Demolition Robots Market Size, Share & Trends Analysis Report by Product Type (Mini Demolition Robots, Medium Demolition Robots, Large Demolition Robots), Robot Type, Control System, Payload Capacity, Sales Type, Application, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

Market Structure & Evolution |

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Demolition Robots Market Size, Share, and Growth

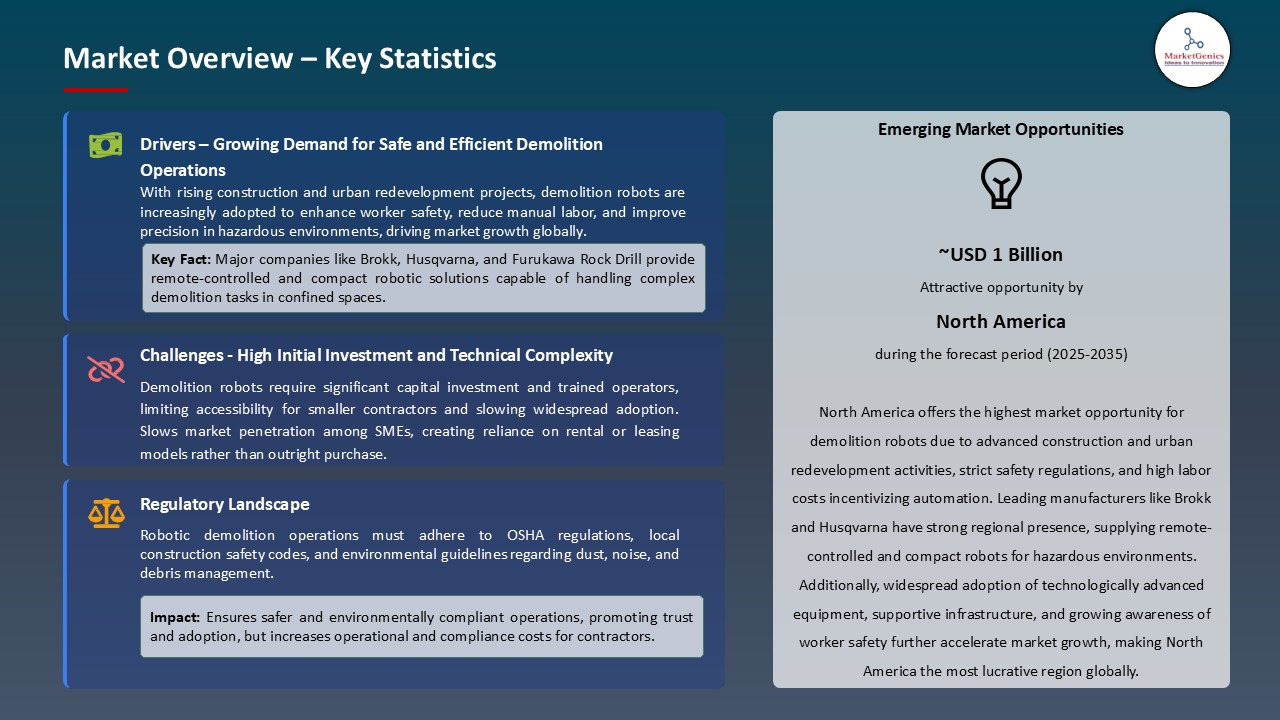

The global demolition robots market is experiencing robust growth, with its estimated value of USD 0.5 billion in the year 2025 and USD 1.7 billion by the period 2035, registering a CAGR of 12%. North America leads the market with a share of 62.3% with USD 0.3 billion revenue. The push to automation of the construction and demolition sector to make it safer and more precise is driving the demand of demolition robots. As an example of this shift in the industry, Husqvarna Construction introduced the DXR 95 in 2024, a compact remote-control demolition robot with special remote-controlled access to confined spaces.

In February 2025, Fujita Corporation, under the guidance of Executive Director Koichi Ueda, launched an AI-coordinated demolition system using collaborative robots (cobots) for precise dismantling of complex structures in earthquake-prone zones in Japan.

Further the increase in building redevelopment and aging infrastructure replacement is fueling the demand to find a robot based solution that would be able to cope with complex demolitions. In 2025, Brokk AB increased its line of electric demolition robots with new models offering increase in arm reach and new tool compatibility as the company looked to expand its line of demolition robots to meet the growing needs of infrastructure renewal projects around the world. The global market growth of demolition robots is already being accelerated by the increasing trends of infrastructure renewal and automation globally.

Robot construction equipment, autonomous mining machines, and remote-controlled fire fighting are the adjacent markets that are important opportunities in the global demolition robots market. The safety, precision and automation requirements in hazardous conditions are the same in these areas, creating opportunities related to cross-application of technology, strategic diversification as well as expansion through innovation. Proximity to high growth-potential automation economies boosts long-term scalability and research and development synergy among demolition robotmakers.

Demolition Robots Market Dynamics and Trends

Driver: Rising Labor Safety Concerns Accelerating Automation in Demolition Activities

- High-costriched concerns over worker safety in hazardous conditions are fueling the global demolition robots market with considerable impetus. Demolition procedures involving manual labor, in most cases, expose workers to unsafe and unfavorable situations like inhalation of dust, falling metal, and working in close contact with structurally unsound buildings. With governments imposing stronger occupational safety standards, the industry is fast shifting towards the use of remote-controlled demolition robots, whose operation is reduced to a minimum of human participation in hazardous works.

- In 2025, Brokk AB launched a modernized model of its Brokk 300 robot which had sophisticated operator interface systems that enabled it to be used remotely in hazardous areas of demolition through safe distances. The trend does not merely indicate adherence to the emerging safety standards but also conforms to the desire of most construction companies worldwide to use automated and AI-powered demolition systems to suppress the injury rates in worksite scenarios.

- The focus on occupational safety is fueling the investment in demolition robotics directly in hazardous industrial uses.

Restraint: High Initial Capital Investment and Integration Costs

- In spite of the great potentials, the initial cost of demolition robots, i.e., cost of purchase, cost of integration, cost of training etc., is a major barrier to small to mid-sized contractors. Depending on the needs powered by these capital-intensive equipment, there are often specialized operators, maintenance programs and retrofitting to suit the various demolition environments, which increase the overall cost of ownership.

- In 2024, Aegion Corporation, a U.S. based construction company, postponed further purchase of advanced demolition robotics equipment due to scarcity of funds allocation as the margin of infrastructure projects continued to narrow. These situations reveal the fact that price sensitivity and lack of modular financing schemes form an obstacle to penetrating the markets further, particularly in price-conscious and emerging markets. Even though the operational efficiency and long-term ROI are evident, the cost escalation during the onset is a hindrance in the accelerated adoption.

- The entry barrier to capital is also restricting the dimensional growth of the market by preventing the utilization of demolition robots by smaller contractors.

Opportunity: Integration of AI and IoT for Autonomous Demolition Systems

- The integration of Artificial Intelligence (AI) and Internet of Things (IoT) into demolition robotics introduces the possibility of transformation. With intelligent systems, structural integrity can be evaluated, sequence of demolitions optimized, and machine maintenance requirements forecasted which enhances overall productivity and minimizes downtime.

- In 2025, Husqvarna Construction collaborated with an AI technology company to launch a pilot program that would introduce autonomous-navigation capabilities to its DXR models to detect hazards and recalculate the path in real-time, when performing demolitions. Such intelligent features make the robots to run on little human control especially during intense demolitions in cities where a lot of precision is required.

- Furthermore, performance tracking and analytics can be used to make decisions using data analytics provided by the IOT sensors which is a strategic value add to construction companies in terms of digitalized asset management. The combination of AI and IoT is transforming the working abilities of the demolition robots to make them into smart assets in the construction ecosystems ready to accept and take on the future.

Key Trend: Growing Preference for Electrically Powered and Eco-Friendly Demolition Robots

- A developing trend affecting the market is the replacement of diesel-powered demolition robots to electrically operated ones. This transition is motivated by environmental concerns, noise provisions extensively used in the urban demolition, and the objectives of the construction industry in reducing the rate of carbon emission.

- As early as in the first half of 2025, Epiroc of Germany introduced its prestigious new-generation electric demolition robot range which is deployed on zero-emission basis and features quieter operation, a crucial feature when smashing inside the house or in sensitive locations. Such electric models are also characterized by energy efficiency and reduced cost of maintenance as compared to the conventional hydraulic system.

- This is a trend that enhances green building and is consistent with international ESG frameworks that are being popularized by both the business and the government infrastructural builders.

Demolition Robots Market Analysis and Segmental Data

Electrification Drives the Surge in Demand for Electric Demolition Robots

- The demand for the electric robots segment in the global demolition robots market is surging due to increasing urban demolition projects requiring low-emission, noise-sensitive, and energy-efficient solutions. Electric robots are ideal in indoor applications and environments subject to the control of stringent environmental regulations. In 2025, Epiroc released its electric option under the name SmartPower Electric Series, battery-powered demolition robots that can run longer and at a reduced operational cost in the sealed urban demolitions.

- The segment is also privileged by the trends in world sustainability and carbon-neutral operations within construction sites. Contractors prefer models that are electric, not only to adhere to the requirements of green buildings; these are considered since they do not require much maintenance and they occupy less ground. This transition is pressuring OEMs to increase electric product offering in a short time and invest in hybrid technology to improve productivity and flexibility.

- Increasing regulatory standards of compliance and sustainability are making electric demolition robots the key choice among the modern, low-impact demolition activities.

North America Maintains Strongest Regional Hold in Demolition Robots Market

- The North American region continues to hold the largest share in the global demolition robots market due to a combination of rapid technological adoption, established safety frameworks, and skilled labor shortages in construction and demolition sectors. In 2025, a Toronto-based, Priestly Demolition Inc. Canadian contractor used the robot-assisted version thereof: Brokk 520Ds to perform the precision dismantling of elevated rails.

- Also, federal infrastructure investments, especially through U.S. economic stimulus programs like the Infrastructure Investment and Jobs Act, are providing opportunities to repair and replace old buildings, building new markets for automated demolition equipment. Adding to the fact that the region has seen the introduction of electric and AI-powered robotics earlier, North America is also leading in the reform and investments in this industry.

- The strong support of the public infrastructure and the gradual adoption of technologies enables North America to remain at the forefront of the introduction and development of demolition robots.

Demolition Robots Market Ecosystem

The global demolition robots market is moderately consolidated, with a medium-to-high concentration of Tier 1 players such as Husqvarna Group, Brokk AB, and Epiroc AB, which command significant market share through advanced technologies and global distribution. Tier 2 players like Conjet AB, TopTec Spezialmaschinen GmbH, and Doosan Robotics cater to specialized applications and regional demand, while Tier 3 entrants including Alpine, Cazza, and Giant Hydraulic Tech focus on localized innovation. According to Porter’s Five Forces, buyer concentration is moderate due to a fragmented contractor base, while supplier concentration is low, given the wide availability of robotic components and embedded systems across geographies.

Recent Development and Strategic Overview:

- In April 2025, Brokk AB unveiled the Brokk 130⁺ featuring a new BHB 175 breaker and SmartPower+ intelligence to boost power and efficiency in compact demolition sites under CEO Martin Krupicka, signaling strategic emphasis on performance innovation.

- In May 2025, Epiroc expanded its electric demolition range with battery-powered models designed for zero-emission urban demolitions, reflecting its push toward sustainability.

Report Scope

|

Attribute |

Detail |

|

Market Size in 2025 |

USD 0.5 Bn |

|

Market Forecast Value in 2035 |

USD 1.7 Bn |

|

Growth Rate (CAGR) |

12.0% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2020 – 2024 |

|

Market Size Units |

US$ Billion for Value Thousand Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

Regions and Countries Covered |

|||||

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Demolition Robots Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Product Type |

|

|

By Robot Type |

|

|

By Control System |

|

|

By Payload Capacity |

|

|

By Sales Type |

|

|

By Application |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Demolition Robots Market Outlook

- 2.1.1. Demolition Robots Market Size (Volume – Thousand Units and Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Demolition Robots Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Automotive Industry Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Automotive Industry

- 3.1.3. Regional Distribution for Automotive Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Automotive Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for safe, precise, and remote-controlled demolition in hazardous or confined environments

- 4.1.1.2. Increasing redevelopment of aging infrastructure in urban centers worldwide

- 4.1.1.3. Growing integration of AI, IoT, and electric mobility in robotic demolition systems

- 4.1.2. Restraints

- 4.1.2.1. High initial procurement and integration costs for small and mid-sized contractors

- 4.1.2.2. Limited technical expertise and skilled workforce for operating advanced robotic systems

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material and Component Suppliers

- 4.4.2. Demolition Robots Manufacturers

- 4.4.3. Distributors/ Suppliers

- 4.4.4. End-users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Demolition Robots Market Demand

- 4.9.1. Historical Market Size - in Volume (Thousand Units) and Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size - in Volume (Thousand Units) and Value (US$ Bn), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Demolition Robots Market Analysis, Product Type

- 6.1. Key Segment Analysis

- 6.2. Demolition Robots Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Mini Demolition Robots

- 6.2.2. Medium Demolition Robots

- 6.2.3. Large Demolition Robots

- 7. Global Demolition Robots Market Analysis, by Robot Type

- 7.1. Key Segment Analysis

- 7.2. Demolition Robots Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by Robot Type, 2021-2035

- 7.2.1. Electric

- 7.2.2. Hydraulic

- 7.2.3. Pneumatic

- 8. Global Demolition Robots Market Analysis, by Control System

- 8.1. Key Segment Analysis

- 8.2. Demolition Robots Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by Control System, 2021-2035

- 8.2.1. Remote-Controlled Robots

- 8.2.2. Autonomous Robots

- 9. Global Demolition Robots Market Analysis, Payload Capacity

- 9.1. Key Segment Analysis

- 9.2. Demolition Robots Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by Payload Capacity, 2021-2035

- 9.2.1. New Equipment Sales

- 9.2.2. Aftermarket Sales

- 10. Global Demolition Robots Market Analysis, Application

- 10.1. Key Segment Analysis

- 10.2. Demolition Robots Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by Application, 2021-2035

- 10.2.1. Construction

- 10.2.2. Mining

- 10.2.3. Tunneling

- 11. Global Demolition Robots Market Analysis and Forecasts, by Region

- 11.1. Key Findings

- 11.2. Demolition Robots Market Size (Volume - Thousand Units and Value - US$ Mn), Analysis, and Forecasts, by Region, 2021-2035

- 11.2.1. North America

- 11.2.2. Europe

- 11.2.3. Asia Pacific

- 11.2.4. Middle East

- 11.2.5. Africa

- 11.2.6. South America

- 12. North America Demolition Robots Market Analysis

- 12.1. Key Segment Analysis

- 12.2. Regional Snapshot

- 12.3. North America Demolition Robots Market Size Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 12.3.1. Product Type

- 12.3.2. Robot Type

- 12.3.3. Control System

- 12.3.4. Payload Capacity

- 12.3.5. Sales Type

- 12.3.6. Application

- 12.3.7. Country

- 12.3.7.1. USA

- 12.3.7.2. Canada

- 12.3.7.3. Mexico

- 12.4. USA Demolition Robots Market

- 12.4.1. Country Segmental Analysis

- 12.4.2. Product Type

- 12.4.3. Robot Type

- 12.4.4. Control System

- 12.4.5. Payload Capacity

- 12.4.6. Sales Type

- 12.4.7. Application

- 12.5. Canada Demolition Robots Market

- 12.5.1. Country Segmental Analysis

- 12.5.2. Product Type

- 12.5.3. Robot Type

- 12.5.4. Control System

- 12.5.5. Payload Capacity

- 12.5.6. Sales Type

- 12.5.7. Application

- 12.6. Mexico Demolition Robots Market

- 12.6.1. Country Segmental Analysis

- 12.6.2. Product Type

- 12.6.3. Robot Type

- 12.6.4. Control System

- 12.6.5. Payload Capacity

- 12.6.6. Sales Type

- 12.6.7. Application

- 13. Europe Demolition Robots Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. Europe Demolition Robots Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 13.3.1. Product Type

- 13.3.2. Robot Type

- 13.3.3. Control System

- 13.3.4. Payload Capacity

- 13.3.5. Sales Type

- 13.3.6. Application

- 13.3.7. Country

- 13.3.7.1. Germany

- 13.3.7.2. United Kingdom

- 13.3.7.3. France

- 13.3.7.4. Italy

- 13.3.7.5. Spain

- 13.3.7.6. Netherlands

- 13.3.7.7. Nordic Countries

- 13.3.7.8. Poland

- 13.3.7.9. Russia & CIS

- 13.3.7.10. Rest of Europe

- 13.4. Germany Demolition Robots Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Product Type

- 13.4.3. Robot Type

- 13.4.4. Control System

- 13.4.5. Payload Capacity

- 13.4.6. Sales Type

- 13.4.7. Application

- 13.5. United Kingdom Demolition Robots Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Product Type

- 13.5.3. Robot Type

- 13.5.4. Control System

- 13.5.5. Payload Capacity

- 13.5.6. Sales Type

- 13.5.7. Application

- 13.6. France Demolition Robots Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Product Type

- 13.6.3. Robot Type

- 13.6.4. Control System

- 13.6.5. Payload Capacity

- 13.6.6. Sales Type

- 13.6.7. Application

- 13.7. Italy Demolition Robots Market

- 13.7.1. Country Segmental Analysis

- 13.7.2. Product Type

- 13.7.3. Robot Type

- 13.7.4. Control System

- 13.7.5. Payload Capacity

- 13.7.6. Sales Type

- 13.7.7. Application

- 13.8. Spain Demolition Robots Market

- 13.8.1. Country Segmental Analysis

- 13.8.2. Product Type

- 13.8.3. Robot Type

- 13.8.4. Control System

- 13.8.5. Payload Capacity

- 13.8.6. Sales Type

- 13.8.7. Application

- 13.9. Netherlands Demolition Robots Market

- 13.9.1. Country Segmental Analysis

- 13.9.2. Product Type

- 13.9.3. Robot Type

- 13.9.4. Control System

- 13.9.5. Payload Capacity

- 13.9.6. Sales Type

- 13.9.7. Application

- 13.10. Nordic Countries Demolition Robots Market

- 13.10.1. Country Segmental Analysis

- 13.10.2. Product Type

- 13.10.3. Robot Type

- 13.10.4. Control System

- 13.10.5. Payload Capacity

- 13.10.6. Sales Type

- 13.10.7. Application

- 13.11. Poland Demolition Robots Market

- 13.11.1. Country Segmental Analysis

- 13.11.2. Product Type

- 13.11.3. Robot Type

- 13.11.4. Control System

- 13.11.5. Payload Capacity

- 13.11.6. Sales Type

- 13.11.7. Application

- 13.12. Russia & CIS Demolition Robots Market

- 13.12.1. Country Segmental Analysis

- 13.12.2. Product Type

- 13.12.3. Robot Type

- 13.12.4. Control System

- 13.12.5. Payload Capacity

- 13.12.6. Sales Type

- 13.12.7. Application

- 13.13. Rest of Europe Demolition Robots Market

- 13.13.1. Country Segmental Analysis

- 13.13.2. Product Type

- 13.13.3. Robot Type

- 13.13.4. Control System

- 13.13.5. Payload Capacity

- 13.13.6. Sales Type

- 13.13.7. Application

- 14. Asia Pacific Demolition Robots Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. East Asia Demolition Robots Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Product Type

- 14.3.2. Robot Type

- 14.3.3. Control System

- 14.3.4. Payload Capacity

- 14.3.5. Sales Type

- 14.3.6. Application

- 14.3.7. Country

- 14.3.7.1. China

- 14.3.7.2. India

- 14.3.7.3. Japan

- 14.3.7.4. South Korea

- 14.3.7.5. Australia and New Zealand

- 14.3.7.6. Indonesia

- 14.3.7.7. Malaysia

- 14.3.7.8. Thailand

- 14.3.7.9. Vietnam

- 14.3.7.10. Rest of Asia Pacific

- 14.4. China Demolition Robots Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Product Type

- 14.4.3. Robot Type

- 14.4.4. Control System

- 14.4.5. Payload Capacity

- 14.4.6. Sales Type

- 14.4.7. Application

- 14.5. India Demolition Robots Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Product Type

- 14.5.3. Robot Type

- 14.5.4. Control System

- 14.5.5. Payload Capacity

- 14.5.6. Sales Type

- 14.5.7. Application

- 14.6. Japan Demolition Robots Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Product Type

- 14.6.3. Robot Type

- 14.6.4. Control System

- 14.6.5. Payload Capacity

- 14.6.6. Sales Type

- 14.6.7. Application

- 14.7. South Korea Demolition Robots Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Product Type

- 14.7.3. Technology

- 14.7.4. Application

- 14.7.5. End-Users

- 14.7.6. Usability

- 14.8. Australia and New Zealand Demolition Robots Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Product Type

- 14.8.3. Robot Type

- 14.8.4. Control System

- 14.8.5. Payload Capacity

- 14.8.6. Sales Type

- 14.8.7. Application

- 14.9. Indonesia Demolition Robots Market

- 14.9.1. Country Segmental Analysis

- 14.9.2. Product Type

- 14.9.3. Robot Type

- 14.9.4. Control System

- 14.9.5. Payload Capacity

- 14.9.6. Sales Type

- 14.9.7. Application

- 14.10. Malaysia Demolition Robots Market

- 14.10.1. Country Segmental Analysis

- 14.10.2. Product Type

- 14.10.3. Robot Type

- 14.10.4. Control System

- 14.10.5. Payload Capacity

- 14.10.6. Sales Type

- 14.10.7. Application

- 14.11. Thailand Demolition Robots Market

- 14.11.1. Country Segmental Analysis

- 14.11.2. Product Type

- 14.11.3. Robot Type

- 14.11.4. Control System

- 14.11.5. Payload Capacity

- 14.11.6. Sales Type

- 14.11.7. Application

- 14.12. Vietnam Demolition Robots Market

- 14.12.1. Country Segmental Analysis

- 14.12.2. Product Type

- 14.12.3. Robot Type

- 14.12.4. Control System

- 14.12.5. Payload Capacity

- 14.12.6. Sales Type

- 14.12.7. Application

- 14.13. Rest of Asia Pacific Demolition Robots Market

- 14.13.1. Country Segmental Analysis

- 14.13.2. Product Type

- 14.13.3. Robot Type

- 14.13.4. Control System

- 14.13.5. Payload Capacity

- 14.13.6. Sales Type

- 14.13.7. Application

- 15. Middle East Demolition Robots Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Middle East Demolition Robots Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Robot Type

- 15.3.3. Control System

- 15.3.4. Payload Capacity

- 15.3.5. Sales Type

- 15.3.6. Application

- 15.3.7. Country

- 15.3.7.1. Turkey

- 15.3.7.2. UAE

- 15.3.7.3. Saudi Arabia

- 15.3.7.4. Israel

- 15.3.7.5. Rest of Middle East

- 15.4. Turkey Demolition Robots Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Robot Type

- 15.4.4. Control System

- 15.4.5. Payload Capacity

- 15.4.6. Sales Type

- 15.4.7. Application

- 15.5. UAE Demolition Robots Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Robot Type

- 15.5.4. Control System

- 15.5.5. Payload Capacity

- 15.5.6. Sales Type

- 15.5.7. Application

- 15.6. Saudi Arabia Demolition Robots Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Robot Type

- 15.6.4. Control System

- 15.6.5. Payload Capacity

- 15.6.6. Sales Type

- 15.6.7. Application

- 15.7. Israel Demolition Robots Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Product Type

- 15.7.3. Robot Type

- 15.7.4. Control System

- 15.7.5. Payload Capacity

- 15.7.6. Sales Type

- 15.7.7. Application

- 15.8. Rest of Middle East Demolition Robots Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Product Type

- 15.8.3. Robot Type

- 15.8.4. Control System

- 15.8.5. Payload Capacity

- 15.8.6. Sales Type

- 15.8.7. Application

- 16. Africa Demolition Robots Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Africa Demolition Robots Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Robot Type

- 16.3.3. Control System

- 16.3.4. Payload Capacity

- 16.3.5. Sales Type

- 16.3.6. Application

- 16.3.7. Country

- 16.3.7.1. South Africa

- 16.3.7.2. Egypt

- 16.3.7.3. Nigeria

- 16.3.7.4. Algeria

- 16.3.7.5. Rest of Africa

- 16.4. South Africa Demolition Robots Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Robot Type

- 16.4.4. Control System

- 16.4.5. Payload Capacity

- 16.4.6. Sales Type

- 16.4.7. Application

- 16.5. Egypt Demolition Robots Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Robot Type

- 16.5.4. Control System

- 16.5.5. Payload Capacity

- 16.5.6. Sales Type

- 16.5.7. Application

- 16.6. Nigeria Demolition Robots Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Robot Type

- 16.6.4. Control System

- 16.6.5. Payload Capacity

- 16.6.6. Sales Type

- 16.6.7. Application

- 16.7. Algeria Demolition Robots Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Robot Type

- 16.7.4. Control System

- 16.7.5. Payload Capacity

- 16.7.6. Sales Type

- 16.7.7. Application

- 16.8. Rest of Africa Demolition Robots Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Robot Type

- 16.8.4. Control System

- 16.8.5. Payload Capacity

- 16.8.6. Sales Type

- 16.8.7. Application

- 17. South America Demolition Robots Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Central and South Africa Demolition Robots Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Robot Type

- 17.3.3. Control System

- 17.3.4. Payload Capacity

- 17.3.5. Sales Type

- 17.3.6. Application

- 17.3.7. Country

- 17.3.7.1. Brazil

- 17.3.7.2. Argentina

- 17.3.7.3. Rest of South America

- 17.4. Brazil Demolition Robots Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Robot Type

- 17.4.4. Control System

- 17.4.5. Payload Capacity

- 17.4.6. Sales Type

- 17.4.7. Application

- 17.5. Argentina Demolition Robots Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Robot Type

- 17.5.4. Control System

- 17.5.5. Payload Capacity

- 17.5.6. Sales Type

- 17.5.7. Application

- 17.6. Rest of South America Demolition Robots Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Robot Type

- 17.6.4. Control System

- 17.6.5. Payload Capacity

- 17.6.6. Sales Type

- 17.6.7. Application

- 18. Key Players/ Company Profile

- 18.1. Alpine

- 18.1.1. Company Details/ Overview

- 18.1.2. Company Financials

- 18.1.3. Key Customers and Competitors

- 18.1.4. Business/ Industry Portfolio

- 18.1.5. Product Portfolio/ Specification Details

- 18.1.6. Pricing Data

- 18.1.7. Strategic Overview

- 18.1.8. Recent Developments

- 18.2. Beijing Borui Intelligent Control Technology

- 18.3. Brokk AB

- 18.4. Cazza

- 18.5. Conjet AB

- 18.6. Construction Robotics

- 18.7. Doosan Robotics

- 18.8. Epiroc AB

- 18.9. FANUC

- 18.10. Fujita Corporation

- 18.11. Giant Hydraulic Tech

- 18.12. Hitachi

- 18.13. Husqvarna Group

- 18.14. Komatsu

- 18.15. KUKA

- 18.16. SANY Group

- 18.17. Sherpa Miniloaders

- 18.18. Shimizu Construction

- 18.19. TEI Rock Drills

- 18.20. TopTec Spezialmaschinen GmbH

- 18.21. Other Key Players

- 18.1. Alpine

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation