Cannabis Vaporizer Market Size, Share & Trends Analysis Report by Product Type (Portable Vaporizers, Desktop Vaporizers, Disposable Vaporizers, Pod System Vaporizers), Technology, Material Compatibility, Battery Type, Temperature Control, Price Range, Distribution Channel, Usage Type, Applications, End-Users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Cannabis Vaporizer Market Size, Share, and Growth

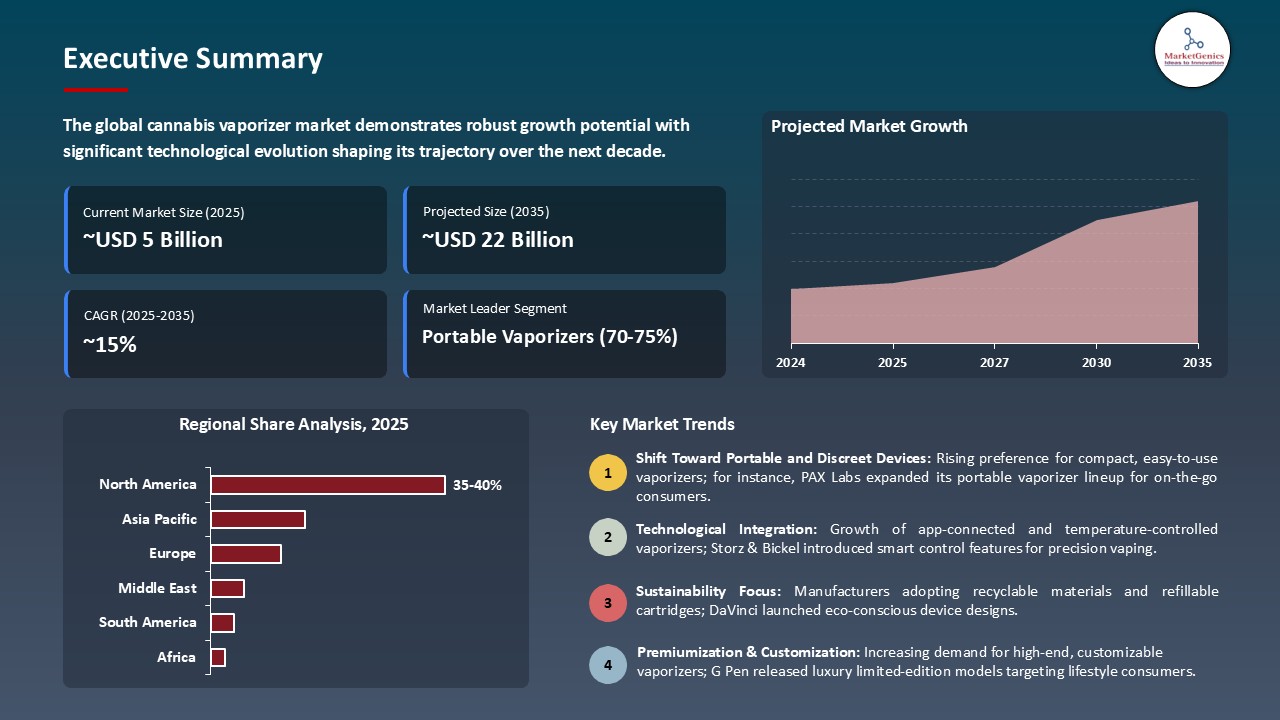

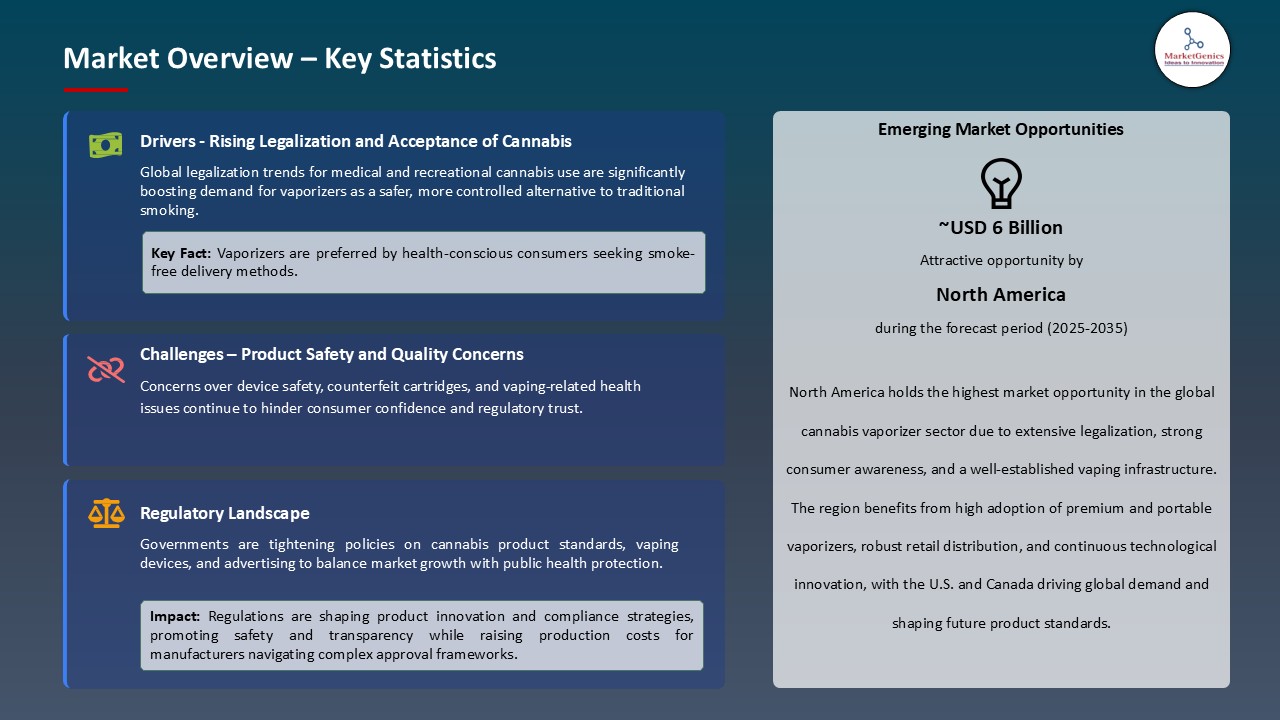

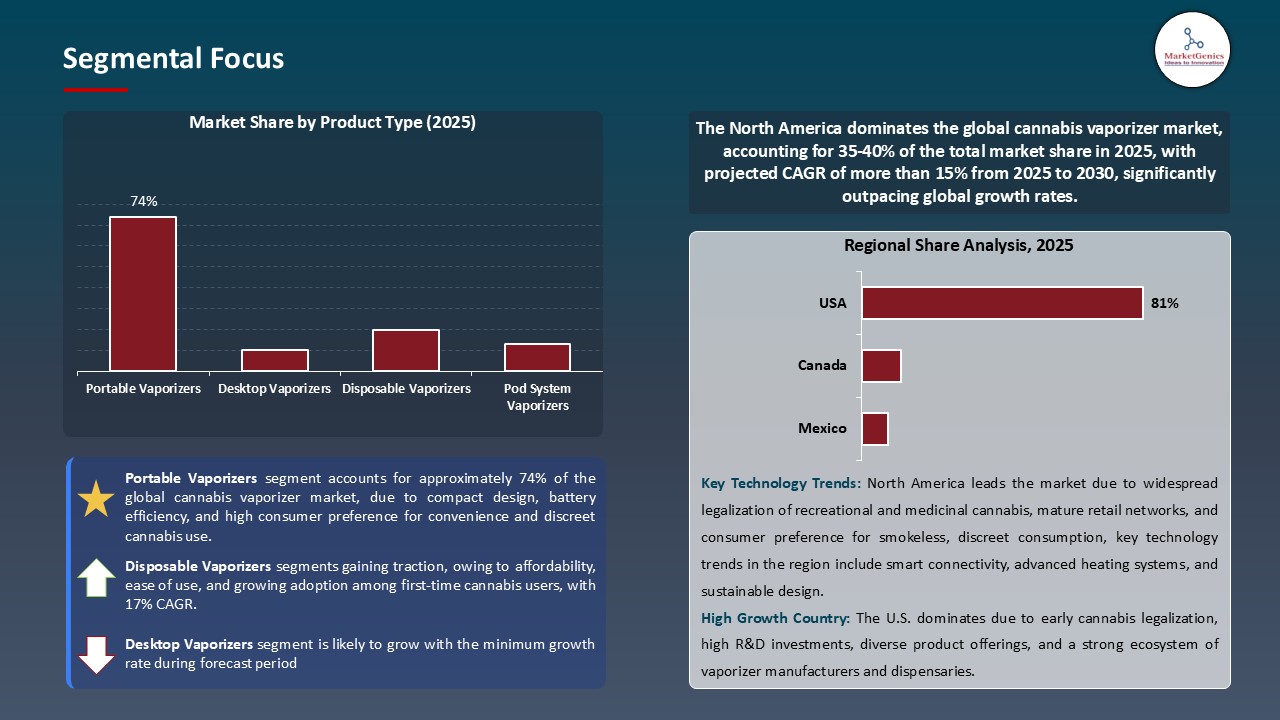

The global cannabis vaporizer market is experiencing robust growth, with its estimated value of USD 5.3 billion in the year 2025 and USD 21.8 billion by the period 2035, registering a CAGR of 15.2%, during the forecast period. The cannabis vaporizer market is boosted due to a shift in consumer preference towards healthier and discreet consumption methods, the increasing global legalization of cannabis, and continuous technological advancements in vaporizer devices.

Jürgen Bickel, Founder and Managing Director, STORZ & BICKEL said, "The VENTY marks a significant milestone in STORZ & BICKEL's innovation journey. As our first entirely new product since 2014, the VENTY builds on our longstanding commitment to quality and innovation. It follows our objective to deliver the highest quality vaporizer experience possible from any device"

The global cannabis vaporizer market is growing due to legalization in several areas, consumers are able legally obtain cannabis at retail and further motivate consumers to consume cannabis using vaporizers. For instance, in 2023, STORZ & BICKEL GmbH unveiled the anticipated launch of the VENTY, STORZ & BICKEL's state-of-the-art portable vaporizer for dry herbs, which the next generation of portable dry herb vaporizers, featuring refined flavor, convection and conduction heating, heating management and cooling technology for quality on-the-go vapor. This is a large market driver through consumption & product innovations and premiumization, and new consumers seeking safer, more efficient, technology-driven cannabis consumption solutions.

Moreover, the global cannabis vaporizer market is being driven by health-conscious consumers preferring new consumption methods over traditional burning and smoking methods. Vaporization offers consumers a safer, cleaner alternative to minimize, by-products. For instance, in February 2024, The Cannabist Company Holdings Inc. revealed an expansion of its partnership with Airo Brands, which is a leading multi-state cannabis enterprise focused on proprietary, innovative vapor delivery systems and unique oils. This partnership is expected to increase market penetration through improved access to products and visibility for both brands while stimulating market engagement for innovative vaporization technologies that align with shifts in consumer demand for safer, quality, health-conscious cannabis consumption experiences.

The regulatory framework in major economies is advancing the cannabis vaporizer market across the globe by cultivating sustainability, product safety, and responsible manufacturing. Governments are now putting strict policies in place that promote the use of recyclable and non-toxic materials, mandate product quality and emissions standards, and dictate the disposal of batteries, in accordance with Extended Producer Responsibility (EPR) policies. This is urging manufacturers to make a greener, compliant, and consumer respected vaporizer, while creating environmental accountability and long-term confidence in the market.

The key market opportunities of the global cannabis vaporizer market include cannabis-infused beverages, CBD wellness products, smart vaporization technology, cannabis packaging innovations, and temperature-control vaporizer accessories. These segments present strong synergies in technology and consumer demand. Expanding into adjacent categories strengthens revenue diversification and supports sustained market growth and competitiveness.

Cannabis Vaporizer Market Dynamics and Trends

Driver: Expanding Medical Cannabis Programs Legitimizing Therapeutic Vaporizer Adoption Globally

- The cannabis vaporizer market is expanding due to an increased medical marijuana legalization framework with a focus on patient safety and accurate dosing - alongside this rapid uptake is health care providers increasingly recommending vaporization as a less risky health event and supported bio-availability compared to other forms of cannabis consumption. For example, in March 2024, CCELL presented vaporizer hardware at the 2024 Spannabis Show in Barcelona, which included products such as the "Rosin Bar" (for 100% rosin) and an Eco Star which is designed for environmentally sustainability with a recyclable battery and biodegradable housing along with other products. These innovations continue to propel the market by advancing sustainable health - centric vaporization technologies that can provide user safety, use medical standards, and keep pace with the growing regulatory acknowledgement for cannabis therapeutic uses.

- Furthermore, the cannabis vaporizer market will be supported by an agenda of growing regulatory acceptance demonstrated in jurisdictions of Germany, Israel, and Canada and to a precedent of global support for consented regulation, expansion and commercialization of the medical cannabis industry. For instance, in April 2024, Germany implemented cannabis legalization reforms decriminalizing possession and enabling regulated medical access, prompting international companies to expand operations and invest in compliant vaporization technologies for medical use.

Restraint: Stringent Regulatory Uncertainties and Product Compliance Requirements Across Jurisdictions

- The cannabis vaporizer market growth is hindered by varying cannabis regulations causing legal and operational difficulties for manufacturers as they navigate various compliance regimes of federal, state, and international regulations. Also, the inconsistent regulatory classification of cannabis vaporizers as a consumer electronic or as a medical product can lead to inconsistency in regulatory testing, labeling, and distribution requirements creating additional costs and burden. For example, in 2024, the U.S. Food and Drug Administration (FDA) and the Federal Trade Commission (FTC) sent five companies warning letters for illegally marketing copycat food products containing delta-8 THC and introducing it into commerce in violation of the Federal Food, Drug and Cosmetic Act.

- In addition, cannabis vaporizer market growth is further restrained by pervasive and complex marketing restricting brand awareness and international trading of vaporizers and consumption of cannabis products. Limitations on health claims, advertising channels, or other marketing channels can restrict promotional advertising. Impediments to accessing advertising can worsen conditions of brand awareness and market disruption. There are complex customs and import regulations, especially for vaporizers, that can subject vaporizers under drug paraphernalia preventing illicit cross-border trade prohibiting the success of extending products into new markets and disrupt the global supply chain.

Opportunity: Premium Customization and Smart Technology Integration Creating High-Margin Product Segments

- The demand for cannabis vaporizers is growing owing to potential market opportunities made possible by technology integration such as mobile app enhancements for phone syncing, temperature control, and usage data to enable premium strategies. Consumers benefit from the loops of customization and data for product development and marketing offered by IoT-enabled vaporizers. as an example, in September 2024, Artrix released a preview of a revolutionary Dip Pod Dapper vaporizer. DabPod is a highly disruptive dab vape product that unifies the benefits of Dab, Pod, and Vape into a single portable dabbing device, poised to revolutionize how consumers dab cannabis concentrates in vapor form.

- Moreover, factor contributing to growth in the cannabis vaporizer market is an increasing focus on premium or customizable vaporizer designs which feature high-end materials like wood inlays, precious metals and custom engraving. The premium touches enhance the aesthetic quality of the vaporizer while creating a luxury lifestyle and status place in the market that provides a different and exclusive consumption experience for affluent consumers. For instance, in December 2024, STORZ & BICKEL GmbH debuted its latest device at the high-end event and was the first vaporizer brand to sponsor NYLON House - this helped to establish the brand as a luxury lifestyle brand. This segment of the vaporizer market continues to drive growth of vaporizers as they continue to extend into areas beyond the class of vaporizers into luxury lifestyle categories, which not only offers further brand differentiation, but caters to high-income, price insensitive consumers, who may want a product, but also prefer the vape as an aesthetic appliance.

Key Trend: Sustainability Focus Driving Recyclable Materials and Modular Design Adoption

- The cannabis vaporizer market is experiencing growth driven by a key trend in the market which is the increasing demand for environmentally friendly products which has led consumers to prefer sustainable designs of vaporizers with sourcing of materials and recyclability valued during decision making. Manufacturers are increasingly leaning towards modular architecture designs that allow for replacing parts instead of throwing away the entire device, subsequently decreasing electronic waste and acquiring lower costs of ownership in the future. For example, in 2024 Artrix introduced the Eco Bar, a fully recyclable disposable vapes, through the introduction of its Green Vape Program that enables brands to engage in sustainability and waste reduction through eco-friendly vaping options.

- In addition, the growth of the cannabis vaporizer market can be attributed to the demand for advance thinking of modular architecture for vaporizers, which will allow for parts to be replaced and longevity of the product to be extended, reducing electronic waste to align with the increasing demand of functionality and value of sourcing sustainable and low-cost solution for consumption of cannabis products. For example, in on April 9, 2024, CCELL, announced the launch of Eco Star. Eco Star casing material is a biodegradable and plant-based PLA, a material that can be decomposed by microorganisms. In addition to the Eco Star focusing on sustainability and customer experience, the all-in-one vaporizer is designed to be compatible with a wide variety of oils in the market.

Cannabis Vaporizer Market Analysis and Segmental Data

Portable Vaporizers Dominate Global Cannabis Vaporizer Market

- Portable vaporizers dominate the global cannabis vaporizer market driven by consumers' desire for portable vaporizers that fit the trend toward convenience, discretion, and on-the-go usability in alignment with modern lifestyle implications and with the increasing acceptance of cannabis consumption in society. For example, in August of 2025, PAX announced its rollout plan to launch a new flagship portable dry-herb vaporizer called, PAX FLOW which is highlight hybrid heating technology in a compact form factor targeting both the connoisseur group and everyday consumer. Additionally, it validates these demands further reaffirming the market dominance of portable vaporizers by setting new performance and design management expectations, fueling consumer acceptance, and building brand positioning into the rapidly growing premium portable space.

- Moreover, improved performance via innovations in battery efficiency, compact systems and sleek, ergonomic designs provide vehicular choices in both medical and recreational segments as market demand grow and shape. For example, in June of 2025, CCELL announced a brand-reinvention driven by innovation and modular architecture in their hardware portfolio focus, claiming to heavily invest back into R&D while disrupting the conceptualization of your advancements for portable vaporizers.

North America Leads Global Cannabis Vaporizer Market Demand

- The North America region leads global cannabis vaporizer market due to supportive cannabis diversity laws across the U.S. and Canada, developed retail distribution systems, consumer consciousness, and an increasing community of medical and recreational consumers. For instance, in 2024, the Bloom Brand (Bloom) announced a distribution supply agreement with Cresco Labs to scale up Bloom's distribution in Florida. All-in-one vape Bloom Surf will be manufactured exclusively by Cresco Labs starting in November 2024 and made available for sale in all 33 Sunnyside dispensaries statewide. The Bloom and Cresco Labs partnership further supports North America's share of the market by enhancing accessibility to purchased products, retail performance, and overall innovation and category-leading position for the premium cannabis vaporization product market.

- In addition, North America continues to be solid with advanced vaporization technology acceptance and premium and portable devices steepening. One case includes Greenlane Holdings, Inc. announcement of a renewed special distribution agreement with PAX in June 2025 for PAX's existing line of premium cannabis vaporization technologies and devices.

Cannabis Vaporizer Market Ecosystem

The global cannabis vaporizer market is moderately fragmented, with high concentration among key players such as PAX Labs, Storz & Bickel, Grenco Science, Davinci Vaporizer, and Kandypens, who dominate through sustained technological advancements, strong brand semiotics, and large combinatory product offerings. These companies continue to bolster their global market presence in both medical and recreational use segments by utilizing disruptive vaporization technologies, embarking on strategic partnership opportunities, and launching premium products. For example, in 2025, Greenlane Holdings, Inc. disclosed the renewal of a continuing distribution agreement with PAX Labs, well known for its dry herb cannabis vaporizers, which will allow Greenlane to continue distribution of PAX products, PAX MINI and PAX PLUS, in the USA.

Recent Development and Strategic Overview:

- In March 2025, Ispire Technology Inc. released the Sprout, said to be an industry-standard all-in-one cannabis vapor device with safety, performance, and purity at its core. The Sprout is manufactured of PA12 - a terpene-safe material that withstands heat and can maintain cannabis purity.

- In March 2024, CCELL, the leaders in technology brand development around creating stylish and innovative vape hardware products and technologies, was at Spannabis debuting their new vaporization hardware technologies leveraging advancements in vaporization hardware.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 5.3 Bn |

|

Market Forecast Value in 2035 |

USD 21.8 Bn |

|

Growth Rate (CAGR) |

15.2% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Million Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Cannabis Vaporizer Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Cannabis Vaporizer Market By Product Type |

|

|

Cannabis Vaporizer Market By Technology |

|

|

Cannabis Vaporizer Market By Material Compatibility |

|

|

Cannabis Vaporizer Market By Battery Type |

|

|

Cannabis Vaporizer Market By Temperature Control

|

|

|

Cannabis Vaporizer Market By Price Range

|

|

|

Cannabis Vaporizer Market By Distribution Channel |

|

|

Cannabis Vaporizer Market By Usage Type |

|

|

Cannabis Vaporizer Market By Applications |

|

|

Cannabis Vaporizer Market By End-Users |

|

Frequently Asked Questions

The global cannabis vaporizer market was valued at USD 5.3 Bn in 2025.

The global cannabis vaporizer market industry is expected to grow at a CAGR of 15.2% from 2025 to 2035.

The cannabis vaporizer market is driving due to shift in consumer preference towards healthier and discreet consumption methods, the increasing global legalization of cannabis, and continuous technological advancements in vaporizer devices.

In terms of product type, portable vaporizers are the segment accounted for the major share in 2025

North America is a more attractive region for vendors.

Key players in the global cannabis vaporizer market include Airistech, Aphria, Arizer, Aurora Cannabis, Boundless Technology, Davinci Vaporizer, Dr. Dabber, Firefly, Grenco Science, Haze Technologies, Healthy Rips, Kandypens, Linx Vapor, Magic Flight, PAX Labs, Pulsar Vaporizers, Storz & Bickel, VapeXhale, Vapium, VUBER Technologies, Yocan, ZEUS Arsenal, and Other Key Players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Cannabis Vaporizer Market Outlook

- 2.1.1. Cannabis Vaporizer Market Size (Volume - Million Units and Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Cannabis Vaporizer Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Cannabis Vaporizer Industry Overview, 2025

- 3.1.1. Consumer Goods & Services Industry Ecosystem Analysis

- 3.1.2. Key Trends for Consumer Goods & Services Industry

- 3.1.3. Regional Distribution for Consumer Goods & Services Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Cannabis Vaporizer Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Increasing legalization of cannabis for medical and recreational use

- 4.1.1.2. Rising consumer preference for smokeless and discreet consumption methods

- 4.1.1.3. Technological advancements in vaporizer design and temperature control

- 4.1.2. Restraints

- 4.1.2.1. Stringent regulatory restrictions and varying legalization frameworks across regions

- 4.1.2.2. High device costs and limited consumer awareness in emerging markets

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Cannabis Vaporizer Manufacturers

- 4.4.3. Distributors/ Suppliers

- 4.4.4. End-users/ Customers

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Cannabis Vaporizer Market Demand

- 4.7.1. Historical Market Size - (Volume - Million Units and Value - US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size - (Volume - Million Units and Value - US$ Bn), 2025–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Cannabis Vaporizer Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Cannabis Vaporizer Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Portable Vaporizers

- 6.2.1.1. Pen-style Vaporizers

- 6.2.1.2. Pocket Vaporizers

- 6.2.2. Desktop Vaporizers

- 6.2.2.1. Whip-style Vaporizers

- 6.2.2.2. Forced-air Vaporizers

- 6.2.3. Disposable Vaporizers

- 6.2.4. Pod System Vaporizers

- 6.2.1. Portable Vaporizers

- 7. Global Cannabis Vaporizer Market Analysis, by Technology

- 7.1. Key Segment Analysis

- 7.2. Cannabis Vaporizer Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Technology, 2021-2035

- 7.2.1. Conduction Heating

- 7.2.2. Convection Heating

- 7.2.3. Hybrid Heating

- 7.2.4. Induction Heating

- 8. Global Cannabis Vaporizer Market Analysis and Forecasts, by Material Compatibility

- 8.1. Key Findings

- 8.2. Cannabis Vaporizer Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Material Compatibility, 2021-2035

- 8.2.1. Dry Herb Vaporizers

- 8.2.2. Concentrate/Wax Vaporizers

- 8.2.3. Oil Vaporizers

- 8.2.4. Multi-material Vaporizers

- 9. Global Cannabis Vaporizer Market Analysis and Forecasts, by Battery Type

- 9.1. Key Findings

- 9.2. Cannabis Vaporizer Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Battery Type, 2021-2035

- 9.2.1. Rechargeable Battery

- 9.2.1.1. USB Rechargeable

- 9.2.1.2. Wireless Charging

- 9.2.2. Replaceable Battery

- 9.2.3. Non-rechargeable

- 9.2.1. Rechargeable Battery

- 10. Global Cannabis Vaporizer Market Analysis and Forecasts, by Temperature Control

- 10.1. Key Findings

- 10.2. Cannabis Vaporizer Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Temperature Control, 2021-2035

- 10.2.1. Fixed Temperature

- 10.2.2. Adjustable Temperature

- 10.2.2.1. Preset Temperature Settings

- 10.2.2.2. Precision Temperature Control

- 11. Global Cannabis Vaporizer Market Analysis and Forecasts, by Price Range

- 11.1. Key Findings

- 11.2. Cannabis Vaporizer Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Price Range, 2021-2035

- 11.2.1. Budget (Under $50)

- 11.2.2. Mid-range ($50 - $150)

- 11.2.3. Premium ($150 - $300)

- 11.2.4. Luxury (Above $300)

- 12. Global Cannabis Vaporizer Market Analysis and Forecasts, by Distribution Channel

- 12.1. Key Findings

- 12.2. Cannabis Vaporizer Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 12.2.1. Online Sales

- 12.2.1.1. Company Website

- 12.2.1.2. E-commerce Platforms

- 12.2.1.3. Cannabis Delivery Platforms

- 12.2.1.4. Others

- 12.2.2. Offline Sales

- 12.2.2.1. Dispensaries

- 12.2.2.2. Smoke Shops

- 12.2.2.3. Specialty Stores

- 12.2.2.4. Pharmacy Stores

- 12.2.2.5. Others

- 12.2.1. Online Sales

- 13. Global Cannabis Vaporizer Market Analysis and Forecasts, by Usage Type

- 13.1. Key Findings

- 13.2. Cannabis Vaporizer Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Usage Type, 2021-2035

- 13.2.1. Medical Use

- 13.2.2. Recreational Use

- 14. Global Cannabis Vaporizer Market Analysis and Forecasts, by Applications

- 14.1. Key Findings

- 14.2. Cannabis Vaporizer Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Applications, 2021-2035

- 14.2.1. Pain Management

- 14.2.2. Anxiety & Stress Relief

- 14.2.3. Sleep Disorders Treatment

- 14.2.4. Appetite Stimulation

- 14.2.5. Recreation & Relaxation

- 14.2.6. Nausea & Vomiting Control

- 14.2.7. Inflammation Reduction

- 14.2.8. Neurological Disorder Management

- 14.2.9. Others

- 15. Global Cannabis Vaporizer Market Analysis and Forecasts, by End-Users

- 15.1. Key Findings

- 15.2. Cannabis Vaporizer Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by End-Users, 2021-2035

- 15.2.1. Individual Consumers

- 15.2.2. Medical Patients

- 15.2.3. Dispensaries/Retailers

- 15.2.4. Wellness Centers

- 15.2.5. Recreational Users

- 15.2.6. Healthcare Facilities

- 15.2.7. Others

- 16. Global Cannabis Vaporizer Market Analysis and Forecasts, by Region

- 16.1. Key Findings

- 16.2. Cannabis Vaporizer Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 16.2.1. North America

- 16.2.2. Europe

- 16.2.3. Asia Pacific

- 16.2.4. Middle East

- 16.2.5. Africa

- 16.2.6. South America

- 17. North America Cannabis Vaporizer Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. North America Cannabis Vaporizer Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Technology

- 17.3.3. Material Compatibility

- 17.3.4. Battery Type

- 17.3.5. Temperature Control

- 17.3.6. Price Range

- 17.3.7. Distribution Channel

- 17.3.8. Usage Type

- 17.3.9. Applications

- 17.3.10. End-Users

- 17.3.11. Country

- 17.3.11.1. USA

- 17.3.11.2. Canada

- 17.3.11.3. Mexico

- 17.4. USA Cannabis Vaporizer Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Technology

- 17.4.4. Material Compatibility

- 17.4.5. Battery Type

- 17.4.6. Temperature Control

- 17.4.7. Price Range

- 17.4.8. Distribution Channel

- 17.4.9. Usage Type

- 17.4.10. Applications

- 17.4.11. End-Users

- 17.5. Canada Cannabis Vaporizer Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Technology

- 17.5.4. Material Compatibility

- 17.5.5. Battery Type

- 17.5.6. Temperature Control

- 17.5.7. Price Range

- 17.5.8. Distribution Channel

- 17.5.9. Usage Type

- 17.5.10. Applications

- 17.5.11. End-Users

- 17.6. Mexico Cannabis Vaporizer Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Technology

- 17.6.4. Material Compatibility

- 17.6.5. Battery Type

- 17.6.6. Temperature Control

- 17.6.7. Price Range

- 17.6.8. Distribution Channel

- 17.6.9. Usage Type

- 17.6.10. Applications

- 17.6.11. End-Users

- 18. Europe Cannabis Vaporizer Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Europe Cannabis Vaporizer Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Technology

- 18.3.3. Material Compatibility

- 18.3.4. Battery Type

- 18.3.5. Temperature Control

- 18.3.6. Price Range

- 18.3.7. Distribution Channel

- 18.3.8. Usage Type

- 18.3.9. Applications

- 18.3.10. End-Users

- 18.3.11. Country

- 18.3.11.1. Germany

- 18.3.11.2. United Kingdom

- 18.3.11.3. France

- 18.3.11.4. Italy

- 18.3.11.5. Spain

- 18.3.11.6. Netherlands

- 18.3.11.7. Nordic Countries

- 18.3.11.8. Poland

- 18.3.11.9. Russia & CIS

- 18.3.11.10. Rest of Europe

- 18.4. Germany Cannabis Vaporizer Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Technology

- 18.4.4. Material Compatibility

- 18.4.5. Battery Type

- 18.4.6. Temperature Control

- 18.4.7. Price Range

- 18.4.8. Distribution Channel

- 18.4.9. Usage Type

- 18.4.10. Applications

- 18.4.11. End-Users

- 18.5. United Kingdom Cannabis Vaporizer Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Technology

- 18.5.4. Material Compatibility

- 18.5.5. Battery Type

- 18.5.6. Temperature Control

- 18.5.7. Price Range

- 18.5.8. Distribution Channel

- 18.5.9. Usage Type

- 18.5.10. Applications

- 18.5.11. End-Users

- 18.6. France Cannabis Vaporizer Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Technology

- 18.6.4. Material Compatibility

- 18.6.5. Battery Type

- 18.6.6. Temperature Control

- 18.6.7. Price Range

- 18.6.8. Distribution Channel

- 18.6.9. Usage Type

- 18.6.10. Applications

- 18.6.11. End-Users

- 18.7. Italy Cannabis Vaporizer Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Technology

- 18.7.4. Material Compatibility

- 18.7.5. Battery Type

- 18.7.6. Temperature Control

- 18.7.7. Price Range

- 18.7.8. Distribution Channel

- 18.7.9. Usage Type

- 18.7.10. Applications

- 18.7.11. End-Users

- 18.8. Spain Cannabis Vaporizer Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Technology

- 18.8.4. Material Compatibility

- 18.8.5. Battery Type

- 18.8.6. Temperature Control

- 18.8.7. Price Range

- 18.8.8. Distribution Channel

- 18.8.9. Usage Type

- 18.8.10. Applications

- 18.8.11. End-Users

- 18.9. Netherlands Cannabis Vaporizer Market

- 18.9.1. Country Segmental Analysis

- 18.9.2. Product Type

- 18.9.3. Technology

- 18.9.4. Material Compatibility

- 18.9.5. Battery Type

- 18.9.6. Temperature Control

- 18.9.7. Price Range

- 18.9.8. Distribution Channel

- 18.9.9. Usage Type

- 18.9.10. Applications

- 18.9.11. End-Users

- 18.10. Nordic Countries Cannabis Vaporizer Market

- 18.10.1. Country Segmental Analysis

- 18.10.2. Product Type

- 18.10.3. Technology

- 18.10.4. Material Compatibility

- 18.10.5. Battery Type

- 18.10.6. Temperature Control

- 18.10.7. Price Range

- 18.10.8. Distribution Channel

- 18.10.9. Usage Type

- 18.10.10. Applications

- 18.10.11. End-Users

- 18.11. Poland Cannabis Vaporizer Market

- 18.11.1. Country Segmental Analysis

- 18.11.2. Product Type

- 18.11.3. Technology

- 18.11.4. Material Compatibility

- 18.11.5. Battery Type

- 18.11.6. Temperature Control

- 18.11.7. Price Range

- 18.11.8. Distribution Channel

- 18.11.9. Usage Type

- 18.11.10. Applications

- 18.11.11. End-Users

- 18.12. Russia & CIS Cannabis Vaporizer Market

- 18.12.1. Country Segmental Analysis

- 18.12.2. Product Type

- 18.12.3. Technology

- 18.12.4. Material Compatibility

- 18.12.5. Battery Type

- 18.12.6. Temperature Control

- 18.12.7. Price Range

- 18.12.8. Distribution Channel

- 18.12.9. Usage Type

- 18.12.10. Applications

- 18.12.11. End-Users

- 18.13. Rest of Europe Cannabis Vaporizer Market

- 18.13.1. Country Segmental Analysis

- 18.13.2. Product Type

- 18.13.3. Technology

- 18.13.4. Material Compatibility

- 18.13.5. Battery Type

- 18.13.6. Temperature Control

- 18.13.7. Price Range

- 18.13.8. Distribution Channel

- 18.13.9. Usage Type

- 18.13.10. Applications

- 18.13.11. End-Users

- 19. Asia Pacific Cannabis Vaporizer Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. East Asia Cannabis Vaporizer Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Technology

- 19.3.3. Material Compatibility

- 19.3.4. Battery Type

- 19.3.5. Temperature Control

- 19.3.6. Price Range

- 19.3.7. Distribution Channel

- 19.3.8. Usage Type

- 19.3.9. Applications

- 19.3.10. End-Users

- 19.3.11. Country

- 19.3.11.1. China

- 19.3.11.2. India

- 19.3.11.3. Japan

- 19.3.11.4. South Korea

- 19.3.11.5. Australia and New Zealand

- 19.3.11.6. Indonesia

- 19.3.11.7. Malaysia

- 19.3.11.8. Thailand

- 19.3.11.9. Vietnam

- 19.3.11.10. Rest of Asia Pacific

- 19.4. China Cannabis Vaporizer Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Technology

- 19.4.4. Material Compatibility

- 19.4.5. Battery Type

- 19.4.6. Temperature Control

- 19.4.7. Price Range

- 19.4.8. Distribution Channel

- 19.4.9. Usage Type

- 19.4.10. Applications

- 19.4.11. End-Users

- 19.5. India Cannabis Vaporizer Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Technology

- 19.5.4. Material Compatibility

- 19.5.5. Battery Type

- 19.5.6. Temperature Control

- 19.5.7. Price Range

- 19.5.8. Distribution Channel

- 19.5.9. Usage Type

- 19.5.10. Applications

- 19.5.11. End-Users

- 19.6. Japan Cannabis Vaporizer Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Technology

- 19.6.4. Material Compatibility

- 19.6.5. Battery Type

- 19.6.6. Temperature Control

- 19.6.7. Price Range

- 19.6.8. Distribution Channel

- 19.6.9. Usage Type

- 19.6.10. Applications

- 19.6.11. End-Users

- 19.7. South Korea Cannabis Vaporizer Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Product Type

- 19.7.3. Technology

- 19.7.4. Material Compatibility

- 19.7.5. Battery Type

- 19.7.6. Temperature Control

- 19.7.7. Price Range

- 19.7.8. Distribution Channel

- 19.7.9. Usage Type

- 19.7.10. Applications

- 19.7.11. End-Users

- 19.8. Australia and New Zealand Cannabis Vaporizer Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Product Type

- 19.8.3. Technology

- 19.8.4. Material Compatibility

- 19.8.5. Battery Type

- 19.8.6. Temperature Control

- 19.8.7. Price Range

- 19.8.8. Distribution Channel

- 19.8.9. Usage Type

- 19.8.10. Applications

- 19.8.11. End-Users

- 19.9. Indonesia Cannabis Vaporizer Market

- 19.9.1. Country Segmental Analysis

- 19.9.2. Product Type

- 19.9.3. Technology

- 19.9.4. Material Compatibility

- 19.9.5. Battery Type

- 19.9.6. Temperature Control

- 19.9.7. Price Range

- 19.9.8. Distribution Channel

- 19.9.9. Usage Type

- 19.9.10. Applications

- 19.9.11. End-Users

- 19.10. Malaysia Cannabis Vaporizer Market

- 19.10.1. Country Segmental Analysis

- 19.10.2. Product Type

- 19.10.3. Technology

- 19.10.4. Material Compatibility

- 19.10.5. Battery Type

- 19.10.6. Temperature Control

- 19.10.7. Price Range

- 19.10.8. Distribution Channel

- 19.10.9. Usage Type

- 19.10.10. Applications

- 19.10.11. End-Users

- 19.11. Thailand Cannabis Vaporizer Market

- 19.11.1. Country Segmental Analysis

- 19.11.2. Product Type

- 19.11.3. Technology

- 19.11.4. Material Compatibility

- 19.11.5. Battery Type

- 19.11.6. Temperature Control

- 19.11.7. Price Range

- 19.11.8. Distribution Channel

- 19.11.9. Usage Type

- 19.11.10. Applications

- 19.11.11. End-Users

- 19.12. Vietnam Cannabis Vaporizer Market

- 19.12.1. Country Segmental Analysis

- 19.12.2. Product Type

- 19.12.3. Technology

- 19.12.4. Material Compatibility

- 19.12.5. Battery Type

- 19.12.6. Temperature Control

- 19.12.7. Price Range

- 19.12.8. Distribution Channel

- 19.12.9. Usage Type

- 19.12.10. Applications

- 19.12.11. End-Users

- 19.13. Rest of Asia Pacific Cannabis Vaporizer Market

- 19.13.1. Country Segmental Analysis

- 19.13.2. Product Type

- 19.13.3. Technology

- 19.13.4. Material Compatibility

- 19.13.5. Battery Type

- 19.13.6. Temperature Control

- 19.13.7. Price Range

- 19.13.8. Distribution Channel

- 19.13.9. Usage Type

- 19.13.10. Applications

- 19.13.11. End-Users

- 20. Middle East Cannabis Vaporizer Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Middle East Cannabis Vaporizer Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Product Type

- 20.3.2. Technology

- 20.3.3. Material Compatibility

- 20.3.4. Battery Type

- 20.3.5. Temperature Control

- 20.3.6. Price Range

- 20.3.7. Distribution Channel

- 20.3.8. Usage Type

- 20.3.9. Applications

- 20.3.10. End-Users

- 20.3.11. Country

- 20.3.11.1. Turkey

- 20.3.11.2. UAE

- 20.3.11.3. Saudi Arabia

- 20.3.11.4. Israel

- 20.3.11.5. Rest of Middle East

- 20.4. Turkey Cannabis Vaporizer Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Product Type

- 20.4.3. Technology

- 20.4.4. Material Compatibility

- 20.4.5. Battery Type

- 20.4.6. Temperature Control

- 20.4.7. Price Range

- 20.4.8. Distribution Channel

- 20.4.9. Usage Type

- 20.4.10. Applications

- 20.4.11. End-Users

- 20.5. UAE Cannabis Vaporizer Market

- 20.5.1. Product Type

- 20.5.2. Technology

- 20.5.3. Material Compatibility

- 20.5.4. Battery Type

- 20.5.5. Temperature Control

- 20.5.6. Price Range

- 20.5.7. Distribution Channel

- 20.5.8. Usage Type

- 20.5.9. Applications

- 20.5.10. End-Users

- 20.6. Saudi Arabia Cannabis Vaporizer Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Product Type

- 20.6.3. Technology

- 20.6.4. Material Compatibility

- 20.6.5. Battery Type

- 20.6.6. Temperature Control

- 20.6.7. Price Range

- 20.6.8. Distribution Channel

- 20.6.9. Usage Type

- 20.6.10. Applications

- 20.6.11. End-Users

- 20.7. Israel Cannabis Vaporizer Market

- 20.7.1. Country Segmental Analysis

- 20.7.2. Product Type

- 20.7.3. Technology

- 20.7.4. Material Compatibility

- 20.7.5. Battery Type

- 20.7.6. Temperature Control

- 20.7.7. Price Range

- 20.7.8. Distribution Channel

- 20.7.9. Usage Type

- 20.7.10. Applications

- 20.7.11. End-Users

- 20.8. Rest of Middle East Cannabis Vaporizer Market

- 20.8.1. Country Segmental Analysis

- 20.8.2. Product Type

- 20.8.3. Technology

- 20.8.4. Material Compatibility

- 20.8.5. Battery Type

- 20.8.6. Temperature Control

- 20.8.7. Price Range

- 20.8.8. Distribution Channel

- 20.8.9. Usage Type

- 20.8.10. Applications

- 20.8.11. End-Users

- 21. Africa Cannabis Vaporizer Market Analysis

- 21.1. Key Segment Analysis

- 21.2. Regional Snapshot

- 21.3. Africa Cannabis Vaporizer Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 21.3.1. Product Type

- 21.3.2. Technology

- 21.3.3. Material Compatibility

- 21.3.4. Battery Type

- 21.3.5. Temperature Control

- 21.3.6. Price Range

- 21.3.7. Distribution Channel

- 21.3.8. Usage Type

- 21.3.9. Applications

- 21.3.10. End-Users

- 21.3.11. Country

- 21.3.11.1. South Africa

- 21.3.11.2. Egypt

- 21.3.11.3. Nigeria

- 21.3.11.4. Algeria

- 21.3.11.5. Rest of Africa

- 21.4. South Africa Cannabis Vaporizer Market

- 21.4.1. Country Segmental Analysis

- 21.4.2. Product Type

- 21.4.3. Technology

- 21.4.4. Material Compatibility

- 21.4.5. Battery Type

- 21.4.6. Temperature Control

- 21.4.7. Price Range

- 21.4.8. Distribution Channel

- 21.4.9. Usage Type

- 21.4.10. Applications

- 21.4.11. End-Users

- 21.5. Egypt Cannabis Vaporizer Market

- 21.5.1. Country Segmental Analysis

- 21.5.2. Product Type

- 21.5.3. Technology

- 21.5.4. Material Compatibility

- 21.5.5. Battery Type

- 21.5.6. Temperature Control

- 21.5.7. Price Range

- 21.5.8. Distribution Channel

- 21.5.9. Usage Type

- 21.5.10. Applications

- 21.5.11. End-Users

- 21.6. Nigeria Cannabis Vaporizer Market

- 21.6.1. Country Segmental Analysis

- 21.6.2. Product Type

- 21.6.3. Technology

- 21.6.4. Material Compatibility

- 21.6.5. Battery Type

- 21.6.6. Temperature Control

- 21.6.7. Price Range

- 21.6.8. Distribution Channel

- 21.6.9. Usage Type

- 21.6.10. Applications

- 21.6.11. End-Users

- 21.7. Algeria Cannabis Vaporizer Market

- 21.7.1. Country Segmental Analysis

- 21.7.2. Product Type

- 21.7.3. Technology

- 21.7.4. Material Compatibility

- 21.7.5. Battery Type

- 21.7.6. Temperature Control

- 21.7.7. Price Range

- 21.7.8. Distribution Channel

- 21.7.9. Usage Type

- 21.7.10. Applications

- 21.7.11. End-Users

- 21.8. Rest of Africa Cannabis Vaporizer Market

- 21.8.1. Country Segmental Analysis

- 21.8.2. Product Type

- 21.8.3. Technology

- 21.8.4. Material Compatibility

- 21.8.5. Battery Type

- 21.8.6. Temperature Control

- 21.8.7. Price Range

- 21.8.8. Distribution Channel

- 21.8.9. Usage Type

- 21.8.10. Applications

- 21.8.11. End-Users

- 22. South America Cannabis Vaporizer Market Analysis

- 22.1. Key Segment Analysis

- 22.2. Regional Snapshot

- 22.3. Central and South Africa Cannabis Vaporizer Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 22.3.1. Product Type

- 22.3.2. Technology

- 22.3.3. Material Compatibility

- 22.3.4. Battery Type

- 22.3.5. Temperature Control

- 22.3.6. Price Range

- 22.3.7. Distribution Channel

- 22.3.8. Usage Type

- 22.3.9. Applications

- 22.3.10. End-Users

- 22.3.11. Country

- 22.3.11.1. Brazil

- 22.3.11.2. Argentina

- 22.3.11.3. Rest of South America

- 22.4. Brazil Cannabis Vaporizer Market

- 22.4.1. Country Segmental Analysis

- 22.4.2. Product Type

- 22.4.3. Technology

- 22.4.4. Material Compatibility

- 22.4.5. Battery Type

- 22.4.6. Temperature Control

- 22.4.7. Price Range

- 22.4.8. Distribution Channel

- 22.4.9. Usage Type

- 22.4.10. Applications

- 22.4.11. End-Users

- 22.5. Argentina Cannabis Vaporizer Market

- 22.5.1. Country Segmental Analysis

- 22.5.2. Product Type

- 22.5.3. Technology

- 22.5.4. Material Compatibility

- 22.5.5. Battery Type

- 22.5.6. Temperature Control

- 22.5.7. Price Range

- 22.5.8. Distribution Channel

- 22.5.9. Usage Type

- 22.5.10. Applications

- 22.5.11. End-Users

- 22.6. Rest of South America Cannabis Vaporizer Market

- 22.6.1. Country Segmental Analysis

- 22.6.2. Product Type

- 22.6.3. Technology

- 22.6.4. Material Compatibility

- 22.6.5. Battery Type

- 22.6.6. Temperature Control

- 22.6.7. Price Range

- 22.6.8. Distribution Channel

- 22.6.9. Usage Type

- 22.6.10. Applications

- 22.6.11. End-Users

- 23. Key Players/ Company Profile

- 23.1. Airistech

- 23.1.1. Company Details/ Overview

- 23.1.2. Company Financials

- 23.1.3. Key Customers and Competitors

- 23.1.4. Business/ Industry Portfolio

- 23.1.5. Product Portfolio/ Specification Details

- 23.1.6. Pricing Data

- 23.1.7. Strategic Overview

- 23.1.8. Recent Developments

- 23.2. Aphria

- 23.3. Arizer

- 23.4. Aurora Cannabis

- 23.5. Boundless Technology

- 23.6. Davinci Vaporizer

- 23.7. Dr. Dabber

- 23.8. Firefly

- 23.9. Grenco Science

- 23.10. Haze Technologies

- 23.11. Healthy Rips

- 23.12. Kandypens

- 23.13. Linx Vapor

- 23.14. Magic Flight

- 23.15. PAX Labs

- 23.16. Pulsar Vaporizers

- 23.17. Storz & Bickel

- 23.18. VapeXhale

- 23.19. Vapium

- 23.20. VUBER Technologies

- 23.21. Yocan

- 23.22. ZEUS Arsenal

- 23.23. Other Key Players

- 23.1. Airistech

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data