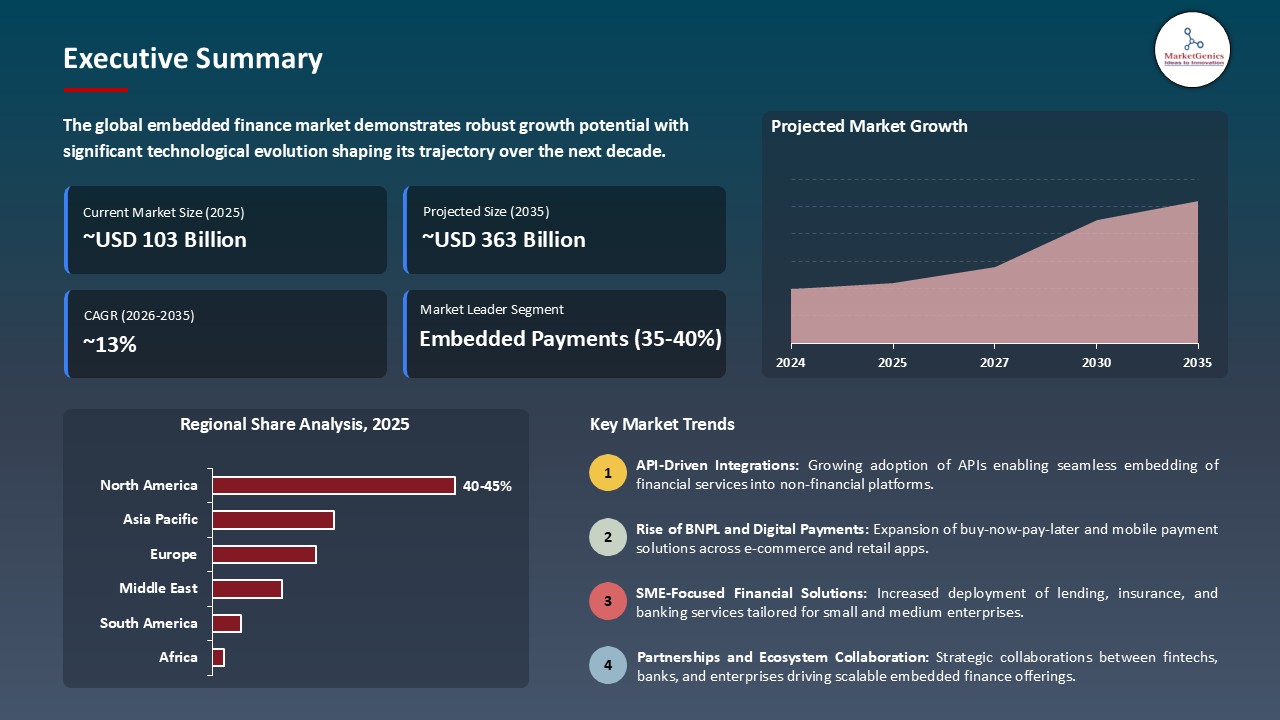

- The global embedded finance market is valued at USD 103.1 billion in 2025.

- The market is projected to grow at a CAGR of 13.4% during the forecast period of 2026 to 2035.

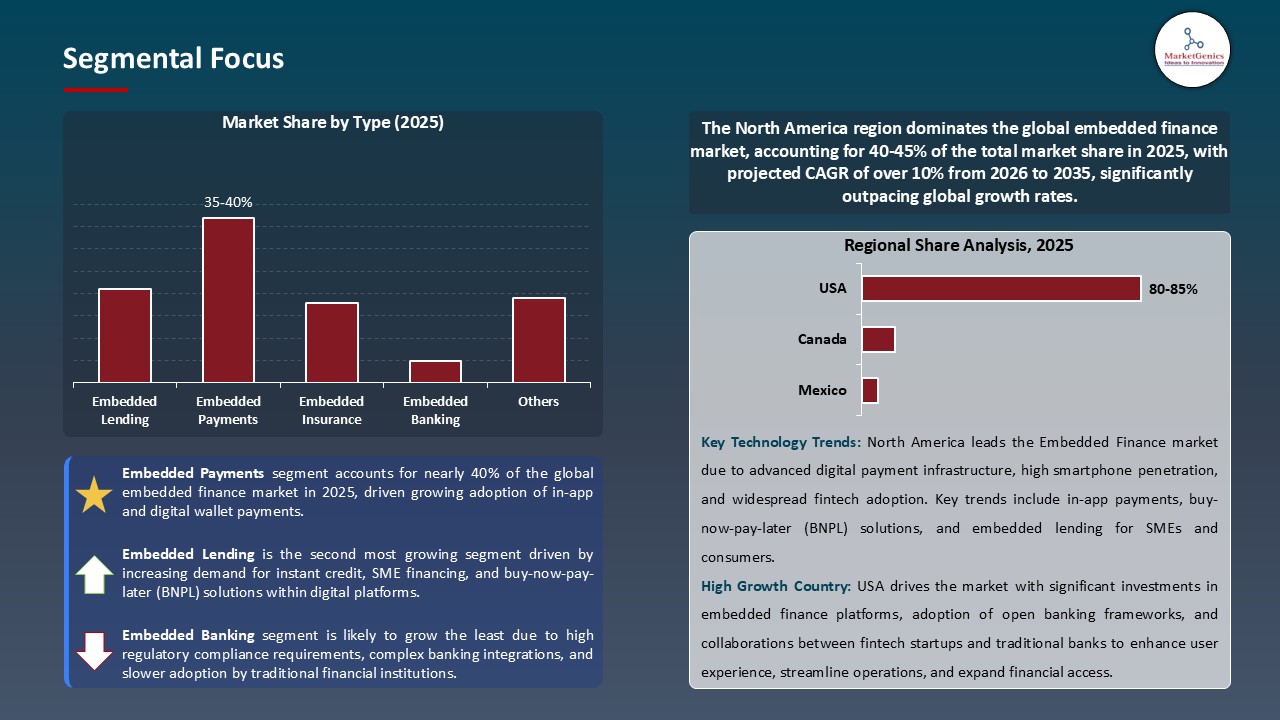

- The embedded payments segment accounts for ~37% of the global embedded finance market in 2025, driven by the expanding use of payment solutions for smooth transactions in digital platforms, ride-hailing, and e-commerce.

- As companies and regulators embrace digital-first financial models to improve accessibility and efficiency, the embedded finance market is growing.

- Real-time data analytics, open banking, and API-driven platforms are enhancing scalability and transparency throughout financial ecosystems.

- The global embedded-finance-market is highly consolidated, with the top five players accounting for over 60% of the market share in 2025.

- In July 2025, Stripe, Inc. released its Embedded Finance Hub, a comprehensive API platform that allows non-financial companies to seamlessly embed payments, lending, and treasury management.

- In October 2025, Mastercard Incorporated launched the Open Finance Connect framework, providing cross-border embedded finance integration among banks, fintechs, and digital platforms.

- Global embedded finance market is likely to create the total forecasting opportunity of USD 260.5 Bn till 2035

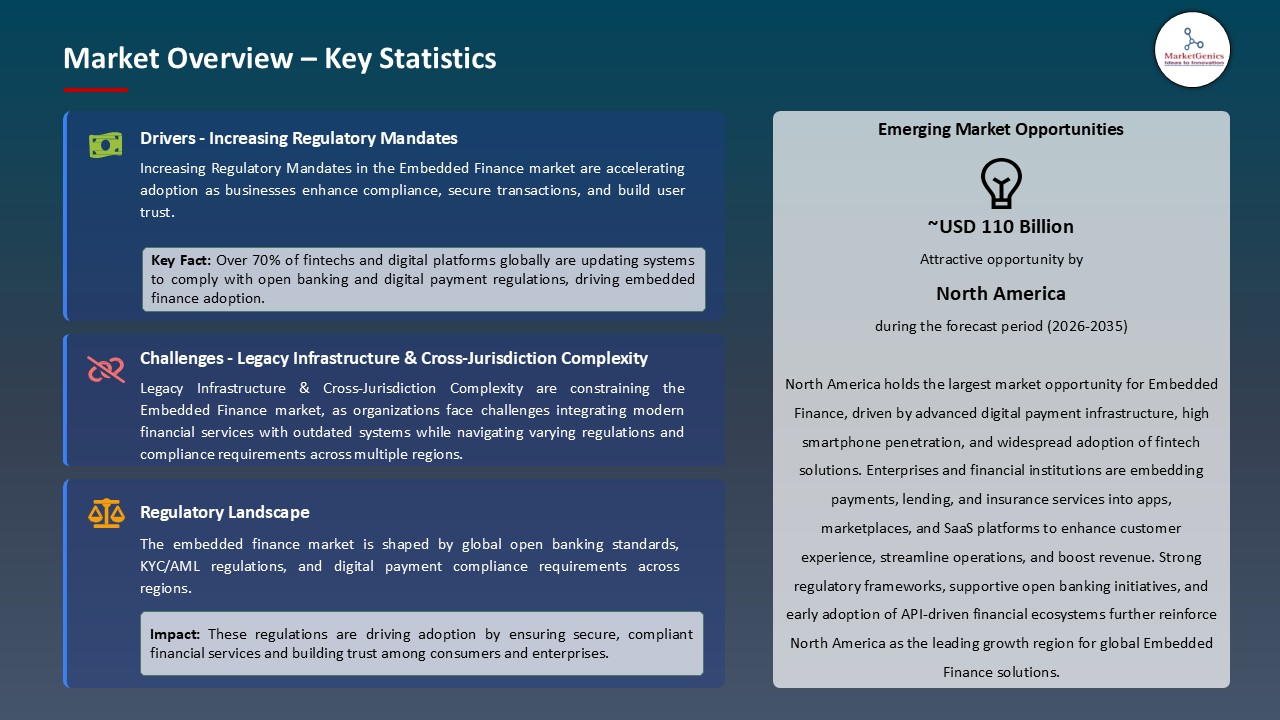

- North America is most attractive region, due to fast-paced innovation in fintech, an advanced API infrastructure, and supportive regulatory environment.

- The advancement of embedded finance is being influenced by changing global regulatory practices: i.e., the eIDAS 2.0 regime in Europe (Regulation (EU) 2024/1183) will introduce cross-border digital identity wallets and stronger authentication standards - stimulating financial-service providers to embed in their service offerings a higher assurance identity verification process.

- Frameworks (i.e., DORA; Digital Operational Resilience Act in the EU, and similar initiatives in Asia-Pacific and North America on resilience / fintech-regulation) create operational-risk, fraud prevention, and cyber-resilience obligations for providers, which weaves identity, trust frameworks, and compliance automation into embedded finance infrastructure.

- Moreover, consumers increasingly access banking, insurance, lending, and other fintech-enabled utilities through digital platforms - fulfilling the privacy / data-sovereignty mandates (e.g., GDPR; as well as local specific data localization laws) requires seamlessly embedded identity proofing in embedded finance flows - while satisfying obligations for legal compliance without compromising the user experience.

- Even with regulatory pressure, many companies (those with legacy systems such as traditional banks or large retail chains or a technology or platform provider) must manage the complexity of the embedded financial modules with legacy identity / KYC systems not designed for an API-first identity / KYC orchestration that is time-consuming, complex, and expensive.

- Building a federated or decentralized identity (or a conformant identity flow to a trust framework) still may require heavy lifting for companies in security API infrastructure, encryption / key-management services, cross-border legal agreements, and cross-platform verification logic to enable KYC or similar transaction remediation behaviors. This remains a difficult engagement for smaller fintechs and SMEs, who often do not have the budget / legal protection to comply with multiple jurisdictions at the same time.

- Lastly, this results in a trade-off between high assurance in identity / fraud risk, and the UX to create frictionless engagement. Too much friction produces drop-offs; too little friction creates too much compliance risk. Creating the right balance is still a hurdle to implementation in many jurisdictions.

- In many developing economies (Asia, Africa, Latin America), governments are launching or expanding digital identity or “e-Government / digital-ID” programs (for example Aadhaar in India, or other national ID schemes). These same identity systems can serve as a basis upon which embedded finance (payments, micro-lending, insurance) can be layered directly into platforms that citizens already engage with.

- Partnerships between telecom / mobile-wallet providers, ID-infrastructure providers, and fintech / platform integrators, present fertile ground for Identity-as-a-Service (IDaaS), biometric-verification modules, and trust framework integrations connected to embedded finance offerings.

- This creates opportunity for new trust frameworks, or identity-wallet based onboarding flows (e.g. digital-ID based KYC), for lower-cost, scalable access to embedded payments, credit / lending, or insurance modules, for previously under-banked populations.

- In growing numbers, embedded finance platforms are implementing biometric verification (face / fingerprint / device-based sensors), behavioral fraud-scoring powered by AI / ML, and risk-profiling engines directly into their onboarding & transaction workflows - decreasing fraud and creating increased conversion.

- Verifiable credentials, digital identity wallets (such as those enabled under eIDAS 2.0), decentralized identity (self-sovereign identity) concepts, and cryptographic proofing (for example zero-knowledge proofs, selective disclosure) are being integrated into embedded finance APIs to provide users with more control over identity data, while maintaining higher compliance assurance.

- Real-time identity / score-based gating (for payments / lending / credit / insurance) is quickly becoming customizable: identity verification is no longer a one-time step, but becomes an ongoing compliance, risk & lifecycle management step for embedded finance services.

- Retail, e-commerce, mobility, and gig platforms are rapidly adding payment capability into their ecosystems to enrich the checkout and transaction experience for their users. For example, in 2025, Walmart collaborated with JPMorgan Chase to integrate embedded payment and cash-flow solutions for marketplace sellers, reinforcing how embedded payments are becoming commonplace standards for digital platforms.

- With the combination of API-based payment gateways, open banking, and AI-enabled risk management solutions, payment systems now enable real-time settlements and automated reconciliation. Fintech companies such as Stripe, Adyen, and PayPal are continually enhancing their APIs for instant payments and cross-border payments using new models such as scheduling payments or subscription payments across multiple industry sectors.

- Initiatives like the EU’s PSD3 regulation and India’s UPI framework are accelerating the pace of embedded payment solutions that meet security, interoperability, and regulatory requirements to create open and frictionless, embedded financial ecosystems.

- The inclusion of AI and analytics into payment tech is driving improved fraud detection, transaction scoring, and personalized user experiences. Today's embedded payments serve not merely as a convenience feature, but also as a significant source of customer engagement and monetization. Current payment orchestration and Banking-as-a-Service solutions have lowered the cost and technical barriers for businesses to initiate embedded payments, converting digital platforms into holistic financial ecosystems.

- North America is well-positioned to lead embedded finance innovation, largely due to fast-paced innovation in fintech, an advanced API infrastructure, and supportive regulatory environment. The United States has become a global leader in embedded payment, embedding lending, and embedded insurance platforms, thanks in part to a significant amount of venture capital funding and an open banking framework that mandates interoperability and secure data sharing.

- Major technology and finance companies including Stripe, Plaid, Goldman Sachs, and Apple are broadening their embedded finance offerings in retail, e-commerce, and enterprise ecosystems. Partnerships between banks and fintech companies are also driving innovation in areas like real-time payments, credit issuance, and financial automation for consumers and businesses.

- The regulators in the region (for example, the U.S. Office of the Comptroller of the Currency (OCC) and the Consumer Financial Protection Bureau (CFPB)) are moving towards an open finance regulatory framework that enhances transparency, consumer protections, and promotes responsible innovation. The regulatory clarity achieved as a result of these advancements is now allowing fintechs and other non-financial companies to scale embedded financial products. The Canadian Department of Finance and the Innovation, Science and Economic Development (ISED) Canada are in the process of facilitating an open banking structure as well, aligned with efforts in the U.S. in facilitating cross-border finance.

- A strong emphasis on investment in risk management for AI and infrastructure required for digital tools keeps the North America region at the leading edge of embedded finance market.

- In July 2025, Stripe, Inc. released its Embedded Finance Hub, a comprehensive API platform that allows non-financial companies to seamlessly embed payments, lending, and treasury management into their digital experience. Using AI-based risk scoring and real-time compliance monitoring, the platform streamlines onboarding and reduces fraud while bolstering transaction efficiency and transparency in global markets.

- In October 2025, Mastercard Incorporated launched the Open Finance Connect framework, providing cross-border embedded finance integration among banks, fintechs, and digital platforms. Using secure API protocols and advanced data tokenization, the framework allows interoperability among financial services and personalized financial service offerings, safeguards consumer data privacy, and enhances innovation efforts across the embedded payment and credit ecosystems.

- United States

- Canada

- Mexico

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic Countries

- Poland

- Russia & CIS

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Turkey

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Nigeria

- Algeria

- Brazil

- Argentina

- Adyen N.V.

- Alviere Inc.

- Cross River Bank

- Marqeta, Inc.

- FIS (Fidelity National Information Services, Inc.)

- Fiserv, Inc.

- Square, Inc. (Block, Inc.)

- Goldman Sachs Group, Inc.

- JPMorgan Chase & Co.

- Mambu GmbH

- Stripe, Inc.

- Mastercard Incorporated

- PayPal Holdings, Inc.

- Plaid Inc.

- Visa Inc.

- Railsr (formerly Railsbank)

- Rapyd Financial Network Ltd.

- Solaris SE

- Thought Machine Group Limited

- TrueLayer Ltd.

- Others Key Players

- Embedded Payments

- Embedded Lending

- Embedded Insurance

- Embedded Investment

- Embedded Banking

- Others

- Platforms

- Services

- Consulting Services

- Integration & Deployment

- Support & Maintenance

- Cloud-Based

- On-Premises

- B2B (Business-to-Business)

- B2C (Business-to-Consumer)

- B2B2C (Business-to-Business-to-Consumer)

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- API-based Platforms

- AI & Machine Learning Integration

- Blockchain & Smart Contracts

- Cloud Computing

- Others

- Online

- Mobile

- Point-of-Sale (POS)

- Payments & Money Transfers

- Buy Now Pay Later (BNPL)

- Insurance Distribution

- Investment & Wealth Management

- Digital Wallets

- Others

- Retail & E-commerce

- BFSI

- Healthcare

- Travel & Hospitality

- Transportation & Logistics

- IT & Telecommunications

- Manufacturing

- Others

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Embedded Finance Market Outlook

- 2.1.1. Embedded Finance Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Embedded Finance Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Information Technology & Media Ecosystem Overview, 2025

- 3.1.1. Information Technology & Media Industry Analysis

- 3.1.2. Key Trends for Information Technology & Media Industry

- 3.1.3. Regional Distribution for Information Technology & Media Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.1. Global Information Technology & Media Ecosystem Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for seamless and integrated financial services within non-financial platforms

- 4.1.1.2. Growing adoption of in-app payments, embedded lending, and insurance solutions

- 4.1.1.3. Increasing regulatory requirements for open banking, KYC/AML, and digital payment compliance

- 4.1.2. Restraints

- 4.1.2.1. High implementation and integration costs of embedded financial solutions

- 4.1.2.2. Challenges in integrating with legacy banking systems and diverse digital platforms

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Platform Developers

- 4.4.2. System Integrators/ Technology Providers

- 4.4.3. Embedded Finance Solution Providers

- 4.4.4. End Users

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Embedded Finance Market Demand

- 4.9.1. Historical Market Size –Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size –Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Embedded Finance Market Analysis, by Type

- 6.1. Key Segment Analysis

- 6.2. Embedded Finance Market Size (Value - US$ Bn), Analysis, and Forecasts, by Type, 2021-2035

- 6.2.1. Embedded Payments

- 6.2.2. Embedded Lending

- 6.2.3. Embedded Insurance

- 6.2.4. Embedded Investment

- 6.2.5. Embedded Banking

- 6.2.6. Others

- 7. Global Embedded Finance Market Analysis, by Component

- 7.1. Key Segment Analysis

- 7.2. Embedded Finance Market Size (Value - US$ Bn), Analysis, and Forecasts, by Component, 2021-2035

- 7.2.1. Platforms

- 7.2.2. Services

- 7.2.2.1. Consulting Services

- 7.2.2.2. Integration & Deployment

- 7.2.2.3. Support & Maintenance

- 8. Global Embedded Finance Market Analysis, by Deployment Mode

- 8.1. Key Segment Analysis

- 8.2. Embedded Finance Market Size (Value - US$ Bn), Analysis, and Forecasts, by Deployment Mode, 2021-2035

- 8.2.1. Cloud-Based

- 8.2.2. On-Premises

- 9. Global Embedded Finance Market Analysis, by Business Model

- 9.1. Key Segment Analysis

- 9.2. Embedded Finance Market Size (Value - US$ Bn), Analysis, and Forecasts, by Business Model, 2021-2035

- 9.2.1. B2B (Business-to-Business)

- 9.2.2. B2C (Business-to-Consumer)

- 9.2.3. B2B2C (Business-to-Business-to-Consumer)

- 10. Global Embedded Finance Market Analysis, by Enterprise Size

- 10.1. Key Segment Analysis

- 10.2. Embedded Finance Market Size (Value - US$ Bn), Analysis, and Forecasts, by Enterprise Size, 2021-2035

- 10.2.1. Small and Medium Enterprises (SMEs)

- 10.2.2. Large Enterprises

- 11. Global Embedded Finance Market Analysis, by Technology

- 11.1. Key Segment Analysis

- 11.2. Embedded Finance Market Size (Value - US$ Bn), Analysis, and Forecasts, by Technology, 2021-2035

- 11.2.1. API-based Platforms

- 11.2.2. AI & Machine Learning Integration

- 11.2.3. Blockchain & Smart Contracts

- 11.2.4. Cloud Computing

- 11.2.5. Others

- 12. Global Embedded Finance Market Analysis, by Payment Channel

- 12.1. Key Segment Analysis

- 12.2. Embedded Finance Market Size (Value - US$ Bn), Analysis, and Forecasts, by Payment Channel, 2021-2035

- 12.2.1. Online

- 12.2.2. Mobile

- 12.2.3. Point-of-Sale (POS)

- 13. Global Embedded Finance Market Analysis, by Application

- 13.1. Key Segment Analysis

- 13.2. Embedded Finance Market Size (Value - US$ Bn), Analysis, and Forecasts, by Application, 2021-2035

- 13.2.1. Payments & Money Transfers

- 13.2.2. Buy Now Pay Later (BNPL)

- 13.2.3. Insurance Distribution

- 13.2.4. Investment & Wealth Management

- 13.2.5. Digital Wallets

- 13.2.6. Others

- 14. Global Embedded Finance Market Analysis and Forecasts, by Industry Vertical

- 14.1. Key Findings

- 14.2. Embedded Finance Market Size (Value - US$ Bn), Analysis, and Forecasts, by Industry Vertical, 2021-2035

- 14.2.1. Retail & E-commerce

- 14.2.2. BFSI

- 14.2.3. Healthcare

- 14.2.4. Travel & Hospitality

- 14.2.5. Transportation & Logistics

- 14.2.6. IT & Telecommunications

- 14.2.7. Manufacturing

- 14.2.8. Others

- 15. Global Embedded Finance Market Analysis and Forecasts, by Region

- 15.1. Key Findings

- 15.2. Embedded Finance Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 15.2.1. North America

- 15.2.2. Europe

- 15.2.3. Asia Pacific

- 15.2.4. Middle East

- 15.2.5. Africa

- 15.2.6. South America

- 16. North America Embedded Finance Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. North America Embedded Finance Market Size Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Type

- 16.3.2. Component

- 16.3.3. Deployment Mode

- 16.3.4. Business Model

- 16.3.5. Enterprise Size

- 16.3.6. Technology

- 16.3.7. Payment Channel

- 16.3.8. Application

- 16.3.9. Industry Vertical

- 16.3.10. Country

- 16.3.10.1. USA

- 16.3.10.2. Canada

- 16.3.10.3. Mexico

- 16.4. USA Embedded Finance Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Type

- 16.4.3. Component

- 16.4.4. Deployment Mode

- 16.4.5. Business Model

- 16.4.6. Enterprise Size

- 16.4.7. Technology

- 16.4.8. Payment Channel

- 16.4.9. Application

- 16.4.10. Industry Vertical

- 16.5. Canada Embedded Finance Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Type

- 16.5.3. Component

- 16.5.4. Deployment Mode

- 16.5.5. Business Model

- 16.5.6. Enterprise Size

- 16.5.7. Technology

- 16.5.8. Payment Channel

- 16.5.9. Application

- 16.5.10. Industry Vertical0

- 16.6. Mexico Embedded Finance Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Type

- 16.6.3. Component

- 16.6.4. Deployment Mode

- 16.6.5. Business Model

- 16.6.6. Enterprise Size

- 16.6.7. Technology

- 16.6.8. Payment Channel

- 16.6.9. Application

- 16.6.10. Industry Vertical

- 17. Europe Embedded Finance Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Europe Embedded Finance Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Type

- 17.3.2. Component

- 17.3.3. Deployment Mode

- 17.3.4. Business Model

- 17.3.5. Enterprise Size

- 17.3.6. Technology

- 17.3.7. Payment Channel

- 17.3.8. Application

- 17.3.9. Industry Vertical

- 17.3.10. Country

- 17.3.10.1. Germany

- 17.3.10.2. United Kingdom

- 17.3.10.3. France

- 17.3.10.4. Italy

- 17.3.10.5. Spain

- 17.3.10.6. Netherlands

- 17.3.10.7. Nordic Countries

- 17.3.10.8. Poland

- 17.3.10.9. Russia & CIS

- 17.3.10.10. Rest of Europe

- 17.4. Germany Embedded Finance Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Type

- 17.4.3. Component

- 17.4.4. Deployment Mode

- 17.4.5. Business Model

- 17.4.6. Enterprise Size

- 17.4.7. Technology

- 17.4.8. Payment Channel

- 17.4.9. Application

- 17.4.10. Industry Vertical

- 17.5. United Kingdom Embedded Finance Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Type

- 17.5.3. Component

- 17.5.4. Deployment Mode

- 17.5.5. Business Model

- 17.5.6. Enterprise Size

- 17.5.7. Technology

- 17.5.8. Payment Channel

- 17.5.9. Application

- 17.5.10. Industry Vertical

- 17.6. France Embedded Finance Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Type

- 17.6.3. Component

- 17.6.4. Deployment Mode

- 17.6.5. Business Model

- 17.6.6. Enterprise Size

- 17.6.7. Technology

- 17.6.8. Payment Channel

- 17.6.9. Application

- 17.6.10. Industry Vertical

- 17.7. Italy Embedded Finance Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Type

- 17.7.3. Component

- 17.7.4. Deployment Mode

- 17.7.5. Business Model

- 17.7.6. Enterprise Size

- 17.7.7. Technology

- 17.7.8. Payment Channel

- 17.7.9. Application

- 17.7.10. Industry Vertical0

- 17.8. Spain Embedded Finance Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Type

- 17.8.3. Component

- 17.8.4. Deployment Mode

- 17.8.5. Business Model

- 17.8.6. Enterprise Size

- 17.8.7. Technology

- 17.8.8. Payment Channel

- 17.8.9. Application

- 17.8.10. Industry Vertical0

- 17.9. Netherlands Embedded Finance Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Type

- 17.9.3. Component

- 17.9.4. Deployment Mode

- 17.9.5. Business Model

- 17.9.6. Enterprise Size

- 17.9.7. Technology

- 17.9.8. Payment Channel

- 17.9.9. Application

- 17.9.10. Industry Vertical

- 17.10. Nordic Countries Embedded Finance Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Type

- 17.10.3. Component

- 17.10.4. Deployment Mode

- 17.10.5. Business Model

- 17.10.6. Enterprise Size

- 17.10.7. Technology

- 17.10.8. Payment Channel

- 17.10.9. Application

- 17.10.10. Industry Vertical

- 17.11. Poland Embedded Finance Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Type

- 17.11.3. Component

- 17.11.4. Deployment Mode

- 17.11.5. Business Model

- 17.11.6. Enterprise Size

- 17.11.7. Technology

- 17.11.8. Payment Channel

- 17.11.9. Application

- 17.11.10. Industry Vertical

- 17.12. Russia & CIS Embedded Finance Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Type

- 17.12.3. Component

- 17.12.4. Deployment Mode

- 17.12.5. Business Model

- 17.12.6. Enterprise Size

- 17.12.7. Technology

- 17.12.8. Payment Channel

- 17.12.9. Application

- 17.12.10. Industry Vertical

- 17.13. Rest of Europe Embedded Finance Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Type

- 17.13.3. Component

- 17.13.4. Deployment Mode

- 17.13.5. Business Model

- 17.13.6. Enterprise Size

- 17.13.7. Technology

- 17.13.8. Payment Channel

- 17.13.9. Application

- 17.13.10. Industry Vertical

- 18. Asia Pacific Embedded Finance Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Asia Pacific Embedded Finance Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Type

- 18.3.2. Component

- 18.3.3. Deployment Mode

- 18.3.4. Business Model

- 18.3.5. Enterprise Size

- 18.3.6. Technology

- 18.3.7. Payment Channel

- 18.3.8. Application

- 18.3.9. Industry Vertical

- 18.3.10. Country

- 18.3.10.1. China

- 18.3.10.2. India

- 18.3.10.3. Japan

- 18.3.10.4. South Korea

- 18.3.10.5. Australia and New Zealand

- 18.3.10.6. Indonesia

- 18.3.10.7. Malaysia

- 18.3.10.8. Thailand

- 18.3.10.9. Vietnam

- 18.3.10.10. Rest of Asia Pacific

- 18.4. China Embedded Finance Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Type

- 18.4.3. Component

- 18.4.4. Deployment Mode

- 18.4.5. Business Model

- 18.4.6. Enterprise Size

- 18.4.7. Technology

- 18.4.8. Payment Channel

- 18.4.9. Application

- 18.4.10. Industry Vertical

- 18.5. India Embedded Finance Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Type

- 18.5.3. Component

- 18.5.4. Deployment Mode

- 18.5.5. Business Model

- 18.5.6. Enterprise Size

- 18.5.7. Technology

- 18.5.8. Payment Channel

- 18.5.9. Application

- 18.5.10. Industry Vertical

- 18.6. Japan Embedded Finance Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Type

- 18.6.3. Component

- 18.6.4. Deployment Mode

- 18.6.5. Business Model

- 18.6.6. Enterprise Size

- 18.6.7. Technology

- 18.6.8. Payment Channel

- 18.6.9. Application

- 18.6.10. Industry Vertical

- 18.7. South Korea Embedded Finance Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Type

- 18.7.3. Component

- 18.7.4. Deployment Mode

- 18.7.5. Business Model

- 18.7.6. Enterprise Size

- 18.7.7. Technology

- 18.7.8. Payment Channel

- 18.7.9. Application

- 18.7.10. Industry Vertical

- 18.8. Australia and New Zealand Embedded Finance Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Type

- 18.8.3. Component

- 18.8.4. Deployment Mode

- 18.8.5. Business Model

- 18.8.6. Enterprise Size

- 18.8.7. Technology

- 18.8.8. Payment Channel

- 18.8.9. Application

- 18.8.10. Industry Vertical

- 18.9. Indonesia Embedded Finance Market

- 18.9.1. Country Segmental Analysis

- 18.9.2. Type

- 18.9.3. Component

- 18.9.4. Deployment Mode

- 18.9.5. Business Model

- 18.9.6. Enterprise Size

- 18.9.7. Technology

- 18.9.8. Payment Channel

- 18.9.9. Application

- 18.9.10. Industry Vertical

- 18.10. Malaysia Embedded Finance Market

- 18.10.1. Country Segmental Analysis

- 18.10.2. Type

- 18.10.3. Component

- 18.10.4. Deployment Mode

- 18.10.5. Business Model

- 18.10.6. Enterprise Size

- 18.10.7. Technology

- 18.10.8. Payment Channel

- 18.10.9. Application

- 18.10.10. Industry Vertical

- 18.11. Thailand Embedded Finance Market

- 18.11.1. Country Segmental Analysis

- 18.11.2. Type

- 18.11.3. Component

- 18.11.4. Deployment Mode

- 18.11.5. Business Model

- 18.11.6. Enterprise Size

- 18.11.7. Technology

- 18.11.8. Payment Channel

- 18.11.9. Application

- 18.11.10. Industry Vertical

- 18.12. Vietnam Embedded Finance Market

- 18.12.1. Country Segmental Analysis

- 18.12.2. Type

- 18.12.3. Component

- 18.12.4. Deployment Mode

- 18.12.5. Business Model

- 18.12.6. Enterprise Size

- 18.12.7. Technology

- 18.12.8. Payment Channel

- 18.12.9. Application

- 18.12.10. Industry Vertical

- 18.13. Rest of Asia Pacific Embedded Finance Market

- 18.13.1. Country Segmental Analysis

- 18.13.2. Type

- 18.13.3. Component

- 18.13.4. Deployment Mode

- 18.13.5. Business Model

- 18.13.6. Enterprise Size

- 18.13.7. Technology

- 18.13.8. Payment Channel

- 18.13.9. Application

- 18.13.10. Industry Vertical

- 19. Middle East Embedded Finance Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Middle East Embedded Finance Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Type

- 19.3.2. Component

- 19.3.3. Deployment Mode

- 19.3.4. Business Model

- 19.3.5. Enterprise Size

- 19.3.6. Technology

- 19.3.7. Payment Channel

- 19.3.8. Application

- 19.3.9. Industry Vertical

- 19.3.10. Country

- 19.3.10.1. Turkey

- 19.3.10.2. UAE

- 19.3.10.3. Saudi Arabia

- 19.3.10.4. Israel

- 19.3.10.5. Rest of Middle East

- 19.4. Turkey Embedded Finance Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Type

- 19.4.3. Component

- 19.4.4. Deployment Mode

- 19.4.5. Business Model

- 19.4.6. Enterprise Size

- 19.4.7. Technology

- 19.4.8. Payment Channel

- 19.4.9. Application

- 19.4.10. Industry Vertical

- 19.5. UAE Embedded Finance Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Type

- 19.5.3. Component

- 19.5.4. Deployment Mode

- 19.5.5. Business Model

- 19.5.6. Enterprise Size

- 19.5.7. Technology

- 19.5.8. Payment Channel

- 19.5.9. Application

- 19.5.10. Industry Vertical

- 19.6. Saudi Arabia Embedded Finance Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Type

- 19.6.3. Component

- 19.6.4. Deployment Mode

- 19.6.5. Business Model

- 19.6.6. Enterprise Size

- 19.6.7. Technology

- 19.6.8. Payment Channel

- 19.6.9. Application

- 19.6.10. Industry Vertical

- 19.7. Israel Embedded Finance Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Type

- 19.7.3. Component

- 19.7.4. Deployment Mode

- 19.7.5. Business Model

- 19.7.6. Enterprise Size

- 19.7.7. Technology

- 19.7.8. Payment Channel

- 19.7.9. Application

- 19.7.10. Industry Vertical

- 19.8. Rest of Middle East Embedded Finance Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Type

- 19.8.3. Component

- 19.8.4. Deployment Mode

- 19.8.5. Business Model

- 19.8.6. Enterprise Size

- 19.8.7. Technology

- 19.8.8. Payment Channel

- 19.8.9. Application

- 19.8.10. Industry Vertical

- 20. Africa Embedded Finance Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Africa Embedded Finance Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Type

- 20.3.2. Component

- 20.3.3. Deployment Mode

- 20.3.4. Business Model

- 20.3.5. Enterprise Size

- 20.3.6. Technology

- 20.3.7. Payment Channel

- 20.3.8. Application

- 20.3.9. Industry Vertical

- 20.3.10. Country

- 20.3.10.1. South Africa

- 20.3.10.2. Egypt

- 20.3.10.3. Nigeria

- 20.3.10.4. Algeria

- 20.3.10.5. Rest of Africa

- 20.4. South Africa Embedded Finance Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Type

- 20.4.3. Component

- 20.4.4. Deployment Mode

- 20.4.5. Business Model

- 20.4.6. Enterprise Size

- 20.4.7. Technology

- 20.4.8. Payment Channel

- 20.4.9. Application

- 20.4.10. Industry Vertical

- 20.5. Egypt Embedded Finance Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Type

- 20.5.3. Component

- 20.5.4. Deployment Mode

- 20.5.5. Business Model

- 20.5.6. Enterprise Size

- 20.5.7. Technology

- 20.5.8. Payment Channel

- 20.5.9. Application

- 20.5.10. Industry Vertical

- 20.6. Nigeria Embedded Finance Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Type

- 20.6.3. Component

- 20.6.4. Deployment Mode

- 20.6.5. Business Model

- 20.6.6. Enterprise Size

- 20.6.7. Technology

- 20.6.8. Payment Channel

- 20.6.9. Application

- 20.6.10. Industry Vertical

- 20.7. Algeria Embedded Finance Market

- 20.7.1. Country Segmental Analysis

- 20.7.2. Type

- 20.7.3. Component

- 20.7.4. Deployment Mode

- 20.7.5. Business Model

- 20.7.6. Enterprise Size

- 20.7.7. Technology

- 20.7.8. Payment Channel

- 20.7.9. Application

- 20.7.10. Industry Vertical

- 20.8. Rest of Africa Embedded Finance Market

- 20.8.1. Country Segmental Analysis

- 20.8.2. Type

- 20.8.3. Component

- 20.8.4. Deployment Mode

- 20.8.5. Business Model

- 20.8.6. Enterprise Size

- 20.8.7. Technology

- 20.8.8. Payment Channel

- 20.8.9. Application

- 20.8.10. Industry Vertical

- 21. South America Embedded Finance Market Analysis

- 21.1. Key Segment Analysis

- 21.2. Regional Snapshot

- 21.3. South America Embedded Finance Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 21.3.1. Type

- 21.3.2. Component

- 21.3.3. Deployment Mode

- 21.3.4. Business Model

- 21.3.5. Enterprise Size

- 21.3.6. Technology

- 21.3.7. Payment Channel

- 21.3.8. Application

- 21.3.9. Industry Vertical

- 21.3.10. Country

- 21.3.10.1. Brazil

- 21.3.10.2. Argentina

- 21.3.10.3. Rest of South America

- 21.4. Brazil Embedded Finance Market

- 21.4.1. Country Segmental Analysis

- 21.4.2. Type

- 21.4.3. Component

- 21.4.4. Deployment Mode

- 21.4.5. Business Model

- 21.4.6. Enterprise Size

- 21.4.7. Technology

- 21.4.8. Payment Channel

- 21.4.9. Application

- 21.4.10. Industry Vertical

- 21.5. Argentina Embedded Finance Market

- 21.5.1. Country Segmental Analysis

- 21.5.2. Type

- 21.5.3. Component

- 21.5.4. Deployment Mode

- 21.5.5. Business Model

- 21.5.6. Enterprise Size

- 21.5.7. Technology

- 21.5.8. Payment Channel

- 21.5.9. Application

- 21.5.10. Industry Vertical

- 21.6. Rest of South America Embedded Finance Market

- 21.6.1. Country Segmental Analysis

- 21.6.2. Type

- 21.6.3. Component

- 21.6.4. Deployment Mode

- 21.6.5. Business Model

- 21.6.6. Enterprise Size

- 21.6.7. Technology

- 21.6.8. Payment Channel

- 21.6.9. Application

- 21.6.10. Industry Vertical

- 22. Key Players/ Company Profile

- 22.1. Adyen N.V.

- 22.1.1. Company Details/ Overview

- 22.1.2. Company Financials

- 22.1.3. Key Customers and Competitors

- 22.1.4. Business/ Industry Portfolio

- 22.1.5. Product Portfolio/ Specification Details

- 22.1.6. Pricing Data

- 22.1.7. Strategic Overview

- 22.1.8. Recent Developments

- 22.2. Alviere Inc.

- 22.3. Cross River Bank

- 22.4. FIS (Fidelity National Information Services, Inc.)

- 22.5. Fiserv, Inc.

- 22.6. Goldman Sachs Group, Inc.

- 22.7. JPMorgan Chase & Co.

- 22.8. Mambu GmbH

- 22.9. Marqeta, Inc.

- 22.10. Mastercard Incorporated

- 22.11. PayPal Holdings, Inc.

- 22.12. Plaid Inc.

- 22.13. Railsr (formerly Railsbank)

- 22.14. Rapyd Financial Network Ltd.

- 22.15. Solaris SE

- 22.16. Square, Inc. (Block, Inc.)

- 22.17. Stripe, Inc.

- 22.18. Thought Machine Group Limited

- 22.19. TrueLayer Ltd.

- 22.20. Visa Inc.

- 22.21. Others Key Players

- 22.1. Adyen N.V.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Insightified

Mid-to-large firms spend $20K–$40K quarterly on systematic research and typically recover multiples through improved growth and profitability

Research is no longer optional. Leading firms use it to uncover $10M+ in hidden revenue opportunities annually

Our research-consulting programs yields measurable ROI: 20–30% revenue increases from new markets, 11% profit upticks from pricing, and 20–30% cost savings from operations

Embedded Finance Market Size, Share & Trends Analysis Report by Type (Embedded Payments, Embedded Lending, Embedded Insurance, Embedded Investment, Embedded Banking and Others), Component, Deployment Mode, Business Model, Enterprise Size, Technology, Payment Channel, Application, Industry Vertical and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

Market Structure & Evolution |

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Embedded Finance Market Size, Share, and Growth

The global embedded finance market is experiencing robust growth, with its estimated value of USD 103.1 billion in the year 2025 and USD 363.6 billion by the period 2035, registering a CAGR of 13.4% during the forecast period.

"The state's Embedded finance has set a new standard for what 'good' means in digital banking — speed, simplicity, and relevance," says Papuna Lezhava, co-founder and CEO of KEEPZ. He stressed that traditional banking models, in order to meet customers' growing expectations for seamless financial experiences in everyday digital journeys, will need to become instant, contextual, and user-focused instead of relying on separate and often laborious processes.

The embedded finance market is rapidly expanding worldwide, driven by various converging forces. Financial and fintech players are rolling out new and versatile embedded finance propositions that both enhance user experience and increase monetization. For example, JPMorgan Chase's partnership with Walmart in mid-2025 to provide payments and cash-flow services to marketplace sellers, which served as a deeper instance of embedded finance and took place deeper than embedding embedded finance practices ultimately.

Concurrently, consumer demand for embedded financial services is increasing as non-financial platforms embed lending, payments, insurance, and banking functionality directly into their apps or ecosystem. This means customer journeys are being redefined by embedding financial capabilities at the moment of need, which reduces friction and grows engagement.

In addition, rapid digitalization of sectors such as e-commerce, mobility, and healthcare vacated new possibilities for embedded lending and payments. Fintechs and larger businesses alike are now using banking-as-a-service (BaaS) approaches to deliver tailored finance experiences without the overhead of building out banking-centric infrastructure.

Tightened regulatory frameworks and increasing need for risk and fraud management, combined with social advances in AI-enabled credit scoring and VaR, have also encouraged companies to facilitate the secure and scalable adoption of embedded fintech solutions. Strategic collaboration/partnerships between incumbent banks, fintechs, and tech partners have aided expanding innovation and reach globally.

Overall, new gradation technologies, regulatory "push," and unprecedented platform consignment and demand for frictionless access to finance solutions have all culminated in a fervent growth of the embedded finance market to now a central plank of many current digital ecosystems and an enabler of financial inclusion worldwide.

Embedded Finance Market Dynamics and Trends

Driver: Increasing Regulatory Mandates Driving Embedded Finance Assurance

Restraint: Legacy Infrastructure & Cross-Jurisdiction Complexity limiting Embedded Finance Widespread Adoption

Opportunity: Emerging Regions & Government-Backed Digital ID Ecosystems

Key Trend: Biometrics, AI-Driven Verification & Trust Frameworks Powering Embedded Finance Growing Embedded Finance Industry

Embedded Finance Market Analysis and Segmental Data

“Embedded Payments Dominates Global Embedded Finance Market amid Surge in Platform-Based Financial Integration"

“North America Leads Embedded Finance Market with Strong Fintech Innovation and Regulatory Support"

Embedded-Finance-Market Ecosystem

The global embedded finance market is becoming more tightly consolidated, driven by companies such as Stripe, Inc., Mastercard Incorporated, Fiserv, Inc., JPMorgan Chase & Co., PayPal Holdings, Inc., and Adyen N.V. These entities are bringing to bear significant market power by utilizing sophisticated API platforms, AI analytics, and a cloud-native architecture that embeds financial services onto ecosystems that are not financially oriented.

Leading players are tackling subsector niches to drive innovation-Marqeta, Inc. is known for customizable card-issuing APIs, Mambu GmbH is known for modular banking platforms, and Plaid Inc. is known for improved real-time data connections and open banking. The specialized affordability of these niches creates an operational efficiency and scalability advantage across verticals.

Government and institutional facilitation will only increase such development. On June 25, 2025, The European Commission announced the launch of an AI-based open finance regulatory sandbox that is designed to engage cross-border testing and experimentation for embedded payment and lending models.

Marketplace leaders continue to emphasize product diversification and integrated solutions that enhance security and operational performance. On Sept 20, 2025, Fiserv launched an AI-based payment orchestration engine that increased transaction accuracy by 32%. This embodies the overall market ethos of innovation, efficiency, and a sustainable pathway for future digital finance.

Recent Development and Strategic Overview:

Report Scope

|

Attribute |

Detail |

|

Market Size in 2025 |

USD 103.1 Bn |

|

Market Forecast Value in 2035 |

USD 363.6 Bn |

|

Growth Rate (CAGR) |

13.4% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

USD Bn for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

Regions and Countries Covered |

|||||

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

|

Embedded-Finance-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Embedded finance Market, By Type |

|

|

Embedded finance Market, By Component |

|

|

Embedded finance Market, By Deployment Mode |

|

|

Embedded finance Market, By Business Model |

|

|

Embedded finance Market, By Enterprise Size |

|

|

Embedded finance Market, By Technology |

|

|

Embedded finance Market, By Payment Channel |

|

|

Embedded finance Market, By Application |

|

|

Embedded finance Market, By Industry Vertical |

|

Frequently Asked Questions

Table of Contents

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

Forecasting Models / Techniques

Multiple Regression Analysis

Time Series Analysis – Seasonal Patterns

Time Series Analysis – Trend Analysis

Expert Opinion – Expert Interviews

Multi-Scenario Development

Time Series Analysis – Moving Averages

Econometric Models

Expert Opinion – Delphi Method

Monte Carlo Simulation

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation