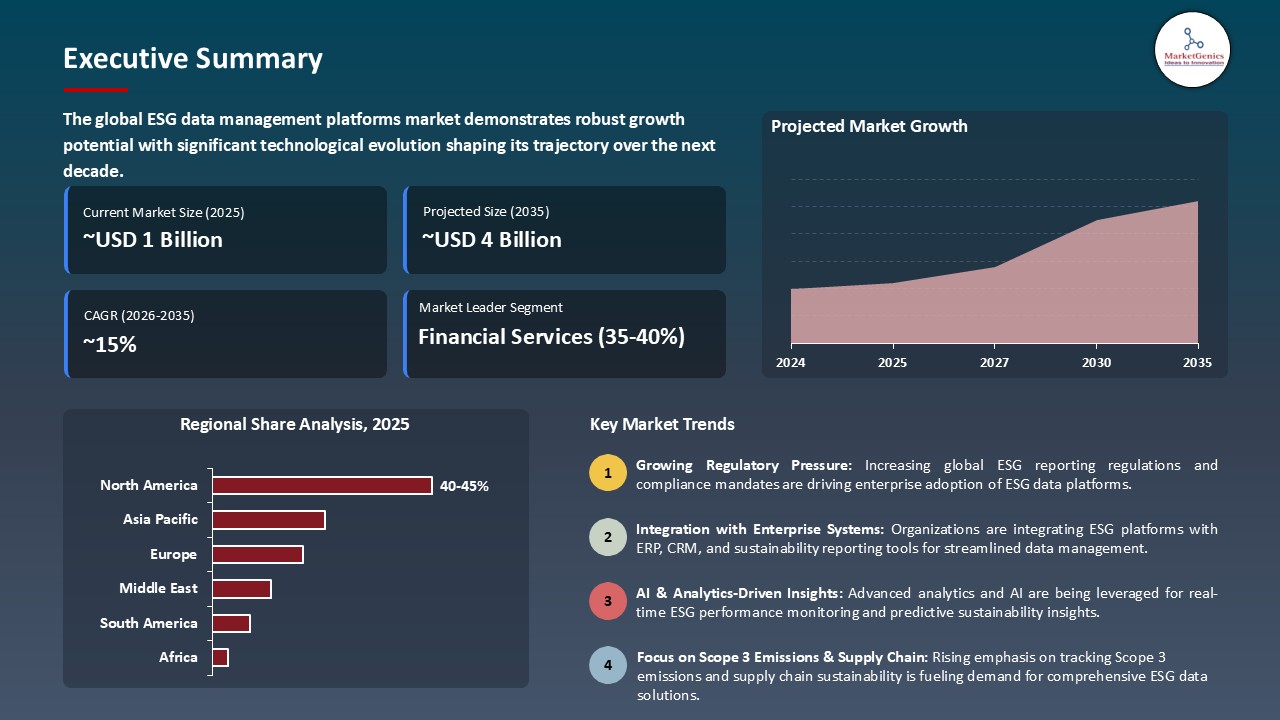

- The global ESG data management platforms market is valued at USD 1.1 billion in 2025.

- The market is projected to grow at a CAGR of 14.5% during the forecast period of 2026 to 2035.

- The financial services segment accounts for ~36% of the global ESG data management platforms market in 2025, driven by strict ESG regulations, the necessity for sustainable finance risk assessment, and investor appetite for clarity.

- Standardized ESG frameworks and automated data-quality checks are enhancing reporting precision and speeding up global platform adoption.

- Data-sharing frameworks across industries and secure API interoperability are enhancing ESG data integration and promoting broader market adoption.

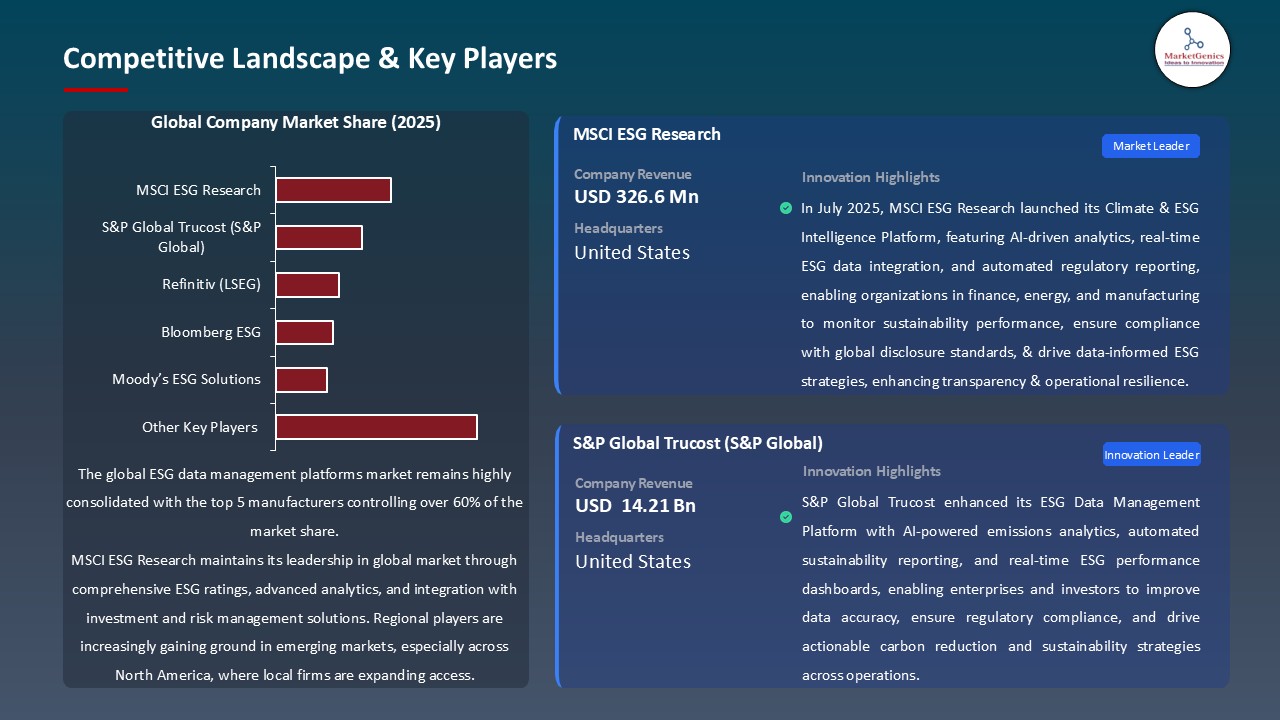

- The global ESG-data-management-platforms-market is highly consolidated, with the top five players accounting for over 60% of the market share in 2025.

- In June 2025, the Global Reporting Initiative (GRI) established its Sustainability Taxonomy, a technologically advanced version of the GRI Standards in XBRL.

- In April 2025, Zevero came up with a revolutionary AI-powered ESG reporting solution that is equipped with natural language processing capability to intuitively extract internal data and effortlessly generate reports conforming to B Corp, CDP, and CSRD requirements.

- Global ESG data management platforms market is likely to create the total forecasting opportunity of USD 3.2 Bn till 2035

- North America is most attractive region, due to the rapid institutionalization of climate-related disclosure and assurance frameworks throughout capital markets.

- The ESG data management platforms market expansion is highly facilitated by the rapidly widening worldwide disclosure mandates. For instance, the EU’s Corporate Sustainability Reporting Directive (CSRD) and the European Sustainability Reporting Standards (ESRS) are notable examples of regulations that demand very detailed, audit-ready sustainability data. This situation is forcing companies to install advanced reporting and data-quality systems.

- A global move towards ISSB’s IFRS S1 and IFRS S2 standards is envisaged from 2024. Such a scenario has escalated the demand for platforms that can provide disclosures of a financial-grade nature, hence, can be used for uniform reporting of climate-risk, emissions, and governance across different jurisdictions.

- In addition to this, the U.S. SEC’s 2024 climate-disclosure rule is a major factor together with the nascent mandatory climate-risk and supply-chain transparency laws in Asia-Pacific and Latin America regions. These changes are turning the organizations into a necessity of procuring ESG platforms that have the capacity to seamlessly perform emissions accounting, data lineage tracking, and assurance-ready reporting functionalities.

- The move towards uniform ESG reporting is obstructed by outdated data environments where sustainability, financial, and supply-chain data are kept separately in spreadsheets, old reporting tools, and unstructured files, thus causing problems for data consolidation and auditability.

- Complying with the assurance criteria set by CSRD/ESRS and that are progressively required by investors and regulators necessitates a substantial investment in internal controls, data-quality validation, emission-measurement methodologies, and digital workflows, thereby making the adoption process slow among small and mid-sized enterprises (SMEs).

- Furthermore, companies are confronted with higher operational costs due to the need for compliance testing across different jurisdictions, changing taxonomies, and the necessity to map ESG metrics to various frameworks (ISSB, GRI, ESRS, SEC), thus, resulting in the increased difficulty of implementation and higher system-integration expenses.

- Global supply chain standards, for example, the EU Deforestation Regulation (EUDR) and value chain reporting requirements under CSRD ESRS E1 and S2, are the main reasons for the growing market of platforms that combine supplier data, traceability systems, and automated Scope 3 emissions-tracking tools.

- The move of companies towards limited and reasonable assurance under CSRD is leading to a huge demand for assurance-tech, e.g. automated audit trails, data-lineage mapping, and real-time validation engines, which is a large opportunity to ESG platform vendors, audit firms, and compliance-tech providers.

- The potential for ESG data platform providers to support the implementation of regulations and enterprise onboarding at the early stage in developing markets is substantial. This is due to Latin America, Southeast Asia, Middle East, where the governments and exchanges are putting into effect the sustainability reporting codes and climate-risk guidelines.

- One of the biggest changes that ESG platforms are making is the use of AI/ML models for a wide variety of tasks such as emissions estimation, anomaly detection, document extraction, predictive analytics, and data-quality scoring. By doing so, they are freeing enterprises from the heavy burden of managing large volumes of unstructured sustainability data, and at the same time, they are increasing the accuracy and speed of the process.

- The development of interoperability frameworks that include XBRL-based digital reporting under ESRS, ISSB’s sustainability taxonomy, and API-driven integrations with ERP, finance, and supply-chain systems is leading to a gradual change from periodic to continuous, machine-readable ESG reporting ecosystems.

- The deployment of real-time environmental data, IoT-based emissions monitoring, satellite-derived climate datasets, and supplier-verification networks as a resource pool for more accurate Scope 1–3 accounting and as a trust mechanism for enhanced transparency across value chains is a core element of the movement. .

- In order to meet the requirements of CSRD/ESRS, ISSB S1–S2, and the 2024 SEC climate-disclosure rule, which necessitate standardized, audit-ready sustainability data across portfolios and financed emissions, financial institutions are rapidly implementing ESG platforms. A major challenge to reporting financed emissions through PCAF is pushing banks and asset managers to adopt platforms capable of tracking emissions at the borrower and issuer levels, conducting scenario analyses, and modeling climate risks.

- Investor demands for clear and reliable ESG reports are leading enterprises to the choice of platforms that provide automated data validation, data-lineage tracking, and uniform measurement of Scope 1–3 for regulatory and stewardship disclosures. The green finance and sustainability-linked lending growth is leading to the rise of real-time ESG data needs which, must be integrated with risk, lending, and portfolio-management systems to support a smooth flow of information.

- The need for disclosure and due diligence in the supply chain, as well as laws in the EU and other regions, are urging financial companies to implement ESG platforms that have supplier-data integration features to evaluate sustainability risks in highly diversified portfolios.

- North America stands at the forefront of the ESG data management platforms market due to the rapid institutionalization of climate-related disclosure and assurance frameworks throughout capital markets. The SEC's climate-disclosure rule seeing debut in 2024 will only ramp up demands for systems enabling issuers and capital market participants to produce standardized, finance-grade emissions data and climate-risk data.

- Moreover, U.S. financial regulators, including the Federal Reserve and OCC, have raised expectations for climate-risk assessment as part of the supervisory process, forcing banks and asset managers to implement platforms that defend data quality, audit trail, and scenario analysis. Large institutional investors in the U.S. and Canada are tightening requirements for transparent and comparable ESG metrics, driving issuers to utilize structured reporting tools.

- The growing acceptance of sustainability-linked financing across North American exchanges also requires continuous, verifiable ESG data streams, underscoring North America's leadership in advanced ESG data and assurance technology.

- In June 2025, the Global Reporting Initiative (GRI) established its Sustainability Taxonomy, a technologically advanced version of the GRI Standards in XBRL, which allows for the automated, structured ESG disclosures and thus the easy compatibility with ISSB and ESRS frameworks. The launch event also gave the impetus to the early digital CSRD-reporting pilots in the U.S. and Canada, where the platforms integrating the taxonomy facilitated seamless cross-framework mapping.

- In April 2025, Zevero came up with a revolutionary AI-powered ESG reporting solution that is equipped with natural language processing capability to intuitively extract internal data and effortlessly generate reports conforming to B Corp, CDP, and CSRD requirements, thus cutting the reporting time by more than 40%. The upgrade was rapidly implemented by the middle-market financial services companies that were in search of the automation of the evidence collection process for disclosure preparation that is assurance-ready.

- United States

- Canada

- Mexico

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic Countries

- Poland

- Russia & CIS

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Turkey

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Nigeria

- Algeria

- Brazil

- Argentina

- Arabesque S-Ray

- Bloomberg ESG

- Clarity AI

- Datamaran

- Diligent

- EcoVadis

- Sustainalytics

- Enablon

- FactSet ESG

- Greenstone

- Workiva

- ISS ESG

- Moody’s ESG Solutions

- MSCI ESG Research

- Persefoni

- Refinitiv (LSEG)

- RepRisk

- Sphera

- S&P Global Trucost

- Truvalue Labs

- Other Key Players

- Data Ingestion & ETL

- Data Warehouse / Lake & Storage

- Data Normalization & Mapping Engine

- Analytics & Insight Modules

- Reporting & Disclosure Tools (templates: CDP, GRI, SASB/ISSB, TCFD)

- Workflow, Collaboration & Audit Trail

- API & Integration Layer

- Professional Services & Verification Support

- Others

- Cloud-Based

- On-Premises

- Hybrid

- Environmental metrics (emissions, energy, water, waste)

- Social metrics (labor, diversity, health & safety)

- Governance metrics (board, policies, anti-corruption)

- Supply-chain & Scope 3 datasets

- Alternative data (news, controversies, satellite, ESG signals)

- Financial + ESG blended metrics (risk adjusted)

- Others

- Public filings & regulatory disclosures

- Company-reported data (surveys, portals)

- Third-party provider & index feeds

- Unstructured text & NLP-extracted signals

- IoT / telemetry / sensor feeds

- Satellite / geospatial data

- Others

- Data aggregation & mastering

- Materiality assessment & gap analysis

- KPI calculation & benchmarking

- Scenario modeling & stress testing

- Regulatory reporting & disclosure automation

- Risk screening & controversy monitoring

- Portfolio ESG scoring & integration

- Others

- ERP / procurement / PLM connectors

- Financial systems & portfolio tools (Bloomberg, FactSet)

- Data warehouse & cloud analytics (Snowflake, BigQuery)

- APIs, webhooks & partner ecosystems

- Others

- Subscription / per-seat SaaS

- Volume / data-point based pricing

- Enterprise / site license + services

- Transaction / reporting-event fees

- Others

- Asset managers & asset owners

- Corporates (sustainability / compliance teams)

- Banks & insurers (risk & lending teams)

- Consultants & auditors

- Regulators & public sector bodies

- Exchanges & index providers

- Others

- Energy & Utilities

- Financial Services

- Manufacturing & Industrials

- Consumer Goods & Retail

- Healthcare & Life Sciences

- Technology & Telecom

- Real Estate & Construction

- Others

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global ESG Data Management Platforms Market Outlook

- 2.1.1. ESG Data Management Platforms Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global ESG Data Management Platforms Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Information Technology & Media Ecosystem Overview, 2025

- 3.1.1. Information Technology & Media Industry Analysis

- 3.1.2. Key Trends for Information Technology & Media Industry

- 3.1.3. Regional Distribution for Information Technology & Media Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.1. Global Information Technology & Media Ecosystem Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for real-time ESG performance tracking and sustainability reporting.

- 4.1.1.2. Growing adoption of AI- and analytics-driven insights for predictive ESG risk management and strategy optimization.

- 4.1.1.3. Increasing investments in integrated ESG platforms with enterprise systems and regulatory compliance tools.

- 4.1.2. Restraints

- 4.1.2.1. High implementation and operational costs of ESG data management platforms and supporting infrastructure.

- 4.1.2.2. Challenges in consolidating fragmented ESG data sources and ensuring data accuracy across global operations.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Data/ Component Suppliers

- 4.4.2. System Integrators/ Technology Providers

- 4.4.3. ESG Data Management Platform Providers

- 4.4.4. End Users

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global ESG Data Management Platforms Market Demand

- 4.9.1. Historical Market Size –Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size –Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global ESG Data Management Platforms Market Analysis, by Component

- 6.1. Key Segment Analysis

- 6.2. ESG Data Management Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by Component, 2021-2035

- 6.2.1. By Component

- 6.2.2. Data Ingestion & ETL

- 6.2.3. Data Warehouse / Lake & Storage

- 6.2.4. Data Normalization & Mapping Engine

- 6.2.5. Analytics & Insight Modules

- 6.2.6. Reporting & Disclosure Tools (templates: CDP, GRI, SASB/ISSB, TCFD)

- 6.2.7. Workflow, Collaboration & Audit Trail

- 6.2.8. API & Integration Layer

- 6.2.9. Professional Services & Verification Support

- 6.2.10. Others

- 7. Global ESG Data Management Platforms Market Analysis, by Deployment Mode

- 7.1. Key Segment Analysis

- 7.2. ESG Data Management Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by Deployment Mode, 2021-2035

- 7.2.1. Cloud-Based

- 7.2.2. On-Premises

- 7.2.3. Hybrid

- 8. Global ESG Data Management Platforms Market Analysis, by Data Type

- 8.1. Key Segment Analysis

- 8.2. ESG Data Management Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by Data Type, 2021-2035

- 8.2.1. Environmental metrics (emissions, energy, water, waste)

- 8.2.2. Social metrics (labor, diversity, health & safety)

- 8.2.3. Governance metrics (board, policies, anti-corruption)

- 8.2.4. Supply-chain & Scope 3 datasets

- 8.2.5. Alternative data (news, controversies, satellite, ESG signals)

- 8.2.6. Financial + ESG blended metrics (risk adjusted)

- 8.2.7. Others

- 9. Global ESG Data Management Platforms Market Analysis, by Source & Collection Method

- 9.1. Key Segment Analysis

- 9.2. ESG Data Management Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by Source & Collection Method, 2021-2035

- 9.2.1. Public filings & regulatory disclosures

- 9.2.2. Company-reported data (surveys, portals)

- 9.2.3. Third-party provider & index feeds

- 9.2.4. Unstructured text & NLP-extracted signals

- 9.2.5. IoT / telemetry / sensor feeds

- 9.2.6. Satellite / geospatial data

- 9.2.7. Others

- 10. Global ESG Data Management Platforms Market Analysis, by Core Functionality

- 10.1. Key Segment Analysis

- 10.2. ESG Data Management Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by Core Functionality, 2021-2035

- 10.2.1. Data aggregation & mastering

- 10.2.2. Materiality assessment & gap analysis

- 10.2.3. KPI calculation & benchmarking

- 10.2.4. Scenario modeling & stress testing

- 10.2.5. Regulatory reporting & disclosure automation

- 10.2.6. Risk screening & controversy monitoring

- 10.2.7. Portfolio ESG scoring & integration

- 10.2.8. Others

- 11. Global ESG Data Management Platforms Market Analysis, by Integration & Interoperability

- 11.1. Key Segment Analysis

- 11.2. ESG Data Management Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by Integration & Interoperability, 2021-2035

- 11.2.1. ERP / procurement / PLM connectors

- 11.2.2. Financial systems & portfolio tools (Bloomberg, FactSet)

- 11.2.3. Data warehouse & cloud analytics (Snowflake, BigQuery)

- 11.2.4. APIs, webhooks & partner ecosystems

- 11.2.5. Others

- 12. Global ESG Data Management Platforms Market Analysis, by Pricing & Commercial Model

- 12.1. Key Segment Analysis

- 12.2. ESG Data Management Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by Pricing & Commercial Model, 2021-2035

- 12.2.1. Subscription / per-seat SaaS

- 12.2.2. Volume / data-point based pricing

- 12.2.3. Enterprise / site license + services

- 12.2.4. Transaction / reporting-event fees

- 12.2.5. Others

- 13. Global ESG Data Management Platforms Market Analysis, by End User / Buyer

- 13.1. Key Segment Analysis

- 13.2. ESG Data Management Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by End User / Buyer, 2021-2035

- 13.2.1. Asset managers & asset owners

- 13.2.2. Corporates (sustainability / compliance teams)

- 13.2.3. Banks & insurers (risk & lending teams)

- 13.2.4. Consultants & auditors

- 13.2.5. Regulators & public sector bodies

- 13.2.6. Exchanges & index providers

- 13.2.7. Others

- 14. Global ESG Data Management Platforms Market Analysis, by Industry Vertical

- 14.1. Key Segment Analysis

- 14.2. ESG Data Management Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by Industry Vertical, 2021-2035

- 14.2.1. Energy & Utilities

- 14.2.2. Financial Services

- 14.2.3. Manufacturing & Industrials

- 14.2.4. Consumer Goods & Retail

- 14.2.5. Healthcare & Life Sciences

- 14.2.6. Technology & Telecom

- 14.2.7. Real Estate & Construction

- 14.2.8. Others

- 15. Global ESG Data Management Platforms Market Analysis and Forecasts, by Region

- 15.1. Key Findings

- 15.2. ESG Data Management Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 15.2.1. North America

- 15.2.2. Europe

- 15.2.3. Asia Pacific

- 15.2.4. Middle East

- 15.2.5. Africa

- 15.2.6. South America

- 16. North America ESG Data Management Platforms Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. North America ESG Data Management Platforms Market Size Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Component

- 16.3.2. Deployment Mode

- 16.3.3. Data Type

- 16.3.4. Source & Collection Method

- 16.3.5. Core Functionality

- 16.3.6. Integration & Interoperability

- 16.3.7. Pricing & Commercial Model

- 16.3.8. End User / Buyer

- 16.3.9. Industry Vertical

- 16.3.10. Country

- 16.3.10.1. USA

- 16.3.10.2. Canada

- 16.3.10.3. Mexico

- 16.4. USA ESG Data Management Platforms Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Component

- 16.4.3. Deployment Mode

- 16.4.4. Data Type

- 16.4.5. Source & Collection Method

- 16.4.6. Core Functionality

- 16.4.7. Integration & Interoperability

- 16.4.8. Pricing & Commercial Model

- 16.4.9. End User / Buyer

- 16.4.10. Industry Vertical

- 16.5. Canada ESG Data Management Platforms Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Component

- 16.5.3. Deployment Mode

- 16.5.4. Data Type

- 16.5.5. Source & Collection Method

- 16.5.6. Core Functionality

- 16.5.7. Integration & Interoperability

- 16.5.8. Pricing & Commercial Model

- 16.5.9. End User / Buyer

- 16.5.10. Industry Vertical

- 16.6. Mexico ESG Data Management Platforms Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Component

- 16.6.3. Deployment Mode

- 16.6.4. Data Type

- 16.6.5. Source & Collection Method

- 16.6.6. Core Functionality

- 16.6.7. Integration & Interoperability

- 16.6.8. Pricing & Commercial Model

- 16.6.9. End User / Buyer

- 16.6.10. Industry Vertical

- 17. Europe ESG Data Management Platforms Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Europe ESG Data Management Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Component

- 17.3.2. Deployment Mode

- 17.3.3. Data Type

- 17.3.4. Source & Collection Method

- 17.3.5. Core Functionality

- 17.3.6. Integration & Interoperability

- 17.3.7. Pricing & Commercial Model

- 17.3.8. End User / Buyer

- 17.3.9. Industry Vertical

- 17.3.10. Country

- 17.3.10.1. Germany

- 17.3.10.2. United Kingdom

- 17.3.10.3. France

- 17.3.10.4. Italy

- 17.3.10.5. Spain

- 17.3.10.6. Netherlands

- 17.3.10.7. Nordic Countries

- 17.3.10.8. Poland

- 17.3.10.9. Russia & CIS

- 17.3.10.10. Rest of Europe

- 17.4. Germany ESG Data Management Platforms Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Component

- 17.4.3. Deployment Mode

- 17.4.4. Data Type

- 17.4.5. Source & Collection Method

- 17.4.6. Core Functionality

- 17.4.7. Integration & Interoperability

- 17.4.8. Pricing & Commercial Model

- 17.4.9. End User / Buyer

- 17.4.10. Industry Vertical

- 17.5. United Kingdom ESG Data Management Platforms Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Component

- 17.5.3. Deployment Mode

- 17.5.4. Data Type

- 17.5.5. Source & Collection Method

- 17.5.6. Core Functionality

- 17.5.7. Integration & Interoperability

- 17.5.8. Pricing & Commercial Model

- 17.5.9. End User / Buyer

- 17.5.10. Industry Vertical

- 17.6. France ESG Data Management Platforms Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Component

- 17.6.3. Deployment Mode

- 17.6.4. Data Type

- 17.6.5. Source & Collection Method

- 17.6.6. Core Functionality

- 17.6.7. Integration & Interoperability

- 17.6.8. Pricing & Commercial Model

- 17.6.9. End User / Buyer

- 17.6.10. Industry Vertical

- 17.7. Italy ESG Data Management Platforms Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Component

- 17.7.3. Deployment Mode

- 17.7.4. Data Type

- 17.7.5. Source & Collection Method

- 17.7.6. Core Functionality

- 17.7.7. Integration & Interoperability

- 17.7.8. Pricing & Commercial Model

- 17.7.9. End User / Buyer

- 17.7.10. Industry Vertical

- 17.8. Spain ESG Data Management Platforms Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Component

- 17.8.3. Deployment Mode

- 17.8.4. Data Type

- 17.8.5. Source & Collection Method

- 17.8.6. Core Functionality

- 17.8.7. Integration & Interoperability

- 17.8.8. Pricing & Commercial Model

- 17.8.9. End User / Buyer

- 17.8.10. Industry Vertical

- 17.9. Netherlands ESG Data Management Platforms Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Component

- 17.9.3. Deployment Mode

- 17.9.4. Data Type

- 17.9.5. Source & Collection Method

- 17.9.6. Core Functionality

- 17.9.7. Integration & Interoperability

- 17.9.8. Pricing & Commercial Model

- 17.9.9. End User / Buyer

- 17.9.10. Industry Vertical

- 17.10. Nordic Countries ESG Data Management Platforms Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Component

- 17.10.3. Deployment Mode

- 17.10.4. Data Type

- 17.10.5. Source & Collection Method

- 17.10.6. Core Functionality

- 17.10.7. Integration & Interoperability

- 17.10.8. Pricing & Commercial Model

- 17.10.9. End User / Buyer

- 17.10.10. Industry Vertical

- 17.11. Poland ESG Data Management Platforms Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Component

- 17.11.3. Deployment Mode

- 17.11.4. Data Type

- 17.11.5. Source & Collection Method

- 17.11.6. Core Functionality

- 17.11.7. Integration & Interoperability

- 17.11.8. Pricing & Commercial Model

- 17.11.9. End User / Buyer

- 17.11.10. Industry Vertical

- 17.12. Russia & CIS ESG Data Management Platforms Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Component

- 17.12.3. Deployment Mode

- 17.12.4. Data Type

- 17.12.5. Source & Collection Method

- 17.12.6. Core Functionality

- 17.12.7. Integration & Interoperability

- 17.12.8. Pricing & Commercial Model

- 17.12.9. End User / Buyer

- 17.12.10. Industry Vertical

- 17.13. Rest of Europe ESG Data Management Platforms Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Component

- 17.13.3. Deployment Mode

- 17.13.4. Data Type

- 17.13.5. Source & Collection Method

- 17.13.6. Core Functionality

- 17.13.7. Integration & Interoperability

- 17.13.8. Pricing & Commercial Model

- 17.13.9. End User / Buyer

- 17.13.10. Industry Vertical

- 18. Asia Pacific ESG Data Management Platforms Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Asia Pacific ESG Data Management Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Component

- 18.3.2. Deployment Mode

- 18.3.3. Data Type

- 18.3.4. Source & Collection Method

- 18.3.5. Core Functionality

- 18.3.6. Integration & Interoperability

- 18.3.7. Pricing & Commercial Model

- 18.3.8. End User / Buyer

- 18.3.9. Industry Vertical

- 18.3.10. Country

- 18.3.10.1. China

- 18.3.10.2. India

- 18.3.10.3. Japan

- 18.3.10.4. South Korea

- 18.3.10.5. Australia and New Zealand

- 18.3.10.6. Indonesia

- 18.3.10.7. Malaysia

- 18.3.10.8. Thailand

- 18.3.10.9. Vietnam

- 18.3.10.10. Rest of Asia Pacific

- 18.4. China ESG Data Management Platforms Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Component

- 18.4.3. Deployment Mode

- 18.4.4. Data Type

- 18.4.5. Source & Collection Method

- 18.4.6. Core Functionality

- 18.4.7. Integration & Interoperability

- 18.4.8. Pricing & Commercial Model

- 18.4.9. End User / Buyer

- 18.4.10. Industry Vertical

- 18.5. India ESG Data Management Platforms Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Component

- 18.5.3. Deployment Mode

- 18.5.4. Data Type

- 18.5.5. Source & Collection Method

- 18.5.6. Core Functionality

- 18.5.7. Integration & Interoperability

- 18.5.8. Pricing & Commercial Model

- 18.5.9. End User / Buyer

- 18.5.10. Industry Vertical

- 18.6. Japan ESG Data Management Platforms Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Component

- 18.6.3. Deployment Mode

- 18.6.4. Data Type

- 18.6.5. Source & Collection Method

- 18.6.6. Core Functionality

- 18.6.7. Integration & Interoperability

- 18.6.8. Pricing & Commercial Model

- 18.6.9. End User / Buyer

- 18.6.10. Industry Vertical

- 18.7. South Korea ESG Data Management Platforms Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Component

- 18.7.3. Deployment Mode

- 18.7.4. Data Type

- 18.7.5. Source & Collection Method

- 18.7.6. Core Functionality

- 18.7.7. Integration & Interoperability

- 18.7.8. Pricing & Commercial Model

- 18.7.9. End User / Buyer

- 18.7.10. Industry Vertical

- 18.8. Australia and New Zealand ESG Data Management Platforms Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Component

- 18.8.3. Deployment Mode

- 18.8.4. Data Type

- 18.8.5. Source & Collection Method

- 18.8.6. Core Functionality

- 18.8.7. Integration & Interoperability

- 18.8.8. Pricing & Commercial Model

- 18.8.9. End User / Buyer

- 18.8.10. Industry Vertical

- 18.9. Indonesia ESG Data Management Platforms Market

- 18.9.1. Country Segmental Analysis

- 18.9.2. Component

- 18.9.3. Deployment Mode

- 18.9.4. Data Type

- 18.9.5. Source & Collection Method

- 18.9.6. Core Functionality

- 18.9.7. Integration & Interoperability

- 18.9.8. Pricing & Commercial Model

- 18.9.9. End User / Buyer

- 18.9.10. Industry Vertical

- 18.10. Malaysia ESG Data Management Platforms Market

- 18.10.1. Country Segmental Analysis

- 18.10.2. Component

- 18.10.3. Deployment Mode

- 18.10.4. Data Type

- 18.10.5. Source & Collection Method

- 18.10.6. Core Functionality

- 18.10.7. Integration & Interoperability

- 18.10.8. Pricing & Commercial Model

- 18.10.9. End User / Buyer

- 18.10.10. Industry Vertical

- 18.11. Thailand ESG Data Management Platforms Market

- 18.11.1. Country Segmental Analysis

- 18.11.2. Component

- 18.11.3. Deployment Mode

- 18.11.4. Data Type

- 18.11.5. Source & Collection Method

- 18.11.6. Core Functionality

- 18.11.7. Integration & Interoperability

- 18.11.8. Pricing & Commercial Model

- 18.11.9. End User / Buyer

- 18.11.10. Industry Vertical

- 18.12. Vietnam ESG Data Management Platforms Market

- 18.12.1. Country Segmental Analysis

- 18.12.2. Component

- 18.12.3. Deployment Mode

- 18.12.4. Data Type

- 18.12.5. Source & Collection Method

- 18.12.6. Core Functionality

- 18.12.7. Integration & Interoperability

- 18.12.8. Pricing & Commercial Model

- 18.12.9. End User / Buyer

- 18.12.10. Industry Vertical

- 18.13. Rest of Asia Pacific ESG Data Management Platforms Market

- 18.13.1. Country Segmental Analysis

- 18.13.2. Component

- 18.13.3. Deployment Mode

- 18.13.4. Data Type

- 18.13.5. Source & Collection Method

- 18.13.6. Core Functionality

- 18.13.7. Integration & Interoperability

- 18.13.8. Pricing & Commercial Model

- 18.13.9. End User / Buyer

- 18.13.10. Industry Vertical

- 19. Middle East ESG Data Management Platforms Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Middle East ESG Data Management Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Component

- 19.3.2. Deployment Mode

- 19.3.3. Data Type

- 19.3.4. Source & Collection Method

- 19.3.5. Core Functionality

- 19.3.6. Integration & Interoperability

- 19.3.7. Pricing & Commercial Model

- 19.3.8. End User / Buyer

- 19.3.9. Industry Vertical

- 19.3.10. Country

- 19.3.10.1. Turkey

- 19.3.10.2. UAE

- 19.3.10.3. Saudi Arabia

- 19.3.10.4. Israel

- 19.3.10.5. Rest of Middle East

- 19.4. Turkey ESG Data Management Platforms Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Component

- 19.4.3. Deployment Mode

- 19.4.4. Data Type

- 19.4.5. Source & Collection Method

- 19.4.6. Core Functionality

- 19.4.7. Integration & Interoperability

- 19.4.8. Pricing & Commercial Model

- 19.4.9. End User / Buyer

- 19.4.10. Industry Vertical

- 19.5. UAE ESG Data Management Platforms Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Component

- 19.5.3. Deployment Mode

- 19.5.4. Data Type

- 19.5.5. Source & Collection Method

- 19.5.6. Core Functionality

- 19.5.7. Integration & Interoperability

- 19.5.8. Pricing & Commercial Model

- 19.5.9. End User / Buyer

- 19.5.10. Industry Vertical

- 19.6. Saudi Arabia ESG Data Management Platforms Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Component

- 19.6.3. Deployment Mode

- 19.6.4. Data Type

- 19.6.5. Source & Collection Method

- 19.6.6. Core Functionality

- 19.6.7. Integration & Interoperability

- 19.6.8. Pricing & Commercial Model

- 19.6.9. End User / Buyer

- 19.6.10. Industry Vertical

- 19.7. Israel ESG Data Management Platforms Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Component

- 19.7.3. Deployment Mode

- 19.7.4. Data Type

- 19.7.5. Source & Collection Method

- 19.7.6. Core Functionality

- 19.7.7. Integration & Interoperability

- 19.7.8. Pricing & Commercial Model

- 19.7.9. End User / Buyer

- 19.7.10. Industry Vertical

- 19.8. Rest of Middle East ESG Data Management Platforms Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Component

- 19.8.3. Deployment Mode

- 19.8.4. Data Type

- 19.8.5. Source & Collection Method

- 19.8.6. Core Functionality

- 19.8.7. Integration & Interoperability

- 19.8.8. Pricing & Commercial Model

- 19.8.9. End User / Buyer

- 19.8.10. Industry Vertical

- 20. Africa ESG Data Management Platforms Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Africa ESG Data Management Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Component

- 20.3.2. Deployment Mode

- 20.3.3. Data Type

- 20.3.4. Source & Collection Method

- 20.3.5. Core Functionality

- 20.3.6. Integration & Interoperability

- 20.3.7. Pricing & Commercial Model

- 20.3.8. End User / Buyer

- 20.3.9. Industry Vertical

- 20.3.10. Country

- 20.3.10.1. South Africa

- 20.3.10.2. Egypt

- 20.3.10.3. Nigeria

- 20.3.10.4. Algeria

- 20.3.10.5. Rest of Africa

- 20.4. South Africa ESG Data Management Platforms Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Component

- 20.4.3. Deployment Mode

- 20.4.4. Data Type

- 20.4.5. Source & Collection Method

- 20.4.6. Core Functionality

- 20.4.7. Integration & Interoperability

- 20.4.8. Pricing & Commercial Model

- 20.4.9. End User / Buyer

- 20.4.10. Industry Vertical

- 20.5. Egypt ESG Data Management Platforms Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Component

- 20.5.3. Deployment Mode

- 20.5.4. Data Type

- 20.5.5. Source & Collection Method

- 20.5.6. Core Functionality

- 20.5.7. Integration & Interoperability

- 20.5.8. Pricing & Commercial Model

- 20.5.9. End User / Buyer

- 20.5.10. Industry Vertical

- 20.6. Nigeria ESG Data Management Platforms Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Component

- 20.6.3. Deployment Mode

- 20.6.4. Data Type

- 20.6.5. Source & Collection Method

- 20.6.6. Core Functionality

- 20.6.7. Integration & Interoperability

- 20.6.8. Pricing & Commercial Model

- 20.6.9. End User / Buyer

- 20.6.10. Industry Vertical e

- 20.7. Algeria ESG Data Management Platforms Market

- 20.7.1. Country Segmental Analysis

- 20.7.2. Component

- 20.7.3. Deployment Mode

- 20.7.4. Data Type

- 20.7.5. Source & Collection Method

- 20.7.6. Core Functionality

- 20.7.7. Integration & Interoperability

- 20.7.8. Pricing & Commercial Model

- 20.7.9. End User / Buyer

- 20.7.10. Industry Vertical

- 20.8. Rest of Africa ESG Data Management Platforms Market

- 20.8.1. Country Segmental Analysis

- 20.8.2. Component

- 20.8.3. Deployment Mode

- 20.8.4. Data Type

- 20.8.5. Source & Collection Method

- 20.8.6. Core Functionality

- 20.8.7. Integration & Interoperability

- 20.8.8. Pricing & Commercial Model

- 20.8.9. End User / Buyer

- 20.8.10. Industry Vertical

- 21. South America ESG Data Management Platforms Market Analysis

- 21.1. Key Segment Analysis

- 21.2. Regional Snapshot

- 21.3. South America ESG Data Management Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 21.3.1. Component

- 21.3.2. Deployment Mode

- 21.3.3. Data Type

- 21.3.4. Source & Collection Method

- 21.3.5. Core Functionality

- 21.3.6. Integration & Interoperability

- 21.3.7. Pricing & Commercial Model

- 21.3.8. End User / Buyer

- 21.3.9. Industry Vertical

- 21.3.10. Country

- 21.3.10.1. Brazil

- 21.3.10.2. Argentina

- 21.3.10.3. Rest of South America

- 21.4. Brazil ESG Data Management Platforms Market

- 21.4.1. Country Segmental Analysis

- 21.4.2. Component

- 21.4.3. Deployment Mode

- 21.4.4. Data Type

- 21.4.5. Source & Collection Method

- 21.4.6. Core Functionality

- 21.4.7. Integration & Interoperability

- 21.4.8. Pricing & Commercial Model

- 21.4.9. End User / Buyer

- 21.4.10. Industry Vertical

- 21.5. Argentina ESG Data Management Platforms Market

- 21.5.1. Country Segmental Analysis

- 21.5.2. Component

- 21.5.3. Deployment Mode

- 21.5.4. Data Type

- 21.5.5. Source & Collection Method

- 21.5.6. Core Functionality

- 21.5.7. Integration & Interoperability

- 21.5.8. Pricing & Commercial Model

- 21.5.9. End User / Buyer

- 21.5.10. Industry Vertical

- 21.6. Rest of South America ESG Data Management Platforms Market

- 21.6.1. Country Segmental Analysis

- 21.6.2. Component

- 21.6.3. Deployment Mode

- 21.6.4. Data Type

- 21.6.5. Source & Collection Method

- 21.6.6. Core Functionality

- 21.6.7. Integration & Interoperability

- 21.6.8. Pricing & Commercial Model

- 21.6.9. End User / Buyer

- 21.6.10. Industry Vertical

- 22. Key Players/ Company Profile

- 22.1. Arabesque S-Ray

- 22.1.1. Company Details/ Overview

- 22.1.2. Company Financials

- 22.1.3. Key Customers and Competitors

- 22.1.4. Business/ Industry Portfolio

- 22.1.5. Product Portfolio/ Specification Details

- 22.1.6. Pricing Data

- 22.1.7. Strategic Overview

- 22.1.8. Recent Developments

- 22.2. Bloomberg ESG

- 22.3. Clarity AI

- 22.4. Datamaran

- 22.5. Diligent

- 22.6. EcoVadis

- 22.7. Enablon

- 22.8. FactSet ESG

- 22.9. Greenstone

- 22.10. ISS ESG

- 22.11. Moody’s ESG Solutions

- 22.12. MSCI ESG Research

- 22.13. Persefoni

- 22.14. Refinitiv (LSEG)

- 22.15. RepRisk

- 22.16. S&P Global Trucost

- 22.17. Sphera

- 22.18. Sustainalytics

- 22.19. Truvalue Labs

- 22.20. Workiva

- 22.21. Other Key Players

- 22.1. Arabesque S-Ray

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

ESG Data Management Platforms Market by Component, Deployment Mode, Data Type, Source & Collection Method, Core Functionality, Integration & Interoperability, Pricing & Commercial Model, End User / Buyer, Industry Vertical and Geography

Insightified

Mid-to-large firms spend $20K–$40K quarterly on systematic research and typically recover multiples through improved growth and profitability

Research is no longer optional. Leading firms use it to uncover $10M+ in hidden revenue opportunities annually

Our research-consulting programs yields measurable ROI: 20–30% revenue increases from new markets, 11% profit upticks from pricing, and 20–30% cost savings from operations

ESG Data Management Platforms Market Size, Share & Trends Analysis Report by Component (Data Ingestion & ETL, Data Warehouse / Lake & Storage, Data Normalization & Mapping Engine, Analytics & Insight Modules, Reporting & Disclosure Tools (Templates: CDP, GRI, SASB/ISSB, TCFD), Workflow, Collaboration & Audit Trail, API & Integration Layer, Professional Services & Verification Support and Others), Deployment Mode, Data Type, Source & Collection Method, Core Functionality, Integration & Interoperability, Pricing & Commercial Model, End User / Buyer, Industry Vertical and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

Market Structure & Evolution |

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

ESG Data Management Platforms Market Size, Share, and Growth

The global ESG data management platforms market is experiencing robust growth, with its estimated value of USD 1.1 billion in the year 2025 and USD 4.3 billion by the period 2035, registering a CAGR of 14.5% during the forecast period. The ESG data management platforms market is rapidly expanding globally due to several factors that are accelerating the adoption of these platforms by enterprises.

“Data is an essential element in the implementation of ESG, The core element of a data integrity strategy is the main factor that gets ESG initiatives working properly... This is because it guarantees that reliable data is always available. In the absence of data, it would have been almost impossible to measure progress, in reaching ESG goals that have been set.” - Pat McCarthy, CRO of Precisely

Such factors include the implementation of mandatory sustainability disclosure frameworks and the emergence of advanced data-integration and assurance technologies that have been tested and are very reliable at large scale. A good example is the International Sustainability Standards Board (ISSB) which, in 2024, implemented its global baseline standards-IFRS S1 and S2, that required thousands of companies to adopt structured, digital ESG reporting systems so as to comply with the new, internationally aligned requirements.

European Union’s Corporate Sustainability Reporting Directive (CSRD) became operational from 2024 and it requires companies to report in line with European Sustainability Reporting Standards (ESRS). This led to a huge demand for platforms that could manage detailed, audit-ready sustainability data as well as cross-system interoperability. The trend was further intensified in 2024 when the U.S. SEC introduced its climate disclosure rule and thus companies had to deploy ESG platforms that facilitate emissions tracking, scenario analysis, and generation of disclosure that are compliant.

All these factors, i.e. regulatory enforcement, investor scrutiny, and demand for high-quality, verifiable ESG data, are the main drivers of the market growth and therefore transparent corporate reporting becomes more and more common and regulators, investors, and stakeholders gain stronger confidence.

The global ESG data management platforms market comprises of adjacent opportunities such as assurance and audit-tech solutions, emissions accounting software, supply-chain traceability tools, ESG analytics engines, digital identity frameworks, and real-time sustainability data monitoring systems. Taking advantage of these adjacent segments allows providers to upgrade the sustainability reporting ecosystems from end to end and to increase their revenue throughout the broader ESG technology landscape.

ESG Data Management Platforms Market Dynamics and Trends

Driver: Global Mandatory Disclosure Standards Accelerating ESG Platform Adoption

Restraint: Data Fragmentation, High Assurance Requirements, and Legacy Reporting Systems

Opportunity: Growth in Supply-Chain Disclosure, Emissions Accounting, and Assurance Technologies

Key Trend: Convergence of AI, Interoperability Standards, and Real-Time Data Systems

ESG Data Management Platforms Market Analysis and Segmental Data

“Financial Services Leads Global ESG Data Management Platforms Market Amid Expanding Regulatory Disclosure Mandates"

“North America Leads the ESG Data Management Platforms Market Amid Strengthening Climate-Disclosure Regulations and Assurance Requirements"

ESG-Data-Management-Platforms-Market Ecosystem

The ESG data management platforms market is increasingly becoming a consolidated space where top-tier players like MSCI ESG Research, Bloomberg ESG, Sustainalytics, S&P Global Trucost, ISS ESG, and EcoVadis are dominating by using advanced analytics, AI-driven scoring models and comprehensive data-aggregation capabilities. These organizations are constantly setting themselves apart by delivering the specialized instruments like automated disclosure mapping, supply-chain sustainability assessment modules, and portfolio-level climate-risk analytics designed for financial institutions and multinational corporations.

The innovation pipeline is being strengthened by government bodies, standards organizations, and research institutions as well. As an instance, in June 2024, the International Sustainability Standards Board (ISSB) released its digital sustainability taxonomy making the machine-readable reporting that is in line with IFRS S1 and S2. This has greatly facilitated interoperability and automated compliance reporting across platforms.

Besides product diversification and integrated ESG-finance solutions that improve operational efficiency, audit readiness, and value-chain transparency, key market players are also focusing on these aspects. In October 2024, a notable provider like Persefoni took a step further by broadening its AI-enabled carbon accounting engine, thereby showing the emission calculation accuracy improvement that can be measured and the data-processing time reduction for enterprise users. All of these innovations, to a great extent, are solidifying the sector's move to standardized, tech-driven, and enterprise-grade ESG data ecosystems.

Recent Development and Strategic Overview:

Report Scope

|

Attribute |

Detail |

|

Market Size in 2025 |

USD 1.1 Bn |

|

Market Forecast Value in 2035 |

USD 4.3 Bn |

|

Growth Rate (CAGR) |

14.5% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

USD Bn for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

Regions and Countries Covered |

|||||

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

|

ESG-Data-Management-Platforms-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

ESG Data Management Platforms Market, By Component |

|

|

ESG Data Management Platforms Market, By Deployment Mode |

|

|

ESG Data Management Platforms Market, By Data Type |

|

|

ESG Data Management Platforms Market, By Source & Collection Method |

|

|

ESG Data Management Platforms Market, By Core Functionality |

|

|

ESG Data Management Platforms Market, By Integration & Interoperability |

|

|

ESG Data Management Platforms Market, By Pricing & Commercial Model |

|

|

ESG Data Management Platforms Market, By End User / Buyer |

|

|

ESG Data Management Platforms Market, By Industry Vertical |

|

Frequently Asked Questions

Table of Contents

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

Forecasting Models / Techniques

Multiple Regression Analysis

Time Series Analysis – Seasonal Patterns

Time Series Analysis – Trend Analysis

Expert Opinion – Expert Interviews

Multi-Scenario Development

Time Series Analysis – Moving Averages

Econometric Models

Expert Opinion – Delphi Method

Monte Carlo Simulation

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation