Digital Identity Market Size, Share & Trends Analysis Report by Component (Solutions, Services, Platforms), Authentication Method, Technology, Deployment Type, Enterprise Size, Application, End-User Industry and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

Market Structure & Evolution |

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Digital Identity Market Size, Share, and Growth

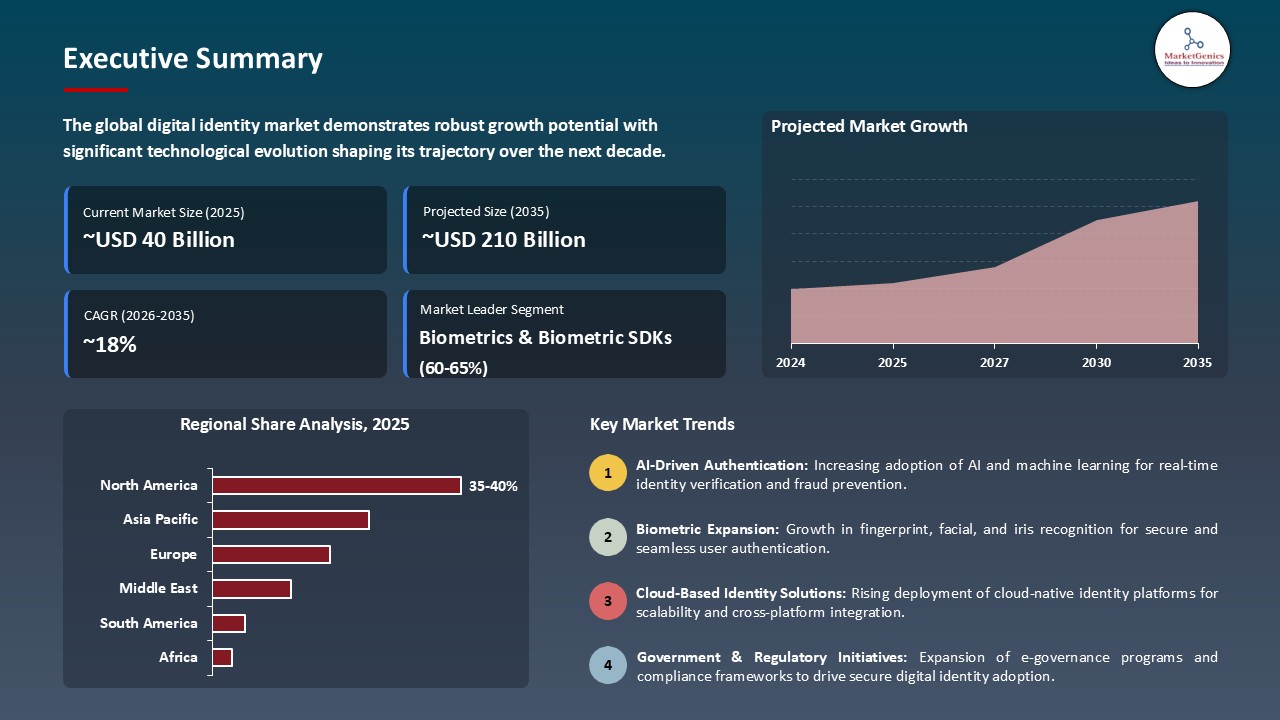

The global digital identity market is experiencing robust growth, with its estimated value of USD 39.8 billion in the year 2025 and USD 210.4 billion by the period 2035, registering a CAGR of 18.1% during the forecast period.

"Identity is security," said Todd McKinnon, co-founder and CEO of Okta. He stressed that identity systems must have connectivity into an organization’s security stack in order to prevent breaches and maintain zero trust resiliency. He further elaborated that as digital interactions proliferate across cloud and AI environments, the identity will still be the underpinning of secure access that protects enterprises and users against increasing levels of cyber malignancy”.

The global digital identity market is experiencing rapid growth due to several key growth factors, including the rising popularity of AI-powered verification solutions, greater regulatory compliance, and new privacy-preserving technologies. In September 2025, Okta announced new AI-based identity lifecycle management capabilities that would improve security and efficiencies for enterprise customers. In Europe, eIDAS 2.0 Regulation 'EU 2024/1183' enforcement will require member states to start rolling out interoperable Digital Identity Wallets in 2026, which will increase levels of trust and authentication in cross-border use cases.

Likewise, the UK’s Digital Identity and Attributes Trust Framework (DIATF) is utilizing certification programs through the BSI to push organizations to meet the new verified identity standards. The convergence of technology, regulatory influence, and digital transformation trends will accelerate the growth of the digital identity market and increase data security, privacy, and usability for the end-user.

Adjacent opportunities include biometrics authentication platforms, decentralized identity, and fraud prevention analytics, along with digital wallet and secure digital identity orchestration systems. Capitalizing on these adjacent markets allows providers to enable trust in digital interactions, expand the digital identity service portfolio, and enhance customer engagement across sectors.

Digital Identity Market Dynamics and Trends

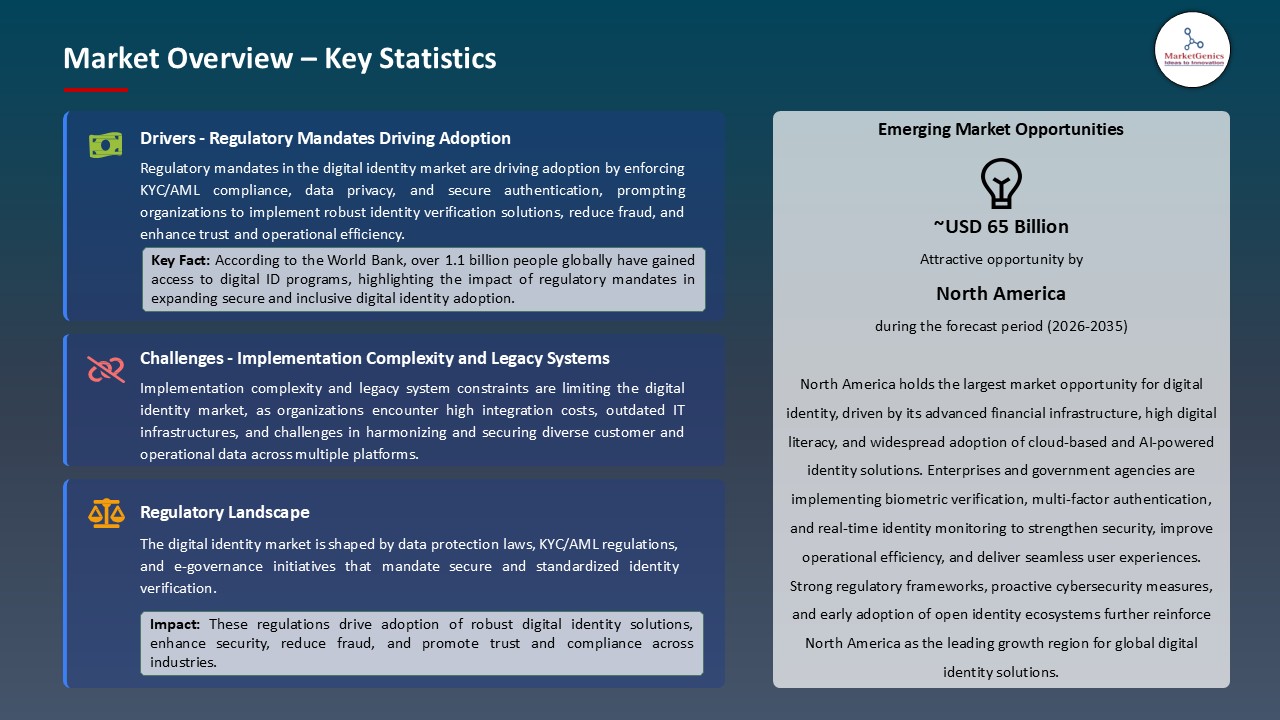

Driver: Increasing Regulatory Mandates Driving Adoption of Advanced Identity Systems

- The growth of the digital identity market is led by a changing regulatory landscape around the world, such as the Europe’s eIDAS 2.0 Regulation (EU 2024/1183), and the UK’s Digital Identity and Attributes Trust Framework (DIATF), which require higher levels of assurance, privacy protection, and cross-border interoperability, forcing companies and Governments to upgrade their identity system.

- The Digital Operational Resilience Act (DORA) and similar frameworks across Asia-Pacific and North America are now also mandating digital identity assurance as part of cybersecurity resilience standards against disruption. Likewise, in September 2025, Okta introduced AI-driven lifecycle management services that include identity within enterprise security and compliance workflows - this demonstrates a global trend towards identity-first cybersecurity models.

- The increasing reliance on digital channels for banking, healthcare, and public sector services continues to fuel demand for identity proofing, with demand for seamless access to services and satisfaction of GDPR and data-sovereignty requirements.

Restraint: Implementation Complexity and Legacy Systems Integration limiting Digital Identity Widespread Adoption

- While pushing forward on the regulatory front, widespread adoption of modern identity systems is difficult due to the complexity of establishing modern identity frameworks with legacy IT systems that predominate in many organizations. Many organizations continue to use outdated databases and manual verification procedures that create friction and interoperability issues.

- Moving to decentralized or federated identity models requires significant investment in API creation, encryption infrastructure, and data governance infrastructure, particularly for public sector agencies and small financial institutions. Sustained deployment costs, together with the need for cross-jurisdictional compliance testing, hold back adoption in developing countries and with small- and medium-sized enterprises (SMEs).

- Balancing your need to meet very high security standards with usability and operational costs continues to be one of the key barriers to rapid adoption around the globe.

Opportunity: Expansion in Emerging Regions and Government-Backed Identity Programs

- Emerging economies in Asia, Africa, and Latin America are implementing large-scale digital identity programs to facilitate financial inclusion and advance e-government progress. Governments are seeing their needs for scalable verification and authentication solutions grow in light of new initiatives like India’s Aadhaar, Nigeria’s NIMC, and Brazil’s gov.br.

- Global technology companies are now working with telecom operators and governments to provide cloud-based and biometric ID infrastructure. For example, MasterCard’s Community Pass platform is enabling trusted digital ID systems for underserved populations.

- These programs provide opportunities for identity-as-a-service (IDaaS) vendors, biometric solution developers, and decentralized identity providers to create compliant and user-centric solutions for the boosting growth in digital identity market.

Key Trend: Integration of Biometrics, AI-Driven Verification, and Trust Frameworks Aiding Digital Identity Industry

- The latest in the digital identity space is using biometrics, fraud detection through AI/ML, and trust frameworks to create a secure yet convenient experience. Real-time risk scoring, behavioral biometrics, and AI models for document authenticity are improving onboarding for banks, fintechs, and government entities.

- The combination of digital wallets, verifiable credentials, and ZKPs shows the movement toward SSI allowing people to control their identity data. The twinning of these technologies with standardized frameworks is reshuffling trust online and getting us to the next level of digital identity market adoption worldwide.

Digital Identity Market Analysis and Segmental Data

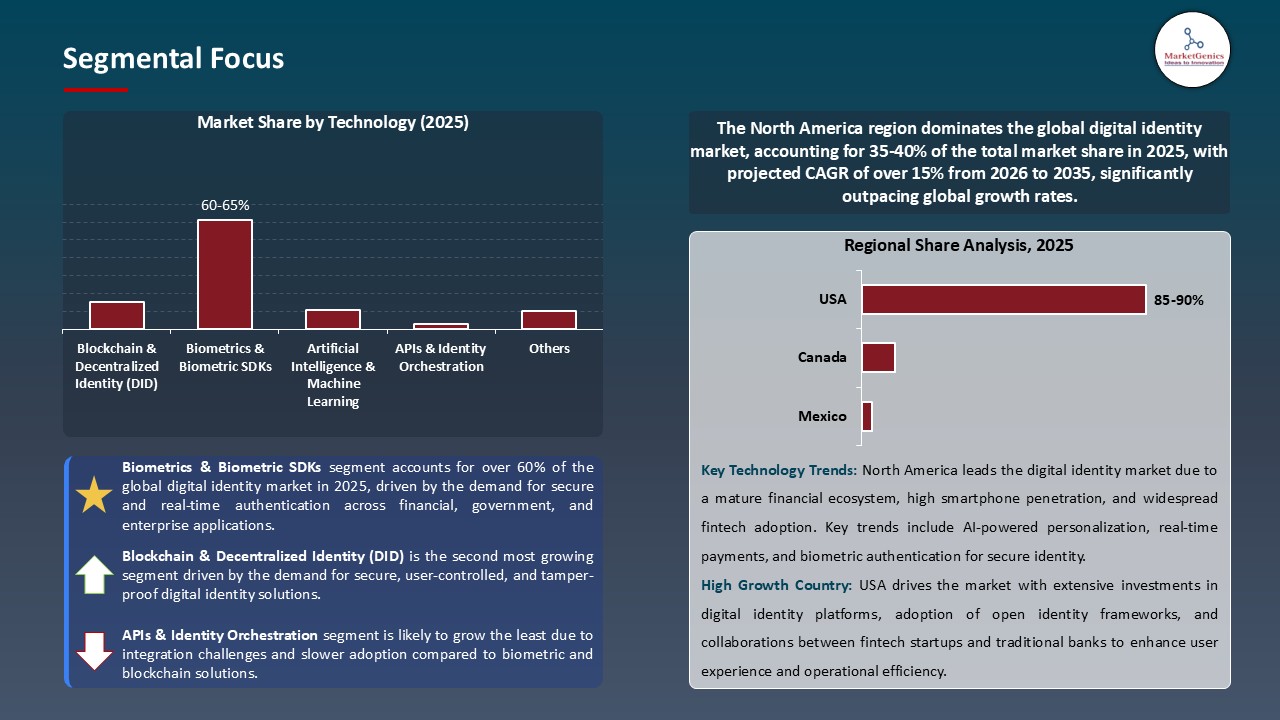

“Biometrics & Biometric SDKs Dominates Global Digital Identity Market amid Rising Demand for Secure and Seamless Authentication"

- Industries such as banking, healthcare, and government are increasingly using facial recognition, fingerprint, and iris scanning for efficient, streamlined onboarding and fraud prevention. For example, Mastercard is expanding its Biometric Checkout Program globally in 2024, showing how biometric authentication is becoming a baseline standard across multiple areas of digital.

- The incorporation of AI and machine learning software development kits with biometric software development kits have led to advances in liveness testing, spoof detection, and credential checking algorithms while facilitating rapid, seamless, mobile-based identity verification. Companies like Okta and IDEMIA are shifting their focus to on-device and edge based-credential verification to improve verification timeliness while offering improved data privacy.

- Recent regulatory approaches like Europe's eIDAS 2.0 or NIST SP 800-63 in the U.S. recognized biometric verification as a trusted credentialing mechanism. This adds to the growing trend of widespread enterprise and government use of biometric technology for AML/KYC security and compliance, as well as general cybersecurity.

- Scalable biometric software development kits now provide app developers and service providers the ability to quickly deploy identity verification and authentication tools to market. Solutions offered by CLEAR, Thales, and other companies demonstrate the arc of biometric software development kits toward a starting point from which entire new and interoperable digital identity eco-systems can be reliably enabled.

“North America Leads Digital Identity Market with Expanding Investments in Cybersecurity and Identity Infrastructure"

- North America maintains a dominant position in the digital identity market, aided by substantial investments in cybersecurity, AI verification, and cloud-based identity management. In 2025, the U.S. Cybersecurity and Infrastructure Security Agency (CISA) took an evolutionary step with its Zero Trust Maturity Model 2.0, which clearly stated that identity is the key building block of cybersecurity and solidified the region's leadership in secure digital environments.

- Cross-sector collaboration has made tremendous strides forward, driven by the Department of Homeland Security (DHS), Microsoft, Okta, and Ping Identity, with trusted verification and lifecycle management solutions in development to safeguard critical infrastructure and combat risk associated with the evolution of cyber threats.

- Gainfully in Canada, a collaborative initiative by the Digital ID and Authentication Council of Canada (DIACC) is positioning Canada to advance the Pan-Canadian Trust Framework (PCTF) to develop interoperable and privacy-preserving identity solutions, independent of the U.S. organization and collaborative platform initiatives on secure onboarding and verification of citizens.

Digital-Identity-Market Ecosystem

The digital identity market across the globe is moderately consolidated with the comprehensive control of the large player ecosystem, which leverage advanced technologies, including artificial intelligence (AI), biometrics, blockchain, and cloud identity. It is the technological advantage of these players that allows them to provide secure, scalable, and seamless authentication capabilities, while keeping pace with the increased demand for cybersecurity and compliance.

Players in the space are concentrating on narrower and specialized offerings to foster innovation and enhance competitive differentiation. Okta, for example, is utilizing Okta AI with its Identity Threat Protection offering to augment its ability to detect anomalies using machine learning; Thales’ SafeNet IDPrime FIDO Bio Smart Cards integrates biometrics and encryption to provide seamless authentication for the government and enterprise use cases.

Government and institutional backing will be important for continued market innovation. In May 2024, the European Union Agency for Cybersecurity (ENISA) started a research initiative focusing on AI-based resilience for digital identity, which will further enhance trust frameworks in cross-border ecosystems.

Companies are also innovating through product diversifications and portfolio expansion to meet the evolving threat landscape for security solutions. In February 2025, IBM announced a generative AI based identity orchestration offering that increases verification accuracy by over 30%, while leveraging automation to increase operational efficiency. Such endeavors reflect the increasingly security focused, interoperable, growth through innovation strategy undertaken in the digital identity market.

Recent Development and Strategic Overview:

- In August 2025, The Hashgraph Group introduced its IDTrust self-sovereign identity (SSI) platform on the Hedera network, where users now have portable, interoperable digital identities based on decentralized identifiers (DIDs) and verifiable credentials. This application provides peer-to-peer verification without reliance on a central authority, while enhancing privacy and trust in identity ecosystems with cross-platform acceptance.

- In June 2025, NEXT Biometrics launched the L1 Slim fingerprint sensor - its newest smaller form factor certified for biometric identity verification (including India’s Aadhaar program) that will make integration easier for ID & financial services devices. The new module reduces device profile thickness and accelerates time-to-market by as much as 12 months for OEMs looking for modular identity verification products.

Report Scope

|

Attribute |

Detail |

|

Market Size in 2025 |

USD 39.8 Bn |

|

Market Forecast Value in 2035 |

USD 210.4 Bn |

|

Growth Rate (CAGR) |

18.1% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

USD Bn for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

Regions and Countries Covered |

|||||

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Digital-Identity-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Digital Identity Market, By Component |

|

|

Digital Identity Market, By Authentication Method |

|

|

Digital Identity Market, By Technology |

|

|

Digital Identity Market, By Deployment Type |

|

|

Digital Identity Market, By Enterprise Size |

|

|

Digital Identity Market, By Application |

|

|

Digital Identity Market, By End User Industry |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Digital Identity Market Outlook

- 2.1.1. Digital Identity Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Digital Identity Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Information Technology & Media Ecosystem Overview, 2025

- 3.1.1. Information Technology & Media Ecosystem Analysis

- 3.1.2. Key Trends for Information Technology & Media Industry

- 3.1.3. Regional Distribution for Information Technology & Media Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.1. Global Information Technology & Media Ecosystem Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for secure and seamless online authentication

- 4.1.1.2. Growing adoption of biometric and multi-factor identity verification solutions

- 4.1.1.3. Increasing regulatory requirements for KYC, AML, and data privacy compliance

- 4.1.2. Restraints

- 4.1.2.1. High implementation and integration costs of advanced identity solutions

- 4.1.2.2. Compatibility challenges with legacy systems and existing IT infrastructures

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Data Enrollment and Verification Suppliers

- 4.4.2. System Integrators/ Technology Providers

- 4.4.3. Digital Identity Solution Providers

- 4.4.4. End Users

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Digital Identity Market Demand

- 4.9.1. Historical Market Size –Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size –Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Digital Identity Market Analysis, by Component

- 6.1. Key Segment Analysis

- 6.2. Digital Identity Market Size (Value - US$ Bn), Analysis, and Forecasts, by Component, 2021-2035

- 6.2.1. Solutions

- 6.2.1.1. Identity and Access Management (IAM) Solutions

- 6.2.1.2. Customer Identity and Access Management (CIAM) Solutions

- 6.2.1.3. Multi-Factor Authentication (MFA) Solutions

- 6.2.1.4. Identity Governance and Administration (IGA) Solutions

- 6.2.1.5. Privileged Access Management (PAM) Solutions

- 6.2.1.6. Single Sign-On (SSO) Solutions

- 6.2.1.7. Identity Verification and KYC Solutions

- 6.2.1.8. Fraud Detection and Risk Analytics Solutions

- 6.2.1.9. Others

- 6.2.2. Services

- 6.2.2.1. Professional Services

- 6.2.2.1.1. Consulting and Advisory Services

- 6.2.2.1.2. System Integration and Deployment

- 6.2.2.1.3. Training and Education Services

- 6.2.2.2. Managed Services

- 6.2.2.2.1. Identity-as-a-Service (IDaaS)

- 6.2.2.2.2. Managed Authentication Services

- 6.2.2.2.3. Managed Identity Governance Services

- 6.2.2.2.4. Cloud Identity Management Services

- 6.2.2.1. Professional Services

- 6.2.3. Platforms

- 6.2.3.1. Digital Identity Management Platforms

- 6.2.3.2. Decentralized Identity Platforms (Blockchain-based)

- 6.2.3.3. Biometric Authentication Platforms

- 6.2.3.4. Cloud-based Identity Platforms

- 6.2.3.5. API-based Identity Orchestration Platforms

- 6.2.3.6. Others

- 6.2.1. Solutions

- 7. Global Digital Identity Market Analysis, by Authentication Method

- 7.1. Key Segment Analysis

- 7.2. Digital Identity Market Size (Value - US$ Bn), Analysis, and Forecasts, by Authentication Method, 2021-2035

- 7.2.1. Password-Based Authentication

- 7.2.2. OTP / SMS / Email Verification

- 7.2.3. Biometric Authentication (fingerprint, face, iris, voice)

- 7.2.4. Token-Based Authentication (hardware/software tokens)

- 7.2.5. Behavioral & Risk-Based Authentication

- 7.2.6. Passwordless Authentication

- 7.2.7. Others

- 8. Global Digital Identity Market Analysis, by Technology

- 8.1. Key Segment Analysis

- 8.2. Digital Identity Market Size (Value - US$ Bn), Analysis, and Forecasts, by Technology, 2021-2035

- 8.2.1. Blockchain & Decentralized Identity (DID)

- 8.2.2. Biometrics & Biometric SDKs

- 8.2.3. Artificial Intelligence & Machine Learning

- 8.2.4. Public Key Infrastructure (PKI) & Digital Certificates

- 8.2.5. APIs & Identity Orchestration

- 8.2.6. Others

- 9. Global Digital Identity Market Analysis, by Deployment Type

- 9.1. Key Segment Analysis

- 9.2. Digital Identity Market Size (Value - US$ Bn), Analysis, and Forecasts, by Deployment Type, 2021-2035

- 9.2.1. On-premises

- 9.2.2. Cloud-based

- 9.2.3. Hybrid

- 10. Global Digital Identity Market Analysis, by Enterprise Size

- 10.1. Key Segment Analysis

- 10.2. Digital Identity Market Size (Value - US$ Bn), Analysis, and Forecasts, by Enterprise Size, 2021-2035

- 10.2.1. Small and Medium Enterprises (SMEs)

- 10.2.2. Large Enterprises

- 11. Global Digital Identity Market Analysis, by Application

- 11.1. Key Segment Analysis

- 11.2. Digital Identity Market Size (Value - US$ Bn), Analysis, and Forecasts, by Application, 2021-2035

- 11.2.1. Customer Onboarding & KYC

- 11.2.2. Workforce Access Management

- 11.2.3. Regulatory Compliance & Audit (AML, GDPR, HIPAA)

- 11.2.4. Fraud Prevention & Risk Management

- 11.2.5. Single Customer View & Personalization

- 11.2.6. Remote Workforce & BYOD Access

- 11.2.7. Others

- 12. Global Digital Identity Market Analysis, by End-User Industry

- 12.1. Key Segment Analysis

- 12.2. Digital Identity Market Size (Value - US$ Bn), Analysis, and Forecasts, by End-User Industry, 2021-2035

- 12.2.1. BFSI (Banking, Financial Services & Insurance)

- 12.2.2. Healthcare & Life Sciences

- 12.2.3. Government & Public Sector

- 12.2.4. Retail & E-commerce

- 12.2.5. Telecom & IT Services

- 12.2.6. Education

- 12.2.7. Travel & Hospitality

- 12.2.8. Energy & Utilities

- 12.2.9. Others

- 13. Global Digital Identity Market Analysis and Forecasts, by Region

- 13.1. Key Findings

- 13.2. Digital Identity Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America Digital Identity Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America Digital Identity Market Size Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Component

- 14.3.2. Authentication Method

- 14.3.3. Technology

- 14.3.4. Deployment Type

- 14.3.5. Enterprise Size

- 14.3.6. Application

- 14.3.7. End-User Industry

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA Digital Identity Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Component

- 14.4.3. Authentication Method

- 14.4.4. Technology

- 14.4.5. Deployment Type

- 14.4.6. Enterprise Size

- 14.4.7. Application

- 14.4.8. End-User Industry

- 14.5. Canada Digital Identity Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Component

- 14.5.3. Authentication Method

- 14.5.4. Technology

- 14.5.5. Deployment Type

- 14.5.6. Enterprise Size

- 14.5.7. Application

- 14.5.8. End-User Industry

- 14.6. Mexico Digital Identity Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Component

- 14.6.3. Authentication Method

- 14.6.4. Technology

- 14.6.5. Deployment Type

- 14.6.6. Enterprise Size

- 14.6.7. Application

- 14.6.8. End-User Industry

- 15. Europe Digital Identity Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe Digital Identity Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Component

- 15.3.2. Authentication Method

- 15.3.3. Technology

- 15.3.4. Deployment Type

- 15.3.5. Enterprise Size

- 15.3.6. Application

- 15.3.7. End-User Industry

- 15.3.8. Country

- 15.3.8.1. Germany

- 15.3.8.2. United Kingdom

- 15.3.8.3. France

- 15.3.8.4. Italy

- 15.3.8.5. Spain

- 15.3.8.6. Netherlands

- 15.3.8.7. Nordic Countries

- 15.3.8.8. Poland

- 15.3.8.9. Russia & CIS

- 15.3.8.10. Rest of Europe

- 15.4. Germany Digital Identity Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Component

- 15.4.3. Authentication Method

- 15.4.4. Technology

- 15.4.5. Deployment Type

- 15.4.6. Enterprise Size

- 15.4.7. Application

- 15.4.8. End-User Industry

- 15.5. United Kingdom Digital Identity Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Component

- 15.5.3. Authentication Method

- 15.5.4. Technology

- 15.5.5. Deployment Type

- 15.5.6. Enterprise Size

- 15.5.7. Application

- 15.5.8. End-User Industry

- 15.6. France Digital Identity Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Component

- 15.6.3. Authentication Method

- 15.6.4. Technology

- 15.6.5. Deployment Type

- 15.6.6. Enterprise Size

- 15.6.7. Application

- 15.6.8. End-User Industry

- 15.7. Italy Digital Identity Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Component

- 15.7.3. Authentication Method

- 15.7.4. Technology

- 15.7.5. Deployment Type

- 15.7.6. Enterprise Size

- 15.7.7. Application

- 15.7.8. End-User Industry

- 15.8. Spain Digital Identity Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Component

- 15.8.3. Authentication Method

- 15.8.4. Technology

- 15.8.5. Deployment Type

- 15.8.6. Enterprise Size

- 15.8.7. Application

- 15.8.8. End-User Industry

- 15.9. Netherlands Digital Identity Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Component

- 15.9.3. Authentication Method

- 15.9.4. Technology

- 15.9.5. Deployment Type

- 15.9.6. Enterprise Size

- 15.9.7. Application

- 15.9.8. End-User Industry

- 15.10. Nordic Countries Digital Identity Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Component

- 15.10.3. Authentication Method

- 15.10.4. Technology

- 15.10.5. Deployment Type

- 15.10.6. Enterprise Size

- 15.10.7. Application

- 15.10.8. End-User Industry

- 15.11. Poland Digital Identity Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Component

- 15.11.3. Authentication Method

- 15.11.4. Technology

- 15.11.5. Deployment Type

- 15.11.6. Enterprise Size

- 15.11.7. Application

- 15.11.8. End-User Industry

- 15.12. Russia & CIS Digital Identity Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Component

- 15.12.3. Authentication Method

- 15.12.4. Technology

- 15.12.5. Deployment Type

- 15.12.6. Enterprise Size

- 15.12.7. Application

- 15.12.8. End-User Industry

- 15.13. Rest of Europe Digital Identity Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Component

- 15.13.3. Authentication Method

- 15.13.4. Technology

- 15.13.5. Deployment Type

- 15.13.6. Enterprise Size

- 15.13.7. Application

- 15.13.8. End-User Industry

- 16. Asia Pacific Digital Identity Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Asia Pacific Digital Identity Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Component

- 16.3.2. Authentication Method

- 16.3.3. Technology

- 16.3.4. Deployment Type

- 16.3.5. Enterprise Size

- 16.3.6. Application

- 16.3.7. End-User Industry

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia Pacific

- 16.4. China Digital Identity Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Component

- 16.4.3. Authentication Method

- 16.4.4. Technology

- 16.4.5. Deployment Type

- 16.4.6. Enterprise Size

- 16.4.7. Application

- 16.4.8. End-User Industry

- 16.5. India Digital Identity Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Component

- 16.5.3. Authentication Method

- 16.5.4. Technology

- 16.5.5. Deployment Type

- 16.5.6. Enterprise Size

- 16.5.7. Application

- 16.5.8. End-User Industry

- 16.6. Japan Digital Identity Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Component

- 16.6.3. Authentication Method

- 16.6.4. Technology

- 16.6.5. Deployment Type

- 16.6.6. Enterprise Size

- 16.6.7. Application

- 16.6.8. End-User Industry

- 16.7. South Korea Digital Identity Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Component

- 16.7.3. Authentication Method

- 16.7.4. Technology

- 16.7.5. Deployment Type

- 16.7.6. Enterprise Size

- 16.7.7. Application

- 16.7.8. End-User Industry

- 16.8. Australia and New Zealand Digital Identity Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Component

- 16.8.3. Authentication Method

- 16.8.4. Technology

- 16.8.5. Deployment Type

- 16.8.6. Enterprise Size

- 16.8.7. Application

- 16.8.8. End-User Industry

- 16.9. Indonesia Digital Identity Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Component

- 16.9.3. Authentication Method

- 16.9.4. Technology

- 16.9.5. Deployment Type

- 16.9.6. Enterprise Size

- 16.9.7. Application

- 16.9.8. End-User Industry

- 16.10. Malaysia Digital Identity Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Component

- 16.10.3. Authentication Method

- 16.10.4. Technology

- 16.10.5. Deployment Type

- 16.10.6. Enterprise Size

- 16.10.7. Application

- 16.10.8. End-User Industry

- 16.11. Thailand Digital Identity Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Component

- 16.11.3. Authentication Method

- 16.11.4. Technology

- 16.11.5. Deployment Type

- 16.11.6. Enterprise Size

- 16.11.7. Application

- 16.11.8. End-User Industry

- 16.12. Vietnam Digital Identity Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Component

- 16.12.3. Authentication Method

- 16.12.4. Technology

- 16.12.5. Deployment Type

- 16.12.6. Enterprise Size

- 16.12.7. Application

- 16.12.8. End-User Industry

- 16.13. Rest of Asia Pacific Digital Identity Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Component

- 16.13.3. Authentication Method

- 16.13.4. Technology

- 16.13.5. Deployment Type

- 16.13.6. Enterprise Size

- 16.13.7. Application

- 16.13.8. End-User Industry

- 17. Middle East Digital Identity Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East Digital Identity Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Component

- 17.3.2. Authentication Method

- 17.3.3. Technology

- 17.3.4. Deployment Type

- 17.3.5. Enterprise Size

- 17.3.6. Application

- 17.3.7. End-User Industry

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey Digital Identity Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Component

- 17.4.3. Authentication Method

- 17.4.4. Technology

- 17.4.5. Deployment Type

- 17.4.6. Enterprise Size

- 17.4.7. Application

- 17.4.8. End-User Industry

- 17.5. UAE Digital Identity Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Component

- 17.5.3. Authentication Method

- 17.5.4. Technology

- 17.5.5. Deployment Type

- 17.5.6. Enterprise Size

- 17.5.7. Application

- 17.5.8. End-User Industry

- 17.6. Saudi Arabia Digital Identity Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Component

- 17.6.3. Authentication Method

- 17.6.4. Technology

- 17.6.5. Deployment Type

- 17.6.6. Enterprise Size

- 17.6.7. Application

- 17.6.8. End-User Industry

- 17.7. Israel Digital Identity Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Component

- 17.7.3. Authentication Method

- 17.7.4. Technology

- 17.7.5. Deployment Type

- 17.7.6. Enterprise Size

- 17.7.7. Application

- 17.7.8. End-User Industry

- 17.8. Rest of Middle East Digital Identity Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Component

- 17.8.3. Authentication Method

- 17.8.4. Technology

- 17.8.5. Deployment Type

- 17.8.6. Enterprise Size

- 17.8.7. Application

- 17.8.8. End-User Industry

- 18. Africa Digital Identity Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa Digital Identity Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Component

- 18.3.2. Authentication Method

- 18.3.3. Technology

- 18.3.4. Deployment Type

- 18.3.5. Enterprise Size

- 18.3.6. Application

- 18.3.7. End-User Industry

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa Digital Identity Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Component

- 18.4.3. Authentication Method

- 18.4.4. Technology

- 18.4.5. Deployment Type

- 18.4.6. Enterprise Size

- 18.4.7. Application

- 18.4.8. End-User Industry

- 18.5. Egypt Digital Identity Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Component

- 18.5.3. Authentication Method

- 18.5.4. Technology

- 18.5.5. Deployment Type

- 18.5.6. Enterprise Size

- 18.5.7. Application

- 18.5.8. End-User Industry

- 18.6. Nigeria Digital Identity Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Component

- 18.6.3. Authentication Method

- 18.6.4. Technology

- 18.6.5. Deployment Type

- 18.6.6. Enterprise Size

- 18.6.7. Application

- 18.6.8. End-User Industry

- 18.7. Algeria Digital Identity Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Component

- 18.7.3. Authentication Method

- 18.7.4. Technology

- 18.7.5. Deployment Type

- 18.7.6. Enterprise Size

- 18.7.7. Application

- 18.7.8. End-User Industry

- 18.8. Rest of Africa Digital Identity Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Component

- 18.8.3. Authentication Method

- 18.8.4. Technology

- 18.8.5. Deployment Type

- 18.8.6. Enterprise Size

- 18.8.7. Application

- 18.8.8. End-User Industry

- 19. South America Digital Identity Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. South America Digital Identity Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Component

- 19.3.2. Authentication Method

- 19.3.3. Technology

- 19.3.4. Deployment Type

- 19.3.5. Enterprise Size

- 19.3.6. Application

- 19.3.7. End-User Industry

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil Digital Identity Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Component

- 19.4.3. Authentication Method

- 19.4.4. Technology

- 19.4.5. Deployment Type

- 19.4.6. Enterprise Size

- 19.4.7. Application

- 19.4.8. End-User Industry

- 19.5. Argentina Digital Identity Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Component

- 19.5.3. Authentication Method

- 19.5.4. Technology

- 19.5.5. Deployment Type

- 19.5.6. Enterprise Size

- 19.5.7. Application

- 19.5.8. End-User Industry

- 19.6. Rest of South America Digital Identity Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Component

- 19.6.3. Authentication Method

- 19.6.4. Technology

- 19.6.5. Deployment Type

- 19.6.6. Enterprise Size

- 19.6.7. Application

- 19.6.8. End-User Industry

- 20. Key Players/ Company Profile

- 20.1. AU10TIX Ltd.

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. Civic Technologies, Inc.

- 20.3. Daon, Inc.

- 20.4. Experian Information Solutions, Inc.

- 20.5. ForgeRock Inc.

- 20.6. HID Global Corporation

- 20.7. IBM Corporation

- 20.8. IDEMIA

- 20.9. Jumio Corporation

- 20.10. LexisNexis Risk Solutions

- 20.11. Microsoft Corporation

- 20.12. NEC Corporation

- 20.13. NortonLifeLock Inc.

- 20.14. Okta, Inc.

- 20.15. OneSpan Inc.

- 20.16. Onfido Ltd.

- 20.17. Ping Identity Holding Corp.

- 20.18. SecureKey Technologies Inc.

- 20.19. Thales Group

- 20.20. TransUnion LLC

- 20.21. Others Key Players

- 20.1. AU10TIX Ltd.

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation