Smart Manufacturing Market Size, Share & Trends Analysis Report by Technology (Industrial IoT (IIoT), Artificial Intelligence (AI) and Machine Learning (ML), Cloud Computing, Big Data Analytics, Augmented Reality (AR) & Virtual Reality (VR), Digital Twin, 3D Printing/ Additive Manufacturing, Cybersecurity and Others), Component, Automation Technology, Deployment Mode, Enterprise Size, Application, Industry Vertical and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

Market Structure & Evolution |

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Smart Manufacturing Market Size, Share, And Growth

The global smart manufacturing market is experiencing robust growth, with its estimated value of USD 94.3 billion in the year 2025 and USD 312.3 billion by the period 2035, registering a CAGR of 12.7% during the forecast period. The smart manufacturing sector is experiencing strong global growth on the heels of advanced automation and IoT-enabled production systems that yield greater efficiency and lower operational costs.

According to James Carter, Product Strategy Manager for AutoTech Solutions, "The smart manufacturing market in the automotive sector is growing rapidly due to IoT integration, automation advancements, and predictive analytics, enabling manufacturers to enhance production efficiency, reduce downtime, and deliver higher-quality vehicles."

In September of 2025, Siemens AG introduced a new IoT-enabled manufacturing platform that enabled users to conduct operations such as real-time monitoring and predictive maintenance with significant increases in uptime and increased resource utilization. Growing connected and electric vehicle demand, as well as the adoption of Industry 4.0, have also increased demand for advanced manufacturing solutions. In August of 2025, ABB Ltd. deployed AI-enabled robotic assembly solutions for a large European automotive manufacturer in order to accommodate higher production volumes while enabling the advantages of robotic precision and minimal human error.

Moreover, with the demand for advanced manufacturing and automation, there are also stringent regulatory and quality standards amongst the automotive, aerospace, and consumer electronics industries encouraging capital investments in state-of-the-art smart manufacturing technologies. The interaction of novel technologies, regulatory and compliance requirements, and the increased industrial demand is an encouraging development in the smart manufacturing market that fosters greater productivity, sustainability, and operational performance.

Furthermore, there are additional opportunities adjacent to smart manufacturing, such as industrial robotics, predictive maintenance, digital twins, AI-enabled quality inspection, and integrated supply chain analytics. All of these areas present manufacturers with opportunities to further enhance their operations, enhance product quality, and increase revenue generation within the smart manufacturing ecosystem.

Smart Manufacturing Market Dynamics and Trends

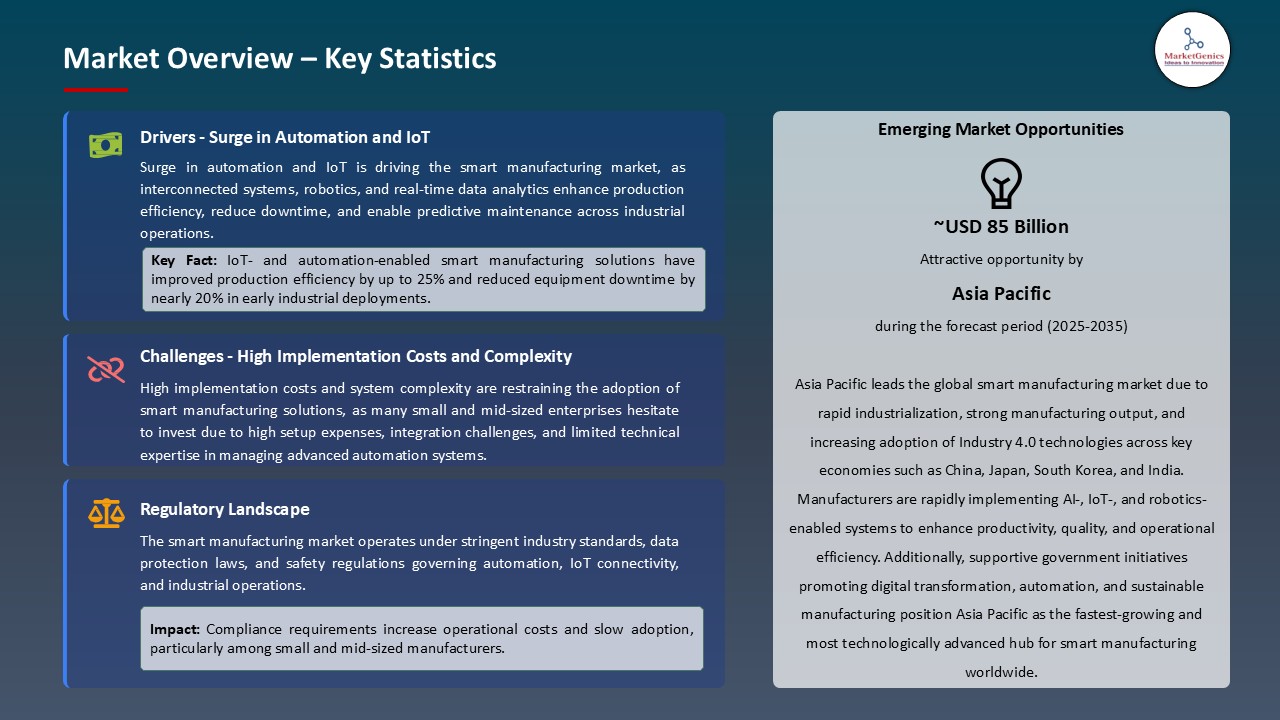

Driver: Surge in Automation and IoT Driving Smart Manufacturing Adoption

- The growing focus on efficiency, production monitoring in real-time and predictive maintenance is accelerating the growth of smart manufacturing solutions across a range of sectors. The deployment of IoT, robotics, and AI on the production line enables manufacturers to optimize their processes, minimize downtime and enhance the quality of products which provides a real opportunity for smart manufacturing market growth.

- Moreover, the smart manufacturing market is forecasted to grow at a projected CAGR of greater than 11% in 2025, which encourages the application of AI-enabled and IoT-connected production systems containing predictive analytics and automatic quality control.

- For example, in 2025, Siemens AG released an AI-IoT manufacturing platform capable of monitoring an assembly line in real-time due to predictive maintenance alerts and energy optimization. Findings from early adopters reported an operational efficiency improvement of 18 percent, speaking to the increasing focus on automation, precision, and sustainability in manufacturing.

Restraint: High Implementation Costs and Complexity Limiting Adoption

- A technology is advancing quickly, adoption trends are slow partly due to a high initial capital cost to convert robotic systems, IoT technologies, and smart factory infrastructures into robots and new technologies. Small- and medium-size manufacturers are more likely to have trouble putting on paper the proposal to spend money for anything beyond traditional methods of production.

- Further, advanced technologies usually require know-how to install, integrate, and/or maintain, which adds to costs and leads to slow adoption.

- For example, during mid-2025 an automotive supplier in Southeast Asia spent 20% more than expected to integrate AI- powered robotic assembly lines into existing legacy equipment, demonstrating the monetary and technical difficulties value-driven manufacturers face.

Opportunity: Expansion of Smart Factories and Industrial Digitalization Boosting Market Growth

- The global shift towards smart factories leveraging Industry 4.0, as well as digitizing the supply chain, presents considerable growth potential for smart manufacturing solutions. The global policies and incentives from government agencies that support automation and digital transformation initiatives are also enhancing adoption in the manufacturing sectors.

- In order to, illustrate the ‘good’ deployments supported by associations and enterprise-based clusters, in 2024, ABB Ltd. partnered with a car manufacturer in Europe to deploy AI-enabled robotic assembly lines coupled with cloud-based monitoring capabilities. This deployment increased production throughput by 22%, met energy savings through new robotics in up to 15%, proactively and effectively maintained equipment, and demonstrated some of the opportunities in sustainable and digital infrastructure in manufacturing.

Key Trend: Integration of AI, IoT, and Cloud Transforming Manufacturing Processes

- The integration of AI, IoT, and cloud computing is an important trend transforming smart manufacturing. Machine learning algorithms are using sensor data to deliver real-time analysis that is used to optimize operations, predict equipment failures, and in some cases, automatically change production parameters to foster efficient manufacturing.

- For instance, in 2025, Rockwell Automation began to deploy a cloud-based, connected, Artificial Intelligence-enabled quality inspection, predictive maintenance, and remote diagnostics system. As preliminary reports come in from the early building block deployments between January 2020 and the close of 2022, a report of a 20% improvement in defect detection and a 17% reduction in unplanned downtime, highlights a top trend towards fully automated, intelligent, and data-driven manufacturing environments.

Smart-Manufacturing-Market Analysis and Segmental Data

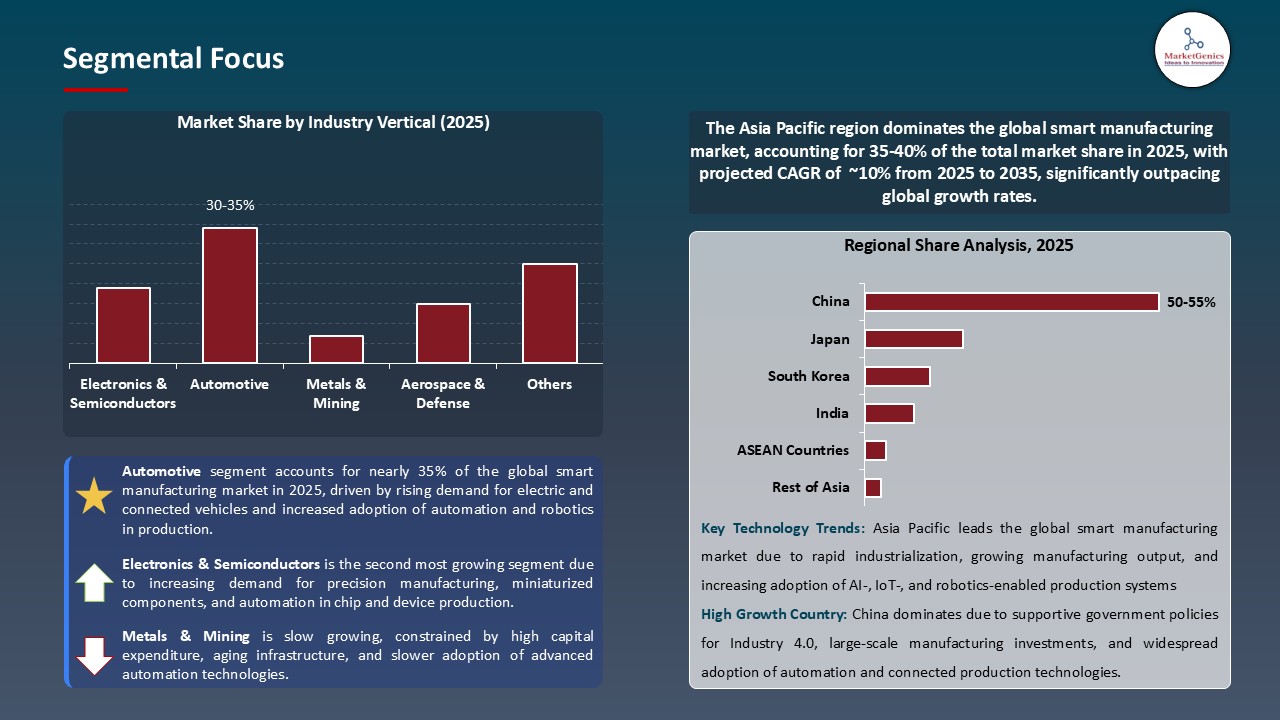

Automotive Industry maintains Dominance in Global Smart Manufacturing Market amid Rising Demand for Connected and Electric Vehicles

- The automotive sector continues to lead in the global smart manufacturing market, owing to the growing need for electric and connected vehicles and increasing focus on efficiency, safety, and automation on their production lines. In 2025, the automotive industry represented about 34% of all smart manufacturing deployments, which demonstrates its importance in creating industry standards.

- For instance, in August 2025, ABB Ltd. launched their first AI-enabled robotic assembly systems and IoT (Internet of Things) sensors and predictive maintenance tools with an automotive manufacturer in Europe and was able to achieve improved production accuracy, lower downtime, and a 20% improvement in energy savings, while demonstrating that the automotive sector's position at the top of smart manufacturing continues to be unchallenged.

- Furthermore, with the growing use of Industry 4.0 technology, continuing pressure for stricter automotive safety and emission regulations, and policy pressure for electrification continues to persuade automotive manufacturers to invest in systems that are more connected, automated, and energy-efficient, solidifying the automotive industry as the largest smart manufacturing segment of the four international segments.

Asia Pacific Leads the Smart Manufacturing Market amid Rapid Industrialization and Adoption of Industry 4.0 Technologies

- Attributed to fast industrialization, the growth of the automotive and electronics industries, and massive investments focused on Industry 4.0 technologies. Nations like China, India, Japan, and South Korea are increasingly implementing automated production systems, robotics, and IoT-connected manufacturing systems that drive growth across the entire region.

- Supportive government initiatives surrounding the implementation of smart factories, energy-efficient production, and the digital transformation of industries are fast-tracking the application of manufacturing systems using AI-integrated, IoT-connected technologies. The demand for real-time monitoring, predictive maintenance, and data-driven process optimization will help satisfy the growing needs for higher efficiency, precision, and operational sustainability in industrial processes.

- For instance, in July of 2025, ABB Ltd. developed an AI-based robotic assembly line using cloud-based IoT monitoring for a large automotive manufacturer in China, boosting production efficiency by 22%, increasing uptime by 18% and optimizing energy usage. This clearly illustrates that the Asia Pacific region is globally leading the charge in the operationalization of smart manufacturing solutions which are intelligent, connected, and high-performance.

Smart-Manufacturing-Market Ecosystem

The smart manufacturing market is moderately consolidated, with a few prominent companies such as Siemens AG, ABB Ltd., Bosch Rexroth AG, Honeywell International Inc., FANUC Corporation, and Dassault Systèmes SE leading the way in smart manufacturing through various methods of advanced automation, Internet of Things (IoT) technologies, Artificial Intelligence (AI), and robotics solutions. These leading companies seek to develop smart manufacturing processes and smart manufacturing technologies to improve efficiency and maintain competitiveness in the marketplace.

Several of the companies mentioned also have specific solutions to help drive innovation in smart manufacturing. Siemens AG has developed MindSphere, a cloud-based industrial IoT solution platform; FANUC Corporation has developed AI-driven robotic arms capable of high-precision assembly; and Dassault Systèmes SE markets digital twin technologies which are virtual prototypes of the manufacturing process for products being developed. All of these offerings help improve the optimization of processes and help speed up development cycles for new products.

Government entities as well as R&D facilities play a role as well. In March 2023 the Department of Energy in the U.S. partnered with Oak Ridge National Laboratory to develop AI-enabled predictive maintenance tools that reduce downtime and power consumption of industrial machines. Leaders whose products improve portfolios or integrate solutions designed to improve productivity, sustainability, and/or operational efficiency are also expanding their firms. For example, IBM announced in August 2023 that they are releasing a quality inspection system driven by Deep Learning, IoT sensors, and AI capabilities that is able to achieve a 25% improvement in defect detection capabilities in the automotive assembly line process.

New product innovations, strategic focus on specialization and advanced technology integrated solutions is sparking ongoing growth and sophistication in the smart manufacturing sector.

Recent Development and Strategic Overview:

- In March 2025, Siemens AG introduced its MindSphere AI platform for smart factories, using the predictive analysis of IoT sensor data to improve production processes. Initial applications in automotive manufacturing plants in Germany resulted in a 25% reduction in downtime and a 15% improvement in throughput.

- In May 2025, FANUC Corporation announced an AI-based assembly line for robotics in electronics production, which employed a wide variety of adaptive task performance coupled with cloud-based performance monitoring. Trials conducted in Japan indicated a 30% gain in assembly accuracy and a 12% reduction in energy use.

Report Scope

|

Attribute |

Detail |

|

Market Size in 2025 |

USD 94.3 Bn |

|

Market Forecast Value in 2035 |

USD 312.3 Bn |

|

Growth Rate (CAGR) |

12.7% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

USD Bn for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

Regions and Countries Covered |

|||||

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Smart-Manufacturing-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Smart Manufacturing Market, By Technology |

|

|

Smart Manufacturing Market, By Component |

|

|

Smart Manufacturing Market, By Automation Technology |

|

|

Smart Manufacturing Market, By Deployment Mode |

|

|

Smart Manufacturing Market, By Enterprise Size |

|

|

Smart Manufacturing Market, By Application |

|

|

Smart Manufacturing Market, By Industry Vertical |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Smart Manufacturing Market Outlook

- 2.1.1. Global Smart Manufacturing Market Size (Value - USD Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Smart Manufacturing Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Automation & Process Control Industry Overview, 2025

- 3.1.1. Automation & Process Control Industry Analysis

- 3.1.2. Key Trends for Automation & Process Control Industry

- 3.1.3. Regional Distribution for Automation & Process Control Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.6. Raw Material Analysis

- 3.1. Global Automation & Process Control Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising adoption of Industrial IoT (IIoT) and AI-driven automation.

- 4.1.1.2. Increasing demand for real-time data analytics to enhance production efficiency.

- 4.1.1.3. Growing emphasis on energy efficiency and predictive maintenance.

- 4.1.2. Restraints

- 4.1.2.1. High implementation and integration costs for smart manufacturing systems.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis/ Ecosystem Analysis

- 4.4.1. Raw Material/ Component Suppliers

- 4.4.2. System Integrators/ Technology Providers

- 4.4.3. Smart Manufacturing Solution Providers

- 4.4.4. End Users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Smart Manufacturing Market Demand

- 4.9.1. Historical Market Size - (Value - USD Bn), 2021-2024

- 4.9.2. Current and Future Market Size - (Value - USD Bn), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Smart Manufacturing Market Analysis, by Technology

- 6.1. Key Segment Analysis

- 6.2. Global Smart Manufacturing Market Size (Value - USD Bn), Analysis, and Forecasts, by Technology, 2021-2035

- 6.2.1. Industrial IoT (IIoT)

- 6.2.2. Artificial Intelligence (AI) and Machine Learning (ML)

- 6.2.3. Cloud Computing

- 6.2.4. Big Data Analytics

- 6.2.5. Augmented Reality (AR) & Virtual Reality (VR)

- 6.2.6. Digital Twin

- 6.2.7. 3D Printing / Additive Manufacturing

- 6.2.8. Cybersecurity

- 6.2.9. Others

- 7. Global Smart Manufacturing Market Analysis, by Component

- 7.1. Key Segment Analysis

- 7.2. Global Smart Manufacturing Market Size (Value - USD Bn), Analysis, and Forecasts, by Component, 2021-2035

- 7.2.1. Hardware

- 7.2.1.1. Sensors and Actuators

- 7.2.1.2. Industrial Robots

- 7.2.1.3. 3D Printers and Additive Manufacturing Equipment

- 7.2.1.4. Industrial Controllers (PLC, DCS)

- 7.2.1.5. Machine Vision Systems

- 7.2.1.6. Industrial PCs and Edge Devices

- 7.2.1.7. Networking Devices (Routers, Switches, Gateways)

- 7.2.1.8. Control Valves and Drives

- 7.2.1.9. Others

- 7.2.2. Software

- 7.2.2.1. Manufacturing Execution Systems (MES)

- 7.2.2.2. Product Lifecycle Management (PLM) Software

- 7.2.2.3. Enterprise Resource Planning (ERP)

- 7.2.2.4. Industrial IoT Platforms

- 7.2.2.5. SCADA and HMI Software

- 7.2.2.6. Quality Management Software

- 7.2.2.7. Predictive Analytics and AI Tools

- 7.2.2.8. Digital Twin and Simulation Software

- 7.2.2.9. Others

- 7.2.3. Services

- 7.2.3.1. Consulting and Integration Services

- 7.2.3.2. Installation and Deployment Services

- 7.2.3.3. Maintenance and Support Services

- 7.2.3.4. Managed Services

- 7.2.3.5. Training and Education Services

- 7.2.3.6. Cloud and Data Management Services

- 7.2.3.7. System Upgradation and Optimization Services

- 7.2.3.8. Others

- 7.2.1. Hardware

- 8. Global Smart Manufacturing Market Analysis, by Automation Technology

- 8.1. Key Segment Analysis

- 8.2. Global Smart Manufacturing Market Size (Value - USD Bn), Analysis, and Forecasts, by Automation Technology, 2021-2035

- 8.2.1. Distributed Control Systems (DCS)

- 8.2.2. Supervisory Control and Data Acquisition (SCADA)

- 8.2.3. Programmable Logic Controllers (PLC)

- 8.2.4. Manufacturing Execution Systems (MES)

- 8.2.5. Human Machine Interface (HMI)

- 8.2.6. Product Lifecycle Management (PLM)

- 8.2.7. Industrial Robotics

- 8.2.8. Others

- 9. Global Smart Manufacturing Market Analysis, by Deployment Mode

- 9.1. Key Segment Analysis

- 9.2. Global Smart Manufacturing Market Size (Value - USD Bn), Analysis, and Forecasts, by Deployment Mode, 2021-2035

- 9.2.1. On-Premise

- 9.2.2. Cloud-Based

- 9.2.3. Hybrid

- 10. Global Smart Manufacturing Market Analysis, by Enterprise Size

- 10.1. Key Segment Analysis

- 10.2. Global Smart Manufacturing Market Size (Value - USD Bn), Analysis, and Forecasts, by Enterprise Size, 2021-2035

- 10.2.1. Large Enterprises

- 10.2.2. Small & Medium Enterprises (SMEs)

- 11. Global Smart Manufacturing Market Analysis, by Application

- 11.1. Key Segment Analysis

- 11.2. Global Smart Manufacturing Market Size (Value - USD Bn), Analysis, and Forecasts, by Application, 2021-2035

- 11.2.1. Predictive Maintenance

- 11.2.2. Asset Monitoring

- 11.2.3. Supply Chain Management

- 11.2.4. Quality Management

- 11.2.5. Production Planning & Scheduling

- 11.2.6. Energy Management

- 11.2.7. Others

- 12. Global Smart Manufacturing Market Analysis and Forecasts, by Industry Vertical

- 12.1. Key Findings

- 12.2. Global Smart Manufacturing Market Size (Value - USD Bn), Analysis, and Forecasts, by Industry Vertical, 2021-2035

- 12.2.1. Automotive

- 12.2.2. Electronics & Semiconductors

- 12.2.3. Aerospace & Defense

- 12.2.4. Pharmaceuticals

- 12.2.5. Food & Beverages

- 12.2.6. Chemicals

- 12.2.7. Oil & Gas

- 12.2.8. Metals & Mining

- 12.2.9. Others

- 13. Global Smart Manufacturing Market Analysis and Forecasts, by Region

- 13.1. Key Findings

- 13.2. Global Smart Manufacturing Market Size (Value - USD Bn), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America Smart Manufacturing Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America Smart Manufacturing Market Size (Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Technology

- 14.3.2. Component

- 14.3.3. Automation Technology

- 14.3.4. Deployment Mode

- 14.3.5. Enterprise Size

- 14.3.6. Application

- 14.3.7. Industry Vertical

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA Smart Manufacturing Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Technology

- 14.4.3. Component

- 14.4.4. Automation Technology

- 14.4.5. Deployment Mode

- 14.4.6. Enterprise Size

- 14.4.7. Application

- 14.4.8. Industry Vertical

- 14.5. Canada Smart Manufacturing Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Technology

- 14.5.3. Component

- 14.5.4. Automation Technology

- 14.5.5. Deployment Mode

- 14.5.6. Enterprise Size

- 14.5.7. Application

- 14.5.8. Industry Vertical

- 14.6. Mexico Smart Manufacturing Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Technology

- 14.6.3. Component

- 14.6.4. Automation Technology

- 14.6.5. Deployment Mode

- 14.6.6. Enterprise Size

- 14.6.7. Application

- 14.6.8. Industry Vertical

- 15. Europe Smart Manufacturing Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe Smart Manufacturing Market Size (Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Technology

- 15.3.2. Component

- 15.3.3. Automation Technology

- 15.3.4. Deployment Mode

- 15.3.5. Enterprise Size

- 15.3.6. Application

- 15.3.7. Industry Vertical

- 15.3.8. Country

- 15.3.8.1. Germany

- 15.3.8.2. United Kingdom

- 15.3.8.3. France

- 15.3.8.4. Italy

- 15.3.8.5. Spain

- 15.3.8.6. Netherlands

- 15.3.8.7. Nordic Countries

- 15.3.8.8. Poland

- 15.3.8.9. Russia & CIS

- 15.3.8.10. Rest of Europe

- 15.4. Germany Smart Manufacturing Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Technology

- 15.4.3. Component

- 15.4.4. Automation Technology

- 15.4.5. Deployment Mode

- 15.4.6. Enterprise Size

- 15.4.7. Application

- 15.4.8. Industry Vertical

- 15.5. United Kingdom Smart Manufacturing Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Technology

- 15.5.3. Component

- 15.5.4. Automation Technology

- 15.5.5. Deployment Mode

- 15.5.6. Enterprise Size

- 15.5.7. Application

- 15.5.8. Industry Vertical

- 15.6. France Smart Manufacturing Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Technology

- 15.6.3. Component

- 15.6.4. Automation Technology

- 15.6.5. Deployment Mode

- 15.6.6. Enterprise Size

- 15.6.7. Application

- 15.6.8. Industry Vertical

- 15.7. Italy Smart Manufacturing Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Technology

- 15.7.3. Component

- 15.7.4. Automation Technology

- 15.7.5. Deployment Mode

- 15.7.6. Enterprise Size

- 15.7.7. Application

- 15.7.8. Industry Vertical

- 15.8. Spain Smart Manufacturing Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Technology

- 15.8.3. Component

- 15.8.4. Automation Technology

- 15.8.5. Deployment Mode

- 15.8.6. Enterprise Size

- 15.8.7. Application

- 15.8.8. Industry Vertical

- 15.9. Netherlands Smart Manufacturing Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Technology

- 15.9.3. Component

- 15.9.4. Automation Technology

- 15.9.5. Deployment Mode

- 15.9.6. Enterprise Size

- 15.9.7. Application

- 15.9.8. Industry Vertical

- 15.10. Nordic Countries Smart Manufacturing Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Technology

- 15.10.3. Component

- 15.10.4. Automation Technology

- 15.10.5. Deployment Mode

- 15.10.6. Enterprise Size

- 15.10.7. Application

- 15.10.8. Industry Vertical

- 15.11. Poland Smart Manufacturing Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Technology

- 15.11.3. Component

- 15.11.4. Automation Technology

- 15.11.5. Deployment Mode

- 15.11.6. Enterprise Size

- 15.11.7. Application

- 15.11.8. Industry Vertical

- 15.12. Russia & CIS Smart Manufacturing Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Technology

- 15.12.3. Component

- 15.12.4. Automation Technology

- 15.12.5. Deployment Mode

- 15.12.6. Enterprise Size

- 15.12.7. Application

- 15.12.8. Industry Vertical

- 15.13. Rest of Europe Smart Manufacturing Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Technology

- 15.13.3. Component

- 15.13.4. Automation Technology

- 15.13.5. Deployment Mode

- 15.13.6. Enterprise Size

- 15.13.7. Application

- 15.13.8. Industry Vertical

- 16. Asia Pacific Smart Manufacturing Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. East Asia Smart Manufacturing Market Size (Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Technology

- 16.3.2. Component

- 16.3.3. Automation Technology

- 16.3.4. Deployment Mode

- 16.3.5. Enterprise Size

- 16.3.6. Application

- 16.3.7. Industry Vertical

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia-Pacific

- 16.4. China Smart Manufacturing Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Technology

- 16.4.3. Component

- 16.4.4. Automation Technology

- 16.4.5. Deployment Mode

- 16.4.6. Enterprise Size

- 16.4.7. Application

- 16.4.8. Industry Vertical

- 16.5. India Smart Manufacturing Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Technology

- 16.5.3. Component

- 16.5.4. Automation Technology

- 16.5.5. Deployment Mode

- 16.5.6. Enterprise Size

- 16.5.7. Application

- 16.5.8. Industry Vertical

- 16.6. Japan Smart Manufacturing Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Technology

- 16.6.3. Component

- 16.6.4. Automation Technology

- 16.6.5. Deployment Mode

- 16.6.6. Enterprise Size

- 16.6.7. Application

- 16.6.8. Industry Vertical

- 16.7. South Korea Smart Manufacturing Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Technology

- 16.7.3. Component

- 16.7.4. Automation Technology

- 16.7.5. Deployment Mode

- 16.7.6. Enterprise Size

- 16.7.7. Application

- 16.7.8. Industry Vertical

- 16.8. Australia and New Zealand Smart Manufacturing Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Technology

- 16.8.3. Component

- 16.8.4. Automation Technology

- 16.8.5. Deployment Mode

- 16.8.6. Enterprise Size

- 16.8.7. Application

- 16.8.8. Industry Vertical

- 16.9. Indonesia Smart Manufacturing Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Technology

- 16.9.3. Component

- 16.9.4. Automation Technology

- 16.9.5. Deployment Mode

- 16.9.6. Enterprise Size

- 16.9.7. Application

- 16.9.8. Industry Vertical

- 16.10. Malaysia Smart Manufacturing Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Technology

- 16.10.3. Component

- 16.10.4. Automation Technology

- 16.10.5. Deployment Mode

- 16.10.6. Enterprise Size

- 16.10.7. Application

- 16.10.8. Industry Vertical

- 16.11. Thailand Smart Manufacturing Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Technology

- 16.11.3. Component

- 16.11.4. Automation Technology

- 16.11.5. Deployment Mode

- 16.11.6. Enterprise Size

- 16.11.7. Application

- 16.11.8. Industry Vertical

- 16.12. Vietnam Smart Manufacturing Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Technology

- 16.12.3. Component

- 16.12.4. Automation Technology

- 16.12.5. Deployment Mode

- 16.12.6. Enterprise Size

- 16.12.7. Application

- 16.12.8. Industry Vertical

- 16.13. Rest of Asia Pacific Smart Manufacturing Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Technology

- 16.13.3. Component

- 16.13.4. Automation Technology

- 16.13.5. Deployment Mode

- 16.13.6. Enterprise Size

- 16.13.7. Application

- 16.13.8. Industry Vertical

- 17. Middle East Smart Manufacturing Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East Smart Manufacturing Market Size (Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Technology

- 17.3.2. Component

- 17.3.3. Automation Technology

- 17.3.4. Deployment Mode

- 17.3.5. Enterprise Size

- 17.3.6. Application

- 17.3.7. Industry Vertical

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey Smart Manufacturing Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Technology

- 17.4.3. Component

- 17.4.4. Automation Technology

- 17.4.5. Deployment Mode

- 17.4.6. Enterprise Size

- 17.4.7. Application

- 17.4.8. Industry Vertical

- 17.5. UAE Smart Manufacturing Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Technology

- 17.5.3. Component

- 17.5.4. Automation Technology

- 17.5.5. Deployment Mode

- 17.5.6. Enterprise Size

- 17.5.7. Application

- 17.5.8. Industry Vertical

- 17.6. Saudi Arabia Smart Manufacturing Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Technology

- 17.6.3. Component

- 17.6.4. Automation Technology

- 17.6.5. Deployment Mode

- 17.6.6. Enterprise Size

- 17.6.7. Application

- 17.6.8. Industry Vertical

- 17.7. Israel Smart Manufacturing Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Technology

- 17.7.3. Component

- 17.7.4. Automation Technology

- 17.7.5. Deployment Mode

- 17.7.6. Enterprise Size

- 17.7.7. Application

- 17.7.8. Industry Vertical

- 17.8. Rest of Middle East Smart Manufacturing Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Technology

- 17.8.3. Component

- 17.8.4. Automation Technology

- 17.8.5. Deployment Mode

- 17.8.6. Enterprise Size

- 17.8.7. Application

- 17.8.8. Industry Vertical

- 18. Africa Smart Manufacturing Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa Smart Manufacturing Market Size (Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Technology

- 18.3.2. Component

- 18.3.3. Automation Technology

- 18.3.4. Deployment Mode

- 18.3.5. Enterprise Size

- 18.3.6. Application

- 18.3.7. Industry Vertical

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa Smart Manufacturing Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Technology

- 18.4.3. Component

- 18.4.4. Automation Technology

- 18.4.5. Deployment Mode

- 18.4.6. Enterprise Size

- 18.4.7. Application

- 18.4.8. Industry Vertical

- 18.5. Egypt Smart Manufacturing Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Technology

- 18.5.3. Component

- 18.5.4. Automation Technology

- 18.5.5. Deployment Mode

- 18.5.6. Enterprise Size

- 18.5.7. Application

- 18.5.8. Industry Vertical

- 18.6. Nigeria Smart Manufacturing Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Technology

- 18.6.3. Component

- 18.6.4. Automation Technology

- 18.6.5. Deployment Mode

- 18.6.6. Enterprise Size

- 18.6.7. Application

- 18.6.8. Industry Vertical

- 18.7. Algeria Smart Manufacturing Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Technology

- 18.7.3. Component

- 18.7.4. Automation Technology

- 18.7.5. Deployment Mode

- 18.7.6. Enterprise Size

- 18.7.7. Application

- 18.7.8. Industry Vertical

- 18.8. Rest of Africa Smart Manufacturing Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Technology

- 18.8.3. Component

- 18.8.4. Automation Technology

- 18.8.5. Deployment Mode

- 18.8.6. Enterprise Size

- 18.8.7. Application

- 18.8.8. Industry Vertical

- 19. South America Smart Manufacturing Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Central and South Africa Smart Manufacturing Market Size (Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Technology

- 19.3.2. Component

- 19.3.3. Automation Technology

- 19.3.4. Deployment Mode

- 19.3.5. Enterprise Size

- 19.3.6. Application

- 19.3.7. Industry Vertical

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil Smart Manufacturing Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Technology

- 19.4.3. Component

- 19.4.4. Automation Technology

- 19.4.5. Deployment Mode

- 19.4.6. Enterprise Size

- 19.4.7. Application

- 19.4.8. Industry Vertical

- 19.5. Argentina Smart Manufacturing Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Technology

- 19.5.3. Component

- 19.5.4. Automation Technology

- 19.5.5. Deployment Mode

- 19.5.6. Enterprise Size

- 19.5.7. Application

- 19.5.8. Industry Vertical

- 19.6. Rest of South America Smart Manufacturing Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Technology

- 19.6.3. Component

- 19.6.4. Automation Technology

- 19.6.5. Deployment Mode

- 19.6.6. Enterprise Size

- 19.6.7. Application

- 19.6.8. Industry Vertical

- 20. Key Players/ Company Profile

- 20.1. ABB Ltd.

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. Autodesk, Inc.

- 20.3. Bosch Rexroth AG

- 20.4. Cisco Systems, Inc.

- 20.5. Dassault Systèmes SE

- 20.6. Emerson Electric Co.

- 20.7. FANUC Corporation

- 20.8. General Electric Company

- 20.9. Honeywell International Inc.

- 20.10. IBM Corporation

- 20.11. Intel Corporation

- 20.12. Mitsubishi Electric Corporation

- 20.13. NVIDIA Corporation

- 20.14. Oracle Corporation

- 20.15. PTC Inc.

- 20.16. Rockwell Automation, Inc.

- 20.17. SAP SE

- 20.18. Schneider Electric SE

- 20.19. Siemens AG

- 20.20. Yokogawa Electric Corporation

- 20.21. Others Key Players

- 20.1. ABB Ltd.

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation