Industrial Internet of Things (IIoT) Market Size, Share & Trends Analysis Report by Component (Hardware, Software, Services), Connectivity Technology, Organization Size, Deployment Model, Technology, Application, End-users, Security Type and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Industrial Internet of Things (IIoT) Market Size, Share, and Growth

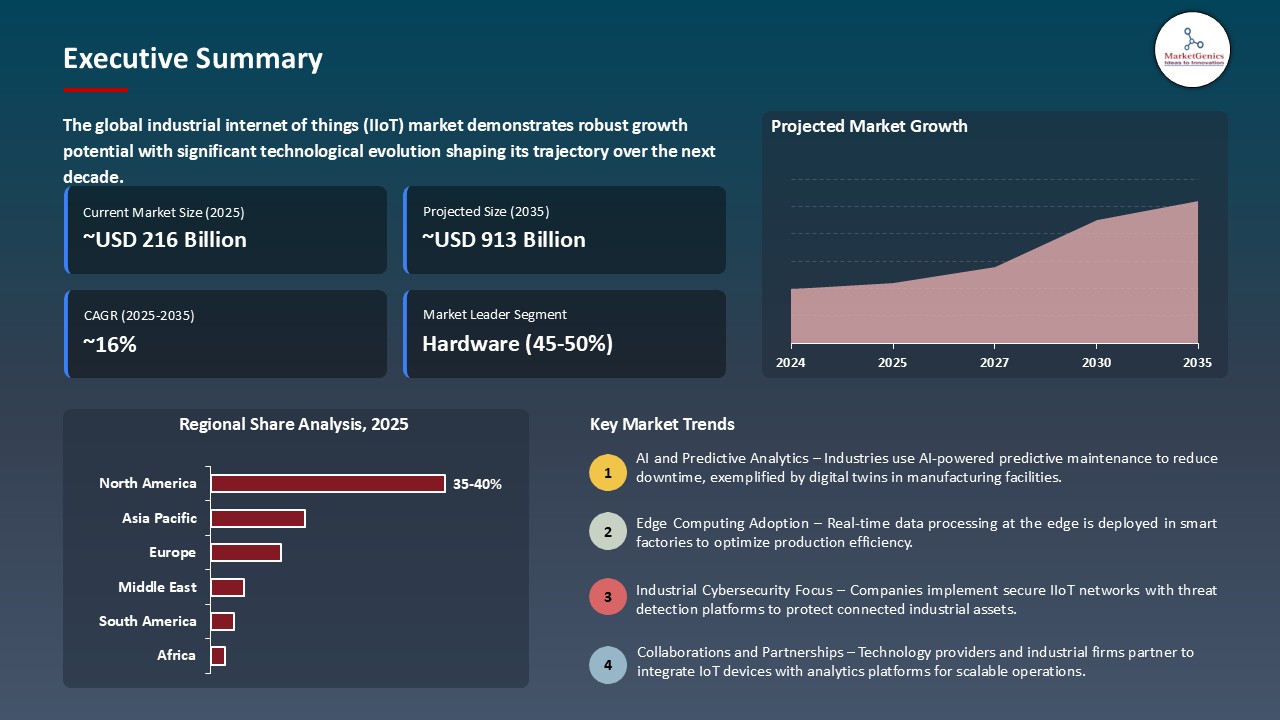

The global industrial internet of things (IIoT) market is witnessing strong growth, valued at USD 216.1 billion in 2025 and projected to reach ~USD 913 billion by 2035, expanding at a CAGR of 15.5% during the forecast period. The Asia Pacific region is the fastest-growing IIoT market due to rapid industrialization, government initiatives for smart manufacturing, and increasing adoption of connected industrial devices.

Dr. Ralf M. Wagner, senior vice president, Insights Hub, Siemens Digital Industries Software, said that “We are honored to be positioned as a Leader in the Magic Quadrant for Industrial IoT solutions. We believe being named a Leader in the Magic Quadrant reflects the trust our customers place in Siemens to accelerate their digital transformation, At Siemens, we empower companies to improve efficiency, achieve sustainability goals and create long-term business value”.

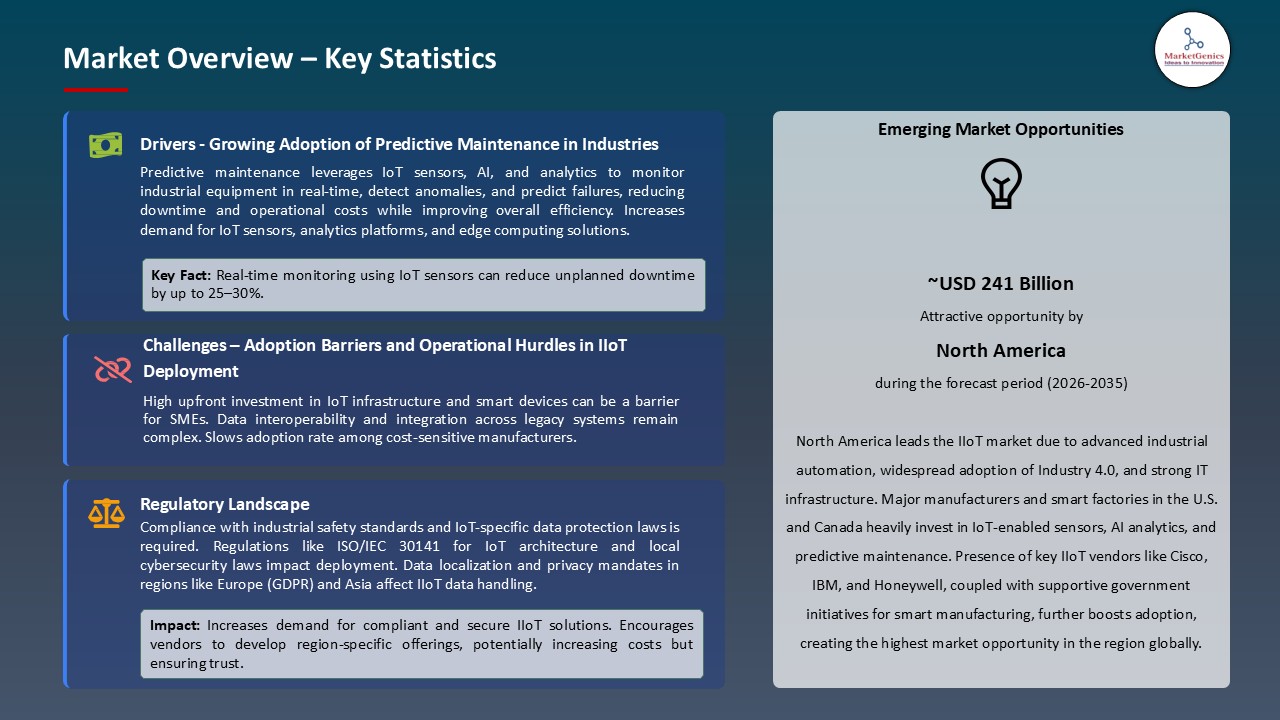

One of the reasons that contribute to the development of the industrial internet of things (IIoT) market is the increase in the demand of predictive maintenance solutions. Through linked sensors and real-time control, as well as AI-powered analytics, industries will be able to predict equipment malfunctions before they emerge. This minimizes unplanned downtime, reduces maintenance and operation expenses, increases the maintenance life of equipment and overall productivity, and predictive maintenance plays an essential role in accelerating the adoption of the IIoT in manufacturing, energy, and infrastructure industries.

The integration of technologies through the collaboration is a factor that helps IIoT markets grow by creating a wider range of solutions and faster adoption in industries. An example is the collaboration of Siemens and Microsoft in 2025 to connect its Building+ platform with Microsoft Azure IoT to provide an opportunity to have smart buildings and industry infrastructure that are interoperable with each other. The joint venture uses the standards of OPC UA and W3C to bridge IoT devices, streamline their work with cloud analytics, and achieve AI-based building management to reinforce the role of Siemens in the IIoT ecosystem.

One of the opportunities in the industrial internet of things (IIoT) market is the possibility to connect AI, digital twins, and predictive analytics to allow real-time monitoring, optimizing processes, and making decisions based on the collected data to optimize the operations of any industry. An example is at the Hannover Messe 2025, Rockwell has introduced Emulate3D Factory Test a digital twin based on AI that combines IoT-connected devices, simulation and emulation on a large scale to optimise factory operations before they are ultimately deployed.

Industrial Internet of Things (IIoT) Market Dynamics and Trends

Driver: Manufacturing Digital Transformation and Industry 4.0 Initiatives

- The industrial internet of things (IIoT) market is driven mainly by the global drive towards digital change in the manufacturing sector and the implementation of the Industry 4.0 technologies. To build smart factories that streamline production, decrease downtime, and improve efficiency, manufacturers are incorporating devices and sensors with IoT capabilities in machineries, which improve usability.

- Industry 4.0 efforts focus on real-time monitoring of data, predictive maintenance, and automation, and all these functions are based on the IIoT. This can support the process of better decision-making, cost-savings, and enhanced product quality by allowing a smooth exchange of information between equipment, supply chains and enterprise systems facilitating ubiquitous implementation in car manufacturing, electronic manufacturing, chemical manufacturing and other manufacturing industries around the globe.

- Siemens Digital Industries Software was shown as a Leader on the Gartner Magic Quadrant of Global Industrial IoT Platforms 2025 due to its Insights Hub platform. The platform integrates and controls industrial assets all over the world using IIoT-enabled devices and drives real-time insights using AI and analytics. It allows manufacturers to streamline the processes, save money, enable predictive maintenance, and meet sustainability goals and is an example of a real, large-scale implementation of Industry 4.0 and IIoT solutions.

- Digital transformation that is IIoT enabled is emerging as an important facilitator of efficiency, innovation and competitive advantage of contemporary manufacturing.

Restraint: Integration Complexity and Legacy System Compatibility

- The complexity of integration of the new IIoT solutions with the existing manufacturing systems tends to slow the growth of the IIoT market. A significant number of the facilities continue to use older equipment, old IT infrastructure, and traditional production processes that have never been configured to be connected or to exchange data in real-time.

- It needs significant technical skills and customization, as well as funding, to install IIoT equipment, sensors, and analytics solutions in these settings. The incompatibility of the protocols, standards, or software frameworks may make the process of ensuring smooth interoperability between old and new systems difficult, leading to disruption in operations, longer rollout periods and a higher cost.

- Smaller manufacturers, especially, can be weak in these integration problems because of the lack of resources and technical capacity that can help them maximize the benefits of IIoT and the overall potentials of adoption of the market.

- Moreover, the issue of data security and privacy in the process of integration further complicates things. The interoperability of legacy systems and the IIoT networks is frequently associated with the exposure of the sensitive data of operations and production processes to the clouds or third-party analytics systems. To assure strong cybersecurity, adherence to the industry regulations, and safeguard against the possible cyberattacks, it is important to invest more, employ specific skills, and continuously monitor.

Opportunity: Edge Computing and 5G Network Convergence

- The integration of edge computing and 5G networks is a major opportunity to the IIoT market since it offers ultra-low latency, high-speed, and real-time data processing at the manufacturing location. Edge computing enables IIoT devices and sensors to compute on-site and simplify the transmission of large amounts of data to centralized servers, and 5G provides the dependability of high-bandwidth communication over large numbers of connected devices.

- The interaction improves predictive maintenance, real time monitoring, and autonomous decision-making, which leads to an increase in operational efficiency and reduction of downtime. Manufacturers will be able to implement smarter and more responsive production systems and use advanced analytics at scale, which will further stimulate the implementation of IIoT solutions in many industries.

- Numaligarh Refinery Limited (NRL) collaborated with Bharat Sanchar Nigam Limited (BSNL) to install the first 5G Captive Non-Public Network (CNPN) in an industrial site in India in 2025. The network assists with IIoT applications, real-time monitoring of equipment, predictive maintenance, digital twins, AR/VR training, edge analytics, optimizing the efficiency, safety, and energy of operations and proves the implementation of 5G-enabled IIoT on a large scale with industry applications.

- The overlap of edge computing and 5G is enabling a case of real-world, large-scale IIoT implementation, which can support smarter, faster, and more efficient industrial processes.

Key Trend: Sustainability Analytics and Carbon Emission Monitoring

- Sustainability and environmental responsibility are rapidly emerging as one of the primary concerns of manufacturers around the world, resulting in the use of IIoT-enabled carbon emission monitoring and sustainability analytics. The real-time information on the energy use, greenhouse gases, water usage as well as waste generation of production processes can be gathered by IIoT devices, sensors, and connected systems.

- By combining this information with high-performance analytics and artificial intelligence, manufacturers will be able to detect the areas of inefficiency, monitor carbon footprints, and take necessary corrective actions to minimize environmental footprint. Such abilities not only contribute to the companies adhering to high global standards and ESG principles but also contribute to the cost-saving solutions by optimizing energy and utilizing resources efficiently.

- In 2025 interim report, Sensirion announced that they started to produce a new chip-based CO 2 sensor and environmental sensor combo modules under their subsidiary services of monitoring methane emission in oil and gas through sensor-based IoT solutions.

- IIoT sensors and related analytics are propelling real-time energy consumption and emission monitoring and reduction, which facilitates sustainable manufacturing practices.

Industrial-Internet-of-Things-Market Analysis and Segmental Data

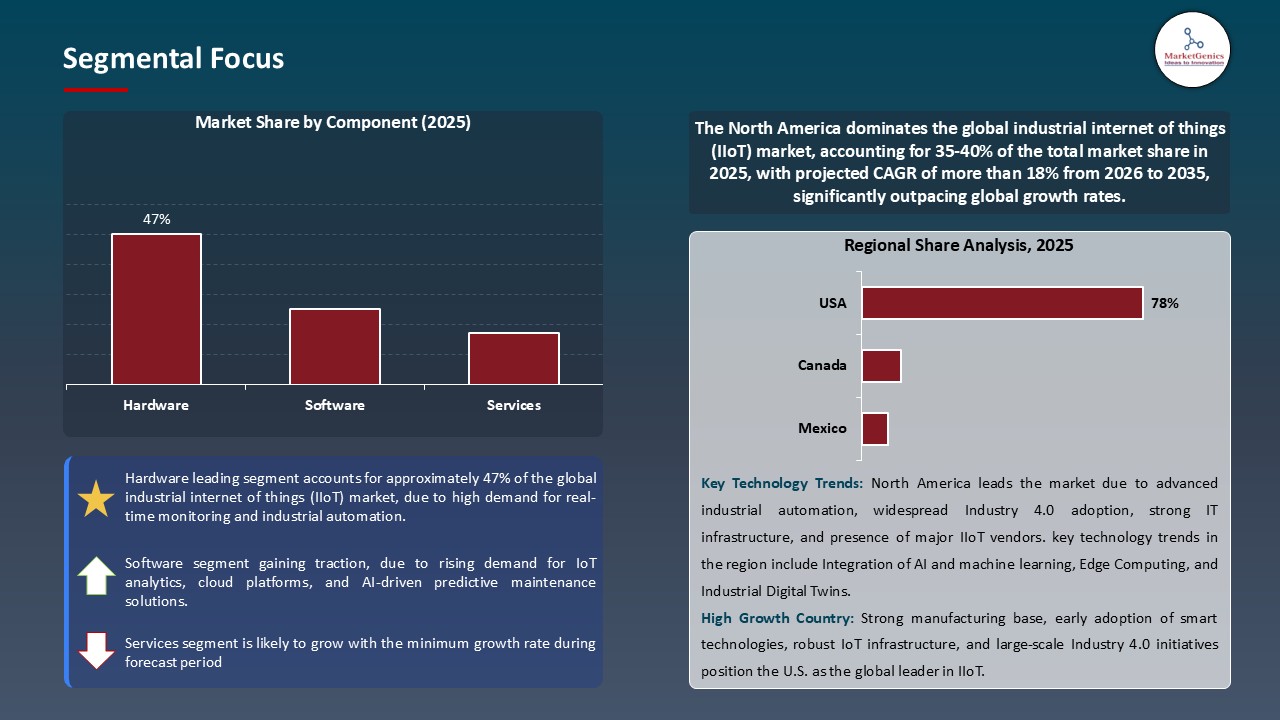

Hardware Segment Dominate Global Industrial Internet of Things (IIoT) Market

- The global industrial internet of things (IIoT) market is dominated by the hardware segment because it is very critical as the basis of connected industrial ecosystems. This component comprises sensors, actuators, gateways, edge devices, and networking devices that allow real-time data gathering, communication and processing in manufacturing and industrial processes.

- The increased application of smart factories, predictive maintenance systems, and automated production systems is largely dependent on strong hardware components that will guarantee an easy integration and high efficiency. The growing interest in Industry 4.0 projects, the development of IIoT infrastructure, and the growing requirements of businesses in accurate monitoring and control of industrial processes continue to boost the demand of IIoT hardware.

- In 2025, STMicroelectronics released the STM32WBA6 MCUs, energy-efficient microcontrollers, including wireless connectivity (Bluetooth LE, Zigbee, Thread, Matter), and extended memory, to enable smart and industrial devices to be connected to the IIoT, edge processing, and real-time monitoring, as the role of hardware is critical in boosting its adoption.

North America Leads Global Industrial Internet of Things (IIoT) Market Demand

- North America leads the world in the industrial internet of things market because of its industrial base, the prevalence of Industry 4.0 technologies, and the volume of investment in the digital transformation programs. The region has the advantage of good government support, good research and development and it has concentration of the major IIoT solution providers in the automotive, electronics, aerospace and energy industry.

- Manufacturers in North America are moving to use connected devices, sensors and automation systems more to improve operational efficiencies, predictive maintenance and real time data analytics. The increased attention to smart factories, energy savings, and regulatory compliance is another factor that leads to the use of IIoT solutions.

- Wiliot collaborated with Walmart to roll out ambient IoT sensors and AI throughout the retail supply chain in the United States that real-time inventory tracking, predictive analytics, and operational optimization, providing a demonstration of mass IIoT deployment bringing efficiency and digital transformation to North American manufacture and retail supply chains.

- North America has a developed infrastructure and Industry 4.0 implementation, which is fueling massive IIoT implementation to achieve operational and digital transformation.

Industrial-Internet-of-Things-Market Ecosystem

The global industrial internet of things market is concentrated, and Siemens AG, Cisco Systems, Inc., Honeywell International Inc., ABB Ltd., and GE Digital own nearly 32% of the market. These large participants have had a huge influence in the industry with their developed IIoT platform, smart factory systems, connected devices, and automation systems contributing to increased efficiency of operations, predictive maintenance, and real-time analytics in the automotive industry, electronics industry, the energy industry, and manufacturing industry. Their large R and D, large portfolios of intellectual property, and already established distribution networks in the globe pose barriers to new entrants.

The further development of IIoT solutions is also achieved through strategic partnerships with manufacturers, system integrators, and technology partners that will facilitate the seamless implementation of the solution, allow tailing to Industry 4.0 efforts, and enhance the market dominance of these major participants.

The buyer concentration in the IIoT market is moderate because giant manufactures, industrial organizations, and utility companies are major sources of revenues. There is a medium level of supplier concentration whereby the major players have large market share, but there is a growing threat posed by new IIoT solution developers and niche technology solution companies. High switching costs of integrating IIoT platforms, connected devices, and automation equipment and lengthy deployment cycles and adherence to the industrial standard favor the establishment of long-term relationships between the suppliers and manufacturers, which strengthens customer loyalty and continues market expansion.

Recent Development and Strategic Overview:

- In September 2025, Honeywell introduced the Honeywell 13MM Pressure Sensor in high-purity production processes, which provided high accuracy in real-time monitoring in semiconductor, solar, and biopharma production. Connected IIoT systems are supported by the sensor which feeds the critical information into automation platforms to streamline processes, enhance yield and reduce defects, which underscores the central role of hardware in the industrial use of the IoT.

- In April 2025, Cassia Networks collaborated with Augury to combine Cassia long-range Bluetooth gateways with the Augury machine-health monitoring platform based on artificial intelligence to support wireless connectivity of industrial equipment at scale. Such co-operation will provide better predictive maintenance and minimize downtime, as well as increase the implementation of IIoT solutions within manufacturing and industrial plants.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 216.1 Bn |

|

Market Forecast Value in 2035 |

USD 913 Bn |

|

Growth Rate (CAGR) |

15.5% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Industrial-Internet-of-Things-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Industrial Internet of Things (IIoT) Market, By Component |

|

|

Industrial Internet of Things (IIoT) Market, By Connectivity Technology |

|

|

Industrial Internet of Things (IIoT) Market, By Organization Size |

|

|

Industrial Internet of Things (IIoT) Market, By Deployment Model |

|

|

Industrial Internet of Things (IIoT) Market, By Technology |

|

|

Industrial Internet of Things (IIoT) Market, By Application |

|

|

Industrial Internet of Things (IIoT) Market, By End-users |

|

|

Industrial Internet of Things (IIoT) Market, By Security Type |

|

Frequently Asked Questions

The global industrial internet of things (IIoT) market was valued at USD 216.1 Bn in 2025.

The global industrial internet of things (IIoT) market industry is expected to grow at a CAGR of 15.5% from 2026 to 2035.

Increasing industrial automation, real-time data analytics, and connected operations are driving the demand for the IIoT market.

In terms of component, the hardware segment accounted for the major share in 2025.

North America is the most attractive region for industrial internet of things (IIoT) market.

Prominent players operating in the global industrial internet of things (IIoT) market are ABB Ltd., Advantech Co., Ltd., Arm Holdings, Bosch Rexroth AG, Cisco Systems, Inc., Cognex Corporation, Emerson Electric Co., General Electric (GE Digital), Hitachi, Ltd., Honeywell International Inc., IBM Corporation, Intel Corporation, Microsoft Corporation, Mitsubishi Electric Corporation, NXP Semiconductors N.V., PTC Inc., Rockwell Automation, Inc., Schneider Electric SE, Siemens AG, Telit Communications PLC, Zebra Technologies Corporation, and Other Key Players

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Industrial Internet of Things (IIoT) Market Outlook

- 2.1.1. Industrial Internet of Things (IIoT) Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Industrial Internet of Things (IIoT) Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Automation & Process Control Industry Overview, 2025

- 3.1.1. Automation & Process Control Industry Ecosystem Analysis

- 3.1.2. Key Trends for Automation & Process Control Industry

- 3.1.3. Regional Distribution for Automation & Process Control Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Automation & Process Control Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Demand for predictive maintenance and real-time analytics

- 4.1.1.2. Falling sensor and device costs with advanced sensors

- 4.1.1.3. Government-backed smart manufacturing and Industry 4.0 initiatives

- 4.1.2. Restraints

- 4.1.2.1. High implementation costs especially for SMEs

- 4.1.2.2. Cybersecurity and operational technology security vulnerabilities

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Ecosystem Analysis

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Industrial Internet of Things (IIoT) Market Demand

- 4.7.1. Historical Market Size –Value (US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size –Value (US$ Bn), 2026–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Industrial Internet of Things (IIoT) Market Analysis, By Component

- 6.1. Key Segment Analysis

- 6.2. Industrial Internet of Things (IIoT) Market Size (Value - US$ Bn), Analysis, and Forecasts, By Component, 2021-2035

- 6.2.1. Hardware

- 6.2.1.1. Sensors

- 6.2.1.1.1. Temperature Sensors

- 6.2.1.1.2. Pressure Sensors

- 6.2.1.1.3. Proximity Sensors

- 6.2.1.1.4. Motion Sensors

- 6.2.1.1.5. Level Sensors

- 6.2.1.1.6. Flow Sensors

- 6.2.1.1.7. Others

- 6.2.1.2. Industrial Controllers

- 6.2.1.2.1. Programmable Logic Controllers (PLCs)

- 6.2.1.2.2. Distributed Control Systems (DCS)

- 6.2.1.2.3. Supervisory Control and Data Acquisition (SCADA)

- 6.2.1.2.4. Manufacturing Execution Systems (MES)

- 6.2.1.2.5. Others

- 6.2.1.3. Industrial Gateways

- 6.2.1.4. Industrial Robots

- 6.2.1.5. RFID Tags and Readers

- 6.2.1.6. Machine Vision Systems

- 6.2.1.7. Actuators

- 6.2.1.8. Other

- 6.2.1.1. Sensors

- 6.2.2. Software

- 6.2.2.1. Device Management Software

- 6.2.2.2. Data Management Software

- 6.2.2.3. Analytics Software

- 6.2.2.4. Application Software

- 6.2.2.5. Platform Software

- 6.2.2.6. Security Software

- 6.2.2.7. Visualization Software

- 6.2.2.8. Other

- 6.2.3. Services

- 6.2.3.1. Professional Services

- 6.2.3.1.1. Consulting Services

- 6.2.3.1.2. Integration Services

- 6.2.3.1.3. Implementation Services

- 6.2.3.1.4. Support and Maintenance

- 6.2.3.2. Managed Services

- 6.2.3.1. Professional Services

- 6.2.1. Hardware

- 7. Global Industrial Internet of Things (IIoT) Market Analysis, By Connectivity Technology

- 7.1. Key Segment Analysis

- 7.2. Industrial Internet of Things (IIoT) Market Size (Value - US$ Bn), Analysis, and Forecasts, By Connectivity Technology, 2021-2035

- 7.2.1. Wired Connectivity

- 7.2.1.1. Ethernet

- 7.2.1.2. Fieldbus

- 7.2.1.3. Modbus

- 7.2.1.4. Profibus

- 7.2.1.5. Others

- 7.2.2. Wireless Connectivity

- 7.2.2.1. Wi-Fi

- 7.2.2.2. Bluetooth/BLE

- 7.2.2.3. Zigbee

- 7.2.2.4. LoRaWAN

- 7.2.2.5. Cellular (3G/4G/5G)

- 7.2.2.6. Satellite

- 7.2.2.7. NFC

- 7.2.2.8. Others

- 7.2.1. Wired Connectivity

- 8. Global Industrial Internet of Things (IIoT) Market Analysis,By Organization Size

- 8.1. Key Segment Analysis

- 8.2. Industrial Internet of Things (IIoT) Market Size (Value - US$ Bn), Analysis, and Forecasts, By Organization Size, 2021-2035

- 8.2.1. Large Enterprises

- 8.2.2. Small and Medium Enterprises (SMEs)

- 9. Global Industrial Internet of Things (IIoT) Market Analysis, By Deployment Model

- 9.1. Key Segment Analysis

- 9.2. Industrial Internet of Things (IIoT) Market Size (Value - US$ Bn), Analysis, and Forecasts, By Deployment Model, 2021-2035

- 9.2.1. On-Premises

- 9.2.2. Cloud-Based

- 9.2.3. Edge Computing

- 10. Global Industrial Internet of Things (IIoT) Market Analysis, By Technology

- 10.1. Key Segment Analysis

- 10.2. Industrial Internet of Things (IIoT) Market Size (Value - US$ Bn), Analysis, and Forecasts, By Technology, 2021-2035

- 10.2.1. Artificial Intelligence (AI) and Machine Learning (ML)

- 10.2.2. Big Data Analytics

- 10.2.3. Digital Twin

- 10.2.4. Blockchain

- 10.2.5. Augmented Reality (AR) and Virtual Reality (VR)

- 10.2.6. Robotics and Automation

- 10.2.7. Cybersecurity Solutions

- 10.2.8. Others

- 11. Global Industrial Internet of Things (IIoT) Market Analysis, By Application

- 11.1. Key Segment Analysis

- 11.2. Industrial Internet of Things (IIoT) Market Size (Value - US$ Bn), Analysis, and Forecasts, By Application, 2021-2035

- 11.2.1. Predictive Maintenance

- 11.2.2. Asset Management

- 11.2.3. Inventory Management

- 11.2.4. Quality Management

- 11.2.5. Production Optimization

- 11.2.6. Supply Chain Management

- 11.2.7. Energy Management

- 11.2.8. Remote Monitoring

- 11.2.9. Real-time Analytics

- 11.2.10. Industrial Automation

- 11.2.11. Others

- 12. Global Industrial Internet of Things (IIoT) Market Analysis, By End-users

- 12.1. Key Segment Analysis

- 12.2. Industrial Internet of Things (IIoT) Market Size (Value - US$ Bn), Analysis, and Forecasts, By End-users, 2021-2035

- 12.2.1. Manufacturing

- 12.2.2. Energy & Utilities

- 12.2.3. Oil & Gas

- 12.2.4. Transportation & Logistics

- 12.2.5. Food & Beverage

- 12.2.6. Pharmaceuticals & Healthcare

- 12.2.7. Chemical

- 12.2.8. Aerospace & Defense

- 12.2.9. Mining & Metals

- 12.2.10. Pulp & Paper

- 12.2.11. Water & Wastewater Management

- 12.2.12. Agriculture

- 12.2.13. Other End-users

- 13. Global Industrial Internet of Things (IIoT) Market Analysis, By Security Type

- 13.1. Key Segment Analysis

- 13.2. Industrial Internet of Things (IIoT) Market Size (Value - US$ Bn), Analysis, and Forecasts, By Security Type, 2021-2035

- 13.2.1. Network Security

- 13.2.2. Endpoint Security

- 13.2.3. Application Security

- 13.2.4. Cloud Security

- 13.2.5. Identity and Access Management

- 14. Global Industrial Internet of Things (IIoT) Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Industrial Internet of Things (IIoT) Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Industrial Internet of Things (IIoT) Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Industrial Internet of Things (IIoT) Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Component

- 15.3.2. Connectivity Technology

- 15.3.3. Organization Size

- 15.3.4. Deployment Model

- 15.3.5. Technology

- 15.3.6. Application

- 15.3.7. End-users

- 15.3.8. Security Type

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Industrial Internet of Things (IIoT) Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Component

- 15.4.3. Connectivity Technology

- 15.4.4. Organization Size

- 15.4.5. Deployment Model

- 15.4.6. Technology

- 15.4.7. Application

- 15.4.8. End-users

- 15.4.9. Security Type

- 15.5. Canada Industrial Internet of Things (IIoT) Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Component

- 15.5.3. Connectivity Technology

- 15.5.4. Organization Size

- 15.5.5. Deployment Model

- 15.5.6. Technology

- 15.5.7. Application

- 15.5.8. End-users

- 15.5.9. Security Type

- 15.6. Mexico Industrial Internet of Things (IIoT) Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Component

- 15.6.3. Connectivity Technology

- 15.6.4. Organization Size

- 15.6.5. Deployment Model

- 15.6.6. Technology

- 15.6.7. Application

- 15.6.8. End-users

- 15.6.9. Security Type

- 16. Europe Industrial Internet of Things (IIoT) Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Industrial Internet of Things (IIoT) Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Component

- 16.3.2. Connectivity Technology

- 16.3.3. Organization Size

- 16.3.4. Deployment Model

- 16.3.5. Technology

- 16.3.6. Application

- 16.3.7. End-users

- 16.3.8. Security Type

- 16.3.9. Country

- 16.3.9.1. Germany

- 16.3.9.2. United Kingdom

- 16.3.9.3. France

- 16.3.9.4. Italy

- 16.3.9.5. Spain

- 16.3.9.6. Netherlands

- 16.3.9.7. Nordic Countries

- 16.3.9.8. Poland

- 16.3.9.9. Russia & CIS

- 16.3.9.10. Rest of Europe

- 16.4. Germany Industrial Internet of Things (IIoT) Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Component

- 16.4.3. Connectivity Technology

- 16.4.4. Organization Size

- 16.4.5. Deployment Model

- 16.4.6. Technology

- 16.4.7. Application

- 16.4.8. End-users

- 16.4.9. Security Type

- 16.5. United Kingdom Industrial Internet of Things (IIoT) Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Component

- 16.5.3. Connectivity Technology

- 16.5.4. Organization Size

- 16.5.5. Deployment Model

- 16.5.6. Technology

- 16.5.7. Application

- 16.5.8. End-users

- 16.5.9. Security Type

- 16.6. France Industrial Internet of Things (IIoT) Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Component

- 16.6.3. Connectivity Technology

- 16.6.4. Organization Size

- 16.6.5. Deployment Model

- 16.6.6. Technology

- 16.6.7. Application

- 16.6.8. End-users

- 16.6.9. Security Type

- 16.7. Italy Industrial Internet of Things (IIoT) Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Component

- 16.7.3. Connectivity Technology

- 16.7.4. Organization Size

- 16.7.5. Deployment Model

- 16.7.6. Technology

- 16.7.7. Application

- 16.7.8. End-users

- 16.7.9. Security Type

- 16.8. Spain Industrial Internet of Things (IIoT) Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Component

- 16.8.3. Connectivity Technology

- 16.8.4. Organization Size

- 16.8.5. Deployment Model

- 16.8.6. Technology

- 16.8.7. Application

- 16.8.8. End-users

- 16.8.9. Security Type

- 16.9. Netherlands Industrial Internet of Things (IIoT) Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Component

- 16.9.3. Connectivity Technology

- 16.9.4. Organization Size

- 16.9.5. Deployment Model

- 16.9.6. Technology

- 16.9.7. Application

- 16.9.8. End-users

- 16.9.9. Security Type

- 16.10. Nordic Countries Industrial Internet of Things (IIoT) Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Component

- 16.10.3. Connectivity Technology

- 16.10.4. Organization Size

- 16.10.5. Deployment Model

- 16.10.6. Technology

- 16.10.7. Application

- 16.10.8. End-users

- 16.10.9. Security Type

- 16.11. Poland Industrial Internet of Things (IIoT) Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Component

- 16.11.3. Connectivity Technology

- 16.11.4. Organization Size

- 16.11.5. Deployment Model

- 16.11.6. Technology

- 16.11.7. Application

- 16.11.8. End-users

- 16.11.9. Security Type

- 16.12. Russia & CIS Industrial Internet of Things (IIoT) Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Component

- 16.12.3. Connectivity Technology

- 16.12.4. Organization Size

- 16.12.5. Deployment Model

- 16.12.6. Technology

- 16.12.7. Application

- 16.12.8. End-users

- 16.12.9. Security Type

- 16.13. Rest of Europe Industrial Internet of Things (IIoT) Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Component

- 16.13.3. Connectivity Technology

- 16.13.4. Organization Size

- 16.13.5. Deployment Model

- 16.13.6. Technology

- 16.13.7. Application

- 16.13.8. End-users

- 16.13.9. Security Type

- 17. Asia Pacific Industrial Internet of Things (IIoT) Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Asia Pacific Industrial Internet of Things (IIoT) Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Component

- 17.3.2. Connectivity Technology

- 17.3.3. Organization Size

- 17.3.4. Deployment Model

- 17.3.5. Technology

- 17.3.6. Application

- 17.3.7. End-users

- 17.3.8. Security Type

- 17.3.9. Country

- 17.3.9.1. China

- 17.3.9.2. India

- 17.3.9.3. Japan

- 17.3.9.4. South Korea

- 17.3.9.5. Australia and New Zealand

- 17.3.9.6. Indonesia

- 17.3.9.7. Malaysia

- 17.3.9.8. Thailand

- 17.3.9.9. Vietnam

- 17.3.9.10. Rest of Asia Pacific

- 17.4. China Industrial Internet of Things (IIoT) Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Component

- 17.4.3. Connectivity Technology

- 17.4.4. Organization Size

- 17.4.5. Deployment Model

- 17.4.6. Technology

- 17.4.7. Application

- 17.4.8. End-users

- 17.4.9. Security Type

- 17.5. India Industrial Internet of Things (IIoT) Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Component

- 17.5.3. Connectivity Technology

- 17.5.4. Organization Size

- 17.5.5. Deployment Model

- 17.5.6. Technology

- 17.5.7. Application

- 17.5.8. End-users

- 17.5.9. Security Type

- 17.6. Japan Industrial Internet of Things (IIoT) Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Component

- 17.6.3. Connectivity Technology

- 17.6.4. Organization Size

- 17.6.5. Deployment Model

- 17.6.6. Technology

- 17.6.7. Application

- 17.6.8. End-users

- 17.6.9. Security Type

- 17.7. South Korea Industrial Internet of Things (IIoT) Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Component

- 17.7.3. Connectivity Technology

- 17.7.4. Organization Size

- 17.7.5. Deployment Model

- 17.7.6. Technology

- 17.7.7. Application

- 17.7.8. End-users

- 17.7.9. Security Type

- 17.8. Australia and New Zealand Industrial Internet of Things (IIoT) Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Component

- 17.8.3. Connectivity Technology

- 17.8.4. Organization Size

- 17.8.5. Deployment Model

- 17.8.6. Technology

- 17.8.7. Application

- 17.8.8. End-users

- 17.8.9. Security Type

- 17.9. Indonesia Industrial Internet of Things (IIoT) Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Component

- 17.9.3. Connectivity Technology

- 17.9.4. Organization Size

- 17.9.5. Deployment Model

- 17.9.6. Technology

- 17.9.7. Application

- 17.9.8. End-users

- 17.9.9. Security Type

- 17.10. Malaysia Industrial Internet of Things (IIoT) Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Component

- 17.10.3. Connectivity Technology

- 17.10.4. Organization Size

- 17.10.5. Deployment Model

- 17.10.6. Technology

- 17.10.7. Application

- 17.10.8. End-users

- 17.10.9. Security Type

- 17.11. Thailand Industrial Internet of Things (IIoT) Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Component

- 17.11.3. Connectivity Technology

- 17.11.4. Organization Size

- 17.11.5. Deployment Model

- 17.11.6. Technology

- 17.11.7. Application

- 17.11.8. End-users

- 17.11.9. Security Type

- 17.12. Vietnam Industrial Internet of Things (IIoT) Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Component

- 17.12.3. Connectivity Technology

- 17.12.4. Organization Size

- 17.12.5. Deployment Model

- 17.12.6. Technology

- 17.12.7. Application

- 17.12.8. End-users

- 17.12.9. Security Type

- 17.13. Rest of Asia Pacific Industrial Internet of Things (IIoT) Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Component

- 17.13.3. Connectivity Technology

- 17.13.4. Organization Size

- 17.13.5. Deployment Model

- 17.13.6. Technology

- 17.13.7. Application

- 17.13.8. End-users

- 17.13.9. Security Type

- 18. Middle East Industrial Internet of Things (IIoT) Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Industrial Internet of Things (IIoT) Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Component

- 18.3.2. Connectivity Technology

- 18.3.3. Organization Size

- 18.3.4. Deployment Model

- 18.3.5. Technology

- 18.3.6. Application

- 18.3.7. End-users

- 18.3.8. Security Type

- 18.3.9. Country

- 18.3.9.1. Turkey

- 18.3.9.2. UAE

- 18.3.9.3. Saudi Arabia

- 18.3.9.4. Israel

- 18.3.9.5. Rest of Middle East

- 18.4. Turkey Industrial Internet of Things (IIoT) Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Component

- 18.4.3. Connectivity Technology

- 18.4.4. Organization Size

- 18.4.5. Deployment Model

- 18.4.6. Technology

- 18.4.7. Application

- 18.4.8. End-users

- 18.4.9. Security Type

- 18.5. UAE Industrial Internet of Things (IIoT) Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Component

- 18.5.3. Connectivity Technology

- 18.5.4. Organization Size

- 18.5.5. Deployment Model

- 18.5.6. Technology

- 18.5.7. Application

- 18.5.8. End-users

- 18.5.9. Security Type

- 18.6. Saudi Arabia Industrial Internet of Things (IIoT) Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Component

- 18.6.3. Connectivity Technology

- 18.6.4. Organization Size

- 18.6.5. Deployment Model

- 18.6.6. Technology

- 18.6.7. Application

- 18.6.8. End-users

- 18.6.9. Security Type

- 18.7. Israel Industrial Internet of Things (IIoT) Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Component

- 18.7.3. Connectivity Technology

- 18.7.4. Organization Size

- 18.7.5. Deployment Model

- 18.7.6. Technology

- 18.7.7. Application

- 18.7.8. End-users

- 18.7.9. Security Type

- 18.8. Rest of Middle East Industrial Internet of Things (IIoT) Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Component

- 18.8.3. Connectivity Technology

- 18.8.4. Organization Size

- 18.8.5. Deployment Model

- 18.8.6. Technology

- 18.8.7. Application

- 18.8.8. End-users

- 18.8.9. Security Type

- 19. Africa Industrial Internet of Things (IIoT) Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Industrial Internet of Things (IIoT) Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Component

- 19.3.2. Connectivity Technology

- 19.3.3. Organization Size

- 19.3.4. Deployment Model

- 19.3.5. Technology

- 19.3.6. Application

- 19.3.7. End-users

- 19.3.8. Security Type

- 19.3.9. Country

- 19.3.9.1. South Africa

- 19.3.9.2. Egypt

- 19.3.9.3. Nigeria

- 19.3.9.4. Algeria

- 19.3.9.5. Rest of Africa

- 19.4. South Africa Industrial Internet of Things (IIoT) Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Component

- 19.4.3. Connectivity Technology

- 19.4.4. Organization Size

- 19.4.5. Deployment Model

- 19.4.6. Technology

- 19.4.7. Application

- 19.4.8. End-users

- 19.4.9. Security Type

- 19.5. Egypt Industrial Internet of Things (IIoT) Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Component

- 19.5.3. Connectivity Technology

- 19.5.4. Organization Size

- 19.5.5. Deployment Model

- 19.5.6. Technology

- 19.5.7. Application

- 19.5.8. End-users

- 19.5.9. Security Type

- 19.6. Nigeria Industrial Internet of Things (IIoT) Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Component

- 19.6.3. Connectivity Technology

- 19.6.4. Organization Size

- 19.6.5. Deployment Model

- 19.6.6. Technology

- 19.6.7. Application

- 19.6.8. End-users

- 19.6.9. Security Type

- 19.7. Algeria Industrial Internet of Things (IIoT) Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Component

- 19.7.3. Connectivity Technology

- 19.7.4. Organization Size

- 19.7.5. Deployment Model

- 19.7.6. Technology

- 19.7.7. Application

- 19.7.8. End-users

- 19.7.9. Security Type

- 19.8. Rest of Africa Industrial Internet of Things (IIoT) Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Component

- 19.8.3. Connectivity Technology

- 19.8.4. Organization Size

- 19.8.5. Deployment Model

- 19.8.6. Technology

- 19.8.7. Application

- 19.8.8. End-users

- 19.8.9. Security Type

- 20. South America Industrial Internet of Things (IIoT) Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. South America Industrial Internet of Things (IIoT) Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Component

- 20.3.2. Connectivity Technology

- 20.3.3. Organization Size

- 20.3.4. Deployment Model

- 20.3.5. Technology

- 20.3.6. Application

- 20.3.7. End-users

- 20.3.8. Security Type

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Industrial Internet of Things (IIoT) Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Component

- 20.4.3. Connectivity Technology

- 20.4.4. Organization Size

- 20.4.5. Deployment Model

- 20.4.6. Technology

- 20.4.7. Application

- 20.4.8. End-users

- 20.4.9. Security Type

- 20.5. Argentina Industrial Internet of Things (IIoT) Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Component

- 20.5.3. Connectivity Technology

- 20.5.4. Organization Size

- 20.5.5. Deployment Model

- 20.5.6. Technology

- 20.5.7. Application

- 20.5.8. End-users

- 20.5.9. Security Type

- 20.6. Rest of South America Industrial Internet of Things (IIoT) Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Component

- 20.6.3. Connectivity Technology

- 20.6.4. Organization Size

- 20.6.5. Deployment Model

- 20.6.6. Technology

- 20.6.7. Application

- 20.6.8. End-users

- 20.6.9. Security Type

- 21. Key Players/ Company Profile

- 21.1. ABB Ltd.

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. Advantech Co., Ltd.

- 21.3. Arm Holdings

- 21.4. Bosch Rexroth AG

- 21.5. Cisco Systems, Inc.

- 21.6. Cognex Corporation

- 21.7. Emerson Electric Co.

- 21.8. General Electric (GE Digital)

- 21.9. Hitachi, Ltd.

- 21.10. Honeywell International Inc.

- 21.11. IBM Corporation

- 21.12. Intel Corporation

- 21.13. Microsoft Corporation

- 21.14. Mitsubishi Electric Corporation

- 21.15. NXP Semiconductors N.V.

- 21.16. PTC Inc.

- 21.17. Rockwell Automation, Inc.

- 21.18. Schneider Electric SE

- 21.19. Siemens AG

- 21.20. Telit Communications PLC

- 21.21. Zebra Technologies Corporation

- 21.22. Other Key Players

- 21.1. ABB Ltd.

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data