Almond Flour Market Size, Share, Growth Opportunity Analysis Report by Type (Blanched Almond Flour, Natural Almond Flour, Roasted Almond Flour), Nature, Form, Packaging Type, Distribution Channel, End Use Industry X Application, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

Market Structure & Evolution |

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Almond Flour Market Size, Share, and Growth

The global almond flour market is projected to grow from USD 1.4 Billion in 2025 to USD 3.0 Billion by 2035, with a strong CAGR of 7.7% during the forecast period. This expansion is fueled by the increased popularity of gluten free, keto, and plant-based lifestyles in which almond flour is a healthy, low carb, and gluten-free alternative to traditional wheat flour.

Bob’s Red Mill partnered with the nonprofit Zero Foodprint to launch an almond flour line sourced through regenerative farming practices. This initiative promotes soil health, carbon sequestration, and biodiversity across almond growers, delivering clean-label baking ingredients with environmental credibility.

For instance, Blue Diamond Growers introduced an ultra-fine blanched almond flour designed for gluten‑free bakery producers. This updated formula enhances the softness and dampness of the bread, so they are fluffier and chewier that can compare to the wheat version by the commercial baker's hand. These innovations give marketers options to meet growing demand for clean‑label and nutrient-dense foods, which bodes well for higher use of almond flour in premium bakery and packaged snack products.

The strong expansion of almond flour is not limited to last year and will be even more intensified as consumer behaviour trends more towards plant‑based and functional food. For Instance, King Arthur Baking Company doubled the size of its Almond flour-based pancake and bread mix line and launched into specialty retail across North America in 2024. This growth further extends the company's position in the health-focused food market and takes advantage of the increasing demand for convenient, diet-friendly meal solutions.

Almond Flour Market Dynamics and Trends

Driver: Rising Demand in Plant-Based and Functional Foods

- Increased adoption of plant-based and specialty diets globally is propelling the growth of almond flour, a nutrient-dense, gluten-free alternative. Its high protein and fibrous structure have made it a favourite ingredient in bakery, snack and protein-enriched products. For Instance, in 2024, Simple Mills introduced a variety of almond flour-based crackers and cookies through key retail outlets in the US, targeting the rise of clean-label snacks. These introductions increase product appeal and shelf space in the health-oriented consumer market.

- With the use of almond flour, food companies can command premium pricing, attract health-focused consumers and penetrate into retail, focusing on the functional/natural food channel.

Restraint: Price Volatility and Climate-Linked Supply Challenges

- Almond prices are always alone due to the supply scarcity that is exacerbated by drought, water rationing, and soaring international demand. For Instance, in 2024, Australian almond exports, which were 15% lower in 2024 because of dry weather and required manufacturers to suck up the higher cost of raw materials or reformulate products.

- Mid-sized food brands struggle to keep prices competitive amid surge in costs that can disrupt contracts and weaken relationships with retailers.

Opportunity: Growing plant-based and clean-label food sector

- Opportunities are to be found in the growing plant-based and clean-label sector, where almond flour is increasingly used in place of refined flours in bakery products, snacks and protein-added meal solutions. Its natural gluten-free status, high protein, and good fats make it attractive to functional food brands and meal kit companies targeting health-conscious consumers.

- For instance, Thrive Market, expanded its private label almond flour SKUs in 2025 to go into direct-to-consumer subscription boxes, meeting growing online demand and promoting repeat sales through convenience and brand loyalty.

Key Trend: Expansion of Clean-Label and Functional Product Lines

- Food manufacturers are producing an increasing number of clean labels, high protein, nutrient dense products using almond flour in order to accommodate growing health-conscious and diet- or lifestyle-oriented consumers. This trend is driving the expansion of gluten-free, keto-friendly, and plant-based product portfolios in both retail and foodservice channels.

- For Instance, Simple Mills launched its first functional snacking platform made from almond flour in 2024 with almond flour crackers with seeds and plant proteins responding to the increasing consumer demand for nutrient-dense and minimally processed food products So, this trend gives brands the opportunity to command premium pricing, expand to functional food categories, and develop consumer loyalty.

Almond Flour Market Analysis and Segmental Data

Blanched Almond Flour holds majority share in Almond Flour Market

- Blanched almond flour is leading the market with an approximate share of 61%, driven by its versatility in bakery, snacks, and packaged foods. The fine texture and neutral taste of almond flour give it a slight advantage over other nut flours, giving it priority over gluten-free and low-carb recipes, as it allows brands to create items that closely mimic wheat-based baked goods. With rising consumer demand for clean label, nutrient-dense baking products, blanched almond flour is highly regarded around many commercial bakeries and packaged food companies, greatly increasing adoption across premium and mainstream brands within retail.

- Furthermore, natural and organic almond flour products are growing in e-commerce and direct-to-consumer channels as these products follow into the growing trend for minimally processed and traceable food ingredients.

North America Dominates Almond Flour Market in 2025 and Beyond

- The almond flour market around the world is dominated by North America due to the increased popularity and prevalence of gluten-free and keto diets, well-established retail and foodservice markets, and major brands like Blue Diamond Growers and King Arthur Baking Company.

- The U.S. dominates North America with a large consumer base, the development of its almond supply chains from California, and increased launch of consumer-focused products focusing on health. Recently, it has seen growth in both online and specialty retail channels. North America will continue to remains the hub for almond flour market.

Almond-Flour-Market Ecosystem

The global almond flour market is moderately consolidated with medium-to-high consolidation. Tier 1 competitors include Blue Diamond Growers, ADM, Olam and Barry Callebaut Group; Tier 2 comprises Bob’s Red Mill, King Arthur, Honeyville and NOW; Tier 3 covers smaller specialty brands and regional millers. Buyer concentration is moderate-to-high as large retailers and food manufacturers command pricing and private-label demand. Supplier concentration is moderate owing to geographic (California-centric) production risks and seasonal yield variability.

Recent Developments and Strategic Overview

- In April 2025, Simple Mills launched a new range of almond-flour-based pancake and waffle mixes aimed at meeting rising demand for gluten-free, clean-label breakfast products. These launches cater to health-conscious consumers looking for nutrient-rich, convenient meal options.

- In February 2025, Blue Diamond Growers expanded its almond flour production facility in California to strengthen supply for commercial bakeries and packaged food brands. This expansion helps address rising global demand while ensuring consistent product quality.

- In March 2025, Hodgson Mill introduced organic, non-GMO almond flour under its premium line, targeting specialty retailers and online platforms. The product appeals to consumers prioritizing sustainable and traceable sourcing in their food choices.

- In January 2025, Anthony’s Goods added bulk almond flour options for foodservice and e-commerce channels, enabling small bakeries and meal kit providers to secure cost-effective supplies for functional and diet-friendly products.

Report Scope

|

Attribute |

Detail |

|

Market Size in 2025 |

USD 1.4 Billion |

|

Market Forecast Value in 2035 |

USD 3 Billion |

|

Growth Rate (CAGR) |

7.7% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

Regions and Countries Covered |

|||||

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Almond-Flour-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Type |

|

|

By Nature

|

|

|

By Form

|

|

|

By Packaging Type |

|

|

By Distribution Channel |

|

|

By End Use Industry

|

|

Frequently Asked Questions

Almond flour is a finely ground product made from blanched almonds. It is widely used as a gluten-free and nutrient-rich alternative to wheat flour in bakery, confectionery, snacks, and functional food products.

The almond flour market is valued at USD 1.4 Billion in 2025.

The almond flour market is expected to grow at a CAGR of 7.7% from 2025 to 2035.

Blanched almond flour leads the market due to its fine texture, mild flavor, and versatility in gluten-free bakery and packaged foods.

North America dominates the almond flour market with and approximate share of 42% in 2025.

Rising demand for gluten-free diets, functional food products, plant-based ingredients, and clean-label formulations.

Key players in the global almond flour market include prominent companies such as Alldrin Brothers, Anthony’s Goods, Barry Callebaut Group, Blue Diamond Growers, Bob’s Red Mill Natural Foods, Danone S.A. (through plant-based divisions), Grain-Free JK Gourmet, Hilltop Ranch, Inc., Hodgson Mill, Honeyville, Inc., King Arthur Baking Company, Milled, Nature’s Eats, NOW Health Group, Inc., Nutraonly (Xi'an Nutraonly Co., Ltd.), Olam Food Ingredients (OFI), The Archer Daniels Midland Company (ADM), TreeHouse California Almonds, WellBees, and Other Key Players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Almond Flour Market Outlook

- 2.1.1. Almond Flour Market Size in Value (US$ Billion), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Almond Flour Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Almond Flour Industry Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Food & Beverages Industry

- 3.1.3. Regional Distribution for Food & Beverages Industry

- 3.2. Supplier Customer Data

- 3.3. Source Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.2. Supply Chain/Distributor

- 3.5.3. End Consumer

- 3.1. Global Almond Flour Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Growing consumer preference for gluten-free and grain-free diets.

- 4.1.1.2. Rising adoption of almond flour in plant-based and keto-friendly products.

- 4.1.1.3. Expanding applications of almond flour in bakery, confectionery, and dairy alternatives.

- 4.1.2. Restraints

- 4.1.2.1. High production cost of almonds leading to premium pricing.

- 4.1.2.2. Supply chain volatility due to fluctuating almond crop yields and climate conditions.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Supplier

- 4.4.2. Almond Flour Producers

- 4.4.3. Distributors

- 4.4.4. End-users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Almond Flour Market Demand

- 4.9.1. Historical Market Size - in Value (US$ Billion), 2021-2024

- 4.9.2. Current and Future Market Size - in Value (US$ Billion), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Almond Flour Market Analysis, by Type

- 6.1. Key Segment Analysis

- 6.2. Almond Flour Market Size in Value (US$ Billion), Analysis, and Forecasts, by Type, 2021-2035

- 6.2.1. Blanched Almond Flour

- 6.2.2. Natural Almond Flour

- 6.2.3. Roasted Almond Flour

- 7. Almond Flour Market Analysis, by Nature

- 7.1. Key Segment Analysis

- 7.2. Almond Flour Market Size in Value (US$ Billion), Analysis, and Forecasts, by Nature, 2021-2035

- 7.2.1. Organic

- 7.2.2. Conventional

- 8. Almond Flour Market Analysis, by Form

- 8.1. Key Segment Analysis

- 8.2. Almond Flour Market Size in Value (US$ Billion), Analysis, and Forecasts, by Form, 2021-2035

- Fine8.2.1. /Extra-Fine

- 8.2.2. Coarse/Ground

- 8.2.3. Paste

- 9. Almond Flour Market Analysis, by Packaging Type

- 9.1. Key Segment Analysis

- 9.2. Almond Flour Market Size in Value (US$ Billion), Analysis, and Forecasts, by Packaging Type, 2021-2035

- 9.2.1. Pouches

- 9.2.2. Cans

- 9.2.3. Paper Bags

- 9.2.4. Bulk Packaging

- 9.2.5. Others

- 10. Almond Flour Market Analysis, by Distribution Channel

- 10.1. Key Segment Analysis

- 10.2. Almond Flour Market Size in Value (US$ Billion), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Specialty Stores

- 10.2.4. Online Retail

- 10.2.5. B2B Direct Sales

- 10.2.6. Others

- 11. Almond Flour Market Analysis, by End-Use Industry X Application

- 11.1. Key Segment Analysis

- 11.2. Almond Flour Market Size in Value (US$ Billion), Analysis, and Forecasts, by End-Use Industry X Application, 2021-2035

- 11.2.1. Food & Beverage

- 11.2.1.1. Bakery Products (cakes, cookies, muffins)

- 11.2.1.2. Confectionery (chocolates, truffles)

- 11.2.1.3. Pasta & Noodles

- 11.2.1.4. Pancake & Waffle Mixes

- 11.2.1.5. Dairy Alternatives (almond milk-based yogurts)

- 11.2.1.6. Others

- 11.2.2. Nutraceuticals

- 11.2.2.1. Energy Bars

- 11.2.2.2. Protein Powders

- 11.2.2.3. Functional Foods

- 11.2.2.4. Meal Replacements

- 11.2.2.5. Others

- 11.2.3. Foodservice

- 11.2.3.1. Restaurant/Bakery Use

- 11.2.3.2. Hotel Catering

- 11.2.3.3. Institutional Food Prep

- 11.2.3.4. Café Gluten-Free Menus

- 11.2.3.5. Others

- 11.2.4. Retail/Household

- 11.2.4.1. Home Baking

- 11.2.4.2. Smoothie Additives

- 11.2.4.3. Gluten-Free Cooking

- 11.2.4.4. Paleo/Keto Diet Ingredients

- 11.2.4.5. Others

- 11.2.5. Cosmetics & Personal Care

- 11.2.5.1. Exfoliating Scrubs

- 11.2.5.2. Natural Soaps

- 11.2.5.3. Facial Masks

- 11.2.5.4. Others

- 11.2.6. Others

- 11.2.1. Food & Beverage

- 12. Almond Flour Market Analysis and Forecasts, by Region

- 12.1. Key Findings

- 12.2. Almond Flour Market Size in Value (US$ Billion), Analysis, and Forecasts, by Region, 2021-2035

- 12.2.1. North America

- 12.2.2. Europe

- 12.2.3. Asia Pacific

- 12.2.4. Middle East

- 12.2.5. Africa

- 12.2.6. South America

- 13. North America Almond Flour Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. North America Almond Flour Market Size in Value (US$ Billion), Analysis, and Forecasts, 2021-2035

- 13.3.1. Type

- 13.3.2. Nature

- 13.3.3. Form

- 13.3.4. Packaging Type

- 13.3.5. Distribution Channel

- 13.3.6. End Use Industry X Application

- 13.3.7. Country

-

- 13.3.7.1.1. USA

- 13.3.7.1.2. Canada

- 13.3.7.1.3. Mexico

-

- 13.4. USA Almond Flour Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Type

- 13.4.3. Nature

- 13.4.4. Form

- 13.4.5. Packaging Type

- 13.4.6. Distribution Channel

- 13.4.7. End Use Industry X Application

- 13.5. Canada Almond Flour Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Type

- 13.5.3. Nature

- 13.5.4. Form

- 13.5.5. Packaging Type

- 13.5.6. Distribution Channel

- 13.5.7. End Use Industry X Application

- 13.6. Mexico Almond Flour Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Type

- 13.6.3. Nature

- 13.6.4. Form

- 13.6.5. Packaging Type

- 13.6.6. Distribution Channel

- 13.6.7. End Use Industry X Application

- 14. Europe Almond Flour Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. Europe Almond Flour Market Size in Value (US$ Billion), Analysis, and Forecasts, 2021-2035

- 14.3.1. Type

- 14.3.2. Nature

- 14.3.3. Form

- 14.3.4. Packaging Type

- 14.3.5. Distribution Channel

- 14.3.6. End Use Industry X Application

- 14.3.7. Country

- 14.3.7.1. Germany

- 14.3.7.2. United Kingdom

- 14.3.7.3. France

- 14.3.7.4. Italy

- 14.3.7.5. Spain

- 14.3.7.6. Netherlands

- 14.3.7.7. Nordic Countries

- 14.3.7.8. Poland

- 14.3.7.9. Russia & CIS

- 14.3.7.10. Rest of Europe

- 14.4. Germany Almond Flour Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Type

- 14.4.3. Nature

- 14.4.4. Form

- 14.4.5. Packaging Type

- 14.4.6. Distribution Channel

- 14.4.7. End Use Industry X Application

- 14.5. United Kingdom Almond Flour Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Type

- 14.5.3. Nature

- 14.5.4. Form

- 14.5.5. Packaging Type

- 14.5.6. Distribution Channel

- 14.5.7. End Use Industry X Application

- 14.6. France Almond Flour Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Type

- 14.6.3. Nature

- 14.6.4. Form

- 14.6.5. Packaging Type

- 14.6.6. Distribution Channel

- 14.6.7. End Use Industry X Application

- 14.7. Italy Almond Flour Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Type

- 14.7.3. Nature

- 14.7.4. Form

- 14.7.5. Packaging Type

- 14.7.6. Distribution Channel

- 14.7.7. End Use Industry X Application

- 14.8. Spain Almond Flour Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Type

- 14.8.3. Nature

- 14.8.4. Form

- 14.8.5. Packaging Type

- 14.8.6. Distribution Channel

- 14.8.7. End Use Industry X Application

- 14.9. Netherlands Almond Flour Market

- 14.9.1. Country Segmental Analysis

- 14.9.2. Type

- 14.9.3. Nature

- 14.9.4. Form

- 14.9.5. Packaging Type

- 14.9.6. Distribution Channel

- 14.9.7. End Use Industry X Application

- 14.10. Nordic Countries Almond Flour Market

- 14.10.1. Country Segmental Analysis

- 14.10.2. Type

- 14.10.3. Nature

- 14.10.4. Form

- 14.10.5. Packaging Type

- 14.10.6. Distribution Channel

- 14.10.7. End Use Industry X Application

- 14.11. Poland Almond Flour Market

- 14.11.1. Country Segmental Analysis

- 14.11.2. Type

- 14.11.3. Nature

- 14.11.4. Form

- 14.11.5. Packaging Type

- 14.11.6. Distribution Channel

- 14.11.7. End Use Industry X Application

- 14.12. Russia & CIS Almond Flour Market

- 14.12.1. Country Segmental Analysis

- 14.12.2. Type

- 14.12.3. Nature

- 14.12.4. Form

- 14.12.5. Packaging Type

- 14.12.6. Distribution Channel

- 14.12.7. End Use Industry X Application

- 14.13. Rest of Europe Almond Flour Market

- 14.13.1. Country Segmental Analysis

- 14.13.2. Type

- 14.13.3. Nature

- 14.13.4. Form

- 14.13.5. Packaging Type

- 14.13.6. Distribution Channel

- 14.13.7. End Use Industry X Application

- 15. Asia Pacific Almond Flour Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. East Asia Almond Flour Market Size in Value (US$ Billion), and Forecasts, 2021-2035

- 15.3.1. Type

- 15.3.2. Nature

- 15.3.3. Form

- 15.3.4. Packaging Type

- 15.3.5. Distribution Channel

- 15.3.6. End Use Industry X Application

- 15.3.7. Country

- 15.3.7.1. China

- 15.3.7.2. India

- 15.3.7.3. Japan

- 15.3.7.4. South Korea

- 15.3.7.5. Australia and New Zealand

- 15.3.7.6. Indonesia

- 15.3.7.7. Malaysia

- 15.3.7.8. Thailand

- 15.3.7.9. Vietnam

- 15.3.7.10. Rest of Asia Pacific

- 15.4. China Almond Flour Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Type

- 15.4.3. Nature

- 15.4.4. Form

- 15.4.5. Packaging Type

- 15.4.6. Distribution Channel

- 15.4.7. End Use Industry X Application

- 15.5. India Almond Flour Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Type

- 15.5.3. Nature

- 15.5.4. Form

- 15.5.5. Packaging Type

- 15.5.6. Distribution Channel

- 15.5.7. End Use Industry X Application

- 15.6. Japan Almond Flour Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Type

- 15.6.3. Nature

- 15.6.4. Form

- 15.6.5. Packaging Type

- 15.6.6. Distribution Channel

- 15.6.7. End Use Industry X Application

- 15.7. South Korea Almond Flour Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Type

- 15.7.3. Nature

- 15.7.4. Form

- 15.7.5. Packaging Type

- 15.7.6. Distribution Channel

- 15.7.7. End Use Industry X Application

- 15.8. Australia and New Zealand Almond Flour Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Type

- 15.8.3. Nature

- 15.8.4. Form

- 15.8.5. Packaging Type

- 15.8.6. Distribution Channel

- 15.8.7. End Use Industry X Application

- 15.9. Indonesia Almond Flour Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Type

- 15.9.3. Nature

- 15.9.4. Form

- 15.9.5. Packaging Type

- 15.9.6. Distribution Channel

- 15.9.7. End Use Industry X Application

- 15.10. Malaysia Almond Flour Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Type

- 15.10.3. Nature

- 15.10.4. Form

- 15.10.5. Packaging Type

- 15.10.6. Distribution Channel

- 15.10.7. End Use Industry X Application

- 15.11. Thailand Almond Flour Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Type

- 15.11.3. Nature

- 15.11.4. Form

- 15.11.5. Packaging Type

- 15.11.6. Distribution Channel

- 15.11.7. End Use Industry X Application

- 15.12. Vietnam Almond Flour Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Type

- 15.12.3. Nature

- 15.12.4. Form

- 15.12.5. Packaging Type

- 15.12.6. Distribution Channel

- 15.12.7. End Use Industry X Application

- 15.13. Rest of Asia Pacific Almond Flour Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Type

- 15.13.3. Nature

- 15.13.4. Form

- 15.13.5. Packaging Type

- 15.13.6. Distribution Channel

- 15.13.7. End Use Industry X Application

- 16. Middle East Almond Flour Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Middle East Almond Flour Market Size in Value (US$ Billion), Analysis, and Forecasts, 2021-2035

- 16.3.1. Type

- 16.3.2. Nature

- 16.3.3. Form

- 16.3.4. Packaging Type

- 16.3.5. Distribution Channel

- 16.3.6. End Use Industry X Application

- 16.3.7. Country

- 16.3.7.1. Turkey

- 16.3.7.2. UAE

- 16.3.7.3. Saudi Arabia

- 16.3.7.4. Israel

- 16.3.7.5. Rest of Middle East

- 16.4. Turkey Almond Flour Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Type

- 16.4.3. Nature

- 16.4.4. Form

- 16.4.5. Packaging Type

- 16.4.6. Distribution Channel

- 16.4.7. End Use Industry X Application

- 16.5. UAE Almond Flour Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Type

- 16.5.3. Nature

- 16.5.4. Form

- 16.5.5. Packaging Type

- 16.5.6. Distribution Channel

- 16.5.7. End Use Industry X Application

- 16.6. Saudi Arabia Almond Flour Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Type

- 16.6.3. Nature

- 16.6.4. Form

- 16.6.5. Packaging Type

- 16.6.6. Distribution Channel

- 16.6.7. End Use Industry X Application

- 16.7. Israel Almond Flour Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Type

- 16.7.3. Nature

- 16.7.4. Form

- 16.7.5. Packaging Type

- 16.7.6. Distribution Channel

- 16.7.7. End Use Industry X Application

- 16.8. Rest of Middle East Almond Flour Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Type

- 16.8.3. Nature

- 16.8.4. Form

- 16.8.5. Packaging Type

- 16.8.6. Distribution Channel

- 16.8.7. End Use Industry X Application

- 17. Africa Almond Flour Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Africa Almond Flour Market Size in Value (US$ Billion), Analysis, and Forecasts, 2021-2035

- 17.3.1. Type

- 17.3.2. Nature

- 17.3.3. Form

- 17.3.4. Packaging Type

- 17.3.5. Distribution Channel

- 17.3.6. End Use Industry X Application

- 17.3.7. Country

- 17.3.7.1. South Africa

- 17.3.7.2. Egypt

- 17.3.7.3. Nigeria

- 17.3.7.4. Algeria

- 17.3.7.5. Rest of Africa

- 17.4. South Africa Almond Flour Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Type

- 17.4.3. Nature

- 17.4.4. Form

- 17.4.5. Packaging Type

- 17.4.6. Distribution Channel

- 17.4.7. End Use Industry X Application

- 17.5. Egypt Almond Flour Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Type

- 17.5.3. Nature

- 17.5.4. Form

- 17.5.5. Packaging Type

- 17.5.6. Distribution Channel

- 17.5.7. End Use Industry X Application

- 17.6. Nigeria Almond Flour Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Type

- 17.6.3. Nature

- 17.6.4. Form

- 17.6.5. Packaging Type

- 17.6.6. Distribution Channel

- 17.6.7. End Use Industry X Application

- 17.7. Algeria Almond Flour Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Type

- 17.7.3. Nature

- 17.7.4. Form

- 17.7.5. Packaging Type

- 17.7.6. Distribution Channel

- 17.7.7. End Use Industry X Application

- 17.8. Rest of Africa Almond Flour Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Type

- 17.8.3. Nature

- 17.8.4. Form

- 17.8.5. Packaging Type

- 17.8.6. Distribution Channel

- 17.8.7. End Use Industry X Application

- 18. South America Almond Flour Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Central and South Africa Almond Flour Market Size in Value (US$ Billion), Analysis, and Forecasts, 2021-2035

- 18.3.1. Type

- 18.3.2. Nature

- 18.3.3. Form

- 18.3.4. Packaging Type

- 18.3.5. Distribution Channel

- 18.3.6. End Use Industry X Application

- 18.3.7. Country

- 18.3.7.1. Brazil

- 18.3.7.2. Argentina

- 18.3.7.3. Rest of South America

- 18.4. Brazil Almond Flour Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Type

- 18.4.3. Nature

- 18.4.4. Form

- 18.4.5. Packaging Type

- 18.4.6. Distribution Channel

- 18.4.7. End Use Industry X Application

- 18.5. Argentina Almond Flour Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Type

- 18.5.3. Nature

- 18.5.4. Form

- 18.5.5. Packaging Type

- 18.5.6. Distribution Channel

- 18.5.7. End Use Industry X Application

- 18.6. Rest of South America Almond Flour Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Type

- 18.6.3. Nature

- 18.6.4. Form

- 18.6.5. Packaging Type

- 18.6.6. Distribution Channel

- 18.6.7. End Use Industry X Application

- 19. Key Players/ Company Profile

- 19.1. Alldrin Brothers

- 19.1.1. Company Details/ Overview

- 19.1.2. Company Financials

- 19.1.3. Key Customers and Competitors

- 19.1.4. Business/ Industry Portfolio

- 19.1.5. Product Portfolio/ Specification Details

- 19.1.6. Pricing Data

- 19.1.7. Strategic Overview

- 19.1.8. Recent Developments

- 19.2. Anthony’s Goods

- 19.3. Barry Callebaut Group

- 19.4. Blue Diamond Growers

- 19.5. Bob’s Red Mill Natural Foods

- 19.6. Danone S.A. (through plant-based divisions)

- 19.7. Grain-Free JK Gourmet

- 19.8. Hilltop Ranch, Inc.

- 19.9. Hodgson Mill

- 19.10. Honeyville, Inc.

- 19.11. King Arthur Baking Company

- 19.12. Milled

- 19.13. Nature’s Eats

- 19.14. NOW Health Group, Inc.

- 19.15. Nutraonly (Xi'an Nutraonly Co., Ltd.)

- 19.16. Olam Food Ingredients (OFI)

- 19.17. The Archer Daniels Midland Company (ADM)

- 19.18. TreeHouse California Almonds

- 19.19. WellBees

- 19.20. Other key Players

- 19.1. Alldrin Brothers

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography.

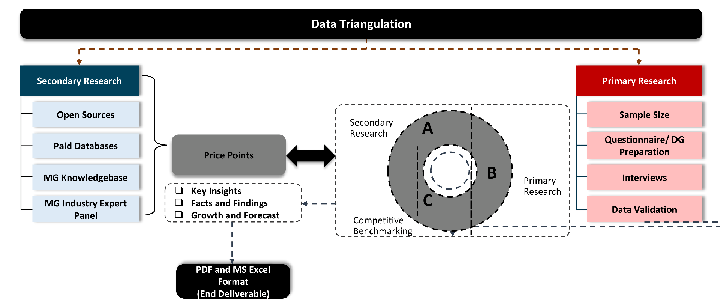

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data