AI Imaging Market Size, Share & Trends Analysis Report by Component (Hardware, Software, Services), Technology, Deployment Mode, Enterprise Size, Imaging Type, Imaging Modality, Functionality, Application, Industry Vertical and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

Market Structure & Evolution |

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

AI Imaging Market Size, Share, and Growth

The global AI imaging market is experiencing robust growth, with its estimated value of USD 1.2 billion in the year 2025 and USD 14.0 billion by the period 2035, registering a CAGR of 28.2% during the forecast period. There is a rapid growth of the global AI imaging market, which is driven by increasing complexities of AI deployment, increased regulatory scrutiny of AI, and the growing emphasis and focus on the ethical use of AI.

"By developing our AI Imaging platforms, we are making sure businesses can use autonomous systems responsibly - delivering scalable, effective, and ethically governed AI solutions that uphold transparency, compliance, and trust across critical business operations," said Dr. Marcus Lee, Head of AI Imaging Solutions at Cohere Inc.

For instance, in June 2025, Siemens Healthineers launched a new AI-based imaging platform that can identify even minor anomalies in medical scans with significantly greater accuracy, enhancing diagnostic efficiency and improving patient care. In the industrial sector, NVIDIA rolled out its AI Vision Suite that gives manufacturers the capability of detecting defects and optimizing production quality via real-time image analysis. These cases show that AI Imaging technologies are transforming accuracy, efficiency, and reliability.

Moreover, the increasing demand for automation and AI Imaging in healthcare diagnostics, autonomous vehicles, and security surveillance has increased the momentum associated with the adoption of AI Imaging solutions. Regulatory bodies, such as the FDA and EMA, are starting to establish clearer guidance and expectations around the ethical and transparent use of AI imaging technology while innovating, protecting public safety, and providing accountability.

The AI imaging market further provides adjacencies, including image data annotation services, AI model training and validation platforms, edge imaging hardware, explainable AI tools, and cloud-based imaging analytics. Technology companies can leverage these adjacencies to build upon imaging accuracy, speed AI adoption, and develop new sources of revenue in healthcare, automotive, and industrial imaging.

AI Imaging Market Dynamics and Trends

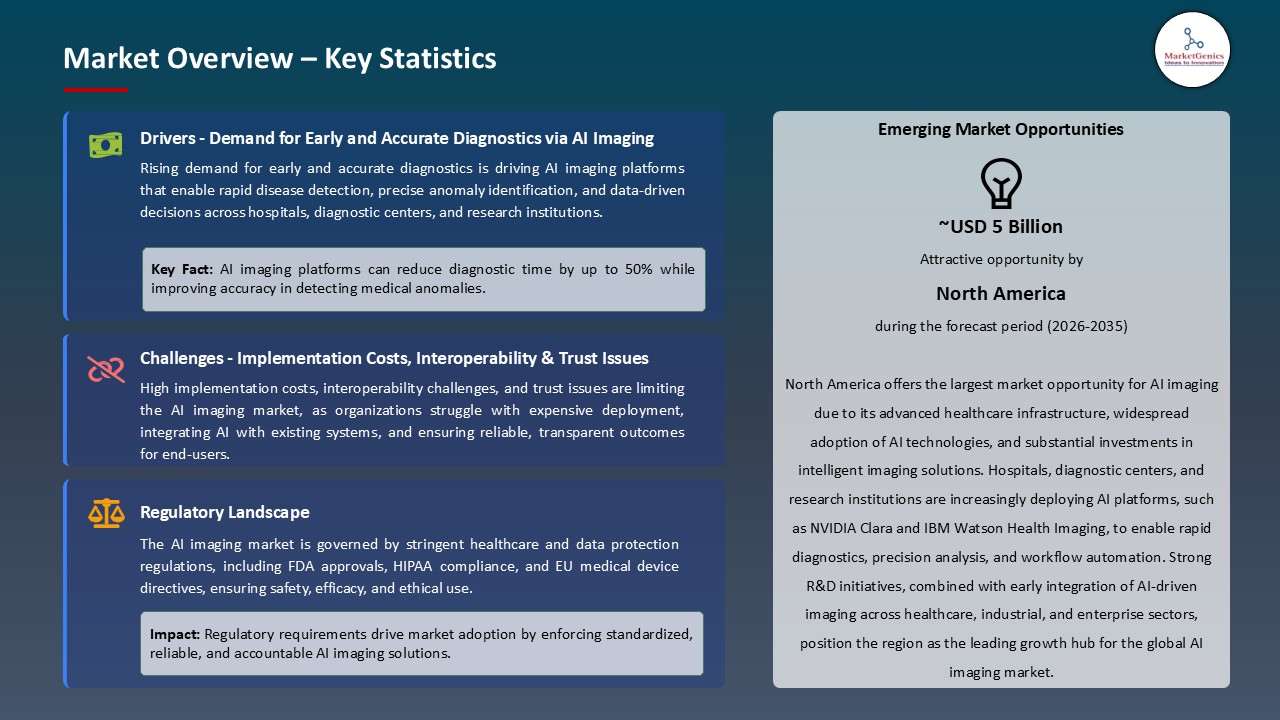

Driver: Increasing Demand for Early and Accurate Diagnostics via AI Imaging

- The need for AI-imaging approaches arises from a growing incidence of chronic diseases, combined with the need for early detection and accurate diagnosis. AI imaging solutions can identify subtle marks on scans that human analyses might miss to improve accuracy of diagnosis, reducing misdiagnosis. Therefore, it is anticipated to boost the growth of AI imaging market across the globe.

- For instance, AI based imaging solutions are now used for analyzing large amounts of scan data, flagging abnormalities more quickly and assisting radiologists in treatment paths. This adds to improving patient outcomes and can also improve workflow bottlenecks at busy healthcare facilities.

- AI imaging is being applied beyond healthcare, such as in industrial inspection, security monitoring/ surveillance, and autonomous vehicles- where visual recognition is paramount and precision is key. There is considerable commitment across sectors to implement AI imaging solutions at speed, providing efficiency and quicker and predictive analysis.

- Such demand is now creating considerable investment in AI imaging software and hardware in hospitals, diagnostic centers and research institutions making AI imaging relative to a modern footprint of diagnostic and functional organizational workflows.

Restraint: High Implementation Costs, Interoperability & Trust Issues Limiting Adoption

- The costs associated with AI imaging systems begin primarily with upfront expenditures needed for software licenses, any required hardware upgrades, required upgrades to any data infrastructure, and needing to provide training for clinical and technical staff. These expenses can be exaggerated for smaller clinics or regional hospitals.

- The lack of consistency with standardization and interoperability across AI imaging platform and pre-existing legacy systems (imaging devices, PACS/EHR systems) as some hospitals will need to have additional IT support or customized IT to integrate AI capabilities into their own workflows.

- Ethical, regulatory and trust-based barriers remain in play as clinician trust in AI and "black-box" algorithms, liability if a misdiagnosis occurs, and compliance with patient data privacy regulations such as HIPAA or GDPR are all as concern. Beyond the financial aspects, software updates, validation, and approvals take time and require a significant number of resources to complete. This, too, is an additional operating cost and holds up deployment in some areas.

Opportunity: Expansion into Emerging Markets and Adjacent Imaging‑Software / Cloud Service Segments

- Growth potential continues in emerging markets in the Asia-Pacific, Latin America, and Africa, as the healthcare infrastructure continues to improve, diagnostic imaging volumes are on the rise, and government support for AI healthcare solutions expands.

- Neighboring possibilities exist in cloud-based AI imaging platforms, federated-learning models (where privacy and data-sharing is achieved), and AI-powered analysis services that enhance traditional imaging hardware.

- While hospital systems and diagnostic centers continue to increase their interest in AI-based solutions to enhance workflow, mitigate patient backlog, and minimize turnaround time for scans and reports, organizations offering subscription-based or cloud-enabled AI imaging service can capture recurring revenue.

- There is also significant upside to expand further into industrial and security imaging. For example, AI imaging is being leveraged in quality control for manufacturing, construction site/equipment monitoring, and surveillance systems that open the addressable market wider than just healthcare.

Key Trend: Integration of Cloud‑Native, IoT/Sensor Enabled and Workflow‑Automation AI Imaging Systems

- There is a significant move toward deploying AI imaging platforms via the cloud to access many unique capabilities, scalability, remote access, centralized updates, and economical infrastructure management. Hospitals and imaging centers can now access AI without significant investment in on-premise infrastructure. The integration of workflow automation and real-time decision support is expanding, for example, automated image segmentation, anomaly detection, triaging urgent cases, and report writing. Minimizing human input reduces the risk of errors and speeds up diagnosis and treatment for the patient.

- Close collaboration among AI imaging software developers and manufacturers of imaging hardware is in development to provide end-to-end solutions that will use integrated sensors, cameras, or imaging devices to provide AI analytics. These platforms will enable smart monitoring of performance, failure prediction, and optimal usage.

- Explainable AI and interactive imaging platforms is a fast-growing trend that will help clinicians better understand the AI thought process justifying the output, building confidence in the automated recommendation with the goal being quicker approval through the regulatory process.

- In general, connected, intelligent, and automated AI imaging platforms will facilitate efficiencies and accuracy and reliability with the expectation for global adoption rate to accelerate even more.

AI Imaging Market Analysis and Segmental Data

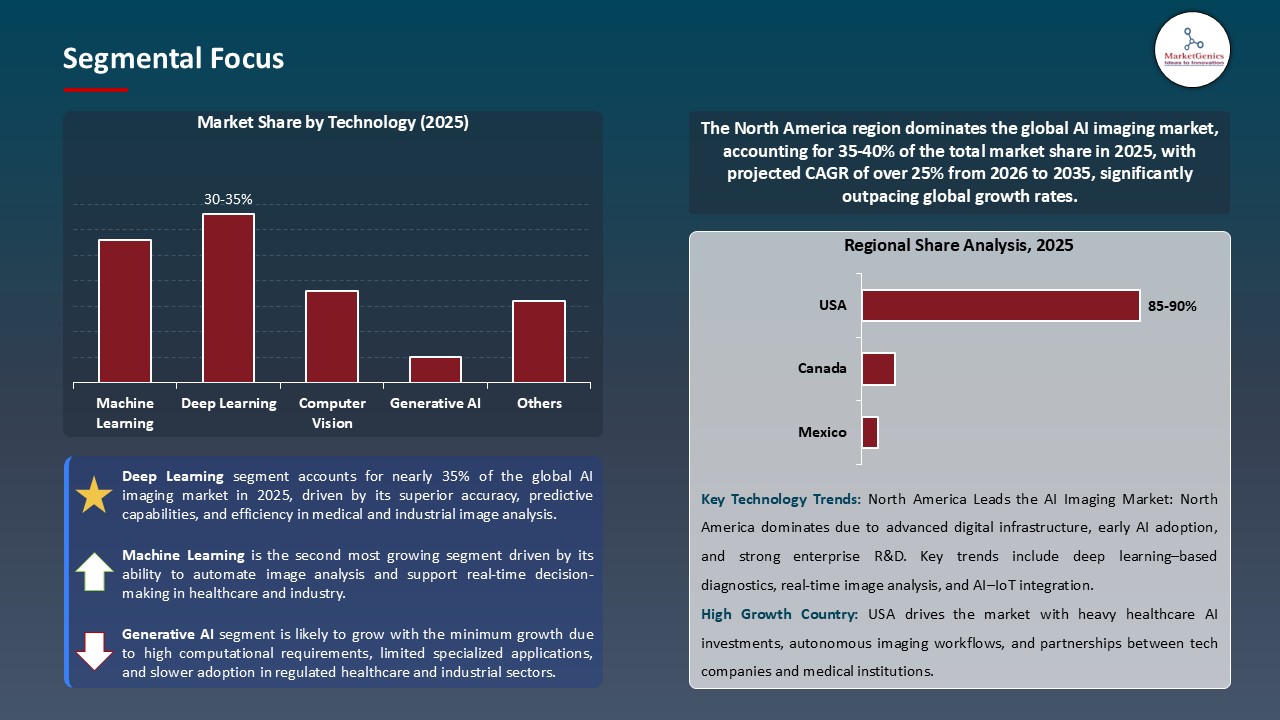

“Deep Learning Maintain Dominance in Global AI Imaging Market amid Rapid Technological Advancements"

- The AI imaging market is leading in the utilization of deep learning in Artificial Intelligence imaging. The expectations of radiologists, pathologists, and oncologists for accurate and timely automated encounters continue to drive the healthcare market. For example, many hospitals are implementing deep learning techniques to assess CT scans, MRIs, and X-ray films in real time. Notably, Google Health, in 2025, was applying deep learning for diabetic retinopathy screening, and Aidoc, the artificial intelligence platform for hospitals, provided radiology triage support, allowing patients to be diagnosed more quickly and dependably.

- Using convolutional neural networks, generative AI, and hybrid deep learning architectures, combined with various predictive capabilities to assist with workflow efficiency while being mindful of regulatory compliance and reducing human errors, is continues to be built upon.

- Deep learning is paired with cloud computing, and edge application insight through IoT imaging devices and similar applications to adjust the capability of real-time analysis in a scalable way, and offsets some level of technological advancements in general and certainly across healthcare, industrial, and security areas.

North America Leads the AI Imaging Market amid Growing Healthcare and Industrial AI Adoption

- North America is expected to dominate the global AI Imaging market, due to mature digital infrastructure, high venture-capital investments, and advanced early adoption of AI Imaging solutions in the healthcare and industrial sectors that help it to garner more than ~40% of the market share in 2024.

- The region possesses extensive collaboration between AI technology vendors, healthcare academia, and industrial companies, aiding the practical and fast rollout of deep learning and AI imaging platforms for diagnostics, quality assurance, and predictive analytics.

- In healthcare, manufacturing, finance, and retail, companies are rapidly adopting deep-learning-based imaging to enable instant diagnostics, predictive maintenance, and workflow automation to support rapid decision-making with increased adaptability. Increasing adoption of AI imaging in hospitals, industrial inspection, and smart retail analytics so firmly consolidates North America’s market position and deepens its prevalence globally.

AI-Imaging-Market Ecosystem

The global AI imaging market is moderately consolidated, with the companies like Aidoc Medical Ltd., Arterys Inc., Butterfly Network Inc., Canon Medical Systems Corporation, DeepMind Technologies (Alphabet Inc.), GE HealthCare Technologies Inc., IBM Corporation, and Siemens Healthineers AG. These companies are adopting and utilizing the latest technologies in the form of deep learning, neural networks, and cloud-based platforms to enhance their current solutions with the aim of speeding up AI adoption in healthcare, industrial, and security applications.

The leading players are focused on delivering specialized innovation. For example, Butterfly Network Inc. has developed portable AI-based ultrasound devices; Lunit Inc. specializes in deep learning - based cancer detection; and HeartFlow, Inc. provides individuals with personalized diagnostics for cardiovascular diseases - all of which highlight precision diagnostics and more narrow applications.

Governments and R&D entities are supporting the advancement of AI imaging. In September 2024, the U.S. NIH supported a funding initiative for a new deep learning MRI program which would help to produce more rapid analysis of MRI images and ultimately, improved identifying of neurological disorders at much earlier stages. The companies are also attempting to diversify and integrate products to improve efficiency. In March 2025, for example, NVIDIA and GE HealthCare introduced a platform integrating IoT and deep learning into an AI-based imaging platform that demonstrated a 15% improvement in diagnostic accuracy and a 20% decrease in workflow time.

The growth of the AI imaging market is attributed largely to the concentrated leadership, a focus on more specialized and dexterous innovations, funding and support from institutions expanding adoption of AI imaging in both health care and industrial applications.

Recent Development and Strategic Overview:

- In June 2025, Zebra Medical Vision Ltd. released InsightAI, an AI-enabled imaging platform for automating radiology evaluations. It utilizes deep learning and computer vision to automatically identify abnormalities in images from X-rays, computed tomography (CT), and magnetic resonance imaging (MRI) scans, producing a diagnostic suggestion and severity score. It enhances early disease detection, lessens the number of images that require manual review, and is operational in hospital health networks and diagnostic centers.

- In August 2025, Enlitic, Inc. released DeepScan Pro, an AI imaging solution that integrates neural networks and real-time analytics to enable new-age diagnostics related to oncology and inferring diagnoses in tumors. With precise identification of tumor regions of interest, predictive progression metrics, and automatic clinical reporting, it helps clinicians improve treatment planning and patient-focused outcomes.

Report Scope

|

Attribute |

Detail |

|

Market Size in 2025 |

USD 1.2 Bn |

|

Market Forecast Value in 2035 |

USD 14 Bn |

|

Growth Rate (CAGR) |

28.2% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

USD Bn for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

Regions and Countries Covered |

|||||

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

AI-Imaging-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

AI Imaging Market, By Component |

|

|

AI Imaging Market, By Technology |

|

|

AI Imaging Market, By Deployment Mode |

|

|

AI Imaging Market, By Enterprise Size |

|

|

AI Imaging Market, By Imaging Type |

|

|

AI Imaging Market, By Imaging Modality |

|

|

AI Imaging Market, By Functionality |

|

|

AI Imaging Market, By Application |

|

|

AI Imaging Market, By Industry Vertical |

|

Frequently Asked Questions

The global AI imaging market was valued at USD 1.2 Bn in 2025

The global AI imaging market industry is expected to grow at a CAGR of 28.2% from 2026 to 2035

The demand for the AI imaging market is driven by the need for faster, more accurate diagnostics, workflow automation, and advanced healthcare and industrial imaging solutions.

In terms of technology, the deep learning segment accounted for the major share in 2025.

North America is the more attractive region for vendors.

Key players in the global AI imaging market include prominent companies such as Aidoc Medical Ltd., Arterys Inc., Butterfly Network Inc., Canon Medical Systems Corporation, DeepMind Technologies (Alphabet Inc.), Enlitic, Inc., Fujifilm Holdings Corporation, GE HealthCare Technologies Inc., HeartFlow, Inc., IBM Corporation, Intel Corporation, unit Inc., NVIDIA Corporation, Oxipit UAB, Perimeter Medical Imaging AI, Inc., Philips Healthcare, Samsung Medison Co., Ltd., Siemens Healthineers AG, Viz.ai Inc., Zebra Medical Vision Ltd., along with several other key players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global AI Imaging Market Outlook

- 2.1.1. Global AI Imaging Market Size (Value - USD Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global AI Imaging Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Information Technology & Media Industry Overview, 2025

- 3.1.1. Information Technology & Media Ecosystem Analysis

- 3.1.2. Key Trends for Information Technology & Media Industry

- 3.1.3. Regional Distribution for Information Technology & Media Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.1. Global Information Technology & Media Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Growing adoption of AI in medical diagnostics for enhanced image interpretation accuracy

- 4.1.1.2. Increasing use of AI imaging in autonomous vehicles, surveillance, and industrial inspection

- 4.1.1.3. Rising demand for high-resolution imaging and real-time image analysis across sectors

- 4.1.2. Restraints

- 4.1.2.1. High cost and complexity of AI imaging system integration and implementation

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Hardware/ Data Providers

- 4.4.2. AI Imaging Model Developers

- 4.4.3. System Integrators

- 4.4.4. End Users

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Porter’s Five Forces Analysis

- 4.7. PESTEL Analysis

- 4.8. Global AI Imaging Market Demand

- 4.8.1. Historical Market Size - (Value - USD Bn), 2021-2024

- 4.8.2. Current and Future Market Size - (Value - USD Bn), 2026–2035

- 4.8.2.1. Y-o-Y Growth Trends

- 4.8.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global AI Imaging Market Analysis, by Component

- 6.1. Key Segment Analysis

- 6.2. Global AI Imaging Market Size (Value - USD Bn), Analysis, and Forecasts, by Component, 2021-2035

- 6.2.1. Hardware

- 6.2.1.1. Imaging Sensors (CMOS, CCD, Infrared Sensors)

- 6.2.1.2. Cameras and Imaging Devices

- 6.2.1.3. GPUs (Graphics Processing Units)

- 6.2.1.4. CPUs (Central Processing Units)

- 6.2.1.5. FPGAs and ASICs

- 6.2.1.6. Edge Devices and Embedded Systems

- 6.2.1.7. Memory and Storage Units

- 6.2.1.8. Networking and Connectivity Components

- 6.2.1.9. Others

- 6.2.2. Software

- 6.2.2.1. AI Imaging Algorithms

- 6.2.2.2. Image Processing Software

- 6.2.2.3. Machine Learning and Deep Learning Frameworks

- 6.2.2.4. Image Recognition and Classification Tools

- 6.2.2.5. Computer Vision Software

- 6.2.2.6. Cloud-Based AI Platforms

- 6.2.2.7. Diagnostic and Analytical Software

- 6.2.2.8. Workflow Management and Integration Tools

- 6.2.2.9. Others

- 6.2.3. Services

- 6.2.3.1. Consulting and Implementation Services

- 6.2.3.2. System Integration and Deployment Services

- 6.2.3.3. Training and Support Services

- 6.2.3.4. Managed Services

- 6.2.3.5. Data Annotation and Labeling Services

- 6.2.3.6. AI Model Customization and Optimization Services

- 6.2.3.7. Maintenance and Upgradation Services

- 6.2.3.8. Others

- 6.2.1. Hardware

- 7. Global AI Imaging Market Analysis, by Technology

- 7.1. Key Segment Analysis

- 7.2. Global AI Imaging Market Size (Value - USD Bn), Analysis, and Forecasts, by Technology, 2021-2035

- 7.2.1. Deep Learning

- 7.2.2. Machine Learning

- 7.2.3. Computer Vision

- 7.2.4. Natural Language Processing (NLP)

- 7.2.5. Generative AI

- 7.2.6. Others

- 8. Global AI Imaging Market Analysis, by Deployment Mode

- 8.1. Key Segment Analysis

- 8.2. Global AI Imaging Market Size (Value - USD Bn), Analysis, and Forecasts, Deployment Mode, 2021-2035

- 8.2.1. Cloud-Based

- 8.2.2. On-Premises

- 8.2.3. Hybrid

- 9. Global AI Imaging Market Analysis, by Enterprise Size

- 9.1. Key Segment Analysis

- 9.2. Global AI Imaging Market Size (Value - USD Bn), Analysis, and Forecasts, by Enterprise Size, 2021-2035

- 9.2.1. Small and Medium Enterprises (SMEs)

- 9.2.2. Large Enterprises

- 10. Global AI Imaging Market Analysis, by Imaging Type

- 10.1. Key Segment Analysis

- 10.2. Global AI Imaging Market Size (Value - USD Bn), Analysis, and Forecasts, by Imaging Type, 2021-2035

- 10.2.1. 2D Imaging

- 10.2.2. 3D Imaging

- 10.2.3. 4D Imaging

- 11. Global AI Imaging Market Analysis, by Imaging Modality

- 11.1. Key Segment Analysis

- 11.2. Global AI Imaging Market Size (Value - USD Bn), Analysis, and Forecasts, by Imaging Modality, 2021-2035

- 11.2.1. X-ray

- 11.2.2. MRI

- 11.2.3. CT Scan

- 11.2.4. Ultrasound

- 11.2.5. PET Scan

- 11.2.6. Optical Imaging

- 11.2.7. Others

- 12. Global AI Imaging Market Analysis, by Functionality

- 12.1. Key Segment Analysis

- 12.2. Global AI Imaging Market Size (Value - USD Bn), Analysis, and Forecasts, by Functionality, 2021-2035

- 12.2.1. Image Acquisition

- 12.2.2. Image Processing

- 12.2.3. Image Analysis and Interpretation

- 12.2.4. Workflow Optimization

- 12.2.5. Others

- 13. Global AI Imaging Market Analysis, by Application

- 13.1. Key Segment Analysis

- 13.2. Global AI Imaging Market Size (Value - USD Bn), Analysis, and Forecasts, by Application, 2021-2035

- 13.2.1. Medical Imaging

- 13.2.2. Industrial Inspection

- 13.2.3. Security and Surveillance

- 13.2.4. Automotive Imaging

- 13.2.5. Satellite and Aerial Imaging

- 13.2.6. Agriculture and Environmental Monitoring

- 13.2.7. Entertainment and Media

- 13.2.8. Others

- 14. Global AI Imaging Market Analysis, by Industry Vertical

- 14.1. Key Segment Analysis

- 14.2. Global AI Imaging Market Size (Value - USD Bn), Analysis, and Forecasts, by Industry Vertical, 2021-2035

- 14.2.1. Healthcare

- 14.2.2. Manufacturing

- 14.2.3. Automotive

- 14.2.4. Aerospace & Defense

- 14.2.5. Media & Entertainment

- 14.2.6. Agriculture

- 14.2.7. Energy & Utilities

- 14.2.8. Government & Public Sector

- 14.2.9. Others

- 15. Global AI Imaging Market Analysis and Forecasts, by Region

- 15.1. Key Findings

- 15.2. Global AI Imaging Market Size (Value - USD Bn), Analysis, and Forecasts, by Region, 2021-2035

- 15.2.1. North America

- 15.2.2. Europe

- 15.2.3. Asia Pacific

- 15.2.4. Middle East

- 15.2.5. Africa

- 15.2.6. South America

- 16. North America AI Imaging Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. North America AI Imaging Market Size (Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Component

- 16.3.2. Technology

- 16.3.3. Deployment Mode

- 16.3.4. Enterprise Size

- 16.3.5. Imaging Type

- 16.3.6. Imaging Modality

- 16.3.7. Functionality

- 16.3.8. Application

- 16.3.9. Industry Vertical

- 16.3.10. Country

- 16.3.10.1. USA

- 16.3.10.2. Canada

- 16.3.10.3. Mexico

- 16.4. USA AI Imaging Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Component

- 16.4.3. Technology

- 16.4.4. Deployment Mode

- 16.4.5. Enterprise Size

- 16.4.6. Imaging Type

- 16.4.7. Imaging Modality

- 16.4.8. Functionality

- 16.4.9. Application

- 16.4.10. Industry Vertical

- 16.5. Canada AI Imaging Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Component

- 16.5.3. Technology

- 16.5.4. Deployment Mode

- 16.5.5. Enterprise Size

- 16.5.6. Imaging Type

- 16.5.7. Imaging Modality

- 16.5.8. Functionality

- 16.5.9. Application

- 16.5.10. Industry Vertical

- 16.6. Mexico AI Imaging Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Component

- 16.6.3. Technology

- 16.6.4. Deployment Mode

- 16.6.5. Enterprise Size

- 16.6.6. Imaging Type

- 16.6.7. Imaging Modality

- 16.6.8. Functionality

- 16.6.9. Application

- 16.6.10. Industry Vertical

- 17. Europe AI Imaging Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Europe AI Imaging Market Size (Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Component

- 17.3.2. Technology

- 17.3.3. Deployment Mode

- 17.3.4. Enterprise Size

- 17.3.5. Imaging Type

- 17.3.6. Imaging Modality

- 17.3.7. Functionality

- 17.3.8. Application

- 17.3.9. Industry Vertical

- 17.3.10. Country

- 17.3.10.1. Germany

- 17.3.10.2. United Kingdom

- 17.3.10.3. France

- 17.3.10.4. Italy

- 17.3.10.5. Spain

- 17.3.10.6. Netherlands

- 17.3.10.7. Nordic Countries

- 17.3.10.8. Poland

- 17.3.10.9. Russia & CIS

- 17.3.10.10. Rest of Europe

- 17.4. Germany AI Imaging Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Component

- 17.4.3. Technology

- 17.4.4. Deployment Mode

- 17.4.5. Enterprise Size

- 17.4.6. Imaging Type

- 17.4.7. Imaging Modality

- 17.4.8. Functionality

- 17.4.9. Application

- 17.4.10. Industry Vertical

- 17.5. United Kingdom AI Imaging Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Component

- 17.5.3. Technology

- 17.5.4. Deployment Mode

- 17.5.5. Enterprise Size

- 17.5.6. Imaging Type

- 17.5.7. Imaging Modality

- 17.5.8. Functionality

- 17.5.9. Application

- 17.5.10. Industry Vertical

- 17.6. France AI Imaging Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Component

- 17.6.3. Technology

- 17.6.4. Deployment Mode

- 17.6.5. Enterprise Size

- 17.6.6. Imaging Type

- 17.6.7. Imaging Modality

- 17.6.8. Functionality

- 17.6.9. Application

- 17.6.10. Industry Vertical

- 17.7. Italy AI Imaging Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Component

- 17.7.3. Technology

- 17.7.4. Deployment Mode

- 17.7.5. Enterprise Size

- 17.7.6. Imaging Type

- 17.7.7. Imaging Modality

- 17.7.8. Functionality

- 17.7.9. Application

- 17.7.10. Industry Vertical

- 17.8. Spain AI Imaging Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Component

- 17.8.3. Technology

- 17.8.4. Deployment Mode

- 17.8.5. Enterprise Size

- 17.8.6. Imaging Type

- 17.8.7. Imaging Modality

- 17.8.8. Functionality

- 17.8.9. Application

- 17.8.10. Industry Vertical

- 17.9. Netherlands AI Imaging Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Component

- 17.9.3. Technology

- 17.9.4. Deployment Mode

- 17.9.5. Enterprise Size

- 17.9.6. Imaging Type

- 17.9.7. Imaging Modality

- 17.9.8. Functionality

- 17.9.9. Application

- 17.9.10. Industry Vertical

- 17.10. Nordic Countries AI Imaging Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Component

- 17.10.3. Technology

- 17.10.4. Deployment Mode

- 17.10.5. Enterprise Size

- 17.10.6. Imaging Type

- 17.10.7. Imaging Modality

- 17.10.8. Functionality

- 17.10.9. Application

- 17.10.10. Industry Vertical

- 17.11. Poland AI Imaging Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Component

- 17.11.3. Technology

- 17.11.4. Deployment Mode

- 17.11.5. Enterprise Size

- 17.11.6. Imaging Type

- 17.11.7. Imaging Modality

- 17.11.8. Functionality

- 17.11.9. Application

- 17.11.10. Industry Vertical

- 17.12. Russia & CIS AI Imaging Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Component

- 17.12.3. Technology

- 17.12.4. Deployment Mode

- 17.12.5. Enterprise Size

- 17.12.6. Imaging Type

- 17.12.7. Imaging Modality

- 17.12.8. Functionality

- 17.12.9. Application

- 17.12.10. Industry Vertical

- 17.13. Rest of Europe AI Imaging Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Component

- 17.13.3. Technology

- 17.13.4. Deployment Mode

- 17.13.5. Enterprise Size

- 17.13.6. Imaging Type

- 17.13.7. Imaging Modality

- 17.13.8. Functionality

- 17.13.9. Application

- 17.13.10. Industry Vertical

- 18. Asia Pacific AI Imaging Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Asia Pacific AI Imaging Market Size (Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Component

- 18.3.2. Technology

- 18.3.3. Deployment Mode

- 18.3.4. Enterprise Size

- 18.3.5. Imaging Type

- 18.3.6. Imaging Modality

- 18.3.7. Functionality

- 18.3.8. Application

- 18.3.9. Industry Vertical

- 18.3.10. Country

- 18.3.10.1. China

- 18.3.10.2. India

- 18.3.10.3. Japan

- 18.3.10.4. South Korea

- 18.3.10.5. Australia and New Zealand

- 18.3.10.6. Indonesia

- 18.3.10.7. Malaysia

- 18.3.10.8. Thailand

- 18.3.10.9. Vietnam

- 18.3.10.10. Rest of Asia-Pacific

- 18.4. China AI Imaging Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Component

- 18.4.3. Technology

- 18.4.4. Deployment Mode

- 18.4.5. Enterprise Size

- 18.4.6. Imaging Type

- 18.4.7. Imaging Modality

- 18.4.8. Functionality

- 18.4.9. Application

- 18.4.10. Industry Vertical

- 18.5. India AI Imaging Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Component

- 18.5.3. Technology

- 18.5.4. Deployment Mode

- 18.5.5. Enterprise Size

- 18.5.6. Imaging Type

- 18.5.7. Imaging Modality

- 18.5.8. Functionality

- 18.5.9. Application

- 18.5.10. Industry Vertical

- 18.6. Japan AI Imaging Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Component

- 18.6.3. Technology

- 18.6.4. Deployment Mode

- 18.6.5. Enterprise Size

- 18.6.6. Imaging Type

- 18.6.7. Imaging Modality

- 18.6.8. Functionality

- 18.6.9. Application

- 18.6.10. Industry Vertical

- 18.7. South Korea AI Imaging Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Component

- 18.7.3. Technology

- 18.7.4. Deployment Mode

- 18.7.5. Enterprise Size

- 18.7.6. Imaging Type

- 18.7.7. Imaging Modality

- 18.7.8. Functionality

- 18.7.9. Application

- 18.7.10. Industry Vertical

- 18.8. Australia and New Zealand AI Imaging Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Component

- 18.8.3. Technology

- 18.8.4. Deployment Mode

- 18.8.5. Enterprise Size

- 18.8.6. Imaging Type

- 18.8.7. Imaging Modality

- 18.8.8. Functionality

- 18.8.9. Application

- 18.8.10. Industry Vertical

- 18.9. Indonesia AI Imaging Market

- 18.9.1. Country Segmental Analysis

- 18.9.2. Component

- 18.9.3. Technology

- 18.9.4. Deployment Mode

- 18.9.5. Enterprise Size

- 18.9.6. Imaging Type

- 18.9.7. Imaging Modality

- 18.9.8. Functionality

- 18.9.9. Application

- 18.9.10. Industry Vertical

- 18.10. Malaysia AI Imaging Market

- 18.10.1. Country Segmental Analysis

- 18.10.2. Component

- 18.10.3. Technology

- 18.10.4. Deployment Mode

- 18.10.5. Enterprise Size

- 18.10.6. Imaging Type

- 18.10.7. Imaging Modality

- 18.10.8. Functionality

- 18.10.9. Application

- 18.10.10. Industry Vertical

- 18.11. Thailand AI Imaging Market

- 18.11.1. Country Segmental Analysis

- 18.11.2. Component

- 18.11.3. Technology

- 18.11.4. Deployment Mode

- 18.11.5. Enterprise Size

- 18.11.6. Imaging Type

- 18.11.7. Imaging Modality

- 18.11.8. Functionality

- 18.11.9. Application

- 18.11.10. Industry Vertical

- 18.12. Vietnam AI Imaging Market

- 18.12.1. Country Segmental Analysis

- 18.12.2. Component

- 18.12.3. Technology

- 18.12.4. Deployment Mode

- 18.12.5. Enterprise Size

- 18.12.6. Imaging Type

- 18.12.7. Imaging Modality

- 18.12.8. Functionality

- 18.12.9. Application

- 18.12.10. Industry Vertical

- 18.13. Rest of Asia Pacific AI Imaging Market

- 18.13.1. Country Segmental Analysis

- 18.13.2. Component

- 18.13.3. Technology

- 18.13.4. Deployment Mode

- 18.13.5. Enterprise Size

- 18.13.6. Imaging Type

- 18.13.7. Imaging Modality

- 18.13.8. Functionality

- 18.13.9. Application

- 18.13.10. Industry Vertical

- 19. Middle East AI Imaging Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Middle East AI Imaging Market Size (Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Component

- 19.3.2. Technology

- 19.3.3. Deployment Mode

- 19.3.4. Enterprise Size

- 19.3.5. Imaging Type

- 19.3.6. Imaging Modality

- 19.3.7. Functionality

- 19.3.8. Application

- 19.3.9. Industry Vertical

- 19.3.10. Country

- 19.3.10.1. Turkey

- 19.3.10.2. UAE

- 19.3.10.3. Saudi Arabia

- 19.3.10.4. Israel

- 19.3.10.5. Rest of Middle East

- 19.4. Turkey AI Imaging Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Component

- 19.4.3. Technology

- 19.4.4. Deployment Mode

- 19.4.5. Enterprise Size

- 19.4.6. Imaging Type

- 19.4.7. Imaging Modality

- 19.4.8. Functionality

- 19.4.9. Application

- 19.4.10. Industry Vertical

- 19.5. UAE AI Imaging Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Component

- 19.5.3. Technology

- 19.5.4. Deployment Mode

- 19.5.5. Enterprise Size

- 19.5.6. Imaging Type

- 19.5.7. Imaging Modality

- 19.5.8. Functionality

- 19.5.9. Application

- 19.5.10. Industry Vertical

- 19.6. Saudi Arabia AI Imaging Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Component

- 19.6.3. Technology

- 19.6.4. Deployment Mode

- 19.6.5. Enterprise Size

- 19.6.6. Imaging Type

- 19.6.7. Imaging Modality

- 19.6.8. Functionality

- 19.6.9. Application

- 19.6.10. Industry Vertical

- 19.7. Israel AI Imaging Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Component

- 19.7.3. Technology

- 19.7.4. Deployment Mode

- 19.7.5. Enterprise Size

- 19.7.6. Imaging Type

- 19.7.7. Imaging Modality

- 19.7.8. Functionality

- 19.7.9. Application

- 19.7.10. Industry Vertical

- 19.8. Rest of Middle East AI Imaging Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Component

- 19.8.3. Technology

- 19.8.4. Deployment Mode

- 19.8.5. Enterprise Size

- 19.8.6. Imaging Type

- 19.8.7. Imaging Modality

- 19.8.8. Functionality

- 19.8.9. Application

- 19.8.10. Industry Vertical

- 20. Africa AI Imaging Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Africa AI Imaging Market Size (Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Component

- 20.3.2. Technology

- 20.3.3. Deployment Mode

- 20.3.4. Enterprise Size

- 20.3.5. Imaging Type

- 20.3.6. Imaging Modality

- 20.3.7. Functionality

- 20.3.8. Application

- 20.3.9. Industry Vertical

- 20.3.10. Country

- 20.3.10.1. South Africa

- 20.3.10.2. Egypt

- 20.3.10.3. Nigeria

- 20.3.10.4. Algeria

- 20.3.10.5. Rest of Africa

- 20.4. South Africa AI Imaging Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Component

- 20.4.3. Technology

- 20.4.4. Deployment Mode

- 20.4.5. Enterprise Size

- 20.4.6. Imaging Type

- 20.4.7. Imaging Modality

- 20.4.8. Functionality

- 20.4.9. Application

- 20.4.10. Industry Vertical

- 20.5. Egypt AI Imaging Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Component

- 20.5.3. Technology

- 20.5.4. Deployment Mode

- 20.5.5. Enterprise Size

- 20.5.6. Imaging Type

- 20.5.7. Imaging Modality

- 20.5.8. Functionality

- 20.5.9. Application

- 20.5.10. Industry Vertical

- 20.6. Nigeria AI Imaging Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Component

- 20.6.3. Technology

- 20.6.4. Deployment Mode

- 20.6.5. Enterprise Size

- 20.6.6. Imaging Type

- 20.6.7. Imaging Modality

- 20.6.8. Functionality

- 20.6.9. Application

- 20.6.10. Industry Vertical

- 20.7. Algeria AI Imaging Market

- 20.7.1. Country Segmental Analysis

- 20.7.2. Component

- 20.7.3. Technology

- 20.7.4. Deployment Mode

- 20.7.5. Enterprise Size

- 20.7.6. Imaging Type

- 20.7.7. Imaging Modality

- 20.7.8. Functionality

- 20.7.9. Application

- 20.7.10. Industry Vertical

- 20.8. Rest of Africa AI Imaging Market

- 20.8.1. Country Segmental Analysis

- 20.8.2. Component

- 20.8.3. Technology

- 20.8.4. Deployment Mode

- 20.8.5. Enterprise Size

- 20.8.6. Imaging Type

- 20.8.7. Imaging Modality

- 20.8.8. Functionality

- 20.8.9. Application

- 20.8.10. Industry Vertical

- 21. South America AI Imaging Market Analysis

- 21.1. Key Segment Analysis

- 21.2. Regional Snapshot

- 21.3. South America AI Imaging Market Size (Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 21.3.1. Component

- 21.3.2. Technology

- 21.3.3. Deployment Mode

- 21.3.4. Enterprise Size

- 21.3.5. Imaging Type

- 21.3.6. Imaging Modality

- 21.3.7. Functionality

- 21.3.8. Application

- 21.3.9. Industry Vertical

- 21.3.10. Country

- 21.3.10.1. Brazil

- 21.3.10.2. Argentina

- 21.3.10.3. Rest of South America

- 21.4. Brazil AI Imaging Market

- 21.4.1. Country Segmental Analysis

- 21.4.2. Component

- 21.4.3. Technology

- 21.4.4. Deployment Mode

- 21.4.5. Enterprise Size

- 21.4.6. Imaging Type

- 21.4.7. Imaging Modality

- 21.4.8. Functionality

- 21.4.9. Application

- 21.4.10. Industry Vertical

- 21.5. Argentina AI Imaging Market

- 21.5.1. Country Segmental Analysis

- 21.5.2. Component

- 21.5.3. Technology

- 21.5.4. Deployment Mode

- 21.5.5. Enterprise Size

- 21.5.6. Imaging Type

- 21.5.7. Imaging Modality

- 21.5.8. Functionality

- 21.5.9. Application

- 21.5.10. Industry Vertical

- 21.6. Rest of South America AI Imaging Market

- 21.6.1. Country Segmental Analysis

- 21.6.2. Component

- 21.6.3. Technology

- 21.6.4. Deployment Mode

- 21.6.5. Enterprise Size

- 21.6.6. Imaging Type

- 21.6.7. Imaging Modality

- 21.6.8. Functionality

- 21.6.9. Application

- 21.6.10. Industry Vertical

- 22. Key Players/ Company Profile

- 22.1. Aidoc Medical Ltd.

- 22.1.1. Company Details/ Overview

- 22.1.2. Company Financials

- 22.1.3. Key Customers and Competitors

- 22.1.4. Business/ Industry Portfolio

- 22.1.5. Product Portfolio/ Specification Details

- 22.1.6. Pricing Data

- 22.1.7. Strategic Overview

- 22.1.8. Recent Developments

- 22.2. Arterys Inc.

- 22.3. Butterfly Network Inc.

- 22.4. Canon Medical Systems Corporation

- 22.5. DeepMind Technologies (Alphabet Inc.)

- 22.6. Enlitic, Inc.

- 22.7. Fujifilm Holdings Corporation

- 22.8. GE HealthCare Technologies Inc.

- 22.9. HeartFlow, Inc.

- 22.10. IBM Corporation

- 22.11. Intel Corporation

- 22.12. Lunit Inc.

- 22.13. NVIDIA Corporation

- 22.14. Oxipit UAB

- 22.15. Perimeter Medical Imaging AI, Inc.

- 22.16. Philips Healthcare

- 22.17. Samsung Medison Co., Ltd.

- 22.18. Siemens Healthineers AG

- 22.19. Viz.ai Inc.

- 22.20. Zebra Medical Vision Ltd.

- 22.21. Others Key Players

- 22.1. Aidoc Medical Ltd.

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data