Diameter)

- 18.3.6. Operating Pressure

- 18.3.7. Installation Type

- 18.3.8. End-Use Industry

- 18.3.9. Country

- 18.3.9.1. Turkey

- 18.3.9.2. UAE

- 18.3.9.3. Saudi Arabia

- 18.3.9.4. Israel

- 18.3.9.5. Rest of Middle East

- 18.4. Turkey Flow Meters and Controllers Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Technology

- 18.4.4. Measurement Type

- 18.4.5. Fluid Type

- 18.4.6. Pipe Size (Diameter)

- 18.4.7. Operating Pressure

- 18.4.8. Installation Type

- 18.4.9. End-Use Industry

- 18.5. UAE Flow Meters and Controllers Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Technology

- 18.5.4. Measurement Type

- 18.5.5. Fluid Type

- 18.5.6. Pipe Size (Diameter)

- 18.5.7. Operating Pressure

- 18.5.8. Installation Type

- 18.5.9. End-Use Industry

- 18.6. Saudi Arabia Flow Meters and Controllers Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Technology

- 18.6.4. Measurement Type

- 18.6.5. Fluid Type

- 18.6.6. Pipe Size (Diameter)

- 18.6.7. Operating Pressure

- 18.6.8. Installation Type

- 18.6.9. End-Use Industry

- 18.7. Israel Flow Meters and Controllers Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Technology

- 18.7.4. Measurement Type

- 18.7.5. Fluid Type

- 18.7.6. Pipe Size (Diameter)

- 18.7.7. Operating Pressure

- 18.7.8. Installation Type

- 18.7.9. End-Use Industry

- 18.8. Rest of Middle East Flow Meters and Controllers Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Technology

- 18.8.4. Measurement Type

- 18.8.5. Fluid Type

- 18.8.6. Pipe Size (Diameter)

- 18.8.7. Operating Pressure

- 18.8.8. Installation Type

- 18.8.9. End-Use Industry

- 19. Africa Flow Meters and Controllers Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Flow Meters and Controllers Market Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Technology

- 19.3.3. Measurement Type

- 19.3.4. Fluid Type

- 19.3.5. Pipe Size (Diameter)

- 19.3.6. Operating Pressure

- 19.3.7. Installation Type

- 19.3.8. End-Use Industry

- 19.3.9. Country

- 19.3.9.1. South Africa

- 19.3.9.2. Egypt

- 19.3.9.3. Nigeria

- 19.3.9.4. Algeria

- 19.3.9.5. Rest of Africa

- 19.4. South Africa Flow Meters and Controllers Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Technology

- 19.4.4. Measurement Type

- 19.4.5. Fluid Type

- 19.4.6. Pipe Size (Diameter)

- 19.4.7. Operating Pressure

- 19.4.8. Installation Type

- 19.4.9. End-Use Industry

- 19.5. Egypt Flow Meters and Controllers Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Technology

- 19.5.4. Measurement Type

- 19.5.5. Fluid Type

- 19.5.6. Pipe Size (Diameter)

- 19.5.7. Operating Pressure

- 19.5.8. Installation Type

- 19.5.9. End-Use Industry

- 19.6. Nigeria Flow Meters and Controllers Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Technology

- 19.6.4. Measurement Type

- 19.6.5. Fluid Type

- 19.6.6. Pipe Size (Diameter)

- 19.6.7. Operating Pressure

- 19.6.8. Installation Type

- 19.6.9. End-Use Industry

- 19.7. Algeria Flow Meters and Controllers Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Product Type

- 19.7.3. Technology

- 19.7.4. Measurement Type

- 19.7.5. Fluid Type

- 19.7.6. Pipe Size (Diameter)

- 19.7.7. Operating Pressure

- 19.7.8. Installation Type

- 19.7.9. End-Use Industry

- 19.8. Rest of Africa Flow Meters and Controllers Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Product Type

- 19.8.3. Technology

- 19.8.4. Measurement Type

- 19.8.5. Fluid Type

- 19.8.6. Pipe Size (Diameter)

- 19.8.7. Operating Pressure

- 19.8.8. Installation Type

- 19.8.9. End-Use Industry

- 20. South America Flow Meters and Controllers Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. South America Flow Meters and Controllers Market Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Product Type

- 20.3.2. Technology

- 20.3.3. Measurement Type

- 20.3.4. Fluid Type

- 20.3.5. Pipe Size (Diameter)

- 20.3.6. Operating Pressure

- 20.3.7. Installation Type

- 20.3.8. End-Use Industry

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Flow Meters and Controllers Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Product Type

- 20.4.3. Technology

- 20.4.4. Measurement Type

- 20.4.5. Fluid Type

- 20.4.6. Pipe Size (Diameter)

- 20.4.7. Operating Pressure

- 20.4.8. Installation Type

- 20.4.9. End-Use Industry

- 20.5. Argentina Flow Meters and Controllers Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Product Type

- 20.5.3. Technology

- 20.5.4. Measurement Type

- 20.5.5. Fluid Type

- 20.5.6. Pipe Size (Diameter)

- 20.5.7. Operating Pressure

- 20.5.8. Installation Type

- 20.5.9. End-Use Industry

- 20.6. Rest of South America Flow Meters and Controllers Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Product Type

- 20.6.3. Technology

- 20.6.4. Measurement Type

- 20.6.5. Fluid Type

- 20.6.6. Pipe Size (Diameter)

- 20.6.7. Operating Pressure

- 20.6.8. Installation Type

- 20.6.9. End-Use Industry

- 21. Key Players/ Company Profile

- 21.1. ABB Ltd.

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. Alicat Scientific Inc.

- 21.3. Azbil Corporation

- 21.4. Badger Meter Inc.

- 21.5. Bronkhorst High-Tech B.V.

- 21.6. Brooks Instrument

- 21.7. Emerson Electric Co.

- 21.8. Endress+Hauser Group

- 21.9. Honeywell International Inc.

- 21.10. KROHNE Messtechnik GmbH

- 21.11. Magnetrol International

- 21.12. McCrometer Inc.

- 21.13. OMEGA Engineering (Spectris plc)

- 21.14. Oval Corporation

- 21.15. Schneider Electric SE

- 21.16. SICK AG

- 21.17. Siemens AG

- 21.18. Sierra Instruments Inc.

- 21.19. Tokyo Keiso Co., Ltd.

- 21.20. Yokogawa Electric Corporation

- 21.21. Other Key Players

- 21.1. ABB Ltd.

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data