Automotive Dashboard Camera Market Size, Share, Growth Opportunity Analysis Report by Application (External View, Internal View and Combined View); Connectivity, Placement, Number of Lens, Power Source, Resolution, Vehicle Type, Propulsion, Sales Channel and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Automotive Dashboard Camera Market Size, Share, and Growth

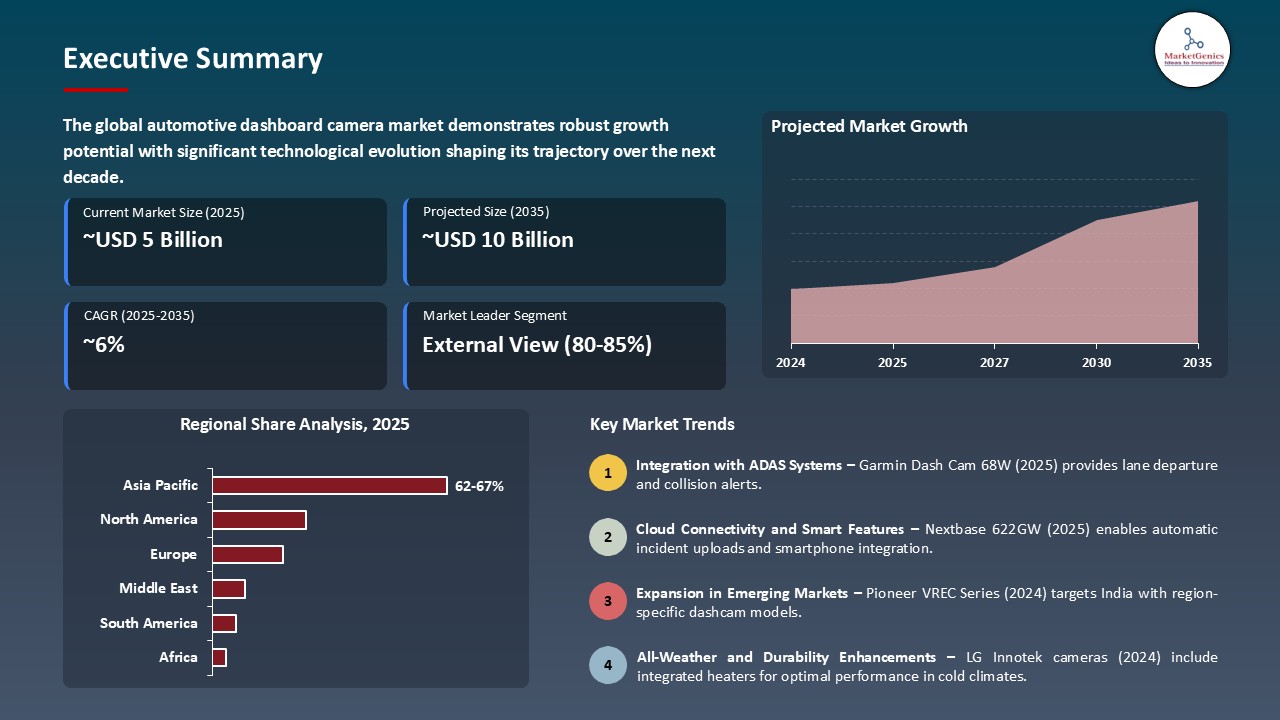

The worldwide automotive dashboard camera market is expanding from USD 4.8 billion in 2025 to USD 9.8 billion by the year 2035, showing a CAGR of 6.7% over the forecast period. The global rise in road accidents and insurance fraud has, therefore, greatly forced the demand on automotive dash cameras, which serve as means to record any driving incident the moment it happens, thus producing irrefutable evidence in any dispute.

In May 2024, Garmin Ltd. expanded its automotive dashboard camera lineup with the Garmin Dash Cam Live 2, offering LTE connectivity and cloud storage to support real-time footage access and remote monitoring. The move, led by Cliff Pemble, President and CEO, reflects Garmin’s strategy to integrate connected features for enhanced driver safety and insurance support.

For example, in India, motor vehicle insurance frauds worth approximately USD 15.86 billion were reported for the financial year ending March 2022, forcing dashcams to be viewed as a deterrent by both the consumers and the insurers. Likewise, in Japan, insurance companies have initiated special contracts for leasing dashcams to curtail tailgating cases and to improve road safety.

These are some market opportunities for global automotive dashboard camera market includes emerging ADAS requirements, increasing vehicle telematics and fleet management, and rising demand for camera-integrated vehicle environments with IoT and cloud. These trends broaden the scope of dashboard cameras from passive recording to active safety and connectivity enablers.

Automotive Dashboard Camera Market Dynamics and Trends

Driver: Rising Road Accidents and Insurance Fraud

- The escalating number of road accidents and fraudulent insurance claims the world over has rendered dash cameras in great demand. The devices validate instances of drivers in real-time such that the instruments may provide concrete evidence in dispute resolution.

- For example, the National Highway Traffic Safety Administration (NHTSA) of the United States estimated nearly 42,915 highway fatalities in the year 2021, and this was estimably an increase of 10.5% from 2020. Such eerie statistics have urged the consumers as well as insurers to mount dash cams as preventive steps. Insurance companies are diligently promoting their policyholder's use of dash cams to fight against fraudulent claims, offering them incentives or discounts for installing them.

Driver: Integration with Advanced Driver Assistance Systems (ADAS)

- The evolution of ADAS acted as the catalyst for dashcam adoption, repositioning dashboard cameras from passive recorders into active contributors within the Automotive Sensors, where real-time visual data supports perception, alerting, and driver-assistance functions. Modern dashcams give lane departure warning, collision avoidance system, and drowsiness alerts to maintain the safety of the driving environment and to satisfy consumer desires for a technically intrepid vehicle.

- Some camera systems for vehicles have integrated AI-based analytics to detect driver behavior and give feedback in real time to help avoid accidents. This adds yet another layer of vehicle safety by way of integration to ADAS technologies in which dashcams provide real-time feedback and alerting to drivers.

Restraint: Privacy Concerns and Regulatory Hurdles

- Even though dashcams could help solve everyday problems, adoption on a large scale runs into the thickets of privacy concern and regulatory hurdles. With continuous recording, a dashcam might capture sensitive personal information and could pose data privacy or surveillance threats. Few jurisdictions have strict regimes as to whether the dashcam should be used or not when it comes to capturing footage of people without prior consent.

- Now taking Europe as an example, there are massive data protection regulations under the tag of the General Data Protection Regulation (GDPR) on data collection and retention, which, therefore, have implications on the use of dashcam footage. Such privacy concerns and regulatory wrangles could dissuade some consumers from adopting dashcams and indeed weigh on the manufacturers concerning compliance efforts and product design.

Opportunity: Emergence of AI-Powered Dashcams

- There is a splendid opportunity that has opened up in the dashcam market for multifunctional dashcams with AI capabilities. AI dashcams are different from regular dashcams. They actively monitor the data streaming in from events happening in real-time around the vehicle. This means they record incidences and warn the driver when there are risks, for instance, a pedestrian or a cyclist entering the road, or the vehicle commencing to drift out of its requested lane to avert accident occurrences.

- The AI version can filter out routine events and focus on important incidents such as accidents or break-ins, saving the relevant video clips with precise timestamps through AI algorithms, thus assisting insurance claims or court corroborations. The interesting thing is that AI-based dashcams can also learn how each driver operates their car to tailor settings aimed at optimizing recording and storage management.

Key Trend: Integration with Telematics and Fleet Management Systems

- A prevailing trend in the dashboard camera market is the incorporation of dashcams with telematics and fleet management systems, embedding them deeper into the Enterprise Mobility, where fleet visibility, driver accountability, and insurance risk mitigation drive large-scale deployments. Such integration monitors the real-time vehicle performance, driver behavior, and route optimization to bring about operational efficiency and safety.

- For example, in June 2023, HCSS, a US-based software provider for heavy civil businesses, introduced a plug-and-play dash camera integrated with an AI processor to detect driving incidents. Such innovations will allow fleet operators to take a more proactive approach in managing vehicles, minimizing accidents, and reducing insurance costs. The integration of dashcams with telematics has changed the face of dashcams as central pieces of a complete fleet management solution.

Automotive Dashboard Camera Market Analysis and Segmental Data

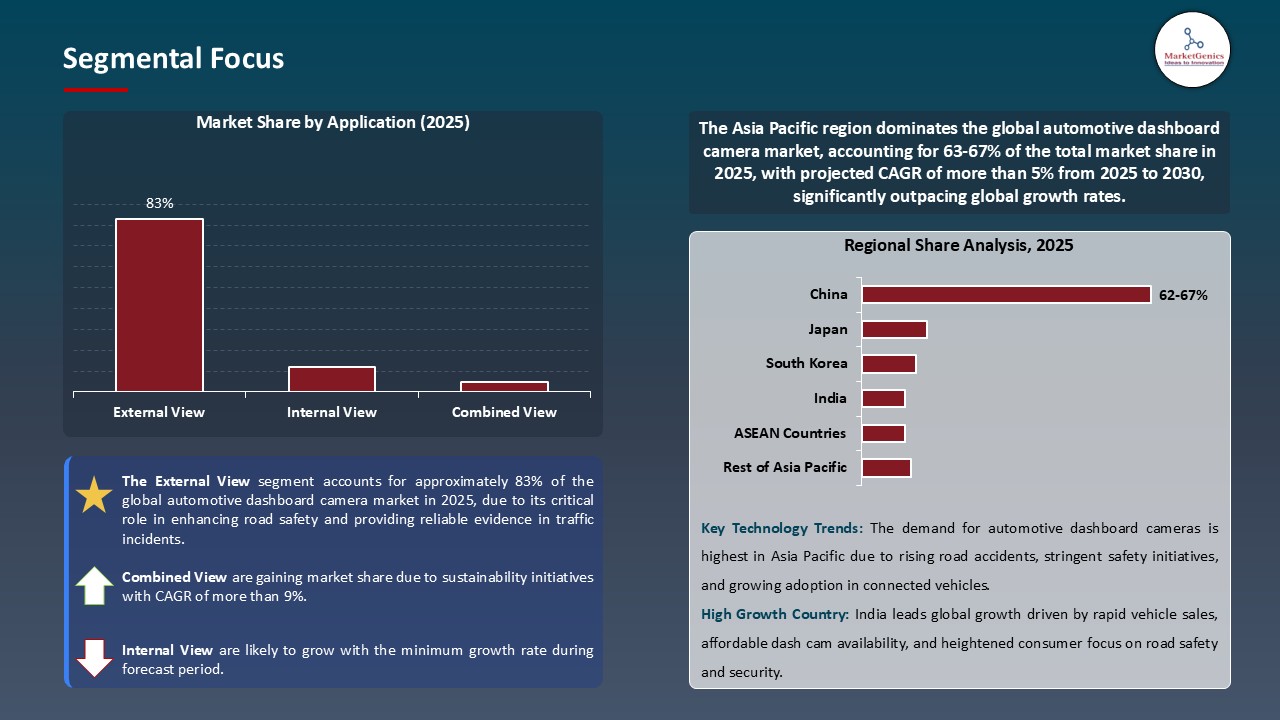

Based on application, the external view segment retains the largest share

- The external view segment holds major share ~83% in the global automotive dashboard camera market due to its critical role in enhancing road safety and providing reliable evidence in traffic incidents. Most recently, front-facing cameras became a necessity to record real-time road footage and provide valuable evidence in cases of accidents or disputes. There are roughly 1.3 million deaths on roadways worldwide yearly, mandating that such instances are adequately captured by cameras for appropriate intervention. External views from dashboard cameras document road incidents that allow for settling of claims, thereby discouraging induced driving practices. For instance, the deployment of front-facing cameras in vehicles has led to a 50% drop in front-to-rear crashes, according to studies by the Insurance Institute for Highway Safety.

- Moreover, with the continuous increase in installation of ADAS, dashboard cameras with external views have seen important growth in demand. Such cameras are considered critical for lane departure warnings and collision avoidance systems since these latter systems require external imaging to ensure proper functioning. The growth therefore reflects the increasing reliance on external view cameras to bolster vehicle safety and driver assistance capabilities. Manufacturers are answering this call by offering high-definition, wide-angle cameras capable of covering roads on a very macro scale, thereby further securing the lead retained by the external view segment in the dashboard camera market.

Asia Pacific Dominates Global Automotive Dashboard Camera Market in 2025 and Beyond

- Asia Pacific is the biggest market for automotive dashboard cameras. This comes from the blend of regulatory activity, technical progress, and customer awareness. For example, the government mandated installing dashboard cameras in commercial vehicles in India, thus generating ample demand for these systems. In China, Japan, and South Korea, dashcam adoption has increased owing to enhanced road safety concerns and the anticipation of insurance fraud. In addition, dashcams, with an integration of ADAS (Advanced Driver Assistance System), ensure enhanced safety of vehicles and contribute further to the market ascension in China. Cheap cameras have made it easy for manufacturers to enter the online market, creating a suitable platform for end consumers to get these dashcams, which in turn stimulates the market growth in this region.

- Technological innovation is yet another growth factor for the Asia Pacific dashboard camera market. Panasonic Automotive Systems offers dashcam systems with Wi-Fi connectivity and HD Video Recording features, catering to ever-evolving consumer preferences. Moreover, AI-based dashcams are gaining traction by providing real-time alerts and driver behavior analysis. This trend is evident especially in Japan and South Korea, where consumers who are quite tech-savvy are seen adopting AI-powered dash cams to better their driving experiences. Regulations, technology, and awareness build up the Asia Pacific region so much so that it stands tall in the world dashboard camera market, expecting continued growth in the years to follow.

Automotive Dashboard Camera Market Ecosystem

Key players in the global automotive dashboard camera market include prominent companies such as Nextbase, Garmin Ltd., Pittasoft (BlackVue), Thinkware, Viofo and Other Key Players.

The global automotive dashboard camera market is moderately fragmented, and thus, a medium level of consolidation prevails. Tier I companies include Garmin Ltd., Continental AG, Valeo SA, and DENSO TEN Limited, which hold very strong footholds due to advanced technologies and broad global reach. Tier II and Tier III companies, such as PAPAGO Inc., Waylens, Inc., and PosiTrace, serve price-sensitive regional segments by offering competitive yet less integrated solutions. In relation to porter’s five forces analysis, buyer concentration is moderate, as OEMs and end-users progressively influence feature integration. Supplier concentration is low to moderate due to several hardware and software vendors.

Recent Development and Strategic Overview:

- In February 2024, The LG Innotek has unveiled a lineup of vehicle cameras with integrated heaters suitable for autonomous vehicles. Therefore, the heater integration would aid the cameras in performing optimally during cold weather conditions for the best energy management of electric vehicles.

- In August 2024, Pioneer India Electronics Pvt Ltd. has launched a series of Indian-modified dash cameras called the VREC series. This series from Pioneer's Mobility AI offerings comprises models like VREC-H120SC and VREC-Z820DC, which work towards providing greater safety and security to the driver in India.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 4.8 Bn |

|

Market Forecast Value in 2035 |

USD 9.8 Bn |

|

Growth Rate (CAGR) |

6.7% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Million Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Automotive Dashboard Camera Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Application |

|

|

By Connectivity |

|

|

By Placement |

|

|

By Number of Lens |

|

|

By Power Source |

|

|

By Vehicle Type |

|

|

By Propulsion |

|

|

By Sales Channel |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Automotive Dashboard Camera Market Outlook

- 2.1.1. Automotive Dashboard Camera Market Size (Volume – Mn Units and Value - US$ Bn), and Forecasts, 2020-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Automotive Dashboard Camera Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Electric Vehicle Industry Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for EV Industry

- 3.1.3. Regional Distribution for EV Industry

- 3.2. Supplier Customer Data

- 3.3. Connectivity Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the Component & Raw Material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Electric Vehicle Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising incidence of road accidents and insurance fraud

- 4.1.1.2. Integration with advanced driver-assistance systems (ADAS)

- 4.1.1.3. Technological advancements and affordability

- 4.1.2. Restraints

- 4.1.2.1. Privacy concerns and regulatory challenges

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Component Suppliers

- 4.4.2. Automotive Dashboard Camera Manufacturers

- 4.4.3. Dealers/ Distributors

- 4.4.4. End-users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Automotive Dashboard Camera Market Demand

- 4.9.1. Historical Market Size - in Volume (Mn Units) and Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size - in Volume (Mn Units) and Value (US$ Bn), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Automotive Dashboard Camera Market Analysis, by Application

- 6.1. Key Segment Analysis

- 6.2. Automotive Dashboard Camera Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, by Application, 2020-2035

- 6.2.1. External View

- 6.2.2. Internal View

- 6.2.3. Combined View

- 7. Global Automotive Dashboard Camera Market Analysis, by Connectivity

- 7.1. Key Segment Analysis

- 7.2. Automotive Dashboard Camera Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, by Connectivity, 2020-2035

- 7.2.1. Wi-Fi

- 7.2.2. Bluetooth

- 7.2.3. 4G

- 7.2.4. Wired

- 7.2.5. Others

- 8. Global Automotive Dashboard Camera Market Analysis, by Placement

- 8.1. Key Segment Analysis

- 8.2. Automotive Dashboard Camera Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, by Placement, 2020-2035

- 8.2.1. Front

- 8.2.2. Rear

- 8.2.3. Side

- 9. Global Automotive Dashboard Camera Market Analysis, by Number of Lens

- 9.1. Key Segment Analysis

- 9.2. Automotive Dashboard Camera Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, by Number of Lens, 2020-2035

- 9.2.1. Single Lens

- 9.2.2. Multi-lens

- 10. Global Automotive Dashboard Camera Market Analysis, by Power Source

- 10.1. Key Segment Analysis

- 10.2. Automotive Dashboard Camera Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, by Power Source, 2020-2035

- 10.2.1. Vehicle Battery Powered

- 10.2.2. Individual Battery Powered

- 11. Global Automotive Dashboard Camera Market Analysis, by Resolution

- 11.1. Key Segment Analysis

- 11.2. Automotive Dashboard Camera Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, by Resolution, 2020-2035

- 11.2.1. SD & HD (Up to 720P)

- 11.2.2. Full HD & 4K (1080P and Above)

- 12. Global Automotive Dashboard Camera Market Analysis, by Vehicle Type

- 12.1. Key Segment Analysis

- 12.2. Automotive Dashboard Camera Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, by Vehicle Type, 2020-2035

- 12.2.1. Two Wheelers

- 12.2.2. Three Wheelers

- 12.2.3. Passenger Cars

- 12.2.3.1. Hatchback

- 12.2.3.2. Sedan

- 12.2.3.3. SUVs

- 12.2.4. Light Commercial Vehicles

- 12.2.5. Heavy Duty Trucks

- 12.2.6. Buses and Coaches

- 12.2.7. Off-road Vehicles

- 13. Global Automotive Dashboard Camera Market Analysis, by Propulsion

- 13.1. Key Segment Analysis

- 13.2. Automotive Dashboard Camera Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, by Propulsion, 2020-2035

- 13.2.1. ICE Vehicles

- 13.2.1.1. Gasoline

- 13.2.1.2. Diesel

- 13.2.2. Electric

- 13.2.2.1. Battery Electric Vehicles (BEVs)

- 13.2.2.2. Plug-in Hybrid Electric Vehicles (PHEVs)

- 13.2.2.3. Hybrid Electric Vehicles (HEVs)

- 13.2.1. ICE Vehicles

- 14. Global Automotive Dashboard Camera Market Analysis, by Sales Channel

- 14.1. Key Segment Analysis

- 14.2. Automotive Dashboard Camera Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, by Sales Channel, 2020-2035

- 14.2.1. OEM

- 14.2.2. Aftermarket

- 15. Global Automotive Dashboard Camera Market Analysis and Forecasts, by Region

- 15.1. Key Findings

- 15.2. Automotive Dashboard Camera Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, by Region, 2020-2035

- 15.2.1. North America

- 15.2.2. Europe

- 15.2.3. Asia Pacific

- 15.2.4. Middle East

- 15.2.5. Africa

- 15.2.6. South America

- 16. North America Automotive Dashboard Camera Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. North America Automotive Dashboard Camera Market Size Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, 2020-2035

- 16.3.1. Application

- 16.3.2. Connectivity

- 16.3.3. Placement

- 16.3.4. Number of Lens

- 16.3.5. Power Source

- 16.3.6. Resolution

- 16.3.7. Vehicle Type

- 16.3.8. Propulsion

- 16.3.9. Sales Channel

- 16.3.10. Country

- 16.3.10.1. USA

- 16.3.10.2. Canada

- 16.3.10.3. Mexico

- 16.4. USA Automotive Dashboard Camera Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Application

- 16.4.3. Connectivity

- 16.4.4. Placement

- 16.4.5. Number of Lens

- 16.4.6. Power Source

- 16.4.7. Resolution

- 16.4.8. Vehicle Type

- 16.4.9. Propulsion

- 16.4.10. Sales Channel

- 16.5. Canada Automotive Dashboard Camera Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Application

- 16.5.3. Connectivity

- 16.5.4. Placement

- 16.5.5. Number of Lens

- 16.5.6. Power Source

- 16.5.7. Resolution

- 16.5.8. Vehicle Type

- 16.5.9. Propulsion

- 16.5.10. Sales Channel

- 16.6. Mexico Automotive Dashboard Camera Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Application

- 16.6.3. Connectivity

- 16.6.4. Placement

- 16.6.5. Number of Lens

- 16.6.6. Power Source

- 16.6.7. Resolution

- 16.6.8. Vehicle Type

- 16.6.9. Propulsion

- 16.6.10. Sales Channel

- 17. Europe Automotive Dashboard Camera Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Europe Automotive Dashboard Camera Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, 2020-2035

- 17.3.1. Application

- 17.3.2. Connectivity

- 17.3.3. Placement

- 17.3.4. Number of Lens

- 17.3.5. Power Source

- 17.3.6. Resolution

- 17.3.7. Vehicle Type

- 17.3.8. Propulsion

- 17.3.9. Sales Channel

- 17.3.10. Country

- 17.3.10.1. Germany

- 17.3.10.2. United Kingdom

- 17.3.10.3. France

- 17.3.10.4. Italy

- 17.3.10.5. Spain

- 17.3.10.6. Netherlands

- 17.3.10.7. Nordic Countries

- 17.3.10.8. Poland

- 17.3.10.9. Russia & CIS

- 17.3.10.10. Rest of Europe

- 17.4. Germany Automotive Dashboard Camera Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Application

- 17.4.3. Connectivity

- 17.4.4. Placement

- 17.4.5. Number of Lens

- 17.4.6. Power Source

- 17.4.7. Resolution

- 17.4.8. Vehicle Type

- 17.4.9. Propulsion

- 17.4.10. Sales Channel

- 17.5. United Kingdom Automotive Dashboard Camera Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Application

- 17.5.3. Connectivity

- 17.5.4. Placement

- 17.5.5. Number of Lens

- 17.5.6. Power Source

- 17.5.7. Resolution

- 17.5.8. Vehicle Type

- 17.5.9. Propulsion

- 17.5.10. Sales Channel

- 17.6. France Automotive Dashboard Camera Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Application

- 17.6.3. Connectivity

- 17.6.4. Placement

- 17.6.5. Number of Lens

- 17.6.6. Power Source

- 17.6.7. Resolution

- 17.6.8. Vehicle Type

- 17.6.9. Propulsion

- 17.6.10. Sales Channel

- 17.7. Italy Automotive Dashboard Camera Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Application

- 17.7.3. Connectivity

- 17.7.4. Placement

- 17.7.5. Number of Lens

- 17.7.6. Power Source

- 17.7.7. Resolution

- 17.7.8. Vehicle Type

- 17.7.9. Propulsion

- 17.7.10. Sales Channel

- 17.8. Spain Automotive Dashboard Camera Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Application

- 17.8.3. Connectivity

- 17.8.4. Placement

- 17.8.5. Number of Lens

- 17.8.6. Power Source

- 17.8.7. Resolution

- 17.8.8. Vehicle Type

- 17.8.9. Propulsion

- 17.8.10. Sales Channel

- 17.9. Netherlands Automotive Dashboard Camera Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Application

- 17.9.3. Connectivity

- 17.9.4. Placement

- 17.9.5. Number of Lens

- 17.9.6. Power Source

- 17.9.7. Resolution

- 17.9.8. Vehicle Type

- 17.9.9. Propulsion

- 17.9.10. Sales Channel

- 17.10. Nordic Countries Automotive Dashboard Camera Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Application

- 17.10.3. Connectivity

- 17.10.4. Placement

- 17.10.5. Number of Lens

- 17.10.6. Power Source

- 17.10.7. Resolution

- 17.10.8. Vehicle Type

- 17.10.9. Propulsion

- 17.10.10. Sales Channel

- 17.11. Poland Automotive Dashboard Camera Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Application

- 17.11.3. Connectivity

- 17.11.4. Placement

- 17.11.5. Number of Lens

- 17.11.6. Power Source

- 17.11.7. Resolution

- 17.11.8. Vehicle Type

- 17.11.9. Propulsion

- 17.11.10. Sales Channel

- 17.12. Russia & CIS Automotive Dashboard Camera Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Application

- 17.12.3. Connectivity

- 17.12.4. Placement

- 17.12.5. Number of Lens

- 17.12.6. Power Source

- 17.12.7. Resolution

- 17.12.8. Vehicle Type

- 17.12.9. Propulsion

- 17.12.10. Sales Channel

- 17.13. Rest of Europe Automotive Dashboard Camera Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Application

- 17.13.3. Connectivity

- 17.13.4. Placement

- 17.13.5. Number of Lens

- 17.13.6. Power Source

- 17.13.7. Resolution

- 17.13.8. Vehicle Type

- 17.13.9. Propulsion

- 17.13.10. Sales Channel

- 18. Asia Pacific Automotive Dashboard Camera Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. East Asia Automotive Dashboard Camera Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, 2020-2035

- 18.3.1. Application

- 18.3.2. Connectivity

- 18.3.3. Placement

- 18.3.4. Number of Lens

- 18.3.5. Power Source

- 18.3.6. Resolution

- 18.3.7. Vehicle Type

- 18.3.8. Propulsion

- 18.3.9. Sales Channel

- 18.3.10. Country

- 18.3.10.1. China

- 18.3.10.2. India

- 18.3.10.3. Japan

- 18.3.10.4. South Korea

- 18.3.10.5. Australia and New Zealand

- 18.3.10.6. Indonesia

- 18.3.10.7. Malaysia

- 18.3.10.8. Thailand

- 18.3.10.9. Vietnam

- 18.3.10.10. Rest of Asia Pacific

- 18.4. China Automotive Dashboard Camera Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Application

- 18.4.3. Connectivity

- 18.4.4. Placement

- 18.4.5. Number of Lens

- 18.4.6. Power Source

- 18.4.7. Resolution

- 18.4.8. Vehicle Type

- 18.4.9. Propulsion

- 18.4.10. Sales Channel

- 18.5. India Automotive Dashboard Camera Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Application

- 18.5.3. Connectivity

- 18.5.4. Placement

- 18.5.5. Number of Lens

- 18.5.6. Power Source

- 18.5.7. Resolution

- 18.5.8. Vehicle Type

- 18.5.9. Propulsion

- 18.5.10. Sales Channel

- 18.6. Japan Automotive Dashboard Camera Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Application

- 18.6.3. Connectivity

- 18.6.4. Placement

- 18.6.5. Number of Lens

- 18.6.6. Power Source

- 18.6.7. Resolution

- 18.6.8. Vehicle Type

- 18.6.9. Propulsion

- 18.6.10. Sales Channel

- 18.7. South Korea Automotive Dashboard Camera Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Application

- 18.7.3. Connectivity

- 18.7.4. Placement

- 18.7.5. Number of Lens

- 18.7.6. Power Source

- 18.7.7. Resolution

- 18.7.8. Vehicle Type

- 18.7.9. Propulsion

- 18.7.10. Sales Channel

- 18.8. Australia and New Zealand Automotive Dashboard Camera Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Application

- 18.8.3. Connectivity

- 18.8.4. Placement

- 18.8.5. Number of Lens

- 18.8.6. Power Source

- 18.8.7. Resolution

- 18.8.8. Vehicle Type

- 18.8.9. Propulsion

- 18.8.10. Sales Channel

- 18.9. Indonesia Automotive Dashboard Camera Market

- 18.9.1. Country Segmental Analysis

- 18.9.2. Application

- 18.9.3. Connectivity

- 18.9.4. Placement

- 18.9.5. Number of Lens

- 18.9.6. Power Source

- 18.9.7. Resolution

- 18.9.8. Vehicle Type

- 18.9.9. Propulsion

- 18.9.10. Sales Channel

- 18.10. Malaysia Automotive Dashboard Camera Market

- 18.10.1. Country Segmental Analysis

- 18.10.2. Application

- 18.10.3. Connectivity

- 18.10.4. Placement

- 18.10.5. Number of Lens

- 18.10.6. Power Source

- 18.10.7. Resolution

- 18.10.8. Vehicle Type

- 18.10.9. Propulsion

- 18.10.10. Sales Channel

- 18.11. Thailand Automotive Dashboard Camera Market

- 18.11.1. Country Segmental Analysis

- 18.11.2. Application

- 18.11.3. Connectivity

- 18.11.4. Placement

- 18.11.5. Number of Lens

- 18.11.6. Power Source

- 18.11.7. Resolution

- 18.11.8. Vehicle Type

- 18.11.9. Propulsion

- 18.11.10. Sales Channel

- 18.12. Vietnam Automotive Dashboard Camera Market

- 18.12.1. Country Segmental Analysis

- 18.12.2. Application

- 18.12.3. Connectivity

- 18.12.4. Placement

- 18.12.5. Number of Lens

- 18.12.6. Power Source

- 18.12.7. Resolution

- 18.12.8. Vehicle Type

- 18.12.9. Propulsion

- 18.12.10. Sales Channel

- 18.13. Rest of Asia Pacific Automotive Dashboard Camera Market

- 18.13.1. Country Segmental Analysis

- 18.13.2. Application

- 18.13.3. Connectivity

- 18.13.4. Placement

- 18.13.5. Number of Lens

- 18.13.6. Power Source

- 18.13.7. Resolution

- 18.13.8. Vehicle Type

- 18.13.9. Propulsion

- 18.13.10. Sales Channel

- 19. Middle East Automotive Dashboard Camera Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Middle East Automotive Dashboard Camera Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, 2020-2035

- 19.3.1. Application

- 19.3.2. Connectivity

- 19.3.3. Placement

- 19.3.4. Number of Lens

- 19.3.5. Power Source

- 19.3.6. Resolution

- 19.3.7. Vehicle Type

- 19.3.8. Propulsion

- 19.3.9. Sales Channel

- 19.3.10. Country

- 19.3.10.1. Turkey

- 19.3.10.2. UAE

- 19.3.10.3. Saudi Arabia

- 19.3.10.4. Israel

- 19.3.10.5. Rest of Middle East

- 19.4. Turkey Automotive Dashboard Camera Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Application

- 19.4.3. Connectivity

- 19.4.4. Placement

- 19.4.5. Number of Lens

- 19.4.6. Power Source

- 19.4.7. Resolution

- 19.4.8. Vehicle Type

- 19.4.9. Propulsion

- 19.4.10. Sales Channel

- 19.5. UAE Automotive Dashboard Camera Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Application

- 19.5.3. Connectivity

- 19.5.4. Placement

- 19.5.5. Number of Lens

- 19.5.6. Power Source

- 19.5.7. Resolution

- 19.5.8. Vehicle Type

- 19.5.9. Propulsion

- 19.5.10. Sales Channel

- 19.6. Saudi Arabia Automotive Dashboard Camera Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Application

- 19.6.3. Connectivity

- 19.6.4. Placement

- 19.6.5. Number of Lens

- 19.6.6. Power Source

- 19.6.7. Resolution

- 19.6.8. Vehicle Type

- 19.6.9. Propulsion

- 19.6.10. Sales Channel

- 19.7. Israel Automotive Dashboard Camera Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Application

- 19.7.3. Connectivity

- 19.7.4. Placement

- 19.7.5. Number of Lens

- 19.7.6. Power Source

- 19.7.7. Resolution

- 19.7.8. Vehicle Type

- 19.7.9. Propulsion

- 19.7.10. Sales Channel

- 19.8. Rest of Middle East Automotive Dashboard Camera Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Application

- 19.8.3. Connectivity

- 19.8.4. Placement

- 19.8.5. Number of Lens

- 19.8.6. Power Source

- 19.8.7. Resolution

- 19.8.8. Vehicle Type

- 19.8.9. Propulsion

- 19.8.10. Sales Channel

- 20. Africa Automotive Dashboard Camera Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Africa Automotive Dashboard Camera Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, 2020-2035

- 20.3.1. Application

- 20.3.2. Connectivity

- 20.3.3. Placement

- 20.3.4. Number of Lens

- 20.3.5. Power Source

- 20.3.6. Resolution

- 20.3.7. Vehicle Type

- 20.3.8. Propulsion

- 20.3.9. Sales Channel

- 20.3.10. Country

- 20.3.10.1. South Africa

- 20.3.10.2. Egypt

- 20.3.10.3. Nigeria

- 20.3.10.4. Algeria

- 20.3.10.5. Rest of Africa

- 20.4. South Africa Automotive Dashboard Camera Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Application

- 20.4.3. Connectivity

- 20.4.4. Placement

- 20.4.5. Number of Lens

- 20.4.6. Power Source

- 20.4.7. Resolution

- 20.4.8. Vehicle Type

- 20.4.9. Propulsion

- 20.4.10. Sales Channel

- 20.5. Egypt Automotive Dashboard Camera Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Application

- 20.5.3. Connectivity

- 20.5.4. Placement

- 20.5.5. Number of Lens

- 20.5.6. Power Source

- 20.5.7. Resolution

- 20.5.8. Vehicle Type

- 20.5.9. Propulsion

- 20.5.10. Sales Channel

- 20.6. Nigeria Automotive Dashboard Camera Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Application

- 20.6.3. Connectivity

- 20.6.4. Placement

- 20.6.5. Number of Lens

- 20.6.6. Power Source

- 20.6.7. Resolution

- 20.6.8. Vehicle Type

- 20.6.9. Propulsion

- 20.6.10. Sales Channel

- 20.7. Algeria Automotive Dashboard Camera Market

- 20.7.1. Country Segmental Analysis

- 20.7.2. Application

- 20.7.3. Connectivity

- 20.7.4. Placement

- 20.7.5. Number of Lens

- 20.7.6. Power Source

- 20.7.7. Resolution

- 20.7.8. Vehicle Type

- 20.7.9. Propulsion

- 20.7.10. Sales Channel

- 20.8. Rest of Africa Automotive Dashboard Camera Market

- 20.8.1. Country Segmental Analysis

- 20.8.2. Application

- 20.8.3. Connectivity

- 20.8.4. Placement

- 20.8.5. Number of Lens

- 20.8.6. Power Source

- 20.8.7. Resolution

- 20.8.8. Vehicle Type

- 20.8.9. Propulsion

- 20.8.10. Sales Channel

- 21. South America Automotive Dashboard Camera Market Analysis

- 21.1. Key Segment Analysis

- 21.2. Regional Snapshot

- 21.3. Central and South Africa Automotive Dashboard Camera Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, 2020-2035

- 21.3.1. Application

- 21.3.2. Connectivity

- 21.3.3. Placement

- 21.3.4. Number of Lens

- 21.3.5. Power Source

- 21.3.6. Resolution

- 21.3.7. Vehicle Type

- 21.3.8. Propulsion

- 21.3.9. Sales Channel

- 21.3.10. Country

- 21.3.10.1. Brazil

- 21.3.10.2. Argentina

- 21.3.10.3. Rest of South America

- 21.4. Brazil Automotive Dashboard Camera Market

- 21.4.1. Country Segmental Analysis

- 21.4.2. Application

- 21.4.3. Connectivity

- 21.4.4. Placement

- 21.4.5. Number of Lens

- 21.4.6. Power Source

- 21.4.7. Resolution

- 21.4.8. Vehicle Type

- 21.4.9. Propulsion

- 21.4.10. Sales Channel

- 21.5. Argentina Automotive Dashboard Camera Market

- 21.5.1. Country Segmental Analysis

- 21.5.2. Application

- 21.5.3. Connectivity

- 21.5.4. Placement

- 21.5.5. Number of Lens

- 21.5.6. Power Source

- 21.5.7. Resolution

- 21.5.8. Vehicle Type

- 21.5.9. Propulsion

- 21.5.10. Sales Channel

- 21.6. Rest of South America Automotive Dashboard Camera Market

- 21.6.1. Country Segmental Analysis

- 21.6.2. Application

- 21.6.3. Connectivity

- 21.6.4. Placement

- 21.6.5. Number of Lens

- 21.6.6. Power Source

- 21.6.7. Resolution

- 21.6.8. Vehicle Type

- 21.6.9. Propulsion

- 21.6.10. Sales Channel

- 22. Key Players/ Company Profile

- 22.1. Cadence Design Systems, Inc.

- 22.1.1. Company Details/ Overview

- 22.1.2. Company Financials

- 22.1.3. Key Customers and Competitors

- 22.1.4. Business/ Industry Portfolio

- 22.1.5. Product Portfolio/ Specification Details

- 22.1.6. Pricing Data

- 22.1.7. Strategic Overview

- 22.1.8. Recent Developments

- 22.2. DENSO Corporation

- 22.3. Infineon Technologies AG

- 22.4. Intel Corporation

- 22.5. Marvell Technology

- 22.6. Microchip Technology Inc.

- 22.7. NEC Corporation

- 22.8. NVIDIA Corporation

- 22.9. NXP Semiconductors

- 22.10. ON Semiconductor Corporation

- 22.11. Qualcomm Technologies, Inc.

- 22.12. Renesas Electronics Corporation

- 22.13. Robert Bosch GmbH

- 22.14. STMicroelectronics

- 22.15. Telechips Inc.

- 22.16. Texas Instruments

- 22.17. Other Key Players

- 22.1. Cadence Design Systems, Inc.

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation