Human Machine Interface (HMI) Market Size, Share & Trends Analysis Report by Component Type (Hardware, Software, Services), Display Size, Display Type, Technology, Interface Type, Configuration Type, Rated Power, End-use Industry and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Human Machine Interface (HMI) Market Size, Share, and Growth

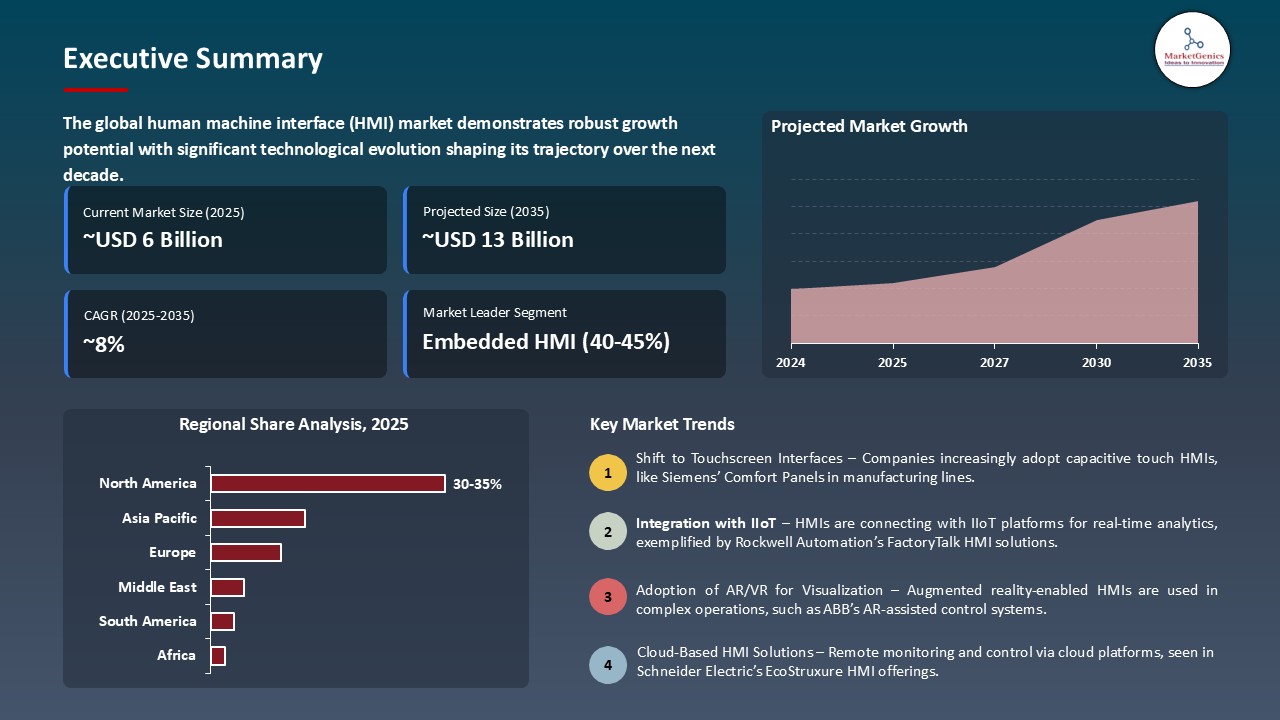

The global human machine interface (HMI) market is witnessing strong growth, valued at USD 6.1 billion in 2025 and projected to reach USD 12.9 billion by 2035, expanding at a CAGR of 7.8% during the forecast period. The Asia Pacific is the fastest-growing region in the HMI market due to rapid industrial automation, increasing smart factory adoption, and strong government support for digital transformation.

Alex Blum, Chief Operating Officer, Unity, said, “We are thrilled to partner with Toyota Motor Corporation and their team of world-renowned engineers to bring Unity’s real-time 3D capabilities to the forefront of next-generation HMI experiences, As consumer expectations continue to evolve, Unity and Toyota can deliver seamless, interactive, cutting-edge solutions for drivers”.

The growing use of augmented reality (AR) and virtual reality (VR) within human machine interfaces (HMIs) is fueling the growth of the market as it alters the way operators interact with the complex systems. AR/VR-based HMIs will enable visualizing training, maintenance, and troubleshooting processes in an immersive way so that operators could simulate real-life situations, detect problems more rapidly, and carry out tasks more efficiently.

Collaborations drive the human machine interface market more rapidly via complementary technology, broader ecosystem availability and accelerate the creation of advanced, high performance user interfaces to both next generation vehicles and industrial systems. As an example, in 2025, FORVIA has collaborated with Rightware to make FORVIA Smart Dimming and MyVue display-optimization software available in the Kanzi Studio HMI development ecosystem by Rightware. This partnership can help the automakers relying on Kanzi Studio to have access to FORVIA innovative technologies on display-enhancement and energy-saving, thus extending FORVIA to the market and assisting the development of more efficient and quality automotive HMIs.

One of the opportunities is in cloud-based and SaaS-based HMIs, which present real-time analytics, remote monitoring, and automatic software updates. The properties of subscription models are the generation of recurring income, lowered hardware reliance, and scalable deployment. The opportunity allows constant upgrades in features, improved efficiency of its systems and flexibility in both industrial, automotive and energy implementations.

Human Machine Interface (HMI) Market Dynamics and Trends

Driver: Hardware Advances Power Next-Generation HMI Performance and Safety

- The human machine interface (HMI) market is rapidly expanding due to the rapid development of hardware technologies. Newer touchscreens that are brighter, more ruggedized and multi-touch are facilitating more responsive and user-friendly operator experiences in industry, automotive and consumer-based applications. New digital cluster designs, including high-resolution displays, OLED screens, AR-HUD-capable screens, and curved screens (among others) are revolutionizing information visualisation, to enhance usability and safety.

- Centrally, next-generation HMI-oriented ICs and microprocessors are able to offer higher graphics rendering, reduced latency, improved security, and assistive AI-based interfaces. These dedicated hardware systems enable HMIs to process complex visualization, real-time analytics and secure communication, which increases the application and use cases, and speeds up adoption in the automotive, manufacturing, healthcare and energy industries.

- Nuvoton developed its 4th-gen Gerda display ICs in 2025, which are low-latency image processing, high visibility with electronic mirrors/AR-HUD, and in-built high-speed memory, which reduces system cost. The series enhances the performance, safety and efficiency of the automotive HMI systems of the next-generation with secure boot, OTA update support and ASIL-B safety support.

- Combined, these hardware improvements are enhancing the strength, safety and performance of current HMI systems and are solidly establishing hardware innovation as a major market growth force.

Restraint: Integration Challenges with Legacy Systems Hinder HMI Modernization

- One major limitation to the human machine interface (HMI) market is the complexity of integration due to legacy and heterogeneous industrial systems. A lot of the older PLCs, SCADA units, and proprietary fieldbus communication networks that most of the factories and process plants are still using were not originally intended to interoperate with the advanced and touchscreen-enabled HMIs that are now possible.

- Linking the modern HMI platforms to the old systems usually involves the use of protocol converters, middleware, or a lot of software customization, boosting the engineering time, project cost, and time to deployment. Also, in other instances, legacy equipment might not have any technical documentation or support, and compatibility tests are hard and unsafe. The industries in which production cycles are continuous like chemicals, power and food processing are even more problematic, since the downtime required in the system during integration is expensive and disruptive to the operations.

- These barriers prevent the adoption of next-generation HMIs, particularly by the small and medium enterprises that have a low budget. Consequently, the complexity of integration tends to be one of the pillars of HMI adoption and decelerates the overall digital transformation in industrial industries.

Opportunity: Growth of High-Performance, Software-Defined Automotive HMIs

- The trend of the fast transition to software-defined vehicles is leaving a significant opportunity with next-generation automotive HMI systems. Recent car models have made use of high-performance low-latency interfaces with ability to provide real time graphics, and synchronization of multiple displays as well as adaptive driving modes. With the replacement of traditional instrument clusters by digital cockpits, HMIs are taking the center stage to vehicle intelligence used to facilitate navigation, performance, and ADAS visualization, as well as, personalized infotainment.

- Auto manufacturers are demanding more customizable, upgradeable HMI systems that can be updated software-wise, meaning that they no longer rely on hardware and can continually add features. This transformation brings about high demand of advanced HMI software, scalable architectures, and high-speed visualization technologies in the auto industry.

- In 2025, DXC Technology has signed a contract with Ferrari to work on next-generation in-vehicle HMI and infotainment systems in the upcoming high-performance models. DXC designed advanced software-controlled HMI systems in the F80 supercar of Ferrari with a smooth multi-screen digital cockpit, high-performance visualization, performance data in real-time and adaptive road-to-track driving modes.

- Overall, this pattern is a strong indicator of software-defined, high-performance HMIs to act as a fundamental facilitator of the next phase of intelligent and immersive automotive interactions.

Key Trend: Rising Adoption of High-Brightness, Power-Efficient Next-Gen Displays for Automotive HMIs

- The increased adoption of more power efficient, high-brightness next-generation displays, including mini-LED, micro-LED, and high-end HDR displays, is becoming a key trend in the HMI market. Car manufacturers and industrial OEMs are now focusing heavily on display technologies that can provide better visibility, expanded color wheel, shorter response times and increased life cycles in harsh environmental conditions.

- The advanced screens enhance immersive cockpits in digital, smooth multi-screen designs, and enhanced real-time visualization of ADAS and navigation. With the increase in user-experience demands, next-gen displays are taking center stage in the creation of premium HMI, making it possible to enhance vehicle or equipment interface safety, energy-saving, and differentiation.

- In January 2025 Himax Technologies and AUO declared a strategic partnership to launch an integrated AmLED vehicle display stage at CES 2025 integrating display HMI innovations and technologies of AUO with complete automotive IC solutions of Himax. The new platform brings new in-car display technologies that are high in clarity, energy efficient and smart, aiming to transition the next generation smart cockpit experiences, and further consolidate the industry trend towards more engaging, sustainable, and richer HMI systems.

- All these developments collectively entrench the next-generation display technologies as a significant driver of innovation, differentiation and value creation throughout the worldwide Human Machine Interface (HMI) market.

Human-Machine-Interface-Market Analysis and Segmental Data

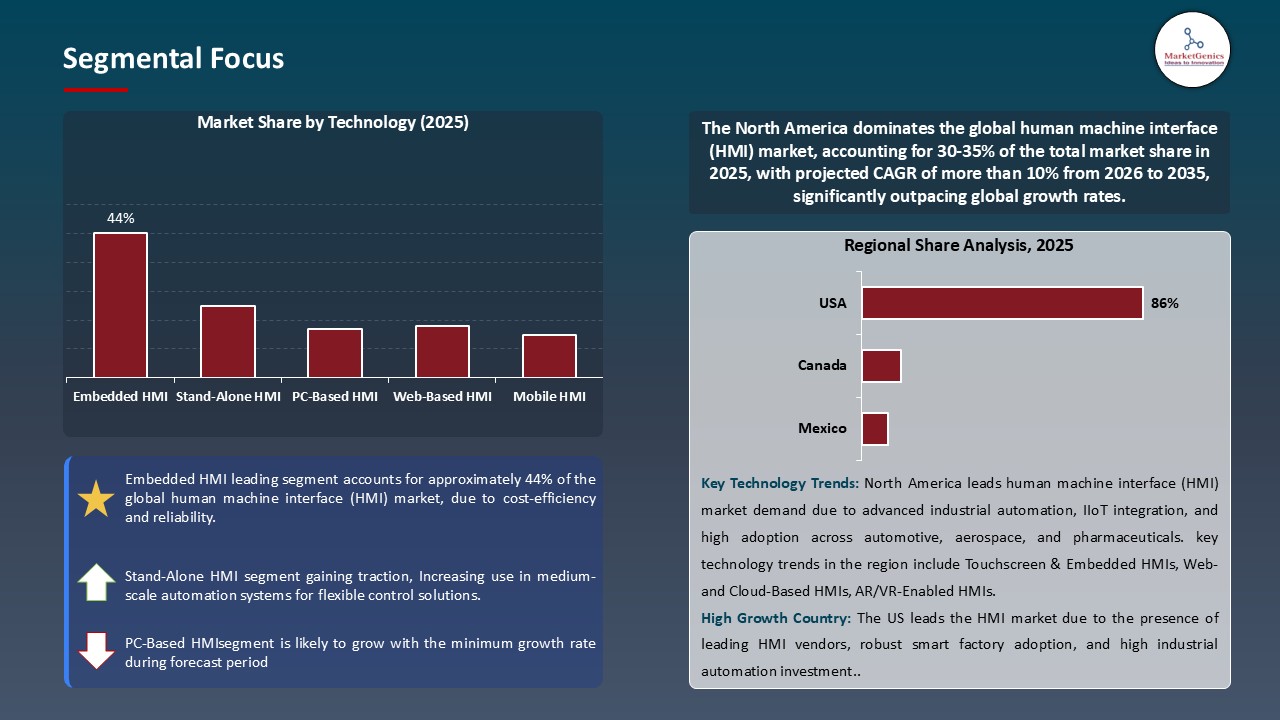

Embedded HMI Dominate Global Human Machine Interface (HMI) Market

- Embedded HMIs are still leading the global human machine interface (HMI) market due to their reliability, real time performance and deep integration with industrial systems as well as automotive systems. These are solutions that run directly on specific hardware, have deterministic response times, are robustly operation and best of all compatible with PLCs, sensors and control devices.

- Industries like manufacturing, automotive, energy, and process automation are more inclined to use embedded HMIs because they can be used in extreme conditions, provide safe local control and reduce the downtime of the system. As edge computing, advanced visualization, and ruggedized touch panels gain more acceptance, embedded HMIs are becoming able to provide more graphic capability, multi-protocol connections, and improved cybersecurity.

- In 2025, SECO with Raspberry Pi launched the SECO Pi Vision 10.1 CM5 at Embedded World 2025 - a high-performance embedded HMI platform based on the Raspberry Pi Compute Module 5. The system combines a 10.1-inch industrial-grade touchscreen with integrated computing, Clea OS, and edge-IoT connectivity and thus allows real-time machine control, visualization of data, and monitoring of smart devices.

- Embedded HMIs play a crucial role in industrial and automotive control systems, promoting stability and innovation in the worldwide human machine interface (HMI) market.

North America Leads Global Human Machine Interface (HMI) Market Demand

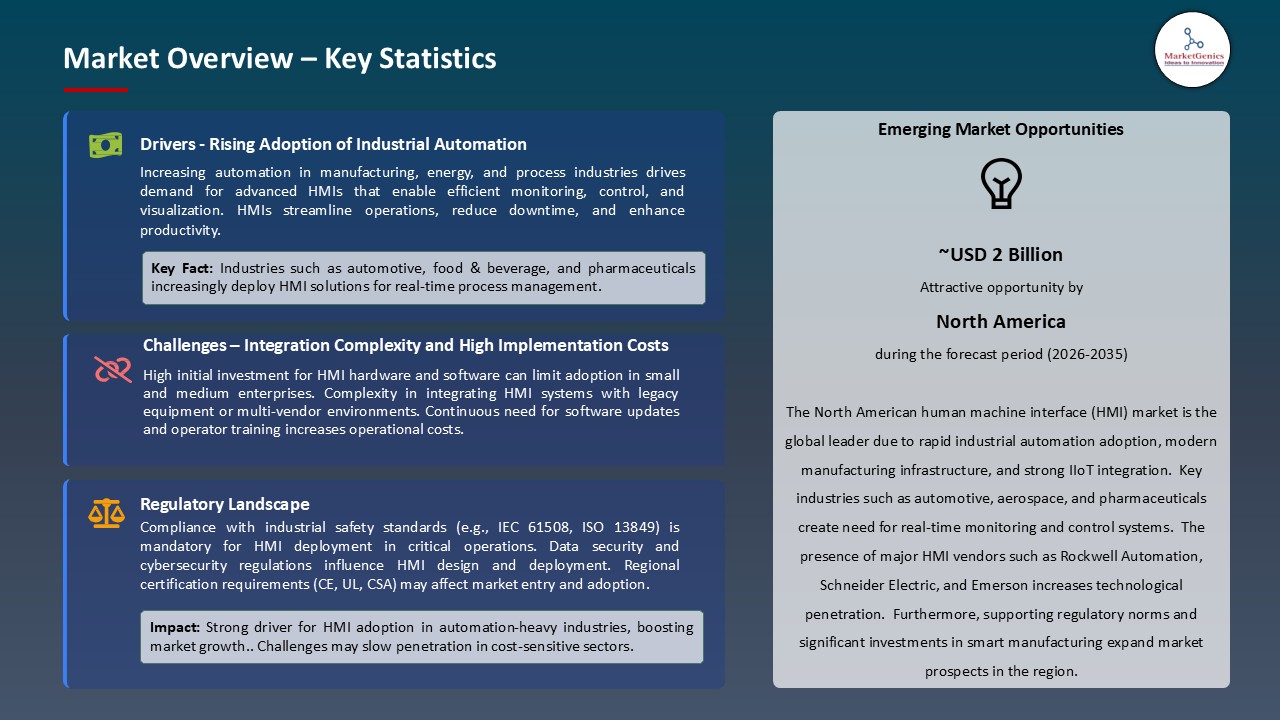

- North America is the largest worldwide Human Machine Interface (HMI) market tradition with a robust industrial automation presence, enough early adopters of advanced digital technologies, and the presence of large automotive, manufacturing, and energy OEMs. The fast transition to Industry 4.0, smart factories, and software-defined vehicles in the region keeps increasing the need in high-performance HMIs and real-time visualization, better safety, and AI-enabled interface.

- Extensive deployment of cloud systems, edge computing and cyber-secure operation systems also reinforce the necessity of next-generation HMI hardware and software. Also, the availability of technology leaders, active R&D, and constant implementation of new innovative UI/UX solutions make North America the leader of the global HMI market and the most innovative area.

- In August 2025, U.S. based AIS Global was renamed as 1HMX and aggregated its entire portfolio of HMI in aerospace, medical, industrial, and robotics. The company is Idaho-based and specializes in the next-generation, immersive, and intuitive human-machine interface technologies, solidifying the leadership of North America in the area of innovation and the advanced use of HMI in the world.

- North America's technological leadership, prompt implementation of advanced systems, and strong industrial ecosystem continue to position it as a global leader in the human machine interface (HMI) market.

Human-Machine-Interface-Market Ecosystem

The global human machine interface (HMI) market is fairly concentrated, with a few significant players, including Siemens AG, Rockwell Automation Inc., Schneider Electric SE, ABB Ltd., and Honeywell International Inc., accounting for approximately 36% of the market. To sustain their leadership, these firms are exploiting their strong customer relationships, platform stability, and high-level of integration, both in the industrial and automation environment.

The HMI value chain extends to the creation of software, production of touchscreens and displays, embedded HMI controllers, engineering communication protocols, system integration, commissioning, and maintenance, and, most recently, cybersecurity risk management. Major vendors normal develop central HMI solutions as they work with hardware vendors and system integration partners to provide complete solutions.

This fully established ecosystem poses very high obstacles to entry due to customer reliance on proven systems. Large vendors still seek dominance, but in the niche segments, specialized regional providers and software developers are innovating with advanced or industry-specific HMI solutions.

Recent Development and Strategic Overview:

- In September 2024, Advantech expanded its smart manufacturing capabilities by developing its integrated edge-to-cloud machine visualization infrastructure, integrating the HMINavi software platform with its rugged WOP-200 operator panels. The solution allows a seamless data transfer between PLCs and cloud environments by supporting 500+ industrial communications, MQTT communications, and OPC UA interoperability.

- In February 2025, Toyota Motor Corporation chose Unity’s real-time 3D platform to develop the GUI for its next-generation in-car HMI. By integrating Unity’s advanced 3D visualization tools into its digital cockpit development pipeline, Toyota significantly improved design efficiency, reduced rework, and enabled high-performance, interactive HMI experiences.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 6.1 Bn |

|

Market Forecast Value in 2035 |

USD 12.9 Bn |

|

Growth Rate (CAGR) |

7.8% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Human-Machine-Interface-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Human Machine Interface (HMI) Market, By Component Type |

|

|

Human Machine Interface (HMI) Market, By Display Size |

|

|

Human Machine Interface (HMI) Market, By Display Type |

|

|

Human Machine Interface (HMI) Market, By Technology |

|

|

Human Machine Interface (HMI) Market, By Interface Type |

|

|

Human Machine Interface (HMI) Market, By Configuration Type |

|

|

Human Machine Interface (HMI) Market, By Rated Power |

|

|

Human Machine Interface (HMI) Market, By End-Use Industry |

|

Frequently Asked Questions

The global human machine interface (HMI) market was valued at USD 6.1 Bn in 2025.

The global human machine interface (HMI) market industry is expected to grow at a CAGR of 7.8% from 2026 to 2035.

The key factors driving demand for the HMI market include rising industrial automation, growing adoption of Industry 4.0, increased need for real-time monitoring, and advancements in intuitive interface technologies.

In terms of technology, the embedded HMI segment accounted for the major share in 2025.

North America is the most attractive region for human machine interface (HMI) market.

Prominent players operating in the global human machine interface (HMI) market are ABB Ltd., Advantech Co., Ltd., Beckhoff Automation, Beijer Electronics Group AB, Bosch Rexroth AG, Danfoss A/S, Eaton Corporation, Emerson Electric Co., Fuji Electric Co., Ltd., General Electric Company, Honeywell International Inc., IDEC Corporation, Kontron AG, Mitsubishi Electric Corporation, Omron Corporation, Panasonic Corporation, Rockwell Automation Inc., Schneider Electric SE, Siemens AG, Yokogawa Electric Corporation, and Other Key Players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Human Machine Interface (HMI) Market Outlook

- 2.1.1. Human Machine Interface (HMI) Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Human Machine Interface (HMI) Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Automation & Process Control Industry Overview, 2025

- 3.1.1. Automation & Process Control Industry Ecosystem Analysis

- 3.1.2. Key Trends for Automation & Process Control Industry

- 3.1.3. Regional Distribution for Automation & Process Control Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Automation & Process Control Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Growing adoption of industrial automation.

- 4.1.1.2. Rising demand for real-time monitoring and control.

- 4.1.1.3. Integration of IIoT and smart manufacturing technologies.

- 4.1.2. Restraints

- 4.1.2.1. High initial investment costs.

- 4.1.2.2. Complexity in system integration and maintenance.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

-

- 4.2.1.1. Regulatory Framework

- 4.2.2. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.2.3. Tariffs and Standards

- 4.2.4. Impact Analysis of Regulations on the Market

-

- 4.3. Value Chain Analysis

- 4.3.1. Raw Material & Component Suppliers

- 4.3.2. Manufacturers and Solution Providers

- 4.3.3. Distributors

- 4.3.4. End Users

- 4.4. Porter’s Five Forces Analysis

- 4.5. PESTEL Analysis

- 4.6. Global Human Machine Interface (HMI) Market Demand

- 4.6.1. Historical Market Size –Value (US$ Bn), 2020-2024

- 4.6.2. Current and Future Market Size –Value (US$ Bn), 2026–2035

- 4.6.2.1. Y-o-Y Growth Trends

- 4.6.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Human Machine Interface (HMI) Market Analysis, By Component Type

- 6.1. Key Segment Analysis

- 6.2. Human Machine Interface (HMI) Market Size (Value - US$ Bn), Analysis, and Forecasts, By Component Type, 2021-2035

- 6.2.1. Hardware

- 6.2.1.1. Display Units

- 6.2.1.2. Input Devices

- 6.2.1.3. Control Panels

- 6.2.1.4. Industrial PCs

- 6.2.1.5. Others

- 6.2.2. Software

- 6.2.2.1. SCADA Software

- 6.2.2.2. Supervisory Software

- 6.2.2.3. Configuration Software

- 6.2.2.4. Others

- 6.2.3. Services

- 6.2.3.1. Installation & Integration

- 6.2.3.2. Maintenance & Support

- 6.2.3.3. Consulting Services

- 6.2.3.4. Others

- 6.2.1. Hardware

- 7. Global Human Machine Interface (HMI) Market Analysis, By Display Size

- 7.1. Key Segment Analysis

- 7.2. Human Machine Interface (HMI) Market Size (Value - US$ Bn), Analysis, and Forecasts, By Display Size, 2021-2035

- 7.2.1. Small Size (< 7 inches)

- 7.2.2. Medium Size (7-12 inches)

- 7.2.3. Large Size (12-17 inches)

- 7.2.4. Extra Large Size (> 17 inches)

- 8. Global Human Machine Interface (HMI) Market Analysis,By Display Type

- 8.1. Key Segment Analysis

- 8.2. Human Machine Interface (HMI) Market Size (Value - US$ Bn), Analysis, and Forecasts, By Display Type, 2021-2035

- 8.2.1. LED Display

- 8.2.2. LCD Display

- 8.2.3. OLED Display

- 8.2.4. TFT Display

- 8.2.5. Others

- 9. Global Human Machine Interface (HMI) Market Analysis, By Technology

- 9.1. Key Segment Analysis

- 9.2. Human Machine Interface (HMI) Market Size (Value - US$ Bn), Analysis, and Forecasts, By Technology, 2021-2035

- 9.2.1. Embedded HMI

- 9.2.2. Stand-Alone HMI

- 9.2.3. PC-Based HMI

- 9.2.4. Web-Based HMI

- 9.2.5. Mobile HMI

- 10. Global Human Machine Interface (HMI) Market Analysis, By Interface Type

- 10.1. Key Segment Analysis

- 10.2. Human Machine Interface (HMI) Market Size (Value - US$ Bn), Analysis, and Forecasts, By Interface Type, 2021-2035

- 10.2.1. Touch Panel

- 10.2.2. Pushbutton Replacers

- 10.2.3. Operator Interface Terminals

- 10.2.4. Industrial Monitors

- 10.2.5. Industrial PCs with HMI Software

- 10.2.6. Others

- 11. Global Human Machine Interface (HMI) Market Analysis, By Configuration Type

- 11.1. Key Segment Analysis

- 11.2. Human Machine Interface (HMI) Market Size (Value - US$ Bn), Analysis, and Forecasts, By Configuration Type, 2021-2035

- 11.2.1. Fixed HMI

- 11.2.2. Portable HMI

- 11.2.3. Panel Mount HMI

- 11.2.4. Rack Mount HMI

- 12. Global Human Machine Interface (HMI) Market Analysis, By Rated Power

- 12.1. Key Segment Analysis

- 12.2. Human Machine Interface (HMI) Market Size (Value - US$ Bn), Analysis, and Forecasts, By Rated Power, 2021-2035

- 12.2.1. Up to 50W

- 12.2.2. 50W - 150W

- 12.2.3. 150W - 300W

- 12.2.4. Above 300W

- 13. Global Human Machine Interface (HMI) Market Analysis, By End-Use Industry

- 13.1. Key Segment Analysis

- 13.2. Human Machine Interface (HMI) Market Size (Value - US$ Bn), Analysis, and Forecasts, By End-Use Industry, 2021-2035

- 13.2.1. Automotive

- 13.2.1.1. Assembly Line Control

- 13.2.1.2. Quality Inspection

- 13.2.1.3. Robotics Control

- 13.2.1.4. Paint Shop Operations

- 13.2.1.5. Vehicle Testing

- 13.2.1.6. Others

- 13.2.2. Oil & Gas

- 13.2.2.1. Pipeline Monitoring

- 13.2.2.2. Refinery Operations

- 13.2.2.3. Drilling Operations

- 13.2.2.4. Storage Tank Management

- 13.2.2.5. Safety & Emergency Systems

- 13.2.2.6. Others

- 13.2.3. Food & Beverage

- 13.2.3.1. Processing Control

- 13.2.3.2. Packaging Operations

- 13.2.3.3. Quality Control

- 13.2.3.4. Temperature Monitoring

- 13.2.3.5. Batch Management

- 13.2.3.6. Others

- 13.2.4. Pharmaceutical

- 13.2.4.1. Drug Manufacturing

- 13.2.4.2. Cleanroom Monitoring

- 13.2.4.3. Compliance & Documentation

- 13.2.4.4. Batch Processing

- 13.2.4.5. Quality Assurance

- 13.2.4.6. Others

- 13.2.5. Chemical

- 13.2.5.1. Reactor Control

- 13.2.5.2. Mixing Operations

- 13.2.5.3. Safety Monitoring

- 13.2.5.4. Batch Processing

- 13.2.5.5. Material Handling

- 13.2.5.6. Others

- 13.2.6. Water & Wastewater Treatment

- 13.2.6.1. Treatment Process Control

- 13.2.6.2. Pump Control

- 13.2.6.3. Filtration Monitoring

- 13.2.6.4. Chemical Dosing

- 13.2.6.5. SCADA Operations

- 13.2.6.6. Others

- 13.2.7. Power Generation & Utilities

- 13.2.8. Pulp & Paper

- 13.2.9. Packaging

- 13.2.10. Transportation & Logistics

- 13.2.11. Building Automation

- 13.2.12. Marine & Offshore

- 13.2.13. Others

- 13.2.1. Automotive

- 14. Global Human Machine Interface (HMI) Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Human Machine Interface (HMI) Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Human Machine Interface (HMI) Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Human Machine Interface (HMI) Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Component Type

- 15.3.2. Display Size

- 15.3.3. Display Type

- 15.3.4. Technology

- 15.3.5. Interface Type

- 15.3.6. Configuration Type

- 15.3.7. Rated Power

- 15.3.8. End-Use Industry

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Human Machine Interface (HMI) Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Component Type

- 15.4.3. Display Size

- 15.4.4. Display Type

- 15.4.5. Technology

- 15.4.6. Interface Type

- 15.4.7. Configuration Type

- 15.4.8. Rated Power

- 15.4.9. End-Use Industry

- 15.5. Canada Human Machine Interface (HMI) Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Component Type

- 15.5.3. Display Size

- 15.5.4. Display Type

- 15.5.5. Technology

- 15.5.6. Interface Type

- 15.5.7. Configuration Type

- 15.5.8. Rated Power

- 15.5.9. End-Use Industry

- 15.6. Mexico Human Machine Interface (HMI) Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Component Type

- 15.6.3. Display Size

- 15.6.4. Display Type

- 15.6.5. Technology

- 15.6.6. Interface Type

- 15.6.7. Configuration Type

- 15.6.8. Rated Power

- 15.6.9. End-Use Industry

- 16. Europe Human Machine Interface (HMI) Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Human Machine Interface (HMI) Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Component

- 16.3.2. Component Type

- 16.3.3. Display Size

- 16.3.4. Display Type

- 16.3.5. Technology

- 16.3.6. Interface Type

- 16.3.7. Configuration Type

- 16.3.8. Rated Power

- 16.3.9. End-Use Industry

- 16.3.10. Country

- 16.3.10.1. Germany

- 16.3.10.2. United Kingdom

- 16.3.10.3. France

- 16.3.10.4. Italy

- 16.3.10.5. Spain

- 16.3.10.6. Netherlands

- 16.3.10.7. Nordic Countries

- 16.3.10.8. Poland

- 16.3.10.9. Russia & CIS

- 16.3.10.10. Rest of Europe

- 16.4. Germany Human Machine Interface (HMI) Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Component Type

- 16.4.3. Display Size

- 16.4.4. Display Type

- 16.4.5. Technology

- 16.4.6. Interface Type

- 16.4.7. Configuration Type

- 16.4.8. Rated Power

- 16.4.9. End-Use Industry

- 16.5. United Kingdom Human Machine Interface (HMI) Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Component Type

- 16.5.3. Display Size

- 16.5.4. Display Type

- 16.5.5. Technology

- 16.5.6. Interface Type

- 16.5.7. Configuration Type

- 16.5.8. Rated Power

- 16.5.9. End-Use Industry

- 16.6. France Human Machine Interface (HMI) Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Component Type

- 16.6.3. Display Size

- 16.6.4. Display Type

- 16.6.5. Technology

- 16.6.6. Interface Type

- 16.6.7. Configuration Type

- 16.6.8. Rated Power

- 16.6.9. End-Use Industry

- 16.7. Italy Human Machine Interface (HMI) Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Component Type

- 16.7.3. Display Size

- 16.7.4. Display Type

- 16.7.5. Technology

- 16.7.6. Interface Type

- 16.7.7. Configuration Type

- 16.7.8. Rated Power

- 16.7.9. End-Use Industry

- 16.8. Spain Human Machine Interface (HMI) Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Component Type

- 16.8.3. Display Size

- 16.8.4. Display Type

- 16.8.5. Technology

- 16.8.6. Interface Type

- 16.8.7. Configuration Type

- 16.8.8. Rated Power

- 16.8.9. End-Use Industry

- 16.9. Netherlands Human Machine Interface (HMI) Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Component Type

- 16.9.3. Display Size

- 16.9.4. Display Type

- 16.9.5. Technology

- 16.9.6. Interface Type

- 16.9.7. Configuration Type

- 16.9.8. Rated Power

- 16.9.9. End-Use Industry

- 16.10. Nordic Countries Human Machine Interface (HMI) Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Component Type

- 16.10.3. Display Size

- 16.10.4. Display Type

- 16.10.5. Technology

- 16.10.6. Interface Type

- 16.10.7. Configuration Type

- 16.10.8. Rated Power

- 16.10.9. End-Use Industry

- 16.11. Poland Human Machine Interface (HMI) Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Component Type

- 16.11.3. Display Size

- 16.11.4. Display Type

- 16.11.5. Technology

- 16.11.6. Interface Type

- 16.11.7. Configuration Type

- 16.11.8. Rated Power

- 16.11.9. End-Use Industry

- 16.12. Russia & CIS Human Machine Interface (HMI) Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Component Type

- 16.12.3. Display Size

- 16.12.4. Display Type

- 16.12.5. Technology

- 16.12.6. Interface Type

- 16.12.7. Configuration Type

- 16.12.8. Rated Power

- 16.12.9. End-Use Industry

- 16.13. Rest of Europe Human Machine Interface (HMI) Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Component Type

- 16.13.3. Display Size

- 16.13.4. Display Type

- 16.13.5. Technology

- 16.13.6. Interface Type

- 16.13.7. Configuration Type

- 16.13.8. Rated Power

- 16.13.9. End-Use Industry

- 17. Asia Pacific Human Machine Interface (HMI) Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Asia Pacific Human Machine Interface (HMI) Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Component Type

- 17.3.2. Display Size

- 17.3.3. Display Type

- 17.3.4. Technology

- 17.3.5. Interface Type

- 17.3.6. Configuration Type

- 17.3.7. Rated Power

- 17.3.8. End-Use Industry

- 17.3.9. Country

- 17.3.9.1. China

- 17.3.9.2. India

- 17.3.9.3. Japan

- 17.3.9.4. South Korea

- 17.3.9.5. Australia and New Zealand

- 17.3.9.6. Indonesia

- 17.3.9.7. Malaysia

- 17.3.9.8. Thailand

- 17.3.9.9. Vietnam

- 17.3.9.10. Rest of Asia Pacific

- 17.4. China Human Machine Interface (HMI) Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Component Type

- 17.4.3. Display Size

- 17.4.4. Display Type

- 17.4.5. Technology

- 17.4.6. Interface Type

- 17.4.7. Configuration Type

- 17.4.8. Rated Power

- 17.4.9. End-Use Industry

- 17.5. India Human Machine Interface (HMI) Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Component Type

- 17.5.3. Display Size

- 17.5.4. Display Type

- 17.5.5. Technology

- 17.5.6. Interface Type

- 17.5.7. Configuration Type

- 17.5.8. Rated Power

- 17.5.9. End-Use Industry

- 17.6. Japan Human Machine Interface (HMI) Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Component Type

- 17.6.3. Display Size

- 17.6.4. Display Type

- 17.6.5. Technology

- 17.6.6. Interface Type

- 17.6.7. Configuration Type

- 17.6.8. Rated Power

- 17.6.9. End-Use Industry

- 17.7. South Korea Human Machine Interface (HMI) Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Component Type

- 17.7.3. Display Size

- 17.7.4. Display Type

- 17.7.5. Technology

- 17.7.6. Interface Type

- 17.7.7. Configuration Type

- 17.7.8. Rated Power

- 17.7.9. End-Use Industry

- 17.8. Australia and New Zealand Human Machine Interface (HMI) Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Component Type

- 17.8.3. Display Size

- 17.8.4. Display Type

- 17.8.5. Technology

- 17.8.6. Interface Type

- 17.8.7. Configuration Type

- 17.8.8. Rated Power

- 17.8.9. End-Use Industry

- 17.9. Indonesia Human Machine Interface (HMI) Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Component Type

- 17.9.3. Display Size

- 17.9.4. Display Type

- 17.9.5. Technology

- 17.9.6. Interface Type

- 17.9.7. Configuration Type

- 17.9.8. Rated Power

- 17.9.9. End-Use Industry

- 17.10. Malaysia Human Machine Interface (HMI) Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Component Type

- 17.10.3. Display Size

- 17.10.4. Display Type

- 17.10.5. Technology

- 17.10.6. Interface Type

- 17.10.7. Configuration Type

- 17.10.8. Rated Power

- 17.10.9. End-Use Industry

- 17.11. Thailand Human Machine Interface (HMI) Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Component Type

- 17.11.3. Display Size

- 17.11.4. Display Type

- 17.11.5. Technology

- 17.11.6. Interface Type

- 17.11.7. Configuration Type

- 17.11.8. Rated Power

- 17.11.9. End-Use Industry

- 17.12. Vietnam Human Machine Interface (HMI) Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Component Type

- 17.12.3. Display Size

- 17.12.4. Display Type

- 17.12.5. Technology

- 17.12.6. Interface Type

- 17.12.7. Configuration Type

- 17.12.8. Rated Power

- 17.12.9. End-Use Industry

- 17.13. Rest of Asia Pacific Human Machine Interface (HMI) Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Component Type

- 17.13.3. Display Size

- 17.13.4. Display Type

- 17.13.5. Technology

- 17.13.6. Interface Type

- 17.13.7. Configuration Type

- 17.13.8. Rated Power

- 17.13.9. End-Use Industry

- 18. Middle East Human Machine Interface (HMI) Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Human Machine Interface (HMI) Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Component Type

- 18.3.2. Display Size

- 18.3.3. Display Type

- 18.3.4. Technology

- 18.3.5. Interface Type

- 18.3.6. Configuration Type

- 18.3.7. Rated Power

- 18.3.8. End-Use Industry

- 18.3.9. Country

- 18.3.9.1. Turkey

- 18.3.9.2. UAE

- 18.3.9.3. Saudi Arabia

- 18.3.9.4. Israel

- 18.3.9.5. Rest of Middle East

- 18.4. Turkey Human Machine Interface (HMI) Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Component Type

- 18.4.3. Display Size

- 18.4.4. Display Type

- 18.4.5. Technology

- 18.4.6. Interface Type

- 18.4.7. Configuration Type

- 18.4.8. Rated Power

- 18.4.9. End-Use Industry

- 18.5. UAE Human Machine Interface (HMI) Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Component Type

- 18.5.3. Display Size

- 18.5.4. Display Type

- 18.5.5. Technology

- 18.5.6. Interface Type

- 18.5.7. Configuration Type

- 18.5.8. Rated Power

- 18.5.9. End-Use Industry

- 18.6. Saudi Arabia Human Machine Interface (HMI) Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Component Type

- 18.6.3. Display Size

- 18.6.4. Display Type

- 18.6.5. Technology

- 18.6.6. Interface Type

- 18.6.7. Configuration Type

- 18.6.8. Rated Power

- 18.6.9. End-Use Industry

- 18.7. Israel Human Machine Interface (HMI) Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Component Type

- 18.7.3. Display Size

- 18.7.4. Display Type

- 18.7.5. Technology

- 18.7.6. Interface Type

- 18.7.7. Configuration Type

- 18.7.8. Rated Power

- 18.7.9. End-Use Industry

- 18.8. Rest of Middle East Human Machine Interface (HMI) Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Component Type

- 18.8.3. Display Size

- 18.8.4. Display Type

- 18.8.5. Technology

- 18.8.6. Interface Type

- 18.8.7. Configuration Type

- 18.8.8. Rated Power

- 18.8.9. End-Use Industry

- 19. Africa Human Machine Interface (HMI) Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Human Machine Interface (HMI) Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Component Type

- 19.3.2. Display Size

- 19.3.3. Display Type

- 19.3.4. Technology

- 19.3.5. Interface Type

- 19.3.6. Configuration Type

- 19.3.7. Rated Power

- 19.3.8. End-Use Industry

- 19.3.9. Country

- 19.3.9.1. South Africa

- 19.3.9.2. Egypt

- 19.3.9.3. Nigeria

- 19.3.9.4. Algeria

- 19.3.9.5. Rest of Africa

- 19.4. South Africa Human Machine Interface (HMI) Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Component Type

- 19.4.3. Display Size

- 19.4.4. Display Type

- 19.4.5. Technology

- 19.4.6. Interface Type

- 19.4.7. Configuration Type

- 19.4.8. Rated Power

- 19.4.9. End-Use Industry

- 19.5. Egypt Human Machine Interface (HMI) Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Component Type

- 19.5.3. Display Size

- 19.5.4. Display Type

- 19.5.5. Technology

- 19.5.6. Interface Type

- 19.5.7. Configuration Type

- 19.5.8. Rated Power

- 19.5.9. End-Use Industry

- 19.6. Nigeria Human Machine Interface (HMI) Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Component Type

- 19.6.3. Display Size

- 19.6.4. Display Type

- 19.6.5. Technology

- 19.6.6. Interface Type

- 19.6.7. Configuration Type

- 19.6.8. Rated Power

- 19.6.9. End-Use Industry

- 19.7. Algeria Human Machine Interface (HMI) Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Component Type

- 19.7.3. Display Size

- 19.7.4. Display Type

- 19.7.5. Technology

- 19.7.6. Interface Type

- 19.7.7. Configuration Type

- 19.7.8. Rated Power

- 19.7.9. End-Use Industry

- 19.8. Rest of Africa Human Machine Interface (HMI) Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Component Type

- 19.8.3. Display Size

- 19.8.4. Display Type

- 19.8.5. Technology

- 19.8.6. Interface Type

- 19.8.7. Configuration Type

- 19.8.8. Rated Power

- 19.8.9. End-Use Industry

- 20. South America Human Machine Interface (HMI) Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. South America Human Machine Interface (HMI) Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Component Type

- 20.3.2. Display Size

- 20.3.3. Display Type

- 20.3.4. Technology

- 20.3.5. Interface Type

- 20.3.6. Configuration Type

- 20.3.7. Rated Power

- 20.3.8. End-Use Industry

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Human Machine Interface (HMI) Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Component Type

- 20.4.3. Display Size

- 20.4.4. Display Type

- 20.4.5. Technology

- 20.4.6. Interface Type

- 20.4.7. Configuration Type

- 20.4.8. Rated Power

- 20.4.9. End-Use Industry

- 20.5. Argentina Human Machine Interface (HMI) Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Component Type

- 20.5.3. Display Size

- 20.5.4. Display Type

- 20.5.5. Technology

- 20.5.6. Interface Type

- 20.5.7. Configuration Type

- 20.5.8. Rated Power

- 20.5.9. End-Use Industry

- 20.6. Rest of South America Human Machine Interface (HMI) Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Component Type

- 20.6.3. Display Size

- 20.6.4. Display Type

- 20.6.5. Technology

- 20.6.6. Interface Type

- 20.6.7. Configuration Type

- 20.6.8. Rated Power

- 20.6.9. End-Use Industry

- 21. Key Players/ Company Profile

- 21.1. ABB Ltd.

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. Advantech Co., Ltd.

- 21.3. Beckhoff Automation

- 21.4. Beijer Electronics Group AB

- 21.5. Bosch Rexroth AG

- 21.6. Danfoss A/S

- 21.7. Eaton Corporation

- 21.8. Emerson Electric Co.

- 21.9. Fuji Electric Co., Ltd.

- 21.10. General Electric Company

- 21.11. Honeywell International Inc.

- 21.12. IDEC Corporation

- 21.13. Kontron AG

- 21.14. Mitsubishi Electric Corporation

- 21.15. Omron Corporation

- 21.16. Panasonic Corporation

- 21.17. Rockwell Automation Inc.

- 21.18. Schneider Electric SE

- 21.19. Siemens AG

- 21.20. Yokogawa Electric Corporation

- 21.21. Other Key Players

- 21.1. ABB Ltd.

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data