Defence Modernization Market Size, Share & Trends Analysis Report by Platform (Aircraft (Manned and Unmanned), Naval Vessels & Submarines, Ground Vehicles & Armored Platforms, Missiles & Launchers, Space Platforms, Fixed and Mobile C4ISR Stations and Others), Technology, Solution Type, Deployment Mode/ Contract Type, Service/ Offering, End User and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

Market Structure & Evolution |

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Defence Modernization Market Size, Share, and Growth

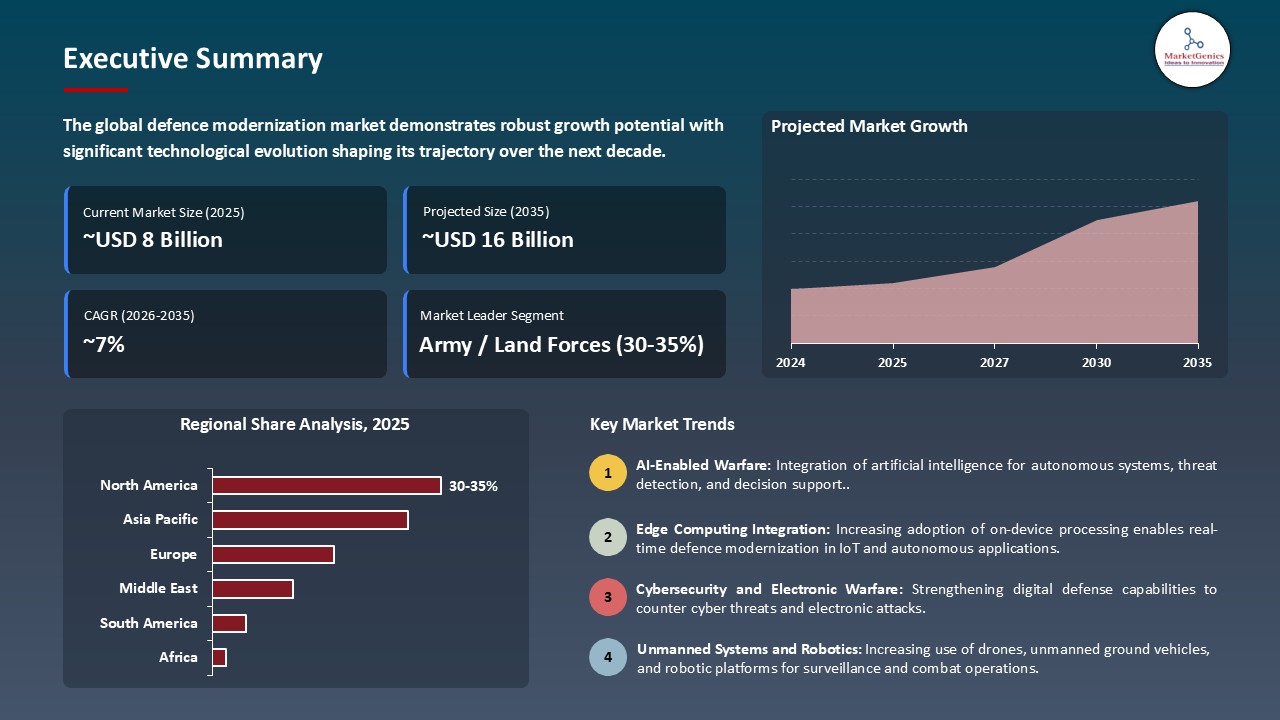

The global defence modernization market is experiencing robust growth, with its estimated value of USD 8.1 billion in the year 2025 and USD 16.2 billion by the period 2035, registering a CAGR of 7.1% during the forecast period.

Rajnath Singh, the Minister of Defence of India, stated, "In future multi-domain defence architectures, AI command systems will be able to understand the commander’s intent and autonomously synchronize sensor-to-shooter operations in the land, sea, air, cyber, and space domains."

There is worldwide growth in the defence modernization market which is driven by multiple factors impacting how militaries equip themselves. In 2025, there is an organizational trend toward advanced C4ISR, to include autonomous systems, as nations are incorporating the use of artificial intelligence and sensor-fusion technologies in their platforms to allow for faster decision making and enhanced awareness on the battlefield.

For example, in June 2025, a large defence prime announced a next-generation ground-combat vehicle featuring optional manning, an AI-enabled target recognition tool, and a digital architecture, reinforcing that armies are pursuing platforms that can adjust to the hybrid warfare environment.

Exponentially increasing geopolitical tensions and increasing military procurements are also driving demand. Countries are rapidly replacing ageing platforms with highly sophisticated systems of systems across land, sea, air and cyber. Regulatory and alliance systems are also a factor. Standards for interoperability among allied forces and freight plans for resilient supply chains are driving defence organizations and manufacturers to purchase modular, upgradeable architectures.

Together, technological innovation, procurement momentum, and strategic demand are driving defence modernization forward to provide enhanced capabilities for national security and new revenue streams for military equipment suppliers.

Further, there are many adjacent opportunities: companies are diversifying into unmanned and optionally-manned vehicles, battlefield-network and situational-awareness software, advanced armor and protective systems for soldiers, and real-time health-monitoring and maintenance of platforms. These adjacent markets enable manufacturers to round out their defence-modernization portfolios and harvest more value across the lifecycle of modern military capabilities.

Defence Modernization Market Dynamics and Trends

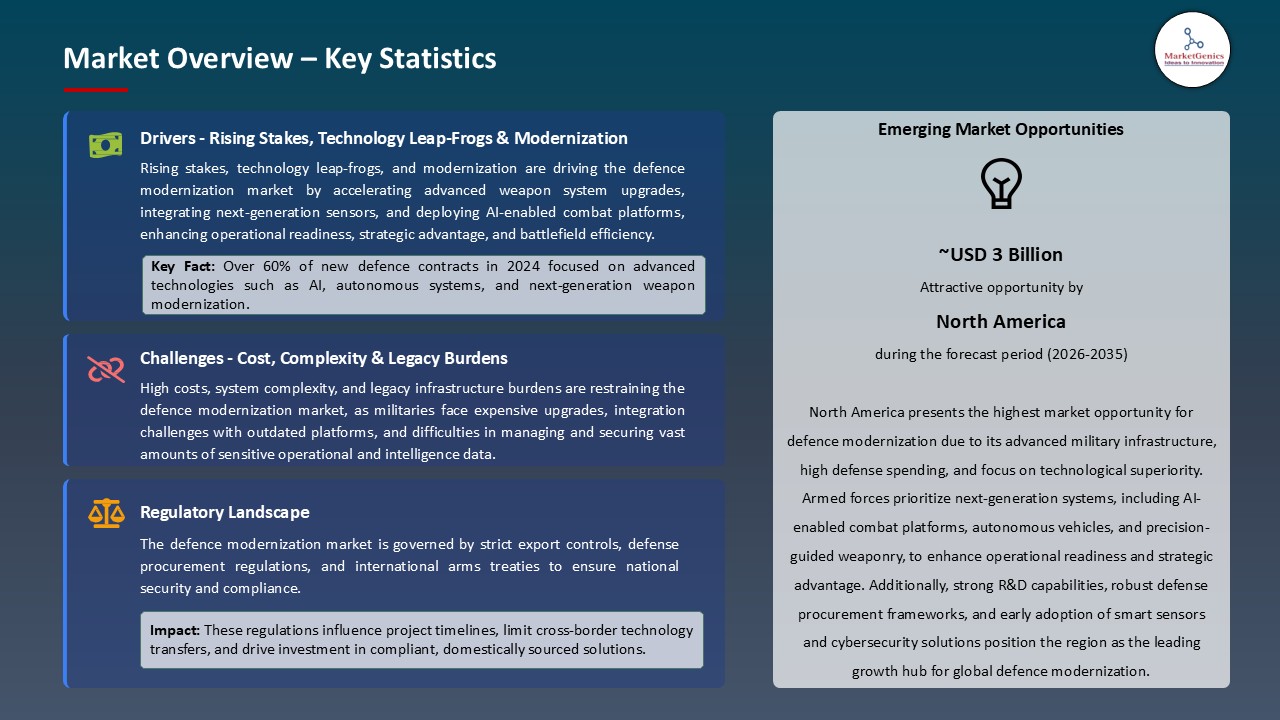

Driver: Rising Stakes, Technology Leap‑Frogs & Modernization Fueling Defence Modernization Market Growth

- Global defence budgets are on the rise attributed to increased geopolitical tensions and great-power competition. For instance, Germany will spend 3.5% of GDP on defence by 2029 as part of a EUR 100 billion modernization fund.

- Militaries are quickly replacing old equipment with systems that incorporate artificial intelligence, unmanned/autonomous capabilities, and sensor-fusion networks. For example, India's defence budget from 2025-26 will be approximately ₹6.81 lakh crore (~US$79 billion) with an emphasis on capital acquisitions and domestic production.

- The push for indigenous manufacturing and self-reliance (e.g., "Atmanirbhar" initiatives in India) is also fast-tracking the acquisition of modern systems from domestic markets to build new supply chains and defence-industrial bases.

Restraint: Cost, Complexity & Legacy Burdens Limiting Uptake and Widespread Adoption

- The expense associated with current defence technologies is still astoundingly high; research and development, procurement, integration (within AI, autonomy, sensors), along with lifecycle sustainment, all add to the costs. Many nations fail to sufficiently fund their capital expenditures. In some cases, even when an increase in budgets occurs, some expense remains unspent, either due to funding bloat or bureaucratic limitations.

- The technical and organizational issues associated with each platform for integration into existing force structures, especially to maintain interoperability in multi‑domain operations, are significant for many nations. New capabilities are also often incorporated into legacy systems, requiring upgrade; for example, using unmanned systems in conjunction with crewed platforms, or upgrading older battle tanks.

- Rapid obsolescence of new technologies, supply-chain vulnerabilities or issues with export‑licensing and regulatory (especially for dual‑use technology or foreign sourcing), limit the potential for widespread deployment of new capabilities and technologies.

Opportunity: Emerging Domains & Adjacent Ecosystems

- Modernization efforts are enabling substantial adjacent markets, such as unmanned/optionally-manned vehicles, battlefield and situational awareness networks and systems, advanced protection and sensor systems, logistics, and maintenance support. India's emphasis on domestic industry and technology transfer provide entry points for the private sector to engage in defense R&D and manufacture.

- Emerging regions- (the Asia-Pacific, Middle East and Africa) are realizing the need to invest in modern defense capabilities as opposed to investing in legacy platforms. This leads to potential growth markets for manufacturers and integrators outside of the traditional western markets.

- Cross-domain partnerships (hardware + software + services) will be increasingly important. Modular vehicle platforms or systems that can be upgraded will also provide opportunities for organizations to upgrade analytics capabilities opposed to full vehicle replacement, producing lifecycle revenues.

- Export markets for modernization packages (software and technology solution upgrade kits, sensor enhancements and upgrades, networked communications and connectivity) allow defense manufacturers to monetize improvements to old fleets that need modernization, to leapfrog capabilities.

Key Trend: Shift Towards Modularity, Autonomy & Data‑Driven Warfare aiding Defence Modernization Industry

- Defence modernization market is performed on the edge is becoming more commonplace in real-time, high-reliability, and privacy-sensitive industries such as autonomous vehicles and robots. 3D vision is paired with LiDAR as the sensing modality of choice for autonomous navigation, robots, AR/VR applications, and industrial inspection so that the system can perceive depth and motion more accurately.

- Additionally, multimodal AI systems, which combine vision (e.g., cameras) with audio, thermal, or radar sensors, are increasingly being adopted in autonomous systems and security applications. Self-supervised learning, synthetic data, and transfer learning, have reduced the reliance on large annotated datasets, enabling faster deployment and greater system robustness.

- Likewise, explainable AI, and ethical computer vision, particularly for surveillance, medical imaging, and autonomous vehicles are growing areas of interest for increasing trust and regulatory compliance.

Defence modernization Market Analysis and Segmental Data

“Army / Land Forces Maintain Dominance in Global Defence Modernization Market amid Rising Geopolitical Tensions and Technological Upgrades"

- Main battle tanks and armored combat vehicles have continued to attract the highest demand in the army/ land forces category, since they represent the foundation of land operations and they are important to maintaining relative advantage and superiority above others on the ground. The latest technologies in modular design, AI-based targeting systems, and active protection systems have improved survivability, increased mobility, and enhanced combat.

- For example, in 2025, the U.S. Army is focusing on platform future prototypes such as the M1E3 that will have initiatives that take advantage of a hybrid electric drive and new AI-based systems. While nations respond to emerging threats and increased complexity in multi-domain operations, many are modernizing older fleets with lighter and more agile AI-enabled platforms.

- Defence manufacturers are actively pursuing autonomous ground vehicles and integrating modular capabilities with next-generation networked command-and-control systems to improve mission planning, enhance situational awareness, and ultimately facilitate faster decision-making. The growing focus on digital warfare, autonomous robotics, and predictive maintenance will continue to promote and encourage faster adoption among global armies.

“Strengthened Army and Land Force Capabilities Elevating North American Market Demand"

- The North America defence modernization market is going through large expansion, while countries remain committed to investment into upgrading army and land-force capabilities. The U.S. Department of Defense is advocating an investment of billions in its 2025 budget for modernization programs including the Next-Generation Combat Vehicle (NGCV) initiative, the upgrade of existing main battle tanks, and battlefield management systems enabled through artificial intelligence to perpetuate technological dominance and operational readiness.

- Increasing geopolitical struggle and the need to sustain quick deployment and multi-domain operational capabilities are enhancing modernization initiatives of both active and reserve units. In Canada, for example, the armored vehicle fleet is being expanded through the acquisition of modernized LAV 6 with improved protection and communications systems to enhance troop mobility and survivability.

- Additionally, commanders are incorporating autonomous ground vehicles, unmanned reconnaissance systems, and networked command-and-control systems to improve situational awareness and decisions efficiency. These developments, combined with increased defence budgets and existing technology, are improving the North American land force structure and driving higher demand in the regional defence modernization industry.

Defence-Modernization-Market Ecosystem

The global defence modernization market is moderately consolidated; leaders such as Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, Thales Group, General Dynamics Corporation and Leonardo S.p.A. use their dominance to apply advanced technologies like sensor-fusion, AI-enabled autonomy and network-centric systems. These dominant firms drive the market and define it by mixing several decades of defence heritage with next-generation capabilities across land, air, sea and cyber domains.

These players emphasize niche and specialized technologies: to provide an example, Leonard's new edge-AI software platform SAGEcore (launched October 2025) aims to provide ruggedized real-time threat detection and decision-support capabilities for tactical vehicles and airborne platforms. The drive for modular ground combat vehicles, unmanned systems and cyber resilient communications highlights how innovation is targeting capability gaps. In addition, government agencies, research institutes and R&D agencies all play an important role in generating momentum.

Companies are also entering markets with overlapping products and services that enhance productivity and operational efficiency; product diversification ranges from enhanced ground platforms and sensor suites to network logistics solutions and training systems. In June 2025, Leonardo S.p.A. introduced its new BriteStorm electronic-warfare jamming solution - underlining how AI, autonomy and integration align with defence modernization.

This confluence of market consolidation, advanced innovation, government/institutional R&D, portfolio expansion, and technology evolution demonstrate why land-force and multi-domain modernization underpin the global defence modernization market.

Recent Development and Strategic Overview:

- In May 2025, Northrop Grumman Corporation showcased its MantaRay Large Uncrewed Undersea Vehicle (UUV) as part of the DARPA parenting autonomy program. The MantaRay uses AI-enabled navigation and modular payloads to conduct long-endurance missions in surveillance, reconnaissance, and logistic resupply, thereby improving autonomy under the water's surface without consistent human control.

- In July 2025, BAE Systems plc launched its Strix Uncrewed Aerial System (UAS), developed with Innovaero in Australia. Strix is characterized by AI-supported flight control capability, real-time threat detection, and autonomous targeting to support land and naval operational plans; it can also provide flexible and rapid-deployment air support in locations not prepared for air operations, marking a move forward in battlefield modernization.

Report Scope

|

Attribute |

Detail |

|

Market Size in 2025 |

USD 8.1 Bn |

|

Market Forecast Value in 2035 |

USD 16.2 Bn |

|

Growth Rate (CAGR) |

7.1% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

USD Bn for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

Regions and Countries Covered |

|||||

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Defence-Modernization-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Defence Modernization Market, By Platform |

|

|

Defence Modernization Market, By Technology |

|

|

Defence Modernization Market, By Solution Type |

|

|

Defence Modernization Market, By Deployment Mode/ Contract Type |

|

|

Defence Modernization Market, By Service/ Offering |

|

|

Defence Modernization Market, By End User |

|

Frequently Asked Questions

The global defence modernization market was valued at USD 8.1 Bn in 2025

The global defence modernization market industry is expected to grow at a CAGR of 7.1% from 2026 to 2035

Rising geopolitical tensions, technological advancements in AI and autonomy, ageing military fleets, and increased defence budgets are the key factors driving demand in the defence modernization market.

In terms of end user, the army / land forces segment accounted for the major share in 2025.

North America is the more attractive region for vendors.

Key players in the global defence modernization market include prominent companies such as Airbus Defence and Space, BAE Systems plc, Boeing Defence, Space & Security, Dassault Aviation, Elbit Systems Ltd., General Dynamics Corporation, Honeywell International Inc., Huntington Ingalls Industries, Israel Aerospace Industries (IAI), L3Harris Technologies, Inc., Leonardo S.p.A., Lockheed Martin Corporation, Mitsubishi Heavy Industries Ltd., Northrop Grumman Corporation, Raytheon Technologies Corporation, Rheinmetall AG, Rolls-Royce Holdings plc, Saab AB, Textron Inc., Thales Group, along with several other key players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Defence Modernization Market Outlook

- 2.1.1. Global Defence Modernization Market Size (Value - USD Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Defence Modernization Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Information Technology & Media Industry Overview, 2025

- 3.1.1. Information Technology & Media Industry Analysis

- 3.1.2. Key Trends for Information Technology & Media Industry

- 3.1.3. Regional Distribution for Information Technology & Media Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Raw Material Analysis

- 3.1. Global Information Technology & Media Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Integration of AI, robotics, and advanced sensors enhances battlefield awareness and decision-making capabilities

- 4.1.1.2. Increasing government investments and defense budgets accelerate adoption of next-generation military technologies

- 4.1.1.3. Rising geopolitical tensions and cross-border threats drive demand for modernized defense infrastructure and systems

- 4.1.2. Restraints

- 4.1.2.1. Cost, Complexity & Legacy Burdens Limiting Uptake and Widespread Adoption

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Defence Modernization Market Demand

- 4.9.1. Historical Market Size - (Value - USD Bn), 2021-2024

- 4.9.2. Current and Future Market Size - (Value - USD Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Defence Modernization Market Analysis, by Platform

- 6.1. Key Segment Analysis

- 6.2. Global Defence Modernization Market Size (Value - USD Bn), Analysis, and Forecasts, by Platform, 2021-2035

- 6.2.1. Aircraft (manned, unmanned)

- 6.2.2. Naval Vessels & Submarines

- 6.2.3. Ground Vehicles & Armored Platforms

- 6.2.4. Missiles & Launchers

- 6.2.5. Space Platforms

- 6.2.6. Fixed and Mobile C4ISR Stations

- 6.2.7. Others

- 7. Global Defence Modernization Market Analysis, by Technology

- 7.1. Key Segment Analysis

- 7.2. Global Defence Modernization Market Size (Value - USD Bn), Analysis, and Forecasts, by Technology, 2021-2035

- 7.2.1. Artificial Intelligence & Machine Learning

- 7.2.2. Robotics & Autonomy

- 7.2.3. Sensors & EO/IR/Radar Systems

- 7.2.4. Hypersonics

- 7.2.5. Quantum Technologies

- 7.2.6. Directed Energy Weapons (DEW)

- 7.2.7. Advanced Materials & Stealth Technologies

- 7.2.8. Others

- 8. Global Defence Modernization Market Analysis, by Solution Type

- 8.1. Key Segment Analysis

- 8.2. Global Defence Modernization Market Size (Value - USD Bn), Analysis, and Forecasts, Solution Type, 2021-2035

- 8.2.1. Systems Integration & Modernization Programs

- 8.2.2. New Platform Procurement

- 8.2.3. Upgrade & Retrofit Packages

- 8.2.4. Simulation, Training & Synthetic Environments

- 8.2.5. MRO (Maintenance, Repair & Overhaul) Services

- 8.2.6. Others

- 9. Global Defence Modernization Market Analysis, by Deployment Mode / Contract Type

- 9.1. Key Segment Analysis

- 9.2. Global Defence Modernization Market Size (Value - USD Bn), Analysis, and Forecasts, by Deployment Mode / Contract Type, 2021-2035

- 9.2.1. Government-to-Government (G2G) / Foreign Military Sales

- 9.2.2. Prime Contractor / OEM Deliveries

- 9.2.3. Defense Offsets & Local Production Partnerships

- 9.2.4. Public-Private Partnerships (PPP)

- 9.2.5. Others

- 10. Global Defence Modernization Market Analysis, by Service/ Offering

- 10.1. Key Segment Analysis

- 10.2. Global Defence Modernization Market Size (Value - USD Bn), Analysis, and Forecasts, by Service/ Offering, 2021-2035

- 10.2.1. Systems Engineering & Integration

- 10.2.2. Cyber Operations & Vulnerability Assessment

- 10.2.3. Intelligence & Data Analytics Services

- 10.2.4. Training, Simulation & Mission Support

- 10.2.5. Logistics, Spare Parts & Sustainment

- 10.2.6. Others

- 11. Global Defence Modernization Market Analysis, by End User

- 11.1. Key Segment Analysis

- 11.2. Global Defence Modernization Market Size (Value - USD Bn), Analysis, and Forecasts, by End User, 2021-2035

- 11.2.1. Army / Land Forces

- 11.2.2. Air Force / Aerospace Commands

- 11.2.3. Navy / Marine Forces

- 11.2.4. Special Forces & Strategic Commands

- 11.2.5. Homeland Security & Border Agencies

- 11.2.6. Others

- 12. Global Defence Modernization Market Analysis and Forecasts, by Region

- 12.1. Key Findings

- 12.2. Global Defence Modernization Market Size (Value - USD Bn), Analysis, and Forecasts, by Region, 2021-2035

- 12.2.1. North America

- 12.2.2. Europe

- 12.2.3. Asia Pacific

- 12.2.4. Middle East

- 12.2.5. Africa

- 12.2.6. South America

- 13. North America Defence Modernization Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. North America Defence Modernization Market Size (Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 13.3.1. Platform

- 13.3.2. Technology

- 13.3.3. Solution Type

- 13.3.4. Deployment Mode / Contract Type

- 13.3.5. Service/ Offering

- 13.3.6. End User

- 13.3.7. Country

- 13.3.7.1. USA

- 13.3.7.2. Canada

- 13.3.7.3. Mexico

- 13.4. USA Defence Modernization Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Platform

- 13.4.3. Technology

- 13.4.4. Solution Type

- 13.4.5. Deployment Mode / Contract Type

- 13.4.6. Service/ Offering

- 13.4.7. End User

- 13.5. Canada Defence Modernization Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Platform

- 13.5.3. Technology

- 13.5.4. Solution Type

- 13.5.5. Deployment Mode / Contract Type

- 13.5.6. Service/ Offering

- 13.5.7. End User

- 13.6. Mexico Defence Modernization Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Platform

- 13.6.3. Technology

- 13.6.4. Solution Type

- 13.6.5. Deployment Mode / Contract Type

- 13.6.6. Service/ Offering

- 13.6.7. End User

- 14. Europe Defence Modernization Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. Europe Defence Modernization Market Size (Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Platform

- 14.3.2. Technology

- 14.3.3. Solution Type

- 14.3.4. Deployment Mode / Contract Type

- 14.3.5. Service/ Offering

- 14.3.6. End User

- 14.3.7. Country

- 14.3.7.1. Germany

- 14.3.7.2. United Kingdom

- 14.3.7.3. France

- 14.3.7.4. Italy

- 14.3.7.5. Spain

- 14.3.7.6. Netherlands

- 14.3.7.7. Nordic Countries

- 14.3.7.8. Poland

- 14.3.7.9. Russia & CIS

- 14.3.7.10. Rest of Europe

- 14.4. Germany Defence Modernization Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Platform

- 14.4.3. Technology

- 14.4.4. Solution Type

- 14.4.5. Deployment Mode / Contract Type

- 14.4.6. Service/ Offering

- 14.4.7. End User

- 14.5. United Kingdom Defence Modernization Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Platform

- 14.5.3. Technology

- 14.5.4. Solution Type

- 14.5.5. Deployment Mode / Contract Type

- 14.5.6. Service/ Offering

- 14.5.7. End User

- 14.6. France Defence Modernization Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Platform

- 14.6.3. Technology

- 14.6.4. Solution Type

- 14.6.5. Deployment Mode / Contract Type

- 14.6.6. Service/ Offering

- 14.6.7. End User

- 14.7. Italy Defence Modernization Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Platform

- 14.7.3. Technology

- 14.7.4. Solution Type

- 14.7.5. Deployment Mode / Contract Type

- 14.7.6. Service/ Offering

- 14.7.7. End User

- 14.8. Spain Defence Modernization Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Platform

- 14.8.3. Technology

- 14.8.4. Solution Type

- 14.8.5. Deployment Mode / Contract Type

- 14.8.6. Service/ Offering

- 14.8.7. End User

- 14.9. Netherlands Defence Modernization Market

- 14.9.1. Country Segmental Analysis

- 14.9.2. Platform

- 14.9.3. Technology

- 14.9.4. Solution Type

- 14.9.5. Deployment Mode / Contract Type

- 14.9.6. Service/ Offering

- 14.9.7. End User

- 14.10. Nordic Countries Defence Modernization Market

- 14.10.1. Country Segmental Analysis

- 14.10.2. Platform

- 14.10.3. Technology

- 14.10.4. Solution Type

- 14.10.5. Deployment Mode / Contract Type

- 14.10.6. Service/ Offering

- 14.10.7. End User

- 14.11. Poland Defence Modernization Market

- 14.11.1. Country Segmental Analysis

- 14.11.2. Platform

- 14.11.3. Technology

- 14.11.4. Solution Type

- 14.11.5. Deployment Mode / Contract Type

- 14.11.6. Service/ Offering

- 14.11.7. End User

- 14.12. Russia & CIS Defence Modernization Market

- 14.12.1. Country Segmental Analysis

- 14.12.2. Platform

- 14.12.3. Technology

- 14.12.4. Solution Type

- 14.12.5. Deployment Mode / Contract Type

- 14.12.6. Service/ Offering

- 14.12.7. End User

- 14.13. Rest of Europe Defence Modernization Market

- 14.13.1. Country Segmental Analysis

- 14.13.2. Platform

- 14.13.3. Technology

- 14.13.4. Solution Type

- 14.13.5. Deployment Mode / Contract Type

- 14.13.6. Service/ Offering

- 14.13.7. End User

- 15. Asia Pacific Defence Modernization Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Asia Pacific Defence Modernization Market Size (Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Platform

- 15.3.2. Technology

- 15.3.3. Solution Type

- 15.3.4. Deployment Mode / Contract Type

- 15.3.5. Service/ Offering

- 15.3.6. End User

- 15.3.7. Country

- 15.3.7.1. China

- 15.3.7.2. India

- 15.3.7.3. Japan

- 15.3.7.4. South Korea

- 15.3.7.5. Australia and New Zealand

- 15.3.7.6. Indonesia

- 15.3.7.7. Malaysia

- 15.3.7.8. Thailand

- 15.3.7.9. Vietnam

- 15.3.7.10. Rest of Asia-Pacific

- 15.4. China Defence Modernization Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Platform

- 15.4.3. Technology

- 15.4.4. Solution Type

- 15.4.5. Deployment Mode / Contract Type

- 15.4.6. Service/ Offering

- 15.4.7. End User

- 15.5. India Defence Modernization Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Platform

- 15.5.3. Technology

- 15.5.4. Solution Type

- 15.5.5. Deployment Mode / Contract Type

- 15.5.6. Service/ Offering

- 15.5.7. End User

- 15.6. Japan Defence Modernization Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Platform

- 15.6.3. Technology

- 15.6.4. Solution Type

- 15.6.5. Deployment Mode / Contract Type

- 15.6.6. Service/ Offering

- 15.6.7. End User

- 15.7. South Korea Defence Modernization Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Platform

- 15.7.3. Technology

- 15.7.4. Solution Type

- 15.7.5. Deployment Mode / Contract Type

- 15.7.6. Service/ Offering

- 15.7.7. End User

- 15.8. Australia and New Zealand Defence Modernization Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Platform

- 15.8.3. Technology

- 15.8.4. Solution Type

- 15.8.5. Deployment Mode / Contract Type

- 15.8.6. Service/ Offering

- 15.8.7. End User

- 15.9. Indonesia Defence Modernization Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Platform

- 15.9.3. Technology

- 15.9.4. Solution Type

- 15.9.5. Deployment Mode / Contract Type

- 15.9.6. Service/ Offering

- 15.9.7. End User

- 15.10. Malaysia Defence Modernization Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Platform

- 15.10.3. Technology

- 15.10.4. Solution Type

- 15.10.5. Deployment Mode / Contract Type

- 15.10.6. Service/ Offering

- 15.10.7. End User

- 15.11. Thailand Defence Modernization Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Platform

- 15.11.3. Technology

- 15.11.4. Solution Type

- 15.11.5. Deployment Mode / Contract Type

- 15.11.6. Service/ Offering

- 15.11.7. End User

- 15.12. Vietnam Defence Modernization Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Platform

- 15.12.3. Technology

- 15.12.4. Solution Type

- 15.12.5. Deployment Mode / Contract Type

- 15.12.6. Service/ Offering

- 15.12.7. End User

- 15.13. Rest of Asia Pacific Defence Modernization Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Platform

- 15.13.3. Technology

- 15.13.4. Solution Type

- 15.13.5. Deployment Mode / Contract Type

- 15.13.6. Service/ Offering

- 15.13.7. End User

- 16. Middle East Defence Modernization Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Middle East Defence Modernization Market Size (Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Platform

- 16.3.2. Technology

- 16.3.3. Solution Type

- 16.3.4. Deployment Mode / Contract Type

- 16.3.5. Service/ Offering

- 16.3.6. End User

- 16.3.7. Country

- 16.3.7.1. Turkey

- 16.3.7.2. UAE

- 16.3.7.3. Saudi Arabia

- 16.3.7.4. Israel

- 16.3.7.5. Rest of Middle East

- 16.4. Turkey Defence Modernization Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Platform

- 16.4.3. Technology

- 16.4.4. Solution Type

- 16.4.5. Deployment Mode / Contract Type

- 16.4.6. Service/ Offering

- 16.4.7. End User

- 16.5. UAE Defence Modernization Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Platform

- 16.5.3. Technology

- 16.5.4. Solution Type

- 16.5.5. Deployment Mode / Contract Type

- 16.5.6. Service/ Offering

- 16.5.7. End User

- 16.6. Saudi Arabia Defence Modernization Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Platform

- 16.6.3. Technology

- 16.6.4. Solution Type

- 16.6.5. Deployment Mode / Contract Type

- 16.6.6. Service/ Offering

- 16.6.7. End User

- 16.7. Israel Defence Modernization Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Platform

- 16.7.3. Technology

- 16.7.4. Solution Type

- 16.7.5. Deployment Mode / Contract Type

- 16.7.6. Service/ Offering

- 16.7.7. End User

- 16.8. Rest of Middle East Defence Modernization Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Platform

- 16.8.3. Technology

- 16.8.4. Solution Type

- 16.8.5. Deployment Mode / Contract Type

- 16.8.6. Service/ Offering

- 16.8.7. End User

- 17. Africa Defence Modernization Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Africa Defence Modernization Market Size (Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Platform

- 17.3.2. Technology

- 17.3.3. Solution Type

- 17.3.4. Deployment Mode / Contract Type

- 17.3.5. Service/ Offering

- 17.3.6. End User

- 17.3.7. Country

- 17.3.7.1. South Africa

- 17.3.7.2. Egypt

- 17.3.7.3. Nigeria

- 17.3.7.4. Algeria

- 17.3.7.5. Rest of Africa

- 17.4. South Africa Defence Modernization Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Platform

- 17.4.3. Technology

- 17.4.4. Solution Type

- 17.4.5. Deployment Mode / Contract Type

- 17.4.6. Service/ Offering

- 17.4.7. End User

- 17.5. Egypt Defence Modernization Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Platform

- 17.5.3. Technology

- 17.5.4. Solution Type

- 17.5.5. Deployment Mode / Contract Type

- 17.5.6. Service/ Offering

- 17.5.7. End User

- 17.6. Nigeria Defence Modernization Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Platform

- 17.6.3. Technology

- 17.6.4. Solution Type

- 17.6.5. Deployment Mode / Contract Type

- 17.6.6. Service/ Offering

- 17.6.7. End User

- 17.7. Algeria Defence Modernization Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Platform

- 17.7.3. Technology

- 17.7.4. Solution Type

- 17.7.5. Deployment Mode / Contract Type

- 17.7.6. Service/ Offering

- 17.7.7. End User

- 17.8. Rest of Africa Defence Modernization Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Platform

- 17.8.3. Technology

- 17.8.4. Solution Type

- 17.8.5. Deployment Mode / Contract Type

- 17.8.6. Service/ Offering

- 17.8.7. End User

- 18. South America Defence Modernization Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. South America Defence Modernization Market Size (Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Platform

- 18.3.2. Technology

- 18.3.3. Solution Type

- 18.3.4. Deployment Mode / Contract Type

- 18.3.5. Service/ Offering

- 18.3.6. End User

- 18.3.7. Country

- 18.3.7.1. Brazil

- 18.3.7.2. Argentina

- 18.3.7.3. Rest of South America

- 18.4. Brazil Defence Modernization Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Platform

- 18.4.3. Technology

- 18.4.4. Solution Type

- 18.4.5. Deployment Mode / Contract Type

- 18.4.6. Service/ Offering

- 18.4.7. End User

- 18.5. Argentina Defence Modernization Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Platform

- 18.5.3. Technology

- 18.5.4. Solution Type

- 18.5.5. Deployment Mode / Contract Type

- 18.5.6. Service/ Offering

- 18.5.7. End User

- 18.6. Rest of South America Defence Modernization Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Platform

- 18.6.3. Technology

- 18.6.4. Solution Type

- 18.6.5. Deployment Mode / Contract Type

- 18.6.6. Service/ Offering

- 18.6.7. End User

- 19. Key Players/ Company Profile

- 19.1. Airbus Defence and Space

- 19.1.1. Company Details/ Overview

- 19.1.2. Company Financials

- 19.1.3. Key Customers and Competitors

- 19.1.4. Business/ Industry Portfolio

- 19.1.5. Product Portfolio/ Specification Details

- 19.1.6. Pricing Data

- 19.1.7. Strategic Overview

- 19.1.8. Recent Developments

- 19.2. BAE Systems plc

- 19.3. Boeing Defence, Space & Security

- 19.4. Dassault Aviation

- 19.5. Elbit Systems Ltd.

- 19.6. General Dynamics Corporation

- 19.7. Honeywell International Inc.

- 19.8. Huntington Ingalls Industries

- 19.9. Israel Aerospace Industries (IAI)

- 19.10. L3Harris Technologies, Inc.

- 19.11. Leonardo S.p.A.

- 19.12. Lockheed Martin Corporation

- 19.13. Mitsubishi Heavy Industries Ltd.

- 19.14. Northrop Grumman Corporation

- 19.15. Raytheon Technologies Corporation

- 19.16. Rheinmetall AG

- 19.17. Rolls-Royce Holdings plc

- 19.18. Saab AB

- 19.19. Textron Inc.

- 19.20. Thales Group

- 19.21. Others Key Players

- 19.1. Airbus Defence and Space

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data