E-commerce Logistics Market Size, Share, Growth Opportunity Analysis Report by Service Type (Transportation, Warehousing, Return Management (Reverse Logistics), Value-added Services and Others), Operational Area, Product Category, Business Model, Transportation Mode, End User and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

E-commerce Logistics Market Size, Share, and Growth

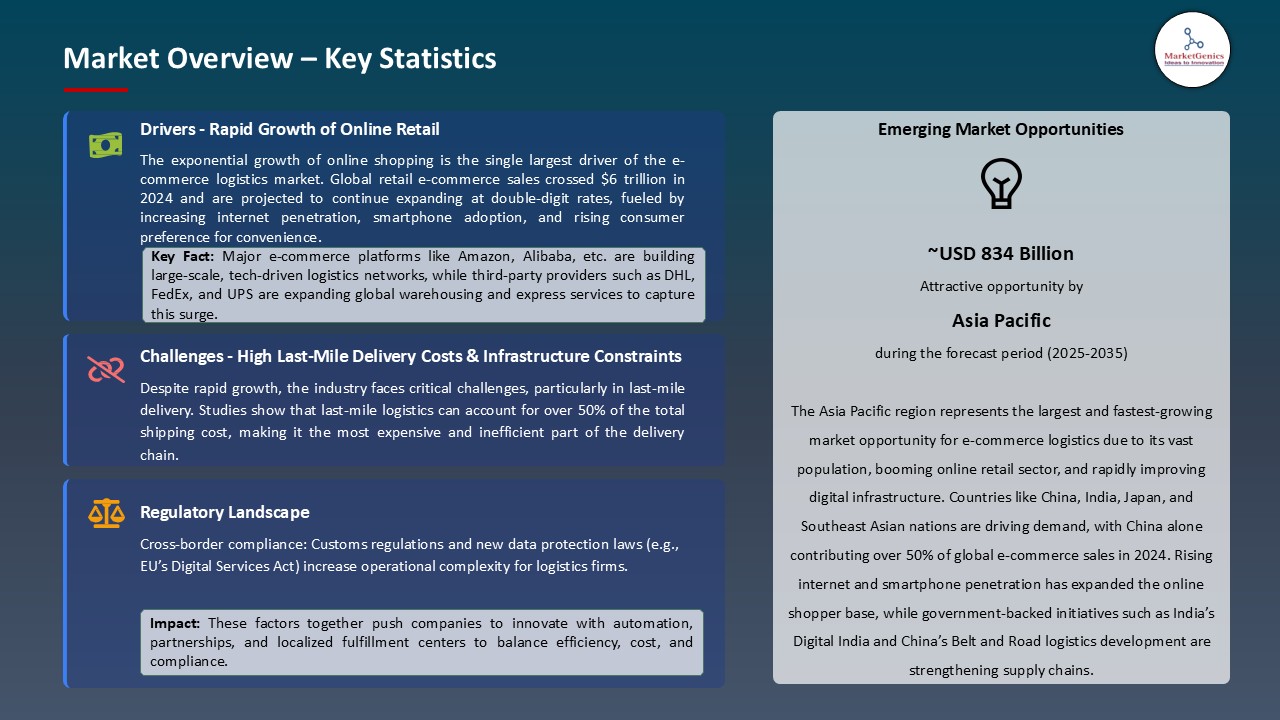

With a significant compounded annual growth rate of 17.2% from 2025-2035, global e-commerce logistics market is poised to be valued at USD 1,899.4 Billion in 2035. Key driving forces behind the global ecommerce logistics market are increasing profusely through-Rapid growth of online retail and last-mile delivery innovations, for instance-Amazon's 2024 expansion of same-day delivery into another 15 cities across the U.S. led to better fulfillment and customer satisfaction.

In May 2025, Delhivery launched its Automated Mega Gateway in Bhiwandi, India, enhancing its express parcel network and reducing turnaround time for high-volume e-commerce shipments. This strategic move aimed to scale its infrastructure to meet rising online retail demand across Tier 2 and Tier 3 cities. Kapil Bharati, Co-founder & CTO of Delhivery, emphasized that the integration of AI-driven automation would significantly boost sorting efficiency and delivery speed across the network.

Delhivery has taken additional strides in implementing AI-based route optimization for fast delivery and cost reduction with its pan-India logistics network. Such service developments make logistics fast, scalable, and consumer-centric. The interplay of technological improvements with e-retail expansion hence drives demand and competition in the global e-commerce logistics sector.

Global e-commerce logistics finds key opportunities within warehouse automation, drone delivery systems, and smart packaging solutions. These markets work toward providing faster order completion processes, reduction in operational costs, and better delivery tracking in accordance with the next-gen e-commerce supply chain. Such adjacent technologies lend very much to the quick and efficient scaling of e-commerce logistics globally.

E-commerce Logistics Market Dynamics and Trends

Driver: Automation & Robotics in Warehouses

- Warehouse automation and robotics are forcing technical changes in the global e-commerce logistics market. There is a tide of acceptance of intelligent robotics and automated storage systems that promise increased operational efficiency, diminished human error, and faster delivery time expectations. These technologies promise faster inventory processing and order fulfillment in the seasonal peaks, thus allowing for efficient scaling of a business.

- For instance, DHL managed to implement more robotic deployments in major global fulfillment centers in 2025, increasing the speed of loading and unloading by 2X. Amazon also deployed a new generation of robotics and conveyor automation to handle orders more than 25% faster. Reduced labor dependency and increased throughput-the shift toward automation-is going to be a strategic priority for large logistics.

- Automation will build fulfillment and cost efficiency for world e-commerce logisticians.

Restraint: High Infrastructure & Technology Investment Costs

- The high capital investment needed for technology deployment and expansion of infrastructure acts as a primary restraint in the e-commerce logistics market. For instance, a smart warehouse powered by AI systems or even electric delivery vehicles integrated with a real-time tracking app: each of these comes with a considerable price tag that can act as a roadblock to smaller and midsized players.

- For instance, Amazon having recently spent many hundreds of millions of dollars to electrify its fleet and for upgrading fulfillment centers with AI and robotics. Whereas such scale applies in favour of big enterprises, smaller regional players face cash flow issues trying to keep the giants with their tech-enabled shares. This leads to greater disparities in performance and diminishes parity in the logistics ecosystem.

- Capital expenditure issues put a barrier in front of smaller companies looking to adopt end-to-end advanced logistics solutions. This, in turn, lowers overall market democratization.

Opportunity: Green & Sustainable Logistics

- With the rise in sustainability emphasis, e-commerce logistics has opened huge opportunities, driven by electrification of fleets and decarbonization initiatives aligned with the Electric Vehicles. Pretty much as environmental awareness increases and emission regulations become stricter, companies are metamorphosing into green operations using electric vehicles, recyclable packaging, and energy-efficient warehouses. In doing so, these sustainability initiatives cut down a carbon footprint, building a positive image that stands for loyal customers.

- In 2025, major e-commerce logistics company Delhivery increased its fleet of electric delivery vehicles and works with partners in green warehousing throughout India. These act to reduce costs in fuel and compliance in the long term, while harmonizing along climate goals internationally. Green logistics is now a differentiation point for competing under markets with ecoconscious consumers.

- This transition to sustainable logistics is opening avenues for cost savings and elevating the brand value in the international markets.

Key Trend: AI-Powered Route Optimization & Predictive Analytics

- The adoption of AI route optimization and predictive analytics is a major trend transmogrifying e-commerce logistics. Such technologies bring last-mile efficiencies and fuel-saving advantages while anticipating demand patterns for better resource allocation and customer satisfaction. In warehousing, the AI further assists in forecasting and real-time tracking.

- FedEx has implemented the AI route optimization software that considerably reduces delivery delays and fuel costs from its North American hubs. Likewise, UPS also improved its AI fleet routing system for better delivery dependability and operational flexibility. These are becoming essential to meet increasing consumer demands in speed and accuracy.

- AI adoption is modernizing logistics operations, making them smarter, faster, and more cost-effective globally.

E-commerce Logistics Market Analysis and Segmental Data

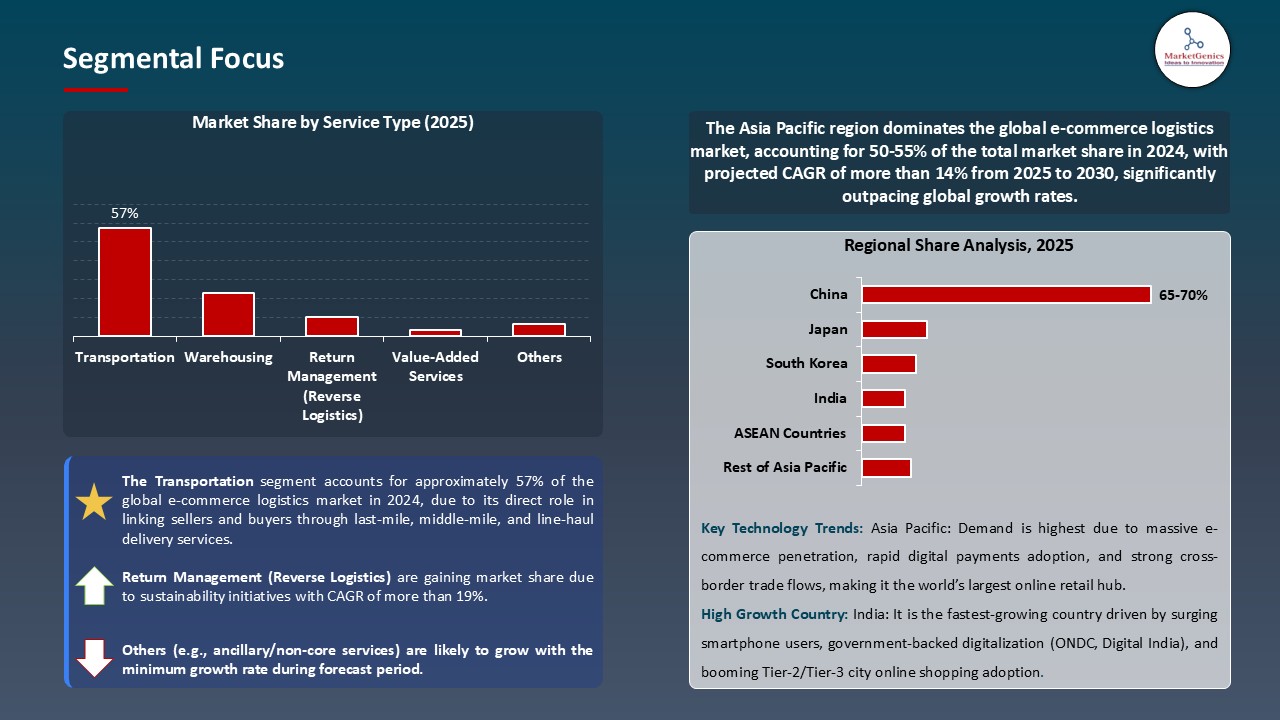

Based on Service Type, the Transportation Segment Retains the Largest Share

- Transportation services occupy a tremendous ~57% market share because they have a direct role in linking sellers and buyers through last-mile, middle-mile, and line-haul delivery services in the global e-commerce logistics market. With the growth of online retail, timely and accurate delivery has gained importance for customers. In 2025, Amazon further increased the size of its local transportation fleet across the United States and European locations to undertake the same-day and one-day deliveries, showing how transportation is at the heart of e-commerce activities. Furthermore, increased demand for express delivery in grocery, electronics, and fashion continues to reinforce the dominance of the transportation segment.

- Moreover, with evolving customer expectations of faster delivery, logistics companies invest in transportation infrastructure and technology. Companies such as Delhivery and DHL have come up with route optimization software and EV fleets and hyperlocal delivery models to boost transportation capabilities. With the rise of cross-border e-commerce, the scope for international freight and customs-related transport services is also gradually expanding, which in turn drives demand.

- Transportation remains the backbone of e-commerce logistics, driving service speed, efficiency, and consumer loyalty.

Asia Pacific Dominates Global E-commerce Logistics Market in 2025 and Beyond

- Due to a growing online consumer base, increased smartphone penetration, and growing digital payment acceptance, the Asia Pacific region is leading the global e-commerce logistics market. The rapid growth of e-commerce in India, China, and Southeast Asian nations is prompting the requirement for solid logistics facilities.

- Reflecting the rapid scaling of logistics infrastructure alongside increasing online orders, JD Logistics inaugurated next-generation automated fulfillment centers in Vietnam and Indonesia in 2025 to meet regional demand.

- As the e-commerce ecosystem flourishes in the Asia Pacific region, it becomes the most vibrant and high-growth market for providers of logistics services.

Key Players Operating in the E-commerce Logistics Market

Key players in the global e-commerce logistics market include prominent companies such as DHL Supply Chain & Global Forwarding, XPO Logistics, FedEx Corporation, United Parcel Service (UPS), Amazon Logistics and Other Key Players.

The e-commerce logistics market is a moderately fragmented, dominated by Tier 1 players such as Alibaba Cainiao Network, Amazon Logistics, and UPS. Tier 2 and Tier 3 players such as Delhivery and ShipBob cater to regional or niche segments. There is low supplier concentration, as many logistics providers give similar services. Buyer concentration is also low as the market caters to several e-commerce businesses, from small vendors to large corporations; hence, it is quite competitive.

Recent Development and Strategic Overview:

- In June 2025, JD Logistics, a logistics division of JD.com, launched the first international express delivery service of JoyExpress, offering same-day shipment within Saudi Arabia-a major step toward global evolution beyond China.

- In May 2025, Amazon made a new partnership with FedEx to deliver extra-large residential packages after UPS scale back its service; this points to a strategic turn toward cheaper logistics solution.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 331.4 Bn |

|

Market Forecast Value in 2035 |

USD 1899.4 Bn |

|

Growth Rate (CAGR) |

17.2% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

E-commerce Logistics Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Service Type |

|

|

By Operational Area |

|

|

By Product Category |

|

|

By Business Model |

|

|

By Transportation Mode |

|

|

By End User |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global E-commerce Logistics Market Outlook

- 2.1.1. E-commerce Logistics Market Size (Value - US$ Billion), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End Use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global E-commerce Logistics Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Automotive & Transportation Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Automotive & Transportation Industry

- 3.1.3. Regional Distribution for Automotive & Transportation

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.1. Global Automotive & Transportation Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rapid growth in online shopping due to increasing internet and smartphone penetration.

- 4.1.1.2. Expansion of cross-border e-commerce, boosting demand for international logistics solutions.

- 4.1.1.3. Adoption of AI, automation, and IoT for enhanced supply chain efficiency and visibility.

- 4.1.2. Restraints

- 4.1.2.1. High costs and complexity associated with last-mile delivery operations.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. E-commerce Retailers & Marketplaces

- 4.4.2. Third-Party Logistics (3PL) Providers

- 4.4.3. Technology & Infrastructure Enablers

- 4.4.4. Last-Mile Delivery Partners

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global E-commerce Logistics Market Demand

- 4.9.1. Historical Market Size - in Value (Value - US$ Billion), 2021-2024

- 4.9.2. Current and Future Market Size - in Value (Value - US$ Billion), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global E-commerce Logistics Market Analysis, by Service Type

- 6.1. Key Segment Analysis

- 6.2. E-commerce Logistics Market Size (Value - US$ Billion), Analysis, and Forecasts, by Service Type, 2021-2035

- 6.2.1. Transportation

- 6.2.1.1. First-mile Delivery

- 6.2.1.2. Mid-mile Delivery

- 6.2.1.3. Last-mile Delivery

- 6.2.2. Warehousing

- 6.2.2.1. Storage

- 6.2.2.2. Fulfillment Centers

- 6.2.2.3. Others

- 6.2.3. Return Management (Reverse Logistics)

- 6.2.4. Value-Added Services

- 6.2.4.1. Packaging

- 6.2.4.2. Labeling

- 6.2.4.3. Quality Checks

- 6.2.4.4. Others

- 6.2.5. Others

- 6.2.1. Transportation

- 7. Global E-commerce Logistics Market Analysis, by Operational Area

- 7.1. Key Segment Analysis

- 7.2. E-commerce Logistics Market Size (Value - US$ Billion), Analysis, and Forecasts, by Operational Area, 2021-2035

- 7.2.1. Domestic E-commerce Logistics

- 7.2.2. International/Cross-border E-commerce Logistics

- 8. Global E-commerce Logistics Market Analysis, by Product Category

- 8.1. Key Segment Analysis

- 8.2. E-commerce Logistics Market Size (Value - US$ Billion), Analysis, and Forecasts, by Product Category, 2021-2035

- 8.2.1. Electronics & Consumer Durables

- 8.2.2. Fashion & Apparel

- 8.2.3. Food & Beverages (including grocery)

- 8.2.4. Beauty & Personal Care

- 8.2.5. Books & Media

- 8.2.6. Home Appliances & Furniture

- 8.2.7. Others

- 9. Global E-commerce Logistics Market Analysis, by Business Model

- 9.1. Key Segment Analysis

- 9.2. E-commerce Logistics Market Size (Value - US$ Billion), Analysis, and Forecasts, by Business Model, 2021-2035

- 9.2.1. Business-to-Business (B2B)

- 9.2.2. Business-to-Consumer (B2C)

- 9.2.3. Consumer-to-Consumer (C2C)

- 10. Global E-commerce Logistics Market Analysis, by Transportation Mode

- 10.1. Key Segment Analysis

- 10.2. E-commerce Logistics Market Size (Value - US$ Billion), Analysis, and Forecasts, by Transportation Mode, 2021-2035

- 10.2.1. Air

- 10.2.2. Road

- 10.2.3. Rail

- 10.2.4. Sea

- 11. Global E-commerce Logistics Market Analysis, by End User

- 11.1. Key Segment Analysis

- 11.2. E-commerce Logistics Market Size (Value - US$ Billion), Analysis, and Forecasts, by End User, 2021-2035

- 11.2.1. Large Enterprises

- 11.2.2. Small and Medium Enterprises (SMEs)

- 11.2.3. Third-party Sellers (Marketplace vendors)

- 12. Global E-commerce Logistics Market Analysis and Forecasts, by Region

- 12.1. Key Findings

- 12.2. E-commerce Logistics Market Size (Value - US$ Billion), Analysis, and Forecasts, by Region, 2021-2035

- 12.2.1. North America

- 12.2.2. Europe

- 12.2.3. Asia Pacific

- 12.2.4. Middle East

- 12.2.5. Africa

- 12.2.6. South America

- 13. North America E-commerce Logistics Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. North America E-commerce Logistics Market Size Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 13.3.1. Service Type

- 13.3.2. Operational Area

- 13.3.3. Product Category

- 13.3.4. Business Model

- 13.3.5. Transportation Mode

- 13.3.6. End User

- 13.3.7. Country

- 13.3.7.1. USA

- 13.3.7.2. Canada

- 13.3.7.3. Mexico

- 13.4. USA E-commerce Logistics Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Service Type

- 13.4.3. Operational Area

- 13.4.4. Product Category

- 13.4.5. Business Model

- 13.4.6. Transportation Mode

- 13.4.7. End User

- 13.5. Canada E-commerce Logistics Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Service Type

- 13.5.3. Operational Area

- 13.5.4. Product Category

- 13.5.5. Business Model

- 13.5.6. Transportation Mode

- 13.5.7. End User

- 13.6. Mexico E-commerce Logistics Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Service Type

- 13.6.3. Operational Area

- 13.6.4. Product Category

- 13.6.5. Business Model

- 13.6.6. Transportation Mode

- 13.6.7. End User

- 14. Europe E-commerce Logistics Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. Europe E-commerce Logistics Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 14.3.1. Service Type

- 14.3.2. Operational Area

- 14.3.3. Product Category

- 14.3.4. Business Model

- 14.3.5. Transportation Mode

- 14.3.6. End User

- 14.3.7. Country

- 14.3.7.1. Germany

- 14.3.7.2. United Kingdom

- 14.3.7.3. France

- 14.3.7.4. Italy

- 14.3.7.5. Spain

- 14.3.7.6. Netherlands

- 14.3.7.7. Nordic Countries

- 14.3.7.8. Poland

- 14.3.7.9. Russia & CIS

- 14.3.7.10. Rest of Europe

- 14.4. Germany E-commerce Logistics Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Service Type

- 14.4.3. Operational Area

- 14.4.4. Product Category

- 14.4.5. Business Model

- 14.4.6. Transportation Mode

- 14.4.7. End User

- 14.5. United Kingdom E-commerce Logistics Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Service Type

- 14.5.3. Operational Area

- 14.5.4. Product Category

- 14.5.5. Business Model

- 14.5.6. Transportation Mode

- 14.5.7. End User

- 14.6. France E-commerce Logistics Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Service Type

- 14.6.3. Operational Area

- 14.6.4. Product Category

- 14.6.5. Business Model

- 14.6.6. Transportation Mode

- 14.6.7. End User

- 14.7. Italy E-commerce Logistics Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Service Type

- 14.7.3. Operational Area

- 14.7.4. Product Category

- 14.7.5. Business Model

- 14.7.6. Transportation Mode

- 14.7.7. End User

- 14.8. Spain E-commerce Logistics Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Service Type

- 14.8.3. Operational Area

- 14.8.4. Product Category

- 14.8.5. Business Model

- 14.8.6. Transportation Mode

- 14.8.7. End User

- 14.9. Netherlands E-commerce Logistics Market

- 14.9.1. Country Segmental Analysis

- 14.9.2. Service Type

- 14.9.3. Operational Area

- 14.9.4. Product Category

- 14.9.5. Business Model

- 14.9.6. Transportation Mode

- 14.9.7. End User

- 14.10. Nordic Countries E-commerce Logistics Market

- 14.10.1. Country Segmental Analysis

- 14.10.2. Service Type

- 14.10.3. Operational Area

- 14.10.4. Product Category

- 14.10.5. Business Model

- 14.10.6. Transportation Mode

- 14.10.7. End User

- 14.11. Poland E-commerce Logistics Market

- 14.11.1. Country Segmental Analysis

- 14.11.2. Service Type

- 14.11.3. Operational Area

- 14.11.4. Product Category

- 14.11.5. Business Model

- 14.11.6. Transportation Mode

- 14.11.7. End User

- 14.12. Russia & CIS E-commerce Logistics Market

- 14.12.1. Country Segmental Analysis

- 14.12.2. Service Type

- 14.12.3. Operational Area

- 14.12.4. Product Category

- 14.12.5. Business Model

- 14.12.6. Transportation Mode

- 14.12.7. End User

- 14.13. Rest of Europe E-commerce Logistics Market

- 14.13.1. Country Segmental Analysis

- 14.13.2. Service Type

- 14.13.3. Operational Area

- 14.13.4. Product Category

- 14.13.5. Business Model

- 14.13.6. Transportation Mode

- 14.13.7. End User

- 15. Asia Pacific E-commerce Logistics Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. East Asia E-commerce Logistics Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 15.3.1. Service Type

- 15.3.2. Operational Area

- 15.3.3. Product Category

- 15.3.4. Business Model

- 15.3.5. Transportation Mode

- 15.3.6. End User

- 15.3.7. Country

- 15.3.7.1. China

- 15.3.7.2. India

- 15.3.7.3. Japan

- 15.3.7.4. South Korea

- 15.3.7.5. Australia and New Zealand

- 15.3.7.6. Indonesia

- 15.3.7.7. Malaysia

- 15.3.7.8. Thailand

- 15.3.7.9. Vietnam

- 15.3.7.10. Rest of Asia Pacific

- 15.4. China E-commerce Logistics Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Service Type

- 15.4.3. Operational Area

- 15.4.4. Product Category

- 15.4.5. Business Model

- 15.4.6. Transportation Mode

- 15.4.7. End User

- 15.5. India E-commerce Logistics Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Service Type

- 15.5.3. Operational Area

- 15.5.4. Product Category

- 15.5.5. Business Model

- 15.5.6. Transportation Mode

- 15.5.7. End User

- 15.6. Japan E-commerce Logistics Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Service Type

- 15.6.3. Operational Area

- 15.6.4. Product Category

- 15.6.5. Business Model

- 15.6.6. Transportation Mode

- 15.6.7. End User

- 15.7. South Korea E-commerce Logistics Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Service Type

- 15.7.3. Operational Area

- 15.7.4. Product Category

- 15.7.5. Business Model

- 15.7.6. Transportation Mode

- 15.7.7. End User

- 15.8. Australia and New Zealand E-commerce Logistics Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Service Type

- 15.8.3. Operational Area

- 15.8.4. Product Category

- 15.8.5. Business Model

- 15.8.6. Transportation Mode

- 15.8.7. End User

- 15.9. Indonesia E-commerce Logistics Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Service Type

- 15.9.3. Operational Area

- 15.9.4. Product Category

- 15.9.5. Business Model

- 15.9.6. Transportation Mode

- 15.9.7. End User

- 15.10. Malaysia E-commerce Logistics Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Service Type

- 15.10.3. Operational Area

- 15.10.4. Product Category

- 15.10.5. Business Model

- 15.10.6. Transportation Mode

- 15.10.7. End User

- 15.11. Thailand E-commerce Logistics Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Service Type

- 15.11.3. Operational Area

- 15.11.4. Product Category

- 15.11.5. Business Model

- 15.11.6. Transportation Mode

- 15.11.7. End User

- 15.12. Vietnam E-commerce Logistics Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Service Type

- 15.12.3. Operational Area

- 15.12.4. Product Category

- 15.12.5. Business Model

- 15.12.6. Transportation Mode

- 15.12.7. End User

- 15.13. Rest of Asia Pacific E-commerce Logistics Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Service Type

- 15.13.3. Operational Area

- 15.13.4. Product Category

- 15.13.5. Business Model

- 15.13.6. Transportation Mode

- 15.13.7. End User

- 16. Middle East E-commerce Logistics Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Middle East E-commerce Logistics Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 16.3.1. Service Type

- 16.3.2. Operational Area

- 16.3.3. Product Category

- 16.3.4. Business Model

- 16.3.5. Transportation Mode

- 16.3.6. End User

- 16.3.7. Country

- 16.3.7.1. Turkey

- 16.3.7.2. UAE

- 16.3.7.3. Saudi Arabia

- 16.3.7.4. Israel

- 16.3.7.5. Rest of Middle East

- 16.4. Turkey E-commerce Logistics Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Service Type

- 16.4.3. Operational Area

- 16.4.4. Product Category

- 16.4.5. Business Model

- 16.4.6. Transportation Mode

- 16.4.7. End User

- 16.5. UAE E-commerce Logistics Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Service Type

- 16.5.3. Operational Area

- 16.5.4. Product Category

- 16.5.5. Business Model

- 16.5.6. Transportation Mode

- 16.5.7. End User

- 16.6. Saudi Arabia E-commerce Logistics Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Service Type

- 16.6.3. Operational Area

- 16.6.4. Product Category

- 16.6.5. Business Model

- 16.6.6. Transportation Mode

- 16.6.7. End User

- 16.7. Israel E-commerce Logistics Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Service Type

- 16.7.3. Operational Area

- 16.7.4. Product Category

- 16.7.5. Business Model

- 16.7.6. Transportation Mode

- 16.7.7. End User

- 16.8. Rest of Middle East E-commerce Logistics Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Service Type

- 16.8.3. Operational Area

- 16.8.4. Product Category

- 16.8.5. Business Model

- 16.8.6. Transportation Mode

- 16.8.7. End User

- 17. Africa E-commerce Logistics Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Africa E-commerce Logistics Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 17.3.1. Service Type

- 17.3.2. Operational Area

- 17.3.3. Product Category

- 17.3.4. Business Model

- 17.3.5. Transportation Mode

- 17.3.6. End User

- 17.3.7. Country

- 17.3.7.1. South Africa

- 17.3.7.2. Egypt

- 17.3.7.3. Nigeria

- 17.3.7.4. Algeria

- 17.3.7.5. Rest of Africa

- 17.4. South Africa E-commerce Logistics Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Service Type

- 17.4.3. Operational Area

- 17.4.4. Product Category

- 17.4.5. Business Model

- 17.4.6. Transportation Mode

- 17.4.7. End User

- 17.5. Egypt E-commerce Logistics Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Service Type

- 17.5.3. Operational Area

- 17.5.4. Product Category

- 17.5.5. Business Model

- 17.5.6. Transportation Mode

- 17.5.7. End User

- 17.6. Nigeria E-commerce Logistics Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Service Type

- 17.6.3. Operational Area

- 17.6.4. Product Category

- 17.6.5. Business Model

- 17.6.6. Transportation Mode

- 17.6.7. End User

- 17.7. Algeria E-commerce Logistics Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Service Type

- 17.7.3. Operational Area

- 17.7.4. Product Category

- 17.7.5. Business Model

- 17.7.6. Transportation Mode

- 17.7.7. End User

- 17.8. Rest of Africa E-commerce Logistics Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Service Type

- 17.8.3. Operational Area

- 17.8.4. Product Category

- 17.8.5. Business Model

- 17.8.6. Transportation Mode

- 17.8.7. End User

- 18. South America E-commerce Logistics Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Central and South Africa E-commerce Logistics Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 18.3.1. Service Type

- 18.3.2. Operational Area

- 18.3.3. Product Category

- 18.3.4. Business Model

- 18.3.5. Transportation Mode

- 18.3.6. End User

- 18.3.7. Country

- 18.3.7.1. Brazil

- 18.3.7.2. Argentina

- 18.3.7.3. Rest of South America

- 18.4. Brazil E-commerce Logistics Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Service Type

- 18.4.3. Operational Area

- 18.4.4. Product Category

- 18.4.5. Business Model

- 18.4.6. Transportation Mode

- 18.4.7. End User

- 18.5. Argentina E-commerce Logistics Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Service Type

- 18.5.3. Operational Area

- 18.5.4. Product Category

- 18.5.5. Business Model

- 18.5.6. Transportation Mode

- 18.5.7. End User

- 18.6. Rest of South America E-commerce Logistics Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Service Type

- 18.6.3. Operational Area

- 18.6.4. Product Category

- 18.6.5. Business Model

- 18.6.6. Transportation Mode

- 18.6.7. End User

- 19. Key Players/ Company Profile

- 19.1. Alibaba Cainiao Network

- 19.1.1. Company Details/ Overview

- 19.1.2. Company Financials

- 19.1.3. Key Customers and Competitors

- 19.1.4. Business/ Industry Portfolio

- 19.1.5. Product Portfolio/ Specification Details

- 19.1.6. Pricing Data

- 19.1.7. Strategic Overview

- 19.1.8. Recent Developments

- 19.2. Amazon Logistics

- 19.3. Aramex

- 19.4. Blue Dart Express

- 19.5. CEVA Logistics

- 19.6. DB Schenker

- 19.7. Delhivery

- 19.8. DHL Supply Chain

- 19.9. Ecom Express

- 19.10. FedEx Corporation

- 19.11. Gati Ltd.

- 19.12. JD Logistics

- 19.13. Kuehne + Nagel

- 19.14. Nippon Express

- 19.15. Rakuten Super Logistics

- 19.16. SF Express

- 19.17. ShipBob

- 19.18. United Parcel Service (UPS)

- 19.19. XPO Logistics

- 19.20. YTO Express

- 19.21. Other Key Players

- 19.1. Alibaba Cainiao Network

Note* - This is just tentative list of players. While providing the report, we will cover a greater number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation