Industrial Robotics Market Size, Share, Growth Opportunity Analysis Report by Robot Type (Articulated Robots (4-axis, 5-axis, 6-axis, 7-axis and above), SCARA Robots, Cartesian/Gantry Robots, Collaborative Robots (Cobots), Delta/Parallel Robots, Cylindrical Robots, Polar/Spherical Robots and Others), Payload Capacity, Component, Function/Application, Technology, Control System, Connectivity, End-users and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Industrial Robotics Market Size, Share, and Growth

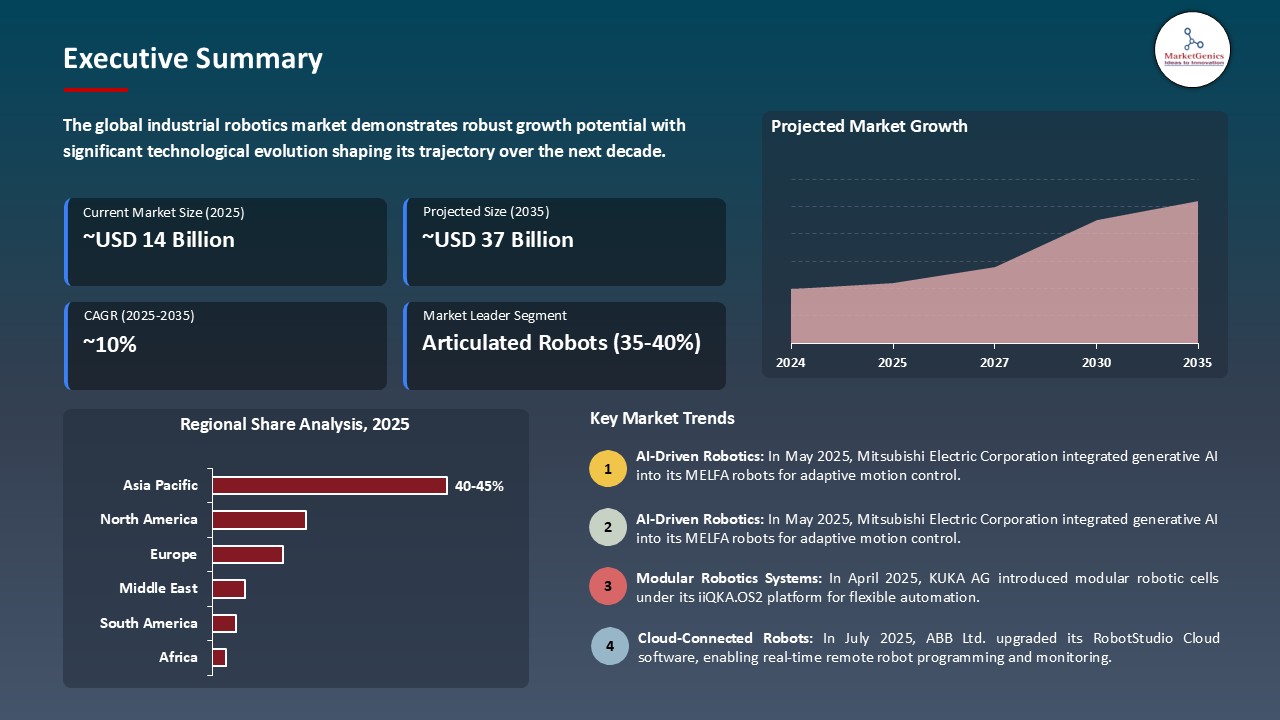

The global industrial robotics market is projected to grow from USD 14.5 Billion in 2025 to USD 36.9 Billion in 2035, with a strong CAGR of 9.8% during the forecasted period. Asia Pacific leads the industrial robotics market with market share of 41.2% with USD 6.0 billion revenue.

In January 2020, Universal Robots introduced a global cobot financing and leasing program in collaboration with DLL. This initiative allowed manufacturers to adopt collaborative robots without large upfront investments, offering flexible leasing and upgrade options. The strategy, led by Kim Povlsen, President of Universal Robots, aimed to accelerate automation adoption among small and medium enterprises and expand the company’s global customer base.

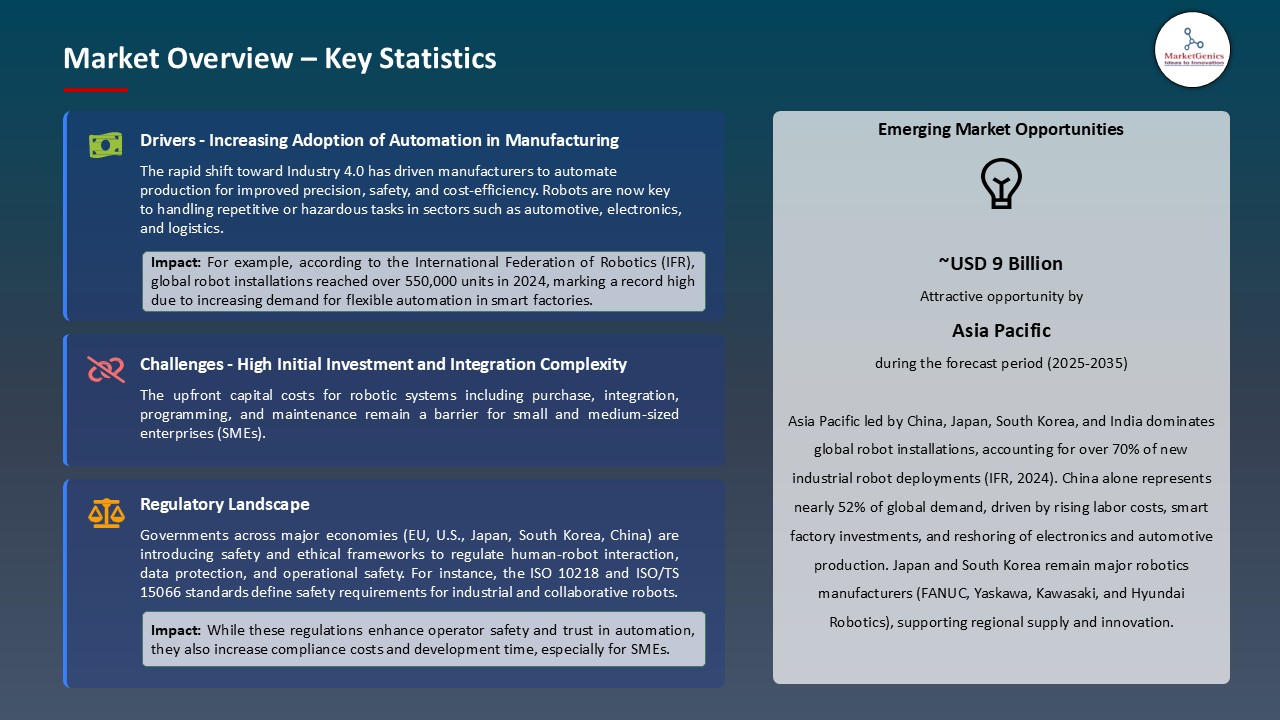

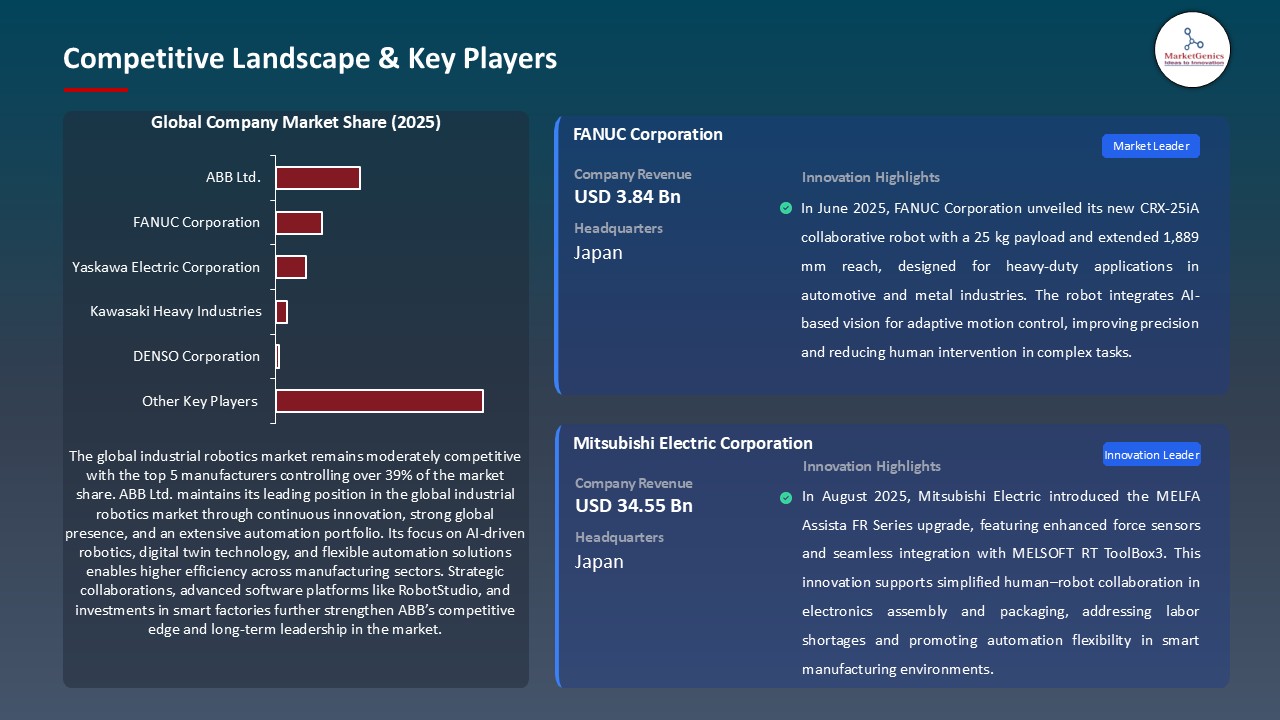

The growing automation in production and demand of collaborative robots (cobots) as the two primary forces behind the industrial robotics market globally. For instance, FANUC Corporation announced its heavy-duty CRX-25iA cobot in June 2025, which allows improving productivity and minimizing human control in the assembly lines.

In May 2025, ABB Ltd. announced its AI-powered OmniVance FlexArc robotic welding cell to enhance precision and throughput in metal fabrication. These innovations are increasing the adoption of smart factories and propelling the industries into a continued upward industrial robotics market.

The opportunities to the global industrial robotics market are the presence of AI-powered predictive maintenance systems, robotic simulation and digital twin software, and industrial IoT connectivity solutions. These markets are complementary to robotic automation in terms of improving performance, reliability and integration. They are converging to broaden robotics uses and develop intelligent manufacturing ecosystems of the next generation.

Industrial Robotics Market Dynamics and Trends

Driver: Rising Labor Shortages and Workforce Aging

- A trends that seek to drive the global industrial robotics market are the increasing scarcity of skilled labour and ageing of the workforce in the developed and emerging economies. Automation is being embraced by manufacturers with greater marks to keep production efficient, minimize the reliance on human workforce and to deal with demographic changes.

- In April 2025, Yaskawa Electric Corporation introduced its Motoman GP25X robot that is capable of performing labor intensive work in packaging, and logistics where dexterity and the rapidity of movement control are required. The use of the robot in the manufacturing facilities in Asia has minimized the number of production downtime as well as the throughput rates.

- Companies are also using robots in the assembly lines to deal with high rates of employee turnover and inefficiencies at work. Due to the challenges that industries like electronics, automotive, and food processing face in terms of distributing skilled labor, the demand of industrial robots keeps increasing all over the world.

- The growth and scalability of the industrial robotics market is rapidly increasing due to the automation adoption caused by labor shortages.

Restraint: High Initial Investment and Integration Costs

- The industry is technologically advanced, expensive nature of acquisition and integration of industrial robots is a significant constraint. The small and medium enterprises (SMEs) especially in the emerging economies are constrained financially in adopting the advanced robotic systems because of costs related to hardware, software, and maintenance.

- KUKA AG has noted this obstacle in its campaign to encourage automation to SMEs in March 2025, by focusing on financing options to help decrease costs of adoption among small-scale manufacturers. Interoperability of robots with existing production systems can be costly as it may require a major process redesign, retraining of employees and technical skills, which may further increase the overall cost of ownership. These issues lengthen the payback period of investments (ROI) of the smaller players, and slows down the full automation.

- The entry point barrier of industrial robotics to small and mid-sized manufacturers remains high due to the high costs of initial and integration.

Opportunity: Expansion in Autonomous Mobile Robots (AMRs)

- The industrial robotics market is provided with a significant opportunity by the accelerating demand of automated and flexible logistics with the use of autonomous mobile robots (AMRs). The material management and warehouse tasks are being transformed with the help of these robots who are being equipped with AI-based navigation and real-time data analytics.

- In February 2025, the Omron Corporation added the HD-1500SE to its AMR series, which can help to carry up to 1500 kg, which would improve automation in e-commerce and automotive supply chains. The rise of e-commerce, as well as growing demands on faster delivery is bringing manufacturers and distributors to the point of AMR implementation. As the fleet management software and the ability to cooperate evolves, AMRs are also becoming crucial in making the intralogistics efficiency optimization and human dependency reduction.

- The increasing adoption of AMRs is creating new sources of income and a firmer presence of the industrial robotics market in the field of logistics and warehousing.

Key Trend: Integration of Generative AI and Vision Systems

- The current trends in the industrial robotics market are the combination of Generative AI and advanced vision systems to enhance autonomy and learning. To achieve dynamically determined decisions and the ability to control the motions, manufacturers are integrating AI algorithms into robotic platforms.

- In July 2025, the Mitsubishi Electric Corporation introduced its MELFA-FR models with artificial intelligence-based real-time path optimization and 3D vision sensors which increase accuracy in the build of electronics and semiconductors. Such smart robots will be in a position to correct any positioning errors, adjust to changing environments, and enhance yield rates.

- Also, predictive analytics based on AI is making robots identify anomalies by preventing failures in the initial stage, minimizing the downtime and maintenance expenditure. This type of development is propelling the shift to smarter and self-learning factories.

- The combination of AI and vision technology is transforming robot intelligence and making them more productive and bringing a new age of adaptive industrial automation.

Industrial Robotics Market Analysis and Segmental Data

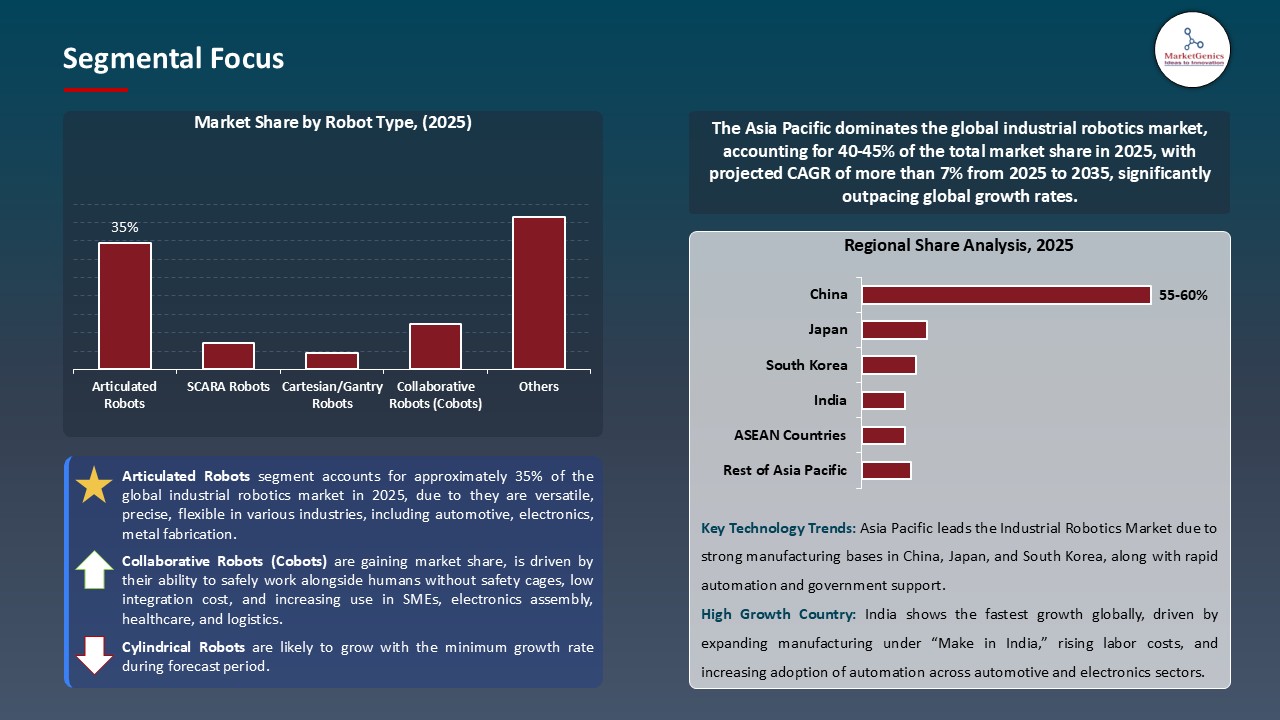

Based on Robot Type, the Articulated Robots Segment Retains the Largest Share

- The articulated robots segment holds major share ~35% in the global industrial robotics market, due to they are versatile, precise, flexible in various industries, including automotive, electronics, metal fabrication. These robots have a number of rotary joints which resemble the movements of human arms; thus, they are best suited to the complicated tasks such as welding, assembly and handling of materials.

- In June 2025, ABB Ltd. launched its IRB 7710 and IRB 7720 articulated robots which have longer payloads and have better motion control in EV and battery production lines. Their flexibility enables an easy adoption to high volume/mixed-model production systems, which is a great enhancement to operational efficiency and consistency.

- Moreover, articulated robots are becoming increasingly new with AI-enabled sensors and preemptive maintenance systems, which saves time and provides better ROI. They are the best option to be used in scaling automation globally due to their scalability and the ability to support Industry 4.0 applications.

- The increasing use of articulated robots is strengthening their role of being the mainstay of the current automated manufacturing systems.

Asia Pacific Dominates Global Industrial Robotics Market in 2025 and Beyond

- The Asia Pacific region has the greatest demand of robots in the industrial robotics market since this region is highly industrialized, has a powerful manufacturing sector, and it has escalating labor costs that are leading to automation. China, Japan, South Korea, and India are among the countries that are making a lead in the number of robots installed in automotive, electronics, and consumer goods sector.

- In 2025, Fanuc Corporation declared its intentions to scale up the robot manufacturing plant at Oshino, Japan, to expand its production to over 1 million units per year to satisfy the dramatically rising demand of Asian manufacturers automating their assembly lines. Also, government programs such as Made in China 2025 and make in India are facilitating smart factory investments and increasing the use of robotics domestically.

- The high density of supplier’s networks, the accessibility of the components, and the increased number of robots using collaborative and AI-based technologies also reinforce the dominance of the region. Developing countries are also joining forces with cross-country robotics companies to hasten automation of small and medium businesses.

- The fact that Asia Pacific is leading in adoption of automation continues to cement its status of being the global centre of industrial robotics innovation and implementation.

Industrial-Robotics-Market Ecosystem

The global industrial robotics market is moderately consolidated with the Tier-1 markets, including FANUC Corporation, ABB Ltd., Yaskawa Electric Corporation, KUKA AG and Mitsubishi Electric Corporation who control the world revenues by broad product line and automation ecosystems. Tier-2 participants, such as Denso Corporation, Kawasaki Heavy Industries, Panasonic Corporation, Epson Robots, and Universal Robots A/S, deal with niche markets, such as collaborative robots and precision assembly. Tier-3 players (including Franka Emika GmbH, Doosan Robotics Inc., and Techman Robot Inc.) are focused on niche or regional markets and use innovation-based solutions.

Designing and manufacturing the robot and its parts (motors, sensors, controllers) and integrating and maintaining the systems and after sales services (installation, software integration, maintenance) are part of the value chain analysis.

In July 2025, Yaskawa Electric Corporation increased its production capacity in the United States to manufacture robots locally and fulfill the increasing demand of automation. The centralized leadership promotes efficiency in innovation and allows niche players to act in new automation segments.

Recent Development and Strategic Overview:

- In April 2025, KUKA AG introduced its new iiQWorks Engineering Suite software platform, which allows offline programming and digital-twin simulation of robotic cells using its new operating system iiQKA.OS2 to serve a shorter time to deployment and greater flexibility to the customers.

- In July 2025, Yaskawa Electric Corporation launched the MOTOMAN GP10 robot, a 10 kg- payload, 1,101 mm reach robot, which is used in space-starved production facilities in industries such as logistics, food and life-sciences to solve labour shortages and enable smaller-scale automation.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 14.5 Bn |

|

Market Forecast Value in 2035 |

USD 36.9 Bn |

|

Growth Rate (CAGR) |

9.8% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Thousand Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Industrial-Robotics-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Industrial Robotics Market, By Robot Type |

|

|

Industrial Robotics Market, By Payload Capacity |

|

|

Industrial Robotics Market, By Component |

|

|

Industrial Robotics Market, By Function/Application |

|

|

Industrial Robotics Market, By Technology |

|

|

Industrial Robotics Market, By Control System |

|

|

Industrial Robotics Market, By Connectivity |

|

|

Industrial Robotics Market, By End Users |

|

Frequently Asked Questions

The global industrial robotics market was valued at USD 14.5 Bn in 2025.

The global industrial robotics market industry is expected to grow at a CAGR of 9.8% from 2025 to 2035.

Key factors driving demand for the industrial robotics market include the increasing need for automation to enhance productivity and efficiency, rising labor costs, and workforce shortages across manufacturing sectors. Additionally, advancements in AI, machine vision, and IoT integration are enabling smarter, flexible, and collaborative robots. Growing adoption in industries such as automotive, electronics, and logistics further accelerates market expansion.

Articulated robots contributed to the largest share of the industrial robotics market business in 2025, due to they are versatile, precise, flexible in various industries, including automotive, electronics, metal fabrication.

The India is among the fastest-growing countries globally.

ABB Ltd., Comau S.p.A., Denso Corporation, Doosan Robotics Inc., Epson Robots, FANUC Corporation, Franka Emika GmbH, Hyundai Robotics, Kawasaki Heavy Industries, KUKA AG, Mitsubishi Electric Corporation, Nachi-Fujikoshi Corp., Panasonic Corporation, Rethink Robotics, Rockwell Automation, Stäubli International AG, Techman Robot Inc., Universal Robots A/S, Yamaha Motor Co., Ltd., Yaskawa Electric Corporation, and Other Key Players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Industrial Robotics Market Outlook

- 2.1.1. Industrial Robotics Market Size (Volume - Thousand Units & Value - US$ Billion), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to-Market Strategy

- 2.5.1. Customer/ End Use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Industrial Robotics Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Automation & Process Control Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Automation & Process Control Industry

- 3.1.3. Regional Distribution for Automation & Process Control

- 3.2. Supplier Customer Data

- 3.3. Technology and Developments

- 3.1. Global Automation & Process Control Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising adoption of automation and Industry 4.0 technologies across manufacturing sectors.

- 4.1.1.2. Increasing demand for precision, efficiency, and scalability in production lines.

- 4.1.1.3. Integration of AI, IoT, and machine vision enhancing robotic intelligence and flexibility.

- 4.1.2. Restraints

- 4.1.2.1. High initial investment and maintenance costs limiting adoption among small and medium enterprises (SMEs).

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis/ Ecosystem Analysis

- 4.4.1. Component Suppliers

- 4.4.2. System Integrators/ Technology Providers

- 4.4.3. Industrial Robots Manufacturers

- 4.4.4. Dealers and Distributors

- 4.4.5. End-users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Porter’s Five Forces Analysis

- 4.7. PESTEL Analysis

- 4.8. Global Industrial Robotics Market Demand

- 4.8.1. Historical Market Size - in Value (Volume - Thousand Units & Value - US$ Billion), 2021-2024

- 4.8.2. Current and Future Market Size - in Value (Volume - Thousand Units & Value - US$ Billion), 2025–2035

- 4.8.2.1. Y-o-Y Growth Trends

- 4.8.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Industrial Robotics Market Analysis, by Robot Type

- 6.1. Key Segment Analysis

- 6.2. Industrial Robotics Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, by Robot Type, 2021-2035

- 6.2.1. Articulated Robots

- 6.2.1.1. 4-axis

- 6.2.1.2. 5-axis

- 6.2.1.3. 6-axis

- 6.2.1.4. 7-axis and above

- 6.2.2. SCARA Robots

- 6.2.3. Cartesian/Gantry Robots

- 6.2.4. Collaborative Robots (Cobots)

- 6.2.5. Delta/Parallel Robots

- 6.2.6. Cylindrical Robots

- 6.2.7. Polar/Spherical Robots

- 6.2.8. Others

- 6.2.1. Articulated Robots

- 7. Global Industrial Robotics Market Analysis, by Payload Capacity

- 7.1. Key Segment Analysis

- 7.2. Industrial Robotics Market Size (Value - US$ Billion), Analysis, and Forecasts, by Payload Capacity, 2021-2035

- 7.2.1. Up to 16 kg

- 7.2.2. 16-60 kg

- 7.2.3. 60-200 kg

- 7.2.4. Above 200 kg

- 8. Global Industrial Robotics Market Analysis, by Component

- 8.1. Key Segment Analysis

- 8.2. Industrial Robotics Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, by Component, 2021-2035

- 8.2.1. Hardware

- 8.2.1.1. Controllers

- 8.2.1.2. Robotic Arms

- 8.2.1.3. End Effectors

- 8.2.1.4. Sensors

- 8.2.1.5. Drive Systems

- 8.2.1.6. Power Supply Units

- 8.2.1.7. Others

- 8.2.2. Software

- 8.2.2.1. Operating Systems

- 8.2.2.2. Simulation Software

- 8.2.2.3. Programming Software

- 8.2.2.4. Analytics Software

- 8.2.2.5. Others

- 8.2.3. Services

- 8.2.3.1. System Integration

- 8.2.3.2. Maintenance and Repair

- 8.2.3.3. Training

- 8.2.3.4. Consulting

- 8.2.3.5. Others

- 8.2.1. Hardware

- 9. Global Industrial Robotics Market Analysis, by Function/Application

- 9.1. Key Segment Analysis

- 9.2. Industrial Robotics Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, by Function/Application, 2021-2035

- 9.2.1. Welding and Soldering

- 9.2.1.1. Arc Welding

- 9.2.1.2. Spot Welding

- 9.2.1.3. Laser Welding

- 9.2.1.4. Others

- 9.2.2. Material Handling

- 9.2.2.1. Pick and Place

- 9.2.2.2. Packaging

- 9.2.2.3. Palletizing

- 9.2.2.4. Machine Tending

- 9.2.2.5. Others

- 9.2.3. Assembly and Disassembly

- 9.2.4. Painting and Coating

- 9.2.5. Cutting and Processing

- 9.2.6. Inspection and Quality Control

- 9.2.7. Dispensing

- 9.2.8. Milling and Grinding

- 9.2.9. Other Applications

- 9.2.1. Welding and Soldering

- 10. Global Industrial Robotics Market Analysis, by Technology

- 10.1. Key Segment Analysis

- 10.2. Industrial Robotics Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, by Technology, 2021-2035

- 10.2.1. Traditional Industrial Robots

- 10.2.2. Collaborative Robots

- 10.2.3. AI-Enabled Robots

- 10.2.4. Cloud-Connected Robots

- 10.2.5. IoT-Integrated Robots

- 10.2.6. Vision-Guided Robots

- 10.2.7. Others

- 11. Global Industrial Robotics Market Analysis and Forecasts, by Control System

- 11.1. Key Findings

- 11.2. Industrial Robotics Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, by Control System, 2021-2035

- 11.2.1. Point-to-Point Control

- 11.2.2. Continuous Path Control

- 11.2.3. Controlled Path Control

- 12. Global Industrial Robotics Market Analysis and Forecasts, by Connectivity

- 12.1. Key Findings

- 12.2. Industrial Robotics Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, by Connectivity, 2021-2035

- 12.2.1. Standalone

- 12.2.2. Connected/Networked

- 12.2.3. Cloud-Based

- 13. Global Industrial Robotics Market Analysis and Forecasts, by End Users

- 13.1. Key Findings

- 13.2. Industrial Robotics Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, by End Users, 2021-2035

- 13.2.1. Automotive

- 13.2.2. Electronics and Electrical

- 13.2.2.1. Assembly

- 13.2.2.2. Pick and Place

- 13.2.2.3. Soldering

- 13.2.2.4. Inspection

- 13.2.2.5. Testing

- 13.2.2.6. Dispensing

- 13.2.2.7. Packaging

- 13.2.2.8. Others

- 13.2.3. Metal and Machinery

- 13.2.4. Plastics and Rubber

- 13.2.5. Food and Beverage

- 13.2.6. Pharmaceutical and Chemical

- 13.2.7. Aerospace and Defense

- 13.2.8. Logistics and Warehousing

- 13.2.8.1. Material Handling

- 13.2.8.2. Sorting

- 13.2.8.3. Palletizing

- 13.2.8.4. Packaging

- 13.2.8.5. Loading/Unloading

- 13.2.8.6. Others

- 13.2.9. Healthcare and Medical Devices

- 13.2.10. Other End-users

- 14. Global Industrial Robotics Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Industrial Robotics Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Industrial Robotics Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Industrial Robotics Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 15.3.1. Robot Type

- 15.3.2. Payload Capacity

- 15.3.3. Component

- 15.3.4. Function/Application

- 15.3.5. Technology

- 15.3.6. Control System

- 15.3.7. Connectivity

- 15.3.8. End Users

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Industrial Robotics Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Robot Type

- 15.4.3. Payload Capacity

- 15.4.4. Component

- 15.4.5. Function/Application

- 15.4.6. Technology

- 15.4.7. Control System

- 15.4.8. Connectivity

- 15.4.9. End Users

- 15.5. Canada Industrial Robotics Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Robot Type

- 15.5.3. Payload Capacity

- 15.5.4. Component

- 15.5.5. Function/Application

- 15.5.6. Technology

- 15.5.7. Control System

- 15.5.8. Connectivity

- 15.5.9. End Users

- 15.6. Mexico Industrial Robotics Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Robot Type

- 15.6.3. Payload Capacity

- 15.6.4. Component

- 15.6.5. Function/Application

- 15.6.6. Technology

- 15.6.7. Control System

- 15.6.8. Connectivity

- 15.6.9. End Users

- 16. Europe Industrial Robotics Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Industrial Robotics Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 16.3.1. Robot Type

- 16.3.2. Payload Capacity

- 16.3.3. Component

- 16.3.4. Function/Application

- 16.3.5. Technology

- 16.3.6. Control System

- 16.3.7. Connectivity

- 16.3.8. End Users

- 16.3.9. Country

- 16.3.9.1. Germany

- 16.3.9.2. United Kingdom

- 16.3.9.3. France

- 16.3.9.4. Italy

- 16.3.9.5. Spain

- 16.3.9.6. Netherlands

- 16.3.9.7. Nordic Countries

- 16.3.9.8. Poland

- 16.3.9.9. Russia & CIS

- 16.3.9.10. Rest of Europe

- 16.4. Germany Industrial Robotics Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Robot Type

- 16.4.3. Payload Capacity

- 16.4.4. Component

- 16.4.5. Function/Application

- 16.4.6. Technology

- 16.4.7. Control System

- 16.4.8. Connectivity

- 16.4.9. End Users

- 16.5. United Kingdom Industrial Robotics Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Robot Type

- 16.5.3. Payload Capacity

- 16.5.4. Component

- 16.5.5. Function/Application

- 16.5.6. Technology

- 16.5.7. Control System

- 16.5.8. Connectivity

- 16.5.9. End Users

- 16.6. France Industrial Robotics Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Robot Type

- 16.6.3. Payload Capacity

- 16.6.4. Component

- 16.6.5. Function/Application

- 16.6.6. Technology

- 16.6.7. Control System

- 16.6.8. Connectivity

- 16.6.9. End Users

- 16.7. Italy Industrial Robotics Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Robot Type

- 16.7.3. Payload Capacity

- 16.7.4. Component

- 16.7.5. Function/Application

- 16.7.6. Technology

- 16.7.7. Control System

- 16.7.8. Connectivity

- 16.7.9. End Users

- 16.8. Spain Industrial Robotics Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Robot Type

- 16.8.3. Payload Capacity

- 16.8.4. Component

- 16.8.5. Function/Application

- 16.8.6. Technology

- 16.8.7. Control System

- 16.8.8. Connectivity

- 16.8.9. End Users

- 16.9. Netherlands Industrial Robotics Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Robot Type

- 16.9.3. Payload Capacity

- 16.9.4. Component

- 16.9.5. Function/Application

- 16.9.6. Technology

- 16.9.7. Control System

- 16.9.8. Connectivity

- 16.9.9. End Users

- 16.10. Nordic Countries Industrial Robotics Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Robot Type

- 16.10.3. Payload Capacity

- 16.10.4. Component

- 16.10.5. Function/Application

- 16.10.6. Technology

- 16.10.7. Control System

- 16.10.8. Connectivity

- 16.10.9. End Users

- 16.11. Poland Industrial Robotics Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Robot Type

- 16.11.3. Payload Capacity

- 16.11.4. Component

- 16.11.5. Function/Application

- 16.11.6. Technology

- 16.11.7. Control System

- 16.11.8. Connectivity

- 16.11.9. End Users

- 16.12. Russia & CIS Industrial Robotics Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Robot Type

- 16.12.3. Payload Capacity

- 16.12.4. Component

- 16.12.5. Function/Application

- 16.12.6. Technology

- 16.12.7. Control System

- 16.12.8. Connectivity

- 16.12.9. End Users

- 16.13. Rest of Europe Industrial Robotics Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Robot Type

- 16.13.3. Payload Capacity

- 16.13.4. Component

- 16.13.5. Function/Application

- 16.13.6. Technology

- 16.13.7. Control System

- 16.13.8. Connectivity

- 16.13.9. End Users

- 17. Asia Pacific Industrial Robotics Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. East Asia Industrial Robotics Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 17.3.1. Robot Type

- 17.3.2. Payload Capacity

- 17.3.3. Component

- 17.3.4. Function/Application

- 17.3.5. Technology

- 17.3.6. Control System

- 17.3.7. Connectivity

- 17.3.8. End Users

- 17.3.9. Country

- 17.3.9.1. China

- 17.3.9.2. India

- 17.3.9.3. Japan

- 17.3.9.4. South Korea

- 17.3.9.5. Australia and New Zealand

- 17.3.9.6. Indonesia

- 17.3.9.7. Malaysia

- 17.3.9.8. Thailand

- 17.3.9.9. Vietnam

- 17.3.9.10. Rest of Asia Pacific

- 17.4. China Industrial Robotics Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Robot Type

- 17.4.3. Payload Capacity

- 17.4.4. Component

- 17.4.5. Function/Application

- 17.4.6. Technology

- 17.4.7. Control System

- 17.4.8. Connectivity

- 17.4.9. End Users

- 17.5. India Industrial Robotics Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Robot Type

- 17.5.3. Payload Capacity

- 17.5.4. Component

- 17.5.5. Function/Application

- 17.5.6. Technology

- 17.5.7. Control System

- 17.5.8. Connectivity

- 17.5.9. End Users

- 17.6. Japan Industrial Robotics Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Robot Type

- 17.6.3. Payload Capacity

- 17.6.4. Component

- 17.6.5. Function/Application

- 17.6.6. Technology

- 17.6.7. Control System

- 17.6.8. Connectivity

- 17.6.9. End Users

- 17.7. South Korea Industrial Robotics Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Robot Type

- 17.7.3. Payload Capacity

- 17.7.4. Component

- 17.7.5. Function/Application

- 17.7.6. Technology

- 17.7.7. Control System

- 17.7.8. Connectivity

- 17.7.9. End Users

- 17.8. Australia and New Zealand Industrial Robotics Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Robot Type

- 17.8.3. Payload Capacity

- 17.8.4. Component

- 17.8.5. Function/Application

- 17.8.6. Technology

- 17.8.7. Control System

- 17.8.8. Connectivity

- 17.8.9. End Users

- 17.9. Indonesia Industrial Robotics Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Robot Type

- 17.9.3. Payload Capacity

- 17.9.4. Component

- 17.9.5. Function/Application

- 17.9.6. Technology

- 17.9.7. Control System

- 17.9.8. Connectivity

- 17.9.9. End Users

- 17.10. Malaysia Industrial Robotics Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Robot Type

- 17.10.3. Payload Capacity

- 17.10.4. Component

- 17.10.5. Function/Application

- 17.10.6. Technology

- 17.10.7. Control System

- 17.10.8. Connectivity

- 17.10.9. End Users

- 17.11. Thailand Industrial Robotics Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Robot Type

- 17.11.3. Payload Capacity

- 17.11.4. Component

- 17.11.5. Function/Application

- 17.11.6. Technology

- 17.11.7. Control System

- 17.11.8. Connectivity

- 17.11.9. End Users

- 17.12. Vietnam Industrial Robotics Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Robot Type

- 17.12.3. Payload Capacity

- 17.12.4. Component

- 17.12.5. Function/Application

- 17.12.6. Technology

- 17.12.7. Control System

- 17.12.8. Connectivity

- 17.12.9. End Users

- 17.13. Rest of Asia Pacific Industrial Robotics Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Robot Type

- 17.13.3. Payload Capacity

- 17.13.4. Component

- 17.13.5. Function/Application

- 17.13.6. Technology

- 17.13.7. Control System

- 17.13.8. Connectivity

- 17.13.9. End Users

- 18. Middle East Industrial Robotics Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Industrial Robotics Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 18.3.1. Robot Type

- 18.3.2. Payload Capacity

- 18.3.3. Component

- 18.3.4. Function/Application

- 18.3.5. Technology

- 18.3.6. Control System

- 18.3.7. Connectivity

- 18.3.8. End Users

- 18.3.9. Country

- 18.3.9.1. Turkey

- 18.3.9.2. UAE

- 18.3.9.3. Saudi Arabia

- 18.3.9.4. Israel

- 18.3.9.5. Rest of Middle East

- 18.4. Turkey Industrial Robotics Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Robot Type

- 18.4.3. Payload Capacity

- 18.4.4. Component

- 18.4.5. Function/Application

- 18.4.6. Technology

- 18.4.7. Control System

- 18.4.8. Connectivity

- 18.4.9. End Users

- 18.5. UAE Industrial Robotics Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Robot Type

- 18.5.3. Payload Capacity

- 18.5.4. Component

- 18.5.5. Function/Application

- 18.5.6. Technology

- 18.5.7. Control System

- 18.5.8. Connectivity

- 18.5.9. End Users

- 18.6. Saudi Arabia Industrial Robotics Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Robot Type

- 18.6.3. Payload Capacity

- 18.6.4. Component

- 18.6.5. Function/Application

- 18.6.6. Technology

- 18.6.7. Control System

- 18.6.8. Connectivity

- 18.6.9. End Users

- 18.7. Israel Industrial Robotics Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Robot Type

- 18.7.3. Payload Capacity

- 18.7.4. Component

- 18.7.5. Function/Application

- 18.7.6. Technology

- 18.7.7. Control System

- 18.7.8. Connectivity

- 18.7.9. End Users

- 18.8. Rest of Middle East Industrial Robotics Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Robot Type

- 18.8.3. Payload Capacity

- 18.8.4. Component

- 18.8.5. Function/Application

- 18.8.6. Technology

- 18.8.7. Control System

- 18.8.8. Connectivity

- 18.8.9. End Users

- 19. Africa Industrial Robotics Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Industrial Robotics Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 19.3.1. Robot Type

- 19.3.2. Payload Capacity

- 19.3.3. Component

- 19.3.4. Function/Application

- 19.3.5. Technology

- 19.3.6. Control System

- 19.3.7. Connectivity

- 19.3.8. End Users

- 19.3.9. Country

- 19.3.9.1. South Africa

- 19.3.9.2. Egypt

- 19.3.9.3. Nigeria

- 19.3.9.4. Algeria

- 19.3.9.5. Rest of Africa

- 19.4. South Africa Industrial Robotics Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Robot Type

- 19.4.3. Payload Capacity

- 19.4.4. Component

- 19.4.5. Function/Application

- 19.4.6. Technology

- 19.4.7. Control System

- 19.4.8. Connectivity

- 19.4.9. End Users

- 19.5. Egypt Industrial Robotics Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Robot Type

- 19.5.3. Payload Capacity

- 19.5.4. Component

- 19.5.5. Function/Application

- 19.5.6. Technology

- 19.5.7. Control System

- 19.5.8. Connectivity

- 19.5.9. End Users

- 19.6. Nigeria Industrial Robotics Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Robot Type

- 19.6.3. Payload Capacity

- 19.6.4. Component

- 19.6.5. Function/Application

- 19.6.6. Technology

- 19.6.7. Control System

- 19.6.8. Connectivity

- 19.6.9. End Users

- 19.7. Algeria Industrial Robotics Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Robot Type

- 19.7.3. Payload Capacity

- 19.7.4. Component

- 19.7.5. Function/Application

- 19.7.6. Technology

- 19.7.7. Control System

- 19.7.8. Connectivity

- 19.7.9. End Users

- 19.8. Rest of Africa Industrial Robotics Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Robot Type

- 19.8.3. Payload Capacity

- 19.8.4. Component

- 19.8.5. Function/Application

- 19.8.6. Technology

- 19.8.7. Control System

- 19.8.8. Connectivity

- 19.8.9. End Users

- 20. South America Industrial Robotics Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Central and South Africa Industrial Robotics Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 20.3.1. Robot Type

- 20.3.2. Payload Capacity

- 20.3.3. Component

- 20.3.4. Function/Application

- 20.3.5. Technology

- 20.3.6. Control System

- 20.3.7. Connectivity

- 20.3.8. End Users

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Industrial Robotics Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Robot Type

- 20.4.3. Payload Capacity

- 20.4.4. Component

- 20.4.5. Function/Application

- 20.4.6. Technology

- 20.4.7. Control System

- 20.4.8. Connectivity

- 20.4.9. End Users

- 20.5. Argentina Industrial Robotics Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Robot Type

- 20.5.3. Payload Capacity

- 20.5.4. Component

- 20.5.5. Function/Application

- 20.5.6. Technology

- 20.5.7. Control System

- 20.5.8. Connectivity

- 20.5.9. End Users

- 20.6. Rest of South America Industrial Robotics Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Robot Type

- 20.6.3. Payload Capacity

- 20.6.4. Component

- 20.6.5. Function/Application

- 20.6.6. Technology

- 20.6.7. Control System

- 20.6.8. Connectivity

- 20.6.9. End Users

- 21. Key Players/ Company Profile

- 21.1. ABB Ltd.

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. Comau S.p.A.

- 21.3. Denso Corporation

- 21.4. Doosan Robotics Inc.

- 21.5. Epson Robots

- 21.6. FANUC Corporation

- 21.7. Franka Emika GmbH

- 21.8. Hyundai Robotics

- 21.9. Kawasaki Heavy Industries

- 21.10. KUKA AG

- 21.11. Mitsubishi Electric Corporation

- 21.12. Nachi-Fujikoshi Corp.

- 21.13. Panasonic Corporation

- 21.14. Rethink Robotics

- 21.15. Rockwell Automation

- 21.16. Stäubli International AG

- 21.17. Techman Robot Inc.

- 21.18. Universal Robots A/S

- 21.19. Yamaha Motor Co., Ltd.

- 21.20. Yaskawa Electric Corporation

- 21.21. Other Key Players

- 21.1. ABB Ltd.

Note* - This is just tentative list of players. While providing the report, we will cover a greater number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data