Automotive Optoelectronics Market Size, Share & Trends Analysis Report by Component Type (Light Emitting Diodes (LEDs), Laser Diodes, Infrared Components, Photo Detectors, Optocouplers, Image Sensors, Photovoltaic Cells, Others), Vehicle Type, Sales Channel, Technology, Wavelength Range, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025 – 2035

|

Market Structure & Evolution |

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Automotive Optoelectronics Market Size, Share, and Growth

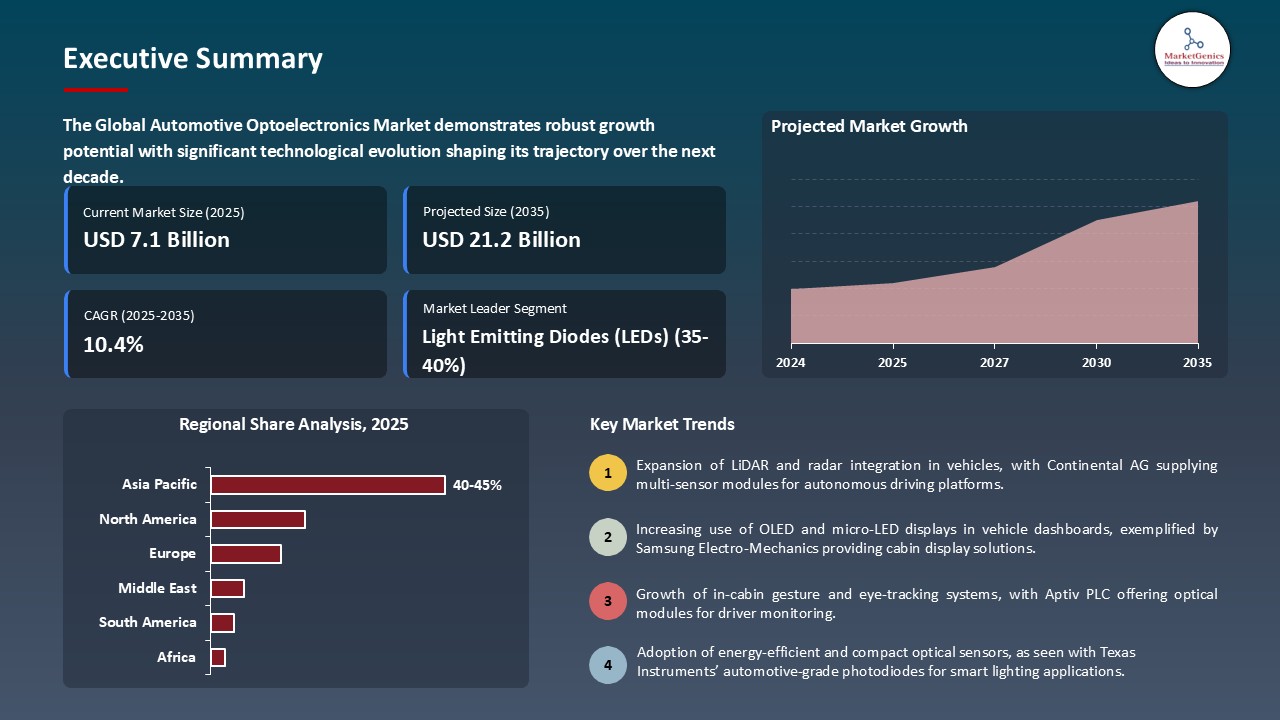

The global automotive optoelectronics market is experiencing robust growth, with its estimated value of USD 7.1 billion in the year 2025 and USD 21.2 billion by the period 2035, registering a CAGR of 10.4%. Asia Pacific leads the market with market share of 43.6% with USD 3.1 billion revenue.

In May 2025, Tianma presented a range of new display products and prototype technologies at Display Week 2025, featuring LTPO & LTPS AMOLED, a-Si, LTPS & Oxide LCD, and Micro-LED technologies tailored for the automotive sector.

The global automotive optoelectronics market is witnessing robust growth driven by increasing adoption of advanced driver-assistance systems (ADAS) and enhanced in-vehicle lighting technologies. Manufacturers are focusing on integrating high-performance optoelectronic components such as LiDAR, infrared sensors, and LED modules to improve vehicle safety, automation, and energy efficiency. For instance, Osram Licht AG recently introduced next-generation high-brightness LEDs for adaptive headlights, enabling precise illumination and reducing glare for oncoming traffic, enhancing overall road safety.

Similarly, Luminar Technologies, Inc. expanded its LiDAR sensor production for autonomous vehicles, emphasizing superior detection range and reliability to support Level 3 and Level 4 autonomous driving applications. The shift toward electric vehicles (EVs) also boosts optoelectronic demand, as manufacturers incorporate energy-efficient displays, sensors, and lighting systems to optimize battery performance and vehicle aesthetics.

Additionally, the rise of connected and smart vehicles is encouraging the integration of optoelectronic sensors for gesture recognition, collision avoidance, and night-vision systems, further propelling the demand across the Automotive Sensors. Strategic partnerships between automotive OEMs and optoelectronic suppliers are facilitating innovation, accelerating product adoption across luxury, commercial, and mass-market segments.

Adjacent opportunities for the automotive optoelectronics market include autonomous vehicle sensors, LiDAR and radar integration, smart headlight systems, in-cabin monitoring solutions, and electric vehicle battery management displays. These segments complement optoelectronic applications, driving innovation and expanding adoption across automotive technology ecosystems.

Automotive Optoelectronics Market Dynamics and Trends

Driver: Increasing Integration of Advanced Driver-Assistance Systems (ADAS) in Vehicles

- The growing emphasis on vehicle safety and automation is driving the demand for automotive optoelectronics. ADAS technologies, including lane departure warning, adaptive cruise control, and collision avoidance, rely heavily on sensors, LiDAR, and infrared cameras to detect obstacles and pedestrians.

- Continental AG recently launched its next-generation radar-optical sensor fusion platform, enhancing accuracy in real-time object detection for mid-to-high-end vehicles, while Bosch Mobility Solutions expanded production of 3D surround-view camera systems for autonomous driving. Manufacturers are also integrating high-efficiency LEDs and optical displays to improve night visibility and driver feedback systems. These advancements enable automakers to meet stringent safety regulations while offering enhanced user experience, particularly in electric and autonomous vehicles.

- The proliferation of connected vehicles further accelerates adoption, as real-time data exchange requires accurate optoelectronic sensing to ensure vehicle safety and operational efficiency.

Restraint: High Production Costs and Complex Integration of Optoelectronic Systems

- Despite growing demand, the high cost of optoelectronic components and complex system integration remains a challenge. LiDAR, high-resolution cameras, and infrared sensors are expensive to produce and require precise calibration with vehicle control systems. Luminar Technologies, Inc. highlighted that scaling LiDAR production for mass-market vehicles faces cost pressures due to advanced semiconductor materials and assembly precision.

- Similarly, Valeo reported challenges in integrating multi-sensor arrays for electric vehicles, as ensuring synchronization with software-driven safety systems increases engineering costs. Additionally, vehicle manufacturers face hurdles in retrofitting existing platforms with optoelectronic systems without redesigning the chassis and electrical architecture. These factors can slow adoption in mid-range and budget vehicles, limiting penetration despite strong demand in premium segments.

- High capital expenditure, combined with technical complexities, could restrain growth in regions with cost-sensitive automotive markets.

Opportunity: Expansion of Electric Vehicles Driving Increased Optoelectronics Demand Globally

- The rapid growth of electric vehicles (EVs) presents a substantial opportunity for automotive optoelectronics. EVs require energy-efficient lighting, battery management sensors, LiDAR for autonomous features, and optical displays for advanced dashboards. Tesla, Inc. has integrated high-efficiency LEDs and LiDAR-inspired sensor suites in its Model 3 and Model Y, improving energy utilization and driver-assistance features.

- Similarly, NVIDIA’s Drive platform collaborates with EV manufacturers to provide AI-enabled optical sensor integration, supporting autonomous driving capabilities. Rising EV adoption, especially in North America, Europe, and Asia Pacific, encourages suppliers to develop lightweight, low-power, and durable optoelectronic components. Governments promoting EV incentives and carbon reduction also indirectly drive demand for advanced sensors, cameras, and lighting technologies.

- This transition enables suppliers to innovate and diversify offerings, particularly in safety-critical applications such as pedestrian detection, adaptive headlights, and cockpit displays.

Key Trend: Adoption of LiDAR and Infrared Optical Sensors for Autonomous Driving Safety

- Autonomous driving development is accelerating the integration of LiDAR and infrared optical sensors in vehicles. These systems provide real-time mapping, obstacle detection, and night vision capabilities, essential for Level 3 and Level 4 autonomous vehicles. Waymo LLC expanded production of LiDAR units for self-driving fleets, emphasizing long-range detection and high-resolution mapping. Velodyne Lidar, Inc. recently launched compact multi-layer LiDAR sensors, reducing installation complexity and improving affordability for automakers.

- Infrared sensors are increasingly used for driver monitoring, pedestrian detection, and adaptive lighting, with FLIR Systems developing advanced thermal cameras for automotive applications. The integration of AI-powered sensor fusion further enhances system accuracy, combining data from LiDAR, radar, and optical cameras for precise environmental perception.

- Consumer preference for autonomous features and government mandates on road safety are pushing OEMs to adopt these technologies rapidly.

Automotive Optoelectronics Market Analysis and Segmental Data

LEDs Illuminate the Path for Automotive Optoelectronics Growth

- Demand for Light Emitting Diodes (LEDs) dominates the Component Type segment in the global automotive optoelectronics market due to their energy efficiency, long lifespan, and superior illumination performance. Osram Opto Semiconductors recently introduced high-brightness automotive LEDs for adaptive headlights, enhancing night visibility and reducing energy consumption in premium vehicles. Similarly, Philips Automotive Lighting launched LED matrix headlamps for electric and autonomous cars, enabling precise beam control and improved safety.

- LEDs are also increasingly used in interior displays, signal lighting, and dashboard indicators, providing flexible design options for automakers. The transition toward electric vehicles amplifies LED adoption, as energy-efficient components help extend battery life while meeting stringent emission and safety standards. Additionally, consumer demand for advanced vehicle aesthetics and customizable lighting accelerates LED integration across multiple vehicle segments.

- High efficiency, versatility, and safety advantages make LEDs the dominant component, driving substantial growth in automotive optoelectronics.

Asia Pacific Accelerates Automotive Optoelectronics Demand

- The Asia Pacific region leads demand for automotive optoelectronics due to rapid vehicle production, rising electric vehicle adoption, and increasing investment in advanced lighting and sensor technologies. Denso Corporation expanded its automotive sensor production in Japan to support ADAS and smart vehicle integration, reflecting heightened regional demand. Meanwhile, Samsung Electro-Mechanics enhanced its LiDAR and optical component manufacturing for autonomous vehicles in South Korea, catering to local EV and mobility trends.

- Robust automotive manufacturing hubs in China, India, and Japan, combined with strong government incentives for EV adoption and smart mobility, further accelerate optoelectronic component deployment. Consumers increasingly prefer vehicles with advanced safety and aesthetic lighting features, creating higher demand for LEDs, sensors, and optical systems. The growing presence of Tier 1 and Tier 2 component manufacturers in the region ensures scalable production and quicker adoption across multiple vehicle segments.

Automotive Optoelectronics Market Ecosystem

The global automotive optoelectronics market exhibits a moderately consolidated structure, with Tier 1 players such as Analog Devices Inc., Infineon Technologies AG, and Robert Bosch GmbH dominating high-value segments, while Tier 2 and Tier 3 firms focus on specialized components. Buyer concentration is moderate, driven by automotive OEMs negotiating pricing and specifications, whereas supplier concentration is relatively high due to limited high-tech semiconductor and optoelectronic material providers, giving suppliers significant leverage in the value chain.

Recent Development and Strategic Overview:

- In August 2025, Lumileds and San’an Optoelectronics have announced that San’an, along with a number of foreign investors, will acquire 100% of Lumileds in a deal valuing the Dutch company at $239 million.

- In May 2025, VueReal introduced new vertical Reference Design Kits (RDKs) tailored for automotive and consumer electronics, focusing on MicroLED technology to improve display performance and energy efficiency.

Report Scope

|

Attribute |

Detail |

|

Market Size in 2025 |

USD 7.1 Bn |

|

Market Forecast Value in 2035 |

USD 21.2 Bn |

|

Growth Rate (CAGR) |

10.4% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value

|

|

Report Format |

Electronic (PDF) + Excel |

|

Regions and Countries Covered |

|||||

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Automotive Optoelectronics Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Component Type |

|

|

By Vehicle Type |

|

|

By Sales Channel |

|

|

By Technology |

|

|

By Wavelength Range |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Automotive Optoelectronics Market Outlook

- 2.1.1. Automotive Optoelectronics Market Size (Value – US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Automotive Optoelectronics Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Automotive & Transportation Industry Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Automotive & Transportation Industry

- 3.1.3. Regional Distribution for Automotive & Transportation Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Automotive & Transportation Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Increasing adoption of advanced driver-assistance systems (ADAS) and autonomous driving technologies

- 4.1.1.2. Growing demand for smart lighting and in-cabin infotainment systems

- 4.1.1.3. Rising focus on vehicle safety and energy-efficient optical components

- 4.1.2. Restraints

- 4.1.2.1. High costs of advanced optoelectronic components limiting adoption in mid-range vehicles

- 4.1.2.2. Supply chain challenges for semiconductor materials affecting production and delivery timeliness

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material & Component Suppliers

- 4.4.2. Automotive Optoelectronics Manufacturers

- 4.4.3. Distributors/ Suppliers

- 4.4.4. End-users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Automotive Optoelectronics Market Demand

- 4.9.1. Historical Market Size - in Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size - in Value (US$ Bn), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Automotive Optoelectronics Market Analysis, by Component Type

- 6.1. Key Segment Analysis

- 6.2. Automotive Optoelectronics Market Size (Value - US$ Bn), Analysis, and Forecasts, by Component Type, 2021-2035

- 6.2.1. Light Emitting Diodes (LEDs)

- 6.2.2. Laser Diodes

- 6.2.3. Infrared Components

- 6.2.4. Photo Detectors

- 6.2.5. Optocouplers

- 6.2.6. Image Sensors

- 6.2.7. Photovoltaic Cells

- 6.2.8. Others

- 7. Global Automotive Optoelectronics Market Analysis, by Vehicle Type

- 7.1. Key Segment Analysis

- 7.2. Automotive Optoelectronics Market Size (Value - US$ Bn), Analysis, and Forecasts, by Vehicle Type, 2021-2035

- 7.2.1. Passenger Vehicles

- 7.2.2. Commercial Vehicles

- 7.2.2.1. Light Commercial Vehicles (LCVs)

- 7.2.2.2. Heavy Commercial Vehicles (HCVs)

- 7.2.3. Two-Wheelers

- 7.2.4. Electric Vehicles (EVs)

- 7.2.5. Luxury and Premium Vehicles

- 7.2.6. Off-road Vehicles & Utility Terrain Vehicles (UTVs)

- 8. Global Automotive Optoelectronics Market Analysis, by Sales Channel

- 8.1. Key Segment Analysis

- 8.2. Automotive Optoelectronics Market Size (Value - US$ Bn), Analysis, and Forecasts, by Sales Channel, 2021-2035

- 8.2.1. OEMs

- 8.2.2. Aftermarket

- 9. Others Global Automotive Optoelectronics Market Analysis, by Technology

- 9.1. Key Segment Analysis

- 9.2. Automotive Optoelectronics Market Size (Value - US$ Bn), Analysis, and Forecasts, by Technology, 2021-2035

- 9.2.1. Silicon-based

- 9.2.2. Compound Semiconductor

- 9.2.3. Organic Optoelectronics

- 9.2.4. Quantum Dot

- 9.2.5. Graphene-based

- 9.2.6. Others

- 10. Global Automotive Optoelectronics Market Analysis, by Wavelength Range

- 10.1. Key Segment Analysis

- 10.2. Automotive Optoelectronics Market Size (Value - US$ Bn), Analysis, and Forecasts, by Wavelength Range, 2021-2035

- 10.2.1. Visible Light

- 10.2.2. Near-Infrared

- 10.2.3. Mid-Infrared

- 10.2.4. Far-Infrared

- 11. Global Automotive Optoelectronics Market Analysis and Forecasts, by Region

- 11.1. Key Findings

- 11.2. Automotive Optoelectronics Market Size (Volume - Million Units and Value - US$ Mn), Analysis, and Forecasts, by Region, 2021-2035

- 11.2.1. North America

- 11.2.2. Europe

- 11.2.3. Asia Pacific

- 11.2.4. Middle East

- 11.2.5. Africa

- 11.2.6. South America

- 12. North America Automotive Optoelectronics Market Analysis

- 12.1. Key Segment Analysis

- 12.2. Regional Snapshot

- 12.3. North America Automotive Optoelectronics Market Size Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 12.3.1. Component Type

- 12.3.2. Vehicle Type

- 12.3.3. Sales Channel

- 12.3.4. Technology

- 12.3.5. Wavelength Range

- 12.3.6. Country

- 12.3.6.1. USA

- 12.3.6.2. Canada

- 12.3.6.3. Mexico

- 12.4. USA Automotive Optoelectronics Market

- 12.4.1. Country Segmental Analysis

- 12.4.2. Component Type

- 12.4.3. Vehicle Type

- 12.4.4. Sales Channel

- 12.4.5. Technology

- 12.4.6. Wavelength Range

- 12.5. Canada Automotive Optoelectronics Market

- 12.5.1. Country Segmental Analysis

- 12.5.2. Component Type

- 12.5.3. Vehicle Type

- 12.5.4. Sales Channel

- 12.5.5. Technology

- 12.5.6. Wavelength Range

- 12.6. Mexico Automotive Optoelectronics Market

- 12.6.1. Country Segmental Analysis

- 12.6.2. Component Type

- 12.6.3. Vehicle Type

- 12.6.4. Sales Channel

- 12.6.5. Technology

- 12.6.6. Wavelength Range

- 13. Europe Automotive Optoelectronics Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. Europe Automotive Optoelectronics Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 13.3.1. Component Type

- 13.3.2. Vehicle Type

- 13.3.3. Sales Channel

- 13.3.4. Technology

- 13.3.5. Wavelength Range

- 13.3.6. Country

- 13.3.6.1. Germany

- 13.3.6.2. United Kingdom

- 13.3.6.3. France

- 13.3.6.4. Italy

- 13.3.6.5. Spain

- 13.3.6.6. Netherlands

- 13.3.6.7. Nordic Countries

- 13.3.6.8. Poland

- 13.3.6.9. Russia & CIS

- 13.3.6.10. Rest of Europe

- 13.4. Germany Automotive Optoelectronics Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Component Type

- 13.4.3. Vehicle Type

- 13.4.4. Sales Channel

- 13.4.5. Technology

- 13.4.6. Wavelength Range

- 13.5. United Kingdom Automotive Optoelectronics Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Component Type

- 13.5.3. Vehicle Type

- 13.5.4. Sales Channel

- 13.5.5. Technology

- 13.5.6. Wavelength Range

- 13.6. France Automotive Optoelectronics Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Component Type

- 13.6.3. Vehicle Type

- 13.6.4. Sales Channel

- 13.6.5. Technology

- 13.6.6. Wavelength Range

- 13.7. Italy Automotive Optoelectronics Market

- 13.7.1. Country Segmental Analysis

- 13.7.2. Component Type

- 13.7.3. Vehicle Type

- 13.7.4. Sales Channel

- 13.7.5. Technology

- 13.7.6. Wavelength Range

- 13.8. Spain Automotive Optoelectronics Market

- 13.8.1. Country Segmental Analysis

- 13.8.2. Component Type

- 13.8.3. Vehicle Type

- 13.8.4. Sales Channel

- 13.8.5. Technology

- 13.8.6. Wavelength Range

- 13.9. Netherlands Automotive Optoelectronics Market

- 13.9.1. Country Segmental Analysis

- 13.9.2. Component Type

- 13.9.3. Vehicle Type

- 13.9.4. Sales Channel

- 13.9.5. Technology

- 13.9.6. Wavelength Range

- 13.10. Nordic Countries Automotive Optoelectronics Market

- 13.10.1. Country Segmental Analysis

- 13.10.2. Component Type

- 13.10.3. Vehicle Type

- 13.10.4. Sales Channel

- 13.10.5. Technology

- 13.10.6. Wavelength Range

- 13.11. Poland Automotive Optoelectronics Market

- 13.11.1. Country Segmental Analysis

- 13.11.2. Component Type

- 13.11.3. Vehicle Type

- 13.11.4. Sales Channel

- 13.11.5. Technology

- 13.11.6. Wavelength Range

- 13.12. Russia & CIS Automotive Optoelectronics Market

- 13.12.1. Country Segmental Analysis

- 13.12.2. Component Type

- 13.12.3. Vehicle Type

- 13.12.4. Sales Channel

- 13.12.5. Technology

- 13.12.6. Wavelength Range

- 13.13. Rest of Europe Automotive Optoelectronics Market

- 13.13.1. Country Segmental Analysis

- 13.13.2. Component Type

- 13.13.3. Vehicle Type

- 13.13.4. Sales Channel

- 13.13.5. Technology

- 13.13.6. Wavelength Range

- 14. Asia Pacific Automotive Optoelectronics Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. East Asia Automotive Optoelectronics Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Component Type

- 14.3.2. Vehicle Type

- 14.3.3. Sales Channel

- 14.3.4. Technology

- 14.3.5. Wavelength Range

- 14.3.6. Country

- 14.3.6.1. China

- 14.3.6.2. India

- 14.3.6.3. Japan

- 14.3.6.4. South Korea

- 14.3.6.5. Australia and New Zealand

- 14.3.6.6. Indonesia

- 14.3.6.7. Malaysia

- 14.3.6.8. Thailand

- 14.3.6.9. Vietnam

- 14.3.6.10. Rest of Asia Pacific

- 14.4. China Automotive Optoelectronics Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Component Type

- 14.4.3. Vehicle Type

- 14.4.4. Sales Channel

- 14.4.5. Technology

- 14.4.6. Wavelength Range

- 14.5. India Automotive Optoelectronics Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Component Type

- 14.5.3. Vehicle Type

- 14.5.4. Sales Channel

- 14.5.5. Technology

- 14.5.6. Wavelength Range

- 14.6. Japan Automotive Optoelectronics Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Component Type

- 14.6.3. Vehicle Type

- 14.6.4. Sales Channel

- 14.6.5. Technology

- 14.6.6. Wavelength Range

- 14.7. South Korea Automotive Optoelectronics Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Component Type

- 14.7.3. Vehicle Type

- 14.7.4. Sales Channel

- 14.7.5. Technology

- 14.7.6. Wavelength Range

- 14.8. Australia and New Zealand Automotive Optoelectronics Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Component Type

- 14.8.3. Vehicle Type

- 14.8.4. Sales Channel

- 14.8.5. Technology

- 14.8.6. Wavelength Range

- 14.9. Indonesia Automotive Optoelectronics Market

- 14.9.1. Country Segmental Analysis

- 14.9.2. Component Type

- 14.9.3. Vehicle Type

- 14.9.4. Sales Channel

- 14.9.5. Technology

- 14.9.6. Wavelength Range

- 14.10. Malaysia Automotive Optoelectronics Market

- 14.10.1. Country Segmental Analysis

- 14.10.2. Component Type

- 14.10.3. Vehicle Type

- 14.10.4. Sales Channel

- 14.10.5. Technology

- 14.10.6. Wavelength Range

- 14.11. Thailand Automotive Optoelectronics Market

- 14.11.1. Country Segmental Analysis

- 14.11.2. Component Type

- 14.11.3. Vehicle Type

- 14.11.4. Sales Channel

- 14.11.5. Technology

- 14.11.6. Wavelength Range

- 14.12. Vietnam Automotive Optoelectronics Market

- 14.12.1. Country Segmental Analysis

- 14.12.2. Component Type

- 14.12.3. Vehicle Type

- 14.12.4. Sales Channel

- 14.12.5. Technology

- 14.12.6. Wavelength Range

- 14.13. Rest of Asia Pacific Automotive Optoelectronics Market

- 14.13.1. Country Segmental Analysis

- 14.13.2. Component Type

- 14.13.3. Vehicle Type

- 14.13.4. Sales Channel

- 14.13.5. Technology

- 14.13.6. Wavelength Range

- 15. Middle East Automotive Optoelectronics Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Middle East Automotive Optoelectronics Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Component Type

- 15.3.2. Vehicle Type

- 15.3.3. Sales Channel

- 15.3.4. Technology

- 15.3.5. Wavelength Range

- 15.3.6. Country

- 15.3.6.1. Turkey

- 15.3.6.2. UAE

- 15.3.6.3. Saudi Arabia

- 15.3.6.4. Israel

- 15.3.6.5. Rest of Middle East

- 15.4. Turkey Automotive Optoelectronics Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Component Type

- 15.4.3. Vehicle Type

- 15.4.4. Sales Channel

- 15.4.5. Technology

- 15.4.6. Wavelength Range

- 15.5. UAE Automotive Optoelectronics Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Component Type

- 15.5.3. Vehicle Type

- 15.5.4. Sales Channel

- 15.5.5. Technology

- 15.5.6. Wavelength Range

- 15.6. Saudi Arabia Automotive Optoelectronics Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Component Type

- 15.6.3. Vehicle Type

- 15.6.4. Sales Channel

- 15.6.5. Technology

- 15.6.6. Wavelength Range

- 15.7. Israel Automotive Optoelectronics Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Component Type

- 15.7.3. Vehicle Type

- 15.7.4. Sales Channel

- 15.7.5. Technology

- 15.7.6. Wavelength Range

- 15.8. Rest of Middle East Automotive Optoelectronics Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Component Type

- 15.8.3. Vehicle Type

- 15.8.4. Sales Channel

- 15.8.5. Technology

- 15.8.6. Wavelength Range

- 16. Africa Automotive Optoelectronics Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Africa Automotive Optoelectronics Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Component Type

- 16.3.2. Vehicle Type

- 16.3.3. Sales Channel

- 16.3.4. Technology

- 16.3.5. Wavelength Range

- 16.3.6. Country

- 16.3.6.1. South Africa

- 16.3.6.2. Egypt

- 16.3.6.3. Nigeria

- 16.3.6.4. Algeria

- 16.3.6.5. Rest of Africa

- 16.4. South Africa Automotive Optoelectronics Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Component Type

- 16.4.3. Vehicle Type

- 16.4.4. Sales Channel

- 16.4.5. Technology

- 16.4.6. Wavelength Range

- 16.5. Egypt Automotive Optoelectronics Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Component Type

- 16.5.3. Vehicle Type

- 16.5.4. Sales Channel

- 16.5.5. Technology

- 16.5.6. Wavelength Range

- 16.6. Nigeria Automotive Optoelectronics Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Component Type

- 16.6.3. Vehicle Type

- 16.6.4. Sales Channel

- 16.6.5. Technology

- 16.6.6. Wavelength Range

- 16.7. Algeria Automotive Optoelectronics Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Component Type

- 16.7.3. Vehicle Type

- 16.7.4. Sales Channel

- 16.7.5. Technology

- 16.7.6. Wavelength Range

- 16.8. Rest of Africa Automotive Optoelectronics Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Component Type

- 16.8.3. Vehicle Type

- 16.8.4. Sales Channel

- 16.8.5. Technology

- 16.8.6. Wavelength Range

- 17. South America Automotive Optoelectronics Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Central and South Africa Automotive Optoelectronics Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Component Type

- 17.3.2. Vehicle Type

- 17.3.3. Sales Channel

- 17.3.4. Technology

- 17.3.5. Wavelength Range

- 17.3.6. Country

- 17.3.6.1. Brazil

- 17.3.6.2. Argentina

- 17.3.6.3. Rest of South America

- 17.4. Brazil Automotive Optoelectronics Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Component Type

- 17.4.3. Vehicle Type

- 17.4.4. Sales Channel

- 17.4.5. Technology

- 17.4.6. Wavelength Range

- 17.5. Argentina Automotive Optoelectronics Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Component Type

- 17.5.3. Vehicle Type

- 17.5.4. Sales Channel

- 17.5.5. Technology

- 17.5.6. Wavelength Range

- 17.6. Rest of South America Automotive Optoelectronics Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Component Type

- 17.6.3. Vehicle Type

- 17.6.4. Sales Channel

- 17.6.5. Technology

- 17.6.6. Wavelength Range

- 18. Key Players/ Company Profile

- 18.1. Analog Devices Inc.

- 18.1.1. Company Details/ Overview

- 18.1.2. Company Financials

- 18.1.3. Key Customers and Competitors

- 18.1.4. Business/ Industry Portfolio

- 18.1.5. Product Portfolio/ Specification Details

- 18.1.6. Pricing Data

- 18.1.7. Strategic Overview

- 18.1.8. Recent Developments

- 18.2. Aptiv PLC

- 18.3. Broadcom Inc.

- 18.4. Continental AG

- 18.5. Denso Corporation

- 18.6. Hella GmbH & Co. KGaA

- 18.7. Hitachi Automotive Systems

- 18.8. Infineon Technologies AG

- 18.9. Magna International Inc.

- 18.10. Mitsubishi Electric Corporation

- 18.11. NXP Semiconductors

- 18.12. ON Semiconductor

- 18.13. Osram Licht AG

- 18.14. Panasonic Holdings Corporation

- 18.15. Robert Bosch GmbH

- 18.16. Samsung Electro-Mechanics

- 18.17. STMicroelectronics

- 18.18. Texas Instruments Incorporated

- 18.19. Valeo SA

- 18.20. Vishay Intertechnology

- 18.21. Other Key Players

- 18.1. Analog Devices Inc.

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation