- The global alternative protein market is valued at USD 23.1 billion in 2025.

- The market is projected to grow at a CAGR of 12.6% during the forecast period of 2026 to 2035.

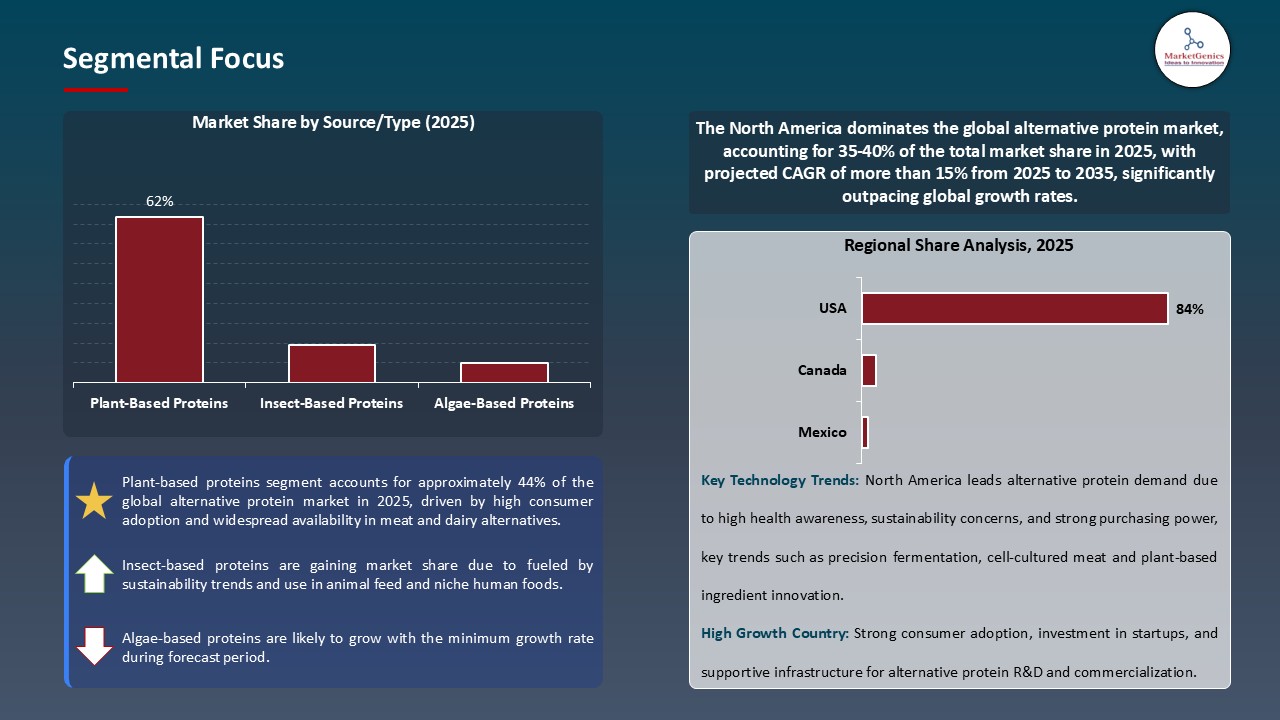

- The plant-based proteins segment holds major share ~62% in the global alternative protein market, driven by strong demand for high-quality, bioavailable, and versatile ingredients. Technological advances in extraction, texturization, and formulation are enhancing product quality, functionality, and scalable production.

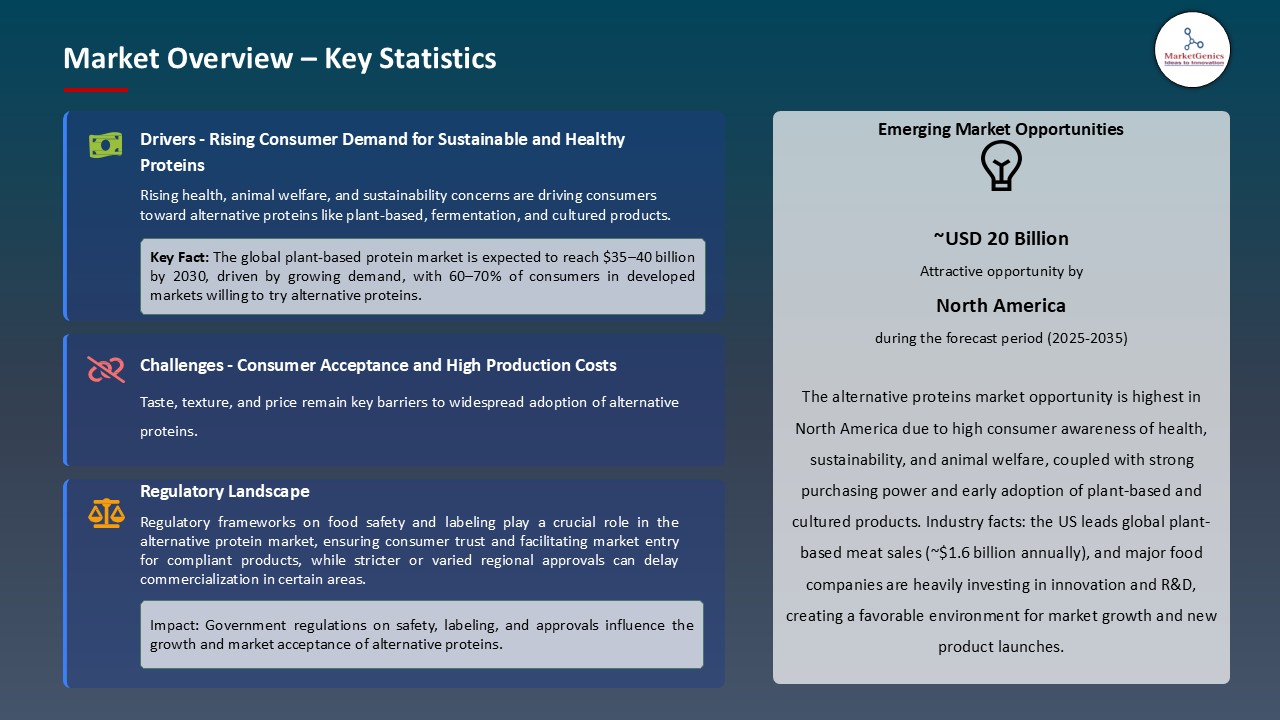

- Rising consumer interest in plant-based and sustainable proteins: Increasing health consciousness, environmental awareness, and flexitarian diets are boosting global adoption of alternative protein products.

- Product and technological innovations: Advances in plant protein extraction, texturization, fermentation, and hybrid formulations are improving taste, texture, nutrition, and scalability, supporting broader market growth.

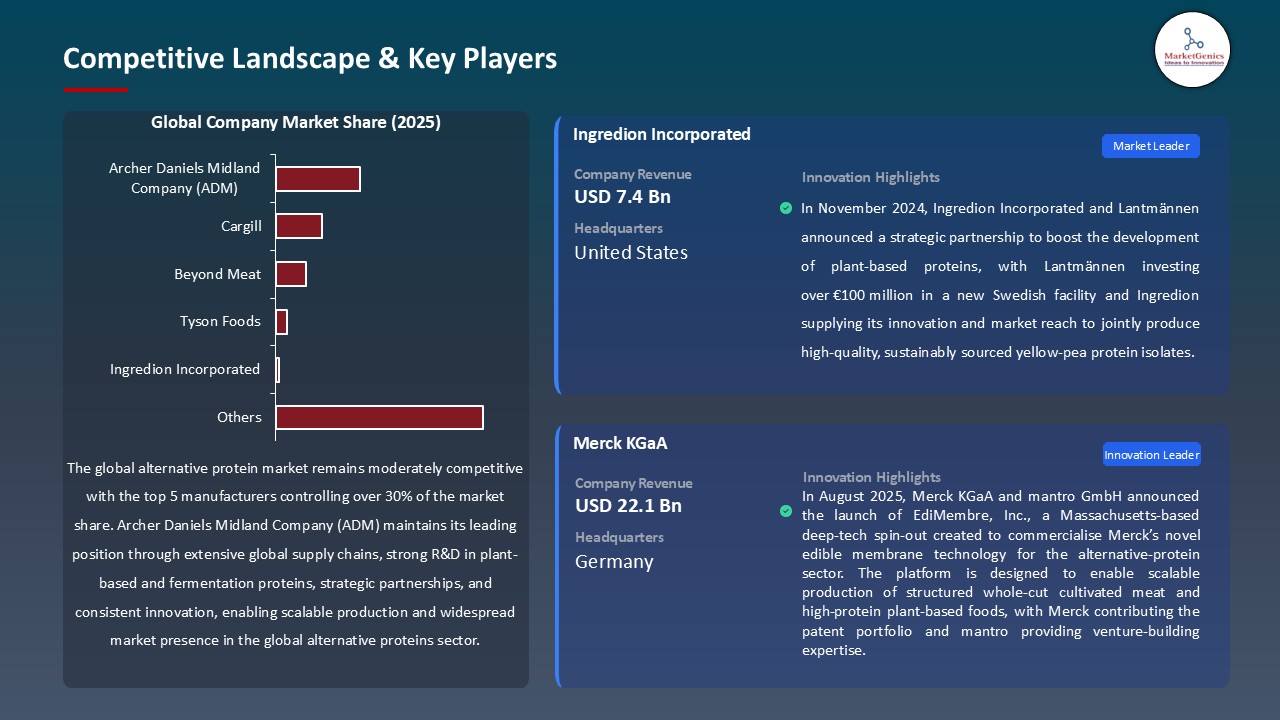

- The top five player’s accounts for over 30% of the global alternative-protein-market in 2025.

- February 2024 – Roquette expanded its NUTRALYS pea-protein range with multifunctional ingredients enhancing texture, taste, and versatility for plant-based and high-protein foods.

- December 2024 – Griffith Foods launched its first Alternative Proteins Portfolio, offering plant-based solutions across seasonings, sauces, and coatings to drive category growth and sustainability goals.

- Global Alternative Protein Market is likely to create the total forecasting opportunity of ~USD 53 Bn till 2035.

- North America is leading the global alternative protein market, driven by rising flexitarian and health-conscious consumers, strong demand for plant-based and functional protein products, and significant investment in product innovation, supply chain expansion, and retail and foodservice distribution channels.

- The global alternative protein market is rapidly growing due to the high investments made by venture capital, corporate strategic investors, and sovereign wealth funds that facilitate the companies to scale production, further develop research and design, decrease costs by automation, and retail and foodservice distribution.

- The alternative protein market is of strong investment trajectory, with Q3 2025 funding returning with a violent force to around USD247m, which is a combination of plant-based proteins and fermentation technology. The main area of investment was oriented on the production scale and development of R&D as well as commercialization in retail and foodservice channels.

- Mainstream retailers and foodservice operators are increasing their alternative protein offerings based on consumer demand and sustainability objectives, including promotion and boosting shelf space. Capital, product innovation and retailer engagement are combining to gain market penetration and remodel competitive forces in the protein industry.

- The global alternative protein market is highly challenged by increased production cost compared to conventional meat, especially in the case of next-generation technologies, including cultivated meat, precision fermentation, and whole-muscle alternatives. Retail prices are significantly higher than conventional ones even with scale-up and technological advances, which restricts uptake by mainstream consumers who are price-sensitive.

- Scalability and production issues are also limiting factors to the alternative protein market. Slow growth rates, environmental sensitivities and possible risks of contamination may restrict supply reliabilities and make producers difficult to respond effectively to changes in demand.

- Moreover, government subsidies in favor of traditional animal agriculture contribute to relative cost disadvantages and, although taste and texture are also better, tend to lag behind standard products. Such aspects have already limited market expansion to the high-end, values-based consumer market and expansion is only possible to a larger audience when cost and quality equality is realized via further technological development.

- The global alternative protein market is witnessing high growth potential among the foodservice outlets such as quick-service and fast-casual restaurants, school and corporate cafeterias and healthcare food services. Integrated buying, ready-made preparations that overcome textural issues, improved flavor platforms, and loyal consumer bases provide good prospects of large-scale uptake of alternative proteins that can frequently surpass the pace of retail penetration.

- Companies are leveraging plant-forward initiatives in professional settings. For instance, in April 2025, Sodexo increased its collaboration with Greener by Default to sell a plant-based meal at 400 hospitals in the U.S., which proves high rates of consumer uptake and satisfaction. Pilot programs showed high consumer acceptability and satisfaction, which showed effectiveness of professional preparation and menu design.

- Foodservice is also a catalyst to ingredient innovation and hybrid products that incorporate conventional and alternative proteins, which allows consumers to be progressively exposed. The flexibility in the menu, the preparation of professionals, and large-scale buying make foodservice one of the core drivers of the use of alternative proteins and the future of retail demand.

- The global alternative protein market is transforming out of direct meat substitutes to hybrid formulations, B2B ingredient solutions, and functional protein applications. This pattern indicates a maturation process of the market, as businesses spread the risk of revenues and are encouraged to realize that mainstream adoption is often achieved by incremental integration, as opposed to total substitution. Innovations in ingredients platforms and technology licensing are playing an important role in creating a service to a variety of brands and reducing direct competition in high-density finished-product markets.

- Large producers are developing alternative protein products, especially natural and precision-fermentation-based, to satisfy increasing demand. For instance, in February 2024, Cargill and ENOUGH increased their collaboration, investing in and commercializing ENOUGH mycoprotein ABUNDA, a move that indicates the emphasis on ingredient- and technology-based growth plans.

- Hybrid foods, containing 50-70 percent plant protein mixed with conventional meat, are on the rise, which has become sustainable, more affordable, and healthier, without changing the familiar taste and texture. This incremental process is in line with consumer preference of gradual change in diet. It endorses greater penetration and long-term development in retail and foodservice outlets.

- The plant-based protein segment leads the global alternative protein market because of established technologies in production, variety in sources of raw materials, regulatory acceptance, low cost competitiveness, and good consumer familiarity, which reduce the barrier to adoption compared to new protein technologies.

- Large producers are expanding the supply of natural alternatives to the protein to meet the rising demand. For instance, in August 2025, Archer Daniels Midland Company (ADM) declared the optimization of its soy-protein manufacturing network, and would be shutting down a facility in Bushnell, Illinois, to consolidate all operations and improve its manufacturing network.

- Continued differentiation is increasing the variety of plant protein sources, such as pea, fava bean, mung bean, chickpea, lentil and new seeds, enhancing amino acid profiles, solving allergen issues, and making clean-label formulations possible. Well-developed supply chains, regulatory frameworks and scalable production infrastructure strengthen the competitive edge of the segment further and its subsequent market ownership as alternative protein technologies develop.

- North America dominates the global protein alternatives market, with a large market share of the population being wealthy, health- and sustainability-aware consumers, large retail base, and favorable venture capital market. The area is home to significant innovators and broad foodservice adoption, which will boost mainstream consumption of plant-based proteins.

- The retail evidence shows that the U.S. plant-based food industries have been growing tremendously, with meat and milk substitutes on the top, with high household penetration indicating the transition between trial and habitual efforts. Positive regulatory policies, unambiguous commercialization avenues of cultivated meat and precision fermentation are other incentives to investment.

- A strong ecosystem of innovation is supported by the concentration of food technology accelerators, university research and corporate R and D. For instance, in July 2025, GEA Group unveiled a new Food Application and Technology Centre in Janesville, Wisconsin to assist pilot-scale facilities of precision fermentation, cell cultivation, and plant-based processing, which is an industrial-scale infrastructure investment in alternative proteins.

- Together with consumer readiness and access to capital, North America continues to be the center of development of alternative proteins market.

- In February 2024, Roquette expanded its NUTRALYS line of pea-based proteins with four new multifunctional ingredients, including NUTRALYS Pea F853M, H85, and T Pea 700M/700FL, which are aimed at enhancing texture, flavor, and versatility in plant-based and high-protein products. The new grades are designed to overcome the formulation issues of high gel strength in meat substitutes, smoothness in bars and beverages, and convenient textured packaged formats of plant-based meats, spreads and desserts to further advance the innovation in alternative protein products.

- In December 2024, Griffith Foods introduced its first Alternative Proteins Portfolio, which it wants to become the foundation of its business. The product line consists of plant-based alternatives to seasonings, sauces, dressings, binders, and coatings as well as all-in-one mixes. This project is in line with the 2030 aims and objectives of Griffith Foods to grow alternative proteins to 103 of its business and regenerative agriculture, net-zero supply chain, and accessible nutrition.

- United States

- Canada

- Mexico

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic Countries

- Poland

- Russia & CIS

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Turkey

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Nigeria

- Algeria

- Brazil

- Argentina

- Archer Daniels Midland Company (ADM)

- Beyond Meat

- Tate & Lyle

- Conagra Brands

- DuPont de Nemours

- Eat Just, Inc.

- Cargill

- Givaudan SA

- Glanbia plc

- Impossible Foods

- Ingredion Incorporated

- JBS S.A.

- Kellogg Company

- Kerry Group

- Maple Leaf Foods

- Unilever

- Nestlé S.A.

- Roquette Frères

- Burcon NutraScience Corporation

- Fonterra Co-operative Group Tyson Foods

- Unilever

- Other Key Players

- Plant-Based Proteins

- Soy Protein

- Pea Protein

- Wheat Protein

- Rice Protein

- Potato Protein

- Lentil Protein

- Mung Bean Protein

- Others

- Insect-Based Proteins

- Cricket Protein

- Mealworm Protein

- Black Soldier Fly Protein

- Others

- Mycoprotein (Fungal Protein)

- Filamentous Fungi

- Yeast Protein

- Others

- Algae-Based Proteins

- Spirulina

- Chlorella

- Others

- Cultured/Cell-Based Proteins

- Cultured Meat

- Cultured Seafood

- Cultured Dairy

- Others

- Fermentation-Derived Proteins

- Solid

- Chunks

- Strips

- Nuggets

- Others

- Liquid

- Powder

- Semi-Solid

- Paste

- Gel

- Meat Alternatives

- Beef Alternatives

- Chicken Alternatives

- Pork Alternatives

- Lamb Alternatives

- Seafood Alternatives

- Others

- Dairy Alternatives

- Milk Alternatives

- Cheese Alternatives

- Yogurt Alternatives

- Butter Alternatives

- Ice Cream Alternatives

- Others

- Egg Alternatives

- Protein Supplements

- Protein Bars and Snacks

- Other Product Types

- Extrusion Technology

- 3D Printing

- Spinning Technology

- Fermentation Technology

- Cell Cultivation Technology

- Shear Cell Technology

- Enzymatic Processing

- Others

- Online Retail

- Offline Retail

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Health Food Stores

- Others

- Direct-to-Consumer

- Below 30%

- 30-50%

- 50-70%

- Above 70%

- Food & Beverages

- Bakery & Confectionery

- Breakfast Cereals

- Meat Products

- Dairy Products

- Ready-to-Eat Meals

- Frozen Foods

- Others

- Nutritional Supplements

- Sports Nutrition

- Weight Management

- Clinical Nutrition

- Infant Nutrition

- Others

- Animal Feed

- Pet Food

- Aquaculture Feed

- Livestock Feed

- Poultry Feed

- Others

- Food Service Industry

- Quick Service Restaurants

- Full-Service Restaurants

- Institutional Catering

- Others

- Personal Care & Cosmetics

- Pharmaceutical

- Others

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Alternative Protein Market Outlook

- 2.1.1. Alternative Protein Market Size (Volume - Metric Tons and Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Alternative Protein Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Food & Beverages Industry Overview, 2025

- 3.1.1. Food & Beverages Industry Ecosystem Analysis

- 3.1.2. Key Trends for Food & Beverages Industry

- 3.1.3. Regional Distribution for Food & Beverages Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Food & Beverages Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for sustainable and plant-based food sources.

- 4.1.1.2. Increasing health awareness and preference for high-protein diets.

- 4.1.1.3. Technological advancements in fermentation and cellular agriculture.

- 4.1.2. Restraints

- 4.1.2.1. High production and processing costs.

- 4.1.2.2. Limited consumer acceptance in certain regions.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Manufacturers

- 4.4.3. Distributors

- 4.4.4. End-Use

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Alternative Protein Market Demand

- 4.9.1. Historical Market Size – Volume (Metric Tons) and Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size – Volume (Metric Tons) Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Alternative Protein Market Analysis, by Source/Type

- 6.1. Key Segment Analysis

- 6.2. Alternative Protein Market Size (Volume - Metric Tons and Value - US$ Bn), Analysis, and Forecasts, by Source/Type, 2021-2035

- 6.2.1. Plant-Based Proteins

- 6.2.1.1. Soy Protein

- 6.2.1.2. Pea Protein

- 6.2.1.3. Wheat Protein

- 6.2.1.4. Rice Protein

- 6.2.1.5. Potato Protein

- 6.2.1.6. Lentil Protein

- 6.2.1.7. Mung Bean Protein

- 6.2.1.8. Others

- 6.2.2. Insect-Based Proteins

- 6.2.2.1. Cricket Protein

- 6.2.2.2. Mealworm Protein

- 6.2.2.3. Black Soldier Fly Protein

- 6.2.2.4. Others

- 6.2.3. Mycoprotein (Fungal Protein)

- 6.2.3.1. Filamentous Fungi

- 6.2.3.2. Yeast Protein

- 6.2.3.3. Others

- 6.2.4. Algae-Based Proteins

- 6.2.4.1. Spirulina

- 6.2.4.2. Chlorella

- 6.2.4.3. Others

- 6.2.5. Cultured/Cell-Based Proteins

- 6.2.5.1. Cultured Meat

- 6.2.5.2. Cultured Seafood

- 6.2.5.3. Cultured Dairy

- 6.2.5.4. Others

- 6.2.6. Fermentation-Derived Proteins

- 6.2.1. Plant-Based Proteins

- 7. Global Alternative Protein Market Analysis, by Form

- 7.1. Key Segment Analysis

- 7.2. Alternative Protein Market Size (Volume - Metric Tons and Value - US$ Bn), Analysis, and Forecasts, by Form, 2021-2035

- 7.2.1. Solid

- 7.2.1.1. Chunks

- 7.2.1.2. Strips

- 7.2.1.3. Nuggets

- 7.2.1.4. Others

- 7.2.2. Liquid

- 7.2.3. Powder

- 7.2.4. Semi-Solid

- 7.2.5. Paste

- 7.2.6. Gel

- 7.2.1. Solid

- 8. Global Alternative Protein Market Analysis, by Product Type

- 8.1. Key Segment Analysis

- 8.2. Alternative Protein Market Size (Volume - Metric Tons and Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 8.2.1. Meat Alternatives

- 8.2.1.1. Beef Alternatives

- 8.2.1.2. Chicken Alternatives

- 8.2.1.3. Pork Alternatives

- 8.2.1.4. Lamb Alternatives

- 8.2.1.5. Seafood Alternatives

- 8.2.1.6. Others

- 8.2.2. Dairy Alternatives

- 8.2.2.1. Milk Alternatives

- 8.2.2.2. Cheese Alternatives

- 8.2.2.3. Yogurt Alternatives

- 8.2.2.4. Butter Alternatives

- 8.2.2.5. Ice Cream Alternatives

- 8.2.2.6. Others

- 8.2.3. Egg Alternatives

- 8.2.4. Protein Supplements

- 8.2.5. Protein Bars and Snacks

- 8.2.6. Other Product Types

- 8.2.1. Meat Alternatives

- 9. Global Alternative Protein Market Analysis, by Processing Technology

- 9.1. Key Segment Analysis

- 9.2. Alternative Protein Market Size (Volume - Metric Tons and Value - US$ Bn), Analysis, and Forecasts, by Processing Technology, 2021-2035

- 9.2.1. Extrusion Technology

- 9.2.2. 3D Printing

- 9.2.3. Spinning Technology

- 9.2.4. Fermentation Technology

- 9.2.5. Cell Cultivation Technology

- 9.2.6. Shear Cell Technology

- 9.2.7. Enzymatic Processing

- 9.2.8. Others

- 10. Global Alternative Protein Market Analysis, by Distribution Channel

- 10.1. Key Segment Analysis

- 10.2. Alternative Protein Market Size (Volume - Metric Tons and Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 10.2.1. Online Retail

- 10.2.2. Offline Retail

- 10.2.2.1. Supermarkets/Hypermarkets

- 10.2.2.2. Specialty Stores

- 10.2.2.3. Convenience Stores

- 10.2.2.4. Health Food Stores

- 10.2.2.5. Others

- 10.2.3. Direct-to-Consumer

- 11. Global Alternative Protein Market Analysis, by Protein Content

- 11.1. Key Segment Analysis

- 11.2. Alternative Protein Market Size (Volume - Metric Tons and Value - US$ Bn), Analysis, and Forecasts, by Protein Content, 2021-2035

- 11.2.1. Below 30%

- 11.2.2. 30-50%

- 11.2.3. 50-70%

- 11.2.4. Above 70%

- 12. Global Alternative Protein Market Analysis, by End-users

- 12.1. Key Segment Analysis

- 12.2. Alternative Protein Market Size (Volume - Metric Tons and Value - US$ Bn), Analysis, and Forecasts, by End-users, 2021-2035

- 12.2.1. Food & Beverages

- 12.2.1.1. Bakery & Confectionery

- 12.2.1.2. Breakfast Cereals

- 12.2.1.3. Meat Products

- 12.2.1.4. Dairy Products

- 12.2.1.5. Ready-to-Eat Meals

- 12.2.1.6. Frozen Foods

- 12.2.1.7. Others

- 12.2.2. Nutritional Supplements

- 12.2.2.1. Sports Nutrition

- 12.2.2.2. Weight Management

- 12.2.2.3. Clinical Nutrition

- 12.2.2.4. Infant Nutrition

- 12.2.2.5. Others

- 12.2.3. Animal Feed

- 12.2.3.1. Pet Food

- 12.2.3.2. Aquaculture Feed

- 12.2.3.3. Livestock Feed

- 12.2.3.4. Poultry Feed

- 12.2.3.5. Others

- 12.2.4. Food Service Industry

- 12.2.4.1. Quick Service Restaurants

- 12.2.4.2. Full-Service Restaurants

- 12.2.4.3. Institutional Catering

- 12.2.4.4. Others

- 12.2.5. Personal Care & Cosmetics

- 12.2.6. Pharmaceutical

- 12.2.7. Others

- 12.2.1. Food & Beverages

- 13. Global Alternative Protein Market Analysis and Forecasts, by Region

- 13.1. Key Findings

- 13.2. Alternative Protein Market Size (Volume - Metric Tons and Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America Alternative Protein Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America Alternative Protein Market Size Volume - Metric Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Source/Type

- 14.3.2. Form

- 14.3.3. Product Type

- 14.3.4. Processing Technology

- 14.3.5. Distribution Channel

- 14.3.6. Protein Content

- 14.3.7. End-users

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA Alternative Protein Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Source/Type

- 14.4.3. Form

- 14.4.4. Product Type

- 14.4.5. Processing Technology

- 14.4.6. Distribution Channel

- 14.4.7. Protein Content

- 14.4.8. End-users

- 14.5. Canada Alternative Protein Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Source/Type

- 14.5.3. Form

- 14.5.4. Product Type

- 14.5.5. Processing Technology

- 14.5.6. Distribution Channel

- 14.5.7. Protein Content

- 14.5.8. End-users

- 14.6. Mexico Alternative Protein Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Source/Type

- 14.6.3. Form

- 14.6.4. Product Type

- 14.6.5. Processing Technology

- 14.6.6. Distribution Channel

- 14.6.7. Protein Content

- 14.6.8. End-users

- 15. Europe Alternative Protein Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe Alternative Protein Market Size (Volume - Metric Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Source/Type

- 15.3.2. Form

- 15.3.3. Product Type

- 15.3.4. Processing Technology

- 15.3.5. Distribution Channel

- 15.3.6. Protein Content

- 15.3.7. End-users

- 15.3.8. Country

- 15.3.8.1. Germany

- 15.3.8.2. United Kingdom

- 15.3.8.3. France

- 15.3.8.4. Italy

- 15.3.8.5. Spain

- 15.3.8.6. Netherlands

- 15.3.8.7. Nordic Countries

- 15.3.8.8. Poland

- 15.3.8.9. Russia & CIS

- 15.3.8.10. Rest of Europe

- 15.4. Germany Alternative Protein Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Source/Type

- 15.4.3. Form

- 15.4.4. Product Type

- 15.4.5. Processing Technology

- 15.4.6. Distribution Channel

- 15.4.7. Protein Content

- 15.4.8. End-users

- 15.5. United Kingdom Alternative Protein Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Source/Type

- 15.5.3. Form

- 15.5.4. Product Type

- 15.5.5. Processing Technology

- 15.5.6. Distribution Channel

- 15.5.7. Protein Content

- 15.5.8. End-users

- 15.6. France Alternative Protein Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Source/Type

- 15.6.3. Form

- 15.6.4. Product Type

- 15.6.5. Processing Technology

- 15.6.6. Distribution Channel

- 15.6.7. Protein Content

- 15.6.8. End-users

- 15.7. Italy Alternative Protein Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Source/Type

- 15.7.3. Form

- 15.7.4. Product Type

- 15.7.5. Processing Technology

- 15.7.6. Distribution Channel

- 15.7.7. Protein Content

- 15.7.8. End-users

- 15.8. Spain Alternative Protein Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Source/Type

- 15.8.3. Form

- 15.8.4. Product Type

- 15.8.5. Processing Technology

- 15.8.6. Distribution Channel

- 15.8.7. Protein Content

- 15.8.8. End-users

- 15.9. Netherlands Alternative Protein Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Source/Type

- 15.9.3. Form

- 15.9.4. Product Type

- 15.9.5. Processing Technology

- 15.9.6. Distribution Channel

- 15.9.7. Protein Content

- 15.9.8. End-users

- 15.10. Nordic Countries Alternative Protein Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Source/Type

- 15.10.3. Form

- 15.10.4. Product Type

- 15.10.5. Processing Technology

- 15.10.6. Distribution Channel

- 15.10.7. Protein Content

- 15.10.8. End-users

- 15.11. Poland Alternative Protein Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Source/Type

- 15.11.3. Form

- 15.11.4. Product Type

- 15.11.5. Processing Technology

- 15.11.6. Distribution Channel

- 15.11.7. Protein Content

- 15.11.8. End-users

- 15.12. Russia & CIS Alternative Protein Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Source/Type

- 15.12.3. Form

- 15.12.4. Product Type

- 15.12.5. Processing Technology

- 15.12.6. Distribution Channel

- 15.12.7. Protein Content

- 15.12.8. End-users

- 15.13. Rest of Europe Alternative Protein Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Source/Type

- 15.13.3. Form

- 15.13.4. Product Type

- 15.13.5. Processing Technology

- 15.13.6. Distribution Channel

- 15.13.7. Protein Content

- 15.13.8. End-users

- 16. Asia Pacific Alternative Protein Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Asia Pacific Alternative Protein Market Size (Volume - Metric Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Source/Type

- 16.3.2. Form

- 16.3.3. Product Type

- 16.3.4. Processing Technology

- 16.3.5. Distribution Channel

- 16.3.6. Protein Content

- 16.3.7. End-users

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia Pacific

- 16.4. China Alternative Protein Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Source/Type

- 16.4.3. Form

- 16.4.4. Product Type

- 16.4.5. Processing Technology

- 16.4.6. Distribution Channel

- 16.4.7. Protein Content

- 16.4.8. End-users

- 16.5. India Alternative Protein Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Source/Type

- 16.5.3. Form

- 16.5.4. Product Type

- 16.5.5. Processing Technology

- 16.5.6. Distribution Channel

- 16.5.7. Protein Content

- 16.5.8. End-users

- 16.6. Japan Alternative Protein Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Source/Type

- 16.6.3. Form

- 16.6.4. Product Type

- 16.6.5. Processing Technology

- 16.6.6. Distribution Channel

- 16.6.7. Protein Content

- 16.6.8. End-users

- 16.7. South Korea Alternative Protein Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Source/Type

- 16.7.3. Form

- 16.7.4. Product Type

- 16.7.5. Processing Technology

- 16.7.6. Distribution Channel

- 16.7.7. Protein Content

- 16.7.8. End-users

- 16.8. Australia and New Zealand Alternative Protein Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Source/Type

- 16.8.3. Form

- 16.8.4. Product Type

- 16.8.5. Processing Technology

- 16.8.6. Distribution Channel

- 16.8.7. Protein Content

- 16.8.8. End-users

- 16.9. Indonesia Alternative Protein Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Source/Type

- 16.9.3. Form

- 16.9.4. Product Type

- 16.9.5. Processing Technology

- 16.9.6. Distribution Channel

- 16.9.7. Protein Content

- 16.9.8. End-users

- 16.10. Malaysia Alternative Protein Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Source/Type

- 16.10.3. Form

- 16.10.4. Product Type

- 16.10.5. Processing Technology

- 16.10.6. Distribution Channel

- 16.10.7. Protein Content

- 16.10.8. End-users

- 16.11. Thailand Alternative Protein Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Source/Type

- 16.11.3. Form

- 16.11.4. Product Type

- 16.11.5. Processing Technology

- 16.11.6. Distribution Channel

- 16.11.7. Protein Content

- 16.11.8. End-users

- 16.12. Vietnam Alternative Protein Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Source/Type

- 16.12.3. Form

- 16.12.4. Product Type

- 16.12.5. Processing Technology

- 16.12.6. Distribution Channel

- 16.12.7. Protein Content

- 16.12.8. End-users

- 16.13. Rest of Asia Pacific Alternative Protein Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Source/Type

- 16.13.3. Form

- 16.13.4. Product Type

- 16.13.5. Processing Technology

- 16.13.6. Distribution Channel

- 16.13.7. Protein Content

- 16.13.8. End-users

- 17. Middle East Alternative Protein Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East Alternative Protein Market Size (Volume - Metric Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Source/Type

- 17.3.2. Form

- 17.3.3. Product Type

- 17.3.4. Processing Technology

- 17.3.5. Distribution Channel

- 17.3.6. Protein Content

- 17.3.7. End-users

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey Alternative Protein Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Source/Type

- 17.4.3. Form

- 17.4.4. Product Type

- 17.4.5. Processing Technology

- 17.4.6. Distribution Channel

- 17.4.7. Protein Content

- 17.4.8. End-users

- 17.5. UAE Alternative Protein Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Source/Type

- 17.5.3. Form

- 17.5.4. Product Type

- 17.5.5. Processing Technology

- 17.5.6. Distribution Channel

- 17.5.7. Protein Content

- 17.5.8. End-users

- 17.6. Saudi Arabia Alternative Protein Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Source/Type

- 17.6.3. Form

- 17.6.4. Product Type

- 17.6.5. Processing Technology

- 17.6.6. Distribution Channel

- 17.6.7. Protein Content

- 17.6.8. End-users

- 17.7. Israel Alternative Protein Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Source/Type

- 17.7.3. Form

- 17.7.4. Product Type

- 17.7.5. Processing Technology

- 17.7.6. Distribution Channel

- 17.7.7. Protein Content

- 17.7.8. End-users

- 17.8. Rest of Middle East Alternative Protein Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Source/Type

- 17.8.3. Form

- 17.8.4. Product Type

- 17.8.5. Processing Technology

- 17.8.6. Distribution Channel

- 17.8.7. Protein Content

- 17.8.8. End-users

- 18. Africa Alternative Protein Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa Alternative Protein Market Size (Volume - Metric Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Source/Type

- 18.3.2. Form

- 18.3.3. Product Type

- 18.3.4. Processing Technology

- 18.3.5. Distribution Channel

- 18.3.6. Protein Content

- 18.3.7. End-users

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa Alternative Protein Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Source/Type

- 18.4.3. Form

- 18.4.4. Product Type

- 18.4.5. Processing Technology

- 18.4.6. Distribution Channel

- 18.4.7. Protein Content

- 18.4.8. End-users

- 18.5. Egypt Alternative Protein Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Source/Type

- 18.5.3. Form

- 18.5.4. Product Type

- 18.5.5. Processing Technology

- 18.5.6. Distribution Channel

- 18.5.7. Protein Content

- 18.5.8. End-users

- 18.6. Nigeria Alternative Protein Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Source/Type

- 18.6.3. Form

- 18.6.4. Product Type

- 18.6.5. Processing Technology

- 18.6.6. Distribution Channel

- 18.6.7. Protein Content

- 18.6.8. End-users

- 18.7. Algeria Alternative Protein Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Source/Type

- 18.7.3. Form

- 18.7.4. Product Type

- 18.7.5. Processing Technology

- 18.7.6. Distribution Channel

- 18.7.7. Protein Content

- 18.7.8. End-users

- 18.8. Rest of Africa Alternative Protein Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Source/Type

- 18.8.3. Form

- 18.8.4. Product Type

- 18.8.5. Processing Technology

- 18.8.6. Distribution Channel

- 18.8.7. Protein Content

- 18.8.8. End-users

- 19. South America Alternative Protein Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. South America Alternative Protein Market Size (Volume - Metric Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Source/Type

- 19.3.2. Form

- 19.3.3. Product Type

- 19.3.4. Processing Technology

- 19.3.5. Distribution Channel

- 19.3.6. Protein Content

- 19.3.7. End-users

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil Alternative Protein Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Source/Type

- 19.4.3. Form

- 19.4.4. Product Type

- 19.4.5. Processing Technology

- 19.4.6. Distribution Channel

- 19.4.7. Protein Content

- 19.4.8. End-users

- 19.5. Argentina Alternative Protein Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Source/Type

- 19.5.3. Form

- 19.5.4. Product Type

- 19.5.5. Processing Technology

- 19.5.6. Distribution Channel

- 19.5.7. Protein Content

- 19.5.8. End-users

- 19.6. Rest of South America Alternative Protein Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Source/Type

- 19.6.3. Form

- 19.6.4. Product Type

- 19.6.5. Processing Technology

- 19.6.6. Distribution Channel

- 19.6.7. Protein Content

- 19.6.8. End-users

- 20. Key Players/ Company Profile

- 20.1. Archer Daniels Midland Company (ADM)

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. Beyond Meat

- 20.3. Burcon NutraScience Corporation

- 20.4. Cargill

- 20.5. Conagra Brands

- 20.6. DuPont de Nemours

- 20.7. Eat Just, Inc.

- 20.8. Fonterra Co-operative Group

- 20.9. Givaudan SA

- 20.10. Glanbia plc

- 20.11. Impossible Foods

- 20.12. Ingredion Incorporated

- 20.13. JBS S.A.

- 20.14. Kellogg Company

- 20.15. Kerry Group

- 20.16. Maple Leaf Foods

- 20.17. Nestlé S.A.

- 20.18. Roquette Frères

- 20.19. Tate & Lyle

- 20.20. Tyson Foods

- 20.21. Unilever

- 20.22. Other Key Players

- 20.1. Archer Daniels Midland Company (ADM)

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Insightified

Mid-to-large firms spend $20K–$40K quarterly on systematic research and typically recover multiples through improved growth and profitability

Research is no longer optional. Leading firms use it to uncover $10M+ in hidden revenue opportunities annually

Our research-consulting programs yields measurable ROI: 20–30% revenue increases from new markets, 11% profit upticks from pricing, and 20–30% cost savings from operations

Alternative Protein Market Size, Share & Trends Analysis Report by Source/Type (Plant-Based Proteins, Insect-Based Proteins, Mycoprotein (Fungal Protein), Algae-Based Proteins, Cultured/Cell-Based Proteins, Fermentation-Derived Proteins), Form, Product Type, Processing Technology, Distribution Channel, Protein Content, End-users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Alternative Protein Market Size, Share, and Growth

The global alternative protein market is experiencing robust growth, with its estimated value of USD 23.1 billion in the year 2025 and USD 75.7 billion by the period 2035, registering a CAGR of 12.6%, during the forecast period. The global alternative protein market is expanding with the increase in consumer focus on health-food, sustainability, and ethical food preferences. Plant-based, cultivated, and fermentation-based proteins, as well as increased retail and foodservice distribution, are further accelerating adoption worldwide.

Mike O’Riordan, Ingredion’s senior vice president of texture and healthful solutions in EMEA, said, “By joining forces with Lantmännen, we are expanding our footprint in the European market. This marks a significant milestone in our strategy to solidify our position as a global leader in the plant-based protein industry. This partnership allows us to leverage our combined strengths to deliver superior, sustainably sourced pea protein isolates that meet the evolving needs of the global market.

The rising consumer preference to flexitarian diets and rising environmental concerns over traditional animal farming are driving the global alternative protein market. The rise of health consciousness, climate-consciousness, ethicality, and food innovation are inspiring consumers who are shifting to the consumption of plant-based, cultivated, and fermentation-derived proteins without necessarily abandoning meat. For instance, in June 2025, Austrian start-up Revo Foods collaborated with Slovenian Juicy Marbles to introduce Kinda Cod, a 3D-printed plant-based fish fillet made with mycoprotein and high-throughput printing technology, emphasizing innovation in products and consumer attraction.

Protein extraction, texturization, flavor systems and the production efficiency are further being advanced through technological means, which are further driving expansion in the market. Advances in cost-effective production, especially in cultivated meat, are moving the price similarity to the high-end conventional products, which allows them wider uptake. For instance, in July 2025, a partnership between Buffalo Trace Distillery and Meridian Biotech illustrated a breakthrough in the sourcing of alternative proteins in a circular economy, using whiskey stillage, the by-product of distillation, to produce multifunctional proteins as the result of fermentation.

Adjacent sectors such as precision fermentation ingredients, vertical farming, and specialized food processing equipment, sustainable packaging, and personalized nutrition platforms provide complementary opportunities. For instance, in October 2025, At Anuga 2025, the first alternative proteins-focused exhibition represented plant-based, insect-, algae-, and fermentation-based products, demonstrating the augmentation of commercialization and technological innovation throughout the ecosystem. These synergies provide an opportunity of providing integrated solutions to satisfy consumer needs of convenience, nutrition, sustainability, and taste.

Alternative Protein Market Dynamics and Trends

Driver: Investment Surge and Mainstream Distribution Expansion

Restraint: Production Costs and Price Premium Challenges Consumer Adoption

Opportunity: Foodservice Channel Penetration and Menu Innovation

Key Trend: Hybrid Products and Ingredient Solutions

Alternative Protein Market Analysis and Segmental Data

Plant-Based Proteins Dominate Global Alternative Protein Market

North America Leads Global Alternative Protein Market Demand

Alternative-Protein-Market Ecosystem

The global alternative protein sector is moderately consolidated, comprising a combination of startups, medium-sized organizations, and large food companies, competing in different technologies, protein sources and product categories. Market leadership is not concentrated but distributed between specialized innovators, which is inherent to the early stage of the sector and the diversity of the technologies.

Major consumer-facing companies, such as Archer Daniels Midland Company (ADM), Cargill, Beyond Meat, Tyson Foods, and Ingredion Incorporated, have strong brand recognition, retail distribution, and foodservice relationships, although each has a minor market share. Niche segments or acting as B2B, mid-tier players include ingredient suppliers, technology platforms, and regional brands to support larger manufacturers. New startups are interested in the new sources of proteins, manufacturing techniques, and niche uses.

The value chain includes upstream sourcing and extraction of ingredients and proteins, midstream formulation, texturization and scale-up, and downstream branding, retail and foodservice channels. Large established food corporations are incorporating substitute proteins in a strategic manner, combining plant and animal proteins and utilizing the existing distribution and consumer loyalty to hasten its acceptance.

In general, the ecosystem spurs quick innovation and diverse commercialization methods but is less stable and concentrated as compared to mature food segments. Consolidation of the markets is likely to happen because cost forces and efficiency demand cuter, larger producers.

Recent Development and Strategic Overview:

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 23.1 Bn |

|

Market Forecast Value in 2035 |

USD 75.7 Bn |

|

Growth Rate (CAGR) |

12.6% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Metric Tons for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

|

Alternative-Protein-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Alternative Protein Market, By Source/Type |

|

|

Alternative Protein Market, By Form |

|

|

Alternative Protein Market, By Product Type |

|

|

Alternative Protein Market, By Processing Technology |

|

|

Alternative Protein Market, Distribution Channel |

|

|

Alternative Protein Market, By Protein Content |

|

|

Alternative Protein Market, By End-users |

|

Frequently Asked Questions

Table of Contents

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

Forecasting Models / Techniques

Multiple Regression Analysis

Time Series Analysis – Seasonal Patterns

Time Series Analysis – Trend Analysis

Expert Opinion – Expert Interviews

Multi-Scenario Development

Time Series Analysis – Moving Averages

Econometric Models

Expert Opinion – Delphi Method

Monte Carlo Simulation

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation