Brewery Equipment Market Size, Share, Growth Opportunity Analysis Report by Brewery Type (Macrobreweries (Large-Scale), Microbreweries, Craft Breweries, Brewpubs and Others), Equipment Type, Material Type, Function, Mode of Operation, Application, End User and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035.

|

Market Structure & Evolution |

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Brewery Equipment Market Size, Share, and Growth

With a significant compounded annual growth rate of 5.3% from 2025-2035, global brewery equipment market is poised to be valued at USD 38.1 Billion in 2035. Demand for craft beer has increased the need for specialized small-batch brewery equipment. These are key driving forces in the global brewery equipment market, growth in demand for craft beer and expansion in the number of microbreweries would be included.

In January 2024, Prodeb Brewery launched its new line of fully automated, AI-integrated microbrewery equipment targeting export markets across Southeast Asia and Africa. This strategic move, led by Ravi Varma, Managing Director of Prodeb, aims to enhance global competitiveness by offering compact, energy-efficient systems with real-time monitoring capabilities. This development strengthens Prodeb's global footprint while addressing the growing demand for smart and scalable brewing solutions.

For instance, in April of 2024, GEA Group AG announced the installation of its GEA CompaCt-Star brewhouse in the craft segment of Uiltje Brewing Company, situated in the Netherlands, so as to improve on the flexibility and batch variety.

Furthermore, in March 2024, in response to surging regional demand in Latin America, Krones AG delivered the complete brewing line to Cervecería Nacional Dominicana for the elevation of production capacity. The global demand for tailor-made brewing systems that are scalable is still a growth driver for the brewery equipment market.

Packaging for craft beverages, fermentation monitoring and control systems, and sustainable water treatment solutions are some of the key opportunities within the global brewery equipment market. These market segments provide technological integration and value-added services for breweries seeking efficiency and compliance. The concurrent innovation processes are accelerating the brewery equipment upgrade process and increasing market appeal.

Brewery Equipment Market Dynamics and Trends

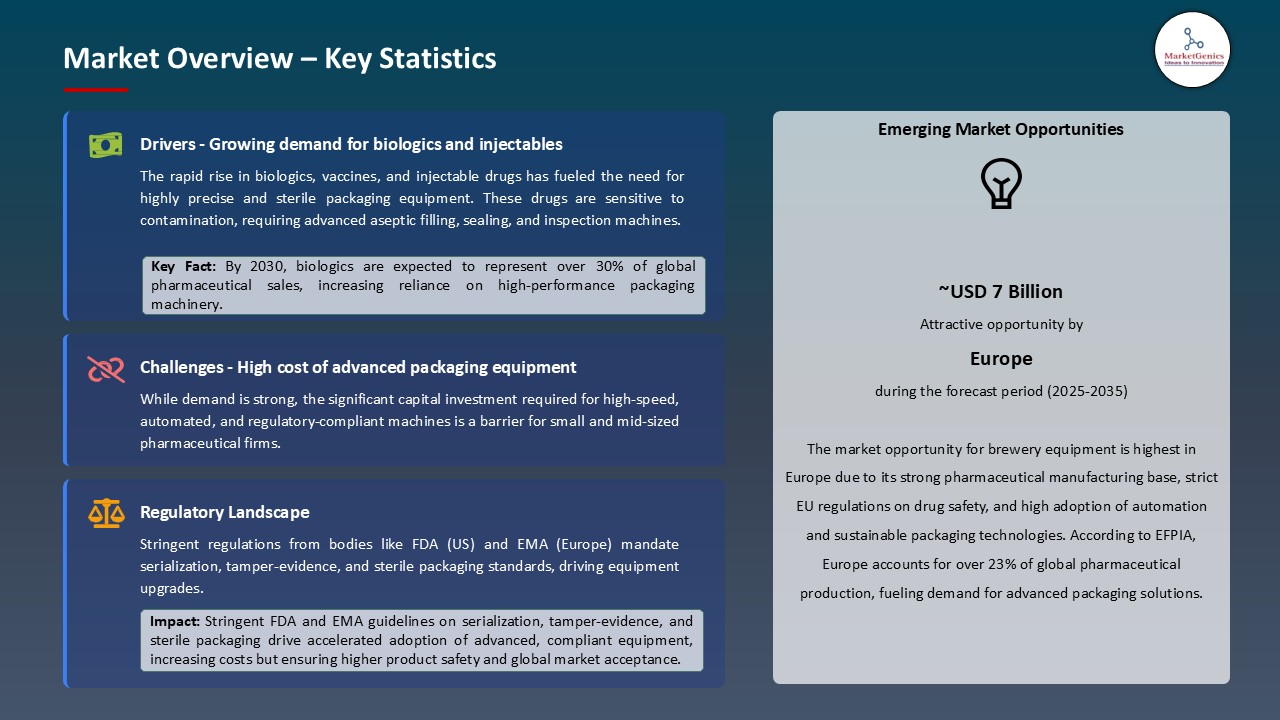

Driver: Growing Demand for Non-Alcoholic and Low-Alcohol Beer

- Rising consumer inclination towards health promotion has considerably pushed up the demand for non-alcoholic and low alcohol beer, forcing breweries to invest in special equipment. Trends in lifestyle choices are increasingly favoring moderation in North America and Europe. This is the momentum that should keep a brewery abreast of new filtration and dealcoholizing techniques and equipment.

- For instance, February 2024 saw the launch of the innovative De-alc Module 2.0, which removes alcohol from beer but retains its flavor and aroma. Modular systems fit very well with the quickly-growing zero-alcohol beer market, which is being embraced by large and craft breweries. This gives brewers a way to add a variety of beverage options to their portfolio without sacrificing production efficiency. Such demand results in product innovation, and thus fosters the adoption of modern and flexible brewing equipment capable of producing varieties of product lines.

- Embracing rising health-consciousness entails investments into adaptable and precision-controlled brewery equipment.

Restraint: High Capital Investment and Operational Costs

- Instead of presenting a detailed analysis about market growth, it goes on to point out that the starting capital cost coupled with high operational costs impedes adoption of brewery equipment among the small and budding brewers. The cost of automated and semi-automated systems, stainless steel vessels, and environment-friendly processing units deters these smaller guys. In a report dated January 2024 (involving Portland-based craft brewer Hopworks Urban Brewery), it was stated that upgrading from an older-semi-automated brewing system to an entirely automated system would, hence, cost over $1.2 million, not including installer costs and losses from downtime.

- In addition to constant costs accrued due to systems-waste management, and energy usage regulations, this limits new entrants and microbreweries from quickly penetrating markets and expanding, thereby restricting the overall growth of the equipment industry. Thus, such affordable modular solutions are stranded in infancy and yet to be on the verge of maturity in affordability.

- Dispensation by way of expenditures upfront and operations is the hindrance in the adoption of equipment for small and mid-level brewers.

Opportunity: Integration of IoT and Automation in Brewing Operations

- With IoT and automation entered into the equation, there is a huge potential in the brewery-equipment-market to enable opportunities for real-time monitoring, predictive maintenance, and optimization processes. Such digitally enabled systems can indeed save on energy consumption, guarantee batch consistency, and even save the back-breaking manual labor.

- In May 2024, Siemens was partnered with BrewDog USA in his deployment of Braumat IoT Systems in BrewDog's Ohio facility in Columbus. This solution brought about improvements in control over fermentation and packaging lines with wastage reduction of 15% and better batch traceability. Considerable automation and data integration allow brewers to increase production while maintaining strict quality standards. The ability to monitor key brewing parameters remotely has increased in desirability for larger breweries looking to expand operations across several geographies. These technologies are, therefore, increasingly adopted by breweries with the acceleration of digital transformation, forming a new revenue stream for smart equipment manufacturers.

- Automation and digital connectivity are lucrative avenues for advanced brewery equipment solutions.

Key Trend: Sustainability-Driven Equipment Innovation

- Sustainability is gaining prominence as a prime trend in the world of the brewery equipment market because manufacturers and brewers are faced with pressure to reduce environmental footprints. These days, equipment innovations revolve around energy recovery, water conservation, and waste reduction. In March 2024, the company State, KHS GmbH, had introduced fermentation tanks by the name of Eco-Buffer that maximize the recovery of CO₂ while also reducing water consumption by nearly 30% during the cleaning cycles.

- Big breweries like Heineken and Carlsberg swiftly introduce such solutions to meet their ESG requirements and legal mandates. This also poses an influence on small and mid-sized brewers as they view sustainability as a point of difference. On the other hand, government grants for green technology adoption add yet another impetus to this change. As environmental matters govern the expectations of consumers and investors, manufacturers are forced to move toward the design of efficient eco-systems in agreement with the principles of the circular economy.

- Moreover, all brewery sizes have sustained a demand for innovative brewery equipment that follows eco-friendly standards.

Brewery Equipment Market Analysis and Segmental Data

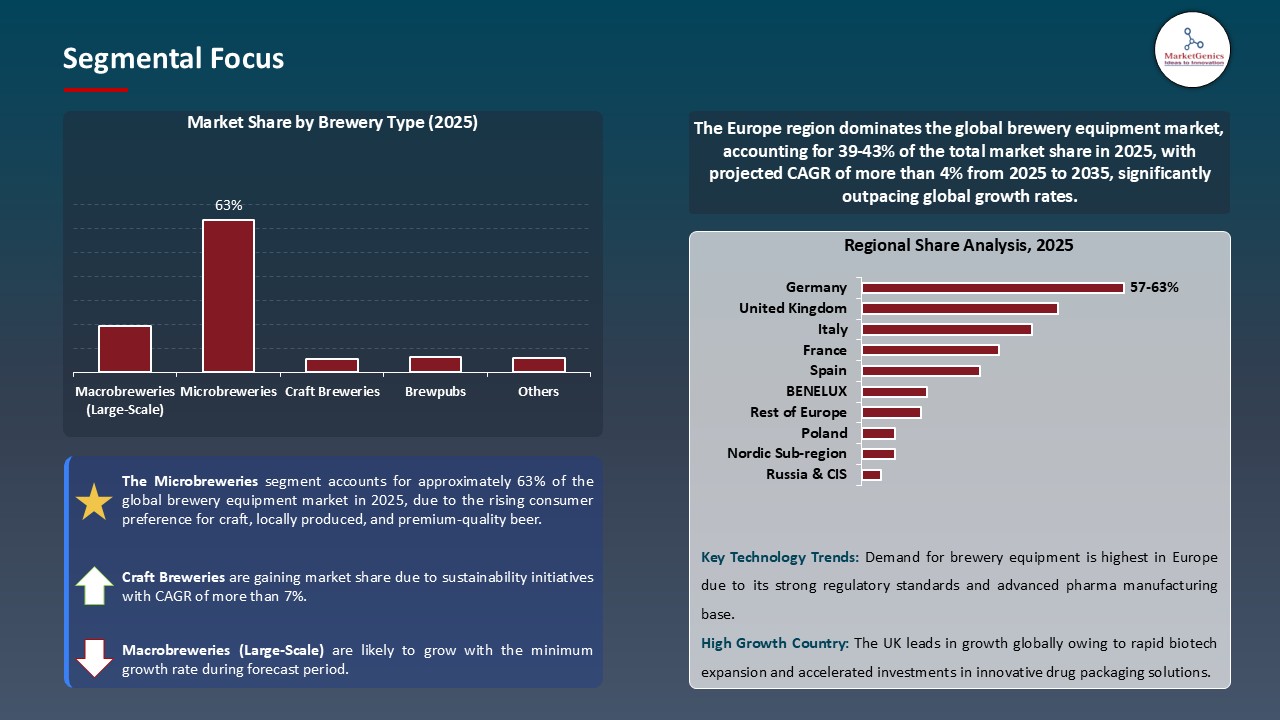

Based on Brewery Type, the Microbreweries Segment Retains the Largest Share

- With rising consumer preference for craft, locally produced, and premium-quality beer, microbreweries hold ~63% of the global brewery equipment market. These breweries have on their agenda peculiar flavor yields and community building, thus investing in flexible and small-batch equipment.

- Microbrewery systems experienced a sales boost of 30% in April 2024 on a year-on-year comparison for Portland Kettle Works, U.S.-based equipment manufacturers, due to a growing demand from Southeast Asia and Latin America.

- Millennials and Gen Z crave the personalized drink experience, and with microbreweries, this trend is blossoming all over the world, particularly in urban and tourism-dependent areas. Craft beer culture is indeed accelerating the need for small yet adaptable brewery equipment.

Europe Dominates Global Brewery Equipment Market in 2025 and Beyond

- Europe is the prime area for the demand of brewery equipment because it has a genuine beer culture, a dense network of breweries, and a regulatory framework supporting craft and sustainable brewing. With Germany, Belgium, and the U.K. at an average for the consumption and production of beer, there is an equally vast market for the constant upgrading of equipment.

- In March 2024, the German top equipment maker Kaspar Schulz won a big contract to supply energy-efficient brewhouses to Brasserie du Pays Flamand based in France, thereby showing continued regional investments. Also, the EU's emphasis on ecological manufacturing is twitching the brewers into an adoption of modern, resource-efficient systems to satisfy environmental standards.

- Robust equipment demand across Europe is thus fostered by a solid brewing heritage and sustainability mandates.

Brewery-Equipment-Market Ecosystem

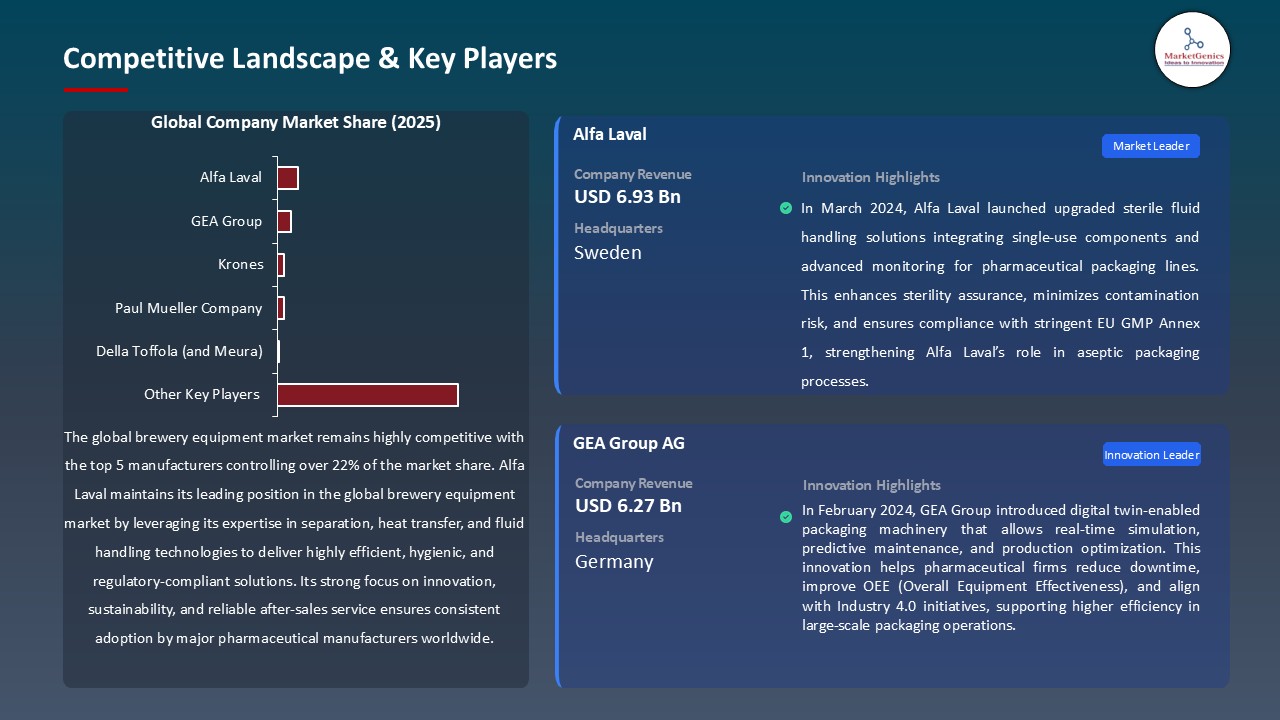

Key players in the global brewery equipment market include prominent companies such as Alfa Laval, GEA Group, Krones, Paul Mueller Company, Della Toffola (and Meura) and Other Key Players.

The market for brewery equipment is moderately fragmented, with Tier-1 players including GEA Group, Krones AG, and Alfa Laval, boasting large-scale production facilities and turnkey solutions. Tier-2 and Tier-3 players, such as BrewFab and Prodeb Brewery, cater to regional craft- and microbrewery requirements. Buyer concentration is low, thanks to the large customer base ranging from big breweries to craft producers, whereas supplier concentration is at a moderate level due to dependence on specialized stainless-steel fabrication, automation, and hygiene-compliant technologies.

Recent Development and Strategic Overview:

- In August 2023, Automation and control by shear force will increase the aroma-terpenoid extraction from Amax and decrease time concept. The application of this would help breweries to enhance flavor profiles with better efficiency.

- In May 2023, KHS Group announced the Innopro EcoClear beer filtration concept, which filters beer with considerably lower energy, water, and chemicals to contribute to cost savings and sustainability.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 21.5 Bn |

|

Market Forecast Value in 2035 |

USD 38.1 Bn |

|

Growth Rate (CAGR) |

5.3% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Brewery-Equipment-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Equipment Type |

|

|

By Brewery Type |

|

|

By Material Type |

|

|

By Function |

|

|

By Mode of Operation |

|

|

By Application |

|

|

By End User |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Brewery Equipment Market Outlook

- 2.1.1. Brewery Equipment Market Size (Value - US$ Billion), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End Use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Brewery Equipment Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Industrial Machinery Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Industrial Machinery Industry

- 3.1.3. Regional Distribution for Industrial Machinery

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.1. Global Industrial Machinery Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising popularity of craft and artisanal breweries

- 4.1.1.2. Technological advancements in brewing automation and control systems

- 4.1.1.3. Increasing global beer consumption and product diversification

- 4.1.2. Restraints

- 4.1.2.1. High capital and maintenance costs for advanced equipment

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis/ Ecosystem Analysis

- 4.4.1. Raw Material/ Function Suppliers

- 4.4.2. System Integrators/ Technology Providers

- 4.4.3. Brewery Equipment Manufacturers

- 4.4.4. Distributors & System Integrators

- 4.4.5. End Users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Porter’s Five Forces Analysis

- 4.7. PESTEL Analysis

- 4.8. Global Brewery Equipment Market Demand

- 4.8.1. Historical Market Size - in Value (Value - US$ Billion), 2021-2024

- 4.8.2. Current and Future Market Size - in Value (Value - US$ Billion), 2025–2035

- 4.8.2.1. Y-o-Y Growth Trends

- 4.8.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Brewery Equipment Market Analysis, by Equipment Type

- 6.1. Key Segment Analysis

- 6.2. Brewery Equipment Market Size (Value - US$ Billion), Analysis, and Forecasts, by Equipment Type, 2021-2035

- 6.2.1. Fermentation Equipment

- 6.2.2. Milling Equipment

- 6.2.3. Filtration Equipment

- 6.2.4. Cooling Equipment

- 6.2.5. Brewhouse Equipment

- 6.2.6. CIP (Clean-in-Place) Systems

- 6.2.7. Control & Monitoring Systems

- 6.2.8. Storage & Maturation Tanks

- 6.2.9. Others (e.g., packaging machinery, pasteurizers)

- 7. Global Brewery Equipment Market Analysis, by Brewery Type

- 7.1. Key Segment Analysis

- 7.2. Brewery Equipment Market Size (Value - US$ Billion), Analysis, and Forecasts, by Brewery Type, 2021-2035

- 7.2.1. Macrobreweries (Large-Scale)

- 7.2.2. Microbreweries

- 7.2.3. Craft Breweries

- 7.2.4. Brewpubs

- 7.2.5. Others

- 8. Global Brewery Equipment Market Analysis, by Material Type

- 8.1. Key Segment Analysis

- 8.2. Brewery Equipment Market Size (Value - US$ Billion), Analysis, and Forecasts, by Material Type, 2021-2035

- 8.2.1. Stainless Steel

- 8.2.2. Copper

- 8.2.3. Others (e.g., plastic, aluminum – limited use)

- 9. Global Brewery Equipment Market Analysis, by Function

- 9.1. Key Segment Analysis

- 9.2. Brewery Equipment Market Size (Value - US$ Billion), Analysis, and Forecasts, by Function, 2021-2035

- 9.2.1. Production

- 9.2.2. Storage

- 9.2.3. Packaging

- 9.2.4. Cleaning & Sterilization

- 9.2.5. Quality Control

- 9.2.6. Others

- 10. Global Brewery Equipment Market Analysis, by Mode of Operation

- 10.1. Key Segment Analysis

- 10.2. Brewery Equipment Market Size (Value - US$ Billion), Analysis, and Forecasts, by Mode of Operation, 2021-2035

- 10.2.1. Automatic

- 10.2.2. Semi-Automatic

- 10.2.3. Manual

- 11. Global Brewery Equipment Market Analysis, by Application

- 11.1. Key Segment Analysis

- 11.2. Brewery Equipment Market Size (Value - US$ Billion), Analysis, and Forecasts, by Application, 2021-2035

- 11.2.1. Alcoholic Beer Production

- 11.2.2. Non-Alcoholic Beer Production

- 11.2.3. Experimental/Flavor Brewing

- 11.2.4. Others

- 12. Global Brewery Equipment Market Analysis, by End User

- 12.1. Key Segment Analysis

- 12.2. Brewery Equipment Market Size (Value - US$ Billion), Analysis, and Forecasts, by End User, 2021-2035

- 12.2.1. Independent Breweries

- 12.2.2. Multinational Beverage Corporations

- 12.2.3. Brewpub Chains

- 12.2.4. Contract Brewing Facilities

- 12.2.5. Others

- 13. Global Brewery Equipment Market Analysis and Forecasts, by Region

- 13.1. Key Findings

- 13.2. Brewery Equipment Market Size (Value - US$ Billion), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America Brewery Equipment Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America Brewery Equipment Market Size Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 14.3.1. Equipment Type

- 14.3.2. Brewery Type

- 14.3.3. Material Type

- 14.3.4. Function

- 14.3.5. Mode of Operation

- 14.3.6. Application

- 14.3.7. End User

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA Brewery Equipment Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Equipment Type

- 14.4.3. Brewery Type

- 14.4.4. Material Type

- 14.4.5. Function

- 14.4.6. Mode of Operation

- 14.4.7. Application

- 14.4.8. End User

- 14.5. Canada Brewery Equipment Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Equipment Type

- 14.5.3. Brewery Type

- 14.5.4. Material Type

- 14.5.5. Function

- 14.5.6. Mode of Operation

- 14.5.7. Application

- 14.5.8. End User

- 14.6. Mexico Brewery Equipment Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Equipment Type

- 14.6.3. Brewery Type

- 14.6.4. Material Type

- 14.6.5. Function

- 14.6.6. Mode of Operation

- 14.6.7. Application

- 14.6.8. End User

- 15. Europe Brewery Equipment Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe Brewery Equipment Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 15.3.1. Equipment Type

- 15.3.2. Brewery Type

- 15.3.3. Material Type

- 15.3.4. Function

- 15.3.5. Mode of Operation

- 15.3.6. Application

- 15.3.7. End User

- 15.3.8. Country

- 15.3.8.1. Germany

- 15.3.8.2. United Kingdom

- 15.3.8.3. France

- 15.3.8.4. Italy

- 15.3.8.5. Spain

- 15.3.8.6. Netherlands

- 15.3.8.7. Nordic Countries

- 15.3.8.8. Poland

- 15.3.8.9. Russia & CIS

- 15.3.8.10. Rest of Europe

- 15.4. Germany Brewery Equipment Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Equipment Type

- 15.4.3. Brewery Type

- 15.4.4. Material Type

- 15.4.5. Function

- 15.4.6. Mode of Operation

- 15.4.7. Application

- 15.4.8. End User

- 15.5. United Kingdom Brewery Equipment Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Equipment Type

- 15.5.3. Brewery Type

- 15.5.4. Material Type

- 15.5.5. Function

- 15.5.6. Mode of Operation

- 15.5.7. Application

- 15.5.8. End User

- 15.6. France Brewery Equipment Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Equipment Type

- 15.6.3. Brewery Type

- 15.6.4. Material Type

- 15.6.5. Function

- 15.6.6. Mode of Operation

- 15.6.7. Application

- 15.6.8. End User

- 15.7. Italy Brewery Equipment Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Equipment Type

- 15.7.3. Brewery Type

- 15.7.4. Material Type

- 15.7.5. Function

- 15.7.6. Mode of Operation

- 15.7.7. Application

- 15.7.8. End User

- 15.8. Spain Brewery Equipment Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Equipment Type

- 15.8.3. Brewery Type

- 15.8.4. Material Type

- 15.8.5. Function

- 15.8.6. Mode of Operation

- 15.8.7. Application

- 15.8.8. End User

- 15.9. Netherlands Brewery Equipment Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Equipment Type

- 15.9.3. Brewery Type

- 15.9.4. Material Type

- 15.9.5. Function

- 15.9.6. Mode of Operation

- 15.9.7. Application

- 15.9.8. End User

- 15.10. Nordic Countries Brewery Equipment Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Equipment Type

- 15.10.3. Brewery Type

- 15.10.4. Material Type

- 15.10.5. Function

- 15.10.6. Mode of Operation

- 15.10.7. Application

- 15.10.8. End User

- 15.11. Poland Brewery Equipment Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Equipment Type

- 15.11.3. Brewery Type

- 15.11.4. Material Type

- 15.11.5. Function

- 15.11.6. Mode of Operation

- 15.11.7. Application

- 15.11.8. End User

- 15.12. Russia & CIS Brewery Equipment Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Equipment Type

- 15.12.3. Brewery Type

- 15.12.4. Material Type

- 15.12.5. Function

- 15.12.6. Mode of Operation

- 15.12.7. Application

- 15.12.8. End User

- 15.13. Rest of Europe Brewery Equipment Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Equipment Type

- 15.13.3. Brewery Type

- 15.13.4. Material Type

- 15.13.5. Function

- 15.13.6. Mode of Operation

- 15.13.7. Application

- 15.13.8. End User

- 16. Asia Pacific Brewery Equipment Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. East Asia Brewery Equipment Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 16.3.1. Equipment Type

- 16.3.2. Brewery Type

- 16.3.3. Material Type

- 16.3.4. Function

- 16.3.5. Mode of Operation

- 16.3.6. Application

- 16.3.7. End User

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia Pacific

- 16.4. China Brewery Equipment Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Equipment Type

- 16.4.3. Brewery Type

- 16.4.4. Material Type

- 16.4.5. Function

- 16.4.6. Mode of Operation

- 16.4.7. Application

- 16.4.8. End User

- 16.5. India Brewery Equipment Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Equipment Type

- 16.5.3. Brewery Type

- 16.5.4. Material Type

- 16.5.5. Function

- 16.5.6. Mode of Operation

- 16.5.7. Application

- 16.5.8. End User

- 16.6. Japan Brewery Equipment Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Equipment Type

- 16.6.3. Brewery Type

- 16.6.4. Material Type

- 16.6.5. Function

- 16.6.6. Mode of Operation

- 16.6.7. Application

- 16.6.8. End User

- 16.7. South Korea Brewery Equipment Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Equipment Type

- 16.7.3. Brewery Type

- 16.7.4. Material Type

- 16.7.5. Function

- 16.7.6. Mode of Operation

- 16.7.7. Application

- 16.7.8. End User

- 16.8. Australia and New Zealand Brewery Equipment Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Equipment Type

- 16.8.3. Brewery Type

- 16.8.4. Material Type

- 16.8.5. Function

- 16.8.6. Mode of Operation

- 16.8.7. Application

- 16.8.8. End User

- 16.9. Indonesia Brewery Equipment Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Equipment Type

- 16.9.3. Brewery Type

- 16.9.4. Material Type

- 16.9.5. Function

- 16.9.6. Mode of Operation

- 16.9.7. Application

- 16.9.8. End User

- 16.10. Malaysia Brewery Equipment Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Equipment Type

- 16.10.3. Brewery Type

- 16.10.4. Material Type

- 16.10.5. Function

- 16.10.6. Mode of Operation

- 16.10.7. Application

- 16.10.8. End User

- 16.11. Thailand Brewery Equipment Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Equipment Type

- 16.11.3. Brewery Type

- 16.11.4. Material Type

- 16.11.5. Function

- 16.11.6. Mode of Operation

- 16.11.7. Application

- 16.11.8. End User

- 16.12. Vietnam Brewery Equipment Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Equipment Type

- 16.12.3. Brewery Type

- 16.12.4. Material Type

- 16.12.5. Function

- 16.12.6. Mode of Operation

- 16.12.7. Application

- 16.12.8. End User

- 16.13. Rest of Asia Pacific Brewery Equipment Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Equipment Type

- 16.13.3. Brewery Type

- 16.13.4. Material Type

- 16.13.5. Function

- 16.13.6. Mode of Operation

- 16.13.7. Application

- 16.13.8. End User

- 17. Middle East Brewery Equipment Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East Brewery Equipment Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 17.3.1. Equipment Type

- 17.3.2. Brewery Type

- 17.3.3. Material Type

- 17.3.4. Function

- 17.3.5. Mode of Operation

- 17.3.6. Application

- 17.3.7. End User

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey Brewery Equipment Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Equipment Type

- 17.4.3. Brewery Type

- 17.4.4. Material Type

- 17.4.5. Function

- 17.4.6. Mode of Operation

- 17.4.7. Application

- 17.4.8. End User

- 17.5. UAE Brewery Equipment Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Equipment Type

- 17.5.3. Brewery Type

- 17.5.4. Material Type

- 17.5.5. Function

- 17.5.6. Mode of Operation

- 17.5.7. Application

- 17.5.8. End User

- 17.6. Saudi Arabia Brewery Equipment Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Equipment Type

- 17.6.3. Brewery Type

- 17.6.4. Material Type

- 17.6.5. Function

- 17.6.6. Mode of Operation

- 17.6.7. Application

- 17.6.8. End User

- 17.7. Israel Brewery Equipment Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Equipment Type

- 17.7.3. Brewery Type

- 17.7.4. Material Type

- 17.7.5. Function

- 17.7.6. Mode of Operation

- 17.7.7. Application

- 17.7.8. End User

- 17.8. Rest of Middle East Brewery Equipment Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Equipment Type

- 17.8.3. Brewery Type

- 17.8.4. Material Type

- 17.8.5. Function

- 17.8.6. Mode of Operation

- 17.8.7. Application

- 17.8.8. End User

- 18. Africa Brewery Equipment Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa Brewery Equipment Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 18.3.1. Equipment Type

- 18.3.2. Brewery Type

- 18.3.3. Material Type

- 18.3.4. Function

- 18.3.5. Mode of Operation

- 18.3.6. Application

- 18.3.7. End User

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa Brewery Equipment Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Equipment Type

- 18.4.3. Brewery Type

- 18.4.4. Material Type

- 18.4.5. Function

- 18.4.6. Mode of Operation

- 18.4.7. Application

- 18.4.8. End User

- 18.5. Egypt Brewery Equipment Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Equipment Type

- 18.5.3. Brewery Type

- 18.5.4. Material Type

- 18.5.5. Function

- 18.5.6. Mode of Operation

- 18.5.7. Application

- 18.5.8. End User

- 18.6. Nigeria Brewery Equipment Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Equipment Type

- 18.6.3. Brewery Type

- 18.6.4. Material Type

- 18.6.5. Function

- 18.6.6. Mode of Operation

- 18.6.7. Application

- 18.6.8. End User

- 18.7. Algeria Brewery Equipment Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Equipment Type

- 18.7.3. Brewery Type

- 18.7.4. Material Type

- 18.7.5. Function

- 18.7.6. Mode of Operation

- 18.7.7. Application

- 18.7.8. End User

- 18.8. Rest of Africa Brewery Equipment Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Equipment Type

- 18.8.3. Brewery Type

- 18.8.4. Material Type

- 18.8.5. Function

- 18.8.6. Mode of Operation

- 18.8.7. Application

- 18.8.8. End User

- 19. South America Brewery Equipment Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Central and South Africa Brewery Equipment Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 19.3.1. Equipment Type

- 19.3.2. Brewery Type

- 19.3.3. Material Type

- 19.3.4. Function

- 19.3.5. Mode of Operation

- 19.3.6. Application

- 19.3.7. End User

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil Brewery Equipment Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Equipment Type

- 19.4.3. Brewery Type

- 19.4.4. Material Type

- 19.4.5. Function

- 19.4.6. Mode of Operation

- 19.4.7. Application

- 19.4.8. End User

- 19.5. Argentina Brewery Equipment Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Equipment Type

- 19.5.3. Brewery Type

- 19.5.4. Material Type

- 19.5.5. Function

- 19.5.6. Mode of Operation

- 19.5.7. Application

- 19.5.8. End User

- 19.6. Rest of South America Brewery Equipment Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Equipment Type

- 19.6.3. Brewery Type

- 19.6.4. Material Type

- 19.6.5. Function

- 19.6.6. Mode of Operation

- 19.6.7. Application

- 19.6.8. End User

- 20. Key Players/ Company Profile

- 20.1. ABE Equipment

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. Alfa Laval

- 20.3. American Beer Equipment

- 20.4. BrauKon GmbH

- 20.5. BrewFab Ltd.

- 20.6. Criveller Group

- 20.7. Della Toffola Group

- 20.8. GEA Group AG

- 20.9. Hypro Engineers Pvt. Ltd.

- 20.10. Kaspar Schulz

- 20.11. Krones AG

- 20.12. Lehui Group

- 20.13. Meura SA

- 20.14. Ningbo Lehui International Engineering Equipment Co., Ltd.

- 20.15. Paul Mueller Company

- 20.16. Portland Kettle Works

- 20.17. Prodeb Brewery

- 20.18. Shanghai HengCheng Beverage Equipment Co., Ltd.

- 20.19. TMCI Padovan S.p.A.

- 20.20. Ziemann Holvrieka GmbH

- 20.21. Other Key Players

- 20.1. ABE Equipment

Note* - This is just tentative list of players. While providing the report, we will cover a greater number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation