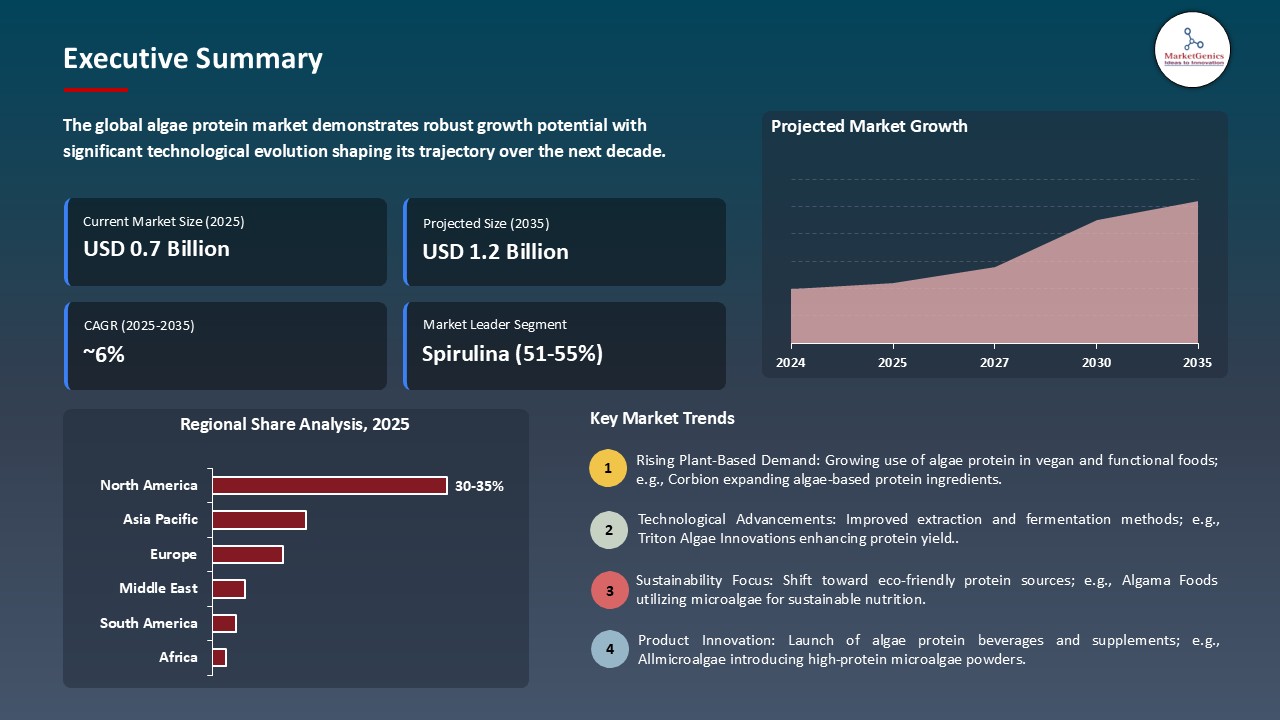

- The global algae protein market is valued at USD 0.7 billion in 2025.

- The market is projected to grow at a CAGR of 5.8% during the forecast period of 2026 to 2035.

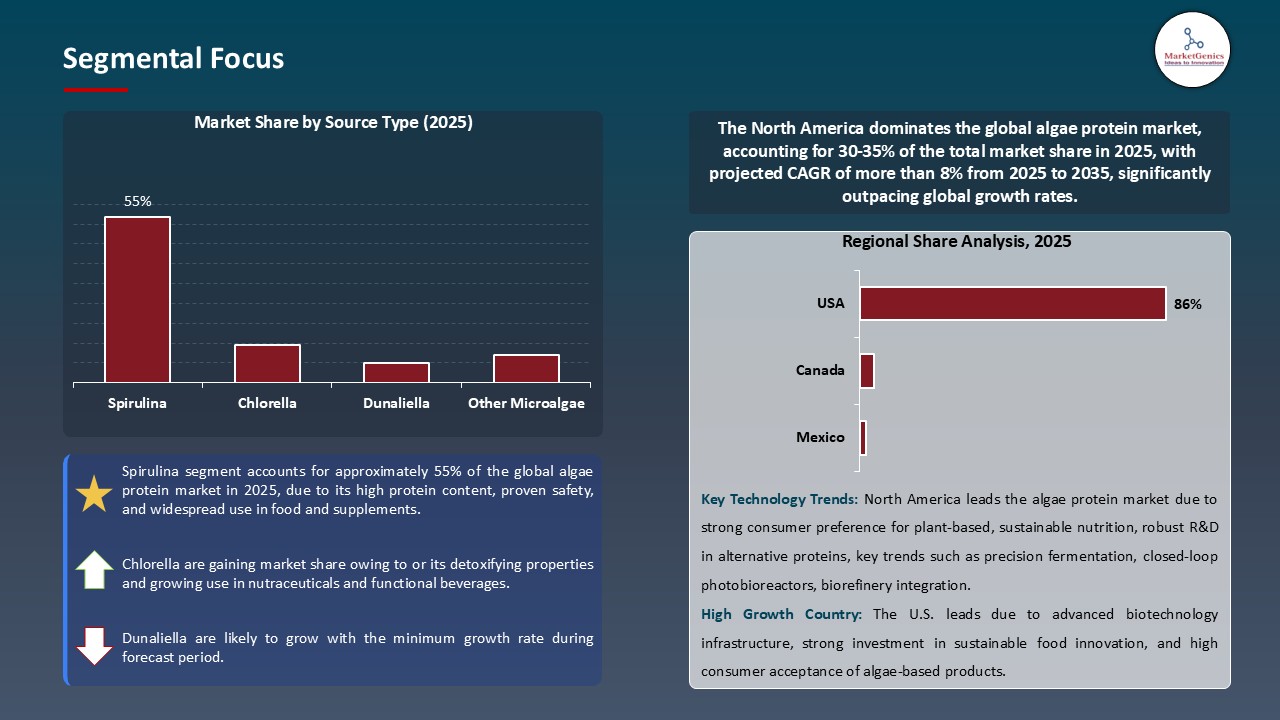

- The spirulina segment holds major share ~55% in the global algae protein market, propelled by rising consumer preference for nutrient-dense, sustainable, and clean-label protein sources. Innovations in cultivation, extraction technologies, and formulation methods are improving bioavailability, taste, and versatility, strengthening its application across supplements, functional foods, and beverages.

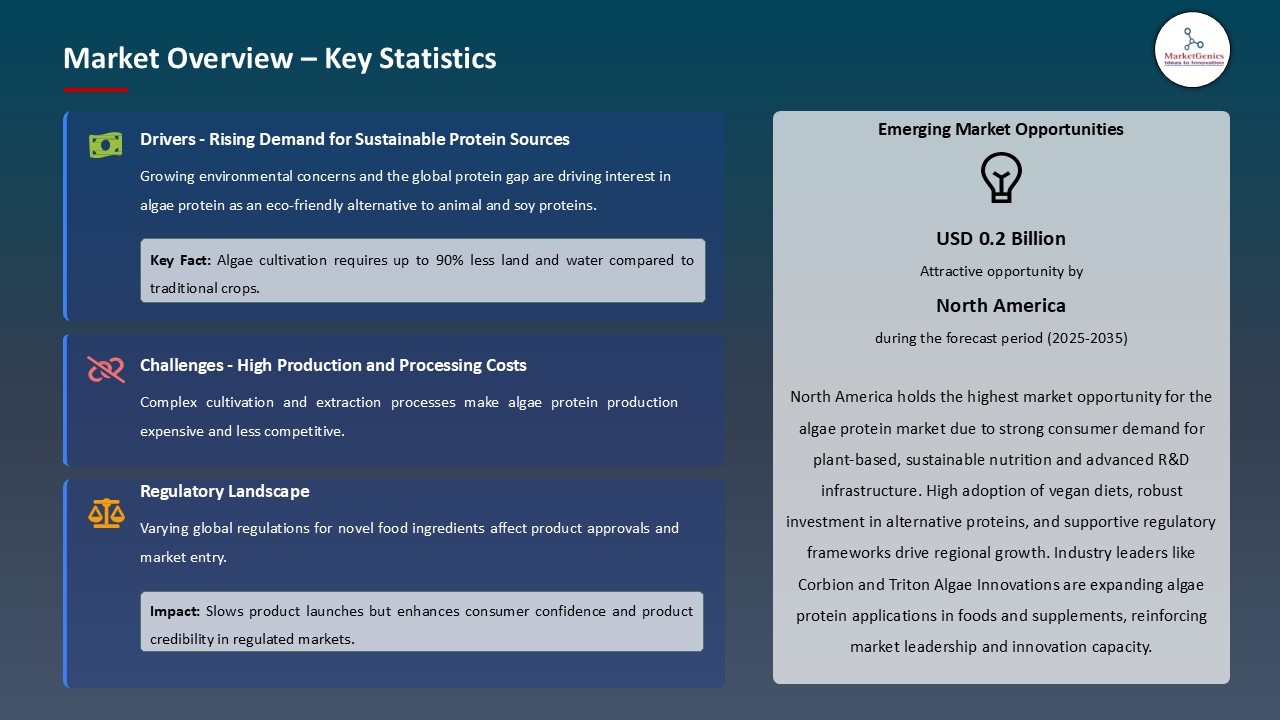

- Rising consumer interest in plant-based and sustainable proteins: Increasing health consciousness, environmental awareness, and flexitarian diets are boosting global adoption of Algae Protein products.

- Product and technological innovations: Advances in plant protein extraction, texturization, fermentation, and hybrid formulations are improving taste, texture, nutrition, and scalability, supporting broader market growth.

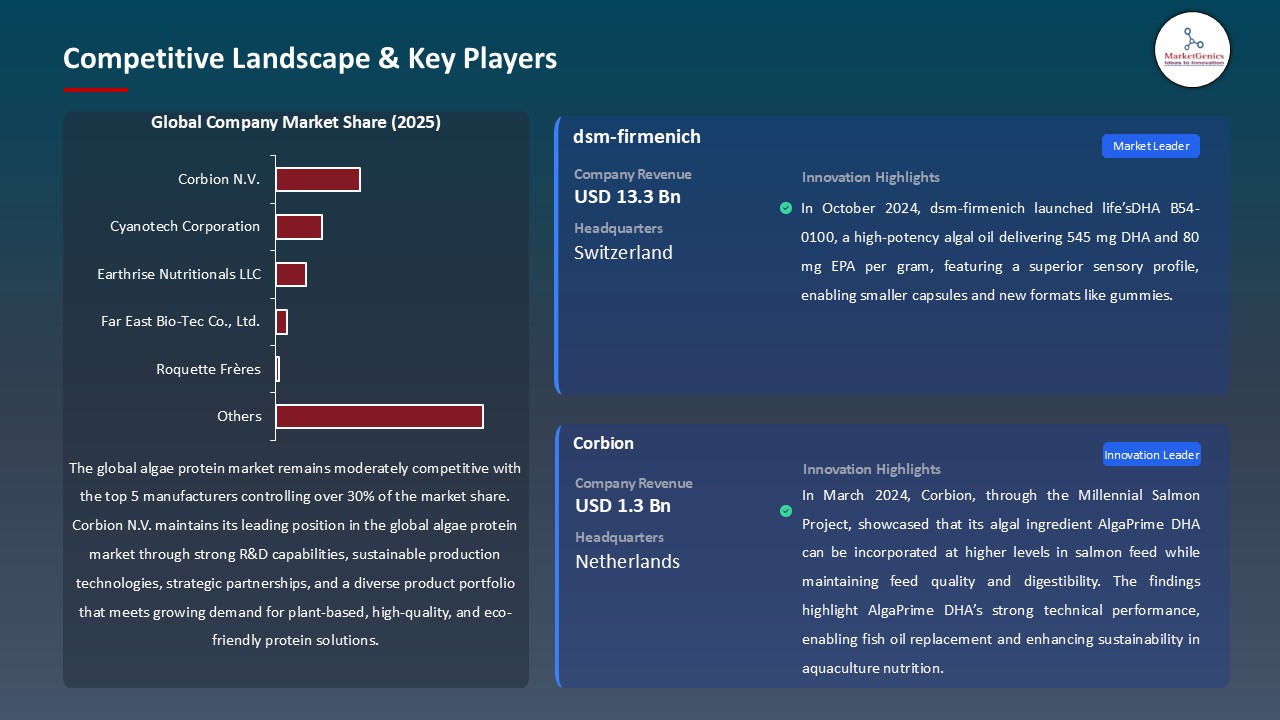

- The top five player’s accounts for over 30% of the global algae-protein-market in 2025.

- February 2024 – Roquette expanded its NUTRALYS pea-protein range with multifunctional ingredients enhancing texture, taste, and versatility for plant-based and high-protein foods.

- December 2024 – Griffith Foods launched its first Algae Proteins Portfolio, offering plant-based solutions across seasonings, sauces, and coatings to drive category growth and sustainability goals.

- Global Algae Protein Market is likely to create the total forecasting opportunity of USD 0.5 Bn till 2035.

- North America is leading the global algae protein market, driven by rising flexitarian and health-conscious consumers, strong demand for plant-based and functional protein products, and significant investment in product innovation, supply chain expansion, and retail and foodservice distribution channels.

- The algae protein market is growing at a very high rate due to the necessity of having sustainable protein production systems that fulfill the global nutritional needs. Algae farming has high ecological value, such as net-negative carbon footprints generated by CO 2 capture, little water consumption, no arable land needs, and no agricultural runoff.

- There is an increasing algae protein investment, especially in technologies that are more sustainable and efficient in production. Recent-quarter funding has enabled scale-up of fermentation-based and cultivation-based production, high-yield protein extraction research, and commercialization in food, supplement, and aquafeed industries and reflects strategic attention to climate-positive protein solutions.

- The environmental imperatives, regulatory support and the desire of consumers to consume sustainable products are increasing the structural demand of low-impact proteins. The global climate-positive food systems rely on its strong environmental performance, increasing cost-competitiveness, and technological innovation, making algae protein one of the major players.

- Higher cost of production of the algae protein is a constraining factor in the algae protein market compared to the traditional plant proteins (soy, pea and wheat). Capital-intensive agriculture, electricity to operate photobioreactors, difficult harvesting, and specialized down-stream processing trigger these cost differences, i.e. until the technologies and scale economies bring the costs down such can only be restricted to high-end applications.

- Lack of sufficient processing facilities and specialized machinery to disrupt cell walls and extract proteins and conserve lipids also increases the complexity and cost of the entire value chain. These aspects cause bottlenecks and do not allow producers to utilize available food processing capacity effectively.

- Together with consumer ignorance that demands heavy marketing expenditure, these issues limit the growth of algae proteins to high-value categories, such as dietary supplements, functional foods, and special aquaculture feeds, and not to large-scale application in mainstream protein markets.

- Algae protein market is a high growth potential in aquaculture feed, which forms a significant sustainability concern of using wild-caught fish to supply fishmeal and fish oil and thus exerting excessive pressure on marine ecosystems and decreasing its availability. Algae proteins have complete amino acid profiles, omega-3 fatty acids identical to those of fish, natural pigments which can give salmon and shrimp their color and immunostimulants which enhance health and performance.

- Infrastructure and strategic partnerships Companies are engaging in infrastructure and strategic partnerships to offer scalability and reliability in supplies. For instance, in September 2025, Veramaris teamed with Merwetank B.V. and built a bulk algae-oil storage in Dordrecht, Netherlands to enhance the logistics of the supply chains and the transportation of large volumes of omega-3-enriched algal oil to aquafeed producers. This assists in development of sustainable salmon and shrimp feeds and offers standardized supply of ingredients in large-scale commercial manufacture.

- Algae protein Shrimp feed also has multi-purpose value in terms of pigmentation (astaxanthin), protein, and lipid content. Aquaculture offers a scale economies that enhance competitiveness in human food products through the application of algae protein, which has the strongest technical performance, sustainability drivers, and advancing cost-efficiency, facilitating the highest-volume growth opportunity.

- Precision fermentation and hybrid production systems are creating new opportunities to develop the algae protein market because they make it possible to control and produce individual proteins and bioactive compounds in large amounts. These technologies deal with limitation of algae protein commercialization in terms of historical costs and consistency.

- There is a growing cooperation and investment in the market to broaden the product range and capitalize on technology changes. For instance, in April 2025, AlgiSys BioSciences introduced plans to introduce an aquafeed ingredient based on algae that is rich in EPA and includes protein and omega-3s to substitute fish meal and oil, which is a sign of protein innovation in aquaculture.

- A combination of photosynthetic growth and heterotrophic fermentation is also demonstrating 200-300% greater productivity than open-pond techniques, capitalizing on capital efficiency. This type of technological diversification, coupled with the introduction of innovative products such as Arctic Blue, indicates market maturity and several avenues to low cost high volume production of algae proteins.

- The spirulina segment leads the global algae protein market due to decades of commercial production, established safety and regulatory clearances, high consumer recognition, and multi-purpose use in dietary supplements, functional foods, animal feeds, and natural coloration.

- Spirulina has further witnessed good innovations in product uses especially in natural colorants and sustainable solutions. For instance, in January 2025, Oterra and VAXA Technologies introduced Arctic Blue, an all-natural blue food colorant, made with a carbon-neutral cultivation process in Iceland, providing a rich color and sustainable use of the product, as well as innovation in its development and use, which is sustainable.

- Its nutrient profile comprising of complete protein, bio-absorbable vitamin A12, iron, and antioxidants with sustainability implications are the factors that push appeal among performance-oriented and environmentally aware customers.

- Spirulina segment’s developed market, regulatory adoption, and commercial viability have placed spirulina to sustain dominance as other algae protein sources are adopted easily.

- North America dominates the global algae protein market, with a robust dietary supplement and functional foods industry, health conscious consumers, supportive FDA GRAS regulatory channels, an effective innovation and environment, and well-developed ingredient distribution channels. Algae-based products, especially spirulina and chlorella, is one of the most rapidly expanding segments in the specialty food retail business in the United States, beyond supplements, into the areas of pasta, protein bars, smoothies and snacks, with nutritional, colour and sustainability benefits.

- Aquaculture industries also utilize algae proteins and oils to make high-performance feeds, which endorse high market standing. The presence of innovation clusters in California, Colorado, and Texas supported by venture capital, research, and good growing conditions enhances the advancement of the technological process and movement of talents.

- North America is the world's largest market and innovation hub for algae protein, owing to abundant, proactive consumers, favorable regulations, and an integrated production and distribution network.

- In October 2025, SIG and Nutrition from Water (NXW) announced a global joint venture to produce micro-algae-protein drinks through the use of the high-performance marine-based protein produced by NXW and aseptic-packaged by SIG. The alliance focuses on underserved markets, and the products are nutrient-dense and have long shelf lives to increase access to protein-based solutions. This initiative has a strategic value in commercializing algae-based protein in the mainstream food and beverage sector by incorporating the application of advanced biotechnology and scalable packaging.

- In February 2025, Brevel collaborated with CBC Group to create beverages and dairy replacements that run on micro-algae. The joint venture utilizes Brevel high-value oil and algae protein ingredients under a long-term supply contract. The partnership should introduce nutrient-rich sustainable algae-based products into mainstream consumer markets.

- United States

- Canada

- Mexico

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic Countries

- Poland

- Russia & CIS

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Turkey

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Nigeria

- Algeria

- Brazil

- Argentina

- Algae Health Sciences

- Algae Systems LLC

- Algenol Biotech

- Nutrex Hawaii

- Allmicroalgae Natural Products S.A.

- BlueBiotech International GmbH

- Corbion N.V.

- Cyanotech Corporation

- DIC Corporation.

- Cargill, Incorporated

- Earthrise Nutritionals LLC

- Far East Bio-Tec Co., Ltd.

- Heliae Development, LLC

- Ingredion Incorporated

- Cellana Inc.

- LiveFuels Inc.

- Algaetech International Sdn Bhd

- Taiwan Chlorella Manufacturing

- Roquette Frères

- Bluetec Naturals Co., Ltd.

- Ocean Harvest Technology

- Other Key Players

- Spirulina

- Arthrospira platensis

- Arthrospira maxima

- Chlorella

- Chlorella vulgaris

- Chlorella pyrenoidosa

- Dunaliella

- Haematococcus

- Nannochloropsis

- Schizochytrium

- Other Microalgae

- Powder

- Liquid/Concentrate

- Capsules/Tablets

- Flakes

- Paste

- Below 30%

- 30-50%

- 50-70%

- Above 70%

- Open Pond Cultivation

- Closed Photobioreactor Systems

- Tubular Photobioreactors

- Flat Panel Photobioreactors

- Vertical Column Photobioreactors

- Hybrid Systems

- Fermentation-based Production

- Organic

- Conventional

- Mechanical Extraction

- Bead Milling

- High-Pressure Homogenization

- Chemical Extraction

- Enzymatic Extraction

- Supercritical Fluid Extraction

- Ultrasound-Assisted Extraction

- Food Grade

- Feed Grade

- Pharmaceutical Grade

- Cosmetic Grade

- Technical/Industrial Grade

- Food & Beverages

- Protein Supplements

- Functional Foods

- Beverages

- Meat Alternatives

- Dairy Alternatives

- Bakery & Confectionery

- Infant Nutrition

- Others

- Animal Feed & Aquaculture

- Aquaculture Feed

- Livestock Feed

- Pet Food

- Others

- Pharmaceuticals & Nutraceuticals

- Dietary Supplements

- Therapeutic Applications

- Clinical Nutrition

- Others

- Cosmetics & Personal Care

- Agriculture & Biofertilizers

- Industrial Applications

- Other Industries

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Algae Protein Market Outlook

- 2.1.1. Algae Protein Market Size Volume (Tons) and Value (US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Algae Protein Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Food & Beverages Industry Overview, 2025

- 3.1.1. Food & Beverages Industry Ecosystem Analysis

- 3.1.2. Key Trends for Food & Beverages Industry

- 3.1.3. Regional Distribution for Food & Beverages Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Food & Beverages Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for plant-based and sustainable protein sources.

- 4.1.1.2. Growing health and wellness awareness.

- 4.1.1.3. Technological advancements in algae cultivation and processing.

- 4.1.2. Restraints

- 4.1.2.1. High production and processing costs.

- 4.1.2.2. Limited consumer awareness and acceptance.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Manufacturing

- 4.4.3. Distribution

- 4.4.4. End-Use

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Algae Protein Market Demand

- 4.9.1. Historical Market Size – Volume (Tons) and Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size – Volume (Tons) and Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Algae Protein Market Analysis, by Source Type

- 6.1. Key Segment Analysis

- 6.2. Algae Protein Market Size Volume (Tons) and Value (US$ Bn), Analysis, and Forecasts, by Source Type, 2021-2035

- 6.2.1. Spirulina

- 6.2.1.1. Arthrospira platensis

- 6.2.1.2. Arthrospira maxima

- 6.2.2. Chlorella

- 6.2.2.1. Chlorella vulgaris

- 6.2.2.2. Chlorella pyrenoidosa

- 6.2.3. Dunaliella

- 6.2.4. Haematococcus

- 6.2.5. Nannochloropsis

- 6.2.6. Schizochytrium

- 6.2.7. Other Microalgae

- 6.2.1. Spirulina

- 7. Global Algae Protein Market Analysis, by Form

- 7.1. Key Segment Analysis

- 7.2. Algae Protein Market Size Volume (Tons) and Value (US$ Bn), Analysis, and Forecasts, by Form, 2021-2035

- 7.2.1. Powder

- 7.2.2. Liquid/Concentrate

- 7.2.3. Capsules/Tablets

- 7.2.4. Flakes

- 7.2.5. Paste

- 8. Global Algae Protein Market Analysis, by Protein Content

- 8.1. Key Segment Analysis

- 8.2. Algae Protein Market Size Volume (Tons) and Value (US$ Bn), Analysis, and Forecasts, by Protein Content, 2021-2035

- 8.2.1. Below 30%

- 8.2.2. 30-50%

- 8.2.3. 50-70%

- 8.2.4. Above 70%

- 9. Global Algae Protein Market Analysis, by Production Method

- 9.1. Key Segment Analysis

- 9.2. Algae Protein Market Size Volume (Tons) and Value (US$ Bn), Analysis, and Forecasts, by Production Method, 2021-2035

- 9.2.1. Open Pond Cultivation

- 9.2.2. Closed Photobioreactor Systems

- 9.2.2.1. Tubular Photobioreactors

- 9.2.2.2. Flat Panel Photobioreactors

- 9.2.2.3. Vertical Column Photobioreactors

- 9.2.3. Hybrid Systems

- 9.2.4. Fermentation-based Production

- 10. Global Algae Protein Market Analysis, by Nature

- 10.1. Key Segment Analysis

- 10.2. Algae Protein Market Size Volume (Tons) and Value (US$ Bn), Analysis, and Forecasts, by Nature, 2021-2035

- 10.2.1. Organic

- 10.2.2. Conventional

- 11. Global Algae Protein Market Analysis, by Extraction Technology

- 11.1. Key Segment Analysis

- 11.2. Algae Protein Market Size Volume (Tons) and Value (US$ Bn), Analysis, and Forecasts, by Extraction Technology, 2021-2035

- 11.2.1. Mechanical Extraction

- 11.2.1.1. Bead Milling

- 11.2.1.2. High-Pressure Homogenization

- 11.2.2. Chemical Extraction

- 11.2.3. Enzymatic Extraction

- 11.2.4. Supercritical Fluid Extraction

- 11.2.5. Ultrasound-Assisted Extraction

- 11.2.1. Mechanical Extraction

- 12. Global Algae Protein Market Analysis, by Grade

- 12.1. Key Segment Analysis

- 12.2. Algae Protein Market Size Volume (Tons) and Value (US$ Bn), Analysis, and Forecasts, by Grade, 2021-2035

- 12.2.1. Food Grade

- 12.2.2. Feed Grade

- 12.2.3. Pharmaceutical Grade

- 12.2.4. Cosmetic Grade

- 12.2.5. Technical/Industrial Grade

- 13. Global Algae Protein Market Analysis, by End-Use Industry

- 13.1. Key Segment Analysis

- 13.2. Algae Protein Market Size Volume (Tons) and Value (US$ Bn), Analysis, and Forecasts, by End-Use Industry, 2021-2035

- 13.2.1. Food & Beverages

- 13.2.1.1. Protein Supplements

- 13.2.1.2. Functional Foods

- 13.2.1.3. Beverages

- 13.2.1.4. Meat Alternatives

- 13.2.1.5. Dairy Alternatives

- 13.2.1.6. Bakery & Confectionery

- 13.2.1.7. Infant Nutrition

- 13.2.1.8. Others

- 13.2.2. Animal Feed & Aquaculture

- 13.2.2.1. Aquaculture Feed

- 13.2.2.2. Livestock Feed

- 13.2.2.3. Pet Food

- 13.2.2.4. Others

- 13.2.3. Pharmaceuticals & Nutraceuticals

- 13.2.3.1. Dietary Supplements

- 13.2.3.2. Therapeutic Applications

- 13.2.3.3. Clinical Nutrition

- 13.2.3.4. Others

- 13.2.4. Cosmetics & Personal Care

- 13.2.5. Agriculture & Biofertilizers

- 13.2.6. Industrial Applications

- 13.2.7. Other Industries

- 13.2.1. Food & Beverages

- 14. Global Algae Protein Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Algae Protein Market Size Volume (Tons) and Value (US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Algae Protein Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Algae Protein Market Size- Volume (Tons) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Source Type

- 15.3.2. Form

- 15.3.3. Protein Content

- 15.3.4. Production Method

- 15.3.5. Nature

- 15.3.6. Extraction Technology

- 15.3.7. Grade

- 15.3.8. End-Use Industry

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Algae Protein Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Source Type

- 15.4.3. Form

- 15.4.4. Protein Content

- 15.4.5. Production Method

- 15.4.6. Nature

- 15.4.7. Extraction Technology

- 15.4.8. Grade

- 15.4.9. End-Use Industry

- 15.5. Canada Algae Protein Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Source Type

- 15.5.3. Form

- 15.5.4. Protein Content

- 15.5.5. Production Method

- 15.5.6. Nature

- 15.5.7. Extraction Technology

- 15.5.8. Grade

- 15.5.9. End-Use Industry

- 15.6. Mexico Algae Protein Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Source Type

- 15.6.3. Form

- 15.6.4. Protein Content

- 15.6.5. Production Method

- 15.6.6. Nature

- 15.6.7. Extraction Technology

- 15.6.8. Grade

- 15.6.9. End-Use Industry

- 16. Europe Algae Protein Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Algae Protein Market Size Volume (Tons) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Source Type

- 16.3.2. Form

- 16.3.3. Protein Content

- 16.3.4. Production Method

- 16.3.5. Nature

- 16.3.6. Extraction Technology

- 16.3.7. Grade

- 16.3.8. End-Use Industry

- 16.3.9. Country

- 16.3.9.1. Germany

- 16.3.9.2. United Kingdom

- 16.3.9.3. France

- 16.3.9.4. Italy

- 16.3.9.5. Spain

- 16.3.9.6. Netherlands

- 16.3.9.7. Nordic Countries

- 16.3.9.8. Poland

- 16.3.9.9. Russia & CIS

- 16.3.9.10. Rest of Europe

- 16.4. Germany Algae Protein Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Source Type

- 16.4.3. Form

- 16.4.4. Protein Content

- 16.4.5. Production Method

- 16.4.6. Nature

- 16.4.7. Extraction Technology

- 16.4.8. Grade

- 16.4.9. End-Use Industry

- 16.5. United Kingdom Algae Protein Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Source Type

- 16.5.3. Form

- 16.5.4. Protein Content

- 16.5.5. Production Method

- 16.5.6. Nature

- 16.5.7. Extraction Technology

- 16.5.8. Grade

- 16.5.9. End-Use Industry

- 16.6. France Algae Protein Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Source Type

- 16.6.3. Form

- 16.6.4. Protein Content

- 16.6.5. Production Method

- 16.6.6. Nature

- 16.6.7. Extraction Technology

- 16.6.8. Grade

- 16.6.9. End-Use Industry

- 16.7. Italy Algae Protein Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Source Type

- 16.7.3. Form

- 16.7.4. Protein Content

- 16.7.5. Production Method

- 16.7.6. Nature

- 16.7.7. Extraction Technology

- 16.7.8. Grade

- 16.7.9. End-Use Industry

- 16.8. Spain Algae Protein Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Source Type

- 16.8.3. Form

- 16.8.4. Protein Content

- 16.8.5. Production Method

- 16.8.6. Nature

- 16.8.7. Extraction Technology

- 16.8.8. Grade

- 16.8.9. End-Use Industry

- 16.9. Netherlands Algae Protein Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Source Type

- 16.9.3. Form

- 16.9.4. Protein Content

- 16.9.5. Production Method

- 16.9.6. Nature

- 16.9.7. Extraction Technology

- 16.9.8. Grade

- 16.9.9. End-Use Industry

- 16.10. Nordic Countries Algae Protein Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Source Type

- 16.10.3. Form

- 16.10.4. Protein Content

- 16.10.5. Production Method

- 16.10.6. Nature

- 16.10.7. Extraction Technology

- 16.10.8. Grade

- 16.10.9. End-Use Industry

- 16.11. Poland Algae Protein Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Source Type

- 16.11.3. Form

- 16.11.4. Protein Content

- 16.11.5. Production Method

- 16.11.6. Nature

- 16.11.7. Extraction Technology

- 16.11.8. Grade

- 16.11.9. End-Use Industry

- 16.12. Russia & CIS Algae Protein Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Source Type

- 16.12.3. Form

- 16.12.4. Protein Content

- 16.12.5. Production Method

- 16.12.6. Nature

- 16.12.7. Extraction Technology

- 16.12.8. Grade

- 16.12.9. End-Use Industry

- 16.13. Rest of Europe Algae Protein Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Source Type

- 16.13.3. Form

- 16.13.4. Protein Content

- 16.13.5. Production Method

- 16.13.6. Nature

- 16.13.7. Extraction Technology

- 16.13.8. Grade

- 16.13.9. End-Use Industry

- 17. Asia Pacific Algae Protein Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Asia Pacific Algae Protein Market Size Volume (Tons) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Source Type

- 17.3.2. Form

- 17.3.3. Protein Content

- 17.3.4. Production Method

- 17.3.5. Nature

- 17.3.6. Extraction Technology

- 17.3.7. Grade

- 17.3.8. End-Use Industry

- 17.3.9. Country

- 17.3.9.1. China

- 17.3.9.2. India

- 17.3.9.3. Japan

- 17.3.9.4. South Korea

- 17.3.9.5. Australia and New Zealand

- 17.3.9.6. Indonesia

- 17.3.9.7. Malaysia

- 17.3.9.8. Thailand

- 17.3.9.9. Vietnam

- 17.3.9.10. Rest of Asia Pacific

- 17.4. China Algae Protein Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Source Type

- 17.4.3. Form

- 17.4.4. Protein Content

- 17.4.5. Production Method

- 17.4.6. Nature

- 17.4.7. Extraction Technology

- 17.4.8. Grade

- 17.4.9. End-Use Industry

- 17.5. India Algae Protein Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Source Type

- 17.5.3. Form

- 17.5.4. Protein Content

- 17.5.5. Production Method

- 17.5.6. Nature

- 17.5.7. Extraction Technology

- 17.5.8. Grade

- 17.5.9. End-Use Industry

- 17.6. Japan Algae Protein Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Source Type

- 17.6.3. Form

- 17.6.4. Protein Content

- 17.6.5. Production Method

- 17.6.6. Nature

- 17.6.7. Extraction Technology

- 17.6.8. Grade

- 17.6.9. End-Use Industry

- 17.7. South Korea Algae Protein Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Source Type

- 17.7.3. Form

- 17.7.4. Protein Content

- 17.7.5. Production Method

- 17.7.6. Nature

- 17.7.7. Extraction Technology

- 17.7.8. Grade

- 17.7.9. End-Use Industry

- 17.8. Australia and New Zealand Algae Protein Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Source Type

- 17.8.3. Form

- 17.8.4. Protein Content

- 17.8.5. Production Method

- 17.8.6. Nature

- 17.8.7. Extraction Technology

- 17.8.8. Grade

- 17.8.9. End-Use Industry

- 17.9. Indonesia Algae Protein Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Source Type

- 17.9.3. Form

- 17.9.4. Protein Content

- 17.9.5. Production Method

- 17.9.6. Nature

- 17.9.7. Extraction Technology

- 17.9.8. Grade

- 17.9.9. End-Use Industry

- 17.10. Malaysia Algae Protein Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Source Type

- 17.10.3. Form

- 17.10.4. Protein Content

- 17.10.5. Production Method

- 17.10.6. Nature

- 17.10.7. Extraction Technology

- 17.10.8. Grade

- 17.10.9. End-Use Industry

- 17.11. Thailand Algae Protein Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Source Type

- 17.11.3. Form

- 17.11.4. Protein Content

- 17.11.5. Production Method

- 17.11.6. Nature

- 17.11.7. Extraction Technology

- 17.11.8. Grade

- 17.11.9. End-Use Industry

- 17.12. Vietnam Algae Protein Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Source Type

- 17.12.3. Form

- 17.12.4. Protein Content

- 17.12.5. Production Method

- 17.12.6. Nature

- 17.12.7. Extraction Technology

- 17.12.8. Grade

- 17.12.9. End-Use Industry

- 17.13. Rest of Asia Pacific Algae Protein Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Source Type

- 17.13.3. Form

- 17.13.4. Protein Content

- 17.13.5. Production Method

- 17.13.6. Nature

- 17.13.7. Extraction Technology

- 17.13.8. Grade

- 17.13.9. End-Use Industry

- 18. Middle East Algae Protein Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Algae Protein Market Size Volume (Tons) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Source Type

- 18.3.2. Form

- 18.3.3. Protein Content

- 18.3.4. Production Method

- 18.3.5. Nature

- 18.3.6. Extraction Technology

- 18.3.7. Grade

- 18.3.8. End-Use Industry

- 18.3.9. Country

- 18.3.9.1. Turkey

- 18.3.9.2. UAE

- 18.3.9.3. Saudi Arabia

- 18.3.9.4. Israel

- 18.3.9.5. Rest of Middle East

- 18.4. Turkey Algae Protein Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Source Type

- 18.4.3. Form

- 18.4.4. Protein Content

- 18.4.5. Production Method

- 18.4.6. Nature

- 18.4.7. Extraction Technology

- 18.4.8. Grade

- 18.4.9. End-Use Industry

- 18.5. UAE Algae Protein Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Source Type

- 18.5.3. Form

- 18.5.4. Protein Content

- 18.5.5. Production Method

- 18.5.6. Nature

- 18.5.7. Extraction Technology

- 18.5.8. Grade

- 18.5.9. End-Use Industry

- 18.6. Saudi Arabia Algae Protein Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Source Type

- 18.6.3. Form

- 18.6.4. Protein Content

- 18.6.5. Production Method

- 18.6.6. Nature

- 18.6.7. Extraction Technology

- 18.6.8. Grade

- 18.6.9. End-Use Industry

- 18.7. Israel Algae Protein Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Source Type

- 18.7.3. Form

- 18.7.4. Protein Content

- 18.7.5. Production Method

- 18.7.6. Nature

- 18.7.7. Extraction Technology

- 18.7.8. Grade

- 18.7.9. End-Use Industry

- 18.8. Rest of Middle East Algae Protein Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Source Type

- 18.8.3. Form

- 18.8.4. Protein Content

- 18.8.5. Production Method

- 18.8.6. Nature

- 18.8.7. Extraction Technology

- 18.8.8. Grade

- 18.8.9. End-Use Industry

- 19. Africa Algae Protein Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Algae Protein Market Size Volume (Tons) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Source Type

- 19.3.2. Form

- 19.3.3. Protein Content

- 19.3.4. Production Method

- 19.3.5. Nature

- 19.3.6. Extraction Technology

- 19.3.7. Grade

- 19.3.8. End-Use Industry

- 19.3.9. Country

- 19.3.9.1. South Africa

- 19.3.9.2. Egypt

- 19.3.9.3. Nigeria

- 19.3.9.4. Algeria

- 19.3.9.5. Rest of Africa

- 19.4. South Africa Algae Protein Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Source Type

- 19.4.3. Form

- 19.4.4. Protein Content

- 19.4.5. Production Method

- 19.4.6. Nature

- 19.4.7. Extraction Technology

- 19.4.8. Grade

- 19.4.9. End-Use Industry

- 19.5. Egypt Algae Protein Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Source Type

- 19.5.3. Form

- 19.5.4. Protein Content

- 19.5.5. Production Method

- 19.5.6. Nature

- 19.5.7. Extraction Technology

- 19.5.8. Grade

- 19.5.9. End-Use Industry

- 19.6. Nigeria Algae Protein Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Source Type

- 19.6.3. Form

- 19.6.4. Protein Content

- 19.6.5. Production Method

- 19.6.6. Nature

- 19.6.7. Extraction Technology

- 19.6.8. Grade

- 19.6.9. End-Use Industry

- 19.7. Algeria Algae Protein Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Source Type

- 19.7.3. Form

- 19.7.4. Protein Content

- 19.7.5. Production Method

- 19.7.6. Nature

- 19.7.7. Extraction Technology

- 19.7.8. Grade

- 19.7.9. End-Use Industry

- 19.8. Rest of Africa Algae Protein Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Source Type

- 19.8.3. Form

- 19.8.4. Protein Content

- 19.8.5. Production Method

- 19.8.6. Nature

- 19.8.7. Extraction Technology

- 19.8.8. Grade

- 19.8.9. End-Use Industry

- 20. South America Algae Protein Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. South America Algae Protein Market Size Volume (Tons) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Source Type

- 20.3.2. Form

- 20.3.3. Protein Content

- 20.3.4. Production Method

- 20.3.5. Nature

- 20.3.6. Extraction Technology

- 20.3.7. Grade

- 20.3.8. End-Use Industry

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Algae Protein Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Source Type

- 20.4.3. Form

- 20.4.4. Protein Content

- 20.4.5. Production Method

- 20.4.6. Nature

- 20.4.7. Extraction Technology

- 20.4.8. Grade

- 20.4.9. End-Use Industry

- 20.5. Argentina Algae Protein Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Source Type

- 20.5.3. Form

- 20.5.4. Protein Content

- 20.5.5. Production Method

- 20.5.6. Nature

- 20.5.7. Extraction Technology

- 20.5.8. Grade

- 20.5.9. End-Use Industry

- 20.6. Rest of South America Algae Protein Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Source Type

- 20.6.3. Form

- 20.6.4. Protein Content

- 20.6.5. Production Method

- 20.6.6. Nature

- 20.6.7. Extraction Technology

- 20.6.8. Grade

- 20.6.9. End-Use Industry

- 21. Key Players/ Company Profile

- 21.1. Algae Health Sciences.

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. Algae Systems LLC

- 21.3. Algaetech International Sdn Bhd

- 21.4. Algenol Biotech

- 21.5. Allmicroalgae Natural Products S.A.

- 21.6. BlueBiotech International GmbH

- 21.7. Bluetec Naturals Co., Ltd.

- 21.8. Cargill, Incorporated

- 21.9. Cellana Inc.

- 21.10. Corbion N.V.

- 21.11. Cyanotech Corporation

- 21.12. DIC Corporation

- 21.13. Earthrise Nutritionals LLC

- 21.14. Far East Bio-Tec Co., Ltd.

- 21.15. Heliae Development, LLC

- 21.16. Ingredion Incorporated

- 21.17. LiveFuels Inc.

- 21.18. Nutrex Hawaii

- 21.19. Ocean Harvest Technology

- 21.20. Roquette Frères

- 21.21. Taiwan Chlorella Manufacturing Company

- 21.22. Other Key Players

- 21.1. Algae Health Sciences.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Insightified

Mid-to-large firms spend $20K–$40K quarterly on systematic research and typically recover multiples through improved growth and profitability

Research is no longer optional. Leading firms use it to uncover $10M+ in hidden revenue opportunities annually

Our research-consulting programs yields measurable ROI: 20–30% revenue increases from new markets, 11% profit upticks from pricing, and 20–30% cost savings from operations

Algae Protein Market Size, Share & Trends Analysis Report by Source Type (Spirulina, Chlorella, Dunaliella, Haematococcus, Nannochloropsis, Schizochytrium, Other Microalgae), Form, Protein Content, Production Method, Nature, Extraction Technology, Grade, End-Use Industry, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Algae Protein Market Size, Share, and Growth

The global algae protein market is experiencing robust growth, with its estimated value of USD 0.7 billion in the year 2025 and USD 1.2 billion by the period 2035, registering a CAGR of 5.8%, during the forecast period. The global algae protein market is growing as a result of the growing consumerism toward sustainable, nutrient-rich, and climate-positives protein sources. Developments in algae technology, accurate fermentation and hybrid production systems, coupled with growing retail, foodservice, and aquafeed distribution networks, are driving the adoption in the global market.

Mike O’Riordan, Ingredion’s senior vice president of texture and healthful solutions in EMEA, said, “By joining forces with Lantmännen, we are expanding our footprint in the European market. This marks a significant milestone in our strategy to solidify our position as a global leader in the plant-based protein industry. This partnership allows us to leverage our combined strengths to deliver superior, sustainably sourced pea protein isolates that meet the evolving needs of the global market.

The increasing demand to use sustainable source of protein and the better nutritional content of algae proteins is driving the global algae protein market. The cultivation of algae is extremely resource-efficient, generating many times more protein per acre than other crops, using very little freshwater, no arable land, and Oxygen as byproduct. For instance, in May 2025, GreenCoLab stated that the prototypes of algae-powered products, including vegan caviar, algae-based beer, and burgers made with chlorella and tetra lemonis, will be introduced in the formats of the algae-based products.

In cultivation, harvesting and downstream processing, technological developments are reducing production cost and enhancing product functionality. For instance, in July 2025, SIG partnered with Nutrition from Water (NXW) to introduce algae-protein beverages in aseptic packaging, which incorporates microalgae-derived proteins and sophisticated packaging technology to increase global accessibility and distribution of sustainable protein products.

Producing omega-3 supplements, natural colorants, aquafeed ingredients, carbon sequestration credits and biofuel co-products made of algae would enable producers to be able to use biomass to full capacity, diversify their revenue streams, and increase the overall economic performance of food, feed, pharmaceutical and industrial sectors.

Algae Protein Market Dynamics and Trends

Driver: Sustainability Imperative and Climate-Positive Protein Production

Restraint: High Production Costs and Limited Processing Infrastructure

Opportunity: Aquaculture Feed Market and Fishmeal Replacement

Key Trend: Precision Fermentation and Hybrid Production Systems

Algae Protein Market Analysis and Segmental Data

Spirulina Dominate Global Algae Protein Market

North America Leads Global Algae Protein Market Demand

Algae-Protein-Market Ecosystem

The algae protein market is moderately consolidated, with a specialisation on a species, production technique, and use. The well-established manufacturers specialize in spirulina and chlorella to produce supplements, the technology developers create new species and fermentation techniques, and the suppliers of aquaculture feed target specific niches and various local startups. The major competitors are Corbion N.V., Cyanotech Corporation, Earthrise Nutritionals LLC, Far East Bio-Tec Co., Ltd., and Roquette Freres.

The market is varied in concentration depending on the species and use spirulina continues to be widely produced, whereas new species and precision fermentation have a few technology-driven firms with a solid patent base. Value chain takes upstream cultivation, harvesting and processing, protein and lipids extraction, formulation and downstream distribution via supplements, functional foods, aquaculture and cosmetics.

The trend of consolidation and strategic alliances is also on the rise with examples of algae based companies partnering with large CPG companies to package algae proteins into portfolios of food and supplements. This ecosystem offers numerous competitive approaches, ranging between commodity scale manufacture of established species, technology-differentiated approaches, vertical integration, and precise B2B ingredient solutions to encourage innovation without breaking up the market.

Recent Development and Strategic Overview:

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 0.7 Bn |

|

Market Forecast Value in 2035 |

USD 1.2 Bn |

|

Growth Rate (CAGR) |

5.8% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Tons for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

|

Algae-Protein-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Algae Protein Market, By Source Type |

|

|

Algae Protein Market, By Form |

|

|

Algae Protein Market, By Protein Content |

|

|

Algae Protein Market, By Production Method |

|

|

Algae Protein Market, By Nature |

|

|

Algae Protein Market, By Extraction Technology |

|

|

Algae Protein Market, By Grade |

|

|

Algae Protein Market, By End-Use Industry |

|

Frequently Asked Questions

Table of Contents

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

Forecasting Models / Techniques

Multiple Regression Analysis

Time Series Analysis – Seasonal Patterns

Time Series Analysis – Trend Analysis

Expert Opinion – Expert Interviews

Multi-Scenario Development

Time Series Analysis – Moving Averages

Econometric Models

Expert Opinion – Delphi Method

Monte Carlo Simulation

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation