AI Radiology Workflows Market Size, Share & Trends Analysis Report by Component (Software, Hardware, Services), Imaging Modality, Deployment Mode, Workflow Stage/ Functionality, Integration/ Interoperability, Application, End User and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

Market Structure & Evolution |

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

AI Radiology Workflows Market Size, Share, and Growth

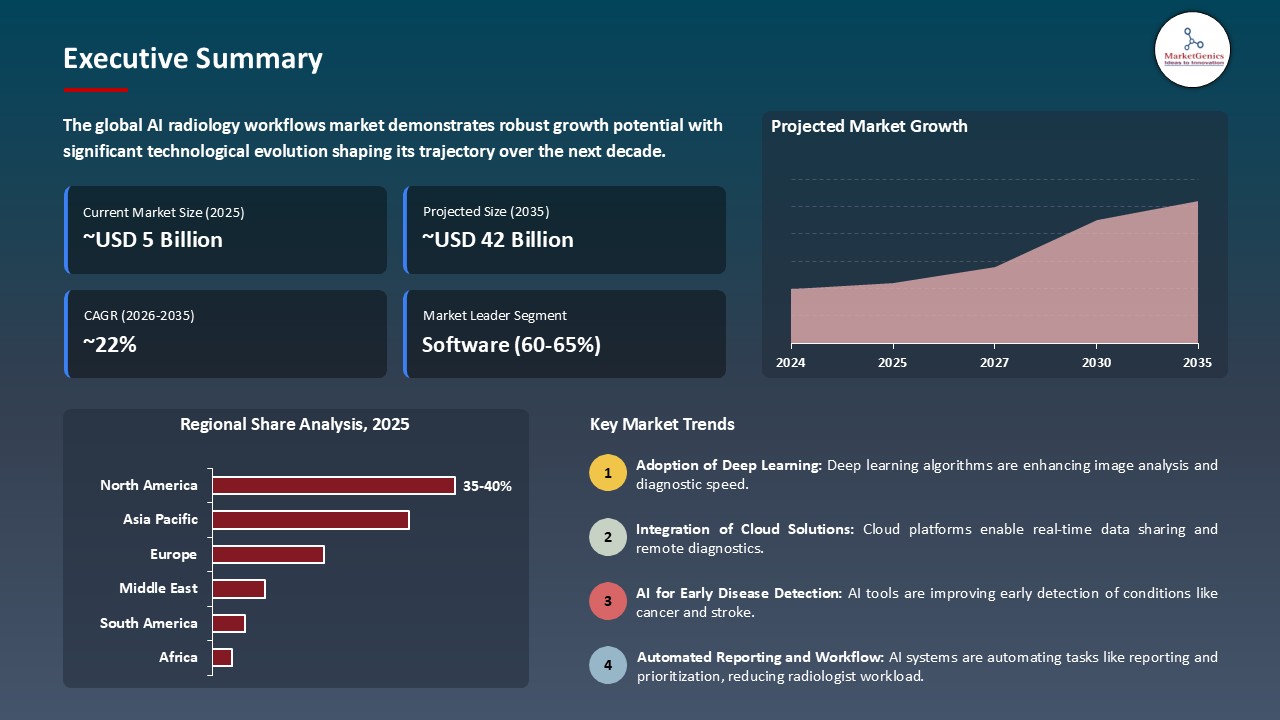

The global AI radiology workflows market is experiencing robust growth, with its estimated value of USD 5.6 billion in the year 2025 and USD 42.0 billion by the period 2035, registering a CAGR of 22.3% during the forecast period. The AI in radiology workflows market is growing worldwide due to various factors, such as new imaging devices that are improving accuracy and efficiency.

"We are empowering healthcare providers to responsibly harness intelligent automation through our AI in radiology workflow platforms - enabling large-scale, accurate, and ethically governed AI solutions that inspire trust, regulatory compliance, and diagnostic reliability across clinical operations," said Dr. Emily Chen, Head of AI Radiology Solutions at MedIntel Technologies.

For instance, in September 2025, Zebra Medical Vision launched InsightAI, an AI-enabled platform that scans CT, MRI, and X-ray images and detects abnormalities and the level of severity of the scan in a fully automatic way, and is reducing the time physicians have to manually review scans and learn of any disease at an earlier stage.

Moreover, as the demand for speed and reliability regarding diagnostic services grows, and the patient volume in hospitals and diagnostics centers seems to be perpetual (and growing), it is driving use of AI-based solutions to streamline and add value to the radiology process. For example, in August 2025, Aidoc announced expansion of its AI triage software platform at various healthcare networks allowing for radiologists to manage workflow and "highlight" critical cases first on a patient's list of studies to review.

Moreover, regulatory standards that improve or increase the requirements of accuracy (e.g., FDA/CE approvals for new AI diagnostics tools), will drive hospitals and imaging centers to invest in an AI-based validated solution. The catalysts for growth in the AI for radiology workflow space is due to technological innovation, regulatory demands, and improved patient outcomes relationship/benefits associated with AI means higher precision or accuracy of a diagnosis and workflow efficiency.

Further, the AI in radiology workflows market also provides opportunities near terms, such as AI-enabled image segmentation, predictive analytics for treatment planning, cloud-based imaging systems, and integration with electronic health records (EHRs). Capitalizing on these adjacencies can support providers in streamlining workflow, increasing patient care, and augmenting revenue opportunities in medical imaging services.

AI Radiology Workflows Market Dynamics and Trends

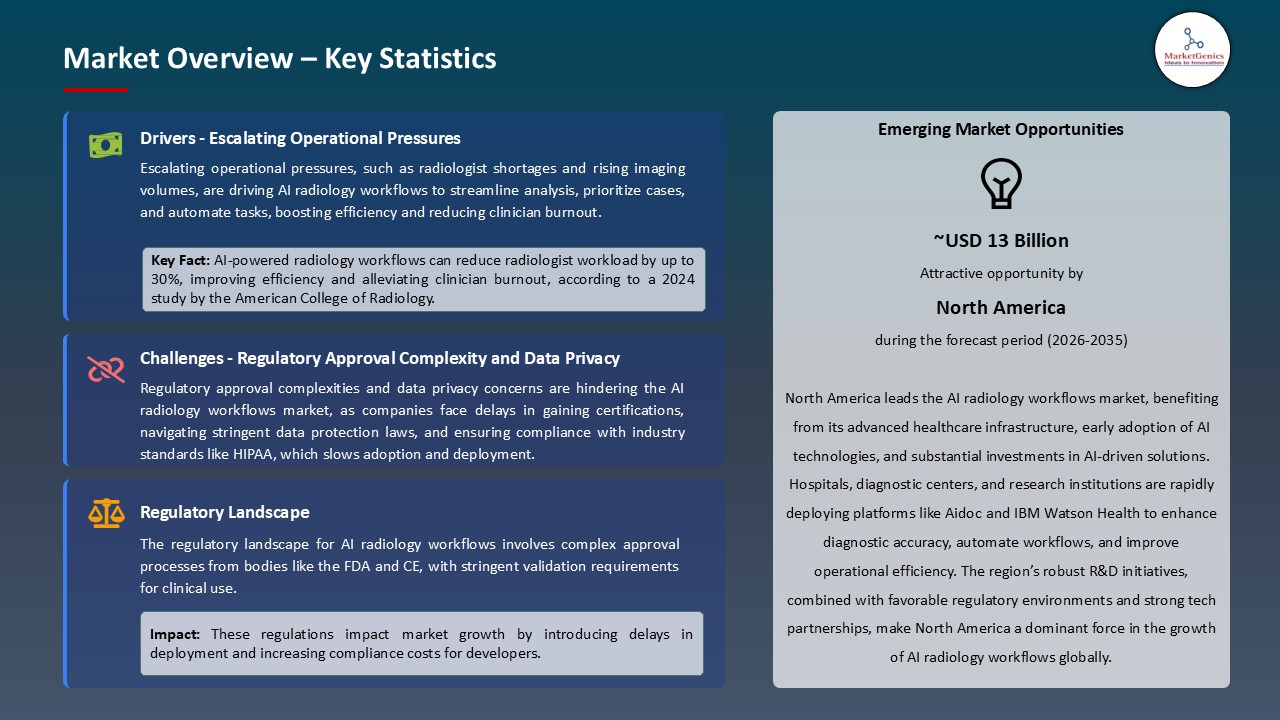

Driver: Escalating Operational Pressures Driving AI-Powered Diagnostic Efficiency and growing AI Radiology Workflows Market

- The healthcare sector is under increasing pressure to speed up diagnostic accuracy or improve workflow diversity given rising patient volumes and the shortage of radiologists. As a consequence, hospitals and diagnostic clinics are beginning to incorporate AI-enabled imaging and analysis platforms to not only streamline manual work but improve resource allocation.

- AI algorithms are able to process CT, MRI and X-Ray scans in real time, identify abnormalities, and provide predictive insights. It does this while constantly learning from historical imaging data to improve the accuracy of diagnoses and reduce error. For example, the Zebra Medical Vision InsightAI product, launched in June 2025, process thousands of imaging studies each day, reduced manual review by over 20%, and provided earlier disease identification.

- When efficiency gains of AI affect ROI, hospitals can quickly assimilate artificial intelligence into their hospital imaging departments.

Restraint: Regulatory Approval Complexity and Data Privacy Challenges Limiting Widespread Adoption

- Regulatory systems for AI tools in diagnostics, such as FDA and CE submissions, necessitate extensive validation to inform how reliable they are to patients, imaging devices, and clinical scenarios. The non-deterministic nature of AI algorithms (for instance, those utilized in deep-learning models) produce reproducibility and explainability imperative, but challenging, for regulators.

- In 2025, several AI radiology platforms do not move ahead significantly because of extensive clinical validation requirements and the need to handle data according to strict HIPAA-compliant standards that also slow the adoption process. Furthermore, implementation across borders in AI will be stalled at even a higher rate where differing regional data privacy laws would limit the standardization required of AI solutions.

- It is necessary that developers, regulators, and healthcare institutions enter a partnership to create a standard validation process that applies to AI and maintains a balance between innovation and patient safety. Additionally, the industry-wide push to create explainable AI practices and the use of transparent reporting mechanisms intended as precautionary measures, are helping to move beyond regulatory concern and into trusting in AI with healthcare providers, payers, and patients.

Opportunity: Expansion in Tele-Radiology and Remote Diagnostics Backing AI Radiology Workflows Market

- The rising pace of telehealth/telemedicine and remote imaging services will promote the demand for AI-enabled radiology tools that can read radiology films in decentralized locations, thereby reducing the reliance on local radiologists. This trend is likely to have particular implications for rural or underserved populations, where the availability of specialized radiologists is limited, so getting a diagnosis in a timely manner may have life-saving implications.

- In August 2025, Aidoc integrated AI triage platforms into several hospital networks, which allowed remote locations to prioritize critical cases and make timely diagnostic decisions. Hospitals reported higher patient throughput, reduced backlog of reporting films, suggesting measurable gains in operational efficiency and improved workflow.

- Integration into cloud platforms and IoT-enabled imaging can also expand the opportunity for scalable and real-time diagnosing and triaging of films in underserved regions. AI also facilitates remote teaming of specialists providing second opinions, assisting multi-center clinical studies, and improving care overall with accompanying cost reductions in travel and other operational expenses for health systems.

Key Trend: Generative AI for Personalized Training and Workflow Optimization

- Generative AI is increasingly used in training radiologists in generated imaging cases that are personalized to the trainee's skill level and highlight areas for improvement. Generative AI processes performance data and creates unique learning pathways that allow the trainee to focus on deficiencies and be more efficient in gaining competency.

- For example, GEHC in 2025 rolled out a generative AI-based simulation system to create thousands of original imaging cases that provided an efficient training experience for radiologists and increased diagnostic accuracy. Hospitals and academic health systems had a significant reduction in time required for training and higher trainee proficiency scores.

- Generative AI facilitates workflow optimization by producing self-directed interactive technical documentation, automated reports of imaging cases, and predictive workflows and scheduling for imaging centers. Furthermore, AI-enabled workflow optimization produced leaner operations with reduced patient wait times, improved prioritization of imaging studies, and improved radiology decision-making in real-time so that the radiology departments can more effectively achieve excellence in patient safety and quality care.

AI Radiology Workflows Market Analysis and Segmental Data

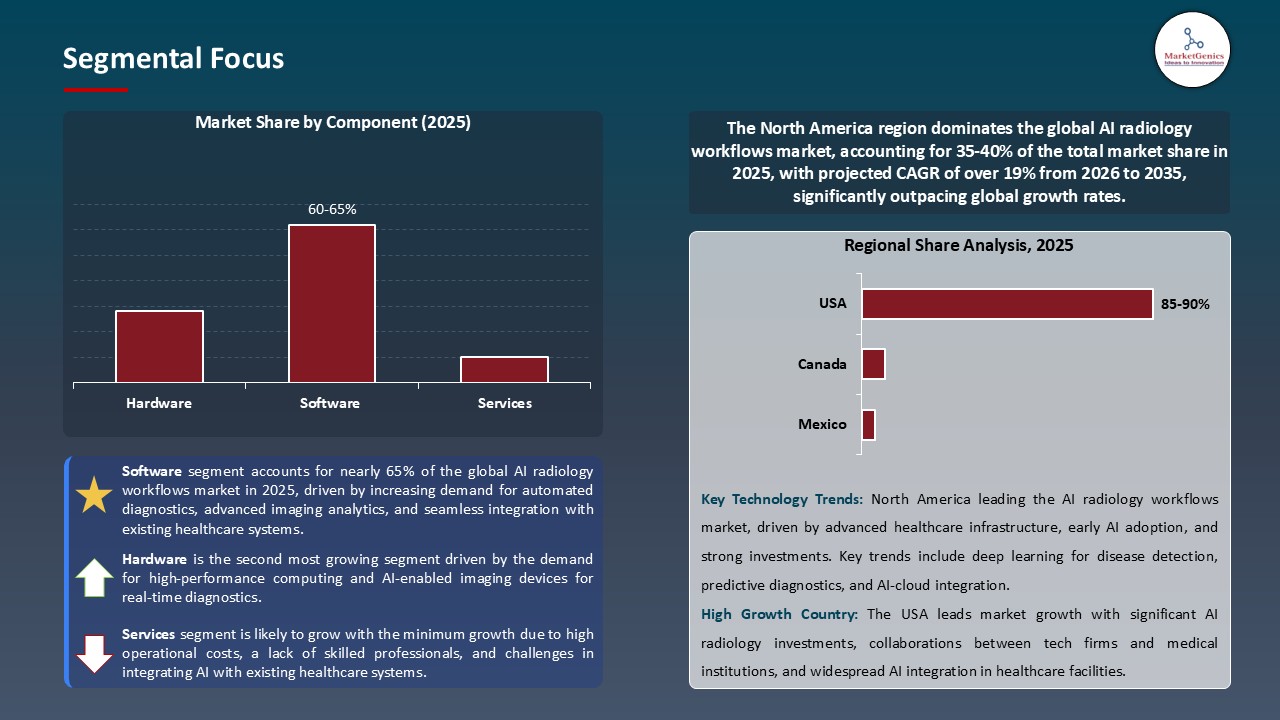

“Software Segment Maintain Dominance in Global AI Radiology Workflows Market amid Growing Demand for Automated Diagnostics and Advanced Imaging Analytics "

- The software segment holds a prominent position in the global AI radiology workflows market due to the increasing emphasis on automated diagnostics and advanced imaging analytics. Hospitals and diagnostic centers are increasingly using AI-powered software to accelerate image analysis, improve the accuracy of diagnostics, and increase efficiency in radiology workflows. In 2025, Aidoc’s AI triage software permitted rapid visibility of prioritizing critical cases across multiple hospital networks, improving patient outcomes and operational efficiencies.

- The software segment leader is enhanced with deep learning, convolutional neural networks, generative AI, and hybrid AI architectures driving technologies. Such solutions have integrated predictive analytics to improve workflow efficiencies, reduce human error, and ensure compliance with health care regulations and procedures to ensure that adoption is further enhanced.

- AI radiology software is likely to also use cloud computing and edge-enabled devices to allow scalable and real-time image analysis capabilities, providing decentralized access to diagnostic insights. This will establish a combination of software intelligence and connected infrastructure, ensuring timely, accurate, and efficient radiology operations between healthcare facilities. This overall reinforces the software segment leader and position in the market.

“North America Leads the AI Radiology Workflows Market amid Rapid Adoption of AI-Driven Diagnostics and Advanced Imaging Technologies”

- North America is anticipated to be the leading region in the global AI radiology workflows market due to its mature digital infrastructure, active venture capital investments, and early adoption of AI-based imaging and diagnostics solutions, which represent ~40% of the market share in 2025.

- The region persists the benefit of easy collaboration among AI technology suppliers, healthcare providers, and industry to introduce AI radiology workflow platforms more quickly using deep learning for diagnostics, predictive analytics, and quality assurance workflows.

- Throughout healthcare, industrial inspection, and the research space, the use of AI radiology workflow is entering into organizations for real time diagnostics, predictive maintenance, and workflow automation to provide operational efficiencies and better decision-making. The expanding presence of AI-enabled imaging solutions in hospitals and industrial applications solidifies the North American presence and provides global leverage in the overall marketplace.

AI-Radiology-Workflows-Market Ecosystem

The global AI radiology workflows market is highly consolidated, with major players such as GE Healthcare, Siemens Healthineers, Philips Healthcare, Aidoc, Zebra Medical Vision, and NVIDIA, leading the industry due to their advanced deep learning, AI, and cloud-enabled imaging solutions. These players have focused on certain technologies that offer specialty tools, such as AI triage platforms, as well as automated and real-time image analysis diagnostics, that allow for better accuracy and efficiency in workflow.

Key players are seeking to expand their product offerings, as well as offering integrated solutions, including AI-integrated workflow optimization, predictive analytics, and cloud-based imaging platforms to improve operational efficiency, reduce errors, and support sustainable care.

In June, 2025, Zebra Medical Vision announced its launch of the AI-driven imaging platform, InsightAI, using deep learning and computer vision technology, and which detects the presence of abnormalities in CT, MRI and X-ray scans. The platform demonstrated improvements in the early detection of disease and demonstrated an ability to reduce the amount of manual image analysis, contributing acceptable measured increases in diagnostic accuracy and improvements in clinical productivity. With all aspects considered, market consolidation, technological specialisation, institutional support, product expansion, and state-of-the-art AI innovations continue to propel the growth of the AI Radiology Workflows market.

Recent Development and Strategic Overview:

- In May 2025, Viz.ai launched its AI-enabled stroke detection system, using deep learning and real-time imaging analytics to identify large vessel occlusions from CT angiography images automatically. The system notifies the neurologist automatically, speeding up treatment plans and improving patient outcomes. It is deployed across several hospital networks in North America, reducing time-to-treatment by 30% on average and improving efficiency in the clinical workflow.

- In September 2025, Lunit launched, Lunit INSIGHT, an AI-based oncology imaging platform that uses deep learning and radiomics to assess mammograms and chest x-rays for early cancer datasets. The system produces automated diagnostic scores and risk scores to help radiologists with triage in high-risk patients. Deployed in many of the top diagnostic centers in Asia and Europe, the platform had a 95% accuracy in identifying lesions and also improved efficiency in the radiology reporting process.

Report Scope

|

Attribute |

Detail |

|

Market Size in 2025 |

USD 5.6 Bn |

|

Market Forecast Value in 2035 |

USD 42.0 Bn |

|

Growth Rate (CAGR) |

22.3% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

USD Bn for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

Regions and Countries Covered |

|||||

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

AI-Radiology-Workflows-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

AI Radiology Workflows Market, By Component |

|

|

AI Radiology Workflows Market, By Imaging Modality |

|

|

AI Radiology Workflows Market, By Deployment Mode |

|

|

AI Radiology Workflows Market, By Workflow Stage/ Functionality |

|

|

AI Radiology Workflows Market, By Integration/ Interoperability |

|

|

AI Radiology Workflows Market, By Application |

|

|

AI Radiology Workflows Market, By End User |

|

Frequently Asked Questions

The global AI radiology workflows market was valued at USD 5.6 Bn in 2025

The global AI radiology workflows market industry is expected to grow at a CAGR of 22.3% from 2026 to 2035

The demand for AI radiology workflows is driven by the need for faster, more accurate diagnostics, workflow automation, and enhanced efficiency in medical imaging.

In terms of component, the software segment accounted for the major share in 2025.

North America is the more attractive region for vendors.

Key players in the global AI radiology workflows market include prominent companies such as Aidence, Aidoc, Arterys, Butterfly Network, Canon Medical Systems, Caption Health, CureMetrix, Enlitic, GE HealthCare, IBM (Watson Health / Merative), Imagen Technologies, Lunit, MaxQ AI, NVIDIA, Oxipit, Philips Healthcare, Qure.ai, Siemens Healthineers, Viz.ai, Zebra Medical Vision, along with several other key players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global AI Radiology Workflows Market Outlook

- 2.1.1. Global AI Radiology Workflows Market Size (Value - USD Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global AI Radiology Workflows Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Information Technology & Media Industry Overview, 2025

- 3.1.1. Information Technology & Media Ecosystem Analysis

- 3.1.2. Key Trends for Information Technology & Media Industry

- 3.1.3. Regional Distribution for Information Technology & Media Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.1. Global Information Technology & Media Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Growing demand for faster and more accurate diagnostic imaging interpretation

- 4.1.1.2. Rising adoption of AI tools to manage increasing radiology workloads and reduce clinician burnout

- 4.1.1.3. Integration of AI with PACS/RIS systems for automated reporting and workflow optimization

- 4.1.2. Restraints

- 4.1.2.1. High implementation costs and lack of interoperability with existing hospital IT infrastructure

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Data Providers

- 4.4.2. AI Radiology Workflow Solution Providers

- 4.4.3. System Integrators

- 4.4.4. End Users

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global AI Radiology Workflows Market Demand

- 4.9.1. Historical Market Size - (Value - USD Bn), 2021-2024

- 4.9.2. Current and Future Market Size - (Value - USD Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global AI Radiology Workflows Market Analysis, by Component

- 6.1. Key Segment Analysis

- 6.2. Global AI Radiology Workflows Market Size (Value - USD Bn), Analysis, and Forecasts, by Component, 2021-2035

- 6.2.1. Software

- 6.2.1.1. AI Algorithms

- 6.2.1.1.1. Deep Learning

- 6.2.1.1.2. Machine Learning

- 6.2.1.1.3. Computer Vision Models

- 6.2.1.1.4. Others

- 6.2.1.2. Image Analysis Software

- 6.2.1.3. Workflow Orchestration Tools

- 6.2.1.4. Reporting and Annotation Tools

- 6.2.1.5. PACS/RIS Integration Modules

- 6.2.1.6. Clinical Decision Support Systems

- 6.2.1.7. Data Management and Analytics Platforms

- 6.2.1.8. Others

- 6.2.1.1. AI Algorithms

- 6.2.2. Hardware

- 6.2.2.1. High-Performance Workstations

- 6.2.2.2. GPU/TPU Servers for AI Training and Inference

- 6.2.2.3. Imaging Equipment with Embedded AI Chips

- 6.2.2.4. Edge Devices for Real-Time Processing

- 6.2.2.5. Data Storage Systems

- 6.2.2.6. Network and Communication Infrastructure

- 6.2.2.7. Others

- 6.2.3. Services

- 6.2.3.1. Implementation and Integration Services

- 6.2.3.2. Consulting and Workflow Optimization

- 6.2.3.3. Training and Education Services

- 6.2.3.4. Maintenance and Technical Support

- 6.2.3.5. Managed AI Services (Monitoring and Upgrades)

- 6.2.3.6. Data Labeling and Annotation Services

- 6.2.3.7. Others

- 6.2.1. Software

- 7. Global AI Radiology Workflows Market Analysis, by Imaging Modality

- 7.1. Key Segment Analysis

- 7.2. Global AI Radiology Workflows Market Size (Value - USD Bn), Analysis, and Forecasts, by Imaging Modality, 2021-2035

- 7.2.1. X-ray

- 7.2.2. CT (Computed Tomography)

- 7.2.3. MRI (Magnetic Resonance Imaging)

- 7.2.4. Ultrasound

- 7.2.5. PET/SPECT

- 7.2.6. Mammography

- 7.2.7. Digital Pathology / Whole Slide Imaging

- 7.2.8. Others

- 8. Global AI Radiology Workflows Market Analysis, by Deployment Mode

- 8.1. Key Segment Analysis

- 8.2. Global AI Radiology Workflows Market Size (Value - USD Bn), Analysis, and Forecasts, Deployment Mode, 2021-2035

- 8.2.1. Cloud-Based

- 8.2.2. On-Premises

- 8.2.3. Hybrid

- 9. Global AI Radiology Workflows Market Analysis, by Workflow Stage/ Functionality

- 9.1. Key Segment Analysis

- 9.2. Global AI Radiology Workflows Market Size (Value - USD Bn), Analysis, and Forecasts, by Workflow Stage/ Functionality, 2021-2035

- 9.2.1. Image Acquisition & Protocol Optimization

- 9.2.2. Automated Triage and Prioritization

- 9.2.3. Image Processing & Enhancement

- 9.2.4. AI-Assisted Interpretation / CAD

- 9.2.5. Reporting Automation & Structured Reporting

- 9.2.6. Post-Processing / Quantification

- 9.2.7. Quality Assurance & Peer Review

- 9.2.8. Clinical Decision Support & Follow-up Recommendations

- 9.2.9. Others

- 10. Global AI Radiology Workflows Market Analysis, by Integration/ Interoperability

- 10.1. Key Segment Analysis

- 10.2. Global AI Radiology Workflows Market Size (Value - USD Bn), Analysis, and Forecasts, by Integration/ Interoperability, 2021-2035

- 10.2.1. PACS/RIS Integrated Solutions

- 10.2.2. EHR/EMR Integrated Solutions

- 10.2.3. Standalone AI Tools

- 10.2.4. Vendor Neutral Archive (VNA) Compatible

- 10.2.5. Others

- 11. Global AI Radiology Workflows Market Analysis, by Application

- 11.1. Key Segment Analysis

- 11.2. Global AI Radiology Workflows Market Size (Value - USD Bn), Analysis, and Forecasts, by Application, 2021-2035

- 11.2.1. Oncology (tumor detection, staging)

- 11.2.2. Cardiovascular (CAD, ejection fraction)

- 11.2.3. Neurology (stroke, hemorrhage detection)

- 11.2.4. Musculoskeletal (fracture, arthritis)

- 11.2.5. Chest & Pulmonary (pneumonia, COVID/ARDS)

- 11.2.6. Breast Imaging

- 11.2.7. Emergency & Trauma Triage

- 11.2.8. Others

- 12. Global AI Radiology Workflows Market Analysis, by End User

- 12.1. Key Segment Analysis

- 12.2. Global AI Radiology Workflows Market Size (Value - USD Bn), Analysis, and Forecasts, by End User, 2021-2035

- 12.2.1. Hospitals (Tertiary, Community)

- 12.2.2. Diagnostic Imaging Centers

- 12.2.3. Ambulatory Clinics

- 12.2.4. Tele-radiology Providers

- 12.2.5. Research & Academic Institutions

- 12.2.6. Others

- 13. Global AI Radiology Workflows Market Analysis and Forecasts, by Region

- 13.1. Key Findings

- 13.2. Global AI Radiology Workflows Market Size (Value - USD Bn), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America AI Radiology Workflows Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America AI Radiology Workflows Market Size (Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Component

- 14.3.2. Imaging Modality

- 14.3.3. Deployment Mode

- 14.3.4. Workflow Stage/ Functionality

- 14.3.5. Integration/ Interoperability

- 14.3.6. Application

- 14.3.7. End User

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA AI Radiology Workflows Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Component

- 14.4.3. Imaging Modality

- 14.4.4. Deployment Mode

- 14.4.5. Workflow Stage/ Functionality

- 14.4.6. Integration/ Interoperability

- 14.4.7. Application

- 14.4.8. End User

- 14.5. Canada AI Radiology Workflows Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Component

- 14.5.3. Imaging Modality

- 14.5.4. Deployment Mode

- 14.5.5. Workflow Stage/ Functionality

- 14.5.6. Integration/ Interoperability

- 14.5.7. Application

- 14.5.8. End User

- 14.6. Mexico AI Radiology Workflows Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Component

- 14.6.3. Imaging Modality

- 14.6.4. Deployment Mode

- 14.6.5. Workflow Stage/ Functionality

- 14.6.6. Integration/ Interoperability

- 14.6.7. Application

- 14.6.8. End User

- 15. Europe AI Radiology Workflows Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe AI Radiology Workflows Market Size (Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Component

- 15.3.2. Imaging Modality

- 15.3.3. Deployment Mode

- 15.3.4. Workflow Stage/ Functionality

- 15.3.5. Integration/ Interoperability

- 15.3.6. Application

- 15.3.7. End User

- 15.3.8. Country

- 15.3.8.1. Germany

- 15.3.8.2. United Kingdom

- 15.3.8.3. France

- 15.3.8.4. Italy

- 15.3.8.5. Spain

- 15.3.8.6. Netherlands

- 15.3.8.7. Nordic Countries

- 15.3.8.8. Poland

- 15.3.8.9. Russia & CIS

- 15.3.8.10. Rest of Europe

- 15.4. Germany AI Radiology Workflows Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Component

- 15.4.3. Imaging Modality

- 15.4.4. Deployment Mode

- 15.4.5. Workflow Stage/ Functionality

- 15.4.6. Integration/ Interoperability

- 15.4.7. Application

- 15.4.8. End User

- 15.5. United Kingdom AI Radiology Workflows Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Component

- 15.5.3. Imaging Modality

- 15.5.4. Deployment Mode

- 15.5.5. Workflow Stage/ Functionality

- 15.5.6. Integration/ Interoperability

- 15.5.7. Application

- 15.5.8. End User

- 15.6. France AI Radiology Workflows Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Component

- 15.6.3. Imaging Modality

- 15.6.4. Deployment Mode

- 15.6.5. Workflow Stage/ Functionality

- 15.6.6. Integration/ Interoperability

- 15.6.7. Application

- 15.6.8. End User

- 15.7. Italy AI Radiology Workflows Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Component

- 15.7.3. Imaging Modality

- 15.7.4. Deployment Mode

- 15.7.5. Workflow Stage/ Functionality

- 15.7.6. Integration/ Interoperability

- 15.7.7. Application

- 15.7.8. End User

- 15.8. Spain AI Radiology Workflows Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Component

- 15.8.3. Imaging Modality

- 15.8.4. Deployment Mode

- 15.8.5. Workflow Stage/ Functionality

- 15.8.6. Integration/ Interoperability

- 15.8.7. Application

- 15.8.8. End User

- 15.9. Netherlands AI Radiology Workflows Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Component

- 15.9.3. Imaging Modality

- 15.9.4. Deployment Mode

- 15.9.5. Workflow Stage/ Functionality

- 15.9.6. Integration/ Interoperability

- 15.9.7. Application

- 15.9.8. End User

- 15.10. Nordic Countries AI Radiology Workflows Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Component

- 15.10.3. Imaging Modality

- 15.10.4. Deployment Mode

- 15.10.5. Workflow Stage/ Functionality

- 15.10.6. Integration/ Interoperability

- 15.10.7. Application

- 15.10.8. End User

- 15.11. Poland AI Radiology Workflows Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Component

- 15.11.3. Imaging Modality

- 15.11.4. Deployment Mode

- 15.11.5. Workflow Stage/ Functionality

- 15.11.6. Integration/ Interoperability

- 15.11.7. Application

- 15.11.8. End User

- 15.12. Russia & CIS AI Radiology Workflows Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Component

- 15.12.3. Imaging Modality

- 15.12.4. Deployment Mode

- 15.12.5. Workflow Stage/ Functionality

- 15.12.6. Integration/ Interoperability

- 15.12.7. Application

- 15.12.8. End User

- 15.13. Rest of Europe AI Radiology Workflows Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Component

- 15.13.3. Imaging Modality

- 15.13.4. Deployment Mode

- 15.13.5. Workflow Stage/ Functionality

- 15.13.6. Integration/ Interoperability

- 15.13.7. Application

- 15.13.8. End User

- 16. Asia Pacific AI Radiology Workflows Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Asia Pacific AI Radiology Workflows Market Size (Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Component

- 16.3.2. Imaging Modality

- 16.3.3. Deployment Mode

- 16.3.4. Workflow Stage/ Functionality

- 16.3.5. Integration/ Interoperability

- 16.3.6. Application

- 16.3.7. End User

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia-Pacific

- 16.4. China AI Radiology Workflows Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Component

- 16.4.3. Imaging Modality

- 16.4.4. Deployment Mode

- 16.4.5. Workflow Stage/ Functionality

- 16.4.6. Integration/ Interoperability

- 16.4.7. Application

- 16.4.8. End User

- 16.5. India AI Radiology Workflows Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Component

- 16.5.3. Imaging Modality

- 16.5.4. Deployment Mode

- 16.5.5. Workflow Stage/ Functionality

- 16.5.6. Integration/ Interoperability

- 16.5.7. Application

- 16.5.8. End User

- 16.6. Japan AI Radiology Workflows Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Component

- 16.6.3. Imaging Modality

- 16.6.4. Deployment Mode

- 16.6.5. Workflow Stage/ Functionality

- 16.6.6. Integration/ Interoperability

- 16.6.7. Application

- 16.6.8. End User

- 16.7. South Korea AI Radiology Workflows Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Component

- 16.7.3. Imaging Modality

- 16.7.4. Deployment Mode

- 16.7.5. Workflow Stage/ Functionality

- 16.7.6. Integration/ Interoperability

- 16.7.7. Application

- 16.7.8. End User

- 16.8. Australia and New Zealand AI Radiology Workflows Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Component

- 16.8.3. Imaging Modality

- 16.8.4. Deployment Mode

- 16.8.5. Workflow Stage/ Functionality

- 16.8.6. Integration/ Interoperability

- 16.8.7. Application

- 16.8.8. End User

- 16.9. Indonesia AI Radiology Workflows Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Component

- 16.9.3. Imaging Modality

- 16.9.4. Deployment Mode

- 16.9.5. Workflow Stage/ Functionality

- 16.9.6. Integration/ Interoperability

- 16.9.7. Application

- 16.9.8. End User

- 16.10. Malaysia AI Radiology Workflows Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Component

- 16.10.3. Imaging Modality

- 16.10.4. Deployment Mode

- 16.10.5. Workflow Stage/ Functionality

- 16.10.6. Integration/ Interoperability

- 16.10.7. Application

- 16.10.8. End User

- 16.11. Thailand AI Radiology Workflows Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Component

- 16.11.3. Imaging Modality

- 16.11.4. Deployment Mode

- 16.11.5. Workflow Stage/ Functionality

- 16.11.6. Integration/ Interoperability

- 16.11.7. Application

- 16.11.8. End User

- 16.12. Vietnam AI Radiology Workflows Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Component

- 16.12.3. Imaging Modality

- 16.12.4. Deployment Mode

- 16.12.5. Workflow Stage/ Functionality

- 16.12.6. Integration/ Interoperability

- 16.12.7. Application

- 16.12.8. End User

- 16.13. Rest of Asia Pacific AI Radiology Workflows Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Component

- 16.13.3. Imaging Modality

- 16.13.4. Deployment Mode

- 16.13.5. Workflow Stage/ Functionality

- 16.13.6. Integration/ Interoperability

- 16.13.7. Application

- 16.13.8. End User

- 17. Middle East AI Radiology Workflows Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East AI Radiology Workflows Market Size (Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Component

- 17.3.2. Imaging Modality

- 17.3.3. Deployment Mode

- 17.3.4. Workflow Stage/ Functionality

- 17.3.5. Integration/ Interoperability

- 17.3.6. Application

- 17.3.7. End User

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey AI Radiology Workflows Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Component

- 17.4.3. Imaging Modality

- 17.4.4. Deployment Mode

- 17.4.5. Workflow Stage/ Functionality

- 17.4.6. Integration/ Interoperability

- 17.4.7. Application

- 17.4.8. End User

- 17.5. UAE AI Radiology Workflows Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Component

- 17.5.3. Imaging Modality

- 17.5.4. Deployment Mode

- 17.5.5. Workflow Stage/ Functionality

- 17.5.6. Integration/ Interoperability

- 17.5.7. Application

- 17.5.8. End User

- 17.6. Saudi Arabia AI Radiology Workflows Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Component

- 17.6.3. Imaging Modality

- 17.6.4. Deployment Mode

- 17.6.5. Workflow Stage/ Functionality

- 17.6.6. Integration/ Interoperability

- 17.6.7. Application

- 17.6.8. End User

- 17.7. Israel AI Radiology Workflows Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Component

- 17.7.3. Imaging Modality

- 17.7.4. Deployment Mode

- 17.7.5. Workflow Stage/ Functionality

- 17.7.6. Integration/ Interoperability

- 17.7.7. Application

- 17.7.8. End User

- 17.8. Rest of Middle East AI Radiology Workflows Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Component

- 17.8.3. Imaging Modality

- 17.8.4. Deployment Mode

- 17.8.5. Workflow Stage/ Functionality

- 17.8.6. Integration/ Interoperability

- 17.8.7. Application

- 17.8.8. End User

- 18. Africa AI Radiology Workflows Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa AI Radiology Workflows Market Size (Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Component

- 18.3.2. Imaging Modality

- 18.3.3. Deployment Mode

- 18.3.4. Workflow Stage/ Functionality

- 18.3.5. Integration/ Interoperability

- 18.3.6. Application

- 18.3.7. End User

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa AI Radiology Workflows Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Component

- 18.4.3. Imaging Modality

- 18.4.4. Deployment Mode

- 18.4.5. Workflow Stage/ Functionality

- 18.4.6. Integration/ Interoperability

- 18.4.7. Application

- 18.4.8. End User

- 18.5. Egypt AI Radiology Workflows Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Component

- 18.5.3. Imaging Modality

- 18.5.4. Deployment Mode

- 18.5.5. Workflow Stage/ Functionality

- 18.5.6. Integration/ Interoperability

- 18.5.7. Application

- 18.5.8. End User

- 18.6. Nigeria AI Radiology Workflows Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Component

- 18.6.3. Imaging Modality

- 18.6.4. Deployment Mode

- 18.6.5. Workflow Stage/ Functionality

- 18.6.6. Integration/ Interoperability

- 18.6.7. Application

- 18.6.8. End User

- 18.7. Algeria AI Radiology Workflows Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Component

- 18.7.3. Imaging Modality

- 18.7.4. Deployment Mode

- 18.7.5. Workflow Stage/ Functionality

- 18.7.6. Integration/ Interoperability

- 18.7.7. Application

- 18.7.8. End User

- 18.8. Rest of Africa AI Radiology Workflows Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Component

- 18.8.3. Imaging Modality

- 18.8.4. Deployment Mode

- 18.8.5. Workflow Stage/ Functionality

- 18.8.6. Integration/ Interoperability

- 18.8.7. Application

- 18.8.8. End User

- 19. South America AI Radiology Workflows Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. South America AI Radiology Workflows Market Size (Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Component

- 19.3.2. Imaging Modality

- 19.3.3. Deployment Mode

- 19.3.4. Workflow Stage/ Functionality

- 19.3.5. Integration/ Interoperability

- 19.3.6. Application

- 19.3.7. End User

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil AI Radiology Workflows Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Component

- 19.4.3. Imaging Modality

- 19.4.4. Deployment Mode

- 19.4.5. Workflow Stage/ Functionality

- 19.4.6. Integration/ Interoperability

- 19.4.7. Application

- 19.4.8. End User

- 19.5. Argentina AI Radiology Workflows Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Component

- 19.5.3. Imaging Modality

- 19.5.4. Deployment Mode

- 19.5.5. Workflow Stage/ Functionality

- 19.5.6. Integration/ Interoperability

- 19.5.7. Application

- 19.5.8. End User

- 19.6. Rest of South America AI Radiology Workflows Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Component

- 19.6.3. Imaging Modality

- 19.6.4. Deployment Mode

- 19.6.5. Workflow Stage/ Functionality

- 19.6.6. Integration/ Interoperability

- 19.6.7. Application

- 19.6.8. End User

- 20. Key Players/ Company Profile

- 20.1. Aidence

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. Aidoc

- 20.3. Arterys

- 20.4. Butterfly Network

- 20.5. Canon Medical Systems

- 20.6. Caption Health

- 20.7. CureMetrix

- 20.8. Enlitic

- 20.9. GE HealthCare

- 20.10. IBM (Watson Health / Merative)

- 20.11. Imagen Technologies

- 20.12. Lunit

- 20.13. MaxQ AI

- 20.14. NVIDIA

- 20.15. Oxipit

- 20.16. Philips Healthcare

- 20.17. Qure.ai

- 20.18. Siemens Healthineers

- 20.19. Viz.ai

- 20.20. Zebra Medical Vision

- 20.21. Others Key Players

- 20.1. Aidence

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data